Attached files

| file | filename |

|---|---|

| 8-K - GLPI 8-K 3.9.15 - Gaming & Leisure Properties, Inc. | glpi39158-k.htm |

| EX-99.1 - GLPI EXHIBIT 99.1 - Gaming & Leisure Properties, Inc. | march092015exhibit991.htm |

Gaming & Leisure Properties Inc. Proposal to Acquire Pinnacle Entertainment’s Real Estate Assets Exhibit 99.2

Forward-looking statements in this document are subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of Gaming and Leisure Properties, Inc. (“GLPI”) (NASDAQ: GLPI) and its subsidiaries (the “Company”) to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements include information concerning the Company’s business strategy, plans, and goals and objectives. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “may increase,” “may fluctuate,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could’ are generally forward-looking in nature and not historical facts. You should understand that the following important factors could affect future results and could cause actual results to differ materially from those expressed in such forward- looking statements: the ultimate outcome of any potential transaction between GLPI and Pinnacle Entertainment, Inc. (“Pinnacle”) (NYSE: PNK) including the possibilities that GLPI will not pursue a transaction with Pinnacle and that Pinnacle will not engage in negotiations with respect to a transaction with GLPI; if a transaction between GLPI and Pinnacle were to occur, the ultimate outcome and results of integrating the assets that would be acquired by GLPI in the transaction; the effects of a transaction between GLPI and Pinnacle, including the post-transaction GLPI’s financial condition, operating results, strategy and plans; and additional factors discussed in the sections entitled “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K as filed with the Securities and Exchange Commission. Other unknown or unpredictable factors may also cause actual results to differ materially from those projected by the forward-looking statements. Most of these factors are difficult to anticipate and are generally beyond the control of the Company. The Company does not undertake any obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events unless required to do so by law. This presentation includes “Non-GAAP financial measures” within the meaning of SEC Regulation G. A reconciliation of all Non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with GAAP can be found at www.glpropinc.com in the Recent News section and financial schedules available on the Company’s website. Forward Looking Statements 2 Gaming & Leisure Properties, Inc.

Additional Information This communication does not constitute an offer to buy or solicitation of an offer to sell any securities and no tender or exchange offer for the shares of Pinnacle has commenced at this time. This communication relates to a proposal which GLPI has made for a business combination transaction with Pinnacle. In furtherance of this proposal and subject to future developments, GLPI (and, if a negotiated transaction is agreed, Pinnacle) may file one or more proxy statements, registration statements, tender or exchange offer documents or other documents with the SEC. This communication is not a substitute for any proxy statement, registration statement, prospectus, tender or exchange offer document or other document GLPI and/or Pinnacle may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF GLPI AND PINNACLE ARE URGED TO READ THE PRELIMINARY PROXY STATEMENT AND ANY OTHER PROXY STATEMENT(s), REGISTRATION STATEMENT, PROSPECTUS, TENDER OR EXCHANGE OFFER DOCUMENTS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive proxy statement(s) or definitive tender or exchange offer documents (if and when available) will be mailed to stockholders of Pinnacle and/or GLPI, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by GLPI and/or Pinnacle through the web site maintained by the SEC at http://www.sec.gov. Certain Information Regarding Participants GLPI and its directors and executive officers may be deemed to be participants in any solicitation with respect to the proposed transaction under the rules of the SEC. Security holders may obtain information regarding the names, affiliations and interests of GLPI’s directors and executive officers in GLPI’s Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 27, 2015, and its proxy statement for the 2014 Annual Meeting, which was filed with the SEC on April 29, 2014. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in any proxy statement and other relevant materials to be filed with the SEC if and when they become available. Important Information for Investors and Security Holders 3 Gaming & Leisure Properties, Inc.

