Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - Meet Group, Inc. | ex21-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Meet Group, Inc. | ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Meet Group, Inc. | ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Meet Group, Inc. | ex32-2.htm |

| EX-23.1 - EXHIBIT 23.1 - Meet Group, Inc. | ex23-1.htm |

| EX-10.23 - EXHIBIT 10.23 - Meet Group, Inc. | ex10-23.htm |

| EX-31.1 - EXHIBIT 31.1 - Meet Group, Inc. | ex31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Meet Group, Inc. | Financial_Report.xls |

| XML - IDEA: XBRL DOCUMENT - Meet Group, Inc. | R9999.htm |

| EX-10.8 - EXHIBIT 10.8 - Meet Group, Inc. | ex10-8.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| |

|

For the fiscal year ended: December 31, 2014 | |

|

| |

|

Or | |

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| |

|

For the transition period from: to | |

MeetMe, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

001-33105 |

86-0879433 |

|

(State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

|

of Incorporation or Organization) |

File Number) |

Identification No.) |

100 Union Square Drive

New Hope, Pennsylvania 18938

(Address of Principal Executive Office) (Zip Code)

(215) 862-1162

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act: | ||

|

|

|

|

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, $0.001 par value |

|

The NASDAQ Stock Market LLC |

| NASDAQ Capital Market | ||

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None | ||

|

|

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☑No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

☐ Yes ☑No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☑ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☑ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☑ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☑ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

☐Yes ☑No

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, June 30, 2014, was approximately $96,000,000 based upon the last reported sale price of $2.72 per share on June 30, 2014 on the NASDAQ Capital Market.

The number of shares outstanding of the registrant’s common stock, par value $0.001, as of March 9, 2015, was 44,910,034.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant’s proxy statement for its 2015 Annual Meeting of Stockholders are incorporated by reference in Part III of this Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2014.

MEETME, INC.

TABLE OF CONTENTS

|

PART I | ||

|

|

|

|

|

Item 1. |

Business |

4 |

|

|

|

|

|

Item 1A. |

Risk Factors |

11 |

|

|

|

|

|

Item 1B. |

Unresolved Staff Comments |

25 |

|

|

|

|

|

Item 2. |

Properties |

25 |

|

|

|

|

|

Item 3. |

Legal Proceedings |

25 |

|

|

|

|

|

Item 4. |

Mine Safety Disclosures |

25 |

|

|

|

|

| PART II | ||

|

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

26 |

|

|

|

|

|

Item 6. |

Selected Financial Data |

26 |

|

|

|

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

26 |

|

|

|

|

|

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

|

|

|

|

|

|

Item 8. |

Financial Statements and Supplementary Data |

36 |

|

|

|

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

36 |

|

|

|

|

|

Item 9A. |

Controls and Procedures |

36 |

|

|

|

|

|

Item 9B. |

Other Information |

38 |

|

|

|

|

|

PART III | ||

|

| ||

|

Item 10. |

Directors, Executive Officers and Corporate Governance |

39 |

|

|

|

|

|

Item 11. |

Executive Compensation |

39 |

|

|

|

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

39 |

|

|

|

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

39 |

|

|

|

|

|

Item 14. |

Principal Accountant Fees and Services |

39 |

|

|

|

|

|

PART IV | ||

|

| ||

|

Item 15. |

Exhibits, Financial Statement Schedules |

40 |

|

|

||

|

Signatures |

||

PART I

ITEM 1. BUSINESS.

COMPANY OVERVIEW

MeetMe, Inc. (the “Company,” “MeetMe,” “us” or “we”) is a location-based social network for meeting new people both on the web and on mobile platforms, including on iPhone, Android, iPad and other tablets, that facilitates interactions among users and encourages users to connect with each other. MeetMe monetizes through advertising and in-app purchases. MeetMe provides users with access to an expansive, multilingual menu of resources that promote social interaction, information sharing and other topics of interest. The Company offers online marketing capabilities, which enable marketers to display their advertisements in different formats and in different locations. The Company works with its advertisers to maximize the effectiveness of their campaigns by optimizing advertisement formats and placement.

Just as Facebook has established itself as the social network of friends and family, and LinkedIn as the social network of colleagues and business professionals, MeetMe is creating the social network not of the people you know but of the people you want to know. We believe meeting new people is a basic human need, especially for users aged 18-30, when so many long-lasting relationships are made.

We believe that we have significant growth opportunities ahead as people increasingly use their mobile devices to discover the people around them. Given the importance of establishing connections within a user’s geographic proximity, we believe it is critical to establish a high density of users within the geographic regions we serve. As the MeetMe network grows the number of users in a location, we believe users who are seeking to meet new people will incrementally benefit from the quantity of relevant connections.

BUSINESS OVERVIEW

How We Create Value for Users

The Company believes that it is in the earliest days of a tremendously large opportunity – to be the mobile version of the neighborhood bar or coffeehouse, the service of choice among youth to find fun new people to meet and chat with. Our end goal is to be the conduit for connecting people to each other for the over 50 million people aged 18-30 in the United States and the more than one billion worldwide. We are unashamedly free, monetizing via an industry-leading mobile monetization infrastructure. We are vastly different from companies like Match.com, Zoosk, and Spark.

A survey of 11,000 MeetMe users indicates that 89% of people prefer to start relationships as friends. The difference between a subscription dating site and MeetMe is the difference between a singles bar and the neighborhood bar. People feel comfortable using MeetMe to make friends, socialize, and chat. We believe this the comfort level drives higher engagement and retention.

We believe a dramatic shift is underway in the multi-billion dollar dating industry, and that the industry is anchoring towards free with lowered pricing and dramatic investments in free services by existing players. We believe the subscription-dating model is ultimately compromised because it leads to massive churn by its nature. We believe churn ultimately reduces daily active users and restricts user density. The density of users within a geographic area is critical to developing a strong meet-new-people service. Ultimately, the network effect in a meet-new-people service comes down to having nearby, highly relevant users to recommend.

MeetMe has a singular focus on attracting and monetizing the vast majority of its users through superior products. We are not burdened by legacy subscription products, and we believe we are as well positioned as any company to build the global brand for meeting new people. We believe our success will depend in large part, as it does every year, on our ability to continue to execute against an aggressive product pipeline.

More than one million people use MeetMe every day to meet new people in their local communities and throughout the world. These daily active users are increasingly choosing to access MeetMe on their mobile devices, in many cases logging in multiple times per day in order to interact with people they have met on MeetMe.

Our top priority is to support and grow our dedicated user base by developing innovative ways of bringing people together online. We have historically been able to attract and retain users because we make meeting new people fun and easy through social games and applications. The products we have built for users can be divided into three categories: social networking products, social discovery products, and in-app products available for purchase.

