Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - MECHANICAL TECHNOLOGY INC | Financial_Report.xls |

| EX-31 - MECHANICAL TECHNOLOGY INC | es31-1.htm |

| EX-21 - MECHANICAL TECHNOLOGY INC | es21.htm |

| EX-32 - MECHANICAL TECHNOLOGY INC | es32-1.htm |

| EX-23 - MECHANICAL TECHNOLOGY INC | es23-1.htm |

| EX-32 - MECHANICAL TECHNOLOGY INC | es32-2.htm |

| EX-31 - MECHANICAL TECHNOLOGY INC | es31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014 |

||

|

OR |

||

|

☐ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE TRANSITION PERIOD FROM _____TO _____ |

||

Mechanical Technology, Incorporated

(Exact name of registrant as specified in its charter)

__________________

|

New York |

000-06890 |

14-1462255 |

|

(State or other jurisdiction |

(Commission File Number) |

(IRS Employer |

|

of incorporation or organization) |

|

Identification No.) |

325 Washington Avenue Extension, Albany, New York 12205

(Address of principal executive offices)

(518) 218-2550

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

None |

None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock

($0.01 par value)

Title of Class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer☐ |

Accelerated Filer☐ |

Non-Accelerated Filer (Do not check if a smaller reporting company) ☐ |

Smaller reporting company ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2014 (based on the last sale price of $1.28 per share for such stock reported on the over-the-counter market for that date) was $6,021,362.

As of February 26, 2015, the Registrant had 5,258,883 shares of common stock outstanding.

Documents incorporated by reference: Portions of the registrant’s Proxy Statement for its 2015 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

| 1 |

|

PART I |

||||

|

Item 1. |

|

|

Page |

|

|

|

|

|

||

|

Item 1A. |

|

|

7 |

|

|

|

|

|

||

|

Item 1B. |

|

|

12 |

|

|

|

|

|

||

|

Item 2. |

|

|

12 |

|

|

|

|

|

||

|

Item 3. |

|

|

12 |

|

|

|

|

|

||

|

Item 4. |

|

|

12 |

|

|

|

|

|||

|

PART II |

||||

|

|

|

|

||

|

Item 5. |

|

|

13 |

|

|

|

|

|

||

|

Item 6. |

|

|

13 |

|

|

|

|

|

||

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

14 |

|

|

|

|

||

|

Item 7A. |

|

|

19 |

|

|

|

|

|

||

|

Item 8. |

|

|

19 |

|

|

|

|

|

||

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

19 |

|

|

|

|

||

|

Item 9A. |

|

|

19 |

|

|

|

|

|

||

|

Item 9B. |

|

|

20 |

|

|

|

|

|||

|

PART III |

||||

|

|

|

|

||

|

Item 10. |

|

|

21 |

|

|

|

|

|

||

|

Item 11. |

|

|

21 |

|

|

|

|

|

||

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

21 |

|

|

|

|

||

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

21 |

|

|

|

|

||

|

Item 14. |

|

|

22 |

|

|

|

|

|||

|

PART IV |

||||

|

|

|

|

||

|

Item 15. |

|

|

23 |

|

| 2 |

Unless the context requires otherwise in this Annual Report on Form 10-K, the terms the “Company,” “we,” “us,” and “our” refer to Mechanical Technology, Incorporated, “MTI Instruments” refers to MTI Instruments, Inc., and “MTI Micro” refers to MTI MicroFuel Cells, Inc. Other trademarks, trade names, and service marks used in this Annual Report on Form 10-K are the property of their respective owners.

Mechanical Technology, Incorporated, a New York corporation, was incorporated in 1961. The Company’s core business is conducted through MTI Instruments, Inc., a wholly-owned subsidiary incorporated in New York on March 8, 2000 and the sole component of the Company’s Test and Measurement Instrumentation segment. The Company’s operations are headquartered in Albany, New York where it designs, manufactures, and markets its products globally. The Company also operated in a New Energy segment with business conducted through MTI MicroFuel Cells, Inc. until December 31, 2013 (date of MTI Micro deconsolidation). In August 2014, its management changed MTI Micro’s name to MeOH Power, Inc. MTI continues to retain our equity ownership in that entity as discussed below. However, to keep prior and future filings consistent, MTI will continue to refer to this entity as MTI Micro in its reports.

MTI Instruments is a supplier of precision linear displacement solutions, vibration measurement and system balancing solutions, and wafer inspection tools. These tools and solutions are developed for markets that require the precise measurements and control of products processes for the development and implementation of automated manufacturing, assembly, and consistent operation of complex machinery.

As part of its strategy, MTI Instruments provides its customers with enabling sensors and sensing technologies that help advance manufacturing processes and new product development efforts. The demand for higher quality and lower cost products ranging from semiconductor chips to electronics and large items such as automobiles continues to drive Original Equipment Manufacturers (OEMs) and their suppliers to invest in technology and the capability to rapidly produce high quality products. Industry has moved towards flexible manufacturing doctrines around mass customization and production incorporating lean principles to reduce labor and waste, while increasing quality. Modern manufacturing advances at a very rapid pace with the help of automation controls and precision sensing technologies for operating equipment, processes in factories, and other applications with minimal or reduced human intervention. OEMs find that using automation helps them not only improve on quality, but also can save labor, energy and materials while significantly improving accuracy and precision. In some industries like semiconductors, fabrication facilities are fully automated and are aided by humans on a low frequency basis.

Using a combination of integrated smart robotics, manufacturing lines, and a myriad of sensors that measure ongoing equipment performance, monitoring and drive controls have resulted in significant advancements in productivity and quality in manufacturing. There is no question that the world is moving from classic manufacturing and assembly towards automation and measurement.

MTI Instruments has decades of experience in working with OEMs and their subcontractors in the supply of sensor technology to complement OEMs’ manufacturing processes, and now in their development of new automation controls and processes by providing sensors and sensing technologies. The Company has taken steps to move towards a market-based approach by examining and targeting specific segments including the industrial and consumer electronics, automotive and other precision automated manufacturing industries, turbo machinery and research for both product and process development segments that lead to the key markets served.

This same approach is driving the demand for engine vibration measurement and balancing. Ongoing efforts to improve engine performance and lower fuel consumption drive both military and commercial axial turbo-machinery operators to maintain their equipment at peak performance.

These market drivers are also providing opportunity and demand for MTI to enhance current and develop new products and technologies. This has become a central theme in our supporting a larger, more complex customer base. Our efforts to become more capable and competitive in operations and quality are being met by our well defined approach to lean manufacturing principles and the achievement of International Organization for Standardization (ISO) ISO 9001:2008 certification in 2014.

| 3 |

Precision

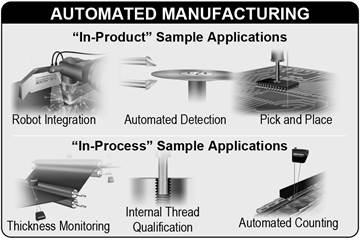

Automated Manufacturing

Precision

Automated Manufacturing

As demand increases for higher quality, lower cost, and more efficient products, there is a world-wide need for OEMs to drive continuous improvement efforts through use of the most innovative manufacturing and assembly techniques in products and processes. Due to the level of precision required, these products or processes are managed through automated systems (Piezo positioners, robots, quality in measurement, etc.) and require precise measurement, data transmission, analysis and management.

