Attached files

| Table of Contents |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 2)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2014

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ____________

Commission File Number: 333-56262

(Exact name of registrant as specified in its charter)

| Nevada | 88-0482413 |

| (State or Other Jurisdiction | (I.R.S. Employer |

| Incorporation or Organization) | Identification No.) |

| 8390 Via de Ventura, Suite F-110 | |

| Scottsdale. Arizona | 85258 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (928) 515-1942

Securities registered pursuant to Section 12(b) of the Exchange Act: None.

Securities registered under Section 12(g) of the Exchange Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

| 1 |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the registrant’s voting common stock held by non-affiliates of the registrant as of March 31, 2014 (the last business day of the registrant’s most recently completed second fiscal quarter), was approximately $58,142,348 based on the last trading price of the registrant’s common stock of $0.23 as reported on the OTC Bulletin Board on such date.

As of December 29, 2014, the registrant had 278,053,877 shares of its $.001 par value common stock issued and outstanding.

Documents incorporated by reference: None.

| 2 |

EXPLANATORY NOTE

El Capitan Precious Metals, Inc. is filing this Form 10-K/A (Amendment No. 2) to our Annual Report on Form 10-K for the year ended September 30, 2014 filed with the Securities and Exchange Commission on December 29, 2014, as amended by Amendment No. 1 filed on February 18, 2015, for the purpose amending certain disclosures regarding our business and properties as of such dates set forth in Part I, Items 1 and 2, of the original Form 10-K, as amended, and to reflect exhibits filed with this Amendment No. 2.

Except as described above, this Form 10-K/A does not modify or update other disclosures in the Form 10-K, including the nature and character of such disclosure to reflect events occurring after the filing date of the original Form 10-K. Accordingly, this Form 10-K/A should be read in conjunction with our filings made with the Securities and Exchange Commission. The filing of this Form 10-K/A is not an admission that the original 10-K, when originally filed or as previously amended, included any untrue statement of a material fact or omitted to state a material fact necessary to make a statement not misleading.

| 3 |

EL CAPITAN PRECIOUS METALS, INC.

TABLE OF CONTENTS

| 4 |

CAUTIONARY NOTE REGARDING EXPLORATION STAGE STATUS

We are considered an “exploration stage” company under the U.S. Securities and Exchange Commission (“SEC”) Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations (“Industry Guide 7”), because we do not have reserves as defined under Industry Guide 7. Reserves are defined in Guide 7 as that part of a mineral deposit which can be economically and legally extracted or produced at the time of the reserve determination. The establishment of reserves under Guide 7 requires, among other things, certain spacing of exploratory drill holes to establish the required continuity of mineralization and the completion of a detailed cost or feasibility study.

Because we have no reserves as defined in Industry Guide 7, we have not exited the exploration stage and continue to report our financial information as an exploration stage entity as required under Generally Accepted Accounting Principles (“GAAP”). Although for purposes of FASB Accounting Standards Codification Topic 915, Development Stage Entities, we have exited the development stage and no longer report inception to date results of operations, cash flows and other financial information, we will remain an exploration stage company under Industry Guide 7 until such time as we demonstrate reserves in accordance with the criteria in Industry Guide 7.

Because we have no reserves, we have and will continue to expense all mine construction costs, even though these expenditures are expected to have a future economic benefit in excess of one year. We also expense our reclamation and remediation costs at the time the obligation is incurred. Companies that have reserves and have exited the exploration stage typically capitalize these costs, and subsequently amortize them on a units-of-production basis as reserves are mined, with the resulting depletion charge allocated to inventory, and then to cost of sales as the inventory is sold. As a result of these and other differences, our financial statements will not be comparable to the financial statements of mining companies that have established reserves and have exited the exploration stage.

| 5 |

SEC INDUSTRY GUIDE 7 DEFINITIONS

The following definitions are taken from the mining industry guide entitled “Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations” contained in the Securities Act Industry Guides published by the United States Securities and Exchange Commission, as amended.

| Exploration State | The term “exploration state” (or “exploration stage”) includes all issuers engaged in the search for mineral deposits (reserves) which are not in either the development or production stage. | |

| Development Stage | The term “development stage” includes all issuers engaged in the preparation of an established commercially mineable deposit (reserves) for its extraction which are not in the production stage. This stage occurs after completion of a feasibility study. | |

| Mineralized Material | The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction. | |

| Probable (Indicated) Reserve | The term “probable reserve” or “indicated reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. | |

| Production Stage | The term “production stage” includes all issuers engaged in the exploitation of a mineral deposit (reserve). | |

| Proven (Measured) Reserve | The term “proven reserve” or “measured reserve” refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. | |

| Reserve | The term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tons and grade to include diluting materials and allowances for losses that might occur when the material is mined. |

| 6 |

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

This report may contain certain “forward-looking” statements as such term is defined by the Securities and Exchange Commission in its rules, regulations and releases, which represent the registrant’s expectations or beliefs, including but not limited to, statements concerning the registrant’s operations, economic performance, financial condition, growth and acquisition strategies, investments, and future operational plans. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intent,” “could,” “estimate,” “might,” “plan,” “predict” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, certain of which are beyond the registrant’s control, and actual results may differ materially depending on a variety of important factors, including uncertainty related to acquisitions, governmental regulation, managing and maintaining growth, the operations of the company and its subsidiaries, volatility of stock price, commercial viability of any mineral deposits and any other factors discussed in this and other registrant filings with the Securities and Exchange Commission.

These risks and uncertainties and other factors include, but are not limited to those set forth under Item 1A. Risk Factors of this Annual Report on Form 10-K. Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Except as otherwise required by applicable law, we undertake no obligation to publicly update or revise any forward-looking statements or the risk factors described in this Annual Report or in the documents we incorporate by reference, whether as a result of new information, future events, changed circumstances or any other reason after the date of this Annual Report on Form 10-K.

Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements.

| 7 |

PART I

| ITEM 1. | BUSINESS |

El Capitan Precious Metals, Inc., a Nevada corporation, is based in Scottsdale, Arizona. Together with its consolidated subsidiaries (collectively referred to as “El Capitan,” the “Company,” “our” or “we”), the Company is an exploration stage company as defined by the Security and Exchange Commission’s (“SEC”) Industry Guide 7, as the Company has no established reserves as required under the Industry Guide 7. We are principally engaged in the exploration of precious metals and other minerals. Our primary asset is the 100% equity interest in El Capitan, Ltd., an Arizona corporation (“ECL”), which holds an interest in the El Capitan property located near Capitan, New Mexico (the “El Capitan Property”). We have completed the research and confirmation procedures on the recovery process for the El Capitan Property mineralized material and our evaluation as to the economic and legal feasibility of the property. We have not yet demonstrated the existence of proven or probable reserves at the El Capitan Property. To date, we have not had any material revenue producing operations. There is no assurance that a commercially viable mineral deposit exists on our property.

We have completed testing and enhancement of our recovery process and have determined the existence and concentration of commercially extractable precious metals or other minerals at the El Capitan Property. Based upon the initial results attained, we engaged an investment banker on January 31, 2012 to assist us in marketing the El Capitan Property for potential sale to a major mining company.

During the remainder of our fiscal year ended September 30, 2012, we continued to enhance our recovery processes and also attempted to recover precious metals from previously stored concentrates using new and different recovery process developed by an outside vendor. This new process proved to be unsuccessful because our vendor’s equipment was insufficient to accomplish an acceptable result. We also undertook to develop a Recovery Demonstration that could be used for presentation purposes in connection with prospective buyers’ due diligence investigations. Dr. Clyde Smith, an internationally recognized geologist who has worked with the Company as a QP (Qualified Person) since 2005, agreed to direct and complete this Recovery Demonstration. Dr. Smith worked independently of El Capitan, directing the mining, crushing and concentration of several tons of mineralized material from the El Capitan Property, and the smelting of the mineralized material into dore’ bars. The project was completed in July 2012. In August 2012 we completed the successful testing of a process for the recovery of precious metals from these concentrates. A test run of this new process, on 700 pounds of concentrates from the El Capitan Property, yielded results consistent with those achieved for the sale last year of a dore’ bar to Gannon & Scott. We continued to make steady progress over the remainder of the 2012 fiscal year to provide our investment bank with information and tools needed to market and sell the El Capitan Property, and the news related to the processing of concentrates was a major step forward in our overall strategy.

Early in fiscal 2013, and based on recommendations made to us by our investment banker, we undertook to have our QP direct an analytic project to determine what and how much precious metals could be recovered with an “industry standard” cyanide leaching recovery method. The QP selected sample materials which were broadly representative of the property and included blanks (no precious metals) and standards (known amounts of precious metals). These were delivered, under chain of custody, to designated laboratories.

In March 2013, we disclosed that we obtained results from a well-respected metallurgical lab which used pre-treatment of mineralized material samples (“samples”) and the industry accepted method of cyanide vat leaching. The resulting assays, which were obtained under chain of custody procedures, demonstrated significant values of gold along with lesser amounts of other precious metals. In order to maximize the recovery of all precious metals, we began to work with five different independent metallurgical laboratories to develop an encompassing recovery process that included both cyanidation recovery as well as the silver-lead process. We continued to engage Dr. Clyde Smith as our QP to be responsible for monitoring and overseeing both processes for continued credibility. The QP selected samples that were broadly representative of the property and included blanks (no precious metal) and standards (known amounts of precious metals). These were delivered, under chain of custody, to the designated laboratories.

| 8 |

The initial analyses conducted to determine precious metals content at one of the labs failed to accurately describe the contents of the blanks and standards which rendered all results unreliable and unusable. This test in no way depicted anything about the El Capitan samples. Significant time, effort and related costs were expended and the QP directed that the tests be conducted again at an Arizona laboratory and were conducted and include chain of custody samples and the required blanks and standards. The tests consisted of three batches of chain of custody samples.

The primary reason for the project was to determine the recovery of precious metals that can be achieved from the El Capitan mineralized material by an industry-standard cyanide vat leach. The preliminary results were significant enough for the QP to recommend enlisting a world-class expert in cyanide leaching. To manage and support the completion of this project, a dedicated engineer was appointed by the QP to oversee the daily schedule and all activities and analytic results. The world-recognized organization chosen is able to validate the recovery of the precious metals and develop the economic model to determine the costs for such recovery in a recovery environment with the expertise that will be recognized by major mining companies. The data generated will be used to update the Major Research Report with both the recovery data and costs requested by the investment banker for presentation of the property. This process requires additional analytic runs. We decided to complete this initiative with such a high-level industry expert in order to give the project results the credibility that only a broadly recognized cyanide leaching and engineering company can convey. This project was undertaken in September 2013 under the direction of our QP and was completed in November 2013.

In late September 2013, with the support of another technology, we began a project of production processing of El Capitan samples collected and managed under chain-of-custody guidelines. This was the first, production-scale process that we have conducted ourselves. We anticipated that the results would describe both the effectiveness of the process being used and the precious metals values recoverable, without the use of chemicals. This process involved the fine grinding of samples and separation of iron from the precious metals without the use of cyanide.

On November 7, 2013 we announced that we had recovered 1.04 ounces per ton of gold equivalent from the El Capitan Property. These results were based on samples sold in an arm’s-length transaction to an independent refinery. The chain-of-custody samples were finely milled and magnetically separated using specific gravity concentrating methodology without the use of cyanide. Parameters used to calculate the economic value were 0.22 and .60 ounces of gold from hematite and magnetite mineralized material, respectively, and 6.05 ounces of silver form the mineralized material at the then current market price of $1,285 and $22.30 per ounce, respectively. This preliminary production testing represents the complete methodology – from samples to final sale.

As part of this project, we processed 30 tons of concentrates that we produced approximately ten years ago stored at the mine site. This was done in order to determine the viability of the recovery of any precious metals under this technology. This initiative was important for two reasons: because it provided materials process-handling information, and because of the potential cash flow from the spot-market sale of any resulting dore’ bars. It is important to note that no direct information related to samples value was to be gained from these concentrates because they did not have a documented history. These concentrates lacked the pedigree of freshly mined and concentrated minerals. Initial testing revealed that they may yield precious metals that can be sold in the spot market.

On November 20, 2013, we announced that the new recovery method was also used on 30 tons of stored concentrates, which had been produced approximately ten years ago. After storage and possible contamination, these concentrates proved to be incompatible with this recovery process. The Company decided to discontinue processing of the stored concentrates and focus on the processing the samples and the recovery of precious metals utilizing the new technology.

“Mineralized material” as used in this Annual Report on Form 10-K, although permissible under the Securities and Exchange Commission’s (“SEC’s”) Industry Guide 7, does not indicate “reserves” by SEC standards. We cannot be certain that any part of the El Capitan Property will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves.” Investors are cautioned not to assume that all or any part of the mineralized material will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

| 9 |

Business Operations

We are considered an exploration stage company and have not established any “reserves” with respect to our exploration projects, and will remain an exploration stage company until the Company has reserves as defined in SEC Industry Guide 7. The Company may never meet the reserve requirements or enter into development with respect to any of our properties.

In March 2014, we announced the Company reached an agreement with Logistica US Terminals LLC (“Logistica”), , a Texas-based limited liability company and member of LIT Group network. The contract, which is the first of several contracts with high-profile mining industry companies, supports the New Mexico mineral exploration plan announced by the Company several months ago and represents another tactical initiative to support the sale of the El Capitan Property. Under the terms of the Master Service Agreement, Logistica, will finance and operate the extraction of iron from mineralized materials at the El Capitan mine and provide the Company with a turnkey solution that also includes shipment of the iron to ports where buyers will take delivery.

We also announced in March 2014 that we reached an agreement with GlencoreXstrata for the purchase of iron extracted from the mineralized materials at the El Capitan mine. Under the terms of the agreement, GlencoreXstrata commits to ongoing purchases of the iron from the El Capitan mine. GlencoreXstrata will issue a Letter of Credit to guarantee payment on the sale of the iron.

For additional information regarding the Glencore Purchase Contract and our agreements with Logistica, see “Note 6 – Commitments and Contingencies” of the Notes to Consolidated Financial Statements.

In late April 2014, we announced the purchase of a heavy metals separation system from AuraSource, Inc (OTCBB and OCTQB: ARAO). This state-of-the-art technology will separate hematite and magnetite from other mineral elements in the El Capitan mineral deposits. The AuraSource process leaves a rich concentrate for additional processing that will further be used by the Company to extract the precious metals. The iron extracted from the mineralized material will be transported to a port for sale, pursuant to the Company’s contract agreements with GlencoreXstrata and Logistica.

In May 2014, we announced recovery results of .40 of gold equivalent per ton of El Capitan samples. The precious metals processing was completed in China as part of testing related to the calibration and tuning of the heavy metals separation device that will be used on site at the El Capitan Property in New Mexico. After the separation of the hematite and magnetite from the El Capitan mineralized material, an independent lab processed the precious metals that yielded the .40 of gold equivalent per ton of samples. Parameters used to calculate the economic value was were 0.20, 3.2 and 0.25 ounces of gold, silver and palladium per ton, respectively, of mineralized material at the then current market price of $1,287.25, $19.56 and $837 per ounce, respectively. We have successfully completed the assembly and testing of the AuraSource Heavy Metals Separation System at the New Mexico mine site.

The Company has methods for both the separation of the iron and the separation and recovery of the precious metals that have repeatedly yielded consistent and commercially viable economic value results. Yet another significant aspect of these breakthrough technologies for separation and recovery is that they are environmentally friendly and do not rely on the use of caustic chemicals.

In September 2014, we announced the Company reached a final agreement for the sale of precious-metals-rich tailings from the El Capitan mine to a Hong Kong-based trading company. We anticipate seeing positive cash flow from revenues in our quarter ending December 31, 2014. The buyer will purchase between 5,000 and 10,000 tons of precious-metals-rich tailings per month, with payment guaranteed against a multimillion-dollar letter of credit.

We are in the final stages of obtaining our amended and expanded mining permits from the Mining and Minerals Division of the New Mexico Energy, Minerals and Natural Resources Department and obtaining the issuance of our required clean air permit from the New Mexico Environment Department Air Quality Bureau. The clean air permit was issued in late November 2014 and we anticipate the issuance of the expanded mining permit in late December 2014. Upon issuance, continued mineral exploration will commence at the El Capitan Property site.

| 10 |

Our Company and its Subsidiaries

El Capitan Precious Metals, Inc. is a Nevada corporation, is an exploration stage company that owns 100% of the outstanding common stock of El Capitan Precious Metals, Inc., a Delaware corporation (“El Capitan Delaware”). Prior to January 19, 2011, El Capitan Delaware owned a 40% interest in ECL. On January 19, 2011, we acquired the remaining 60% interest in ECL from Gold and Minerals Company, Inc. (“G&M”) by merging an acquisition subsidiary created by the Company with and into G&M. In connection with the merger, each share of G&M common and preferred stock outstanding was exchanged for approximately 1.414156 shares of the Company’s common stock, resulting in the issuance of an aggregate of 148,127,043 shares of the Company’s common stock to former G&M stockholders. Upon closing of the merger, G&M became a wholly-owned direct Company subsidiary and our consolidated Company acquired 100% of ECL. As a result, we now own 100% of the El Capitan Property site.

Price of Precious Metals

Gold and silver are each traded as investments on various world markets including London, New York, Zurich and Tokyo and are fixed twice daily in London. The “fix” is the reference price on which a large number of precious metal transactions around the world are based. The price is set by a number of market members matching buy and sell orders from all over the world.

High, low and average London afternoon fix prices for gold and silver for the period from January 1, 2014 to September 30, 2014 and for the last five calendar years are as follows:

| Gold - London Afternoon Fix Prices - US Dollars | ||||||||||||

| High | Low | Average | ||||||||||

| Period | ||||||||||||

| For the nine months ended September 30, 2014 | $ | 1,385 | $ | 1,214 | $ | 1,288 | ||||||

| For the year ended December 31, 2013 | 1,694 | 1,192 | 1,411 | |||||||||

| For the year ended December 31, 2012 | 1,750 | 1,540 | 1,669 | |||||||||

| For the year ended December 31, 2011 | 1,895 | 1,319 | 1,572 | |||||||||

| For the year ended December 31, 2010 | 1,421 | 1,058 | 1,225 | |||||||||

| For the year ended December 31, 2009 | 1,213 | 810 | 972 | |||||||||

| Data Source: Kitco | ||||||||||||

| Silver - London Afternoon Fix Prices - US Dollars | ||||||||||||

| High | Low | Average | ||||||||||

| Period | ||||||||||||

| For the nine months ended September 30, 2014 | $ | 22.05 | $ | 17.11 | $ | 19.95 | ||||||

| For the year ended December 31, 2013 | 32.23 | 18.61 | 23.79 | |||||||||

| For the year ended December 31, 2012 | 37.23 | 28.00 | 31.15 | |||||||||

| For the year ended December 31, 2011 | 48.70 | 26.16 | 35.12 | |||||||||

| For the year ended December 31, 2010 | 30.70 | 15.14 | 20.19 | |||||||||

| For the year ended December 31, 2009 | 19.18 | 10.51 | 14.67 | |||||||||

| Data Source: Kitco | ||||||||||||

Our ability to sell our property will be highly dependent upon the price of these precious metals, the market for which can be highly volatile. There is no assurance that we will be able to recover precious metals from the El Capitan Property or that we will generate significant revenue from the sale of the El Capitan Property.

| 11 |

Competition

The mining industry has historically been highly competitive. It is dominated by multi-billion dollar, multi-national companies that possess resources significantly greater than ours. Additionally, due to our limited resources, we do not intend to develop any of our properties on our own, but rather to only perform exploration on our properties with the anticipation of selling or developing through a joint venture any properties in which our exploration proves successful. Given our size and financial condition, there is no assurance we can compete with any larger companies for the acquisition of additional potential mineral properties, and we have no current plans to do so.

Government Regulation

Mining and exploration is highly regulated and subject to various constantly changing federal and state laws and regulations. These laws are becoming more and more restrictive, and include without limitation: the Clean Water Act; the Clean Air Act; the Comprehensive Environmental Response, Compensation and Liability Act; the Emergency Planning and Community Right-to-Know Act; the Endangered Species Act; the Federal Land Policy and Management Act; the National Environmental Policy Act; the Resource Conservation and Recovery Act; and related state laws. The environmental protection laws dramatically impact the mining and mineral extraction industries as it pertains to both the use of hazardous materials in the mining and extraction process and from the standpoint of returning the land to a natural look once the mining process is completed. Compliance with federal and state environmental regulations can be expensive and time consuming, and given our limited resources, such regulations may have a material effect on the success of our operations.

Compliance with the various federal and state governmental regulations requires us to obtain multiple permits for each mining property. Although the requirements may differ slightly in each of the respective states in which we may hold claims or may hold claims in the future, the process of securing such permits generally require the filing of a “Notice of Intent to Locate Mining Claims” and the payment of a fee of $25 to the Bureau of Land Management (“BLM”) office in the state in which the claim is located. Subsequently, we are required to file and record a New Location Notice for each such claim within 90 days of locating the claim, the fee for which is approximately $165. On an annual basis, we are required to pay a maintenance fee of $155 per claim.

To the extent we intend to take action on a property that is more than “casual use,” which generally includes activities that cause only negligible disturbance to the land (this would not generally include drilling or operating earthmoving equipment on the property), we are required to prepare and file with the BLM either a notice of operation or plan of operation identifying the activity we intend to take on the property, including a plan of reclamation indicating how we intend to return the land to its prior state upon completion of our activities. For each claim that we file a notice or plan of operations, we are required to pay a one-time reclamation bond to the BLM to be used toward restoration of the property upon completion of our activities. The amount of the reclamation bond is determined by the BLM based upon the scope of the activity described in the notice or plan of operation, and will thus vary with each property. We filed an original plan of operation on the El Capitan Property. We were required to pay a reclamation bond of $15,000 in connection with that plan of operation, and upon payment were issued a notice to proceed from the BLM. This allowed us to proceed with our current plan of operation on up to five (5) acres. The permit was received by the Company from the previous owners of the El Capitan Property under a grandfather clause and allows operations on five (5) acres of the property at a time. We are currently amending this permit to allow operations on forty acres (40) of property at a time. We expect the amended permit to be issued in January 2015.

| 12 |

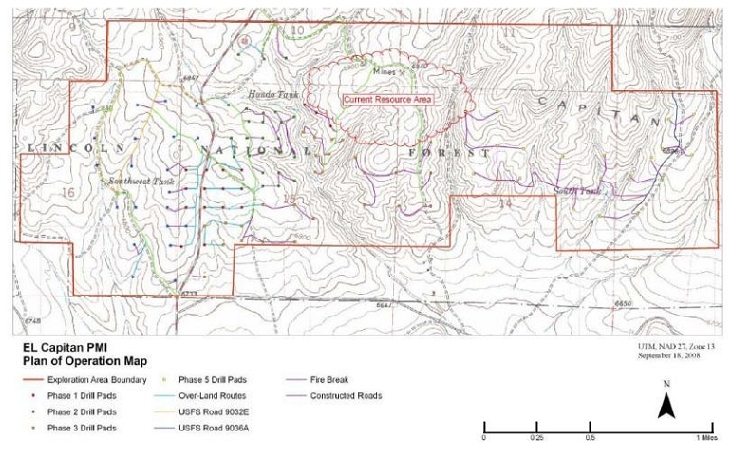

In July 2007, we submitted a Plan of Operation for continued exploration on a 2,000 acre parcel within our more than 7,000 acres, at that time, Company claim block near Capitan, New Mexico with the U.S. Forest Service (“USFS”). We hired an experienced environmental services firm to manage this effort. Having this permit in place would provide the opportunity for a professional and methodical investigation into the additional geologic potential of this portion of our holdings, without requiring further time-consuming permitting efforts. The area being permitted will allow access to a number of high-potential targets identified through previous surface sampling and remote sensing efforts, as well as to the prospective area to the west of the existing deposit, which remains open to geologic resource extension. The USFS permitting effort is governed by the National Environmental Policy Act of 1970 (“NEPA”) and under the General Mining Law of 1872, as amended. In conjunction with the USFS filing, the Company submitted an Exploration Permit with the New Mexico Mining and Minerals Division. The permitting process is a robust process that can take a significant amount of time to complete. The typical process generally takes longer than the prescribed regulatory time frame, and is dependent upon a number of factors outside of our control, including, without limitation, governmental approvals, licensing and permitting, as well as potential opposition by third parties. Both permits must be approved prior to the commencement of drilling activity.

In July 2008, we entered into a Memorandum of Understanding with the USFS related to the permitting of 112 exploration drill holes planned on 2,000 acres of Company claims in Lincoln County, New Mexico. The action signaled the initiation of the Federal Environmental Assessment (“EA”) permitting process. It was originally anticipated that the receipt of these two permits would occur in the second or third quarter of 2009. Subsequently in late 2008, this process was put on hold due to a lack of working capital and a potential conflict of interest with the USFS by the environmental services firm we were utilizing for the permitting process.

In December 2009, we hired a new experienced environmental services firm, AMEC Environment & Infrastructure, Inc. (“AMEC”), to manage and oversee our continued permitting process. AMEC has drafted a replacement Plan of Operations (“PoO”) and submitted it to the USFS. The USFS has provided technical comments on the PoO and AMEC has responded to their comments and submitted a revised PoO for approval. AMEC has met with representatives of the USFS at the project site to review the proposed exploration locations and general discussion of the project. Subsequent to the meeting, the USFS agreed to work with AMEC to develop the third part of the National Environmental Policy Act (“NEPA”) scope of work. The USFS provided a draft NEPA scope of work template to AMEC in electronic format. AMEC revised the draft template and submitted it to the USFS for review and approval.

AMEC has also prepared the Stormwater Pollution Prevention Plan (“SWPPP”) that will be sent to the agencies upon permit approval. Informational copies of the SWPPP will be provided to the New Mexico Energy, Minerals, and Natural Resources Department Mining and Minerals Division (“MMD”), and the United States Forest Service (“USFS”). The SWPPP is an EPA required document for construction projects that disturb more than one (1) acre of land. Prior to field activities, coverage under the New Mexico Construction General Permit (“CGP”) will be obtained by filing a Notice of Intent (“NOI”) with EPA Region 6. Coverage under the CGP is required prior to field work. A copy of the SWPPP must be maintained at the project site during all construction activities. New Mexico does not have primacy over the SWPPP requirements. EPA Region 6 is the primary agency.

AMEC prepared and submitted a revised New Mexico Mining and Minerals Subpart 4 Exploration permit application. The revised application was submitted on September 16, 2011 and MMD issued administrative completeness determination on October 4, 2012. The Agency comment period closed on December 31, 2012. MMD requested a site visit as part of the Agency review process, and the site visit was conducted on December 5, 2012. A second site visit was requested by MMD to view locations that were not accessible. Revisions to the boring locations were made, based on the field visit, and revised boring location figures were submitted to the MMD on April 26, 2013. To date a second site visit has not been conducted related to the drill hole sites.

A Plan of Operations (“PoO”) was submitted to the United States Forest Service (“USFS”) in 2011. Comments were received from the USFS and incorporated into a revised document which was resubmitted to the USFS. In addition, at the request of the USFS, a National Environmental Policy Act (“NEPA”) scope of work (“SOW”) was prepared and submitted to the USFS in 2012. Comments were received from the USFS and incorporated into a revised NEPA SOW. This activity has been on hold since April 2013. In February through April 2013, the existing mine permit (LI005 ME) for the Capitan Iron Mine and a cursory review of water rights issues were evaluated.

| 13 |

In May 2014, and in conjunction with requesting modifications to our mining permit, we submitted a revised PoP, as well as the required reclamation plan for the site. As part of the modified permit approval, we are required to post financial assurance of $74,495 to pay for the reclamation, in the event we walk away. The financial assurance was posted in January 2015.

In June 2014 we applied for an air quality permit for our operation, which is tied to the generation of dust from the mining and crushing process. This permit is in the final stages approval and the permit fees have been paid. This permit was issued by the New Mexico Environment Department Air Quality Bureau in November 2014.

Employees

We currently have informal arrangements with three individuals, two of whom are officers and Directors of the Company, who serve as support staff for the functioning of all the corporate activities. There are no written agreements with these individuals. Additionally, we use consultants for the testing and exploration of property claims. If administrative requirements expand, we anticipate that we may hire additional employees, and utilizing a combination of employees and consultants as necessary to conduct of these activities.

Available Information

The Company is a Nevada corporation with its principal executive office located at 8390 Via de Ventura, Suite F-110, Scottsdale, Arizona 85258, and its administrative office located at 5871 Honeysuckle Road, Prescott, Arizona 86305. The Company’s telephone number is (928) 515-1942. The Company’s website address is www.elcapitanpmi.com. Our website contains links to download free of charge our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Unless expressly noted, none of the information on our website is part of this Annual Report.

| ITEM 2. | PROPERTIES |

El Capitan Property

Our primary asset is the 100% equity interest in El Capitan, Ltd., an Arizona corporation (“ECL”), which holds a 100% interest in the El Capitan property located near Capitan, New Mexico (the “El Capitan Property”).

| 14 |

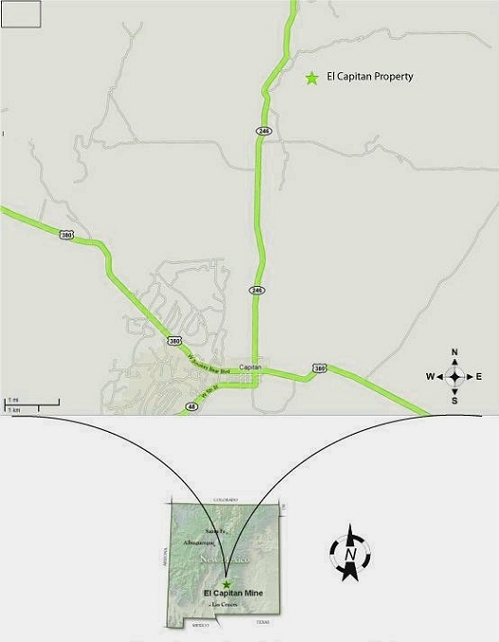

Below is a map setting forth the location of the El Capitan Property.

| 15 |

Location and Access to Deposits – El Capitan Property

The El Capitan Property is situated in the Capitan Mountains, near the city of Capitan, in southwest New Mexico. The main site can be reached by going north from Capitan on State Road 246 for 5.5 miles, turning right onto an improved private road and proceeding for about 0.7 miles.

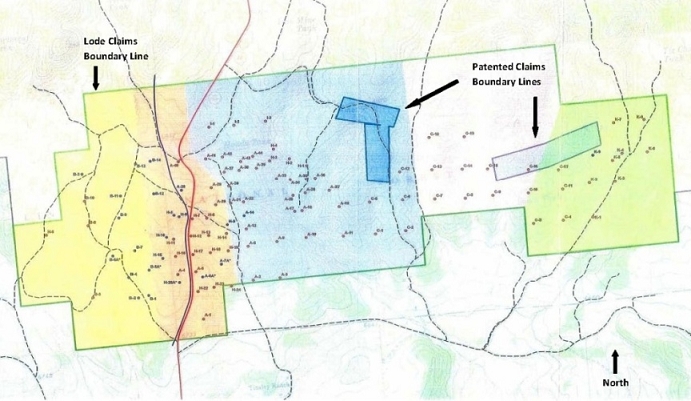

Description of Interests

The El Capitan Property originally consisted of four (4) patented and nine (9) Bureau of Land Management (“BLM”) lode claims; and mineral deposits are covered by these claims. The lode claims, known as Mineral Survey Numbers 1440, 1441, 1442 and 1443, were each located in 1902 and patented in 1911. On January 1, 2006, ECL finalized the purchase of the four patented mining claims on the property, which constitute approximately 77.5 acres in the aggregate. These claims are bounded by the Lincoln National Forest in Lincoln County, New Mexico.

During October and November 2005, based upon recommendations from our consulting geologist, we staked and claimed property surrounding the El Capitan site located in Lincoln County, New Mexico, increasing the total BLM claimed area to approximately 10,000 acres. In August 2006, we reduced the number of BLM claims to cover approximately 7,400 acres, and in August 2009, we reduced the number of BLM claims to approximately 2,800 acres based upon continuing geological work and recommendations by our consulting geologist. In October and November 2011, at the recommendation of the Company’s geological consultant, the Company filed an additional 48 BLM claims of approximately 20 acres each on property adjacent to the Company’s existing BLM claims, aggregating an additional 960 acres.

| 16 |

El Capitan has power supplied to a mobile home on the patented land by Otero County Electric Co-op, Inc.

Currently the Company transports water to the El Capitan Property in a Company-owned water truck. The Company plans to have a water well permitted and drilled on a turn-key basis and has received bids on this project. The well will be situated on our patented property.

Mineral Title

El Capitan’s holdings at the El Capitan Property as of September 30, 2014, we own four patented mining claims, covering approximately 77.5 acres, and 188 lode claims with the BLM covering approximately 3,760 acres. The four wholly-owned patented mining claims and 140 of the BLM mining claims are held in the name of El Capitan. Ltd. and 48 of the BLM claims are held in the name of ECPN Technologies, Inc. Each of El Capitan. Ltd. and ECPN Technologies, Inc. is a wholly-owned subsidiary of the Company. The BLM claims are Federal unpatented mining claims for locatable minerals and are located on public land and held pursuant to the General Mining Law of 1872, as amended. El Capitan fully owns the mining rights and believes the claims are in good standing in accordance with the mining laws of the United States.

To maintain our claims in good standing, for its patented mining claims El Capitan must pay annual property taxes to Lincoln County, and for its unpatented mining claims El Capitan must pay annual assessment fees to the Bureau of Land Management and record the payment of rental fees with Lincoln County. The current year annual assessment and recording costs for our unpatented claims total approximately $29,600. El Capitan has paid the required assessment fees for the 2014 and 2015 assessment years (September 1, 2013 through August 31, 2015).

El Capitan has no underlying agreements or royalty agreements on any of its claims.

The map set forth below shows the location of our claims on the El Capitan Property as of September 30, 2014:

| 17 |

Permits

Pursuant to the New Mexico Mining Act, the New Mexico Mining and Minerals Division have issued Permit No. l1005ME to El Capitan, Ltd. The permit is a “minimal impact existing mining operation.” The Company is in the process of modifying the permit as necessary in order to commence expanded exploration activities at the El Capitan Property. For the issuance of the modified permit, it is necessary to increase our posted financial assurance for reclamation to $74,495.

The New Mexico Environmental Department has issued El Capitan our air quality permit, NSR permit No. 5951 in November 2014.

Previous Operations

To our knowledge, prior to its acquisition by ECL, the property was last active in 1988. The property was previously drilled as an iron (Fe) resource by the U.S. Bureau of Mines in 1944 and 1948. From 1961 to 1988, to our knowledge, an estimated 250,000 tons of iron were produced on the property. Prior to December 2004, there had not been any significant exploration completed on the property. There had only been shallow drilling of the upper magnetite horizon, which was completed by the U.S. Bureau of Mines in 1944 and 1948, and additionally performed by ECL in 2005 and 2006. Additionally, there was geologic mapping of the property at a scale of 1:3,600 by Kelley in 1952.

There were no significant surface disturbances or contamination issues found on the surface or underground water due to the historical mining activities referred to above and no remediation has been required to be performed by the Company. However, the Company was required to provide, and has provided, a $15,000 financial assurance in connection with the issuance of our Permit No. L1005ME by the New Mexico Mining and Minerals Division.

Geology

The main El Capitan deposit is exposed in an open-pit and outcrops within a nearly circular 1,300 foot diameter area, with smaller bodies stretching eastward for a distance of up to 7,000 feet. The El Capitan Property includes two magnetite-dominant bodies. The upper magnetite zone lies below a limestone cap that is a few tens of feet thick, and that is bleached and fractured with hematite-calcite fracture filling. Hematite is an iron oxide mineral, and calcite is a calcium carbonate mineral. Below the limestone cap, there is a mineral deposit which consists mainly of calc-silicate minerals, or minerals which have various ratios of calcium, silicon and oxygen. Beneath the calc-silicate deposit is granite rock. The El Capitan Property has an abundance of hematite, which occurs with calcite in later stage fracture fillings, breccias (rock composed of sharp-angled fragments), and stockworks (multi-directional fractured rock containing veinlets of hydrothermally introduced materials).

Potential mineralization has been defined as two separate types: (i) magnetite iron, and (ii) hematite-calcite mineralized skarn and limestone, which may contain precious metals. By using core holes located at strategic points throughout the property, we have been able to develop subsurface information and define the mineralization. To date, there have been no proven commercial precious metals reserves on the El Capitan Property site. To establish “reserves” (as defined under Industry Guide 7 issued by the SEC), we will be required to establish that the property is commercially viable. As of September 30, 2013, we have not completed a feasibility study on the property, and thus cannot identify the economic significance of the property, if any, at this time.

Exploration

Historical

After a preliminary sampling and assay program in early 2005, the Company implemented three stages of diamond drilling and rotary drilling, totaling 45 holes between April 2005 and September 2006.

| 18 |

Stage 1 of the drilling program was completed between April and May 2005, and consisted of 1,391 feet drilled in 12 vertical core holes, with depths ranging from 38 to 142 feet. Between June and August 2005, we completed Stage 2 drilling, which consisted of both drilling in areas adjacent to some of the Stage 1 drilling holes and drilling in new target areas to the southwest of the main deposit site. Stage 2 drilling consisted of 1,204 feet of combined core and rotary footage in 10 vertical holes, ranging from 24.5 to 344.5 feet in depth. The Stage 3 drilling program began in February 2006 and was completed in May 2006. The program consisted of 23 vertical reverse drill holes totaling 9,685 feet and varying depths from 270 to 710 feet. Drill cuttings were sent to AuRIC and fusion assays of these holes were completed. The samples were collected and controlled under “Chain-of-Custody” by our outside quality control person.

Because caustic fusion is not a precious metal industry accepted assay technique, we retained M.H.S. Research of Lakewood, Colorado (“M.H.S.”) in August 2006 to research and develop a modified fire assay technique that we believe is more appropriate for the material from the El Capitan Property. Preliminary results to date by M.H.S. indicated values that meet or exceed the values obtained by AuRic. The principal of M.H.S. is Michael Thomas who had over thirty years of experience in geology and mining related area including extensive laboratory work in fire assaying, mineral processing and precious metals recovery. He also was an adjunct professor in the Mining Engineering Department at the Colorado School of Mines providing part-time instruction in mineral processing and fire assays.

We also retained the services of Dr. Clyde Smith to manage the exploration of the property. Dr. Smith is a Consulting Geologist who had over 30 years of experience in the mining industry. Dr. Smith holds a B.A. from Carleton College, a M.Sc. from the University of British Columbia, and a Ph.D. from the University of Idaho. Dr. Smith also served as a member of the Industrial Associates of the School of Earth Sciences at Stanford University for several years.

After several months of investigation into the composite sample from the El Capitan Property, M.H.S. results have shown the ability to readily produce ‘metal-in-hand’ using a minor modification of standard fire assay procedures. Mr. Thomas began testing various fire assay fluxes to improve the effectiveness and repeatability of the fire assay procedure on the specific rock matrix of this material. M.H.S. worked in these areas and performed multiple replicate tests on chain of custody composite material in order to establish a benchmark head grade for the composite sample. There can be no assurance that any mineral grade or recovery determined in a small scale laboratory test can or will be duplicated in larger tests under on-site conditions or during mineral exploration.

The Company has entered into agreements with various contractors (as referenced above) for exploration of the El Capitan Property. Each of the respective contractors utilizes its own equipment to complete such exploration and testing.

The Company has worked with third parties to analyze samples from the El Capitan Property to create an economically feasible recovery model for the El Capitan Property mineralized material. We have successfully utilized a repeatable concentration and recovery procedure, which is a modified fire assay technique, to allow evaluation of the mineralized material. Results using this procedure have been positive and show potential economically feasible mineralized material. Based upon these results and part of our strategic plan, on January 31, 2012 the Company engaged an investment banking firm to assist the Company in marketing and selling the El Capitan Property to a major mining company. Given our current plans to market the property for sale, we do not currently have any timetable, budget and will continue further mineral exploration on the El Capitan Property. The Company has not filed any geological reports on SEDAR for review by Canadian authorities and does not intend to do so.

The Company and Gold and Minerals Company, Inc. (“G&M”), a wholly owned subsidiary of the Company, have incurred a total of $10,907,023 in exploration and mine development costs associated with the El Capitan Property. G&M incurred $5,275,916 in exploration costs from January 1, 1994 through January 19, 2011, at which time it was merged into the Company, and the Company has incurred $5,631,107 in exploration costs from its inception on July 26, 2002 through September 30, 2014. The foregoing exploration and mine development costs include costs associated with drilling, assaying, filing fees, extraction process development, consultant, geological, metallurgical, chemist, environmental and legal fees, and other miscellaneous property exploration costs have been expensed as required under the SEC Industry Guide 7.

| 19 |

Historical Sampling and Assaying

The following describes the Company’s historical extraction and analysis of samples from the El Capitan Property.

Over the years, samples taken on the El Capitan Property, including samples taken by ECL, have given low-grade precious metal results when using standard fire assay methods. Through August 2006, due to the unique nature of the mineralization of the El Capitan Property, we have at times utilized testing and assaying methods that may be uncommon, including the use of alkali fusion assays, a more aggressive form of assay which completely converts the sample into a water soluble salt.

In January 2005, ECL completed a preliminary 32-sample surface sampling and assay program on the El Capitan Property to determine the property’s gold and platinum potential. This preliminary sampling was completed by Dr. Clyde L. Smith, PhD, and was followed by three stages of diamond drilling and rotary drilling, totaling 45 holes between April 2005 and September 2006.

In 2007, the Company engaged Dr. Smith to prepare a report to “provide an explanation of the work conducted on the El Capitan Project ... and to summarize the results of the geologic investigations ....” In this report, dated April 16, 2007, Dr. Smith states that “Preliminary hydrometallurgical extraction results indicate potentially acceptable levels of recovery of mineralized material.”

We have continued to utilize the services of Dr. Smith to manage the exploration of the El Capitan Property. Dr. Smith, a Consulting Geologist with over 34 years of experience in the mining industry, holds a B.A. from Carleton College, a M.Sc. from the University of British Columbia, and a Ph.D. from the University of Idaho. Dr. Smith also served as a member of the Industrial Associates of the School of Earth Sciences at Stanford University for several years. ECL has also retained the services of a Ph.D. chemist to compile the prior and ongoing metallurgical and geological information for incorporation into a formal presentation for the purpose of the future marketing of the property.

We retained a small metallurgical research and development laboratory in August 2006 to assess the potential for a modified fire assay technique that we believe is more appropriate for the material from the El Capitan deposit. Throughout 2007, investigations into the potential use of various industry-standard fire assay techniques to estimate the metal content of the El Capitan samples were conducted. Such standard fire assay techniques produced marginally improved results, and beginning in early 2008 and through early 2009, we conducted research into other assay techniques, including leaching, acid dissolution, and the addition of various precious metal collecting agents during the assay process. In early 2009, we completed these research analytical projects at the commercial laboratory and small, R&D-oriented facility with which we had contracted. Although encouraging, the results obtained were inconsistent.

In May 2009, we received results from a commercial lab for additional assay tests that were comparable to the test procedures used in December 2008. The gold values indicated average gold grades of .032 ounces per ton, which were similar to the December 2008 values and also indicated average silver grades of 1.25 ounces per ton, equating to an average gold equivalent of .05 ounces per ton at the then current market price of $913 and $13.90 per ounce, respectively. The test representing recoverable values using standard extraction techniques. The December 2008 tests did not test for silver values. Our consultants determined that the low assay results reported in February 2009 came from an entirely different assay procedure and therefore were not comparable to the results obtained in the December 2008 and May 2009 tests.

In June 2009, we contacted Planet Resource Recovery, Inc. (“PRR”) in hopes of PRR evaluating the use of its recovery technology in recovering precious metals from concentrates produced from El Capitan Property samples. Effective May 4, 2010, we entered into a Joint Venture Agreement with PRR to process approximately 200 tons of concentrate from the El Capitan Property. As part of the Agreement, PRR was to build a production facility for this El Capitan recovery process at their Texas site. The production facility was never completed and the Joint Venture Agreement was terminated.

In March 2010, we started a separate project using a team of experienced mining chemists and metallurgists to develop an assay process and a commercial precious metals recovery process for the mineralized materials from the El Capitan Property. This team initially focused on three (3) different recovery processes. By September 2010, this team had developed processes that yielded “metal in hand” assays, which indicated the El Capitan Property contained mineralized materials that could be of commercial grade, if the recovery cost is not prohibitive.

| 20 |

In September 2010, we announced that the team of chemists and metallurgists had developed a recovery process which uses “lead collection with silver inquarting.” An independent certified analytical laboratory utilized this recovery process to recover metal from 3,000 tons of El Capitan “Chain-of-Custody” mineralized concentrates and produced a certified report of such results, indicating a value of 0.421 ounces of gold per ton. Subsequently it was determined this recovery process would not economically commercially viable.

On November 3, 2010, we engaged another qualified consulting company to analyze ten chain-of-custody core samples from the El Capitan Property, utilizing three different recovery processes. These tests were conducted in early 2011. In April 2011, we received results that indicated potential economic values of mineralized material The results differed by analytical method, and the consulting company undertook additional testing to achieve comparable results before proceeding with analysis and process testing of additional samples. In August 2011, we received the analytical data from work performed by the consulting company. This third party source took considerable time to perform the needed research to confirm the values of the mineralized material samples taken from “Chain-of-Custody” samples removed from the El Capitan Property. Review of the data supported El Capitan’s expectations of commercially recoverable mineralized material, and the most recent samples of the mineralized material produced dore’ bars sold on the basis of their 1.2 ounces of gold equivalent per ton. Parameters used to calculate the economic value were .19 and 41 ounces of gold and silver per ton, respectively, of mineralized material at the then current market price of $1,511 and $37.84 per ounce, respectively.

The Company’s prior results have been replicated with “Chain-of-Custody” samples of mineralized materials collected under the direction of a qualified metallurgical engineer and an independent laboratory utilized a repeatable concentration and recovery procedure, which is a modified fire assay technique, to allow evaluations of the mineralized materials. Results using this procedure show potential gold and silver deposits, which could be economically and legally extracted or produced at the time of reserve determination. The prior geological report by Dr. Smith, when updated, will be used solely for purposes of presenting the El Capitan Property to the market for sale. A final recovery process was developed for the El Capitan mineralized materials that is well in line with the current mineral values being recovered to ensure the recovery process costs are not prohibitive in comparison to the value of the mineralized materials recoverable at the El Capitan Property.

On January 31, 2012, and based upon the results received to such date, we engaged an investment banker to formalize plans for the marketing of the El Capitan Property for potential sale to a major mining company.

After the Company announced the silver-lead inquart of three dore’ bar tests of concentrates, it continued its verification of metals values with 20 chain-of-custody samples. These analyses were performed as part of our investment banker’s due diligence procedures. These tests were concluded in September, 2012. These results are listed below. Further tests performed with material prepared by Proven Technologies, LLC, located in Houston, Texas (“Proven”), are also listed below. We have since discontinued working with Proven as they have repeatedly had significant equipment problems with the technology they utilize.

| Metallurgical Data | ||||||||

| Sample | Sample Size | (10

to 1) Cons or Mineralized Material Samples |

Silver

Oz/Ton of Mineralized Material Samples |

Gold

Oz/Ton of Mineralized Material Samples | ||||

| Dore’ Bar 1 – Sold | 200 lbs | Magnitite Cons | 41 ozs | .19 ozs | ||||

| Dore’ Bar 2 – Sold | 20 lbs | Magnitite Cons | 190 ozs | -0- (inquarted with silver) | ||||

| El Capitan Cons | 9 x 1 lbs | Magnitite Cons | 158 ozs (average) | .14 ozs (average) | ||||

| Hazen (chain of custody) | 20 x 1 lbs | Hematite Mineralized Material Samples | 77 ozs (average) | .13 ozs (average) | ||||

| Proven Technology | 700 lbs | Cons | 179 ozs | -0- | ||||

These results are not necessarily representative of the 141,000,000 tons of mineralized material at the El Capitan Property. They are samples.

| 21 |

During our fiscal year 2013 we continued work on the recovery of precious metals mainly utilizing the industry accepted method of cyanide vat leaching under chain of custody procedures. Initial results demonstrated significant values of mineralized material. We continued working with independent metallurgical labs during the year to enhance the recovery process to include both the cyanidation recovery as well as the silver–lead process. Subsequently theses recovery process were set aside in fiscal year 2014 as advancements in technology became available to effectively process the El Capitan Property mineralized material and remove the iron effectively and economically.

Current Developments in Fiscal Year 2014

In October 2013, we announced recovery gold equivalent assay results involving the El Capitan samples, collected and managed under “Chain-of-Custody” guidelines, as follows:

| Ounces | ||||

|---|---|---|---|---|

| Per Ton | ||||

| A. | Initial Cyanide Leaching, 14- day test | .12 | ||

| B. | Fine Grind, Magnetically-Separated Ore | .28 |

Parameters used to calculate the economic value in A above were 0.077 and 0.038 ounces of gold and platinum per ton, respectively, of mineralized material at the then current market price of $1,270.50 and $1,372 per ounce, respectively.

Parameters used to calculate the economic value in B above were 0.17, 1.34 and 0.07 ounces of gold, silver and platinum per ton, respectively, of mineralized material at the then current market price of $1,270.50, $20.49 and $1,372 per ounce, respectively.

Based upon these results we are continued the initiatives to validate the results of the fine grinding of samples and separation of iron from the mineralized material. The iron, which historically has presented challenges related to the recovery of precious metals from the El Capitan Property mineralized material, also represents an opportunity: a valuable and saleable by-product that can offset a significant portion of the mineral exploration costs. We continued to work on enhancing this technology procedure and achieve replicated results on chain of custody samples.

We utilized and verified the three recovery processes on the El Capitan mineralized material: cyanide leaching utilizing various pre-step ore processing, silver –lead inquarting and the find grind and magnetically separated ore. The final verification process is to ensure that value of the El Capitan mineralized materials is sufficient so that the costs of the recovery process are not prohibitive in comparison to the price of the precious metals recoverable at the El Capitan Property.

Based upon the test results that utilized the fine-grinding and separation method, we moved forward with our strategic plan for a limited-scale continued mineral exploration at the El Capitan Property site in New Mexico in support of the sale of that property.

The chain-of-custody samples that were finely milled and magnetically separated using specific gravity concentrating methodology from extraction testing represents the complete methodology ̶ from samples to final mineralized materials without the use of cyanide.

In March 2014, we announced that the Company had reached an agreement with Logistica US Terminals LLC (:Logistica”), a Texas-based limited liability company and member of LIT Group network. The contract represents a tactical initiative to support the sale of the El Capitan Property. Under the terms of the Master Service Agreement, Logistica will finance and operate the extraction of iron at the El Capitan Property and provide the Company with a turnkey solution that also includes shipment of the iron to ports where buyers will take delivery.

In March 2014, we also announced that we reached an agreement with GlencoreXstrata for the purchase of iron from the El Capitan mine. Under the terms of the agreement, GlencoreXstrata committed to ongoing purchases of iron from the El Capitan Property. GlencoreXstrata will issue a Letter of Credit to guarantee payment on iron sales.

| 22 |

In late April 2014, we announced the purchase of a heavy metals separation system from AuraSource, Inc. that uses state-of-the-art technology to separate hematite and magnetite from other elements in the El Capitan mineralized material. The AuraSource system leaves a rich concentrate of mineralized material that we will use to extract the mineralized materials. We have successfully completed the assembly and testing of the AuraSource heavy metals separation system at the El Capitan Property. When the mineral exploration commences, the iron extracted from the mineralized material will be transported to a port for sale pursuant to the Company’s agreements with GlencoreXstrata and Logistica.

In May 2014, we announced recovery results of .40 of gold equivalent per ton of El Capitan samples. The precious metals processing was completed in China as part of testing related to the calibration and tuning of the heavy metals separation device that will be used on site at the El Capitan Property in New Mexico. After the separation of the hematite and magnetite from the El Capitan mineralized materials, an independent lab processed the precious metals that yielded the .40 of gold equivalent per ton of samples.

Parameters used to calculate the economic value were 0.20, 3.2 and 0.25 ounces of gold, silver and palladium per ton, respectively, of mineralized material at the then current market price of $1,287.25, $19.56 and $837 per ounce, respectively.

The Company has methods for both the separation of the iron and the separation and recovery of mineralized material that have repeatedly yielded consistent and commercially viable economic value results. Yet another significant aspect of these breakthrough technologies for separation and recovery is that they are environmentally friendly and do not rely on the use of caustic chemicals.

In September 2014, we announced that we had reached a final agreement for the sale of mineralized tailings from the El Capitan Property to a Hong Kong-based trading company. The terms of the agreement were not disclosed, but the Company expects to see positive cash flow in the second quarter of its 2015 fiscal year (the first quarter of the 2015 calendar year). We expect that the buyer will purchase between 5,000 and 10,000 tons of mineralized tailings per month, with payment guaranteed against a letter of credit.

We have a 5-acre minimal impact mining permit that can be used on our patented land. During the current fiscal year we have modified this mining permit to encompass allowing exploration on 40 acres at a time on our patented land. We are in the final stages of obtaining our amended and expanded mining permit from the state of New Mexico and will increase our reclamation bond to $74,495. The Company’s clean air permit was issued in late November 2014 and the expanded mining permit will be issued in early 2015 upon placing the increased financial assurance bond with the New Mexico Energy, Minerals and Natural Resources Department. Upon issuance, mineral exploration will commence at the El Capitan Property site.

Currently the property has been prepared for mineral exploration upon issuance of the modified minimal impact mining permit. Leased fencing encompasses the mineral exploration area and other criteria that the New Mexico Mining and Minerals Division has required and inspected. Mineral exploration will be conducted on open pit basis and no tunneling will be involved.

We engage third party consultants and companies to provide mineral exploration and analysis of samples. As part of its selection process, we take into account the quality assurance practices of such consultants and companies prior to engagement. Consequently, the Company has not created an independent quality assurance program.

Description of Equipment

We have purchased heavy metals separation system from AuraSource, Inc that uses state-of-the-art technology to separate hematite and magnetite from other elements in the mineralized materials collected at the El Capitan Property. The AuraSource system leaves a rich mineralized concentrate that we will use to extract mineralized materials. The system does not use any water or toxic chemicals and utilizes complete green industrial extraction of precious metals. At full capacity, the machine can process 400 tons of mineralized material per hour. The Company built various protective coverings for the AuraSource machine and for storage of small tools.

| 23 |

The Company has purchased a water truck to transport water to the El Capitan Property pending the drilling on-site. We also have a mobile home situated on our patented land. The Company currently has no other material equipment or buildings on site.

From time to time, we have entered into agreements with various personnel and companies to conduct exploration projects on the El Capitan Property. Each of the respective companies utilizes its own equipment to perform contracted work at the El Capitan Property.

Other Properties

El Capitan has a 20% joint venture interest in the COD property. Based upon the events and financial condition of the 80% joint venture partner, we have determined that this joint venture is not viable and, as a result, the Company does not consider the COD property to be a material property of the Company at this time.

Executive Offices and Administrative Offices

The executive office is at 8390 Via de Ventura, Suite F-110, Scottsdale, Arizona 85258 and the administrative office is at 5871 Honeysuckle Road, Prescott. Arizona 86305. The administrative office premises are contributed free of charge by Mr. Stephen J. Antol, Controller for the Company. We believe that the offices are adequate to meet our current operational requirements. Other than our property as described above, we do not own any real property.

| 24 |

PART IV

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

Exhibit Number |

Description | |

| 2.1 | Agreement and Plan of Merger between the Company, Gold and Minerals Company, Inc. and MergerCo, dated June 28, 2010 (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K filed July 7, 2010). | |

| 3.1 | Articles of Incorporation, as amended (incorporated by reference to Exhibit 3.1 to the Company’s Form S-4 Registration Statement #333-170281 filed on November 2, 2010). | |

| 3.2 | Certificate of Amendment to Articles of Incorporation (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed October 1, 2014). | |

| 3.3 | Certificate of Designation of Series A Junior Participating Preferred Stock (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed August 31, 2011). | |

| 3.4 | Certificate of Designation of Series B Convertible Preferred Stock (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed August 1, 2014). | |

| 3.5 | Restated Bylaws (incorporated by reference to Exhibit 3.2 to the Company’s Form S-4 Registration Statement #333-170281 filed on November 2, 2010). | |

| 4.1 | Rights Agreement dated August 25, 2011 between the Company and OTR, Inc. (incorporated by reference to Exhibit 4.2 to the Company’s Form 8-K filed on August 31, 2011). | |

| 10.1 | Equity Purchase Agreement dated July 11, 2011 between El Capitan Precious Metals, Inc. and Southridge Partners II, LP. (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed July 12, 2011). | |

| 10.2 | Amendment No. 1 to Equity Purchase Agreement by and between El Capitan Precious Metals, Inc. and Southridge Partners II, LP, dated April 3, 2013 (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed April 4, 2013). | |

| 10.3 | Equity Purchase Agreement dated July 30, 2014 by and between El Capitan Precious Metals, Inc. and Southridge Partners II, LP (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed July 30, 2014). | |

| 10.4 | 2005 Stock Incentive Plan, as amended (incorporated by reference to Exhibit 10.1 to the Company’s Form S-8 Registration Statement #333-177417 filed on October 20, 2011). | |

| 10.5 | Form of Stock Option Agreement (Director) (incorporated by reference to Exhibit 10.1 to the Company’s Annual Report on Form 10-K filed December 14, 2012). | |

| 10.6 | Agreement dated March 10, 2014 between the Company and Glencore AG (incorporated by reference to Exhibit 10.1 to Amendment No. 1 to the Company’s Quarterly Report on Form 10-Q filed on July 22, 2014).+ | |

| 10.7 | Master Services Agreement dated February 28, 2014 by and between the Company and Logistica, U.S. Terminals, LLC, including the Iron Ore Processing Agreement attached as Appendix A thereto (incorporated by reference to Exhibit 10.2 to the Company’s Quarterly Report on Form 10-Q filed on May 14, 2014). + | |

| 10.8 | Note and Warrant Purchase Agreement dated October 17, 2014, including the 8% Secured Promissory Note, Common Stock Purchase Warrant and Security Agreement attached as Exhibits A, B and C thereto (incorporated by referenced to Exhibit 10.8 to the Company’s Annual Report on Form 10-K filed on December 29, 2014). | |

| 21.1 | Subsidiaries of El Capitan Precious Metals, Inc. (incorporated by referenced to Exhibit 21.1 to the Company’s Annual Report on Form 10-K filed on December 29, 2014). | |

| 23.1* | Consent of Clyde L. Smith, Ph.D. | |

| 23.2 | Consent of MaloneBailey, LLP (incorporated by referenced to Exhibit 23.2 to the Company’s Amendment No. 1 to Annual Report on Form 10-K filed on February 18, 2015). |

| 25 |

Exhibit Number |

Description | |

| 31.1* | Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 31.2* | Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 32.1* | Certification of Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 101.INS | XBRL Instance Document (incorporated by reference to Exhibit 101.INS to the Company’s Amendment No. 1 to Annual Report on Form 10-K filed on February 18, 2015).** | |

| 101.SCH | XBRL Extension Schema Document (incorporated by reference to Exhibit 101.SCH to the Company’s Amendment No. 1 to Annual Report on Form 10-K filed on February 18, 2015).** | |

| 101.CAL | XBRL Extension Calculation Linkbase Document (incorporated by reference to Exhibit 101.CAL to the Company’s Amendment No. 1 to Annual Report on Form 10-K filed on February 18, 2015).** | |

| 101.DEF | XBRL Extension Definition Linkbase Document (incorporated by reference to Exhibit 101.DEF to the Company’s Amendment No. 1 to Annual Report on Form 10-K filed on February 18, 2015).** | |

| 101.LAB | XBRL Extension Labels Linkbase Document (incorporated by reference to Exhibit 101.LAB to the Company’s Amendment No. 1 to Annual Report on Form 10-K filed on February 18, 2015).** | |