Attached files

| file | filename |

|---|---|

| EX-99 - mcgregor power systems | ex6.htm |

| EX-99.2 BYLAWS - mcgregor power systems | ex32bylaws.htm |

| EX-14 - mcgregor power systems | ex14ethics.htm |

| EX-5 - mcgregor power systems | ex5opinion.htm |

| EX-99.1 CHARTER - mcgregor power systems | ex31articles.htm |

| EX-23 - mcgregor power systems | ex23.htm |

| EX-10 - mcgregor power systems | ex10.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MCGREGOR POWER SYSTEMS, INCORPORATED

(Exact name of registrant as specified in its charter)

|

Delaware |

3585 |

20-5572576 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

4426 N 21st St.

Ozark, MO 65721

Telephone: 417-207-3249

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Michael McGregor Brown

Executive Chairman and Chief Executive Officer

MCGREGOR POWER SYSTEMS

4426 N 21st St.

Ozark, MO 65721

Telephone: 417-207-3249

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

Accelerated filer |

|

Non-accelerated filer (Do not check if a smaller reporting company) |

|

Smaller reporting company XX |

CALCULATION OF REGISTRATION FEE

|

Securities to be |

Amount To Be |

Offering Price |

Aggregate |

Registration Fee | ||||

|

Registered |

Registered |

Per Share |

Offering Price |

[1] | ||||

|

|

|

|

| |||||

|

Common Stock: |

50,000,000 |

$ |

1.00 |

$ |

50,000,000 |

$ |

5,810.00 | |

|

[1] |

Estimated solely for purposes of calculating the registration fee under Rule 457. | |||||||

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED MARCH 13, 2015.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

PROSPECTUS

MCGREGOR POWER SYSTEMS

50,000,000 Shares of Common Stock

OFFERED BY MCGREGOR POWER SYSTEMS

This offering is self-underwritten and conducted on a “Best Efforts No Minimum” basis and will end one year from the date that the registration statement is effective. No arrangement has been made to escrow funds received from the stock sales pending the completion of the offering. In that regard, proceeds from sales of the common stock will be delivered directly to the Company as sales occur. Directly funding the Company from the common stock sales exposes investors to significant risks as disclosed further in the section The Offering-Plan of Distribution. Because the offering has no set minimum and there is no plan to escrow the offering proceeds, the Company may fail to raise enough capital to fund its business plan and operations and it’s possible that investors may lose substantially all of their investment. No underwriter or person has been engaged to facilitate the sale of shares of common stock in this offering. There are no underwriting commissions involved in this offering. The Company does not intend to sell any specific minimum number or dollar amount of securities but will use its best efforts to sell the securities offered.

A Total of Up to 50,000,000 Shares of Class B Stock Par Value $ 0.000001 per Share

Offered at $1.00 (one dollar) Per Share

OUR COMMON STOCK IS NOT TRADED ON ANY NATIONAL SECURITIES EXCHANGE AND IS NOT QUOTED ON ANY OVER-THE-COUNTER MARKET. THIS INVESTMENT INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS” FOR A DISCUSSION OF RISKS APPLICABLE TO US AND AN INVESTMENT IN OUR COMMON STOCK.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

TABLE OF CONTENTS

|

Page | |

|

Prospectus Summary |

3 |

|

Risk Factors |

7 |

|

Use of Proceeds |

16 |

|

Determination of Offering Price |

16 |

|

Management’s Discussion and Analysis or Plan of Operation |

19 |

|

Description of our Business |

23 |

|

Directors, Executive Officers and Control Persons |

26 |

|

Executive Compensation |

27 |

|

Legal Proceedings |

27 |

|

Anti-Takeover Provisions |

27 |

|

Plan of Distribution |

28 |

|

Description of Securities |

30 |

|

Recent Sales of Unregistered Securities |

31 |

|

Financial Statements |

31 |

|

Interests of Named Experts & Counsel |

39 |

|

Where to Find More Information |

39 |

|

Undertakings |

40 |

|

Signatures |

41 |

PROSPECTUS SUMMARY

THIS SUMMARY HIGHLIGHTS SELECTED INFORMATION AND DOES NOT CONTAIN ALL THE INFORMATION THAT MAY BE IMPORTANT TO YOU. YOU SHOULD CAREFULLY READ THIS PROSPECTUS, ANY RELATED PROSPECTUS SUPPLEMENT AND THE DOCUMENTS WE HAVE REFERRED YOU TO IN THE SECTION “WHERE YOU CAN FIND MORE INFORMATION” BEFORE MAKING AN INVESTMENT IN OUR COMMON STOCK, INCLUDING THE “RISK FACTORS” IN THIS PROSPECTUS, REFERENCES TO “ THE COMPANY,” “McGregor Power Systems”, “McGregor,” “WE,” “US,” “OUR,” refer to McGregor Power Systems, Inc. unless otherwise indicated or the context otherwise requires.

THE BUSINESS OF THE COMPANY

Our Company

We incorporated in Delaware on 6/11/14. McGregor Power Systems is a development stage company that intends to build and lease electrical generation equipment. Our current mailing address is 4426 North 21st St. in Ozark, Missouri. Our main phone number is 417-207-3249. Our website is www.mcgregorpowersystems.com.

The Company’s overall business is founded on the ability to produce heat, cooling, and electrical power using proprietary technology to power electrical generation equipment which generates electricity at a much lower cost than the existing means of producing or providing primary electric power. The Company expects that the difference between its cost to produce electrical power and the current billing rate of existing local utility providers presents a sizable cost savings for customers and revenue opportunity for the McGregor.