MTI Instruments provides advanced, ultra precision linear displacement solutions that help customers achieve higher levels of efficiency through precision measurement systems that enable valuable data collection and allow process and quality control. We customize linear displacement solutions for OEMs that can be incorporated into a tool or equipment manufactured by a company to monitor performance and/or achieve control (“in product application”) or into a process to control the manufacture of parts or measure critical parameters of parts as they enter or leave a process (“in process applications”).

MTI Instruments is a preferred supplier for applications that require complex and extremely precise measurement of small, intricate targets and assemblies. MTI Instruments uses its significant track record and experience using capacitance, laser and fiber optic technologies to make accurate linear displacement measurements to the sub-nanometer level of accuracy. These advanced sensing and physical measurement technologies are used to produce products that range from basic sensors to complete, fully integrated measurement systems. Applications include precision positioning, material surface measurements, off-center vibration measurements, and pattern recognition analysis.

Listed below are selected MTI Instruments’ Automated Manufacturing product offerings and technologies:

|

|

Product Model |

Description |

|

|

Accumeasure Series |

Ultra-high precision capacitive systems offering nanometer accuracy. |

|

|

Microtrak 3

|

Single spot laser sensor equipped with the latest complementary metal oxide semiconductor (CMOS) sensor technology with higher sensitivity than previous generation. |

|

|

Microtrak PRO-2D |

2D laser triangulation scanners that provide profile, displacement, and 3D images. |

|

|

MTI-2100 Fotonic Sensor Series |

Fiber-optic based displacement sensor systems with high frequency response. |

|

NEW |

Accumeasure D Series |

Ultra-high precision digital capacitive systems offering sub-nanometer accuracy. |

|

NEW |

Microtrak TGS

|

Intuitive laser thickness systems using two single spot laser heads with digital linearization providing superb linearity. |

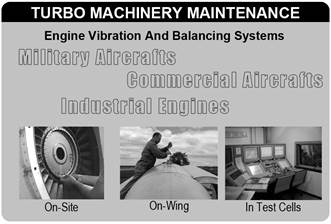

Axial Turbo Machinery

Turbo

machines are categorized according to the type of flow. When the fuel and air

flow is parallel to the axis of rotation, they are referred to as axial flow

machines. MTI Instruments is a leader in the development and commercialization

of vibration measurement and system balancing for axial type engines –

typically medium and large turbo fan aircraft engines – for both military and

commercial applications. In addition, we are exploring possibilities for

expansion of its product offerings for a variety of applications within this

market segment.

Turbo

machines are categorized according to the type of flow. When the fuel and air

flow is parallel to the axis of rotation, they are referred to as axial flow

machines. MTI Instruments is a leader in the development and commercialization

of vibration measurement and system balancing for axial type engines –

typically medium and large turbo fan aircraft engines – for both military and

commercial applications. In addition, we are exploring possibilities for

expansion of its product offerings for a variety of applications within this

market segment.

MTI Instruments designs and manufactures computer-based portable balancing systems (PBS) products which automatically collect and record engine vibration data, identifying vibration or balance trouble, and calculating a solution to the problem. These products are designed to quickly pinpoint engine vibration issues for improved fuel efficiency, lower maintenance cost and safety.

PBS products are used by major aircraft engine manufacturers, the U.S. and foreign militaries, and commercial airlines, as well as gas turbine manufacturers.

| 4 |

Listed below are selected MTI Instruments’ Turbo Machinery product offerings and technologies:

|

|

Product Model |

Description |

|

|

PBS-4100+ Portable Balancing System |

Provides easy to follow solutions for engine vibration and trim balancing problems. |

|

|

PBS-4100R+ Test Cell Vibration Analysis & Trim Balancing System |

Advanced trim balancing and diagnostics for engine test cells. |

|

|

TSC-4800A Tachometer Signal Conditioner |

Tachometer signal conditioner detects and conditions signals for monitoring, measuring, and indicating engine speeds. |

|

|

1510A Calibrator

|

National Institute of Standards and Technology (NIST) traceable signal generator that outputs voltage signals useful to test and calibrate electronic equipment. |

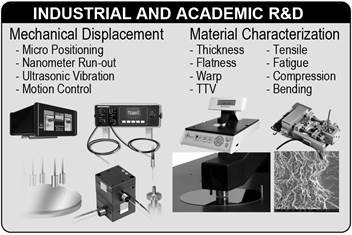

Industrial and Academic Research

and Development (R&D)

|

|

|

|

|

Present-day research and process development is a core part of the modern business world; critical decisions are made from data and discoveries made through these efforts. As companies understand and profit from the benefits of organized R&D efforts, they also make further commitments and investments into new R&D cycles making internal R&D budgets reach higher and higher levels. R&D is also a tool for modern companies to proactively leapfrog competition and keep pace with trends, enhance manufacturing processes, and develop products to meet new customer demands.

MTI Instruments has a long track record of working with private sector companies as well as academic institutions on their R&D efforts. We have a dedicated line of tabletop linear displacement instruments, material testers, and wafer metrology tools that help provide valuable information to enhance products and processes. Our family of R&D related products are used widely in applications including wafer surface metrology, nano-material testing, and precision linear displacement and positioning. Our customers include testing and R&D departments in large industry and academia as well as process development laboratories focused in automotive, electronics, semiconductor, solar, and material development. |

Listed below are MTI Instruments’ Industrial and Academic Research and Development product offerings and technologies:

|

|

Product Model |

Description |

|

|

Accumeasure Digital Series

|

Ultra-high precision digital capacitive systems offering sub-nanometer accuracy. |

|

|

Accumeasure Analog Series |

Ultra-high precision capacitive displacement systems offering nanometer accuracy. |

|

|

Semtester Tensile Stages

|

Tensile testers specifically designed for use inside SEM (scanning electron microscopes) and light microscopes. |

|

|

Proforma 300i |

Manual, non-contact measurement of semiconductor wafer thickness, TTV and bow. |

|

|

PV 1000 |

Manual tool for measuring thickness and bow of solar wafers. |

|

|

MTI-2100 Fotonic Sensor Series

|

Fiber-optic based displacement sensor systems with high frequency response.

|

| 5 |

Marketing and Sales

MTI Instruments markets its products and services using selected and specific channels of distribution. In the Americas, for precision automated manufacturing and the R&D sectors, MTI Instruments uses a combination of direct sales and representatives. Overseas, particularly in Europe and Asia, MTI Instruments uses distributors and agents specific to our targeted end markets. For axial turbo machinery, MTI Instruments primarily sells directly to end users.

