Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - La Quinta Holdings Inc. | d859384dex51.htm |

| EX-1.1 - EX-1.1 - La Quinta Holdings Inc. | d859384dex11.htm |

| EX-23.2 - EX-23.2 - La Quinta Holdings Inc. | d859384dex232.htm |

| EX-99.2 - EX-99.2 - La Quinta Holdings Inc. | d859384dex992.htm |

| EX-23.3 - EX-23.3 - La Quinta Holdings Inc. | d859384dex233.htm |

Table of Contents

As filed with the Securities and Exchange Commission on March 12, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

La Quinta Holdings Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 7011 | 90-1032961 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

909 Hidden Ridge, Suite 600

Irving, Texas 75038

(214) 492-6600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark M. Chloupek

Executive Vice President, Secretary and General Counsel

909 Hidden Ridge, Suite 600

Irving, Texas 75038

(214) 492-6600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Michael D. Nathan, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 (212) 455-2000 |

Marc D. Jaffe, Esq. Cathy A. Birkeland, Esq. Latham & Watkins LLP 885 Third Avenue New York, New York 10022-4834 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate |

Amount of Registration Fee | ||||

| Common Stock, par value $0.01 per share |

20,125,000(1) | $22.48(2) | $452,410,000 | $52,571 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 2,625,000 shares subject to the underwriters’ option to purchase additional shares. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended. The price per share and aggregate offering price are based on the average of the high and low prices of the Registrant’s common stock on March 6, 2015, as reported on the New York Stock Exchange. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated March 12, 2015.

17,500,000 Shares

La Quinta Holdings Inc.

Common Stock

The selling stockholders identified in this prospectus are offering 17,500,000 shares of common stock of La Quinta Holdings Inc. We will not receive any of the proceeds from the sale of our common stock by the selling stockholders.

Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “LQ.” The last reported sale price of our common stock on the NYSE on March 10, 2015 was $22.74 per share.

See “Risk Factors” beginning on page 19 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

|

|

||||||||

To the extent that the underwriters sell more than 17,500,000 shares of common stock, the underwriters have the option to purchase up to an additional 2,625,000 shares of common stock from the selling stockholders at the public offering price less the underwriting discounts and commissions. The selling stockholders will receive all of the proceeds from the sale of any such additional shares to the underwriters.

The underwriters expect to deliver the shares against payment in New York, New York on , 2015.

| J.P. Morgan | Morgan Stanley |

Prospectus dated , 2015.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Prospectus

| Page | ||||

| i | ||||

| ii | ||||

| ii | ||||

| iv | ||||

| 1 | ||||

| 13 | ||||

| 15 | ||||

| 19 | ||||

| 24 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION |

30 | |||

| 39 | ||||

| 43 | ||||

| 46 | ||||

| 48 | ||||

| 55 | ||||

| CERTAIN UNITED STATES FEDERAL INCOME AND ESTATE TAX CONSEQUENCES TO NON-U.S. HOLDERS |

58 | |||

| 62 | ||||

| 67 | ||||

| 67 | ||||

| 68 | ||||

| 69 | ||||

Neither we nor the selling stockholders have authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectuses we have prepared. Neither we nor the selling stockholders take any responsibility for, or can provide any assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained or incorporated by reference in this prospectus is current only as of its respective date.

Table of Contents

Within this prospectus and the documents incorporated by reference herein, we reference information and statistics regarding the hotel industry and various segments within such industry. We have obtained this information and statistics from various independent third-party sources, including independent industry publications, reports by market research firms and other independent sources. Smith Travel Research (“STR”) and PKF Hospitality Research, LLC (“PKF-HR”) are the primary sources for third-party market data and industry statistics and forecasts. STR does not guarantee the performance of any company about which it collects and provides data. Nothing in the STR or PKF-HR data should be construed as advice. Some data and other information are also based on our good faith estimates, which are derived from our review of internal surveys and independent sources. We believe that these external sources and estimates are reliable, but have not independently verified them.

RevPAR Index, which measures a hotel’s fair market share of its competitive set’s revenue per available room, is stated as a percentage and is calculated for a hotel by comparing the hotel’s RevPAR to the aggregate RevPAR of a group of competing hotels generally in the same market (referred to as a “competitive set”); and when presented for a group of hotels is a weighted average of the individual hotel results. The manager for each of our owned hotels and each franchisee exercises discretion, subject to (i) adherence to certain guidelines published by STR and described below and (ii) review by La Quinta management to ensure system-wide consistency, in identifying the competitive set of properties for each such hotel. They consider such factors as physical proximity, competition for similar customers, services and amenities, quality and average daily rate, with location being the most significant factor. Competitive set makeup is initially determined when a new hotel enters our system and is reviewed for continuing appropriateness as non-La Quinta hotels enter and leave our markets. Each La Quinta hotel’s competitive set complies with the following four STR published guidelines, each of which places limitations on properties that may be included in a competitive set: (1) each competitive set must include a minimum of three participating properties, in addition to the subject property; (2) no single property or brand can account for more than 40% of the total participating room supply of a competitive set, excluding the rooms of the subject property; (3) no single company can account for more than 60% of the total participating room supply of a competitive set, excluding the rooms of the subject property; and (4) each competitive set must include a minimum of two companies other than that of the subject property. We may include certain competitors in a hotel property’s competitive set and those competitors may or may not include our hotel in their competitive set. We provide, for each La Quinta hotel, our proposed competitive set to STR for publication. STR confirms that each proposed competitive set complies with their published guidelines and then uses that information, along with ADR and RevPAR for each such hotel (which ADR and RevPAR may be calculated differently than we or our competitors do for internal purposes) to calculate RevPAR Index. STR calculates RevPAR Index for the current period and prior periods based on the competitive sets existing as of the date of the STR report for the current period of such report. Accordingly, our future filings may disclose historical RevPAR Index for prior periods that differ from those disclosed in this prospectus.

i

Table of Contents

Trademarks, service marks and trade names

We own or have rights to use a number of registered and common law trademarks, service marks and trade names in connection with our business in the United States and/or in certain foreign jurisdictions. Our primary trademarks are “La Quinta,” “LQ,” “Returns” and the sunburst Q symbol.

Solely for convenience, the trademarks, service marks, logos and trade names referred to in this prospectus or the documents incorporated by reference herein are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names. This prospectus and the documents incorporated by reference herein contain additional trademarks, service marks and trade names of others, which are the property of their respective owners. All trademarks, service marks and trade names appearing in this prospectus or in the documents incorporated by reference herein are, to our knowledge, the property of their respective owners.

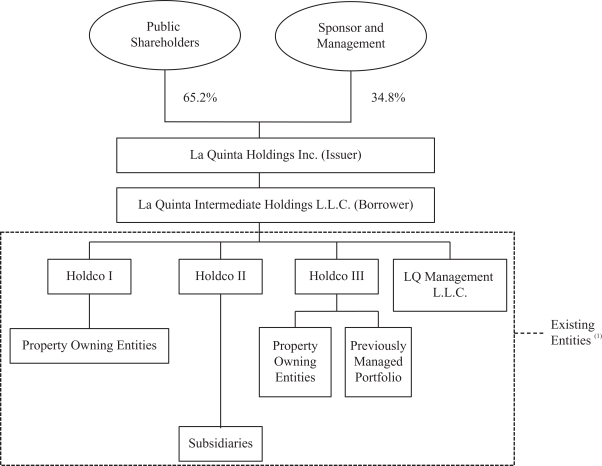

On April 14, 2014, we completed our initial public offering (the “IPO”), in which we issued and sold approximately 44.0 million shares of common stock of La Quinta Holdings Inc. Our business prior to the IPO was conducted, and our hotel properties were owned, through multiple entities (including the entities owned by the Company at the completion of the IPO and previously under common control or otherwise consolidated for financial reporting purposes and their consolidated subsidiaries (the “Predecessor Entities”) and the entities that own the 14 La Quinta hotels managed by the Predecessor Entities (the “Previously Managed Portfolio”), collectively, the “Existing Entities”). Prior to the IPO, certain of our Existing Entities operated as real estate investment trusts (“REITs”) for U.S. federal income tax purposes.

