Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - On Deck Capital, Inc. | d851079dex231.htm |

| EX-32.1 - EX-32.1 - On Deck Capital, Inc. | d851079dex321.htm |

| EX-32.2 - EX-32.2 - On Deck Capital, Inc. | d851079dex322.htm |

| EX-31.2 - EX-31.2 - On Deck Capital, Inc. | d851079dex312.htm |

| EX-31.1 - EX-31.1 - On Deck Capital, Inc. | d851079dex311.htm |

| EX-10.16 - EX-10.16 - On Deck Capital, Inc. | d851079dex1016.htm |

| EX-10.21 - EX-10.21 - On Deck Capital, Inc. | d851079dex1021.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(MARK ONE)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-36779

On Deck Capital, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 42-1709682 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1400 Broadway, 25th Floor

New York, New York 10018

(Address of principal executive offices)

(888) 269-4246

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $0.005 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ¨ NO x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

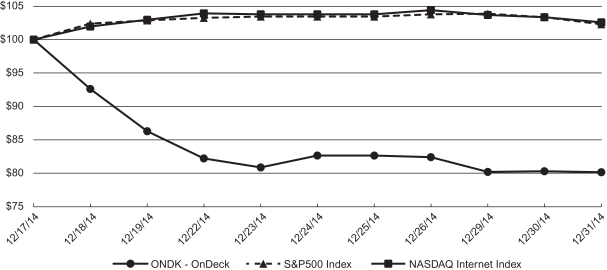

There was no public market for the registrant’s common stock as of June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter. The registrant’s common stock began trading on the New York Stock Exchange on December 17, 2014.

The aggregate market value of the common stock by non-affiliates of the registrant, based on the closing price of a share of the registrant’s common stock on December 31, 2014 as reported by the New York Stock Exchange on such date was approximately $1,029,624,858. The registrant has elected to use December 31, 2014, the last day of the fiscal year covered by this report, as the calculation date because on June 30, 2014 (the last business day of the registrant’s mostly recently completed second fiscal quarter), the registrant was a privately-held company. Shares of the registrant’s common stock held by each executive officer, director and holder of 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This calculation does not reflect a determination that certain persons are affiliates of the registrant for any other purpose.

The number of shares of the registrant’s common stock outstanding as of February 28, 2015 was 69,457,401.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2015 Annual Meeting of Stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K. Such Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as part of this Form 10-K.

Table of Contents

On Deck Capital, Inc.

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other legal authority. These forward-looking statements concern our operations, economic performance, financial condition, goals, beliefs, future growth strategies, objectives, plans and current expectations.

Forward-looking statements appear throughout this report including in Item 1. Business, Item 1A. Risk Factors, Item 3. Legal Proceedings and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations. Forward-looking statements can generally be identified by words such as “will,” “enables,” “expects,” “allows,” “continues,” “believes,” “anticipates,” “estimates” or similar expressions.

Forward-looking statements are neither historical facts nor assurances of future performance. They are based only on our current beliefs, expectations and assumptions regarding the future of our business, anticipated events and trends, the economy and other future conditions. As such, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and in many cases outside our control. Therefore, you should not rely on any of these forward-looking statements. Our expected results may not be achieved, and actual results may differ materially from our expectations.

Important factors that could cause or contribute to such differences include risks relating to: our ability to attract potential customers to our platform; the degree to which potential customers apply for loans, are approved and borrow from us; anticipated trends, growth rates and challenges in our business and in the markets in which we operate; the ability of our customers to repay loans and our ability to accurately assess credit worthiness; our ability to adequately reserve for loan losses; our plans to implement certain additional compliance measures related to our funding advisor channel and their potential impact; changes in our product distribution channel mix or our funding mix; our ability to anticipate market needs and develop new and enhanced offerings to meet those needs; interest rates and origination fees on loans; maintaining and expanding our customer base; the impact of competition in our industry and innovation by our competitors; our anticipated growth and growth strategies, including the possible introduction of new products and possible expansion into new international markets, and our ability to effectively manage that growth; our reputation and possible adverse publicity about us or our industry; the availability and cost of our funding; our failure to anticipate or adapt to future changes in our industry; our ability to hire and retain necessary qualified employees; the lack of customer acceptance or failure of our products; our reliance on our third-party service providers; the evolution of technology affecting our offerings and our markets; our compliance with applicable local, state and federal laws, rules and regulations and their application and interpretation, whether existing, modified or new; our ability to adequately protect our intellectual property; the effect of litigation or other disputes to which we are or may be a party; the increased expenses and administrative workload associated with being a public company; failure to maintain an effective system of internal controls necessary to accurately report our financial results and prevent fraud; our liquidity and working capital requirements; the estimates and estimate methodologies used in preparing our consolidated financial statements; the future trading prices of our common stock, the impact of securities analysts’ reports and shares eligible for future sale on these prices; our ability to prevent or discover security breaks, disruption in service and comparable events that could compromise the personal and confidential information held in our data systems, reduce the attractiveness of our platform or adversely impact our ability to service our loans; and other risks, including those described in this report in Item 1A. Risk Factors and other documents that we file with the Securities and Exchange Commission, or SEC, from time to time which are available on the SEC website at www.sec.gov.

Except as required by law, we undertake no duty to update any forward-looking statements. Readers are also urged to carefully review and consider all of the information in this report, as well as the other documents we make available through the SEC’s website.

When we use the terms “OnDeck,” the “Company,” “we,” “us” or “our” in this report, we are referring to On Deck Capital, Inc. and its consolidated subsidiaries unless the context requires otherwise.

1

Table of Contents

| Item 1. | Business |

Our Company

We are a leading online platform for small business lending. We are seeking to transform small business lending by making it efficient and convenient for small businesses to access capital. Enabled by our proprietary technology and analytics, we aggregate and analyze thousands of data points from dynamic, disparate data sources to assess the creditworthiness of small businesses rapidly and accurately. Small businesses can apply for a term loan or line of credit on our website in minutes and, using our proprietary OnDeck Score®, we can make a funding decision immediately and transfer funds as fast as the same day. We have originated more than $2 billion in loans and collected more than 5.3 million customer payments since we made our first loan in 2007. Our loan originations have increased at a compound annual growth rate of 159% from 2012 to 2014 and achieved a year-over-year growth rate of 152% in 2014.

The 28 million small businesses in the United States are integral to the U.S. economy and the vibrancy of local communities, employing approximately 50% of the private workforce. According to Civic Economics, spending at local retailers and restaurants contributes to the local community on average more than double the amount per dollar spent compared to spending at national chains.