To supplement these efforts, we use both commercial and industrial search engines, targeted newsletters, purchased customer lists and participation in trade shows to identify and expand its customer base.

Product Development

MTI Instruments continuously conducts research to develop new and advance existing technologies in support of its business strategy. Along with innovation as a key hallmark to its efforts, we carefully consider a number of factors including customer needs, product or technology uniqueness, market trends, costs, the competitive landscape, and creative marketing and communications plans in developing our products. We take a customer-centered approach in order to find new ways to solve customer needs, engage with customers directly, and create a loyal customer base while offering a more compelling value proposition.

In 2014, MTI Instruments continued the commercialization efforts of its new, state-of-the-art, family of products – the Accumeasure D series. Using more than 30 years of linear displacement experience, our engineers and scientists worked hand in hand to combine capacitance principles with modern enabling digital technology – the result, an ultra precise linear displacement capacitance system with a true digital output, and a range of sensing probes to accommodate a large range of customer applications. This series of products also offers a range of unique features that allow customers the ability to quickly and easily set them up in production, thereby minimizing downtime.

Following the 2013 launch of our Microtrak 3 family of single spot laser sensors equipped with the latest CMOS technology, we strengthened our development efforts and, as a result, plan to launch the next generation Microtrak 3 plus system in early 2015 which, like the Accumeasure D series of products, emphasizes its digital capabilities and features. The new Microtrak 3 plus system has a sampling rate to 40 kilo-samples per second, providing 16bit output at full sample rate bandwidth via a USB connection – covering the majority of application in selected target markets. The last few years of product development for our optical based laser systems has proven successful – today, this series of new products have been adopted and used by some of the largest consumer electronic assembly operations in Asia.

In 2014, we also launched our brand new Microtrak LTS product, which uses all of the advancements of the Microtrak series and packages it in a convenient and easy to use system providing accurate and reliable non-contact thickness linear displacement measurements for in process applications. Additionally, we continue to invest in the development of a thread checking system as a product extension of our Accumeasure D series of products.

With investments in research and product development, we seek to achieve a competitive position by continuously advancing our technology, producing new state-of-the-art precision measurement equipment, expanding our worldwide distribution, and providing intimate customer support. Management believes that MTI Instruments’ success depends to a large extent on identifying market requirements, innovation, and utilizing our technological expertise to develop and implement new products.

Product Manufacturing & Operations

We conduct research, product development and innovation, and manufacture our products, in the United States (U.S.). We manufacture our products in the U.S. While many of our competitors have reached out and moved manufacturing operations overseas, MTI has remained a U.S. based manufacturing company. Products are conceived, developed, tested, and shipped out from our headquarters in Albany, New York.

Management believes that there are inherent advantages in keeping manufacturing in the U.S. including attenuating the risk of inadvertent technology transfer, the ability to control manufacturing quality, and a much more effective customer management and satisfaction process. We have long-term vendor relationships and believe that most raw materials used in our products are readily available from a variety of vendors.

To prepare for future growth, we have also made strides in bringing a more flexible approach to manufacturing. While cross-training in different functional areas, management has also implemented lean principles on the manufacturing floor to increase capacity, productivity and throughput, eliminate waste, and quickly adapt to larger customers demands while continuing to keep inventory levels under control. As production volumes increase, MTI now has additional capabilities in its existing, flexible manufacturing space. In 2014, MTI was able to increase its production of single point lasers more than tenfold to meet the demands of a large Asian customer with existing resources, proving its ability to effectively increase product throughput.

On April 7, 2014, the Company received ISO certification 9001:2008. The certification was authorized by TÜVRheinland®, an independent agency. To obtain certification, we underwent a rigorous five step process including preparation, documentation, implementation, internal audit, and final certification. The ISO 9001:2008 certification confirms our commitment to an effective management system and continuous improvement, a practice management believes is important for continuous growth.

| 6 |

Intellectual Property and Proprietary Rights

We rely on trade secret and copyright laws to establish and protect the proprietary rights of our products. In addition, we enter into standard confidentiality agreements with our employees and consultants and seek to control access to and distribution of our proprietary information. Even with these precautions, it may be possible for a third party to copy or otherwise obtain and use our products or technology without authorization or to develop similar technology independently. In addition, effective copyright and trade secret protection may be unavailable or limited in certain foreign countries.

Significant Customers

MTI Instruments’ largest customer is the U.S. Air Force. We also have strong relationships with companies in the electronics, aircraft, aerospace, automotive, semiconductor and research industries. The U.S. Air Force accounted for 27.9% and 27.2%, respectively, of total product revenues during 2014 and 2013. The largest commercial customer in 2014 was an Asian customer, who accounted for 8.3% of total product revenue in 2014. The largest commercial customer in 2013 was an Asian customer, who accounted for 6.8% of total product revenue in 2013.

Competition

We compete with several companies, substantially all of which are larger than MTI Instruments.

In the precision automated manufacturing market, MTI Instruments faces competition from companies including Keyence, Micro Epsilon, Schmitt Industries, Capacitec, and Lion Precision Instruments.

In axial turbo machinery, MTI Instruments competes with companies including ACES Systems and Meggitt Sensing Systems.

In R&D, competition includes companies in precision linear displacement, including Gatan, Deben, and E+H (Eichhorn+Hausmann) GmbH.

The primary competitive considerations in MTI Instruments’ markets are product quality, performance, price, timely delivery, and the ability to identify, pursue and obtain new customers. MTI Instruments believes that its employees, product development skills, sales and marketing systems and reputation are competitive advantages.

Research and Development

MTI Instruments conducts research and develops technology to support its existing products and develop new products. MTI incurred research and development costs of approximately $1.3 million in each of the years ended December 31, 2014 and 2013, which is exclusively related to MTI Instruments. We expect to continue to invest in research and development in the future at MTI Instruments as part of our growth strategy.

Employees

As of December 31, 2014, we had 35 employees including 30 full-time employees.

Factors Affecting Future Results

This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act) and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements contained, or incorporated by reference, in this Annual Report on Form 10-K that are not statements of historical fact may be forward-looking statements. When we use the words “anticipate,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” “should,” “could,” “may,” “will” and similar words or phrases, we are identifying forward-looking statements. Such forward-looking statements include, but are not limited to, statements regarding:

| 7 |

- anticipated growth in revenues and cashflows;

- management’s belief that it will have adequate resources to fund the Company’s operations and capital expenditures over at least the next twelve months;

- projected taxable income and the ability to use deferred tax assets;

- the expected impact of new accounting pronouncements;

- anticipated levels of future earnings and continued positive cash flow;

- the expectation that cost-cutting measures will be avoided;

- future capital expenditures and spending on research and development;

- needing to purchase equipment; and

- expected funding of future cash expenditures.

