Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PBF Logistics LP | a8-kpbfx3x4x15.htm |

PBF Logistics LP (NYSE: PBFX) Barclays MLP Corporate Access Day March 2015

2 Safe Harbor Statements This presentation contains forward-looking statements made by PBF Logistics LP and PBF Energy Inc. (together, the “Companies”, or “PBFX” or “PBF”) and their management teams. Such statements are based on current expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time, and are subject to various risks and uncertainties that could cause the Companies’ actual performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products; the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics infrastructure; effects of litigation and government investigations; the timing and announcement of any potential acquisitions and subsequent impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry, including any lifting by the federal government of the restrictions on exporting U.S. crude oil; actions taken or non-performance by third parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; inability to successfully integrate acquired refineries or other acquired businesses or operations; effects of existing and future laws and governmental regulations, including environmental, health and safety regulations; and, various other factors. Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Companies assume no responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information after such date.

3 PBF Logistics launched in May 2014 Market capitalization of ~$800 million(1) PBF Energy owns 52.1% of PBFX, 100% of the GP and IDRs Revenues supported by long-term agreements with minimum volume commitments No direct commodity exposure Significant portfolio of logistics assets retained at PBF that support refinery operations PBF Logistics LP Overview (NYSE: PBFX) Assets Service Capacity Loop Track – rail Light crude oil unloading ~130,000 bpd West Rack – rail Heavy crude oil unloading ~40,000 bpd Toledo Truck Terminal Crude oil unloading ~15,000 bpd Toledo Storage Facility and LPG Rack Crude oil and product storage, LPG storage and loading 3.9 million barrels ___________________________ 1. As of 2/27/2015

4 PBFX Investment Highlights PBFX is the primary vehicle to expand PBF Energy’s (“PBF”) logistics asset base PBF underpins the stability of PBFX’s cash flow 100% of forecast revenue generated through MVCs Long-term, fee-based contracts with minimum volume commitments and inflation escalators PBF is incentivized and economically aligned ~52% LP ownership, in addition to 100% GP and IDR ownership Strategically located, well-maintained and integrated assets East Coast rail facilities supply PBF Energy’s Delaware City and Paulsboro refineries with North American crude oils Mid-continent crude oil truck unloading racks, feedstock and product storage facilities and LPG truck rack provide flexible supply, storage and off-take infrastructure for the Toledo refinery Current and anticipated future drop-down assets are integral to the operations of PBF’s refineries Financial flexibility Significant financial flexibility to execute growth strategy $325 million revolving credit facility with an accordion to $600 million Target debt of 3x – 4x EBITDA Experienced leadership team Significant experience operating and managing logistics and refining assets Long and successful track record of executing profitable acquisitions and driving organic growth Focused on growing logistics assets Relationship with PBF provides growth and stability

5 Delaware City Loop Track Light crude oil rail unloading terminal Supports Delaware City and Paulsboro refineries Combined refining capacity: 370,000 bpd Supplies cost-advantaged, light crude oil from Western Canada and U.S. Mid-continent Current discharge capacity: ~130,000 bpd Double-loop track accommodates up to two 100-car unit trains Original construction completed: February 2013 Expansion completed: August 2014 Revenue secured through seven-year agreement with minimum volume commitments (MVCs) $2.00 per barrel unloading fee up to MVC, $0.50 per barrel unloading fee above the MVC MVC of 85,000 bpd Annual maintenance capital expenditures of ~$1.25 million

6 Toledo Truck Terminal 15,000 bpd truck crude unloading facility Services PBF’s 170,000 bpd Toledo refinery Primarily receives locally-gathered, cost-advantaged crude oil Potential for growth through increased production in nearby shale basins, including Utica Shale in Ohio and New Albany Shale in Illinois Newly constructed assets Assets placed into service: Dec. 2012 – June 2014 Revenue secured through seven-year agreement with minimum volume commitments (MVCs) $1.00 per barrel unloading fee MVC of 5,500 barrels per day Annual maintenance capital expenditures of ~$0.8 million Illinois Basin Appalachian Basin New Albany Devonian (Ohio) Marcellus Utica Michigan Basin Antrim Forest City Basin Fayetteville Cherokee Platform Chattanooga Source: EIA Toledo Current Plays Prospective Plays Basins Shale Plays Stacked Plays Intermediate Depth / Age Deepest / Oldest Shallowest / Youngest