Proposed Transaction Summary 4 Structure • Pinnacle spins-off gaming operations (“OpCo”) in a taxable transaction • PropCo merged into GLPI • OpCo enters into a triple-net Master Lease Agreement with GLPI • Pinnacle pro forma ownership in GLPI of 20% and 100% ownership in OpCo • GLPI acquires Pinnacle’s real estate (“PropCo”) for $4.1 billion (1) • Pinnacle shareholders receive approximately 36 million shares in GLPI as consideration • Pinnacle shareholders receive one share of OpCo common stock and 0.5517 shares of GLPI common stock for each share of Pinnacle (2) The Proposal • OpCo: 4.5x Debt / 2015E EBITDA • Pro Forma GLPI: 6.0x Debt / 2015E EBITDA, with any remaining financing need funded with common equity Pro Forma Capitalization • Will be a fully underwritten and financed transaction • Prepared to enter into a definitive agreement without any financing condition Financing • Value to Pinnacle shareholders of approximately $36 per share at closing − 30% premium to Pinnacle’s current share price − 47% premium to Pinnacle’s 30-day VWAP − 59% premium to Pinnacle’s share price on date of GLPI’s first offer (January 16, 2015) Value Creation (1) Assumes 2015E property-EBITDAR of $680 million and 1.90x property-EBITDAR lease coverage at OpCo (2) Pinnacle fully diluted shares outstanding of 64.5MM based on 60.2MM basic shares outstanding as of 2/26/15; 5.6MM options outstanding with a weighted average exercise price of $15.17 as of 12/31/14; 1.2MM non-vested restricted stock units as of 12/31/14; and 0.5MM non-vested performance stock units as of 12/31/14 Gaming & Leisure Properties, Inc. • Expected transaction close in 2015 Timing

GLPI Proposal Enables and Enhances Planned Separation 5 We agree that a separation of the real estate generates long-term value to shareholders; our proposal is consistent with Pinnacle’s Board approved plan OpCo PropCo Proposed by Pinnacle Our Proposal Existing Pinnacle Shareholders OpCo PropCo Existing Pinnacle Shareholders Gaming & Leisure Properties, Inc.

Shareholders Have The Right to Know: 6 Gaming & Leisure Properties, Inc. • Pro forma leverage levels of OpCo and PropCo • Pro forma historical results and forward guidance on a PropCo and OpCo basis • Business purpose justification for tax-free spin and related execution risk • Solution for active trade or business requirement for tax-free spin • Treatment of outstanding equity incentive awards and potential effect on spin economics • Expected corporate overhead of PropCo • Estimated costs to achieve internal restructuring, including any taxable gains and other taxes triggered by the restructuring • Master Lease key terms, including rent calculation and adjustment mechanism • Estimated time frame to obtain regulatory approvals and relative progress made with respect to each interim process • Constraints from equity raise on ability to pursue future acquisitions post-spin • Senior executive leadership of PropCo • Outcome of private letter ruling (PLR) from IRS • Scope of PLR coverage and remaining tax risk to shareholders – Extent to which Pinnacle’s internal reorganization will be covered by a PLR – Extent to which Pinnacle will rely on legal and tax opinions rather than comfort from the IRS GLPI prepared and provided substantially more information when it announced its intent to pursue its own separation…and still took a year to complete post-announcement

Benefits of GLPI Proposal 7 Faster Path to Completion • GLPI transaction expected to close in 2015 • Pinnacle publicly acknowledged separation will not be completed until sometime in 2016 • Spin-off in next 12 months unlikely even if Pinnacle were to obtain an IRS ruling this year (uncertain) Reduced Management Burden • Ability for Pinnacle’s management to devote attention towards optimizing performance of gaming operations • Eliminates requirement to identify and appoint senior executive leadership (and substantial associated costs) Creation of an Industry Leader • Combined business would constitute 3rd largest publicly traded triple-net REIT − Extensive scale − Diversified tenant base − Broad financial resources − Access to far-ranging growth opportunities − 2x+ the assets & cash flows of standalone Pinnacle PropCo Superior Value Creation • Approximately $36 per share in value to Pinnacle shareholders - substantial premium to recent Pinnacle trading levels • Pro forma GLPI will have stronger, more stable currency and trade at quantifiable premium to standalone Pinnacle PropCo Gaming & Leisure Properties, Inc. Greater Transaction Certainty • No IRS ruling required • GLPI currently / formerly licensed in each jurisdiction • No financing condition • Pinnacle currently over-levered and reliant on up to $700MM equity issuance (~40% of current market capitalization)

