Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - Howard Bancorp Inc | a51049957ex2_1.htm |

| EX-99.1 - EXHIBIT 99.1 - Howard Bancorp Inc | a51049957ex99_1.htm |

| EX-10.1 - EXHIBIT 10.1 - Howard Bancorp Inc | a51049957ex10_1.htm |

| EX-99.3 - EXHIBIT 99.3 - Howard Bancorp Inc | a51049957ex99_3.htm |

| 8-K - HOWARD BANCORP, INC. 8-K - Howard Bancorp Inc | a51049957.htm |

Exhibit 99.2

Investor PresentationMarch 2015

Cautionary Statements about Forward Looking Statements Other Placeholder:This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements of the goals, intentions, and expectations of Howard Bancorp, Inc. (“Howard”) as to future trends, plans, events, projections, results of operations and policies and regarding general economic conditions. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the merger, (ii) Howard’s recent capital raise (iii) Howard’s plans, obligations, expectations and intentions. In some cases, forward-looking statements can be identified by use of words such as “may”, “will”, “anticipates”, “believes”, “expects”, “plans”, “estimates”, “potential”, “continue”, “should”, and similar words of phrases. These statements, projections and estimates are based upon the beliefs of the management of Howard, as the date hereof, as to the expected outcome of future events, current and anticipated economic conditions, nationally and in Howard’s market, and their impact on the operations and assets of Howard, interest rates and interest rate policy, competitive factors, judgments about the ability of Howard and Patapsco Bancorp, Inc. (“Patapsco”) to successfully consummate the merger and to integrate the operations of the two companies, the ability of Howard and Patapsco to avoid customer dislocation during the period leading up to and following the merger, and other conditions which by their nature, are not susceptible to accurate forecast and are subject to significant uncertainty. Factors that could cause results and outcomes to differ materially include, among others, the ability to obtain required regulatory and shareholder approvals; the ability to complete the merger and/or the capital raise as expected and within the expected timeframe; and the possibility that one or more of the conditions thereto are satisfied. Because of these uncertainties and the assumptions on which the forward-looking statements, projections and estimates are based, actual future operations and results in the future may differ materially from those indicated herein. Readers are cautioned against placing undue reliance on such forward-looking statements, projections and estimates. Past results are not necessarily indicative of future performance. Howard assumes no obligations to revise, update, or clarify forward-looking statements, projections and estimates to reflect events or conditions after the date of this presentation.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the merger, Howard will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 to register shares of Howard common stock to be issued to Patapsco’s shareholders. The registration statement will include a proxy statement of Patapsco that also will constitute a proxy statement and a prospectus of Howard. A definitive proxy statement and prospectus will be mailed to stockholders of Howard and Patapsco seeking their respective approvals of the merger. Howard and Patapsco may also file other relevant documents with SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS OF HOWARD AND PATAPSCO ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Such documents are not currently available. Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s website, www.sec.gov. Copies of the documents filed with the SEC by Howard will be available free of charge on Howard’s website at www.Howardbank.com under the tab “Investor Relation” and then under the heading “Filings Only” or by contacting George Coffman, Investor Relations Contact. You may also read and copy any reports, statements and other information filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington DC. Information about the operation of the SEC Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The information on Howard's websites is not, and shall not be deemed to be, a part of this release or incorporated into other filings Howard makes with the SEC.Howard, Patapsco and their respective directors, executive officers and members of management may be deemed to be participants in the solicitation of proxies from the stockholders of Howard in connection with the transaction. Information about the directors and executive officers of Howard is set forth in the proxy statement for Howard's 2014 annual meeting of stockholders filed with the SEC on April 17, 2014. Additional information regarding the interests of these participants and other persons who may be deemed participants in the merger may be obtained by reading the joint proxy statement/prospectus regarding the merger when it becomes available.This information is substantially identical, in form and substance, to the information provided to potential investors in Howard’s $25 million capital raise. Safe Harbor and Legend

Table of Contents Howard Bancorp, Inc. 4Howard Bancorp Management 12Offering of Common Stock 14Transaction with Patapsco Bancorp, Inc. 23Explanatory NoteBackground and ReasonsTerms of Indication of Interest Patapsco BancorpHoward and Patapsco Combined with $10 million of New Common Equity 27Summary 34Appendices: Patapsco PricingMarket ComparablesAccretion/Dilution Sensitivity Analysis to Howard’s Stock Price for Determining Exchange Ratio for PatapscoPro Forma Accretion/Dilution with Patapsco and $10 to $30 million of CapitalExchange Ratio Matrix

I .Howard Bancorp, Inc.

