Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - TriVascular Technologies, Inc. | triv-ex321_20141231570.htm |

| EX-23.1 - EX-23.1 - TriVascular Technologies, Inc. | triv-ex231_20141231670.htm |

| EX-21.1 - EX-21.1 - TriVascular Technologies, Inc. | triv-ex211_20141231573.htm |

| EX-31.1 - EX-31.1 - TriVascular Technologies, Inc. | triv-ex311_20141231572.htm |

| EX-31.2 - EX-31.2 - TriVascular Technologies, Inc. | triv-ex312_20141231571.htm |

| EXCEL - IDEA: XBRL DOCUMENT - TriVascular Technologies, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

or

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36419

TRIVASCULAR TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

|

87-0807313 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

3910 Brickway Blvd.

Santa Rosa, CA 95403

(Address of principal executive offices)

(707) 573-8800

(Registrant’s telephone number, including area code)

Securities Registered pursuant to Section 12 (b) of the Act

|

Title of Each Class |

|

Name of Exchange on Which Registered |

|

Common Stock, par value $0.01 per share |

|

The NASDAQ Stock Market LLC |

Securities Registered pursuant to Section 12 (g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

x (do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of the shares of common stock on The NASDAQ Stock Market on June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, was $153,128,334.

As of February 27, 2015, the registrant had 20,384,113 shares of common stock, $0.01 par value per share, outstanding.

Portions of the registrant’s definitive Proxy Statement for the 2015 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Form 10-K, are incorporated by reference in Part III, Items 10-14 of this Form 10-K. Except for the portions of the Proxy Statement specifically incorporated by reference in this Form 10-K, the Proxy Statement shall not be deemed to be filed as part hereof.

Table of Contents

|

|

|

|

|

Page |

|

PART I |

|

|

|

|

|

Item 1. |

|

|

1 |

|

|

Item 1A. |

|

|

18 |

|

|

Item 1B. |

|

|

36 |

|

|

Item 2. |

|

|

36 |

|

|

Item 3. |

|

|

36 |

|

|

Item 4. |

|

|

36 |

|

|

|

|

|

||

|

PART II |

|

|

|

|

|

Item 5. |

|

|

37 |

|

|

Item 6. |

|

|

39 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

39 |

|

Item 7A. |

|

|

50 |

|

|

Item 8. |

|

|

51 |

|

|

Item 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

79 |

|

Item 9A. |

|

|

79 |

|

|

Item 9B. |

|

|

79 |

|

|

|

|

|

||

|

PART III |

|

|

|

|

|

Item 10. |

|

|

80 |

|

|

Item 11. |

|

|

80 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

80 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

80 |

|

Item 14. |

|

|

80 |

|

|

|

|

|

||

|

PART IV |

|

|

|

|

|

Item 15. |

|

|

81 |

|

PART I

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) . All statements included or incorporated by reference in this Annual Report other than statements of historical fact, are forward-looking statements. You can identify these and other forward-looking statements by the use of words such as “may,” “will,” “could,” “anticipate,” “expect,” “intend,” “believe,” “continue” or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to such statements.

Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth below under the caption “Risk Factors” in Part I, Item 1A and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of this Annual Report and elsewhere in this Annual Report. Readers are cautioned not to place undue reliance on forward-looking statements. The forward-looking statements speak only as of the date on which they are made and we undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made except as required by law.

TRADEMARKS

As of January 31, 2015, our trademark portfolio contained 35 trademark registrations, 5 of which were U.S. trademark registrations, as well as several pending U.S. and foreign trademark applications. All other trademarks or trade names referred to in this report are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

PART I

When we refer to “we,” “our,” “us” or ““TriVascular”” in this Annual Report on Form 10-K, we mean TriVascular Technologies, Inc., as well as all of our consolidated subsidiaries, unless otherwise expressly stated or the context otherwise requires. References to the “Ovation System” refer to our “Ovation” and “Ovation Prime” Systems and their related components.

Overview

We are a medical device company developing and commercializing innovative technologies to significantly advance minimally invasive treatment of abdominal aortic aneurysms, or AAA. Our mission is to help physicians improve the lives of patients suffering from aortic disease through excellence in research, product development, manufacturing, sales and service. We developed our technology platform leveraging engineering principles utilized in many industries, including aerospace, aircraft and automotive, and applied these concepts with the goal of designing an optimal solution for AAA therapy to address unmet clinical needs. The Ovation System, our solution for the treatment of AAA through minimally invasive endovascular aortic repair, or EVAR, is a new stent graft platform, providing an innovative and effective alternative to conventional devices. It is designed to specifically address many of the limitations associated with conventional EVAR devices and expand the pool of patients eligible for EVAR.

We estimate the global market for AAA stent grafts was approximately $1.5 billion in 2014 and expect it grow to approximately $1.8 billion in 2017. Improvements in EVAR technology, combined with its demonstrated safety and other advantages relative to open surgical repair, have led to EVAR generally becoming the preferred approach to AAA repair in the United States and many other countries. In the United States, it is reported that EVAR is used to treat approximately 70% of all patients receiving AAA repair. However, given the technical limitations of conventional EVAR devices and the variability in patient anatomy, no currently available commercial EVAR device can address 100% of AAA patients, and a significant number of patients diagnosed with AAA are ineligible for EVAR with conventional devices or are unable or unwilling to undergo an open surgical procedure and receive no AAA treatment at all.

Our differentiated platform, by virtue of its low profile, flexible delivery system and novel sealing mechanism, offers physicians and patients eligible for EVAR a new solution to AAA repair, and has the added benefit of being able to treat a broader population of patients. The Ovation System consists of a main aortic body, injected with a conformable polymer, and typically two iliac limbs. These components, delivered sequentially through the lowest profile FDA-approved delivery system, allow for customization to an

1

individual patient’s unique anatomy. We received CE Mark clearance for the Ovation System from the European Commission in August 2010 and approval from the U.S. Food and Drug Administration, or FDA, in October 2012.

We believe we have an opportunity to rapidly increase the adoption and use of the Ovation System by further investing in our sales infrastructure, generating additional clinical data and expanding our professional education efforts. As of December 31, 2014, our Ovation System has been used to treat more than 5,400 patients in over 30 countries, both in clinical trials and commercially. We market and sell our products through a direct sales organization in the United States, Germany, the United Kingdom, the Netherlands and Canada. In other markets, we market and sell our products through distributors or agents. We began selling the Ovation System commercially in the United States in November 2012. For the year ended December 31, 2014 our total revenue was $31.8 million. For the year ended December 31, 2014, our net loss was $57.4 million. Our accumulated deficit as of December 31, 2014 was $295.9 million.

In our Ovation Pivotal Trial, we validated the safety and efficacy of the Ovation System through both femoral cut-down access and less invasive percutaneous access, or PEVAR, and received FDA approval for both access techniques. We have available three-year clinical data from our Ovation Pivotal Trial, and we intend to continue to invest in clinical studies and registries to further demonstrate the patient, physician and cost benefits of our low profile Ovation System. Based on the available data from our Ovation Pivotal trial, we believe the low profile, flexible delivery system and novel sealing mechanism of the Ovation System offers more patients the opportunity to be treated less invasively, more efficiently and potentially more cost effectively through decreased anesthesia, shorter procedural time and hospital stay, and fewer complications, and will provide advantages to many patients, physicians and payors. Our corporate headquarters and vertically integrated production facilities are located in Santa Rosa, California, and as of December 31, 2014, we had 307 employees. We have an experienced executive leadership team, maintain substantial research and development capabilities and hold an extensive patent portfolio.