To effectuate the IPO, we enacted a series of transactions that resulted in a reorganization of our business (the “Pre-IPO Transactions”). Specifically, among other transactions, one of the Predecessor Entities purchased the Previously Managed Portfolio and we purchased the management company for the Predecessor Entities and the equity interests in the Predecessor Entities held by the pre-IPO owners were exchanged for shares of common stock of the Issuer. Additionally, all of the shares of capital stock held by third-party stockholders of the Existing Entities that were REITs were redeemed for cash and the REITs were converted into limited liability companies. Following the IPO, neither we nor any of our subsidiaries were operated as a REIT, and we are taxed as a “C” corporation at the federal and state level. See “Prospectus summary—Corporate history, growth and structure.” For a further discussion of the Pre-IPO Transactions, see the italicized introduction to the section entitled “Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (the “2014 Form 10-K”) incorporated by reference into this prospectus.

Unless otherwise indicated or the context otherwise requires, all information in this prospectus reflects the consummation of the Pre-IPO Transactions and references in this prospectus to “we,” “our,” “us” and the “Company” refer to La Quinta Holdings Inc. and its consolidated subsidiaries, and references to “La Quinta Holdings Inc.” and the “Issuer” refer only to La Quinta Holdings Inc. exclusive of its subsidiaries.

ii

Table of Contents

As of December 31, 2013, four of our La Quinta-branded hotels were designated as assets held for sale and the results of their operations, together with the operations of the 29 hotels sold during 2013, have been classified as discontinued operations (collectively, the “Hotels Designated for Sale”). Sales of these four hotels closed in February 2014.

Presentation of historical non-financial data and pro forma financial information. Unless otherwise indicated or the context otherwise requires, (i) operating and other non-financial data, including number of hotels and related data, disclosed in the sections of this prospectus and the documents incorporated by reference herein other than the Financial Statement Sections (as defined below) and (ii) pro forma financial information in this prospectus:

| • | reflects the combined and consolidated business and operations of the Predecessor Entities; |

| • | treats the Previously Managed Portfolio as owned hotels, which were acquired by the Predecessor Entities at the time of the IPO; |

| • | includes the Hotels Designated for Sale (with the Hotels Designated for Sale treated as discontinued operations in the pro forma financial information) until such hotels were sold in February 2014; and |

| • | excludes 11 Baymont-branded hotels (the “Baymont Hotels”) which we sold on August 8, 2013 (with the Baymont Hotels treated as discontinued operations in the pro forma financial information). |

Presentation of consolidated financial information and certain other non-financial data. Unless otherwise indicated, or the context otherwise requires, for periods prior to the completion of the IPO, (i) the historical financial data (excluding all pro forma financial data) included or incorporated by reference in this prospectus and (ii) the operating and other non-financial data (but excluding all related data prepared on a pro forma basis), including number of hotels and related data, disclosed in “Summary historical consolidated financial data” in this prospectus and “Part II—Item 6. Selected Financial Data” and “Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the 2014 Form 10-K incorporated by reference into this prospectus (collectively, the “Financial Statement Sections”):

| • | reflects the combined and consolidated business and operations of the Predecessor Entities (including the management company, which was consolidated for financial reporting purposes); |

| • | treats the Previously Managed Portfolio as franchised and managed hotels; |

| • | excludes the Hotels Designated for Sale (other than as discontinued operations); and |

| • | excludes the Baymont Hotels (other than as discontinued operations). |

Except where the context requires otherwise, the information in this prospectus assumes no exercise by the underwriters of their option to purchase up to an additional 2,625,000 shares of common stock from the selling stockholders.

iii

Table of Contents

The following are definitions of certain terms used in this prospectus:

| • | “ADR” or “average daily rate” means hotel room revenues divided by total number of rooms sold in a given period; |

| • | “Blackstone” or “our Sponsor” means The Blackstone Group L.P. and its affiliates; |

| • | “CAGR” means compound annual growth rate; |

| • | “Comfort” refers to Comfort Inns and Comfort Suites collectively; |

| • | “comparable hotels” means hotels that: (i) were active and operating in our system for at least one full calendar year as of the end of the applicable period and were active and operating as of January 1st of the previous year; and (ii) have not sustained substantial property damage, business interruption or for which comparable results are not available. Management uses comparable hotels as the basis upon which to evaluate ADR, occupancy, RevPAR and RevPAR Index on a system-wide basis and for each of our reportable segments; |

| • | “franchised hotels” refers to La Quinta-branded hotels which are owned and operated by third party franchisees under franchise agreements with us; |

| • | “Hampton” refers to Hampton Inns and Hampton Inn & Suites collectively; |

| • | “main STR competitive set” refers to Comfort, Holiday Inn Express and/or Hampton, the brands most often included in our STR competitive sets; |

| • | “occupancy” means the total number of rooms sold in a given period divided by the total number of rooms available at a hotel or group of hotels; |

| • | “owned hotels” and “owned portfolio” refer to our hotels located on properties in which we have an ownership interest or leasehold interest; |

| • | “pipeline” means our portfolio of future La Quinta-branded hotels, each of which is represented by an executed franchise agreement; |

| • | “pre-IPO owners” refers to Blackstone and the members of our management and consultants that owned, directly or indirectly, interests in the Predecessor Entities; |

| • | “RevPAR” or “revenue per available room” means the product of the ADR charged and the average daily occupancy achieved; |

| • | “RevPAR Index” measures a hotel’s fair market share of its competitive set’s revenue per available room. See “Market and industry data”; |

| • | “system-wide” refers collectively to our owned, franchised and managed hotel portfolios; and |

| • | “U.S. defined market tracts” refers to the 629 geographic areas or locations in the United States, compiled by STR, each of which is a subset of a geographic market. |

iv

Table of Contents

This summary highlights certain significant aspects of our business and this offering. This is a summary of information contained elsewhere in this prospectus and the documents incorporated by reference herein, is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, the documents incorporated by reference in this prospectus and any free writing prospectus prepared by us, including the section entitled “Risk factors” in this prospectus and the section entitled “Part I—Item 1A. Risk Factors” and our audited consolidated financial statements and the notes thereto, in each case in our 2014 Form 10-K incorporated by reference into this prospectus, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of certain factors such as those set forth in “Risk factors” and “Special note regarding forward-looking statements” in this prospectus and “Part I—Item 1A. Risk Factors” in our 2014 Form 10-K incorporated by reference in this prospectus. When making an investment decision, you should also read the discussion under “Basis of presentation” above for the definition of certain terms used in this prospectus and a description of certain transactions and other matters described in this prospectus.

Company overview

We are a leading owner, operator and franchisor of select-service hotels primarily serving the midscale and upper-midscale segments under the La Quinta brand. Based on data provided by STR, over the last ten years ended December 31, 2014, La Quinta is the fastest growing of the hotel brands comprising our main STR competitive set in terms of percentage growth of number of hotels in the United States, significantly outpacing the percentage increase in number of hotels by each of such brands. Our system-wide portfolio, as of December 31, 2014, consisted of 867 hotels representing approximately 86,500 rooms located predominantly across 47 U.S. states, as well as in Canada and Mexico, of which 353 hotels were owned and operated and 514 were franchised. We also had a pipeline of 207 franchised hotels as of December 31, 2014, to be located in the United States, Mexico, Canada, Colombia, Honduras, Nicaragua and Guatemala (86% of which represents new construction as opposed to the conversion of an existing hotel).

