Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - BioAmber Inc. | bioa-ex311_201412318.htm |

| EX-31.2 - EX-31.2 - BioAmber Inc. | bioa-ex312_201412317.htm |

| EX-32.1 - EX-32.1 - BioAmber Inc. | bioa-ex321_2014123110.htm |

| EX-21.1 - EX-21.1 - BioAmber Inc. | bioa-ex211_2014123112.htm |

| EX-10.67 - EX-10.67 - BioAmber Inc. | bioa-ex1067_20141231602.htm |

| EXCEL - IDEA: XBRL DOCUMENT - BioAmber Inc. | Financial_Report.xls |

| EX-23.1 - EX-23.1 - BioAmber Inc. | bioa-ex231_201412319.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

For the fiscal year ended December 31, 2014

OR

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

For the transition period from to

Commission file number: 001-35905

BioAmber Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

20-1579162 |

|

(State or other jurisdiction of incorporation) |

(I.R.S. Employer Identification No.) |

|

1250 Rene Levesque West, Suite 4110 Montreal, Quebec, Canada H3B 4W8 |

H3B 4W8 |

|

(Address of principal executive offices) |

(Zip Code) |

(514) 844-8000

(Registrant’s telephone number, including area code)

Securities Registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Name of Exchange on Which Registered |

|

Common Stock, par value $0.01 per share |

New York Stock Exchange |

Securities Registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

¨ |

Accelerated filer |

x |

|

|

|

|

|

|

Non-accelerated filer |

¨ (Do not check if a smaller reporting company) |

Smaller reporting company |

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of common stock held by non-affiliates of the registrant based on the closing price of the registrant’s common stock as reported on the New York Stock Exchange on June 30, 2014, was $155 million. As of March 13, 2015, there were 21,838,671 shares of the registrant’s common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement relating to its 2015 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Such Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. The statements contained in this Annual Report on Form 10-K that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Such forward-looking statements include any expectation of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; factors that may affect our operating results; statements related to adding employees; statements related to future capital expenditures; statements related to future economic conditions or performance; statements as to industry trends and other matters that do not relate strictly to historical facts or statements of assumptions underlying any of the foregoing. Forward-looking statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “will,” “plan,” “project,” “seek,” “should,” “target,” “will,” “would,” and similar expressions or variations intended to identify forward-looking statements. These statements are based on the beliefs and assumptions of our management based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below, and those discussed in the section titled “Risk Factors” included in Item 1A of Part I of this Annual Report on Form 10-K, and the risks discussed in our other Securities and Exchange Commission, or SEC, filings. Furthermore, such forward-looking statements speak only as of the date of this report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Forward-looking statements in this Annual Report on Form 10-K may include statements about:

|

• |

the expected funding sources of our planned Sarnia, Ontario plant and our other planned manufacturing facilities and the expected timing of the completion of construction and the start of commercial operations at each of these facilities; |

|

• |

our joint venture with Mitsui & Co. Ltd., or Mitsui; |

|

• |

our take-or-pay agreements with Vinmar International Ltd., or Vinmar, related to bio-based 1, 4 BDO and bio-succinic acid, and with PTTMCC Biochem for bio-succinic acid; |

|

• |

the expected applications of our products and the sizes of addressable markets; |

|

• |

our ability to gain market acceptance for bio-succinic acid, its derivatives and other building block chemicals; |

|

• |

the benefits of our transition from our E. coli bacterium to our yeast; |

|

• |

our ability to commence commercial sales and execute on our commercial expansion plan, including the timing and volume of our future production and sales; |

|

• |

the expected cost-competitiveness and relative performance attributes of our bio-succinic acid and the products derived from it; |

|

• |

our ability to cost-effectively produce and commercialize bio-succinic acid, its derivatives and other building block chemicals; |

|

• |

customer qualification, approval and acceptance of our products; |

|

• |

our ability to maintain and advance strategic partnerships and collaborations and the expected benefits and accessible markets related to those partnerships and collaborations; |

|

• |

our ability to economically obtain feedstock and other inputs; |

|

• |

the achievement of advances in our technology platform; |

|

• |

our ability to obtain and maintain intellectual property protection for our products and processes and not infringe on others’ rights; |

|

• |

government regulatory and industry certification approvals for our facilities and products; and |

|

• |

government policymaking and incentives relating to bio-chemicals. |

Overview

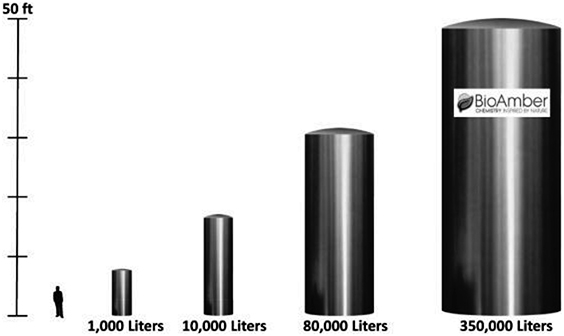

We are an industrial biotechnology company producing sustainable chemicals. Our proprietary technology platform combines industrial biotechnology and chemical catalysis to convert renewable feedstocks into sustainable chemicals that are cost-competitive replacements for petroleum-derived chemicals, which are used in a wide variety of everyday products including plastics, resins, food additives and personal care products. We currently sell our first product, bio-succinic acid, to customers in a variety of chemical markets. We intend to produce bio-succinic acid that is cost-competitive with succinic acid produced from petroleum at our facility under construction in Sarnia, Ontario. We produced our bio-succinic acid in a large-scale demonstration facility using a 350,000 liter fermenter in Pomacle, France, which we believe to be among the largest bio-based chemical fermenters in the world. We have produced approximately 3.5 million pounds, or 1,580 metric tons, of bio-succinic acid at this facility as of December 31, 2014.

Succinic acid can be used to manufacture a wide variety of products used every day, including plastics, food additives and personal care products, and can also be used as a building block for a number of derivative chemicals. Today, petroleum-derived succinic acid is not used in many potential applications because of its relatively high production costs and selling price. We believe that our low-cost production capability and our development of next-generation bio-succinic derived products including 1,4 BDO, which is used to produce polyesters, plastics, spandex and other products, will provide us with access to a more than $10 billion market opportunity. Combining these opportunities with other building block chemicals we are developing, such as adipic acid which is used in the production of nylons, we believe that our total addressable market is in excess of $30 billion.

We believe we can produce bio-succinic acid that is cost-competitive with succinic acid produced from oil priced as low as $35 per barrel, based on management’s estimates of production costs at our planned facility in Sarnia, Ontario and an assumed corn price of $6.50 per bushel. While we can provide no assurance that we will be able to secure corn at $6.50 per bushel given the fluctuations in corn prices, we believe this assumption is reasonable given the historic price of corn and management’s expectations as to their ability to manage the cost of glucose from corn and other inputs for our planned facility in Sarnia, Ontario. Over the past five years, the price of corn ranged from a low of $2.68 per bushel to a high of $8.44 per bushel. As of March 13, 2015, the spot price was $3.59 per bushel and the six month forward price was $3.88 per bushel. We estimate that a $1.00 increase or decrease in the per bushel price of corn would result in just a $0.054 per pound change in our variable cost of our bio-succinic acid. We expect the productivity of our yeast organism and on-going process improvements to further reduce our production costs. Our ability to compete on cost is not dependent on government subsidies or tariffs.

We are working to rapidly expand our accessible markets and product portfolio. We have entered into strategic relationships with several leading companies, such as our multi-year agreements with PTTMCC Biochem and Vinmar International Ltd., or Vinmar, for bio-succinic acid and Vinmar, for bio-based 1,4 Butanediol. We have also entered into agreements with LANXESS Inc., or LANXESS, Faurecia S.A., or Faurecia, NatureWorks LLC, or NatureWorks, and others for the development of derivatives of bio-succinic acid.

