Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - JP Energy Partners LP | a14-25710_1ex32d1.htm |

| EX-31.2 - EX-31.2 - JP Energy Partners LP | a14-25710_1ex31d2.htm |

| EX-23.1 - EX-23.1 - JP Energy Partners LP | a14-25710_1ex23d1.htm |

| EX-32.2 - EX-32.2 - JP Energy Partners LP | a14-25710_1ex32d2.htm |

| EX-31.1 - EX-31.1 - JP Energy Partners LP | a14-25710_1ex31d1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - JP Energy Partners LP | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-36647

JP ENERGY PARTNERS LP

(Exact name of registrant as specified in its charter)

|

Delaware |

|

27-2504700 |

|

(State or other jurisdiction of |

|

(I.R.S. employer |

|

incorporation or organization) |

|

identification number) |

600 East Las Colinas Blvd

Suite 2000

Irving, Texas 75039

(Address of principal executive offices, including zip code)

(972) 444-0300

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Units Representing Limited Partner Interests |

|

New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o |

|

Accelerated filer o |

|

|

|

|

|

Non-accelerated filer x |

|

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 30, 2014 the last business day of the registrant’s most recently completed second fiscal quarter, the registrant’s equity was not listed on any domestic exchange or over-the-counter market. The registrant’s common units began trading on the New York Stock Exchange on October 2, 2014.

As of March 2, 2015, the Registrant had 18,200,121 common units and 18,158,903 subordinated units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Unless the context otherwise requires, references in this Annual Report on Form 10-K (this “report” or this “Form 10-K”) to “JP Energy Partners,” “the Partnership,” “we,” “our,” “us,” or like terms refer to JP Energy Partners LP and its subsidiaries, and references to “our general partner” refer to JP Energy GP II LLC, our general partner. References to “our sponsor” or “Lonestar” refer to Lonestar Midstream Holdings, LLC, which, together with JP Energy GP LLC, CB Capital Holdings II, LLC and the Greg Alan Arnold Separate Property Trust, entities owned by certain members of our management, owns and controls our general partner. References to “ArcLight Capital” refer to ArcLight Capital Partners, LLC and references to “ArcLight Fund V” refer to ArcLight Energy Partners Fund V, L.P. References to “ArcLight” refer collectively to ArcLight Capital and ArcLight Fund V. ArcLight Capital manages ArcLight Fund V, which controls our general partner through its ownership and control of Lonestar.

Cautionary Note Regarding Forward-Looking Statements

Certain statements and information in this Annual Report on Form 10-K may constitute “forward-looking statements.” The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. All comments concerning our expectations for future revenues and operating results are based on our forecasts for our existing operations and do not include the potential impact of any future acquisitions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, those summarized below:

· the price of, and the demand for, crude oil, refined products and natural gas liquids (“NGLs”) in the markets we serve;

· the volumes of crude oil that we gather, transport and store, the throughput volumes at our refined products terminals and our NGL sales volumes;

· the fees we receive for the crude oil, refined products and NGL volumes we handle;

· pressures from our competitors, some of which may have significantly greater resources than us;

· the cost of propane that we buy for resale, including due to disruptions in its supply, and whether we are able to pass along cost increases to our customers;

· competitive pressures from other energy sources such as natural gas, which could reduce existing demand for propane;

· the risk of contract cancellation, non-renewal or failure to perform by our customers, and our inability to replace such contracts and/or customers;

· leaks or releases of hydrocarbons into the environment that result in significant costs and liabilities;

· the level of our operating, maintenance and general and administrative expenses;

· regulatory action affecting our existing contracts, our operating costs or our operating flexibility;

· failure to secure or maintain contracts with our largest customers, or non-performance of any of those customers under the applicable contract;

· competitive conditions in our industry;

· changes in the long-term supply of and demand for oil and natural gas;

· volatility of fuel prices;

· actions taken by our customers, competitors and third-party operators;

· our ability to complete growth projects on time and on budget;

· inclement or hazardous weather conditions, including flooding, and the physical impacts of climate change;

· environmental hazards;

· industrial accidents;

· changes in laws and regulations (or the interpretation thereof) related to the transportation, storage or terminaling of crude oil and refined products or the distribution and sales of NGLs;

· fires, explosions or other accidents;

· the effects of future litigation; and

· other factors discussed elsewhere in this Annual Report.

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.

Overview

We are a growth-oriented limited partnership formed in May 2010 by members of management and further capitalized by ArcLight to own, operate, develop and acquire a diversified portfolio of midstream energy assets. Our operations currently consist of four business segments: (i) crude oil pipelines and storage, (ii) crude oil supply and logistics, (iii) refined products terminals and storage and (iv) NGL distribution and sales. Together our businesses provide midstream infrastructure solutions for the growing supply of crude oil, refined products and NGLs in the United States. Since our formation, our primary business strategy has been to focus on:

· owning, operating and developing midstream assets serving two of the most prolific shale plays in the United States, as well as serving key crude oil, refined product and NGL distribution hubs;

· providing midstream infrastructure solutions to users of liquid petroleum products in order to capitalize on changing product flows between producing and consuming markets resulting from the significant growth in hydrocarbon production across the United States; and

· operating one of the largest portable propane cylinder exchange businesses in the United States and capitalizing on the increase in demand and extended applications for portable propane cylinders.

We are focused on growing our business through organic development, acquiring and constructing additional midstream infrastructure assets and increasing the utilization of our existing assets to gather, transport, store and distribute crude oil, refined products and NGLs. Our crude oil businesses are situated in high growth areas, including the Permian Basin, Mid-Continent and Eagle Ford shale, and provide us with a footprint to increase our volumes as these areas experience further drilling and production growth. In addition, we believe we have a competitive advantage with regard to the sourcing of opportunities to build, own and operate additional crude oil pipelines due to the insights in the market that we obtain while providing services to customers in our crude oil supply and logistics segment. We believe that our NGL distribution and sales segment will continue to grow due to our recent expansion into new geographic markets, an increased market presence in our existing areas of operation and the increase in industrial and commercial applications for NGLs such as in oilfield and agricultural services.

For additional information relating to our disclosure of revenues, profits and total assets by operating segment, please read “Note 16—Reportable Segments” included in our audited consolidated financial statements incorporated by reference into this Form 10-K.

Our Acquisition History

Since our formation and the formation of our affiliate, JP Energy Development LP (“JP Development”), in July 2012, our management team has successfully established a strategic midstream platform through us and JP Development by way of 25 third-party acquisitions and numerous organic capital projects. These include the acquisitions of:

· the Silver Dollar Pipeline System in October 2013;

· our NGL transportation business in October 2013, consisting of approximately 43 hard shell tank trucks;

· our North Little Rock, Arkansas and Caddo Mills, Texas refined products terminals in November 2012;

· our crude oil storage facility in Cushing, Oklahoma in August 2012;

· our initial crude oil gathering and transportation operations, consisting of approximately 69 crude oil gathering and transportation trucks and our proprietary CAST software, in July 2012;

· our cylinder exchange business in June 2012; and

· 17 separate wholesale and retail propane businesses from July 2010 through July 2013.

How We Conduct Our Business

We conduct our business through fee-based and margin-based arrangements.

