Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OneMain Holdings, Inc. | shi8-kearningsrelease4q2014.htm |

SPRINGLEAF HOLDINGS, INC. REPORTS FOURTH QUARTER

AND FULL YEAR 2014 RESULTS

ACQUISITION OF ONEMAIN FINANCIAL ANNOUNCED ON MARCH 3rd, 2015

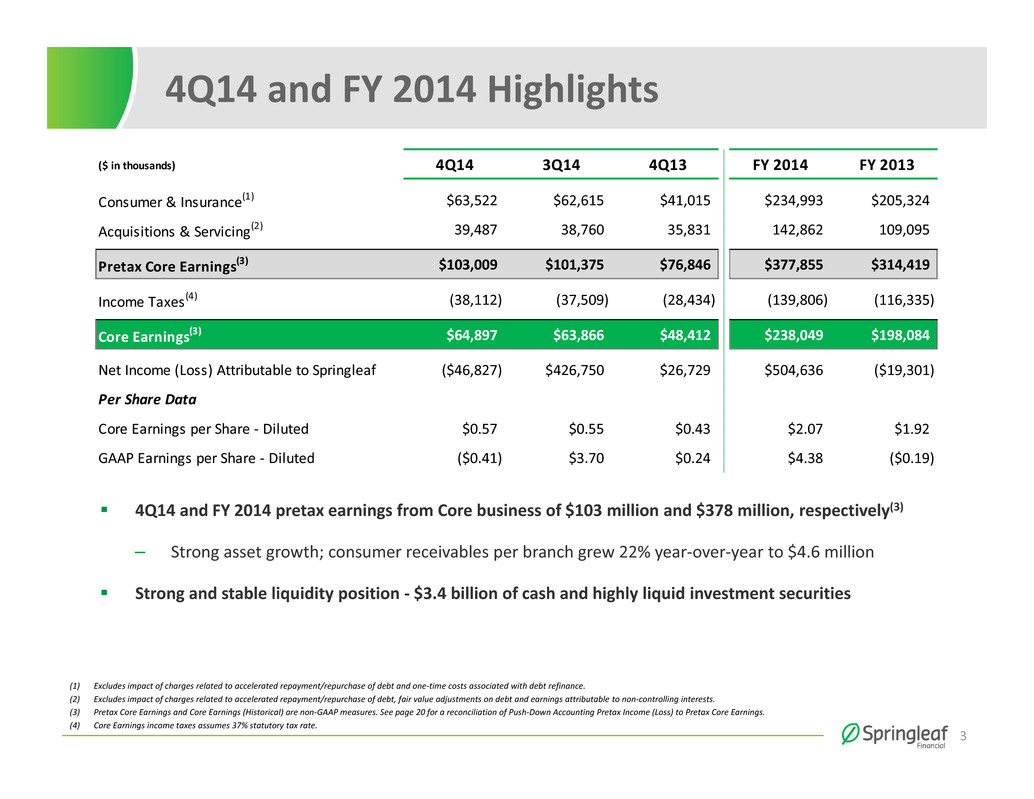

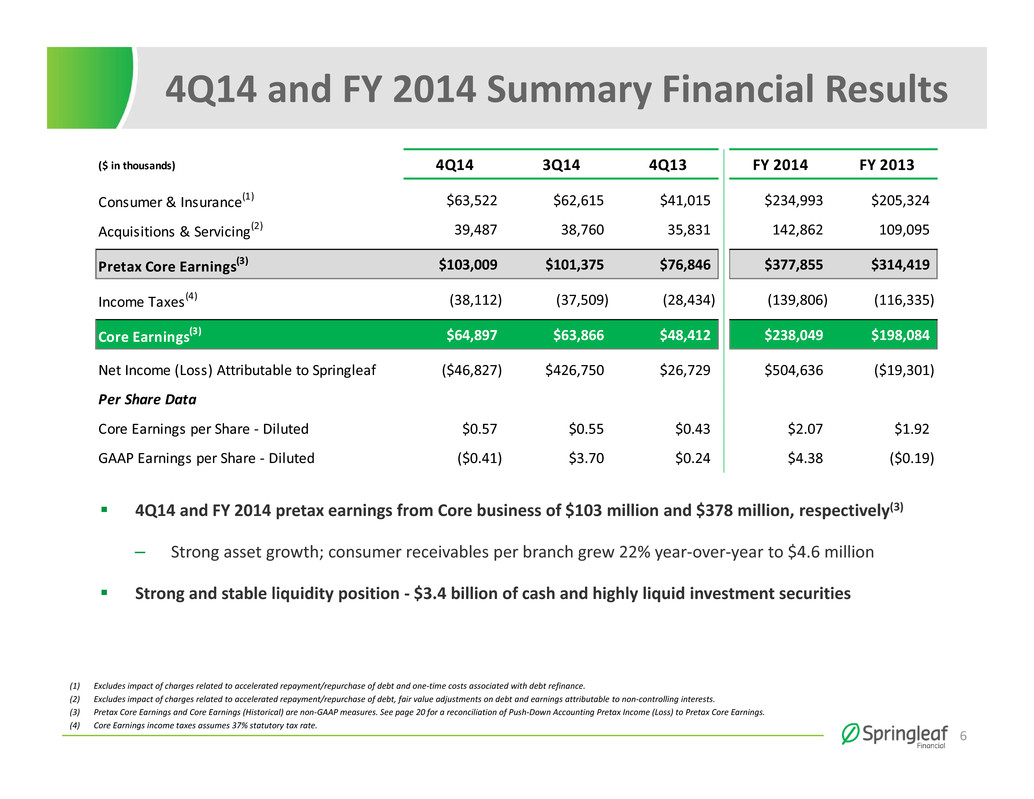

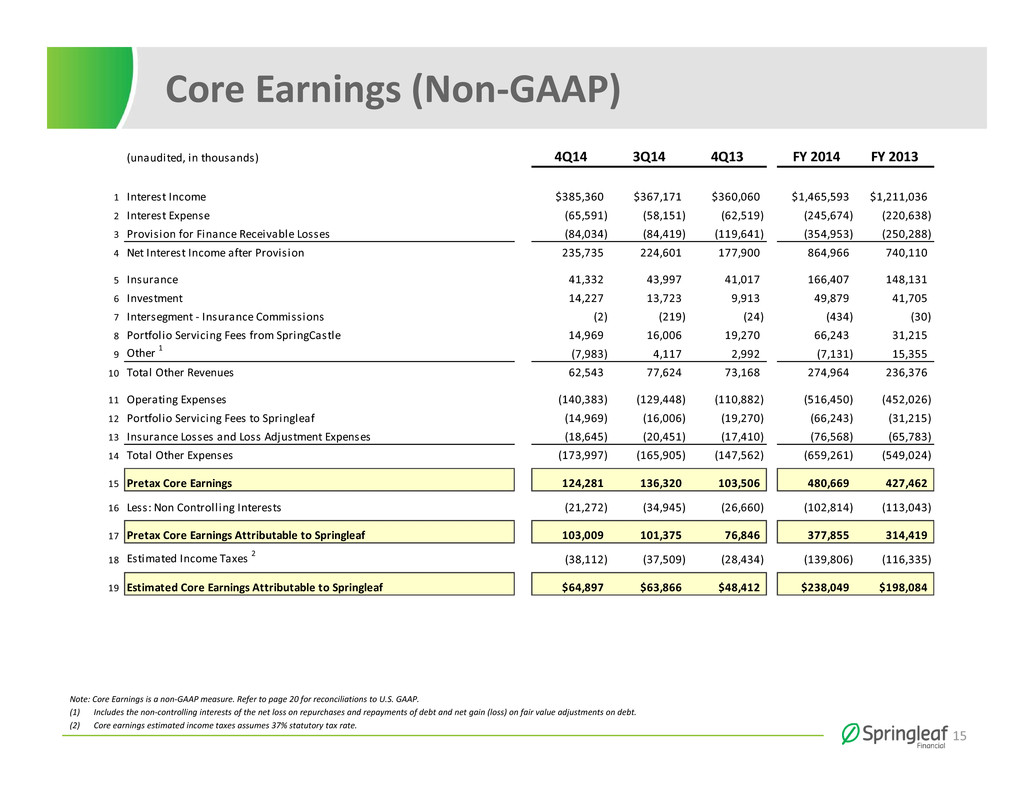

Evansville, IN, MARCH 12, 2015 - Springleaf Holdings, Inc. (NYSE:LEAF), today reported a GAAP basis net loss of $47 million, or $0.41 per diluted share for the fourth quarter of 2014, compared with net income of $27 million or $0.24 per diluted share in the fourth quarter of 2013. Net income for the full year 2014 was $505 million, or $4.38 per diluted share, largely attributable to the previously announced pretax gain of $726 million on the sale of approximately $8 billion of real estate assets1,2.

