Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KEMET CORP | a2015_q4x8kxinvestorslides.htm |

1 Investor Relation Presentation Looking to the Future

2 Cautionary Statement Certain statements included herein contain forward-looking statements within the meaning of federal securities laws about KEMET Corporation's (the "Company") financial condition and results of operations that are based on management's current expectations, estimates and projections about the markets in which the Company operates, as well as management's beliefs and assumptions. Words such as "expects," "anticipates," "believes," "estimates," variations of such words and other similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in, or implied by, such forward-looking statements. Readers are cautioned not to place undue reliance on these forward- looking statements, which reflect management's judgment only as of the date hereof. The Company undertakes no obligation to update publicly any of these forward-looking statements to reflect new information, future events or otherwise. Factors that may cause actual outcome and results to differ materially from those expressed in, or implied by, these forward-looking statements include, but are not necessarily limited to, the following: (i) adverse economic conditions could impact our ability to realize operating plans if the demand for our products declines, and such conditions could adversely affect our liquidity and ability to continue to operate; (ii) continued net losses could impact our ability to realize current operating plans and could materially adversely affect our liquidity and our ability to continue to operate; (iii) adverse economic conditions could cause the write down of long-lived assets or goodwill; (iv) an increase in the cost or a decrease in the availability of our principal or single-sourced purchased materials; (v) changes in the competitive environment; (vi) uncertainty of the timing of customer product qualifications in heavily regulated industries; (vii) economic, political, or regulatory changes in the countries in which we operate; (viii) difficulties, delays or unexpected costs in completing restructuring plans; (ix) equity method investments expose us to a variety of risks; (x) acquisitions and other strategic transactions expose us to a variety of risks; (xi) inability to attract, train and retain effective employees and management; (xii) inability to develop innovative products to maintain customer relationships and offset potential price erosion in older products; (xiii) exposure to claims alleging product defects; (xiv) the impact of laws and regulations that apply to our business, including those relating to environmental matters; (xv) the impact of international laws relating to trade, export controls and foreign corrupt practices; (xvi) volatility of financial and credit markets affecting our access to capital; (xvii) the need to reduce the total costs of our products to remain competitive; (xviii) potential limitation on the use of net operating losses to offset possible future taxable income; (xix) restrictions in our debt agreements that limit our flexibility in operating our business; and (xx) additional exercise of the warrant by K Equity which could potentially result in the existence of a significant stockholder who could seek to influence our corporate decisions.

3 A global company – A historic brand Simpsonville Ciudad Victoria, Monterrey (2) & Matamoros (2), Mexico Evora, Portugal Pontecchio, Italy Landsberg, Germany Kyustendil, Bulgaria Anting-Shanghai, China Knoxville Carson City, NV Batam, Indonesia Chicago Suomussalmi, Finland Granna & Farjestaden, Sweden Suzhou, China (2) Skopje, Macedonia Founded in 1919 20 Manufacturing Plants 9800 Employees EASY TO BUY FROM 1,145 Components shipped per second

4 Recent Accomplishments • Acquisitions for product expansion and growth – Film Capacitors – Electrolytic Capacitors – Niotan Tantalum Powder Plant – NEC TOKIN joint venture • Restructuring Film and Electrolytic business Group • Leadership in Polymer capacitor technology • Margin expansion – Vertical integration Solid Capacitor Business Group – Gross margin improvement of 390 basis points over the past 12 months in a time of flat revenue

5 Scheduled Film & Electrolytic Labor Cost Reductions Fiscal 2016 Achieve additional cost reduction up to $3.0M/quarter by 2Q FY16 • Reduction of Western and Northern Europe workforce: – Reduce headcount by 316 globally – Reduce Finland by 36 from moving production to Macedonia and China – Reduce Sweden by 22 from receiving automated equipment for a 30% capacity increase – Reduce Germany by 48 from moving production to Macedonia • Close one operation in Germany – Reduce Italy by 70 from re-organizing indirect staffing – An additional 140 across the globe • Reduce labor cost in Italy: – Increased productivity – decreased cost of temporary labor displacement programs (CIGO/CIGS)

6 Cost Rationalization Drives Margin Improvement LTM Adj. EBITDA Margins 7.1% 7.2% 7.7% 8.5% 9.7% 10.6% 11.1% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 *EBITDA margin of 13.5% for the quarter ended December 31, 2014

7 Balanced Geographical & Product Portfolio Telecom 19% Computer 15% Consumer 8% Ind/Light 23% Automotive 21% Def/Med 14% SEGMENT Dist 44% EMS 19% OEM 37% CHANNEL Americas 32% EMEA 33% APAC 35% REGION TA 46% CE 30% F&E 24% BUSINESS GROUP

8 Positioned for the future Up Next: GROWTH Organic NEC TOKIN

9 Driven by a passion for technology… …from our global innovation centers 501 KEMET Engineers 12,552 New Products in 2014 33 KEMET PhD Scientists 164 KEMET Patents

10 To solve basic electronic problems Products that store, filter and regulate electrical energy in anything that turns on/off, plugs in or uses a battery