Fee-based. We charge our customers a capacity, throughput or volume-based fee that is not contingent on commodity price changes. Our fee-based services include the operations in our crude oil pipelines and storage segment, our refined products terminals and storage segment, and the NGL transportation services we provide within our NGL distribution and sales segment. In our crude oil pipelines business, we purchase crude oil at an index price less a transportation fee, and simultaneously sell an identical volume of crude oil at a designated delivery point to the same party at the same index price. We consider this a fee-based business because we lock in the economic equivalent of a transportation fee. Our fee-based businesses are governed by tariffs or other negotiated fee agreements between us and our customers with terms ranging from one month to nine years.

Margin-based. We purchase and sell crude oil in our crude oil supply and logistics segment, and NGLs and refined products in our NGL distribution and sales segment. A substantial portion of our margin related to the purchase and sale of crude oil in our crude oil supply and logistics segment is derived from “fee equivalent” transactions in which we concurrently purchase and sell crude oil at prices that are based on an index, thereby generating revenue consisting of a margin plus our purchase, transportation, handling and storage costs. In our NGL distribution and sales segment, sales prices to our customers generally provide for a margin plus the cost of our products to our customers. We also perform blending services in our crude oil supply and logistics segment and our refined products terminals and storage segment, which allows us to generate additional margin based on the difference between our cost to purchase and blend the products and the market sales price of the finished blended product. We manage commodity price exposure through the structure of our sales and supply contracts and through a managed hedging program. Our risk management policy permits the use of financial instruments to reduce the exposure to changes in commodity prices that occur in the normal course of business but prohibits the use of financial instruments for trading or to speculate on future changes in commodity prices.

Our Relationship With JP Development and ArcLight

Our affiliate, JP Development, is a growth-oriented limited partnership that was formed in July 2012 by members of our management team and ArcLight for the express purpose of supporting our growth. JP Development intends to acquire growth-oriented midstream assets and to develop organic capital projects and then offer those assets for sale to us after they have been sufficiently developed such that their financial profile is suitable for us.

Since its formation, our management team and ArcLight have successfully grown JP Development through the acquisition of midstream assets and the execution of growth projects strategically located in our current areas of operation as well as new areas for expansion. In February 2014, we acquired from JP Development an intrastate crude oil pipeline system as well as a portfolio of crude oil logistics and NGL transportation and distribution assets for aggregate consideration valued at approximately $319.1 million. We refer to this transaction as the JP Development Dropdown. Please read “—JP Development Dropdown.”

We believe that ArcLight Fund V’s and our management’s collective ownership of (i) 95% of our general partner, which owns all of our incentive distribution rights, (ii) a 56.1% limited partner interest in us and (iii) 100% of the partnership interests in JP Development create a unique and strong incentive for ArcLight to support the successful execution of our business plan and to pursue projects and acquisitions that should enhance the overall value of our business. We believe that our relationship with JP Development and ArcLight will provide us with future growth opportunities, including the potential acquisition of the ROFO Assets (as defined below).

Right of First Offer

JP Development has granted us a right of first offer on all of its current and future assets, and ArcLight Fund V has granted us a right of first offer with respect to a 50% indirect interest in Republic Midstream, LLC (“Republic”), an ArcLight portfolio company. The right of first offer with respect to JP Development’s current and future assets is for a period of five years from the closing of our initial public offering (“IPO”) and the right of first offer with respect to Republic is for a period of eighteen months from the closing of our IPO. A description of JP Development’s current assets and Republic, which we collectively refer to as the ROFO Assets, is provided below.

· Great Salt Plains Pipeline. An approximately 115-mile intrastate crude oil pipeline that runs from Cherokee, Oklahoma to Cushing, Oklahoma that was placed in service in October 2012. The Great Salt Plains Pipeline has a current capacity of approximately 27,000 barrels per day (“bpd”) and JP Development has the capability to install two pump stations that will expand its capacity to in excess of 40,000 bpd. The Great Salt Plains Pipeline serves the Mississippian Lime play and connects to (i) crude oil storage tanks owned by JP Development in Cherokee, Oklahoma with a shell capacity of approximately 170,000 barrels and (ii) leased crude oil storage tanks in Cushing, Oklahoma with a shell capacity of approximately 700,000 barrels leased by us pursuant to a long-term lease with a third party.

· Red River Pipeline. An approximately 75-mile interstate crude oil pipeline serving the Fort Worth Basin that originates in Grayson County, Texas and runs to its principal terminus at the Elmore City Station in Garvin County, Oklahoma. The Red River Pipeline has a current capacity of approximately 5,000 bpd.

· Republic Midstream. A 100% member interest in Republic Midstream Gathering II, LLC, which owns a 50% indirect interest in Republic. Republic has agreed to build, own and operate certain crude oil midstream assets for Penn Virginia Corp. in the Eagle Ford shale region. Republic’s initial assets will consist of a 180-mile crude oil gathering system in Gonzales and Lavaca Counties that will deliver the gathered volumes to a 144-acre central delivery terminal in Lavaca County that is capable of storing and blending crude oil volumes. Republic is also constructing a 12-inch, 30-mile takeaway pipeline from the central delivery terminal. Subject to entering into definitive documentation, we have agreed to perform certain commercial services for Republic, including working with producers to transport crude oil from the wellhead to end markets.

JP Development Dropdown

In February 2014, we acquired the following assets in the JP Development Dropdown in exchange for consideration valued at approximately $319.1 million:

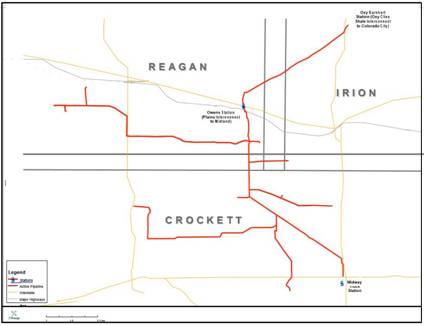

· Silver Dollar Pipeline System. The Silver Dollar Pipeline System is a long-term contracted crude oil pipeline system consisting of approximately 94 miles of high-pressure steel pipeline in the Spraberry, Wolfberry and Wolfcamp plays within Crockett, Reagan and Irion counties in Texas, with throughput capacity of 130,000 bpd, truck terminals and truck injection stations, multiple receipt points and 40,000 barrels of crude oil storage.

· Crude oil supply and logistics assets. A portfolio of crude oil assets consisting of approximately 70 crude oil gathering and transportation trucks and approximately 30 truck injection stations that provide our customers with multiple outlets within a market.

· Natural gas liquids assets. Approximately 43 hard shell tank trucks engaged in the transportation of NGLs and condensate, including Y-grade, propane, butane and other NGLs, in the Eagle Ford shale and the Permian.

Our Assets and Operations

Crude Oil Pipelines and Storage

Crude Oil Pipelines

Silver Dollar Pipeline System. The Silver Dollar Pipeline System provides crude oil gathering services for producers targeting the Spraberry, Wolfberry and Wolfcamp plays in the Midland Basin. The system currently consists of approximately 94 miles of high-pressure steel pipeline with throughput capacity of approximately 130,000 barrels per day and two interconnections to third-party long-haul transportation pipelines. Our operations are underpinned by long-term, fee-based contracts with leading producers in the Midland Basin. One significant contract has a remaining term of approximately nine years and contains an acreage dedication related to crude oil production from approximately 110,000 acres in Crockett and Schleicher counties, Texas. Another significant contract has a remaining term of approximately

five years and contains a minimum volume commitment that was amended in March 2014 and again in September and November 2014 to significantly increase the volumes committed thereunder. A third significant contract has a remaining term of approximately 10 years and contains an acreage dedication related to crude oil production from approximately 53,000 acres in Reagan, Glasscock, Sterling and Irion Counties.

The Silver Dollar Pipeline System is located in the Spraberry, Wolfberry and Wolfcamp plays in the Midland Basin within Crockett, Reagan and Irion Counties, Texas, liquids-rich plays being developed by several large oil and gas producers. The Spraberry, Wolfberry and Wolfcamp are stacked plays with multiple horizontal targets that can be accessed with a single well. As of December 2014, the Silver Dollar Pipeline System is connected to producers that control approximately 321,000 acres in Crockett, Reagan, Irion and Schleicher Counties, Texas, and we are in advanced negotiations with other producers in the area to connect substantial additional acreage to the system and contract for additional minimum volume commitments or acreage dedications. The table below contains operational information related to the Silver Dollar Pipeline System.

|

|

|

|

|

|

|

Throughput as of the |

| ||

|

Length |

|

Capacity |

|

Storage Capacity |

|

December 31, 2014 |

|

December 31, 2013 |

|

|

94 miles |

|

130,000bpd |

|

40,000 barrels |

|

27,149bpd |

|

16,957bpd |

|

Construction of the Silver Dollar Pipeline System began in October 2012, and it was put into service in April 2013. The pipeline extends from the Midway Station in Crockett County, Texas to the Owens Station in Reagan County, Texas, a 4.3-acre site with an interconnection to Plains All American Pipeline, L.P.’s Spraberry Expansion. The Midway Station is strategically located in the heart of the Southern Wolfcamp. It receives trucking volumes from multiple producers located to the south and has connections to neighboring producer facilities. The Midway Station currently has a 10,000 barrel tank and seven truck injection stations.

During the third quarter of 2014, we completed expansions of our Silver Dollar Pipeline System located in the Permian Basin. These expansions added an incremental 36 miles to the existing pipeline system, resulting in a total length of approximately 94 miles. As a result of these expansion projects, we amended an existing contract with one of our major customers, which increased the minimum volume commitment thereunder and extended the contract term by five years. In addition, the throughput capacity of our Silver Dollar Pipeline System increased by 30,000 barrels per day.

In our crude oil pipelines business, we purchase crude oil from a producer or supplier at a designated receipt point on our Silver Dollar Pipeline System at an index price less a transportation fee, and simultaneously sell an identical volume of crude oil at a designated delivery point to the same party at the same index price, allowing us to lock in a fixed margin that

is in effect economically equivalent to a transportation fee. These transactions account for substantially all of the Adjusted EBITDA we generate on our Silver Dollar Pipeline System.

Crude Oil Storage

We own a crude oil storage facility in Cushing, Oklahoma with an aggregate shell capacity of approximately 3.0 million barrels, consisting of five 600,000-barrel storage tanks. These storage tanks were built in 2009 and are located on the western side of a terminal owned by Enterprise Products Partners L.P. (the “Enterprise Terminal”). The storage tanks are able to receive approximately 22,000 barrels of crude oil per hour or deliver approximately 8,000 barrels of crude oil per hour, and have inbound connections with multiple pipelines and two-way interconnections with all of the other major storage facilities in Cushing, including the delivery point specified in all crude oil futures contracts traded on the NYMEX. TEPPCO Partners LP (“TEPPCO”), a wholly owned subsidiary of Enterprise, serves as the operator of our facilities.

Our crude oil storage business provides stable and predictable fee-based cash flows. All of the shell capacity of our storage tanks is dedicated to one customer pursuant to a long-term contract, backed by a letter of credit, with a remaining term of approximately 2.5 years as of December 31, 2014. Our customer has the option to extend this contract by two years pursuant to a renewal option. We generate crude oil storage revenues by charging this customer a fixed monthly fee per barrel of shell capacity that is not contingent on the customer’s actual usage of our storage tanks.

Our storage facility is on land that is subject to a 50-year lease with TEPPCO. We have the option to extend our lease by up to an additional 30 years. Our location in the Enterprise Terminal provides our customer with access to multiple pipelines outbound from Cushing, including a manifold connecting our tanks to the Enterprise Terminal. The Enterprise Terminal is connected to the Seaway Pipeline, which is owned and operated by Enterprise and Enbridge Inc. and transports crude oil from Cushing to the Gulf Coast.

We are party to an operating agreement pursuant to which an affiliate of TEPPCO operates and maintains the crude oil storage tanks located at our crude oil storage facility and provides us with certain services, including services related to product movements, data tracking, station operations (including documentation and inspection programs), financial and accounting matters and purchases of material. These services are provided to us at a monthly base rate and we are permitted to request additional services from TEPPCO, which are provided to us at cost. TEPPCO is obligated to perform the services as a reasonably prudent operator and in accordance with all applicable laws and accepted industry practices. The operating agreement contains certain other customary terms, including provisions relating to restrictions on assignment, terms of payment, indemnification, confidentiality and dispute resolution. The operating agreement remains in place for the same term as the lease agreement described above.

Crude Oil Supply and Logistics

Our crude oil supply and logistics segment manages the physical movement of crude oil from origination to final destination largely through our network of owned and leased assets. Our assets and operations are located in areas of substantial crude oil production growth, including the Permian Basin, Mid-Continent and Eagle Ford shale. We own and operate a fleet of approximately 135 crude oil gathering and transportation trucks and approximately 30 crude oil truck injection stations and terminals. We also lease crude oil storage tanks in Cushing, Oklahoma with a shell capacity of approximately 700,000 barrels pursuant to a long-term lease with a third party. Due to the limited pipeline infrastructure in some of the basins in which we operate, our crude oil gathering and transportation trucks provide immediate access for customers to transport their crude oil to the most advantageous outlets, including pipelines, rail terminals and local refining centers.

We primarily generate revenues in our crude oil supply and logistics segment by purchasing crude oil from producers, aggregators and traders at an index price less a discount and selling crude oil to producers, traders and refiners at a price linked to the same index. The majority of activities that are carried out within our crude oil supply and logistics segment are designed to produce a stable baseline of results in a variety of market conditions, while at the same time providing upside opportunities. We intend to utilize our knowledge of matters related to crude oil supply and logistics to create opportunities to address the infrastructure needs of developing crude oil basins. We believe this will allow us to significantly grow our operations in the Permian Basin, Mid-Continent and Eagle Ford shale.

In general, sales prices referenced in the underlying contracts, most of which have a 30-day evergreen term, are market-based and may include pricing differentials for such factors as delivery location or crude oil quality. Our crude oil supply and logistics operations generate substantial revenues and cost of products sold as a result of the significant volume of crude oil bought and sold. While the absolute price levels of crude oil significantly impact revenues and cost of products sold,

such price levels normally do not bear a relationship to gross profit for crude oil sales generated under buy/sell contracts. As a result, period-to-period variations in revenues and cost of products sold are not generally meaningful in analyzing the variation in gross profit for our crude oil supply operations.

We also generate revenue in this segment by performing blending services whereby we purchase varying qualities of crude oil from our producer and logistics customers, which we blend in our leased storage tanks to WTI or other specifications. The level of profit associated with our blending operations is influenced by overall contract structure and the degree of market volatility, as well as variable operating expenses. Please read “—How We Conduct Our Business” for more details on these contractual arrangements.

We mitigate the commodity price exposure of our crude oil supply and logistics operations by limiting our net open positions through the concurrent purchase and sale of like quantities of crude oil intended to lock in positive margins based on the timing, location or quality of the crude oil purchased and delivered. All of our supply activities are subject to our comprehensive risk management policy, which establishes limits in order to manage risk and mitigate our commodity price exposure.

We are focused on increasing the utilization of our crude oil gathering and transportation fleet. We typically assign crude oil gathering and transportation trucks to a specific area but can temporarily relocate them to meet demand as needed.

CAST. We equip our drivers with advanced computer technology and dispatch them from central locations in Perryton, Texas, San Angelo, Texas, Whitesboro, Texas, Pearsall, Texas and Pratt, Kansas. We believe that our proprietary CAST software, which is employed by our entire fleet of crude oil gathering and transportation trucks, provides us with a competitive advantage by allowing us to offer our customers a differentiated level of service. Our drivers are provided with hand-held computers which allow them to utilize our CAST software after they have loaded product. Our CAST software is a centralized system for dispatch, electronic ticket management, reporting, operations data management and lease data management. The CAST software validates ticket data in the field to greatly improve accuracy relative to paper tickets and provides our customers with near real-time views of dispatch, truck tickets, vehicle location, load acceptances and rejections and drivers. The CAST software also offers our customers flexible reporting options by providing customized data to the customer in the format that works best for its accounting and marketing needs.

Refined Products Terminals and Storage

Our refined products terminals and storage segment is comprised of two refined products terminals located in North Little Rock, Arkansas and Caddo Mills, Texas. Our refined products terminals are facilities where refined products are transferred to or from storage or transportation systems, such as pipelines, to other transportation systems, such as trucks. Our refined products terminals play a key role in moving product to the end-user market by providing the following services:

· receipt, storage, inventory management and distribution;

· blending and injection of additives to achieve specified grades of gasoline; and

· other ancillary services that include heating of bio-diesel, product transfer and railcar handling services.

Our refined products terminals consist of multiple storage tanks with a combined aggregate storage capacity of 1.3 million barrels and are equipped with automated truck loading equipment that is operational 24 hours per day. This automated system provides for control of security, allocations, and credit and carrier certification by remote input of data by the terminal and our customers. In addition, our refined products terminals are equipped with truck loading racks capable of providing automated computer blending to individual customer specifications.

We generate fee-based revenues in our refined products terminals and storage segment from:

· throughput fees based on the receipt and redelivery of refined products, including fees based on the volume of product redelivered from the terminal;

· storage fees based on a rate per barrel of storage capacity per month;

· additive service fees based on ethanol and biodiesel used in blending services and for additive injection; and

· ancillary fees for the heating of bio-diesel, product transfer and railcar handling services.

Our refined products terminals and storage segment generates its fee-based revenues pursuant to contracts that typically contain evergreen provisions consistent with industry practice so that, after an initial term of six months to two years, they can be canceled upon 60 days’ notice. We also generate revenues from (i) blending activities, such as ethanol blending and butane blending, and (ii) our vapor recovery units. A majority of the customers in our refined products terminals and storage segment are large, well-known oil companies and independent refiners with whom we have longstanding relationships.

The following table highlights the storage capacity, number of loading lanes, number of tanks, supply source, mode of distribution and average daily throughput of our refined products terminals:

|

|

|

Shell |

|

|

|

|

|

|

|

|

|

Approximate Average Throughput |

| ||

|

Terminal Location |

|

Capacity |

|

Loading |

|

Number |

|

Supply Source |

|

Mode of |

|

Year Ended |

|

Year Ended |

|

|

Little Rock, AR |

|

550,000 |

|

8 |

|

11 |

|

Pipeline, Rail and Truck |

|

Truck |

|

44,415 |

|

53,028 |

|

|

Caddo Mills, TX |

|

770,000 |

|

5 |

|

10 |

|

Pipeline and Truck |

|

Truck |

|

19,444 |

|

16,053 |

|

North Little Rock terminal. Our North Little Rock terminal consists of 11 storage tanks with an aggregate capacity of approximately 550,000 barrels and has eight loading lanes with automated truck loading equipment to minimize wait time for our customers. Our truck loading racks are capable of providing automated computer blending to customer specifications. The North Little Rock terminal handles products such as multi-octane conventional gasoline, ultra-low sulphur diesel with dye-at-rack capability, bio-diesel with ratio blending capability and ethanol. This terminal is supplied by two receipt lines from the TEPPCO Pipeline, one for ultra-low sulphur diesel and the other for all other refined products, and has full offloading capability for 10 rail cars of ethanol at a time via a rail spur served by the Union Pacific system via the Genesee and Wyoming Railroad. Our North Little Rock terminal serves the Little Rock metropolitan area, which grew 15% from 2000 to 2010 according to Census Bureau data, and is expected to grow another 11% by 2025.

Caddo Mills terminal. Our Caddo Mills terminal consists of 10 storage tanks with an aggregate capacity of approximately 770,000 barrels and has five loading lanes with automated truck loading equipment to minimize wait time for our customers. This terminal is served by the Explorer Pipeline and has truck loading racks capable of providing automated computer blending to customer specifications. Our Caddo Mills terminal handles products such as conventional blend stock for oxygenate blending (CBOB) gasoline, reformulated blend stock for oxygenate blending (RBOB), premium blend stock for oxygenate blending (PBOB), ethanol, ultra-low sulphur diesel with dye-at-rack capability and bio-diesel with ratio blending capability. We own approximately 6 additional acres of land at our Caddo Mills terminal that is available for future expansion. Management estimates that this acreage is capable of housing an additional 200,000 barrels of storage capacity. The Caddo Mills terminal serves Collin County, located in the northeast portion of the Dallas-Fort Worth metroplex, which, according to Census Bureau data, grew 23% from 2000 to 2010, making it one of the fastest growing large markets in the United States.

NGL Distribution and Sales

Cylinder Exchange

We currently operate the third-largest propane cylinder exchange business in the United States, which consists of the distribution of propane-filled cylinder tanks typically used in barbeque grilling and which covers all 48 states in the continental United States through a network of over 18,800 distribution locations. We market our business under the brand name Pinnacle Propane Express or under the brand names of our customers. Our customers include grocery stores, pharmacies, convenience stores and hardware retailers which sell or exchange our propane-filled cylinders to consumers for end-use. For the year ended December 31, 2014, we sold or exchanged approximately 4.8 million propane cylinders containing approximately 16.8 million aggregate gallons of propane, representing a 6% increase in cylinder sales and exchanges compared to the same period during the previous year. We believe our cylinder exchange business is strategically positioned for continued growth resulting from the overall increase in demand and extended applications for portable propane cylinders and our recently completed expansion in the western United States.

