Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITED FIRE GROUP INC | a8kufg3-12x2015.htm |

| EX-99.1 - EXHIBIT 99.1 - UNITED FIRE GROUP INC | ufgpressrelease03-12x15.htm |

NYSSA Conference — March 16, 2015

TABLE OF CONTENTS Company Overview Slide 3 P&C Companies Slide 4 Life Company Slide 4 2014 Highlights Slide 5 2020 Vision Slide 6 Life Company Objectives Slide 7 Enterprise Risk Management Slide 8 Additional Issues / Actions Small Business Unit Update Slide 9 2015 Reinsurance Changes Slide 10 Specialty Division Slide 11 Brand Refreshing Slide 12 Smart Phone Apps Slide 13 Economic/Market Conditions Slide 14 Premium Growth Slide 15 Organic Growth Slide 16 Underwriting Performance Slide 17 Financial Performance Slide 18 Reserving Slide 19 Portfolio Management Slide 20 Capital Management Slide 21 Compensation Alignment w/SH Slide 22 Organizational Alignment w/SH Slide 23 Key Investment Considerations Slide 24 Appendix 2

United Fire Group, Inc. (NASDAQ: UFCS) • Super–regional • Provider of a complete line of insurance products • Founded in 1946; and based in Cedar Rapids, Iowa • Six regional offices plus an office in Los Angeles, CA • $817 million in shareholders’ equity at 12/31/2014 • Approximately 980 employees COMPANY OVERVIEW 3

COMPANY OVERVIEW P& C Companies • Rated “A” (Excellent) by A.M. Best • 91% commercial lines / 9% personal lines • Licensed in 43 states and the District of Columbia, active in 33 • Represented by approximately 1,200 independent agencies • At 12/31/2014, $805 million in net written premiums United Life Insurance Co. • Rated “A-” (Excellent) by A.M. Best • 73% annuities / 27% traditional life insurance products • Licensed in 37 states, active in 35 • Represented by approximately 1,000 independent agencies • At 12/31/2014, $4 billion of net life insurance in force 4

2014 HIGHLIGHTS • GAAP combined ratio deteriorated to 97.8% from 94.8% • Book value grew 6% to $32.67 • Catastrophe losses were $50 million or 6.5 percentage points of the combined ratio, up slightly from our expected CAT load of 6% • GAAP expense ratio improved slightly to 31.4% • Policy retention remained high at 83% • Mercer integration substantially completed 5

CURRENT AND LONG-TERM OBJECTIVES • Objectives: • Increase ROE • Increase Written Premium • Provide best-in-class service • Be a “best place to work” (employee recruitment and retention) • Expand our agency plant and penetration • Leverage our existing product portfolio • Expand our geographic footprint • Expand our specialty division • New Branch in Los Angeles as of February 1, 2014 • Continue to capitalize on strategic growth opportunities 2020 Vision 6

• Geographic expansion – eight new states in 2013 (currently receiving premium in five of those states) • Life / Fixed Annuity mix – goal is 50/50 in order to reduce exposure to interest sensitive products (currently 27/73) • Lapse ratio under 6% (5.4% in 2014) • Automation commitment (ease of doing business) LIFE COMPANY – OBJECTIVES 7

ERM management committee meets quarterly Board of Directors risk management committee oversees ERM effort – Management reviews risk metrics with risk management committee – Risk appetite statement developed – Economic capital modeling used to assess capital adequacy ORSA – Summary ORSA report will be filed in 2015 ENTERPRISE RISK MANAGEMENT (ERM) 8

ADDITIONAL ISSUES / ACTIONS Small Business Unit Update Assessment perspectives – Enhanced workflow – Enhanced class offerings – Enhanced coverage options – Enhanced pricing sophistication Distinct profit center 2014 growth in written premium of 5.3% 9 13.7% 5.7% (2.8%) NOTE: Significant increase between 2011 and 2012 is due to the inclusion of Mercer Insurance Group – 2011 and prior does not include Mercer $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 2009 2010 2011 2012 2013 2014 (6.2%) 5.3% 98.5%

2015 Reinsurance Programs Catastrophe program • Renewed with ROL (rate on line) down 6% and adjustable rate down 11% • $230 million excess of $20 million retention • No co-participation on losses • 120-hour limit rather than 96-hour limit Core program • $2 million retention • $23 million per risk property coverage • $38 million per occurrence casualty coverage • $20 million maximum any one life ADDITIONAL ISSUES / ACTIONS 10