11 Supported by Vertical Integration K-Salt Ta Powder Ta Capacitor Electronic Devices Ta Ore Completely conflict-free Ta supply chain

12 While being socially responsible

13 52.5% 52.0% 22.4% 22.0%10.9% 11.5% 10.4% 10.6% 3.8% 4.0% $18.3 $22.7 FY 2014 FY 2019 Ceramic Aluminum Paper & Plastic Film Tantalum Other Organic Growth- Technology for the Future • Global appetite for higher bandwidth • Enhanced complexity of new products • Demand for high capacitance values • Upgrade of global energy networks • Development of alternative energy solutions Enhanced metafile See v2 (From Graphics) for source chart (editable) Source (both charts above): Paumanok Publications, Inc. Dollars in billions. In the air In your hand In the cloud In your body On the ground Under the ground In space 57.0% 59.5% 16.0% 13.8% 15.0% 14.9% 12.0% 11.8% $0 $5 $10 $15 $20 $25 FY 2014 FY 2019 China & SE Asia Japan Europe Americas & ROW By Segment By Region $ In billions $ In billions $18.3 $22.7

14 Growth expected in all major end markets Systems View 2013 / 2017 6%+ AUTOMOTIVE 5%+ INDUSTRIAL 4%+ MEDICAL 3%+ CONSUMER 3%+ COMPUTER 3%+ AEROSPACE/DEFENSE 3%+ TELECOMM 4%+ OVERALL

15 Ce Capacitors Ta Capacitors Film Capacitors Al E Capacitors Inductors Relays 5 year CAAGR 22%+* Mobility Connected Car *Cellular, Bluetooth & WiFi modules within vehicles

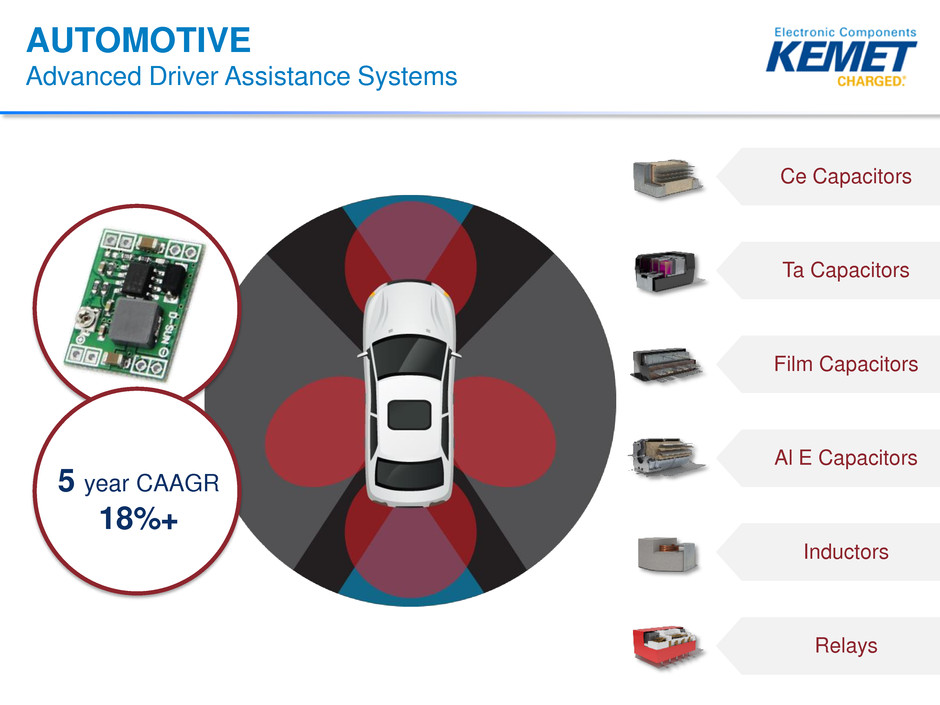

16 AUTOMOTIVE Advanced Driver Assistance Systems Ce Capacitors Ta Capacitors Film Capacitors Al E Capacitors Inductors Relays 5 year CAAGR 18%+