We generate revenues in our cylinder exchange business through the sale or exchange of propane-filled cylinders at an agreed upon contract price. For the years ended December 31, 2014 and December 31, 2013, we distributed 54% and 51%, respectively, of our propane volumes in our cylinder exchange business under long-term agreements and the remaining 46% and 49%, respectively, under one-month contracts or on a spot/demand basis. As of December 31, 2014, our contracts had a weighted average remaining term of approximately 1.9 years. Our long-term cylinder exchange agreements typically permit us to adjust our prices at the time of contract renewal while our month-to-month cylinder exchange agreements allow us to pass our costs on to our customers and thereby minimize our commodity price exposure. In order to manage our cost of propane we enter into hedging arrangements on all fixed-price contracts. We use financial swaps to hedge a majority of the forecasted volumes in our cylinder exchange business, where approximately half of our sales volumes are under contracts with two- and three-year terms.

Cylinder production cycle. We own nine production facilities strategically located in Alabama, Illinois, Michigan, Missouri, Nevada, Oregon, Pennsylvania, South Carolina and Texas. Our production facilities receive inbound pallets of empty 20-pound propane cylinders, which are put through a processing cycle that includes cleaning, inspection, testing, painting, refilling and loading onto relay trucks for delivery to our 56 distribution depot locations. Drivers at our depots receive the full cylinders from our production facilities for delivery to our customer service locations and pick up empty cylinders, which are shipped to our production facilities for processing.

NGL Sales

Our NGL sales business involves the retail, commercial and wholesale sale of NGLs and other refined products (including sales of gasoline and diesel to our oilfield service and agricultural customers) in seven states in the Southwest and Midwest to approximately 96,900 customers through our distribution network of 34 customer service locations. We generate revenues by charging a price per gallon consisting of our product supply, transportation, handling, and storage costs plus a margin. Our contracts permit us to pass through our supply costs on a regular basis, thereby limiting our commodity price exposure. Since July 2010, we have acquired 17 propane franchises to expand our market presence within our operating region in Texas, Oklahoma, New Mexico, Arizona, Arkansas and Missouri.

Customers. We sell propane, butane and refined fuels, including diesel, gasoline, lubricants and solvents, primarily to three customer markets: retail, commercial and wholesale, which include a mix of residential, commercial, agricultural, oilfield service and industrial customers. The customer service centers in our NGL sales business are located in suburban and rural areas where natural gas is not readily available. These customer service centers generally consist of an office, warehouse and service facilities, with one or more 2,500 to 45,000 gallon storage tanks on the premises. These tanks are used to supply our bobtail trucks, which in turn make deliveries to our retail customers. Customers can also bring their own NGL storage containers to our customer service centers to be filled.

Retail. We primarily serve residential customers through the sale of propane for home heating and power generation. We deliver propane through our 125 active bobtail trucks, which have capacities ranging from 2,000 gallons to 5,000 gallons of propane into stationary storage tanks on our customers’ premises. Tank ownership and control at customer locations are important components of our operations and customer retention, and account for approximately half of our retail volumes. The capacity of these storage tanks ranges from approximately 100 gallons to approximately 12,000 gallons, with a typical tank having a capacity of 250 to 500 gallons. We also offer a propane supply commitment program to customers who own their own tanks that we believe increases customer loyalty. Under the program, customers receive progressively larger discounts off our posted prices each year that they remain as our customer. We also offer our customers a budget payment plan whereby the customer’s estimated annual propane purchases and service contracts are paid for in a series of estimated equal monthly payments over a twelve-month period.

In Arizona, our subsidiary, Alliant Arizona Propane, L.L.C., sells propane to residential and commercial customers through regulated central distribution systems in Payson and Page, Arizona that utilize pipelines to distribute propane through meters at the customer’s location. Alliant Arizona Propane, L.L.C. is a regulated utility that receives a fixed cost-plus fee for propane sold. Another subsidiary, Alliant Gas, serves 25 communities in Texas and two communities in Arizona through regulated central distribution systems pursuant to long-term contracts. Net customer turnover at Alliant Gas is nearly zero.

Commercial. Our commercial customers include a mix of industrial customers, hotels, restaurants, churches, warehouses and retail stores. These customers generally use propane for the same purposes as our residential customers as well as industrial, oilfield service and agricultural customers, who use propane and refined fuels, such as gasoline and diesel, for heating requirements and as fuel to power over-the-road vehicles, forklifts and stationary engines.

Wholesale. Our wholesale customers are principally governmental agencies and other propane distributors. Our LPG transports, which are large trucks that have capacities ranging from 9,000 to 11,500 gallons, load propane at third-party supply points for delivery directly to tanks located on the property of our wholesale customers.

Product supply. We utilize approximately 20 domestic sources of propane supply, including spot market purchases, with four suppliers providing a substantial portion of our propane. Our propane supply contracts are typically from agreements with one-year terms and standard commercial provisions. During the years ended December 31, 2014 and December 31, 2013, we purchased the majority of our propane needs from these four suppliers.

Our supply group manages and sources propane to ensure secure and reliable supply throughout the year. Our LPG transports pick up propane at our supply points, typically refineries, natural gas processing and fractionation plants or LPG storage terminals, for delivery to our customer service centers and our wholesale customers. Supplies of propane from our sources historically have been readily available. During the years ended December 31, 2014 and December 31, 2013, approximately 87% and 76%, respectively, of our propane supply was purchased under supply agreements, which typically have a term of one year, and the remainder on the spot market.

Our supply contracts typically provide for pricing based upon (i) index formulas using the current prices established at a major storage point such as Mont Belvieu, Texas, or Conway, Kansas or (ii) posted prices at the time of delivery. We use a variety of delivery methods, including our LPG transports and common carrier transports, to transport propane from suppliers to our customer service locations as well as various third-party storage facilities and terminals located in strategic areas across our area of operations. In order to manage our cost of propane, we enter into hedging arrangements on all fixed-price contracts.

NGL Transportation

In October 2013 we expanded our NGL distribution and sales segment by acquiring a fleet of approximately 43 hard shell tank trucks that gather and transport NGLs and condensate for producers, gas processing plants, refiners and fractionators located in the Eagle Ford shale and Permian Basin. For the years ended December 31, 2014 and December 31, 2013, our NGL transportation trucks transported approximately 311,733 gallons per day and 203,005 gallons per day, respectively, of NGLs.

Competition

Crude oil pipelines and storage. We are subject to competition from other crude oil pipelines, crude oil storage tank operators and crude oil marketing companies that may be able to transport or store crude oil at more favorable prices or transport crude oil greater distance or to more favorable markets. We compete with national, regional and local crude oil pipeline transportation and storage companies, including the major integrated oil companies, of widely varying sizes, financial resources and experience. Our competitors in our crude oil storage segment include Plains All American Pipeline, L.P., Occidental Petroleum Corporation, SemGroup Corporation, Rose Rock Midstream, L.P., Blueknight Energy Partners, L.P., Medallion Midstream LLC and Enterprise Products Partners L.P.