Forward-looking statements involve risks, uncertainties, estimates and assumptions that may cause our actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Important factors that could cause these differences include the following:

- statements with respect to management’s strategy and planned initiatives;

- sales revenue growth may not be achieved or maintained;

- the dependence of our business on a small number of customers and potential loss of government contracts - particularly in light of potential cuts that may be imposed as a result of U.S. government budget appropriations;

- our lack of long-term purchase commitments from our customers and the ability of our customers to cancel, reduce, or delay orders for our products;

- our inability to build and maintain relationships with our customers;

- our inability to develop and utilize new technologies that address the needs of our customers;

- the cyclical nature of the electronics and military industries;

- the uncertainty of the U.S. and global economy;

- the impact of future exchange rate fluctuations;

- failure of our strategic alliances to achieve their objectives or perform as contemplated and the risk of cancellation or early termination of such alliance by either party;

- the loss of services of one or more of our key employees or the inability to hire, train, and retain key personnel;

- risks related to protection and infringement of intellectual property;

- our occasional dependence on sole suppliers or a limited group of suppliers;

- our ability to generate income to realize the tax benefit of our historical net operating losses;

- risks related to the limitation of the use, for tax purposes, of our net historical operating losses in the event of certain ownership changes; and

- other risks discussed below.

Except as may be required by applicable law, we do not undertake or intend to update or revise our forward-looking statements, and we assume no obligation to update any forward-looking statements contained in, or incorporated by reference into, this Annual Report on Form 10-K as a result of new information or future events or developments. Thus, assumptions should not be made that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements.

Risk Factors

You should consider carefully the following risks, along with other information contained in this Annual Report on Form 10-K. The risks and uncertainties described below are not the only ones that may affect us. Additional risks and uncertainties also may adversely affect our business and operations including those discussed in the heading “Factors Affecting Future Results” above. Any of the following events, should they actually occur, could materially and adversely affect our business and financial results.

If we are unsuccessful at addressing our business challenges, our business and results of operations and financial condition may be adversely affected and our ability to invest in and grow our business could be limited.

In order to sustain profitability and improve liquidity, we must successfully achieve all or some combination of the following initiatives: increasing sales, developing new products, controlling operating expenses, managing our cash flows, improving operational efficiency and estimating and projecting accurately our liquidity and capital resources. In Management’s Discussion and Analysis of Financial Condition and Results of Operations — Management’s Plan, Liquidity and Capital Resources in this Annual Report on Form 10-K, we made estimates regarding our cash flow, results of operations and ability to access our existing line of credit for the year ending December 31, 2015. If our cash flow, results of operations or ability to borrow under our line of credit are less favorable than we have estimated, we may not be able to make all of our planned operating or capital expenditures or fully execute all of our other plans. Our financial success depends in part on management’s ability to execute our growth strategy. We expect that we will depend primarily on cash generated by our operations for funds to pay our expenses and any amounts due under our credit facility and any other indebtedness we may incur. Our ability to make these payments depends on our future performance, which will be affected by financial, business, economic and other factors, many of which we cannot control. Our business may not generate sufficient cash flows from operations in the future and our currently anticipated growth in revenues and cash flows may not be realized, either or both of which could result in our being unable to repay indebtedness or to fund other liquidity needs. If we do not have enough money, we may be required to sell assets or borrow money, in each case on terms that may not be acceptable to us. In addition, the terms of existing or future debt agreements, including our existing line of credit, may restrict us from adopting any of these alternatives. Further, any significant levels of indebtedness in the future could place us at a competitive disadvantage compared to our competitors that may have access to additional resources or proportionately less debt and could make us more vulnerable to economic downturns and adverse developments in our business. Any future loss incurred by the Company could have a material adverse effect on our business and our ability to generate the cash needed to operate our business. Even though we achieved profitability during 2013 and 2014, we may be unable to sustain or increase our profitability in the future. Failure to continue to implement these initiatives successfully, or the failure of such initiatives to result in improved profitability, could have a material adverse effect on our business plans, liquidity, results of operations and financial condition and may result in a downsize to the business.

| 8 |

We currently derive all of our product revenue from our MTI Instruments business.

All of our revenue is currently derived from our MTI Instruments business. We do not have a broad portfolio of other products we could rely on to support operations if we were to experience a substantial slowdown in our MTI Instruments business, which is subject to a number of risks, including:

- dependence on a limited number of customers;

- a continued slow down or cancellation of sales to the military as a result of a potential redeployment, or sequestration, of governmental funding;

- our ability to maintain, improve, or expand its channels of distribution;

- the potential failure to expand or maintain the business as a result of competition, a lack of brand awareness, or market saturation; and

- an inability to launch new products as a result of intense competition, uncertainty of new technology development, or limited or unavailable resources to fund development.

In addition, revenues from the sale of MTI Instruments’ products can vary significantly from one period to the next. We may sell a significant amount of our products to one or a few customers for various short term projects in one period, and then have markedly decreased sales in following periods as these projects end or customers have the products they require for the foreseeable future. The fact that we sell a significant amount of our products to a limited number of customers also results in a customer concentration risk. The loss of any significant portion of such customers or a material adverse change in the financial condition of any one of these customers could have a material adverse effect on our revenues, our business and our ability to generate the cash needed to operate our business.

Variability of customer requirements resulting in cancellations, reductions, or delays may adversely affect our operating results.

We are required to provide rapid product turnaround and respond to short lead times. A variety of conditions, both specific to individual customers and generally affecting the demand for OEMs’ products, may cause customers to cancel, reduce, or delay orders. Cancellations, reductions, or delays by a significant customer or by a group of customers could adversely affect our operating results. Conversely, if our customers unexpectedly and significantly increase product orders, we may be required to rapidly increase production, which could strain our resources and reduce our margins.

If we do not keep pace with technological innovations, our products may not be competitive and our revenue and operating results may suffer.

The electronic, semiconductor, solar, automotive and general industrial segments are subject to constant technological change. Our future success will depend on our ability to respond appropriately to changing technologies and changes in product function and quality. If we rely on products and technologies that are not attractive to end users, we may not be successful in capturing or retaining market share. Technological advances, the introduction of new products, and new design techniques could adversely affect our business prospects unless we are able to adapt to the changing conditions. Technological advances could render our products obsolete, and we may not be able to respond effectively to the technological requirements of evolving markets. As a result, we will be required to expend substantial funds for and commit significant resources to:

-

continue research and development activities on all product lines;

-

hire additional engineering and other technical personnel; and

-

purchase advanced design tools and test equipment.

Our business could be harmed if we are unable to develop and utilize new technologies that address the needs of our customers, or our competitors do so more effectively than we do.

We may not be able to enhance our product solutions and develop new product solutions in a timely manner.

Our future operating results will depend to a significant extent on our ability to provide new products that compare favorably with alternative solutions on the basis of time to introduction, cost, performance, and end-user preferences. Our success in attracting and retaining customers and developing business will depend on various factors, including the following:

| 9 |

-

innovative development of new products for customers;

-

utilization of advances in technology;

-

maintenance of quality standards;

-

efficient and cost-effective solutions; and

-

timely completion of the design and introduction of new products.

