Attached files

| file | filename |

|---|---|

| EX-10.27 - EX-10.27 - Dicerna Pharmaceuticals Inc | d851674dex1027.htm |

| EX-31.1 - EX-31.1 - Dicerna Pharmaceuticals Inc | d851674dex311.htm |

| EX-31.2 - EX-31.2 - Dicerna Pharmaceuticals Inc | d851674dex312.htm |

| EX-23.1 - EX-23.1 - Dicerna Pharmaceuticals Inc | d851674dex231.htm |

| EX-21.1 - EX-21.1 - Dicerna Pharmaceuticals Inc | d851674dex211.htm |

| EX-10.28 - EX-10.28 - Dicerna Pharmaceuticals Inc | d851674dex1028.htm |

| EX-10.25 - EX-10.25 - Dicerna Pharmaceuticals Inc | d851674dex1025.htm |

| EX-10.26 - EX-10.26 - Dicerna Pharmaceuticals Inc | d851674dex1026.htm |

| EX-10.29 - EX-10.29 - Dicerna Pharmaceuticals Inc | d851674dex1029.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Dicerna Pharmaceuticals Inc | Financial_Report.xls |

| EX-32.1 - EX-32.1 - Dicerna Pharmaceuticals Inc | d851674dex321.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2014

or

| ¨ | TRANSITION REPORTS PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from to

Commission File Number: 001-36281

DICERNA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 20-5993609 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

87 Cambridgepark Drive Cambridge, MA 02140

(Address of principal executive offices and zip code)

(617) 621-8097

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.0001 par value | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days) Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2) Yes ¨ No x

Based on the closing price of the registrant’s Common Stock on the last business day of the registrant’s most recently completed second fiscal quarter, which was June 30, 2014, the aggregate market value of its shares (based on a closing price of $22.57 per share) held by non-affiliates was approximately $118.8 million. Shares of the registrant’s Common Stock held by each executive officer and director and by each entity or person that owned five percent or more of the registrant’s outstanding Common Stock were excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 11, 2015, there were 17,820,985 shares of common stock outstanding.

Table of Contents

DICERNA PHARMACEUTICALS, INC.

2014 ANNUAL REPORT ON FORM 10-K

2

Table of Contents

Forward-Looking Statements

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are “forward-looking statements” for purposes of this Annual Report on Form 10-K. In some cases, you can identify forward-looking statements by terminology such as “may,” “could,” “will,” “would,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “intend,” “predict,” “seek,” “contemplate,” “project,” “continue,” “potential,” “ongoing” or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

| • | the initiation, timing, progress and results of our research and development programs, preclinical studies, any clinical trials and Investigational New Drug (IND) application, New Drug Application (NDA) and other regulatory submissions; |

| • | our ability to identify and develop product candidates for treatment of additional disease indications; |

| • | our or a collaborator’s ability to obtain and maintain regulatory approval of any of our product candidates; |

| • | the rate and degree of market acceptance of any approved products candidates; |

| • | the commercialization of any approved product candidates; |

| • | our ability to establish and maintain additional collaborations and retain commercial rights for our product candidates in the collaborations; |

| • | the implementation of our business model and strategic plans for our business, technologies and product candidates; |

| • | our estimates of our expenses, ongoing losses, future revenue and capital requirements; |

| • | our ability to obtain additional funds for our operations; |

| • | our ability to obtain and maintain intellectual property protection for our technologies and product candidates and our ability to operate our business without infringing the intellectual property rights of others; |

| • | our reliance on third parties to conduct our preclinical studies or any future clinical trials; |

| • | our reliance on third party supply and manufacturing partners to supply the materials and components for, and manufacture, our research and development, preclinical and clinical trial drug supplies; |

| • | our ability to attract and retain qualified key management and technical personnel; |

| • | our dependence on our existing collaborator, Kyowa Hakko Kirin Co., Ltd. (KHK), for developing, obtaining regulatory approval for and commercializing product candidates in the collaboration; |

| • | our receipt and timing of any milestone payments or royalties under our research collaboration and license agreement with KHK or arrangement with any future collaborator; |

| • | our expectations regarding the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act; |

| • | our financial performance; and |

| • | developments relating to our competitors or our industry. |

These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these

3

Table of Contents

forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, among other things, those set forth in Part I, Item 1A “Risk Factors” below and for the reasons described elsewhere in this Annual Report on Form 10-K. Any forward-looking statement in this Annual Report on Form 10-K reflects our current view with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, industry and future growth. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

This Annual Report on Form 10-K also contains estimates, projections and other information concerning our industry, our business and the markets for certain drugs, including data regarding the estimated size of those markets, their projected growth rates and the incidence of certain medical conditions. Information that is based on estimates, forecasts, projections or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained these industry, business, market and other data from reports, research surveys, studies and similar data prepared by third parties, industry, medical and general publications, government data and similar sources. In some cases, we do not expressly refer to the sources from which these data are derived.

Except where the context otherwise requires, in this Annual Report on Form 10-K, “we,” “us,” “our” and the “Company” refer to Dicerna Pharmaceuticals, Inc. and, where appropriate, its consolidated subsidiary.

Trademarks

This Annual Report on Form 10-K includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included in this Annual Report on Form 10-K are the property of their respective owners.

4

Table of Contents

| Item 1. | Business |

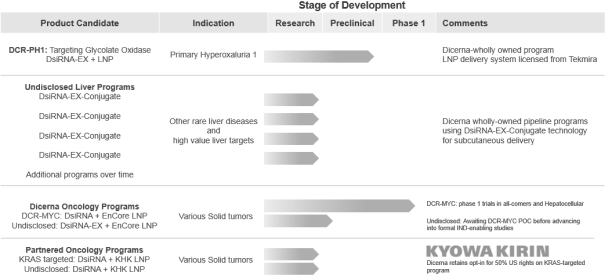

We are an RNA interference-based biopharmaceutical company focused on the discovery and development of innovative treatments for rare inherited diseases involving the liver and for cancers that are genetically defined. We are using our RNA interference (RNAi) technology platform to build a broad pipeline in these therapeutic areas. In both rare diseases and oncology, we are pursuing targets that have historically been difficult to inhibit using conventional approaches, but where we believe connections between targets and diseases are well understood and documented. We aim to discover, develop and commercialize these novel therapeutics either on our own or in collaboration with pharmaceutical partners. In indications such as rare diseases in which a small sales force will suffice, we seek to retain substantially all commercial rights in key markets. In oncology and other more prevalent disease areas, we may partner our products while seeking to retain significant portions of the commercial rights. We have partnered two of our oncology development programs with the global pharmaceutical company Kyowa Hakko Kirin Co., Ltd. (KHK). We are eligible to receive royalties on worldwide net sales for these product candidates. In addition, we have an option to co-promote, in the U.S., a therapeutic targeting the KRAS gene for an equal share of the profits from U.S. net sales.

In choosing which development programs to advance, we apply scientific, clinical, and commercial criteria that we believe allow us to best leverage our RNAi platform and maximize value for our company. Our current development programs are as follows.

| • | DCR-PH1 for Primary Hyperoxaluria Type 1 (PH1). We are developing DCR-PH1 for the treatment of PH1 by targeting the gene encoding the liver enzyme glycolate oxidase. PH1 is known to afflict an estimated one to three people per million of population, and may afflict as many as six to eight people per million of population, and causes severe renal disease and early mortality. In pre-clinical studies, we have shown that, by using our RNAi technology to inactivate the gene encoding glycolate oxidase, we can significantly reduce oxalate levels, the key pathology of PH1. We intend to begin clinical trials for DCR-PH1 in mid to late 2015. We expect to announce initial proof-of-concept clinical data in late 2015. |

| • | Other rare inherited diseases involving the liver. We are investigating a number of other rare diseases involving genes expressed in the liver. We have selected these diseases and disease target genes based on criteria that include having a strong therapeutic hypothesis, a readily-identified patient population, the availability of predictive biomarkers, high unmet medical need, favorable competitive positioning, and a rapid projected path to approval. |

| • | DCR-MYC for MYC-related cancers. We are developing DCR-MYC for the treatment of various cancers by targeting the MYC gene. Multiple lines of genetic evidence implicate MYC in the initiation and progression of tumors, including natural variations in the MYC gene that predispose to certain types of cancer, and frequent genetic amplification and overexpression of MYC within tumors. In preclinical studies, inhibition of the MYC gene with DCR-MYC has shown strong anti-tumor effects in animal models of human cancers. In the second quarter of 2014, we initiated a multi-center, dose-escalating Phase 1 clinical study of DCR-MYC to assess the safety and tolerability of DCR-MYC in patients with solid tumors, multiple myeloma, or lymphoma who are refractory or unresponsive to standard therapies. In fourth quarter of 2014, we initiated a global Phase 1b/2 clinical trial of DCR-MYC in patients with advanced hepatocellular carcinoma (HCC). We expect to announce initial proof-of-concept data from the first Phase 1 study in mid to late 2015. |

| • | Two product candidates in collaboration with KHK, including one for KRAS-related cancers. We are developing, in collaboration with KHK, a therapeutic targeting the KRAS oncogene, a gene that is frequently mutated in numerous cancers, including non-small cell lung cancer, colorectal cancer and pancreatic cancer. Such mutations are associated with aggressive disease and resistance to current |