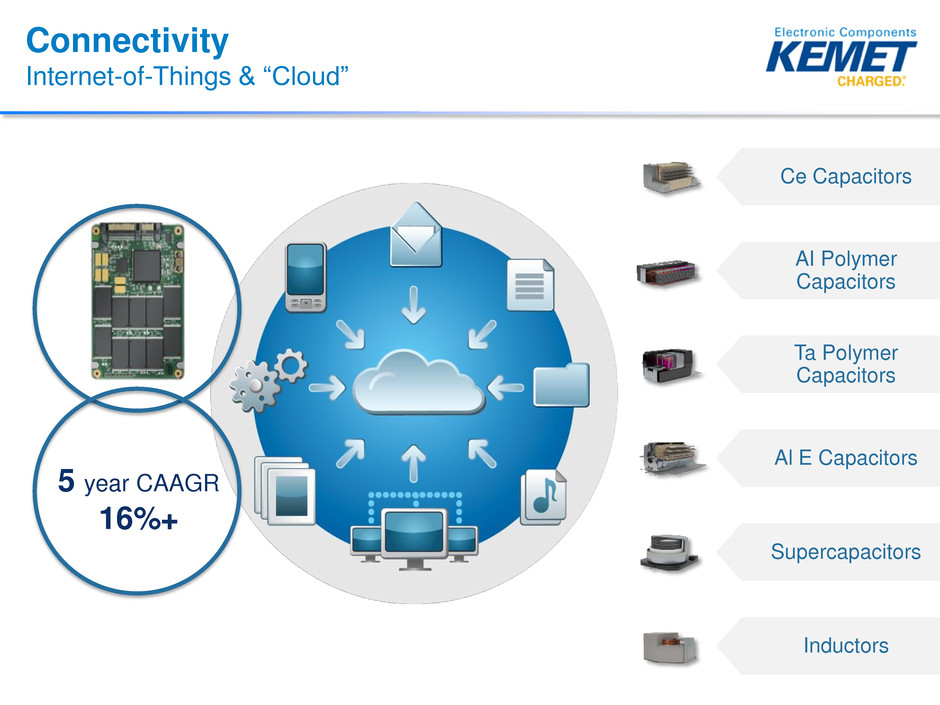

17 Ce Capacitors AI Polymer Capacitors Ta Polymer Capacitors Al E Capacitors Supercapacitors Inductors 5 year CAAGR 16%+ Connectivity Internet-of-Things & “Cloud”

18 Energy Efficiency Smart Grid & Green Energy Ce Capacitors Ta Capacitors Film Capacitors Al E Capacitors Inductors Relays 5 year CAAGR 8%+

19 Mass Market Lighting & Wearables Ce Capacitors Ta Capacitors Inductors 5 year CAAGR 30%+ Wearables 5 year CAAGR 17%+ LED Lighting

20 Inductors, Relays, Piezo,Sensors and EMI Solutions NEC TOKIN Inductors, Relays, Piezo, Sensors and EMI Solutions

21 • NEC TOKIN Products • Capacitors Tantalum Supercapacitors • Electro-magnetic materials and devices Inductors, Filters, Flex Suppression Sheets • Piezoelectric components • Electro-mechanical devices Signal Relays Power Relays NEC TOKIN Overview • On February 1, 2013 KEMET acquired a 34% economic interest with a 51% voting interest in NEC TOKIN Corporation (“NEC TOKIN”) • NEC TOKIN manufactures tantalum and other capacitors, electro-magnetic materials, piezoelectric components, electro-mechanical devices and access devices • Manufacturing locations in Japan, China, Vietnam, Philippines and Thailand • In conjunction with the investment of NEC TOKIN, KEMET received two call options that, if exercised, would result in the acquisition of 100% of NEC TOKIN AUTOMOTIVE TELECOMM INDUSTRIAL MEDICAL CONSUMER COMPUTER 21

22 What NEC Tokin does for KEMET • What NEC TOKIN (NT) does for KEMET: • Expands Serviceable Available Market to approximately $8-9 billion • Expands product portfolio • Complementary geographic footprint KEMET has very few manufacturing locations in Asia while this is where all of TOKIN’s manufacturing is located TOKIN has no manufacturing presence in North America or Europe ~50% of TOKIN’s sales are generated in Japan ~70% of KEMET’s sales are generated outside of Asia Key: KEMET Capacitors NT EMI Power Inductors, EMI Cores, and AC Line filter NT EMD Signal & Power Relays

23 Combined Proforma Consolidated Income Statement* FY15 Q3 (Non-GAAP) (in thousands USD) NEC TOKIN KEMET Consolidated Net sales 115,102$ 201,310$ 316,412$ Cost of sales 88,196 156,201 244,397 Gross margin 26,906 45,109 72,015 Gross margin % 23.4% 22.4% 22.8% SG&A 21,238 21,511 42,749 R&D 3,475 6,203 9,678 Operating income 2,195 17,395 19,590 % of net sales 1.9% 8.6% 6.2% Other income / expense, net (7,805) (84) (7,889) Interest income / expense, net 559 9,611 10,170 Profit before income taxes 9,441 7,868 17,309 Income tax 4,034 1,363 5,397 Net income from continuing operations 5,407$ 6,505$ 11,912$ % of net sales 4.7% 3.2% 3.8% Earnings per share - basic 0.26$ Earnings per share - diluted 0.23$ Weighted avg. shares - basic 45,407 Weighted avg. shares - diluted 52,228 Adjusted EBITDA 13,593$ 27,199$ 40,792$ 23 *Illustrative purposes only

24 KEMET/NT Combination- What are the possibilities for Financial Performance? Assumptions: 1)Constant exchange rates 2)NT acquisition is financed with debt in Asia at Asian rates at the minimum purchase price 3)CAGR rate applied to the four years ending FY19 at a conservative rate of 2.2% (50% of projected industry rate) for FY19 projection w/o synergies 4)Tax Expense: NOL’s in the U.S. and Japan used to offset incremental taxable income for the four-year period 5)Starting point is the actual results for the 9 months ending December 31, 2014 annualized 6)NT Restructuring includes $40 million of cost reductions and additional 5% Revenue from PLP of products 7)See Appendix for Recent Disclosures

