Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CarParts.com, Inc. | d889013d8k.htm |

Investor

Presentation Exhibit 99.1 |

Safe

Harbor 2

This

presentation

may

contain

certain

forward-looking statements and

management

may make additional forward-looking statements in response to your

questions. These statements do not guarantee future performance and

speak only as of the date hereof, and qualify for the safe harbor provided by

Section 21E of the Securities Exchange Act of 1934, as amended, and Section

27A of the Securities Act of 1933. We refer all of you to the risk

factors contained in US Auto Parts Annual Report on Form 10-K and

quarterly reports on Form 10-Q filed with the Securities and Exchange

Commission,

for

more

detailed

discussion

on

the

factors

that

can

cause

actual

results to differ materially from those projected in any forward-looking

statements. |

Case

for Investment 3

Large and Growing Online Market

Significant Customer Reach

Significant Private Label Offering

Experienced Leadership Team |

4

Total revenue $283.4M

Sales up 11% for the year

Adjusted EBITDA was $8.1M

Adjusted EBITDA up 35% from $6.0M in FY-13

Highlights from FY-14

Earnings Call

* Revenue includes $3.6M in sales and $0.1M in EBITDA for additional week

|

At

9.7% online market penetration, auto parts still lags industry average in the teens.

US Auto Parts is the largest pure-play online retailer of auto parts

1

AASA estimates

2

Estimates by US Auto Parts where amounts are not publicly reported & we

estimate the total online DIY

market

to

be

larger

than

the

$3.8B

that

is

reported

in

the

2014

AAIA

Fact

Book

3

Excludes AutoAnything which is wholly owned by AutoZone

Do It Yourself (DIY) Market Size

Company

2013 Est. Rev²

% of total

Marketplaces

(in million)

eBay Motors

$2,200

47.6%

Amazon

$600

13.0%

Sub Total

$2,800

60.6%

Wholesale Online

Tire Rack (online)

$440

9.5%

Other Tire Companies

$190

4.1%

Sub Total

$630

13.6%

Pure Play

US Auto Parts

$250

5.4%

Rock Auto

$180

3.9%

Summit

$170

3.7%

Auto Anything

(AutoZone)

$120

2.6%

JEGS

$70

1.5%

CarID

$60

1.3%

All Other Pure Play

$90

1.9%

Sub Total

$940

20.3%

Brick & Mortar Retailers

AutoZone

(w/o

AA)

3

$110

2.4%

Advance

$80

1.7%

Pep

$30

0.6%

O'Reilly

$20

0.4%

NAPA

$10

0.2%

Sub Total

$250

5.4%

Total

4,620

100.0%

Total

DIY

Market

Size

for

2013

of

47.2B

1

$42.6B

$4.6B

9.7%

90.3%

5 |

Booz & Co. estimates by 2018 that Online DIY

could reach 17% of the total DIY market

6

Online Market is Vibrant and Growing

Aftermarket e-Commerce Overview

DIY Online Penetration

Mean Light Vehicle age

Source: R.L. Polk and BB&TCM

Source: Booz & Co.

The average age of a light vehicle on the road

continues to increase each year since 1997

1

2014 is estimated by IHS |

Offline

$42.6

$43.5

$44.2

$44.8

$45.3

$45.5

Online

4.6

5.5

6.6

8.0

9.5

11.5

Total

$47.2

$49.0

$50.9

$52.8

$54.8

$56.9

% Online

9.8%

11.3%

13.0%

15.1%

17.4%

20.1%

7

Do It Yourself (DIY) Projections¹

1

Projections obtained from AAIA 2014 Digital Automotive Aftermarket Fact Book and

March 2014 AASA Digital Disruption: e-tailing in the Automotive Aftermarket Report

DIY Projected Revenue (in Billions) |

(some overlap of monthly visitors across websites)

8

Competitive sites’

traffic based on Compete December 2014 reports

US Auto Parts Dominant Reach-

Largest Pure Play Internet Retailer

Over 500 man years of hand written unique content

Long domain history to help indexing in search

Multiple website management

Customer Reach is a Competitive Moat |

9

Broad Auto Parts Product Offering

Body Parts

Engine Parts

Performance & Accessories

*Represents USAP online mix

30%

50%

20%

Revenue*

US

Auto

Parts

has

one

of

the

largest

product

offerings

with

over

1.6 million

products across body parts, engine parts, and performance & accessories

Broad Auto Parts Product Offering

Brake

Discs

Catalytic

Converters

Radiators

Headers

Oxygen

Sensors

Alternators

Exhaust

Driveshaft

Fuel Injection /

Delivery

Lamps

Mirrors

Bumpers

Hoods

Tailgates

Doors

Grills

Wheels

Window

Regulators

Seat Covers

Car Covers

Floor Mats /

Carpeting

Cold Air

Intakes

Vent Visors

Tonneau

Covers

Nerf Bars

Bug Shields

Car Bras |

–

Currently over 40,000 Private Label Products.

–

Adding 6,000 –

7,000 Private Label SKUs this year

–

The Company sources product directly from over 200 factories in Asia

10

Margin %

In-Stock

Private Label

(Asia Sourced)

Branded

(U.S. Sourced)

30% -

60%

15% -

30%

5% -

20%

Drop Shipped

Current Mix

58%

42%

Current Mix

66%

34%

The

breadth

of

our

Private

Label

products

provides

a

significant

competitive

moat

USAP’s Supply Chain Creates

Pricing Advantage

USAP’s ability to competitively price products while maintaining healthy

margins is a function of the Company’s ability to leverage its robust

private label supply chain. |

Revenue

100%

Gross Margins

26% -

29%

Variable OPEX Costs

15%

Fixed Cost

0%

Incremental Flow

11% -

14%

11

Incremental Flow Thru

Growth and Profitability |

12

Our business model has significant cost leverage as revenues grow

1.

Excludes stock based compensation, depreciation and amortization

2.

For every incremental year required to achieve growth levels, fixed expenses

increase $1.0M or 3% Financial Sensitivity

Base

10%

20%

30%

40%

50%

Revenue

$275

$303

$330

$358

$385

$413

Gross Margin %

26.0%

–

29.0%

26.0%

–

29.0%

26.0%

–

29.0%

26.0%

–

29.0%

26.0%

–

29.0%

26.0%

–

29.0%

Variable:

Fulfillment

3.3%

3.3%

3.3%

3.3%

3.3%

3.3%

Marketing

9.3%

9.3%

9.3%

9.3%

9.3%

9.3%

Technology

0.6%

0.6%

0.6%

0.6%

0.6%

0.6%

G&A

1.8%

1.8%

1.8%

1.8%

1.8%

1.8%

Total Variable

15.0%

15.0%

15.0%

15.0%

15.0%

15.0%

Fixed:

Fulfillment

2.0%

1.8%

1.7%

1.6%

1.5%

1.4%

Marketing

4.1%

3.7%

3.4%

3.1%

2.9%

2.7%

Technology

1.0%

0.9%

0.8%

0.8%

0.7%

0.7%

G&A

4.0%

3.6%

3.3%

3.1%

2.8%

2.7%

Total Fixed

11.1%

10.1%

9.2%

8.5%

7.9%

7.4%

Adjusted EBITDA %

-0.1%

–

2.9%

0.9%

–

3.9%

1.7%

–

4.7%

2.5%

–

5.5%

3.1%

–

6.1%

3.6%

–

6.6%

Adjusted EBITDA $

($0)

–

$8

$3

–

$12

$6

–

$16

$9

–

$19

$12

–

$23

$15

–

$27 |

13

AutoMD –

Repair Lead Generation Site

Overview

•

Repair

lead

generation

site

addresses

the

DIFM market

Recent Strategic Investment

•

$12.5M pre-money valuation

•

Raised $7.0M in capital

•

Fed Mogul: $3.0M

•

Cox Automotive: $2.0M

•

Insiders: $2.0M

•

Post-funding valuation of $19.5M

•

USAP in control with 64% of the

business

•

There are approximately 2,000 shops on

the program currently and growing |

Case for Investment

14

Large and Growing Online Market

Significant Customer Reach

Significant Private Label Offering

Experienced Leadership Team |

15

Shane Evangelist -

Chief Executive Officer

Chief

Executive

Officer

since

October

2007

with

over

10

years

of

leading

internet businesses

Senior Vice President and General Manager of Blockbuster Online

Vice President of Strategic Planning for Blockbuster Inc.

B.A. degree in Business Administration from the University of New Mexico

and a M.B.A. from Southern Methodist University

Michael Yoshida-

Interim Chief Financial Officer

Interim Chief Financial Officer since September 2008

Prior to his appointment as the Company's Principal Accounting Officer

and

Interim

Chief

Financial

Officer,

Mr.

Yoshida

has

served

as

the

Controller of the Company since 2009.

Vice

President

Finance

and

Controller

for

Hot

Topic,

Inc.

Senior

Director

of

Finance

and

Controller

for

Bristol

Farms

Chief Financial Officer, Vice President Finance at Farmers Market

B.S.

degree

in

Accounting

from

the

University

of

Southern

California

and

an

M.B.A.

from

the

California

State

University,

Los

Angeles

and

is a

Certified Public Accountant.

Aaron E. Coleman -

Chief Operating Officer

Chief Operating Officer since September 2010, and was Executive Vice

President of Operations and CIO from April 2008 until September 2010

with over 18 years of e-commerce experience

Senior

Vice

President

–

Online

Systems

at

Blockbuster

Inc.

Multiple positions with internet and technology companies including

American Airlines, Travelweb (Priceline), Baan

B.A. degree in Business Administration from Gonzaga University

Leadership Team

Charles Fischer -

Senior Vice President of Global

Procurement

Senior Vice President of Global Sourcing and Procurement since May

2008 with over 30 years of global sourcing experience

Vice President, Supply Chain Management for Keystone Automotive

Industries

Director, Business Development for Modern Engineering

Multiple leadership positions with multiple companies in the automotive

aftermarket industry |

16

Over $19M of costs have been reduced over a two year period

Adjusted EBITDA

(Non-GAAP Financial Measure –

in thousands)

Fourteen

Weeks Ended

Fiscal Year Ended

January 3

December 28

January 3

December 28

2015

2013

2015

2013

Net loss

(2,613)

$

(1,325)

$

(7,086)

$

(15,634)

$

Interest expense, net

317

276

1,101

972

Income tax provision

70

(48)

138

43

Amortization of intangible assets

106

82

422

381

Depreciation and amortization expense

2,090

2,439

8,923

12,175

EBITDA

(30)

1,424

3,498

(2,063)

Share-based compensation expense

680

198

2,371

1,263

Impairment loss on property and equipment

-

-

-

4,832

Impairment loss on intangible assets

-

-

-

1,245

Inventory write-down related to Carson closure

419

-

897

-

Restructuring costs

102

-

1,137

723

Adjusted EBITDA

1,171

$

1,622

$

7,903

$

6,000

$

Thirteen

Weeks Ended |

17

Consolidated Statements of Comprehensive

Operations

(Unaudited, in Thousands, Except Per Share Data)

(1)

Excludes

depreciation

and

amortization

expense

which

is

included

in

marketing,

general

and

administrative

and

fulfillment

expense.

Fourteen

Weeks Ended

Fiscal Year Ended

January 3

December 28

January 3

December 28

2015

2013

2015

2013

Net sales

70,568

$

59,735

$

283,508

$

254,753

$

Cost of sales

(1)

51,653

42,260

205,058

180,620

Gross profit

18,915

17,475

78,450

74,133

Operating expenses:

Marketing

10,652

9,284

42,008

41,045

General and administrative

4,169

3,941

16,701

17,567

Fulfillment

5,017

4,112

20,368

18,702

Technology

1,223

1,093

4,863

5,128

Amortization of intangible assets

106

82

422

381

Impairment loss on property and equipment

-

-

-

4,832

Impairment loss on intangible assets

-

-

-

1,245

Total operating expenses

21,167

18,512

84,362

88,900

Loss from operations

(2,252)

(1,037)

(5,912)

(14,767)

Other income (expense):

Other income, net

26

(66)

65

148

Interest expense

(317)

(270)

(1,101)

(972)

Total other expense, net

(291)

(336)

(1,036)

(824)

Loss before income taxes

(2,543)

(1,373)

(6,948)

(15,591)

Income tax (benefit) provision

70

(48)

138

43

Net loss including noncontrolling interests

(2,613)

(1,325)

(7,086)

(15,634)

Net Loss attributable to non-controlling interests

(207)

-

(207)

Net loss attributable to U.S. Auto Parts

(2,406)

(1,325)

(6,879)

(15,634)

Other comprehensive income attributable to U.S. Auto Parts, net of

tax: Foreign currency translation adjustments

-

24

19

55

Actuarial loss on defined benefit plan

(106)

-

(106)

-

Unrealized gains on investments

-

3

-

7

Total other comprehensive income attributable to U.S. Auto Parts

(106)

27

(87)

62

Comprehensive loss attributable to U.S. Auto Parts

(2,512)

$

(1,298)

$

(6,966)

$

(15,572)

$

Basic and diluted net loss per share

(0.07)

$

(0.04)

$

(0.21)

$

(0.48)

$

Shares used in computation of basic and

diluted net loss per share

33,573

33,308

33,489

32,697

Thirteen

Weeks Ended |

18

Consolidated Balance Sheet

(Unaudited, in Thousands, Except Par and Per Share Liquidation value)

January 3

December 28

ASSETS

2015

2013

Current assets:

Cash and cash equivalents

7,653

$

818

$

Short-term

investments 62

47

Accounts receivable, net of allowances of $41 and

$213 at January 3,

2015 and December 28, 2013, respectively 3,804

5,029

Inventory

48,362

36,986

Other current assets

2,669

3,234

Total current assets 62,550

46,114

Property and equipment, net

16,966

19,663

Intangible assets, net

1,707

1,601

Other non-current assets

1,684

1,804

Total assets 82,907

$

69,182

$

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

25,362

$

19,669

$

Accrued expenses

7,747

5,959

Revolving loan

payable 11,022

6,774

Current portion of

capital leases payable 269

269

Other current liabilities 3,505

3,682

Total current liabilities 47,905

36,353

Capital leases payable, net of current portion

9,270

9,502

Deferred income taxes

1,618

335

Other non-current

liabilities 1,891

2,126

Total liabilities 60,684

48,316

Commitments and contingencies

Stockholders' equity:

Series A convertible preferred stock, $0.001 par

value; $1.45 per share

liquidation value or

aggregate of $6,017; 4,150 shares authorized; 4,150

shares issued and outstanding at

1/3/15 and 12/28/13, respectively 4

4

Common stock, $0.001 par value; 100,000 shares

authorized; 33, 624 shares &

33,352 shares issued and

outstanding at 1/3/15 & 12/28/13, 2013, respectively

33

33

Additional paid-in capital

174,369

168,693

Common stock dividend distributable on

Series A convertible preferred stock -

60

Accumulated other comprehensive income

360

446

Accumulated deficit (155,489)

(148,370)

Total stockholders' equity

19,277

20,866

Noncontrolling interest

2,946

-

Total stockholders' equity

22,223

20,866

Total

liabilities and equity 82,907

$

69,182

$

|

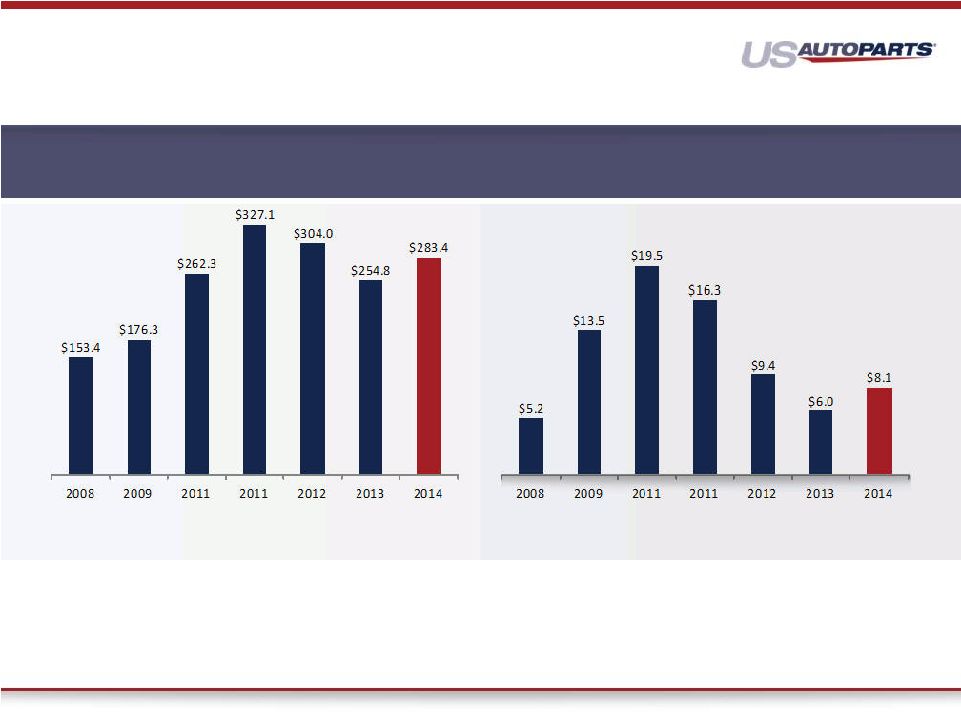

Sales & Adjusted EBITDA

1

19

Consolidated Sales²

($ In Millions)

Consolidated Adjusted EBITDA³

($ In Millions)

1.

Excludes AMD starting in Q4-14 which is funded through capital raised

2.

JC

Whitney

was

acquired

in

Aug

2010

adding

revenue

of

$39.1M

in

2010

and

$83.4M

in

2011.

Amounts

not

separately

disclosed

after

2011.

3.

Non-GAAP

financial

measure

EBITDA

consists

of

net

income

before

(a)

interest

expense,

net;

(b)

income

tax

provisions;

(c)

amortization

of

intangible

assets;

(d)

depreciation

and

amortization.

Adjusted EBITDA

excludes

Stock

based

compensation

of

$2.9M,

$3.3M,

$2.7M,

$2.6M,

$1.7M

,

$1.3M

and

$2.4M

in

2008,

2009,

2010,

2011,

2012,

2013,

and

2014,

respectively

and

restructuring

costs

and

other one

time

charges

of

$23.4M,

$0.4M,

$5.8M,

$12.9M,

$27.5M,

$6.8M,

and

$2.4

in

2008,

2009,

2010,

2011,

2012,

2013

and

2014,

respectively.

Adj. EBITDA Margin

3%

5%

8%

7%

3%

2%

3% |