Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MERIT MEDICAL SYSTEMS INC | a03052015-8k.htm |

| EX-99.1 - EXHIBIT 99.1 - MERIT MEDICAL SYSTEMS INC | a352015-8kpressreleaseex991.htm |

1

2 FRED P. LAMPROPOULOS CHAIRMAN & CHIEF EXECUTIVE OFFICER KENT W. STANGER CHIEF FINANCIAL OFFICER INVESTOR DAY | March 5th 2015

3 DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS This presentation includes “forward-looking statements” as defined within applicable securities laws and regulators. All statements in this presentation, other than statements of historical fact, are “forward-looking statements”, including any projections of earnings, revenues or other financial items, any statements regarding our plans and objectives for future operations, any statements concerning proposed new products or services, any statements regarding the integration, development or commercialization of our business, any statements regarding future economic conditions or performance, and any statements of assumptions underlying any of the foregoing. All forward-looking statements, including financial projections, included in this presentation are made as of the date of this presentation, and are based on information available to us as of such date. We assume no obligation to update or disclose revisions to any forward-looking statement. In some cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,” “likely,” “expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,” “projects,” ”forecast,” “potential,” “plan” or “continue,” or other comparable terminology. Forward-looking statements are based on our current beliefs, expectations and assumptions regarding our business, domestic and global economies, regulatory and competitive environments and other future conditions. There can be no assurance that such beliefs, expectations or assumptions or any of the forward-looking statements will prove to be correct, and actual results will likely differ, and could differ materially, from those projected or assumed in the forward-looking statements. Our future financial and operating results and condition, as well as any forward-looking statements, are subject to inherent risks and uncertainties, including risks relating to possible allegations of infringement of the intellectual property rights of others; protection of our own proprietary technology; product recalls and product liability claims; restrictions and limitations imposed by our debt agreements and instruments; compliance with governing regulations; international economic conditions; greater governmental scrutiny and increasing regulation of the medical device industry; termination or disruption of relationships with our suppliers; research and development activities; regulatory approval or clearance of our products and the risk that such products may not be developed successfully or approved for commercial use; concentration of our revenues among a few products and procedures; development of new products and technology that could render our existing products obsolete; volatility in the market price of our common stock; the potential imposition of fines, penalties and other adverse consequences resulting from the violation of domestic or foreign laws or regulations; and other factors referenced in our press releases and in our reports filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the Year Ended December 31, 2014. All subsequent forward- looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. The financial projections set forth in this presentation are based on a number of assumptions, estimates and forecasts. The inaccuracy of any one of those assumptions, estimates or forecasts could materially impact our actual financial results. Inevitably, some of those assumptions, estimates or forecasts will not occur and unanticipated events and circumstances will occur subsequent to the date of this presentation. In addition to changes in the underlying assumptions, our future performance is subject to a number of risks and uncertainties, with respect to our existing and proposed business, and other factors that may cause our actual results or performance to be materially different from any predicted or implied. Although we have attempted to identify important assumptions in the financial projections, there may be other factors that could materially affect our actual financial performance, and no assurance can be given that all material factors have been considered in the preparation of the financial projections. Accordingly, you should not place undue reliance on such projections. Future operating results are, in fact, impossible to predict.

4 4 Disciplined, customer-focused enterprise 3 Target high-growth, high-return opportunities 2 Optimize operational capability 1 Enhance growth and profitability

5 Revenue Outlook

6 Revenue Drivers Market Share Products o Control of key business processes such as licenses and distribution to build sustainable growth o Diversified revenue streams: direct, distributor, OEM, and semi-direct Sales Model Optimization o Enter complementary product segments while securing existing market positions o Continue investment in Tier One Global Markets o Continued introduction of high-margin products annually o System selling in key areas such as radial, embolization, cardiac rhythm management, electrophysiology, and peripheral artery disease

7 Global Logistical Reach & Revenue Channels OEM Direct To Hospital Developed Distribution Network Semi Direct SENSORS COATINGS

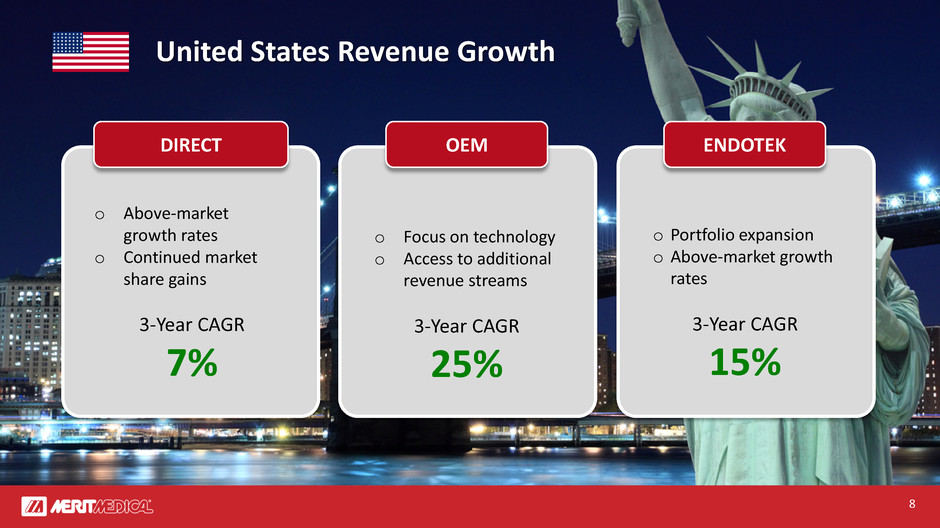

8 o Above-market growth rates o Continued market share gains 3-Year CAGR 7% United States Revenue Growth o Focus on technology o Access to additional revenue streams 3-Year CAGR 25% o Portfolio expansion o Above-market growth rates 3-Year CAGR 15% OEM DIRECT ENDOTEK

9 CHINA Population 1,357,380,000 3-Year CAGR 25% International Tier One Focus JAPAN Population 126,435,000 3-Year CAGR 18% BRAZIL Population 202,768,000 3-Year CAGR 17% SOUTHEAST ASIA Hong Kong & Taiwan Population 673,981,000 3-Year CAGR 31% RUSSIA Population 143,976,000 3-Year CAGR 31%

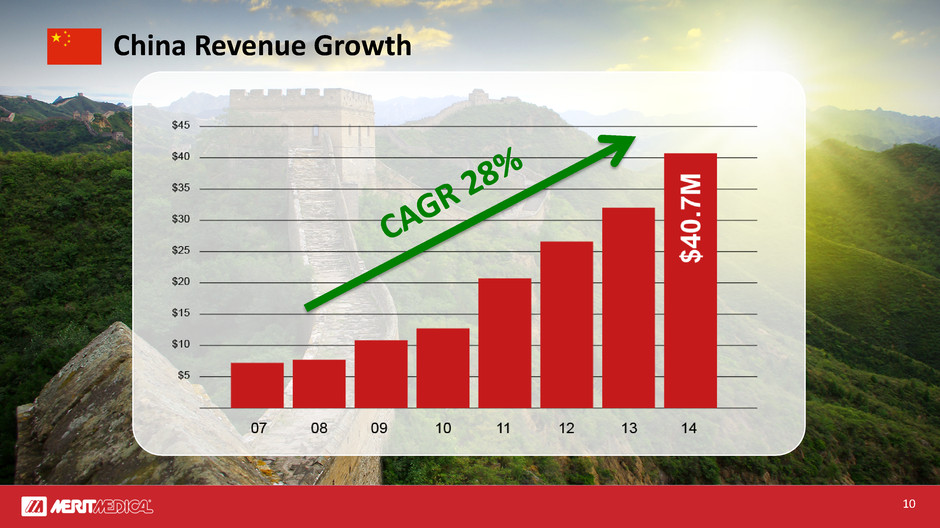

10 China Revenue Growth

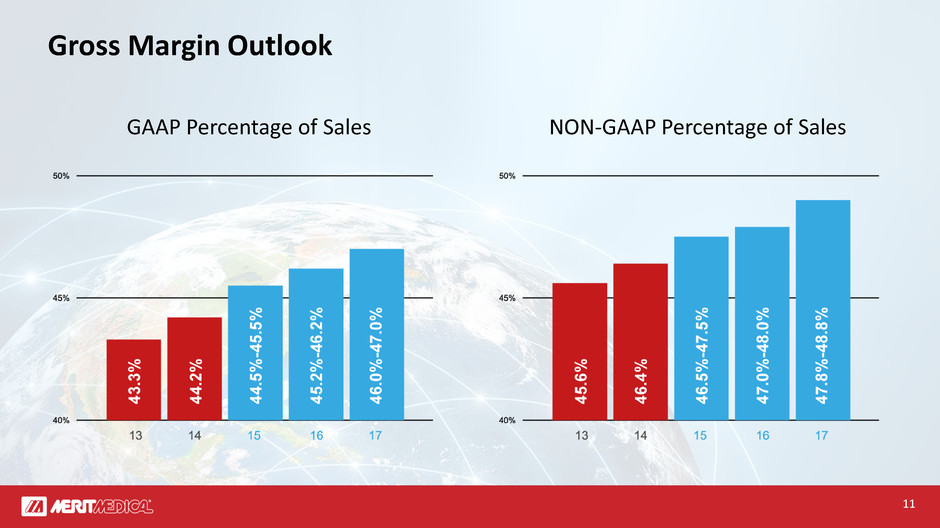

11 Gross Margin Outlook GAAP Percentage of Sales NON-GAAP Percentage of Sales

12 Gross Margin Drivers • Efficient Asset Utilization • Facility Consolidation • Insourcing • Lean Manufacturing

13 Gross Margin Drivers • Automation • Fulfillment • Shipping • Digital Initiatives • Print & Apply Global Logistics

14 Gross Margin Drivers Product Mix System Selling R&D Strategy Sales Focus Advanced Products & Therapies

15 Cost Effective Environments Mexico • 150 employees as of May 1st • 500 employees in 3 years • Rapid response, logistics pipeline • Improved product economics South Jordan, Utah Tijuana, Mexico

16 Cost Effective Environments Ireland • Highly trained workforce • Favorable incentives • Research and development • Manufacturing access to our fastest growing markets

17 Operating Focus 1 2 3 4 Value Per Dollar Spent o Buying authority o Shared services o Capitalize on global scale Culture o Understand. Innovate. Deliver.™ o Cost discipline while preserving quality and innovation Sales Force Efficiency o Relatively fixed cost, focused sales force o Effective new product introduction Maximize Operating Leverage o Focus on financial performance o Gross margin improvement o Disciplined expense management

18 Research & Development

19 Research & Development Strategy 1 2 3 4 Global R&D Centers of Excellence o Coatings o Guide Wires o Catheters o Sensors o Embolization o Stents Disciplined Investment o Develop high margin advanced products and therapies that address underserved, sizable global markets o Enhance existing portfolios and services Clinical Evidence & Value o Produce clinical evidence that influences health economics o Clinical trial investment Global Commercialization o High-growth, high- return markets o Education o Adoption o Measurement for return and effectiveness

20 Endoscopy Portfolio Priorities • Introduce new, high-margin products • Secure airway stent market position with optimized, comprehensive product lines • Offer customers improved balloon dilation, through proprietary balloon design • Improve patient care and outcomes by offering advanced esophageal stents with integral reflux control valve Initiatives • Complete development and launch of ELATION™ Balloon Dilators—representing significant market potential and multi-call point opportunities • Deliver a differentiated procedural solution and address a larger market size with AEROmini™ • Complete U.S. clinical trial and launch EndoMAXX EVT™ Merit Endotek Market Opportunity $145M

21 Peripheral Intervention Portfolio Priorities • Interventional Gynecology: UTERINE • Interventional Oncology: HEPATIC • Interventional Urology: PROSTATIC • Interventional Gastroenterology: LEFT GASTRIC Initiatives • ask4UFE® patient education • Clinical differentiation • Radial education and adoption • Clinical data: HiQuality, BEST, BEAT • Key opinion leader development • Therapeutic adoption through education • System selling Embolotherapy Market Opportunity $167M

22 Peripheral Intervention Portfolio Priorities • Complementary capability from diagnosis to treatment • Improved sample quality in smaller, lighter device • Leverage current call point presence Initiatives • Needle design and mechanical technology • Leverages Merit’s core strengths • Training for adoption awareness • Complete competitive offering Merit Biopsy Device Market Opportunity $241M

23 Peripheral Intervention Portfolio Priorities • Designed to address an unmet clinical need • Broad range of diameters and lengths with a single-handed ergonomic delivery mechanism • Merit's initial entry into vascular stent market Initiatives • Utilize the stent graft technology platform to expand indications for use • Establish world class centers of excellence with prominent key opinion leaders • Deliver stent graft training and education programs to increase physician engagement Market Opportunity $908M Vascular Stent Graft

24 Cardiac Intervention Portfolio Priorities • Pacing Lead Introduction– Classic Sheath™, Prelude Snap™ • Left Ventricular Lead Delivery – Worley™ Advanced LV Lead Delivery System • Electrophysiology Diagnostic & Ablation Therapies—HeartSpan® Steerable and fixed curve sheaths, and transseptal needles Initiatives • Portfolio Revitalization & Differentiation – Launching 4 new products in 2015 • Geographic Expansion – Launching electrophysiology portfolio into 27 new countries • Clinical Program Education – Global interventional technique training to electrophysiologists Electrophysiology Market Opportunity $305M

25 Cardiac Intervention Health Care Economics • Cost savings and patient preference drive adoption of radial access Clinical Program Development • Provide ThinkRadial training program to physicians Portfolio Optimization • Deliver full solution of radial products across the workflow to enable adoption ThinkRadial™ Program Market Opportunity $365M

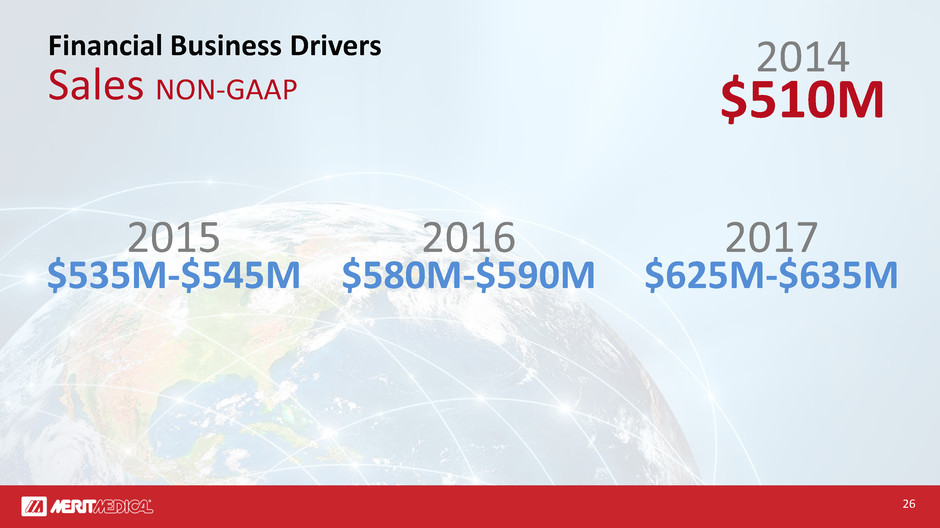

26 Financial Business Drivers Sales NON-GAAP 2014 $510M 2015 $535M-$545M 2016 $580M-$590M 2017 $625M-$635M

27 Financial Business Drivers Gross Margins NON-GAAP 2014 46.4% 2015 46.5%-47.5% 2016 47.0%-48.0% 2017 47.8%-48.8%

28 Financial Business Drivers Income from Operations NON-GAAP 2014 11.1% 2015 10.9%-11.9% 2016 11.5%-12.5% 2017 12.4%-13.4%

29 Financial Business Drivers EPS NON-GAAP 2014 $0.78 2015 $0.85-$0.89 2016 $0.95-$1.01 2017 $1.10-$1.18

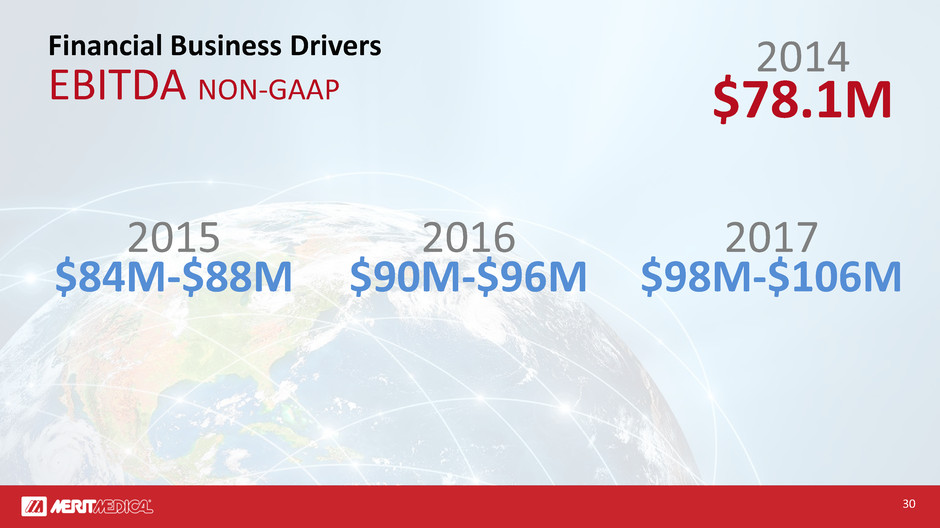

30 Financial Business Drivers EBITDA NON-GAAP 2014 $78.1M 2015 $84M-$88M 2016 $90M-$96M 2017 $98M-$106M

31 Financial Business Drivers Free Cash Flow NON-GAAP 2014 $19M 2015 $20M-$25M 2016 $30M-$35M 2017 $35M-$40M

32 Financial Business Drivers NON-GAAP 2014 2015 2016 2017 Sales $510M $535M-$545M $580M-$590M $625M-$635M Gross Margin 46.4% 46.5%-47.5% 47.0%-48.0% 47.8%-48.8% Income From Operations 11.1% 10.9%-11.9% 11.5%-12.5% 12.4%-13.4% EPS $0.78 $0.85-$0.89 $0.95-$1.01 $1.10-$1.18 EBITDA $78.1M $84M-$88M $90M-$96M $98M-$106M Free Cash Flow $19M $20M-$25M $30M-$35M $35M-$40M

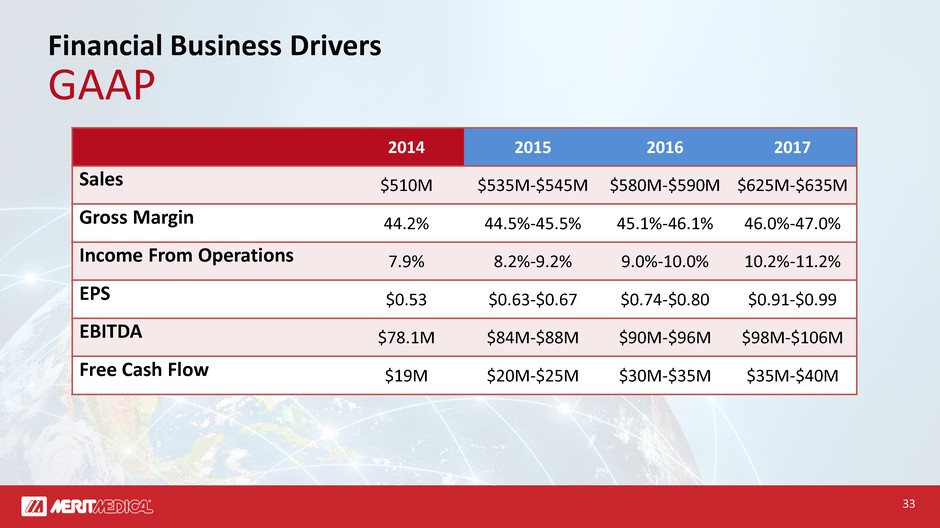

33 Financial Business Drivers GAAP 2014 2015 2016 2017 Sales $510M $535M-$545M $580M-$590M $625M-$635M Gross Margin 44.2% 44.5%-45.5% 45.1%-46.1% 46.0%-47.0% Income From Operations 7.9% 8.2%-9.2% 9.0%-10.0% 10.2%-11.2% EPS $0.53 $0.63-$0.67 $0.74-$0.80 $0.91-$0.99 EBITDA $78.1M $84M-$88M $90M-$96M $98M-$106M Free Cash Flow $19M $20M-$25M $30M-$35M $35M-$40M

34 1 2 3 4 Disciplined, customer-focused enterprise Guided by strong core values to globally address unmet or underserved healthcare needs Target high-growth, high-return opportunities Through understanding, innovating, and delivering in peripheral, cardiac, OEM, and endoscopy business lines Optimize operational capability Through lean processes, cost effective environments, and asset utilization Enhance growth and profitability Through R&D, sales model optimization, cost discipline, and operational focus

35