Our inability to develop new product solutions on a timely basis could harm our operating results and impede our growth.

Our efforts to develop new technologies may not result in commercial success and/or may result in delays in development, which could cause a decline in our revenue and could harm our business.

Our research and development efforts with respect to our technologies may not result in customer or market acceptance. Some or all of those technologies may not successfully make the transition from the research and development lab to cost-effective production as a result of technology problems, competitive cost issues, yield problems, and other factors. Even when we successfully complete a research and development effort with respect to a particular technology, our customers may decide not to introduce or may discontinue products utilizing the technology for a variety of reasons, including the following:

-

difficulties with other suppliers of components for the products;

-

superior technologies developed by our competitors and unfavorable comparisons of our solutions with these technologies;

-

price considerations; and

-

lack of anticipated or actual market demand for the products.

The nature of our business will require us to make continuing investments for new technologies. Significant expenses relating to one or more new technologies that ultimately prove to be unsuccessful for any reason could have a material adverse effect on us. In addition, any investments or acquisitions made to enhance our technologies may prove to be unsuccessful. If our efforts are unsuccessful, our business could be harmed.

The electronics and military industries are cyclical and may result in fluctuations in our operating results.

The electronics and military industries have experienced significant economic downturns at various times. These downturns are characterized by diminished product demand, accelerated erosion of average selling prices, and production overcapacity. We may seek to reduce our exposure to industry downturns by providing design and production services for leading companies in rapidly expanding industry segments. We may, however, experience substantial period-to-period fluctuations in future operating results because of general industry conditions or events occurring in the general economy.

Our operating results may experience significant fluctuations.

In addition to the variability resulting from the short-term nature of our customers’ commitments, other factors contribute to significant periodic fluctuations in our results of operations. These factors include:

-

the cyclicality of the markets we serve;

-

the timing and size of orders;

-

the volume of orders relative to our capacity;

-

product introductions and market acceptance of new products or new generations of products;

-

evolution in the life cycles of our customers’ products;

-

timing of expenses in anticipation of future orders;

-

changes in product mix;

-

availability of manufacturing and assembly services;

-

changes in cost and availability of labor and components;

-

timely delivery of product solutions to customers;

-

pricing and availability of competitive products;

-

introduction of new technologies into the markets we serve;

-

pressures on reducing selling prices;

-

our success in serving new markets; and

-

changes in economic conditions.

| 10 |

International sales risks could adversely affect our operating results. Furthermore, our operating results could be adversely affected by fluctuations in the value of the U.S. dollar against foreign currencies.

Having a worldwide distribution network for our products exposes us to various economic, political, and other risks that could adversely affect our operations and operating results, including the following:

-

unexpected changes in regulatory requirements;

-

timing to meet regulatory requirements;

-

tariffs, duties and other trade barrier restrictions;

-

greater difficulty in collecting accounts receivable;

-

the burdens and costs of compliance with a variety of foreign laws;

-

potentially reduced protection for intellectual property rights; and

-

political or economic instability in certain parts of the world.

The risks associated with international sales could negatively affect our operating results.

We transact our business in U.S. dollars and bill and collect our sales in U.S. dollars. In 2014, approximately 35.6% of our revenue was from customers outside of the United States. A weakening of the dollar could cause our overseas vendors to require renegotiation of either the prices or currency we pay for their goods and services. Similarly, a strengthening of the dollar could cause our products to be more expensive for our international customers, which could impact price and margins and/or cause the demand for our products, and thus our revenue, to decline.

In the future, customers may negotiate pricing and make payments in non-U.S. currencies. If our overseas vendors or customers require us to transact business in non-U.S. currencies, fluctuations in foreign currency exchange rates could affect our cost of goods, operating expenses, and operating margins and could result in exchange losses. In addition, currency devaluation can result in a loss to us if we hold deposits of that currency. Hedging foreign currencies can be difficult, especially if the currency is not freely traded. We cannot predict the impact that future exchange rate fluctuations may have on our operating results.

Continuing uncertainty of the U.S. and global economy may have serious implications for the growth and stability of our business.

Revenue growth and continued profitability of our business will depend significantly on the overall demand for test and measurement instrumentations in key markets including research and development, automotive, semiconductor and electronics. Softening demand in these markets caused by ongoing economic uncertainty, technological developments, competitive changes or other factors may result in decreased revenue or earnings levels. The U.S. and global economy has been historically cyclical and market conditions continue to be challenging, which has resulted in individuals and companies delaying or reducing expenditures. Further delays or reductions in spending could have a material adverse effect on demand for our products, and consequently on our business, financial condition, results of operations, prospects, stock price, and ability to continue to operate.

We depend on key personnel who would be difficult to replace, and our business will likely be harmed if we lose their services or cannot hire additional qualified personnel.

Our success depends substantially on the efforts and abilities of our senior management and key personnel. The competition for qualified management and key personnel, especially engineers, is intense. Although we maintain non-competition and non-disclosure covenants with most of our key personnel, we do not have employment agreements with most of them. The loss of services of one or more of our key employees or the inability to hire, train, and retain key personnel, especially engineers, technical support personnel, and capable sales and customer-support employees outside the United States, could delay the development and sale of our products, disrupt our business, and interfere with our ability to execute our business plan.

We may become subject to claims of infringement or misappropriation of the intellectual property rights of others, which could prohibit us from selling our products, require us to obtain licenses from third parties or to develop non-infringing alternatives, and subject us to substantial monetary damages and injunctive relief.

We may receive notices from third parties that the manufacture, use, or sale of any products we develop infringes upon one or more claims of their patents. Moreover, because patent applications can take many years to issue, there may be currently pending applications, unknown to us, that may later result in issued patents that materially and adversely affect our business. Third parties could also assert infringement or misappropriation claims against us with respect to our future product offerings, if any. We cannot be certain that we have not infringed the intellectual property rights of any third parties. Any infringement or misappropriation claim could result in significant costs, substantial damages, and our inability to manufacture, market, or sell any of our product offerings that are found to infringe. Even if we were to prevail in any such action, the litigation could result in substantial cost and diversion of resources that could materially and adversely affect our business. If a court determined, or if we independently discovered, that our product offerings violated third-party proprietary rights, there can be no assurance that we would be able to re-engineer our product offerings to avoid those rights or obtain a license under those rights on commercially reasonable terms, if at all. As a result, we could be prohibited from selling products that are found to infringe upon the rights of others. Even if obtaining a license were feasible, it may be costly and time-consuming. A court could also enter orders that temporarily, preliminarily, or permanently enjoin us from making, using, selling, offering to sell, or importing our products that are found to infringe on third parties’ intellectual property rights, or could enter orders mandating that we undertake certain remedial actions. Further, a court could order us to pay compensatory damages for any such infringement, plus prejudgment interest, and could in addition treble the compensatory damages and award attorneys’ fees. Any such payments could materially and adversely affect our business and financial condition.

| 11 |

Our confidentiality agreements with employees and others may not adequately prevent disclosure of our trade secrets and other proprietary information, which could limit our ability to compete.