1

Table of Contents

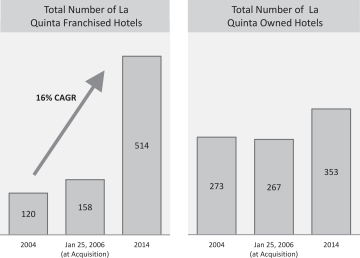

The following tables illustrate the growth in number of our owned and franchised hotels from 2004 to December 31, 2014.

| (1) | Certain of our owned hotels were previously operated by us as non-La Quinta hotels and are not included in this table until such time as they were converted to La Quinta-branded hotels. From the Acquisition, as defined below, through December 31, 2014 and primarily in 2006, we converted 128 such hotels. |

We primarily derive our revenues from owned hotel operations and fees generated from franchised and managed hotels. On a pro forma basis, for the year ended December 31, 2014, we generated total revenue of $988.9 million, Adjusted EBITDA of $375.5 million and net income from continuing operations of $54.6 million. For a reconciliation of Adjusted EBITDA, see “Summary historical consolidated financial data.”

We are focused on providing clean and comfortable guest rooms at affordable prices in convenient locations. When STR’s price points by segment are applied to each of our hotels, approximately 30% would be considered upper-midscale, approximately 53% would be considered midscale, approximately 7% (principally our owned hotels) would be considered economy and the balance would be considered in the segments above upper-midscale. Our hotels have fewer costly services and amenities than full-service hotels, which we believe results in a highly efficient hotel-level cost structure. Our hotels typically include common areas with amenities such as a great room (including breakfast seating area, lobby with seating area and business center), swimming pool and vending areas and generally offer a complimentary breakfast. As of December 31, 2014, the hotels in our system consisted of 607 La Quinta Inn & Suites, which include guest suites and generally are our newer hotels with interior corridors, and 260 La Quinta Inns, 140 of which include interior corridors. Our guest mix includes both business and leisure travelers.

La Quinta was founded in San Antonio, Texas in 1968 and has a 46-year history of owning and operating hotels. From 1973 to January 2006, we operated through our predecessors as a public company. In January 2006, we were acquired by Blackstone (the “Acquisition”), who identified a strategic repositioning opportunity to improve the quality and performance of our owned portfolio, narrow the RevPar Index gap between us and our main STR competitive set and accelerate growth in our franchise business. RevPAR Index measures a hotel’s fair market share of

2

Table of Contents

its competitive set’s revenue per available room and is calculated by comparing the hotel’s RevPAR to the aggregate RevPAR of a group of competing hotels generally in the same market.

Our strategic repositioning plan included:

| • | assembling a management team led by lodging industry and La Quinta veteran Wayne Goldberg; |

| • | investing capital into our owned real estate, brand and technology infrastructure; |

| • | prioritizing the growth of our franchise business and dedicating resources to existing and new domestic franchise markets; |

| • | establishing a franchising infrastructure in Mexico and Central America; |

| • | increasing the focus on operating efficiencies and revenue management within our owned portfolio; |

| • | consolidating operations around the La Quinta brand; and |

| • | increasing the marketing spend with a focus on differentiating the La Quinta brand and growing our loyalty program. |

In connection with our strategic repositioning plan from the Acquisition through December 31, 2014, we have expanded our franchise system by over three times, growing from 158 franchised hotels to 514 franchised hotels, with an additional 207 hotels in our pipeline. Based on historical experience, converted hotels in our pipeline can generally become operational between 12 to 18 months from the date of execution of the franchise agreement, and newly constructed hotels in our pipeline can generally become operational between 36 to 48 months from the date of execution of the franchise agreement. Openings may be delayed, or franchises canceled, for a number of factors, including economic conditions, weather and construction delays, and certain of our pipeline properties may not become operational. Additionally, because revenues from franchised hotels are principally derived from franchise fees rather than room rentals, as we grow our system by increasing the number of franchised hotels, our revenues and expenses will increase at a significantly slower rate than if we were growing our system through an increase in number of owned hotels.

Additionally, over the period from 2007 through the last full fiscal year prior to our IPO, we:

| • | invested a total of $759 million in capital, $310 million of which we consider repositioning capital which was invested to increase our RevPAR Index. Repositioning capital investments included $148 million for improvements across our owned hotel portfolio, including acceleration of some aspects of cycle renovations, and $45 million for upgrades to our technology infrastructure. Repositioning capital also included over $74 million expended to upgrade the non-La Quinta hotels we converted to La Quinta-branded hotels after the Acquisition and $42 million to develop our flagship downtown Chicago property; |

| • | after experiencing a decrease in RevPAR Index of 340 basis points from 2006 to 2007, principally due to the conversion over that period of 128 non-La Quinta hotels to La Quinta-branded hotels, increased our system-wide RevPAR Index by 990 basis points to 98.5% over the |

| annual periods from 2007 through the last full fiscal year prior to our IPO, based on the STR competitive set of hotels existing as of December 31, 2013; |

3

Table of Contents

| • | sold (or were holding for sale) 33 La Quinta hotels, the effect of which was to improve our system-wide RevPAR and guest satisfaction scores for our remaining portfolio; and |

| • | increased membership in our La Quinta Returns loyalty program by 143% from 3.7 million to over nine million members. |

Additionally, following the industry-wide economic downturn that began in 2008, our operating performance has improved significantly over the past five fiscal years, during the strong lodging industry recovery that industry analysts believe will continue for the next several years. Specifically, we have:

| • | increased our ADR 20.1% from $69.38 to $83.34 for the year ended December 31, 2014 compared to the year ended December 31, 2010; |

| • | increased our RevPAR 36.4% from $40.49 to $55.21 for the year ended December 31, 2014 compared to the year ended December 31, 2010; and |

| • | realized Adjusted EBITDA growth (including the Previously Managed Portfolio as franchised and managed hotels) of 60.8% for the twelve months ended December 31, 2014 compared to the twelve months ended December 31, 2010. |

Although we believe we have been successful in implementing our strategic repositioning plan, we believe there remains significant opportunity for future growth:

| • | There remains a meaningful ADR differential between us and the hotels in our main STR competitive sets, which we believe we can continue to decrease over time. |

| • | Our 2014 Adjusted EBITDA and Adjusted EBITDA margins for our owned portfolio remain below comparable 2008 metrics which we believe represent significant capacity for future organic growth at our hotels. |

| • | We remain approximately half the size of the hotel brands in our main STR competitive set in terms of number of hotels in the United States, which we believe provides for significant future expansion opportunity. |