Small business growth benefits from efficient and frictionless access to capital, yet small businesses face numerous challenges that make it difficult to secure such capital. Small business owners are time and resource constrained, but the traditional borrowing process is time consuming and burdensome. Small businesses surveyed by the Federal Reserve Bank of New York indicated that the traditional funding process required them, on average, to dedicate 33 hours, contact 2.7 financial institutions and submit 3 loan applications. These challenges exist in part because it is inherently difficult to assess the creditworthiness of small businesses. Small businesses are a diverse group spanning many different industries, stages in development, geographies, financial profiles and operating histories, historically making it difficult to assess creditworthiness in a uniform manner. Small business data is scattered across dynamic online and offline sources, making it difficult to aggregate, analyze and monitor. There is no widely-accepted credit score for a small business, and frequently a small business owner’s personal credit score is used to assess creditworthiness even though it may not be indicative of the business’s credit profile. Furthermore, small businesses are not well served by traditional loan products. For example, small businesses often seek small, short-term loans to fund short-term projects and investments, but traditional lenders may only offer products that feature large loan sizes, longer durations and rigid collateral requirements that are not well suited to their needs.

The small business lending market is vast and underserved. According to the Federal Deposit Insurance Corporation, or FDIC, there were $180 billion in business loan originations under $250,000 in the United States in the fourth quarter of 2014 across 22.1 million loans. Oliver Wyman, a management consulting firm and business unit of Marsh & McLennan, estimates that there is a potential $80 to $120 billion in unmet demand for small business lines of credit, and we believe that there is also substantial unmet demand for other credit-related products, including term loans. We also believe that the application of our technology to credit assessment can stimulate additional demand for our products expand the total addressable market for small business credit.

To better meet the capital needs of small businesses, we are seeking to use technology to transform the way this capital is accessed. We built our integrated platform specifically to meet their financing needs. Our platform touches every aspect of the customer lifecycle, including customer acquisition, sales, scoring and underwriting, funding, and servicing and collections. A small business can complete an online application 24 hours a day, 7 days a week. Our proprietary data and analytics engine aggregates and analyzes thousands of online and offline data attributes and the relationships among those attributes to assess the creditworthiness of a small business in real time. The data points include customer bank activity shown on their bank statements, government filings, tax and census data. In addition, in certain instances we also analyze reputation and social data. We look at both

2

Table of Contents

individual data points and relationships among the data, with each transaction or action being a separate data point that we take into account. A key differentiator of our solution is the OnDeck Score, the product of our proprietary small business credit scoring system. Both our data and analytics engine and the algorithms powering the OnDeck Score undergo continuous improvement to automate and optimize the credit assessment process, enabling more rapid and predictive credit decisions. Each loan that we make involves our proprietary automated process and approximately two-thirds of our loans are completely underwritten using our proprietary automated underwriting process. Our platform supports same-day funding and automated loan repayment. This technology-enabled approach provides small businesses with efficient, frictionless access to capital.

Our business has grown rapidly. In 2014, we originated $1.2 billion of loans, representing year-over-year growth of 152%, while maintaining consistent credit quality. Our growth in originations has been supported by a diverse and scalable set of funding sources, including committed debt facilities, a securitization facility and our OnDeck Marketplace®, our proprietary whole loan sale platform for institutional investors. In 2014, we recorded gross revenue of $158.1 million, representing year-over-year growth of 142%. In 2014, our Adjusted EBITDA, a non-GAAP financial measure, was a loss of $0.2 million, our loss from operations was $7.1 million, and our net loss was $18.7 million. See the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures” for a discussion and reconciliation of Adjusted EBITDA to net loss. As of December 31, 2014, our total assets were $729.6 million and the Unpaid Principal Balance on loans outstanding was $490.6 million.

We were incorporated in the state of Delaware on May 4, 2006. We operate from our headquarters in New York, New York and also have offices in Arlington, Virginia, and Denver, Colorado. Additional information about us is available on our website at http://www.ondeck.com. The information on our website is not incorporated herein by reference and is not a part of this report.

OnDeck, the OnDeck logo, OnDeck Score, OnDeck Marketplace and other trademarks or service marks of OnDeck appearing in this report are the property of OnDeck. Trade names, trademarks and service marks of other companies appearing in this report are the property of their respective holders. We have generally omitted the ® and ™ designations, as applicable, for the trademarks used in this report.

Industry Background and Trends

Small Businesses are an Enormous Driver of the U.S. Economy

The growth and prosperity of small businesses are vital to the success of the U.S. economy and essential to the strength of local communities. According to the most recent data available from the U.S. Small Business Administration, there are 28 million small businesses in the United States. These small businesses contribute approximately 45% of U.S. non-agricultural gross domestic product and employ approximately 50% of the private workforce. Small businesses help build vibrant communities with local character and help support the growth of local economies. According to Civic Economics, spending at local retailers and restaurants contributes to the local community on average more than double the amount per dollar spent compared to spending at national chains.

Small Businesses Need Capital to Survive and Thrive

Small businesses need access to capital to purchase supplies and inventory, hire employees, market their businesses and invest in new potential growth opportunities. The need for capital may be seasonal, such as an ice cream vendor hiring for the summer months or a retailer buying inventory in anticipation of the holiday season. It may also be sudden and unexpected, such as a restaurant responding to a last minute catering request or a manufacturer winning a valuable new contract that requires more raw materials. According to a survey by the Federal Reserve Bank of New York, ability to manage uneven cash flow was cited as the most frequent concern of small businesses. The payback period on these investments can be short while the return on investment may benefit the small business for years.

3

Table of Contents

Small Businesses are Unique and Difficult to Assess

Small businesses are a diverse group spanning many different industries, stages in development, geographies, financial profiles and operating histories, historically making it difficult to assess creditworthiness in a uniform manner, and there is no widely-accepted credit score for small businesses. For example, a restaurant has a very different operating and financial profile from a retail store and both are very different from a doctor’s office. Credit assessment is inherently difficult because small business data is constantly changing as the business evolves and is scattered across a myriad of online and offline sources, unlike consumer credit assessment where a lender can generally look to scores provided by consumer credit bureaus. Small business data includes financial data, credit data, government and public records, transactional data, online social data, accounting data and behavioral data. While much of this data is rapidly moving online, certain data remains predominantly offline. In addition, small businesses are not consistently covered by traditional credit bureaus. Once obtained, the data needs to be cleansed, normalized, weighted and analyzed to be useful in the credit scoring decision.

Small Businesses are Not Adequately Served by Traditional Lenders

We believe traditional lenders face a number of challenges and limitations that make it difficult to address the capital needs of small businesses, such as:

| • | Organizational and Structural Challenges. The costly combination of physical branches and manually intensive underwriting procedures makes it difficult for traditional lenders to efficiently serve small businesses. They also serve a broad set of customers, including both consumers and enterprises, and are not solely focused on addressing the needs of small businesses. |

| • | Technology Limitations. Many traditional lenders use legacy or third-party systems that are difficult to integrate or adapt to the shifting needs of small businesses. These technology limitations make it challenging for traditional lenders to aggregate new data sources, leverage advanced analytics and streamline and automate credit decisions and funding. |

| • | Loan Products not Designed for Small Businesses. Small businesses are not well served by traditional loan products. We believe that traditional lenders often offer products characterized by larger loan sizes, longer durations and rigid collateral requirements. By contrast, small businesses often seek small loans for short-term investments. |

As a result, we believe that small businesses feel underserved by traditional lenders. According to the FDIC, the percentage of commercial and industrial loans with a balance less than $250,000 has declined from 20% of total dollars borrowed in 2004 to 12% in the fourth quarter of 2014. According to Oliver Wyman, 75% of small businesses are looking to borrow less than $50,000. In addition, according to the first quarter 2015 Wells Fargo/Gallup Small Business Index, only 34% of small businesses reported that obtaining credit was easy.

Other Credit Products Have Significant Limitations

Certain additional products, including widely available business credit cards, provide small businesses with access to capital but may not be designed for their borrowing needs. For example, business credit cards may not have sufficient credit limits to handle the needs of the small business, particularly in the case of large, one-time projects such as capital improvements or expanding to a new location. In addition, certain business opportunities, such as discounts for paying with cash, and certain business expenses, such as payroll, rent or equipment leases, may not be payable with credit cards. Business credit cards are also typically not designed to fund many small business working capital needs.

4

Table of Contents

Challenges for Small Businesses

Small Business Owners are Time and Resource Constrained

We believe that small business owners lack many of the resources available to larger businesses and have fewer staff on which to rely for critical business issues. According to a survey by eVoice, time is viewed as the most valuable asset to small business owners. Small businesses typically do not employ a financial staff or internal advisors, and small business owners often act as both manager and employee. According to the same survey, 90% of small business owners perform three or more employee roles in any given day. Time spent inefficiently may mean lost sales, extra expenses and personal sacrifices.

Traditional Lending is Not Geared Towards Small Businesses

Traditional lenders do not meet the needs of small businesses for a number of reasons, including the following:

| • | Time Consuming Process. According to a Harvard Business School study, the traditional borrowing process includes application forms which are time consuming to assemble and complete, long in-person meetings during business hours and manual procedures that delay decisions. Small businesses surveyed by the Federal Reserve Bank of New York indicated that the traditional funding process required them, on average, to dedicate 33 hours, contact 2.7 financial institutions and submit 3 loan applications. |

| • | Non-Tailored Credit Assessment. There is no widely-accepted credit score for small businesses. Traditional lenders frequently rely upon the small business owner’s personal credit as a primary indicator of the business’s creditworthiness, even though it is not necessarily indicative of the business’s credit profile. As a result, a creditworthy business may be denied funding or offered a product that fits poorly with its needs. |

| • | Product Mismatch. According to Oliver Wyman, small businesses often seek small loans and evaluate their investment opportunities on a “dollars in, dollars out” basis, since the payback period is short. According to survey data reported by Oliver Wyman, 75% of small businesses are looking to borrow less than $50,000. Small businesses often seek small, short-term loans to fund short-term projects and investments, but are met with traditional loan products that feature large loan sizes, longer durations and rigid collateral requirements that are not well suited to their needs. |

Alternatives to Traditional Bank Loans are Inadequate

Small businesses whose lending needs are not met by traditional bank loans have historically resorted to a fragmented landscape of products, including merchant cash advances, credit cards, receivables factoring, equipment leases and home equity lines, each of which comes with its own challenges and limitations. Merchant cash advances are expensive and limited to certain industries. Credit cards are pervasive but cannot be used for certain types of expenses and face limitations on size. Equipment leasing and receivables factoring both have a cumbersome application process and are only appropriate for specific use cases. Home equity lines have strict collateral requirements, are unappealing to business owners on a personal level and are challenging for businesses with multiple owners.

Modernization of Small Businesses

Small Businesses are Embracing Technology

The proliferation of technology is changing the way small business owners manage their operations. According to a National Small Business Association survey, 70% of small businesses view technology as very important to the success of a business. Small businesses are increasingly using technology to purchase inventory, pay bills, manage accounting and conduct digital marketing. According to the survey, 85% of small businesses purchase supplies online, 83% manage bank accounts online, 82% maintain their own website, 72% pay bills online and 41% use tablets for their business. We believe small business owners expect a user-friendly online borrowing experience.

5

Table of Contents

The Digital Footprint of Small Businesses is Expanding

An increasing amount of information about small businesses is available electronically. Traditional data sources used to assess business creditworthiness, including government data, transactional information, bank accounts, public records and credit bureau data, are all transitioning online. In addition, many small businesses use social media such as Facebook, Twitter and LinkedIn to interact with customers, partners and stakeholders and manage their online business listings on review sites such as Yelp. A National Small Business Association survey reports that 73% of small businesses use a social media platform for their online strategies. This vast amount of real-time digital data about small businesses can be used to generate valuable insights that help better assess the creditworthiness of a small business.

The Opportunity

The small business lending market is vast and underserved. According to the FDIC, there were $180 billion in business loan originations under $250,000 in the United States in the fourth quarter of 2014, across 22.1 million loans. Oliver Wyman estimates that there is a potential $80 to $120 billion in unmet demand for small business lines of credit, and we believe that there is also substantial unmet demand for other credit-related products, including term loans. We also believe that the application of our technology to credit assessment can stimulate additional demand for our products and expand the total addressable market for small business credit.

Our Solution

Our mission is to power the growth of small business through lending technology and innovation. We are combining our passion for small business with technology and analytics to transform the way small businesses access capital. Our solution was built specifically to address small businesses’ capital needs and consists of our loan products, our end-to-end integrated platform and the OnDeck Score. We offer two products to small businesses to enable them to access capital: term loans and lines of credit. Our proprietary, end-to-end integrated platform includes: our website, which allows small businesses to apply for a loan in minutes, 24 hours a day 7 days a week; our proprietary data and analytics engine that analyzes thousands of data attributes from disparate sources to assess the real-time creditworthiness of a small business; the technology that enables seamless funding of our loans; our daily and weekly collections and ongoing servicing system. A key differentiator of our solution is the OnDeck Score, the product of our proprietary small business credit-scoring system. The OnDeck Score aggregates and analyzes thousands of data elements and attributes related to a business and its owners that are reflective of the creditworthiness of the business as well as predictive of its credit performance. Our proprietary data and analytics engine and the algorithms powering the OnDeck Score undergo continuous improvement through machine learning and other statistical techniques to automate and optimize the credit assessment process.

Our customers choose us because we provide the following key benefits:

| • | Access. By combining technology with comprehensive and relevant data that captures the unique aspects of small businesses, we are able to better assess the creditworthiness of small businesses and approve more loans. In addition, we provide customers with access to products that match their capital needs. |

| • | Speed. Small businesses can submit an application on our website in as little as minutes. We are able to provide most loan applicants with an immediate approval decision and, if approved, transfer funds as fast as the same day. Because we require no in-person meetings and have an intuitive online application form, we have been able to significantly increase the convenience and efficiency of the application process without burdensome documentation requirements. |

| • | Customer Experience. Our U.S.-based internal salesforce and customer service representatives provide high tech, high touch, personalized support to our applicants and customers. Our team answers questions and provides assistance throughout the application process and the life of the loan. Our representatives are available Monday through Saturday before, during and after regular business hours |

6

Table of Contents

| to accommodate the busy schedules of small business owners. We also offer our customers credit education and consulting services and other value added services. Our commitment to provide a great customer experience has helped us earn a 73 Net Promoter Score, a widely used system of measuring customer loyalty, and consistently achieve A+ ratings from the Better Business Bureau. Furthermore, the OnDeck Score incorporates data from each customer’s history with us, ensuring that we deliver increasing efficiency to our customers in making repeat loan decisions. We also report back to several business credit bureau agencies, which can help small businesses build their business credit. |

Our Competitive Strengths

We believe the following competitive strengths differentiate us and serve as barriers for others seeking to enter our market:

| • | Significant Scale. Since we made our first loan in 2007, we have funded more than $2 billion in loans across more than 700 industries in all 50 U.S. states and have recently begun lending in Canada. We have collected more than 5.3 million customer payments and maintain a proprietary database of more than 10 million small businesses. In 2014, we originated $1.2 billion of loans, representing year-over-year growth of 152%, all while maintaining consistent credit quality. Our increasing scale offers significant benefits including lower customer acquisition costs, access to a broader dataset, better underwriting decisions and a lower cost of capital. |

| • | Proprietary Data and Analytics Engine. We use data analytics and technology to optimize our business operations and the customer experience including sales and marketing, underwriting, servicing and risk management. Our proprietary data and analytics engine and the OnDeck Score provide us with significant visibility and predictability in assessing the creditworthiness of small businesses and allow us to better serve more customers across more industries. With each loan application, each funded loan and each daily or weekly payment, our data set expands and our OnDeck Score improves. In the latter part of 2014, we introduced the fifth generation, or v5, of the OnDeck Score which has enhanced our credit scoring capabilities, enabling us to improve offers to our customers while preserving the credit quality of our portfolio. Our analysis suggests that v5 has become 85% more accurate at predicting bad credit risk in small businesses across a range of credit risk profiles than personal credit scores alone. We are therefore able to lend to more small businesses than traditional lenders, which need to compensate for their more limited analytical model by being more restrictive in lending decisions. We are also able to use our proprietary data and analytics engine to pre-approve customers and target those customers predisposed to take a loan and that have a high likelihood of approval. |

| • | End-to-End Integrated Technology Platform. We built our integrated platform specifically to meet the financing needs of small businesses. Our platform touches every aspect of the customer lifecycle, including customer acquisition, sales, scoring and underwriting, funding, and servicing and collections. This purpose-built infrastructure is enhanced by robust fraud protection, multiple layers of security and proprietary application programming interfaces. It enables us to deliver a superior customer experience, facilitates agile decision making and allows us to efficiently roll out new products and features. We use our platform to underwrite, process and service all of our small business loans regardless of distribution channel. |

| • | Diversified Distribution Channels. We are building our brand awareness and enhancing distribution capabilities through diversified distribution channels, including direct marketing, strategic partnerships and funding advisors. Our direct marketing includes direct mail, radio, TV, social media and other online marketing channels. Our strategic partners, including banks, payment processors and small business-focused service providers, offer us access to their base of small business customers, and data that can be used to enhance our targeting capabilities. We also have relationships with a large network of funding advisors, including businesses that provide loan brokerage services, which drive distribution and aid brand awareness. Our internal salesforce contacts potential customers, responds to inbound inquiries from potential customers, and is available to assist all customers throughout the application process. |

7

Table of Contents

The following table summarizes the percentage of loans originated by our three distribution channels for the periods indicated:

| Year Ended December 31, | ||||||||||||

| Percentage of Originations (Number of Loans) | 2014 | 2013 | 2012 | |||||||||

| Direct |

55.4 | % | 44.1 | % | 23.4 | % | ||||||

| Strategic Partner |

14.4 | % | 10.3 | % | 8.0 | % | ||||||

| Funding Advisor |

30.2 | % | 45.6 | % | 68.6 | % | ||||||

| Year Ended December 31, | ||||||||||||

| Percentage of Originations (Dollars) | 2014 | 2013 | 2012 | |||||||||

| Direct |

44.7 | % | 34.4 | % | 19.4 | % | ||||||

| Strategic Partner |

13.9 | % | 9.2 | % | 5.5 | % | ||||||

| Funding Advisor |

41.4 | % | 56.4 | % | 75.1 | % | ||||||

| • | High Customer Satisfaction and Repeat Customer Base. Our strong value proposition has been validated by our customers. We had a Net Promoter Score of 73 in December 2014 based on our internal survey of customers. The Net Promoter Score is a widely used index ranging from negative 100 to 100 that measures customer loyalty. Our score places us at the upper end of customer satisfaction ratings and compares favorably to the average Net Promoter Score score of 9 for national banks, 19 for regional banks and 46 for community banks. We have also consistently achieved an A+ rating from the Better Business Bureau. We believe that high customer satisfaction has played an important role in repeat borrowing by our customers. In 2014 and 2013, 50.1% and 43.5%, respectively, of loan originations were by repeat customers, who either replaced their existing loan with a new, usually larger, loan or took out a new loan after paying off their existing OnDeck loan in full. Repeat customers generally comprise our highest quality loans, given many repeat customers require additional financing for growth or expansion. From our 2013 direct and strategic partner customer cohort, customers who took at least three loans grew their revenue and bank balance, respectively, on average by 25% and 42% from their initial loan to their third loan. On average, their OnDeck Score increased by 24 points, enabling us to grow their mean loan amount by 106% while decreasing their annual percentage rate, or APR, by 17.5 percentage points. Twenty-seven percent of our origination volume from repeat customers in 2014 was due to unpaid principal balances rolled from existing loans directly into such repeat originations. Each repeat customer seeking another term loan must pass the following standards: |

| • | the business must be approximately 50% paid down on its existing loan; |

| • | the business must be current on its outstanding OnDeck loan with no material delinquency history; and |

| • | the business must be fully re-underwritten and determined to be of adequate credit quality. |

| • | Durable Business Model. Since we began lending in 2007, we have successfully operated our business through both strong and weak economic environments. Our real-time data, short duration loans, automated daily and weekly collection, risk management capabilities and unit economics enable us to react rapidly to changing market conditions and generate attractive financial results. In addition, we believe the historical consistency and stability of the credit performance of our loan portfolio are appealing to our sources of funding and help validate our proprietary credit scoring model. |

| • | Differentiated Funding Platform. We source capital through multiple channels, including debt facilities, securitization and the OnDeck Marketplace, our proprietary whole loan sale platform for institutional investors. This diversity provides us with multiple, scalable funding sources, long-term capital commitments and access to flexible funding for growth. In addition, because we contribute a portion of the capital for each loan we fund via our debt facilities and securitization, we are able to align interests with our investors. |

8

Table of Contents

| • | 100% Small Business-Focused. We are passionate about small businesses. We have developed significant expertise since we began lending in 2007, remaining exclusively focused on assessing and delivering credit to small businesses. We believe this passion, focus and small business credit expertise provides us with significant competitive advantages. |

Our Strategy for Growth

Our vision is to become the most trusted lender to small businesses, and to accomplish this, we intend to:

| • | Continue to Acquire Customers Through Direct Marketing and Sales. We plan to continue investing in direct marketing and sales to add new customers and increase our brand awareness. As our dataset expands, we will continue to pre-approve and target those customers predisposed to take a loan and that have a high likelihood of approval. We have already seen success from this strategy with an increase in loan transactions attributable to direct marketing of 227% in 2014. |

| • | Broaden Distribution Capabilities Through Partners. We plan to expand our network of strategic partners, including banks, payment processors and small business-focused service providers, and leverage their relationships with small businesses to acquire new customers. |

| • | Enhance Data and Analytics Capabilities. We plan to make substantial investments in our data and analytics capabilities. Our data science team continually uncovers new insights about small businesses and their credit performance and considers new data sources for inclusion in our models, allowing us to evaluate and lend to more customers. As our dataset expands, our self-reinforcing scoring algorithm continues to improve through machine learning, enabling us to make better lending decisions. |

| • | Expand Product Offerings. We will continue developing products that support small businesses from inception through maturity. Following the successful introduction of our line of credit and 24-month term loan products, over time we plan to expand our offerings by introducing new credit-related products for small businesses. We believe this will allow us to provide a more comprehensive offering for our current customers and introduce small business owners to our platform whose needs are not currently met by our term loan and line of credit products. We also recently introduced capability to cross-sell our loan products to existing term loan and line of credit customers, giving small business owners more flexibility to finance their business needs. |

| • | Extend Customer Lifetime Value. We believe we have an opportunity to increase revenue and loyalty from new and existing customers. We have the ability to accommodate our customers’ needs as they grow and as their funding needs increase and change. We plan to introduce new features to continue driving the increased use of our platform, including mobile functionality to increase user engagement. We are focused on providing a positive customer experience and on continuing to drive customer loyalty. |

| • | Targeted International Expansion. We believe small businesses around the world need capital to grow, and there is an opportunity to expand our small business lending in select countries outside of the United States. For example, in the second quarter of 2014, we started providing loans in Canada, and we continue to evaluate additional international market opportunities. |

Our Sales and Marketing

We originate small business loans through three channels: direct marketing, strategic partners and a funding advisor program. While customers can apply for a loan directly on our website, they also have the ability to initiate contact with us through other means, such as by telephone or through a strategic partner or funding advisor. We underwrite, process and service all of our small business loans on our platform regardless of distribution channel.

9

Table of Contents

Direct Marketing

We have originated small business term loans through the direct marketing channel since 2007 and began originating lines of credit in 2013. Through this channel, we make contact with prospective customers utilizing direct mail, social media, television, radio and online marketing. We also engage in outbound calling. Supported by our direct sales team, we funnel customer leads generated through such efforts to our website.

When a customer that has previously taken a loan from us returns for a repeat loan, our direct sales team interacts directly with the customer to help facilitate the process, including for customers initially acquired via a strategic partner or funding advisor. Although our direct sales team facilitates repeat loan transactions, we generally still pay commissions to such strategic partner or funding advisor based on the amount of the net new loan to the customer. Our sales agent assisting the customer also receives a commission, but the commission is generally less than the commission on the initial loan. The amount of commissions, on a percentage basis, paid to a strategic partner will generally be less than the commission earned on the initial loan based on the terms applicable to a particular strategic partner. The amount of commissions, on a percentage basis, paid to a funding advisor on a repeat loan is generally consistent with the commission earned on the initial loan.

Our direct sales team is located in our New York City and Denver offices. This team primarily focuses on generating loan originations and assisting applicants throughout the application process by responding to applicant questions, collecting documentation and providing notification of application outcomes. While our website facilitates the loan application process, customers may elect to mail, fax or email us documentation. In such cases, our direct sales team assists in collecting this documentation. Members of the direct sales team have a commission component to their compensation that is based on loan volume in the case of term loans and number of lines opened in the case of lines of credit.

Strategic Partners

We have originated small business loans through our strategic partner channel since 2011. Through this channel, we are introduced to prospective customers by third parties, who we refer to as strategic partners, that serve or otherwise have access to the small business community in the regular course of their business. Strategic partners conduct their own marketing activities which may include direct mail, online marketing or leveraging existing business relationships. Strategic partners include, among others, banks, small business-focused service providers, other financial institutions, financial and accounting solution providers, payment processors, independent sales organizations, leasing companies and financial and other websites. The material terms of our agreements with strategic partners include the payment by us of commissions, generally based on the amount of the funded loan, in exchange for customers referred to our platform. Such agreements also typically contain other customary terms, including representations and warranties, covenants, termination provisions and expense allocation. Strategic partners differ from funding advisors (described below) in that strategic partners generally provide a referral to our direct sales team and our direct sales team is the main point of contact with the customer. On the other hand, funding advisors serve as the main point of contact with the customer on its initial loan and may help a customer assess multiple funding opportunities. As such, funding advisors’ commissions generally exceed strategic partners’ referral fees. We generally do not recover these amounts upon default of the loan. We have entered into a general marketing agreement with one strategic partner that provides for common stock purchase warrants that vest upon reaching certain performance goals. No other fees are paid to strategic partners.

Funding Advisor Program

We have originated small business loans through the funding advisor program channel since 2007. Through this channel we make contact with prospective customers by entering into relationships with third-party independent advisors, known as Funding Advisor Program partners, which we refer to as funding advisors or FAPs, that typically offer a variety of financial services to small businesses, including commission-based business loan brokerage services. FAPs conduct their own marketing activities which may include direct mail, online marketing, paid leads, television and radio advertising or leveraging existing business relationships. FAPs

10

Table of Contents

include independent sales organizations, commercial loan brokers and equipment leasing firms. FAPs act as intermediaries between potential customers and lenders by brokering business loans on behalf of potential customers. In order to become a FAP, an authorized representative of the FAP must complete an interview with us, clear a personal criminal background check, undergo training and sign an agreement with us. We began implementing background checks, generally on the authorized representative of the FAP, in 2010, but we did not conduct any background checks with respect to any FAPs that began working with us before 2010 or who had annual revenue greater than $15 million when they became a FAP. We generally reject a prospective FAP and terminate our relationship with a current FAP if a background check with respect to such FAP reveals the commission of a crime involving moral turpitude, financial crimes or fraud. In February 2015, we began enhancing our FAP due diligence process as described below. Our relationships with FAPs provide for the payment of a commission at the time the term loan is funded or line of credit account is opened. As of December 31, 2014, we had relationships with more than 600 FAPs and no single FAP was associated with more than 3% of our total originations.

In February 2015, we began to implement enhanced compliance-related measures related to our funding advisor channel in addition to our existing measures. For example, we are expanding the extent to which our funding advisor partners are required to submit to and conduct background checks, including requiring checks on owners, senior management and sales employees of the FAP rather than only the authorized representative of the FAP. We are strengthening the FAP application process and adding an annual re-certification requirement. We will also conduct such diligence on all existing FAPs over a period of months. In addition, we plan to strengthen our contractual provisions with our FAPs to enable us to monitor continuing compliance after these initial checks and to expand our rights to terminate the relationship. We anticipate requiring that FAPs agree to abide by these enhanced compliance obligations as a condition to establishing or maintaining their partnership with us. We have also recently hired a senior compliance officer whose responsibilities include overseeing compliance matters involving our funding advisor channel.

Our Customers

We provide term loans and lines of credit to a diverse set of small businesses. We have funded more than $2 billion in loan volume across more than 700 industries in all 50 U.S. states and have recently begun lending in Canada and have collected more than 5.3 million customer payments since our first loan in 2007. The top five states in which we originated loans in 2014 were California, Florida, Texas, New York and New Jersey, representing approximately 14%, 9%, 8%, 8% and 4% of our total loan originations. Our customers have a median of $569,000 in annual revenue, with 90% of our customers having between $150,000 and $3.2 million in annual revenue, and have been in business for a median of 7.5 years, with 90% in business between 2 and 31 years.

During 2014, the average size of a term loan made on our platform was $45,428 and the average size of a line of credit extended to our customers was $16,397.

Our Products

We offer financing to small businesses through a term loan product and a revolving line of credit product. In the fourth quarter of 2014, we instituted a program that allowed us to offer our term loan and line of credit products to the same customers, subject to customary credit and loan underwriting procedures.

Term Loan Product

Our primary business is to offer fixed term loans to eligible small businesses. The principal amount of each term loan ranges from $5,000 to $250,000. The principal amount of our term loan is a function of the requested borrowing amount and our credit risk assessment, using the OnDeck Score, of the customer’s ability to repay the loan. The original term of each individual term loan ranges from 3 to 24 months. We believe that the highly tailored loan terms are a competitive advantage given the short-term, project-specific nature of many of our

11

Table of Contents

customers’ borrowing needs. Customers repay our term loans through fixed automatic ACH collections from their business bank account on either a daily or weekly basis. Certain term loans are originated by our issuing bank partners and loans that we purchase from the issuing banks have similar performance to loans that we originate.

Line of Credit Product

Our second loan product is a revolving line of credit with fixed six-month level-yield amortization on amounts outstanding and automated weekly payments. The credit lines currently offered to customers are from $10,000 to $25,000. A customer may be offered a line of credit based on our credit risk assessment of the customer’s ability to repay the line of credit. We do not currently purchase lines of credit from issuing bank partners.

Our Loan Pricing

Our loans are priced based on a risk assessment generated by our proprietary data and analytics engine, which includes the OnDeck Score. Customer pricing is determined primarily based on the customer’s OnDeck Score, the loan term and origination channel. Loans originated through direct marketing and strategic partners are generally lower cost than loans originated through FAPs due to the commission structure of the FAP program.

Our customers pay between $0.01 to $0.04 per month in interest for every dollar they borrow under one of our term loans, with the actual amount typically driven by the length of term of the particular loan. Our loans are quoted in “Cents on Dollar,” or COD, or based on an interest rate, depending on the type of loan. In general, term loans are quoted in COD terms, and lines of credit are quoted with an interest rate. Given the use case and payback period associated with shorter term products, many of our customers prefer to understand pricing on a “dollars in, dollars out” basis and are primarily focused on total payback cost.

We believe that our product pricing has historically fallen between traditional bank loans to small businesses and certain non-bank small business financing alternatives such as merchant cash advances. The weighted average pricing on our originations has declined over time as measured by both average “Cents on Dollar” borrowed per month and APR as shown in the table below.

| Q4 2014 |

Q3 2014 |

Q2 2014 |

Q1 2014 |

Q4 2013 |

Q3 2013 |

Q2 2013 |

Q1 2013 |

|||||||||||||||||||||||||

| Weighted Average Term Loan “Cents on Dollar” Borrowed, per Month |

2.23 | ¢ | 2.24 | ¢ | 2.38 | ¢ | 2.53 | ¢ | 2.60 | ¢ | 2.62 | ¢ | 2.71 | ¢ | 2.73 | ¢ | ||||||||||||||||

| Weighted Average APR—Term Loans and Lines of Credit |

51.2 | % | 52.8 | % | 56.7 | % | 59.9 | % | 61.8 | % | 62.9 | % | 65.0 | % | 65.9 | % | ||||||||||||||||

On an annual basis, the weighted average APR for term loans and lines of credit declined from 69.0% in 2012 to 63.4% in 2013, and further declined to 54.4% in 2014. We attribute this pricing shift to increased originations from our direct and strategic partner channels as a percentage of total originations, as well as our declining Cost of Funds Rate. “Cents on Dollar” borrowed reflects the monthly interest paid by a customer to us for a loan, and does not include the loan origination fee and the repayment of the principal of the loan. The APRs of our term loans currently range from 17% to 98% and the APRs of our lines of credit range from 30% to 36%. Because many of our loans are short term in nature and APR is calculated on an annualized basis, we believe that small business customers tend to evaluate term loans primarily on a “Cents on Dollar” borrowed basis rather than APR. Despite these limitations, we are providing historical APRs as supplemental information for comparative purposes. We do not use APR as an internal metric to evaluate performance of our business or as a basis to compensate our employees or to measure their performance. The interest on commercial business loans is also tax deductible as permitted by law, as compared to typical personal loans which do not provide a tax deduction. APR does not give effect to the small business customer’s possible tax deductions and cash savings associated with business related interest expenses. For these and other reasons, we do not believe that APR is a meaningful measurement of the expected returns to us or costs to our customer.

12

Table of Contents

Our Platform and the Underwriting Process

We believe that our technology platform enables a significantly faster process to apply for a loan, a credit assessment that more accurately determines a small business applicant’s creditworthiness and a superior overall experience. Our platform touches each point of our relationship with customers, from the application process through the funding and servicing of loans.

We provide an automated, streamlined application process that potential customers may complete in as little as minutes. Our proprietary scoring model provides applicants with a funding decision rapidly and we can then fund customers as fast as the same day. Once funded, our customers can use our online portal to monitor their loan balance in real time. To the customer, the process appears simple, seamless and efficient because our platform leverages sophisticated, proprietary technology to make it possible.

Since inception, our platform has processed more than 5.3 million customer payments and currently incorporates a proprietary database of more than 10 million small businesses. We believe our technology platform is a significant competitive advantage and is one of the most important reasons that customers take loans from us.

Our Subsidiaries

We currently have five active subsidiaries, each of which is wholly-owned by On Deck Capital, Inc. These subsidiaries perform the following functions:

| • | On Deck Asset Company, LLC. This special purpose vehicle is the borrower under a current asset-backed revolving debt facility. |

| • | OnDeck Asset Pool, LLC. This special purpose vehicle is the borrower under a current asset-backed revolving debt facility. |

| • | Small Business Asset Fund 2009 LLC. This special purpose vehicle is the borrower under a current asset-backed revolving debt facility. |

| • | OnDeck Account Receivables Trust 2013-1 LLC. This special purpose vehicle is the borrower under a current asset-backed revolving debt facility. |

| • | OnDeck Asset Securitization Trust LLC. This special purpose vehicle is the issuer under our current asset-backed securitization facility. |

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” and Note 7 of Notes to Consolidated Financial Statements elsewhere in this report for more information regarding these five subsidiaries.

Our Risk Management

Our management team has operated the business through both strong and weak economic environments and has developed significant risk management experience and protocols. Accordingly, we employ a rigorous, comprehensive and programmatic approach to risk management that is ingrained in our business. The objectives of our risk management program are to:

| • | manage the risks of the company, including developing and maintaining systems and internal controls to identify, approve, measure, monitor, report and prevent risks; |

| • | manage reputational and counterparty risk; |

| • | foster a strong risk-centric mindset across the company; and |

| • | control and plan for credit risk-taking consistent with expectations. |

13

Table of Contents

We accomplish these risk management objectives both structurally, through product and platform features, as well as by employing a team of risk management professionals focused on credit and portfolio risks and broader enterprise risks.

The structural protections inherent in our products and technology platform enable us to provide real-time risk monitoring and management. From an underwriting perspective, we make credit decisions based on real-time performance data about our small business customers. We believe that the data and analytics powering the OnDeck Score can predict the creditworthiness of a small business better than models that rely solely on the personal credit score of the small business owner. Our analysis suggests that the current iteration of our proprietary credit-scoring model has become 85% more accurate at predicting bad credit risk in small businesses across a range of credit risk profiles than personal credit scores alone.

In addition, because our products generally require automated payback each business day and allow for ongoing data collection, we obtain early-warning indicators that provide a high degree of visibility not just on individual loans, but also macro portfolio trends. Insights gleaned from such real-time performance data enable us to be agile and adapt quickly to changing conditions. Furthermore, the loans we originate are generally short term in nature. This rapid amortization and recovery of amounts loaned limits our overall loss exposure.

Organizationally, we have a risk management committee, comprised of members of our board of directors, that meets regularly to examine credit risks and enterprise risks of the company. We also have several subcommittees of our risk management committee that are comprised of members of our management team that monitor credit risks, enterprise risks and other risks of the company.

In addition, we have teams of non-management employees within the company that monitor these and other risks. Our credit risk team is responsible for portfolio management, allowance for loan losses, or ALLL, credit model validation and underwriting performance. This team engages in numerous risk management activities, including reporting on performance trends, monitoring of portfolio concentrations and stability, performing economic stress tests on our portfolio, randomly auditing underwriting processes and loan decisions and conducting peer benchmarking and exogenous risk assessments.

Our enterprise risk team focuses on the following additional risks:

| • | ensuring our IT systems, security protocols, and business continuity plans are well established, reviewed and tested; |

| • | establishing and testing internal controls with respect to financial reporting; and |

| • | regularly reviewing the regulatory environment to ensure compliance with existing laws and anticipate future regulatory changes that may impact us. |

Our management team also closely monitors our competitive landscape in order to assess any competitive threats. Finally, from a capital availability perspective, we employ a diverse and scalable funding strategy that allows us to access debt facilities, the securitization markets and institutional capital through our OnDeck Marketplace, reducing our dependence on any one source of capital.

Our Information Technology and Security

Our network is configured with multiple layers of security to isolate our databases from unauthorized access. We use sophisticated security protocols for communication among applications and we encrypt private information, such as an applicant’s social security number. All of our public and private APIs and websites use Secure Sockets Layer.

Our systems infrastructure is deployed on a private cloud hosted in co-located redundant data centers in New Jersey and Colorado. We believe that we have enough physical capacity to support our operations for the

14

Table of Contents

foreseeable future. We have multiple layers of redundancy to ensure reliability of network service and have a 99.99% uptime. We also have a working data redundancy model with comprehensive backups of our databases and software taken nightly.

Our Intellectual Property

We protect our intellectual property through a combination of trademarks, trade dress, domain names, copyrights, trade secrets and patents, as well as contractual provisions and restrictions on access to our proprietary technology.

We have registered trademarks in the United States and Canada for “OnDeck,” “OnDeck Score,” “OnDeck Marketplace,” the OnDeck logo and many other trademarks. We also have filed other trademark applications in the United States and certain other jurisdictions and will pursue additional trademark registrations to the extent we believe it will be beneficial.

Our Employees

As of December 31, 2014, we had 444 full-time employees located throughout our New York, Denver, and Virginia offices as well as several employees in remote locations.

We are proud of our culture, which is anchored by four key values:

| Ingenuity |

We create new solutions to old problems. We imagine what’s possible and seek out innovation and technology to reinvent small business financing and delight our customers. | |

| Passion |

We think big and act boldly. We care intensely about each other, our company, and the small businesses we serve. | |

| Openness |

We are collaborative and accessible. We know that the best outcomes come when we work together. | |

| Impact |

We focus on results. We are committed to making every day count and constantly strive to improve our business. We work to make a difference to small businesses, their customers and our employees. | |

We consider our relationship with our employees to be good and we have not had any work stoppages. Additionally, none of our employees are represented by a labor union or covered by a collective bargaining agreement.

Government Regulation

We are affected by laws and regulations that apply to businesses in general, as well as to commercial lending. This includes a range of laws, regulations and standards that address information security, data protection, privacy, licensing and interest rates, among other things. However, because we are only engaged in commercial lending and do not make any consumer loans or take deposits, we are subject to fewer regulations than businesses involved in those activities.

State Lending Regulations

Interest Rate Regulations

Although the federal government does not regulate the maximum interest rates that may be charged on commercial loan transactions, some states have enacted commercial rate laws specifying the maximum legal interest rate at which loans can be made in the state. We only originate commercial loans and do so under Virginia law. Virginia does not have rate limitations on commercial loans of $5,000 or more or licensing requirements for commercial lenders making such loans. Our underwriting, servicing, operations and collections teams are headquartered in Arlington, Virginia, and that is where the commercial loan contracts are made. All

15

Table of Contents

loans originated directly by us provide that they are to be governed by Virginia law. With respect to loans where we work with a partner or issuing bank, the partner bank may utilize the law of the jurisdiction applicable to the bank in connection with its commercial loans.

Licensing Requirements

In states that do not require a license to make commercial loans, we make term loans directly to customers pursuant to Virginia law, which is the governing law we require in the underlying loan agreements with our customers. However, nine states and jurisdictions, namely Alaska, California, Maryland, Nevada, North Dakota, Rhode Island, South Dakota, Vermont, and Washington, D.C., require a license to make certain commercial loans and may not honor a Virginia choice of law. They assert either that their own licensing laws and requirements should generally apply to commercial loans made by nonbanks or apply to commercial loans made by nonbanks of certain principal amounts or with certain interest rates or other terms. In such states and jurisdictions and in some other circumstances, term loans are made by an issuing bank partner that is not subject to state licensing, primarily BofI Federal Bank (a federally chartered bank), or BofI, and may be sold to us. For the years ended December 31, 2012, 2013 and 2014, loans made by issuing bank partners constituted 21.1%, 16.1% and 15.9%, respectively, of our total loan originations.

BofI establishes its underwriting criteria for the issuing bank partner program in consultation with us. We recommend term loans to BofI that meet BofI’s underwriting criteria, at which point BofI may elect to fund the loan. If BofI decides to fund the loan, BofI retains the economics on the loan for the period that it owns the loan. BofI earns origination fees from the customers who borrow from it and in addition retains the interest paid during the period BofI holds the loan. In exchange for recommending loans to BofI, we earn a marketing referral fee based on the loans recommended to, and funded by, BofI. BofI has the right to hold the loans or sell the loans to us or other purchasers, though it generally sells the loans to us on the business day following its origination of the loan. We are generally the purchaser of the loans that we refer to BofI, and to the extent we choose not to purchase a loan in any individual circumstance, we are obligated to identify an alternative purchaser. During the period when BofI owns the loans, we service the loans in exchange for a nominal fee which is waived if we end up purchasing the loan within 10 days of BofI originating the loan. Our agreement with BofI also provides for a collateral account, which is an account maintained at BofI. The account serves as cash collateral for the performance of our obligations under the agreement, which among other things may include compliance with certain covenants, and also serves to indemnify BofI for breaches by us of representations and warranties where BofI suffers damages as a result of the loans that we refer to it. The initial term of our agreement with BofI was for two years, and the agreement automatically extends for one-year periods unless terminated by either party. The agreement is currently in an extension period. Finally, the agreement may not be assigned without the prior written consent of the non-assigning party.

We are not required to have licenses to make commercial loans based on applicable laws as currently in effect and our operations as presently conducted, including when we service loans made by a federally chartered bank in states that otherwise require licensing of lenders. Some states have licensing requirements in connection with commercial lending. Virginia does not. Because our loans are made in Virginia, we are not required to be licensed in other states where our borrowers are located. Our bank partner is not required to be licensed in any state.

Federal Lending Regulations

We are a commercial lender and as such there are federal laws and regulations that affect our, and other lenders’ lending operations. These laws include, among others, portions of the Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, anti-money laundering requirements (such as the Bank Secrecy Act of 1970 and the law commonly referred to as the USA PATRIOT Act), Equal Credit Opportunity Act, Fair Credit Reporting Act, privacy regulations (such as the Right to Financial Privacy Act of 1978), Telephone Consumer Protection Act of 1991, and requirements relating to unfair, deceptive, or abusive acts or practices.

16

Table of Contents

Competition

The small business lending market is competitive and fragmented. We expect competition to continue to increase in the future. We believe the principal factors that generally determine a company’s competitive advantage in our market include the following:

| • | ease of process to apply for a loan; |

| • | brand recognition and trust; |

| • | loan features, including rate, term and pay-back method; |

| • | loan product fit for business purpose; |

| • | transparent description of key terms; |

| • | effectiveness of customer acquisition; and |

| • | customer experience. |

Our principal competitors include traditional banks, legacy merchant cash advance providers, and newer, technology-enabled lenders.

Facilities

As of December 31, 2014, our principal facilities are located as follows. Our corporate headquarters are located in New York, New York, where we lease approximately 38,000 square feet of office space pursuant to a lease expiring in 2023. We also lease approximately 11,000 square feet of office space in Arlington, Virginia for our underwriting, servicing, collections and operations headquarters under a lease that expires in 2018 and an approximately 13,000 square foot sales office in Denver, Colorado under a lease that expires in March 2019. Subsequent to year end, we entered into leases for additional space as further described in Note 17 of Notes to Consolidated Financial Statements elsewhere in this report.

Disclosure of Information

We recognize that in today’s environment, our current and potential investors, the media and others interested in us look to social media and other online sources for information about us. We believe that these sources represent important communications channels for disseminating information about us, including information that could be deemed to constitute material non-public information. As a result, in addition to our investor relations website (http://investors.ondeck.com), filings made with the SEC, press releases we issue from time to time, and public webcasts and conference calls, we have used and intend to continue to use various social media and other online sources to disseminate information about us and, without limitation, our general business developments; financial performance; product and service offerings; research, development and other technical updates; relationships with customers, platform providers and other partners; and market and industry developments. We intend to use the following social media and other websites for the dissemination of information:

Our blog: https://www.ondeck.com/blog

Our Twitter feed: http://twitter.com/ondeckcapital

Our CEO, Noah Breslow’s Twitter feed: http://twitter.com/noahbreslow

Our Facebook page: http://www.facebook.com/OnDeckCapital

Our corporate LinkedIn page: https://www.linkedin.com/company/ondeck

We invite our current and potential investors, the media and others interested in us to visit these sources for information related to us. Please note that this list of social media and other websites may be updated from time to time on our investor relations website and/or filings we make with the SEC.

17

Table of Contents

Industry and Market Data

This report contains estimates, statistical data, and other information concerning our industry, including market size and growth rates, that are based on industry publications, surveys and forecasts, including those by Civic Economics, Oliver Wyman, Gallup, National Small Business Association and other publicly available sources. The industry and market information included in this report involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such information.

The sources of industry and market data contained in this report are listed below:

| • | Civic Economics, Indie Impact Study Series: A National Comparative Survey with the American Booksellers Association, October 2012. |

| • | eVoice, 25 Hour Day Survey, March 2012. |

| • | FDIC, Loans to Small Businesses and Farms, FDIC-Insured Institutions 1995-2014, Q4 2014. |

| • | Federal Reserve Bank of New York, Small Business Credit Survey Spring 2014, August 2014. |

| • | Gallup, Wells Fargo Small Business Survey Topline, Quarter 1, 2015. |

| • | National Small Business Association, 2013 Small Business Technology Survey, September 2013. |

| • | Karen Gordon Mills and Brayden McCarthy, The State of Small Business Lending: Credit Access during the Recovery and How Technology May Change the Game, Harvard Business School, July 22, 2014. |

| • | Oliver Wyman, Financing Small Businesses, 2013. |

| • | Oliver Wyman, Small Business Banking, 2013. |

| • | U.S. Small Business Administration, Small Business GDP: Update 2002-2010, January 2012. |

| • | U.S. Small Business Administration, United States Small Business Profile, 2014. |

The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in Item 1A. Risk Factors and elsewhere in this report. These and other factors could cause our actual results to differ materially from those expressed in the estimates made by the independent parties and by us.

18

Table of Contents

| Item 1A. | Risk Factors |