We rely on trade secrets to protect our proprietary technology and processes. Trade secrets are difficult to protect. We enter into confidentiality and intellectual property assignment agreements with our employees, consultants, and other advisors. These agreements generally require that the other party keep confidential and not disclose to third parties confidential information developed by the party under such agreements or made known to the party by us during the course of the party’s relationship with us. However, these agreements may not be honored and enforcing a claim that a party illegally obtained and is using our trade secrets is difficult, expensive and time-consuming, and the outcome is unpredictable. Our failure to obtain and maintain trade secret protection could adversely affect our competitive position.

We experienced an ownership change in MTI Micro that resulted in a limitation of tax attributes relating to the use of their net operating losses, and we may experience further ownership changes in MTI which would result in a further limitation of the use of our net operating losses.

A corporation generally undergoes an “ownership change” when the ownership of its stock, by value, changes by more than 50 percentage points over any three-year testing period. In the event of an ownership change, Section 382 of the Internal Revenue Code of 1986 imposes an annual limitation on the amount of post-ownership change taxable income a corporation may offset with pre-ownership change net operating loss (NOL) carryforwards and certain recognized built-in losses.

We estimate that as of December 31, 2014, the Company and MTI Instruments have NOL carryforwards of approximately $51.2 million. Our ability to utilize the MTI NOL carryforwards, including any future NOL carryforwards that may arise, may be limited by Section 382 if we undergo any further “ownership changes” as a result of subsequent changes in the ownership of our outstanding common stock pursuant to the exercise of MTI options outstanding, additional financings obtained, or otherwise.

Item 1B: Unresolved Staff Comments

Not applicable.

We lease approximately 17,400 square feet of office, manufacturing and research and development space at 325 Washington Avenue Extension, Albany, NY 12205. The current lease agreement expires on November 30, 2019. We believe our facilities are generally well maintained and adequate for our current needs and for expansion, if required.

At any point in time, we may be involved in various lawsuits or other legal proceedings. Such lawsuits could arise from the sale of products or services or from other matters relating to our regular business activities, compliance with various governmental regulations and requirements, or other transactions or circumstances. We do not believe there are any such proceedings presently pending that could have a material effect on our business, financial condition or results of operations.

Item 4: Mine Safety Disclosure

Not applicable.

| 12 |

(a)

Market Information

Our common stock is quoted on the OTC Markets Group quotation system (OTCQB: MKTY) on the OTCQB venture stage marketplace for early stage and developing U.S. and international companies. We are current in our reporting and undergo an annual verification and management certification process. Investors can find Real-Time quotes and market information for the Company on www.otcmarkets.com. The following table sets forth the high and low bid information for our common stock as reported on the OTC Market Group quotation system for the periods indicated:

|

|

High |

|

Low |

||

|

Fiscal Year Ended December 31, 2014 |

|

|

|

|

|

|

First Quarter |

$ |

1.83 |

|

$ |

.88 |

|

Second Quarter |

|

1.66 |

|

|

1.01 |

|

Third Quarter |

|

1.38 |

|

|

.90 |

|

Fourth Quarter |

|

1.18 |

|

|

.64 |

|

|

|

|

|

|

|

|

Fiscal Year Ended December 31, 2013 |

|

|

|

|

|

|

First Quarter |

$ |

.39 |

|

$ |

.11 |

|

Second Quarter |

|

.70 |

|

|

.22 |

|

Third Quarter |

|

1.65 |

|

|

.49 |

|

Fourth Quarter |

|

1.08 |

|

|

.75 |

Holders

We have one class of common stock, par value $.01, and are authorized to issue 75,000,000 shares of common stock. Each share of the Company’s common stock is entitled to one vote on all matters submitted to stockholders. As of December 31, 2014, there were 5,258,883 shares of common stock issued and outstanding. As of February 18, 2015, there were approximately 216 shareholders of record of the Company’s common stock. The number of shareholders of record does not reflect the number of persons whose shares are held in nominee or “street” name accounts through brokers.

Dividends

We have never declared or paid dividends on our common stock and do not anticipate or contemplate paying cash dividends on our common stock in the foreseeable future. We currently intend to use all available funds to develop our business. We can give no assurances that we will ever have excess funds available to pay dividends. Any future determination as to the payment of dividends will depend upon critical requirements and limitations imposed by our credit agreements, if any, and such other factors as our board of directors may consider.

Item 6: Selected Financial Data

Not applicable.

| 13 |

Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with our Consolidated Financial Statements and the related notes included elsewhere in this Annual Report. This discussion contains forward-looking statements, which involve risk and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of certain factors, including those discussed in Item 1A: “Risk Factors” and elsewhere in this Annual Report.

Overview

MTI’s core business is conducted through MTI Instruments, Inc., a wholly-owned subsidiary and the sole component of the Company’s Test and Measurement Instrumentation segment. The Company also operated in a New Energy segment with business conducted through MTI MicroFuel Cells, Inc. until December 31, 2013 (date of MTI Micro deconsolidation). In August 2014, its management changed MTI Micro’s name to MeOH Power, Inc. MTI continues to retain our equity ownership in that entity as discussed below. However, to keep prior and future filings consistent, MTI will continue to refer to this entity as MTI Micro in its reports.

Test and Measurement Instrumentation Segment – MTI Instruments is a supplier of precision linear displacement solutions, vibration measurement and system balancing solutions, precision tensile measurement systems and wafer inspection tools, serving markets that require 1) the precise measurements and control of products and processes in automated manufacturing, assembly, and consistent operation of complex machinery, 2) metrology tools for semiconductor and solar wafer characterization, tensile stage systems for materials testing and precision linear displacement gauges all for use in academic and industrial research and development settings, and 3) engine balancing and vibration analysis systems for both military and commercial aircraft.

We are continuously working on ways to increase our sales reach, including expanded worldwide sales coverage and enhanced internet marketing.

New Energy Segment – MTI Micro had been developing an off-the-grid power solution for various portable electronic devices. Its patented proprietary direct methanol fuel cell technology platform converts methanol fuel to usable electricity capable of providing continuous power, as long as necessary fuel flows are maintained. We are no longer active in this segment as of December 31, 2013.

Recent Developments

On April 7, 2014, MTI Instruments received International Organization for Standardization (ISO) ISO 9001:2008 certification, an internationally recognized standard issued to organizations with a quality management system. The certification was authorized by TÜVRheinland®, a premier global provider of independent testing and certification services with 15 locations throughout North America. ISO certification, in many cases, is a pre-requisite for vendors to establish relationships with large OEMs – an important set of customers for MTI Instruments.

The Mechanical Technology, Incorporated 2014 Equity Incentive Plan (the 2014 Plan) was adopted by the Company’s Board of Directors on March 12, 2014 and approved by its stockholders on June 11, 2014. The 2014 Plan provides an initial aggregate number of 500,000 shares of common stock that may be awarded or issued. The number of shares that may be awarded under the 2014 Plan and awards outstanding may be subject to adjustment on account of any stock dividend, spin-off, stock split, reverse stock split, split-up, recapitalization, reclassification, reorganization, combination or exchange of shares, merger, consolidation, liquidation, business combination, exchange of shares or the like. Under the 2014 Plan, the Board-appointed administrator of the 2014 Plan is authorized to issue stock options (incentive and nonqualified), stock appreciation rights, restricted stock, restricted stock units, phantom stock, performance awards and other stock-based awards to employees, officers and directors of, and other individuals providing bona fide services to or for, the Company or any affiliate of the Company. Incentive stock options may only be granted to employees of the Company and its subsidiaries. As of December 31, 2014, 102,000 option awards have been issued under the 2014 Plan.

Results of Operations

Results of Operations for the Year Ended December 31, 2014 Compared to the Year Ended December 31, 2013.

Test and Measurement Instrumentation Segment

Product Revenue: Product revenue consists of revenue recognized from the Test and Measurement Instrumentation product lines.

Product revenue in our Test and Measurement Instrumentation segment for the year ended December 31, 2014 increased by $429 thousand, or 5.1%, to $8.8 million in 2014 from $8.4 million in 2013. This increase in product revenue was attributable to an increase in both instruments for automated manufacturing and engine vibration and balancing system activity under government contracts as noted below. For the year ended December 31, 2014, the largest commercial customer for the segment was an Asian customer, which accounted for 8.3% of annual product revenue. In 2013, the largest commercial customer for the segment was an Asian customer, which accounted for 6.8% of annual product revenue. The U.S. Air Force was the largest government customer for the years ended December 31, 2014 and 2013, and accounted for 27.9% and 27.2%, respectively of annual product revenue.

| 14 |

Information regarding government contracts included in product revenue is as follows:

|

(Dollars in thousands) |

|

|

Revenues for the Year Ended |

|

Contract Revenues to Date Date |

|

Total Contract Orders Received To Date |

|||||||

|

|

|

|

December 31, |

|

December 31, |

|

December 31, |

|||||||

|

Contract(1) |

Expiration |

|

2014 |

|

2013 |

|

2014 |

|

2014 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$6.5 million U.S. Air Force Maintenance |

09/27/2014 |

(2) |

|

$ |

731 |

|

$ |

863 |

|

$ |

5,001 |

|

$ |

5,001 |

|

$4.1 million U.S. Air Force Systems |

08/29/2015 |

(2) |

|

$ |

1,539 |

|

$ |

399 |

|

$ |

2,793 |

|

$ |

2,793 |

|

$917 thousand U.S. Air Force Kit |

09/30/2014 |

(2) |

|

$ |

__ |

|

$ |

585 |

|

$ |

769 |

|

$ |

769 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________________

|

(1) |

Contract values represent maximum potential values at time of contract placement and may not be representative of actual results. |

|

|

(2) |

Date represents expiration of contract, including the exercise of option extensions. |

Cost of Product Revenue: Cost of product revenue includes the direct material and labor cost as well as an allocation of overhead costs that relate to the manufacturing of products we sell. In addition, cost of product revenue also includes the labor and material costs incurred for product maintenance, replacement parts and service under our contractual obligations.

Cost of product revenue in our Test and Measurement Instrumentation segment for the year ended December 31, 2014 increased by $30 thousand, or 0.9%, remaining at $3.3 million in both 2014 and 2013. This increase was primarily as a result of the increased sales as discussed above under Product Revenue, partially offset by lower product material costs and improved inventory management. Gross profit, as a percentage of product revenue, increased to 62.6% in 2014 compared to 61.0% in 2013 due to the composition of the product sales mix and lower product material costs.

Unfunded Research and Product Development Expenses: Unfunded research and product development expenses (meaning research and development that we conduct that is not reimbursed by customers) includes the costs of materials to build development and prototype units, cash and non-cash compensation and benefits for the engineering and related staff, expenses for contract engineers, fees paid to outside suppliers for subcontracted components and services, fees paid to consultants for services provided, materials and supplies consumed, facility related costs such as computer and network services, and other general overhead costs associated with our research and development activities.

Unfunded research and product development expenses in our Test and Measurement Instrumentation segment for the year ended December 31, 2014 increased by $26 thousand, or 2.0%, remaining at $1.3 million in both 2014 and 2013. This increase was due to higher labor costs.

Selling, General and Administrative Expenses: Selling, general and administrative expenses includes cash and non-cash compensation, benefits and related costs in support of our general corporate functions, including general management, finance and accounting, human resources, selling and marketing, information technology and legal services.

Selling, general and administrative expenses in our Test and Measurement Instrumentation segment for the year ended December 31, 2014 increased by $213 thousand, or 10.4%, to $2.3 million in 2014 from $2.1 million in 2013. This increase is the result of additional staffing in the sales department, increased international travel and higher promotional spending.

New Energy Segment

Selling, General and Administrative Expenses: Selling, general and administrative expenses in our New Energy segment for the year ended December 31, 2013 were $89 thousand. As of December 31, 2013, the Company no longer reported the New Energy segment as a VIE and therefore there were no expenses related to this segment in 2014. Refer to the Consolidated Financial Statements Note 2 regarding the deconsolidation of the VIE.

MTI Parent – Corporate Entity

Selling, General and Administrative Expenses: Selling, general and administrative expenses incurred by the Corporate Entity for the year ended December 31, 2014 increased by $45 thousand, or 3.6%, remaining at $1.3 million in both 2014 and 2013. This increase is primarily the result of increased compensation benefits partially offset by consulting costs incurred during 2013 in connection with the termination of the Company’s former Chief Executive Officer, in 2012, for which there was no corresponding expense in 2014.

| 15 |

Results of Consolidated Operations

Operating Income: Operating income for the year ended December 31, 2014 was $565 thousand compared to $361 thousand in 2013. The change in operating income was a result of the factors noted above, primarily the increase in product revenue and the composition of the product sales mix.

Gain on Variable Interest Entity Deconsolidation: Gain on variable interest entity deconsolidation was $3.6 million for the year ended December 31, 2013. As of December 31, 2013, the Company no longer reported MTI Micro as a VIE and the removal of the associated non-controlling interest from MTI’s consolidated equity triggered this one-time gain. Refer to the Consolidated Financial Statements Note 2 regarding the deconsolidation of the VIE.

Other Income (Expense): Other income for the year ended December 31, 2014 was $135 thousand compared to other expense of $366 thousand in 2013. The increase in other income of $501 thousand primarily relates to the $380 thousand allowance recorded on a related party note receivable with MTI Micro in 2013 and a $122 thousand reduction of the allowance during 2014 for funds received in 2014 and early 2015 related to New York State tax refunds.

Income Tax Benefit (Expense): Income tax benefit for the year ended December 31, 2014 was $40 thousand and income tax expense for the year ended December 31, 2013 was $35 thousand. Our income tax rate for the years ended December 31, 2014 and 2013 was (6)% and 1%, respectively. The year ended December 31, 2014 income tax benefit consists primarily of a $210 thousand New York State tax refund and $165 thousand in tax expense related to the utilization of our deferred tax assets. The year ended December 31, 2013 income tax expense consists of minimal state tax expense of under $1 thousand and $35 thousand in deferred tax expense related to the utilization of our deferred tax assets and an increase in the valuation allowance.

Net Loss Attributed to Non-Controlling Interests (of MTI Micro): The net loss attributed to non-controlling interests for the year ended December 31, 2013 was $75 thousand. As of December 31, 2013, the Company no longer reported the New Energy segment as a VIE. Refer to the Condensed Consolidated Financial Statements Note 2 regarding the deconsolidation of the VIE.

Net Income: Net income for the year ended December 31, 2014 was $740 thousand compared to net income of $3.7 million for the same period in 2013. The decrease in net income of $3.0 million for the year ended December 31, 2014 as compared to the same period in 2013 is primarily attributable to the $3.6 million gain on variable interest entity deconsolidation in 2013.

Management’s Plan, Liquidity and Capital Resources

Several key indicators of our liquidity are summarized in the following table:

|

(Dollars in thousands) |

Years Ended December 31, |

|

||||||

|

|

2014 |

|

2013 |

|

||||

|

Cash |

$ |

1,923 |

|

|

$ |

1,211 |

|

|

|

Working capital |

|

2,763 |

|

|

|

1,771 |

|

|

|

Net income attributed to MTI |

|

740 |

|

|

|

3,654 |

|

|

|

Net cash provided by operating activities |

|

686 |

|

|

|

1,017 |

|

|

|

Purchase of property, plant and equipment |

|

(77 |

) |

|

|

(108 |

) |

|

The Company has historically incurred significant losses, until 2012 the majority stemming from the direct methanol fuel cell product development and commercialization programs of MTI Micro, and had a consolidated accumulated deficit of $117.8 million as of December 31, 2014. During the year ended December 31, 2014, the Company generated net income attributed to MTI of $740 thousand, had cash provided by operating activities totaling $686 thousand and had working capital of $2.8 million at December 31, 2014. Management believes that the Company currently has adequate resources to avoid cost cutting measures that could adversely affect the business. As of December 31, 2014, we had no debt, $5 thousand in outstanding commitments for capital expenditures and approximately $1.9 million of cash available to fund our operations.

If production levels rise at MTI Instruments, additional capital equipment may be required in the foreseeable future. We expect to spend approximately $400 thousand on capital equipment and $1.5 million in research and development on MTI Instruments’ products during 2015. We expect to finance any future expenditures and continue funding our operations from our current cash position and our projected 2015 cash flow pursuant to management’s current plan. We may also seek to supplement our resources through sales of stock or assets. Besides the Company’s line of credit, the Company has no other commitments for funding future needs of the organization at this time and such additional financing during 2015, if required, may not be available to us on acceptable terms or at all.

| 16 |

While it cannot be assured, management believes that, due in part to our current working capital level, recent replacements in sales staff, improved inventory management and stabilized spending, the Company should continue the positive cash flows that it experienced during 2014 and 2013 to fund the Company’s active operations for the foreseeable future. However, if revenue estimates are delayed or missed, the Company may need to implement additional steps to ensure liquidity including, but not limited to, the deferral of planned capital spending and/or delaying existing or pending product development initiatives. Such steps, if required, could potentially have a material and adverse effect on our business, results of operations and financial condition.

Line of Credit

On May 5, 2014, the Company entered into a new revolving line of credit with Bank of America, N.A. (the Bank) to replace MTI Instruments’ line of credit as discussed below. The Company may borrow under the line of credit from time to time up to $1 million to support its working capital needs. The line of credit is available until July 31, 2015 and may be renewed subject to all the terms and conditions as set forth in the Loan Agreement (the Loan). The Loan is payable no later than the expiration date of the Loan, currently July 31, 2015, and interest is payable on the last day of each month beginning on May 30, 2014 and until payment has been made in full. The interest rate on funds borrowed under the line of credit is equal to the LIBOR Daily Floating Rate plus 2.75%. The Loan is secured by equipment and fixtures, inventory and receivables owned by the Company and guaranteed by MTI Instruments. The Company is required to hold a balance of $0 for 30 consecutive days during the period from May 5, 2014 through July 31, 2015, and each subsequent one-year period of the Loan, if any. Upon the occurrence of an event of default, the Bank may set off against our repayment obligations any amounts we maintain at the Bank. The Company is also subject to other restrictions as set forth in the Loan. As of December 31, 2014, there were no amounts outstanding under the line of credit.

On September 20, 2011, MTI Instruments entered into a working capital line of credit with First Niagara Bank, N.A. Under this agreement, MTI Instruments could borrow from time to time up to $400 thousand to support its working capital needs. The note was payable upon demand, and the interest rate on the note was equal to the prime rate with a floor of 4.0% per annum. The note was secured by a lien on all of the assets of MTI Instruments and was guaranteed by the Company. The line of credit was renewed on September 23, 2013 and expired on June 30, 2014. Under this line of credit, MTI Instruments was required to maintain a line balance of $0 for 30 consecutive days during each calendar year. As of December 31, 2013, there were no amounts outstanding under the line of credit.

Backlog, Inventory and Accounts Receivable

At December 31, 2014, the Company’s order backlog was $665 thousand, compared to $198 thousand at December 31, 2013. The increase in backlog was due to additional capacitance and fiber-optic products, along with a wafer metrology tool, in process at the end of the year.

Our inventory turnover ratios and average accounts receivable days outstanding for the years ended December 31, 2014 and 2013 and their changes are as follows:

|

|

Years Ended December 31, |

|

|

|||

|

|

2014 |

|

2013 |

|

Change |

|

|

Inventory turnover |

3.9 |

|

3.8 |

|

|

0.1 |

|

Average accounts receivable days outstanding |

39 |

|

42

|

|

|

(3) |

The improvement in inventory turns is due to a 7% decrease in average inventory balances on 5% higher sales during the comparable periods.

The average accounts receivable days’ outstanding decreased three days in 2014 compared with 2013 due to the increase in sales to the U.S. Government, which pays within 30 days.

Off-Balance Sheet Arrangements

We have no off balance sheet arrangements.

Critical Accounting Policies and Significant Judgments and Estimates

The prior discussion and analysis of our financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. Note 2 of the Consolidated Financial Statements included in this Annual Report on Form 10-K includes a summary of our most significant accounting policies. The preparation of these consolidated financial statements requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue, expenses, and related disclosure of assets and liabilities. On an ongoing basis, we evaluate our estimates and judgments, including those related to revenue recognition, inventories, income taxes and share-based compensation. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. Periodically, our management reviews our critical accounting estimates with the Audit Committee of our Board of Directors.

| 17 |

The significant accounting policies that we believe are most critical to aid in fully understanding and evaluating our consolidated financial statements include the following: