Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - WAVE SYSTEMS CORP | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - WAVE SYSTEMS CORP | wavxq42014ex-312.htm |

| EX-31.1 - EXHIBIT 31.1 - WAVE SYSTEMS CORP | wavxq42014ex-311.htm |

| EX-23.1 - EXHIBIT 23.1 - WAVE SYSTEMS CORP | wavxq42014ex-231.htm |

| EX-32.1 - EXHIBIT 32.1 - WAVE SYSTEMS CORP | wavxq42014ex-321.htm |

Use these links to rapidly review the document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2014

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission File Number 0-24752

Wave Systems Corp.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 13-3477246 (I.R.S. Employer Identification No.) | |

480 Pleasant Street Lee, Massachusetts (Address of principal executive offices) | 01238 (Zip Code) | |

413-243-1600

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Class A Common Stock, $.01 par value |

(Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter), during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "accelerated filer", "large accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one).

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company ý | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES o NO ý

The aggregate market value of the shares of Common Stock of the registrant held by non-affiliates based on the closing price (as reported by NASDAQ) of such common stock on the last business day of the registrant's most recently completed second fiscal quarter (June 30, 2013) was approximately $35 million. (For purposes of this calculation, the market value of a share of Class B Common Stock was assumed to be the same as a share of Class A Common Stock, into which it is convertible.)

As of March 1, 2015, there were 51,475,368 shares of the registrant's Class A Common Stock and 8,885 shares of the registrant's Class B Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of our definitive Proxy Statement for the 2015 Annual Meeting of Stockholders, to be filed pursuant to Regulation 14A on or before April 30, 2015, have been incorporated by reference into Part III of this annual report.

EXCEPT FOR HISTORICAL INFORMATION CONTAINED HEREIN, THIS FORM 10-K CONTAINS FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE U.S. SECURITIES LITIGATION REFORM ACT OF 1995. THESE STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS AND UNCERTAINTIES THAT MAY CAUSE WAVE'S ACTUAL RESULTS OR OUTCOMES TO BE MATERIALLY DIFFERENT FROM THOSE ANTICIPATED AND DISCUSSED HEREIN. FURTHER, WAVE OPERATES IN AN INDUSTRY SECTOR WHERE SECURITIES VALUES MAY BE VOLATILE AND MAY BE INFLUENCED BY REGULATORY AND OTHER FACTORS BEYOND WAVE'S CONTROL. IMPORTANT FACTORS THAT WAVE BELIEVES MIGHT CAUSE SUCH DIFFERENCES ARE DISCUSSED IN THE CAUTIONARY STATEMENTS ACCOMPANYING THE FORWARD-LOOKING STATEMENTS AND IN THE RISK FACTORS DETAILED IN PART I, ITEM 1 OF THIS FORM 10-K. IN ASSESSING FORWARD-LOOKING STATEMENTS CONTAINED HEREIN, READERS ARE URGED TO READ CAREFULLY ALL RISK FACTORS AND CAUTIONARY STATEMENTS CONTAINED IN THIS FORM 10-K.

Table of Contents

PART I

Item 1. Business

Company Overview

References to "Wave," "we," "us," "our" or "the Company" refer to Wave Systems Corp. and its consolidated subsidiaries and include the financial statements of Wave Systems Corp. ("Wave" or "the Company"); Wave Systems Holdings, Inc., a wholly-owned subsidiary; Wavexpress, Inc. (referred to individually, as the context so requires, as "Wavexpress"), a majority-owned subsidiary; and Safend, Ltd. (referred to individually, as the context so requires, as "Safend"), a wholly-owned subsidiary; and Safend, Inc., a wholly owned US-based subsidiary of Safend, Ltd. Safend, Ltd. was acquired on September 22, 2011. All intercompany transactions have been eliminated.

Wave was incorporated in Delaware under the name Indata Corp. on August 12, 1988. We changed our name to Cryptologics International, Inc. on December 4, 1989. We changed our name again to Wave Systems Corp. on January 22, 1993. Our principal executive offices are located at 480 Pleasant Street, Lee, Massachusetts 01238 and our telephone number is (413) 243-1600.

Wave reduces the complexity, cost and uncertainty of data protection and authentication by starting inside the device. Unlike other vendors who try to secure information by adding layers of software for security, Wave leverages the hardware security capabilities built directly into endpoint computing platforms themselves. Wave has been among the foremost experts on this growing trend, leading the way with first-to-market solutions and helping shape standards through its work as a board member for the Trusted Computing Group (TCG).

Industry Background

The market for information security products and services is being driven by three key factors: the adoption of cloud-computing; the mobilization of the workforce; and the "Bring Your Own Device" trend. Each of these factors pose significant new challenges for a company's Information Technology ("IT") department. This is resulting in increasing allocation of IT budget and resources to improve key security areas, such as user authentication and data protection. In many industries, such as Finance, Energy, and Healthcare, compliance requirements play a key role.

The increasing frequency and sophistication of cyberattacks against corporations mean that security is no longer purely the concern of IT. Junior level executives and board members are spending more time focused on security and risk. In 2014, major data breaches occurred at companies including Sony, J.P. Morgan Chase, Target, and Home Depot. In the public sector, hacks have occurred at the State Department, the White House, the U.S. Postal Service, and the National Oceanic and Atmospheric Administration. These high profile attacks are leading many companies to question whether continuing with a software-only approach to security will provide them with sufficient protection.

Wave believes that software alone does not offer sufficient protection against cyberattack. Wave has been instrumental in the development of purpose-built hardware to enable secure cryptographic operations. In other words, security is not an afterthought addressed with a software download, but rather it is a capability embedded within the device itself. This approach is commonly referred to as "Trusted Computing".

Trusted Computing is widely supported across the PC industry. The TCG was formed in April 2003 by its promoting founders: AMD, HP, IBM, Intel, and Microsoft. Wave was initially invited to join the founding group as a contributing member. Since 2008, Wave has held a permanent seat on the TCG Board of Directors. Permanent members of the TCG Board of Directors provide guidance to the organization's work groups in the creation of specifications used to protect computing devices from attacks and to help prevent data loss and theft. Wave's status allows it to take a more active role in helping to develop, define and promote hardware-enabled trusted computing security technologies, including related hardware building blocks and software interfaces.

The TCG promotes a hardware-based trusted computing platform, which is a platform that uses a semiconductor device, known as a Trusted Platform Module ("TPM") that contains protected storage and performs protected activities allowing for the attestation of the state of the platform which provides the first level of trust for the computing platform (a "Trusted Platform"). The TPM is a hardware chip that is separate from the platform's main central processing unit(s) that enables secure protection of files and other digital secrets and performs critical security functions. While TPMs provide the anchor for hardware security, known as the "root of trust," trust is achieved by integrating the TPM within a carefully architected trust infrastructure and supporting the TPM with essential operational and lifecycle services, such as key management and credential authentication.

The TCG also promotes the use of self-encrypting drives ("SEDs"). SEDs are based on TCG specifications which enable integrated encryption and access control within the protected hardware of the disk drive. SEDs are designed to provide

2

advanced data protection technology and they differ from software-based full disk encryption in that encryption takes place in hardware in a manner designed to provide robust security without slowing processing speeds. Because the drives can be factory-installed, these systems can be configured such that encryption is "always on" for the protection of proprietary information.