Crude oil supply and logistics. We are subject to competition from other providers of crude oil supply and logistics services that may be able to supply our customers with the same or comparable services on a more competitive basis. We compete with national, regional and local storage, gathering, transportation and pipeline companies, including the major integrated oil companies, of widely varying sizes, financial resources and experience. Our competitors in this segment include Plains All American Pipeline, L.P., Rose Rock Midstream, L.P., Blueknight Energy Partners, L.P., SemGroup Corporation, Sunoco Logistics, Enterprise Products Partners L.P., Genesis Energy, L.P. and NGL Energy Partners L.P.

Refined products terminals and storage. Our refined products terminals located in North Little Rock, Arkansas and Caddo Mills, Texas compete with other independent terminals on price, versatility and services provided. The competition primarily comes from integrated petroleum companies, refining and marketing companies, independent terminal companies and distribution companies with marketing and trading activities. In the North Little Rock, Arkansas market, these competitors include Magellan Midstream Partners LP and HWRT Oil Company, LLC. In Dallas, Texas, the market served by our Caddo Mills, Texas terminal, these competitors include Valero Energy Corporation, Delek Logistics Partners, LP, Magellan Midstream Partners LP and Flint Hills Resources LP.

NGL distribution and sales. In addition to competing with suppliers of other energy sources such as natural gas, our NGL distribution and sales segment competes with other retail propane distributors. The retail propane industry is highly fragmented and competition generally occurs on a local basis with other large full-service multi-state propane marketers,

thousands of smaller local independent marketers and farm cooperatives. The large, full-service multi-state marketers we compete with include Ferrellgas, L.P. and AmeriGas Partners, L.P. Each of our customer service centers operates in its own competitive environment because retail marketers tend to be located in close proximity to customers in order to lower the cost of providing service. Our typical customer service center has an effective marketing radius of approximately 50 miles, although in certain areas the marketing radius may be extended by one or more satellite offices. Most of our customer service centers compete with five or more marketers or distributors.

Customers

We rely on a limited number of customers for a substantial portion of our revenues. Glencore, Ltd., Chesapeake Energy Marketing, Inc. and Phillips 66 each accounted for 10% or more of our total revenue for the year ended December 31, 2014, at approximately 37%, 10% and 10%, respectively.

Seasonality

Weather conditions have a significant impact on the demand for our products, particularly propane and refined fuels for heating purposes. Many of our customers rely on propane primarily as a heating source. Accordingly, the volumes sold are directly affected by the severity of the winter weather in our service areas, which can vary substantially from year to year. In any given area, sustained warmer than normal temperatures, as was the case in the heating season over the last three years throughout our operating territories, will tend to result in reduced propane, fuel oil and natural gas consumption, while sustained colder than normal temperatures will tend to result in greater consumption. Meanwhile, our cylinder exchange operations experience higher volumes in the spring and summer, which includes the majority of the grilling season. Sustained periods of poor weather, particularly in the grilling season, can negatively affect our cylinder exchange revenues. In addition, poor weather may reduce consumers’ propensity to purchase and use grills and other propane-fueled appliances, thereby reducing demand for cylinder exchange.

The volume of propane used by customers of our NGL sales business is higher during the first and fourth calendar quarters and lower during the second and third calendar quarters. Conversely, the volume of propane that we sell through our cylinder exchange business is higher during the second and third calendar quarters and lower in the first and fourth calendar quarters. We believe that our combination of our winter-weighted NGL sales business with our higher-margin, summer-weighted cylinder exchange business reduces overall seasonal fluctuations in volumes and financial results, as our cylinder exchange business is more active in summer months and our NGL sales business is more active in winter months. The impact of seasonality is also mitigated by non-heating related demand throughout the year for propane for oilfield services, fuel for automobiles and for industrial applications, such as forklifts, mowers and generators. For the year ended December 31, 2014, we sold approximately 73 million gallons of NGLs in our cylinder exchange and NGL sales businesses, selling approximately 43% in the second and third quarters of 2014 and 57% in the first and fourth quarters of 2014.

The volume of product that is handled, transported, throughput or stored in our refined products terminals is directly affected by the level of supply and demand in the wholesale markets served by our terminals. Overall supply of refined products in the wholesale markets is influenced by the absolute prices of the products, the availability of capacity on delivering pipelines and vessels, fluctuating refinery margins and the market’s perception of future product prices. Although demand for gasoline typically peaks during the summer driving season, which extends from April to September, and declines during the fall and winter months, most of the revenues generated at our refined products terminals do not experience any effects from such seasonality. However, the butane blending operations at our refined products terminals are affected by seasonality because of federal regulations governing seasonal gasoline vapor pressure specifications. Accordingly, we expect that the revenues we generate from butane blending will be highest in the winter months and lowest in the summer months.

Insurance

Our assets may experience physical damage as a result of an accident or natural disaster. These hazards can also cause personal injury and loss of life, severe damage to and destruction of property and equipment, pollution or environmental damage and suspension of operations. We maintain our own property, business interruption and pollution liability insurance policies at varying levels of deductibles and limits that we believe are reasonable and prudent under the circumstances to cover our operations and assets. As we continue to grow, we will continue to evaluate our policy limits and retentions as they relate to the overall cost and scope of our insurance program.

Regulation of the Industry and Our Operations

Crude Oil

We own and operate a fleet of trucks to transport crude oil. We are licensed to perform both intrastate and interstate motor carrier services and are subject to certain safety regulations issued by the DOT. DOT regulations cover, among other things, driver operations, maintaining log books, truck manifest preparations, the placement of safety placards on trucks and trailer vehicles, drug and alcohol testing, safety of operation and equipment and many other aspects of our trucking operations. Our trucking operations are also subject to regulations and oversight by the Occupational Safety and Health Administration. Additionally, our Silver Dollar Pipeline System is subject to the regulatory oversight of the Texas Railroad Commission and the DOT’s Pipeline and Hazardous Materials Safety Administration (“PHMSA”).

Refined Products and NGLs

All states in which we operate have adopted fire safety codes that regulate the storage and distribution of propane. In some states, these laws are administered by state agencies, and in others they are administered on a municipal level. We maintain various permits necessary to ensure that our operations comply with applicable regulations. We conduct training programs to help ensure that our operations are in compliance with applicable governmental regulations. With respect to general operations, certain National Fire Protection Association (“NFPA”) Pamphlets, including Nos. 54 and 58 and/or one or more of various international codes (including international fire, building and fuel gas codes) establish rules and procedures governing the safe handling of propane, or comparable regulations, which have been adopted by all states in which we operate. In addition, Alliant Arizona Propane, LLC is subject to regulation by the Arizona Corporation Commission and Alliant Gas, LLC is subject to regulation by the Texas Railroad Commission. We believe that the policies and procedures currently in effect at all of our facilities for the handling, storage and distribution of propane are consistent with industry standards and are in compliance in all material respects with applicable environmental, health and safety laws.