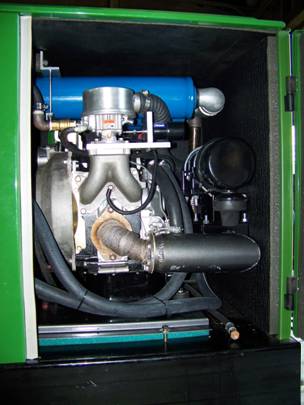

The Company’s product ‘genset’ unit is called a Thermal Watt Furnace; a self contained generator that is powered by a modified rotary liquid cooled rotary engine to drive a minimum of a 10 kilowatt generator. The entire unit, which runs on natural gas or propane, is compact, lightweight and clean burning. As a result, the unit produces extremely low emissions and is extremely energy-efficient. The technical name of this unit is Combined Heat and Power (CHP), otherwise known as co-generation.

The idea for using a liquid cooled engine to drive a generator posed operating difficulties due to the fact that the engine was not designed to run on gaseous fuels. Therefore, a completely new system for delivering a gaseous fuel to the engine had to be invented and developed. The inventor, Larry Pendell, pioneered a new system capable of delivering the gaseous fuel to the engine. Further testing and modifications have produced a solid state unit that efficiently delivers the fuel to the engine, resulting in a strong and reliable engine that can operate on any gaseous fuel with a sustained engine life and maximum horsepower.

Patents, Trademarks, Intellectual Property

We have no copyrights, or trademarks. We plan to manufacture, install, maintain and sell cogeneration units (also known as the Thermal Watt Furnace, patent no. 6,788,031), created by Larry Pendell. The patent is expired, however we are in the process of designing a newer version of the TWF, with the assistance of Mr. Pendell. We intend to file for a patent in the fourth quarter of 2015. McGregor will own the patent. We have a prototype that is targeted for residential use, but we intend to have a full product line that will include units for industrial and commercial customers. The Company expects that in many markets any excess electricity generated can be sold by the customer to its primary electrical utility, thereby reducing the customer’s operating costs.

Risks and Uncertainties facing the Company

As a development stage company, the Company has no operating history and has continuously experienced losses since its inception. The Company needs to create a source of revenue or locate additional financing in order to continue its manufacturing plans. As a development stage company, our sole Director and CEO, Michael M. Brown, has had 25 years’ experience in machine shop production, management, and engineering. The inventor, Larry Pendell, has in the past, owned, operated, and managed several different manufacturing companies. Neither Brown nor Pendell have had experience in manufacturing on this scale previously.

One challenge facing the Company is identifying and targeting effective sales, marketing and distribution strategies. As a developing company, the Company is in the process of identifying and targeting potential distributors and marketers of its products in order to reach the intended end users for the products. To reach potential end customers, the Company will need to have an effective sales, marketing and distribution strategy.

If the Company were unable to develop strong and reliable sources of potential end users and a means to efficiently reach buyers and customers for its products, it is unlikely that the Company could develop its operations to return revenue sufficient to further develop its business plan. Moreover, the above assumes that the Company’s products are met with customer satisfaction in the marketplace and exhibit steady adoption of products amongst the potential customer base, neither of which is currently known or guaranteed.

McGregor’s independent auditors have issued a report questioning the Company’s ability to continue as a going concern.

Our sole Director owns a significant amount of stock as of the date of this Offering. Accordingly, he will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets. The interests of our directors may differ from the interests of the other stockholders and thus result in corporate decisions that are disadvantageous to other shareholders.

THE OFFERING-PLAN OF DISTRIBUTION

This prospectus refers to the sale of 50,000,000 shares of the Company's Class B stock. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The shares will be offered at a fixed price of $1.00 per share for the duration of the offering, which will be for one year from the date of effectiveness of this prospectus.

This offering is a self-underwritten offering, which means that it does not involve the participation of an underwriter to market, distribute or sell the shares offered under this prospectus. We will sell shares on a continual basis. We reasonably expect the amount of securities registered pursuant to this offering to be offered and sold within one year from this initial effective date of this registration.

We are offering the shares on a "self-underwritten" best efforts basis directly through our President & CEO, Michael M. Brown. They are both qualified pursuant to the safe harbor provision from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. He will attempt to sell the shares. This Prospectus will permit Brown to use their best efforts to market and sell this common stock directly, with no commission or other remuneration payable to them for any shares they may sell. At this time, the Company has not made any arrangements to place the funds received in an escrow or trust account, thus, the Company and its executive officers will have immediate access to such funds. This offering will terminate upon the earliest to occur of (i) the first anniversary of the effective date of the registration statement, (ii) the date on which all 50,000,000 shares registered hereunder have been sold, or (iii) the date on which we terminate this offering.

In connection with his selling efforts in the offering, Mr. Brown will not register as a broker-dealer pursuant to Section 15 of the Exchange Act but rather will rely upon the "safe harbor" provisions of Rule 3a4-1 under the Exchange Act. Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participates in an offering of the issuer's securities. Mr. Brown is not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act. Mr. Brown will not be compensated in connection with his participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Mr. Brown have not been within the past 12 months, a broker or dealer, and have not within the past 12 months, an associated person of a broker or dealer. At the end of the offering, Mr. Brown will continue to primarily perform substantial duties for us or on our behalf otherwise than in connection with transactions in securities. Mr. Brown have not participated in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

Any investment in the shares offered herein involves a high degree of risk. You should only purchase shares if you can afford a loss of your investment. Our independent registered public accountant has issued an audit opinion for our company, which includes a statement expressing substantial doubt as to our ability to continue as a going concern.

There currently is no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop.

The following table shows the possible outcomes for computing the Company's outstanding stock given partial sales of the total offering given in percentage intervals. The Company has made no plans to place the proceeds of the offering in escrow or trust account. The proceeds are to be used when available. Immediate use of the proceeds when received in the Company’s accounts regardless of the total received at any time during the offering has the possibility of having a negative effect on investors. Because the offering has no set minimum and there is no plan to escrow the offering proceeds, the Company may fail to raise enough capital to fund its business plan and operations and it’s possible that investors may lose all or substantially all of their investment.

