Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Forestar Group Inc. | earningsfy148-k.htm |

| EX-99.1 - EX 99.1 PRESS RELEASE - Forestar Group Inc. | exh991forreleasefy14.htm |

Fourth Quarter & Full Year 2014 Financial Results March 5, 2015

Notice to Investors This presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. These statements reflect management’s current views with respect to future events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our actual results to differ significantly from the results discussed in the forward-looking statements, including but not limited to: general economic, market, or business conditions; changes in commodity prices; opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses including development costs; demand for new housing, including impacts from mortgage credit rates or availability; lengthy and uncertain entitlement processes; cyclicality of our businesses; accuracy of accounting assumptions; competitive actions by other companies; changes in laws or regulations; and other factors, many of which are beyond our control. Except as required by law, we expressly disclaim any obligation to publicly revise any forward-looking statements contained in this presentation to reflect the occurrence of events after the date of this presentation. This presentation includes Non-GAAP financial measures. The required reconciliation to GAAP financial measures can be found as an exhibit to this presentation and on our website at www.forestargroup.com. 2

Focused On Delivering Shareholder Value in 2014 Delivering Record Real Estate Segment EBITDA of $100 Million Growing Oil and Gas Production and Reserves 20% Repurchasing almost $25 million of common stock Adding Two New Directors To The Board Proposing To Declassify Board of Directors Evaluating Strategic Alternatives To Enhance Shareholder Value Including Review of Oil and Gas Business 3

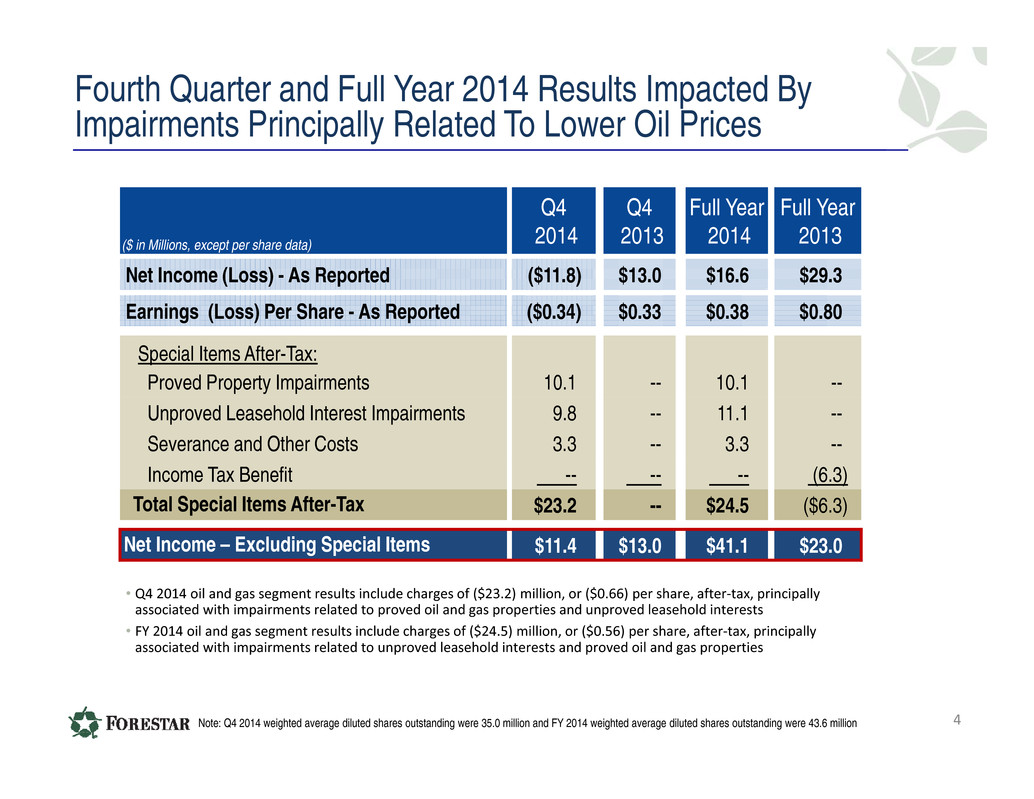

Fourth Quarter and Full Year 2014 Results Impacted By Impairments Principally Related To Lower Oil Prices 4 ($ in Millions, except per share data) Q4 2014 Q4 2013 Full Year 2014 Full Year 2013 Net Income (Loss) - As Reported ($11.8) $13.0 $16.6 $29.3 Earnings (Loss) Per Share - As Reported ($0.34) $0.33 $0.38 $0.80 Special Items After-Tax: Proved Property Impairments 10.1 -- 10.1 -- Unproved Leasehold Interest Impairments 9.8 -- 11.1 -- Severance and Other Costs 3.3 -- 3.3 -- Income Tax Benefit -- -- -- (6.3) Total Special Items After-Tax $23.2 -- $24.5 ($6.3) Net Income – Excluding Special Items $11.4 $13.0 $41.1 $23.0 • Q4 2014 oil and gas segment results include charges of ($23.2) million, or ($0.66) per share, after‐tax, principally associated with impairments related to proved oil and gas properties and unproved leasehold interests • FY 2014 oil and gas segment results include charges of ($24.5) million, or ($0.56) per share, after‐tax, principally associated with impairments related to unproved leasehold interests and proved oil and gas properties Note: Q4 2014 weighted average diluted shares outstanding were 35.0 million and FY 2014 weighted average diluted shares outstanding were 43.6 million