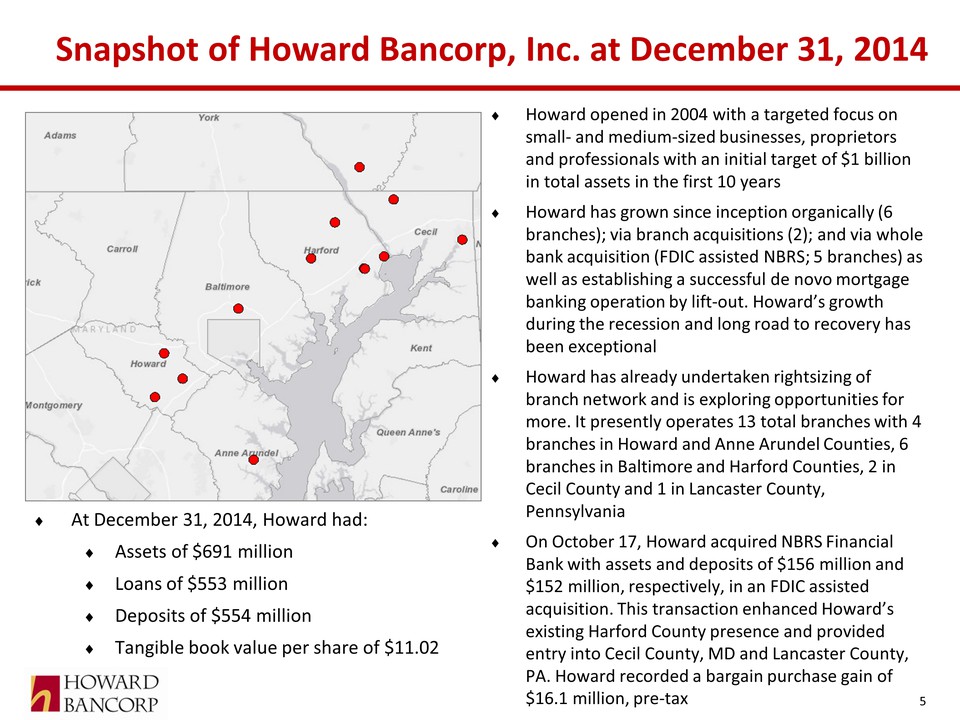

Snapshot of Howard Bancorp, Inc. at December 31, 2014 Other Placeholder: Howard opened in 2004 with a targeted focus on small- and medium-sized businesses, proprietors and professionals with an initial target of $1 billion in total assets in the first 10 yearsHoward has grown since inception organically (6 branches); via branch acquisitions (2); and via whole bank acquisition (FDIC assisted NBRS; 5 branches) as well as establishing a successful de novo mortgage banking operation by lift-out. Howard’s growth during the recession and long road to recovery has been exceptionalHoward has already undertaken rightsizing of branch network and is exploring opportunities for more. It presently operates 13 total branches with 4 branches in Howard and Anne Arundel Counties, 6 branches in Baltimore and Harford Counties, 2 in Cecil County and 1 in Lancaster County, PennsylvaniaOn October 17, Howard acquired NBRS Financial Bank with assets and deposits of $156 million and $152 million, respectively, in an FDIC assisted acquisition. This transaction enhanced Howard’s existing Harford County presence and provided entry into Cecil County, MD and Lancaster County, PA. Howard recorded a bargain purchase gain of $16.1 million, pre-tax At December 31, 2014, Howard had:Assets of $691 millionLoans of $553 million Deposits of $554 millionTangible book value per share of $11.02