For Core Consumer Operations, core earnings (a non-GAAP measure) for the quarter was $65 million, versus $48 million in the prior year quarter, and earnings per diluted share (a non-GAAP measure) was $0.57 for the fourth quarter versus $0.43 in the prior year quarter3,4. For the segment, full year core earnings were $238 million, versus $198 million in the prior year, and earnings per diluted share was $2.07 versus $1.92 in the prior year.

Fourth Quarter Highlights

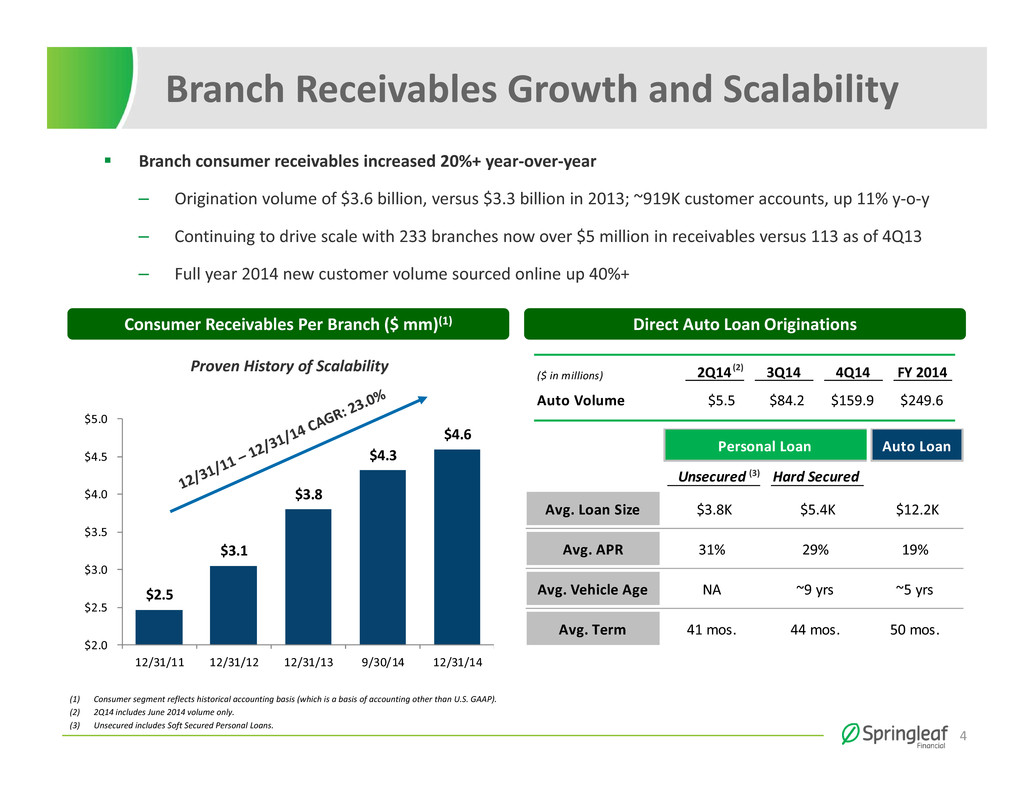

• | Consumer net finance receivables reached $3.8 billion at December 31, 2014, an increase of $666 million, or 21% from December 31, 2013, and 6% from September 30, 2014. |

• | Consumer net finance receivables per branch were $4.6 million at December 31, 2014, up 22% from December 31, 2013 and 6% from September 30, 2014. |

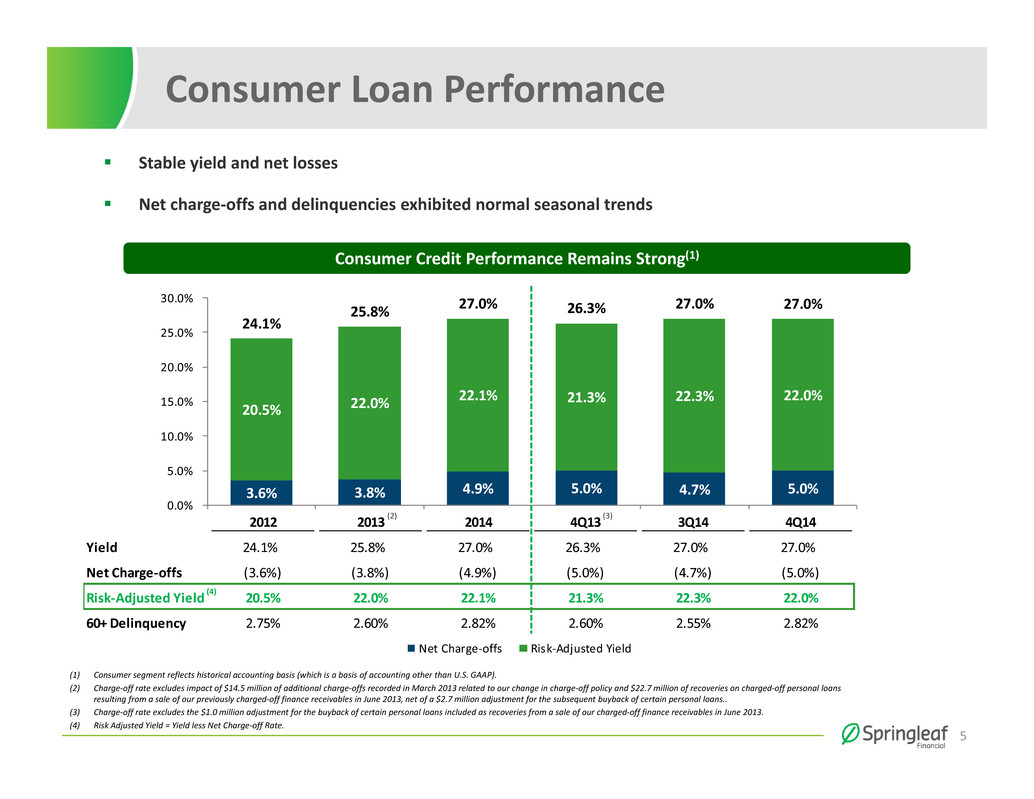

• | Risk-adjusted yield for our Consumer segment in the quarter was 21.99%, up 81 basis points from the fourth quarter 2013. |

• | The company generated over $1.0 billion of total consumer origination volume in the fourth quarter including $160 million of direct auto loan originations. Direct auto loan receivables reached $238 million at year-end. |

Jay Levine, President and CEO of Springleaf said, “Just last week we were very excited to have reached an agreement to acquire OneMain Financial, a leading national provider of personal loans, and we look forward to closing on the acquisition and building on the enormous potential of the combined company.”

1 Real Estate segment and Other Non-Core reflect historical accounting basis (which is a basis of accounting other than U.S. GAAP).

2 Gain from sale of real estate assets excludes restructuring, transaction expenses and provision adjustments.

3 Excludes the impact of charges related to accelerated repayment/repurchase of debt, fair value adjustments on debt, one-time costs associated with debt refinance, and earnings attributable to non-controlling interests.