Our competitive strengths

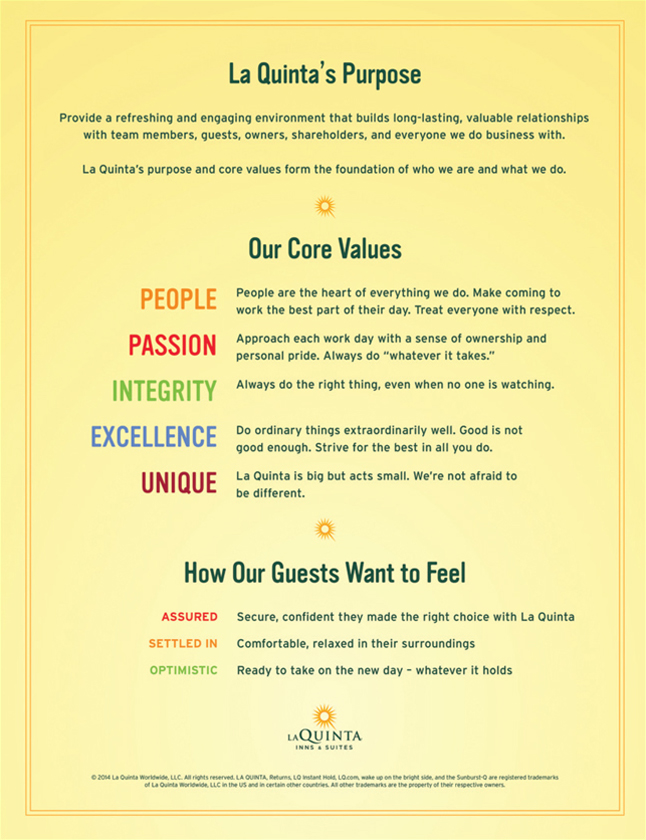

We are driven by our core values and principles that we believe drive a high level of employee and guest engagement. Together with these core values and principles, we believe that the following competitive strengths position us to execute on our business plan and growth strategies.

| • | Scalable and efficient business model with attractive cash flow characteristics. Our hotel product offering is efficient, replicable and supported by a scalable operational, technological and administrative platform. In 2014, over 98% of our owned hotel revenue was derived solely from room rentals, as compared to 63% for full-service hotels, according to STR, and our operating margins in 2014 were 47% as compared to operating margins in 2013 of 32% for full-service hotels (which reflects the most current available information). As a select-service hotel brand, our hotels require fewer costly services, amenities and capital expenditures than full-service hotels, resulting in what we believe to be a highly efficient hotel-level cost structure, strong Adjusted EBITDA margins and stable cash flows. Even during the height of the |

4

Table of Contents

| recent economic downturn in 2009, our Adjusted EBITDA margins remained above 32% as compared to approximately 20% for full-service hotels, based on data provided by STR. In addition, our model enables us to manage corporate overhead expenses even though the number of our hotels, particularly the number of our franchised hotels, has increased substantially. |

| • | Established and rapidly growing franchise business. Since 2004, we have grown our total number of franchised hotels from 120 in 2004 to 514 as of December 31, 2014, achieving a franchise compounded annual growth rate of 16%. Our franchise business requires little or no capital investment by us (which we refer to as “capital light”), and has substantial scale and an established infrastructure that we believe positions us to achieve meaningful franchise growth as development capital for franchisees continues to become more available. The hotels in our franchised portfolio have an average age of 14 years, with 34% of our franchised portfolio being in our system less than 5 years. Despite the strong decade of growth, we are still less than half the size of our main STR competitive set, allowing room for continued aggressive franchise growth in a number of under-penetrated U.S. markets. As of December 31, 2014, we have a large pipeline of 207 franchised hotels (of which 86% are new construction), each represented by an executed franchise agreement. Given our founding and significant presence in Texas, our presence in the U.S. southern border states and our established brand history with travelers from this region, we believe La Quinta has significant brand awareness in Mexico and believe Mexico, Central America and South America provide opportunities for significant franchise growth internationally where we have laid the foundation for expansion. In Central and South America, we will build on this awareness of the La Quinta brand by emphasizing the associated “LQ” registered marks to identify La Quinta hotels in certain markets. Additionally, as our franchise business continues to grow, we expect cash flow from this segment will comprise a higher percentage of our total cash flow. Given that the average remaining term of our existing franchise contracts is approximately 14 years, we believe that our existing franchisees provide a long-term stable income stream. Moreover, we anticipate our franchise revenues will grow over time as new franchise agreements and renewals of existing franchise agreements are executed at our current published rates, which include a 4.5% royalty fee, which is higher than the 4.0% royalty fee generally applicable to our franchise agreements entered into prior to April 2013. |

| • | Widely recognized and differentiated brand. We own, operate and franchise all of our hotels under a single brand, La Quinta, a highly recognizable brand in the select-service market, established over a 46-year history. We have a loyal base of customers and a growing loyalty program, La Quinta Returns, with over ten million members as of December 31, 2014. We believe the capital investments we have made to upgrade and reposition our brand and hotel experience have helped to improve our brand awareness, brand perception, guest loyalty and guest experience. Our improved guest experience, brand perception and growing loyalty have contributed to consistent market share increases as reflected by our RevPAR Index growth. We believe that the demonstrated strength of our brand and loyal customer base drive revenues for our existing owned and franchised hotels and also makes us attractive to new franchisees. |

| • | Owner and operator business model promotes alignment with our franchisees. Our position as an owner and operator of La Quinta-branded hotels creates an alignment of economic objectives with our franchisees, which we believe is a differentiating factor among our competitors. We are focused on delivering value to our guests, which generates repeat stays |

5

Table of Contents

| and increases guest loyalty. Delivering value combined with the benefits of an increasing market presence through our growth in the number of hotels has strengthened our brand. We believe this focus and the powerful alignment with our franchisees drive strong operating results and financial returns which benefit both us and our franchisees and will continue to benefit and grow our business in the future. We have an active advisory Brand Council that includes both Company and franchisee representation and meets three to four times a year to discuss ways to strengthen our brand. Through the Brand Council, we often test new concepts at both owned and franchised hotels, which we believe promotes collaboration between us and our franchisees. We believe our model incentivizes franchisees to invest in growing the La Quinta brand through additional capital investment into existing franchised hotels and through the development of new La Quinta hotels. |

| • | Highly experienced and successful management team. Our management team has extensive experience in hospitality, consumer-facing and brand-based companies, with a proven track record for delivering strong results. Our executive management team has an average industry tenure of over 19 years, including Wayne Goldberg, with 36 years of select-service experience, Rajiv Trivedi, our Chief Development Officer, with 26 years of industry experience and Angelo Lombardi, our Chief Operating Officer, with 26 years of industry experience. In addition, Keith Cline, our Chief Financial Officer, who joined our executive management team in January 2013, brings over 22 years of finance, accounting and brand experience, which includes over 13 years of public company experience. Management has developed a culture of strong collaboration and teamwork that runs throughout the organization and has contributed to La Quinta’s successful performance. |

Our strategies

The following are key elements of our strategy to become the preferred select-service brand for our guests and franchise partners.

| • | Take advantage of our significant capital investment to optimize the performance of our owned hotels. We will continue to focus on maximizing revenues and managing costs at each of our owned hotels where we have updated our guest rooms to generally include a 32” flat panel high definition television, pillow-top mattresses, a large work desk with an ergonomic “task” chair, high speed internet access, a coffee-maker, and high-flow shower heads and curved shower rods. As of December 31, 2014, we had 353 owned hotels, representing 41% of our system-wide units and 52% of our system-wide rooms. We intend to drive revenue growth by employing our active revenue management strategies and increasing our ADR, share of hotel stays by return guests, membership in our Returns program, overall brand awareness and volume of our corporate guests. There is currently a meaningful ADR differential between us and the hotels in our main STR competitive sets. We believe the significant amount of capital we have spent since 2007 to reposition and improve the brand and the quality of our hotels, the growth in the number of hotel units in our system and the resulting increased brand awareness will allow us to continue to increase ADR. We expect to continue to enhance the profitability of our owned hotels by maximizing cost efficiencies through disciplined cost control and focusing on operational enhancements. |

| • | Continue to aggressively grow our capital light franchise business both domestically and internationally. A primary element of our growth strategy is to continue to grow the number |