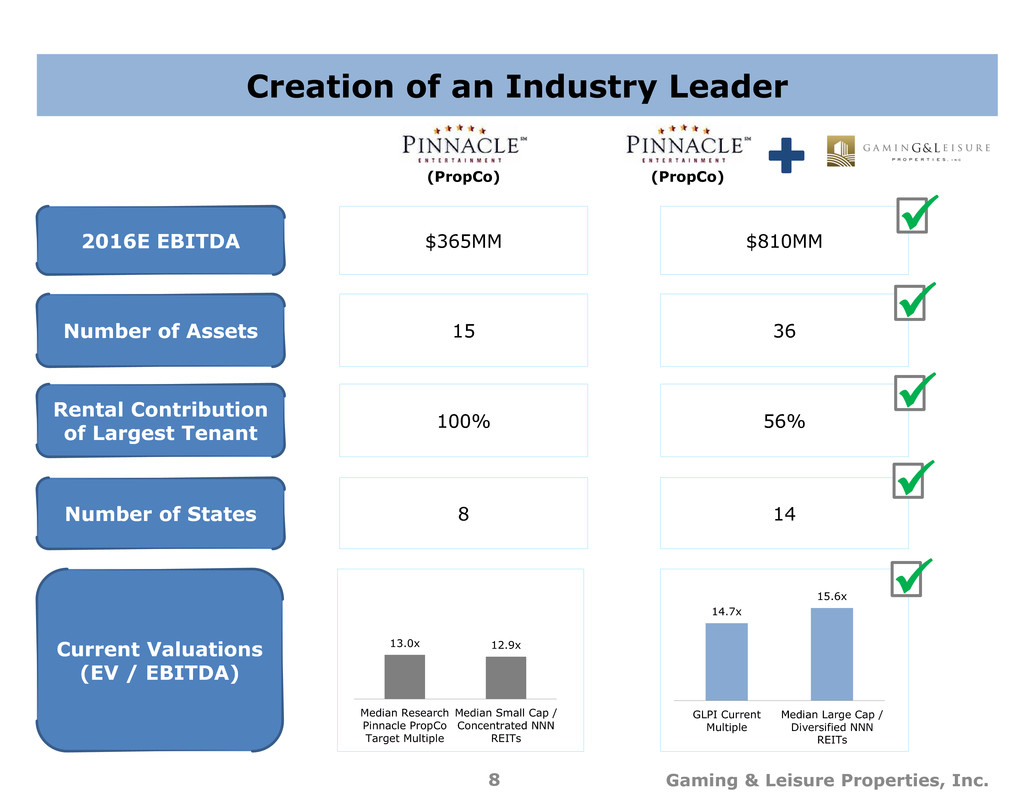

Creation of an Industry Leader 8 $365MM $810MM 2016E EBITDA 15 36 Number of Assets 8 14 Number of States (PropCo) (PropCo) Current Valuations (EV / EBITDA) 13.0x 12.9x Median Research Pinnacle PropCo Target Multiple Median Small Cap / Concentrated NNN REITs 14.7x 15.6x GLPI Current Multiple Median Large Cap / Diversified NNN REITs 100% 56% Rental Contribution of Largest Tenant Gaming & Leisure Properties, Inc.

Market-Leading Scale 9 Gaming and Leisure Properties Will Become the Third-Largest Triple-Net REIT $20 $17 $12 $11 $9 $8 $7 $6 $5 $5 $0 $5 $10 $15 $20 ARCP O PF GLPI WPC SRC NNN GLPI EPR LXP Pinnacle Standalone PropCo E n te rp ri se Va lue ( $ B n ) (1) Based on current GLPI EV / EBITDA multiple of 14.7x (2) Based on median research EV / EBITDA multiple of 13.0x (1) (2) Gaming & Leisure Properties, Inc.