Certain Information about this Offering

|

|

|

Offering Price Per Share |

|

Commissions |

|

Proceeds to Company Before Expenses if 10% of the shares are sold |

|

|

Proceeds to Company Before Expenses if 50% of the shares are sold |

|

|

Proceeds to Company Before Expenses if 100% of the shares are sold |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class B Common Stock |

|

$ |

1.00 |

|

Not Applicable |

|

$ |

5,000,000 |

|

|

$ |

25,000,000 |

|

|

$ |

50,000,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals |

|

$ |

1.00 |

|

Not Applicable |

|

$ |

5,000,000 |

|

|

$ |

25,000,000 |

|

|

$ |

50,000,000 |

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Where You Can Find Us

Our current mailing address is 4426 North 21st St., Ozark, MO 65721. The Company’s main phone number is 417-207-3249. Our primary website address is www.mcgregorpowersystems.com.

SUMMARY FINANCIAL INFORMATION

We have prepared the following summary of our consolidated financial statements. The summary of our consolidated financial data set forth below should be read together with our separate audited financial statements and the notes thereto, as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this prospectus.

|

|

|

12/31/14 ($) |

| |

|

Financial Summary (Audited) |

|

|

|

|

|

Cash and Deposits |

|

|

100 |

|

|

Total Assets |

|

|

7,219 |

|

|

Total Liabilities |

|

|

- |

|

|

Total Stockholder’s Equity |

|

|

7,219 |

|

|

Common Stock, $.000001 par value, 2,000,000,000 shares authorized; 219,110,000 shares issued and outstanding |

|

|

214 |

|

|

Additional Paid in Capital |

|

|

9,843 |

|

|

(Deficit) accumulated during development stage |

|

|

(2,838 |

) |

|

|

|

Accumulated from 6/11/14 (Inception) to 12/31/14 ($) |

| |

|

Consolidated Statements of Expenses and Comprehensive Loss |

|

|

| |

|

Total Operating Expenses |

|

|

2,838 |

|

|

Total Loss |

|

|

(2,838) |

|

EMERGING GROWTH COMPANY

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of:

a. the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

b. the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

c. the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

d. the date on which such issuer is deemed to be a `large accelerated filer', as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and

procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A and B of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

SMALLER REPORTING COMPANY

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY - THE JOBS ACT

We qualify as an emerging growth company as that term is used in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

* A requirement to have only two years of audited financial statements and only two years of related MD&A;

* Exemption from the auditor attestation requirement in the assessment of the emerging growth company's internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002;

* Reduced disclosure about the emerging growth company's executive compensation arrangements; and

* No non-binding advisory votes on executive compensation or golden parachute arrangements.

We may take advantage of the reduced reporting requirements applicable to smaller reporting companies even if we no longer qualify as an "emerging growth company."

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the "Securities Act") for complying with new or revised accounting standards. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

We could remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. Currently, shares of our common stock are not publicly traded. In the event that shares of our common stock become publicly traded, the trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. In the event our common stock fails to become publicly traded you may lose all or part of your investment.

The Company has no revenues to date.

The Company has generated no revenues to date nor sold a single product, nor have any other products been manufactured by us. To date, most of management’s time, and the Company’s limited resources have been spent in developing strategy, researching potential opportunities, contacting partners, exploring marketing contacts, establishing operations and management personnel and resources, preparing its business plan and model, selecting professional advisors and consultants and seeking capital for the Company.

We may experience significant fluctuations in revenues from quarter to quarter due to a preponderance of one-time sales.

Our products will be low volume, high dollar sales for customers that are generally non-recurring, and therefore our sales will fluctuate significantly from period to period. Fluctuations cannot be predicted because they are affected by the purchasing decisions and timing requirements of our customers, which are unpredictable.

If we experience a period of significant growth or expansion, it could place a substantial strain on our resources.

If our cogeneration products penetrate the market rapidly, we would be required to deliver even larger volumes of technically complex products or components to our customers on a timely basis and at a reasonable cost to us. We have never ramped up our manufacturing capabilities to meet large-scale production requirements. If we were to commit to deliver large volumes of products, we may not be able to satisfy these commitments on a timely and cost-effective basis.

The Executive Order to accelerate investments in industrial energy efficiency may lead to increased competition.

An Executive Order to accelerate investments in industrial energy efficiency, including CHP, was promulgated in August 2012. The goal of the Executive Order is to supply 40 gigawatts of energy by 2020 from greater efficiency such as CHP systems. With this Executive Order, it is expected that a number of barriers to CHP development will be removed with effective programs, policies, and financing opportunities resulting in significant new capital investment in CHP. This initiative by the U.S. government may lead to increased competition in the CHP market.

If we are unable to create and maintain technological expertise in design and manufacturing processes, we will not be able to successfully compete.

We believe that our future success will depend upon our ability to continue to develop and provide innovative products and product enhancements that meet the increasingly sophisticated needs of our customers. However, this requires that we successfully anticipate and respond to technological changes in design and manufacturing processes in a cost-effective and timely manner. The development of new, technologically advanced products and enhancements is a complex and uncertain process requiring high levels of innovation, as well as the accurate anticipation of technological and market trends. There can be no assurance that we will successfully identify new product opportunities, develop and bring new or enhanced products to market in a timely manner, successfully lower costs, and achieve market acceptance of our products, or that products and technologies developed by others will not render our products or technologies obsolete or noncompetitive.

The introduction of products embodying new technologies, and the shifting of customer demands or changing industry standards, could render our existing products obsolete and unmarketable. We may experience delays in releasing new products and product enhancements in the future. Material delays in introducing new products or product enhancements may cause customers to forego purchases of our products and purchase those of our competitors.