4 Core Earnings income taxes assumes 37% statutory tax rate.

1

Commenting on the company’s fourth quarter results, Levine added, “We remain focused on supporting our customer needs and growing our branch loan receivables while maintaining appropriate pricing and effective credit risk management. Once again this quarter we have grown branch receivables north of 20% year over year, and consumer receivables per branch reached $4.6 million.”

Core Consumer Operations: (Reported on a historical accounting basis, which is a non-GAAP measure. Refer to the reconciliation of non-GAAP to comparable GAAP measures below.)

Consumer and Insurance

Consumer and Insurance pretax income was $64 million in the quarter versus $41 million in the fourth quarter of 2013, and flat from the third quarter of 20145.

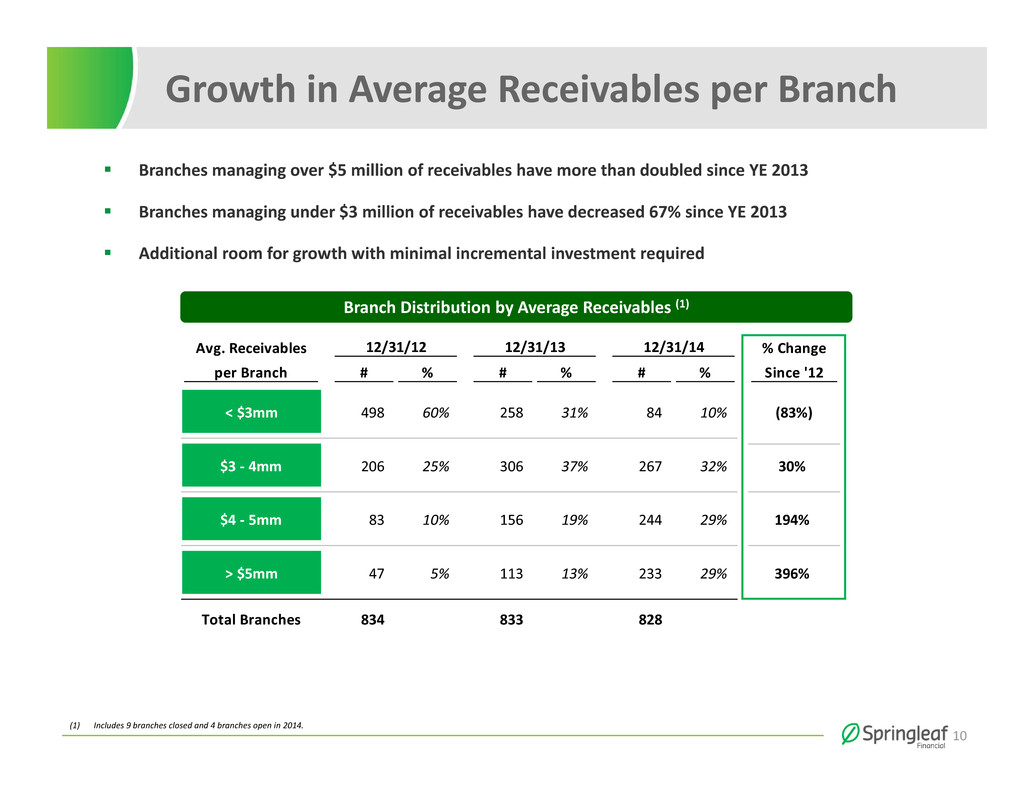

Consumer net finance receivables reached $3.8 billion at December 31, 2014, an increase of 21% from December 31, 2013 and 6% from September 30, 2014, driven by the company’s focus on increasing personal loan originations through its branch network and diversifying its product offerings. Consumer net finance receivables per branch continued to grow, reaching $4.6 million at December 31, 2014, up from $3.8 million at December 31, 2013 and $4.3 million at September 30, 2014.

Net interest income was $208 million in the quarter, up 27% from the prior year quarter and 6% from the prior quarter. Yield in the current quarter was 26.95%. Risk adjusted yield, representing yield less net charge-off rate, was 21.99% in the quarter, up 81 basis points from the fourth quarter of 2013 as gross yield expanded while net charge-offs remained flat year-over-year. Risk adjusted yield declined 35 basis points from the third quarter of 2014 due primarily to the seasonal increase in charge-offs.

The annualized net charge-off ratio was 4.96% in the quarter, versus 5.16% in the prior year quarter and 4.68% in the prior quarter.

The annualized gross charge-off ratio was 5.78% in the quarter, up 29 basis points from the prior year quarter and up 32 basis points from the third quarter 2014. Recoveries continued to normalize in the quarter at 82 basis points versus 33 basis points in the fourth quarter of 2013, following the sale of a pool of previously charged-off accounts in June 2013.

The 60+ delinquency ratio was 2.82% at quarter end, versus 2.60% at prior year quarter end and 2.55% at prior quarter end.

5 Consumer and Insurance segment reflects historical accounting basis (which is a basis of accounting other than U.S. GAAP). Pretax income excludes impact of charges related to accelerated repayment / repurchase of debt and one-time costs associated with debt refinance.

2

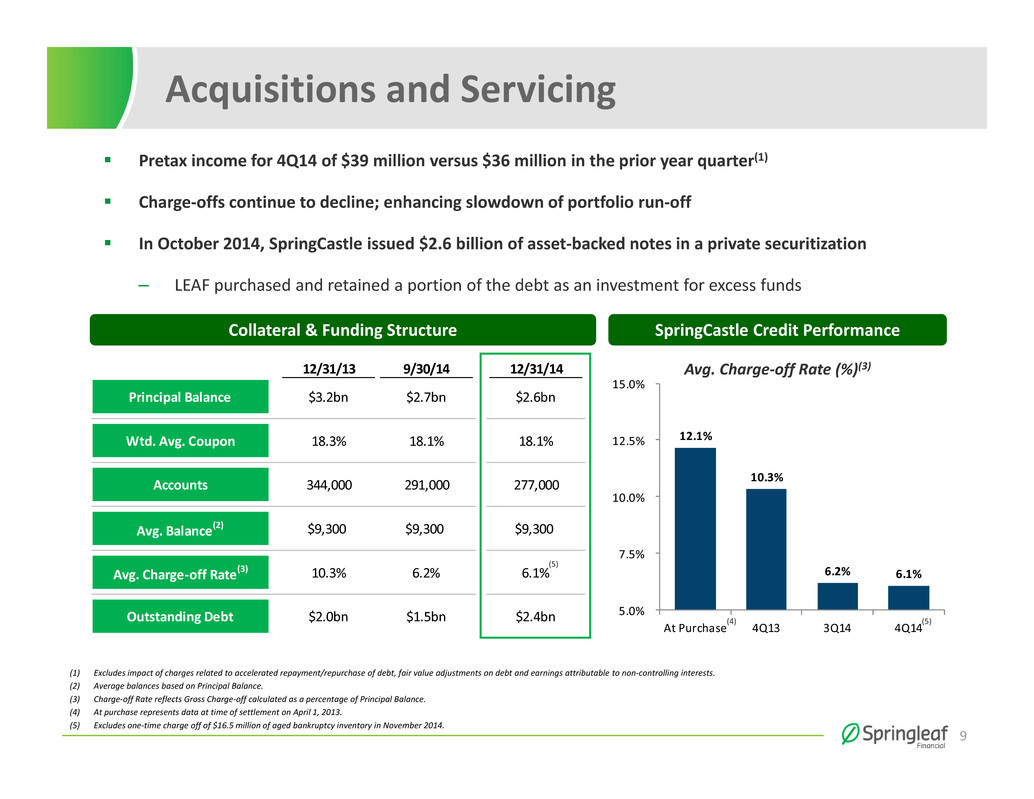

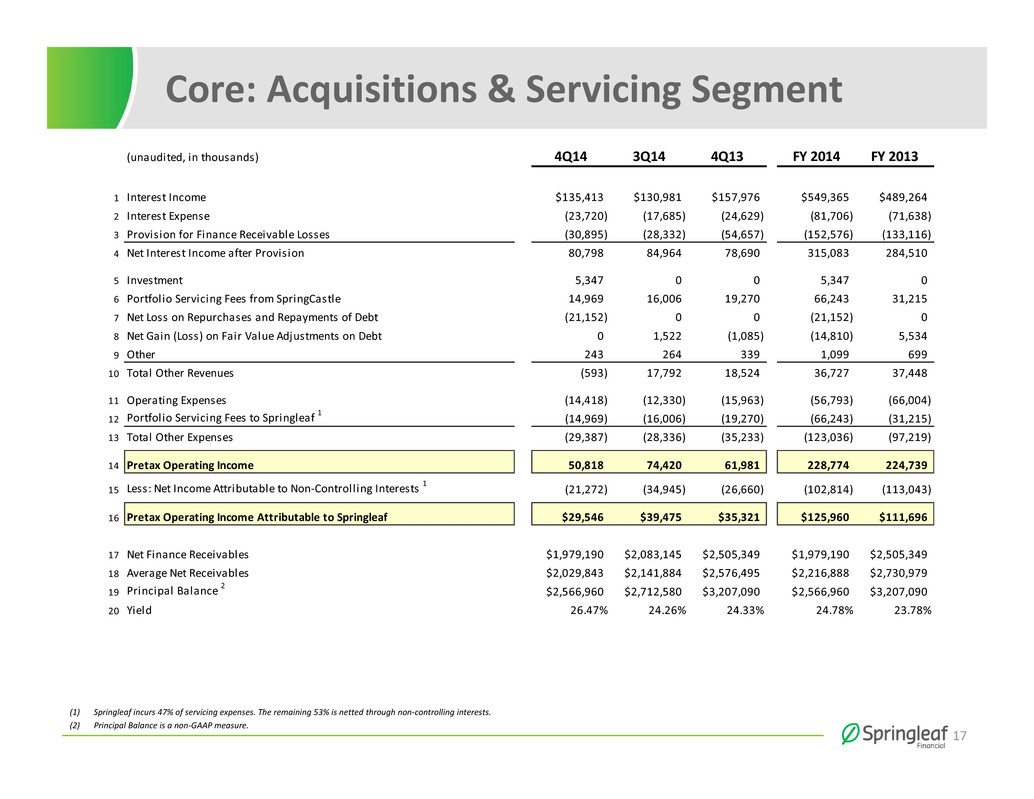

Acquisitions and Servicing

The Acquisitions and Servicing segment contributed $39 million to the company’s consolidated pretax income in the quarter6. The entire Acquisitions and Servicing segment, which includes non-controlling interests, generated pretax income of $51 million in the quarter7, with net interest income of $112 million and yield of 26.47%. Actual net finance receivables at quarter-end were $2.0 billion, down from $2.1 billion at September 30, 2014. The principal balance of the portfolio was $2.6 billion at quarter-end versus $3.2 billion at December 31, 2013.

The annualized net charge-off ratio was 5.56% in the quarter, versus 8.46% in the prior year quarter and 5.31% in the prior quarter.

The annualized gross charge-off ratio was 6.15% in the quarter, down 284 basis points from the prior year quarter and up 32 basis points from the third quarter 2014. Recoveries continued to improve in the quarter at 59 basis points versus 53 basis points in the fourth quarter of 2013.

The delinquency ratio for the Acquisitions and Servicing segment was 4.69% at the end of the quarter, a decrease of 42 basis points from the prior quarter end.

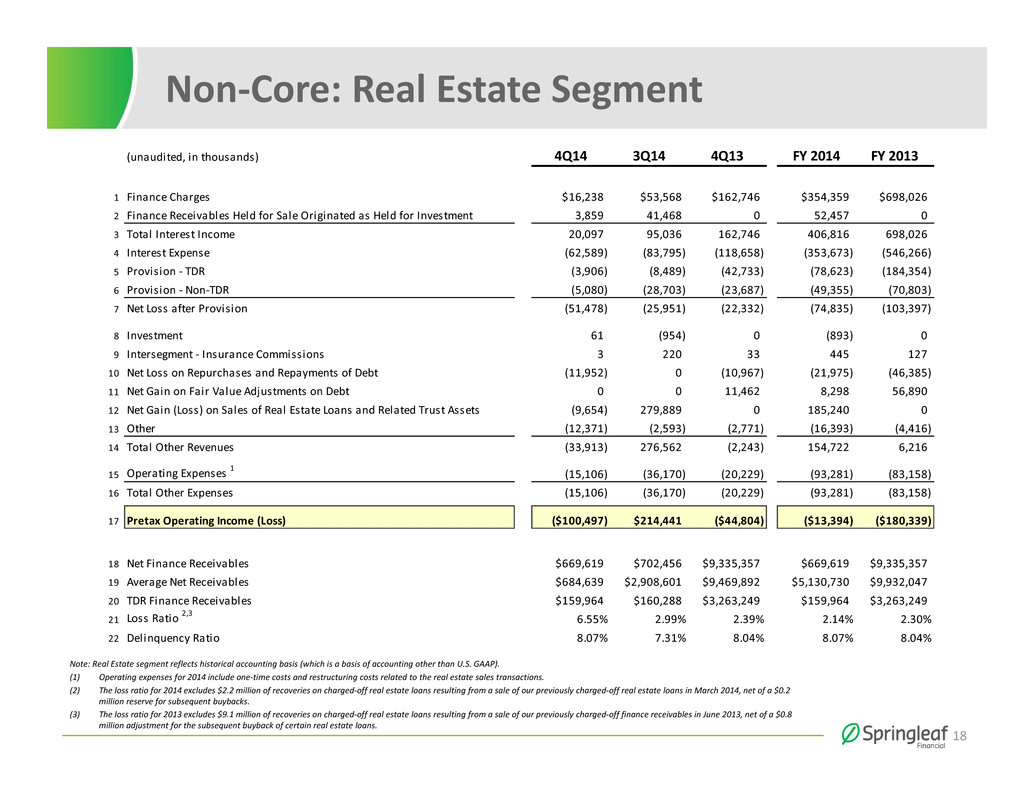

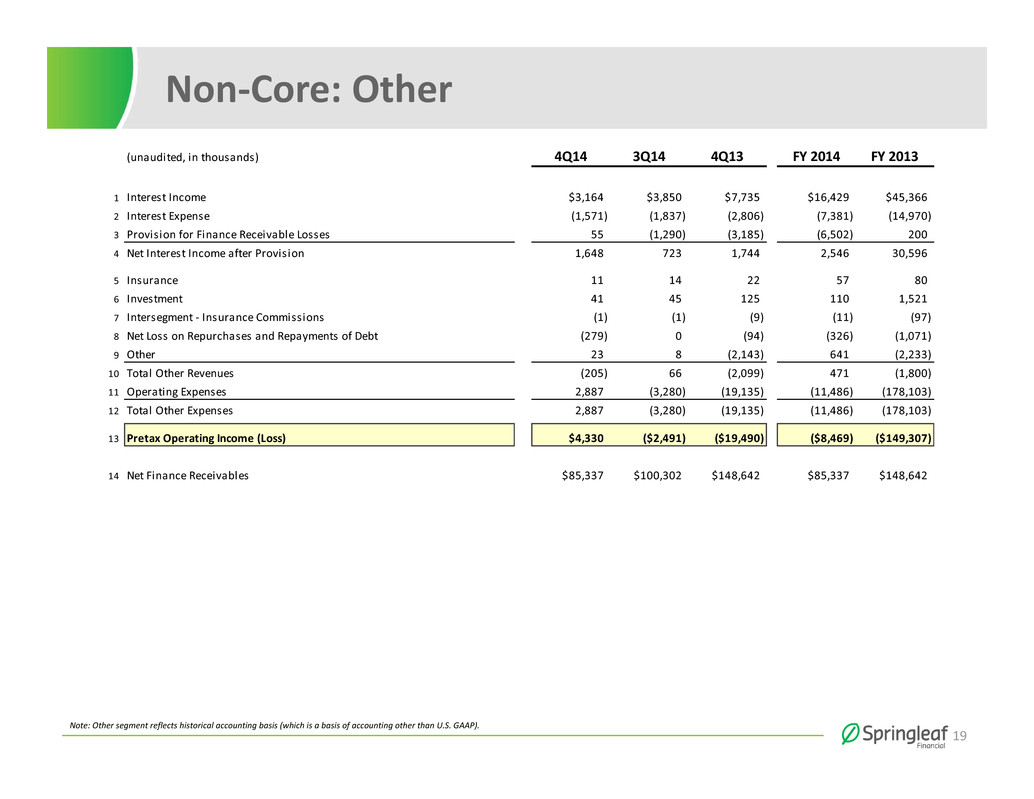

Non-Core Portfolio: (Reported on a historical accounting basis, which is a non-GAAP measure.)