10x 12x 14x 16x 18x 20x Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Large Cap NNN Index Small Cap NNN Index Favorable Valuation Environment 10 Mar-15 Historically High Triple-Net REIT Valuations and a Tangible Premium for Scale (1) Includes companies with enterprise values in excess of $8 billion (Realty Income Corporation, W.P. Carey Inc., Spirit Realty Capital, and National Retail Properties) (2) American Realty Capital Properties excluded from index due to historical volatility related to accounting irregularities (3) Includes companies with enterprise values below $8 billion (Entertainment Properties Trust, Lexington Corporate Properties Trust, Store Capital Corporation, Chambers Street Properties, STAG Industrial, Select Income REIT, Gramercy Property Trust, Getty Realty, and Agree Realty Corporation) (1) (3) EV / NTM EBITDA Gaming & Leisure Properties, Inc. Median EV / EBITDA Multiple: 15.9x Median EV / EBITDA Multiple : 12.5x Current EV / EBITDA Multiple: 17.4x Current EV / EBITDA Multiple: 13.8x (2)

$27.00 $22.13 $7.36 $13.64 $34.36 $35.77 0 15 30 45 Pinnacle Standalone Plan Proposed GLPI Transaction $28.89 $23.32 $10.73 $14.51 $2.71 $39.62 $40.54 0 15 30 45 Pinnacle Standalone Plan Proposed GLPI Transaction Superior Value Creation 11 Gaming & Leisure Properties, Inc. Value Comparison As of Year-End 2015 (1) Value Comparison As of Year-End 2016 (1) Value in OpCo Value in PF GLPI Dividend Payment (3) (1) Based on 13.0x EV / EBITDA multiple for standalone PropCo; proposed GLPI transaction based on current GLPI EV / EBITDA multiple of 14.7x (2) Based on median research forward EV / EBITDA multiple of 8.4x (3) Based on 80% payout ratio on pro forma AFFO of $603MM divided by pro forma share count of 178MM Potential upside from REIT transaction Median research price target (no REIT transaction) Implied base share price (2) Potential upside from REIT transaction

A Compelling Proposal to Shareholders Retain 100% OpCo Ownership Retain OpCo Management PropCo Management In Place No Requirement for IRS Private Letter Ruling Previously Received Regulatory Approvals Established and Supportive Investor Base Trade with Premium Sector Valuation (PropCo) (Proposal) O pe ra ti o n s Ce rt a inty & A pp rov a ls T imi n g & V a lu a ti o n Diversified Tenant Credit Strength Capture Today’s Historically High Valuations Gaming & Leisure Properties, Inc. 12

(75%) (25%) 25% 75% 125% May-94 Nov-97 Apr-01 Oct-04 Mar-08 Sep-11 Feb-15 1% 22% Long-Track Record of Delivering Shareholder Value 13 GLPI and Its Board Has Consistently Outperformed Pinnacle Since Its IPO in 1994 Annualized Shareholder Return Gaming & Leisure Properties, Inc. Mar PENN + GLPI Pinnacle

Conclusion 14 Our proposed transaction offers superior strategic and financial benefits for Pinnacle shareholders − Creation of an industry leader − Superior value creation − Greater transaction certainty − Faster path to completion − Reduced management burden We have invested substantial resources in pursuing this transaction and remain fully committed to achieving the tremendous potential this transaction has to offer We have more experience on gaming REIT tax and transaction issues than any other firm - with certain limited non-competitive information, we would be able to refine our proposal to deliver maximum value The combination of our management team and Board have consistently delivered value to our shareholders through optimizing operations and pursuing accretive strategic opportunities We desire to pursue a friendly, constructive negotiation with Pinnacle’s management team and advisors, and are ready to commence substantive discussions immediately Gaming & Leisure Properties, Inc.

Detailed Financial Overview 15 Gaming & Leisure Properties, Inc.

Pinnacle Projections $MM 2015 2016 Property EBITDAR $680 $686 Lease Payment (PropCo EBITDA) (358) (365) Corporate Expenses (76) (77) PF OpCo EBITDA $246 $244 Property EBITDAR Lease Coverage 1.9x 1.9x Corporate EBITDAR Lease Coverage 1.7x 1.7x Acquisition Debt $2,257 New Primary Equity (25MM Shares) 804 Equity to Pinnacle Shareholders (36MM Shares) 1,151 Total Transaction (Including Fees) $4,213 Acquisition Debt 2,257 Existing GLPI Debt 2,518 PF GLPI Debt $4,775 Illustrative Transaction Mechanics 16 • Pinnacle shareholders own 100% of OpCo as well as a material equity interest in GLPI • Total value per share to Pinnacle shareholders of $35.77 (30% premium to current share price) • Pinnacle separates OpCo assets into a new corporation through a taxable spin – Assumes pro forma OpCo is levered at 4.5x 2015E EBITDA (net of lease payments to PropCo) Outcome PropCo Pinnacle Shareholders New Primary Shareholders GLPI Existing Business Lease Payments OpCo 36MM shares (20% ownership) 25MM shares (14% ownership) 100% Step 2: All Stock Merger of GLPI / Pinnacle PropCo PropCo Pinnacle Pinnacle Shareholders OpCo GLPI GLPI Shareholders GLPI Stock (36MM shares) Pinnacle PropCo Stock ($1,151MM equity value) • Concurrent with closing of spin, GLPI merges with public Pinnacle PropCo for all stock consideration and assumes all PropCo debt 100% Step 1: Taxable Spin of OpCo OpCo Pinnacle Shareholders PropCo Stock OpCo Stock Pinnacle Debt: $1,107MM + $2,616MM = $3,723 Total: Existing GLPI Shareholders 118MM shares (66% ownership) Gaming & Leisure Properties, Inc. Notes (1) Estimated as of 12/31/15; consists of $67MM for 6.375% Senior Notes, $59MM for 7.50% Senior Notes, $39MM for 7.75% Senior Sub. Notes and $15MM for 8.75% Senior Sub. Notes (2) Assumes $1.8Bn OpCo value (PF 2015E EBITDA of $246MM multiplied by PENN average trading multiple of 7.5x), $812MM estimated OpCo tax basis, $700MM NOL utilization and 35% tax rate (3) Actual OpCo tax basis to be determined; however, a third party arms length transaction with GLPI may enable Pinnacle to pursue more efficient transaction structures (4) Includes both illustrative advisory fees and financing fees for OpCo Offer Value $4,113 Assumed Debt (2,616) Debt Breakage (1) (180) OpCo Spin Taxes (2) (3) (116) Transaction Fees (4) (50) Implied Equity Value $1,151 Current Gold Share Price $32.37 Shares Issued to Platinum Shareholders 36

Value Creation Analysis 17 Gaming & Leisure Properties, Inc. Notes: (1) Based on median research estimates for Pinnacle EBITDAR and assumed 1.9x property EBITDAR lease coverage at OpCo (2) Based on pro forma debt / 2015E EBITDA of 6.0x and pro forma GLPI 2015E EBITDA of $796MM (3) Pinnacle shareholders to receive 0.5517 shares of GLPI common stock for each share of Pinnacle they own (4) Pinnacle fully diluted shares outstanding of 64.5 million based on 60.2 million basic shares outstanding as of February 26, 2015; 5.6 million options outstanding with a weighted average exercise price of $15.17 as of December 31, 2014; 1.2 million non-vested restricted stock units as of December 31, 2014; and 0.5 million non-vested performance stock units as of December 31, 2014 (5) Based on pro forma debt / 2015E EBITDA of 4.5x and pro forma Pinnacle OpCo 2015E EBITDA of $246MM Total Value to Pinnacle Value Per Pinnacle Share in Pro Forma GLPI $22.13 Value Per Pinnacle Share in Pro Forma OpCo $13.64 Value Per Share to Pinnacle $35.77 Premium to Pinnacle's Current Share Price 30% Premium to Pinnacle's 30-Day VWAP 47% Premium to Pinnacle's Price on Date of GLPI's First Offer 59% Value in Pro Forma GLPI GLPI 2016E EBITDA $446 Pinnacle PropCo 2016E EBITDA (1) 365 Pro Forma GLPI 2016E EBITDA $810 Current GLPI Forward EV / EBITDA Multiple 14.7x Pro Forma GLPI Enterprise Value $11,902 Pro Forma GLPI Debt (2) (4,775) Pro Forma GLPI Cash 30 Pro Forma GLPI Equity Value $7,157 Pinnacle Ownership (3)(4) 20% Value in Pro Forma GLPI $1,426 Value Per Pinnacle Share (4) $22.13 Value in Pro Forma Pinnacle OpCo Pro Forma Pinnacle OpCo 2016E EBITDA $244 Trading Multiple 7.5x Pro Forma Pinnacle OpCo Enterprise Value $1,833 Pro Forma Pinnacle OpCo Debt (5) (1,107) Pro Forma Pinnacle OpCo Non-Controlling Interest (11) Pro Forma Pinnacle OpCo Cash 165 Pro Forma Pinnacle OpCo Equity Value $880 Pinnacle Ownership 100% Value in Pro Forma Pinnacle OpCo $880 Value Per Pinnacle Share (4) $13.64

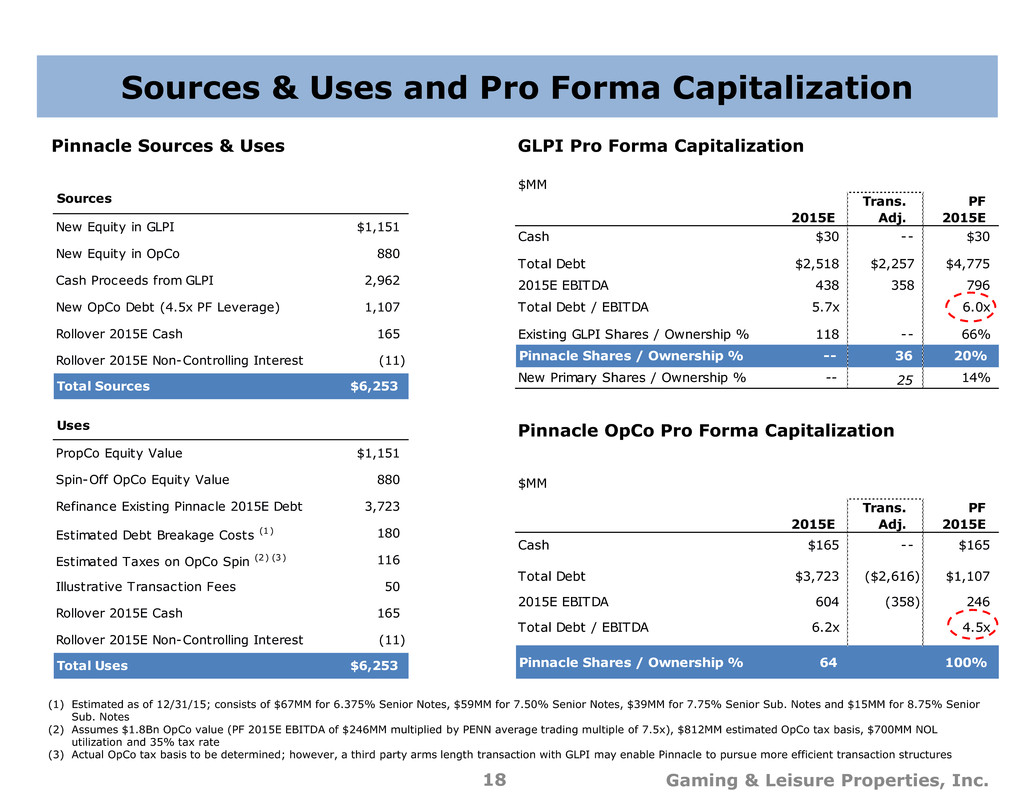

$MM Trans. PF 2015E Adj. 2015E Cash $165 -- $165 Total Debt $3,723 ($2,616) $1,107 2015E EBITDA 604 (358) 246 Total Debt / EBITDA 6.2x 4.5x Pinnacle Shares / Ownership % 64 100% $MM Trans. PF 2015E Adj. 2015E Cash $30 -- $30 Total Debt $2,518 $2,257 $4,775 2015E EBITDA 438 358 796 Total Debt / EBITDA 5.7x 6.0x Existing GLPI Shares / Ownership % 118 -- 66% Pinnacle Shares / Ownership % -- 36 20% New Primary Shares / Ownership % -- 25 14% Sources New Equity in GLPI $1,151 New Equity in OpCo 880 Cash Proceeds from GLPI 2,962 New OpCo Debt (4.5x PF Leverage) 1,107 Rollover 2015E Cash 165 Rollover 2015E Non-Controlling Interest (11) Total Sources $6,253 Uses PropCo Equity Value $1,151 Spin-Off OpCo Equity Value 880 Refinance Existing Pinnacle 2015E Debt 3,723 Estimated Debt Breakage Costs (1) 180 Estimated Taxes on OpCo Spin (2) (3) 116 Illustrative Transaction Fees 50 Rollover 2015E Cash 165 Rollover 2015E Non-Controlling Interest (11) Total Uses $6,253 Sources & Uses and Pro Forma Capitalization 18 Pinnacle Sources & Uses GLPI Pro Forma Capitalization Pinnacle OpCo Pro Forma Capitalization (1) Estimated as of 12/31/15; consists of $67MM for 6.375% Senior Notes, $59MM for 7.50% Senior Notes, $39MM for 7.75% Senior Sub. Notes and $15MM for 8.75% Senior Sub. Notes (2) Assumes $1.8Bn OpCo value (PF 2015E EBITDA of $246MM multiplied by PENN average trading multiple of 7.5x), $812MM estimated OpCo tax basis, $700MM NOL utilization and 35% tax rate (3) Actual OpCo tax basis to be determined; however, a third party arms length transaction with GLPI may enable Pinnacle to pursue more efficient transaction structures Gaming & Leisure Properties, Inc.

Definitions and Reconciliation of Non-GAAP Measures to GAAP Adjusted EBITDA, or earnings before interest, taxes on income, stock-based compensation, management fees, depreciation, amortization, and gains and/or losses on dispositions of property is not a measure of performance or liquidity calculated in accordance with GAAP Adjusted EBITDA information is presented as a supplemental disclosure. Adjusted EBITDA