25 KEMET / NEC TOKIN FY19 Projection (Non-GAAP) Assumptions: 1) Constant exchange rates 2) NT acquisition is financed with debt in Asia at Asian rates at the minimum purchase price 3) CAGR rate applied to the four years ending FY19 at 2.2% for FY19 projection w/o synergies 4) Tax Expense: NOL’s in the U.S. and Japan used to offset incremental taxable income for the four-year period 5) Starting point is the actual results for the 9 months ending December 31, 2014 annualized 6) NT Restructuring includes $40 million of cost reductions and additional 5% Revenue from PLP of products FY15 FY19 FY19 Projected (in thousands USD) Annualized Projected w/ NT Restructuring Net sales 1,335,200$ 1,456,600$ 1,529,500$ Cost of sales 1,056,200 1,107,100 1,128,800 Gross margin 279,000 349,500 400,700 Gross margin % 20.9% 24.0% 26.2% SG&A 195,000 196,600 173,600 R&D 25,300 29,100 29,100 Operating income 58,700 123,800 198,000 % of net sales 4.4% 8.5% 12.9% Other (income) / expense, net (14,600) - - Interest (income) / expense, net 41,600 47,500 47,300 Profit before income taxes 31,700 76,300 150,700 Income tax 14,400 9,500 9,600 Net income from continuing operations 17,300$ 66,800$ 141,100$ % of net sales 1.3% 4.6% 9.2% Earnings per share - basic 0.38$ 1.47$ 3.11$ Earnings per share - diluted 0.33$ 1.27$ 2.69$ Weighted avg. shares - basic 45,360 45,360 45,360 Weighted avg. shares - diluted 52,549 52,549 52,549 Adjusted EBITDA 148,100$ 213,600$ 287,700$

26 Financial Overview

27 Quarter Ending 12/31 Year Over Year Comparison Discussion of Financial Results: Gross Margin: • 390 basis point improvement driven by Solid Capacitors successful implementation of a vertical integration strategy for raw materials, yield improvements, and other cost reduction strategies. EBITDA: • 17.2% growth versus the prior year quarter ($4 million) on slightly less revenue driven by margin improvement and lower SG&A costs ($ in millions) 12/31/2013 12/31/2014 $ Δ Y-O-Y Total Revenues $207.3 $201.3 ($6.0) % Growth - -2.9% - Cost of sales 169.60 156.80 (12.8) Gross Profit $37.7 $44.5 $6.8 % Margin 18.2% 22.1% 3.9% Operating Income $3.6 $9.3 $5.7 % Margin 1.7% 4.6% 2.9% Net Income ($5.8) $2.9 $8.7 Adj. EBITDA $23.2 $27.2 $4.0 % Margin 11.2% 13.5% 2.3% % Growth - 17.2% - Credit Statistics: Total Debt 401.9 404.6 2.7 Total Debt / LTM Adj. EBITDA 6.4x 4.3x (2.1) Net Leverage / LTM Adj. EBITDA 5.3x 3.7x (1.6) Adj. EBITDA / Interest Expense 2.2x 2.7x 0.5 Quarter Ending

28 Annual Financial Summary Revenue and Adj. EBITDA Margins Adj. EBITDA Capital Expenditures (Adj. EBITDA – CapEx) CAPEX As a % of Revenue 5.6% 3.9% 3.0% Note: Amounts shown remove effects of machining business $ In millions $ In millions $ In millions $ In millions $824 $834 $845 7.6% 8.5% 11.1% $0 $200 $400 $600 $800 $1,000 $1,200 FY 2013 FY 2014 LTM Dec '14 $63 $71 $94 $0 $50 $100 $150 $200 FY 2013 FY 2014 LTM Dec '14 $17 $39 $69 $0 $20 $40 $60 $80 FY 2013 FY 2014 LTM Dec '14 $46 $32 $25 $0 $10 $20 $30 $40 $50 FY 2013 FY 2014 LTM Dec '14

29 Notes: Amounts shown remove effects of machining business Quarterly Financial Summary Revenue Adj. EBITDA Adj. LTM EBITDA Margins 7.1% 7.2% 7.7% 8.5% 9.7% 10.6% 11.1% $ In millions $ In millions $202 $208 $207 $216 $213 $215 $201 $0 $50 $100 $150 $200 $250 $300 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 $9 $18 $23 $21 $20 $26 $27 $0 $5 $10 $15 $20 $25 $30 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14

30 5.4x 5.6x 5.3x 4.6x 4.0x 4.0x 3.7x 6.6x 6.9x 6.4x 6.8x 4.9x 4.7x 4.3x 2.0x 3.0x 4.0x 5.0x 6.0x 7.0x 8.0x Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Net Leverage Leverage Quarterly Leverage and Net Leverage Metrics Leverage and Net Leverage