6

Table of Contents

| of units in our higher margin, scalable franchise fee-based business. As of December 31, 2014, we had 514 franchised hotels, representing 59% of our system-wide units and 48% of our system-wide rooms. Additionally, we have a large pipeline of 207 franchised hotels, 86% of which represents new construction, rather than the conversion of an existing hotel. We believe that there remains meaningful opportunity for continued growth in the United States, with La Quinta under-penetrated in many of the markets served by our main STR competitive set, including the Northeast and Northwest. For example, as of December 31, 2014, we are represented in 65% of the 629 U.S. defined market tracts and have an average 2.09 hotels in such represented markets, whereas the hotel brands of our main STR competitive set are represented in over 93% of such market tracts and have an average 3.21 hotels in our represented markets. In addition, our pipeline includes hotels in 29 additional market tracts, which represents new distribution for our brand. We also intend to add new domestic franchised hotels in highly populated urban locations to serve a wider group of guests and increase brand awareness. We believe the opportunity for franchise growth in Mexico, Central America and South America under the “La Quinta,” “LQ,” “LQ Hotel” and other similar marks is significant given our existing infrastructure, established brand history with travelers from these regions and our presence in the U.S. southern border states and Mexico. We have dedicated franchise and sales personnel who are focused exclusively on our franchise operations in these regions. As of December 31, 2014, we had 27 hotels either open or in the pipeline in those regions, and we continue to explore other franchise opportunities in these international markets. |

| • | Continue to increase La Quinta brand awareness. We will continue to invest in marketing and brand building in order to increase awareness and differentiation of the La Quinta brand to improve hotel performance in our owned and franchised hotels and attract new La Quinta franchisees. We are able to concentrate our marketing and advertising efforts under a single brand rather than spreading them across multiple brands, which we believe enhances our ability to raise awareness of La Quinta hotels. Our owned and franchised hotels contribute 2.5% of gross room revenues to our Brand Marketing Fund (“BMF”) to support our marketing and build the brand and, from 2007 to 2014, total annual contributions to our BMF have grown 39.9% to $42.7 million, and, for the year ended December 31, 2014, 49.6% of contributions to the BMF, or $21.2 million, were funded by our franchisees. We expect amounts available in the BMF and the percentage of such amounts contributed by our franchisees to continue to grow as the number of hotels in the La Quinta system grows and the performance of our hotels continues to improve. We will seek to continue to expand existing relationships and develop new relationships with franchise owners who demonstrate an ability to provide an excellent guest experience and maintain our brand standards, and who can broaden our reach into existing and under penetrated markets. We will continue to focus on growing our loyal customer base by increasing the membership in La Quinta Returns, our loyalty program designed to increase stays and raise market share. Our over ten million La Quinta Returns members as of December 31, 2014 (representing growth of 152% in membership since January 1, 2008) generated 48% of room revenues at our owned and franchised hotels for the year ended December 31, 2014 (representing a 130% increase in room revenue contributed by the program at owned and franchised hotels since 2008). In 2011, we introduced our “Taking Care of Business” national advertising campaign, featuring points of differentiation and the role of people and service in delighting our guests with our “Here For You” branded guest experience. We will continue to test media, technology, social platforms and email campaigns to find new ways to strengthen our brand. |

7

Table of Contents

| • | Expand distribution channels and grow corporate accounts. In 2014, system-wide consumed room revenues from bookings made through our website increased by 8%, while total system-wide consumed room revenues attributable to our internal distribution channels (including property direct, website and our call center) increased 16%, each as compared to the year ended December 31, 2013. Guests who book through www.LQ.com can also take advantage of our innovative and industry leading Ready For YouTM option and receive a notice on their smart devices that their room is ready for check in. Approximately 35% of guests booking through www.LQ.com since Ready For You was introduced in March 2014 have elected this option. In addition, in 2012, we launched a new mobile site and introduced our new LQ Instant Hold feature (patent pending), which permits our guests to use a mobile application to hold a room for up to 4 hours from any smart device by just entering a phone number. We will continue to develop our online and mobile channels in an effort to use lower cost, proprietary distribution channels. We will also seek to grow our market share by establishing new online relationships as new technologies and platforms are introduced. La Quinta is also well recognized in the corporate community and, for the year ended December 31, 2014, corporate accounts, including government and military accounts, generated 25% of room revenue at our owned and franchised hotels. We will seek to increase room revenues from corporate accounts, as we believe such accounts are associated with more consistent demand and longer stays. |

Our industry—the select-service segment

Select-service hotels generally serve the midscale and upper-midscale chain segments as defined by STR. Select-service hotels typically have fewer costly services and amenities than full-service hotels, which results in a highly efficient hotel-level cost structure. Select-service hotels typically have limited food and beverage outlets and do not offer comprehensive business or banquet facilities. Hotels in the midscale segment had an average ADR of $79.63 in 2014, and hotels in the upper-midscale segment had an average ADR of $104.45 in 2014. As of December 31, 2014, the midscale and upper-midscale segments collectively represent 1,359,308 rooms, or approximately 27% of the overall U.S. lodging industry.

The midscale and upper-midscale segments tend to follow the cyclicality of the overall lodging industry and have also improved with the economic recovery in recent years. According to data provided by STR for the lodging industry, demand for the U.S. midscale and upper-midscale segments has improved, experiencing a CAGR of 3.4% over the three years ended December 31, 2014, while U.S. midscale and upper-midscale supply has grown at a CAGR of 0.5%. This recent demand growth has exceeded the CAGR of 1.5% over the ten years ended December 31, 2014, while supply growth has trended lower than the CAGR of 0.9% over the ten years ended December 31, 2014. We believe this positive imbalance between demand growth and supply growth, together with the economic recovery, has contributed to a RevPAR CAGR of 6.5% over the three years ended December 31, 2014, well above the CAGR of 3.5% over the ten years ended December 31, 2014. We believe that the fundamentals of the U.S. lodging industry in the midscale and upper-midscale segments will yield strong industry segment performance and support the growth of our business. According to PKF-HR, U.S. midscale and upper-midscale segment RevPAR is expected to increase 7.0% and 7.2%, respectively, in 2015 and 5.3% and 5.4%, respectively, in 2016.

8

Table of Contents

Investment risks

An investment in shares of our common stock involves substantial risks and uncertainties that may adversely affect our business, financial condition and results of operations and cash flows. Some of the more significant challenges and risks relating to an investment in our Company include, among other things, the following:

| • | We are subject to the business, financial and operating risks inherent to the hospitality industry, any of which could reduce profits and limit opportunities for growth. |

| • | Macroeconomic and other factors beyond our control can adversely affect and reduce demand for rooms at hotels that we own or franchise. |

| • | Contraction in the global economy or low levels of economic growth could adversely affect our revenues and profitability as well as limit or slow our future growth. |

| • | Because we operate in a highly competitive industry, our revenues or profits could be harmed if we are unable to compete effectively. |

| • | Any deterioration in the quality or reputation of our brand could have an adverse impact on our reputation, business, financial condition or results of operations. |

| • | Some of our existing development pipeline may not be developed into La Quinta hotels, which could adversely affect our growth prospects. |

| • | Our hotels are geographically concentrated, with 25% of our hotel rooms and 29% of our pipeline properties located in Texas, which exposes our business to the effects of regional events and occurrences. |

| • | Our efforts to renovate, redevelop or develop our hotels could be delayed or become more expensive, which could reduce profits or impair our ability to compete effectively. |

| • | The hotels in our owned portfolio have an average age of 27 years, and the hotels in our franchise portfolio have an average age of 14 years. Our business is capital intensive and our failure or the failure of our franchises to make necessary investments could adversely affect the quality and reputation of our brand. |

| • | The hospitality industry is subject to seasonal and cyclical volatility, which may contribute to fluctuations in our financial condition and results of operations. |

| • | If our franchisees are unable to access the capital necessary to implement plans for growth, including our existing pipeline, our revenues may be reduced and our ability to compete effectively may be diminished. |

| • | If we are unable to maintain good relationships with our franchisees, revenues could decrease and we may be unable to expand our presence. |

| • | Franchise agreement standards are important to protecting our brand reputation and perception, and if our franchisees fail to make investments necessary to maintain or improve their hotels, guest preference for the La Quinta brand and reputation could suffer or the franchise agreements with those parties could terminate. |

9

Table of Contents

| • | If our franchisees are unable to repay or refinance loans secured by the mortgaged hotels, our revenues, profits and capital resources could be reduced and our business could be harmed. |

| • | We are exposed to the risks resulting from significant investments in owned real estate, which could increase our costs, reduce our profits and limit our ability to respond to market conditions. |

| • | Changes in local market or neighborhood conditions may diminish the value of real property. |

| • | Failure to keep pace with developments in technology could adversely affect our operations or competitive position. |

| • | Failures in, material damage to, or interruptions in our information technology systems, software or websites, including as a result of cyber-attacks, and difficulties in updating our existing software or developing or implementing new software could have a material adverse effect on our business or results of operations. |

| • | We may be exposed to risks and costs associated with protecting the integrity and security of our guests’ personal information. |

| • | Any failure to protect our trademarks and other intellectual property could reduce the value of our brand and harm our business. |

| • | The loss of senior executives or key field personnel could significantly harm our business. |

| • | We are currently under audit by the Internal Revenue Service and may be required to pay additional taxes. |

| • | As of December 31, 2014, our total indebtedness was approximately $1.9 billion. Our substantial indebtedness could adversely affect our financial condition, our ability to raise additional capital to fund our operations, our ability to operate our business, our ability to react to changes in the economy or our industry and our ability to pay our debts. Our substantial indebtedness could also expose us to interest rate risk to the extent of our variable debt and divert our cash flow from operations to make debt payments. |

| • | Following this offering, our Sponsor will beneficially own approximately 31.7% of our common stock (or 29.7% if the underwriters exercise in full their option to purchase additional shares), and their interests may conflict with ours or yours in the future. |

| • | Future issuances of common stock by us, and the resale of shares held by our pre-IPO owners, may depress the price of our common stock. |

Please see “Risk factors” in this prospectus and “Part I—Item 1A. Risk Factors” in our 2014 Form 10-K, which is incorporated by reference in this prospectus, for a discussion of these and other factors you should consider before making an investment in shares of our common stock.

10

Table of Contents

Corporate history, growth and structure

La Quinta Holdings Inc. was incorporated in Delaware on December 9, 2013. Our principal executive offices are located at 909 Hidden Ridge, Suite 600, Irving, Texas 75038, and our telephone number is (214) 492-6600. We maintain a website at www.lq.com. The information contained on our website or that can be accessed through our website neither constitutes part of this prospectus nor is incorporated by reference herein.

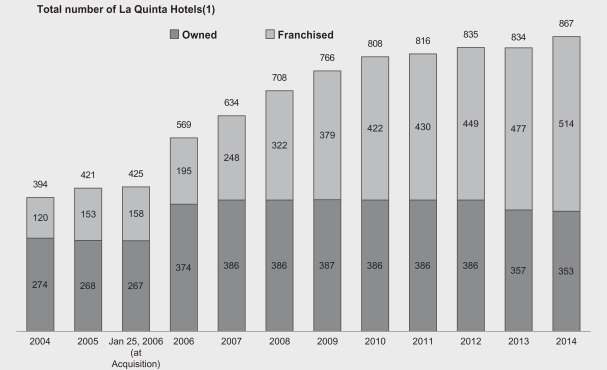

The following table illustrates our growth in total number of owned and franchised hotels worldwide from 2004 to December 31, 2014.

| (1) | Certain of our owned hotels were previously operated by us as non-La Quinta hotels and are not included in this table until such time as they were converted to La Quinta-branded hotels. From the Acquisition through December 31, 2014 and primarily in 2006, we converted 128 such hotels. |

11

Table of Contents

In addition, the simplified chart below summarizes our corporate structure and equity ownership immediately following this offering (assuming no exercise of the underwriters’ option to purchase additional shares of our common stock from the selling stockholders).

| (1) | All Existing Entities other than the Previously Managed Portfolio constituted the Predecessor Entities. |

At the time of the IPO, we were an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, as modified by the Jumpstart Our Business Startups Act of 2012. As of December 31, 2014, we no longer take advantage of “emerging growth company” status or any exemptions from various reporting requirements afforded to emerging growth companies.

12

Table of Contents

| Common stock offered by the selling stockholders |

17,500,000 shares. |

| Option to purchase additional shares of common stock from the selling stockholders |

2,625,000 shares. |

| Common stock outstanding after giving effect to this offering |

130,859,362 shares. |

| Use of proceeds |

We will not receive any of the proceeds from the sale of the shares by the selling stockholders, including upon the sale of shares if the underwriters exercise their option to purchase additional shares from the selling stockholders. See “Use of proceeds.” |

| Dividend policy |

We have no current plans to pay dividends on our common stock. Any decision to declare and pay dividends in the future will be made at the sole discretion of our board of directors and will depend on, among other things, our results of operations, cash requirements, financial condition, contractual restrictions and other factors that our board of directors may deem relevant. |

| Risk factors |

See “Risk factors” and other information included or incorporated by reference in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| NYSE ticker symbol |

“LQ.” |

Unless otherwise indicated or the context requires, all information in this prospectus assumes an offering of 17,500,000 shares by the selling stockholders and no exercise of the underwriters’ option to purchase additional shares.

In this prospectus, unless otherwise indicated, the number of shares of common stock that will be outstanding after this offering is based on the number of shares of our common stock outstanding as of March 6, 2015. The number of issued shares of our common stock as of March 6, 2015 excludes:

| • | an aggregate of 682,687 shares issuable upon settlement of restricted stock units (granted to our directors) and performance share units assuming maximum performance for each of the performance measures (granted to our management) outstanding under our 2014 Omnibus Incentive Plan (other than the performance share units granted to our management under our 2014 Omnibus Incentive Plan in February 2015 (the “2015 PSUs”)); |

| • | an aggregate of 10,884,636 additional shares reserved for future awards under our 2014 Omnibus Incentive Plan and for settlement of the 2015 PSUs; and |

13

Table of Contents

| • | subject to stockholder approval, an aggregate of 2,600,000 shares reserved for future issuance under our 2015 Employee Stock Purchase Plan (the “ESPP”) as of such date. |

See “Part III—Item 11. Executive Compensation” in our Amendment No. 1 to our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2014 (the “2014 Form 10-K/A”) for a further discussion of our 2014 Omnibus Incentive Plan and grants under the plan.

14

Table of Contents

Summary historical consolidated financial data

The following table sets forth summary financial and operating data on a historical basis and on a pro forma basis.

We derived the summary statement of operations data for the years ended December 31, 2014, 2013 and 2012 and the summary balance sheet data as of December 31, 2014 and 2013 from our audited consolidated financial statements incorporated by reference into this prospectus. We derived the summary balance sheet data as of December 31, 2012 from our audited consolidated financial statements not included or incorporated by reference into this prospectus. Historical results are not necessarily indicative of the results expected for any future period. Our historical financial statements for the periods prior to the IPO were prepared by consolidating the financial results of the entities owned by the Company at the completion of the IPO, including those entities under common control and their consolidated subsidiaries, which corresponds to the results of operations for the Company on a prospective basis after giving effect to the consummation of the Pre-IPO Transactions and the IPO. The table below for the periods prior to the completion of the IPO does not include the Previously Managed Portfolio. Prior to their acquisition as part of the Pre-IPO Transactions, the Previously Managed Portfolio were not under common control. Further, the historical information provided below (other than the information relating to discontinued operations) does not include the Hotels Designated for Sale and the Baymont Hotels. Because the information presented below is only a summary and does not provide all of the information contained in our historical consolidated financial statements, including the related notes thereto, you should read it in conjunction with “Part II—Item 6. Selected Financial Data” and “Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical consolidated financial statements, including the related notes thereto, in our 2014 Form 10-K, which is incorporated by reference in this prospectus.

