Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CPI AEROSTRUCTURES INC | v403625_8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - CPI AEROSTRUCTURES INC | v403625_ex99-1.htm |

Exhibit 99.2

A Premier Supplier of Aircraft Structures and Systems NYSE MKT: CVU 2014 Full - Year Results Presentation March 5, 2015 Speakers: Douglas McCrosson , President & Chief Executive Officer Vincent Palazzolo, Chief Financial Officer

Forward Looking Statements 2 This presentation contains forward - looking statements that involve risks and uncertainties . All statements, other than statements of historical fact, included in this presentation, including without limitation, statements regarding projections, future financing needs, and statements regarding future plans and objectives of the Company, are forward - looking statements . Words such as "believes," "expects," "anticipates," "intends," "plans," "estimates" and similar expressions are intended to identify forward - looking statements . These forward - looking statements are based upon the current expectations of management and certain assumptions that are subject to risks and uncertainties . Accordingly, there can be no assurance that such risks and uncertainties will not affect the accuracy of the forward - looking statements contained herein or that our actual results will not differ materially from the results anticipated in such forward - looking statements . Such factors include, but are not limited to, the following : the cyclicality of the aerospace market, the level of U . S . defense spending, production rates for commercial and military aircraft programs, competitive pricing pressures, start - up costs for new programs, technology and product development risks and uncertainties, product performance, increasing consolidation of customers and suppliers in the aerospace industry and costs resulting from changes to and compliance with applicable regulatory requirements . The information contained in this presentation is qualified in its entirety by cautionary statements and risk factors disclosed in the Company's Securities and Exchange Commission filings, including its Annual Report on Form 10 - K filed on March 11 , 2014 and Quarterly Reports on Form 10 - Q filed on May 9 , 2014 , August 8 , 2014 and November 10 , 2014 , available at http : //www . sec . gov . This presentation includes references to “adjusted revenue,” “adjusted gross profit” and “adjusted gross margin” which are non - GAAP financial measures as defined by Regulation G promulgated under the Securities Act of 1933 , as amended . A reconciliation of these non - GAAP financial measures to relevant GAAP financial measures can be found in Appendix I of this presentation . We caution readers not to place undue reliance on any forward - looking statements, which speak only as of the date hereof and for which the Company assumes no obligation to update or revise the forward - looking statements herein . CPI AERO is a registered trademark of CPI Aerostructures, Inc . All other trademarks referenced herein are the property of their respective owners .

Speaker Recent Highlights Douglas McCrosson President & Chief Executive Officer 3

Recent Business Highlights • 2014 – Ended with funded backlog of $120.6 million, up $10.2 million for the year – Received $92.9 million in new contract awards for commercial and defense programs – Commercial revenue of $36.9 million, up 37.6% as compared to 2013 commercial revenue – Year - end results included a one - time, non - cash charge related to the A - 10 Wing Replacement Program (WRP) • 2015 – Reaffirms Guidance: record revenue of $92 - $102 million; net income of $7.2 - $8.0 million – Expect approximately $9 million in tax refund and over $5 million in tax loss carry forwards related to the A - 10 WRP 4

Speaker Financial Highlights Vincent Palazzolo Chief Financial Officer 5

Fourth Quarter 2014 vs. Fourth Quarter 2013 3 - months ended December 31 , 2014 2013 Revenue $20,067,439 $21,285,992 Gross profit 4,276,019 5,280,303 Gross margin 21.3% 24.8% Income from operations 2,113,259 3,376,242 Net income 1,717,259 2,370,242 Income per common share - diluted $0.20 $ 0.28 Shares used in computing earnings per common share : Basic 8,486,437 8,394,413 Diluted 8,530,032 8,529,434 6

Fourth Quarter 2014 vs. Fourth Quarter 2013 Adjusted Revenue, Adjusted Gross Profit and A djusted Gross Margin excluding the A - 10 WRP from both reporting periods * 3 - months ended December 31 , 2014 2013 Adjusted Revenue $17,446,054 $16,868,592 Adjusted Gross P rofit 4,276,019 4,114,109 Adjusted Gross Margin 24.5% 24.4% 7 * Note: see reconciliation of A - 10 GAAP Financial Measures on Appendix I