Delivering Record Real Estate Segment Results Segment Earnings (Loss) Q4 2014 Q4 2013 Full Year 2014 Full Year 2013 Real Estate $30.0 $27.7 $96.9 $68.4 Oil and Gas (39.0) 1.0 (22.7) 18.9 Other Natural Resources 3.3 3.7 5.5 6.5 Total Segment Earnings (Loss) ($5.7) $32.4 $79.7 $93.8 • Q4 2014 real estate segment results include $7.6 million in earnings from the sale of over 8,400 acres of timberland and a $6.6 million gain associated with $46.5 million in bond proceeds from the Cibolo Canyons Special Improvement District • Q4 2014 oil and gas segment results include charges of ($35.7) million principally associated with impairments related to proved oil and gas properties ($15.5 million), unproved leasehold interests ($15.1 million) and other costs ($5.1 million) • FY 2014 oil and gas segment results include charges of ($37.7) million principally associated with impairments related to unproved leasehold interests ($17.1 million), proved oil and gas properties ($15.5 million) and other costs ($5.1 million) • Other natural resources segment results include a $2.7 million and $3.4 million gain in Q4 and FY 2014 and a $3.8 million gain in Q4 and FY 2013 related to the termination of a timber lease in connection with land sales from the Ironstob venture 5 ($ in Millions)

Morgan Farms - Tennessee

1,707 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 0 500 1,000 1,500 2,000 2,500 3,000 3,500 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Est.Bulk Lot Sales Lot Sales Average Lot Margin Average Lot Margin Excl. Bulk Sales Delivering Higher Lot Margins and Increasing Lot Profits Annual Lot Sales and Average Lot Margin Note: Includes ventures 1,060 642 804 1,117 1,365 1,883 2,343 FOR Share of Total Lot Gross Profit ($ in millions) $30 $52 $0 $10 $20 $30 $40 $50 $60 2006 2007 2008 2009 2010 2011 2012 2013 2014 FOR Share of Total Lot Gross Profit A v e r a g e L o t M a r g i n 7 ~1,900 Recognizing and Responsibly Delivering The Greatest Value From Every Acre - FOR Share of Total Lot Profit Up >70% vs. 2006 Despite 33% Lower Sales Volume 3,539

Lower Oil Prices Expected to Slow Texas Job Growth, But Real Estate Markets Well Positioned With Low Housing Inventories and Increased Affordability 8 Texas Market Summary • Texas markets expected to experience slower job growth with recent decline in oil prices • Energy industry = 2.9% of TX employment • Housing inventories remain below equilibrium • Texas markets remain very affordable relative to U.S. averages • FOR communities located in areas of favorable job growth and housing demand • <10% of FOR total real estate investment located in Houston Forestar Texas and Houston Exposure Texas Housing Inventories Below Equilibrium ($ in millions) Texas Houston Community Development Projects 45 11 Pipeline: Acres 9,113 4,939 Residential Lots 23,146 3,729 Investment $279 $51 Multifamily & Income Producing Projects 6 1 Units 1,859 360 Investment $148 $9 Undeveloped Land $3 $3 Total Investment $430 $63 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 0 5,000 10,000 15,000 20,000 25,000 30,000 Housing Inventory Months of Supply Equilibrium M o n t h s o f S u p p l y N e w H o m e I n v e n t o r i e s

Delivering Record Real Estate Earnings $96.9 $68.4 $26.0 $19.5 $7.0 $1.4 ($11.9) ($11.3) ($2.2) $0 $25 $50 $75 $100 $125 FY 2013 Gain on Asset Purchase, Exchange and Sale Undeveloped Land Sales Lot Sales Asset Impairments Residential & Commercial Tract Sales Multifamily and Income Producing Properties Opex FY 2014 Segment Earnings Reconciliation FY 2013 vs. FY 2014 ($ in millions) FY 2014 Highlights • Exchanged 10,000 acres of timber leases into ownership of 5,400 acres of land, generating $10.5 million gain • Acquired partner’s interest in Eleven venture for $21.5 million, generating $7.6 million gain • Received $60 million from Cibolo Canyons Special Improvement District, generating $6.6 million gain FY 2014 Sales Activity • Undeveloped Land – 22,137 acres • Almost $2,200 per acre • Residential Lots – 2,343 lots, up 24% vs. 2013 • Total residential lot gross profit = $60 million • $30,000 gross profit per lot - up 17% vs. 2013* • Residential Tracts – 944 acres • > $8,500 per acre • Commercial Tracts – 32 acres • > $258,600 per acre 9Note: FY 2014 multifamily results include ($5.1) million in charges principally associated with additional costs at Denver multifamily project Note: Includes ventures * Excluding bulk lot sales