Social Networking Products

Our traditional social networking products support our social discovery mission by enabling users to learn about, communicate with, and organize the people they meet on MeetMe.

|

|

● |

Profile: A user’s profile represents his or her identity within MeetMe. Basic demographic information is highlighted, along with a user-generated “About Me” blurb, while activities within social discovery applications, such as Feed, are also featured prominently. Profiles are one of the most popular areas on MeetMe for members to interact with one another. |

|

|

● |

Chat: MeetMe provides a robust chat product for private one-on-one communication between MeetMe users. Our users sent more than 500 million chats per month in the fourth quarter of 2014. |

|

|

● |

Friends: Within the Friends section, members interact with the friends they have made on MeetMe, accept new friend requests from MeetMe members, and invite their real-world friends to join MeetMe. |

Social Discovery Products

Our social discovery products facilitate interactions among members. They are the key vehicles through which we make it fun and easy to meet new people.

|

|

● |

Feed: Feed is MeetMe’s location-based stream communication feature and its most popular application. Unlike the Facebook News Feed, which surfaces content from users’ existing social graphs, our Feed surfaces content from people nearby, thus creating a broader conversation to help users discover new people to meet. Feed can be custom filtered based on age, gender, location or an existing MeetMe friend graph. |

|

|

● |

Meet: Meet showcases nearby, recently active members (filtered by age and gender preferences) that a member may want to chat with. Because it displays members sorted by proximity to the viewing user, Meet is where MeetMe members go to discover and potentially chat with people geographically closest to them. |

In-App Products Available For Purchase

MeetMe features an in-app product called Credits, which users can buy directly or earn by completing third-party offers, and several virtual products that users must spend Credits to access or use. Additionally, MeetMe offers a subscription product, MeetMe+, which is currently available only on our mobile apps.

|

|

● |

Boost: Like Google’s AdSense, but for people, Boost enables users to purchase placement in some of the most highly trafficked areas of MeetMe, to garner more attention from the community and increase the ability to meet more people faster. |

|

|

● |

Feed Spotlight: Feed Spotlight enables users to spend Credits in order to “pin” their post to the top of Feed for a limited period of time in order to drive more views, likes, and comments for their content. Spotlighted posts are targeted to a given geographic region and age group. |

|

|

● |

MeetMe+: MeetMe+ is a subscription product, available only on our mobile apps, that gives members extra privileges on MeetMe, including allowances and bonuses of Credits, the ability to see who is viewing your photos, and the ability to suppress mobile advertisements. |

How We Create Value for Marketers

We believe our youthful, highly engaged audience makes MeetMe an attractive publisher for marketers of all sizes, and we focus on providing a wide variety of advertising products that drive our users to engage with brands. During the fourth quarter in 2014, we served over six billion ad impressions each month across our web and mobile applications. Our brand and agency advertising business, also known as direct-sold advertising, is generally powered by companies looking for high-impact ad units and brand engagement from our younger demographic. Due to the sheer volume of available ad impression inventory, we do not typically sell out through direct-sold advertising alone; we attempt to fill the remainder of our inventory through a third-party advertising exchange or network, or remnant advertising.

In 2014 we teamed with two companies that were primarily responsible for filling our advertising inventory: Beanstock Media, Inc., or Beanstock, for our website and Pinsight Media+, Inc., or Pinsight, for our mobile applications. Both companies resold our inventory to numerous individual advertisers and paid us stated contractual rates. We believe this arrangement helped to limit our dependence on one or a few major brands, and minimized the impact of seasonal rate variations typical in the advertising industry. Our agreement with Pinsight terminated at the end of 2014, with a wind-down period that lasted through February 28, 2015. In December of 2014, we expanded out relationship with Beanstock such that beginning on March 1, 2015, Beanstock now has the right and obligation to fill certain advertising inventory on our MeetMe mobile apps for iOS and Android, as well as the meetme.com website when accessed using a mobile device and as optimized for mobile devices. The terms of both of our agreements with Beanstock extends to the end of 2015, subject to various termination rights.

Social Theater

Our Social Theater product enables publishers to incentivize their users to take certain actions in exchange for the hosting platform’s virtual currency. Social Theater advertising runs not only on MeetMe, where our users can watch videos and otherwise engage with brands in exchange for Credits, but also on social games and applications across other social networks, including Facebook. Social Theater can also be used by marketers to drive video views, application installs, and “likes” and “shares” on Facebook, Twitter, and other social platforms. When a Social Theater campaign is distributed outside of MeetMe on a different platform we consider it “Cross-Platform Revenues."

Our Strategy

We believe we are well positioned to pioneer the next category of social networking: social discovery. Our strategy for 2015 and beyond is aimed at continued growth and engagement of our active user base and improving the rate at which we monetize our active users, especially on mobile.

Key elements of our strategy include:

|

|

● |

Build Great Products to Acquire, Engage, and Thrill Users: Our core focus is to create innovative social experiences that help our users meet new people in their local communities or throughout the world. We plan on continuing to invest in improving our core platform as technology advances and in devising new ways of transforming the traditional experience of friendship-making as that activity increasingly moves online. |

|

|

● |

Offer Innovative and Engaging Ad Products for Marketers: We consider it critical to continue improving our advertising products to create more value for our marketers, attract new customers, and display targeted advertisements that are more relevant for our users. We pursue these goals through a combination of internal innovation and rapid integration of advertising solutions that have been successful in the marketplace. |

|

|

● |

Expand Our Reach Internationally: There are over one billion people aged 18-30 worldwide, of which approximately 50 million reside in the United States, where our traffic has historically been centered. In 2013, we internationalized the platform and launched in twelve languages other than English, laying the foundation for significant future growth in other geographies. In 2014, some of our fastest growing audiences were international, including in countries such as Turkey, Italy, India, and elsewhere. |

Operating Metrics

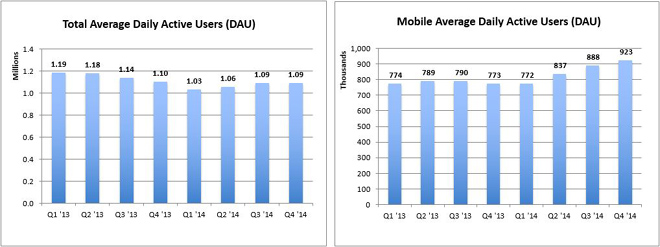

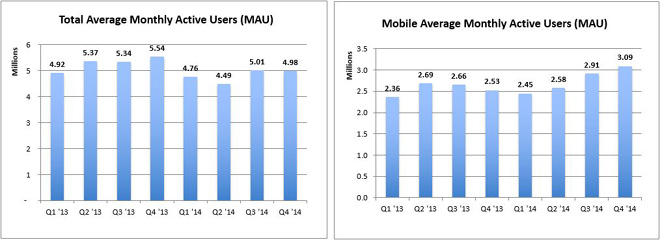

We measure website and application activity in terms of monthly active users (MAUs) and daily active users (DAUs). We define “MAU” as a registered user of one of our platforms who has logged in and visited within the last month of measurement. We define “DAU” as a registered user of one of our platforms who has logged in and visited within the day of measurement. For the quarters ended December 31, 2014 and 2013, the total MeetMe MAUs were approximately 4.98 million and 5.54 million, respectively, and total MeetMe DAUs were approximately 1.09 million and 1.10 million, respectively. The aggregate total of registered users on meetme.com and the MeetMe mobile applications were approximately 109 million and 82 million, for the years ended December 31, 2014 and 2013, respectively.

