Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DARLING INGREDIENTS INC. | dar-201539x8kinvestpres.htm |

Roth Investor Conference March 10, 2015 Creating sustainable food, feed and fuel ingredients for a growing population Randall C. Stuewe, Chairman and CEO John O. Muse, EVP Chief Financial Officer Exhibit 99.1

Creating sustainable food, feed and fuel ingredients for a growing population Safe Harbor Statement This presentation contains “forward-looking” statements regarding the business operations and prospects of Darling Ingredients Inc. and industry factors affecting it. These statements are identified by words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “could,” “may,” “will,” “should,” “planned,” “potential,” “continue,” “momentum,” and other words referring to events that may occur in the future. These statements reflect Darling Ingredient’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and uncertainties beyond its control, each of which could cause actual results to differ materially from those indicated in the forward-looking statements. These factors include, among others, existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to upstream their profits to the Company for payments on the Company's indebtedness or other purposes; unanticipated costs or operating problems related to the acquisition and integration of Rothsay and Darling Ingredients International (including transactional costs and integration of the new enterprise resource planning (ERP) system); global demands for bio-fuels and grain and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s products; reductions in raw material volumes available to the Company due to weak margins in the meat production industry as a result of higher feed costs, reduced consumer demand or other factors, reduced volume from food service establishments, reduced demand for animal feed, or otherwise; reduced finished product prices; continued decline in fat and used cooking oil finished product prices; changes to worldwide government policies relating to renewable fuels and greenhouse gas emissions that adversely affect programs like the Renewable Fuel Standards Program (RFS2) and tax credits for biofuels both in the Unites States and abroad; possible product recall resulting from developments relating to the discovery of unauthorized adulterations to food or food additives; the occurrence of Bird Flu including, but not limited to H1N1 flu, bovine spongiform encephalopathy (or "BSE"), porcine epidemic diarrhea ("PED") or other diseases associated with animal origin in the United States or elsewhere; unanticipated costs and/or reductions in raw material volumes related to the Company’s compliance with the existing or unforeseen new U.S. or foreign regulations (including, without limitation, China) affecting the industries in which the Company operates or its value added products (including new or modified animal feed, Bird Flu, PED or BSE or similar or unanticipated regulations); risks associated with the renewable diesel plant in Norco, Louisiana owned and operated by a joint venture between Darling Ingredients and Valero Energy Corporation, including possible unanticipated operating disruptions; risks relating to possible third party claims of intellectual property infringement; increased contributions to the Company’s pension and benefit plans, including multiemployer and employer-sponsored defined benefit pension plans as required by legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal event; bad debt write-offs; loss of or failure to obtain necessary permits and registrations; continued or escalated conflict in the Middle East, North Korea, Ukraine or elsewhere; and/or unfavorable export or import markets. These factors, coupled with volatile prices for natural gas and diesel fuel, climate conditions, currency exchange fluctuations, general performance of the U.S. and global economies, disturbances in world financial, credit, commodities and stock markets, and any decline in consumer confidence and discretionary spending, including the inability of consumers and companies to obtain credit due to lack of liquidity in the financial markets, among others, could negatively impact the Company's results of operations. Among other things, future profitability may be affected by the Company’s ability to grow its business, which faces competition from companies that may have substantially greater resources than the Company. Other risks and uncertainties regarding Darling Ingredients Inc., its business and the industries in which it operates are referenced from time to time in the Company’s filings with the Securities and Exchange Commission. Darling Ingredients Inc. is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise. 2

Creating sustainable food, feed and fuel ingredients for a growing population Global footprint: 5 continents, 200+ locations Founded: 1882 Listed: 1994 Publicly traded: NYSE: DAR 2014 revenue: ~$4.0 billion • Gelatin • Casings • Functional Proteins • Food Grade Fats • Heparin • Bone China • Proteins • Fats • Bakery Feeds • Organic Fertilizers • Plasmas • Hides • Renewable Fuels • Biofuels • Green Gas • Green Electricity FUE L FEE D F O O D Employees: Approx. 10,000 Headquarters: Irving, Texas, USA Industries served: Pharma, food, feed, pet food, technical, fuel, bio-energy, fertilizer A Global Leader in Sustainable Ingredient Creation 3

Creating sustainable food, feed and fuel ingredients for a growing population Process USA Canada Europe China S. America Australia Total: Rendering - (C3 By-products & UCO) 93 5 18 116 Bakery 11 11 Used Cooking Oil processing only 8 1 9 Disposal Rendering - (C1 & C2) 6 6 Food Grade Fat Processing 5 5 Blood Processing 1 4 5 1 1 12 Bone Processing 2 2 Bio Diesel 1 1 2 Renewable Diesel 1 1 Gelatin 2 4 4 3 13 Casings 4 1 5 Environmental Services 4 1 5 Fertilizer 1 1 Petfood 1 1 2 Hides 3 3 6 126 6 49 10 4 1 196 *Includes transfer stations and blending ** Facility in the permitting process Locations by Continent and Process European categories for rendering of animal by-products: • C3 – food-grade material, for food and feed products • C2 – unfit for food or animal feed, can be used as fertilizer • C1 – must be destroyed; used to generate green energy ** * Note: List excludes administrative and dedicated sales offices. 4

Creating sustainable food, feed and fuel ingredients for a growing population Creates Margin Opportunity DAR is operated as a spread business Operating Costs Transportation Costs Energy Costs Global Drivers to Business Raw Material Availability Competing Ingredient Supply Some sources estimate strong growth in world population which will drive Food, Feed & Fuel demand “How We Buy It” 5

Creating sustainable food, feed and fuel ingredients for a growing population Darling Ingredients Recipe Diverse Raw Material Supply Establish Spread/Margin Transform and Value Add Key Suppliers Procure Raw Mat Identify Margin Opportunity Process to highest value Manage Margin Our model today has evolved to one that reduces commodity exposure by partnering with our key suppliers Procuring raw material is critical to our business. Identifying and creating value added products is our goal Our global processing network is instrumental in allowing us to create high value products Finished product prices do move in relation to competing Ingredients thus we must share risk to be successful. The most critical factor in our business is “How we buy raw material” Identify Highest Value Market 6

Food, Feed & Fuel Our Business Segments Creating sustainable food, feed and fuel ingredients for a growing population

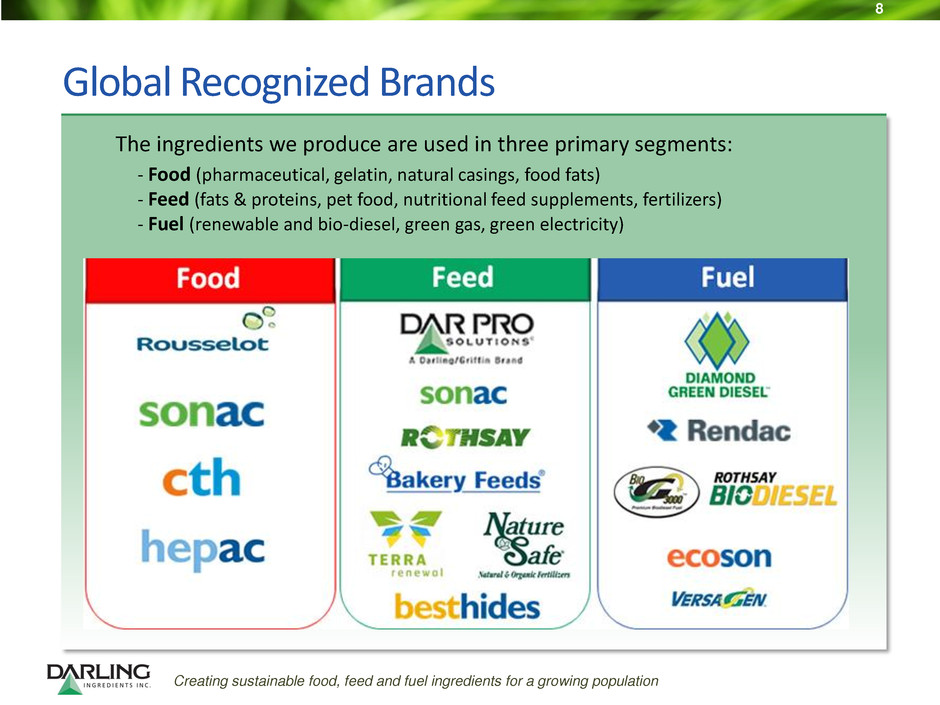

Creating sustainable food, feed and fuel ingredients for a growing population The ingredients we produce are used in three primary segments: - Food (pharmaceutical, gelatin, natural casings, food fats) - Feed (fats & proteins, pet food, nutritional feed supplements, fertilizers) - Fuel (renewable and bio-diesel, green gas, green electricity) Global Recognized Brands 8

Creating sustainable food, feed and fuel ingredients for a growing population Food Ingredients Segment Ingredients for living: Darling transforms nutrient streams into high value food ingredients The odds are high that one of our ingredients was part of your life today! . 9

Creating sustainable food, feed and fuel ingredients for a growing population Food – A Closer Look: • Rousselot is the world’s leading supplier of gelatin and collagen peptides* • Headquartered in Son, Netherlands, 4 continent network • Rousselot has 13 production facilities selling to 75 countries worldwide KEY DRIVERS • Supply and competing uses for bones, hides and pig skins • Demand for gelatin in food and beverages • Pharmaceutical demand • Film industry demand * “Gelatin Market Analysis by Raw Material, By Application, and Segment Forecasts to 2020” by Grand View Research, Inc., 2014 10

Creating sustainable food, feed and fuel ingredients for a growing population • Sonac fat processes, refines and packages high-quality food-grade animal fats for baking, frying and technical applications • Sonac fat has 6 processing facilities in Germany and the Netherlands • Sonac bone provides food grade raw material for our gelatin plants • Sonac bone ash is for our Global Ceramics opera- tion in the U.K. and other bone china customers MARKET DRIVERS • Palm oil • Branded products growing • Food service is growth opportunity • LARU and VADA trademarks • Food grade glues and binders • Primarily Euro-centric Food – A Closer Look: 11

Creating sustainable food, feed and fuel ingredients for a growing population • A top supplier of natural sausage casings • 50 years experience sourcing, processing and selling the highest quality product through an extensive distribution network • CTH has sorting facilities in Europe and China MARKET DRIVERS • Supply of hogs and sheep globally • Quality of product • World demand for sausage products particularly in China and Eastern Europe • Competition from collagen casings Food – A Closer Look: 12

Creating sustainable food, feed and fuel ingredients for a growing population Feed Ingredients Segment Nutrients for growth. Our feed ingredients compose the largest segment of our platform with facilities located on 4 continents. We provide nutrient solutions to livestock, poultry, aquaculture and pet food manufacturers worldwide. 13

Creating sustainable food, feed and fuel ingredients for a growing population Feed Ingredients – North America North American Feed Ingredients • DAR PRO Ingredients • DAR PRO Solutions • Bakery Feeds • Rothsay • Terra Renewal • Nature Safe Operated as Margin Management Business Feed is our largest segment FEED MARKET DRIVERS • Raw material availability • Competing agricultural-based ingredients • Feed demand/Consumer protein demand • Pet food demand • Global biofuel production 14

Creating sustainable food, feed and fuel ingredients for a growing population • DAR PRO Solutions is North America’s leading collector of used cooking oil • Focused on providing services to the restaurant and food industry • Collects, transforms, and markets used cooking oil • Leading provider of grease trap services • Leading provider of used and fresh cooking oil equipment MARKET DRIVERS • Corn prices • Raw material volume • Competition in the industry • No. American biofuel demand • Export markets Feed Segment – North America: 15

