Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Vaulted Gold Bullion Trust | ex31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - Vaulted Gold Bullion Trust | ex32_1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

|

ý

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the Quarterly Period Ended January 31, 2015

|

||

| Or | ||

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the Transition Period from ___________ to _____________

|

||

Commission File Number: 001-_________

VAULTED GOLD BULLION TRUST

(Exact name of registrant as specified in its charter)

|

Delaware

|

46-7176227

|

|

(State or other jurisdiction of incorporation or

|

(I.R.S. Employer Identification No.)

|

|

organization)

|

|

|

c/o Bank of Montreal

3 Times Square

New York, New York 10036

Attention: Legal Department

(Address of principal executive offices)

|

|

|

(212) 885-4000

|

|

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non accelerated filer

|

ý

|

Smaller reporting company

|

¨

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

As of January 31, 2015, there were no Gold Deposit Receipts outstanding.

VAULTED GOLD BULLION TRUST

FORM 10-Q

FOR THE QUARTER ENDED JANUARY 31, 2015

INDEX

|

PART I. FINANCIAL INFORMATION

|

2

|

|

|

Item 1.

|

Condensed Financial Statements (Unaudited)

|

2

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

2

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

3

|

|

Item 4.

|

Controls and Procedures

|

3

|

|

PART II. OTHER INFORMATION

|

4

|

|

|

Item 1.

|

Legal Proceedings

|

4

|

|

Item 1A.

|

Risk Factors

|

4

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

4

|

|

Item 3.

|

Defaults Upon Senior Securities

|

4

|

|

Item 4.

|

Mine Safety Disclosures

|

4

|

|

Item 5.

|

Other Information

|

4

|

|

Item 6.

|

Exhibits

|

5

|

|

SIGNATURES

|

6

|

|

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

The statements contained in this report that are not purely historical are forward-looking statements. The Trust's forward-looking statements include, but are not limited to, statements regarding its expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words "anticipates," "believe," "continue," "could," "estimate," "expect," "intends," "may," "might," "plan," "possible," "potential," "predicts," "project," "should," "would" and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this report may include, for example, statements about:

|

|

•

|

the gold industry, sources of and demand for gold bullion, and the performance of the gold market; and

|

|

|

•

|

the development of a secondary market for the Gold Deposit Receipts.

|

The forward-looking statements contained in this report are based on the Trust's current expectations and beliefs concerning future developments and their potential effects on the Trust. There can be no assurance that future developments affecting the Trust will be those that it has anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the Trust's control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include those factors described under the heading "Risk Factors" in the Trust’s Registration Statement on Form S-1 (File No. 333-194144) filed with the SEC. Should one or more of these risks or uncertainties materialize, or should any of the Trust's assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. The Trust undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

1

PART I. FINANCIAL INFORMATION

Item 1. Condensed Financial Statements (Unaudited)

As discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below, the Trust had not commenced operations as of January 31, 2015. As of the date hereof, the Trust has not issued any Gold Deposit Receipts. As a result, we have omitted financial statements from this Quarterly Report on Form 10-Q.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

The Trust is a business trust formed under the laws of the state of Delaware on December 10, 2013 pursuant to an interim trust agreement that was amended and restated by the Depositary Trust Agreement, dated December 1, 2014, by and among Bank of Montreal, as Initial Depositor, BMO Capital Markets Corp., as Placement Agent, The Bank of New York Mellon, as Trustee and BNY Mellon Trust of Delaware, as Delaware Trustee (the “Depositary Trust Agreement”). The Trust commenced operations on February 4, 2015. Accordingly, it had no operations prior to January 31, 2015.

The Vaulted Gold Bullion Trust holds gold bullion for the benefit of owners of Gold Deposit Receipts. One receipt represents the undivided beneficial ownership of one troy ounce of gold bullion. The trustee performs only administrative and ministerial acts. The property of the Trust consists of the gold bullion and all monies or other property, if any, received by the trustee. The Initial Depositor sells gold bullion to the Trust and arranges custodial services through its gold storage account. There were no Gold Deposit Receipts outstanding during the three-month period covered by this report.

The Trust is not managed like a corporation or an active investment vehicle. It does not have any officers, directors, or employees and is administered by the Trustee pursuant to the Depositary Trust Agreement. The Trust has no activities other than the issuance of Gold Deposit Receipts, which represent an interest in gold bullion. The expenses of the Trust are borne by the Initial Depositor.

The Trust is not registered as an investment company under the Investment Company Act of 1940 and is not required to register under such Act. It will not hold or trade in commodity futures contracts, nor is it a commodity pool, or subject to regulation as a commodity pool operator or a commodity trading adviser in connection with issuing its Gold Deposit Receipts.

The fiscal year end for the Trust is October 31.

Gold Industry

The gold market may be classified into sectors. The Mining and Producer Sector includes mining companies that specialize in gold and silver production; mining companies that produce gold as a byproduct of other production (such as a copper or silver producer); scrap merchants; and recyclers. Bullion banks provide a variety of services to the gold market and its participants, thereby facilitating interactions between other parties. The official sector encompasses the activities of the various central banking operations of gold-holding countries. The investment sector includes the investment and trading activities of both professional and private investors and speculators. These participants range from large hedge and mutual funds to day-traders on futures exchanges and retail-level coin collectors. The fabrication and manufacturing sector represents all the commercial and industrial users of gold for whom gold is a daily part of their business. The jewelry industry is a large user of gold. Other industrial users of gold include the electronics and dental industries.

2

Historic Movements in the Price of Gold

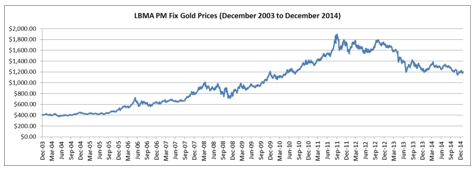

As movements in the price of gold are expected to directly affect the price of the Gold Deposit Receipts, investors should understand what the recent movements in the price of gold have been. Investors, however, should also be aware that past movements in the gold price are not indicators of future movements.

The following chart provides historical background on the price of gold. The chart illustrates movements in the price of gold in U.S. dollars per ounce over the period from December 1, 2003 through to December 31, 2014, and is based on the London PM fix.

During calendar year 2014, gold prices fluctuated between a low of $1,132 and a high of $1,392. The price on December 31, 2014 was $1,182.90. As of March 11, 2015, the price of gold was $1,150.00 per ounce.

Liquidity and Capital Resources

The Trust is not aware of any trends, demands, commitments, events or uncertainties that are reasonably likely to result in material changes to its liquidity needs. In exchange for the Initial Depositor’s Fee, the Initial Depositor has agreed to assume the expenses incurred by the Trust.

Off-Balance Sheet Arrangements

The Trust has no off-balance sheet arrangements.

Critical Accounting Policies

The Trust will prepare its financial statements in accordance with accounting principles generally accepted in the United States of America.

The Trust intends to adopt the provisions of Topic 946, Investment Companies, and follow specialized accounting. As a result of the adoption of this provision, the Trust will record its investment in gold at fair value and expects that there will be fluctuations in the value of investments based on changes in the price of gold.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

The Trust does not engage in transactions in foreign currencies which could expose the Trust or holders of Gold Deposit Receipts to any foreign currency related market risk. The Trust does not invest in any derivative financial instruments or long-term debt instruments.

Item 4. Controls and Procedures

The Trust maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in its reports under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the Securities and Exchange Commission (“SEC”), and that such information is accumulated and communicated to an executive or senior officer of the Initial Depositor familiar with and responsible for supervising the Trust and its operations, as appropriate, to allow timely decisions regarding required disclosure.

3

Under the supervision and with the participation of an executive or senior officer of the Initial Depositor, the Initial Depositor conducted an evaluation of the Trust’s disclosure controls and procedures, as defined under Exchange Act Rules 13a-15(e) and 15d-15(e). Based on this evaluation, the designated officer of the Initial Depositor concluded that, as of January 31, 2015, the Trust’s disclosure controls and procedures were effective.

There have been no changes in the Trust’s or Initial Depositor’s internal control over financial reporting that occurred during the Trust’s fiscal quarter ended January 31, 2015 that have materially affected, or are reasonably likely to materially affect, the Trust’s or Initial Depositor’s internal control over financial reporting.

PART II. OTHER INFORMATION

Item 1. Legal Proceedings

None.

Item 1A. Risk Factors

There have been no material changes to the risk factors previously disclosed in the Trust’s Registration Statement on Form S-1 (File No. 333-194144) filed with the SEC.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

Item 2(a). None.

Item 2(b). Not applicable.

Item 2(c). None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

None.

Item 5. Other Information

None.

4

Item 6. Exhibits

|

|

(a)

|

Exhibits

|

|

Exhibit No.

|

Description

|

|

1.1

|

Placement Agency Agreement by and among Bank of Montreal, the Trust and BMO Capital Markets Corp., filed as an exhibit to the Registrant’s current report on Form 8-K dated December 12, 2014.

|

|

4.1

|

Depositary Trust Agreement by and among Bank of Montreal, BMO Capital Markets Corp., The Bank of New York Mellon, as Trustee and BNY Mellon Trust of Delaware, as Delaware Trustee, and included as an exhibit thereto, form of Gold Deposit Receipt, filed as an exhibit to the Registrant’s current report on Form 8-K dated December 12, 2014.

|

|

10.1

|

Form of Gold Carrier Agreement by and among Bank of Montreal and [________], filed as an exhibit to Amendment No. 1 to Registration Statement No. 333-194144 on June 5, 2014.

|

|

31.1

|

Certificate pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

32.1

|

Certificate pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned in the capacities thereunto duly authorized.

|

BANK OF MONTREAL

|

|||

|

Initial Depositor of the Vaulted Bullion Gold Trust

|

|||

|

(Registrant)

|

|||

|

Date: March 13, 2015

|

/s/ Deland Kamanga | ||

|

Managing Director and Head, Structured Products

|

|

Date: March 13, 2015

|

/s/ Vandra Goedvolk | ||

|

Assistant Corporate Secretary

|

* The Registrant is a trust and the persons are signing in their capacities as officers of Bank of Montreal, the Initial Depositor of the Registrant.

6