5

Table of Contents

| therapies. We are also developing, with KHK, a therapeutic targeting a second cancer-related gene, which we are not identifying at this time. KHK is responsible for all preclinical and clinical development activities, including the selection of patient population and disease indications for clinical trials. |

Our drug discovery and development efforts are based on the therapeutic modality of RNAi, a highly potent and specific mechanism for silencing the activity of a targeted gene. In this naturally occurring biological process, double-stranded RNA molecules induce the enzymatic destruction of the messenger RNA (mRNA) of a target gene that contains sequences that are complementary to one strand of the therapeutic double-stranded RNA molecule. Our approach is to design proprietary double-stranded RNA molecules that engage the enzyme Dicer and initiate an RNAi process to silence a specific target gene. We refer to these proprietary molecules generally as Dicer substrate short interfering RNAs (DsiRNAs), or as DsiRNA or DsiRNA-EX molecules, depending on the specific structure.

RNAi therapeutics represent a novel advance in drug development. Historically, the pharmaceutical industry has developed small molecules or antibodies to inhibit the activity of disease-causing proteins. This approach is effective for many diseases; nevertheless, many proteins cannot be inhibited by either small molecules or antibodies. Some proteins lack the binding pockets small molecules require for interaction. Other proteins are solely intracellular and therefore inaccessible to antibody-based therapeutics which are limited to cell surface and extracellular proteins.

The novel advantage of RNAi is that instead of targeting proteins, RNAi goes upstream to silence the genes themselves. In 2006, the Nobel Prize was awarded for the discovery of RNAi. That same year we incorporated with the goal of developing RNAi-based therapeutics for previously “undruggable” disease target genes. Rather than seeking to inhibit a protein directly, the better approach may be to prevent its creation in the first place.

We believe our approach to RNAi drug development provides the following qualities and advantages compared to other methods of inducing RNAi.

| • | We initiate RNAi through the Dicer enzyme. DsiRNA and DsiRNA-EX molecules are structured to be processed by the enzyme Dicer, the initiation point for RNAi in the human cell cytoplasm. Unlike earlier generation RNAi molecules, which mimic the output product of Dicer processing, DsiRNA and DsiRNA-EX molecules enter the RNAi pathway prior to Dicer processing. This can result in preferential use of the correct strand of a double-stranded RNA molecule, and therefore increase the efficacy of the RNAi mechanism. We believe this benefit increases the potency of our DsiRNA and DsiRNA-EX molecules compared to other RNAi-inducing molecules. In addition, due to processing by the Dicer enzyme, our DsiRNA and DsiRNA-EX molecules have multiple sites for chemical modification and conjugation compared to earlier RNAi technologies. At these sites we can use modifications that enhance the drug-like properties on our molecules. Specifically, we can employ modifications that enhance the pharmacokinetic profile and/or suppress immunostimulatory activity. |

| • | Our DsiRNA-EX Conjugates enable subcutaneous delivery to the liver. We have developed a proprietary subcutaneous conjugate-based delivery technology for our DsiRNA-EX molecules that enables delivery to hepatocytes in the liver. This technology involves conjugation of a hepatocyte-targeting ligand to the extended portion of our DsiRNA-EX molecules, and we term the entire construct a DsiRNA-EX Conjugate. This technology is well-suited to our focus on rare inherited diseases involving the liver and can generally be applied to disease target genes and viral pathogens in the liver. We intend to use DsiRNA-EX Conjugates in all future programs involving targets in the liver. |

| • | Our EnCore lipid nanoparticle technology enables delivery to solid tumors. We have developed our proprietary EnCore lipid nanoparticle (LNP) technology for delivery of DsiRNA and DsiRNA-EX molecules to tumors. The EnCore system is engineered to accumulate in tumors and mediate delivery of DsiRNA and DsiRNA-EX molecules into tumor cells. We have extensive pre-clinical data, in multiple animal models of human tumors, of effective RNAi delivery mediated by the EnCore system. |

6

Table of Contents

| We utilize this delivery system in our DCR-MYC program and intend to utilize it for future programs in oncology. |

We believe we have a robust patent portfolio covering our proprietary RNAi platform. As of February 1, 2015, our patent estate included over 20 issued patents and over 70 pending patent applications covering our DsiRNA and DsiRNA-EX payload technologies and our lipid nanoparticle and conjugate delivery technologies.

Our executive management team has extensive experience in the biopharmaceutical industry. In addition, various members of our management team and our board of directors have contributed to the progress of the RNAi field through their substantial involvement in companies such as Alnylam Pharmaceuticals Inc. (Alnylam), Genta Inc., Genzyme Inc., GlaxoSmithKline plc, Pfizer Inc., Sirna Therapeutics Inc. and other companies. Our co-founder and chief executive officer, Douglas M. Fambrough III, Ph.D., was a lead venture capital investor and board member of Sirna Therapeutics, an early RNAi company acquired by Merck & Co., Inc. in 2006 for $1.1 billion. He played a pivotal role in the restructuring of Ribozyme Pharmaceuticals into Sirna Therapeutics, the management of the company as a member of its Board of Directors, and the execution of its 2006 acquisition by Merck & Co., Inc.

Strategy

We are committed to delivering transformative RNAi-based therapies to patients with rare inherited diseases involving the liver and for cancers that are genetically defined. The key elements of our strategy are as follows.

| • | Validate our product candidates and our platform in clinical proof-of-concept studies. In 2014, we initiated a Phase 1 study of DCR-MYC in patients with solid tumors, multiple myeloma, or lymphoma. In the fourth quarter of 2014, we initiated a Phase 1b/2 study of DCR-MYC in patients with advanced HCC. In the second half of 2015, we plan to initiate a Phase 1 study of DCR-PH1 in patients with Primary Hyperoxaluria Type 1 (PH1). We expect to announce initial proof-of-concept clinical data for DCR-MYC in mid to late 2015 and DCR-PH1 in late 2015. Based on precedents in the RNAi field, we are optimistic that our preclinical data showing the significant knockdown of target mRNA activity may translate into clinical results. |

| • | Create new programs in indication areas with high unmet medical need. We intend to continue to use our proprietary RNAi technology platform to create new, high value pharmaceutical programs. Our primary focus will remain: (1) rare inherited diseases involving the liver; and (2) genetically-defined oncogene targets in oncology. |

| • | Continue to develop product candidates for rare diseases and oncology while retaining meaningful commercial rights. We seek to maintain significant commercial rights to our key development programs. In rare disease areas, such as PH1, we seek to retain full commercial rights in key markets. In oncology, we seek to partner our product candidates while retaining meaningful commercial rights. For example, in our collaboration with KHK, we have an option to co-promote the product candidate targeting KRAS in the U.S. if it is approved for an equal share of profits from U.S. net sales. |

| • | Enter into additional partnerships with pharmaceutical companies either on our RNAi technology platform or specific indications or therapeutic areas. We may choose to establish partnerships with pharmaceutical companies across multiple programs or indication areas depending on the attractiveness of the opportunities. These partnerships may provide us with further validation of our technology platform, funding to advance our proprietary product candidates, and/or access to development, manufacturing and commercial capabilities. |

| • | Continue to invest in our RNAi technology platform. We will continue to invest in expanding and improving our DsiRNA and DsiRNA-EX RNAi payload technologies and our conjugate and LNP delivery technologies. Building on what we believe are significant advantages in potency and delivery, we seek to develop product candidates that will have a profound impact on the lives of patients. |

7

Table of Contents

Our RNAi Technology Platform

All of our drug discovery and development efforts are based on the therapeutic modality of RNAi, a highly potent and specific mechanism for silencing the activity of a targeted gene. The RNAi process is triggered by double-stranded RNA molecules containing sequences that are complementary to the sequence of the targeted gene. Our novel and highly potent approach is based on double-stranded RNAs that are aimed to serve as optimal substrates for the RNAi initiating enzyme Dicer, and thus our proprietary RNAi molecules are known as Dicer substrates, which we refer to as DsiRNAs generally or as DsiRNA or DsiRNA-EX molecules, depending on the specific structure. The RNAi machinery, guided by a DsiRNA or DsiRNA-EX molecule (or other double-stranded RNAi-inducing molecules) causes the targeted destruction of specific mRNAs of the complementary target gene. Destroying these mRNAs immediately decreases the biological activity from the target gene. A single DsiRNA or DsiRNA-EX molecule incorporated into the RNAi machinery can destroy hundreds or thousands of mRNAs from the targeted gene.

We believe that our DsiRNA and DsiRNA-EX molecules have distinct traits in triggering the RNAi pathway to silence certain disease-driving genes, thereby providing advantages for triggering RNA interference compared to other types of double-stranded RNAs used to induce RNAi. Our DsiRNA and DsiRNA-EX molecules are structured to be optimal for processing by the Dicer enzyme. We believe that other RNAi-inducing molecules currently in development mimic the output of a Dicer enzyme processing event, and thus act at a later point in the RNAi pathway. By contrast, DsiRNA and DsiRNA-EX molecules enter the RNAi pathway through being presented to Dicer itself, the pathway’s natural initiation point. By entering the RNAi pathway at that point, we believe that DsiRNA and DsiRNA-EX molecules are able to maximize the efficacy of the RNAi mechanism, making DsiRNA and DsiRNA-EX molecules inherently more potent than traditional RNAi-inducing molecules. This potency advantage derives from the structure of the DsiRNA and DsiRNA-EX molecules and how they interact with the Dicer enzyme. Specifically, the structure of the DsiRNA and DsiRNA-EX molecule is able to indicate to the Dicer enzyme which of the two RNA strands should be used to guide the selective destruction of disease gene target mRNAs by the RNAi machinery. We have found in animal tests that this benefit both increases the potency of our DsiRNA and DsiRNA-EX molecules relative to other RNAi-inducing molecules and enables many more sequences to be used to generate our potent DsiRNAs compared to other RNAi-inducing molecules. We therefore believe that the nature of the interaction of our DsiRNA and DsiRNA-EX molecules with the RNAi pathway intervention facilitates the discovery of new DsiRNA and DsiRNA-EX therapeutic candidates and further strengthens our intellectual property position.

Schematic representation of our DsiRNA

DsiRNAs are precisely-sized double-stranded RNA molecules that are asymmetric. In the form we use for some of our therapeutic programs, the longer strand is 27 bases long and is complementary to the target gene we seek to silence, known as the Guide Strand. The shorter strand is 25 bases long and known as the Passenger Strand. The two strands are complementary across their length, with the two additional bases of the 27-mer forming a two-base overhang at the 3’-end of the molecule. For our product candidates we use chemical modifications (for example, 2’-OMe, 2’-F and phosphorothioates) and we also use two bases of DNA at the 3’ end of the Passenger Strand. These DNA bases, along with the two-base overhang on the 27-mer, cause the Dicer enzyme preferentially to take up the Guide Strand, leading to several advantages for DsiRNAs compared to other RNAi-inducing molecules.

8

Table of Contents

Schematic representation of our DsiRNA-EX

In addition to 25/27-mer duplex DsiRNAs, we have developed the DsiRNA-EX technology, where extensions to one or more of the ends of the RNA strands can provide added functionality including sites for conjugation and other modifications. Chemical modifications (for example, 2’-OMe, 2’-F and phosphorothioates) are located on both strands at specific positions.

In addition, due to the nature of how the Dicer enzyme processes a DsiRNA or DsiRNA-EX molecule, our DsiRNA and DsiRNA-EX molecules may provide advantages for targeted delivery methods that do not use lipid nanoparticles. Our DsiRNA molecules present chemical conjugation points, which can be used to attach targeting agents or other agents that facilitate delivery or enhance the “drug-like” properties of the molecules. Our DsiRNA-EX molecules include extensions to one or more of the ends of the RNA strands, which allows even further potential for chemical modification. Notably, the extensions enable the development of subcutaneously delivered molecules that are conjugated to targeting ligands and possess enhanced biological stability, and that can be administered subcutaneously or intravenously without LNPs. These and other favorable features are introduced into the DsiRNA and DsiRNA-EX molecules while maintaining high RNAi activity. Due to how the Dicer enzyme processes a DsiRNA or DsiRNA-EX molecule, we can use stable covalent non-cleavable linkers for conjugation instead of less stable cleavable linkers that other RNAi molecules may require.

Optimization of our DsiRNA and DsiRNA-EX molecules

For therapeutic use in humans, our DsiRNA and DsiRNA-EX molecules are optimized both with respect to base sequence and chemical modifications to increase stability and mask them from mechanisms that recognize foreign RNAs, inducing immune system stimulation. Our optimization process begins with the screening of 300 to 600 RNA sequences predicted to have good activity based on a proprietary DsiRNA prediction algorithm. Through optimization and chemical modification we identify the most active RNAi molecules while engineering in enhanced stability and engineering out immunostimulatory activity. Our DsiRNA and DsiRNA-EX molecules routinely achieve high potencies, with IC50 values (the amount of material required to silence a target gene by 50 percent) typically in the 0.1 to 3.0 picomolar range in in vitro studies. Owing to the enzymatic nature of the RNAi pathway, this is 100 to 1,000 times as great as, or greater than, the potency of most traditional small molecule therapeutics. Furthermore, our research and testing to date suggest that our optimized DsiRNA and DsiRNA-EX molecules are significantly reduced in their ability to induce an immune system response in humans.

9

Table of Contents

Our drug delivery technologies

Our process of delivery

From the initial discovery of the RNAi pathway in mammals through more recent attempts at creating RNAi-based therapeutics, drug delivery has been a profound challenge. Most nucleic acids, including our DsiRNA and DsiRNA-EX molecules, are unable to enter cells on their own, but cell entry is required to access the RNAi machinery in the cytoplasm and thus to silence the targeted genes. An effective drug delivery technology is required to ferry the DsiRNA and DsiRNA-EX molecules into cells, through the cell internalization pathway and ultimately release the DsiRNA and DsiRNA-EX molecules into the cell cytoplasm. We believe that our drug delivery technologies overcome these challenges. Effective RNAi drug delivery requires the following three steps: Step 1. Accumulation in the target tissue, Step 2. Binding to and internalization by the target tissue cells, Step 3. Release from the internalization compartment into the cytoplasm.

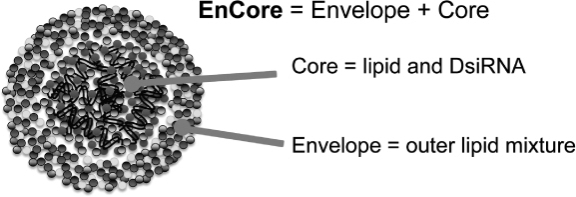

EnCore lipid nanoparticles are composed of a lipid-DsiRNA or lipid-DsiRNA-EX core surrounded by an envelope of different lipids which mediate the accumulation, internalization and release into the cytoplasm of the DsiRNA or DsiRNA-EX molecules in the core of the particle.

EnCore lipid nanoparticles

We believe that our EnCore lipid nanoparticles (LNPs) effectively mediate all steps required for delivery of our DsiRNA product candidates: accumulation, binding and internalization, and release into the cytoplasm. Our EnCore LNPs also have beneficial properties such as high tolerability (low toxicity), ease of manufacturing, effective RNAi payload loading, and protection of the DsiRNA or DsiRNA-EX payload. We have successfully demonstrated each of these properties of EnCore LNPs and have used them to achieve effective delivery of our DsiRNA and DsiRNA-EX molecules in animal models.