We do not have a majority of independent directors on our Board and the Company has not voluntarily implemented various corporate governance measures, in the absence of which stockholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or the NASDAQ Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors’ independence, audit committee oversight, and the adoption of a code of ethics. We have not yet adopted any of these other corporate governance measures and since our securities are not yet listed on a national securities exchange, we are not required to do so. Our Board of Directors is comprised of two individuals, both of whom are also our executive officers. As a result, we do not have independent directors on our Board of Directors.

We have not adopted corporate governance measures such as an audit or other independent committee of our board of directors, as we presently do not have independent directors on our board. If we expand our board membership in future periods to include additional independent directors, we may seek to establish an audit and other committee of our board of directors. It is possible that if our Board of Directors included independent directors and if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurance that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. For example, at present in the absence of audit, nominating and compensation committees comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages or employment contracts to our senior officers are made by a majority of directors who have an interest in the outcome of the matters being decided. However, as a general rule, the board of directors, in making its decisions, determines first that the terms of such transaction are no less favorable to us that those that would be available to us with respect to such a transaction from unaffiliated third parties. The company executes the transaction between executive officers and the company once it was approved by the Board of Directors.

Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

Our sole Director is not considered an audit committee financial expert. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results. As a result, current and potential shareholders could lose confidence in our financial reporting, which would harm our business and the trading price of our stock.

Our CEO/ President is inexperienced with U.S. GAAP and the related internal control procedures required of U.S. public companies. Our CEO has determined that our internal audit function is also significantly deficient due to insufficient qualified resources to perform internal audit functions. Finally, we have not established an Audit Committee for our Board of Directors.

We are a development stage company with limited resources. Therefore, we cannot assure investors that we will be able to maintain effective internal controls over financial reporting based on criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control-Integrated Framework. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company's annual or interim financial statements will not be prevented or detected on a timely basis. For these reasons, we are considering the costs and benefits associated with improving and documenting our disclosure controls and procedures and internal controls and procedures, which includes (i) hiring additional personnel with sufficient U.S. GAAP experience and (ii) implementing ongoing training in U.S. GAAP requirements for our CFO and accounting and other finance personnel. If the result of these efforts are not successful, or if material weaknesses are identified in our internal control over financial reporting, our management will be unable to report favorably as to the effectiveness of our internal control over financial reporting and/or our disclosure controls and procedures, and we could be required to further implement expensive and time-consuming remedial measures and potentially lose investor confidence in the accuracy and completeness of our financial reports which could have an adverse effect on our stock price and potentially subject us to litigation.

No shares will be issued prior to the minimum offering amount being met. Investors bear risk without enjoying any benefits of share ownership.

The funds received from investors will be maintained in a separate bank account until we receive a minimum of $100,000, at which time we will begin to issue shares pursuant to the subscription agreements. We will remove the funds from the separate account and use the same as set forth in the Use of Proceeds section of this prospectus.

No shares will be issued if the minimum amount is not reached. As a result, investors bear the risk of investing without enjoying any benefits of share ownership. Our officers and directors will not use the subscription proceeds prior to satisfaction of the minimum and issuance of the shares for working capital, collateral for the company or other purposes.

The company is subject to the 15(D) reporting requirements under the Securities Exchange Act of 1934, which does not require a company to file all the same reports and information as a fully reporting company.

Until our common stock is registered under the Exchange Act, we will not be a fully reporting company, but only subject to the reporting obligations imposed by Section 15(d) of the Securities Exchange Act of 1934. Pursuant to Section 15(d), we will be required to file periodic reports with the SEC, such as annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, once this registration statement is declared effective, including the annual report on Form 10-K for the fiscal year during which the registration statement is declared effective. That filing obligation will generally apply even if our reporting obligations have been suspended automatically under section 15(d) of the Exchange Act prior to the due date for the Form 10-K.

After that fiscal year and provided the Company has less than 300 shareholders, the Company is not required to file these reports. If the reports are not filed, the investors will have reduced visibility as to the Company and its financial condition. In addition, as a filer subject to Section 15(d) of the Exchange Act, the Company is not required to prepare proxy or information statements; our common stock will not be subject to the protection of the going private regulations; the company will be subject to only limited portions of the tender offer rules; our officers, directors, and more than ten (10%) percent shareholders are not required to file beneficial ownership reports about their holdings in our company; that these persons will not be subject to the short-swing profit recovery provisions of the Exchange Act; and that more than five percent (5%) holders of classes of your equity securities will not be required to report information about their ownership positions in the securities

Our intellectual property may not be adequately protected.

We will seek to protect our intellectual property rights through patents, trademarks, copyrights, trade secret laws, confidentiality agreements and licensing arrangements, but we cannot ensure that we will be able to adequately protect our technology from misappropriation or infringement. We cannot ensure that our existing intellectual property rights will not be invalidated, circumvented, challenged or rendered unenforceable.

We intend to apply for a patent on a modified version of the thermal watt furnace, and may obtain patents on certain key components used in our products. Our competitors may successfully challenge the validity of our patents, may design non-infringing products, or deliberately infringe our patents. There can be no assurance that other companies are not investigating or developing other similar technologies. In addition, our intellectual property rights may not provide a competitive advantage to us or that our products and technology will be adequately covered by our patents and other intellectual property. Any of these factors or the expiration, termination or invalidity of one or more of our patents may have a material adverse effect on our business.

We may in the future file for patents in the U.S. and Europe. The outcome of the patent office application review is important because this technology could apply to all of our genset products and may have licensing application to other natural gas engines. There is no assurance, however, that the patent applications will be approved.