The majority of Wave's TPM and SED related products, as detailed below in Products and Services, utilize the standards and specifications set by the TCG.

Products and Services

Cyberattacks are a constant threat to every company. Last year, the Target Corporation attack resulted in the theft of personal information from an estimated 110 million accounts. As the sophistication of cyberattacks grows, the inadequacies of many legacy, software-based solutions are exposed. Wave' products are purpose-built to prevent such attacks. Wave products can be combined to form a hardened cybersecurity solution covering access management, encryption, and data protection. Wave's products provide a complementary set of solutions that focus on authentication, encryption and data-loss protection. Unlike other solutions that depend on software as the foundation of security, Wave's solutions utilize hardware as the security foundation for devices. This security foundation is provided by built in hardware that is part of the device, not added on. With hardware as the security foundation, IT has unprecedented, yet straightforward control over exactly who has access to sensitive data and control over what devices can access that data.

Wave provides centralized remote management of its products in both on-premise and cloud platforms. For on-premise configurations, EMBASSY Remote Administration Server ("ERAS") hosts Wave’s Virtual Smart Card 2.0, TPM Management, SED Management and BitLocker Management products. The Data Protection Server hosts the Protector, Inspector and Encryptor products. For cloud configurations, Wave Cloud Encryption Management hosts SED Management, BitLocker Management and Macintosh Operating Systems ("Mac OS") Encryption management. Wave’s core set of offerings are set forth below:

•Authentication Solutions

◦Wave Virtual Smart Card 2.0 ("VSC") provides two factor authentication for Windows login as well as authentication for any software application that supports the Microsoft Smart Card infrastructure. Currently, Wave’s VSC product eliminates the expense of distributing physical tokens and the expense of replacing lost tokens, removing the biggest barrier to entry for enterprises to use two factor solutions.

◦TPM Management - The TPM Management solution provides device and user identification management by allowing IT administrators to manage and provision TPMs. TPM Management provides the ability to use TPM security for authentication to Virtual Private Networks, 802.1x Wireless and Microsoft Direct Access. Access to a network can be restricted to only known devices based on a TPM based certificate, providing further protection for the corporate network.

•Encryption Solutions

◦SED Management provides full lifecycle management of Opal 1 and Opal 2 SEDs. SEDs are the industry leading standard for hardware-based end point device encryption. Wave’s solution offers SED initialization, user management, SED locking, SED user recovery and SED crypto erase. Wave's solution support substantially more Opal SED's than any other product on the market today.

◦BitLocker® Management provides automated turn-key management for Microsoft BitLocker® encryption. Bitlocker is a suitable interim encryption solution for organizations that have not yet fully phased SEDs into their environment. Wave’s BitLocker® Management allows IT to set policies and monitor security from a single console-simplifying an organization's deployment by reducing the need for specialized knowledge or costly systems.

◦Mac OS Encryption provides management of encryption on Mac OS devices. It is available from the Wave Cloud Encryption platform only. Mac OS devices are typically a small percentage of an enterprise's population of devices. Wave Cloud Encryption Management of Mac OS devices provides an economic way to protect data for the enterprise.

3

• Data Loss Protection

◦The Protector product ("Protector") provides port control and removable media encryption. Protector blocks users from connecting to unauthorized devices or using unauthorized interfaces (including public hot spots). As an example, Protector allows an IT Administrator to define if users can use USB memory devices. Also when the action is authorized, it enforces encryption, automatically guiding the user through securing data.

◦The Inspector product ("Inspector") provides enforcement of data-centric security policies across multiple channels, including email, web (HTTP, HTTPS), FTP, external storage devices, CD/DVD burners, iPhone, iPad and other smart phones, file repositories, print screen, local printers, and network printers. Inspector will inspect, classify and block leakage of sensitive data in real time. Enterprise users access large amounts of data in the course of their normal jobs, Inspector ensures they do not mistakenly send a document with sensitive data to an unauthorized source.

◦The Encryptor product ("Encryptor") provides software full disk encryption. It is suitable as part of an enterprise migration to SED to cover their legacy systems running Windows XP or Vista

Market Overview

Software has traditionally secured critical information on networks and PCs and allowed for user access to various applications. Virus attacks and breaches of security are on the rise and have demonstrated that software, on its own, is not always capable of completely securing a network or platform. Because of these security concerns, we believe that there is a need in the computer industry for the development and deployment of a more robust and reliable security infrastructure including new security hardware in devices to guard against these persistent security risks. Wave is seeking to become a software, application and services leader in the hardware-based digital security market. We believe Wave has been a pioneer in developing hardware-based computer security systems and that we are distinctly positioned to take advantage of our unique knowledge, significant technology assets and trusted computing intellectual property. Our objective is to make our products and services the preferred applications and infrastructure for Trusted Platforms.

We operate in the information security market, a highly competitive and fragmented environment that is characterized by rapidly evolving technology. The competitive factors defining these evolving markets include product features, compatibility, standards compliance, quality and reliability, ease of use, performance, customer service and support, distribution and price. The features of Wave's products should allow it to compete favorably primarily because of its cross-platform interoperability and ease of use. The rate of market acceptance of trusted computing solutions continues to reflect its formative and early stages despite the substantial increase in distribution of the technology.

Our key competitors currently include WinMagic, Inc. ("WinMagic"), RSA Security, Inc., Sophos Ltd. ("Sophos"), Symantec Corporation ("Symantec"), McAfee Inc. ("McAfee"), SafeNet Inc. ("SafeNet"), Softex, Inc. ("Softex"), Entrust, Inc. and Absolute Software Corporation ("Absolute Software"). Recent consolidations of large competitors (including acquisitions made by our competitors named above) within our market have further increased the size and resources of some of these firms. These competitors are often able to offer more scale, which in some instances has enabled them to significantly discount their services in exchange for revenues in other areas or at later dates. Additionally, in an effort to maintain market share, many of our competitors are heavily discounting their services.

Marketing and Sales

Wave provides hardened cybersecurity solutions for the protection of corporate data. Many of our customers operate in industries that are subject to stringent data protection regulations. Our products focus on protecting these companies against the threats posed by unauthorized access and data breach. Our principal competitive strengths include our longstanding focus on hardware-enabled security; our experience with extremely large national and multi-national deployments; our industry reputation as a leader and a visionary; and our direct partnerships with many of the major hardware manufacturers and PC OEMs.

We market and sell our solutions worldwide primarily through our direct sales force and through indirect distribution channel partners and strategic partners. The direct sales force is responsible for providing highly responsive, quality service and ensuring client satisfaction. Strategic partnerships and alliances provide us with additional access to potential clients. We also market our solutions to original equipment manufacturers ("OEMs") in an effort to get our solutions in personal computers ("PCs") that are ultimately purchased by enterprise customers. Key decision makers involved in the sales process on the

4

customer side typically consists of information technology executives, finance executives and managers of communications assets and networks.

Our marketing strategy is to focus on large national and multinational corporations, as well as significant opportunities in the government sector. The information security market is crowded with competitors. We believe we are differentiated by our consistent focus on leveraging the native capabilities of many computing devices in order to offer solutions that combine stronger security with a better user experience. We have developed a strong corporate identity and are focused on driving increased market awareness with a combination of corporate marketing and partner marketing programs. Our solutions are marketed to a precisely targeted set of customers within specific industry verticals.