The summary unaudited pro forma consolidated statement of operations has been prepared to reflect (1) the acquisition of the Previously Managed Portfolio (the “WIH La Quinta Inn Hotels”) by the Predecessor Entities and the sale of four hotels which were classified as held for sale as of December 31, 2013 and sold in February 2014, (2) the income tax impact of the Predecessor Entities and the WIH La Quinta Inn Hotels being owned by a “C” corporation, (3) the refinancing of our debt facilities outstanding at the time of our IPO and (4) the issuance of shares of our common stock offered by us in the IPO and the application of the net proceeds thereof, as if these transactions had occurred on January 1, 2014. The summary unaudited pro forma consolidated statement of operations for the year ended December 31, 2014 is derived from our unaudited pro forma financial information included elsewhere in this prospectus. The unaudited pro forma condensed consolidated financial information excludes the Hotels Designated for Sale. The summary unaudited pro forma consolidated financial data has been prepared for illustrative purposes only and is not necessarily indicative of our financial position or results of operations had the transactions described above for which we are giving pro forma effect actually occurred on the dates or for the periods indicated, nor is such unaudited pro forma financial information necessarily indicative of the results to be expected for any future period. See “Unaudited pro

15

Table of Contents

forma condensed consolidated financial information” for a complete description of the adjustments and assumptions underlying the summary unaudited pro forma consolidated data.

| Pro forma

as of and for the year ended December 31, |

As of and for the year ended December 31, |

|||||||||||||||

| (in thousands) | 2014 | 2014 | 2013 | 2012 | ||||||||||||

|

|

||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||

| Revenues: |

||||||||||||||||

| Room revenues |

$ | 859,026 | $ | 846,203 | $ | 757,699 | $ | 714,143 | ||||||||

| Franchising and other fee-based revenues |

88,986 | 89,718 | 79,180 | 69,206 | ||||||||||||

| Other hotel revenues |

19,686 | 19,536 | 17,949 | 17,506 | ||||||||||||

|

|

|

|||||||||||||||

| 967,698 | 955,457 | 854,828 | 800,855 | |||||||||||||

| Brand marketing fund revenues from franchised and managed properties |

21,160 | 21,481 | 19,065 | 17,157 | ||||||||||||

|

|

|

|||||||||||||||

| Total revenues |

988,858 | 976,938 | 873,893 | 818,012 | ||||||||||||

| Operating Expenses: |

||||||||||||||||

| Direct lodging expenses |

381,212 | 378,705 | 344,515 | 334,394 | ||||||||||||

| Depreciation and amortization |

174,520 | 173,145 | 164,077 | 155,879 | ||||||||||||

| General and administrative expenses |

100,727 | 142,636 | 74,794 | 74,111 | ||||||||||||

| Other lodging and operating expenses |

57,056 | 56,984 | 56,068 | 58,266 | ||||||||||||

| Marketing, promotional and other advertising expenses |

62,161 | 62,161 | 59,193 | 48,610 | ||||||||||||

| Impairment loss |

5,157 | 5,157 | — | — | ||||||||||||

|

|

|

|||||||||||||||

| 780,833 | 818,788 | 698,647 | 671,260 | |||||||||||||

| Brand marketing fund expenses from franchised and managed properties |

21,160 | 21,481 | 19,065 | 17,157 | ||||||||||||

|

|

|

|||||||||||||||

| Total operating expenses |

801,993 | 840,269 | 717,712 | 688,417 | ||||||||||||

|

|

|

|||||||||||||||

| Operating Income |

186,865 | 136,669 | 156,181 | 129,595 | ||||||||||||

| Income from continuing operations before income taxes |

91,048 | 16,955 | 8,614 | 20,223 | ||||||||||||

| Income (loss) from continuing operations, net of tax |

54,629 | (332,904 | ) | 5,016 | 17,088 | |||||||||||

| Net Income (loss) |

$ | 54,629 | $ | (333,407 | ) | $ | 2,521 | $ | (35,764 | ) | ||||||

| Net (income) loss attributable to noncontrolling interests |

(401 | ) | (3,890 | ) | 1,455 | 4,810 | ||||||||||

|

|

|

|||||||||||||||

| Net income (loss) attributable to the Company |

$ | 54,228 | $ | (337,297 | ) | $ | 3,976 | $ | (30,954 | ) | ||||||

|

|

||||||||||||||||

16

Table of Contents

| As of and for the year

ended December 31, |

||||||||||||

| (in thousands) | 2014 | 2013 | 2012 | |||||||||

|

|

||||||||||||

| Selected Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 109,857 | $ | 33,412 | $ | 40,813 | ||||||

| Restricted cash |

— | 104,026 | 113,407 | |||||||||

| Total assets |

3,265,707 | 3,169,834 | 3,356,320 | |||||||||

| Total debt(1) |

1,885,699 | 2,720,286 | 2,899,965 | |||||||||

| Total equity (deficit)(2) |

808,455 | 305,253 | 303,385 | |||||||||

| Adjusted EBITDA(3) |

$ | 369,889 | $ | 326,807 | $ | 297,823 | ||||||

|

|

||||||||||||

| (1) | Includes current portion. |

| (2) | Reflects the impact of the Predecessor Entities and the WIH La Quinta Inn Hotels being owned by a “C” corporation, which results in the recording of a net deferred tax liability of approximately $321 million. |

| As of and for the year ended December 31, |

||||||||||||

| (in thousands other than operating data) | 2014 | 2013 | 2012 | |||||||||

|

|

||||||||||||

| Summary Statement of Cash Flows Data: |

||||||||||||

| Capital expenditures |

$ | (78,630 | ) | $ | (115,529 | ) | $ | (102,886 | ) | |||

| Cash flow from operating activities |

286,082 | 232,858 | 248,187 | |||||||||

| Cash flow from investing activities |

(44,116 | ) | 1,719 | (150,952 | ) | |||||||

| Cash flow from financing activities |

(165,521 | ) | (241,978 | ) | (147,279 | ) | ||||||

| Operating Data*: |

||||||||||||

| Number of hotels |

793 | 771 | 756 | |||||||||

| Number of rooms |

79,973 | 78,045 | 76,688 | |||||||||

| Hotel occupancy |

66.8% | 64.8% | 63.5% | |||||||||

| Hotel ADR |

$ | 83.02 | $ | 79.11 | $ | 75.66 | ||||||

| Hotel RevPAR |

$ | 55.48 | $ | 51.26 | $ | 48.05 | ||||||

| Hotel RevPAR Index |

97.2% | 96.9% | 95.0% | |||||||||

|

|

||||||||||||

| * | Operating data (other than RevPAR Index) are for comparable hotels on a system-wide basis as of each period end. RevPAR Index is based on the STR competitive set of hotels existing as of December 31, 2014. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2014 Form 10-K, which is incorporated by reference into this prospectus. |

| (3) | Earnings before interest, taxes, depreciation and amortization (“EBITDA”) is a commonly used measure in many industries. We adjust EBITDA when evaluating our performance because we believe that the adjustment for certain items, such as impairment charges, discontinued operations, gains (losses) on asset sales, certain financing costs, non-cash equity-based compensation, and other items not indicative of ongoing operating performance, provides useful supplemental information to management and investors regarding our ongoing operating performance. We believe that EBITDA and Adjusted EBITDA provide useful information to investors about us and our financial condition and results of operations for the following reasons: (i) EBITDA and Adjusted EBITDA are among the measures used by our management team to evaluate our operating performance and make day-to-day operating decisions; and (ii) EBITDA and Adjusted EBITDA are frequently used by securities analysts, investors, lenders, and other interested parties as a common performance measure to compare results or estimate valuations across companies in our industry. |

| EBITDA and Adjusted EBITDA are not recognized terms under GAAP, have limitations as analytical tools and should not be considered either in isolation or as a substitute for net income (loss), cash flow or other methods of analyzing our results as reported under GAAP. Some of these limitations are: |

| • | EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs; |

| • | EBITDA and Adjusted EBITDA do not reflect our interest expense, or the cash requirements necessary to service interest or principal payments, on our indebtedness; |

| • | EBITDA and Adjusted EBITDA do not reflect our tax expense or the cash requirements to pay our taxes; |