Legacy Real Estate and Other Non-Core

The Non-Core Portfolio (consisting of legacy real estate loans) and Other Non-Core activities generated a pretax loss of $71 million in the quarter8. The legacy real estate portfolio pretax loss primarily results from the impact of full year real estate sales on the segment’s interest earning assets. The proceeds from these sales have been allocated to the Non-Core portfolio, which resulted in a reduction to net interest margin.

6 Excludes impact of one-time items related to accelerated repayment/repurchase of debtand earnings attributable to non-controlling interests.

7 Includes impact of charges related to accelerated repayment/repurchase of debt and earnings attributable to non-controlling interests.

8 Excludes impact of one-time items related to the accelerated repayment/repurchase of debt, real estate sales (including restructuring and transaction costs), and one-time costs associated with debt refinance.

3

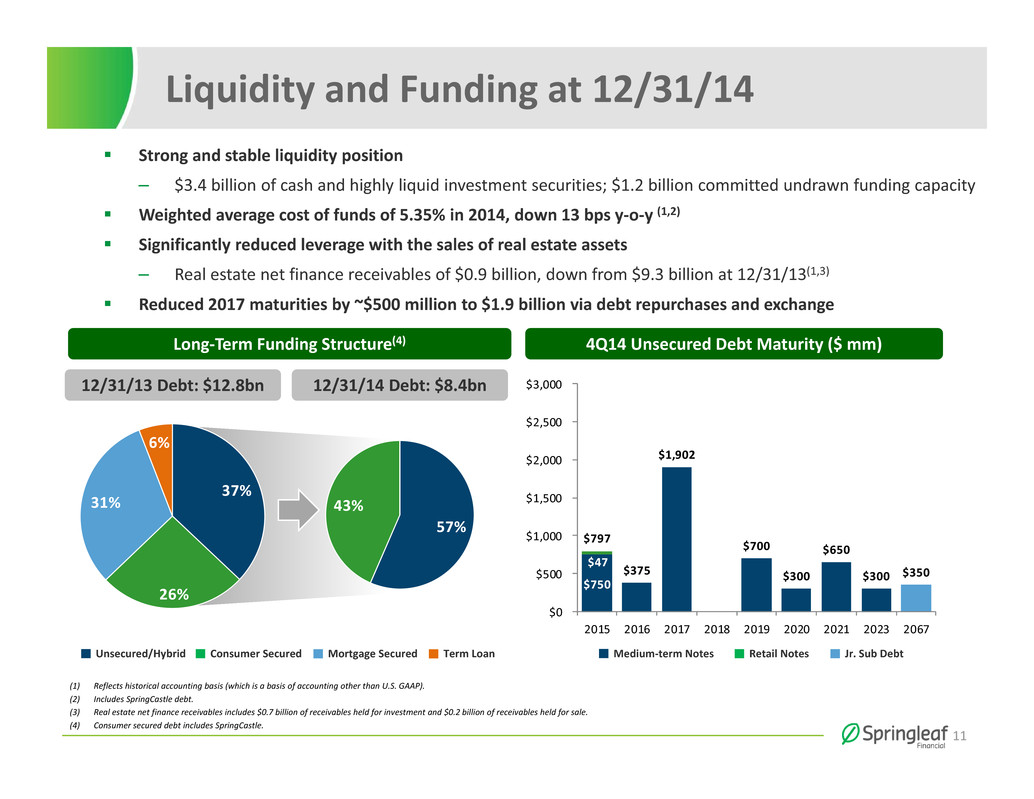

Liquidity and Capital Resources

As of December 31, 2014, the company had $3.4 billion of cash and highly liquid investment securities. The company had total outstanding debt of $8.4 billion at quarter-end, in a variety of debt instruments.

2015 Guidance

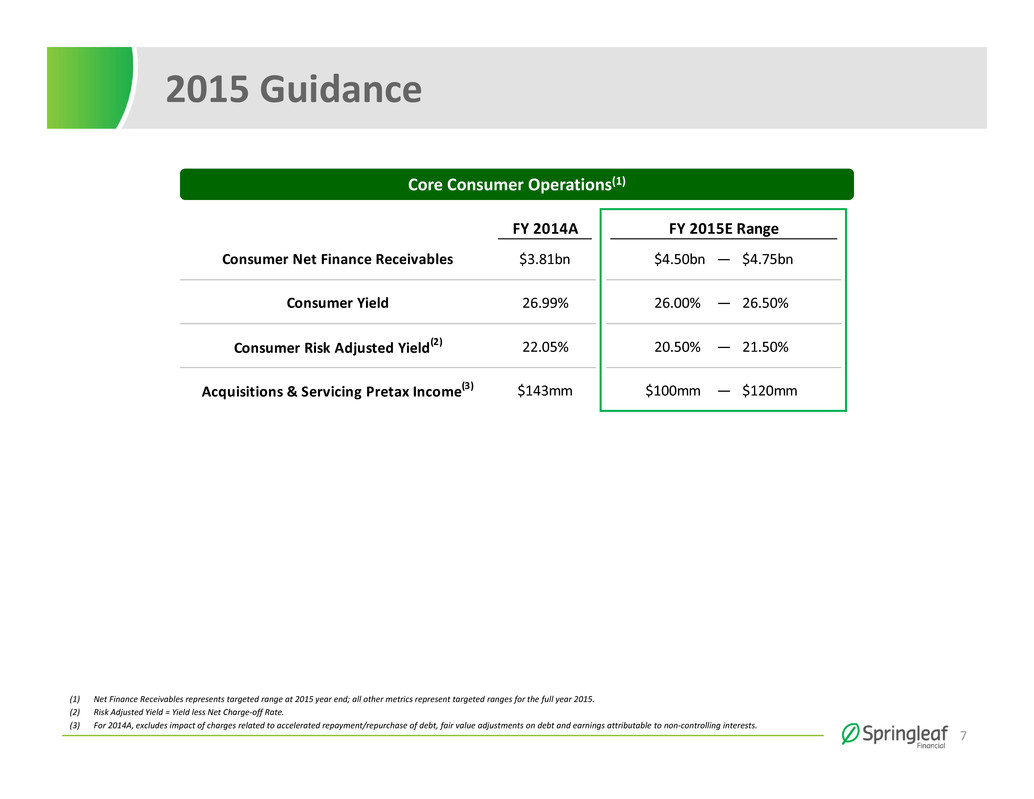

The company has established 2015 guidance ranges for certain metrics related to its Core Consumer Operations as follows:

2014A1 | 2015E Guidance | |

Consumer Net Finance Receivables at Period End | $3.81bn | $4.50bn - $4.75bn |

Consumer Yield | 26.99% | 26.00% - 26.50% |

Consumer Risk-Adjusted Yield2 | 22.05% | 20.50% - 21.50% |

Acquisitions & Servicing Pretax Income3 | $143mm | $100mm - $120mm |

1. Net Finance Receivables represents data as of December 31, 2014. All other metrics represent data for the year ended December 31, 2014.

2. Risk Adjusted Yield = Yield less Net Charge-off rates.

3. Excludes impact of charges related to accelerated repayment/repurchase of debt, fair value adjustments on debt and earnings attributable to non-controlling interests.