We have also entered into technology partnerships to lower our production costs, expand our product portfolio and enhance our biochemical production platform. For example, we entered into a technology partnership with Cargill through which we exclusively license a proprietary yeast organism for use in our fermentation process to produce our products. We refer to the yeast organism that we have licensed from Cargill as “our yeast.” We have also established other technology licenses and collaborations, including with DuPont, Evonik and Celexion.

Our business strategy is to leverage the value of our technology by building and operating production facilities around the world. However, depending on our access to capital and third-party demand for our technology, we may also enter into technology licenses on an opportunistic basis.

In order to support our growth strategy, we have begun to rapidly expand our manufacturing capacity. We have entered into a joint venture agreement with Mitsui & Co. Ltd. for our facility under construction in Sarnia, Ontario, which has an initial projected capacity of 30,000 metric tons of bio-succinic acid and could subsequently be expanded to produce another 20,000 metric tons of bio-succinic acid. The initial phase of the facility is expected to be mechanically complete in the second quarter 2015, and we began commissioning and start-up in March 2015. We expect this facility to be in commercial operation in the third quarter of 2015 and to be fully funded through equity contributions by both us, with a portion of the net proceeds of our recent equity offerings, and Mitsui, as well as a combination of government grants, interest-free and interest-bearing loans. We terminated production of our products at the large-scale demonstration facility in Pomacle, France at the end of 2014. Our joint venture with Mitsui also contemplates the potential construction and operation of an additional facility, which we expect to occur over the next three to five years.

1

On January 22, 2014, we entered into a 15 year take-or-pay contract for bio-based 1,4-Butanediol (BDO) with Vinmar, a privately held marketing, distribution, and project developed company headquartered in Houston, Texas. Under the terms of the master off-take agreement, Vinmar has committed to purchase 100% of the bio-based 1,4 BDO produced in a 100,000 metric ton per year capacity plant that we plan to build in North America and commission in 2018. Vinmar also plans to invest in the facility alongside us. While this agreement is binding, our inability to finance and construct the BDO plant would relieve Vinmar of its obligation to purchase BDO under the terms of the take-or-pay agreement. We signed a second take-or-pay agreement on July 3, 2014 with Vinmar to supply 10,000 tons of bio-succinic acid per year for 15 years from the Sarnia plant. The take-or-pay agreement also includes an expansion to the BDO facility previously announced of an additional 70,000 tons per year of bio-succinic acid, with Vinmar off-taking 70% of the bio-succinic acid produced for 15 years. Vinmar also commits to off-take 75% of the production from a new, third bio-succinic acid plant with 200,000 MT capacity that BioAmber plans to commission in 2020.

We are committed to managing our economic, social, environmental and ethical performance through continued sustainable business practices. We have completed a life cycle analysis for our planned facility in Sarnia that indicates that no carbon dioxide equivalent (or greenhouse gases) will be emitted per kilogram of our bio-succinic acid produced, making our process carbon neutral. This is significantly less carbon intensive than the current petrochemical process for making succinic acid, in which 7.1 kilograms of carbon dioxide equivalent are emitted per kilogram of succinic acid produced. This represents a 100% reduction in greenhouse gases for our bio-succinic acid process, relative to the current petrochemical process for making succinic acid. The life cycle analysis also indicates that our planned facility in Sarnia will consume 64% less energy than the current petrochemical process.

We were incorporated in the State of Delaware in October 2008 as DNP Green Technology, Inc. and were established as the result of a spin-off of certain assets from Diversified Natural Products, Inc. In September 2010, we acquired the 50% interest in our joint venture Bioamber S.A.S. that we did not already own, after which, Bioamber S.A.S. became wholly owned by us. Concurrent with this acquisition, the Company changed its name from DNP Green Technology, Inc. to BioAmber Inc. and changed its fiscal year end from June 30 to December 31. Bioamber S.A.S. had been wholly owned by the Company until its liquidation in December 2014.

Our Industry

The global chemical industry is a $4.1 trillion market, based on total global chemical shipments in 2012, according to the American Chemistry Council. Chemicals are utilized in a broad range of end-use markets, including heavy industry, mining, construction, consumer goods, textiles and healthcare. While there is significant ongoing process innovation and technological development in the broader chemicals industry, producers are still heavily reliant on petroleum-derived feedstocks. The following table lists five of the key chemical classes from two carbon, or C2, to six carbon, or C6, that are primarily being produced from fossil fuels today along with examples of derivative compounds and end-use applications.

|

|

C2 Ethylene |

C3 Propylene |

C4 n-Butane Butadiene |

C5 and greater Benzene/Toluene/Xylene |

|

Derivatives |

•Ethylene glycol •Polyethylene •PVC •Vinyl |

•Acrylic •Polypropylene |

•Maleic anhydride •Succinic Acid •1,4 BDO and THF |

•Adipic acid •Caprolactam •Caprolactone •Cyclohexane •Hexamethylenediamine (HMDA) •Hexanediol |

|

|

|

|

|

|

|

Applications |

•Anti-freeze •Building materials •Foam packaging •Plastic bags •Plastic films |

•Automotive components •Coatings •Packaging •Plastic parts •Textiles and fibers |

•Adhesives •Elastomers •Footwear •Synthetic rubber •Tires |

•Carpet fiber •Clothing •Nylon •Thread, ropes and netting |

Reliance on Petrochemicals

While the global chemical industry provides many value-added products to industrial and consumer end-markets, it is facing an increasing number of challenges as a result of its significant reliance on petroleum as its primary feedstock for the following reasons:

|

• |

A Finite, Non-Renewable Resource as its Primary Input. Chemical companies are heavily dependent on oil, a finite, non-renewable resource that is in growing demand, particularly from developing economies such as India and China. , Recent supply growth has been limited. Given the demand pressures on such a critical input, the purchasers of chemical have shown growing interest in finding cost-effective, renewable alternatives. |

2

|

• |

Hydrocarbon Feedstock Price Volatility. Crude oil prices have experienced significant price volatility over time. For example, during the last five years, the market price per barrel of West Texas Intermediate crude oil ranged from a low of $44.45 to a high of $112.93 and was $47.05 on March 12, 2015. As a result, we believe chemical companies are looking for more stable solutions. |

|

• |

Potential for Margins Pressure at Existing Petrochemical Facilities. Given the price volatility around crude oil, chemical companies are increasingly concerned about rapid raw material price increases driven by supply shortages in basic petrochemical inputs that could negatively impact their profit margins. Due to the nature of contracts with their customers, chemical companies often cannot pass-through rising raw materials costs to their customers quickly. |

|

• |

Reduced Supply of C4 Chemicals. In the past five years, there has been a 25% reduction in the supply of C4 chemicals due to the emergence of relatively inexpensive natural gas in certain geographies including shale gas in North America. In these geographies there has been a shift away from naphtha cracking to natural gas liquid cracking as a means of producing ethylene. As such, there is significantly less crude C4 fraction produced, which is a principal source of supply for C4 chemicals. Consequently, the shift to natural gas cracking has led to a drop in the supply of crude C4, a primary feedstock for C4 chemicals. This has led to increased volatility in the prices of C4 derived chemicals, including butadiene, maleic anhydride and 1,4 BDO. |

|

• |

Increasing Governmental Regulation. Increasing government regulation and climate change initiatives are driving up the cost of using high carbon emitting processes, such as chemical production via petrochemicals. The third phase of the European Union’s Emission Trading System when implemented is expected to more broadly cover petrochemical production activities, potentially increasing costs at European petrochemical plants. In addition to regulation of carbon emitting processes, the use of petrochemicals in certain products, such as plasticizers containing phthalates, are subject to increasing regulatory pressure. |

|

• |

Customer Demand for Renewable and Sustainable Products. Consumers are increasingly choosing renewable alternatives to products when available. As consumers become more aware of the environmental footprint of petroleum-derived products, they may shy away from less sustainable products in favor of readily available, non-petrochemical based alternatives, especially if these products are priced competitively. We believe that there is demand among certain players in the chemical industry for sustainable alternatives in order to differentiate themselves from their competitors. |