EnCore structure and function

The EnCore LNPs are comprised of a “Core” of lipid and DsiRNA or DsiRNA-EX molecules, surrounded by an “Envelope” of chemically distinct lipids that are designed to interact with the target tissue. The Core allows EnCore to carry a large payload of DsiRNA or DsiRNA-EX molecules while simultaneously protecting them from degrading enzymes. The envelope interacts with the target tissue to mediate accumulation, binding and internalization, and release into the cytoplasm.

Delivery to solid tumors with EnCore

We are using our EnCore LNPs for delivery to solid tumors. Historically, LNPs have also been used to deliver RNAi molecules to the liver. By adjusting the lipid components in the EnCore envelope, we have been

10

Table of Contents

able to adjust whether EnCore mediates delivery to the liver or to solid tumors in animal models. In each case, the first step of delivery is accumulation in the target tissue. Both liver tissue and tumor tissue have porous vasculature that allows the EnCore lipid nanoparticles to exit the vasculature and accumulate in the target tissue. Our studies to date indicate that other tissues do not accumulate EnCore lipid nanoparticles in significant amounts. EnCore lipid nanoparticles with a low level of polyethylene glycol (PEG) on their surface immediately enter the liver tissue and mediate delivery of DsiRNAs to liver cells. EnCore lipid nanoparticles with a high level of PEG on their surface are blocked from immediate liver uptake, allowing them to continue circulating and to accumulate in tumors. Over time, the PEG is shed from the surface of the EnCore lipid nanoparticles, allowing them to internalize in the tumor cells and mediate delivery of DsiRNAs. We have found that particular lipid structures also facilitate delivery to tumor cells, instead of liver cells, and we have incorporated such lipids in our EnCore LNPs.

Delivery to the liver with Tekmira Pharmaceuticals Corporation’s LNP

Our licensing agreement with Tekmira Pharmaceuticals Corporation (Tekmira) and one of its subsidiaries enables us to use Tekmira’s proprietary LNP for delivery of DCR-PH1 to treat PH1. Tekmira’s lipid nanoparticle system has been shown in other human clinical studies to provide potent, safe and effective RNA delivery to hepatocytes (liver cells). We anticipate that our licensing of Tekmira’s LNP technology will help streamline the development path for DCR-PH1 and allows us to focus our EnCore LNP efforts on our oncology pipeline.

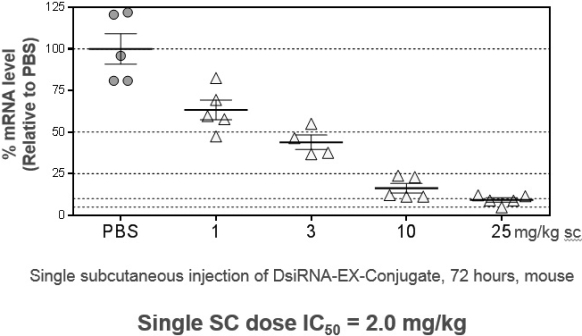

Subcutaneous delivery to the liver by DsiRNA-EX Conjugates

We believe that the structure of DsiRNA-EX molecules are well suited for direct conjugation to delivery agents. We are working to develop a delivery system based on conjugation of a targeting agent to the extended region of the DsiRNA-EX molecules. We call such molecules DsiRNA-EX Conjugates. If our development efforts are successful, this system would provide for generalized subcutaneous administration in humans of DsiRNA-EX Conjugates to the liver. The initial application will be delivery via conjugation to a GalNAc (n-acetyl galactosamine) targeting agent that provides for highly specific uptake in hepatocyptes and can be administered by subcutaneous administration. For example, we have administered DsiRNA-EX Conjugate molecules subcutaneously in mice and have seen IC50 values as low as 2.0 milligrams per kilograms of body weight.

11

Table of Contents

DsiRNA-EX Conjugate Potency Supports Convenient Subcutaneous Administration

DsiRNA-EX Conjugates yield high-potency gene silencing agents. The data shows a dose response curve for silencing of a therapeutic liver target after subcutaneous administration of a DsiRNA-EX Conjugate in mice. In this example the calculated IC50 value is 2.0 milligrams per kilogram of body weight.

Our Product Candidates

In choosing clinical programs to pursue using our DsiRNA and drug delivery technologies, we apply the criteria listed below. We believe that our current development programs meet most or all of these criteria.

| • | Strength of therapeutic hypothesis. Our current product candidate gene targets, and those we intend to pursue in the future, are a well-understood part of the disease process where a therapeutic intervention is likely to have substantial benefit for the patient. Because our RNAi technology platform allows us to pursue product candidate gene targets that have historically been difficult to inhibit using conventional approaches, we believe that there are a substantial number of such targets without existing pharmaceuticals on the market. |

| • | Readily-identified patient population. We seek disease indications where patients can be readily identified by the presence of characteristic genetic mutations. In the case of genetic diseases, these are heritable genetic traits. In the case of oncology, these are genetic changes that have occurred in tumor cells as part of the tumor-formation process. In both cases, available genetic tests and techniques can identify patients that carry these mutations. |

| • | Predictivity of biomarkers for early efficacy assessment. We seek indications where there is a clear relationship between the disease status and an associated biomarker that we can readily measure. This approach will allow us to determine in early stages of clinical development whether our DsiRNA molecules are likely to have the expected biological and clinical effects in patients. |

| • | Unmet medical need. We seek to provide patients with significant benefit and alleviation of disease. The indications we choose to approach have high unmet medical need, which is intended to enable us to better access patients and qualify for pricing and reimbursement that justify our development efforts. |

12

Table of Contents

| • | Competitive positioning. We seek indications where we believe we have the opportunity to develop either a first-in-class product or a clearly differentiated therapy. |

| • | Rapid development path to approval. To reach commercialization expeditiously and to help ensure our ability to finance development of our product candidates, we have identified indications with the potential for rapid development through marketing approval. Specifically, we believe that certain of our product candidates have the potential to obtain Breakthrough Therapy Designation as well as accelerated approval from the U.S. Food and Drug Administration (FDA). |

DCR-PH1 for PH1

PH1 is a rare, inherited autosomal recessive disorder of metabolism in the liver that usually results in severe damage to the kidneys. PH1 is caused by the failure of the liver to metabolize a precursor of oxalate, a highly insoluble metabolic end-product in humans, resulting in excess oxalate and high levels of oxalate in the urine. This oxalate is formed during the metabolic breakdown of hydroxyproline, a naturally occurring component of collagen. In individuals with PH1, crystals of calcium oxalate form in the renal tubules, leading to chronic and painful cases of kidney stones and subsequent fibrosis, known as nephrocalcinosis. Despite the typical interventions of a large daily intake of water to dilute the oxalate and other interventions, many patients eventually enter kidney failure (end-stage renal disease, or ESRD) and become eligible for transplant. While in ESRD, besides having to endure frequent dialysis, patients are afflicted with a build-up of oxalate in the bone, skin, heart and retina with concomitant debilitating complications, a condition known as systemic oxalosis. Some patients show partial disease amelioration with oral pyridoxine supplementation, although disease progression usually continues. Supportive care treatments are available, generally with only minor or no effect on disease progression. Currently, aside from dual liver and kidney organ transplantation, there are no highly efficacious therapeutic options for most patients with PH1. Dual liver and kidney transplantation presents a challenge in identifying a donor and is associated with high co-morbidity rates. Even in those U.S. patients treated with dual liver and kidney transplant, five-year post-transplant survival is 64 percent. For patients treated with kidney transplant alone, five-year survival is 45 percent.

While the true prevalence of PH1 is unknown, according to estimates recently published by the New England Journal of Medicine the prevalence of PH1 is at least one to three per million of population. Based on the frequency of occurrence of disease mutations in the population derived from genome sequence databases, the estimated genetic incidence is six and half per million of population, which we believe suggests that PH1 is under-diagnosed. Roughly consistent with the genetic incidence estimate, the disease is thought to have an

13

Table of Contents

incidence of one per 120,000 live births a year in Europe. Certain populations, for example in the Canary Islands (Spain) or Kuwait, have higher incidences due to founder effects or consanguinity. We believe approximately 800 patients total are currently in two distinct disease registries in North America and Europe, although these registries do not capture all afflicted patients. Incidence is believed to be similar in Asia. Given the severity of PH1, we believe this disease represents a significant market opportunity. The patient advocacy group, the Oxalosis and Hyperoxaluria Foundation, based in New York City, New York, seeks to represent patients with PH1.

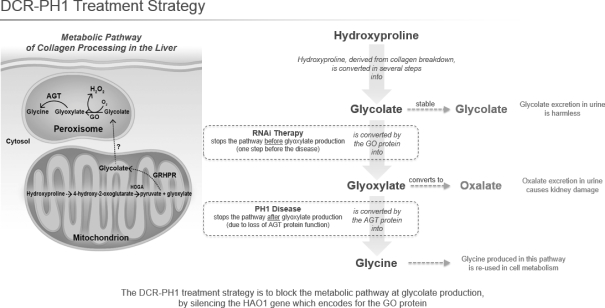

Therapeutic rationale for PH1

We believe that there is a strong rationale for focusing our RNAi technology on the development of product candidates for the treatment of PH1. The hydroxyproline breakdown metabolic pathway that is disrupted in PH1 consists of a number of enzymes. The gene encoding the final enzyme in the pathway, alanine-glyoxylate aminotransferase 1 (AGT1), is mutated in patients with PH1. Under normal circumstances, AGT1 metabolizes oxalate precursors into the harmless amino acid glycine, which is then used by the body or excreted. But when AGT1 function is disrupted due to mutation, oxalate begins to build up, resulting in progressive loss of kidney function and, ultimately, kidney failure. Approximately 50 percent of PH1 patients have kidney failure by age 30 to 35.

Animal studies have shown that intervening one step earlier in the metabolic pathway can reduce or eliminate the abnormally high oxalate production caused by the absence of AGT1 enzyme activity. These studies employ mice in which the gene encoding AGT1 has been genetically deleted to create an animal model of PH1. Similar to human patients, these mice have elevated levels of oxalate in their urine. When the enzyme one step earlier in the metabolic pathway than AGT1 is eliminated by genetic deletion in this animal model of PH1, oxalate levels in the urine are substantially reduced. These studies demonstrate that genetic deletion of the enzyme prior to AGT1 in the pathway prevents the formation of the oxalate precursor and the buildup of oxalate. The enzyme upstream of AGT1 is known as glycolate oxidase (GO) and is encoded by the gene HAO1. In normal animals and humans HAO1 is expressed exclusively or nearly exclusively in the liver.

14

Table of Contents

Preclinical data for DCR-PH1

We are using our DsiRNA-EX technology and licensed lipid nanoparticle delivery technology to develop DCR-PH1, a product candidate designed to specifically inhibit the gene HAO1, which encodes GO. We have generated highly potent and specific DsiRNA-EX molecules targeting HAO1 and believe we have optimized these molecules to enhance their pharmaceutical properties. We are conducting manufacturing scale-up and Good Laboratory Practice (GLP) toxicity studies in anticipation of filing an IND application in mid to late of 2015 and initiating clinical trials in mid to late of 2015.

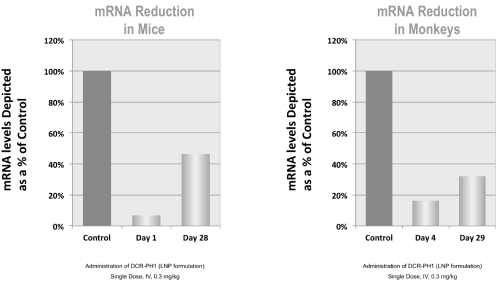

We have demonstrated the efficacy of DCR-PH1 in both mice and in non-human primates (monkeys). The data demonstrate that after a single intravenous dose of 0.3 milligrams per kilogram body weight of DCR-PH1 the average reduction of HAO1 gene expression was 95% in mice and 84% in monkeys soon after dosing. At a much later time, 28 and 29 days after dosing, the target gene expression was still significantly reduced by an average of 54% in mice and 68% in monkeys. These data are supportive of an infrequent clinical dosing regimen.

DCR-PH1 consists of a DsiRNA-EX payload formulated in a lipid nanoparticle delivery system

15

Table of Contents

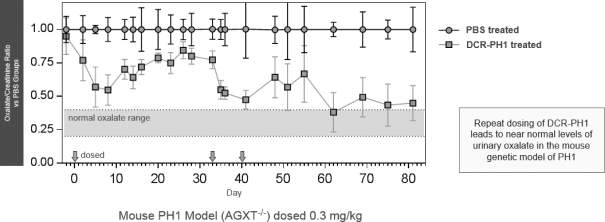

A. Long-duration Reduction in Urinary Oxalate after HAO1 Knockdown

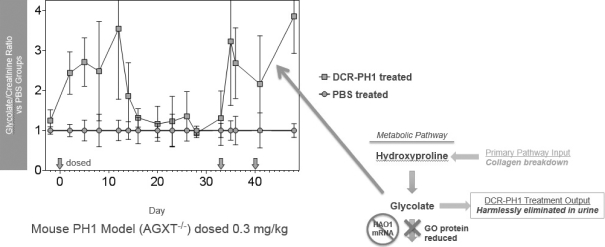

B. Urinary Glycolate Elevation – a Biomarker of HAO1 mRNA and GO Protein Reduction

In the mouse model of PH1, treatment with DCR-PH1 results in a reduction in levels of urinary oxalate and, as expected by the mechanism of action, elevation in levels of urinary glycolate. Increased urinary glycolate alone may indicate a positive treatment effect; in PH1 patients treated with DCR-PH1, elevation of urinary glycolate may precede reduction in urinary oxalate as accumulated oxalate is flushed out in urine over time.

Phase 1 Clinical Development plan for DCR-PH1

We intend to initiate a development program for DCR-PH1 for patients who have PH1 in 2015, including both an observational natural history study and clinical studies.

We plan to initiate a natural history study for patients with genetically confirmed diagnosis of PH1 and mild to moderate renal impairment to (1) characterize the baseline variability and factors that influence changes in urine and blood oxalate and glycolate levels and renal function over time; (2) characterize the systemic complications associated with PH1 . Currently, enrollment is scheduled for the second quarter of 2015. We anticipate that up to 50 patients will be enrolled. We anticipate a majority of the patients enrolled in the natural history study will be subsequently enrolled in the First in Human (FIH) study which will be a Phase 1, open label study with dose escalation in a Single Ascending Dose (SAD) and Multiple Ascending Dose (MAD) level

16

Table of Contents

cohorts. We intend to file an IND application and enroll the first patient in the second half of 2015. We intend for the study to be conducted in the US, EU, and other countries. The primary objective of the study is to determine the safety profile and recommended Phase 2 dose (RP2D) of DCR-PH1. Secondary objectives include the determination of pharmacokinetics (PK) and the pharmacodynamics (PD) profile of DCR-PH1, including changes in urine oxalate levels.

Additional programs under investigation involving the liver

We are investigating a number of other rare diseases involving disease target genes expressed in the liver. We have selected these diseases and disease target genes based on our stated criteria, including having a strong of therapeutic hypothesis, a readily-identified patient population, the availability of predictive biomarkers, high unmet medical need, favorable competitive positioning, and a rapid path to approval. We are currently optimizing DsiRNA-EX Conjugate molecules directed toward multiple disease target genes. Based on the results of our investigations, we plan to select additional development programs.

DCR-MYC for solid tumors

For the treatment of cancer we are developing the product candidate DCR-MYC, which utilizes our DsiRNA and EnCore LNP technologies to target the oncogene MYC. We believe that DCR-MYC has the potential to be used broadly in solid tumors from many tissues of origin, based on observed patterns of MYC oncogene amplification across diverse tumor types.

There is abundant evidence that the MYC oncogene is a driver of human cancer. The MYC oncogene, originally identified as a transformative agent in naturally-occurring tumor viruses, is one of the most frequently mutated oncogenes found in human cancers. A therapy that reduces or eliminates elevated MYC activity has the potential to generate therapeutic benefits for patients with various tumor types that include MYC amplifications or other elevations of MYC activity. Inhibition of MYC activity has generated strong anti-tumor responses in a variety of animal models of cancer, which we have also observed in our own labs. Genetic techniques in mice which reduce MYC expression or inhibit MYC protein activity have been shown to prevent tumor formation or cause substantial tumor shrinkage, depending on the mouse genetic model of cancer employed in the experiment. These results have been obtained from mouse tumor models where MYC is not responsible for tumor initiation. We believe that this animal model data is supportive of the use of MYC-targeted therapy to treat cancer in humans.

Association of U.S. cancer patients with aberrant MYC expression

| CANCER TYPE |

APPROXIMATE PERCENTAGE OF PATIENTS |

|||

| Liver (hepatocellular) |

50 | % | ||

| Breast |

80 | % | ||

| Colorectal |

70 | % | ||

| Gastric |

51-77 | % | ||

| Gynecological |

90 | % | ||

| Prostate |

80-90 | % | ||

| Small cell lung |

18-30 | % | ||

The frequently observed mutations in the MYC gene usually result in the duplication or higher-order amplification of the MYC oncogene within the tumor cell DNA, resulting in elevated levels of MYC activity. Other types of mutations have also been shown to cause elevated levels of MYC activity, such as chromosomal translocations that result in the activation of the MYC oncogene. In addition, human genetic variants known as single-nucleotide polymorphisms in the MYC gene have been identified that are believed to predispose humans

17

Table of Contents

to various cancers. Based on these genetic data in humans, we believe that a therapy that reduces or eliminates elevated MYC activity has the potential to generate therapeutic benefits for patients with various tumor types that include MYC amplifications or other elevations of MYC activity.

Recent molecular work demonstrates that MYC over-expression drives the cancer process by selectively amplifying expression of genes typically expressed by a cell type. Based on this property, MYC is sometimes described as a “universal amplifier,” which can boost the activity of other cancer-related genes and push a cell to abnormal levels of growth. This model for MYC function suggests that an intervention that could bring down the expression of MYC to normal levels could have therapeutic benefit for cancer patients.

Despite its obvious attractiveness as a therapeutic target, MYC has not been successfully targeted by conventional small molecule drugs and is not amenable to antibody therapeutics. Others have attempted to develop small molecules that inhibit MYC but to date these have not been sufficiently potent and specific to be viable product candidates. We believe that the reason for this is likely due to the absence of a good binding pocket on the MYC protein. MYC is a member of a protein family known as transcription factors, and these proteins generally lack good binding pockets for small molecules. MYC is not amenable to treatment with antibodies; MYC is only found inside the cell and antibodies are limited to extracellular and cell surface targets.

Therapeutic rationale for DCR-MYC in hepatocellular carcinoma (HCC)

For several reasons, we believe that HCC presents an excellent starting point for clinical development of an MYC-targeted therapeutic. First, HCC patients frequently show amplifications of the MYC oncogene, suggesting an important role for MYC activity in a significant fraction of HCC patients. Second, in animal models of disease, we have observed strong anti-tumor responses after treatments with our product candidate DCR-MYC. Finally, there is high unmet medical need for effective treatments for advanced HCC.

Liver cancer is the second leading cause of cancer-related deaths worldwide, with 745,000 deaths per year. HCC is the most common form of liver cancer in adults, accounting for 85-90% of primary liver cancers. Many cases of HCC result from inflammation associated with infection with the hepatitis B or C virus, which can lead to cirrhosis of the liver. However, non-alcoholic fatty liver disease, associated with obesity and diabetes, is also an important risk factor for HCC.

Early-stage HCC is generally treated with surgery that has the potential to be curative. However, given the non-specific symptoms characteristic of HCC, the majority of patients are diagnosed only after HCC is at an advanced stage. Advanced HCC has limited treatment options and is associated with poor patient outcome and high mortality. Chemotherapies have demonstrated poor efficacy in HCC and there is no FDA-approved chemotherapeutic regime. Nexavar (marketed by Amgen Inc. and Bayer AG) is the only FDA-approved drug for the treatment of advanced or unresectable HCC. Unmet medical needs include the identification and development of additional and more effective treatments for patients not eligible for surgical resection, a reduction in relapse rates and an increase in overall survival rates.

Preclinical data for DCR-MYC

We have used our DsiRNA and EnCore LNP delivery technology to develop a product candidate that is designed to serve as a potent and specific inhibitor of the MYC oncogene. We have performed extensive screening and optimization of DsiRNAs targeting MYC, resulting in a proprietary, highly potent,stable and non-immunostimulatory DsiRNA that inhibits MYC in animal studies. We have packaged the DsiRNA targeting MYC in a tumor-delivery formulation of EnCore that has exhibited the ability to effectively deliver DsiRNAs to multiple mouse tumor models, including both xenograft models and a genetically-engineered mouse tumor model. The resulting product candidate that we have selected for development is known as DCR-MYC.

We have conducted extensive preclinical studies that have demonstrated the efficacy of DCR-MYC in tumor-bearing animals, while demonstrating good tolerability in multiple animal species, including non-human

18

Table of Contents

primates. We have directly observed up to 70 percent reductions in the level of the MYC oncogene transcript in xenograft-bearing animal models and also strong reductions in MYC transcript level in a genetically engineered mouse tumor model. Based on these studies, we believe that DCR-MYC has the properties that justify advancement into clinical development.

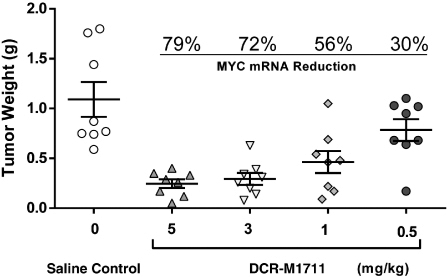

Anti-tumor efficacy of DCR-MYC in a xenograft model of HCC

The graph shows the reduction in tumor weight in mice treated with DCR-MYC at the dose levels shown, compared to tumor weight in mice treated with saline. Also shown on the graph are the mean MYC mRNA reduction percentages for each dose level, demonstrating a strong correlation between the reduction of MYC mRNA activity and the reduction of tumor weight in tumor-bearing mice. This preclinical experiment shows efficacy after DCR-MYC treatment. These mice have xenograft tumors of the human Hep3B HCC cell line in their livers, which were allowed to establish for 14 days prior to the commencement of dosing. Tumor-bearing mice were dosed with 5.0 to 0.5 milligrams per kilogram of DCR-MYC or saline control administered intravenously three times per week for two weeks for a total of six doses.

Phase 1 clinical development plan for DCR-MYC

We have initiated a clinical development program of DCR-MYC for the treatment of MYC-related cancers. The DCR-MYC development program includes two separate Phase 1 trials: one trial in patients with solid tumors, multiple myeloma or lymphoma, and one trial in patients with advanced Hepatocellular carcinoma (HCC). Each Phase 1 trial is an open label study with two parts. The first part is a standard dose escalation study to determine the maximum tolerated dose. The second part is an expansion cohort treated at the maximum tolerated dose determined from the dose escalation portion of the study. We submitted an IND application for DCR-MYC to the FDA in the second quarter of 2014 for the First in Human Study (FIH) which is indicated for the treatment patients with solid tumors, multiple myeloma, or lymphoma without other alternative therapeutic options. The FIH trial enrolled the first patient shortly thereafter in the second quarter of 2014.

Our FIH Phase 1 trial has a primary objective of determining the safety and tolerability of DCR-MYC in patients and to determine the maximum tolerated dose when administered in a cycle of two weekly infusions followed by one week without an infusion. Secondary objectives of the trial include: (1) evaluating the action in the body of the active ingredient in DCR-MYC (a DsiRNA known as DCR-M1711), such as absorption,

19

Table of Contents

distribution, metabolism and elimination over time. (2) observing decreases in the level of MYC transcript when comparing pre- and post-treatment biopsies of tumor tissues; (3) observing a decrease in tumor metabolic activity by imaging techniques, as a biomarker for inhibition of MYC function in tumors; (4) evaluating evidence of anti-tumor activity in patients treated with DCR-MYC; and (5) evaluating the potential use of blood biomarkers to assess activity of DCR-MYC.

Our FIH study has enrolled patients at the South Texas Accelerated Research Therapeutics (START) in San Antonio, Texas, and at the University of Chicago. Additional trial sites may be added to the study during the dose escalation or expansion portions of the trial in order to focus on particular tumor types or, if needed, to meet enrollment goals. Review of response data will be evaluated after completion of the dose-escalation phase of the study, which we expect to be completed by the end of 2015. Once the dose-escalation phase results have been evaluated, and assuming no problems, we intend to enroll additional patients at the maximum tolerated dose. We expect this expansion cohort to be completed and results evaluated by the end of 2016.

The second study of DCR-MYC is a Phase 1b/2 trial in patients with locally advanced or metastatic HCC. This study has a primary objective of determining the safety and tolerability of DCR-MYC in patients with late stage HCC and to determine a maximum tolerated dose when administered in a cycle of two weekly infusions followed by one week without an infusion. Secondary objectives of the trial include: (1) evaluating the action in the body of the active ingredient in DCR-MYC, DCR-M1711, such as absorption, distribution, metabolism and elimination over time ; (2) observing decreases in the level of MYC transcript when comparing pre- and post-treatment biopsies of tumor tissues; (3) evaluating evidence of anti-tumor activity in patients treated with DCR-MYC; and (4) evaluating the potential use of blood biomarkers to assess activity of DCR-MYC.

The first patient was enrolled in this trial during the first quarter of 2015 at the South Texas Accelerated Research Therapeutics (START) in San Antonio, Texas. We will conduct this trial in additional US sites and at sites in one or more East Asian countries, such as Singapore and South Korea. Additional trial sites may be added to the study during the dose escalation or expansion portions of the trial if needed to meet enrollment goals.

As with most Phase 1 trials, ours are not designed to yield statistically significant efficacy or molecular marker results. Accordingly, any observed results may be due to chance and not efficacy of DCR-MYC. The principal purpose of our Phase 1 trials will be to provide the basis for design of larger, definitive trials. Those trials will enroll more patients and they will be designed to demonstrate potential efficacy of the product candidate with statistical significance.

Product candidate for KRAS-related solid tumors

We believe that the KRAS oncogene represents an excellent target for our RNAi-based therapy because it is a frequently-mutated oncogene found in several common cancers, but it has historically been difficult to inhibit by the pharmaceutical industry. We are pursuing a DsiRNA-based product candidate targeting KRAS in conjunction with our collaborator KHK. Under the terms of our collaboration, KHK is responsible for selection of the clinical product candidate (including delivery system), all preclinical and clinical development activities and the choice of patient population and disease indications for clinical trials. We have an option to co-promote any KRAS product in the U.S. for an equal share of the profits from U.S. net sales.

Therapeutic rationale for KRAS-related solid tumors

Activating mutations in the KRAS gene are commonly found in a wide variety of tumor types. Among cancer indications with large patient populations, KRAS is found to be mutated in approximately 90 percent of pancreatic cancers, approximately 40 percent of colorectal cancers and approximately 25 percent of non-small cell lung cancers. KRAS mutations are also found in cancers with smaller patient numbers, such as bile duct cancers. In general, the presence of a KRAS mutation correlates with poorer disease prognosis. In the case of non-small cell lung cancer, certain therapeutics approved by the FDA and other global regulatory agencies which

20

Table of Contents

have demonstrated clinical efficacy in non-small cell lung cancer are known to be ineffective in patients with KRAS mutations. While our collaborator KHK will decide which disease indications to pursue, we believe the potential market for a KRAS therapeutic is highly significant. In the U.S. alone, there are estimated to be over 43,000 cases of pancreatic cancer, 125,000 cases of colorectal cancer and over 202,000 cases of non-small cell lung cancer diagnosed each year.

Association of U.S. cancer patients with activating KRAS mutations

| CANCER TYPE |

APPROXIMATE PERCENTAGE WITH ACTIVATING KRAS MUTATIONS |

IMPLIED PATIENT NUMBERS BASED ON INCIDENCE AND MUTATION FREQUENCY |

||||||

| Pancreatic adenocarcinoma |

90 | % | 38,700 | |||||

| Colorectal |

40 | % | 50,000 | |||||

| Non-small cell lung |

25 | % | 50,500 | |||||

We believe that our DsiRNA for KRAS-related solid tumors will be developed and used with a companion diagnostic that allows for the selection of patients carrying tumors with KRAS mutations. Clinical diagnostic tests for the presence of KRAS mutations have already been approved by the FDA and other global regulatory agencies and are commercially available.

As with MYC, Numerous studies have indicated that KRAS is a transformative agent in tumor viruses, which led to the identification of the human KRAS oncogene in the 1980s. Yet despite being known as an important drug target since that time, traditional small molecule approaches have not yielded effective KRAS inhibitors. Also, similar to MYC, KRAS is an intracellular protein and thus is not amenable to antibody therapeutics, which are limited to extracellular and cell surface drug targets

In its normal non-mutant form, the KRAS protein plays a key role in the promotion and regulation of cell growth and division. The KRAS protein acts in a keystone position in an intracellular signaling pathway often called the Ras-MAP Kinase pathway. This pathway is responsible for receiving growth-promoting signals from outside the cell and communicating those signals within the cell so that the cell can respond appropriately to the cell growth signals.

Preclinical data for product candidate for KRAS-related solid tumors

KRAS was the initial target of our collaboration with KHK, signed in December 2009. During the first two years of the collaboration KHK and Dicerna scientists worked to identify optimal DsiRNAs against the KRAS oncogene and to optimize an LNP delivery technology containing KHK’s proprietary lipids for tumor delivery. These DsiRNAs and LNP formulations were tested both in cell culture and in animals using human tumor cell lines, from different tumor types, carrying activating mutations in the KRAS oncogene.

21

Table of Contents

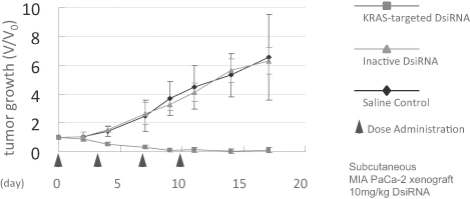

Full tumor regression shown in the KRAS-positive pancreatic tumor model MIA PaCa-2

Xenograft pancreatic tumors were grown subcutaneously in mice, followed by intravenous treatment with an LNP formulated KRAS DsiRNA . Treated animals showed full tumor regression, while saline control treated animals showed rapid tumor growth.

The KRAS DsiRNAs and LNP formulations have shown good activity in both cell culture and xenograft animal tumor models. For example, full regression of subcutaneously implanted xenograft pancreatic tumors has been achieved with the formulated KRAS DsiRNAs. These results were independently generated at our facility in Massachusetts and at KHK’s facility in Japan and have been observed using five independent KRAS sequences. As expected, KRAS oncogene knockdown is observed in tumors after a single dose of KRAS DsiRNA, further validating the observed efficacy.

Based on these preclinical efficacy data, KHK has advanced a product candidate resulting from this program into development. KHK has assumed responsibility for preclinical and clinical development of the program and bears the expense of that effort.

Additional product candidates for cancer gene targets

We are developing a second product candidate targeting a cancer-related gene in collaboration with KHK. We have not disclosed the identity of this target. In January 2013 we announced that KHK elected to advance this second therapeutic oncology product candidate from the research to the development stage. The achievement of this milestone triggered a $5.0 million payment from KHK to Dicerna. KHK is responsible for all development costs associated with this product candidate and has worldwide commercialization rights. We are eligible to receive royalties on worldwide net sales of the product candidate and payments of up to $110.0 million based on achievement of certain clinical, regulatory and commercialization milestones.

We have developed an additional product candidate using our DsiRNA-EX technology and EnCore tumor delivery technology. We have not disclosed the identity of this target. We are currently awaiting additional data from our DCR-MYC clinical trials before deciding how or whether to advance this product candidate forward in development.