Real Estate - Accelerating Value Realization $1.5 ($12.4)$27.7 $7.9 $4.6 $1.9 ($0.8) ($0.4) $30.0 $0 $10 $20 $30 $40 $50 Q4 2013 Gain on Asset Purchase, Exchange and Sale Undeveloped Land Sales Multifamily and Income Producing Properties Asset Impairments Residential & Commercial Tract Sales Lot Sales Opex Q4 2014 Segment Earnings Reconciliation Q4 2013 vs. Q4 2014 ($ in millions) Q4 2014 Highlights • Received $55 million from Cibolo Canyons Special Improvement District, generating $6.6 million gain • Generated $1.3 million gain on sale of land purchase contract near Charlotte Q4 2014 Sales Activity • Undeveloped Land – 8,963 acres • Average $2,100 per acre • Residential Lots – 509 lots • > $71,700 average price per lot • > $35,700 gross profit per lot - up 29% vs Q4 2013* • Residential Tracts – 26 acres • > $54,800 per acre • Commercial Tracts – 25 acres • > $227,400 per acre 10 Note: Includes ventures Note: Q4 2014 multifamily results include almost ($1.0) million in charges principally associated with additional costs at Denver multifamily project * Excluding bulk lot sales

Cibolo Canyons – Accelerating Value Realization Cibolo Canyons Community Cibolo Canyons - Cumulative Cash Flows YE 2014 11 • 2,800 acre master plan community - San Antonio • 1st and 2nd move-up, custom, active adult, multifamily and condominium products Cibolo Canyons Special Improvement District (CCSID) Payments to Forestar ($ in millions) Investment Received Future 2015 – 2034 Infrastructure Reimbursement $66 $34 $32** HOT & Sales and Use Tax*** 43 66 35 Total $109 $100 $67 Lot Sales + Tract Sales + CCSID Payments Cibolo Canyons Project Mix Sold Remaining Total Residential Lots 911 858 1,769 Commercial Acres 130* 56 153 *Includes 33 acres of commercial tracts sold in 2013, which are now available for sale at YE 2014, due to foreclosure **Excludes interest ***Assumes no growth in HOT and Sales and Use tax collections through 2034 Peak Investment = $108 million Note: Based on estimates, actual results may vary 20342005

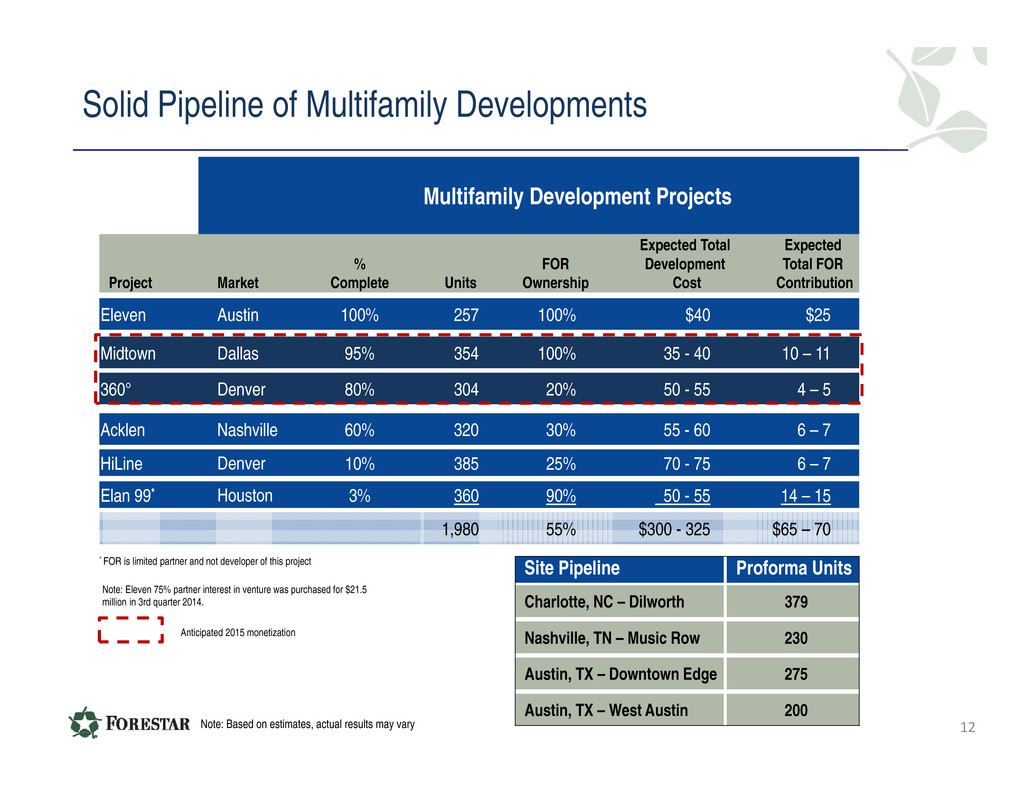

Solid Pipeline of Multifamily Developments Multifamily Development Projects Project Market % Complete Units FOR Ownership Expected Total Development Cost Expected Total FOR Contribution Eleven Austin 100% 257 100% $40 $25 Midtown Dallas 95% 354 100% 35 - 40 10 – 11 360° Denver 80% 304 20% 50 - 55 4 – 5 Acklen Nashville 60% 320 30% 55 - 60 6 – 7 HiLine Denver 10% 385 25% 70 - 75 6 – 7 Elan 99* Houston 3% 360 90% 50 - 55 14 – 15 1,980 55% $300 - 325 $65 – 70 Site Pipeline Proforma Units Charlotte, NC – Dilworth 379 Nashville, TN – Music Row 230 Austin, TX – Downtown Edge 275 Austin, TX – West Austin 200 * FOR is limited partner and not developer of this project Note: Eleven 75% partner interest in venture was purchased for $21.5 million in 3rd quarter 2014. Anticipated 2015 monetization 12Note: Based on estimates, actual results may vary