|

Monthly Average for the |

||||||||

|

Quarter Ended December 31, |

||||||||

|

2014 |

2013 |

|||||||

|

MAU- MeetMe |

4,983,122 | 5,542,317 | ||||||

|

For the Quarter Ended |

||||||||

|

December 31, |

||||||||

|

2014 |

2013 |

|||||||

|

DAU- MeetMe |

1,088,999 | 1,100,195 | ||||||

Trends in Our Metrics

In addition to MAUs and DAUs, we measure activity on MeetMe in terms average revenue per user (ARPU) and average daily revenue per daily active user (ARPDAU). We define ARPU as the average revenue per average monthly active user. We define ARPDAU as the average revenue per average daily active user. We define mobile MAU as a user who accessed our sites by a one of our mobile applications or by the mobile optimized version of our website, whether on a mobile phone or tablet during the month of measurement. We define a mobile DAU as a user who accessed our sites by one of our mobile applications or by the mobile optimized version of our website, whether on a mobile phone or tablet during the day of measurement. Visits represent the number of times during the measurement period that users came to the website or mobile applications for distinct sessions. A page view is a page that a user views during a visit.

In the quarter ended December 31, 2014, MeetMe averaged 3.09 million mobile MAUs and 4.98 million total MAUs on average, as compared to 2.53 million mobile MAUs and 5.54 million total MAUs on average in 2013, a net increase of 0.60 million or 22% for mobile MAUs, and a net decrease of 0.60 million or 10% for total MeetMe MAUs. Mobile DAUs increased 150,000 to 923,000 for the quarter ended December 31, 2014, a 19% improvement, from 773,000 in the fourth quarter of 2013. For the quarter ended December 31, 2014, MeetMe averaged 1.09 million total DAUs, as compared to 1.10 million total DAUs on average for the quarter ended December 31, 2013, a net decrease of approximately 11,000 total DAUs, or 1%.

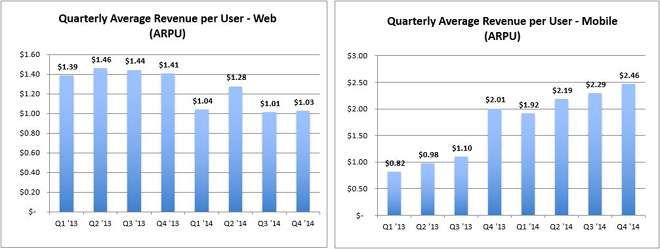

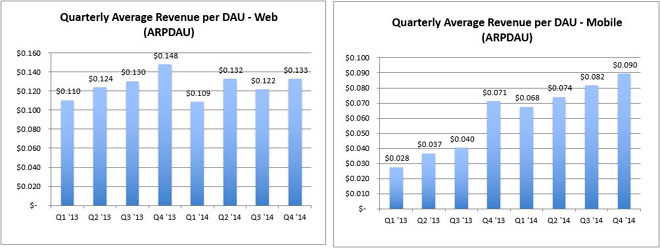

We believe the shift of our audience from web to mobile is an important driver of our business. Although decreasing web traffic has resulted in declining web revenue, we have successfully increased our mobile revenue by 50% and our mobile ARPDAU by 26% to $7.60 million and $0.09, respectively, for the quarter ended December 31, 2014 from $5.10 million and $0.07, respectively, for the quarter ended December 31, 2013. We believe our ability to continue to grow our mobile audience and our mobile monetization at a faster pace than the decline in our web revenue will impact the performance of our business.

In the quarter ended December 31, 2014, MeetMe earned an average of $1.03 ARPU on the web and $2.46 in ARPU in our mobile applications, as compared to $1.41 in web ARPU and $2.01 in mobile ARPU for the quarter ended December 31, 2013. In the quarter ended December 31, 2014, MeetMe earned an average of $0.13 in web ARPDAU and $0.09 in mobile ARPDAU, as compared to $0.15 in web ARPDAU and $0.07 in mobile ARPDAU for the quarter ended December 31, 2013.

PRODUCT DEVELOPMENT

We are continually developing new products, as well as optimizing our existing platform and feature set in order to meet the evolving needs of our user base and advertising partners.

We develop most of our software internally. We will, however, purchase technology and license intellectual property rights where it is strategically important, operationally compatible, and economically advantageous. For instance, we partner with third parties to further our internationalization efforts as we look to bring additional languages into our existing platforms. We are not materially dependent upon licenses and other agreements with third parties relating to product development.

Our technology team of approximately 66 people consists of our product development and engineering team, our database administration team, our quality assurance team and our network system operators. These teams are responsible for feature enhancements and general maintenance across all of our platforms. Our technology team is headquartered in New Hope, Pennsylvania.

SALES AND MARKETING

Historically, we have grown our user base in large part through organic, viral channels. By encouraging members to invite their friends to join MeetMe and to share their activity across other external platforms, including Facebook and Twitter, and by providing members with easy-to-use tools, we believe we have successfully grown our user base while minimizing marketing costs. We focus primarily on creating a truly differentiated experience and compelling value proposition for new users in our markets and developing the technologies needed to facilitate their word-of-mouth marketing on our behalf in order to attract and retain new members.

In 2013, we launched a new paid customer acquisition strategy, with a focus on acquiring users in new geographies where the active user base on the core MeetMe platform had previously been small in comparison to our user base in the United States and Canada. We spent $2.0 million and $2.5 million on paid direct user acquisition in 2014 and 2013, or 4.5% and 6.2% of our total revenue, respectively.

SALES AND OPERATIONS

Our advertising sales department of 14 full-time employees in the United States covers major brand agencies, direct response and cost-per-action engagement advertisers, advertising networks, and mobile agencies. Our advertising operations are headquartered in New Hope, Pennsylvania, with additional offices in New York, New York and Los Angeles, California.

Our operations and member services team consists of 20 full-time employees, 8 part-time employees, and 30 contractors split between Delhi and Bangalore, India. This team is responsible for reviewing images and other user-generated content, investigating and responding to member abuse reports, and providing general customer support.

INTELLECTUAL PROPERTY

Our intellectual property includes trademarks related to our brands, product, and services; copyrights in software and creative content; trade secrets; domain names; and other intellectual property rights and licenses of various kinds. We seek to protect our intellectual property through copyright, trade secret, trademark and other laws of the U.S. and other countries of the world, and through contractual provisions.