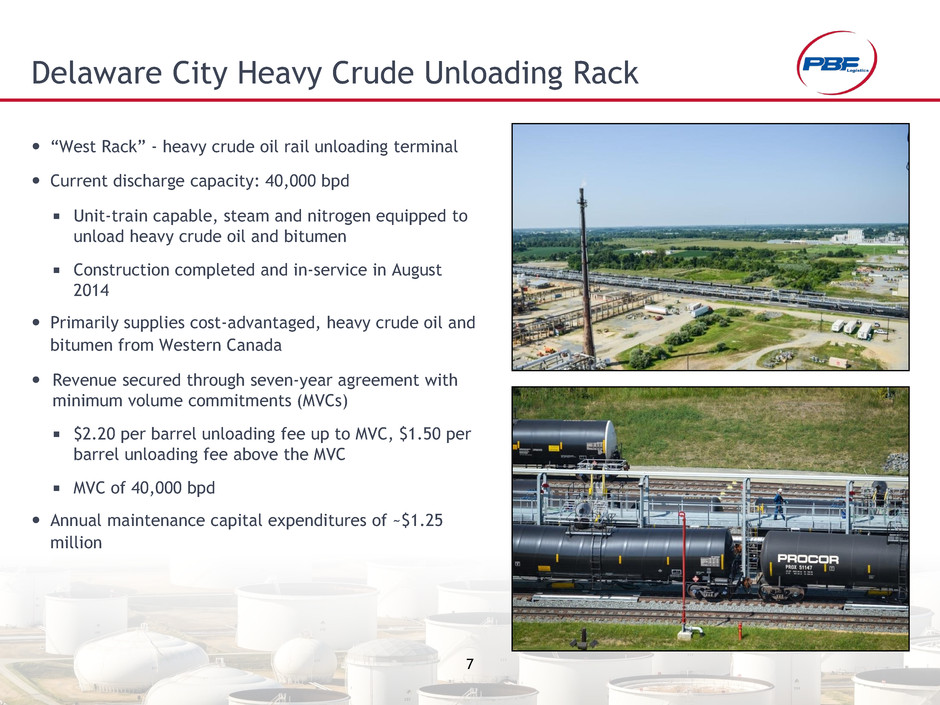

7 Delaware City Heavy Crude Unloading Rack “West Rack” - heavy crude oil rail unloading terminal Current discharge capacity: 40,000 bpd Unit-train capable, steam and nitrogen equipped to unload heavy crude oil and bitumen Construction completed and in-service in August 2014 Primarily supplies cost-advantaged, heavy crude oil and bitumen from Western Canada Revenue secured through seven-year agreement with minimum volume commitments (MVCs) $2.20 per barrel unloading fee up to MVC, $1.50 per barrel unloading fee above the MVC MVC of 40,000 bpd Annual maintenance capital expenditures of ~$1.25 million

8 Storage facility and LPG truck rack serve Toledo refinery’s operations and product distribution activities Services include: Crude oil and product storage Propane truck loading 30 tanks with total shell capacity of ~3.9 million barrels Crude – 7 tanks with ~1.3 million barrels of capacity Includes recently commissioned ~450,000 barrel crude storage tank Products – 23 tanks with ~2.6 million barrels of capacity Includes ~17.5 thousand barrels of propane storage capacity Toledo Storage Facility and LPG Truck Rack Revenue secured through ten-year agreement with minimum volume commitments (MVCs) $0.50 per barrel/month of available shell capacity $2.52 per barrel for propane storage and throughput MVC of 4,400 barrels per day Annual maintenance capital expenditures of ~$3.0 million

9 PBF Energy’s Strengths as a Sponsor Financial Conservative financial profile with strong liquidity and access to capital markets PBF / PBFX have entered into long-term, fee-based contracts with minimum volume commitments and inflation escalators Substantial economic interest in PBFX Operational Significant acquisition experience Long history of operating logistics and refining assets Excellent safety record; early adopter of rail safety initiatives Strategic PBFX’s assets are critical to PBF’s refineries Continually evaluating growth and optimization projects PBFX provides PBF with vehicle to grow platform and enhance investor returns

10 PBF Energy Company Profile Market capitalization of ~$3.0 billion (1) Ba3 / BB- credit ratings Owns three oil refineries in Ohio, Delaware and New Jersey Aggregate throughput capacity of ~540,000 bpd Weighted-average Nelson Complexity of 11.3 East Coast rail infrastructure provides PBF with the flexibility to source cost-advantaged North American crude oil or waterborne crude oil depending on economics PBF's core strategy is to grow and diversify through acquisitions PBF indirectly owns 100% of the general partner and ~52% of the limited partner interest of PBF Logistics LP (NYSE: PBFX) PBFX market capitalization of ~$800 million(1) Region Throughput Capacity (bpd) Nelson Complexity Mid-continent 170,000 9.2 East Coast 370,000 12.2 Total 540,000 11.3 (2) ___________________________ 1. As of 2/27/2015 2. Represents weighted average Nelson Complexity for PBF’s three refineries Paulsboro Delaware City Toledo

11 Robust Drop-down Inventory Retained at PBF Significant growth potential through future drop- downs of logistics infrastructure retained by PBF Energy Approximately ~$100 - $125 million of drop- down EBITDA remaining at PBF Energy East Coast Storage Facilities 10.0 million bbls at Delaware City 7.5 million bbls at Paulsboro Multiple marine terminals Adds future export optionality Refined products pipeline and heavy crude oil terminal Additional truck racks, rail terminals and LPG loading/unloading facilities PBFX has ROFO on substantial portfolio of logistics assets retained at PBF

12 PBFX Outlook and Strategy Conservative financial profile with strong liquidity and access to capital markets Target PBFX debt of 3x to 4x EBITDA Return excess cash to shareholders Focus on Stable, Fee-based Business Focused on stable, fee-based business supported by long-term, minimum volume commitments Maintain minimal commodity risk Demonstrate commitment to safe and reliable operations in all areas PBFX provides PBF with vehicle to grow platform and enhance investor returns PBFX’s assets are critical to PBF’s refineries Continually evaluating growth and optimization opportunities Financial Strategic Grow through Acquisitions Invest in growth opportunities to drive further value creation Pursue additional drop-down transactions with sponsor Expand and diversify third-party earnings base

Appendix

14 Non-GAAP Financial Measures Our management uses EBITDA (earnings before interest, income taxes, depreciation and amortization) and Adjusted EBITDA as measures of operating performance to assist in comparing performance from period to period on a consistent basis and to readily view operating trends, as a measure for planning and forecasting overall expectations and for evaluating actual results against such expectations, and in communications with our board of directors, creditors, analysts and investors concerning our financial performance. Our outstanding indebtedness for borrowed money and other contractual obligations also include similar measures as a basis for certain covenants under those agreements which may differ from the Adjusted EBITDA definition described below. EBITDA and Adjusted EBITDA are not presentations made in accordance with GAAP and our computation of EBITDA and Adjusted EBITDA may vary from others in our industry. In addition, Adjusted EBITDA contains some, but not all, adjustments that are taken into account in the calculation of the components of various covenants in the agreements governing the senior secured notes and other credit facilities. EBITDA and Adjusted EBITDA should not be considered as alternatives to operating income or net income as measures of operating performance. In addition, EBITDA and Adjusted EBITDA are not presented as, and should not be considered, an alternative to cash flows from operations as a measure of liquidity. Adjusted EBITDA is defined as EBITDA before equity-based compensation expense, gains (losses) from certain derivative activities and contingent consideration and the non-cash change in the deferral of gross profit related to the sale of certain finished products. Other companies, including other companies in our industry, may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. Adjusted EBITDA also has limitations as an analytical tool and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP.

15 PBFX 2015 Guidance Guidance provided constitutes forward-looking information and is based on current PBF Logistics operating plans, assumptions and configuration. All figures are subject to change based on market and macroeconomic factors, as well as management’s strategic decision- making and overall Partnership performance ($ in millions) FY 2015 Revenues $122.0 Operating expenses $35.0 SG&A $10.5 D&A $5.8 Interest expense, net $8.5 Maintenance capital expenditures $5.2 Targeted distribution coverage 1.15x Leverage target 3x-4x EBITDA Units outstanding(1) 33.3 million • All figures are based on minimum volume commitments under existing long-term agreements ___________________________ 1. Units outstanding figure represents the fully-diluted number of units issued during the IPO, subsequent transactions and under partnership compensation programs outstanding at 12/31/14