Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MRC GLOBAL INC. | d884042d8k.htm |

1

March 4, 2015

Investor Presentation

Andrew Lane

Chairman, President & CEO

Jim Braun

Executive Vice President & CFO

Exhibit 99.1

TM |

2

2

This

presentation

contains

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

and

Section

21E

of

the

Exchange

Act.

Words

such

as

“will,”

“expect,”

“expected”,

“looking

forward”,

“guidance”

and

similar

expressions

are

intended

to

identify

forward-looking

statements.

Statements

about

the

company’s

business,

including

its

strategy,

the

impact

of

changes

in

oil

prices

and

customer

spending,

its

industry,

the

company’s

future

profitability,

the

company’s

guidance

on

its

sales,

adjusted

EBITDA,

adjusted

gross

profit,

tax

rate,

capital

expenditures

and

cash

flow,

growth

in

the

company’s various markets and the company’s expectations, beliefs, plans,

strategies, objectives, prospects and assumptions are not guarantees of future

performance. These statements are based on management’s expectations that

involve a number of business risks and uncertainties, any of which could

cause actual results to differ materially from those expressed in or implied by the

forward-looking statements. These statements involve known and unknown

risks, uncertainties and other factors, most of which are difficult to predict and

many of which are beyond our control, including the factors described in the

company’s SEC filings that may cause our actual results and performance to be

materially different from any future results or performance expressed or

implied by these forward-looking statements.

For a discussion of key risk factors, please see the risk factors disclosed in the

company’s SEC filings, which are available on the SEC’s website at

www.sec.gov

and

on

the

company’s

website,

Our

filings

and

other

important

information

are

also

available

on

the

Investor

Relations

page

of

our

website

at

Undue reliance should not be placed on the company’s forward-looking

statements. Although forward-looking statements reflect the company’s good faith

beliefs,

reliance

should

not

be

placed

on

forward-looking

statements

because

they

involve

known

and

unknown

risks,

uncertainties

and

other

factors,

which

may

cause

the

company’s

actual

results,

performance

or

achievements

or

future

events

to

differ

materially

from

anticipated

future

results,

performance

or

achievements or future events expressed or implied by such forward-looking

statements. The company undertakes no obligation to publicly update or revise

any forward-looking statement, whether as a result of new information, future

events, changed circumstances or otherwise, except to the extent required by

law.

www.mrcglobal.com.

Forward Looking Statements and Non-GAAP Disclaimer

www.mrcglobal.com. |

3

By the Numbers

1

Industry Sectors

Product Categories

2014 Sales

Adjusted EBITDA

$5.933B

$424M

Upstream

Line Pipe & OCTG

Employees

~4,900

2

Locations

400+

Midstream

Valves

Countries

•

Operations

•

Direct Sales

(>$100,000)

•

All countries

20

45+

90+

Customers

21,000+

Downstream/

Industrial

Fittings & Flanges

Suppliers

21,000+

SKU’s

230,000+

Company Snapshot

MRC

Global

is

the

largest

global

distributor

of

pipe,

valves

and

fittings

(PVF)

to the energy industry, by sales

1.

As of December 31, 2014.

2.

With cost savings actions taken in the first quarter, this figure is expected to be

about 4,700. |

4

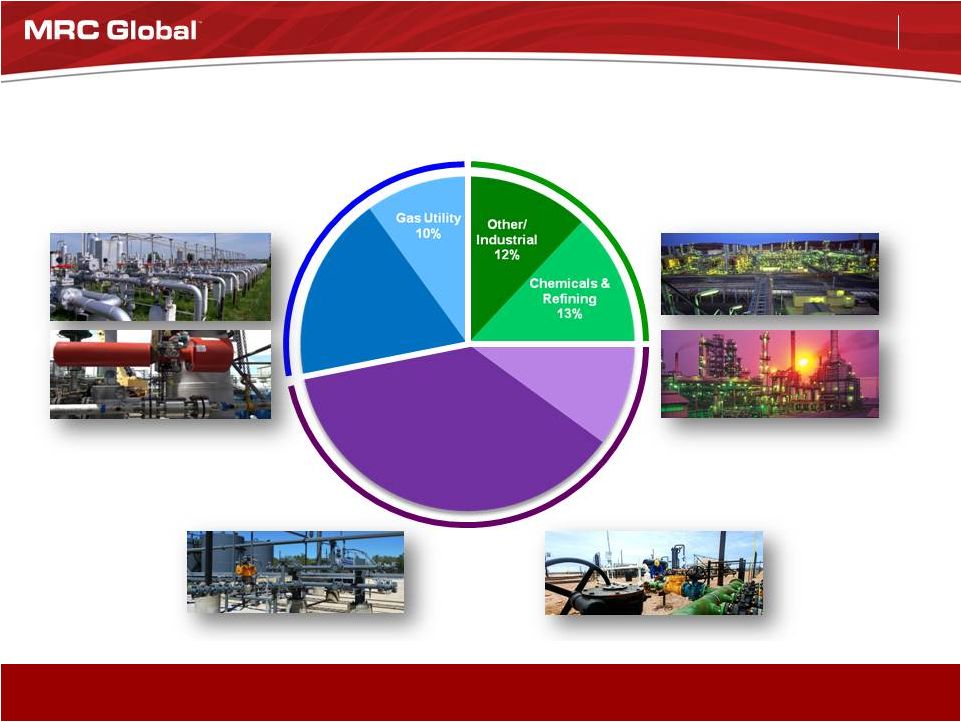

Revenue by Industry Sector

Note: Percentage of sales for the year ended December 31, 2014.

Upstream

47%

Downstream 25%

28% Midstream

Diversified Across All Three Major Energy Sectors

Transmission

18%

Drilling & Completion

Tubulars

(OCTG)

10%

Production

Infrastructure,

Materials &

Supplies

37% |

5

By Product Line

Revenue by Geography and Product Line

Note: Percentage of sales for the year ended December 31, 2014.

By Geography

Houston, TX

Edmonton, AB

Bradford, UK

Singapore

Perth, AU

Stavanger, NO

Diversified Across Multiple Geographies -

Domestically (all shale plays) and Internationally

32%

18%

21%

19%

10% |

6

Downstream

Midstream

Upstream

MRC Global plays a vital role in the complex, technical, global energy supply

chain Long-Term Supplier & Customer Relationships

CUSTOMERS

SUPPLIERS

IOCs

Phillips 66

Valero

DOW

DuPont

Marathon

Petroleum

Access

Midstream

AGL

Resources

Atmos

NiSource

PG&E

Williams

DCP

Midstream

Chesapeake

Energy

ConocoPhillips

Devon

Apache

Anadarko

CNRL

Hess

Husky

Energy

Marathon

Oil

Statoil

Energy Carbon Steel

Tubular Products

Valves

Fittings, Flanges and General

Use Products

Tenaris

TMK-

IPSCO

U.S.

Steel

CSI Tubular

JMC

Wheatland

Balon

Cameron

Flowserve

Kitz

Neway

Velan

Boltex

Bonney

Forge

Chevron

Phillips

Chemical

Tube

Forgings of

America

WL Plastics

Emerson |

7

Benefits of MRC Global

Generating savings and efficiencies for our customers

enabling them to focus on their core competencies

MRC Global is #7 on Industrial

Distribution magazine’s annual list of

the

50

largest

industrial

distributors

1

,

“The Big 50”

1. September/October 2014 edition, based on 2013 revenue.

1.

Wolseley

2.

Wurth Group

3.

W.W. Grainger

4.

HD Supply

5.

Wesco

6.

Anixter

7.

MRC Global

•

Supplier Registration / Preferred Supplier List

•

Global delivery footprint with 1.5 million + sq. ft. of

regional distribution centers

•

Approximately $1.2B in global inventory, net

•

Global sourcing from 45+ countries

Why

Customers

Choose

MRC

Global

–

Well

Positioned |

8

Integrated Supply Statistics

•

Supplying Integrated Supply services since

1988 •

Accounts

for

sales

in

excess

of

$825

million

and

growing

rapidly

•

Employ over 190 personnel at customer

sites •

Providing Integration Services on over 100 customer

sites •

Managing

over 1.4 million customer part numbers

•

Consignment inventories in excess of $35 million at 700

locations

•

Manage

customer-owned

point

of

use

materials

at

over

800 locations

MRC Global is a leading provider of Integrated Supply

Services to the Energy Industry |

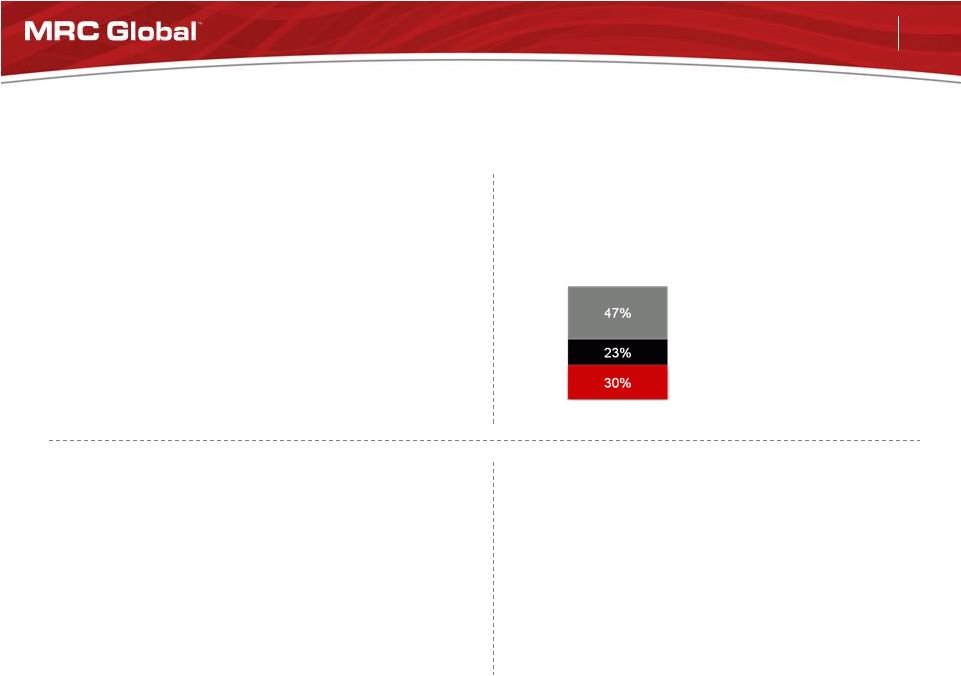

9

Strategic Objectives

Rebalance Product Mix to

Higher Margin Items

•

Focus on valve and valve automation

•

Strengthen offerings in stainless & alloy PFF

Growth from Mergers & Acquisitions

1.

Percentage of sales for the year ended December 30, 2014.

All

Other

-

21,000+

customers

Targeted Growth Accounts

Top 1 -

25

Customer

Mix

-

Sales

1

Execute Global Preferred Supplier Contracts

•

Targeted Growth Accounts:

Organic Growth

develop the “next 75”

customers

•

Marathon Oil –

US MRO, 5 years

•

Statoil –

Johan Sverdrup project, instrumentation

•

Mark West –

midstream MRO, 5 years

•

Recently added or renewed:

•

Focus

on

multi-year

“Top

25”

MRO

agreements

and

adding scope to current agreements

•

Current expectation is to use free cash flow to

repay debt $200-$300 million in 2015

•

Continue to identify geographic and product line

opportunities, no acquisitions expected in 2015 |

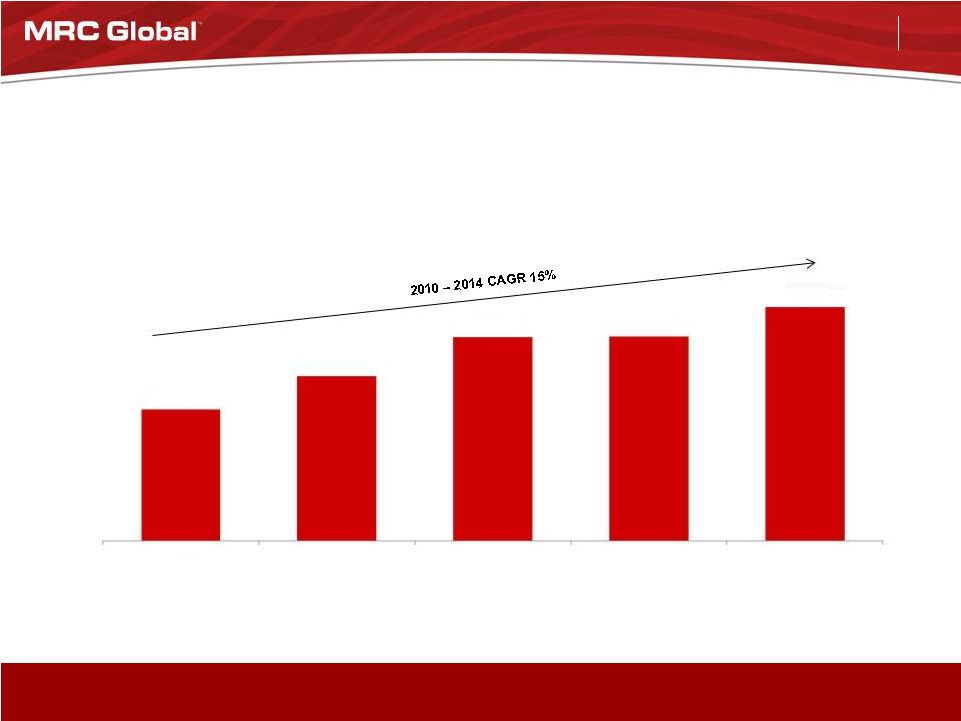

10

Strategic Shift in Product Mix to Higher Margin Products

($ millions)

Total Revenue less Carbon Energy Tubulars (OCTG & Line Pipe)

15%

CAGR

for

Higher

Margin

Products

2010

-

2014

$2,384

$2,989

$3,697

$3,705

$4,238

2010

2011

2012

2013

2014 |

11

Product Mix Shift from 2008 to 2014

•

Stable, higher margin valves are a larger percentage of revenue

•

More volatile carbon pipe is a smaller percentage of revenue

•

The prices of higher margin products are more stable

55%

Higher

Margin

Products

45%

Carbon

Pipe

2008

71%

Higher

Margin

Products

29%

Carbon

Pipe

2014

Note: Percentage of sales for the year ended December 31, 2008 and December 31, 2014.

|

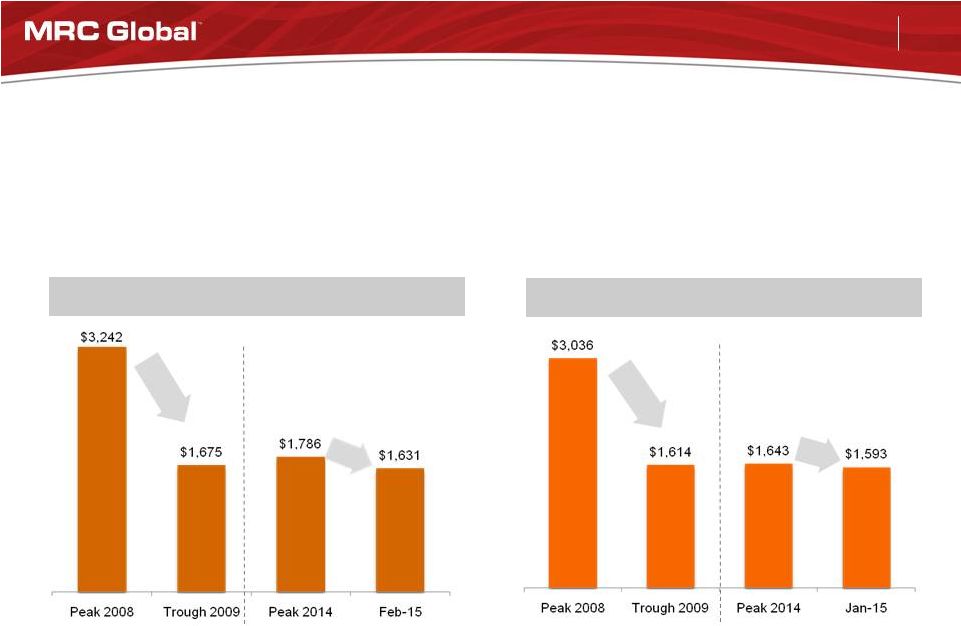

12

•

Inflation impacted both OCTG and LP in 2008…resulting in a significant

reduction in prices in 2009

•

Today, prices are lower and have less to fall in a downturn

Line Pipe Prices

OCTG Prices

48%

47%

Carbon Steel Prices in 2008/2009 as Compared to Today

Note:

Prices

are

per

ton

as

reported

in

published

market

data.

Amounts

reflect

peak

prices

in

September

2008,

trough

prices

in

November

2009.

2014

peak

prices

for

OCTG

are

from

November

and

Line

Pipe from August. 2015 prices are the most recently available.

9%

1% |

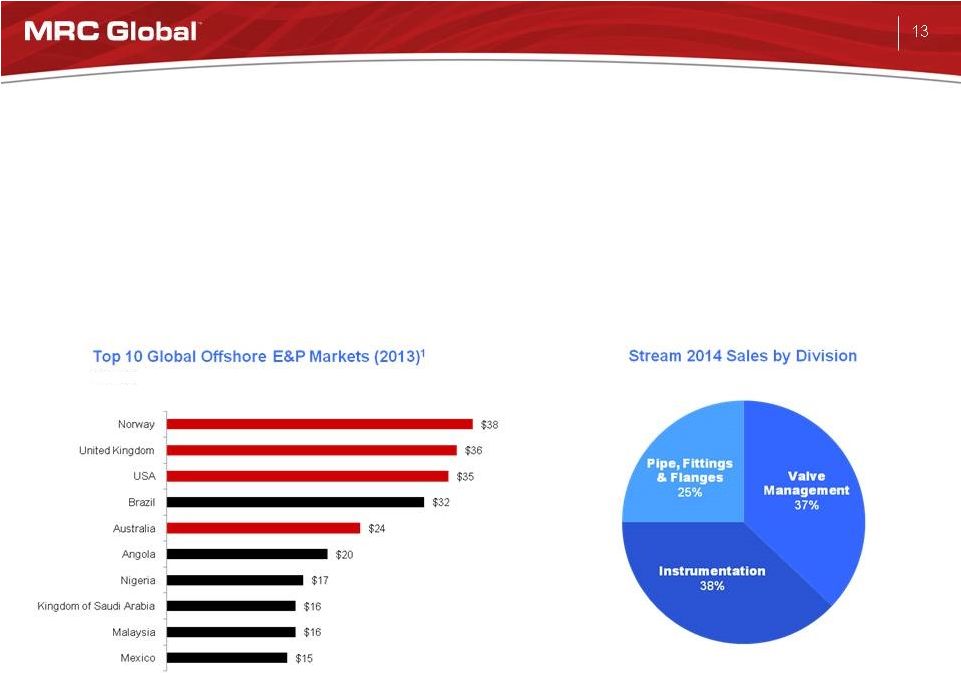

13

Strategic Expansion into Offshore Production Platform MRO

1. Source: Rystad Energy, September 2014

($ billions)

•

MRC Global revenue mix

•

Top 4 largest offshore markets ~$140 billion E&P spend

•

Norway

is

the

largest

–

we

are

now

positioned

in

4

of

the

5

largest

offshore

markets

•

Pro-forma

post

Stream

acquisition

–

approx.

92%

onshore,

8%

offshore

•

Pre

Stream

acquisition

–

approx.

98%

onshore,

2%

offshore |

14

Building an International Platform

$0

$52

$256

$330

$567

$554

$873

2008

2009

2010

2011

2012

2013

2014

International Segment Revenue

($ millions) |

15

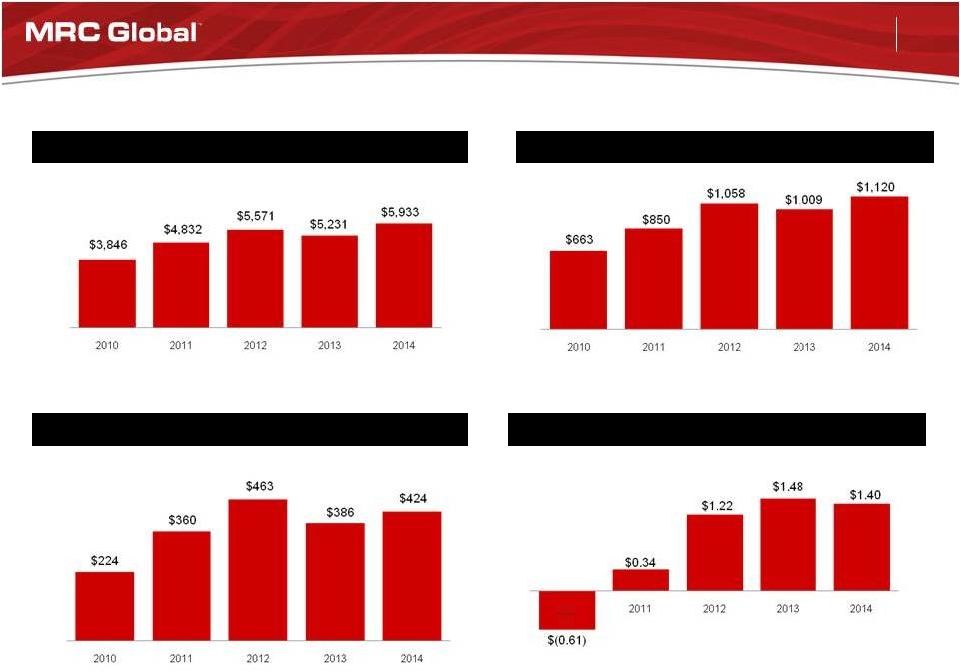

Financial Overview |

16

Financial Metrics

Sales

Adjusted Gross Profit and % Margin

Adjusted EBITDA and % Margin

8.5%

($ millions, except per share data)

Y-o-Y Growth

28%

24%

(5%)

11%

Y-o-Y Growth

61%

29%

(17%)

10%

5.8%

7.5%

8.3%

7.4%

7.1%

Y-o-Y Growth

26%

15%

(6%)

13%

Diluted EPS

Y-o-Y Growth

156%

259%

21%

(5%)

17.2%

17.6%

19.0%

19.3%

18.9%

2010 |

17

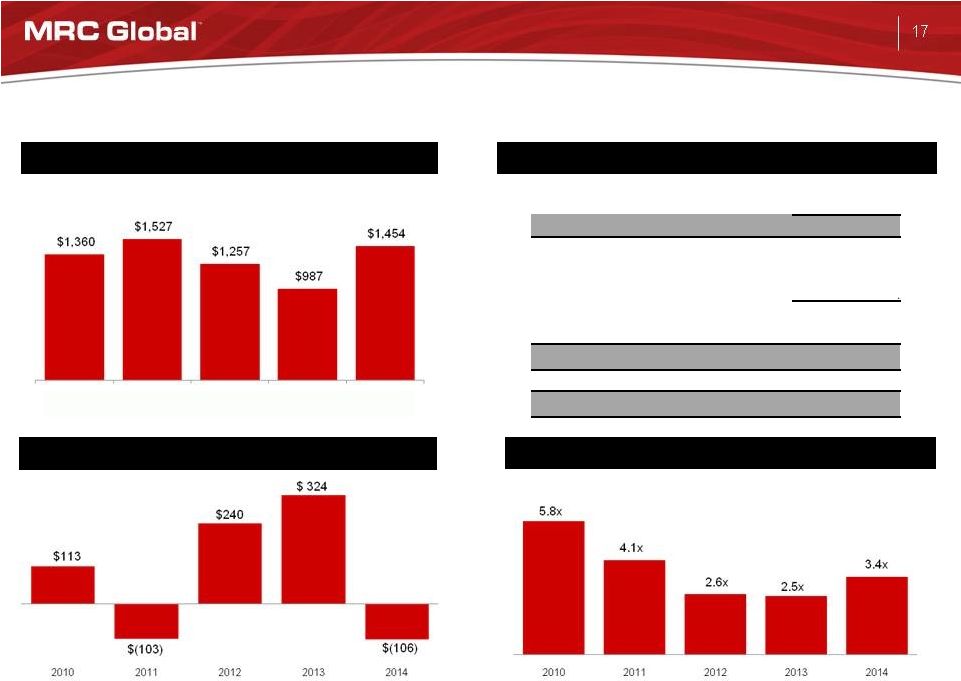

Balance Sheet Metrics

Total Debt

Capital Structure

Cash Flow from Operations

Net Leverage

($ millions)

2014

Cash and Cash Equivalents

$ 25

Total Debt

(including

current portion):

Term Loan

B due 2019, net of discount

780

Global ABL Facility due 2019

674

Total Debt

$

1,454

Total Equity

$ 1,397

Total Capitalization

$ 2,851

Liquidity

$ 302

2010

2011

2012

2013

2014 |

18

Summary of Certain Debt Terms

•

Repayment

•

No

near-term

maturities

-

Global

ABL

and

Term

Loan

B

mature

in

2019

•

Term Loan B has 1% per year amortization, paid quarterly

•

Term Loan B requires repayment in form of annual excess cash flow sweep

•

maximum of 50% of annual “Excess Cash Flow”

•

Financial Maintenance Covenants

•

No financial maintenance covenants currently in effect

•

Under

the

Global

ABL,

if

“Excess

Availability”

is

less

than

the

greater of :

•

10%

of

the

“ABL

Commitment”

-

The

threshold

is

approximately

$105

million

(10%

of

the

$1.050

billion

commitment)

or

$79.8

million,

•

then

a

“Fixed

Charge

Coverage

Ratio”

of

1.0

:

1.0

is

required

•

As of December 30, 2014:

•

“Excess

Availability”

is

approximately

$302

million

•

“Fixed

Charge

Coverage

Ratio”

is

2.29 |

19

2015 Outlook

•

Market indicators

–

North American E&P capital expenditure budgets down 35% or more

–

US rig count down 800-900 from peak in 2014

•

Commodities

–

WTI Oil price $45-$55/bbl (Brent $50-$60)

–

US Natural Gas prices $2.50-$3.50/mcf

•

Expect to generate $200-$300 million of free cash flow

•

Cash flow to be used to reduce debt

•

Cost savings measure undertaken

–

Headcount reduction

–

Lower incentive compensation

–

Salary and hiring freezes

•

Revenue headwinds $100 million or more related to currency

•

Potential deflation in tubular products 5%-15% |

20

Macro drivers

•

Growth in global energy consumption

driving investment

•

Increased global production

•

Need for additional energy infrastructure

•

Expansion of downstream energy

conversion businesses

Investment Thesis Highlights

Leading global PVF distributor to the energy sector

MRC Global attributes

•

Market leader

•

Exposed to all sectors of global energy

•

Long term global customer & supplier

relationships

•

Generates strong cash flow from operations

over the cycle |

21

Appendix |

22

Global

Footprint

to

Serve

Customers

-

North

America

Munster, IN

Nitro, WV

Tulsa, OK

Houston, TX

Nisku, AB

Cheyenne, WY

Odessa, TX

Bakersfield, CA

San Antonio, TX

By the Numbers

As of 12/31/2014

Branches

RDCs

VACs

Employees

170+

10

14

~3,400

Regional Distribution Centers

Corporate Headquarters

Valve Automation Centers

Branch Locations |

23

Global

Footprint

to

Serve

Customers

-

Europe

Regional Distribution Centers

Valve Automation Centers

Branch Locations

Stavanger, NO

By the Numbers

As of 12/31/2014

Branches

37

RDCs

3

VACs

14

Countries

8

Employees

~900

Rotterdam, NL

Bradford, UK |

24

Global Footprint to Serve Customers -

Asia Pacific & Middle East

Regional Distribution Centers

Valve Automation Centers

Branch Locations

Singapore

Perth, WA

Brisbane, QLD

Dubai, UAE

By the Numbers

As of 12/31/2014

Branches

24

RDCs

4

VACs

6

Countries

10

Employees

~400 |

25

1.

Reflects reported revenues for the year of acquisition or 2013 for Stream, MSD and

HypTeck. M&A -

Track Record of Strategic Acquisitions

Acquisition Priorities

•

International

branch

platform

for

“super

majors”

E&P

spend

•

Branch platforms/infrastructure for North American shale plays

•

Global valve and valve automation

•

Global stainless/alloys

$ 1.46 Billion +

Date

Acquisition

Rationale

Region

Revenue

1

($ millions)

Oct-08

LaBarge

Midstream

U.S.

$ 233

Oct-09

Transmark

International valve platform

Europe and Asia

346

May-10

South Texas Supply

Domestic shale

Eagle

Ford

Shale

-

South

Texas

9

Aug-10

Dresser Oil Tools Supply

Domestic shale

Bakken

Shale

-

North

Dakota

13

Jun-11

Stainless Pipe and Fittings

Projects

Australia / SE Asia

91

Jul-11

Valve Systems and Controls

Valve automation

U.S. Gulf of Mexico

13

Mar-12

OneSteel

Piping Systems

International PVF expansion

Australia

174

Jun-12

Chaparral Supply

Domestic shale

Mississippian Lime -

Oklahoma / Kansas

71

Dec-12

Production Specialty Services

Domestic shale

Permian Basin / Eagle Ford shale

127

Jul-13

Flow Control

Products

Valve automation

Permian Basin / Eagle Ford shale

28

Dec-13

Flangefitt

Stainless

Stainless/Alloys

United Kingdom

24

Jan-14

Stream

International Offshore PVF

Norway

271

May-14

MSD Engineering

Valve automation

Singapore & SE Asia

26

Jun-14

HypTeck

International Offshore

Norway

38 |

26

Year Ended December 31

($ millions)

2014

2013

2012

2011

2010

Net income

$ 144.1

$ 152.1

$ 118.0

$ 29.0

$ (51.8)

Income tax expense

81.8

84.8

63.7

26.8

(23.4)

Interest expense

61.8

60.7

112.5

136.8

139.6

Depreciation and amortization

22.5

22.3

18.6

17.0

16.6

Amortization of intangibles

67.8

52.1

49.5

50.7

53.9

Increase (decrease) in LIFO reserve

11.9

(20.2)

(24.1)

73.7

74.6

Expenses associated with refinancing

-

5.1

1.7

9.5

-

Loss on early extinguishment of debt

-

-

114.0

-

-

Change in fair value of derivative instruments

1.1

(4.7)

(2.2)

(7.0)

4.9

Equity-based compensation expense

8.9

15.5

8.5

8.4

3.7

Inventory write-down

-

-

-

-

0.4

M&A transaction & integration expenses

-

-

-

0.5

1.4

Severance & related costs

7.5

0.8

-

1.1

3.2

Loss on sale of Canadian progressive cavity pump business

6.2

-

-

-

-

Loss on disposition of rolled and welded business

4.1

-

-

-

-

Cancellation of executive employment agreement (cash portion)

3.2

-

-

-

-

Insurance charge

-

2.0

-

-

-

Foreign currency losses (gains)

2.5

12.9

(0.8)

(0.6)

0.3

Pension settlement

-

-

4.4

-

-

Legal and consulting expenses

-

-

-

9.9

4.2

Provision for uncollectible accounts

-

-

-

0.4

(2.0)

Joint venture termination

-

-

-

1.7

-

Other expense (income)

0.6

3.0

(0.6)

2.6

(1.4)

Adjusted EBITDA

$ 424.0

$ 386.4

$ 463.2

$ 360.5

$ 224.2

Adjusted EBITDA Reconciliation |

27

Year Ended December 31

($ millions)

2014

2013

2012

2011

2010

Gross profit

$ 1,018.1

$ 954.8

$ 1,013.7

$ 708.2

$ 518.1

Depreciation and amortization

22.5

22.3

18.6

17.0

16.6

Amortization of intangibles

67.8

52.1

49.5

50.7

53.9

Increase (decrease) in LIFO reserve

11.9

(20.2)

(24.1)

73.7

74.6

Adjusted Gross Profit

$ 1,120.3

$ 1,009.0

$ 1,057.7

$ 849.6

$ 663.2

Adjusted Gross Profit Reconciliation |