Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Recro Pharma, Inc. | d889543d8k.htm |

| EX-99.1 - EX-99.1 - Recro Pharma, Inc. | d889543dex991.htm |

Relieving

Pain….Improving Lives Exhibit 99.2 |

Special Note

Regarding Forward-Looking Statements

2

This presentation contains forward-looking statements that involve risks and

uncertainties. Such forward-looking statements reflect Recro

Pharma’s expectations about its future operating results,

performance

and

opportunities

that

involve

substantial

risks

and

uncertainties.

When

used

herein,

the words "anticipate," "believe," "estimate,"

"upcoming," "plan," "target", "intend" and "expect" and

similar expressions, as they relate to Recro Pharma or its management, are intended

to identify such forward-looking statements. These forward-looking

statements are based on information available to Recro Pharma as of the date

of this presentation and are subject to a number of risks, uncertainties,

and other factors that could cause actual events to differ materially from those

expressed in the forward-looking statements set forth in this presentation

including, without limitation:

the

success

of

Recro’s

products

and

of

the

newly

acquired

products;

the

parties’

ability

to

satisfy

the

purchase

agreement

conditions

(including

required

regulatory

approvals);

Recro’s

ability to realize anticipated growth, synergies and costs savings from the

acquisition; changes in laws and regulations; Recro’s ability to

successfully integrate the acquired operations, technology and products and

to realize anticipated growth, synergies and cost savings; Recro’s ability to

successfully develop, obtain regulatory approvals or commercialize new products and

Recro’s ability to protect intellectual property rights. In

addition, the forward-looking statements in this presentation should be

considered together with the risks and uncertainties that may affect Recro

Pharma’s business and future results included in Recro Pharma’s filings

with the Securities and Exchange Commission at www.sec.gov. Recro pharma

assumes no obligation to update any such forward looking statements.

|

Complementary Fit

3

IV / IM

Meloxicam

Manufacturing,

Royalties &

Formulation

Dex-IN / Fado |

Transformative

Transaction •

Diversifies development risk with second, complementary hospital

acute pain product to pipeline

–

Dex-IN has upcoming interim analysis of ongoing Ph II trial

–

Meloxicam ready for Ph III –

successfully completed multiple Ph II trials

•

Manufacturing & royalty business provides manufacturing

capability and scale

–

Enhances ability for BD opportunities

–

Depending on performance, potential for cashflows to fund development

•

Depending on Dex-IN clinical success, possibility for two proprietary

compounds to enter Ph III by year end

–

Assuming sufficient capital to fund development

–

Dex-IN interim results upcoming

4 |

Transaction

Structure •

$50 million up-front cash payment

–

non-dilutive up-front financed by senior secured loan from

OrbiMed

•

Up to $120 million in milestone payments upon

regulatory and sales milestones related to

meloxicam

•

Royalty on meloxicam net sales

•

Warrant to purchase 350,000 shares of common

stock at closing

5 |

OrbiMed

Financing Terms Term

Summary

Amount

$50 million funded on closing date

Structure

Senior secured term loan and warrants

Security interest

First lien security on all assets

Maturity date

60 months from closing date

Interest rate

Greater of (i) LIBOR or (ii) 1.0% plus applicable margin of 14.0%

Repayment and

amortization

100% excess cash flow sweep on manufacturing & royalty business at

OrbiMed’s option

Pre-payment

penalty

Prior

to

3

rd

year:

1.5x

loan

less

all

prior

payments

of

principal

and

interest

After

3

rd

year:

10%

exit

fee

prior

to

scheduled

maturity

date

Financial covenants

Manufacturing

&

royalty

business:

Quarterly

minimum

net

sales;

Quarterly

maximum

total

leverage

ratio

&

maximum

capital

expenditures

Consolidated

business:

Minimum

liquidity

covenant

Warrant

3% of fully diluted common stock at closing, exercise price is $3.28 per share,

and 7 year term

6 |

Acquisition Provides Scale and Diversification

•

Adds manufacturing & royalty business and Phase III ready hospital

asset –

85,000 sq. ft. facility (DEA licensed) manufactures 5 commercial

products

–

$70M+ historical revenues; manufacturing division cashflow positive

•

IV/IM meloxicam –

long acting COX-2 NSAID for moderate to severe acute

pain ready for Ph III

–

Approved, widely prescribed oral COX-2 therapeutic

–

Multiple Phase II studies successfully completed in acute pain models

–

Dosing advantages over existing acute pain therapeutics, including long

action –

Non-opioid

•

Meloxicam complementary to Dex-IN in treating moderate to severe

acute pain

–

Long

acting

formulation

has

successfully

treated

acute

pain

post

operatively

(hysterectomy)