ADDITIONAL ISSUES /ACTIONS New Branch Office for Specialty Division Effective February 1, 2014 Located in Los Angeles, California First policies effective in 1Q2014 Initially wrote business in states of CA, OR, NV, AZ 2015 expansion into UT, ID 2015 expansion to both admitted and non-admitted 11

ADDITIONAL ISSUES / ACTIONS Branding “Refresh” Project “Refreshed” logo More unified look and feel across all regional offices Unified message (both internal and external) UFG rather than United Fire Group Corporate VP of Marketing 12

ADDITIONAL ISSUES / ACTIONS Smart Phone Apps 13 Tap into United Life for: • Customer searches • Policy and client details • Term and Whole Life quotes • Company publications • Current interest rates • Company contacts (P&C App currently under development for 2015)

ECONOMIC/MARKET CONDITIONS • Positive rate environment for thirteen quarters • Rate increases are expected through 2015 but tapering • Positive audit premium for the last fifteen quarters • Our insureds continue to add exposures at renewal • Policy count growth opportunities 14

PREMIUM GROWTH 15 $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $900,000 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Net Written Premiums ($ in 1,000's)

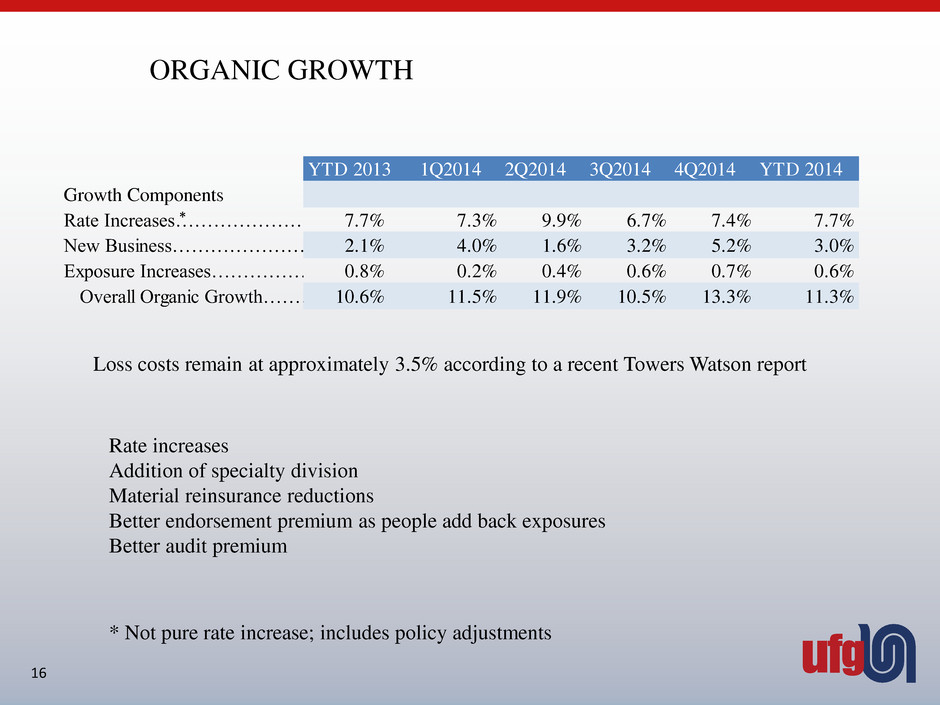

ORGANIC GROWTH 16 Loss costs remain at approximately 3.5% according to a recent Towers Watson report YTD 2013 1Q2014 2Q2014 3Q2014 4Q2014 YTD 2014 Growth Components Rate Increases………………………….7.7% 7.3% 9.9% 6.7% 7.4% 7.7% New Business… ..2.1 4.0 1.6 3.2 5.2 3.0 Exposure Increases…………………..0.8% 0.2% 0.4% 0.6% 0.7% 0.6% Overall Organic Growth 10.6 11.5 11.9 10.5 13.3 11.3 Rate increases Addition of specialty division Material reinsurance reductions Better endorsement premium as people add back exposures Better audit premium * * Not pure rate increase; includes policy adjustments

UNDERWRITING PERFORMANCE GAAP Combined Ratio 17 Catastrophe Loss Contribution 81.3 % 113.9 % 115.2 % 99.9 % 112.1 % 101.2 % 94.8 % 97.8 % 0% 20% 40% 60% 80% 100% 120% 140% 2007 2008 2009 2010 2011 2012 2013 2014 65.9 % 70.1 % 64.2 % 61.3 % 59.4 % 58.6 % 60.0 % 18.6% 13.8% 4.7% 15.1% 10.3% 4.4% 6.5% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 2008 2009 2010 2011 2012 2013 2014 Non-cat Losses Cat Losses

FINANCIAL PERFORMANCE ROE averaged 7.6% (including unrealized gains/losses) Between 2001 and 2014 $32.67 18 $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Book Value Per Share

RESERVING Average 8.9% NOTE: 2008 and 2009 reflect litigation costs associated with Hurricane Katrina 19 -10% -5% 0% 5% 10% 15% 20% 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Prior Year Development as % Premiums Earned

PORTFOLIO MANAGEMENT Conservative Investment Philosophy Manage our own portfolios • We maintain a fixed-to-equity ratio of 90/10 How we are addressing the low interest rate environment • We continue to purchase quality investments rated investment grade or better • We more closely match duration of our investment portfolio to liabilities Portfolio yield of 3.3% and duration of 5.0 years at December 31, 2014 International corporate bond holdings account for approximately 8% of the fixed asset portfolio Highly Rated Fixed Income Portfolio NOTE: Baa/BBB comprised of mostly corporate bonds of well-known brands with little likelihood of default. 20 0% 5% 10% 15% 20% 25% 30% 35% 40% AAA AA A BBB Below BBB 2013 2012

CAPITAL MANAGEMENT 21 February 20, 2015 Declaration of $0.20 quarterly cash dividend Record Date: March 2, 2015 Payment Date: March 16, 2015 1.5 1.2 1.2 0.8 0.7 0.8 0.8 0.7 1.0 1.1 1.1 1.2 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Premium to Surplus Ratio 2010 2011 2012 2013 2014 2010-2014 Total Shares O/S 26,195,552 25,505,350 25,227,463 25,360,893 25,019,415 Shares Repurchased 343,328 702,947 340,159 59,603 461,835 1,907,872 Average Repurchase Price/share 18.29$ 17.69$ 21.46$ 27.58$ 28.02$ 22.61$ Total Repurchased 6,280,042$ 12,433,158$ 7,300,724$ 1,643,645$ 12,941,886$ 40,599,455$ Dividend Payments 15,773,889$ 15,507,401$ 15,269,472$ 17,483,803$ 19,680,192$ 83,714,757$ Total Capital Returned to SH $22,053,931 $27,940,559 $22,570,196 $19,127,448 $32,622,078 124,314,212$

COMPENSATION ALIGNMENT TOWARD SHAREHOLDER VALUE Maximize Shareholder Value 22 2014 Threshold Target Maximum Actual Performance Indicators (%) (%) (%) Results Chief Executive Officer Return on Equity (ex. AOCI) 8.0% 12.0% 16.0% 8.9% Corporate Growth 2.5% 5.0% 7.5% 11.1% All Others Return on Equity (ex. AOCI) 8.0% 12.0% 16.0% 8.9% Business Unit Loss Ratio 56.0% 49.0% 43.0% 57.5% Cost Center Expense Ratio 4.0% 3.5% 3.0% 3.0% Program includes other metrics specific to job function 2014 Plan Goals

ORGANIZATIONAL ALIGNMENT TOWARD SHAREHOLDER VALUE Profitable organic and strategic growth Competitive advantage – Local market knowledge – Strong agency relationships – Disciplined underwriting – Service center – Exceptional customer service – Superior loss control services – Fair and ethical claims handling – Efficient and effective technology Deep, tenured management team Active capital management Maximize Shareholder value through growth in book value per share 23

• Expanded geographic presence through acquisition • Growth opportunities through recent acquisitions and existing markets • Decentralized underwriting and marketing • Opportunities for efficiencies • Exposure management ------------------------------------------------------------------------------------------- • Historically reported favorable loss reserve development • Conservative investment philosophy • Strong balance sheet • No debt ------------------------------------------------------------------------------------------- • Proactive capital management • Paid a quarterly dividend since 1968 • Dividend yield at 12/31/2014 of 2.6% • 11% increase in the dividend on May 21, 2014 KEY INVESTMENT CONSIDERATIONS 24 Ca p it al V al u at io n O p era ti o n s

Appendix ____________________________________________

APPENDIX Senior Management Slide 27 Financial Summary Slide 28 P&C Financial Highlights Slide 29 Definitions/Reconciliations Slide 30 Exposure Management Slide 31 Expertise (Businesses) Slide 32 Agency Philosophy Slide 33 Commission Strategy Slide 34 Reserving Philosophies Slide 35 Claims Philosophies Slide 35 Capital Mgmt. Philosophy Slide 36 2014 Product Niches Slide 37 Top Eight States Slide 38 Forward-Looking Statements Back Pg. 26

SENIOR MANAGEMENT RANDY A. RAMLO President and Chief Executive Officer Years at UFG: 30 Years in Industry: 30 MICHAEL T. WILKINS Executive Vice President and Chief Operating Officer Years at UFG: 29 Years in Industry: 29 KEVIN W. HELBING Interim Principal Financial Officer / Controller / AVP Years at UFG: 8 Years in Industry: 15 DAVID E. CONNER Vice President/CCO Years at UFG: 16 Years in Industry: 33 BARRIE W. ERNST Vice President/CIO Years at UFG: 12 Years in Industry: 34 NEAL R. SCHARMER Vice President/Gen. Counsel Years at UFG: 19 Years in Industry: 24 Average Years at UFG: 19 Average Years in Industry: 28 27

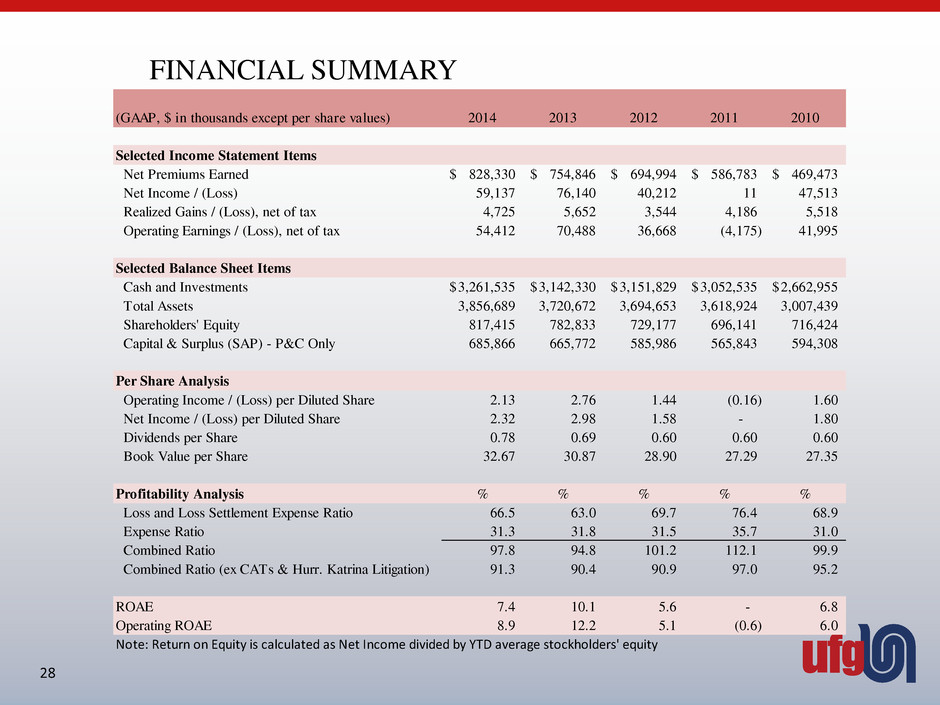

FINANCIAL SUMMARY 28 (GAAP, $ in thousands except per share values) 2014 2013 2012 2011 2010 Selected Income Statement Items Net Premiums Earned 828,330$ 754,846$ 694,994$ 586,783$ 469,473$ Net Income / (Loss) 59,137 76,140 40,212 11 47,513 Realized Gains / (Loss), net of tax 4,725 5,652 3,544 4,186 5,518 Operating Earnings / (Loss), net of tax 54,412 70,488 36,668 (4,175) 41,995 Selected Balance Sheet Items Cash and Investments 3,261,535$ 3,142,330$ 3,151,829$ 3,052,535$ 2,662,955$ Total Assets 3,856,689 3,720,672 3,694,653 3,618,924 3,007,439 Shareholders' Equity 817,415 782,833 729,177 696,141 716,424 Capital & Surplus (SAP) - P&C Only 685,866 665,772 585,986 565,843 594,308 Per Share Analysis Operating Income / (Loss) per Diluted Share 2.13 2.76 1.44 (0.16) 1.60 Net Income / (Loss) per Diluted Share 2.32 2.98 1.58 - 1.80 Dividends per Share 0.78 0.69 0.60 0.60 0.60 Book Value per Share 32.67 30.87 28.90 27.29 27.35 Profitability Analysis % % % % % Loss and Loss Settlement Expense Ratio 66.5 63.0 69.7 76.4 68.9 Expense Ratio 31.3 31.8 31.5 35.7 31.0 Combined Ratio 97.8 94.8 101.2 112.1 99.9 Combined Ratio (ex CATs & Hurr. Katrina Litigation) 91.3 90.4 90.9 97.0 95.2 ROAE 7.4 10.1 5.6 - 6.8 Operating ROAE 8.9 12.2 5.1 (0.6) 6.0 Note: Return on Equity is calculated as Net Income divided by YTD average stockholders' equity

P&C OPERATING SEGMENT FINANCIAL HIGHLIGHTS 29 (GAAP, $ in thousands except per share values) 2014 2013 2012 2011 2010 Commercial Net Premiums Written 722,632$ 640,539$ 576,076$ 481,520$ 363,806$ Net Premiums Earned 685,148 613,878 551,846 464,942 370,479 Loss and Loss Settlement Expenses 443,541 384,629 367,208 331,320 271,184 Loss and Loss Settlement Expense Ratio 64.7% 62.7% 66.5% 71.3% 73.2% Personal Net Premiums Written 68,891$ 67,803$ 64,846$ 57,133$ 40,807$ Net Premiums Earned 68,646 65,908 63,092 55,568 39,731 Loss and Loss Settlement Expenses 61,187 47,744 54,268 51,725 25,576 Loss and Loss Settlement Expense Ratio 89.1% 72.4% 86.0% 93.1% 64.4% Assumed Net Premiums Written 13,192$ 14,479$ 14,409$ 13,270$ 10,295$ Net Premiums Earned 13,145 14,406 14,473 13,261 10,163 Loss and Loss Settlement Expenses 5,083 4,980 17,661 24,786 (7,323) Loss and Loss Settlement Expense Ratio 38.7% 34.6% 122.0% 186.9% (72.1%) Total Net Premiums Written 804,715$ 722,821$ 655,331$ 551,923$ 414,908$ Net Premiums Earned 766,939 694,192 629,411 533,771 420,373 Loss and Loss Settlement Expenses 509,811 437,353 439,137 407,831 289,437 Loss and Loss Settlement Expense Ratio 66.5% 63.0% 69.8% 76.4% 68.9% Segment Net Income / (Loss) 52,376$ 67,456$ 33,512$ (7,639)$ 34,726$

DEFINITIONS AND RECONCILIATIONS NOT PREPARED IN ACCORDANCE WITH GAAP Operating income is a commonly used Non-GAAP financial measure of net income excluding realized capital gains and losses and related federal income taxes. Because our calculation may differ from similar measures used by other companies, investors should be careful when comparing our measure of operating income to that of other companies. Management evaluates this measurement and ratios derived from this measurement because we believe it better represents the normal, ongoing performance of our businesses. 30 (GAAP, $ in thousands) 2014 2013 2012 2011 2010 2009 2008 Net Income / (Loss) 59,137$ 76,140$ 40,212$ 11$ 47,513$ (10,441)$ (13,064)$ Realized Investment Gains / (Losses), after tax 4,725$ 5,652$ 3,544$ 4,186$ 5,518$ (8,566)$ (6,749)$ Net Operating Income / (Loss) 54,412$ 70,488$ 36,668$ (4,175)$ 41,995$ (1,875)$ (6,315)$ Earnings / (Losses) Per Share, diluted 2.32$ 2.98$ 1.58$ -$ 1.80$ (0.39)$ (0.48)$ Operating earnings / (Loss) Per Share, diluted 2.13$ 2.76$ 1.44$ (0.16)$ 1.60$ (0.07)$ (0.23)$ Return on Equity 7.4% 10.1% 5.6% 0.0% 6.8% (1.6%) (1.9%) Note: Return on Equity is calculated as Net Income divided by YTD average stockholders' equity

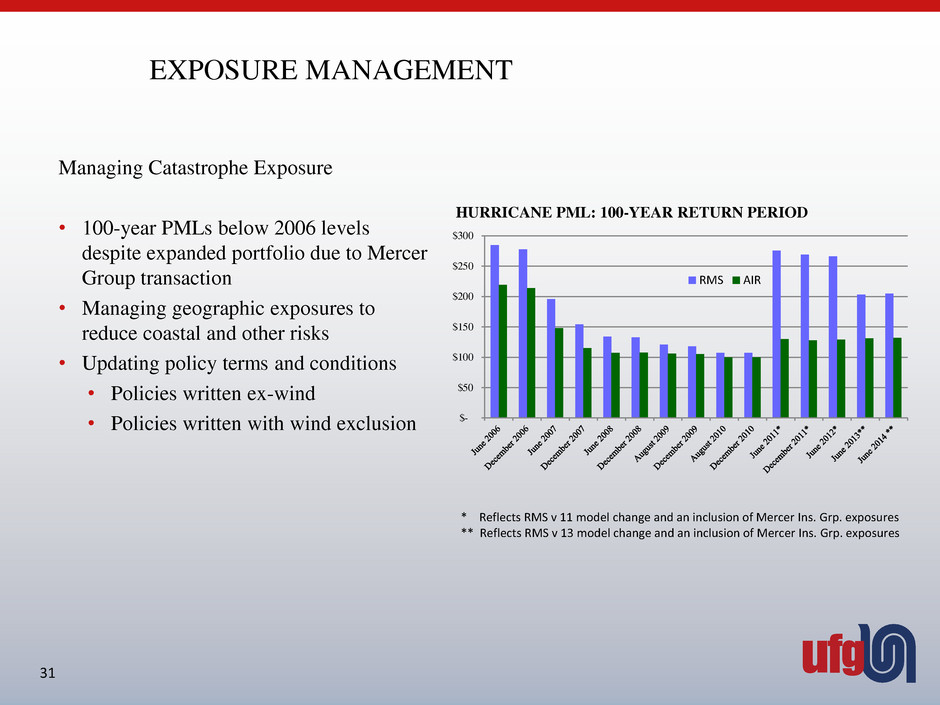

EXPOSURE MANAGEMENT Managing Catastrophe Exposure • 100-year PMLs below 2006 levels despite expanded portfolio due to Mercer Group transaction • Managing geographic exposures to reduce coastal and other risks • Updating policy terms and conditions • Policies written ex-wind • Policies written with wind exclusion 31 * Reflects RMS v 11 model change and an inclusion of Mercer Ins. Grp. exposures ** Reflects RMS v 13 model change and an inclusion of Mercer Ins. Grp. exposures $- $50 $100 $150 $200 $250 $300 HURRICANE PML: 100-YEAR RETURN PERIOD RMS AIR

EXPERTISE WITH “MAIN STREET” BUSINESSES Percent of DESCRIPTION (Property and Casualty) Total DWP Concrete Construction Including Flat Work 8 Carpentry - residential 7 Excavation 7 Lessors' risk 6 Carpentry - commercial 4 Land grading / earth moving 4 Automobile repair or service shops 4 Electrical work 4 Metal goods manufacturing / machine shops 4 Plumbing - commercial 3 Plumbing - residential 3 Roofing - commercial 3 Landscape gardening 3 Heating and air conditioning 2 Restaurants 2 TOTALS 64 NWP by Product Line Top 15 Classes Show Main Street Focus 32 Nine months ended 12/31/2014 - NPW NPW Property/Casualty ($ in millions) $ % Fire & Allied Lines 235.2 29.2% Automobile 197.0 24.5% Other Liability 243.3 30.2% Workers' Compensation 91.8 11.4% Surety 20.5 2.6% Miscellaneous 3.7 0.5% Reinsurance (Assumed) 13.2 1.6% Total 804.7

• We continually monitor agencies for compatibility • Criteria: loss ratio, volume, relationship • We seek “top three” position (as measured by direct premiums written) • We seek agencies that focus on providing value-added services to their customers • Our best agencies are medium-sized working in urban communities with strong economic growth • We offer competitive performance-based compensation • We contract with more than 1,200 independent agencies • Average agency size: $563,000 • Size of largest agency: $11.9 million • Premium from our top 20: $152.3 million • Premium from our top 50: $262.7 million AGENCY PHILOSOPHY 33

COMMISSION STRATEGY Be competitive, but not excessive Support our corporate goals by encouraging agents to place and retain business in geographic locations targeted for organic growth Effectively balance commissions with other incentives – As part of a total compensation package 34

RESERVING Claims Handling Philosophy • FAIR claims service • FAST claims service • Use of outside adjusters is infrequent, allowing us to more closely control the adjusting function • We employ top industry fraud predictive analytics technology Reserving Philosophy • We historically reported favorable loss reserve development • We employ conservative reserving practices • We reserve on a case basis with some pessimism • We reserve for IBNR and LAE using actuarial methods 35

• Strong economic capital position • Prudent reinsurance programs • History of consistently conservative reserves • Use of capital – acquisition of Mercer Insurance Company and organic growth CAPITAL MANAGEMENT PHILOSOPHY 36 Avg. Price No. Shares Total Price Share Repurchase Per Share ($) Repurchased ($ in millions) 12 Months Ended 12/31/2010 18.29 343,328 6.3 12 Months Ended 12/31/2011 17.69 702,947 12.4 12 Months Ended 12/31/2012 21.46 340,159 7.3 12 Months Ended 12/31/2013 27.58 59,603 1.6 12 Months Ended 12/31/2014 28.02 461,835 12.9

2014 PRODUCT NICHES • Religious Institutions – Churches • Auto Service and Repair Garages • Condominiums • Small Artisan Service and Repair contractors • Retail Small Business (Business Owners Program) • Land Improvement Contractors (Excavation, Land Grading) • Commercial Output Program (Manufacturing) • Contractors E & O • Mechanical Contractors • Plumbing & Heating Contractors • Metal Goods Fabricators • Machine Shops • Restaurants • Golf Courses • Winery Program • Peripheral Oil Field Contractors • Inland Marine • Micro Brewers • Water Well Drillers • Agriculture Service Contractors • Program Business • Commercial Roofers • Hardware Stores 37

TOP EIGHT STATES 38 Twelve months ended 12/31/14 - NPW DPW Property/Casualty ($ in millions) $ % Texas 122.6 14.6% Iowa 97.8 11.7% California 92.8 11.1% New Jersey 51.4 6.1% Missouri 50.7 6.0% Illinois 41.8 5.0% Colorado 40.3 4.8% Minnesota 39.8 4.8% All Other States 301.4 35.9%

FORWARD-LOOKING STATEMENTS This presentation may contain forward-looking statements about our operations, anticipated performance and other similar matters. The Private Securities Litigation Reform Act of 1995 provides a safe harbor under the Securities Act of 1933 and the Securities Exchange Act of 1934 for forward-looking statements. The forward-looking statements are not historical facts and involve risks and uncertainties that could cause actual results to differ materially from those expected and/or projected. Such forward-looking statements are based on current expectations, estimates, forecasts and projections about our company, the industry in which we operate, and beliefs and assumptions made by management. Words such as “expect(s),” “anticipate(s),” “intend(s),” “plan(s),” “believe(s),” “continue(s),” “seek(s),” “estimate(s),” “goal(s),” “target(s),” “forecast(s),” “project(s),” “predict(s),” “should,” “could,” “may,” “will continue,” “might,” “hope,” “can” and other words and terms of similar meaning or expression in connection with a discussion of future operating, financial performance or financial condition, are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed in such forward-looking statements. Information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained in Part I Item 1A “Risk Factors” of our annual report on Form 10-K for the year ended December 31, 2014 filed with the SEC on March 2, 2015 and any subsequent quarterly reports on Form 10-Q. The risks identified on Form 10-K are representative of the risks, uncertainties, and assumptions that could cause actual outcomes and results to differ materially from what is expressed in forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release or as of the date they are made. Except as required under the federal securities laws and the rules and regulations of the Securities and Exchange Commission, we do not have any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Reconciliations of non-GAAP measures are on Page 30 of this presentation and also available in our quarterly news releases, which are available on the Investors Relations page of our website www.UnitedFireGroup.com. 39