31 KEMET – Future Strategies • Driving organic growth in line with the technology market • An intent to acquire the remainder of NEC TOKIN and drive synergies • Increase excess cash and reduce debt • Increase Earnings per Share • Create Value for shareholders, customers and employees

32 Follow KEMET Social Media

33

34 Appendix

35 Recent Disclosures – NEC TOKIN • In March and April 2014, NEC TOKIN and certain of its subsidiaries received inquiries, requests for information and other communications from government authorities in China, the United States, the European Commission, Japan and South Korea concerning alleged anti-competitive activities within the capacitor industry. Subsequently, NEC TOKIN has also communicated with government authorities regarding related investigations in Taiwan and Singapore. The investigations are continuing at various stages. In addition, beginning in July 2014, NEC TOKIN and its subsidiary, NEC TOKIN America, Inc., have been named, along with more than 20 other capacitor manufacturers and subsidiaries, as defendants in purported antitrust class action suits in the United States and Canada. As of this date, except for legal expenses, NEC TOKIN has not recorded an accrual as a result of the investigations and civil litigation. • KEMET has advised that it is awaiting clarity on the inquiry detailed above before considering exercising its call options to acquire NEC TOKIN.

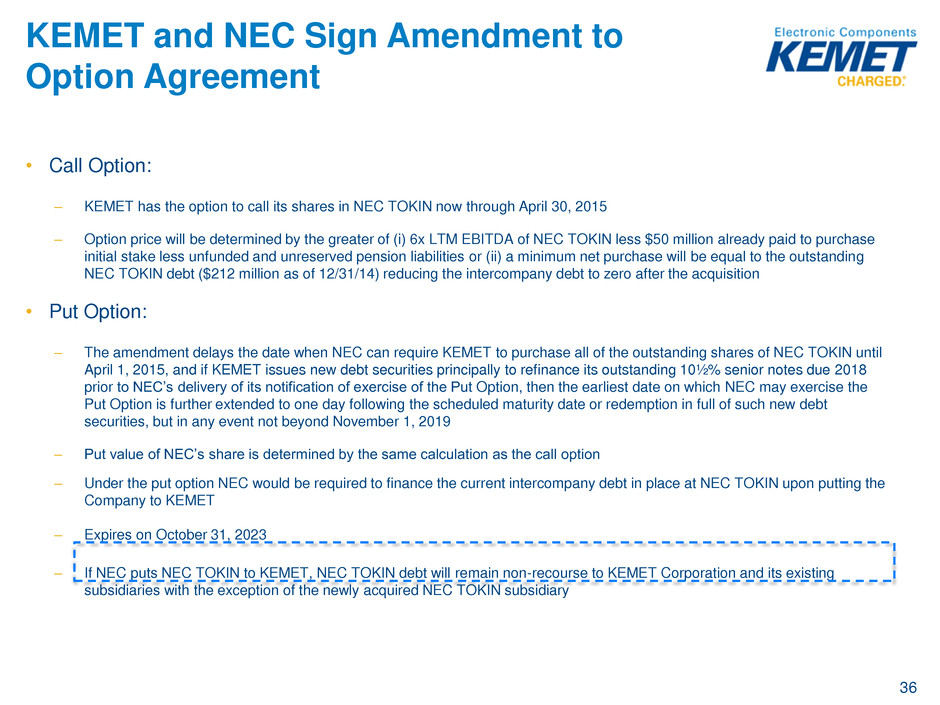

36 KEMET and NEC Sign Amendment to Option Agreement • Call Option: – KEMET has the option to call its shares in NEC TOKIN now through April 30, 2015 – Option price will be determined by the greater of (i) 6x LTM EBITDA of NEC TOKIN less $50 million already paid to purchase initial stake less unfunded and unreserved pension liabilities or (ii) a minimum net purchase will be equal to the outstanding NEC TOKIN debt ($212 million as of 12/31/14) reducing the intercompany debt to zero after the acquisition • Put Option: – The amendment delays the date when NEC can require KEMET to purchase all of the outstanding shares of NEC TOKIN until April 1, 2015, and if KEMET issues new debt securities principally to refinance its outstanding 10½% senior notes due 2018 prior to NEC’s delivery of its notification of exercise of the Put Option, then the earliest date on which NEC may exercise the Put Option is further extended to one day following the scheduled maturity date or redemption in full of such new debt securities, but in any event not beyond November 1, 2019 – Put value of NEC’s share is determined by the same calculation as the call option – Under the put option NEC would be required to finance the current intercompany debt in place at NEC TOKIN upon putting the Company to KEMET – Expires on October 31, 2023 – If NEC puts NEC TOKIN to KEMET, NEC TOKIN debt will remain non-recourse to KEMET Corporation and its existing subsidiaries with the exception of the newly acquired NEC TOKIN subsidiary

37 Last Twelve Months (Amounts in millions) 2013 2014 2013 2014 Dec-14 GAAP Net income (loss) (82.2)$ (68.5)$ (54.1)$ 5.7$ (8.7)$ Depreciation and amortization 45.2 49.5 37.4 30.7 42.9 Interest expense, net 41.2 40.8 30.1 30.7 41.3 Income tax expense 3.3 1.5 4.3 5.2 2.4 EBITDA 7.4 23.3 17.6 72.3 77.9 Excluding the following items (Non-GAAP) Restructuring charges 18.7 14.1 8.2 9.6 15.5 Write down of long-lived assets 7.6 4.5 3.4 - 1.1 ERP integration costs 7.4 3.9 3.0 2.0 2.8 (Income) loss from discontinued operations 3.7 3.6 3.7 (5.4) (5.5) Plant start-up costs 6.1 3.3 2.7 3.9 4.6 Stock-based compensation 4.6 2.9 2.3 3.2 3.8 (Gain) loss on early extinguishment of debt - - - (1.0) (1.0) Professional fees related to financing activities - - - 1.1 1.1 Plant shut-down costs - 2.7 - 0.9 3.6 NEC TOKIN investment related expenses 4.6 2.3 1.7 1.6 2.2 Infrastructure tax - 1.1 - - 1.1 Goodwill impairment 1.1 - - - - Equity loss from NEC TOKIN 1.3 7.1 3.0 0.1 4.2 Net curtailment and settlement gain on benefit plans 0.3 - - - - Loss (gain) on sales and disposals of assets - - 0.1 (0.8) (0.8) Net foreign exchange (gain) loss - (0.3) 0.1 (2.1) (2.5) Long-term receivable write down - 1.4 1.4 - - Change in value of NEC Tokin options - (3.1) (1.3) (13.2) (15.0) Inventory write down - 3.9 3.9 - - Inventory revaluation - - - 0.9 0.9 Adjusted EBITDA 62.7$ 70.7$ 49.9$ 73.1$ 94.0$ For the Years Ended March 31, Nine Months Ended December 31, Adjusted EBITDA Reconciliation – KEMET

38 KEMET / NEC TOKIN FY15 Annualized (US GAAP) Nine Months Ended FY15 Nine Months Ended FY15 Nine Months Ended FY15 Dec 31, 2014 Annualized Dec 31, 2014 Annualized Dec 31, 2014 Annualized (in thousands USD) NEC TOKIN NEC TOKIN KEMET KEMET Combined Combined Net sales 371,926$ 495,901$ 629,484$ 839,312$ 1,001,410$ 1,335,213$ Cost of sales 292,699 390,265 506,304 675,072 799,003 1,065,337 Gross margin 79,227 105,636 123,180 164,240 202,407 269,876 Gross margin % 21.3% 21.3% 19.6% 19.6% 20.2% 20.2% SG&A 77,909 103,879 73,663 98,217 151,572 202,096 R&D - - 19,230 25,640 19,230 25,640 Net (gain) on sales and disposals of assets - - (759) (1,012) (759) (1,012) Restructuring - - 9,580 12,773 9,580 12,773 Operating income 1,318 1,757 21,466 28,621 22,784 30,379 % of net sales 0.4% 0.4% 3.4% 3.4% 2.3% 2.3% Other (income) / expense, net (11,284) (15,045) (14,829) (19,772) (26,113) (34,817) Interest (income) / expense, net 2,064 2,752 30,670 40,893 32,734 43,645 Profit before income taxes 10,538 14,051 5,625 7,500 16,163 21,551 Income tax 5,610 7,480 5,224 6,965 10,834 14,445 Income from continuing operations * 4,928$ 6,571$ 401$ 535$ 5,329$ 7,105$ % of net sales 1.3% 1.3% 0.1% 0.1% 0.5% 0.5% Earnings per share - basic 0.12$ 0.16$ Earnings per share - diluted 0.10$ 0.14$ Weighted avg. shares - basic 45,360 45,360 Weighted avg. shares - diluted 52,549 52,549 Adjusted EBITDA 37,954$ 50,605$ 73,101$ 97,468$ 111,055$ 148,073$ * before equity loss from NEC TOKIN

39 KEMET / NEC TOKIN FY15 Annualized (Non-GAAP) Nine Months Ended FY15 Nine Months Ended FY15 Nine Months Ended FY15 Dec 31, 2014 Annualized Dec 31, 2014 Annualized Dec 31, 2014 Annualized (in thousands USD) NEC TOKIN NEC TOKIN KEMET KEMET Combined Combined Net sales 371,926$ 495,901$ 629,484$ 839,312$ 1,001,410$ 1,335,213$ Cost of sales 292,699 390,265 499,471 665,961 792,170 1,056,227 Gross margin 79,227 105,636 130,013 173,351 209,240 278,987 Gross margin % 21.3% 21.3% 20.7% 20.7% 20.9% 20.9% SG&A 77,909 103,879 68,334 91,112 146,243 194,991 R&D - - 18,959 25,279 18,959 25,279 Operating income 1,318 1,757 42,720 56,960 44,038 58,717 % of net sales 0.4% 0.4% 6.8% 6.8% 4.4% 4.4% Other (income) / expense, net (11,284) (15,045) 313 417 (10,971) (14,628) Interest (income) / expense, net 2,064 2,752 29,099 38,799 31,163 41,551 Profit before income taxes 10,538 14,051 13,308 17,744 23,846 31,795 Income tax 5,610 7,480 5,160 6,880 10,770 14,360 Income from continuing operations * 4,928$ 6,571$ 8,148$ 10,864$ 13,076$ 17,435$ % of net sales 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% Earnings per share - basic 0.29$ 0.38$ Earnings per share - diluted 0.25$ 0.33$ Weighted avg. shares - basic 45,360 45,360 Weighted avg. shares - diluted 52,549 52,549 Adjusted EBITDA 37,954$ 50,605$ 73,101$ 97,468$ 111,055$ 148,073$ * before equity loss from NEC TOKIN