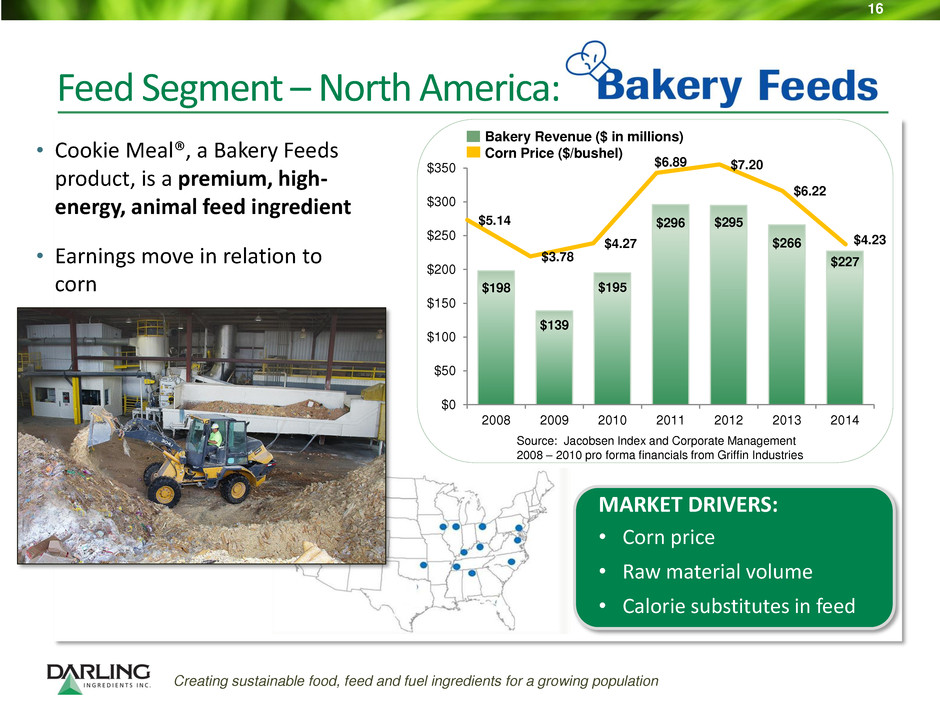

Creating sustainable food, feed and fuel ingredients for a growing population Feed Segment – North America: • Cookie Meal®, a Bakery Feeds product, is a premium, high- energy, animal feed ingredient • Earnings move in relation to corn MARKET DRIVERS: • Corn price • Raw material volume • Calorie substitutes in feed $198 $139 $195 $296 $295 $266 $227 $0 $50 $100 $150 $200 $250 $300 $350 2008 2009 2010 2011 2012 2013 2014 $5.14 $3.78 $4.27 $6.89 $7.20 $6.22 $4.23 Source: Jacobsen Index and Corporate Management 2008 – 2010 pro forma financials from Griffin Industries Bakery Revenue ($ in millions) Corn Price ($/bushel) 16

Creating sustainable food, feed and fuel ingredients for a growing population • Sonac is Europe’s leading supplier of consistent and high-quality proteins, fats and minerals from food grade animal by-products that are used in pet foods, animal feed and fertilizers. Sonac products are marketed as: Feed Ingredients – International: Sonac Blood: • Highly functional proteins for aquaculture, animal feed and pet food Sonac: • Rendered fats and proteins for animal feeds and pet food (similar to US operations) MARKET DRIVERS • Raw material supply • Euro demand for fats and protein • Asian aqua feed demand • Energy costs 17

Creating sustainable food, feed and fuel ingredients for a growing population Fuel Ingredients Segment Energy for today’s world. Bio-fuels are a key part of our portfolio. Not only are they key to the environment, they are critical for the global demand of our fats and oils. 18

Creating sustainable food, feed and fuel ingredients for a growing population Fuel Ingredients– DGD: • July 2013, DGD commissioned as North America’s largest facility to convert animal fats, used cooking oils and distillers corn oil into renewable diesel • 50/50 Joint Venture with Valero • Unconsolidated subsidiary for DAR; now capable of processing in excess of 12,000 barrels per day of input making it North America’s single largest demand point • Lowest variable cost processing facility in North America MARKET DRIVERS • Renewable Fuel Standard (RFS)/Government regulations • Ultra low sulfur diesel price • Feedstock cost • Co-product values • Hydrogen costs 19

Creating sustainable food, feed and fuel ingredients for a growing population 2014– DGD Look Back • Approximately 126 million gallons of renewable diesel produced • Darling EBITDA share is $81.6 million • $126 million tax credit due Apr-2015 • Total facility debt $212.7 million • Mandatory repayment of debt • Dividend anticipated Darling continues to believe in the earnings potential of DGD and that government policies will support on going growth and investment 20