Full Year 2014 vs. Full Year 2013 Years ended December 31 , 2014 2013 Revenue $39,687,010 $82,988,522 Gross profit (loss) (29,724,699) 18,433,247 Gross margin (74.9)% 22.2% Income (loss) from operations (37,032,919) 11,728,723 Net income (loss) (25,209,275) 7,736,894 Income (loss) per common share - diluted ($2.98) $0.91 Shares used in computing earnings per common share : Basic 8,465,937 8,389,048 Diluted 8,465,937 8,470,578 8

A - 10 Program: Effects of Shorter Life Change in estimate of the A - 10 WRP was recorded in Q2’14 resulted in: • One - time, non - cash charge of approx. $47.3 million • $44.7 million adjustment to revenue and $2.6 million adjustment to cost of sales GAAP loss recorded in Q2’14 will allow CPI Aero to claim: • 2015 tax refund of approximately $9 million from prior years’ tax payments • Over $5 million tax loss carry forwards that we expect to utilize in 2015 2015 revenue and gross margin for the A - 10 program: • Booking this program at cost = revenue • The longer this program continues, the higher the revenue and the lower the company’s gross profit margin. • No impact to bottom line is anticipated For full year 2014 and 2015 results 9

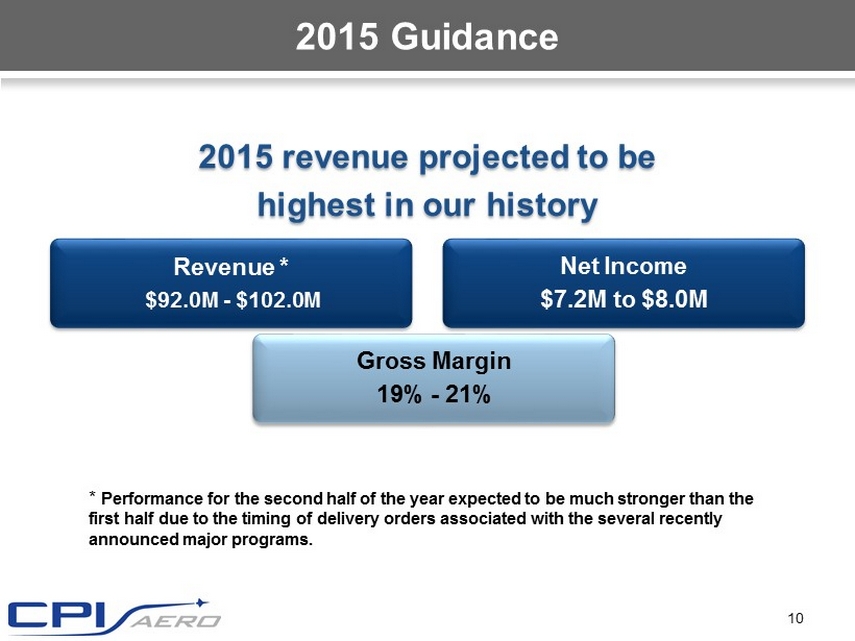

2015 Guidance 2015 revenue projected to be highest in our history Revenue * $92.0M - $102.0M Gross Margin 19% - 21% Net Income $7.2M to $8.0M 10 * Performance for the second half of the year expected to be much stronger than the first half due to the timing of delivery orders associated with the several recently announced major programs.

Revenue Breakdown: by Market Commercial 35% Military 65% 2015 Revenue (Guidance) $92.0M - $102.0M Military/commercial split effected by recent military contract wins 11 Military Over 25% growth due to recent wins Commercial To decline as majority of new business wins in 2014 were for military programs Existing programs Approx. 94% of forecast comes from existing backlog

Revenue Breakdown: by Subcontractor Role Tier 1 81% Tier 2 14% Prime 5% 2015 Revenue (Guidance) $92.0M - $102.0M 12 Prime More than double due to recent wins Tier 1 Double digit growth Tier 2 Slight decline due to G650

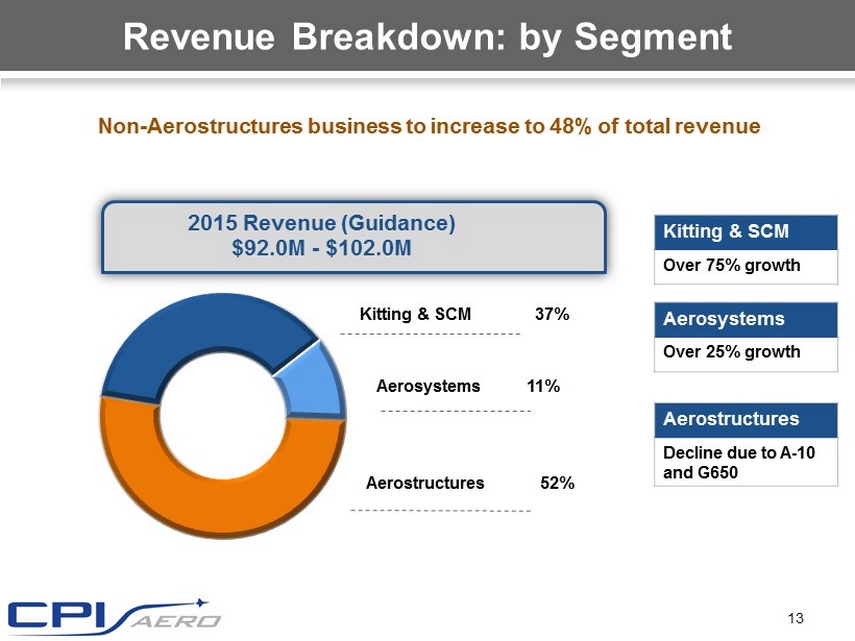

Revenue Breakdown: by Segment Aerostructures 52% Kitting & SCM 37% Aerosystems 11% 2015 Revenue (Guidance) $92.0M - $102.0M Non - Aerostructures business to increase to 48% of total revenue 13 Kitting & SCM Over 75% growth Aerosystems Over 25% growth Aerostructures Decline due to A - 10 and G650

2015 Financial Initiatives Strengthen Financial Position Invest in Automation & Robotics Continue to Generate Positive Cash Flow from Operations Further Reduce Overhead & SG&A Expenses Expect to continue to pay down debt and reduce interest expense Investments anticipated to favorably impact operating efficiencies Currently at historical low rates $13M - $15 M expected from recovery of income tax related to A - 10 WRP 14

Investments Capital • Refund / loss carry forwards related to the change in estimate of the A - 10 WRP recorded 2Q14 • $35 M Revolving Credit Facility (expandable to $50M) • $4.5 M Term Loan Investments • Facility improvements • Cap - Ex • New programs • Marketing 15

Speaker Backlog, Recent Programs, Bids and Market Update Douglas McCrosson President & Chief Executive Officer 16

Large Order Backlog Funded / Unfunded $120.6M $283.1M Funded Unfunded Unfunded backlog represents remaining potential value of long term agreements Defense / Commercial Consolidated Backlog at 12/31/2014 – $403.7 Million $254.8M $148.9M Military Aerospace Commercial 31% Funded / 69% Unfunded 63 % Defense / 37 % Commercial 17

Long - Term Visibility - Contracts (as of 2/28/15) Firm, Funded Contracts Provide Long - Term Revenue Visibility and Operating Leverage NORTHROP GRUMMAN - for the E - 2D and C - 2A aircraft TRIUMPH GROUP - for the Gulfstream G650 business jet SIKORSKY - for the S - 92® helicopter HONDA AIRCRAFT - for the HondaJet business jet BELL HELICOPTER - for the AH - 1Z ZULU attack helicopter UTC AEROSPACE SYSTEMS – for the DB - 110 ISR Pod EMBRAER - for the Embraer Phenom 300 business jet SIKORSKY - for the UH - 60 BLACK HAWK TEXTRON - for the Cessna Citation X+ civilian jet ‘08 ‘09 ’10 ’11 ’12 ’13 ‘14 ‘15 ‘16 ‘17 ‘18 ‘19 ‘20 ‘21 ‘22 ‘23 ‘24 ‘25 US GOVERNMENT - for the F16 aircraft Potential to collectively generate revenue of $445M during their remaining periods of performance US GOVERNMENT - for the T - 38C aircraft 18

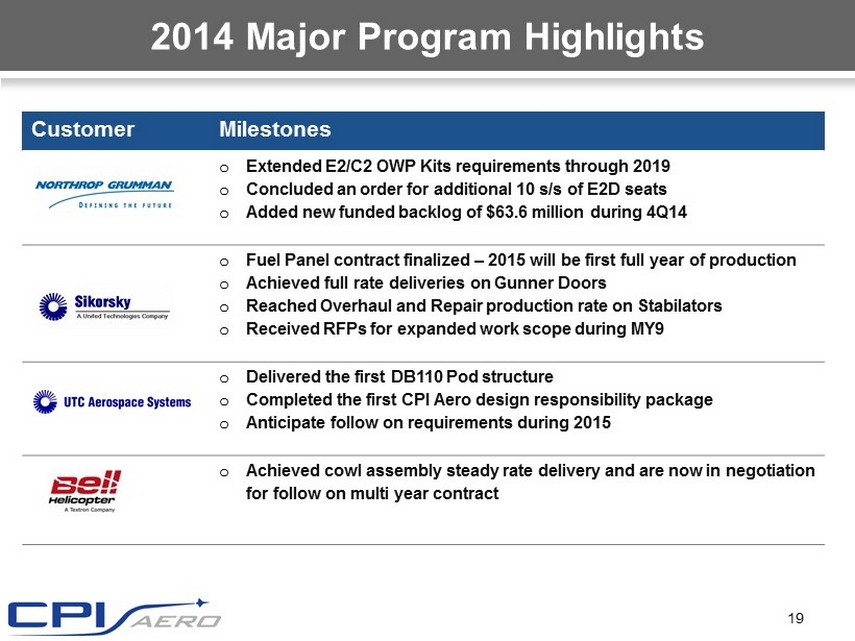

2014 Major Program Highlights Customer Milestones o Extended E2/C2 OWP Kits requirements through 2019 o Concluded an order for additional 10 s/s of E2D seats o Added new funded backlog of $63.6 million during 4Q14 o Fuel Panel contract finalized – 2015 will be first full year of production o Achieved full rate deliveries on Gunner Doors o Reached Overhaul and Repair production rate on Stabilators o Received RFPs for expanded work scope during MY9 o Delivered the first DB110 Pod structure o Completed the first CPI Aero design responsibility package o Anticipate follow on requirements during 2015 o Achieved cowl assembly steady rate delivery and are now in negotiation for follow on multi year contract 19

2014 Major Program Highlights Customer Milestones o Gulfstream G650 Fixed Leading Edge: Smoothly transitioned to new customer, when Spirit AeroSystems sold program to Triumph Group o Master agreement assigned to new customer (through 2019) o Ramped up delivery of the Phenom 300 engine inlets from 2 s/s to 10+ s/s per month o Running at 10+ s/s per month during 2015 o Transitioned Citation X+ from a start up project to rate production o Received customer accolades for transitioning a legacy program flawlessly, which has led to new opportunities o Delivered Flaps and Inlets for first aircraft to be delivered to customers in early 2015 o Participated in redesign effort to improve producability and minimize weight o Honda expects FAA type certification in Q1’15 20

Defense Business Coming Back E - 2D Advanced Hawkeye and the C - 2A Greyhound aircraft F - 16 Fighter Jet T - 38C Aircraft $86.1 million $53.5 million $49 million Contract Period 2013 - 2021 Contract Period 2014 - 2022 Contract Period 2013 - 2021 Recent wins added over $188 million in backlog until 2022 21

Recent Contract Wins • Multi - year contract worth approx. $86.1 million • To supply Outer Wing Panel (OWP) kits used to manufacture complete wings for the E - 2D Advanced Hawkeye and the C - 2A Greyhound aircraft. • Includes approx. $63.6 million in new funded backlog and approx. $22.5 million in requirements that were released to CPI Aero in 2013. • CPI Aero has produced OWP kits for the E - 2D Advanced Hawkeye and the C - 2A Greyhound aircraft, which share a common wing design, since June 2008. E - 2D Advanced Hawkeye and the C - 2A Greyhound aircraft Program Info: • Outer Wing Panel • Seats - Pilot, Co - Pilot, (3) Operator OWP: 18 complete shipsets delivered to date • (10) shipsets in WIP to be delivered through 2015 $86.1 million 22

Recent Contract Wins 23 Program Info: • Single supplier of 439 structural wing parts used for MRO efforts for both U.S. and worldwide fleet of the F - 16 aircraft • Forecasting, acquisition, inventory management and distribution F - 16 Fighter Jet • Contract value, including options, to be approximately $53.5 million . • The term of the contract is for a period of 5 years , with a single option for an additional 3 - year period. • CPI Aero supports MRO efforts for both the U.S. fleet of more than 1,000 F - 16 aircraft as well as the nearly 1,900 F - 16s flown by air forces around the world. $53.5 million

Recent Contract Wins • $49 million m ulti - year ID / IQ contract from the United States Air Force • CPI Aero to support the T - 38C Pacer Classic III (PC III) aircraft structural modification program during Phase II for up to 74 aircrafts. • CPI Aero will provide the necessary integration of kits, program management, logistics, discrepancy reporting/resolution, and sub - contract management. • The Period of Performance and Ordering Period for Phase II commences immediately and will span five years , with an anticipated delivery period of six years, ending in February 2021. T - 38C Aircraft $49 million 24

T - 38C Program Overview 25

Bid Pipeline (2/28/15) Military vs Commercial 30% 70% Commercial Military By Position Within the Supply Chain Defense opportunities increasing Expect near - term acceleration of Tier 2 opportunities for large c ommercial 71% 29% Tier 1 Tier 2 26

Bid Landscape Boeing 787 Dreamliner Bombardier C - series Lockheed Martin F - 35 Embraer E2 27

2015 Focus Areas EXECUTE Maintain and grow Tier 1 status Continuously improve delivery , quality and performance Capture returns on initial automation GROW Continued investment in automation and productivity Replace A - 10 program revenues with additional new long - term programs Focus on organic growth May consider acquisitions to gain scale, enter new markets EVOLVE Deploy capital to create shareholder value Expand global supply chain services Continued improvement of design and manufacturing capabilities Drive balance across segments and diversify customer base 28

Conclusion CPI is well positioned to continue to grow its business due to: • Our large and diversified b acklog • Our effort to continuously expand & improve capabilities • Vast growth opportunities arising from developments in both commercial aerospace and military/defense sector • Significant bid pipeline for both the defense and commercial m arkets 29

Q&A Q&A Session Douglas McCrosson President & Chief Executive Officer Vincent Palazzolo Chief Financial Officer 30

Contact us CPI Aerostructures Vincent Palazzolo, CFO (631) 586 - 5200 www.cpiaero.com Investor Relations Lena Cati (212) 836 - 9611 www.theequitygroup.com lcati@equityny.com 31

Appendix I 32 We use in this presentation the terms “Adjusted Revenue,” “Adjusted Gross Profit” and “Adjusted Gross Margin” for the quarters ending December 31 , 2013 and 2014 . Such measures (arrived at by eliminating the Company's A - 10 Program with Boeing from revenue and in calculating gross profit and gross margin for such periods) are not derived in accordance with generally accepted accounting principles (“GAAP ”) . “Adjusted Revenue,” “Adjusted Gross Profit” and “Adjusted Gross Margin” are each considered a non - GAAP financial measure as defined by Regulation G promulgated by the SEC under the Securities Act of 1933 , as amended . CPI Aero believes that “Adjusted Revenue,” “Adjusted Gross Profit” and “Adjusted Gross Margin” provide information useful to investors for evaluating CPI Aero’s 2014 financial performance on a consistent basis across financial reporting periods . The presentation of “Adjusted Revenue,” “Adjusted Gross Profit” and “Adjusted Gross Margin” should not be construed as an inference that CPI Aero's future results will be unaffected by unusual or non - recurring items or by non - cash items, such as changes in estimates . “Adjusted Revenue,” “Adjusted Gross Profit” and “Adjusted Gross Margin” should be considered in addition to, rather than as a substitute for, revenue, gross profit and gross margin derived under GAAP .

Appendix I 33 Quarter ended Quarter ended Quarter ended December 31, 2014 December 31, 2014 December 31, 2014 GAAP A - 10 WRP as adjusted w/o A - 10 Revenue and Adjusted Revenue $ 20,067,439 $ 2,621,384 $ 17,446,055 Gross Profit and Adjusted Gross Profit 4,276,019 0 4,276,019 Gross Margin and Adjusted Gross Margin 21.3% 0.0% 24.5% Quarter ended Quarter ended Quarter ended December 31, 2013 December 31, 2013 December 31, 2013 GAAP A - 10 WRP as adjusted w/o A - 10 Revenue and Adjusted Revenue $ 21,285,992 $ 4,417,400 $ 16,868,592 Gross Profit and Adjusted Gross Profit 5,280,303 1,166,194 4,114,109 Gross Margin and Adjusted Gross Margin 24.8% 26.4% 24.4% Reconciliation of Non - GAAP Financial Measures