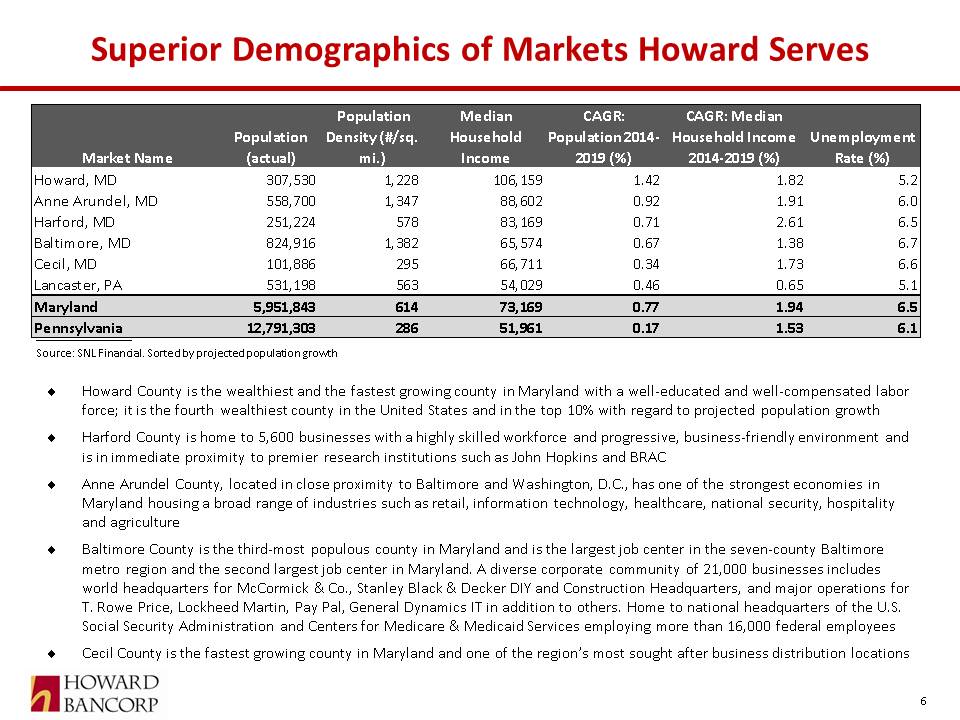

Superior Demographics of Markets Howard Serves Source: SNL Financial. Sorted by projected population growth Howard County is the wealthiest and the fastest growing county in Maryland with a well-educated and well-compensated labor force; it is the fourth wealthiest county in the United States and in the top 10% with regard to projected population growthHarford County is home to 5,600 businesses with a highly skilled workforce and progressive, business-friendly environment and is in immediate proximity to premier research institutions such as John Hopkins and BRACAnne Arundel County, located in close proximity to Baltimore and Washington, D.C., has one of the strongest economies in Maryland housing a broad range of industries such as retail, information technology, healthcare, national security, hospitality and agricultureBaltimore County is the third-most populous county in Maryland and is the largest job center in the seven-county Baltimore metro region and the second largest job center in Maryland. A diverse corporate community of 21,000 businesses includes world headquarters for McCormick & Co., Stanley Black & Decker DIY and Construction Headquarters, and major operations for T. Rowe Price, Lockheed Martin, Pay Pal, General Dynamics IT in addition to others. Home to national headquarters of the U.S. Social Security Administration and Centers for Medicare & Medicaid Services employing more than 16,000 federal employeesCecil County is the fastest growing county in Maryland and one of the region’s most sought after business distribution locations

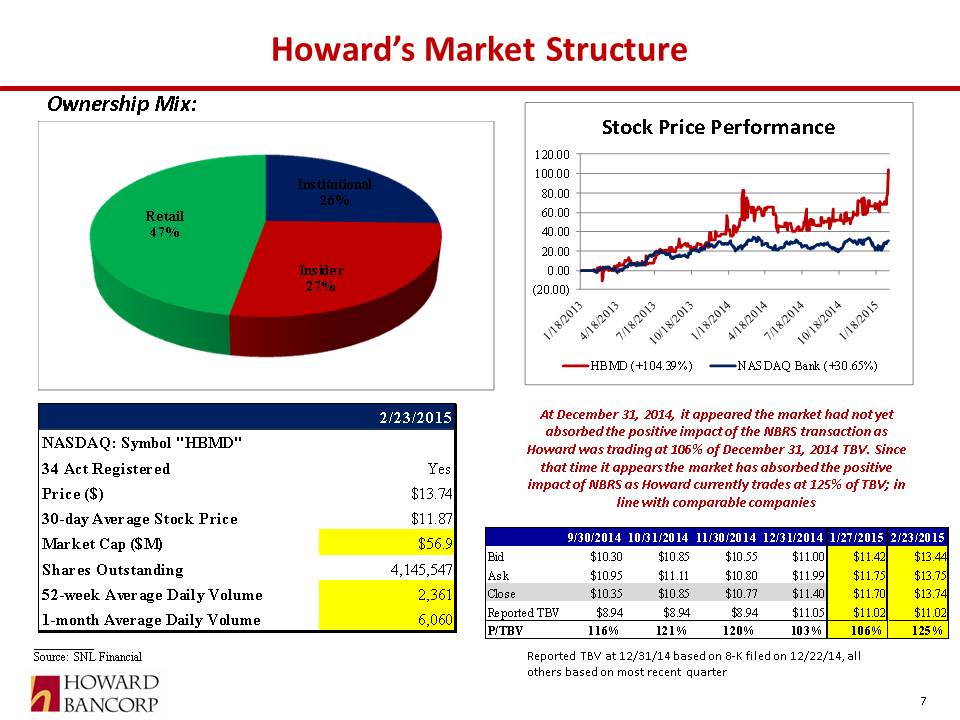

Howard’s Market Structure Source: SNL Financial Ownership Mix: Reported TBV at 12/31/14 based on 8-K filed on 12/22/14, all others based on most recent quarter At December 31, 2014, it appeared the market had not yet absorbed the positive impact of the NBRS transaction as Howard was trading at 106% of December 31, 2014 TBV. Since that time it appears the market has absorbed the positive impact of NBRS as Howard currently trades at 125% of TBV; in line with comparable companies

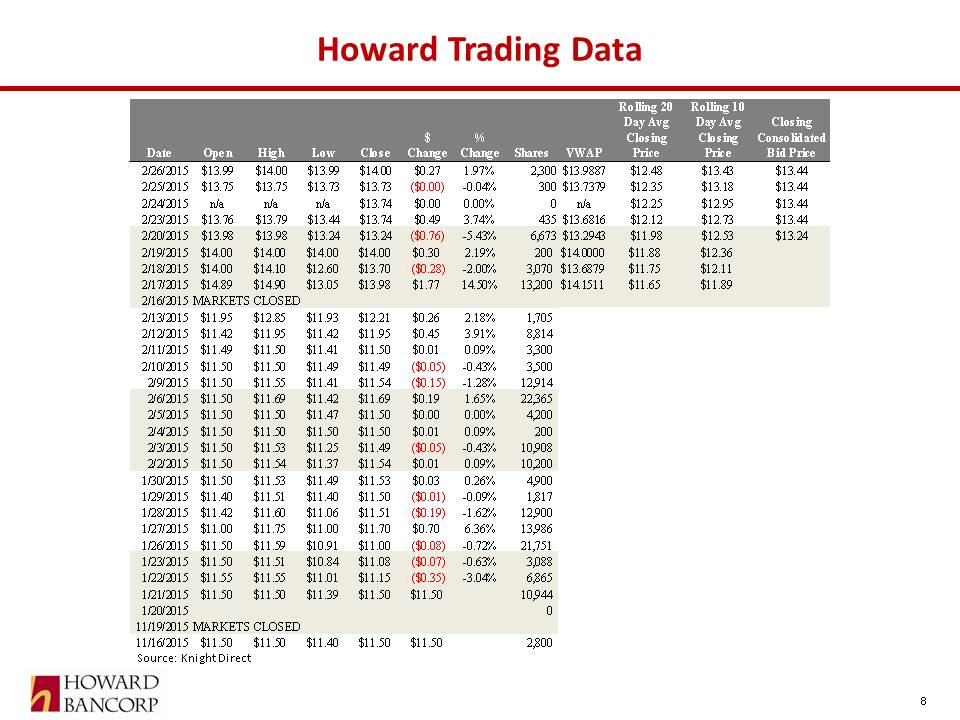

Howard Trading Data Source: Knight Direct

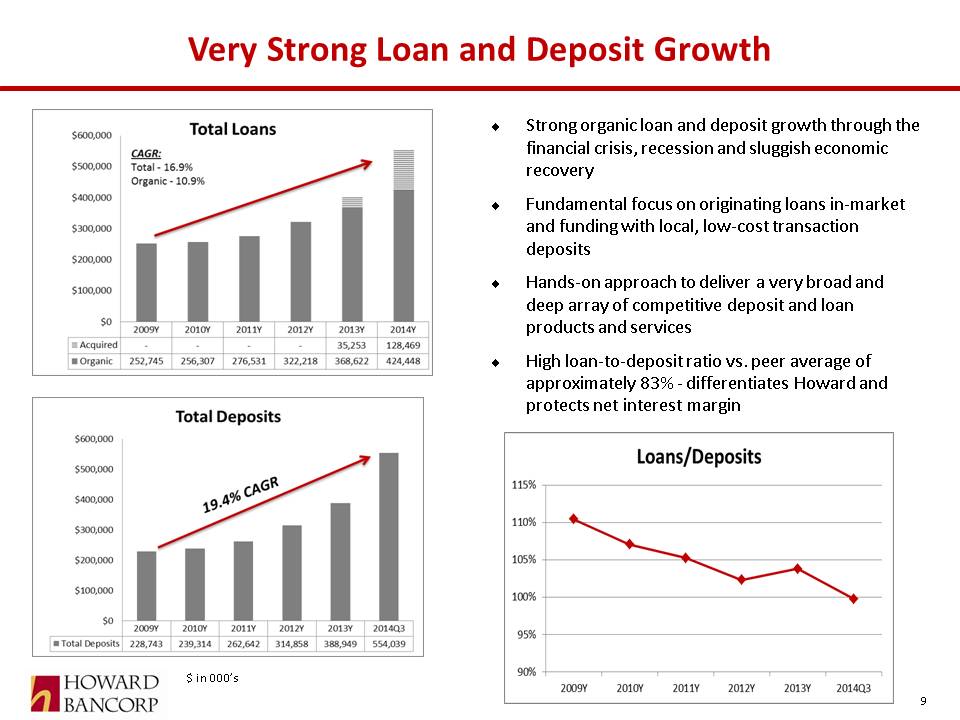

Strong organic loan and deposit growth through the financial crisis, recession and sluggish economic recoveryFundamental focus on originating loans in-market and funding with local, low-cost transaction depositsHands-on approach to deliver a very broad and deep array of competitive deposit and loan products and servicesHigh loan-to-deposit ratio vs. peer average of approximately 83% - differentiates Howard and protects net interest margin Very Strong Loan and Deposit Growth $ in 000’s

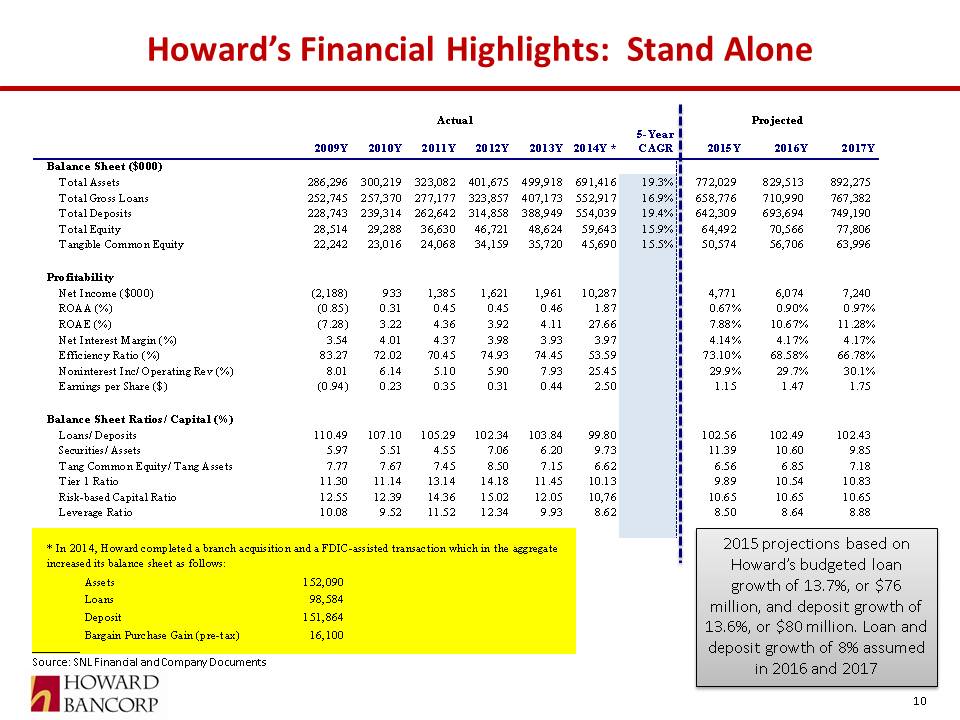

Howard’s Financial Highlights: Stand Alone Source: SNL Financial and Company Documents 2015 projections based on Howard’s budgeted loan growth of 13.7%, or $76 million, and deposit growth of 13.6%, or $80 million. Loan and deposit growth of 8% assumed in 2016 and 2017

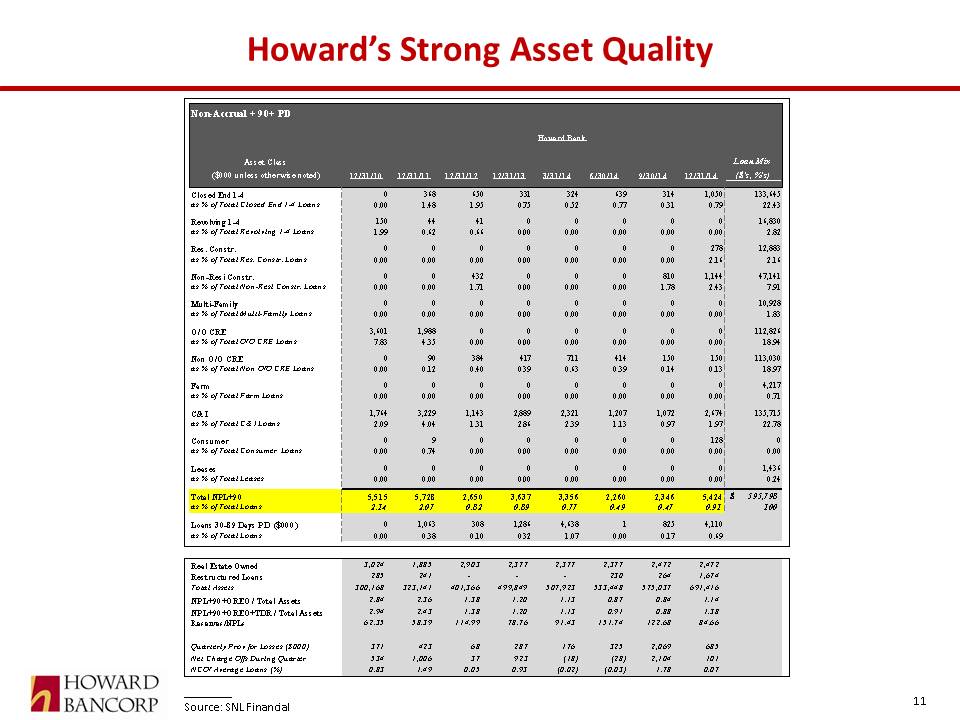

Howard’s Strong Asset Quality Source: SNL Financial

II. Howard Bancorp Management

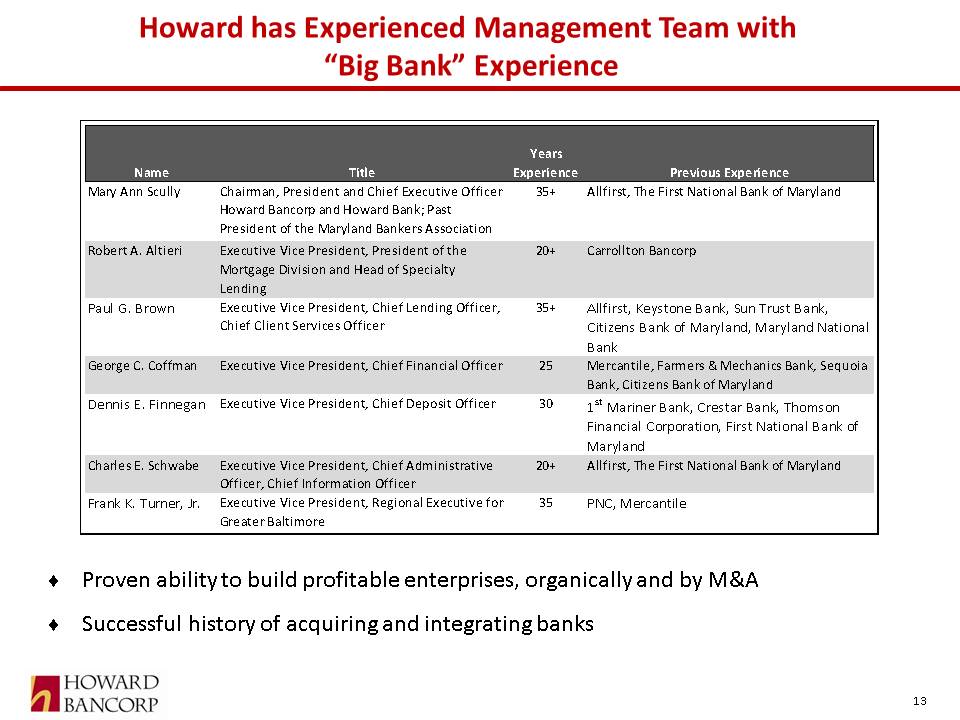

Howard has Experienced Management Team with “Big Bank” Experience Other Placeholder: Proven ability to build profitable enterprises, organically and by M&ASuccessful history of acquiring and integrating banks

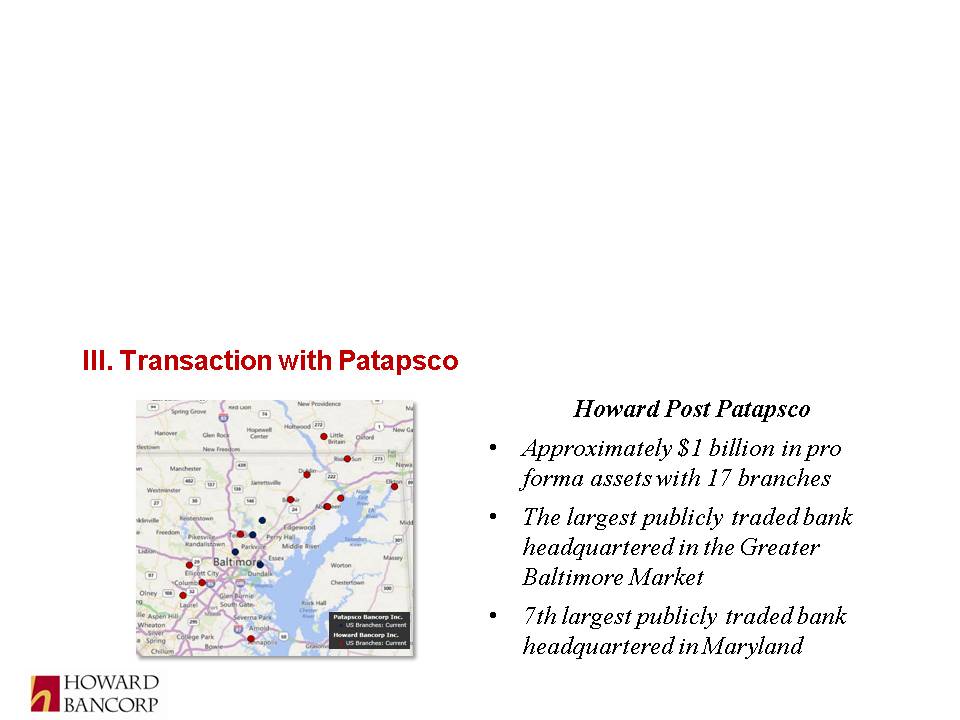

III. Transaction with Patapsco Howard Post PatapscoApproximately $1 billion in pro forma assets with 17 branchesThe largest publicly traded bank headquartered in the Greater Baltimore Market7th largest publicly traded bank headquartered in Maryland