Strategic Partnerships and Collaborations

KHK research collaboration and license agreement

In December 2009, we entered into a research collaboration and license agreement (the collaboration agreement) with KHK for the research, development and commercialization of drug delivery platforms and DsiRNA molecules for therapeutic targets, primarily in oncology. Under the collaboration agreement, we

22

Table of Contents

engaged in the discovery of DsiRNA molecules against KRAS and other gene targets nominated by KHK. In 2011, KHK exercised its option for one additional target, the identity of which has not been publicly disclosed. As part of the research we are conducting in the collaboration, we are using our specific RNAi-inducing double-stranded DsiRNA molecules with a lipid nanoparticle drug delivery platform proprietary to KHK. KHK is responsible for all costs it incurs to develop any compound that is directed against a target included in the collaboration that KHK designates for development, subject to our exercise of our co-promotion option with respect to that compound if that compound is directed against KRAS.

We have granted KHK an exclusive license to certain of our technology and patents relating to compounds resulting from the collaboration. KHK has granted us certain non-exclusive licenses in its technology as necessary for us to perform research and development activities as part of the research collaboration.

Under the terms of the collaboration agreement, we have received total payments of $17.5 million. We are entitled to receive up to an additional $110.0 million for each product candidate resulting from the collaboration of certain clinical, regulatory and commercialization milestones. KHK is also obligated to pay us royalties on net sales of products resulting from the research collaboration. These royalties vary depending on the total net sales and range from percentages of net sales in the high single digits to the teens. None of the previously paid milestones are subject to reimbursement.

We have the option to elect to co-promote the KRAS product in the U.S. for an equal share of the profits resulting from U.S. net sales of the product.

If we exercise our option to co-promote a KRAS product in the U.S., the collaboration agreement will remain in effect pursuant to its terms in the U.S. for as long as any product is being sold by either KHK or us in the U.S. For each country outside of the U.S., the agreement will remain in effect pursuant to its terms on a product-by-product and country-by-country basis until the later of the last to expire of any patent rights licensed under the agreement applicable to the manufacture, use or sale of the product or twelve years after the date of the first commercial sale of such product in the applicable country. In the event we do not exercise our option to co-promote an oncogene KRAS product in the U.S., the collaboration agreement will remain in effect pursuant to its terms on a product-by-product and country-by-country basis until the later of the last to expire of any patent rights licensed under the agreement applicable to the manufacture, use or sale of the product or twelve years after the date of the first commercial sale of such product in the applicable country.

KHK may terminate the agreement at any time upon prior written notice to us. We may terminate the agreement if KHK challenges the validity or enforceability of any patents licensed by us to KHK. Either we or KHK may terminate the agreement in the event of the bankruptcy or uncured material breach by the other party. Finally, KHK may terminate the agreement in its entirety at the end of the research collaboration if it determines not to proceed with further development of compounds.

City of Hope license agreement

In September 2007, we entered into a license agreement with City of Hope (COH), an academic research and medical center, pursuant to which COH has granted to us an exclusive (subject to the exception described below), royalty-bearing, worldwide license under certain patent rights in relation to DsiRNA, including the core DsiRNA patent (U.S. 8,084,599), to manufacture, use, offer for sale, sell and import products covered by the licensed patent rights for the prevention and treatment of any disease in humans. COH is restricted from granting any additional rights to develop, manufacture, use, offer to sell, sell or import products covered by the licensed patent rights for the prevention and treatment of any disease in humans. Prior to entering into the license with us, COH had entered into a non-exclusive license with respect to such patent rights to manufacture, use, import, offer for sale and sell products covered by the licensed patent rights for the treatment or prevention of disease in humans (excluding viruses and delivery of products into the eye or ear). While that non-exclusive license has been terminated, a sublicensee to that non-exclusive license was permitted to enter into an equivalent non-

23

Table of Contents

exclusive license which, to our knowledge, is subsisting with Arrowhead Research Corporation, (Arrowhead) as successor to the non-exclusive license holder. In addition, COH has granted to us an exclusive, royalty-bearing, worldwide license under the licensed patent rights providing certain rights for up to 20 licensed products selected by us for human diagnostic uses, provided that COH has not granted or is not negotiating a license of rights to diagnostic uses for such licensed products to a third party. The exclusive licenses granted by COH to us under the agreement are subject to any retained rights of the U.S. government in the licensed patent rights and a royalty-free right of COH to practice the licensed patent rights for educational, research and clinical uses. We have the right to sublicense the licensed patent rights to third parties with COH’s written consent. The core DsiRNA patent (U.S. 8,084,599), titled “methods and compositions for the specific inhibition of gene expression by double-stranded RNA,” describes RNA structures having a 25 to 30 nucleotides sense strand, a blunt end at the 3’ end of the sense strand and a one to four nucleotides overhang at the 3’ end of the antisense strand. The expiration date of this patent is July 17, 2027. The COH license is applicable to our DCR-MYC and KHK programs.

Pursuant to the terms of the agreement, we paid COH a one-time, non-refundable license fee and issued shares of our common stock to COH and a co-inventor of the core DsiRNA patent. COH is entitled to receive milestone payments in an aggregate amount of up to $5.25 million for each licensed product upon achievement of certain clinical and regulatory milestones. COH is further entitled to receive royalties at a low single-digit percentage of any net sale revenue of the licensed products sold by us and our sublicensees. If we sublicense the licensed patent rights to a third party, COH has the right to receive a double digit percentage of sublicense income, the percentage of which decreases after we have expended $12.5 million in development and commercialization costs. We are also obligated to pay COH an annual license maintenance fee, which may be credited against any royalties due to COH in the same year, and reimburse COH for expenses associated with the prosecution and maintenance of the license patent rights. Royalties shall be paid on a product-by-product and country-by-country basis until the expiration in each country of the last to expire of the licensed patent rights.

Under the agreement, we are obligated to use commercially reasonable efforts to develop and commercialize the licensed products in certain major markets. COH has the right to terminate the agreement in its entirety if we fail to enroll patients for clinical trials of one or more licensed products at various phases before certain specified deadlines unless we exercise the right to extend the deadlines in one-year increments by making a payment of $0.5 million to COH for each one-year extension. We have extended one milestone deadline for three one-year extensions, paying an aggregate of $1.5 million to COH for such extensions.

The agreement will remain in effect pursuant to its terms until all of the obligations under the agreement with respect to the payment of milestones or royalties related to licensed products have terminated or expired. Either party may terminate the license agreement for any uncured material breach by the other party. COH may terminate the agreement upon our bankruptcy or insolvency. We may terminate the agreement without cause upon written notice to COH.

Tekmira Pharmaceuticals Corporation license agreement

In November 2014, we entered into a licensing and collaboration agreement with Tekmira and one of its subsidiaries to license their LNP delivery technology for exclusive use in our PH1 development program. We will use Tekmira’s LNP technology to deliver DCR-PH1, for the treatment of PH1. As of December 31, 2014, we paid $3.0 million in license fees. Tekmira is entitled to receive additional payments of $22.0 million in aggregate development milestones, plus a mid-single-digit royalty on future PH1 sales. This new partnership also includes a supply agreement with Tekmira and one of its subsidiaries providing clinical drug supply and regulatory support.

Under the agreement, we are obligated to use commercially reasonable efforts to develop and commercialize the product.

The agreement will remain in effect pursuant to its terms until all of the obligations under the agreement with respect to the payment of milestones or royalties related to licensed products have terminated or expired.

24

Table of Contents

Either party may terminate the license agreement for any uncured material breach by the other party. Tekmira may terminate the agreement upon our bankruptcy or insolvency. We may terminate the agreement without cause upon written notice to Tekmira.

In addition to the license agreement, we entered into a development and supply agreement with Tekmira and one of its subsidiaries. Tekmira and its subsidiary will perform certain development and manufacture processes in accordance with the specifications in development and supply agreement. There is no minimum purchase requirement for the services provided by Tekmira or its subsidiaries.

Intellectual Property

We invest significant amounts in research and development. Our research and development expenses were approximately $29.5 million, $11.6 million and $11.6 million in 2014, 2013 and 2012, respectively.

We are seeking multifaceted protection for our intellectual property that includes licenses, confidentiality and non-disclosure agreements, copyrights, patents, trademarks and common law rights, such as trade secrets. We enter into confidentiality and proprietary rights agreements with our employees, consultants, collaborators, subcontractors and other third parties and generally control access to our documentation and proprietary information.

Patents and proprietary rights