40 (Amounts in thousands) Dec 31, 2014 Dec 31, 2014 Dec 31, 2014 GAAP Net income (loss) 2,914$ 5,704$ 7,605$ Equity (income) loss from NEC TOKIN (1,367) 76 101 (Income) loss from discontinued operations 164 (5,379) (7,172) Income from continuing operations * 1,711$ 401$ 535$ * before equity loss from NEC TOKIN For the Quarter Ended For the Nine Months Ended Annualized FY15 from the Nine Months Ended Net Income Reconciliation – KEMET

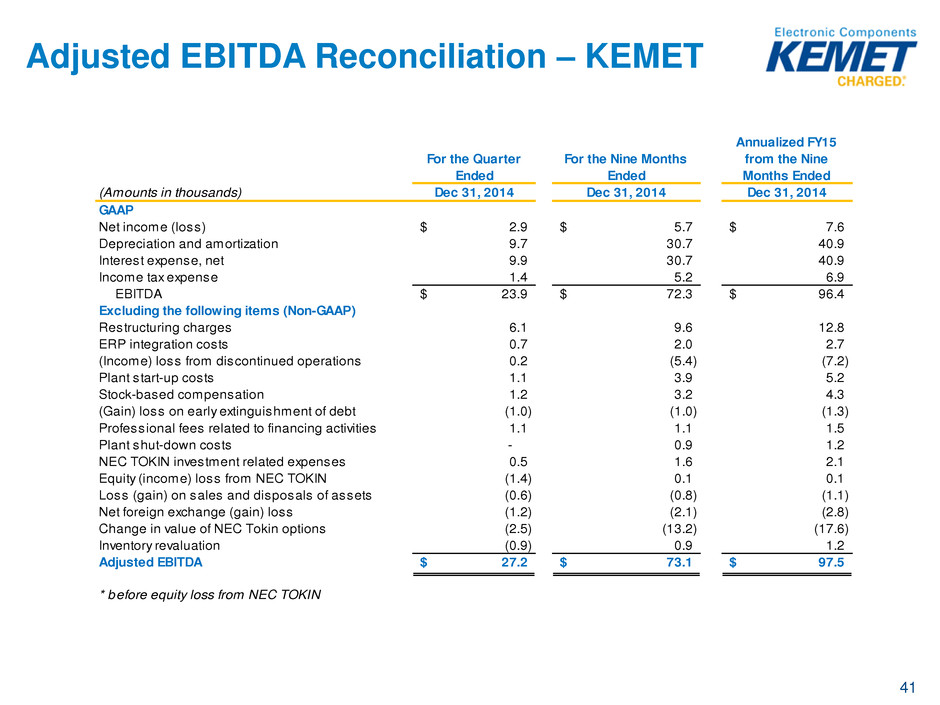

41 (Amounts in thousands) Dec 31, 2014 Dec 31, 2014 Dec 31, 2014 GAAP Net income (loss) 2.9$ 5.7$ 7.6$ Depreciation and amortization 9.7 30.7 40.9 Interest expense, net 9.9 30.7 40.9 Income tax expense 1.4 5.2 6.9 EBITDA 23.9$ 72.3$ 96.4$ Excluding the following items (Non-GAAP) Restructuring charges 6.1 9.6 12.8 ERP integration costs 0.7 2.0 2.7 (Income) loss from discontinued operations 0.2 (5.4) (7.2) Plant start-up costs 1.1 3.9 5.2 Stock-based compensation 1.2 3.2 4.3 (Gain) loss on early extinguishment of debt (1.0) (1.0) (1.3) Professional fees related to financing activities 1.1 1.1 1.5 Plant shut-down costs - 0.9 1.2 NEC TOKIN investment related expenses 0.5 1.6 2.1 Equity (income) loss from NEC TOKIN (1.4) 0.1 0.1 Loss (gain) on sales and disposals of assets (0.6) (0.8) (1.1) Net foreign exchange (gain) loss (1.2) (2.1) (2.8) Change in value of NEC Tokin options (2.5) (13.2) (17.6) Inventory revaluation (0.9) 0.9 1.2 Adjusted EBITDA 27.2$ 73.1$ 97.5$ * before equity loss from NEC TOKIN For the Quarter Ended For the Nine Months Ended Annualized FY15 from the Nine Months Ended Adjusted EBITDA Reconciliation – KEMET

42 Adjusted Gross Margin – KEMET Non-GAAP (Amounts in thousands) Dec 31, 2014 Dec 31, 2014 Dec 31, 2014 Net Sales 201,310$ 629,484$ 839,312$ Gross Margin 44,468$ 123,180$ 164,240$ djustments: Plant start-up costs 1,144 3,905 5,207 Plant shut down costs - 889 1,185 Stock-based compensation expense 424 1,112 1,483 Inventory revaluation (927) 927 1,236 Adjusted Gross Margin 45,109$ 130,013$ 173,351$ Adjusted gross margin as a percentage of net sales 22.4% 20.7% 20.7% For the Quarter Ended For the Nine Months Ended Annualized FY15 from the Nine Months Ended

43 Adjusted Selling, General & Administrative Expenses – KEMET Non-GAAP (Amounts in thousands) Dec 31, 2014 Dec 31, 2014 Dec 31, 2014 Net Sales 201,310$ 629,484$ 839,312$ SG&A * 23,374$ 73,663$ 98,217$ Less adjustments: ERP int gration costs 671 1,975 2,633 NEC TOKIN investment-related expenses 485 1,552 2,069 Stock-based compensation expense 708 1,802 2,403 Adjusted SG&A 21,510$ 68,334$ 91,112$ Adjusted SG&A as a percentage of net sales 10.7% 10.9% 10.9% * Selling, general, and administrative expenses For the Quarter Ended For the Nine Months Ended Annualized FY15 from the Nine Months Ended

44 Adjusted Research and Development – KEMET Non-GAAP (Amounts in thousands) Dec 31, 2014 Dec 31, 2014 Dec 31, 2014 Net Sales 201,310$ 629,484$ 839,312$ Research and development 6,302$ 19,230$ 25,640$ Less adjustments: Stock-based compensation expense 99 271 361 Adjusted research and development 6,203$ 18,959$ 25,279$ Adjusted R&D* as a percentage of net sales 3.1% 3.0% 3.0% * Research and development For the Quarter Ended For the Nine Months Ended Annualized FY15 from the Nine Months Ended

45 Adjusted Operating Income – KEMET Non-GAAP (Amounts in thousands) Dec 31, 2014 Dec 31, 2014 Dec 31, 2014 Operating income 9,302$ 21,466$ 28,621$ Adjustments: Restructuring charges 6,063 9,581 12,775 Write down of long-lived assets - - - Stock-based compensation expense 1,232 3,184 4,245 ERP integration costs 671 1,975 2,633 Plant start-up costs 1,144 3,905 5,207 Plant shut down costs - 889 1,185 NEC TOKIN investment-related expenses 485 1,552 2,069 Net (gain) loss on sales and disposals of assets (574) (759) (1,012) Inventory revaluation (927) 927 1,236 Adjusted SG&A 17,396$ 42,720$ 56,960$ For the Quarter Ended For the Nine Months Ended Annualized FY15 from the Nine Months Ended

46 Adjusted Net Income (Loss) From Continuing Operations and Adjusted EBITDA – KEMET Non-GAAP (Amounts in thousands) Dec 31, 2014 Dec 31, 2014 Dec 31, 2014 Net income (loss) 2,914$ 5,704$ 7,605$ Adjustments: Restructuring charges 6,063 9,581 12,775 Equity (income) loss from NEC TOKIN (1,367) 76 101 Inventory revaluation (927) 927 1,236 Net (gain) loss on sales and disposals of assets (574) (759) (1,012) Write down of long-lived assets - - - Stock-based compensation expense 1,232 3,184 4,245 (Gain) loss on early extinguishment of debt (1,003) (1,003) (1,337) Professional fees related to financing activities 1,142 1,142 1,523 ERP integration costs 671 1,975 2,633 Change in value of NEC TOKIN options (2,500) (13,200) (17,600) Plant start-up costs 1,144 3,905 5,207 Plant shut down costs - 889 1,185 Net foreign exchange (gain) loss (1,257) (2,081) (2,775) NEC TOKIN investment-related expenses 485 1,552 2,069 (Income) loss from discontinued operations 164 (5,379) (7,172) Amortization included in interest expense 322 1,571 2,095 Income tax effect of non-GAAP adjustments 37 64 85 djusted net income (loss) 6,546$ 8,148$ 10,864$ Adjusted net income (loss) per share from continuing operations - basic 0.14$ 0.18$ 0.24$ Adjusted net income (loss) per share from continuing operations - diluted 0.13$ 0.16$ 0.21$ Adjusted EBITDA 27,199$ 73,101$ 97,468$ Weighted avg. shares - basic 45,407 45,360 45,360 Weighted avg. shares - diluted 52,228 52,549 52,549 For the Quarter Ended For the Nine Months Ended Annualized FY15 from the Nine Months Ended