Real Estate Business Well Positioned $0 $20 $40 $60 $80 $100 $120 $140 $160 2011 2012 2013 2014 T o t a l R e v e n u e s ( $ i n m i l l i o n s ) Residential Lots Residential Tracts Commercial Tracts Income Producing Forestar Real Estate Revenues (Excluding Timberland & Multifamily Revenues) Note: Includes consolidated ventures, but excludes mitigation credit sales Accelerating Value Realization • Capitalizing on housing recovery by driving lot sales, residential tract sales and margins • Almost 1,300 residential lots under contract • Marketing $25 million of commercial tracts (~69 acres) • Growing residential and multifamily development portfolio through strategic and disciplined acquisitions • 2014 Acquisitions • 5 community sites – 850 planned lots • Partner’s interest in Lantana – 650 planned lots • 3 multifamily sites – 700 planned units • Building solid pipeline of multifamily properties • 6 projects - 1,980 units stabilized or under construction • 4 development sites in pipeline • 2 communities positioned for sale in 2015 13

Georgia

Harvesting Value From Timberland and Water Rights $6.5 ($3.5) $1.3 ($0.4) $1.6 $5.5 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 FY 2013 Operating Expenses Water Sales Fiber Sales Gain on Termination of Timber Lease FY 2014 S e g m e n t E a r n i n g s Segment Earnings Reconciliation FY 2013 vs. FY 2014 ($ in millions) Segment Earnings Reconciliation Q4 2013 vs. Q4 2014 ($ in millions) $3.7 $0.1 ($1.1) ($0.1) $0.7 $3.3 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 Q4 2013 Operating Expenses Water Sales Gain on Termination of Timber Lease Fiber Sales Q4 2014 S e g m e n t E a r n i n g s FY 2014 Highlights • Sold almost 330,000 tons of fiber, down nearly 46% vs. 2013 due to lower harvest activity • Average pricing $14.93 per ton, up ~5% vs. 2013 • $3.4 million gain on termination of timber lease • $1.1 million in revenue from groundwater reservation agreement and $0.2 million gain on sale of water rights near Denver Q4 2014 Highlights • Sold nearly 72,000 tons of fiber, 22% lower vs. Q4 2013 due to lower harvest activity • Average fiber pricing $13.22 per ton, down 5% vs. Q4 2013 due to higher mix of pulpwood • $2.7 million gain on termination of timber lease 15Note: Includes venturesQ4 & FY 2013 segment results include a $3.8 million gain associated with partial termination of a timber lease in connection with the sale of 2,400 acres from Ironstob venture near Atlanta

The Bakken - North Dakota The Bakken - North Dakota

Working Interest Investments and Asset Sales Drive Higher EBITDAX $18.9 $7.2 ($32.2) $25.5 ($16.8) ($8.1) ($6.6) ($6.1) ($4.5) ($22.7)($30.0) ($20.0) ($10.0) $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 FY 2013 Working Interest Volume Gain on Sales Impairments Working Interest Cost of Sales Working Interest Pricing Exploration Costs Legacy Minerals Operating Expenses FY 2014 S e g m e n t E a r n i n g s ( L o s s ) Segment Earnings (Loss) Reconciliation FY 2013 vs. FY 2014 ($ in millions) Segment EBITDAX Reconciliation FY 2013 vs. FY 2014 ($ in millions) $49.4 $48.3 $25.5 ($8.1) ($32.2) $7.2 ($6.6) ($16.8) ($6.1)($4.5) $56.1 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 FY 2013 DD&A Working Interest Volume Gain on Sales Impairments Working Interest Cost of Sales Working Interest Pricing Exploration Costs Legacy Minerals Operating Expenses FY 2014 S e g m e n t E B I T D A X FY 2014 Highlights • Production of almost 1.3 MMBOE, up 21% vs. FY 2013 • Working interest oil volume up nearly 53% vs. FY 2013* • Avg. working interest oil price down nearly 12% vs. FY 2013* • Royalty interest volume down 20% vs. FY 2013, and lower lease bonus and delay rental revenues and higher costs negatively impacted segment earnings by $6.1 million • 3,905 fee mineral acres leased to third parties for $320/acre • Received nearly $17.7 million in proceeds from sale of oil and gas properties primarily in Oklahoma and North Dakota, generating gains of $8.5 million • $37.7 million in charges principally related to impairments of unproved leasehold interests and proved oil and gas properties Note: EBITDAX = segment earnings before interest and taxes, plus depreciation, depletion, amortization, impairments, geological, geophysical, seismic and dry hole costs. EBITDAX is a Non-GAAP financial measure. The reconciliation between GAAP and Non- GAAP financial measures is included in the appendix to this presentation and provided on the company’s investor relations website. 17 * Note: Oil volumes and prices include NGL’s **Other costs principally include severance, legal and other expenses DD&A includes impairments Charges (Pre-Tax) ($ in millions) FY 2014 Unproved Leasehold Interest Impairments $17.1 Proved Properties Impairments 15.5 Other Costs** 5.1 Total Charges $37.7