•

Increases Company infrastructure and scale

–

Improved positioning for future BD opportunities

–

Manufacturing capacity

7 |

Updated

Clinical Stage Pipeline Product

PC

I

II

III

Rights

IV/IM Meloxicam

WW

Acute post-operative pain

Dexmedetomidine (“Dex”)

WW, exc. Europe, Turkey, CIS

Dex-

IN (intranasal)

Acute post-operative pain

Cancer breakthrough pain

Dex-SL (sublingual)

Transdermal

Fadolmidine (“Fado”)

WW, exc. Europe, Turkey, CIS

Intrathecal

Post-operative pain

Topical

Neuropathic pain

8 |

IV/IM Meloxicam Overview

•

FDA approved, oral selective COX-2 inhibitor used in a

wide variety of indications

•

Proprietary long acting injectable form for moderate to

severe acute pain

–

Utilizes Alkermes’

NanoCrystal

TM

technology

•

Phase III ready –

multiple Phase II studies completed on

IV and a Phase I on IM

–

Positive Ph II hysterectomy and dental pain studies with large

effect sizes

•

IP issued through 2022 and additional IP could extend

protection through 2030

9

NanoCrystal

®

is a registered trademark of Alkermes plc. |

Favorable Dosing Profile

Attribute

Meloxicam

Ketorolac

Caldolor

(ibuprofen)

Ofirmev

(APAP)

Route

IV/IM

IV/IM

IV

IV

Onset of pain

relief

< 10 min

30 min

N/A

N/A

Time to peak

analgesic effect

40 min

1-2 hrs

N/A

N/A

Duration of

pain relief

18-24 hrs

4-6 hrs

4-6 hrs

4-6 hrs

Admin.

IV bolus / pre-

filled syringe

Ready to use IV

bolus (15 sec)

Dilution required,

30 min infusion

Ready to use, 15

min infusion

10 |

Multiple

Successful IV Phase 2 Trials 11

•

Elan/ALKS have conducted 5 IV and 1 IM clinical trials

Trial

Design

Outcome

Phase II Study

N1539-02

Acute pain following dental

surgery (N = 230)

Statistically significant differences for all

doses compared to placebo were seen in

SPID24, pain relief and onset of pain relief

Phase II Study

N1539-04

Acute pain following open

abdominal hysterectomy

surgery (N = 486)

Statistically significant differences for all

doses compared to placebo were seen in

multiple efficacy analyses, including SPID24.

meloxicam 30 mg and 60 mg produced the

greatest response with no difference

between doses

Phase II Study

N1539-05

Acute pain following

laparoscopic abdominal

surgery (N =50)