We consider the MeetMe and Social Theater trademarks and our related trademarks to be valuable to the Company, and we have registered these trademarks in the U.S. and other countries throughout the world and aggressively seek to protect them.

COMPETITION

We operate at the forefront of a nascent segment (social discovery) of a broader sector that is still being defined (social networking). As such, we face significant competition in every aspect of our business, both from established companies whose products help users meet new people, or are evolving to do so, and from smaller but well-funded startups that can quickly gain attention and compete with us for users. Examples of services that compete with us for users and advertiser interest include, but are not limited to:

|

|

● |

Websites and mobile applications whose primary focus is to help users meet new people in their geographical area, including Tagged, Badoo, Skout, Twoo, and Meetup. |

|

|

● |

Social networking websites and mobile applications with a focus on dating, which is a subset of the opportunity around meeting new people, such as Zoosk, Match.com, PlentyOfFish, Okcupid, and Tinder. |

|

|

● |

Broader social networks that currently offer or may evolve to offer services aimed at helping users meet new people in their area, such as Facebook, Twitter, and LinkedIn. |

|

|

● |

Interest-based communities that help users connect with like-minded people online, including Pinterest, Reddit, Tumblr, and Quora, as well as vertical communities such as Goodreads, Last.fm, and Fitocracy. |

|

|

● |

Significant competition for Social Theater comes from publishers including TrueX, Unruly Media, SuperSonic Advertising, Jun Group, and Genesis Media. |

As we introduce new products, and as other companies introduce new products and services, we expect to become subject to additional competition. Additional information regarding certain risks related to our competition is included in Part I, Item 1A, “Risk Factors” of this report.

EMPLOYEES

As of March 2, 2015, we employed approximately 113 full time and 8 part time employees in the United States. Our future success is substantially dependent on the performance of our senior management and key technical personnel, as well as our continuing ability to attract, maintain the caliber of, and retain highly qualified technical and managerial personnel. Additional information regarding certain risks related to our employees is included in Part I, Item 1A “Risk Factors” of this report and is incorporated herein by reference.

GOVERNMENT REGULATION

In the United States, advertising and promotional information presented to visitors on our website and mobile applications and our other marketing activities are subject to federal and state consumer protection laws that regulate unfair and deceptive practices. There are a variety of state and federal restrictions on the marketing activities conducted by email, or over the Internet, including U.S. federal and state privacy laws and the Telephone Consumer Protection Act of 1991, or the TCPA, the Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2001, or the CAN-SPAM Act. We may also be subject to laws in the various other countries in which we operate. The rules and regulations are complex and may be subject to different interpretations by courts or other governmental authorities. We may unintentionally violate such laws, such laws may be modified, and new laws may be enacted in the future. Any such developments (or developments stemming from enactment or modification of other laws) or the failure to anticipate accurately the application or interpretation of these laws could create liability to us, result in adverse publicity, and negatively affect our businesses. Additional information regarding certain risks related to government regulations is included in Part I, Item 1A, “Risk Factors” of this report.

CORPORATE HISTORY

MeetMe was incorporated in Nevada in June 1997, and merged with Insider Guides, Inc., doing business as myYearbook.com, on November 10, 2011. On December 6, 2011, the Company changed its legal domicile to Delaware. The Company is a social media technology company that owns and operates meetme.com. Effective June 1, 2012, the Company changed its name from Quepasa Corporation to MeetMe, Inc. The Company was previously known as myYearbook.com and Quepasa.com and completed its transition to meetme.com in the fourth quarter of 2012. On June 20, 2012, the Company discontinued the games development business and creation of intellectual properties business of Quepasa Games. On December 31, 2014, the Company closed the Sao Paolo, Brazil office.

Our executive offices and principal facilities are located at 100 Union Square Drive, New Hope, Pennsylvania, 18938. Our telephone number is (215) 862-1162. Our corporate website is www.meetmecorp.com. Investors can obtain copies of our SEC filings from our corporate website free of charge, as well as from the SEC website, www.sec.gov. The information contained on our corporate website and the SEC website is not incorporated herein.

AVAILABLE INFORMATION

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, are available free of charge on our Investor Relations website at www.meetmecorp.com/investors/sec-filings/ as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains a website that contains these filings at www.sec.gov. The information posted on our corporate website and the SEC website is not incorporated herein.

ITEM 1A. RISK FACTORS.

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this report, including the consolidated financial statements and the related notes included elsewhere in this report, before deciding whether to invest in shares of our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material may also become important factors that adversely affect our business. If any of the following risks actually occurs, our business, financial condition, results of operations, and future prospects could be materially and adversely affected. In that event, the market price of our common stock could decline, and you could lose part or all of your investment.

Risk Related to Our Business

If we cannot increase our daily and monthly active users and increase their engagement on MeetMe, our future operating results may decline.

We offer applications that are free to use, with only a small percentage of our users paying for virtual goods. Our financial performance has been and will continue to be significantly determined by our success in adding, retaining, and engaging active users. We must continue to add new members to our user base and retain existing members by offering new and engaging features and products in order to attract advertising investment and generate virtual currency revenue. The challenges we face include, among other things, our ability to:

|

|

● |

attract new users and retain existing users at a consistent rate; |

|

|

|

|

|

|

● |

increase engagement by existing users; |

|

|

|

|

|

|

● |

monetize our growing base of mobile users; |

|

|

|

|

|

|

● |

anticipate changes in the social networking and social discovery industry; |

|

|

|

|

|

|

● |

launch new products and release enhancements that become popular; |

|

|

|

|

|

|

● |

develop and maintain a scalable, high-performance technology infrastructure that can efficiently and reliably handle increased member usage, fast load times and the deployment of new features and applications; |

|

|

|

|

|

|

● |

process, store and use data in compliance with governmental regulation and other legal obligations related to privacy; |

|

|

● |

compete with other companies that are currently in, or may in the future enter, the social networking or social discovery industry; |

|

|

|

|

|

|

● |

hire, integrate and retain world class talent; and, |

|

|

|

|

|

|

● |

expand our business internationally and with respect to mobile devices. |

If we fail to retain existing users or add new users, or if our users decrease their level of engagement, our revenue, financial results, and business may be significantly harmed.