Market Overview

AAA Disease

The wall of the aorta, the largest artery in the body, can weaken over time due to loss of a protein called elastin. This often occurs in the presence of atherosclerotic disease, which is a hardening of the arteries due to the build-up of fatty deposits, known as plaque, a leading cause of heart attacks and strokes. Over time, plaque can harden and become calcified. As the wall weakens, a bulging, or an aneurysm, can develop, causing further stress to the dilated vessel wall, and potentially leading to rupture and death. The aorta extends from the heart to the lower abdomen, and aortic aneurysms most frequently occur in the lower abdominal section, and are referred to as abdominal aortic aneurysms. The incidence of AAA increases with age and affects as many as 8% of people over the age of 65 according to the Society of Interventional Radiology, though due to the low rate of diagnosis and challenges of available conventional treatment, only a small percentage of potential patients receive treatment for AAA. Risk factors for aneurysm formation include smoking, high blood pressure, high cholesterol, age, gender and family history. The Centers for Disease Control reports that AAA ruptures carry a risk of death up to 90%, and it is the third leading cause of sudden death in men over the age of 60. The AAA rupture mortality rate may be under-reported since autopsies are not always performed in such cases, and the cause of death is sometimes attributed to heart attacks or other diseases.

2

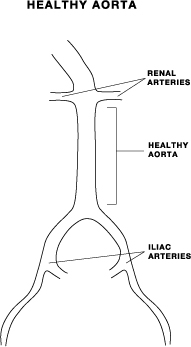

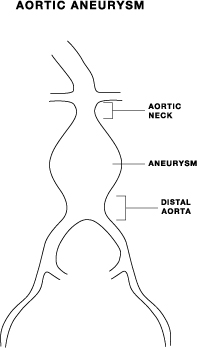

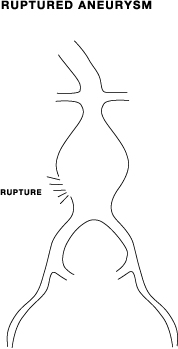

The illustrations below demonstrate the differences between a healthy abdominal aorta, an abdominal aortic aneurysm and a ruptured abdominal aortic aneurysm.

|

|

|

|

|

|

Market Size

We estimate the U.S. market for abdominal aortic stent grafts to be approximately $600 million in 2014. In addition, we estimate the global market to be approximately $1.5 billion in 2015 and we expect it to grow to approximately $1.8 billion in 2017. There is a substantial patient population with AAA disease. It has been reported that in the United States alone there are currently an estimated 1.2 million people with AAA disease. Of those, it is estimated that only approximately 200,000 are diagnosed annually, and of the diagnosed population, only approximately 70,000 are treated. AAA disease is frequently asymptomatic prior to aneurysm rupture, and is often discovered during procedures for unrelated medical conditions, leading to a fairly low diagnosis rate. Since AAAs generally arise with little warning, screening initiatives have been undertaken. Studies have shown that AAA screening reduces AAA related mortality by up to 50%. The Screening Abdominal Aortic Aneurysms Very Efficiently Act, or SAAAVE, was signed into law in the United States on February 8, 2006, and began providing coverage on January 1, 2007. SAAAVE provides for a one-time, free of charge AAA screening for men or women who have a family history of the disease, or for men who have smoked at some time in their life. We believe that the increase in prevalence of AAA due to the aging population, combined with increased focus on awareness and screening, may lead to increased detection and treatment, further expanding the market.

Treatment

Until recently, open surgery was the standard for AAA repair. Over the last several years, EVAR has generally become the preferred approach to AAA repair in the United States and many other countries, with EVAR being reported to be used for approximately 70% of all patients receiving AAA repair in the United States. Open surgery is still necessary for some patients due to anatomic considerations, life expectancy, other medical conditions and the limitations of conventional EVAR devices.

Open Surgery

Open surgical repair is a highly invasive procedure requiring a large incision in the patient’s torso, displacement of the patient’s intestines to provide access to the aneurysm, clamping of the aorta to temporarily stop blood flow, and implantation of a graft which is sewn to the aorta, bypassing the aneurysm. Open surgical repair typically lasts two to four hours. After open surgical repair, the average hospital stay of a patient is 10.4 days, according to the Journal of the American Medical Association. Post-procedure convalescence may take another four to eight weeks due to the invasiveness of the operation. Procedural mortality and overall morbidity rates associated with open surgical repair prompted physicians to look for alternative options.

3

EVAR

EVAR uses stent grafts to provide a new conduit for blood flow that internally bypasses an aneurysm within the aorta without the significant invasiveness of an open surgical procedure. Conventional EVAR devices are composed of synthetic fabric attached to metal scaffolds. These devices are pre-loaded into catheters for insertion into a patient’s femoral arteries and advancement through the femoral and iliac access vessels. The devices are then deployed at the site of the aneurysm using real-time imaging guidance. The femoral arteries are accessed either through surgical incisions, referred to as cut-downs, or through a less invasive needle stick of the skin, referred to as percutaneous EVAR, or PEVAR.

An EVAR procedure typically lasts one to two hours. In addition, according to the Journal of the American Medical Association, the average hospital stay for EVAR patients was 3.6 days. The near-term safety advantages of EVAR were further demonstrated by two randomized clinical trials conducted with 1,252 patients over 37 centers from 1999 through 2009 in the United Kingdom, collectively known as the UK EVAR Trial. This trial demonstrated a 30-day mortality rate of 1.8% for EVAR, compared to 4.3% for open surgical repair, according to the New England Journal of Medicine. Also, according to the SVS Surgical Control—Lifeline Registry, EVAR procedures demonstrate an 11% major adverse event rate at 30 days, as compared to 56% for open surgical repair. The PEVAR approach can further provide patient and procedural benefits through lower procedure times, reduced hospital stay, fewer complications and the potential use of regional or local anesthesia instead of general anesthesia.

Improvements in EVAR technology, combined with its demonstrated safety advantages, have led EVAR to generally become the preferred approach for AAA repair in the United States and many other countries. In the United States, it is reported that EVAR is used to treat approximately 70% of all patients receiving AAA repair. As EVAR device technology advances to treat a wider range of aneurysms and anatomies and longer term supporting clinical data is collected, we believe more patients will be treated with EVAR. However, conventional EVAR devices have notable limitations.

Limitations of Conventional EVAR Devices

Patient Eligibility

Given the technical limitations of conventional EVAR devices and the variability in patient anatomy, as explained below, a significant number of patients diagnosed with AAA are ineligible for EVAR with conventional devices. As a result, in the United States, it is reported that approximately 30% of AAA patients receiving treatment undergo an open surgical procedure. Because of the highly invasive nature of open surgery, some patients not eligible for EVAR are also unable to tolerate or are unwilling to undergo such a procedure, and receive no AAA treatment at all.

Patient eligibility for treatment with an EVAR device is often determined on the basis of the instructions for use, or IFUs. IFUs are granted by regulatory agencies based on clinical trial and supporting data, and are specific to anatomical and other treatment criteria for which the devices were tested. Physicians may offer to perform and patients may elect to undergo EVAR procedures using devices outside of their IFUs as an alternative to open surgery. In addition, physicians may modify devices outside of the IFU in order to treat challenging anatomies. Some estimate that more than 30% of EVAR procedures are performed outside the implanted device’s IFU. Clinical data has shown that patients undergoing EVAR procedures outside of device IFUs, known as off-label use, experience higher complication rates and less successful outcomes.

Anatomical Access

Difficulty Passing through Small Access Vessels. The larger profile delivery systems of conventional EVAR devices relative to the size of many patients’ access vessels limit the patient population that can be treated to those with larger access vessels. Conventional FDA-approved devices have an outer diameter of between 18F and 23F, or 6mm and 7.7mm. Small access vessels may be due to the size of the patient or the existence of blockage within the blood vessels. For example, it is reported that women represent 25% of all patients diagnosed with AAA, but make up only about 10% to 15% of EVAR patients, principally due to their small access vessels. Ancillary devices are sometimes used to dilate, or stretch, a patient’s small access vessels so that large diameter catheters may be utilized to reach the aneurysm. Advancing these larger devices through the access vessels can potentially lead to increased complication rates, resulting in longer recovery time and potentially additional procedural costs.