Study stopped early (planned N = 250) for

business reasons. However, statistically

significant differences in SPID48 observed for

30mg QD dose despite small sample size |

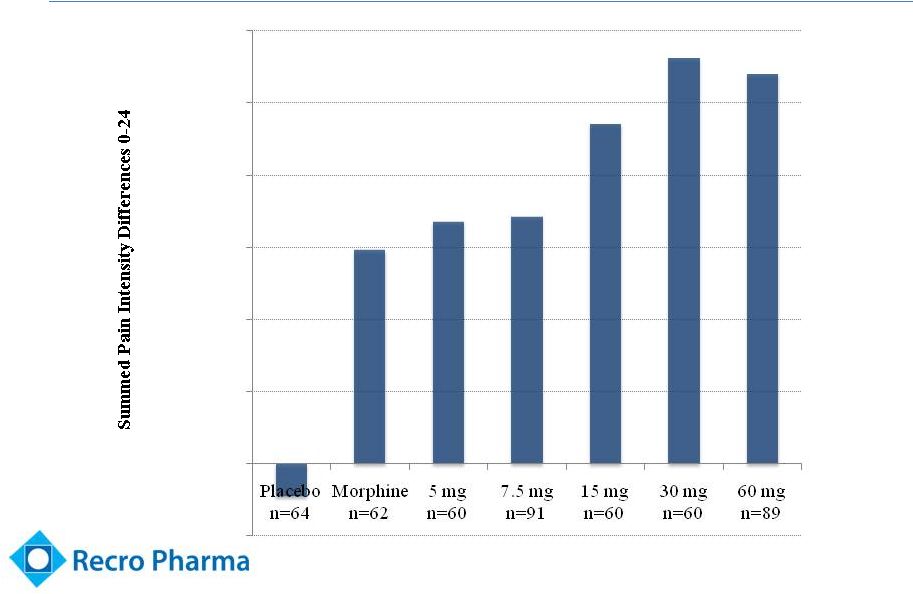

Robust

Efficacy (Abdominal Hysterectomy Trial –

IV Meloxicam)

12

*** p < 0.001 vs. Placebo

***

***

***

***

***

***

(10,000)

-

10,000

20,000

30,000

40,000

50,000

60,000 |

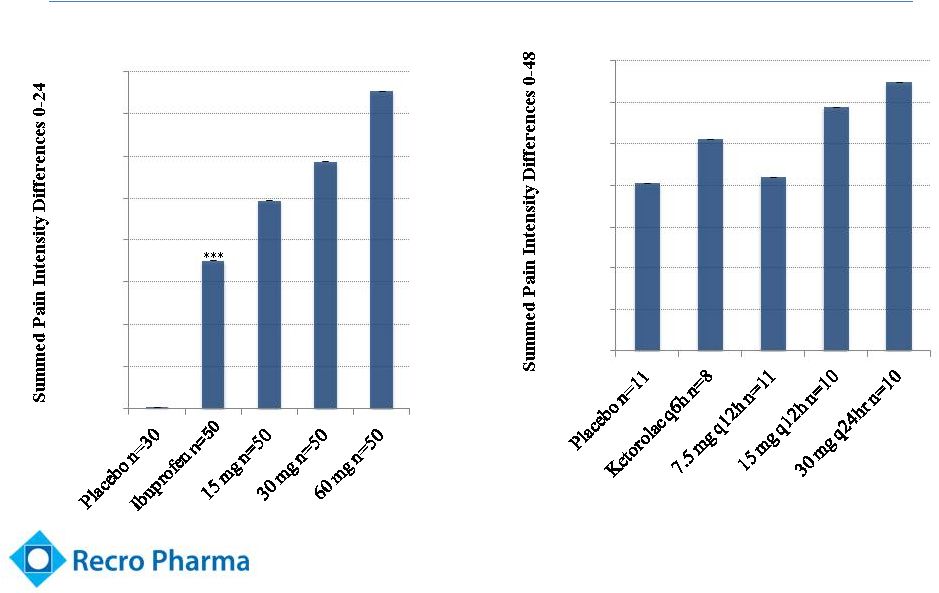

Confirmed

Efficacy in Multiple Studies Summary of Pain Intensity Differences (SPID)

13

*** p < 0.001 vs. Placebo

Dental Pain Study

Abdominal Laparoscopic Pain Study

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

***

***

***

0

200

400

600

800

1000

1200

1400

p = 0.0682

p = 0.0392 |

Single 30 mg

Dose Maintained for 24 hrs (Abdominal Hysterectomy Trial –

IV Meloxicam)

14

Baseline

Pain

Level

60

Time (Hours) |

Well Tolerated

(Abdominal Hysterectomy Trial –

IV Meloxicam)

15

**Reported in

3% of Subjects in any group and greater than Placebo

Meloxicam

Placebo

n=64

Morphine

n=62

5 mg

n=60

7.5 mg

n=91

15 mg

n=60

30 mg

n=60

60 mg

n=89

Anemia

3.1

4.8

3.3

13.2

3.3

1.7

10.1

Anemia Postoperative

-

1.6

-

-

-

3.3

-

Constipation

-

4.8

5.0

1.1

1.7

-

-

Flatulence

-

4.8

1.7

1.1

3.3

-

-

Hypokalaemia

-

3.2

1.7

1.1

-

1.7

-

Insomnia

4.7

8.1

10.0

4.4

5.0

5.0

4.5

Ketonuria

7.8

9.7

6.7

9.9

15

10

10.1

Leukocytosis

-

-

1.7

-

-

3.3

-

Pyrexia

1.6

3.2

3.3

2.2

-

-

-

Sinus Tachycardia

-

-

3.3

-

-

-

1.1

Percent of Subjects Reporting an Adverse Event **

|

US Based

Manufacturing Facility 16 |

Manufacturing

& Royalty Overview Manufacturing facility

•

87,000 sq. ft. solid oral dosage manufacturing cGMP

•

DEA licensed

•

~165 employees

Service capabilities

•

Formulation, process development and optimization

•

Process scale-up

•

Clinical supply and validation

•

Commercial supply

Ritalin LA

•

Once daily ADHD treatment marketed by Novartis

Focalin XR

•

ADHD treatment marketed by Novartis

Verelan / verapamil

•

High blood pressure treatment marketed by Actavis and

UCB

Zohydro ER

•

Extended release hydrocodone marketed by Zogenix

•

Launched in 2014

•

Abuse deterrent form expected to be launched near term

17 |

Strong

Historical Manufacturing Performance •

Unaudited, carve-out financials –

12 mos ended 12/31/14

–

Revenues -

$73.6 million

–

EBITDA -

$26.5 million

•

Zohydro ER –

abuse deterrent form expected to be

launched in the near term

•

Additional capacity for new product opportunities

•

Positive cashflow expected to cover all debt service

obligations and excess cashflows to repay loan principal

18 |

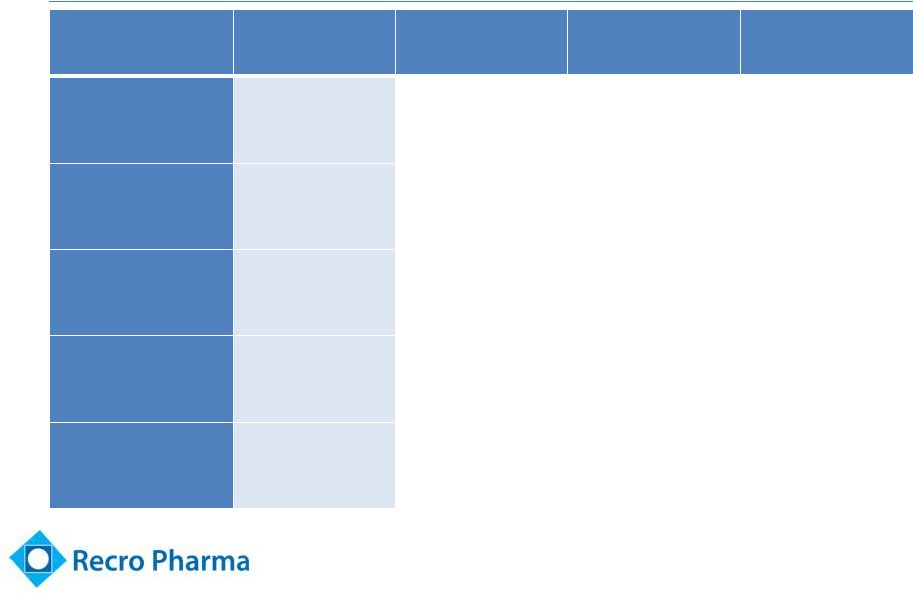

Illustrative

Pro Forma Capitalization Pre-transaction

Post-transaction

Common stock

7,804,063

7,804,063

Options

962,800

962,800

(1)

Existing warrants

150,000

150,000

Alkermes warrants

0

350,000

OrbiMed warrants

0

278,006

(2)

Total commons stock equiv.

8,916,863

9,544,869

19

(1) Outstanding at signing. Excludes options to be issued to acquired

employees at closing. (2) This number will be calculated based on common

stock outstanding (on a fully diluted basis) as of the Closing of the

transaction. |

Transformative

Transaction •

Diversifies development risk with second, complementary hospital

acute pain product to pipeline

–

Dex-IN has upcoming interim analysis of ongoing Ph II trial

–

Meloxicam ready for Ph III –

successfully completed multiple Ph II trials

•

Manufacturing & royalty business provides manufacturing

capability and scale

–

Enhances ability for BD opportunities

–

Depending on performance, potential for cashflows to fund development

•

Depending on Dex-IN clinical success, possibility for two proprietary

compounds to enter Ph III by year end

–

Assuming sufficient capital to fund development

–

Dex-IN interim results upcoming

20 |