Non-Cash Asset Impairments Driven By Lower Oil Prices Result in Fourth Quarter Segment Loss $1.0 ($30.1) $0.7 ($2.5) ($2.2) ($4.7) ($39.0)($1.8) ($50.0) ($40.0) ($30.0) ($20.0) ($10.0) $0.0 $10.0 Q4 2013 Working Interest Volumes Exploration Costs Impairment Costs Working Interest Pricing Working Interest Cost of Sales Operating Expenses Legacy Minerals Gain on Sales Q4 2014 S e g m e n t E a r n i n g s ( L o s s ) ($6.0) $6.6 $12.6 $32.4 $6.6 ($2.2) ($6.0) ($30.1) ($2.5) ($4.7) $5.0 ($1.8)$0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 Q4 2013 DD&A Working Interest Volumes Exploration Costs Impairment Costs Working Interest Pricing Working Interest Cost of Sales Operating Expenses Legacy Minerals Gain on Sales Q4 2014 S e g m e n t E B I T D A X $0.7 Segment Earnings (Loss) Reconciliation Q4 2013 vs. Q4 2014 ($ in millions) Segment EBITDAX Reconciliation Q4 2013 vs. Q4 2014 ($ in millions) Note: EBITDAX = segment earnings before interest and taxes, plus depreciation, depletion, amortization, impairments geological, geophysical, seismic and dry hole costs. EBITDAX is a Non-GAAP financial measure. The reconciliation between GAAP and Non- GAAP financial measures is included in the appendix to this presentation and provided on the company’s investor relations website. Q4 2014 Highlights • Working interest oil volume up 48% vs. Q4 2013* • Avg. oil price down over 30% vs. Q4 2013* • Royalty interest volume down 11% vs. Q4 2013 • 6 Bakken wells IP in Q4 2014 • Average 6% working interest • Average ~2,700 BOEPD initial production • 20 Bakken/Three Forks gross wells waiting on completion with average 10% working interest • $35.7 million in charges principally related to impairments of proved oil and gas properties and unproved leasehold interests 18 * Note: Oil volumes and prices include NGL’s **Other costs principally include severance, legal and other expenses Charges (Pre-Tax) ($ in millions) Q4 2014 Proved Properties Impairments $15.5 Unproved Leasehold Interest Impairments 15.1 Other Costs** 5.1 Total Charges $35.7

Delivering Reserve Growth 2.4 3.0 5.6 8.5 10.1 2010 2011 2012 2013 2014 Year-End Proved Reserves (MMBOE) Note: MMBOE = million barrels of oil equivalent *PV-10 represents present value of estimated future oil and gas revenues, net of estimated direct expenses, discounted at an annual discount rate of 10%. Future Net Cash flows represents an undiscounted value based upon estimate of future net cash flows from proved developed reserves after deducting estimated severance and ad valorem taxes, but before deducting estimates of future income taxes. These are Non-GAAP financial measures. The reconciliation between GAAP and Non-GAAP financial measures is provided in the tables following this presentation, and on the company’s investor relations website. **Reserve oil price represents SEC average oil price per barrel used in reserve calculation, which are then adjusted for transportation and differentials. ***Probable reserves are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered. Possible reserves are those additional reserves that are less certain to be recovered than probable reserves. Year-End Proved Reserves PV-10** ($ in millions) $45 $82 $138 $183 $229 $0 $40 $80 $120 $160 $200 $240 2010 2011 2012 2013 2014 19 PV‐0 $77 $133 $222 $317 $399 Oil Price** $75.96 $92.71 $94.71 $96.91 $94.99 % Oil & Liquids 25% 36% 57% 69% 76% Probable and Possible Reserves*** (MMBOE) = 4.7 8.1 Note: Applying 12/31/2014 strip average oil price of $61.07 / bbl to our 2014 proved reserves determined in accordance with GAAP would result in $128 million if discounted at 10% and $240 million if undiscounted. This information is supplemental only, and is not intended to replace disclosure of proved reserves in accordance with SEC and GAAP requirements.

Reserve Growth Driven By Bakken / Three Forks Reserve Growth (MMBOE) Production Replaced (MMBOE) Net Reserve Increase (MMBOE) % Oil* 2.9 1.3 1.6 76% 4.0 1.1 2.9 69% 3.3 0.7 2.6 57% 1.0 0.4 0.6 36% 0.7 0.4 0.3 25% Proved Reserves (MMBOE) 2010 2011 2012 2013 2014 North Dakota Texas & Louisiana Other Kansas & Nebraska 20 10.1 8.5 5.6 3.0 2.4 *Note: Oil includes NGL’s * Excludes Probable and Possible reserves Note: MMBOE = million barrels of oil equivalent SEC average adjusted oil price used in reserve calculation

Bakken / Three Forks Driving Production and Reserve Growth 490 680 0 100 200 300 400 500 600 700 800 2013 2014 NSAI Avg. Bakken Reserves Per New PDP Well* (MBOE) * Based on YE 2013 and YE 2014 Proved Developed Producing wells based on reserve estimates prepared by independent petroleum engineering firm, Netherland, Sewell, and Associates (NSAI). B a k k e n / T h r e e F o r k s A v g . P D P W e l l E U R ' s ( M B O E ) FY 2014 Results: • 50% Reserve growth • Weighted Avg. Bakken proved developed producing well reserve estimates up >38% vs. 2013 • Acquired leasehold interest in ~2,800 net mineral acres in Bakken / Three Forks • ~ 9,300 net mineral acres leasehold non-operating position • >330 wells remaining in leasehold acreage • Operators continue to increase productivity and lower costs Bakken / Three Forks Activity 21 New PDP Wells 46 39 ($ in millions)