Difficulty Passing through Diseased and/or Tortuous Access Vessels. AAA patients often have diseased and/or highly contorted, or tortuous, access vessels with extensive calcification, or hardening of the arteries. Conventional EVAR devices are fabric structures with metal support scaffolds extending over most or all of their length, which decrease the flexibility of both the device and its delivery catheter. Advancing stiff catheters through diseased arteries may lead to access vessel trauma or dissection, increasing complication rates and recovery times.

Larger Profile Devices Limit the Practice of Less Invasive Techniques. The larger profile of conventional EVAR devices can inhibit the ability to perform PEVAR, a less invasive technique. In some cases, PEVAR can be performed under regional or local anesthesia, typically reducing procedure and recovery times and avoiding some of the risks associated with the use of general

4

anesthesia. In contrast, the majority of EVAR cases today are performed via surgical cut-down under general anesthesia. With conventional larger profile devices, greater patient selectivity is required, and some physicians may be reluctant to use PEVAR with regional or local anesthesia due to potential complications of using a larger profile device.

Difficulty Treating Aneurysms with Narrowing in the Distal Aorta. Another anatomic characteristic of AAA disease that can limit the use of some conventional EVAR devices is extensive narrowing at the lower end of the aneurysm where the aorta splits into the two iliac arteries, known as the distal aorta. Larger and/or stiffer conventional EVAR devices can be difficult to deploy in these narrow distal aortas because the larger catheter and stent graft components significantly obstruct the already narrow area. Longer term issues can also develop in such instances, as blood flow within the device in the narrow distal aorta can be compromised.

Sealing the Aneurysm

Ineffective Seal of Aortic Blood Flow from the Aneurysm. The aortic wall of a AAA patient is rarely disease-free and can be lined with extensive and irregular calcified plaque and blood clots, or thrombus. Conventional EVAR devices, due to their metal and fabric structures for sealing, may not be able to adequately conform to the irregular surface of the aortic wall, potentially exposing the patient to continued risk of aneurysm rupture. If an incomplete seal occurs and blood clotting does not block the small gaps resulting from irregular aortic wall contact, blood pressure and flow can still reach the aneurysm. This is known as a Type I endoleak and is a severe post-implantation complication that exposes the patient to continued risk of aneurysm rupture.

Inability to Treat Challenging Short Neck Anatomy. Another anatomic characteristic of AAA disease that limits the use of conventional EVAR devices is the proximity of the aneurysm to the renal arteries, which supply blood to the kidneys. If the aortic neck, which is the section of the aorta just below the renal arteries and before the aneurysm begins, is too short, conventional devices that require longer areas of contact with the aortic wall can fail to achieve adequate contact and seal. In addition, these devices have varying degrees of placement accuracy, which can further limit their use in short necks. For these reasons, the FDA-approved IFUs for most conventional EVAR devices require a minimum neck length of 15mm with one requiring 10mm. In a database maintained by an independent third-party clinical data management company and containing approximately 43,000 scans of aneurysm anatomies, approximately 52% of patients had a neck length less than 15mm. In addition, as an aneurysm grows, the neck typically shortens. Due to such limitations of conventional EVAR devices, many patients with advanced AAA disease have few treatment options.

Aortic Neck Dilation over Time. Conventional EVAR devices typically utilize self-expanding metal stents to push graft fabric against the aortic wall to seal the aneurysm. Research has shown that chronic, outward pressure exerted on the aortic neck can lead to long-term enlargement of this section of the aorta, a process referred to as aortic neck dilation. This outward growth of the aorta over time may lead to loss of seal, exposing the patient to continued risk of aneurysm rupture. This risk may be exacerbated when physicians choose an oversized conventional EVAR device in anticipation of neck dilation.

As a result of these challenges, there remains a significant unmet clinical need not addressed by conventional EVAR devices.

Our Solution

Our technology platform was conceived applying principles utilized and proven in other industries. Rather than attempting to improve or adapt an existing EVAR device, we set out to understand the goals of AAA therapy and leverage proven engineering concepts to create an optimal solution. For example, we leveraged our knowledge of fluid mechanics in developing our sealing technology. The result is a new solution designed to specifically address many of the challenges faced in EVAR. While some conventional EVAR devices may claim advantages based on some of their features, no conventional EVAR device contains all of the described advantages of the Ovation System. Our founding purpose was, and remains, to significantly advance minimally invasive treatment of AAA.

Patient Eligibility

Our FDA-approved IFU allows for the on-label treatment of more patients who otherwise may undergo an off-label EVAR procedure or be subject to open surgery, or not receive treatment at all. Our differentiated platform expands the pool of patients eligible for EVAR by virtue of its low profile and flexible delivery system that addresses several key anatomical access challenges, while providing a novel sealing mechanism to address many of the difficulties of diseased patient anatomies. Of the patients treated in the Ovation Pivotal Trial, approximately 40% had anatomies that were outside of the IFUs for other commercially available EVAR devices. In the Ovation Pivotal Trial, 25% of the patients treated had access vessels smaller than the lowest profile of conventional EVAR devices, 7% had neck lengths shorter than the IFUs for those devices and an additional 8% had both of these anatomical characteristics.

5

Anatomical Access

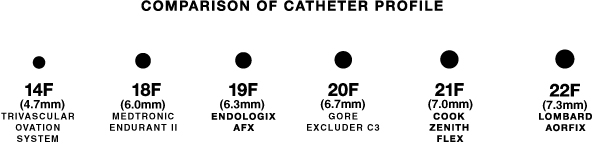

Ability to Pass through Small Access Vessels: Low Profile. The Ovation System’s novel separation and optimization of fixation and seal minimize the overlap between metal and fabric within the catheter, allowing the device to be loaded in a delivery catheter that is smaller than those of conventional EVAR devices. At an outer diameter of 14F, or approximately 4.7mm, the Ovation System is the lowest profile FDA-approved stent graft. Conventional EVAR devices have an outer diameter of between 18F and 23F, or approximately 6mm and 7.7mm. The Ovation System’s low profile enables treatment of more patients with small access vessels and more diseased vessels. This can potentially decrease the incidence of complications by reducing the need for dilation of access vessels for catheter insertion and improving recovery time.

Ability to Pass through Diseased and/or Tortuous Access Vessels: Catheter Flexibility. The Ovation System has the lowest profile FDA-approved delivery system. Its design characteristics significantly increase flexibility, enabling easier passage through diseased and tortuous access vessels. Unlike conventional EVAR devices, the Ovation aortic body design minimizes the overlap between metal and fabric within the catheter, reducing the cross-sectional diameter, or profile, and further enhancing flexibility. This increased flexibility can potentially expand the pool of eligible patients, reduce access vessel trauma and complications and provide enhanced ease of use for physicians.

The Ovation System Enables Minimally Invasive Techniques: Low Profile and Flexibility. The Ovation System’s low profile and proven safety record offer physicians the opportunity to provide PEVAR with regional or local anesthesia to more patients. Studies have shown that the use of smaller profile delivery devices results in fewer access site complications. Therefore, physicians may be more likely to perform PEVAR with the Ovation System and also be more inclined to perform PEVAR under regional or local anesthesia. As a result, PEVAR with the Ovation System may meaningfully reduce procedure and recovery time for certain patients.

Treatment of Aneurysms with Narrowing in the Distal Aorta: Tri-Modular Design and Low Profile. The Ovation System has a tri-modular, low profile architecture, with smaller diameter components that allow it to be deployed in patients with distal aortas that may be too narrow for conventional EVAR devices. In addition, the Ovation System’s highly flexible and smaller iliac limbs potentially allow treatment of more aneurysms with narrow distal aortas.

Sealing the Aneurysm

Ability to Effectively Seal in Highly Diseased Aortas: Polymer-Filled Sealing Rings. The Ovation System’s main aortic body includes a sealing ring that inflates when injected with liquid polymer during implantation. The ring conforms to the aortic wall as the polymer cures, creating a custom seal and preventing blood flow to the aneurysm. The continuous engagement achieved by these rings creates a watertight seal of the aneurysm, which can be particularly important for patients with highly diseased, thrombus-lined and/or calcified aortic necks. In the Ovation Pivotal Trial, our platform demonstrated 100% freedom from Type I endoleaks through the available one- and two-year follow-up data as reported by an independent Core Lab.

Treatment of Challenging Short Neck Anatomy: Separate Anchoring and Sealing. The separation and optimization of the fixation and sealing mechanisms of the Ovation System enable the device to seal with a smaller aortic contact area than conventional EVAR devices. This can be particularly important for patients with irregular or short aortic neck anatomies. An aortic neck is defined as the length of aorta below the renal arteries at which the diameter of the aorta expands 10%. All FDA approved devices, except for the Ovation System have an FDA-approved minimum neck length requirement. Most conventional EVAR devices that require a 15mm neck, with one requiring 10mm, for treatment within approved indications. The Ovation System does not have a conventional neck length requirement and can treat patients of any aortic neck length so long as its sealing ring diameter allows it to maintain contact with the aortic wall at 13mm below the renal arteries. Additionally, the Ovation System utilizes a progressive, staged delivery of its anchor stent, allowing precise placement relative to the renal arteries. This can be particularly important in short neck anatomies in which the aneurysm encroaches closely to the renal arteries.

Avoiding Aortic Neck Dilation: Polymer-Filled Sealing Rings Cast in Place. The Ovation System’s nonexpanding polymer filled sealing rings do not exert significant chronic, outward pressure at the neck of the aorta. In addition, the sealing rings, after being cast in place during implantation, are designed to insulate the aortic neck from the outward force of blood pressure. This is in sharp contrast to conventional EVAR devices, which are self-expanding and exert long-term outward force on the aortic neck in conjunction with the force exerted by local blood pressure. This combined stress on the aortic neck can contribute to aortic neck dilation and potential loss of seal over time. In various published studies, patients treated with conventional EVAR devices demonstrated notable aortic neck dilation over a two-year follow-up period. In contrast, in the Ovation Pivotal Trial, no aortic neck dilation was observed through a similar two-year and even three-year follow-up.

6

Our Strategy

Our mission is to help physicians improve the lives of patients suffering from aortic disease through excellence in research, product development, manufacturing, sales and service. In order to accomplish this mission, we have established and are pursuing several business priorities:

|

· |

Expand Patient Access to the Ovation System through Further Investment in our Sales Infrastructure. We are creating a hybrid sales organization consisting of direct representatives and distributors to provide service excellence to physicians worldwide. Upon receipt of U.S. regulatory approval in October 2012, we began building our direct U.S. sales infrastructure and, as of December 31, 2014, we employed 60 sales representatives. In the United States, we plan to continue to recruit, hire and train experienced sales representatives in order to increase the size and geographic coverage of our sales organization. Outside of the United States, we plan to target additional markets via a self-sufficient distributor and agency model, with the exceptions of Canada, Germany, the Netherlands and the United Kingdom where we already have direct sales capability. We will continue to empower our sales representatives with high impact clinical training, educational and marketing programs. We believe that expanding our U.S. sales infrastructure and establishing additional distributor relationships outside of the United States will drive further adoption of the Ovation System. |

|

· |

Generate Additional Clinical Data to Further Validate the Ovation System Advantage. We believe clinical data demonstrating efficacy, safety and cost effectiveness is critical to the adoption of the Ovation System. As of December 31, 2014, over 5,400 patients have been treated worldwide with the Ovation System and over 800 of these were in ongoing pre-approval and post-market clinical studies. In the Ovation Pivotal Trial, efficacy and safety were validated for both EVAR through surgical cut-down and PEVAR. PEVAR achieved similar clinical outcomes to EVAR, but with less general anesthesia and shorter procedural and hospitalization times. We intend to continue to invest in clinical studies and registries to further demonstrate the patient, physician and cost benefits of our low profile Ovation System. |

|

· |

Increase Awareness of the Ovation System through Professional Education Efforts. We specifically designed our products to address many of the limitations of conventional EVAR devices. We intend to position the Ovation System as the broadest IFU platform with the ability to provide a better solution to treat more patients from the straightforward cases to the more complex. We believe that our technology can benefit patients with a wide range of anatomic characteristics, but only if physicians are aware of, have access to and are properly trained in the use of the Ovation System. We plan to utilize and expand our training centers and broaden our network of physician educators. We believe our investment in these professional education activities will facilitate peer-to-peer education and knowledge dissemination among physicians and healthcare providers, and provide more patients with access to less invasive and improved EVAR treatment. |

|

· |

Leverage our Technology Platform and Culture of Innovation to Advance and Expand our Product Pipeline. We are extending our novel and proprietary technologies into a series of products with the goals of improving outcomes while reducing the invasiveness of therapy, further expanding the pool of patients eligible for EVAR and enhancing the physician experience. Products in development include our next-generation Ovation iliac limbs and our next-generation aortic body, named the Ovation Alto stent graft. We believe these innovative products will continue to drive adoption of our Ovation platform and further validate the advantages and benefits of our technology. |

|

· |

Optimize Manufacturing and Operations to Achieve Cost and Production Efficiencies While Maintaining Quality as our Top Priority. We employ a vertically integrated operating model, designing, developing and manufacturing many of our products in-house at our headquarters in Santa Rosa, California. With our current infrastructure, we have the capacity to significantly increase our manufacturing volume. We intend to use our design, engineering and manufacturing capabilities to further advance and improve the efficiency of our manufacturing processes, which we believe will result in significant margin expansion. |

7

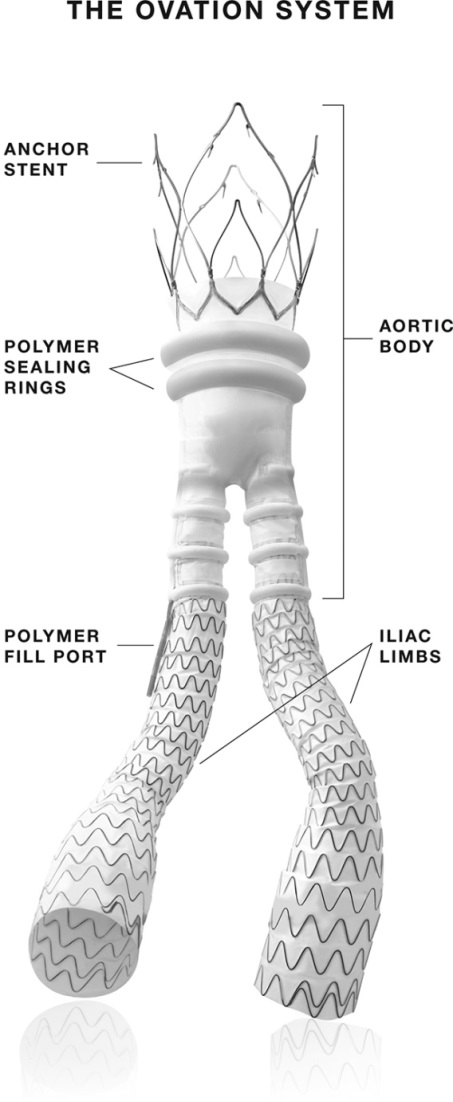

Our Products

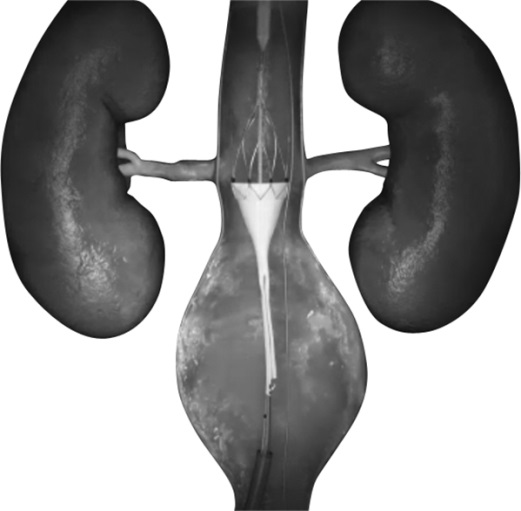

Our Ovation System is an FDA-approved, new AAA stent graft solution designed to specifically address many of the challenges faced in EVAR and to significantly advance minimally invasive treatment of AAA. Our tri-modular design employs a main aortic body, injected with conformable polymer, and typically two iliac limbs. In some cases, extra iliac limbs or iliac extensions may be required. These components, delivered sequentially through the lowest profile FDA-approved delivery system, allow for customization to an individual patient’s unique anatomy. The following illustration shows the Ovation System and its implantable components.

Aortic Body

The aortic body consists of a nitinol metal proximal anchor stent and a polytetrafluoroethylene, or PTFE, graft containing a network of sealing rings that inflate when injected with a liquid fill polymer that solidifies during the deployment procedure. These rings conform to the aortic wall as the polymer cures, creating a custom seal and preventing blood flow to the aneurysm. The stent contains integral angled barbs that anchor the device to the aortic wall and are designed to prevent device migration. The graft has a polymer fill port that connects the network of inflatable rings in the graft to the delivery catheter. The radiopaque nitinol stent is connected to the PTFE graft by radiopaque marker coils, permitting visualization through real-time imaging during delivery for accurate placement. We offer five different aortic body sizes allowing for the use of the Ovation System in a wide variety of anatomies.

Iliac Limbs

The iliac limbs are composed of a nitinol metal stent encapsulated in PTFE material. The iliac limbs are deployed into the leg sections of the aortic body. Radiopaque markers enable the physician to visualize placement of the iliac limb within the aortic body. When the iliac limb is deployed and expands, it is held in place by resistance against the aortic body legs. We offer a wide range of iliac limbs and limb extensions of different lengths and diameters to allow customization to each patient’s anatomy.

8

Fill Polymer

The fill polymer is composed of three elements that are mixed in our pre-loaded kit prior to injection. Upon mixing and injection into the graft using our fill polymer autoinjector, these elements form a radiopaque polymer that fills the sealing rings of the channels in the wall of the aortic body graft. As the polymer cures, a customized seal conforms to the patient’s anatomy allowing for the treatment of many shorter and more diseased necks. We recently introduced the CustomSeal technology, our next generation fill polymer, designed with the same biocompatible components as the Ovation Prime polymer, but with a 30% reduction in cure time, enabling faster procedure times. We received CE mark approval in March 2014 and FDA approval in October 2014 for the CustomSeal short-cure fill polymer.

Delivery System

To facilitate introduction of the Ovation System into patients’ access vessels, the aortic body, iliac limbs and iliac extensions are preloaded into delivery catheters with outer diameters that range in size from 13F to 15F, or approximately 4.3mm to 5.0mm. The aortic body delivery catheters have the lowest profile of any FDA approved EVAR system. The small size of our delivery system compared to conventional EVAR devices, and the resulting ability to navigate small access vessels, allow for the treatment of a broader patient population.

The following figure illustrates the difference in the profile of delivery catheters, shown in relative scale to one another, used in the Ovation System and conventional EVAR devices.

9

The Typical EVAR Procedure with the Ovation System

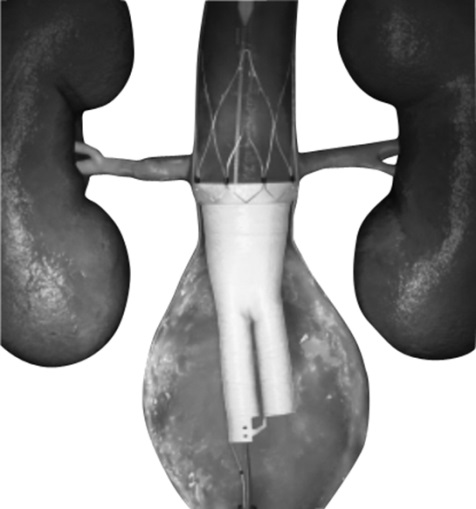

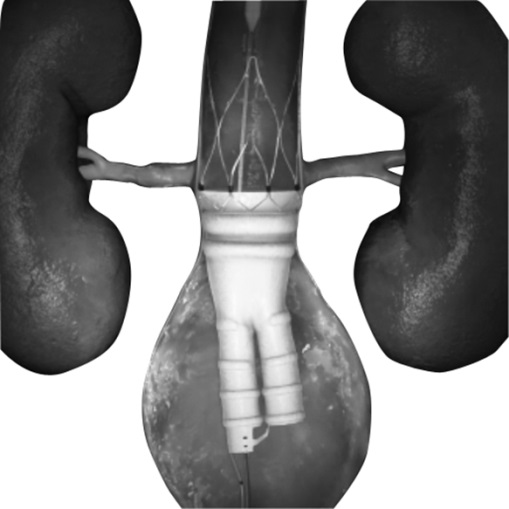

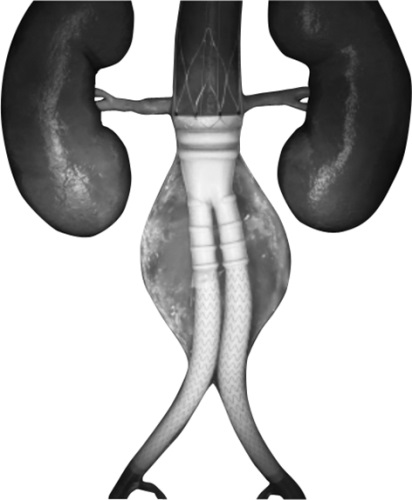

The following figure and discussion summarize the primary steps of a typical EVAR procedure performed with the Ovation System.

|

|

|

|

|

|

|

(1) |

|

(2) |

|

(3) |

|

|

|

|

|

(4) |

|

(5) |

Once a patient is prepped for the AAA repair procedure, a physician typically begins by accessing the femoral arteries at the top of each leg, through either a surgical cut-down or percutaneous approach, creating two separate access points.

Over a guide wire, the main aortic body is inserted into the first access vessel and advanced to the site of the aneurysm using real-time imaging. The catheter’s outer sheath is retracted to uncover the stent graft. The anchor stent at the top of our device is positioned just above the renal arteries.

(1) The first stage of the anchor stent is released by turning and pulling the largest, outermost of three nested knobs of the catheter handle. This nested knob design is intended to ensure the device is deployed in the proper sequence.

(2) The device is precisely positioned below the renal arteries. By pulling the second knob of the catheter handle, the barbed portion of the anchor stent is then released fixing the graft in place.

(3) After mixing the fill polymer in its pre-loaded kit, a syringe containing the mixed polymer is then connected to the catheter for injection. Our autoinjector is inserted over the syringe to facilitate hands-free and controlled delivery of the polymer into the graft.

10

The delivery of the fill polymer is visible under real-time imaging so the filling process can be monitored. Depending on the size of the graft, it takes approximately 30 to 60 seconds for the sealing ring and channels of the graft to fill. The polymer-filled sealing rings conform to the aortic wall and provide a custom seal that is unique for each patient. The CustomSeal polymer cures in approximately 14 minutes.

(4) While the polymer is curing, a guide wire is advanced through the second access vessel into the open leg of the aortic body. Over this wire a catheter containing an iliac limb is inserted into the aortic body leg using real-time imaging to position it within the aortic body leg. By retracting the outer sheath of the catheter, the iliac limb is deployed.

(5) The iliac limb delivery catheter is retracted and then withdrawn from the patient. The main body catheter is then disengaged by pulling the third knob on the catheter handle and withdrawn. Following the removal of the main aortic body catheter, the second iliac limb is then deployed through the first access vessel.

To conclude the procedure, imaging is performed to confirm blood flow is contained entirely within the device. Typically, the entire procedure takes one to two hours.