With respect to the transportation of NGLs, including propane, by truck, we are subject to regulation by PHMSA under the Federal Motor Carrier Safety Act and the Homeland Security Act of 2002, among other statutes. Our propane gas pipeline systems are also subject to regulation by the PHMSA under the Natural Gas Pipeline Safety Act of 1968, which applies to, among other things, a propane gas system that supplies ten or more residential customers or two or more commercial customers from a single source and to a propane gas system any portion of which is located in a public place. The DOT’s pipeline safety regulations require operators of all gas systems to train employees and third-party contractors, establish written procedures to minimize the hazards resulting from gas pipeline emergencies and conduct and keep records of inspections and testing.

PHMSA requires pipeline operators to implement integrity management programs, including more frequent inspections and other measures to ensure pipeline safety in high-consequence areas (“HCAs”), defined as those areas that are unusually sensitive to environmental damage, that cross a navigable waterway, or that have a high population density. The regulations require operators, including us, to (i) perform ongoing assessments of pipeline integrity, (ii) identify and characterize applicable threats to pipeline segments that could impact a HCA, (iii) improve data collection, integration and analysis, (iv) repair and remediate pipelines as necessary and (v) implement preventive and mitigating actions.

The Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011, among other things, increases the maximum civil penalty for pipeline safety violations and directs the Secretary of Transportation to promulgate rules or standards relating to expanded integrity management requirements, automatic or remote-controlled valve use, excess flow valve use, leak detection system installation and testing to confirm the material strength of pipe operating above 30% of specified minimum yield strength in high consequence areas. Effective October 25, 2013, PHMSA adopted new rules increasing the maximum administrative civil penalties for violation of the pipeline safety laws and regulations after January 3, 2012 to $200,000 per violation per day, with a maximum of $2,000,000 for a related series of violations. PHMSA also has published an advisory bulletin providing guidance on verification of records related to pipeline maximum operating pressure. We have performed hydrotests of our facilities to confirm the maximum operating pressure and do not expect that any final rulemaking by PHMSA regarding verification of maximum operating pressure would materially affect our operations or revenue.

States are largely preempted by federal law from regulating pipeline safety for interstate lines but most states are certified by the DOT to assume responsibility for enforcing federal intrastate pipeline regulations and inspection of intrastate pipelines. States may adopt stricter standards for intrastate pipelines than those imposed by the federal government for interstate lines; however, states vary considerably in their authority and capacity to address pipeline safety. State standards may include requirements for facility design and management in addition to requirements for pipelines.

Management believes that the policies and procedures currently in effect at all of our propane gas systems are consistent with industry standards and are in compliance with applicable law. Due to our ownership and control of these gas utility companies, we are required to notify FERC of our status as a holding company. We filed such a notification of holding company status and we qualified for an exemption from FERC accounting regulations and access to our books and records because we are a holding company solely by reason of our interests in local gas distribution systems.

Environmental Matters

General

Our operations are subject to stringent and complex federal, state and local laws and regulations relating to the protection of the environment. As an owner or operator of certain terminals, storage and transportation facilities, we must comply with these laws and regulations at the federal, state and local levels. These laws and regulations can restrict or impact our business activities in many ways, such as:

· requiring the installation of pollution-control equipment or otherwise restricting the way we operate;

· limiting or prohibiting construction activities in sensitive areas, such as wetlands, coastal regions or areas inhabited by endangered or threatened species;

· delaying system modification or upgrades during permit reviews;

· requiring investigatory and remedial actions to mitigate pollution conditions caused by our operations or attributable to former operations; and

· enjoining the operations of facilities deemed to be in non-compliance with permits issued pursuant to or permit requirements imposed by such environmental laws and regulations.

Failure to comply with these laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties. Certain environmental statutes impose strict joint and several liability for costs required to clean up and restore sites where hazardous substances, hydrocarbons or wastes have been disposed or otherwise released. Moreover, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the release of hazardous substances, hydrocarbons or other waste products into the environment.

We do not believe that compliance with federal, state or local environmental laws and regulations will have a material adverse effect on our business, financial position or results of operations or cash flows. In addition, we believe that the various environmental activities in which we are presently engaged are not expected to materially interrupt or diminish our operational ability. We cannot assure you, however, that future events, such as changes in existing laws or enforcement policies, the promulgation of new laws or regulations or the development or discovery of new facts or conditions will not cause us to incur significant costs. Below is a discussion of the material environmental laws and regulations that relate to our business.

Hazardous Substances and Waste

Our operations are subject to environmental laws and regulations relating to the management and release of solid and hazardous wastes and other substances, including hydrocarbons. These laws generally regulate the generation, storage, treatment, transportation and disposal of solid and hazardous waste and may impose strict joint and several liability for the investigation and remediation of affected areas where hazardous substances may have been released or disposed. For instance, the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”), and comparable state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons that contributed to the release of a hazardous substance into the environment. We may handle hazardous substances within the meaning of CERCLA, or similar state statutes, in the course of our ordinary operations and, as a result, may be jointly and severally liable under CERCLA for all or part of the costs required to clean up sites at which these hazardous substances have been released into the environment.

We also generate industrial wastes that are subject to the requirements of the Resource Conservation and Recovery Act (“RCRA”) and comparable state statutes. While RCRA regulates both solid and hazardous wastes, it imposes strict

requirements on the generation, storage, treatment, transportation and disposal of hazardous wastes. We generate little hazardous waste. However, it is possible that wastes currently designated as non-hazardous, which could include wastes currently generated during our operations, will in the future be designated as “hazardous wastes” and, therefore, be subject to more rigorous and costly disposal requirements. Moreover, from time to time, the EPA and state regulatory agencies have considered the adoption of stricter disposal standards for non-hazardous wastes, including natural gas wastes. Any such changes in the laws and regulations could have a material adverse effect on our maintenance capital expenditures and operating expenses or otherwise impose limits or restrictions on our operations or those of our customers.

We currently own or lease properties where hydrocarbons are being or have been handled for many years. Although previous operators have utilized operating and disposal practices that were standard in the industry at the time, hydrocarbons or other wastes may have been disposed of or released on or under the properties owned or leased by us or on or under the other locations where these hydrocarbons and wastes have been transported for treatment or disposal. These properties and the wastes disposed thereon may be subject to CERCLA, RCRA and analogous state laws. Under these laws, we could be required to remove or remediate previously disposed wastes (including wastes disposed of or released by prior owners or operators), to clean up contaminated property (including contaminated groundwater) or to perform remedial operations to prevent future contamination. We are not currently aware of any facts, events or conditions relating to such requirements that could materially impact our operations or financial condition.

Oil Pollution Act

Th Oil Pollution Act (“OPA”) requires the preparation of a Spill Prevention Control and Countermeasure Plan (“SPCC”) for facilities engaged in drilling, producing, gathering, storing, processing, refining, transferring, distributing, using, or consuming oil and oil products, and which due to their location, could reasonably be expected to discharge oil in harmful quantities into or upon the navigable waters of the United States. The owner or operator of an SPCC-regulated facility is required to prepare a written, site-specific spill prevention plan, which details how a facility’s operations comply with the requirements. To be in compliance, the facility’s SPCC plan must satisfy all of the applicable requirements for drainage, bulk storage tanks, tank car and truck loading and unloading, transfer operations (intrafacility piping), inspections and records, security, and training.

Air Emissions

Our operations are subject to the Clean Air Act (“CAA”) and comparable state and local laws and regulations. These laws and regulations regulate emissions of air pollutants from various industrial sources and also impose various monitoring and reporting requirements. Such laws and regulations may require us to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly increase air emissions, obtain and strictly comply with air permits containing various emissions and operational limitations and utilize specific emission control technologies to limit emissions. Our failure to comply with these requirements could subject us to monetary penalties, injunctions, conditions or restrictions on operations and criminal enforcement actions. We may be required to incur certain capital expenditures in the future for air pollution control equipment in connection with obtaining and maintaining operating permits and approvals for air emissions.

On August 20, 2010, the EPA published regulations to control emissions of hazardous air pollutants from existing stationary reciprocating internal combustion engines, which was later amended in response to several petitions for reconsideration. The rule requires us to make certain expenditures and undertake certain activities, including the purchase and installation of emissions control equipment (e.g. oxidation catalysts, non-selective catalytic reduction equipment) on our engines following prescribed maintenance practices. In addition, on June 28, 2011, the EPA issued a final rule that establishes new source performance standards for manufacturers, owners and operators of new, modified and reconstructed stationary internal combustion engines. This rule requires us to purchase, install, monitor and maintain emissions control equipment.

Water Discharges

The Clean Water Act (“CWA”) and analogous state laws impose restrictions and strict controls regarding the discharge of pollutants into regulated waters and impose requirements affecting our ability to conduct construction activities in waters and wetlands.. In addition, these laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. These permits may require us to monitor and sample the storm water runoff from certain of our facilities. Some states also maintain groundwater protection programs that require permits for discharges or operations that may impact groundwater conditions. Federal and state regulatory agencies can impose

administrative, civil and criminal penalties for non-compliance with discharge permits or other requirements of the CWA and analogous state laws and regulations.

Endangered Species

The Endangered Species Act (“ESA”) restricts activities that may affect endangered or threatened species or their habitats. In addition, as a result of a settlement approved by the United States District Court for the District of Columbia on September 9, 2011, the United States Fish and Wildlife Service is required to consider listing more than 250 species as endangered under the Endangered Species Act. Under the September 9, 2011 settlement, the United States Fish and Wildlife Service is required to review and address the needs of more than 250 species on the candidate list over a 6-year period. The designation of previously unprotected species as threatened or endangered in areas where we or our oil and propane exploration and production customers operate could cause us or our customers to incur increased costs arising from species protection measures and could result in delays or limitations in our customers’ performance of operations, which could reduce demand for our services.

Hydraulic Fracturing

Increased regulation of hydraulic fracturing could result in reductions or delays in crude oil, natural gas and NGL production by our customers, which could materially adversely impact our revenues. Hydraulic fracturing involves the injection of water, sand and chemicals under pressure into geographic formations to stimulate hydrocarbon production. Although we do not engage in hydraulic fracturing activities, an increasing percentage of hydrocarbon production by our customers and suppliers is developed from unconventional sources, such as shales, that require hydraulic fracturing as part of the completion process. Hydraulic fracturing is typically regulated by state oil and gas commissions. Some states, including those in which we operate, have adopted, and other states are considering adopting, regulations that could impose more stringent disclosure and/or well construction requirements on hydraulic fracturing operations. In addition, a number of federal agencies, including the EPA and the Department of Energy, are analyzing, or have been requested to review, a variety of environmental issues associated with hydraulic fracturing, and have asserted federal regulatory authority over the process. Moreover, Congress from time to time has proposed legislation to more closely and uniformly regulate hydraulic fracturing at the federal level. If new laws or regulations that significantly restrict hydraulic fracturing are adopted, such laws could make it more difficult or costly for our customers to perform fracturing to stimulate production from tight formations. Restrictions on hydraulic fracturing could also reduce the volume of hydrocarbons that our customers produce, and could thereby adversely affect our revenues and results of operations.

Climate Change

On December 15, 2009, the EPA published its findings that emissions of carbon dioxide, methane and other greenhouse gases (“GHGs”) present an endangerment to public health and the environment because emissions of such gases are contributing to warming of the earth’s atmosphere and other climatic changes. These findings allow the EPA to adopt and implement regulations that restrict emissions of GHGs under existing provisions of the Clean Air Act (“CAA”). Accordingly, the EPA adopted emissions limits for motor vehicles, which then triggered the development and adoption of construction and operating permit requirements under the Prevention of Significant Deterioration and Title V programs for certain stationary sources. In addition, the EPA has adopted a mandatory GHG emissions reporting program that imposes reporting and monitoring requirements on various types of facilities and industries. In November 2010, the EPA expanded its GHG reporting rule to include onshore and offshore oil and natural gas production, processing, transmission, storage, and distribution facilities, requiring reporting of GHG emissions from such facilities on an annual basis. In December 2014, the EPA proposed additional amendments to its greenhouse gas reporting rule, which could add reporting requirements for additional facilities.

While Congress has from time to time considered legislation to reduce emissions of GHGs, there has not been significant activity in the form of adopted legislation to reduce GHG emissions at the federal level in recent years. In the absence of federal climate legislation in the United States, a number of state and regional efforts have emerged that are aimed at tracking or reducing GHG emissions by means of cap and trade programs that typically require major sources of GHG emissions, such as electric power plants, to acquire and surrender emission allowances in return for emitting those GHGs. If Congress undertakes comprehensive tax reform, it is possible that such reform may include a carbon tax, which could impose additional direct costs on operations and reduce demand for refined products.

Although it is not possible at this time to predict how legislation or new regulations that may be adopted to address GHG emissions would affect our business, any such future laws and regulations could require us to incur increased operating costs, such as costs to purchase and operate emissions control systems, acquire emissions allowances or comply with new regulatory or reporting requirements, including the imposition of a carbon tax. Any such legislation or regulatory programs

could also increase the cost of consuming, and thereby reduce demand for, oil and gas, which could reduce the demand for crude oil or refined products produced or distributed by our customers, which could in turn reduce revenues we are able to generate by providing services to our customers. Accordingly, legislation and regulatory programs to reduce emissions of GHGs could have an adverse effect on our business, financial condition and results of operations. Also, some scientists have concluded that increasing concentrations of GHGs in the Earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, droughts, floods and other climatic events. If any such effects were to occur, they could have an adverse effect on our financial condition and results of operations.

Anti-terrorism Measures

Certain of our bulk storage facilities are also subject to regulation by the Department of Homeland Security (“DHS”). The Department of Homeland Security Appropriation Act of 2007 requires the DHS to issue regulations establishing risk-based performance standards for the security of chemical and industrial facilities, including oil and gas facilities that are deemed to present “high levels of security risk.” The DHS issued an interim final rule in April 2007 regarding risk-based performance standards to be attained pursuant to this act and, on November 20, 2007, further issued an Appendix A to the interim rules that establish chemicals of interest and their respective threshold quantities that will trigger compliance with these interim rules. Covered facilities that are determined by DHS to pose a high level of security risk will be required to prepare and submit Security Vulnerability Assessments and Site Security Plans as well as comply with other regulatory requirements, including those regarding inspections, audits, recordkeeping, and protection of chemical-terrorism vulnerability information.

Trademarks and Tradenames