Oil and Gas Operating Plan Bakken/Three Forks Illustrative Returns* • Significant planned 2015 capital investment reductions, principally reflecting existing well commitments • 20 wells waiting on completion at year-end 2014 • Planned to reduce annual operating expenses by 50%*, focused on generating cash flow and earnings 2015 Oil and Gas Operating Plan 22*Excluding non-recurring restructuring costs Bakken Well EUR’s (MBOE) Well Costs 600 700 800 900 $8 MM 11% 20% 31% 44% $9 MM 6% 14% 23% 33% $10 MM 2% 10% 17% 25% $11 MM ‐‐ 6% 12% 19% Well EUR’s (MBOE) Oil Prices 600 700 800 900 Break‐Even $58 $52 $47 $44 $50 ‐‐ ‐‐ 4% 10% $60 2% 10% 17% 25% $70 12% 21% 32% 44% $80 23% 35% 49% 65% $90 35% 50% 69% 90% Well Costs & Recovery Rates at $60 WTI Oil Price Oil Prices & EUR’s Assuming $10MM Well Cost *Returns include $12 per barrel price deduction for transportation costs Note: EUR’s represent estimated ultimate recoveries for wells in barrel of oil equivalents Note: Illustrative returns include costs for land, drilling & completion, LOE and production severance taxes. Note: Actual results may vary from illustrations

Strategic Review Update 23

Focused On Maximizing Long-Term Shareholder Value Board, management and financial advisors exploring strategic alternatives to enhance shareholder value, including review of the oil and gas business Comprehensive strategic review driven by commitment to maximize long‐term shareholder value Concurrently, Company plans to reduce 2015 operating expenses by 50% vs. 2014* and significantly lower oil and gas capital investments Committed to developing best of class real estate business with growth opportunities 24* Excluding non-recurring restructuring costs

25

26

Real Estate Segment KPI’s Q4 2014 Q4 2013 FY 2014* FY 2013** Residential Lot Sales Lots Sold 509 530 2,343 1,883 Average Price / Lot $71,800 $66,000 $58,100 $58,300 Gross Profit / Lot*** $35,700 $27,700 $25,600 $25,000 Commercial Tract Sales Acres Sold 25 115 32 171 Average Price / Acre $227,500 $210,300 $258,600 $197,100 Land Sales Acres Sold 8,963 3,509 22,137 6,811 Average Price / Acre $2,100 $3,100 $2,200 $3,400 Segment Revenues ($ in Millions) $60.0 $77.7 $213.1 $248.0 Segment Earnings ($ in Millions) $30.0 $27.7 $96.9 $68.4 *FY 2014 real estate segment results include $10.5 million gain associated with the exchange of 10,000 acres of timber leases into 5,400 acres of undeveloped land, $7.6 million gain associated with acquisition of our partner’s interest in Eleven venture and $6.6 million gain associated with $46.5 million of bond proceeds received from Cibolo Canyons Special Improvement District. **FY 2013 real estate segment results include revenues of $41.0 million and earnings of $10.9 million associated with the sale of Promesa multifamily community we developed in Austin. *** FY 2014 gross profit per lot was approximately $30,000 per lot, excluding almost 370 bulk lot sales. . Note: Includes ventures 27

Oil and Gas Segment KPI’s Q4 2014** Q4 2013 FY 2014*** FY 2013 Fee Leasing Activity Net Fee Acres Leased 40 800 3,905 9,200 Avg. Bonus / Acre $200 $310 $320 $270 Total Oil and Gas Interests* Oil Produced (Barrels) 236,900 184,400 869,700 648,000 Average Price / Barrel $63.91 $88.97 $83.43 $93.74 NGL Produced (Barrels) 22,900 10,700 61,400 49,700 Average Price / Barrel $38.42 $44.58 $41.02 $32.92 Natural Gas Produced (MMCF) 614.1 518.0 2,060.2 2,158.5 Average Price / MCF $3.77 $3.61 $4.19 $3.46 Total BOE 362,100 281,500 1,274,500 1,057,500 Average Price / BOE $50.63 $66.62 $65.68 $66.04 Segment Revenues ($ in millions) $18.2 $18.9 $84.3 $72.3 Segment Earnings (Loss) ($ in millions) ($39.0) $1.0 ($22.7) $18.9 Producing Wells (end of period) 944 1,011 944 1,011 * Includes our share of venture production: 47 MMcf in Q4 2014, 200 MMcf FY 2014, 58 MMcf in Q4 2013, and 247 MMcf FY 2013 ** Fourth quarter 2014 oil and gas segment results include $35.7 million of charges principally related to non-cash impairments for proved properties and unproved leasehold interests. ***FY 2014 oil and gas segment results include $37.7 million of charges principally related to unproved leasehold interests and proved oil and gas properties as well as $8.5 million in gains associated with the sale of various oil and gas properties in Oklahoma and North Dakota. 28

Other Natural Resources Segment KPI’s Q4 2014 Q4 2013 FY 2014 FY 2013 Fiber Sales Pulpwood Tons Sold 52,000 60,800 209,900 375,200 Average Pulpwood Price / Ton $9.49 $10.01 $10.62 $9.26 Sawtimber Tons Sold 20,000 31,600 120,000 234,300 Average Sawtimber Price / Ton $22.94 $21.26 $22.47 $22.31 Total Tons Sold 72,000 92,400 329,900 609,500 Average Price / Ton $13.22 $13.85 $14.93 $14.28 Recreational Leases Average Acres Leased 107,800 118,500 110,500 120,400 Average Lease Rate / Acre $9.00 $9.08 $9.13 $9.08 Segment Revenues ($ in Millions) $2.1 $1.8 $9.4 $10.7 Segment Earnings ($ in Millions) * $3.3 $3.7 $5.5 $6.5 *Note: Segment results include costs of $0.4 million in Q4 2014, $2.9 million FY 2014, $1.0 million in Q4 2013 and $4.0 million FY 2013 associated with the development of our water initiatives Note: Q4 and FY 2014 segment earnings include a $2.7 and $3.4 million gain on termination of timber lease in connection with the sale of land from Ironstob venture near Atlanta. 29 Q4 & FY 2013 segment results include a $3.8 million gain associated with the partial termination of a timber lease in connection with the sale of land from the Ironstob venture.

Full Year 2014 Earnings Reconciliation $29.3 $16.6 $8.7 $18.5 ($27.0) ($11.8) ($0.7) ($0.4) $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 2013 Real Estate Share Based Comp Oil & Gas Interest, Taxes & Other Expenses Other Natural Resources G&A 2014 N e t I n c o m e ($ in millions) Net Income Reconciliation FY 2013 vs. FY 2014 • Full year 2014 oil and gas segment results include charges of ($24.5) million, after‐tax, principally associated with impairments related to unproved leasehold interests and proved oil and gas properties. • Full year 2013 results include a previously unrecognized tax benefit of approximately $6.3 million, related to qualified timber gains from sales in 2009. 30

Fourth Quarter 2014 Earnings Reconciliation $13.0 ($11.8) $1.5$1.7 $0.2 ($26.0) ($1.9) ($0.3) ($15.0) ($10.0) ($5.0) $0.0 $5.0 $10.0 $15.0 $20.0 Q4 2013 Share Based Comp Real Estate G&A Oil & Gas Interest, Taxes & Other Expenses Other Natural Resources Q4 2014 N e t I n c o m e ( L o s s ) Net Income Reconciliation Q4 2013 vs. Q4 2014 ($ in millions) • Fourth quarter 2014 oil and gas segment results include charges of ($23.2) million, after‐tax, principally associated with impairments related to proved oil and gas properties and unproved leasehold interests 31

Reconciliation of Non-GAAP Financial Measures (Unaudited) Forestar’s Segment EBITDA is a non-GAAP financial measure within the meaning of Regulation G of the Securities and Exchange Commission. Non-GAAP financial measures are not in accordance with, or an alternative to, U.S. Generally Accepted Accounting Principles (GAAP). The company believes presenting non-GAAP Segment EBITDA is helpful to analyze financial performance without the impact of items that may obscure trends in the company’s underlying performance. A detailed reconciliation is provided below outlining the differences between these non- GAAP measures and the directly related GAAP measures. Fourth Quarter Full Year ($ in millions) 2014 2013 2014 2013 Real Estate Segment Earnings in accordance with GAAP $30.0 $27.7 $96.9 $68.4 Depreciation, Depletion & Amortization 1.7 0.6 3.7 3.1 Real Estate Segment EBITDA $31.7 $28.3 $100.6 $71.5 Oil & Gas Segment Earnings (Loss) in accordance with GAAP ($39.0) $1.0 ($22.7) $18.9 Depreciation, Depletion & Amortization 8.8 5.8 29.5 19.5 Oil and Gas Segment EBITDA ($30.2) $6.8 $6.8 $38.4 Other Natural Resources Segment Earnings in accordance with GAAP $3.3 $3.7 $5.5 $6.5 Depreciation, Depletion & Amortization 0.1 0.1 0.5 0.7 Other Natural Resources Segment EBITDA $3.4 $3.8 $6.0 $7.2 Total Segment Total Segment Earnings (Loss) in accordance with GAAP ($5.7) $32.4 $79.7 $93.8 Depreciation, Depletion & Amortization 10.6 6.5 33.7 23.8 Total Segment EBITDA $4.9 $38.9 $113.4 $117.1 32

Reconciliation of Non-GAAP Financial Measures (Unaudited) Forestar’s Oil and Gas Segment EBITDAX is a non-GAAP financial measure within the meaning of Regulation G of the Securities and Exchange Commission. Non-GAAP financial measures are not in accordance with, or an alternative to, U.S. Generally Accepted Accounting Principles (GAAP). The company believes presenting non-GAAP Oil and Gas Segment EBITDAX is helpful to analyze financial performance without the impact of items that may obscure trends in the company’s underlying performance. A detailed reconciliation is provided below outlining the differences between these non-GAAP measures and the directly related GAAP measures. Fourth Quarter Full Year ($ in millions) 2014 2013 2014 2013 Oil and Gas Segment Earnings (Loss), in accordance with GAAP ($39.0) $1.0 ($22.7) $18.9 EBITDAX adjustments, pre-tax Depreciation, Depletion & Amortization 8.8 5.8 29.5 19.5 Geological, Geophysical, Seismic and Dry Hole Costs 4.6 5.3 16.7 10.5 Proved Property Impairments 15.5 0.0 15.5 0.0 Unproved Leasehold Interest Impairments 15.1 0.5 17.1 0.5 Total Oil and Gas Segment EBITDAX $5.0 $12.6 $56.1 $49.4 33