Products in Development

Our objective is to continue to improve patient outcomes and reduce procedural times through ease of use enhancements to our existing products and the development of new products to further expand patient access to EVAR. Research and development expenses were $13.3 million and $15.5 million, for the years ended December 31, 2013 and December 31, 2014, respectively. We have several product development projects underway, including the following:

Ovation iX Iliac Limbs

We are developing next generation Ovation iX iliac limbs for use with both our current Ovation Prime and our next generation Ovation iX and Alto aortic bodies, which are currently in development. These limbs are designed to have integrated sheaths, reducing the number of catheter exchanges during the procedure. These devices are expected to have size ranges to include larger diameters and longer lengths. We expect the expanded size matrix and ease of use improvements will further increase the number of patients eligible to be treated with EVAR. We have received initial FDA and CE Mark approvals for the Ovation iX Iliac limbs and have submitted supplemental filings for manufacturing changes. Upon approval of the supplemental applications we plan to launch the Ovation iX iliac limbs in the U.S. and Europe.

Ovation iX Aortic Bodies

We are developing Ovation iX aortic bodies for use with both our Ovation Prime and our Ovation iX iliac limbs. These aortic bodies are designed to have integrated sheaths, reducing the number of catheter exchanges during the procedure. The Ovation iX aortic bodies also incorporate an integrated cannulation assist conduit to enable quicker placement of the contralateral iliac limb in certain complex anatomies. We expect these features to further enhance the physician implant experience.

Ovation Alto System

We are developing a next generation aortic body that together with the next generation iliac limbs make up the Ovation Alto stent graft. The Ovation Alto aortic body is expected to contain several design changes to enhance physician experience and allow access to EVAR for more patients, including:

|

· |

sealing rings moved closer to the top of the aortic body, enabling the treatment of shorter necks; |

|

· |

differentiated aortic body leg lengths to better distinguish the aortic body legs under real-time imaging; |

|

· |

wider diameter aortic body legs to facilitate placement of the iliac limbs; |

|

· |

anchor stents sized specifically for each individual aortic body size, potentially allowing treatment of more patients with highly diseased aortas; and |

|

· |

integrated delivery sheaths. |

Other Potential Platform Applications

We have other platform applications in various stages of development. For example, we conducted first-in-man studies, with positive clinical results, for an early generation device to treat thoracic aneurysms and received investigational device exemption approval from the FDA in 2010 to conduct further studies in the United States.

11

While we are currently focusing our resources on the treatment of AAA, we believe these results are encouraging for other potential applications of our technology. Since our technology platform was conceived and developed internally, we believe our organization is well equipped to leverage and extend our highly differentiated and innovative technology going forward.

Clinical Trials

The Ovation Pivotal Trial

We conducted a global, multi-center, 161 patient pivotal trial to obtain regulatory approvals for the Ovation System, referred to here as the Ovation Pivotal Trial. The Ovation Pivotal Trial took place in three countries, with 36 centers enrolling subjects. The first patient was enrolled in November 2009 and the last patient was treated in May 2011. Of the 161 patients enrolled, 111 were treated in the United States. We received CE Mark clearance for the Ovation System in August 2010 on the basis of 30-day data on the initial 21 patients enrolled in this trial. We received FDA premarket approval, or PMA, for the Ovation System in October 2012, based on one-year data from the full 161 patient cohort. The Ovation Pivotal Trial included the first-in-man experience with the Ovation System, as well as all initial cases at participating centers. We believe the inclusion of first-in-man data demonstrates the inherent ease-of-use of the Ovation System, which is further supported by the inclusion of all of the first patients treated at participating centers. Following enrollment of the 161st patient in the Ovation Pivotal Trial, we enrolled an additional 77 patients across the 28 U.S. sites that participated in the Ovation Pivotal Trial, utilizing the same protocol.

The follow-up data from the Ovation Pivotal Trial demonstrates the efficacy of EVAR with the Ovation System with 100% freedom from device-related Type I and III endoleaks, migration, aneurysm rupture and conversion to open surgical repair at one and two years. When blood flows into the aneurysm due to inadequate or ineffective sealing of overlapping graft joints or rupture of the graft fabric, this is referred to as a Type III endoleak. This data also shows a low rate of aneurysm growth, which is generally considered a surrogate for successful treatment.

Notably, the Ovation Pivotal Trial included a large number of patients with complex anatomies. Of the patients treated in our Ovation Pivotal Trial, approximately 40% had anatomies outside of the IFUs for other commercially available EVAR devices. In the Ovation Pivotal Trial, 25% of the patients treated had access vessels smaller than the lowest profile of conventional EVAR devices, 7% had neck lengths shorter than the IFUs for those devices and an additional 8% had both of these anatomical characteristics. In this subgroup of complex patients, the performance of the Ovation System was consistent with the performance in the overall patient cohort. EVAR with the Ovation System also required an average post-procedure hospital stay of 2.3 days, compared to 3.6 days average for EVAR patients in general.

In the Ovation Pivotal Trial, the decision whether to use a surgical cut-down or PEVAR was left to the discretion of the implanting physician. In 77 of the 161 patients (48%), the procedure was performed utilizing PEVAR. Accordingly, the FDA approval for our Ovation System includes indications for both PEVAR and surgical cut-down methods of vessel access. When comparing patient data on the basis of vessel access, as summarized in the table below, the PEVAR arm demonstrated strong safety and effectiveness and a reduction in mean anesthesia time, mean procedure time and median hospital stay, versus the cut-down cohort.

|

|

|

Cut-Down |

|

PEVAR |

|

|

Patients enrolled |

|

84 (52%) |

|

77 (48%) |

|

|

Major adverse event rate at 30 days |

|

3.6% (3/84) |

|

1.3% (1/77) |

|

|

Treatment success at one-year |

|

98.8% (83/84) |

|

98.7% (76/77) |

|

|

Anesthesia time (mean) |

|

191 minutes |

|

155 minutes |

|

|

Procedure time (mean) |

|

120 minutes |

|

98 minutes |

|

|

Hospitalization (median) |

|

2 days |

|

1 day |

|

Ovation Post Approval Study

As a condition of our PMA approval, we are required to enroll 82 patients in a post approval study in the United States, referred to as the Ovation Post Approval Study. The primary endpoint of the Ovation Post Approval Study is freedom from aneurysm mortality. Patients will be followed for five years. As of December 31, 2014, we had enrolled 43 patients in this study.

Ovation PMR

In 2011, we initiated a 500 patient, 30 center, European post-market registry, referred to as Ovation PMR. The primary endpoint of the Ovation PMR is treatment effectiveness. The intention of the Ovation PMR is to determine how real world use of the Ovation System compares to the results garnered in the Ovation Pivotal Trial. We completed the enrollment in the Ovation PMR in December 2013.

12

LIFE Study

In October 2014, we initiated our Least Invasive Fast track EVAR, or LIFE, Study, which we expect will illustrate the potential advantages of PEVAR with the Ovation Prime System, including reduced invasiveness, procedure time, need for anesthesia, costs, complications, and length of hospital stay. We plan to enroll 250 patients across 25 centers in the United States. We plan to conduct a similar study in Europe commencing in 2015. As of December 31, 2014, 12 patients had been enrolled in our U.S. LIFE study.

LUCY Study

In early 2015, we initiated our TriVascular Evaluation of Females who are Underrepresented Candidates for Abdominal Aortic Aneurysm Repair, or LUCY study, which will evaluate the clinical benefits associated with EVAR using the Ovation System in female patients. We expect the study will show:

|

· |

High eligibility rate even in female patients with complex anatomies, including small access vessel diameter, short neck length and increased neck angulation; |

|

· |

Low access-related vascular complications rate; |

|

· |

Low mortality rate. |

Manufacturing and Quality Assurance

Our manufacturing facilities are located within our corporate headquarters in Santa Rosa, California. Our manufacturing capabilities are vertically integrated, in large part due to the considerable amount of proprietary manufacturing technology we have developed over the course of the company’s history. All of our stent grafts and catheters are manufactured and packaged in our rigorously monitored and maintained production environments. We engage third party contractors and suppliers to perform sterilization and accessory component assembly. We perform regular quality system audits of all of our key suppliers, and we maintain strategic inventory levels or qualifying second sources for all significant materials and components.

We have received International Standards Organization, or ISO, 13485 certification, which includes design control requirements. The manufacturing process has been validated as required by FDA and other regulatory bodies. As a medical device manufacturer, our manufacturing facility and the facilities of our sterilization and other critical suppliers are subject to periodic inspection by FDA and other regulatory agencies.

We have significantly increased manufacturing output in each of the last two years. We believe we are well positioned to continue advancing our manufacturing technology and efficiency going forward.

Sales and Marketing

The decision makers for EVAR device selection are primarily vascular surgeons, and to a lesser extent, interventional cardiologists and radiologists. Hospital administrators and group purchasing organizations may also influence device purchasing decisions and limit device selection.

As of December 31, 2014, our U.S. sales organization consisted of a team of nine experienced sales managers employed by us who recruit, train and lead our direct sales force consisting of 60 sales representatives and 9 clinical specialists. Through our direct sales force, we provide product support and service to our hospital and physician customers in the United States. Approximately 68% of our revenues for the year ended December 31, 2014 were generated from sales of our Ovation System in the United States. For the year ended December 31, 2014, no single customer represented more than 10% of our revenues.

Internationally, we sell our Ovation System in Canada, Germany, the Netherlands, and the United Kingdom through a direct sales force, and through independent distributors and agents in other countries. As of December 31, 2014, we marketed our Ovation System in 23 countries outside of the United States through 25 independent distributors. We had 18 sales managers, representatives and clinical specialists in international markets as of December 31, 2014. In addition, from time to time we may engage a limited number of agents to facilitate sales in certain international geographies.

13

Competition

The medical device industry is highly competitive. Any product we develop that achieves regulatory clearance or approval will compete for market acceptance and market share. We believe that the primary competitive factors in the AAA stent graft market segment are:

|

· |

clinical effectiveness; |

|

· |

product safety, reliability, and durability; |

|

· |

ease of use; |

|

· |

scope of instructions for use and eligible patient populations; |

|

· |

physician experience and comfort with use of a particular EVAR device; |

|

· |

product support and service; |

|

· |

sales force experience and relationships; and |

|

· |

price. |

We experience significant competition and we expect that the intensity of competition will increase over time. For example, our major competitors, Medtronic, Inc., W.L. Gore Inc., Cook Medical Products, Inc. and Endologix, Inc., have each obtained full regulatory approval for their EVAR systems in the United States and Europe. In addition to these major competitors, we also have smaller competitors and emerging competitors, including Lombard Medical, Inc. and Cordis Corporation with recent introductions into the EVAR market in the U.S. and Europe.

Many of our competitors have substantially greater capital resources, longer commercial history and established relationships with physicians. Many also have greater resources and expertise in the areas of research and development, obtaining regulatory approvals, manufacturing, marketing, and sales. In addition, some of these competitors have multiple product offerings, in addition to EVAR products, allowing them more opportunities to interact with physicians and purchasing decision makers. We also face fierce competition in recruiting and retaining qualified sales and other personnel.

Intellectual Property

As of January 31, 2015, we owned 134 issued patents globally, of which 46 were issued U.S. patents. As of January 31, 2015, we owned 60 patent applications pending globally, of which 32 were patent applications pending in the United States. Subject to payment of required maintenance fees, annuities and other charges, 11 of our issued U.S. patents expire between 2018 and 2020, 25 expire between 2021 and 2025, and the remaining 10 expire between 2026 and 2030.

As of January 31, 2015, our trademark portfolio contained 33 trademark registrations, 5 of which were U.S. trademark registrations, as well as several pending U.S. and foreign trademark applications.

In March 2008, in connection with the spin-off from Boston Scientific Corporation, we entered into several intellectual property agreements with the subsidiaries of Boston Scientific Corporation, Boston Scientific Scimed, Inc., referred to here as Scimed, and Endovascular Technologies, Inc., referred to here as EndoT. Under an exclusive license agreement with Scimed, we granted Scimed various exclusive and non-exclusive licenses to use certain patents and know-how outside of our retained field of EVAR, dissections or trauma for aortic, thoracic and iliac blood vessels. Scimed’s rights include the first right to enforce the licensed patents against third parties for infringement outside of our retained field and the right to consult with us and our counsel in the preparation and prosecution of the licensed patents and patent applications. Under a non-exclusive license agreement, Scimed and EndoT granted to us a non-exclusive, worldwide, royalty-free license to use certain other patents and know-how in the field of EVAR and dissections or trauma for aortic, thoracic and related repair of iliac blood vessels. Pursuant to the know-how agreement, Scimed irrevocably assigned to us the rights to technology and regulatory filings and granted us a further non-exclusive worldwide, royalty-free license to use certain additional patents and know-how related to the field of EVAR, dissections or trauma for aortic, thoracic or iliac blood vessels. Each of the exclusive license and the non-exclusive license agreement remains in effect, unless earlier terminated by either party for common contractual reasons such as a material breach by the other party, declaration of bankruptcy by a party or dissolution or liquidation of one party’s business, through the expiration of the last-to-expire patent underlying each respective agreement. The know-how agreement includes use of patents licensed to Scimed by a third party, and the know-how agreement remains in effect for as long as Scimed continues to have rights to those patents, which Scimed must use commercially reasonable efforts to maintain.

We also rely upon trade secrets, know-how, continuing technological innovation, and may rely upon licensing opportunities in the future, to develop and maintain our competitive position. We protect our proprietary rights through a variety of methods, including confidentiality agreements and proprietary information agreements with suppliers, employees, consultants and others who may have access to proprietary information.

14

Third-Party Coverage and Reimbursement

In the United States, hospitals are the primary purchasers of our Ovation System. Hospitals in turn bill various third-party payors, such as Medicare, Medicaid and private health insurance plans, for the total healthcare services required to treat the patient’s AAA procedure. Government agencies, private insurers and other payors determine whether to provide coverage for a particular procedure and to reimburse hospitals for inpatient treatment at a fixed rate based on the diagnosis-related group, or DRG, as determined by the U.S. Centers for Medicare and Medicaid Services, or CMS. The fixed rate of reimbursement is based on the procedure performed, and is unrelated to the specific medical device used in that procedure. Medicare rates for the same or similar procedures vary due to geographic location, nature of facility in which the procedure is performed (i.e., teaching or community hospital) and other factors. While private payors vary in their coverage and payment policies, most look to coverage and payment by Medicare as a benchmark by which to make their own decisions.

Reimbursement of procedures utilizing our Ovation Systems currently is covered under specific DRG codes. For hospital reimbursement, patients treated with our Ovation Systems are classified under DRG codes 237 or 238, “Major Cardiovascular Procedures with Major Complications” and “Major Cardiovascular Procedures without Major Complications,” respectively, using the ICD-9 procedure code 39.71, “Endovascular implantation of other graft in abdominal aorta.” In the latest data published by CMS, the national average reimbursement under DRG codes 237 and 238 was approximately $29,500 and $19,500, respectively.

Some payors may deny reimbursement if they determine that the device used in a treatment was unnecessary, not cost-effective, or used for a non-approved indication. We cannot assure you that government or private third-party payors will cover and reimburse the procedures using our products in whole or in part in the future or that payment rates will be adequate.

Outside the United States, market acceptance of medical devices, including EVAR systems, depends partly upon the availability of reimbursement within the prevailing healthcare payment system. Reimbursement levels vary significantly by country, and by region within some countries. Reimbursement is obtained from a variety of sources, including government-sponsored and private health insurance plans, and combinations of both. A small number of countries may require us to gather additional clinical data before recognizing coverage and reimbursement for our products. It is our intent to complete the requisite clinical studies and obtain coverage and reimbursement approval in countries where it makes economic sense to do so.

Further, the increased emphasis on managed healthcare in the U.S. and on country and regional pricing and reimbursement controls in international markets will put additional pressure on product pricing, reimbursement and usage, which may adversely affect our product sales and results of operations. These pressures can arise from rules and practices of insurers and managed care organizations, judicial decisions and governmental laws and regulations related to Medicare, Medicaid and healthcare reform, medical device reimbursement policies and pricing in general. Our ability to achieve market acceptance or significant sales volume will be dependent in large part on the availability of coverage and the level of reimbursement for procedures performed using our products under healthcare payment systems in such markets.

Government Regulation

Government Regulation—Medical Devices

United States

Our products are regulated in the United States as Class III medical devices by the FDA under the Federal Food, Drug and Cosmetic Act. The FDA classifies medical devices into one of three classes based upon controls the FDA considers necessary to reasonably ensure their safety and effectiveness. Class I devices are subject to general controls such as labeling, adherence to good manufacturing practices and maintenance of product complaint records, but are usually exempt from premarket notification requirements. Class II devices are subject to the same general controls and also are subject to special controls such as performance standards, and FDA guidelines, and may also require clinical testing prior to approval. Class III devices are subject to the highest level of controls because they are life-sustaining or life-supporting devices. Class III devices require rigorous clinical testing prior to their approval and generally require a pre-market approval, or PMA, or a PMA supplement approval prior to their sale.

Manufacturers must file an Investigational Device Exemption, or IDE, application if human clinical studies of a device are required and if the FDA considers investigational use of the device to represent significant risk to the patient. The IDE application must be supported by data, typically including the results of animal and engineering testing of the device. The animal and laboratory testing must meet the FDA’s good laboratory practice requirements. If the IDE application is approved by the FDA, human clinical studies may begin at a specific number of investigational sites with a maximum number of patients, as approved by the FDA. The clinical studies must be conducted under the review of an independent institutional review board to ensure the protection of patients’ rights.

15

Generally, upon completion of these human clinical studies, a manufacturer seeks approval of a Class III medical device from the FDA by submitting a PMA application. A PMA application must be supported by extensive data, including the results of the clinical studies, as well as testing and literature to establish the safety and effectiveness of the device. PMA approval may be conditioned upon the conduct of certain post-approval studies, such as long term follow-up studies.

FDA regulations require us to register as a medical device manufacturer with the FDA. Additionally, the California Department of Health Services, or CDHS, requires us to register as a medical device manufacturer within the state. Because of this, the FDA and the CDHS inspect us on a routine basis for compliance with the Quality System Regulation, or QSR. These regulations require that we manufacture our products and maintain related documentation in a prescribed manner with respect to manufacturing, testing and control activities. We have undergone and expect to continue to undergo regular QSR inspections in connection with the manufacture of our products at our facility. Further, the FDA requires us to comply with various FDA regulations regarding labeling. Failure by us or by our suppliers to comply with applicable regulatory requirements can result in enforcement action by the FDA or state authorities, which may include any of the following sanctions:

|

· |

warning letters, fines, injunctions, consent decrees and civil penalties; |

|

· |

customer notifications, recall or seizure of our products; |

|

· |

operating restrictions, partial suspension or total shutdown of production; |

|

· |

delay in processing applications for new products or modifications to existing products; |

|

· |

mandatory product recalls; |

|

· |

withdrawing approvals that have already been granted; and |

|

· |

criminal prosecution. |

The Medical Device Reporting laws and regulations require us to provide information to the FDA on deaths or serious injuries alleged to have been associated with the use of our devices, as well as product malfunctions that likely would cause or contribute to death or serious injury if the malfunction were to recur. In addition, the FDA prohibits an approved device from being marketed for off-label use. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant liability, including substantial monetary penalties and criminal prosecution.

We are also subject to other federal, state and local laws, regulations, and recommendations relating to safe working conditions, laboratory, and manufacturing practices.

International

Our international sales are subject to regulatory requirements in the countries in which our products are sold. The regulatory review process varies from country to country and may in some cases require the submission of clinical data. In addition, the FDA must be notified of, or approve the export to certain countries of devices that require a PMA, and not yet approved in the United States.

In Europe, we need to comply with the requirements of the Medical Devices Directive, or MDD, and appropriately affix the CE Mark on our products to attest to such compliance. To achieve compliance, our products must meet the “Essential Requirements” of the MDD relating to safety and performance and we must successfully undergo verification of our regulatory compliance, or conformity assessment, by a Notified Body selected by us. The level of scrutiny of such assessment depends on the regulatory class of the product. We are subject to continued surveillance by our Notified Body and will be required to report any serious adverse incidents to the appropriate authorities. We also must comply with additional requirements of individual countries in which our products are marketed.

Government Regulation—Fraud and Abuse and Other Healthcare Regulation

Anti-Kickback Statute

We are subject to various federal and state healthcare laws, including, but not limited to, anti-kickback laws. In particular, the federal Anti-Kickback Statute prohibits persons or entities from knowingly and willfully soliciting, offering, receiving or paying any remuneration, directly or indirectly, overtly or covertly, in cash or in kind, in exchange for or to induce either the referral of an individual, or the furnishing, arranging for or recommending a good or service, or for the purchasing, leasing, ordering, or arranging for or recommending, any good, facility, service or item for which payment may be made in whole or in part under federal healthcare programs, such as the Medicare and Medicaid programs. The federal Anti-Kickback Statute is broad and prohibits many arrangements and practices that are lawful in businesses outside of the healthcare industry. The term “remuneration” expressly includes kickbacks, bribes, or rebates and also has been broadly interpreted to include anything of value, including for example, gifts, discounts, the

16

furnishing of supplies or equipment, credit arrangements, payments of cash, waivers of payments, ownership interests and providing anything at less than its fair market value.

There are a number of statutory exceptions and regulatory safe harbors protecting certain business arrangements from prosecution under the federal Anti-Kickback Statute. These statutory exceptions and safe harbors set forth provisions that, if all their applicable requirements are met, will assure healthcare providers and other parties that they may not be prosecuted under the federal Anti-Kickback Statute. The failure of a transaction or arrangement to fit precisely within one or more applicable statutory exceptions or safe harbors does not necessarily mean that it is illegal or that prosecution will be pursued. However, conduct and business arrangements that do not fully satisfy all requirements of an applicable safe harbor may result in increased scrutiny by government enforcement authorities and will be evaluated on a case-by-case basis based on a cumulative review of all of its facts and circumstances. Additionally, the intent standard under the federal Anti-Kickback Statute was amended under the Affordable Care Act, to a stricter standard such that a person or entity no longer needs to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation. The Affordable Care Act provides that the government may assert that a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the federal civil False Claims Act which is discussed below. Penalties for violations of the anti-kickback statute include, but are not limited to, criminal, civil and/or administrative penalties, damages, fines, disgorgement, individual imprisonment, possible exclusion from Medicare, Medicaid and other federal healthcare programs, and the curtailment or restructuring of operations. Various states have adopted laws similar to the federal Anti-Kickback Statute, and some of these state laws may be broader in scope in that some of these state laws extend to all payors and may not contain safe harbors.

Federal Civil False Claims Act

The federal civil False Claims Act prohibits, among other things, persons or entities from knowingly presenting or causing to be presented a false or fraudulent claim to, or the knowing use of false statements to obtain payment from or approval by, the federal government. Suits filed under the federal civil False Claims Act, known as “qui tam” actions, can be brought by any individual on behalf of the government. These individuals, sometimes known as “relators” or, more commonly, as “whistleblowers”, may share in any amounts paid by the entity to the government in fines or settlement. The number of filings of qui tam actions has increased significantly in recent years, causing more healthcare companies to have to defend a case brought under the federal civil False Claim Act. If an entity is determined to have violated the federal civil False Claims Act, it may be required to pay up to three times the actual damages sustained by the government, plus civil penalties for each separate false claim. Many of these state laws are broader in scope and apply to all payors, and therefore, are not limited to only those claims submitted to the federal government.

Federal Civil Monetary Penalties Statute

The federal Civil Monetary Penalties Statute, among other things, imposes fines against any person who is determined to have presented, or caused to be presented, claims to a federal healthcare program that the person knows, or should know, is for an item or service that was not provided as claimed or is false or fraudulent.

Health Insurance Portability and Accountability Act of 1996