The size of our user base and our users’ level of engagement are critical to our success. Our financial performance is significantly affected by our success in adding, retaining, and engaging active users. If people do not perceive our products to be useful, reliable, and trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their engagement. A number of other social networking companies that achieved early popularity have since seen their active user bases or levels of engagement decline, in some cases precipitously. There is no guarantee that we will not experience a similar erosion of our active user base or engagement levels. A decrease in user retention, growth, or engagement could render us less attractive to advertisers, which may have a material and adverse impact on our revenue, business, financial condition, and results of operations. Any number of factors could potentially negatively affect user retention, growth, and engagement, including if we fail to:

|

|

● |

introduce new and improved products that are favorably received; |

|

|

|

|

|

|

● |

identify and respond to emerging technological trends in the market; |

|

|

|

|

|

|

● |

provide a compelling user experience with the decisions we make with respect to the frequency, prominence, and size of advertising and other commercial content we display; |

|

|

|

|

|

|

● |

continue to develop features for mobile devices that users find engaging, that work with a variety of mobile operating systems and networks, and that achieve a high level of market acceptance; |

|

|

|

|

|

|

● |

acquire or license leading technologies; |

|

|

|

|

|

|

● |

avoid technical or other problems that prevent us from delivering our services in a rapid and reliable manner or otherwise affect the user experience; or |

|

|

|

|

|

|

● |

provide adequate customer service to users or advertisers. |

If we are unable to maintain and increase our user base and user engagement, our revenue, financial results, and future growth potential may be adversely affected.

We believe the number of our registered members is higher than the number of actual users.

We believe the number of registered members in our network may be higher than the number of actual users because some members may have multiple registrations, other members may have died or may have become incapacitated, and others may have registered under fictitious names. Members also terminate their memberships and delete their profiles. Given the challenges inherent in identifying these accounts, we do not have a reliable system to accurately identify the number of our active members.

If our members do not interact with each other or our viral marketing strategy fails, our ability to attract new members may suffer and our revenue may decrease.

The majority of our members do not visit MeetMe frequently and spend a limited amount of time when they do visit. The majority of our page views are generated by a minority of our users. If we are unable to encourage our members to interact more frequently and to increase the amount of user generated content they provide, our ability to attract new users and our financial results may suffer. In addition, part of our success depends on our users interacting with our products and contributing to our viral advertising platform (Social Theater). If our Social Theater platform is unsuccessful and our users do not participate in Social Theater campaigns, our operating results may suffer.

We generate the majority of our revenue from advertising. If we incur a loss of advertisers, or a reduction in spending by advertisers, our revenue could substantially decline resulting in significant operating losses and negatively impacting our cash flows.

The majority of our revenue is currently generated from parties advertising on our platform. As is common in the industry, our advertisers typically do not have long-term advertising commitments with us. Many of our advertisers spend only a relatively small portion of their overall advertising budget with us. Advertisers will not continue to do business with us, or they will reduce the prices they are willing to pay to advertise with us, if we do not deliver advertising and other commercial content in an effective manner, or if they do not believe that their investment in advertising with us will generate a competitive return relative to other alternatives. Our advertising revenue could be adversely affected by a number of other factors, including:

|

|

● |

decreases in user engagement, including time spent on MeetMe; |

|

|

● |

product changes or inventory management decisions we may make that reduce the size, frequency, or relative prominence of advertising and other commercial content that we display; |

|

|

● |

our inability to improve our analytics and measurement solutions that demonstrate the value of our advertising and other commercial content; |

|

|

● |

loss of advertising market share to our competitors; |

|

|

● |

adverse legal developments relating to advertising, including legislative and regulatory developments and developments in litigation; |

|

|

● |

adverse media reports or other negative publicity involving us or other companies in our industry; |

|

|

● |

changes in the way online advertising is priced; |

|

|

● |

the impact of new technologies that could block or obscure the display of our advertising and other commercial content; and |

|

|

● |

the impact of macroeconomic conditions and conditions in the advertising industry in general. |

The occurrence of any of these or other factors could result in a reduction in demand for our advertising and other commercial content, which may reduce the prices we receive for our advertising and other commercial content, or cause advertisers to stop advertising with us altogether. In turn, we may incur a substantial decline in revenue, increased operating losses, and a negative impact on cash flows.

We have entered into significant agreements with our advertising partner, and its default or other inability to perform under these contracts could harm our business and results of operations.

We have entered into two agreements with Beanstock Media, Inc., or Beanstock, with respect to our advertising inventory on both web and mobile. We have a Media Publisher Agreement with Beanstock under which Beanstock has the exclusive right and obligation to fill substantially all of our remnant advertising inventory on www.meetme.com through December 31, 2015. We anticipate that revenue under this agreement for the year 2015 will constitute approximately 12% of our total revenue. In addition, we have entered into an Advertising Agreement with Beanstock whereby Beanstock will have the exclusive right and obligation to fill certain advertising inventory on our MeetMe mobile apps for iOS and Android, as well as the meetme.com website when accessed using a mobile device and as optimized for mobile devices, starting on or about March 1, 2015. We anticipate that revenue under this agreement for the year 2015 will constitute approximately 50% of our total revenue.

A failure by us to renew either of these agreements, or to do so on terms less favorable, or a failure by Beanstock to effectively perform its obligations under either agreement could have detrimental operating, financial and reputational consequences for our business. In particular, if Beanstock files for bankruptcy protection, becomes insolvent or otherwise fails to meet its payment obligations to us, we could be prevented from collecting on receivables under the respective agreement, which would have an adverse effect on our results of operations.

If we cannot effectively monetize our mobile products, we may not be able to successfully grow our business.

The shift of our audience from web to mobile may be disruptive to our business and operating results. As our users shift from web to mobile access, web page views have decreased. Decreasing web traffic contributes to declining web revenue. Our business faces the challenge of ramping up mobile monetization to offset declining web revenues as users continue to increase their mobile access. The transition in our user access may impact revenue in the short-term and medium-term as mobile monetization continues to mature slowly. Accordingly, as users increasingly access MeetMe mobile products as a substitute for using personal computers, if personal computer usage continues to be phased out by the popularity of smart phones and tablets, and if we are unable to successfully implement monetization strategies for our mobile users, our revenue and financial results may be negatively affected.

Because we face significant competition from other social networks and companies with greater resources, we may not be able to compete effectively.

We face significant competition from other companies that seek to connect members online. Our competitors are other companies providing portal and online community services, such as Facebook, Google, Tagged, Badoo, PlentyOfFish, Skout, and Okcupid. Many of our competitors have greater resources, more established reputations, a broader range of content and products and services, longer operating histories, and more established relationships with their users than we do. They can use their experience and resources against us in a variety of competitive ways, including developing ways to attract and maintain users. These factors may allow our competitors to respond more effectively than us to new or emerging technologies and changes in market requirements. Our competitors may develop products, features, or services that are similar to ours or that achieve greater market acceptance, may undertake more far-reaching and successful efforts at developing new services or marketing campaigns, or may adopt more aggressive pricing policies.

We believe that our ability to compete effectively depends upon many factors both within and beyond our control, including:

|

|

● |

the usefulness, ease of use, performance, and reliability of our services compared to our competitors; |

|

|

● |

the size and composition of our user base; |

|

|

● |

the engagement of our users with our services; |

|

|

● |

the timing and market acceptance of services, including developments and enhancements to our or our competitors’ services; |

|

|

● |

our ability to monetize our services, including our ability to successfully monetize mobile usage; |

|

|

● |

the frequency, size, and relative prominence of the advertising and other commercial content displayed by us or our competitors; |

|

|

● |

customer service and support efforts; |

|

|

● |

marketing and selling efforts; |

|

|

● |

changes mandated by legislation, regulatory authorities, or litigation, including settlements and consent decrees, some of which may have a disproportionate effect on us; |

|

|

● |

acquisitions or consolidation within our industry, which may result in more formidable competitors; |

|

|

● |

our ability to attract, retain, and motivate talented employees, particularly software engineers; |

|

|

● |

our ability to cost-effectively manage and grow our operations; and |

|

|

● |

our reputation and brand strength relative to our competitors. |

If we are not able to effectively compete, our user base and level of user engagement may decrease, which could make us less attractive to advertisers and materially and adversely affect our revenue and results of operations.

Because we face competition from traditional media companies, we may not be included in the advertising budgets of large advertisers, which could harm our operating results.

Major brand and network advertising drives most of our revenue. We rely primarily on cost per thousand (“CPM”) advertising, where the price for advertising is based on the number of users who view it. In addition to Internet companies, we face competition from companies that offer traditional media advertising opportunities. Most large advertisers have set advertising budgets, a portion of which is allocated to Internet and mobile advertising. We expect that large advertisers will continue to increase their advertising efforts on the Internet and mobile devices. If we fail to convince these companies to spend a portion of their advertising budgets on social media and specifically with us, however, our operating results could be harmed.

An increasing number of individuals are utilizing devices other than personal computers to access the Internet. If versions of our applications developed for these devices do not gain widespread adoption, or do not function as intended, our business could be adversely affected.

The number of people who access the Internet through devices other than personal computers, including smart phones, cell phones and handheld tablets, has increased dramatically in the past few years and is projected to continue to increase. We have launched a MeetMe mobile application for Android smart phones, iPhones and iPads. We are dependent on interoperability with popular mobile operating systems that we do not control, such as Android and iOS, and any changes in such systems that degrade our platform’s functionality or give preferential treatment to competitive services could adversely affect our mobile application usage on mobile devices. Each device manufacturer or platform provider may establish unique or restrictive terms and conditions for developers on such devices or platforms, and our games may not work well or be viewable on these devices as a result. Smart phones, cell phones and handheld tablets generally have lower processing speed, power, functionality and memory than computers. As a result, our mobile application and similar applications we may develop in the future may not be compelling to users. As new devices and new platforms are continually being released, it is difficult to predict the problems that we may encounter in developing versions of our solutions for use on these alternative devices, and we may need to devote significant resources to the creation, support, and maintenance of such devices. If we cannot effectively monetize the continuing shift to mobile devices, our business could be negatively affected.

Since we rely on the Apple “App Store” and “Google Play” to obtain new mobile MeetMe members, if either denies us access or changes its search and rating algorithms we may not be able to acquire new mobile members.

We acquire new mobile members for MeetMe primarily through the Apple “App Store” and Google “Play” (formerly the Android “Marketplace”). On more than one occasion in the past, Apple has rejected our applications because of user generated content and other concerns. In response we devoted additional resources to image review, and changed some of our content allowance policies. If we fail to maintain access to either or both the App Store and Google Play outlets, our business and operating results will suffer. In addition, our iPhone and Android applications rank near the top of the “Free Social” categories and near the top of many key search terms. However, Apple and Google have changed their rating and search algorithms in the past without notice. Future changes to the rating and search algorithms by Apple or Google may impact our rating and search results, causing a drop in new mobile application downloads and causing our business and operating results to suffer.

If we are unable to continue to develop successful applications for mobile platforms and standalone mobile applications, our growth prospects could suffer.

We have offered applications for mobile platforms since May 2010. We launched our first standalone application in 2013 and are continuing to develop standalone applications. We expect to continue to devote substantial resources to the development of mobile applications and standalone applications, but there can be no assurances that we will continue to succeed in developing applications that appeal to users or advertisers. We may encounter difficulty in attracting leading advertisers to our mobile applications. With respect to our standalone applications, we may encounter difficulty attracting users to those applications. We may also face challenges working with wireless carriers, mobile platform providers and other mobile communications partners. Finally, we may face challenges converting mobile users into users that pay for in-app products. These and other uncertainties make it difficult to know whether we will continue to succeed in developing commercially viable applications for mobile platforms and standalone applications. If we do not succeed in doing so, our growth prospects will suffer.

If we cannot address technological change in our industry in a timely fashion and develop new services, our future results of operations may be adversely affected.

The Internet and electronic commerce industries are characterized by:

|

|

● |

rapidly changing technology; |

|

|

● |

evolving industry standards and practices that could render our platform and proprietary technology obsolete; |

|

|

● |

changes in consumer tastes and demands; and |

|

|

● |

frequent introductions of new services or products that embody new technologies. |

Our future performance will depend, in part, on our ability to develop, license or acquire leading technologies and program formats, enhance our existing services, and respond to technological advances and consumer tastes and emerging industry standards and practices on a timely and cost-effective basis. Developing website, mobile, and other technology involves significant technical and business risks. We may not be able to successfully use new technologies or adapt our platforms and technology to emerging industry standards. We may not be able to remain competitive or sustain growth if we do not adapt to changing market conditions or customer requirements.

Because we plan to continue expanding our operations abroad where we have limited operating experience, we may be subject to increased business, economic and regulatory risks that could affect our financial results.

We plan to continue the international expansion of our business operations. We may enter new international markets where we have limited or no experience in marketing, selling, and deploying our products. If we fail to deploy or manage our operations in international markets successfully, our business may suffer. In addition, we are subject to a variety of risks inherent in doing business internationally, including:

|

|

● |

political, social, or economic instability; |

|

|

● |

risks related to the legal and regulatory environment in foreign jurisdictions, including with respect to privacy, and changes in laws, regulatory requirements, and enforcement; |

|

|

● |

burdens of complying with a variety of foreign laws; |

|

|

● |

potential damage to our brand and reputation due to our compliance with local laws, including potential censorship or requirements to provide user information to local authorities, and/or potential penalties for failing to comply with such local laws; |

|

|

● |

lack of familiarity with local customs; |

|

|

● |

fluctuations in currency exchange rates; |

|

|

● |

higher levels of credit risk and payment fraud; |

|

|

● |

reduced protection for intellectual property rights in some countries; |

|

|

● |

difficulties in staffing and managing global operations and the increased travel, infrastructure; and |

|

|

● |

compliance with the United States Foreign Corrupt Practices Act and similar laws in other jurisdictions. |

If we are unable to expand internationally and manage the complexity of our global operations successfully, our financial results could be adversely affected.

If we are unable to implement payment gateways to our users, our results of operations may be adversely affected.

We conduct our business in countries outside of the United States and depend on payment gateways that are not as well developed as those in the United States, where most people have credit cards or bank debit cards to use in paying for virtual goods, products, and services. Users in some countries in which we operate do not always have access to credit and debit cards and other payment methods common in the United States. If we are unable to implement payment gateways that provide our members with the ability to pay for goods, products and services easily, our future results may be adversely affected. Additionally, our inability to collect and receive payments from these other sources may have an adverse effect on our business and results of operations.

Because we rely on Facebook as a significant distribution, marketing, and promotion platform, if our relationship with Facebook changes or if Facebook loses market share, our business may be adversely affected.

Facebook is an important distribution, marketing and promotion platform for our content and applications. We generate a number of our new users through the Facebook platform and we expect to continue to do so for the foreseeable future. As such, we are subject to Facebook’s standard terms and conditions for Facebook Connect and for application developers, which govern the promotion, distribution and operation of applications on the Facebook platform.

Our ability to acquire new members and provide services to our existing members would likely be harmed if:

|

|

● |

Facebook discontinues or limits access to its platform by us and other application developers; |

|

|

● |

Facebook modifies its terms of service or other policies, including changing how the personal information of its users is made available to application developers on the Facebook platform or shared by users; |

|

|

● |

Facebook develops its own competitive offerings; or |

|

|

● |

Facebook disallows our advertising in its platforms. |

We have benefited from Facebook’s strong brand recognition and large user base. If Facebook loses its market position or otherwise falls out of favor with users, we would need to identify alternative channels for marketing, promoting and distributing our content and applications, which could consume substantial resources and may not be effective. In addition, Facebook has broad discretion to change its terms of service and other policies with respect to us and other developers, and any such changes could be unfavorable. Facebook may also change its fee structure or add fees associated with access to and use of the Facebook platform.

Because our business is subject to complex and evolving United States and foreign laws and regulations regarding privacy, data protection, and other matters, we may be subject to claims, changes to our business practices, increased cost of operations, or declines in user growth or engagement, or otherwise sustain harm to our business.

We are subject to a variety of laws and regulations in the United States and abroad that involve matters central to our business, including user privacy, rights of publicity, data protection, intellectual property, gaming, electronic contracts and other communications, competition, protection of minors, consumer protection, taxation, and online payment services. Foreign data protection, privacy, and other laws and regulations are often more restrictive than those in the United States. United States federal, state and foreign laws and regulations are constantly evolving and can be subject to significant change. The application and interpretation of these laws and regulations are often uncertain, particularly in the new and rapidly evolving industry in which we operate. In addition, federal, state and foreign legislative or regulatory bodies may enact new or additional laws and regulations concerning data privacy and retention issues which could adversely impact our business. The interpretation and application of privacy, data protection and data retention laws and regulations are currently unsettled in the United States and internationally. These laws may be interpreted and applied inconsistently from country to country and inconsistently with our current data protection policies and practices. Complying with these varying state to state or international requirements could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business.

We use email, push notifications, and text message campaigns to drive user engagement. Disruptions in, restrictions on, and certain legal risks associated with the sending or receipt of emails, push notifications, or text messages or a decrease in user willingness to receive emails, push notifications, and text messages could adversely affect our revenues and business.

We use email, push notifications, and text message campaigns to drive user engagement. We send a large volume of emails, push notifications, and text messages to users notifying them of a variety of activities on our platform, such as new connections. We also rely on the use of email, push notifications, and text messages as a part of our registration and validation processes. Because of the importance of email, push notifications, and text messages to our business, if we are unable to successfully deliver emails, push notifications, or text messages to our users or if users consistently decline to open our emails, push notifications, or text messages, our business could be adversely affected.

We also face a risk that service providers or email applications may block bulk message transmissions or otherwise experience technical difficulties that result in our inability to successfully deliver emails, push notifications, or text messages to our users. Third parties may also block our emails as spam, impose restrictions on our emails, push notifications, or text messages, or start to charge for the delivery of emails through their email systems. In addition, changes in how webmail applications organize and prioritize email may reduce the number of users opening our emails. For example, Google’s Gmail service recently introduced a new feature that organizes incoming emails into categories (for example, primary, social and promotions). Such categorization or similar inbox organizational features may result in our emails being delivered in a less prominent location in a user’s inbox or viewed as “spam” by our users and may reduce the likelihood of that user opening our emails.

Email communications may subject us to potential risks, such as liabilities or claims resulting from unsolicited email or spamming, lost or misdirected messages, security breaches, illegal or fraudulent use of email or personal information or interruptions or delays in email service. For example, in the United States, the CAN-SPAM Act establishes certain requirements for the distribution of “commercial” email messages and provides for penalties for transmission of commercial email messages that are intended to deceive the recipient as to source or content. In addition, some countries and states have passed laws regulating commercial email practices that are, in some cases, significantly more punitive and difficult to comply with than the CAN-SPAM Act.

Push notifications and text messages may subject us to potential risks, including liabilities or claims relating to consumer protection laws. For example, the Telephone Consumer Protection Act of 1991, or the TCPA, restricts telemarketing and the use of automatic SMS text messages without proper consent. The Federal Trade Commission, or the FTC, has guidelines that impose responsibilities on companies with respect to communications with consumers, such as text messages, and impose fines and liability for failure to comply with rules with respect to advertising or marketing practices it may deem misleading or deceptive. Furthermore, a number of states and countries have enacted statutes that address telemarketing through SMS text messages. Restrictions on marketing through text messages are enforced in the United States by the FTC, the Federal Communications Commission, state agencies and through the availability of statutory damages and class action lawsuits for violations of the TCPA or similar laws. The scope and interpretation of the laws that are or may be applicable to our use of push notifications and text messages are continuously evolving and developing. If we do not comply with these laws or regulations or if we become liable under these laws or regulations, we could be harmed, and we may be forced to implement new marketing methods, which may be costly or ineffective.

Without the ability to deliver emails, push notifications, and text messages to our users we may have limited means of maintaining contact and inducing them to use our platform. Due to the importance of email, push notifications, and text messages to our business, any disruptions or restrictions on the distribution or receipt of emails, push notifications, or text messages or increase in the associated costs could have a material adverse effect on our business and operating results.

A failure in or breach of our operational or security systems or infrastructure, or those of third parties with which we do business, including as a result of cyber attacks, could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses.

Integral to our performance is the continued efficacy of our internal processes, systems, relationships with third parties and the employees and key executives in our day-to-day ongoing operations. Our ability to conduct business may be adversely affected by any significant and widespread disruption to our infrastructure or systems. Our technologies, systems, networks and our users’ devices have been subject to, and are likely to continue to be the target of, cyber attacks, computer viruses, malicious code, phishing attacks or information security breaches that could result in the unauthorized release, gathering, monitoring, misuse, loss or destruction of confidential, proprietary and other information of the Company, our employees or users, or otherwise disrupt our or our users’ or other third parties’ business operations.

Disruptions or failures in the physical infrastructure or operating systems that support our businesses and users, or cyber attacks or security breaches of the networks, systems or devices that our users use to access our products and services could result in the loss of users and business opportunities, significant business disruption to the Company’s operations and business, misappropriation of the Company’s confidential information and/or that of its users, or damage to the Company’s computers or systems and/or those of its users and/or counterparties, and could result in violations of applicable privacy laws and other laws, litigation exposure, regulatory fines, penalties or intervention, loss of confidence in the Company’s security measures, reputational damage, and additional compliance costs.

Increased government regulation could adversely affect our business.

Due to the rapid growth and widespread use of the Internet, national and local governments are enacting and considering various laws and regulations. In February of 2015, for example, the United States Federal Communication Commission announced its “net neutrality” intention of regulating broadband Internet providers as common carriers under Title II of the Communications Act of 1934 and Section 706 of the Telecommunications act of 1996. We face uncertainty as to the impact of this decision and other government regulation on our business. New laws and regulations designed to protect consumers could adversely affect our business and operations by exposing us to substantial compliance costs and liabilities and impeding growth in use of the Internet. Furthermore, the application of existing domestic laws and regulations to Internet companies remains somewhat unclear, and courts may apply these laws in unintended and unexpected ways. While online dating and social networking websites are not currently required to verify the age or identity of their members or to run criminal background checks on them, for example any such requirements could increase our cost of operations or discourage use of our services.

As we expand internationally, we will also become increasingly subject to foreign laws and regulations which could be inconsistent from country to country. Foreign governments may restrict Internet social networking usage, pass laws that negatively impact our business, or prosecute us for our services. We may incur substantial liabilities for expenses necessary to comply with laws and regulations or penalties for any failure to comply. Additionally, restrictions and compliance costs associated with current and possible future laws and regulations could harm our business and operating results.

If laws that tax usage and sales on the Internet are enacted, increased taxes could adversely affect the commercial use of our marketing services and our financial results.

Due to the global nature of the Internet, it is possible that governments might attempt to tax our activities, including the sale of virtual currency. New or revised tax regulations may subject us to additional sales, use, income, and other taxes. We cannot predict the effect of current attempts to impose sales, income, or other taxes on commerce over the Internet. New or revised taxes and especially sales taxes would likely increase the cost of doing business online, reduce Internet sales, and decrease the attractiveness of advertising over the Internet. Any of these events could have an adverse effect on our business and results of operations.

If we fail to comply with existing or future laws, regulations or user concerns regarding privacy and protection of user data could adversely affect our business.

We have posted our own privacy policy and practices concerning the collection, use, and disclosure of user data. Any actual or perceived failure by us to comply with our privacy policy or with any data-related consent orders, Federal Trade Commission requirements or orders, or other federal, state or foreign privacy or consumer protection-related laws, regulations or industry self-regulatory principles, or any compromise of security that results in the unauthorized release or transfer of personally identifiable information or other user data, could result in proceedings or actions against us by governmental entities, consumer advocacy groups or others, which could potentially have an adverse effect on our business. Our efforts to protect the information that our users have chosen to share may be unsuccessful due to the actions of third parties, software bugs or other technical malfunctions, employee error or malfeasance, or other factors. In addition, third parties may attempt to fraudulently induce employees or users to disclose information in order to gain access to our data or our users’ data. If any of these events occur, our users’ information could be accessed or disclosed improperly.

Further, actual or perceived failure by us to comply with our policies, applicable requirements, or industry self-regulatory principles related to the collection, use, sharing or security of personal information, or other privacy or data protection-related matters could result in a loss of user confidence in us, damage to our brands, and ultimately in a loss of users and advertising partners, any of which could adversely affect our business.

We have been subject to regulatory investigations and governmental legal proceedings and we expect to be subject to the same in the future, which could cause us to incur substantial costs or require us to change our business practices in a manner materially adverse to our business.

From time to time, we receive inquiries from regulators and other governmental entities regarding our compliance with laws and other matters. On February 3, 2014 the San Francisco City Attorney filed a complaint against the Company in the Superior Court of the State of California, County of San Francisco, alleging that the Company engages in unfair business practices with respect to its use of information relating to minors, and particularly with respect to location information and the Company’s disclosure of such use. Responding to or defending this or other such actions may cause us to incur substantial expenses and divert our management’s attention. If we are unsuccessful, we could subject to substantial monetary fines and other penalties that could negatively affect our financial condition and results of operations; furthermore, we may have to change our business practices that could impair our ability to obtain new members or service to our members. Any change in our business practices or defense of a legal action or regulatory investigation or action could reduce our future revenues and increase our costs and adversely affect our future operating results.

Violation of existing or future regulatory or judicial orders or consent decrees could subject us to substantial monetary fines and other penalties that could negatively affect our financial condition and results of operations. In addition, it is possible that future orders issued by, or enforcement actions initiated by, regulatory authorities could cause us to incur substantial costs or require us to change our business practices in a manner materially adverse to our business.

If our members fail to comply with existing or future laws and regulations, it could adversely affect our business.

We provide platforms for meeting new people. Although we devote substantial resources to member services and safety, our members have in the past and will likely in the future commit crimes against other members or violate other laws in interacting with such members, which could impair our brand and raise the prospect of litigation that may be costly to defend. Additionally, any inappropriate content or behavior by our members could cause our mobile apps to be removed from the App Store and/or Google Play, which could adversely affect our business.

The requirements of being a public company may strain our resources and divert management's attention.

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, the Sarbanes-Oxley Act, the Dodd-Frank Act, the listing requirements of the NASDAQ Capital Market, and other applicable securities rules and regulations. Compliance with these rules and regulations has increased and may continue to increase our legal and financial compliance costs, make some activities more difficult, time-consuming, or costly, and increase demand on our systems and resources. As a result, management's attention may be diverted from other business concerns, which could harm our business and operating results. In addition, complying with public disclosure rules makes our business more visible, which we believe may result in threatened or actual litigation, including by competitors and other third parties. If such claims are successful, our business and operating results could be harmed, and even if the claims do not result in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert the resources of our management and harm our business and operating results.

If we do not attract and retain highly qualified employees, we may not be able to grow effectively.

Our ability to compete and grow depends in large part on the efforts and talents of our executive officers and other employees. Such employees, particularly product managers and engineers for both web and mobile applications, quality assurance personnel, graphic designers and salespeople, are in high demand, and we devote significant resources to identifying, hiring, training, successfully integrating and retaining these employees. We require certain key employees to enter into employment agreements, but in the United States employees are free to leave an employer at any time without penalties. The loss of key employees or the inability to hire additional skilled employees as necessary could result in significant disruptions of our business, and the integration of replacement personnel could be time-consuming and expensive and cause us additional disruptions.

If we experience any failure or significant interruption in our network, it could harm our business.