should not be construed as an alternative to operating income, as an indicator of the Company's operating performance, as an alternative to cash flows from operating activities, as a measure of liquidity, or as any other measure of performance determined in accordance with GAAP. The Company has significant uses of cash flows, including capital expenditures, interest payments, dividend payments, taxes and debt principal repayments, which are not reflected in adjusted EBITDA. Adjusted EBITDA is presented as a supplemental disclosure as this measure is considered by many to be a better indicator of the Company’s operating results than net income (computed in accordance with GAAP). A reconciliation of the Company’s adjusted EBITDA to net income (computed in accordance with GAAP) is included in the Company’s news announcements and financial schedules available on the Company’s website. Funds From Operations (“FFO”) is equal to net income, excluding gains or losses from dispositions of property, and real estate depreciation FFO is defined by NAREIT (the National Association of Real Estate Investment Trusts, the trade organization for REITs) as “the most commonly accepted and reported measure of REIT operating performance.” Adjusted Funds From Operations (“AFFO”) is defined as FFO excluding stock based compensation expense, the amortization of debt issuance costs and other depreciation reduced by maintenance capex. A reconciliation of FFO and AFFO to net income (computed in accordance with GAAP) is included in the news announcements and financial schedules available on the Company’s website. FFO and AFFO do not represent cash flow from operations as defined by GAAP, should not be considered as an alternative to net income as defined by GAAP and are not indicative of cash available to fund all cash flow needs. Notwithstanding the foregoing, GLPI’s measures of adjusted EBITDA, FFO and AFFO may not be comparable to similarly titled measures used by other companies 19 Gaming & Leisure Properties, Inc.

Gaming & Leisure Properties Inc. Proposal to Acquire Pinnacle Entertainment’s Real Estate Assets