We will rely on treatment of our technology as trade secrets through confidentiality agreements, which our employees and vendors will be required to sign. We also rely on non-disclosure agreements with others that have or may have access to confidential information to protect our trade secrets and proprietary knowledge. These agreements may be breached, and we may not have adequate remedies for any breach. Our trade secrets may also be or become known without breach of these agreements or may be independently developed by competitors. Failure to maintain the proprietary nature of our technology and information could harm our results of operations and financial condition.

Others may assert that our technology infringes their intellectual property rights.

We may be subject to infringement claims in the future. The defense of any claims of infringement made against us by third parties could involve significant legal costs and require our management to divert time from our business operations. If we are unsuccessful in defending any claims of infringement, we may be forced to obtain licenses or to pay additional royalties to continue to use our technology. We may not be able to obtain any necessary licenses on commercially reasonable terms or at all. If we fail to obtain necessary licenses or other rights, or if these licenses are costly, our operating results would suffer either from reductions in revenues through our inability to serve customers or from increases in costs to license third-party technologies.

Certain businesses and consumers might not consider cogeneration solutions as a means for obtaining their electricity and power needs.

Generating electricity and heat at the customers’ building (on-site CHP) is an established technology, but it is more complex than buying electricity from the utility and using a furnace for heat. Customers have been slow to accept it in part because of this complexity. In addition, the development of a larger market for our products will be impacted by many factors that are out of our control, including cost competitiveness, regulatory requirements, and the emergence of newer and potentially better technologies and products. If a larger market for cogeneration technology in general and our products in particular fails to grow substantially, we may be unable to continue our business.

Utilities or governmental entities could hinder our entry into and growth in the marketplace, and we may not be able to effectively sell our products.

Utilities or governmental entities on occasion have placed barriers to the installation of our products or their interconnection with the electric grid, and they may continue to do so. Utilities may charge additional fees to customers who install on-site CHP and rely on the grid for back-up power. These types of restrictions, fees, or charges could make it harder for customers to install our products or use them effectively, as well as increasing the cost to our potential customers. This could make our systems less desirable, thereby adversely affecting our revenue and other operating results.

We may not achieve production cost reductions necessary to competitively price our products, which would adversely affect our sales.

We believe that we will need to reduce the unit production cost of our products over time to maintain our ability to offer competitively priced products. Our ability to achieve cost reductions will depend on our ability to develop low-cost design enhancements, to obtain necessary tooling and favorable supplier contracts, and to increase sales volumes so we can achieve economies of scale. We cannot assure you that we will be able to achieve any such production cost reductions. Our failure to do so could have a material adverse effect on our business and results of operations.

Commodity market factors impact our costs and availability of materials.

Our products contain a number of commodity materials, from metals, which include steel, special high temperature alloys, copper, nickel and molybdenum. The availability of these commodities could impact our ability to acquire the materials necessary to meet our requirements. The cost of metals has historically fluctuated. The pricing could impact the costs to manufacture our products. If we are not able to acquire commodity materials at prices and on terms satisfactory to us or at all, our operating results may be materially adversely affected.

Our products involve a lengthy sales cycle and we may not anticipate sales levels appropriately, which could impair our results of operations.

The sale of our products typically involves a significant commitment of capital by customers, with the attendant delays frequently associated with large capital expenditures. For these and other reasons, the sales cycle associated with our products is typically lengthy and subject to a number of significant risks over which we have little or no control. We expect to plan our production and inventory levels based on internal forecasts of customer demand, which is highly unpredictable and can fluctuate substantially. If sales in any period fall significantly below anticipated levels, our financial condition, results of operations and cash flow would suffer. If demand in any period increases well above anticipated levels, we may have difficulties in responding, incur greater costs to respond, or be unable to fulfill the demand in sufficient time to retain the order, which would negatively impact our operations. In addition, our operating expenses are based on anticipated sales levels, and a high percentage of our expenses are generally fixed in the short term. As a result of these factors, a small fluctuation in timing of sales can cause operating results to vary materially from period to period.

The economic viability of our projects depends on the price spread between fuel and electricity, and the variability of these prices creates a risk that our projects will not be economically viable and that potential customers will avoid such energy price risks.

The economic viability of our CHP products depends on the spread between natural gas fuel and electricity prices. Volatility in one component of the spread, the cost of natural gas and other fuels (e.g., propane or distillate oil), can be managed to some extent by means of futures contracts. However, the regional rates charged for both base load and peak electricity may decline periodically due to excess generating capacity or general economic recessions.

Our products could become less competitive if electric rates were to fall substantially in the future. Also, potential customers may perceive the unpredictable swings in natural gas and electricity prices as an increased risk of investing in on-site CHP, and may decide not to purchase CHP products.

We may make acquisitions that could harm our financial performance.

To expedite development of our corporate infrastructure, particularly with regard to equipment installation and service functions, we anticipate the future acquisition of complementary businesses. Risks associated with such acquisitions include the disruption of our existing operations, loss of key personnel in the acquired companies, dilution through the issuance of additional securities, assumptions of existing liabilities, and commitment to further operating expenses. If any or all of these problems actually occur, acquisitions could negatively impact our financial performance and future stock value.

Our success is dependent upon attracting and retaining highly qualified personnel and the loss of key personnel could significantly hurt our business.

To achieve success, we must attract and retain highly qualified technical, operational, and executive employees. The loss of the services of key employees or an inability to attract, train, and retain qualified and skilled employees, specifically engineering, operations, and business development personnel, could result in the loss of business or could otherwise negatively impact our ability to operate and grow our business successfully.

Our business is subject to product liability and warranty claims.

Our business exposes us to potential product liability claims, which are inherent in the manufacturing, marketing and sale of our products, and we may face substantial liability for damages resulting from the faulty design or manufacture of products or improper use of products by end users. We do not currently maintain product liability insurance, but if we do obtain insurance, there can be no assurance that this insurance will provide sufficient coverage in the event of a claim. Also, we cannot predict whether we will be able to maintain such coverage on acceptable terms, if at all, or that a product liability claim would not harm our business or financial condition. In addition, negative publicity in connection with the faulty design or manufacture of our products would adversely affect our ability to market and sell our products.

We intend to sell our products with warranties. We cannot ensure that our efforts to reduce our risk through warranty disclaimers will effectively limit our liability. Any significant occurrence of warranty expense in excess of estimates could have a material adverse effect on our operating results, financial condition and cash flow.

We may be unable to fund our future operating requirements, which could force us to curtail our operations.

To the extent that our funds are insufficient to fund our future operating requirements, we would need to raise additional funds through further public or private equity or debt financings depending upon prevailing market conditions. These financings may not be available to us, or if available, may be on terms that are not favorable to us and could result in significant dilution to our stockholders and reduction of the trading price of our stock (if then publicly traded). The state of worldwide capital markets could also impede our ability to raise additional capital on favorable terms or at all. If adequate capital were not available to us, we likely would be required to significantly curtail our operations or possibly even cease our operations.

The Company’s independent auditors have issued a report questioning the Company’s ability to continue as a going concern.

In their audited financial report, the company’s independent auditors have issued a comment that unless the Company is able to develop and market its products or obtain financing from other sources, there is a significant question as to its ability to continue as a going concern.

There can be no assurance of production or commercial feasibility of our product

Even if the Company can successfully manufacture products, there can be no assurance that such products will have any commercial advantages. Also, there is no assurance that the products will perform as intended in the marketplace. Therefore, you could lose all or part of your investment

The Company is a development-stage company and has little experience in commercializing products.

The Company is a development-stage company and has little experience in commercializing products and managing a public company. This may result in the Company experiencing difficulty in adequately operating and growing its business. Further, the Company may be hampered by lack of experience in addressing the issues and considerations which are common to growing product companies. If MPS’s operating or management abilities consistently perform below expectations, then the Company’s business is unlikely to thrive. In addition, the Company’s lack of experience may result, in spite of the successful product development and commercialization, in difficulty in managing the operations and finances of a public company.

McGregor Power Systems is a development stage company and has a correspondingly small financial and accounting organization. Being a public company may strain the Company's resources, divert management’s attention and affect its ability to attract and retain qualified officers and directors.

The Company is a development stage company with no developed finance and accounting organization and the rigorous demands of being a publicly traded company will require a structured and developed finance and accounting group. The requirements of these Securities laws and the rules and regulations promulgated thereunder entail significant accounting, legal and financial compliance costs which may be prohibitive to McGregor Power Systems as it develops its business plan, products and scope. These costs have made, and will continue to make, some activities more difficult, time consuming or costly and may place significant strain on its personnel, systems and resources.

The Securities Exchange Act requires, among other things, that companies maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain the requisite disclosure controls and procedures and internal control over financial reporting, significant resources and management oversight are required. As a result, management’s attention may be diverted from other business concerns, which could have a material adverse effect on the development of the Company's business, financial condition and results of operations.

These rules and regulations may also make it difficult and expensive for the Company to obtain director and officer liability insurance. If the Company is unable to obtain adequate director and officer insurance, its ability to recruit and retain qualified officers and directors, especially those directors who may be deemed independent, will be significantly curtailed.

We have elected under the JOBS Act to delay the adoption of new or revised accounting pronouncements applicable to public companies until such pronouncements are made applicable to private companies.

Under the JOBS Act, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of this extended transition period. Since we will not be required to comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies, our financial statements may not be comparable to financial statements of companies that comply with public company effective dates.

While we currently qualify as an “Emerging Growth Company” under the JOBS Act and we will lose that status by the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement, if we qualify as a “smaller reporting company” which we are at the present time, our non-financial and financial information will be less than is required by other non-smaller reporting companies.

Currently we qualify as an “Emerging Growth Company”. At the latest, by the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement, we will lose that qualification and be required to report as other public companies are required to report. While we will no longer qualify as an “Emerging Growth Company”, we may qualify as a “smaller reporting company”. The “smaller reporting company” category includes companies that (1) have a common equity public float of less than $75 million or (2) are unable to calculate their public float and have annual revenue of $50 million or less, upon entering the system. A smaller reporting company prepares and files SEC reports and registration statements using the same forms as other SEC reporting companies, though the information required to be disclosed may differ and be less comprehensive. Regulation S-X contains the SEC requirements for financial statements, while Regulation S-K contains the non-financial disclosure requirements. To locate the scaled disclosure requirements, smaller reporting companies will refer to the special paragraphs labeled “smaller reporting companies” in Regulation S-K. As an example only, smaller reporting companies are not required to make risk factor disclosure in Item 1A of Form 10-K. Other disclosure required by non-smaller reporting companies can be omitted in Form 10-K and Form 10-Q by smaller reporting companies.

Reliance on third party agreements and relationships is necessary for development of the Company's business.

The Company will need third party relationships in order to develop and grow its business. The Company will be substantially dependent on these strategic partners and third party relationships for sales and marketing. To date, the Company has not entered into any such relationships.

If the Company is unable to generate sufficient cash from operations, it may find it necessary to curtail development and operational activities.

The Company has an extensive business plan hinged on its ability to manufacture and commercialize its products. If McGregor Power Systems is unable to manufacture and/or commercialize its products, then it would not be able to proceed with its business plan or possibly to successfully develop its planned operations at all.

The proposed operations of McGregor Power Systems are speculative.

The success of the proposed business plan of McGregor Power Systems will depend to a great extent on the operations, financial condition and management of the Company. Although McGregor Power Systems has a business plan and intends to execute its overall business strategy, no operations have been conducted to date. As no revenues have been finalized or consummated as of yet, the proposed operations of the Company remain speculative.

The Company depends on its CEO to manage its business effectively.

McGregor Power System’s future success depends in large part upon its ability to execute its business plan and to attract and retain highly skilled employees. In particular, due to the relatively early stage of the Company's business, its future success is highly dependent on its CEO, to provide the necessary experience and background to execute the Company's business plan. The loss of our CEO’s services could impede, in particular as the Company builds a record and reputation, its ability to develop its objectives, specifically in its ability to develop a successful strategy to manufacture, market and sell its products, and as such would negatively impact the Company's possible development.

The Company may face significant competition from other companies.

There are several competitors with somewhat similar devices that sell for approximately twice what we intend to sell our Thermal Watt Furnace for. However, in the future, if any of our patents we apply for eventually expire, or if another company patents a similar product, McGregor Power Systems may face substantial competition from those companies. Some of these potential competitors may have longer operating histories, greater brand recognition, larger client bases and significantly greater financial, technical and marketing resources than we have. These advantages may enable such competitors to respond more quickly to new or emerging technologies and changes in customer preferences. These advantages may also allow them to engage in more extensive research and development, undertake extensive far-reaching marketing campaigns, adopt more aggressive pricing policies and make more attractive offers to potential customers, employees and strategic partners. The Company believes that its current and anticipated products are, and will be, sufficiently different from existing competition. However, few of these organizations are using their products in the configuration that the Company is currently proposing. As a result, it is possible that potential competitors may have or may rapidly acquire significant market share. Increased competition may result in price reductions, reduced gross margin and loss of market share. McGregor may not be able to compete successfully, and competitive pressures may adversely affect its business, results of operations and financial condition.

The Company’s pricing strategy presents special risks.

The Company has initially priced the residential Thermal Watt Furnace unit to customers for $20,000, and may also offer an annual service maintenance fee. The cost is large and may dissuade potential customers from doing business with us. As a development stage company without an established business and set of customers, McGregor’s strategy of requiring a significant upfront cash outlay from its customers may create a significant obstacle to sales of McGregor’s products and market acceptance generally of the Company and its products.

McGregor Power Systems is subject to the potential factors of obsolescence and technological change

The business of the Company is susceptible to rapidly changing technology and the Company's product manufacturing process is subject to constant change. Although the Company intends to continue to develop and improve its products and manufacturing capability, there can be no assurance that funds for such expenditures will be available or that the Company's competition will not develop similar or superior capabilities, or that the Company will be successful in its internal efforts. The future success of the Company will depend in part on its ability to respond effectively to rapidly changing technologies, industry standards and customer requirements by adapting and improving the performance features and reliability of its products.

We have not developed a complete product line.

While the company has a single prototype for residential use, the Company has not completed the development of a full product line, and further, it anticipates a continuing need to develop additional products. No assurance can be given that the products can be developed to implementation or that the products will achieve commercially viable sales levels.

No formal market survey has been conducted

No independent marketing survey has been performed to determine the potential demand for the Company’s products. The Company has conducted only limited marketing studies, which indicate that its products would potentially be marketable. However, no assurances can be given that upon marketing, sufficient markets can be developed to sustain the Company's operations on a continued basis.

The Company may be subject to increasing environmental and regulatory restrictions and developments, which may result in increased costs, lower revenue and profits and/or difficulty in conducting business.

Current, or future, environmental regulations may affect the availability or cost of goods and services, such as natural resources, which are necessary to operate the Company’s business. Any violation of these laws could adversely affect the Company and its business. The Company’s operations may necessitate the use and handling of hazardous materials and, as a result, they may be subject to various federal, state, local and foreign laws, regulations and ordinances relating to the protection of the environment, including (without limitation) those regulations governing discharges to air and water, handling and disposal practices for solid and hazardous wastes, the cleanup of contaminated sites and the maintenance of a safe work place. These laws impose penalties, fines and other sanctions for noncompliance and liability for response costs, property damages and personal injury resulting from past and current spills, disposals or other releases of, or exposure to, hazardous materials. The Company could incur substantial costs as a result of noncompliance with or liability for cleanup or other costs or damages under these laws. The Company may become subject to more stringent environmental laws in the future. If more stringent environmental laws are enacted in the future, these laws could have a material adverse effect on the business, financial condition and results of operations of the Company.

Government regulation could negatively impact the business.

The Company’s products may be subject to various government regulations in the jurisdictions in which they operate. Due to the potential wide geographic scope of the Company’s operations, the Company could be subject to regulation by political and regulatory entities throughout the United States, including various local and municipal agencies and government sub-divisions, and various foreign governments and political subdivisions thereof. The Company may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply. The Company’s operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to its business or industry.

The Company does not maintain certain insurance, including errors and omissions and indemnification insurance.

The Company has limited capital and, therefore, does not currently have a policy of insurance against liabilities arising out of the negligence of its officers and directors and/or deficiencies in any of its business operations. Even assuming that the Company obtained insurance, there is no assurance that such insurance coverage would be adequate to satisfy any potential claims made against the Company, its officers and directors, or its business operations or products. Any such liability which might arise could be substantial and may exceed the assets of the Company. The certificate of incorporation and by-laws of the Company provide for indemnification of officers and directors to the fullest extent permitted under Delaware law. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons, it is the opinion of the Securities and Exchange Commission that such indemnification is against public policy, as expressed in the Act, and is therefore, unenforceable.

Patent(s) and/or trade secret protection applied for by the Company may be inadequate

The Company plans on attempting to obtain additional patents, copyright, trademarks and service marks on its products and services. However, there can be no assurance that the Company can obtain effective protection against unauthorized duplication or the introduction of substantially similar products or that the existing patent, trade secret or other intellectual property protection adequately protects the Company.

Risks Related to Our Common Stock

We could issue additional Common Stock, which might dilute the book value of our Common Stock.

Our board of directors has the authority, without action or vote of our stockholders, to issue all or a part of any authorized but unissued shares. Such stock issuances may be made at a price that reflects a discount from the then-current trading price of our Common Stock. We may issue securities that are convertible into or exercisable for a significant amount of our Common Stock. These issuances would dilute your percentage ownership interest, which would have the effect of reducing your influence on matters on which our stockholders vote, and might dilute the book value of our Common Stock. You may incur additional dilution of net tangible book value if holders of stock options, whether currently outstanding or subsequently granted, exercise their options or if warrant holders exercise their warrants to purchase shares of our Common Stock. There can be no assurance that any future offering will be consummated or, if consummated, will be at a share price equal or superior to the price paid by our investors even if we meet our technological and marketing goals.

Our President and CEO holds the only voting stock for the entire company. This will prevent any shareholders who purchase our nonvoting stock from having the ability to control any of our corporate actions. As a result, he can exercise substantial control over stockholder and corporate actions.

Our President controls the only voting stock in the Company. This means that any corporate transactions can be completed only at his discretion. As a result of this substantial control of our voting stock, our CEO will have total control over the entire company. This concentration of ownership may also have the effect of delaying or preventing a change in control, which in turn could have a material adverse effect on the market price of McGregor Power System’s common stock or prevent stockholders from realizing a premium over the market price for their Shares. In addition, this ownership could discourage the acquisition of our common stock by potential investors and could have an anti-takeover effect, possibly depressing the trading price of our common stock. Our Director has the ability to control various corporate decisions, including our direction and policies, the election of directors, the content of our charter and bylaws and the outcome of any other matter requiring stockholder approval, including a merger, consolidation and sale of substantially all of our assets or other change of control transaction. The concurrence of our Class B stockholders will not be required for any of these decisions.

Trading of our Common Stock may be restricted by the SEC’s “penny stock” regulations which may limit a stockholder’s ability to buy and sell our stock.

The SEC has adopted regulations which generally define “penny stock” to be any equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities may be covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and other quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statement showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure and suitability requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules may discourage investor interest in and limit the marketability of our capital stock. Trading of our capital stock may be restricted by the SEC’s “penny stock” regulations which may limit a stockholder’s ability to buy and sell our stock.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock

FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity and liquidity of our common stock. Further, many brokers charge higher transactional fees for penny stock transactions. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder’s ability to resell shares of our common stock.

We may, in the future, issue additional securities, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize us to issue 2,000,000,000 shares of Class A & B stock. As of the date of this prospectus, we had 219,110,000 shares of class A and B stock outstanding. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis including for services or acquisitions or other corporate actions that may have the effect of diluting the value of the shares held by our stockholders, and might have an adverse effect on any trading market for our common stock. Our board of directors may designate the rights terms and preferences at its discretion including conversion and voting preferences without notice to our shareholders.

FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements,” which include information relating to future events, future financial performance, strategies, expectations, competitive environment, regulation and availability of resources. These forward-looking statements include, without limitation, statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operating results, and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. Words such as “may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar expressions, as well as statements in future tense, identify forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

|

|

our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; | |

|

|

general economic conditions, nationally and globally, and their effect on the market for our services; | |

|

|

changes in laws, regulations, or policies; our ability to successfully manage our growth strategy; | |

|

|

other factors identified throughout this prospectus, including those discussed under the headings “Risk Factors | |

Forward-looking statements speak only as of the date the statements are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions, or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

USE OF PROCEEDS

If we are able to sell all of the shares of our common stock we are offering through this prospectus, then we will raise gross proceeds of $50,000,000.

Our offering is being made on a self-underwritten basis. No minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $1.00. The following table sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100%, respectively, of the securities offered for sale by us. If less than the 25% is raised in this offering, we will still have sufficient funds to lease a building, lease equipment and materials, and hire personnel to begin manufacturing our TWF, as well as meet our SEC filing obligations and continue to seek alternative sources of financing.

|

|

| ||||||||||||||||

|

USE OF PROCEEDS |

|

If 25% of the Shares are Sold |

|

If 50% of the Shares are Sold |

|

If 75% of the Shares are Sold |

|

If 100% of the Shares are Sold | |||||||||

|

|

|

|

|

|

|

|

|

| |||||||||

|

Gross Proceeds |

|

$ |

12,500,000 |

|

|

$ |

25,000,000 |

|

|

$ |

37,500,000 |

|

|

$ |

50,000,000 |

| |

|

General Operations (1)* |

|

|

1,250,000 |

|

|

|

2,500,000 |

|

|

|

3,750,000 |

|

|

|

5,000,000 |

| |

|

Lease / Land Acquisition |

|

|

2,000,000 |

|

|

|

4,000,000 |

|

|

|

6,000,000 |

|

|

|

8,000,000 |

| |

|

Machine Tool Acquisition |

|

|

5,000,000 |

|

|

|

10,000,000 |

|

|

|

15,000,000 |

|

|

|

20,000,000 |

| |

|

Employees New Hires |

|

|

1,500,000 |

|

|

|

3,000,000 |

|

|

|

4,500,000 |

|

|

|

6,000,000 |

| |

|

Company Marketing |

|

|

625,000 |

|

|

|

1,250,000 |

|

|

|

1,875,000 |

|

|

|

2,500,000 |

| |

|

Cash Reserve |

|

|

2,125,000 |

|

|

|

4,250,000 |

|

|

|

6,375,000 |

|

|

|

8,500,000 |

| |

|

TOTALS |

|

$ |

12,500,000 |

|

|

$ |

25,000,000 |

|

|

$ |

37,500,000 |

|

|

$ |

50,000,000 |

| |

(1) Includes: Executive salaries, general/administrative overhead, licensing and permitting fees.