Proved Reserves Summary ($ in millions) 2014 2013 2012 2013-2014 % Change 2012-2013 % Change Proved Developed Producing Reserves1 Oil and NGL Reserves MBBL 4,588.4 3,224.6 2,105.2 42% 53% Gas Reserves BCF 12.2 13.3 12.2 (8%) 9% Future Net Revenues* $282.5 $222.6 $162.2 27% 37% PV-10 3* $174.6 $140.5 $103.8 24% 35% Proved Developed Non-Producing Reserves1 Oil and NGL Reserves MBBL 680.6 668.7 311.4 2% 115% Gas Reserves BCF 0.4 0.5 0.8 (20%) (38%) Future Net Revenues* $36.8 $35.6 $24.8 3% 44% PV-10 3* $22.4 $22.2 $17.2 1% 29% Proved Undeveloped Reserves1 Oil and NGL Reserves MBBL 2,402.6 1,931.0 803.8 24% 140% Gas Reserves BCF 1.8 2.2 1.3 (18%) 69% Future Net Revenues* $80.1 $58.3 $35.1 37% 66% PV-10 3* $31.9 $20.0 $16.6 59% 20% Total Proved Reserves1 Oil and NGL Reserves MBBL 7,671.5 5,824.5 3,220.4 32% 81% Gas Reserves BCF 14.4 16.0 14.3 (10%) 12% Reserves MMBoe2 10,071.5 8,484.8 5,602.7 19% 51% Future Net Revenues* $399.4 $316.5 $222.2 26% 42% PV-10 3* $228.9 $182.8 $137.7 25% 33% Note: PV-10 analysis based on 2014 average benchmark prices of $94.99 for oil and $4.35 for natural gas, compared with 2013 average benchmark prices of $96.91 for oil and $3.67 for natural gas, compared with 2012 average benchmark prices of $94.71 for oil and $2.76 for natural gas. 1 Includes Forestar’s share of equity method ventures 2 Boe – Barrel of Oil Equivalent (converting oil to natural gas at 6 Mcf / Bbl) 3 PV-10 – Present Value at 10% (before income taxes) *These are Non-GAAP financial measures. The reconciliation between GAAP and Non-GAAP financial measures is provided in the tables following this presentation, and on the company’s investor relations website. 34

Reconciliation of Non-GAAP Financial Measures (Unaudited) In our full year and fourth quarter 2014 earnings release and conference call presentation materials furnished to the Securities and Exchange Commission on Form 8-K on March 5, 2015, we used certain non-GAAP financial measures. The non-GAAP financial measures should not be relied upon to the exclusion of GAAP financial measures. These non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when viewed with our GAAP financial statements and the accompanying reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of our business. We strongly encourage investors to review our consolidated financial statements and publicly filed reports in their entirety. Reconciliation of Non-GAAP Financial Measures (Unaudited) The following table shows a reconciliation of PV-10 (discounted future net cash flows before income taxes) to the standardized measure of discounted future net cash flows (the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles, or GAAP). PV-10 is an estimate of the present value of future net cash flows from proved developed reserves after deducting estimated severance and ad valorem taxes, but before deducting any estimates of future income taxes. The estimated future net cash flows are discounted at an annual rate of 10%. A reconciliation of PV-10 to the standardized measure of discounted future net cash flows as computed under GAAP is illustrated below: ($ in 000’s) Actual YE 2014* Actual YE 2013* Actual YE 2012* PV – 10 (discounted future net cash flows before income taxes) $228,862 $182,776 $137,675 Less: discounted future income taxes (63,245) (45,923) (29,719) Standardized measure of discounted future net cash flows $165,616 $136,853 $107,956 The undiscounted value represents an estimate of future net cash flows from proved developed reserves after deducting estimated severance and ad valorem taxes, but before deducting estimates of future income taxes. A reconciliation of undiscounted future net cash flows before income taxes to the undiscounted future net cash flows after income taxes is illustrated below: ($ in 000’s) Actual YE 2014* Actual YE 2013* Actual YE 2012* Undiscounted future net cash flows before income taxes $399,444 $316,550 $222,231 Less: undiscounted future income taxes (108,100) (78,977) (52,088) Undiscounted future net cash flows after income taxes $291,344 $237,573 $170,143 We believe both PV-10 and undiscounted values are important for evaluating the relative significance of our oil and gas interests and that the presentation of the non-GAAP financial measures provides useful information to investors because they are widely used by professional analysts and sophisticated investors in evaluating oil and gas companies. Because there are many unique factors that can impact an individual company when estimating the amount of future income taxes to be paid, we believe the use of a pre-tax measure is valuable for evaluating our mineral assets. *Note: Includes our share of proved developed reserves in equity-method ventures 35

36