Wave is an innovative company and thought leadership is a key component of our messaging strategy. We engage in a wide variety of marketing activities including digital marketing, e-mail and direct mail campaigns, co-marketing strategies designed to leverage existing strategic relationships, website marketing, webcasts, public relations campaigns, speaking engagements and forums. We participate in and sponsor conferences that cater to our target market and demonstrate and promote our software and services at trade shows targeted to information technology and finance executives. We also publish "white papers" relating to relevant cybersecurity issues and develop customer reference programs, such as customer case studies, in an effort to promote better awareness of industry issues and demonstrate that our solutions can address many of these risks to an organization.

Segment Reporting

Information required by this item is incorporated herein by reference to "Segment Reporting" in Note 19 of the Notes to Consolidated Financial Statements.

Financial Information about Geographic Areas

Information required by this item is incorporated herein by reference to "Segment Reporting" in Note 19 of the Notes to Consolidated Financial Statements.

International Market

Most of our software products are controlled under various United States export control laws and regulations and may require export licenses for certain exports of the products and components outside of the United States and Canada. With respect to our products, we have applied for and received export classifications that allow us to export our products, without a license and with no restrictions, to any country throughout the world with the exception of Cuba, Iran, North Korea, Sudan and Syria.

We believe the export classifications that we have received for our software products allow us to sell our products internationally in an effective, competitively advantageous manner. Enhancements to existing products may, and new products will, be subject to reviews by the Bureau of Export Administration to determine what export classification they will receive. Some of our partners demand that our products be allowed to be exported without restrictions and/or reporting requirements. Current export regulations have, in part, allowed us to receive the desired classification without undue cost or effort. However, the export regulations may be modified at any time. Modifications to the export regulations could prevent us from exporting our existing and future products in an unrestricted manner without a license, as we are currently allowed for the products that we have received classification, or make it more difficult to receive the desired classification. If export regulations were to be modified in such a way we may be put at a competitive disadvantage with respect to selling our products internationally.

Proprietary Rights and Licenses and Intellectual Property

Our success depends, in part, on our ability to enjoy or obtain protection for our products and technologies under United States and foreign patent laws, copyright laws and other intellectual property laws, to preserve our trade secrets and to operate without infringing the proprietary rights of other parties. Any issued patent owned or licensed by us may not, however, afford adequate protection to us and may be challenged, invalidated, infringed upon or circumvented. Furthermore, you should understand that our activities may unknowingly infringe upon patents owned by others.

We rely on trade secrets and proprietary know-how, which we protect, in part, by confidentiality agreements with our employees and contract partners. However, we caution you that our confidentiality agreements may be breached and we may not have adequate remedies if such a breach occurs. Furthermore, we can provide no assurance that our trade secrets will not otherwise become known or be independently discovered by competitors.

Wave has eighteen (18) United States patents active and twelve (12) patents pending before the United States Patent and Trademark Office. In addition, we have nine (9) foreign patents active and fifteen (15) foreign patents pending before various foreign patent offices. Our patents are material to protecting some of our technology.

5

We also rely on copyright law to prevent the unauthorized duplication of our software and hardware products. We have and will continue to protect our software and our copyright interest therein through agreements with our consultants. We can provide no assurance that copyright laws will adequately protect our technology.

Research and Development

Wave's products incorporate technologies in which we have made a substantial investment in research and development ("R&D"). We will likely be required to continue to make substantial investments in the design of information security applications and services. For the years ended December 31, 2014, 2013 and 2012, we spent approximately $10.3 million, $11.4 million and $19.1 million, respectively, on R&D activities.

Employees

As of December 31, 2014, we employed one hundred thirty-two (132) full-time employees, eighty-six (86) of whom were involved in sales, marketing and administration and forty-six (46) of whom were involved in research and development. As of December 31, 2014, we retained the services of three (3) full-time and three (3) part-time consultants.

Available Information

Wave makes available, free of charge on its website by means of a link to www.nasdaq.com, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. Reports may be viewed and obtained on the Company's website, www.wave.com, or by calling Investor Relations at (212) 924-9800.

The public may read and copy any materials the Company files with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxies and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Item 1A. Risk Factors

Our business, financial condition and results of operations may be adversely affected by the unprecedented economic and market conditions.

The U.S. and numerous other leading markets around the world continue to experience slow recoveries or more challenging economic conditions, and we believe meaningful risk remains of returned deterioration in economic conditions and of substantial and continuing financial market disruptions in certain large economies. Conditions in the global financial markets and economic and geopolitical conditions throughout the world are outside of our control and difficult to predict, being influenced by factors such as national and international political circumstances (including governmental instability, wars, terrorist acts or security operations), interest rates, market volatility, asset or market correlations, equity prices, availability of credit, inflation rates, economic uncertainty, changes in laws or regulation including as regards taxation, trade barriers, commodity prices, interest rates, currency exchange rates and controls. While many governments, including the U.S. federal government, have taken substantial steps to stabilize economic conditions in an effort to increase liquidity and capital availability, if economic conditions should weaken, the business environment in our principal markets would be adversely affected, which may negatively impact, among other things:

• | the continued growth and development of our business; |

• | our liquidity; |

• | our ability to raise capital and obtain financing; and |

• | the price of our common stock. |

We have a history of net losses and expect net losses will continue. If we continue to operate at a loss our business will not be financially viable.

We have experienced significant losses and negative cash flow from operations since our inception. We have not realized a net operating profit in any quarter since we began our operations. Wave's revenue in 2014 was less than operating expenses as

6

our products have not yet attained widespread commercial acceptance. This is due in part to the early stage nature of our products with respect to the digital security industry in which we operate. As of December 31, 2014, we had an accumulated deficit of approximately $430.1 million and negative working capital of approximately $5.0 million. Given the lack of widespread adoption of the technology for our products and services, there is little basis for evaluating the financial viability of our business and our long-term prospects. You should consider our prospects in light of the risks, expenses and difficulties that companies in their early stage of development encounter, particularly companies in new and rapidly evolving markets such as digital security.

To achieve profitability we must, among other things:

• | continue to convince chip, personal computer motherboard, personal computer and computer peripheral manufacturers to license and distribute our products and services and/or make them available to their customers through their sales channels; |

• | convince computer end users and enterprise computer customers to purchase our upgrade software and server products for trusted computing; |

• | convince consumers to choose to order, purchase and accept products using our products and services; |

• | continue to maintain the necessary resources, especially talented software programmers; |

• | continue to develop relationships with personal computer manufacturers, computer chip manufacturers and computer systems integrators to facilitate and to maximize acceptance of our products and services; and |

• | generate substantial revenue, complete one or more commercial or strategic transactions or raise additional capital to support our operations until we can generate sufficient revenues and cash flows. |

If we do not succeed in these objectives we will not generate revenues; hence our business will not be sustainable.

We may be unable to raise or generate the additional financing or cash flow which will be necessary to continue as a going concern for the next twelve months.

Since we began our operations we have incurred net losses and experienced significant negative cash flow from operations. This is due to the early stage nature of market development for our products and services and the digital security industry as a whole. Wave expects to continue to incur substantial additional expenses associated with continued research and development and business development activities that will be necessary to commercialize our technology. We may be unable to raise or generate the additional financing or cash flow which will be necessary to continue as a going concern for the next twelve months.

In addition to our efforts to generate revenue sufficient to fund our operations, or complete one or more commercial or strategic transactions, Wave may evaluate additional financing options to generate additional capital in order to continue as a going concern, to capitalize on business opportunities and market conditions and to insure the continued development of our technology, products and services. We do not know if additional financing will be available or that, if available, it will be available on favorable terms. If we issue additional shares of our stock our stockholders' ownership will be diluted and the shares issued may have rights, preferences or privileges senior to those of our common stock. In addition, if we pursue debt financing we will be required to pay interest costs. The failure to generate sufficient cash flow to fund our forecasted expenditures would require us to reduce our cash burn rate which would in turn impede our ability to achieve our business objectives. Even if we are successful in raising additional capital, uncertainty with respect to Wave's viability will continue until we are successful in achieving our objectives. Furthermore, although we may be successful at achieving our business objectives, a positive cash flow from operations may not ultimately be realized unless we are able to sell our products and services at a profit. Given the early stage nature of the markets for our products and services considerable uncertainty exists as to whether or not Wave's business model is viable. If we are not successful in generating sufficient cash flow or obtaining additional funding we may be unable to continue our operations, develop or enhance our products, take advantage of future opportunities or respond to competitive pressures. Due to our current cash position, our forecasted capital needs over the next twelve months and beyond, the fact that we will require additional financing and uncertainty as to whether we will achieve our sales forecast for our products and services, substantial doubt exists with respect to our ability to continue as a going concern.

A single customer accounts for a significant portion of our revenues and, therefore, the loss of that customer may have a material adverse effect on our results of operations.

7

We expect that a small number of customers will continue to account for a large portion of our revenues for the foreseeable future. Dell accounted for approximately 32% of our revenue for the year ended December 31, 2014, as discussed below. Barring another royalty agreement with Dell, we anticipate that this Dell royalty revenue will continue to decline until it terminates completely. For the year ended December 31, 2015 and beyond, the Company will attempt to mitigate the loss of Dell revenue by, among other things, increasing sales to large enterprise customers and engaging other OEM customers in long-term licensing and distribution agreements.

If our relationship with any of our significant customers were disrupted we could lose a significant portion of our anticipated revenues which may have a material adverse effect on our results of operations as discussed below.

Factors that could influence our relationships with our customers include, among other things:

• | our ability to sell our products at prices that are competitive with our competitors; |

• | our ability to maintain features and quality standards for our products sufficient to meet the expectations of our customers; and |

• | our ability to produce and deliver a sufficient quantity of our products in a timely manner to meet our customers' requirements. |

If our OEM customers fail to purchase our components or to sell sufficient quantities of their products incorporating our components or if our OEM customers' sales timing and volume fluctuates, it may have a material adverse effect on our results of operations.

In general, our ability to make sales to OEM customers depends on our ability to compete on price, delivery and quality. The timing and volume of these sales depend upon the sales levels and shipping schedules for the products into which our OEM customers incorporate our products. Thus, even if we develop a successful component, our sales will not increase unless the product into which our component is incorporated is successful. If our OEM customers decide not to incorporate our products as components of their products or fail to sell a sufficient quantity of products incorporating our components, or if the OEM customers' sales timing and volume fluctuate, it may lead to a reduction in our sales and have a material adverse effect on our results of operations.

Sales to a relatively small number of OEM customers, as opposed to direct retail sales to end customers, comprised a significant portion of our revenues for the year ended December 31, 2014. Dell accounted for approximately 32% of our revenue for the year ended December 31, 2014. From time to time Dell updates its hardware platforms with new security solutions packages. Our bundled software has been included on Dell platforms since 2006 with the Dell Data Protection Access solution (DDPA). On March 15, 2013, Dell notified us that it will be replacing the DDPA solution in its next generation of client hardware platforms that began shipping in late 2013. As it has with other solution upgrades since 2006, Dell has also informed us that it will continue to discuss with Wave opportunities to include our software on future Dell platforms. However, Dell has not communicated to us any decisions regarding future platforms and we have no assurance that our software will be included in Dell's future platforms. We anticipate that our royalty revenue received from Dell will continue to decline as the Dell platforms that include Wave software decrease in shipping volume. For each of the three-months ended March 31, June 30, September 30 and December 31, 2014, Dell royalty revenue declined quarter over quarter as we had anticipated. Barring another royalty agreement with Dell, we anticipate that this Dell royalty revenue will continue to decline until it terminates completely. For the year ended December 31, 2015 and beyond, the Company will attempt to mitigate the loss of Dell revenue by, among other things, increasing sales to large enterprise customers and engaging other OEM customers in long-term licensing and distribution agreements.

Our market is in the early stage of development so we are unable to accurately ascertain the size and growth potential for revenue in such a market.

The market for our products and services is still developing and is continually evolving. As a result, substantial uncertainty exists with respect to the size of the market for these products and the level of capital that will be required to meet the evolving technical requirements of the marketplace.

Wave's business model relies on an assumed market of tens of millions of units shipping with built-in security hardware. Because this market remains in the early stage of development there is significant uncertainty with respect to the validity of the future size of the market. If the market for computer systems that utilize our products and services does not grow to the extent necessary for us to realize our business plan, we may not be successful.

As this early stage market develops and evolves, significant capital will likely be required to fund the resources needed to meet the changing technological demands of the marketplace. There is uncertainty with respect to the level of capital that may

8

be required to meet these changing technological demands. If the amount of capital resources needed exceeds our ability to obtain such capital, we may not be a viable enterprise.

Wave is not established in the industry so we may not be accepted as a supplier or service provider to the market.

Wave's product offering represents a highly complex architecture designed to solve many of the security issues currently present with computer systems such as identity theft, fraudulent transactions, virus attacks, unauthorized access to restricted networks and other security problems that users of computer systems generally encounter. We are uncertain as to whether the marketplace will accept our solution to these security problems. We will not be successful if the market does not accept the value proposition that we perceive to be present in our products and services.

Although Wave has expended considerable resources in developing technology and products that utilize our technology and in business development activities in an attempt to drive the development of the hardware security market, we do not have a track record as a substantial supplier or service provider to consumers of computer systems. Therefore, uncertainty remains as to whether we will be accepted as a supplier to the enterprise and consumer markets which will likely be necessary for us to be a successful commercial enterprise.

Our products have not been accepted as industry standards which may slow their sales growth.

We believe platforms adopting integrated hardware security into the PC will become a significant standard feature in the overall PC marketplace. However, our technologies have not been accepted as industry standards. Standards for trusted computing are still evolving. To be successful we must obtain acceptance of our technologies as industry standards, modify our products and services to meet whatever industry standards ultimately develop and/or adapt our products to be complementary to whatever these standards become. If we fail to do any of these we will not be successful in commercializing our technology; and therefore, we will not generate sales to fund our operations and develop into a self-sustaining, profitable business.

If we do not keep up with technological changes our product development and business growth will suffer.

Because the market in which we operate is characterized by rapidly changing technology, changes in customer requirements, frequent new products, service introductions and enhancements and emerging industry standards, our success will depend upon, among other things, our ability to improve our products, develop and introduce new products and services that keep pace with technological developments, remain compatible with changing computer system platforms, respond to evolving customer requirements and achieve market acceptance on a timely and cost effective basis. If we do not identify, develop, manufacture, market and support new products and deploy new services effectively and timely our business will not grow, our financial results will suffer and we may not have the ability to remain in business.

We are subject to risks relating to potential security breaches of our software products.

Although we have implemented in our products various security mechanisms, our products and services may nevertheless be vulnerable to break-ins, piracy and similar disruptive problems caused by Internet users. Any of these disruptions would harm our business. Advances in computer capabilities, new discoveries in the field of security or other developments may result in a compromise or breach of the technology we use to protect products and information in electronic form. Computer break-ins and other disruptions would jeopardize the security of information stored in and transmitted through the computer systems of users of our products which may result in significant liability to us and may also deter potential customers.

A party who is able to circumvent our security measures could misappropriate proprietary electronic content or cause interruptions in our operations and those of our strategic partners. We may be required to expend significant capital and other resources to protect against security breaches or to alleviate problems caused by breaches. Our attempts to implement contracts that limit our liability to our customers, including liability arising from a failure of security features contained in our products and services, may not be enforceable. We currently do not have product liability insurance to protect against these risks. If the security of products or services is breached, our results of operations may be materially adversely affected by the liability resulting from the breach.

Competition and competing technologies may render some or all of our products non-competitive or obsolete.

An increasing number of market entrants have introduced or are developing products and services that compete with Wave's. Our competitors may be able to develop products and services that are more attractive to customers than our products and services. Many of our competitors and potential competitors have substantially greater financial, technical and marketing resources than we have. Also, many current and potential competitors have greater name recognition and larger customer bases that could be leveraged to enable them to gain market share or product acceptance to our detriment. Wave's potential competitors include security solutions providers such as WinMagic, RSA Security, Inc., Sophos, Symantec, McAfee, SafeNet, Softex, Entrust, Inc. and Absolute Software.

9

Other companies have developed or are developing technologies that are, or may become, the basis for competitive products in the field of security and electronic content distribution. Some of those technologies may have an approach or means of processing that is entirely different from ours. Existing or new competitors may develop products that are superior to ours or that otherwise achieve greater market acceptance than ours. Due to Wave's early stage and lower relative name recognition compared to many of our competitors and potential competitors, our competitive position in the marketplace is vulnerable.

We have a high dependence on relationships with strategic partners that must continue or our ability to successfully produce and market our products will be impaired.

Due in large part to Wave's early stage and lesser name recognition we depend upon strategic partners such as large, well established personal computer and semiconductor manufacturers and computer systems' integrators to adopt our products and services within the marketplace. These companies may choose not to use our products and could develop or market products or technologies that compete directly with us. We cannot predict whether these third parties will commit the resources necessary to achieve broad-based commercial acceptance of our technology. Any delay in the use of our technology by these partners could impede or prohibit the commercial acceptance of our products. Although we have established some binding commitments from some of our strategic partners there can be no assurance that we will be able to enter into additional definitive agreements or that the terms of such agreements will be satisfactory. It will be necessary for Wave to expand upon our current business relationships with our partners, or form new ones, in order to sell more products and services for Wave to become a viable, self-sufficient enterprise.

Product defects or development delays may limit our ability to sell our products.

We may experience delays in the development of our new products and services and the added features and functionality to our existing products and services that our customers and prospective customers are demanding. If we are unable to successfully develop products that contain the features and functionality being demanded by these customers and prospective customers in a timely manner, we may lose business to our competitors. In addition, despite testing by us and potential customers, it is possible that our products may nevertheless contain defects. Development delays or defects could have a material adverse effect on our business if such defects and delays result in our inability to meet the market's demand.

If we lose our key personnel, or fail to attract and retain additional personnel, we will be unable to continue to develop our products and technology.

We believe that our future success depends upon the continued service of our key technical personnel and on our ability to attract and retain highly skilled technical, sales and marketing personnel. Our industry is characterized by a high level of employee mobility and aggressive recruiting of skilled personnel. There can be no assurance that our current employees will continue to work for us or that we will be able to hire any additional personnel necessary for our growth. Our future success also depends on our continuing ability to identify, hire, train and retain other highly qualified technical and managerial personnel. Competition for these employees can be intense. We may not be able to attract, assimilate or retain qualified technical and managerial personnel in the future, and the failure of us to do so would have a material adverse effect on our business.

We have a limited ability to protect our intellectual property rights and others could infringe on or misappropriate our proprietary rights.

Our success depends, in part, on our ability to enjoy or obtain protection for our products and technologies under United States and foreign patent laws, copyright laws and other intellectual property laws and to preserve our trade secrets. We cannot assure you that any patent owned or licensed by us will provide us with adequate protection or will not be challenged, invalidated, infringed or circumvented.

We rely on trade secrets and proprietary know-how which we protect, in part, by confidentiality agreements with our employees and contract partners. However, our confidentiality agreements may be breached and we may not have adequate remedies for these breaches. Our trade secrets may become known or be independently discovered by competitors. We also rely on intellectual property laws to prevent the unauthorized duplication of our software and hardware products. However, intellectual property laws may not adequately protect our technology. We have registered various trademark and service mark registrations with the United States Patent and Trademark Office. Wave may apply for additional name and logo marks in the United States and foreign jurisdictions in the future but we cannot be assured that registration of any of these trademarks will be granted.

We conduct a portion of our operations in the State of Israel and, therefore, political, economic and military instability in Israel and its region may adversely affect our business.

10

Safend's operations are located in the State of Israel which will constitute a material portion of our business. Accordingly, political, economic and military conditions in Israel and the surrounding region may affect our business. Since the establishment of the State of Israel in 1948, a number of armed conflicts have occurred between Israel and its Arab neighbors. A state of hostility, varying in degree and intensity, has caused security and economic problems in Israel. Although Israel has entered into peace treaties with Egypt and Jordan, and various agreements with the Palestinian Authority, there has been a marked increase in violence, civil unrest and hostility, including armed clashes, between the State of Israel and the Palestinians and others, since September 2000. The establishment in 2006 of a government in the Gaza Strip by representatives of the Hamas militant group has created heightened unrest and uncertainty in the region. In mid-2006, Israel engaged in an armed conflict with Hezbollah, a Shiite Islamist militia group based in Lebanon, and in June 2007, there was an escalation in violence in the Gaza Strip. From December 2008 through January 2009, Israel engaged in an armed conflict with Hamas, which involved missile strikes against civilian targets in various parts of Israel and which negatively affected business conditions in Israel. During July 2014, Israel was again engaged in an armed conflict with Hamas involving missile strikes against civilian targets in various parts of Israel which negatively affected business conditions in the region. Also, there continues to be great international concern in connection with Iran’s efforts to develop and enrich uranium which could lead to the development of nuclear weapons. Iran’s successful enrichment of uranium could significantly alter the geopolitical landscape in the Middle East, including the threat of international war, which could significantly impact business conditions in Israel.

Recent political uprisings, regime changes and social unrest in various countries in the Middle East and North Africa are affecting the political stability of those countries. This instability may lead to deterioration of the political relationships that exist between Israel and these countries and have raised new concerns regarding security in the region and the potential for armed conflict. Among other things, this instability may affect the global economy and marketplace through changes in oil and gas prices. Further escalation of tensions or violence might result in a significant downturn in the economic or financial condition of Israel, which could have a material adverse effect on our operations in Israel and the portion of our business related to our operations there.

Safend received Israeli government grants for certain of its research and development activities. The terms of these grants may require Safend to meet certain requirements in order to manufacture products and transfer technologies outside of Israel. Safend may be required to pay penalties in addition to repayment of the grants. Such grants may be terminated or reduced in the future, which would increase our costs.

The research and development efforts of Safend have been financed, in part, through grants that Safend has received from the Israeli Office of the Chief Scientist, or OCS. Safend therefore must comply with the requirements of the Israeli Law for the Encouragement of Industrial Research and Development, 1984, and related regulations, or the Research Law regarding the intellectual property and products generated by Safend. The terms of these grants and the Research Law restrict the transfer of know-how if such know-how is related to products, know-how and/or technologies which were developed using the OCS grants, and the transfer of manufacturing or manufacturing rights of such products, technologies and/or know-how outside of Israel without the prior approval, pursuant to the Research Law, of the appropriate authority of the OCS. Therefore, the discretionary approval of an OCS committee will be required for any transfer to third parties outside of Israel of rights related to certain of Safend's technologies which have been developed with OCS funding. Safend may not receive the required approvals should it wish to transfer this technology and/or development outside of Israel in the future. Safend did not receive any grants during the year ended December 31, 2014 and does not intend on applying for new grants in the future.

Furthermore, the OCS may impose certain conditions on any arrangement under which Safend transfers technology or development out of Israel. Overseas transfers of technology, manufacturing and/or development from OCS funded programs, even if approved by the OCS, may be subject to restrictions set forth in the Research Law. We cannot be certain that any approval of the OCS will be obtained on terms that are acceptable to us, or at all. If Safend fails to comply with the conditions imposed by the OCS, including the payment of royalties with respect to grants received, we may be required to refund any OCS payments previously received by Safend, together with interest and penalties, and may also be subject to criminal penalties.

Failure to comply with the Foreign Corrupt Practices Act (“FCPA”), and other similar anti-corruption laws, could subject us to penalties and damage our reputation.

We are subject to the FCPA, which generally prohibits U.S. companies and their intermediaries from making corrupt payments to foreign officials for the purpose of obtaining or keeping business or otherwise obtaining favorable treatment, and requires companies to maintain certain policies and procedures. Certain of the jurisdictions in which we conduct business are at a heightened risk for corruption, extortion, bribery, pay-offs, theft and other fraudulent practices. Under the FCPA, U.S. companies may be held liable for actions taken by their strategic or local partners or representatives. If we, or our intermediaries, fail to comply with the requirements of the FCPA, or similar laws of other countries, governmental authorities in the United States or elsewhere, as applicable, could seek to impose civil and/or criminal penalties, which could damage our reputation and have a material adverse effect on our business, financial condition and results of operations.

11

Regulation of international transactions may limit our ability to sell our products in foreign markets.

Most of our software products are controlled under various United States export control laws and regulations and may require export licenses for certain exports of the products and components outside of the United States and Canada. With respect to our EMBASSY Trust Suite and EMBASSY Trust Server software applications, we have applied for and received export classifications that allow us to export our products without a license and with no restrictions to any country throughout the world with the exception of Cuba, Iran, North Korea, Sudan and Syria.

Any new product offerings will be subject to review by the Bureau of Export Administration to determine what export classification they will receive. Enhancements to existing products may be subject to review by the Bureau of Export Administration to determine their export classification. Some of our partners demand that our products be allowed to be exported without restrictions and/or reporting requirements. Current export regulations have, in part, allowed us to receive the desired classification without undue cost or effort. However, the export regulations may be modified at any time. Currently we are allowed to export the products for which we have received classification in an unrestricted manner without a license. However, modifications to the export regulations could prevent us from exporting our existing and future products in an unrestricted manner without a license. Such modifications could also make it difficult to receive the desired classification. If export regulations were to be modified in such a way, we may be put at a competitive disadvantage with respect to selling our products internationally.

In addition, import and export regulations of encryption/decryption technology vary from country to country. We may be subject to different statutory or regulatory controls in different foreign jurisdictions, and as such, our technology may not be permitted in these foreign jurisdictions. Violations of foreign regulations or regulation of international transactions could prevent us from being able to sell our products in international markets. Our success depends in large part to having access to international markets. A violation of foreign regulations could limit our access to such markets and have a negative effect on our results of operations.

Our stock price is volatile.

The price of our Class A Common Stock has been, and likely will continue to be, subject to wide fluctuations in response to a number of events and factors such as:

• | quarterly variations in operating results; |

• | announcements of technological innovations, new products, acquisitions, capital commitments or strategic alliances by us or our competitors; |

• | the operating and stock price performance of other companies that investors may deem comparable to us; and |

• | news reports relating to trends in our markets. |

In addition, the stock market in general and the market prices for technology-related companies in particular, have experienced significant price and volume fluctuations. These broad market fluctuations may adversely affect the market price of our Class A Common Stock and any of our other securities for which a market develops regardless of our operating performance. Securities class action litigation has often been instituted against companies that have experienced periods of volatility in the market price for their securities. It is possible that we could become the target of additional litigation of this kind that would require substantial management attention and expense. The diversion of management's attention and capital resources could have a material adverse effect on our business. In addition, any negative publicity or perceived negative publicity of any such litigation could have an adverse impact on our business.

Governmental regulation may slow our growth and decrease our profitability.

There are currently few laws or regulations that apply directly to the Internet. Because our business is dependent, in significant respect, on the Internet, the adoption of new local, state, national or international laws or regulations may decrease the growth of Internet usage or the acceptance of Internet commerce which could decrease the demand for our products and services and increase our costs or otherwise have a material adverse effect on our business.

Tax authorities in a number of states are currently reviewing the appropriate tax treatment of companies engaged in Internet commerce. New state tax regulations may subject us to additional state sales, use and income taxes.

If we make any acquisitions we will incur a variety of costs and may never realize the anticipated benefits.

If appropriate opportunities become available we may attempt to acquire businesses, technologies, services or products that we believe are a strategic fit with our business. If we do undertake any transaction of this sort the process of integrating an

12

acquired business, technology, service or product may result in operating difficulties and expenditures and may absorb significant management attention that would otherwise be available for ongoing development of our business. Moreover, we may never realize the anticipated benefits of any acquisition. Future acquisitions could result in potentially dilutive issuances of equity securities, the incurrence of debt, contingent liabilities and/or amortization expenses related to certain intangible assets and increased operating expenses which could adversely affect our results of operations and financial condition.

If our common stock ceases to be listed for trading on the NASDAQ Capital Market, it may harm our stock price and make it more difficult to sell shares.

Our common stock is listed on the National Association of Securities Dealers Automated Quotations Capital Market ("NASDAQ"). In order to maintain our NASDAQ listing, NASDAQ Marketplace Rule 5550(a)(2) (the “Bid Price Rule”) requires that the bid price for our common stock not fall below $1.00 per share for a period of 30 consecutive trading days. On January 15, 2015, we received notification from the Listing Qualifications Department of the NASDAQ Stock Market indicating that our common stock is subject to potential delisting from the NASDAQ Capital Market because for a period of 30 consecutive business days, the bid price of our common stock closed below the minimum $1.00 per share requirement for continued inclusion under the Bid Price Rule. The NASDAQ notice indicated that, in accordance with NASDAQ Marketplace Rule 5810(c)(3)(A), we will be provided 180 calendar days, or until July 14, 2015, to regain compliance. If, at anytime before July 14, 2015, the bid price of the our common stock closes at $1.00 per share or more for a minimum of 10 consecutive business days, NASDAQ staff will provide written notification that it has achieved compliance with the Bid Price Rule. If we fail to regain compliance with the Bid Price Rule before July 14, 2015 but we meet all of the other applicable standards for initial listing on the NASDAQ Capital Market with the exception of the minimum bid price, then we may be eligible to have an additional 180 calendar days, or until January 10, 2016, to regain compliance with the Bid Price Rule. In addition to the Bid Price Rule, in order to remain listed on the NASDAQ Capital Market, we must also maintain compliance with all of the other required continued listing requirements of the NASDAQ Capital Market, including the $35 million market capitalization requirement. If our common stock ceases to be listed for trading on the NASDAQ Capital Market, we expect that our common stock would be traded on the Financial Industry Regulatory Authority’s Over-the-Counter Bulletin Board (OTC-BB). The level of trading activity of our common stock may decline if it is no longer listed on the NASDAQ Capital Market. If our common stock ceases to be listed for trading on the NASDAQ Capital Market for any reason, it may harm our stock price, increase the volatility of our stock price and make it more difficult to sell your shares of our common stock.

Our ability to raise capital may be limited by applicable laws and regulations.

Our ability to raise capital using a shelf registration statement may be limited by, among other things, current Securities and Exchange Commission (“SEC”) rules and regulations. Under current SEC rules and regulations, we must meet certain requirements to use a Form S−3 registration statement to raise capital without restriction as to the amount of the market value of securities sold thereunder. One such requirement is that the market value of our outstanding common stock held by non−affiliates, or public float, be at least $75.0 million as of a date within 60 days prior to the date of filing the Form S−3. If we do not meet that requirement, then the aggregate market value of securities sold by us or on our behalf under the Form S−3 in any 12−month period is limited to an aggregate of one−third of our public float. Moreover, even if we meet the public float requirement at the time we file a Form S−3, SEC rules and regulations require that we periodically re−evaluate the value of our public float, and if, at a re−evaluation date, our public float is less than $75.0 million, we would become subject to the one−third of public float limitation described above. If our ability to utilize a Form S−3 registration statement for a primary offering of our securities is limited to one−third of our public float, we may conduct such an offering pursuant to an exemption from registration under the Securities Act or under a Form S−1 registration statement and we would expect either of those alternatives to increase the cost of raising additional capital relative to utilizing a Form S−3 registration statement.

In addition, under current SEC rules and regulations, our common stock must be listed and registered on a national securities exchange in order to utilize a Form S−3 registration statement (i) for a primary offering, if our public float is not at least $75.0 million as of a date within 60 days prior to the date of filing the Form S−3, or a re−evaluation date, whichever is later, and (ii) to register the resale of our securities by persons other than us (i.e., a resale offering). While currently our common stock is listed on the NASDAQ, there can be no assurance that we will be able to maintain such listing. The NASDAQ reviews the appropriateness of continued listing of any issuer that falls below the exchange’s continued listing standards. Previously, including as recently as January 2015, we were not in compliance with certain NASDAQ continued listing standards and were at risk of having our common stock delisted from the NASDAQ. For additional information regarding this risk, see the risk factor above titled “If our common stock ceases to be listed for trading on the NASDAQ Capital Market, it may harm our stock price and make it more difficult to sell shares.”

Our ability to timely raise sufficient additional capital also may be limited by the NASDAQ’s stockholder approval requirements for transactions involving the issuance of our common stock or securities convertible into our common stock. For instance, the NASDAQ requires that we obtain stockholder approval of any transaction involving the sale, issuance or potential issuance by us of our common stock (or securities convertible into our common stock) at a price less than the greater of book or

13

market value, which (together with sales by our officers, directors and principal stockholders) equals 20% or more of our then outstanding common stock, unless the transaction is considered a “public offering” by the NASDAQ staff. Based on 51,475,368 shares of our common stock outstanding as of March 2, 2014 and the closing price per share of our common stock on such date, which was $0.81, we could not raise more than approximately $8.3 million without obtaining stockholder approval, unless the transaction is deemed a public offering or does not involve the sale, issuance or potential issuance by us of our common stock (or securities convertible into our common stock) at a price less than the greater of book or market value. In addition, certain prior sales by us may be aggregated with any offering we may propose in the future, further limiting the amount we could raise in any future offering that is not considered a public offering by the NASDAQ staff and involves the sale, issuance or potential issuance by us of our common stock (or securities convertible into our common stock) at a price less than the greater of book or market value. The NASDAQ also requires that we obtain stockholder approval if the issuance or potential issuance of additional shares will be considered by the NASDAQ staff to result in a change of control of our company.

Obtaining stockholder approval is a costly and time-consuming process. If we are required to obtain stockholder approval for a potential transaction, we would expect to spend substantial additional money and resources. In addition, seeking stockholder approval would delay our receipt of otherwise available capital, which may materially and adversely affect our ability to execute our current business strategy, and there is no guarantee our stockholders ultimately would approve a proposed transaction. A public offering under the NASDAQ rules typically involves broadly announcing the proposed ultimately would approve a proposed transaction. A public offering under the NASDAQ rules typically involves broadly announcing the proposed transaction, which often times has the effect of depressing the issuer’s stock price. Accordingly, the price at which we could sell our securities in a public offering may be less, and the dilution existing stockholders experience may in turn be greater, than if we were able to raise capital through other means.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Summarized below is a listing of properties leased by Wave and Safend. Our principal research and development activities are conducted at the Princeton and Cupertino facilities in the United States and at the Tel Aviv facility in Israel. We believe our office facilities are suitable and adequate for our business as it is presently conducted.

Facility | Sq. Ft. | Annualized Lease Cost | Lease Expires | |||||

Cupertino, CA | 16,000 | $ | 624,000 | Jul. 2016 | ||||

Tel Aviv, Israel | 10,000 | 209,000 | Jan. 2016 | |||||

Lee, MA | 13,000 | 159,000 | Feb. 2016 | |||||

Princeton, NJ | 5,000 | 103,000 | Dec. 2015 | |||||

Frankfurt, Germany | 500 | 27,000 | Monthly | |||||

London, UK | 250 | 26,000 | Monthly | |||||

Orvault, France | 250 | 24,000 | Mar. 2018 | |||||

Taipei, Taiwan | 250 | 7,000 | Monthly | |||||

Item 3. Legal Proceedings

Brian Berger, a former employee of Wave who was terminated on November 1, 2013, has indicated that he may file a lawsuit against the company for unpaid compensation and penalties. The parties are currently in discussions regarding Mr. Berger’s claims and the Company is evaluating its defenses. The Company has also advised Mr. Berger that he may not misappropriate Wave’s proprietary technology and information and that the Company has reserved all of its rights with respect to any such activities.

Item 4. Mine Safety Disclosures

Not applicable.

14

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information & Dividends

Our Class A Common Stock trades on the NASDAQ Capital Market under the symbol "WAVX". The following table sets forth, for the periods indicated, the high and low sales prices per share for our Class A Common Stock. There is no established trading market for our Class B Common Stock.

High | Low | ||||||

Year Ended December 31, 2014 | |||||||

First Quarter | $ | 1.18 | $ | 0.69 | |||

Second Quarter | 2.32 | 0.80 | |||||

Third Quarter | 1.66 | 1.03 | |||||

Fourth Quarter | 1.34 | 0.76 | |||||

Year Ended December 31, 2013 | |||||||

First Quarter | $ | 4.24 | $ | 2.60 | |||

Second Quarter | 2.80 | 1.20 | |||||

Third Quarter | 1.91 | 0.87 | |||||

Fourth Quarter | 1.44 | 0.82 | |||||

As of March 1, 2015, there were approximately 17,500 holders of our Class A Common Stock. As of such date, there were 11 holders of our Class B Common Stock.

On March 2, 2015, the last sale price reported on the NASDAQ Capital Market for the Class A Common Stock was $0.81.

We have never declared, nor paid, cash dividends on our Class A Common Stock. We currently anticipate that we will retain all future earnings, if any, to fund the development and growth of our business and do not anticipate paying cash dividends on our Class A Common Stock in the foreseeable future.

15

Performance Graph

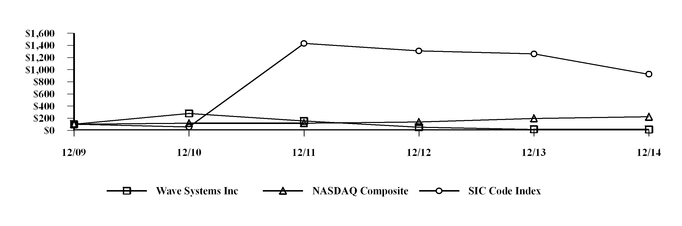

The following line graph compares the Company's cumulative total return to stockholders with the cumulative total return of the NASDAQ Market Value Index and the Computer Related Services SIC Code Index from December 31, 2009 through December 31, 2014. These comparisons assume the investment of $100 on December 31, 2009 and the reinvestment of dividends. The stock performance on the graph is not necessarily indicative of future stock price performance.

Wave Systems Corp.

Comparison of Cumulative Total Return to Stockholders

December 31, 2009 through December 31, 2014

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Wave Systems Corp., the NASDAQ Composite Index, and SIC Code Index

* $100 invested on 12/31/09 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.

Wave Systems | Peer Group (SIC Code 7379) | NASDAQ Market | |||||||||

12/31/2009 | $ | 100.00 | $ | 100.00 | $ | 100.00 | |||||

12/31/2010 | 277.46 | 56.56 | 117.61 | ||||||||

12/31/2011 | 152.82 | 1,433.24 | 118.70 | ||||||||

12/31/2012 | 50.49 | 1,310.01 | 139.00 | ||||||||

12/31/2013 | 16.02 | 1,258.64 | 196.83 | ||||||||

12/31/2014 | 14.08 | 924.71 | 223.74 | ||||||||

Item 6. Selected Financial Data

The selected historical consolidated financial data presented below as of December 31, 2014 and 2013 and for the years ended December 31, 2014, 2013 and 2012 are derived from our audited Consolidated Financial Statements contained in Item 8 of this report. The historical consolidated data as of December 31, 2012, 2011 and 2010 and for the years ended December 31, 2011 and 2010 are derived from our audited Consolidated Financial Statements, which are not included in this report. This information should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the audited consolidated financial statements and related notes in Part IV, Item 15(a) of this Annual Report on Form 10-K.

16

Consolidated Statement of Operations Data

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

Net Revenues | $ | 16,970,834 | $ | 24,400,852 | $ | 28,844,513 | $ | 36,139,015 | $ | 26,050,792 | |||||||||

Operating expenses: | |||||||||||||||||||

Cost of net revenues | 1,288,776 | 3,696,936 | 6,866,332 | 2,037,649 | 1,776,818 | ||||||||||||||

Adjustments to purchase accounting | — | — | — | 1,033,206 | — | ||||||||||||||

Selling, general and administrative | 18,794,273 | 26,829,636 | 32,632,237 | 27,871,223 | 18,019,707 | ||||||||||||||

Research and development | 10,333,607 | 11,380,258 | 19,055,894 | 16,087,129 | 10,288,460 | ||||||||||||||

Impairment of goodwill and purchased intangible assets | — | 2,590,000 | 4,054,732 | — | — | ||||||||||||||

Total operating expenses | 30,416,656 | 44,496,830 | 62,609,195 | 47,029,207 | 30,084,985 | ||||||||||||||

Operating loss | (13,445,822 | ) | (20,095,978 | ) | (33,764,682 | ) | (10,890,192 | ) | (4,034,193 | ) | |||||||||

Other income (expense): | |||||||||||||||||||

Net currency transaction gain (loss) | (14,828 | ) | (17,220 | ) | 12,156 | 175,004 | — | ||||||||||||

Gain on sale of eSign | 1,304,579 | — | — | — | — | ||||||||||||||

Net interest and other income (expense) | (712,527 | ) | (200,456 | ) | (197,989 | ) | (4,589 | ) | (15,842 | ) | |||||||||

Total other income (expense) | 577,224 | (217,676 | ) | (185,833 | ) | 170,415 | (15,842 | ) | |||||||||||

Loss before income taxes | (12,868,598 | ) | (20,313,654 | ) | (33,950,515 | ) | (10,719,777 | ) | (4,050,035 | ) | |||||||||

Income tax expense | (12,000 | ) | (10,610 | ) | (12,033 | ) | (74,959 | ) | (72,782 | ) | |||||||||

Net loss | $ | (12,880,598 | ) | $ | (20,324,264 | ) | $ | (33,962,548 | ) | $ | (10,794,736 | ) | $ | (4,122,817 | ) | ||||

Weighted average number of common shares outstanding during the period | 43,024,449 | 29,825,854 | 24,051,126 | 21,086,182 | 19,981,119 | ||||||||||||||

Loss per common share—basic and diluted | $ | (0.30 | ) | $ | (0.68 | ) | $ | (1.41 | ) | $ | (0.51 | ) | $ | (0.21 | ) | ||||

Cash dividends declared per common share | -0- | -0- | -0- | -0- | -0- | ||||||||||||||

Consolidated Balance Sheet Data

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

Working capital | $ | (5,048,377 | ) | $ | (8,194,200 | ) | $ | (5,731,535 | ) | $ | (1,984,916 | ) | $ | 2,588,456 | |||||

Total assets | 8,033,360 | 11,824,909 | 18,633,158 | 30,122,257 | 17,083,883 | ||||||||||||||

Long-term liabilities | 5,904,762 | 5,591,861 | 6,396,437 | 5,188,545 | 1,466,734 | ||||||||||||||

Total liabilities | 14,949,187 | 20,808,084 | 21,498,615 | 18,580,902 | 14,387,112 | ||||||||||||||

Total stockholders' (deficit) equity | $ | (6,915,827 | ) | $ | (8,983,175 | ) | $ | (2,865,457 | ) | $ | 11,540,575 | $ | 2,696,771 | ||||||

17

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations