Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LABORATORY CORP OF AMERICA HOLDINGS | form8-kbarclaysppt31015.htm |

MARCH 10, 2015 | MIAMI, FL BARCLAYS GLOBAL HEALTHCARE CONFERENCE

1 FORWARD LOOKING STATEMENT Cautionary Statement Regarding Forward Looking Statements This presentation contains forward-looking statements including with respect to estimated 2015 guidance and the impact of various factors on operating results. Each of the forward-looking statements is subject to change based on various important factors, including without limitation, competitive actions in the marketplace, adverse actions of governmental and other third-party payers and the results from the Company’s acquisition of Covance. Actual results could differ materially from those suggested by these forward-looking statements. Further information on potential factors that could affect LabCorp’s operating and financial results is included in the Company’s Form 10-K for the year ended December 31, 2014, including in each case under the heading risk factors, and in the Company’s other filings with the SEC, as well as in the risk factors included in Covance’s filings with the SEC. The information in this press release should be read in conjunction with a review of the Company’s filings with the SEC including the information in the section of the Company’s Form 10-K for the year ended December 31, 2014, and subsequent Forms 10-Q, under the heading MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

2 INTRODUCTION TO LABCORP • >$6B in revenue in 2014 • $60B US Clinical Laboratory market • >36,000 employees worldwide • National network of 37 primary laboratories and 1,750 patient service centers • Offers broad range of 4,500+ clinical, anatomic pathology, genetic and genomic tests • Processes ~500,000 patient specimens daily • Serves >220,000 physicians, government agencies, managed care organizations, hospitals, clinical labs and pharmaceutical companies • Comprehensive logistics and IT connectivity capabilities Leading National Clinical Laboratory

3 CREATING THE WORLD'S LEADING HEALTHCARE DIAGNOSTICS COMPANY Acquisition of Covance Growth: New value for pharma, payers, providers, and consumers • Consideration: $75.76 in cash and 0.2686 LabCorp shares per Covance share • Valuation: Approximately $5.7 billion, net of cash acquired • Financing: Approximately $3.9 billion in long-term debt • Timing: Closed February 19, 2015 The merger with Covance creates value and delivers sustained profitable growth

4 INTRODUCTION TO COVANCE • >$2.5B in revenue last year • Serves $140 billion global pharmaceutical R&D market • Only provider of full spectrum of drug development services • Involved in the development of all of the top 50 drugs on the market • #1 in central laboratory / preclinical services • ~$900M revenue in Phase I-IV clinical trial management services • Generates more safety and efficacy data than any other CRO • Market leader in nutritional chemistry and food safety testing • >12,500+ employees worldwide • Global network of operations in 30+ countries with trial activity in over 100 countries Leading CRO & Drug Development Services Provider

5 TRANSFORMATIVE COMBINATION: CREATING THE WORLD'S LEADING HEALTHCARE DIAGNOSTICS COMPANY Powerful combination of personnel, assets, and capabilities Strong management teams Commercial infrastructure and global footprint Physician and consumer access and connectivity Scientific, bioinformatics and analytics expertise Continued innovation and targeted investment Industry growth Complementary datasets Breadth of relationships (physicians, pharma, consumers, payers, hospitals, etc.) Trends favor high quality, efficient providers that deliver better outcomes at lower cost

6 Diagnostic development Biomarker discovery & validation Pre- clinical Phase IV On-market care delivery • Post-mkt drug surveillance • Lab services • Monitoring outcomes COMBINATION CREATES THE BEST END-TO-END PARTNER FOR PHARMACEUTICAL AND BIOTECH DEVELOPMENT New/small position Leading position Strong position Central laboratory Phase I Phase II Phase III Approval & Launch

7 LABCORP WILL BE THE PARTNER OF CHOICE FOR BIOPHARMA AND IMPROVE THE LIVES OF PATIENTS • Faster, higher quality clinical trials at lower cost • Increased sales during patent lifetime • Expedited commercialization of companion diagnostics • Data analytics reduce safety recalls • Greater access to clinical trials for patients • Data & analytics drive increased confidence in prescriptions for: – ...the right drug... – ...the right patient... – ...the right time • More personalized medicines • Extended life and improved quality of life • Greater access to and transparency regarding clinical trials • Improved patient outcomes at lower cost • Fewer failures of therapy • Data & analytics to inform prescribing decisions • Reduced hospitalization costs • Improve people's health • Drive profitable growth • Create shareholder value LabCorp LabCorp

8 2015 AND 2016 PRIORITIES Deliver synergies ($100M annual cost reduction by 2017) Fully deploy top three value creation opportunities Continue core business initiatives (Business process re-engineering, BeaconLBS, Enlighten Health) Capitalize on the enhanced capabilities of our combined lab organizations Unify organizations

9 COMBINATION PROVIDES SIGNIFICANT NEW GROWTH AVENUES Prioritized top 3 opportunities based on materiality, feasibility, and strategic fit Deliver faster clinical trial enrollment 1 Partner of choice to develop and commercialize companion diagnostics 2 Enhance Phase IV trial experience and post-market surveillance 3 International expansion Predictive analytics for stakeholders Food safety & nutritional chemistry Wave One Wave Two

10 DETAIL ON THE TOP THREE OPPORTUNITIES Enhance Phase IV trial experience and post-market surveillance 3 Deliver faster clinical trial enrollment 1 Partner of choice to develop and commercialize companion diagnostics 2 >$150M >$100M >$50M Incremental 2018 Revenue

11 TOP THREE VALUE CREATORS TO BRING TO MARKET IN 2016 Enhance Phase IV trial experience and post-market surveillance 3 Deliver faster clinical trial enrollment 1 Partner of choice to develop and commercialize companion diagnostics 2

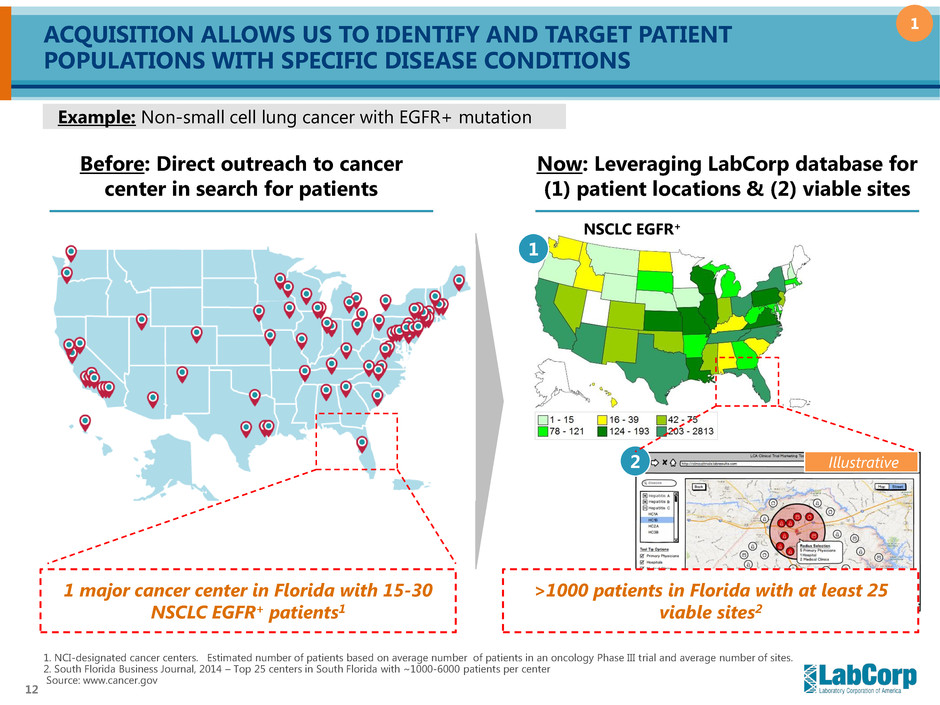

12 ACQUISITION ALLOWS US TO IDENTIFY AND TARGET PATIENT POPULATIONS WITH SPECIFIC DISEASE CONDITIONS Before: Direct outreach to cancer center in search for patients Now: Leveraging LabCorp database for (1) patient locations & (2) viable sites 1 2 >1000 patients in Florida with at least 25 viable sites2 1. NCI-designated cancer centers. Estimated number of patients based on average number of patients in an oncology Phase III trial and average number of sites. 2. South Florida Business Journal, 2014 – Top 25 centers in South Florida with ~1000-6000 patients per center Source: www.cancer.gov Illustrative NSCLC EGFR+ 1 major cancer center in Florida with 15-30 NSCLC EGFR+ patients1 Example: Non-small cell lung cancer with EGFR+ mutation 1

13 COMBINED COMPANY HAS THE OPPORTUNITY TO BENEFIT FROM CRO MARKET EXPANSION AND AN INCREASE IN SHARE 1 2014 2016 2018 Biopharma spend on Phase II-III trials1 $30B $32B $34B CRO served Phase II-III trial spend (% served by CROs)1 $12B (40%) $13B (42%) $15B (44%) Combined company revenue for Phase II-III trials (% share)2 $750M (~6%) ~850M (~6-7%) ~$1B (~6-7%) 1. Covance market research; Numbers rounded to the nearest $1B 2. Numbers rounded to the nearest $50M 3. Assumes average Phase III trial cost of $75M and that CRO served revenue per trial varies between 30-60% of total cost, amortized over a period of 3 years (approximate length of a Phase III trial) Note: Numbers may not sum due to rounding. Source: Covance market research Phase II-III trial market growing CRO revenue capture increasing Equivalent to winning ~1-2 incremental Phase III trials per year3 $1.1B+ (~7-8%) $900M+ (~7%) Maintain current growth trend Combined company poised to increase Phase III share $150M+ increase $50M+ increase

14 TOP THREE VALUE CREATORS TO BRING TO MARKET IN 2016 Enhance Phase IV trial experience and post-market surveillance 3 Deliver faster clinical trial enrollment 1 Partner of choice to develop and commercialize companion diagnostics 2

15 Capabilities Capabilities CDx development enabled by biomarker discovery and validation Market-leading biomarker and early stage trial support Execution on lab-based CDx for clinical validation in trials Late stage trial support linked seamlessly with CDx validation CDx approval and commercialization Peri-approval and market access support Experience with utilization of lab network to offer CDx at wide scale and/or enable kit development Phase IV and post- marketing surveillance support Preclinical and early stage trials Drug-CDx approval and launch Drug-CDx market delivery COMBINED COMPANY WILL DRIVE CRO SHARE GAIN FOR DRUG TRIALS REQUIRING CDX PROGRAMS Drug-CDx approval and commercialization Late stage trials Early stage services strength followed by seamless execution of CDx will boost share of clinical trials 2

16 COMPANION DIAGNOSTICS CAPABILITIES ADD >$100M REVENUE BY 2018 1. Based on estimated biomarker testing revenue of $200K per compound and total historical downstream testing revenue equal to 8.6x biomarker testing revenue 2. Covance estimates for currently obtainable projects with CDx development partner onboard 3. Assumptions based on market conditions expected by Covance 4. 2018 range corresponds to 1% additional market share on estimated 6% baseline for Covance in Phase II currently 5. Based on Credit Suisse 2013 analyst report figures for total trial cost by phase and CRO-addressable trial costs Note: "Opportunity" column shows potential yearly incremental revenue reasonably achievable as a result of CDx development and commercialization offerings Source: Credit Suisse 2013, Jefferies 2014, KeyBanc 2014, Covance 2 Sources of new value for combined company 2018 added opportunity Revenue generator Key figures for estimate Biomarker & central lab testing $60M+ 50-200 added biomarker development and testing contracts per year $1.8M total downstream testing revenue per biomarker contract1 CDx development services $40M+ ~30 new CDx partner opportunities now; ~$240M potential annual revenue2 15-40% of potential revenue captured; 10% CAGR to 20183 Early-Phase clinical trials share $30M+ 1-2 incremental Phase II trials won per year by 20184 $30M revenue per Phase II trial5

17 TOP THREE VALUE CREATORS TO BRING TO MARKET IN 2016 Enhance Phase IV trial experience and post-market surveillance 3 Deliver faster clinical trial enrollment 1 Partner of choice to develop and commercialize companion diagnostics 2

18 UNMET NEEDS ADDRESSED BY COMBINED COMPANY'S ENHANCED PHASE IV PATIENT EXPERIENCE AND POST-MARKET SURVEILLANCE 3 LabCorp patient web portal eliminates scheduling hassle 1,750 LabCorp patient service centers and ~5,000 phlebotomists in physician offices make testing more convenient Combined company positioned to deliver superior Phase IV trial experience 1863861194391962838870543677743224276809 3237695737015808068229045992123661689025 9627304306793165311494017647376938735140 9336183321644828584837011709672125353387 5862158231013310387766827211572694951817 9589754693992642197915523385766231676275 4757036876987687698769876q8ew6rq98ew76r9 8q7ew6r98q7ew6r8q7ew6r98qw7e6r98qw7e6r8q w7e6r98qw7e6r8w7e6r98q7we6r98qw7e6r8qw7e 6r8qw7e6rq87wqe6r8qw7e6r98qw7e6r8wq7e6r98 wq7e6r8q9w7e6r85469941489290413018638611 9439196283887054367774322427685465465413 2132132168798746546543213213213579873541 32135879879541321321321321987*9/768465143 2132132132132789/709187987987432513213210 ..354987*/74351321357/94321321322165879879 87451327/76987321321213323654494853667680 0000106526248547305586159899914017076983 8548318875014293890899506854530765116803 3373222651756622075269517914422528081651 7166776672304306793165311494017647376938 7351409336183321654587254354654653373222 6517566220752337322265175662207523373222 6517566220752337322265175662207523373222 6517566220752337322265175662207523373222 6517566220752337322265175662207524448798 Real World Safety: prevent drugs f om being recalled 12 Billion test results and 70M+ unique patients enable Post-market surveillance Real World Efficacy: expand commercial indications Identify safety signals early Avoid recall Modify prescription guidelines Combined co. real world evidence Identify new indications

19 COMBINED COMPANY HAS OPPORTUNITY TO GROW SHARE IN PHASE IV TRIALS AND POST-MARKET SURVEILLANCE 3 2014 2016 2018 Biopharma Phase IV and post-market spend1 $12B $13B $14B CRO served Phase IV / post- market spend (% served by CROs) 1 $5B (38%) $5B (39%) $6B (40%) Combined company revenue for Phase IV / post-market (% share)2 ~$150M (~3%) ~$180M (~4%) ~$220M (~4%) Phase IV trial market growing CRO revenue capture increasing Equivalent to winning ~2-4 incremental Phase IV / post-market trials per year3 $270M+ (~4-5%) $200M+ (~4%) Maintain current growth trend Combination poised to increase Phase IV/post-mkt share $50M+ increase $20M+ increase 1. Covance market research; Numbers rounded to the nearest $1B 2. Numbers rounded to the nearest $10M 3. Assumes average Phase IV trial cost of $10M and length of <1 year, and average post-market surveillance cost of $30-40M and length of ~5 years; assumes CRO served revenue per trial varies between 30-60% of total cost (Covance market research, Parexel Biopharmaceutical Statistical Sourcebook 2014) Note: Numbers may not add up due to rounding.

20 COMBINED COMPANY RETAINS FINANCIAL STRENGTH 2014 Financial Review and 2015 Financial Guidance

21 COMBINED COMPANY RETAINS FINANCIAL STRENGTH: NO FUNDAMENTAL SHIFT IN LONG-TERM CAPITAL ALLOCATION STRATEGY • Accretive to Adjusted EPS before synergies in Year 1; Earns cost of capital by Year 4 • Commitment to investment grade balance sheet • Near-Term Free Cash Flow used to pay down debt and invest in fold-in acquisitions • Share buyback program resumes as we approach 2.5x target leverage ratio 2014 Results ($ in Millions) LabCorp Covance $6,012 Revenue $2,521 $952 Adjusted Operating Income1, 2 $304 15.8% Adjusted Operating Margin1, 2 12.1% $6.80 Adjusted EPS3 N/A $739 Operating Cash Flow $296 $204 Capital Expenditures $142 $536 Free Cash Flow $154 (1) LabCorp operating income adjusted to exclude restructuring and other special items of $41.2 million. See non-GAAP reconciliation in the Appendix. (2) Covance operating income adjusted to exclude restructuring costs, transaction related expenses and asset impairments of $69.7 million. See non-GAAP reconciliation in the Appendix. (3) LabCorp EPS adjusted to exclude amortization, restructuring and special items. See non-GAAP reconciliation in the Appendix.

22 2015 FINANCIAL GUIDANCE • Total revenue growth: Approximately 40% - 44%(1) • Clinical lab business revenue growth: Approximately 3% - 5% • Covance business revenue growth: Approximately 4% - 6%(2) • Adjusted EPS: $7.35 - $7.70 • Operating cash flow: $1,075 Million - $1,100 Million(3) • Capital expenditures: $325 Million - $350 Million • Free cash flow: $725 Million - $775 Million(3) Excluding the impact of amortization, restructuring and special items, guidance for 2015 is: (1) Revenue growth is adjusted for approximately 160 basis points of negative currency impact assuming foreign exchange rates effective as of January 31, 2015. (2) Revenue growth versus full year 2014 revenue, and is adjusted for approximately 330 basis points of negative currency impact assuming foreign exchange rates effective as of January 31, 2015. (3) Operating and free cash flow are burdened by approximately $90 million of net non-recurring items related to the Covance acquisition.

23 COMBINATION CREATES THE WORLD'S LEADING HEALTHCARE DIAGNOSTICS COMPANY • Improve people's health • Drive profitable growth • Create shareholder value LabCorp • Faster, higher quality clinical trials at lower cost • Increased sales during patent lifetime • Expedited commercialization of companion diagnostics • Data analytics reduce safety recalls • Greater access to clinical trials for patients • Data & analytics drive increased confidence in prescriptions for: – ...the right drug... – ...the right patient... – ...the right time • More personalized medicines • Extended life and improved quality of life • Greater access to and transparency regarding clinical trials • Improved patient outcomes at lower cost • Fewer failures of therapy • Data & analytics to inform prescribing decisions • Reduced hospitalization costs

24 Appendix

25 (In millions, except per share data) Year Ended Adjusted Operating Income December 31, 2014 Operating income 910.4$ Restructuring and other special charges (1) 17.8 Consulting fees and CFO transition expenses (1) 23.4 Adjusted operating income 951.6$ RECONCILIATION OF NON-GAAP FINANCIAL MEASURES LabCorp Adjusted Operating Income (1) During 2014, the Company recorded net restructuring and special items of $17.8 million. The charges included $10.6 million in severance and other personnel costs along with $8.3 million in facility-related costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.4 million in unused severance and $0.7 million in unused facility-related costs. In addition to these net restructuring charges, the Company recorded $23.4 million in consulting expenses relating to fees incurred as part of Project LaunchPad, its comprehensive enterprise-wide cost structure review, as well as legal fees associated with its Covance, Inc. and LipoScience acquisitions, and one-time CFO transition costs (all such fees are recorded in selling, general and administrative).

26 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES LabCorp Adjusted EPS (1) The after tax impact of the restructuring and other special charges decreased net earnings for the year ended December 31, 2014, by $29.1 million and diluted earnings per share by $0.34 ($29.1 million divided by 86.4 million shares). (2) The Company continues to grow the business through acquisitions and uses Adjusted EPS (excluding restructuring, special items and amortization) as a measure of operational performance, growth and shareholder returns. The Company believes adjusting EPS for these items provides investors with better insight into the operating performance of the business. For the year ended December 31, 2014, intangible amortization was $76.7 million ($47.3 million net of tax) and decreased EPS by $0.55 ($47.3 million divided by 86.4 million shares). Year Ended Adjusted EPS Excluding Amortization December 31, 2014 Diluted earnings per common share 5.91$ Restructuring and special items (1) 0.34 Amortization expense (2) 0.55 Adjusted EPS 6.80$

27 (1) During 2014, Covance incurred restructuring and transaction related expenses of $17.1 million. The charges included $7.6 million in restructuring costs, $5.5 million in other cost reduction actions and $4.0 million in transaction related expenses. In addition to these restructuring charges and other cost reduction actions, Covance recorded asset impairment charges totaling $52.6 million relating to its Chandler, Arizona and Basel, Switzerland facilities and to land owned in Shanghai, China. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Covance Adjusted Operating Income (In millions, except per share data) Year Ended Adjusted Operating Income December 31, 2014 Operating income 234.8$ Restructuring costs and transaction related expenses (1) 17.1 Asset impairments (1) 52.6 Adjusted operating income 304.4$