Creating sustainable food, feed and fuel ingredients for a growing population • Europe’s has strict laws enacted post-BSE, Rendac collects, pasteurizes, and sterilizes mortalities and slaughter by-products that are designated unfit for animal feeds or human consumption (Category C1 & C2) • Rendac plays an important role in the control and prevention of animal diseases operating plants in 3 countries. • Rendac’s end products must be sold as to the energy sector. MARKET DRIVERS • Raw material volume • Government disposal regulations • Tariffs • Long term contracts • Customer service requirements • Excess capacity required Fuel – A Closer Look: 21

Creating sustainable food, feed and fuel ingredients for a growing population Fuel – A Closer Look: o A leading provider of renewable energy in the Netherlands o Our Ecoson Green Energy Park is located in Son o Organic residuals from food industry are converted to biogas for renewable electricity o Bio-phosphate produced from pig manure for use as fertilizer MARKET DRIVERS • Raw material volume • Manure and organics supply • Energy prices • Fertilizer values 22

Growth Strategy How we will grow and sustain our business Creating sustainable food, feed and fuel ingredients for a growing population

Creating sustainable food, feed and fuel ingredients for a growing population Darling Ingredients is focused on global growth How we plan to do it... • Expansions of Rousselot platform • Casings business growth • Branded fats Food • 6 new plants under construction • 2 more on drawing board • USA and Global acquisition opportunities Feed • DGD • West Coast biodiesel • Europe biodiesel Fuel Our growth will focus on investing cash generated and shareholder monies in projects and geographies that meet or exceed our return standards. We will take a long term and balanced approach in managing our portfolio of ingredient businesses while keeping our debt loads manageable. Organic Growth vs. Acquisition 24

Creating sustainable food, feed and fuel ingredients for a growing population Growth happening in 2015 and 2016….. Food • Dubuque Expansion • Europe modernizations and debottlenecking • Specialty product developments • China debottlenecking • Packaged fat • Expansion of sorting plant in China Feed • Bastrop, Texas Feb-2015 • New Arkansas rendering plant Late 2015 • New Ohio rendering plant 2016 • New Nebraska wet pet food plant Late 2015 • New Kentucky wet pet food plant Late 2015 • New Texas bakery plant Summer 2015 • New Brazilian blood plant Early 2016 Fuel • DGD capable of producing 160 million gallons • ECOSON bio-phosphate early 2015 • RENDAC added new location in Germany in 2015 25

Financials Creating sustainable food, feed and fuel ingredients for a growing population

Creating sustainable food, feed and fuel ingredients for a growing population Adjusted EBITDA is presented here not as an alternative to net income, but rather as a measure of the Company’s operating performance and is not intended to be a presentation in accordance with GAAP. Since EBITDA (generally, net income plus interest expenses, taxes, depreciation and amortization) is not calculated identically by all companies, this presentation may not be comparable to EBITDA or adjusted EBITDA presentations disclosed by other companies. Adjusted EBITDA is calculated in this presentation and represents, for any relevant period, net income/(loss) plus depreciation and amortization, goodwill and long-lived asset impairment, interest expense, (income)/loss from discontinued operations, net of tax, income tax provision, other income/(expense) and equity in net loss of unconsolidated subsidiary. Management believes that Adjusted EBITDA is useful in evaluating the Company’s operating performance compared to that of other companies in its industry because the calculation of Adjusted EBITDA generally eliminates the effects of financing income taxes and certain non-cash and other items that may vary for different companies for reasons unrelated to overall operating performance. As a result, the Company’s management used Adjusted EBITDA as a measure to evaluate performance and for other discretionary purposes. However, Adjusted EBITDA is not a recognized measurement under GAAP, should not be considered as an alternative to net income as a measure of operating results or to cash flow as a measure of liquidity, and is not intended to be a presentation in accordance with GAAP. In addition to the foregoing, management also uses or will use Adjusted EBITDA to measure compliance with certain financial covenants under the Company’s Senior Secured Credit Facilities and 5.375% Notes that were outstanding at January 3, 2015. However, the amounts shown in this presentation for Adjusted EBITDA differ from the amounts calculated under similarly titled definitions in the Company’s Senior Secured Credit Facilities and 5.375% Notes, as those definitions permit further adjustments to reflect certain other non-recurring costs and non-cash charges. In addition, the Company’s management used adjusted diluted earnings per share as a measure of earnings due to the significant merger and acquisition activity of the Company. However, adjusted earnings per share is not a recognized measurement under GAAP and should not be considered as an alternative to diluted earnings per share presented in accordance with GAAP. Adjusted diluted earnings per share is defined as adjusted net income attributable to Darling divided by the weighted average shares of diluted common stock. Adjusted net income attributable to Darling is defined as a reconciliation of net income attributable to Darling, net of tax (i) adjusted for net of tax acquisition and integration costs related to merger and acquisitions, (ii) net of tax amortization of acquisition related intangibles and (iii) net of tax certain non-recurring items that are not part of normal operations. This measure is solely for the purpose of calculating adjusted diluted earnings per share and is not intended to be a substitute of presentation in accordance with GAAP. Non-U.S. GAAP Measures 27

Creating sustainable food, feed and fuel ingredients for a growing population Earnings Summary January 3, December 28, January 3, December 28, $ Change 2015 2013 2015 2013 Favorable (Unfavorable) Revenues 1,000,203$ 447,939$ 3,956,443$ 1,802,268$ 2,154,175$ Gross profit 205,905 110,345 833,272 462,449 370,823 Selling, general, and administrative expenses 94,841 45,982 374,580 170,825 (203,755) Depreciation and amortizaton 69,039 31,713 269,517 98,787 (170,730) Acquisition and integration costs 2,363 14,114 24,667 23,271 (1,396) Interest expense 24,633 21,501 135,416 38,108 (97,308) Foreign currency gain/(loss) (1,267) 28,107 (13,548) 28,107 (41,655) Other income/(expense), net 271 (928) 299 (3,547) 3,846 Equity in net income of unconsolidated subsidary 59,547 (1,136) 65,609 7,660 57,949 Income before taxes 73,580 23,078 81,452 163,678 (82,226) Income tax expense 4,792 585 13,141 54,711 41,570 Net income 68,788 22,493 68,311 108,967 (40,656) Net (income)/loss attributable in minority interests 1,155 − (4,096) − (4,096) Net income attributable to Darling 69,943$ 22,493$ 64,215$ 108,967$ (44,752)$ Earnings per share (fully diluted) 0.42$ 0.18$ 0.39$ 0.91$ (0.52)$ Three Months Ended Fiscal Year Ended 28

Creating sustainable food, feed and fuel ingredients for a growing population Adjusted (Non-GAAP) Diluted EPS Note: Adjustments to diluted earnings per share of acquisition related items are net of tax. Calculations of all adjustment tax amounts were at the applicable effective tax rate for the period, except for fiscal 2014 nd fiscal 2013, which were impacted by biofuel tax incentives an nonr curring acquistion and integration costs. The effective tax rate used for calculating Non-GAAP Adjusted EPS in the above t bl for the years ended January 3, 2105, December 28, 2013 a d December 29, 2012 was 37.1%, 38.5% and 36.8%, respectively. The applicable effective t x rate for the fourth quarter of fiscal 2014 and 2013 were impacted by biofu l tax incentives and nonrecurring acquisition and integration costs. The efectiv tax rate used for calculaing Non-GAAP adjusted EPS for three months end January 3, 2015 a d Dec mber 28, 2013 was 37.2% and 38.7%, respectiv ly. January 3, December 28, January 3, December 28, December 29, 2015 2013 2015 2013 2012 Reported Earnings Per Share (fully diluted) $ 0.42 $ 0.18 $ 0.39 $ 0.91 $ 1.11 Adjustments: Non-cash inventory step-up associated with VION Acquisition − − 0.19 − − Acquisition and integration costs 0.01 0.08 0.13 0.13 − Amortization of intangibles 0.08 0.05 0.32 0.16 0.15 Bridge financing − 0.06 − 0.07 − Redemption premium on 8.5% Senior Notes and write off deferred loan costs − − 0.12 − − Foreign currency price risk VION Acquisition (0.14) 0.05 (0.14) − Adjusted diluted earnings per share attributable to Darling (Non-GAAP) $ 0.51 $ 0.23 $ 1.20 $ 1.13 $ 1.26 Weighted average shares of common stock outstanding (in millions) 165,224 124,202 165,059 119,924 118,089 Three Months Ended Fiscal Year Ended 29

Creating sustainable food, feed and fuel ingredients for a growing population Adjusted EBITDA (1) January 7, 2014 closed on VION Ingredients, thus the 13th week would be revenue adjusted for January 1, 2014 through January 7, 2014 (2) Darling's pro forma adjusted EBITDA (Non-GAAP)in the above table does not include the DGD Joint Venture adjusted EBITDA (Darling's share) if we had consolidated the DGD Joint Venture Adjusted EBITDA and Pro Forma Adjusted EBITDA January 3, December 28, January 3, December 28, (US$ in thousands) 2015 2013 2015 2013 Net income attributable to Darling $ 69,943 $ 22,493 $ 64,215 $ 108,967 Depreciation and amortization 69,039 31,713 269,517 98,787 Interest expense 24,633 21,501 135,416 38,108 Income tax expense 4,792 585 13,141 54,711 Foreign currency (gain)/loss 1,267 (28,107) 13,548 (28,107) Other expense/(income), net (269) 928 (299) 3,547 Equity in net (income)/loss of unconsolidated subsidiaries (59,547) 1,136 (65,609) (7,660) Net income attributable to noncontrolling interests -1,155 − 4,096 − Adjusted EBITDA (Non-GAAP) $ 108,703 $ 50,249 $ 434,025 $ 268,353 Non-cash inventory step-up associated with VION Acquisition − − 49,803 − Acquisition and integration-related expenses 2,362 14,114 24,667 23,271 Darling Ingredients International - 13th week (1) − − 4,100 − Pro Forma Adjusted EBITDA (Non-GAAP) $ 111,065 $ 64,363 $ 512,595 $ 291,624 DGD Joint Venture Adjusted EBITDA (Darling's Share) (2) $ 63,757 $ 3,295 $ 81,639 $ 16,490 Three Months Ended Fiscal Year Ended 30

Creating sustainable food, feed and fuel ingredients for a growing population Balance Sheet Highlights and Debt Summary (US$, in thousands) January 3, 2015 Cash 108,784$ Accounts receivable 409,779 Total inventories 401,613 Net working capital 569,570 Net property, plant and equipment 1,574,116 Total assets 5,170,713 Total debt 2,152,440 Shareholders' equity 2,051,134 (US$, in thousands) January 3, 2015 Credit Agreement Revolving Credit Facility 101,863$ Term Loan A 312,161 Term Loan B 1,205,669 5.375% Senior Notes due 2022 500,000 Other Notes and Obligations 32,747 Total Debt: 2,152,440$ Debt Summary Balance Sheet Highlights 31

Creating sustainable food, feed and fuel ingredients for a growing population Operational Highlights • Gelatin business performed nicely; China normalizing and South American margins adjusting to supply and currency • European edible fats business volumes remained strong • CTH showed improved margins on hog casings Food Segment (1) Has impact of inventory step-up in 1st and 2nd quarter. (2) Exclusive of non-cash inventory step-up and Darling Ingredients International 13th week. (3) Raw material process volumes for the first quarter have been adjusted to be consistent with the presentation of the second quarter figures. $ and metric tons (millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total Delta % Q3 to Q4 Revenue 293.5 331.4 301.4 322.0 1,248.3 6.8% Gross Margin (1) 62.3 65.3 64.2 63.4 255.2 -1.3% Gross Margin % (1) 21.2% 19.7% 21.3% 19.7% 20.4% Operating Income/(Loss) (2) (12.1) 11.3 14.0 13.7 26.9 -2.1% Adjusted Operating Income (1) 30.8 14.7 14.0 13.7 73.2 -2.1% EBITDA (2) 5.3 30.9 32.6 31.4 100.2 -3.7% Adjusted EBITDA (1) 38.3 34.3 32.6 31.4 136.6 -3.7% Adjusted EBITDA/Revenue 13.0% 10.4% 10.8% 9.7% 10.9% Raw Material Processed (millions of metric tons) 0.25 0.27 0.26 0.28 1.06 7.7%(3) (A) Quarters 1, 2 and 3 revenues have been adjusted for reclass between sales and cost of sales. (A) 32

Creating sustainable food, feed and fuel ingredients for a growing population Feed Segment Operational Highlights • Lower finished product pricing in 4th quarter, primarily in fats • Protein prices eased, but demand remained strong • Strong raw material volumes • Raw material procurement formulas being adjusted globally (1) Has impact of inventory step-up in 1st and 2nd quarter. (2) Exclusive of non-cash inventory step-up and Darling Ingredients International 13th week. (3) Raw material process volumes for the first quarter have been adjusted to be consistent with the presentation of the second quarter figures. US$ and metric tons (millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total Delta % Q3 to Q4 Revenue $586.1 $622.1 $607.3 $606.0 $2,421.5 0.2% Gross Margin (1) 142.5 165.4 132.5 132.5 572.9 0.0% Gross Margin % (1) 24.3% 26.6% 21.8% 21.9% 23.7% Operating Income (2) 37.5 74.7 46.4 33.6 192.2 -27.6% Adjusted Operating Income (1) 52.4 76.2 46.4 33.6 208.6 -27.6% EBITDA (2) 76.1 114.6 84.2 76.4 351.3 -9.3% Adjusted EBITDA (1) 90.9 116.1 84.2 76.4 367.6 -9.3% Adjusted EBITDA/R v ue 15.5% 18.7% 13.9% 12.6% 15.2% Raw Material Processed (millions of metric tons) 1.67 1.67 1.66 1.85 6.85 11.4% (3) (A) Quarters 1, 2 and 3 revenues have been adjusted for reclass between sales and cost of sales. (A) 33

Creating sustainable food, feed and fuel ingredients for a growing population Operational Highlights • Diamond Green Diesel, as well as our biodiesel operations in Canada and US, received the Tax Credit Benefit for 2014 • DGD running in excess of 11,000 barrels per day of input feedstock • New Ecoson biogas plant in Son, Netherlands is on line Fuel Segment $ and metric tons (millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total Delta % Q3 to Q4 Revenue $66.7 77.7 70.0 72.2 286.6 3.1% Gross Margin 15.3 15.9 17.8 10.0 59.0 -43.8% Gross Margin % 21.1% 20.5% 25.4% 13.9% 20.6% Operating Income (2) 2.3 5.2 2.8 10.9 21.2 289.3% Adjusted Operating Income (1) 3.5 5.2 2.8 10.9 22.4 289.3% EBITDA (2) 9.7 11.1 11.5 16.9 49.2 47.0% Adjusted EBITDA (1) 10.9 11.1 11.5 16.9 50.4 47.0% Adjusted EBITDA/Revenue 16.3% 14.3% 16.4% 23.4% 17.6% Raw Material Processed * (millions of metric tons) 0.23 (3) 0.24 0.26 0.33 1.07 26.9% *Excludes raw material processed at the DGD joint venture. Diamond Green Diesel (50% Joint Venture) US$ (millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total Delta % Q3 to Q4 EBITDA (Darling's share) $9.1 5.9 2.9 63.7 $81.6 2096.6% (1) Has impact of inventory step-up in 1st quarter. (2) Exclusive of non-cash inventory step-up and Darling Ingredients Int'l 13th week. (3) Raw material process volumes for the first quarter have been adjusted to be consistent with the presentation of the second quarter figures. (A) (A) Quarters 1, 2 and 3 revenues have been adjusted for reclass between sales and cost of sales. 34

Creating Shareholder Value Success is consistently providing maximum value to the supply chain Our Recipe for Success... Creating sustainable food, feed and fuel ingredients for a growing population 35 Protein Production Maximize the valuation of our raw materials by focusing on their highest and best possible use Value Adding Identify the world population’s food, feed and fuel needs Develop new products and applications and grow geographically to answer these needs

Q&A 36 Creating sustainable food, feed and fuel ingredients for a growing population