Biochemical Alternatives

We believe there is significant and growing demand for a low-cost and sustainable alternative to using petroleum for chemical production. Multiple biochemical processes have been developed to address this demand, primarily using microorganisms that can convert sugars derived from renewable feedstocks into various chemical building blocks including:

|

• |

Bio-succinic acid: A biologically produced, chemically identical replacement for petroleum-derived succinic acid that can be utilized to produce derivative products such as bio-based 1,4 BDO, and can substitute petrochemicals such as maleic anhydride, phthalic acid and adipic acid in a number of applications. Target end-uses for bio-succinic acid include plasticizers, polyurethanes, personal care products, resins and coatings, de-icing solutions, lubricants and food additives. |

|

• |

Bio-adipic acid: A biologically produced, chemically identical replacement for adipic acid. Target end-uses for bio-adipic acid include nylon fibers, resins, plasticizers, solvents and adhesives. |

Bio-succinic acid and bio-adipic acid are often referred to as “building block” chemicals because they can be converted into intermediate chemicals that are then used in the production of a wide array of consumer end-products. Bio-succinic acid is produced from renewable sugars in a carbon dioxide-sequestering process, which results in higher theoretical yields than other bio-based chemicals, as shown in the table below.

|

Chemical |

Theoretical Yield |

Kg Sugar Needed to Produce a Kg of Product |

|

Bio-succinic acid |

112% |

0.9 |

|

Lactic acid |

100% |

1.0 |

|

Bio-based 1,4 BDO via succinic acid |

85% |

1.2 |

|

1,3 Propanediol |

63% |

1.6 |

|

Adipic acid |

58% |

1.7 |

|

1,4 BDO via direct fermentation |

54% |

1.9 |

|

Ethanol |

51% |

2.0 |

|

Iso-Butanol |

41% |

2.4 |

|

Farnesene |

29% |

3.5 |

3

Bio-adipic acid is also produced from renewable sugars in a process that does not consume carbon dioxide, but is free of nitrous oxide emissions, which are a significant drawback of the petrochemical process. We produce bio-based succinic acid and we intend to produce bio-based 1,4 BDO via succinic acid and are also developing a bio-based route to adipic acid.

Despite their inherent benefits, there has not been a critical mass of bio-based chemical manufacturing facilities operating at sufficient scale to prove out the cost and quality necessary to compete with their petrochemical equivalents. We believe that if manufacturers of bio-based chemicals can produce at reduced costs compared to their petrochemical equivalents, the market for the bio-based chemicals could be significantly larger than it is today. The high cost of producing succinic acid from petroleum feedstock has limited its use. We believe there is a significant opportunity for bio-based chemical manufacturers who can reliably deliver product at scale, with the required specifications of potential customers and at a competitive cost.

Our Strengths

Our business benefits from a number of competitive strengths, including:

Proprietary Technology Platform that Addresses a Large Market Opportunity

Our proprietary technology platform integrates industrial biotechnology, and chemical catalysis to produce bio-based chemicals as cost-competitive, chemically identical replacements for petroleum-derived equivalents. We own or have exclusive rights to specific microorganisms, chemical catalysis technology and a scalable and flexible purification process that, when combined and optimized, convert renewable feedstocks into platform chemicals. We believe the strength of our platform, our intellectual property portfolio and our licensing agreements with Cargill, Celexion and DuPont will allow us to extend our chemical production beyond our current product, bio-succinic acid, to large markets including bio-based 1,4 BDO and bio-based adipic acid. We believe our bio-based chemicals can serve as “drop-in” replacements for existing petroleum-based chemicals in these markets. Together, these chemicals address what we believe to be an approximately $30 billion market opportunity.

Selling Commercial Product Today

We believe we were the first company selling bio-succinic acid in commercial quantities. Our customers utilize our product as a cost-competitive, sustainable alternative to the petroleum-based specialty chemicals they currently use in polymers, food additives and flavorings, bath salts, polyurethanes, pharmaceutical and other applications. Our ability to supply large scale quantities of bio-succinic acid allows our customers to develop new applications and initiate commercialization of their products.

Cost-Competitive Economics at Large Scale

Our experience operating the large-scale demonstration facility in Pomacle, France for five years helped us refine our process and make bio-succinic acid cost-competitively without subsidies. We expect to produce bio-succinic acid that is cost-competitive with succinic acid produced from oil priced as low as $35 per barrel, based on management’s estimate of input prices in Sarnia, Ontario and an assumed corn price of $6.50 per bushel. Through extensive research and development efforts relating to our bio-succinic acid production process, including pilot plant phase, process efficiency enhancements and scaling up our process to our current scale, we have been able to thoroughly address the operational complexities in our process. We believe that our experience operating at the large demonstration scale in France provided us with the know-how to efficiently design, build and operate our Sarnia facility currently under construction.

Limited Exposure to the Availability and Price of Sugar

Our process requires less sugar than other renewable products. We require approximately 50% less sugar to produce a pound of bio-succinic acid than is needed to produce a pound of ethanol (0.15 gallons), and even less sugar than is needed to produce a pound of several other bio-based chemicals. This makes our process less vulnerable to price increases in sugar, relative to other bio-based processes. This efficient use of sugar translates into reduced consumption. To produce $1 billion worth of bio-succinic acid and $1 billion worth of bio-based 1,4 BDO at current prices, we would require approximately 1.2 million metric tons of sugar. Even if the entire $2 billion worth of bio-succinic acid and bio-based 1,4 BDO were produced in North America, it would require only 6.0% of the sugar produced in existing corn wet mills. Given this modest demand and our ability to source sugar from a variety of sources, rapid growth in our production capacity would not likely have a material impact on the sugar markets from which we plan to source.

Established, Diverse Customer Base

Our leadership in bio-succinic acid technology, our product quality and the economics of our process are validated by the contracts we have signed with customers in a variety of end-markets. We have entered into two take-or-pay agreements for the Sarnia plant for the sale of 162,000 metric tons of bio-succinic acid over the next 15 years. We have also entered into supply agreements for

4

the sale of approximately 47,000 metric tons of bio-succinic acid and its derivatives until the end of 2017. These supply agreements typically obligate our customers, subject to certain conditions, to purchase 75% to 100% of their succinic acid needs from us, contingent on our ability to meet their price and other requirements. There are no penalties in the event these customers do not purchase or we do not supply them with bio-succinic acid in the projected purchase volumes indicated in the agreements.

Global Manufacturing Expansion Plan

We have signed a joint venture agreement with Mitsui to build and operate a commercial scale plant in Sarnia, Ontario, that is expected to produce bio-succinic acid. We commenced construction of this facility in 2013 and expect the facility to be mechanically complete in the second quarter of 2015. This facility has been designed to have an initial capacity of 30,000 metric tons of bio-succinic acid and could subsequently be expanded to produce another 20,000 metric tons of bio-succinic acid. Pursuant to the July 3, 2014 take-or-pay agreement with Vinmar, which expands the scope of our next plant to include 70,000 tons per year of succinic acid capacity in addition to the 100,000 tons per year of BDO capacity, we are re-evaluating the timing and eventual size of the Sarnia expansion. Since we expect our next plant to be in construction in 2016 and completed by early 2018, we may decide to focus our human and financial resources on the second plant and not simultaneously expand the Sarnia plant. We anticipate making a final decision in the second half of 2015.

Experienced Management Team with Strong Track Record

Our management team consists of experienced professionals, possessing on average over 25 years of relevant experience in scaling up, manufacturing and commercializing chemicals and bio-based products, gained at both large companies and entrepreneurial start-ups. Members of our senior management team have worked at companies including Abengoa, Cargill, DuPont, Dow Corning Corporation, Royal DSM N.V., Suncor, Sanofi and Tate & Lyle.

Our Strategy

Our goal is to be the leading provider of renewable chemicals by replacing petroleum-based chemicals with our bio-based alternatives, which we believe could revolutionize the global chemical industry.

Rapidly Expand Our Global Manufacturing Capacity

We operated a large-scale demonstration facility in Pomacle, France until December 31, 2014, and are building our first commercial facility in cooperation with Mitsui in Sarnia, Ontario. We expect this facility to be mechanically complete in the second quarter of 2015, and we began commissioning and start-up activities in March 2015. We plan to construct additional large-scale bio-based succinic acid facilities in multiple geographic regions employing a standardized design that facilitates expedient and capital-efficient growth. We expect to benefit from incremental cost reductions and further technological and engineering improvements at each additional facility. To further streamline production and reduce costs, we plan to integrate production and locate these facilities in proximity to required infrastructure and feedstock. We intend to retain operational control and a majority interest in these facilities and collaborate with third parties to obtain capital, construct the facilities, secure feedstock, sell future output and assist with manufacturing and market access.

Target the Large and Established 1,4 BDO Market

We intend to leverage our ability to produce high quality bio-succinic at low cost, as well as high value-added derivatives of bio-succinic, such as bio-based 1,4 BDO, which is used in the production of polyesters, plastics, spandex and other products. We have licensed technology from DuPont, which we believe will enable us to produce bio-based 1,4 BDO at a lower cost than alternative processes with equivalent purity. In January 2014 we announced our intention to build a 100,000 ton per year capacity bio-based 1,4-BDO plant in North America, which we plan to commission by early 2018. We have entered into a 15 year take-or-pay contract with Vinmar International Ltd. in which they will guarantee 100% off-take of bio-based 1,4 BDO from the 100,000 ton per year facility. We expect to benefit from Vinmar’s global logistics expertise and its experience selling large volumes of BDO and executing large chemical facility projects. We expect that Vinmar will invest alongside us in the planned North American facility, and Mitsui may also participate as a minority equity partner in the plant.

5

Develop Next-Generation Succinic-Derived Products

We intend to leverage our proprietary technology platform and expertise in the production of bio-succinic acid to target high value-added products such as bioplastics and plasticizers that can be made with succinic acid and replacements for silicone in personal care.

Continue to Reduce the Cost of Our Products

Our goal is to be the low-cost producer of the bio-based chemicals we manufacture. Our bio-succinic acid production process has high yields and benefits from our proprietary, low-cost purification. We believe that at our manufacturing facility under construction in Sarnia, Ontario, we will produce bio-succinic acid at a significantly reduced cost compared to the cost of other bio-based succinic acid processes and petroleum-derived succinic acid, according to our estimates of what the costs of the inputs will be at our facility in Sarnia. We have reduced our production costs by increasing the scale of our manufacturing process to realize economies of scale and by transitioning from an E. coli bacterium to a yeast licensed from Cargill.

Expand Product Platform to Additional Building Block Chemicals

We are working to expand our product portfolio to C6 building block chemicals including adipic acid, hexamethylene diamine (HMDA) and caprolactam. These products are used in the production of carpeting, rugs, textile laminations, garment linings, adhesives for shoe soles and resins used in the paper products industry. We expect to use our flexible technology platform to expand our product base, starting with bio-adipic acid, by leveraging our extensive experience developing, producing and marketing bio-succinic acid. We believe our technology platform, including an exclusive license to a biochemical pathway discovered by Celexion, an exclusive license to use Cargill’s proprietary yeast and our innovative purification process will provide us with a competitive advantage.

Our Products

Our bio-based specialty chemicals can be used in multiple end-markets and applications and can serve as key building blocks for a wide variety of products used every day. The table below sets forth, for both C4 and C6 chemicals, the development stage of each of the products we currently sell or are in our pipeline and typical applications for these products. The dollar amounts set forth in the table represent management’s estimates of the addressable market size for each of these products, which together represent a total addressable market in excess of $30 billion. Management’s estimates of the addressable market sizes are based on industry reports from the last five years, pricing information in the industry reports and from ICIS pricing, publicly available information, and management’s estimates of what portion of the total market size may be addressable through bio-succinic acid.

Market Opportunity

|

|

C4 Platform |

|

C6 Platform |

||||

|

|

Commercial |

Pre-Commercialization(1) |

|

In Development(2) |

|||

|

|

Bio-Succinic Acid |

1,4 BDO / THF / |

Polyesters made |

|

Adipic Acid |

Caprolactam |

HMDA |

|

Applications |

•Plasticizers •Polyurethanes •Personal care products •Resins and coatings/paints •De-icing and coolant solutions •Fine chemicals •Lubricants •Food additives |

•Elastomers •Engineering plastics •Shoe soles •Spandex •Solvents |

•Automotive interiors •Fibers and non-wovens •Food packaging •Plastic bags •Plastic cups •Organic composite boards |

|

•Carpets •Engineering plastics •Textiles and fibers |

•Carpets •Films •Textiles and fibers |

•Carpets •Engineering plastics •Polyurethanes •Textiles and fibers |

|

|

|

|

|

|

|

|

|

|

|

$4.0 billion |

$4.3 billion |

$2.0 billion |

|

$4.9 billion |

$10.7 billion |

$4.7 billion |

|

(1) |

“Pre-Commercialization” refers to products that have been produced at pilot scale and tested and for which the production process is in the process of being scaled up, with samples available for product testing and qualification. |

|

(2) |

“In Development” refers to products that have not yet been produced at the laboratory scale in adequate quantities to undergo testing. These are early stage research projects and no samples are expected to be available for at least two years. |

6

Bio-Succinic Acid

We chose to develop bio-succinic acid as our first product because it is a platform chemical that can be used in a broad range of markets, from high value niche applications such as personal care products and food additives, to large volume applications such as plasticizers, polyurethanes, resins and coatings. Bio-succinic acid is also unique in terms of the limited quantity of sugar that is needed for its production. In 2004, the DOE published a report on “Top Value-Added Chemicals from Biomass,” identifying the top opportunities for the production of chemicals from biomass. The study prioritized twelve chemicals, from a group of over 300 possible building blocks that could be most effectively manufactured from sugars. Bio-succinic acid was recognized as one of the renewable building block chemicals with the greatest technical feasibility and commercial potential.

We have identified three main market opportunities for our bio-succinic acid platform:

|

• |

First, we intend to replace petroleum-based succinic acid in applications where it is currently in use, such as food additives and fine chemicals, where the “natural” aspect of bio-based succinic acid adds value to these applications and drives greater market demand. |

|

• |

Second, we intend to expand into new applications for succinic acid, such as phthalate-free plasticizers, silicone replacements and bioplastics such as PBS, using application development and technical support to demonstrate performance advantages as well as health and environmental benefits of products made with bio-succinic acid compared to the petrochemicals currently being used for these applications. |

|

• |

Third, we intend to convert bio-succinic acid to bio-based 1,4 BDO, THF and gamma-butyrolactone, or GBL, which are large volume, existing markets accessible to our “drop-in” bio-based alternatives. These chemical intermediates are used to produce polyesters, plastics, spandex and other products. |

Historically, the high cost of producing succinic acid from petroleum feedstock limited its use to a narrow range of applications such as pharmaceuticals and food ingredients. As a result, based on 2011 estimates, the market for petroleum-based succinic acid is approximately 51,000 metric tons per year, representing a market size of approximately $350 million. However, market research firms and consultants have predicted that manufacturing bio-succinic acid will make succinic acid economically feasible for use in greater volumes across a spectrum of new applications. A study published in May 2012 by Nexant projects that the global market for succinic acid will be 424,000 metric tons in 2016, representing a compounded annual growth rate in excess of 50% between 2010 and 2016. A study published in August 2012 by Roland Berger, a consulting firm, projects that the succinic acid market will grow at a compounded annual growth rate of between 25% and 30% through 2020, when the global market size is expected to be between 500,000 and 700,000 metric tons. We have entered into two take-or-pay agreements for the Sarnia plant for the sale of 162,000 metric tons of bio-succinic acid over the next 15 years. We have also entered into supply agreements for the sale of approximately 47,000 metric tons of bio-succinic acid and its derivatives until the end of 2017. These supply agreements obligate our customers to exclusively fulfill 75% to 100% of their needs for bio-succinic acid from us, contingent on our ability to meet their price and other requirements; however, there are no penalties in the event they do not purchase or we do not supply them with bio-succinic acid in the projected purchase volumes indicated in the agreements.

We are currently focused on the following applications for bio-succinic acid, listed in descending size of the addressable markets:

|

• |

Plasticizers. Plasticizers are organic esters that are primarily used to render polyvinyl chloride, or PVC, more flexible. PVC is widely used in multiple end-markets because it is low cost, durable and versatile. Bio-succinic acid esters can serve as replacements for the major phthalate-based plasticizers, which account for over 80% of the worldwide plasticizer market. There is increasing demand for renewable, phthalate-free plasticizers, particularly in sensitive applications such as children’s toys and childcare articles. We entered into a joint development agreement with Lanxess, a global leader in phthalate-free plasticizers, to develop a portfolio of bio-succinic-based phthalate-free plasticizers that can exceed the performance of general purpose plasticizers at competitive prices. Lanxess has begun to market a range of succinic acid based plasticizers, under the Uniplex brand. These succinic acid based plasticizers have been tested by Solvin, a division of Solvay and one of the world’s leading producers of PVC, and they achieved positive results that collectively outperformed existing phthalate alternatives. While the global market for plasticizers exceeds $30 billion, we believe the addressable market for phthalate-free plasticizers is approximately $1.5 billion. |

|

• |

Polyurethanes. Succinic acid, and to a greater extent adipic acid, are currently used in polyester polyols, which are used to make polyurethanes. Polyurethanes are used in, among other things, soles for footwear, molded foams for automotive applications like car seats and arm rests, and non-foam applications such as coatings, adhesives and sealants. Bio-succinic acid can be used to replace adipic acid in this market and is currently the only renewable alternative to adipic acid for the production of polyurethanes. Suppliers of polyester polyols are actively looking for bio-based, cost-effective substitutes for adipic acid to improve the environmental profile and reduce the cost of their products. Some of the largest producers in Western Europe and North America have tested and validated our bio-succinic acid as a replacement for adipic acid in polyester polyols. Due to our first mover advantage, low cost of production and strong relationships with key customers, we believe we will be able to capture a significant portion of the market for bio-succinic acid in polyurethanes. We believe the addressable market for polyurethanes exceeds $1 billion. |

7

|

• |

Personal Care Products. Our initial focus in the personal care market has been the use of esters of bio-succinic acid as natural emollients and surfactants. Emollients are used in lotions, liquid soaps and cleansers to improve and moisturize skin, while surfactants are used in soaps, body washes and shampoos to allow easier spreading. We believe there is a significant opportunity for bio-based alternatives as consumers are increasingly demanding renewable products and ingredients in the personal care products they use including the replacement of silicone based ingredients in shampoos and other products. We believe the addressable market for succinic acid and succinate esters in the personal care industry is approximately $500 million. |

|

• |

Resins and Coatings. Bio-succinic acid can be used to replace adipic acid in polyester coating resins, powder coatings, unsaturated polyester resins, or UPR, and polyester polyols used in urethane surface coatings. Bio-succinic acid can also replace, or be used in conjunction with phthalic anhydride in UPR and alkyd resins. Bio-succinic acid offers performance equivalent to petroleum-based raw materials, as well as environmental advantages and cost-effectiveness. We believe the addressable market for resins and coatings exceeds $500 million. |

|

• |

Food Additives. Succinic acid is currently used for its multiple functions in food applications; as an acidulant, to increase the tartness or acidity of food, as a pH regulator for food ingredients, and as a flavoring agent. The unique ‘umami’ flavor of succinic acid gives a salty, soy-like taste to food and is used in the production of soy sauce, miso, sake and synthetic liquors in Asia. Outside of Asia, succinic acid is primarily used in the baking industry. Succinic acid can also be used to replace malic acid, which provides a bitter salty taste similar to succinic acid, and adipic acid that is used as a flavor in fruit drinks and as a gelling aid for gelatin desserts. Initially, we are targeting existing succinic acid applications, but we believe our bio-succinic acid will rapidly expand succinic acid’s portion of the overall flavors and food ingredients market as a natural alternative. We believe the addressable market for food additives is approximately $200 million. |

|

• |

Lubricants. Adipate esters are widely used in the lubricants market as base oils or as additives to form industrial lubricants and metal-working fluids. Bio-succinic acid is capable of replacing adipate esters and producing sustainable succinate esters that meet the demand for more environmentally friendly, non-toxic lubricants. We are working with third parties to assess our bio-succinate esters and accelerate market penetration. To date, our bio-succinate esters have performed well in product testing, showing improved flowability in cold temperatures and better prevention of oxidation, rust and corrosion. We believe the addressable market for lubricants exceeds $100 million. |

|

• |

Fine Chemicals. Succinic acid is used today in a variety of high value added applications including dyes, inks, and toners. Succinic acid is also used in pharmaceutical applications. Derivatives of succinic acid such as succinimides can provide multiple functions in pharma applications, such as a pH buffer, an antibacterial or chelating agent, a coatings/sizing agent, or as a stabilizer for other ingredients. We believe the addressable market for fine chemical applications exceeds $100 million. |

|

• |

De-icing Solutions. Chlorides are the most commonly used de-icer for roadways. Potassium salts are typical non-chloride de-icers used for roadways as well as airport runways and other surfaces. We have developed a patented bio-succinic acid-based de-icer formulation for use on airport runways. Our bio-based product is significantly less corrosive than potassium acetate and potassium formate. We are also developing bio-succinic acid based products as wetting agents for chlorides in the larger roadway market, which can reduce the corrosiveness of the chlorides applied. We believe the addressable market for de-icing solutions exceeds $100 million. |

|

• |

Other Markets. Other applications of bio-succinic acid that are currently being developed and tested by potential customers and partners include anti-freeze solutions, coolants solvents, water treatment chemicals, effervescence agents such as laundry tablets and bath salts, artificial leather products and foams made with recycled polyethylene terephthalate (PET). |

Our Product Pipeline

Derivatives of Bio-Succinic Acid

Succinic acid can be used to produce 1,4 BDO, THF and GBL. Succinic acid is also a monomer used to produce certain polyesters, including PBS. We are actively targeting these derivatives of bio-succinic acid, which offer large existing drop-in markets to broaden our addressable market and maximize the value of our technology.

1,4 Butanediol (1,4 BDO)

The major uses of 1,4 BDO are in the production of THF and polybutylene terephthalate, or PBT. THF is used to produce spandex fibers and other performance polymers, resins, solvents and printing inks for plastics. PBT is an engineering-grade thermoplastic that combines excellent mechanical and electrical properties with robust chemical resistance. The automotive and electronics industries heavily rely on PBT to produce connectors, insulators, wheel covers, gearshift knobs and reinforcing beams. We believe there is also growing demand in the automotive industry to produce PBT and blends that are partially bio-based to enable

8

automobile manufacturers to meet their sustainability goals. There is also growing demand in the apparel industry for renewable, bio-based spandex. In 2010, we licensed DuPont’s hydrogenation catalyst technology to make bio-based 1,4 BDO and bio-THF from our bio-succinic acid. We have been working with several third parties to validate the technology performance. We believe the addressable market for 1,4 BDO and THF exceeds $4.3 billion.

Gamma-Butyrolactone (GBL)

The hydrogenation catalyst technology we license from DuPont can also convert our bio-succinic acid into bio-based GBL. GBL is used to produce a number of value added specialty chemicals, including 2-pyrrolidone, N-methyl pyrrolidone and N-vinyl pyrrolidone. Pyrrolidones are generally produced from the reaction of GBL with amines. GBL and the pyrrolidones have wide use as solvents in applications from extraction solvents in petroleum processing to surface coatings. These materials are also intermediates used in the manufacture of pharmaceuticals, fine chemicals and agrochemicals. Poly-vinyl pyrrolidone, or PVP, polymers are used in pharmaceuticals, food, agrochemicals, cosmetics and personal care and detergent applications. We believe the addressable market for GBL is approximately $900 million and the pyrrolidones market is approximately $1 billion.

Succinic Acid Based Polyesters

Succinic acid can be reacted with different alcohols to produce polyesters. Polybutylene succinate, or PBS, is one such polyester. PBS is a biodegradable polymer made by reacting succinic acid with 1,4 BDO. The market for this biopolymer is currently limited by capacity and price, and the fact that it has traditionally been made with petroleum-derived succinic acid and 1,4 BDO. Applications range from single use in food service ware, including cutlery, cups and lids, agricultural mulching film and compostable bags. Our bio-succinic acid enables PBS to be lower cost and partially renewable, and upon commercialization, we expect our bio-based 1,4 BDO will enable PBS to be 100% bio-based. We believe that this will drive PBS market growth beyond current applications to include paper coating, food packaging, fibers and non-wovens, and durable applications including automotive interiors, consumer goods and household appliances. We are the exclusive supplier of bio-succinic acid to Mitsubishi Chemical, which they use to produce partially bio-based PBS.

PBS can be used in combination with other biopolymers such as PLA, PHA and poly(3-hydroxybutyrate-co-3-hydroxyvalerate), or PHBV, and with petrochemical polymers such as polypropylene, polystyrene and polycarbonate. These combinations, known as blends, combine the properties of the polymers that are being mixed and can lead to specific properties and performance that are being sought by customers. PBS composites are compounds in which PBS is filled with fibers (such as natural fibers, glass fibers or carbon fibers) or fillers (such as wood flour or starch). Blends and composites can alter properties such as stiffness, mechanical resistance and density, and lead to more cost-effective solutions. Potential applications include automotive interiors, non-wovens (such as disposal hygiene products), construction materials, consumer goods and appliances. We believe the potential addressable market for succinic acid based polyesters, including PBS, along with polyester and composites is approximately $2 billion.

C6 Building Block Chemicals

We expect to use our flexible technology platform, including our partnership with Celexion and our exclusive rights to the Cargill yeast, to expand our product base to C6 building block chemicals, starting with bio-adipic acid, by leveraging our extensive experience developing, producing and marketing bio-succinic acid. We also plan to produce bio-based caprolactam, bio-based hexamethylenediamine, bio-based hexanediol and bio-based caprolactone.

Adipic Acid

Adipic acid is primarily used in the production of Nylon 6,6 fibers, plastics and resins. Nylon fibers are used in carpeting and rugs, nylon plastics are used in molding and extrusion applications and nylon resins are used mainly for injection molding in automotive and electrical applications, as well as for hardware, appliance and machine parts. We believe the addressable market for adipic acid exceeds $4.9 billion.

Caprolactam

Caprolactam is an intermediate used in the production of Nylon 6, a major engineering plastic. Nylon 6 finds significant use in film and wire and cable insulation, as well as in automotive applications like intake manifolds, previously made with aluminum ingots, replaced by plastics such as Nylon 6 in order to reduce weight and obtain flexibility of design. We believe the addressable market for caprolactam is approximately $10.7 billion.

9

Hexamethylenediamine (HMDA)

Our C6 Platform also offers a proprietary route to bio-HMDA, which is an intermediate used to produce Nylon 6,6. Nylon 6,6 polymer is principally converted into fibers, with the remainder going into Nylon 6,6 plastics used in molding and extrusion applications, primarily in automotive applications such as exterior body components, under-the-hood components, and some mechanical components. Other Nylon 6,6 resin applications include electronics, film and extrusion coatings. A major use of Nylon fibers is in carpeting and rugs. We believe the addressable market for HMDA exceeds $4.7 billion.

Our Commercial Strategy and Partnerships

Existing Markets for Succinic Acid

For the past five years we have been sampling and qualifying our bio-succinic acid among existing purchasers of succinic acid. Our initial focus was to identify customers that valued natural, bio-based succinic acid, and to sign them to long-term supply agreements. The figure below illustrates the existing markets and applications we have targeted with this product. The use of succinic acid in these markets and applications is already well-established.

We sold bio-succinic acid to 42, 37 and 19 customers in 2014, 2013 and 2012, respectively. During the year ended December 31, 2014, 47% our sales were to International Flavor and Fragrances, Inc., or IFF, Brenntag AG, or Brenntag and Olon Italy. During the year ended December 31, 2013, 64% our sales were to IFF, and Brenntag.

10

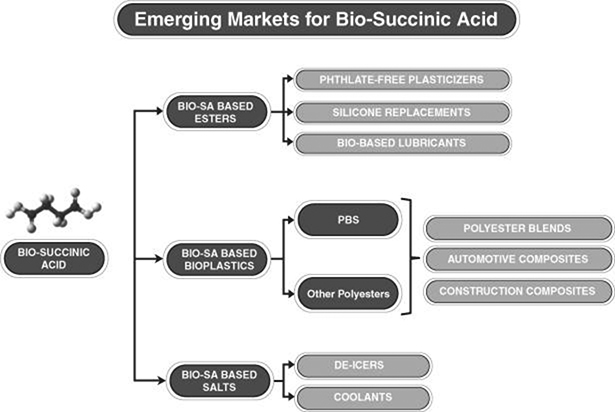

Emerging Markets for Bio-Succinic Acid

Beyond the established markets for succinic acid, we have been working with third parties in a number of applications to expand the use of bio-succinic acid. These partnerships are currently immaterial to our financial results and many of these partnerships are in the early stages—in most cases pursuant to non-binding letters of intent—so we can provide no assurances as to the timing or amount of commercial sales that may result from these partnerships, if any. We have and intend to continue to utilize collaborations in an effort to secure development expertise, intellectual property, market access and commercialization capabilities, in an effort to establish barriers to entry for our competitors and accelerate market uptake of our bio-succinic acid. The figure below illustrates the emerging markets for bio-succinic acid that we have targeted. We believe our collaboration strategy for these markets provides us with a cost-effective approach to expanding our addressable markets while capitalizing on our first-mover advantage for bio-based alternatives.

Bio-Succinic Acid Based Esters

Phthalate-Free Plasticizers. Plasticizers are softeners that are primarily used in PVC and other plastics to make these materials more flexible. Most plasticizers are phthalate-based, and phthalates have been identified as a possible health risk. We have partnered with a leader in phthalate-free plasticizers and have jointly developed bio-succinic acid-based plasticizers that are both renewable and phthalate-free. We have developed a portfolio of succinic acid based plasticizers, which our partner is now sampling to the marketplace and actively promoting. We have also been working with a leading producer of PVC, which has tested our succinic acid based plasticizers and found them to collectively outperform existing phthalate alternatives.

Silicone Replacements. Silicone replacements are used across all segments of the personal care market, including skin care, hair care (shampoos), antiperspirants and deodorants, as well as color cosmetics. In the past, attempts by third parties to develop silicon replacements have generally resulted in the need to compromise performance. We have been collaborating with a specialty ingredients company and have jointly developed bio-succinic acid based esters that are effective silicone replacements without compromising performance. We are jointly marketing these natural silicone replacements with our partner, which has begun to commercialize a range of bio-based silicone replacements to the personal care industry.

Bio-Based Lubricants. We have been collaborating with a manufacturer of lubricant formulations to develop formulations containing bio-based succinate esters to be used as a substitute for conventional petroleum-based lubricants. Pursuant to this collaboration, we are developing a range of succinic acid based esters that are renewable and testing a range of esters for lubricant applications. The lubricant manufacturer is currently seeking to complete the development and testing of these formulations and we

11

will jointly own the intellectual property rights related to the formulations and we expect to jointly commercialize successful formulations.

Bio-Succinic Acid Based Bioplastics

Bio-Based PBS/PLA Resins for Food Service Applications. We have partnered with a leading producer of polylactic acid (PLA), a biodegradable polyester. We have been jointly developing and bringing to market a new family of bio-based compounded PBS/PLA resins, which are initially designed for food service applications.

Bio-Based PBS for the Automotive Industry. We have been collaborating for several years with a leader in automotive interiors. The goal of the collaboration was to develop succinic acid based polyesters that could be combined with natural fibers and other proprietary ingredients into lightweight composites that could be used to make injected molded parts for automobile interiors. The automotive parts company intends to commercialize this technology and has established a partnership with Mitsubishi Chemical, whereby we will supply bio-succinic to Mitsubishi Chemical and the automotive parts company will source PBS from Mitsubishi Chemical for the subsequent manufacture of its proprietary composites.

Organic Composite Boards. We have been collaborating with a sustainable construction products designer and manufacturer to incorporate succinic acid polyesters into organic composite boards. These boards could replace medium density fiberboard, offering superior strength without formaldehyde. We have signed an exclusive supply agreement whereby we supply the composite board company with succinic acid based polyester, which we source from Mitsubishi Chemical.

Bio-Succinic Acid Based Salts

De-icers. We have been working with a company engaged in the development and marketing of chemical solutions, to develop an innovative bio-based airport runway de-icer, which we expect will be commercialized through our collaborator’s existing marketing channels. We have also entered into a collaborative arrangement with a company engaged in the development, production and sale of deicer formulations, to develop formulations based on our proprietary succinate salt compositions to be used as a bio-based, non-toxic and biodegradable deicers for roadway, consumer and windshield washer applications. We will supply the bio-succinic acid and jointly own with our partner the intellectual property rights related to the formulations. We intend to work together to commercialize successful formulations.

Heat Transfer Fluids. We are collaborating with a leading manufacturer and distributor of oenological products, to develop a formulation based on succinate salts to be used as a heat transfer fluid in the production of wines. Our collaborator is completing the development and testing of such formulation based on the succinate salts, and, if the development of the formulation is successful and our collaborator commercializes the formulation, we expect to enter into a supply agreement with our collaborator for a five year period governing the sales of bio-based succinic acid or the salts. We will also jointly own the intellectual property rights related to the further development made on these salts.

Other Succinic Acid Based Polyesters. In addition to our work on PBS, we have explored succinic acid in combination with other alcohols and monomers. We are evaluating the performance of these polymers in broad applications such as automotive, adhesives and packaging. These materials are complimentary to PBS and we believe the addressable market for all succinic acid based polyesters, blends and composites, is approximately $2 billion.

12

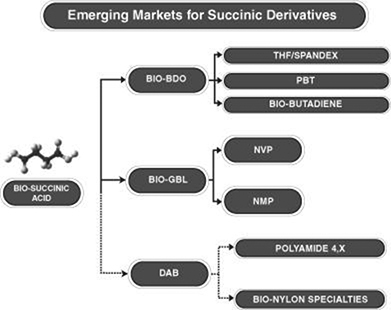

Existing Markets for Derivatives of Bio-Succinic Acid

In an effort to expand the addressable markets for our bio-succinic acid, we secured catalyst technology from DuPont in 2010 that allows us to convert our bio-succinic acid into “drop-in” 1,4 BDO, THF and GBL, which together represent existing chemical markets with annual sales in excess of $4.3 billion. We subsequently established an exclusive partnership with Evonik, a global leader in catalyst development, to optimize the DuPont catalysts and further improve their performance and economics. Since then, we have established several relationships with the goal to commercialize value-added derivatives of 1,4 BDO, THF and GBL. The figure below illustrates value-added derivatives we have targeted.

Bio-Based 1,4 BDO

Spandex. We have established a collaboration with a global leader in the manufacture and distribution of spandex fibers, and our collaborator has tested our bio-based 1,4 BDO in the production of bio-spandex. We are currently assessing opportunities for joint production of bio-based 1,4 BDO, from which our collaborator would off-take a portion of the BDO produced for its bio-spandex needs.

Polyesters including PBT. We have been collaborating with several manufacturers of PBT, a heat resistant polymer used widely in automotive and electronic applications. We expect to sell our bio-based 1,4 BDO to these companies for the subsequent manufacture of bio-based polyesters.

Butadiene. Butadiene is used in the production of synthetic rubber and we estimate that the market for butadiene is approximately $14.5 billion. However, we do not believe that in the current environment of low oil prices and relative low butadiene prices that BDO is a cost effective feedstock for making butadiene.

N-Vinyl-Pyrrolidone (NVP)

NVP is used in the production of specialty polymers. We have established a collaboration with a specialty chemicals company to develop a new technology that would allow the production of a bio-based NVP from our bio-succinic acid. Our collaborator has identified a large addressable market for NVP in oil and gas drilling, using proprietary technology. The collaboration involves a three-phased development program with the goal of constructing a large-scale plant to produce NVP products using jointly developed NVP technology.

13

Diaminobutane (DAB)

1,4 Diaminobutane, or DAB, is an intermediate used in the production of Nylon 4,6 and other high performance polyamides. These materials have a higher crystallinity and temperature performance than Nylon 6,6 and can be injection molded and extruded into fibers, tubes, and hoses. They are used in components for computers, mobile phones and personal electronics as well as in electrical applications such as connectors, circuit breaker housings, micro-switches and electric motor parts. We are in discussion with several potential partners that are producers of high performance polyamides. We believe the addressable market for DAB is approximately $500 million.

Our Technology

Our proprietary technology platform combines commercial scale industrial biotechnology and chemical catalysis to convert renewable feedstocks into chemicals that are cost-competitive replacements for petroleum-derived chemicals. We are developing three distinct technologies:

|

• |

the production of succinic acid through fermentation; |

|

• |

the conversion of succinic acid into 1,4 BDO, THF and GBL by catalyst assisted hydrogenation reaction; and |

|

• |

the production of adipic acid and other C6 chemical intermediates through fermentation and purification with or without catalytic conversion. |

Succinic Acid Production

Our process is based on the fermentation of sugar using a proprietary yeast organism to produce bio-succinic acid. Following separation and purification, bio-succinic acid, in its finished form, is a white crystal that physically resembles table salt. Two ways to produce bio-succinic acid through fermentation are using a bacterium, such as E. coli, or using yeast. Our process initially used E. coli, however, we have transitioned to yeast. We have been using a proprietary E. coli bacterium that is under exclusive license from entities funded by the DOE. From 2005 to 2010, we scaled up our proprietary E. coli technology in a series of steps, from a 1,000 liter fermenter in 2005, moving to a 10,000 liter fermenter in 2007, and an 80,000 liter fermenter in 2008. From 2010 until the end of 2014, we produced bio-succinic acid in a 350,000 liter fermenter located in a toll manufacturing facility in Pomacle, France.

One disadvantage of using bacterium like E. coli is that bacterium produce succinic acid in a salt form as opposed to an acid form. This has two negative consequences: (1) it requires energy to acidify the succinic acid (split the salt); and (2) it generally leads to additional processing steps, which in turn lead to higher capital and operating costs. Another disadvantage of bacterium relative to yeast, is the risk of contamination that can significantly reduce fermentation performance. E. coli are also limited in terms of fermenter size relative to yeast due to sensitivity to pH, agitation, process disruption and contamination.

Given the limitations of E. coli described above, in 2010 we signed a license with Cargill granting us exclusive rights to their yeast platform for the production of bio-succinic acid that could offer lower capital costs and lower operating costs. Cargill had developed a proprietary yeast host that is very robust and capable of thriving in harsh fermentation conditions, including high tolerance to organic acids such as succinic acid, good tolerance to low pH, physical robustness to heat, agitation and processing, high glycolytic rates and the ability to grow in a simple medium with inexpensive nutrients. Cargill has a patent portfolio to protect its yeast platform.

We worked with Cargill for over three years to develop our yeast and reached the final development milestone in the fall of 2013. Working with Cargill, we sequentially scaled up our yeast at the 20 liter, 600 liter, 2,000 liter and 180,000 liter scale, and we have seen the same performance (measured as succinic acid production over time) for our yeast at each successive size of fermenter. We have also validated the production process we plan to run in Sarnia, Ontario both at small-scale and at the large-scale demonstration facility in Pomacle, France. We have seen that the succinic acid we produce with our yeast offers improved quality compared to succinic acid produced using our E. coli bacterium, with fewer impurities.

The figure below summarizes the performance of a production strain of our E. coli bacterium, an earlier development strain of our yeast, and a production strain of our yeast that we have developed for use at our facility in Sarnia, Ontario. The figure also highlights the improved general performance of yeast relative to E. coli bacterium.

14

The development strain of our yeast was engineered and tested at small scale in the fall of 2012, while the production strain of our yeast was engineered and tested at small scale in early 2013. Both strains were tested in the large scale demonstration facility in Pomacle, France in the first quarter of 2013. The dotted line in the graphic below indicates the succinic acid concentration that was originally targeted for the commercialization of our yeast.

In the fall of 2013 we announced that we had achieved the final milestone of our yeast joint development program with Cargill. Our yeast had met the performance targets that we set out when we initially licensed the technology, and was ready for commercial use. The Sarnia plant under construction has been designed to operate with this yeast.

Our yeast produces succinic acid at a low pH, so that there is very little base added during the fermentation. This results in reduced energy consumption and a simplified purification process. Yeast also gives us the ability to use larger, less complex fermenters relative to E. coli, leading to significantly lower capital intensity. Our Sarnia plant has been designed to operate the yeast. We are continuing to make improvements to our yeast to further improve its performance and reduce the cost of production and the capital intensity of future plants.

1,4-BDO / THF / GBL Production

We utilize catalyst technology licensed from DuPont to transform our bio-succinic acid into bio-based 1,4 BDO, bio-THF and bio-GBL. The process involves passing bio-succinic acid and hydrogen gas into a fixed bed reactor over a heterogeneous catalyst, converting the bio-succinic acid into a mixture of bio-based 1,4 BDO, bio-THF and GBL, followed by distillation to separate, purify and recover the bio-based 1,4 BDO, bio-THF and bio-GBL. The relative concentrations of these three products can be modified by adjusting the reaction conditions.

We have partnered with Evonik, a world leader in catalyst manufacturing, to scale up the catalyst compositions under license from DuPont using bio-succinic acid as a starting material. Evonik is assisting us in the optimization of the catalyst and its manufacturing scale-up. It is important for catalyst production to be scaled-up in parallel to the scale-up of the 1,4 BDO process, to ensure that adequate catalyst is available at an acceptable cost. In the spring of 2012, we produced several tons of 1,4 BDO and THF at a toll manufacturing facility in Germany, using bio-succinic acid produced in our French demonstration plant and a catalyst produced by Evonik. The bio-based 1,4 BDO we produced was sent to over 20 potential customers. These companies found the purity to be equivalent to petroleum derived 1,4 BDO and they were able to successfully produce their products (PBT, polyurethanes) with our bio-based 1,4 BDO.

15

Adipic Acid and Other C6 Intermediates

We have licensed worldwide, exclusive rights to a metabolic pathway that transforms sugar into a family of value-added products, including adipic acid, caprolactam, HMDA, caprolactone and hexanediol. The patents covering this pathway have been issued in the United States and Europe and are pending in a number of other jurisdictions. We believe this pathway has the advantage of offering a good yield on sugar, relative to alternative routes to these products, and having several products that can be derived from a common pathway.

We are currently focused on the development of adipic acid, which allows us to leverage our experience in producing and scaling up succinic acid, including our experience with our yeast. We have secured an exclusive, worldwide license from Cargill to use their proprietary low pH yeast platform to produce adipic acid.

Technology Partnerships

We have developed our succinic acid, BDO/THF/GBL and C6 platforms through open innovation—using partnerships and licenses to access the best available technologies, facilities and know-how. We have complemented these third party contributions with in-house development efforts, integrating the whole into competitive platforms. The use of open innovation has reduced the capital and operating costs of development and accelerated our development efforts. This approach to technology development contributed to our winning the 2011 ICIS Innovation Award, which recognized our use of open innovation to develop our succinic acid platform. Our principal technology partnerships are summarized below.

ARD

In September 2010, we entered into two agreements with Agro-Industrie Recherches et Développements, or ARD, to cover a two-part consecutive plan for our exclusive use of the large-scale demonstration facility in Pomacle, France. These agreements ended at the end of 2014. Under the first agreement we developed a work plan with ARD to improve the manufacturing efficiency of the French demonstration plant, improve the purity and quality of the product, meet certain target usage factors and implement quality control procedures. We compensated ARD for labor costs, the full cost of producing successful batches of bio-succinic acid and the partial cost of lost batches. Once these objectives were met, we entered into a toll manufacturing agreement pursuant to which we retained ARD to produce succinic acid in this facility exclusively. During the course of this agreement, we compensated ARD per metric ton of product, a price that was calculated by multiplying the cost of raw materials and utilities by agreed quantities consumed per metric ton of succinic acid produced. We also paid labor fees and half of any additional capital investments and equipment leasing. We exercised options to renew the toll manufacturing agreement for three successive six-month periods ending December 31, 2014. Pursuant to the renewal terms, we secured 60% of the capacity at the large-scale demonstration facility in Pomacle, France and paid, in addition to the variable and labor costs that we had been paying to date, a portion of the annual depreciation of the plant. As planned, the toll manufacturing agreement ended in December 2014 and we ceased to have access to the demonstration plant. We have built up sufficient inventory levels so that we can manage the transition from the French toll production to manufacturing in our Sarnia facility, which we expect to be in mechanically complete in the second quarter of 2015.

Cargill