Use of Non-GAAP Measures

We report the operating results of our Core Consumer Operations, Non-Core Portfolio and Other Non-Core using the same accounting basis that we employed prior to 2010 when we were acquired by Fortress (the “Fortress Acquisition”), which we refer to as “historical accounting basis,” to provide a consistent basis for both management and other interested third parties to better understand our operating results. The historical accounting basis (which is a basis of accounting other than U.S. GAAP) also provides better comparability of the operating results of these segments to our competitors and other companies in the financial services industry. The historical accounting basis is not applicable to Acquisitions and Servicing since this segment resulted from the purchase of the SpringCastle Portfolio on April 1, 2013 and therefore, was not affected by the Fortress Acquisition.

Pretax Core Earnings is a key performance measure used by management in evaluating the performance of our Core Consumer Operations. Pretax Core Earnings represents our income (loss) before provision for (benefit from) income taxes on a historical accounting basis and excludes results of operations from our Non-Core Portfolio (legacy real estate loans) and other non-originating legacy operations, gains (losses) resulting from accelerated long-term debt repayment and repurchases of long-term debt related to Core Consumer Operations (attributable to Springleaf), gains (losses) on fair value adjustments on debt related to Core Consumer Operations (attributable to Springleaf), one-time costs associated with debt refinance related to Consumer and Insurance, and results of operations attributable to non-controlling interests. Pretax Core Earnings provides us with a key measure of our Core Consumer Operations’ performance as it assists us in comparing its performance on a consistent basis. Management believes Pretax Core Earnings is useful in assessing the profitability of our core business and uses Pretax Core Earnings in evaluating our operating performance. Pretax Core Earnings is a non-GAAP measure and should be considered in addition to, but not as a substitute for or superior to, operating income, net income, operating cash flow, and other measures of financial performance prepared in accordance with U.S. GAAP.

4

Conference Call Information

Springleaf management will host a conference call and webcast to discuss our fourth quarter and full year 2014 results and other general matters at 10:00 am Eastern on Thursday, March 12, 2015. Both the call and webcast are open to the general public. The general public is invited to listen to the call by dialing 877-330-3668 (U.S. domestic), or 678-304-6859 (international), conference ID 83319327, or via a live audio webcast through the Investor Relations section of the website. For those unable to listen to the live broadcast, a replay will be available on our website or by dialing 800-585-8367 (U.S. domestic), or 404-537-3406, conference ID 83319327, beginning approximately two hours after the event. The replay of the conference call will be available through March 26, 2015. An investor presentation will be available by visiting the Investor Relations page of Springleaf’s website at www.springleaf.com on Thursday, March 12, 2015, prior to the start of the conference call.

Forward Looking Statements

This press release contains “forward looking statements” within the meaning of the U.S. federal securities laws. Forward looking statements include, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, our 2015 guidance ranges and underlying assumptions and other statements, which are not statements of historical facts. Statements preceded by, followed by or that otherwise include the words “anticipate,” “appears,” “believe,” “foresee,” “intend,” “should,” “expect,” “estimate,” “project,” “plan,” “may,” “could,” “will,” “are likely” and similar expressions are intended to identify forward looking statements. These statements involve predictions of our future financial condition, performance, plans and strategies, and are thus dependent on a number of factors including, without limitation, assumptions and data that may be imprecise or incorrect. Specific factors that may impact performance or other predictions of future actions include, but are not limited to: changes in general economic conditions, including the interest rate environment and the financial markets; levels of unemployment and personal bankruptcies; shifts in residential real estate values; shifts in collateral values, delinquencies, or credit losses; natural or accidental events such as earthquakes, hurricanes, tornadoes, fires, or floods; war, acts of terrorism, riots, civil disruption, pandemics, or other events disrupting business or commerce; our ability to successfully realize the benefits of the SpringCastle Portfolio and the OneMain acquisition if completed; the effectiveness of our credit risk scoring models; changes in our ability to attract and retain employees or key executives; changes in the competitive environment in which we operate; changes in federal, state and local laws, regulations, or regulatory policies and practices; potential liability relating to real estate and personal loans which we have sold or may sell in the future, or relating to securitized loans; the costs and effects of any litigation or governmental inquiries or investigations; our continued ability to access the capital markets or the sufficiency of our current sources of funds to satisfy our cash flow requirements; our ability to generate sufficient cash to service all of our indebtedness; the potential for downgrade of our debt by rating agencies; and other risks described in the “Risk Factors” section of the Company’s Form 2013 10-K filed with the SEC on April 15, 2014. Forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. We caution you not to place undue reliance on these forward looking statements that speak only as of the date they were made. We do not undertake any obligation to publicly release any revisions to these forward looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events. You should not rely on forward looking statements as the sole basis upon which to make any investment decision.

5

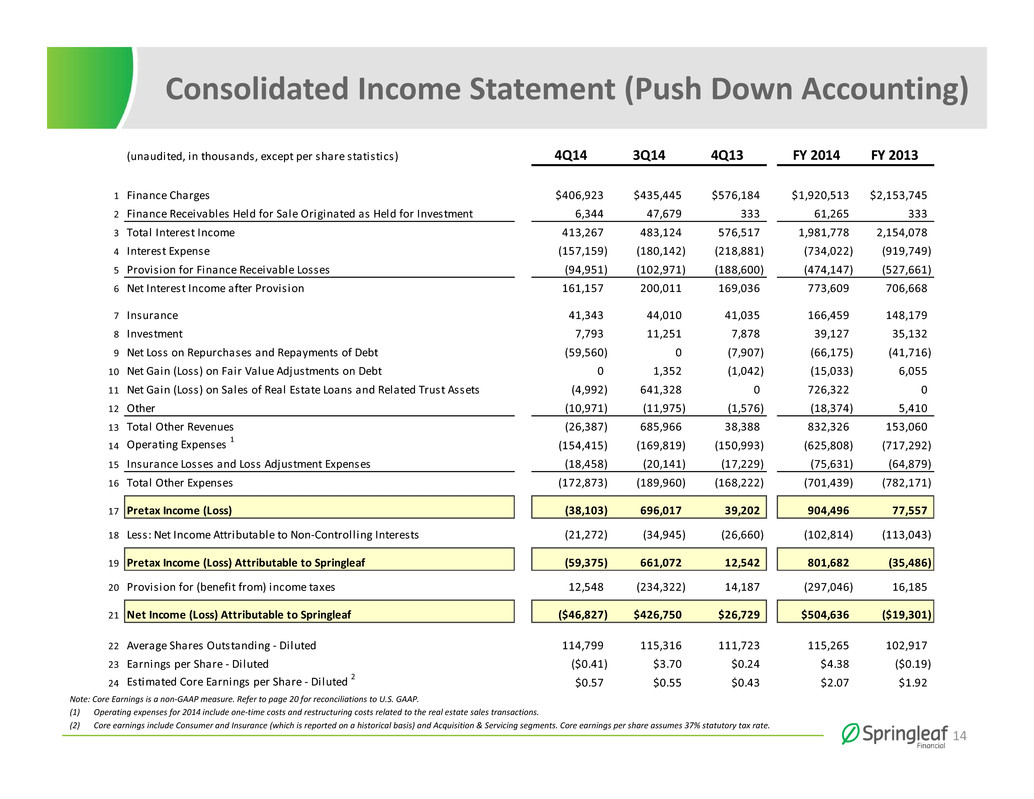

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(dollars in thousands except | Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||

earnings (loss) per share) | 2014 | 2013 | 2014 | 2013 | ||||||||||||

Interest income: | ||||||||||||||||

Finance charges | $ | 406,923 | $ | 576,184 | $ | 1,920,513 | $ | 2,153,745 | ||||||||

Finance receivables held for sale originated as held for investment | 6,344 | 333 | 61,265 | 333 | ||||||||||||

Total interest income | 413,267 | 576,517 | 1,981,778 | 2,154,078 | ||||||||||||

Interest expense | 157,159 | 218,881 | 734,022 | 919,749 | ||||||||||||

Net interest income | 256,108 | 357,636 | 1,247,756 | 1,234,329 | ||||||||||||

Provision for finance receivable losses | 94,951 | 188,600 | 474,147 | 527,661 | ||||||||||||

Net interest income after provision for finance receivable losses | 161,157 | 169,036 | 773,609 | 706,668 | ||||||||||||

Other revenues: | ||||||||||||||||

Insurance | 41,343 | 41,035 | 166,459 | 148,179 | ||||||||||||

Investment | 7,793 | 7,878 | 39,127 | 35,132 | ||||||||||||

Net loss on repurchases and repayments of debt | (59,560 | ) | (7,907 | ) | (66,175 | ) | (41,716 | ) | ||||||||

Net gain (loss) on fair value adjustments on debt | — | (1,042 | ) | (15,033 | ) | 6,055 | ||||||||||

Net gain (loss) on sales of real estate loans and related trust assets | (4,992 | ) | — | 726,322 | — | |||||||||||

Other | (10,971 | ) | (1,576 | ) | (18,374 | ) | 5,410 | |||||||||

Total other revenues | (26,387 | ) | 38,388 | 832,326 | 153,060 | |||||||||||

Other expenses: | ||||||||||||||||

Operating expenses: | ||||||||||||||||

Salaries and benefits | 81,314 | 92,078 | 359,818 | 463,920 | ||||||||||||

Other operating expenses | 73,101 | 58,915 | 265,990 | 253,372 | ||||||||||||

Insurance losses and loss adjustment expenses | 18,458 | 17,229 | 75,631 | 64,879 | ||||||||||||

Total other expenses | 172,873 | 168,222 | 701,439 | 782,171 | ||||||||||||

Income (loss) before provision for (benefit from) income taxes | (38,103 | ) | 39,202 | 904,496 | 77,557 | |||||||||||

Provision for (benefit from) income taxes | (12,548 | ) | (14,187 | ) | 297,046 | (16,185 | ) | |||||||||

Net income (loss) | (25,555 | ) | 53,389 | 607,450 | 93,742 | |||||||||||

Net income attributable to non-controlling interests | 21,272 | 26,660 | 102,814 | 113,043 | ||||||||||||

Net income (loss) attributable to Springleaf Holdings, Inc. | $ | (46,827 | ) | $ | 26,729 | $ | 504,636 | $ | (19,301 | ) | ||||||

Share Data: | ||||||||||||||||

Weighted average number of shares outstanding: | ||||||||||||||||

Basic | 114,799,490 | 111,573,561 | 114,791,225 | 102,917,172 | ||||||||||||

Diluted | 114,799,490 | 111,722,546 | 115,265,123 | 102,917,172 | ||||||||||||

Earnings (loss) per share: | ||||||||||||||||

Basic | $ | (0.41 | ) | $ | 0.24 | $ | 4.40 | $ | (0.19 | ) | ||||||

Diluted | $ | (0.41 | ) | $ | 0.24 | $ | 4.38 | $ | (0.19 | ) | ||||||

6

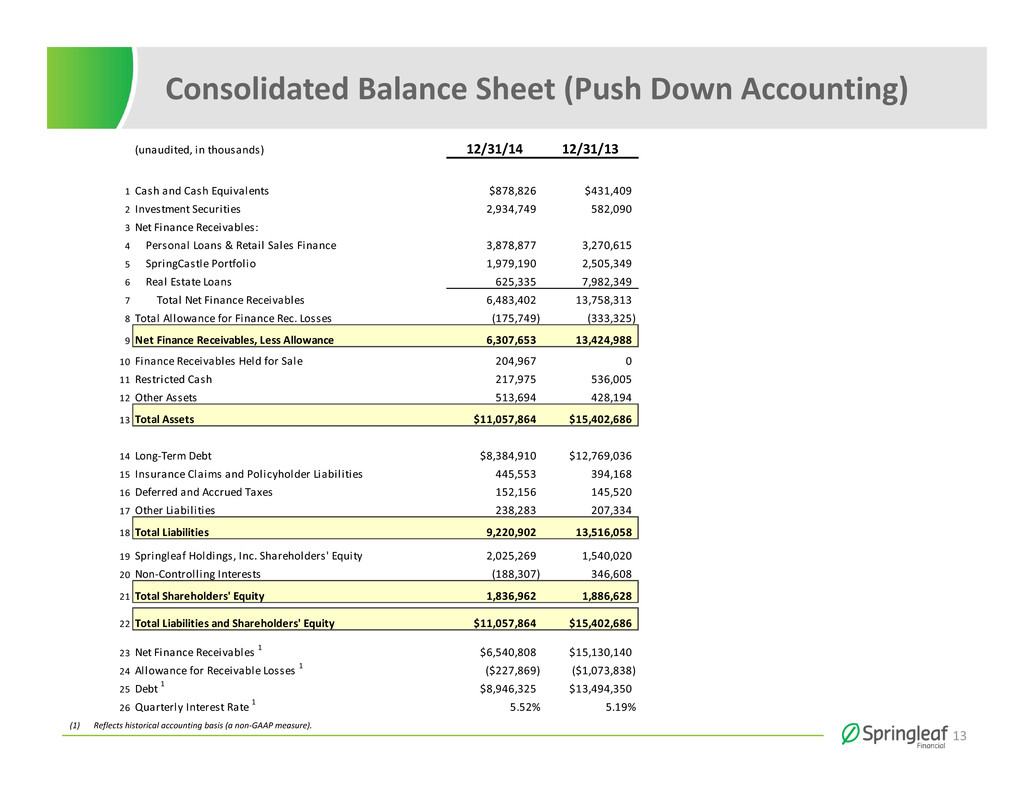

CONSOLIDATED BALANCE SHEET (UNAUDITED)

(dollars in thousands) | ||||||||

December 31, | 2014 | 2013 | ||||||

Assets | ||||||||

Cash and cash equivalents | $ | 878,826 | $ | 431,409 | ||||

Investment securities | 2,934,749 | 582,090 | ||||||

Net finance receivables: | ||||||||

Personal loans | 3,831,172 | 3,171,704 | ||||||

SpringCastle Portfolio | 1,979,190 | 2,505,349 | ||||||

Real estate loans | 625,335 | 7,982,349 | ||||||

Retail sales finance | 47,705 | 98,911 | ||||||

Net finance receivables | 6,483,402 | 13,758,313 | ||||||

Allowance for finance receivable losses | (175,749 | ) | (333,325 | ) | ||||

Net finance receivables, less allowance for finance receivable losses | 6,307,653 | 13,424,988 | ||||||

Finance receivables held for sale | 204,967 | — | ||||||

Restricted cash and cash equivalents | 217,975 | 536,005 | ||||||

Other assets | 513,694 | 428,194 | ||||||

Total assets | $ | 11,057,864 | $ | 15,402,686 | ||||

Liabilities and Shareholders’ Equity | ||||||||

Long-term debt | $ | 8,384,910 | $ | 12,769,036 | ||||

Insurance claims and policyholder liabilities | 445,553 | 394,168 | ||||||

Deferred and accrued taxes | 152,156 | 145,520 | ||||||

Other liabilities | 238,283 | 207,334 | ||||||

Total liabilities | 9,220,902 | 13,516,058 | ||||||

Shareholders’ equity: | ||||||||

Common stock | 1,148 | 1,148 | ||||||

Additional paid-in capital | 529,569 | 524,087 | ||||||

Accumulated other comprehensive income | 3,226 | 28,095 | ||||||

Retained earnings | 1,491,326 | 986,690 | ||||||

Springleaf Holdings, Inc. shareholders’ equity | 2,025,269 | 1,540,020 | ||||||

Non-controlling interests | (188,307 | ) | 346,608 | |||||

Total shareholders’ equity | 1,836,962 | 1,886,628 | ||||||

Total liabilities and shareholders’ equity | $ | 11,057,864 | $ | 15,402,686 | ||||

7

CORE KEY METRICS

At or for the | At or for the | |||||||||||||||

Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||

(dollars in thousands) | 2014 | 2013 | 2014 | 2013 | ||||||||||||

Consumer and Insurance | ||||||||||||||||

Net finance receivables | $ | 3,806,662 | $ | 3,140,792 | ||||||||||||

Number of accounts | 918,564 | 830,513 | ||||||||||||||

TDR finance receivables | $ | 22,107 | $ | 14,840 | ||||||||||||

Allowance for finance receivables losses - TDR | $ | 1,523 | $ | 923 | ||||||||||||

Provision for finance receivable losses - TDR | $ | 1,122 | $ | 627 | $ | 1,786 | $ | 1,892 | ||||||||

Average net receivables | $ | 3,693,857 | $ | 3,055,927 | $ | 3,394,790 | $ | 2,793,060 | ||||||||

Yield | 26.95 | % | 26.34 | % | 26.99 | % | 25.84 | % | ||||||||

Gross charge-off ratio | 5.78 | % | 5.49 | % | 5.65 | % | 5.18 | % | ||||||||

Recovery ratio | (0.82 | )% | (0.33 | )% | (0.71 | )% | (1.66 | )% | ||||||||

Charge-off ratio | 4.96 | % | 5.16 | % | 4.94 | % | 3.52 | % | ||||||||

Delinquency ratio | 2.82 | % | 2.60 | % | ||||||||||||

Origination volume | $ | 1,049,579 | $ | 926,047 | $ | 3,644,224 | $ | 3,253,008 | ||||||||

Number of accounts | 218,581 | 227,412 | 784,613 | 790,943 | ||||||||||||

Acquisitions and Servicing | ||||||||||||||||

Net finance receivables | $ | 1,979,190 | $ | 2,505,349 | ||||||||||||

Number of accounts | 277,533 | 344,045 | ||||||||||||||

TDR finance receivables | $ | 9,905 | $ | — | ||||||||||||

Allowance for finance receivables losses - TDR | $ | 2,673 | $ | — | ||||||||||||

Provision for finance receivable losses - TDR | $ | 1,366 | $ | — | $ | 2,689 | $ | — | ||||||||

Average net receivables | $ | 2,029,843 | $ | 2,576,495 | $ | 2,216,888 | $ | 2,730,979 | ||||||||

Yield | 26.47 | % | 24.33 | % | 24.78 | % | 23.78 | % | ||||||||

Net charge-off ratio | 5.56 | % | 8.46 | % | 6.74 | % | 6.44 | % | ||||||||

Delinquency ratio | 4.69 | % | 8.18 | % | ||||||||||||

8

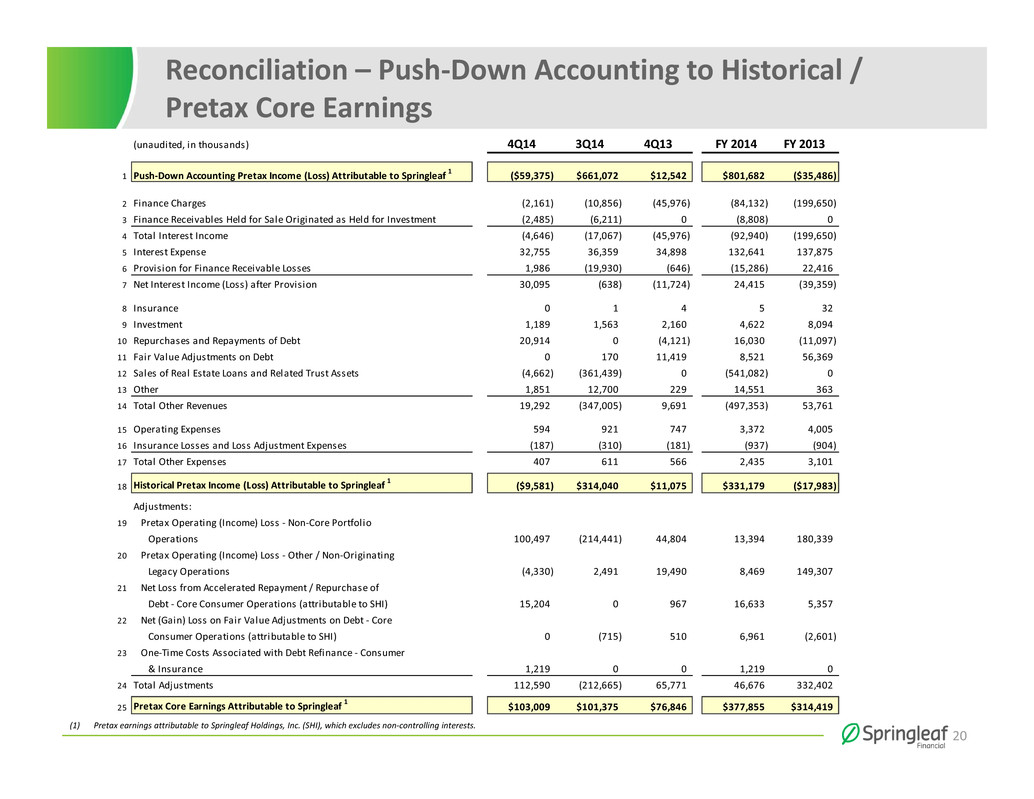

RECONCILIATION OF PGAAP AND HISTORICAL INCOME (LOSS) (NON-GAAP)

Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||

(dollars in thousands) | 2014 | 2013 | 2014 | 2013 | ||||||||||||

Income (loss) before provision for (benefit from) income taxes - push-down accounting basis | $ | (38,103 | ) | $ | 39,202 | $ | 904,496 | $ | 77,557 | |||||||

Interest income adjustments | (4,646 | ) | (45,976 | ) | (92,940 | ) | (199,650 | ) | ||||||||

Interest expense adjustments | 32,755 | 34,898 | 132,641 | 137,875 | ||||||||||||

Provision for finance receivable losses adjustments | 1,986 | (646 | ) | (15,286 | ) | 22,416 | ||||||||||

Repurchases and repayments of long-term debt adjustments | 20,914 | (4,121 | ) | 16,030 | (11,097 | ) | ||||||||||

Fair value adjustments on debt | — | 11,419 | 8,521 | 56,369 | ||||||||||||

Sales of finance receivables held for sale originated as held for investment adjustments | (4,662 | ) | — | (541,082 | ) | — | ||||||||||

Amortization of other intangible assets | 1,061 | 1,167 | 4,355 | 5,113 | ||||||||||||

Other | 2,386 | 1,792 | 17,258 | 6,477 | ||||||||||||

Income before provision for income taxes - historical accounting basis | $ | 11,691 | $ | 37,735 | $ | 433,993 | $ | 95,060 | ||||||||

PRETAX CORE EARNINGS (NON-GAAP) RECONCILIATION

Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||

(dollars in thousands) | 2014 | 2013 | 2014 | 2013 | ||||||||||||

Income before provision for income taxes - historical accounting basis | $ | 11,691 | $ | 37,735 | $ | 433,993 | $ | 95,060 | ||||||||

Adjustments: | ||||||||||||||||

Pretax operating loss - Non-Core Portfolio Operations | 100,497 | 44,804 | 13,394 | 180,339 | ||||||||||||

Pretax operating (income) loss - Other/non-originating legacy operations | (4,330 | ) | 19,490 | 8,469 | 149,307 | |||||||||||

Net loss from accelerated repayment/repurchase of debt - Core Consumer Operations (attributable to SHI) | 15,204 | 967 | 16,633 | 5,357 | ||||||||||||

Net (gain) loss on fair value adjustments on debt - Core Consumer Operations (attributable to SHI) | — | 510 | 6,961 | (2,601 | ) | |||||||||||

One-time costs associated with debt refinance - Consumer and Insurance | 1,219 | — | 1,219 | — | ||||||||||||

Pretax operating income attributable to non-controlling interests | (21,272 | ) | (26,660 | ) | (102,814 | ) | (113,043 | ) | ||||||||

Pretax core earnings | $ | 103,009 | $ | 76,846 | $ | 377,855 | $ | 314,419 | ||||||||

Springleaf Holdings, Inc.

Contact:

Craig Streem, 812-468-5752

craig.streem@springleaf.com

Source: Springleaf Holdings, Inc.

9