17

Table of Contents

| • | EBITDA and Adjusted EBITDA do not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments; |

| • | EBITDA and Adjusted EBITDA do not reflect the impact on earnings or changes resulting from matters that we consider not to be indicative of our future operations; |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements; and |

| • | other companies in our industry may calculate EBITDA and Adjusted EBITDA differently, limiting their usefulness as comparative measures. |

| Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as discretionary cash available to us to reinvest in the growth of our business or as measures of cash that will be available to us to meet our obligations. |

| The following table provides a reconciliation of EBITDA and Adjusted EBITDA to net income attributable to the Company, which we believe is the most closely comparable U.S. GAAP financial measure: |

| (in thousands) | Pro forma for the year ended December 31, 2014 |

For the year ended December 31, | ||||||||||||||

| 2014 | 2013 | 2012 | ||||||||||||||

|

|

||||||||||||||||

| Net Income (Loss) Attributable to the Company |

$ | 54,228 | $ | (337,297 | ) | $ | 3,976 | $ | (30,954 | ) | ||||||

| Interest expense |

99,127 | 120,994 | 148,806 | 103,342 | ||||||||||||

| Income tax expense |

36,419 | 28,805 | 3,665 | 3,283 | ||||||||||||

| Recognition of net deferred tax liabilities upon C-corporation conversion |

— | 321,054 | — | — | ||||||||||||

| Depreciation and amortization |

175,512 | 174,137 | 170,401 | 172,787 | ||||||||||||

| Non-controlling interests |

401 | 3,890 | (1,455 | ) | (4,810 | ) | ||||||||||

| EBITDA |

365,687 | 311,583 | 325,393 | 243,648 | ||||||||||||

| Fixed asset impairment loss |

5,157 | 5,308 | 19,533 | 53,228 | ||||||||||||

| Income from discontinued operations |

— | 377 | (8,636 | ) | (12,723 | ) | ||||||||||

| Gain on sale from discontinued operations |

— | — | (10,714 | ) | — | |||||||||||

| Loss on retirement of assets |

177 | 177 | 359 | 1,562 | ||||||||||||

| (Gain) Loss related to casualty disasters |

(6,764 | ) | (6,772 | ) | (1,825 | ) | 4,730 | |||||||||

| (Gain) Loss on extinguishment of debt, net |

— | 2,030 | — | (1,192 | ) | |||||||||||

| Off-cycle management bonus related to debt amendment |

— | — | — | 4,932 | ||||||||||||

| Financing costs expensed as incurred |

— | — | — | 7,749 | ||||||||||||

| Equity based compensation |

11,850 | 58,007 | — | — | ||||||||||||

| Other (gains) losses, net |

(558 | ) | (821 | ) | 2,697 | (4,111 | ) | |||||||||

| Adjusted EBITDA |

$ | 375,549 | $ | 369,889 | $ | 326,807 | $ | 297,823 | ||||||||

|

|

|

|

||||||||||||||

18

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider each of the risks described below as well as those contained in our 2014 Form 10-K, including “Part I—Item 1A. Risk Factors” and the other information included in this prospectus and the documents incorporated by reference herein, including “Part II—Item 6. Selected Financial Data,” “Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes included in our 2014 Form 10-K, which is incorporated by reference into this prospectus, before investing in our common stock. Any of these risks could materially and adversely affect our business, financial condition and results of operations. In such a case, the trading price of our common stock could decline and you may lose all or part of your investment in the Company.

Risks related to this offering and ownership of our common stock

Our Sponsor may exercise significant influence over us and its interests may conflict with ours or yours in the future.

Immediately following this offering, our Sponsor will beneficially own approximately 31.7% of our common stock, or 29.7% if the underwriters exercise in full their option to purchase additional shares from the selling stockholders. Moreover, under our amended and restated bylaws and the stockholders’ agreement with our Sponsor, we have agreed to nominate to our board individuals designated by our Sponsor, whom we refer to as the “Sponsor Directors,” according to the following scale: (1) if our Sponsor continues to beneficially own at least 30% (but less than 40%) of our stock, the lowest whole number that is at least 30% of the total number of directors comprising our board of directors; (2) if our Sponsor continues to beneficially own at least 20% (but less than 30%) of our stock, the lowest whole number that is at least 20% of the total number of directors comprising our board of directors; and (3) if our Sponsor continues to beneficially own at least 5% (but less than 20%) of our stock, the lowest whole number that is at least 10% of the total number of directors comprising our board of directors. We have four directors on our board that are current employees of our Sponsor and one director on our board that is a retired employee of our Sponsor. We are currently seeking a new non-Sponsor Director for our board, and it is expected that upon such person’s appointment, one of the current employees of our Sponsor serving on our board will resign. Although our Sponsor does not own shares of our stock representing a majority of our total voting power, our Sponsor is able to significantly influence the composition of our board of directors and the approval of actions requiring stockholder approval. Accordingly, our Sponsor has and will continue to have significant influence with respect to our affairs, including the appointment and removal of our officers. In particular, for so long as our Sponsor continues to own a significant percentage of our stock, our Sponsor may be able to cause or prevent a change of control of our Company or a change in the composition of our board of directors and may be able to preclude any unsolicited acquisition of our Company. The concentration of ownership could deprive you of an opportunity to receive a premium for your shares of common stock as part of a sale of our Company and ultimately might affect the market price of our common stock.

Our Sponsor engages in a broad spectrum of activities, including investments in real estate generally and in the hospitality industry in particular. In the ordinary course of their business activities, our Sponsor may engage in activities where their interests conflict with our interests or those of our stockholders. For example, our Sponsor owns interests in Extended Stay America, Inc.,

19

Table of Contents

Hilton Worldwide Holdings Inc. and G6 Hospitality, LLC, and certain other investments in the hotel industry that may compete directly or indirectly with us. As a result, they could have interests that could conflict with ours. Additionally, some of our directors are, and our directors may in the future be, engaged in the hospitality industry. Our amended and restated certificate of incorporation provides that none of our Sponsor or any director who is not employed by us (including any non-employee director who serves as one of our officers in both his director and officer capacities) or his or her affiliates has any duty to refrain from engaging, directly or indirectly, in the same business activities or similar business activities or lines of business in which we operate. Our Sponsor also may pursue acquisition opportunities that may be complementary to our business, and, as a result, those acquisition opportunities may not be available to us. In addition, our Sponsor may have an interest in having the Company pursue acquisitions, divestitures and other transactions that, in its judgment, could enhance its investment in the Company, even though such transactions might involve risks to you.

We have incurred, and will continue to incur, increased costs, and are subject to additional regulations and requirements as a result of being a public company, which could lower our profits or make it more difficult to run our business.