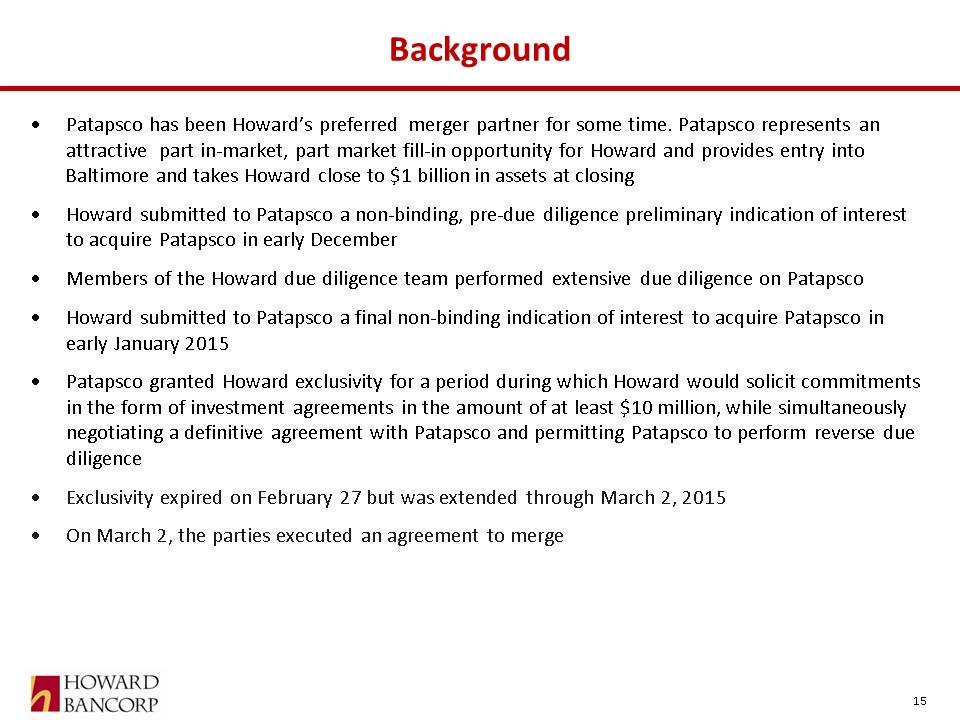

Patapsco has been Howard’s preferred merger partner for some time. Patapsco represents an attractive part in-market, part market fill-in opportunity for Howard and provides entry into Baltimore and takes Howard close to $1 billion in assets at closingHoward submitted to Patapsco a non-binding, pre-due diligence preliminary indication of interest to acquire Patapsco in early DecemberMembers of the Howard due diligence team performed extensive due diligence on PatapscoHoward submitted to Patapsco a final non-binding indication of interest to acquire Patapsco in early January 2015Patapsco granted Howard exclusivity for a period during which Howard would solicit commitments in the form of investment agreements in the amount of at least $10 million, while simultaneously negotiating a definitive agreement with Patapsco and permitting Patapsco to perform reverse due diligenceExclusivity expired on February 27 but was extended through March 2, 2015On March 2, the parties executed an agreement to merge Background

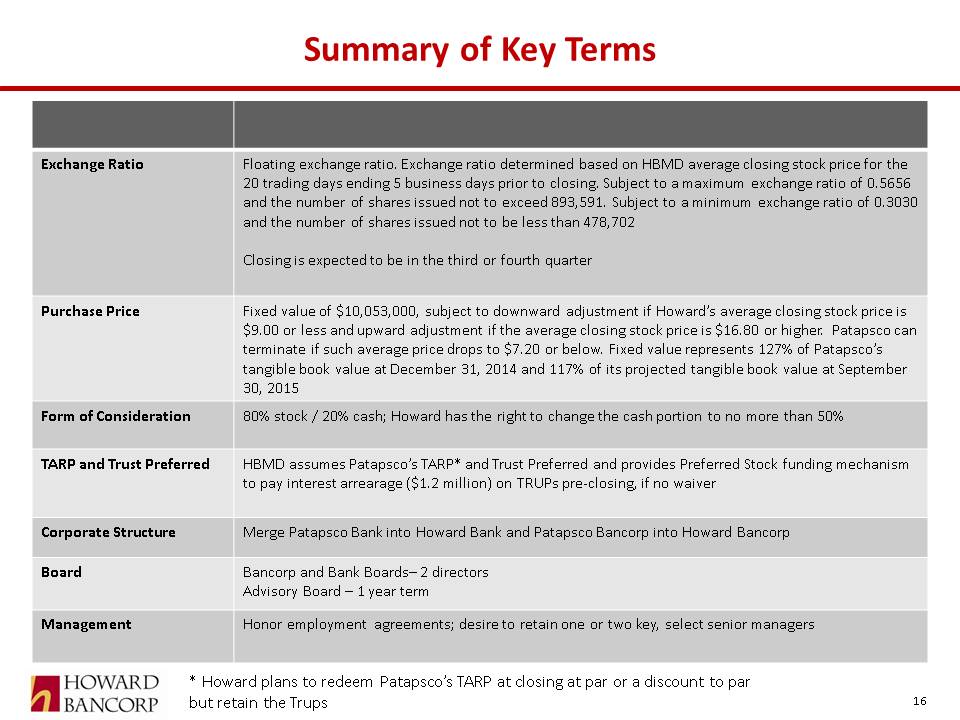

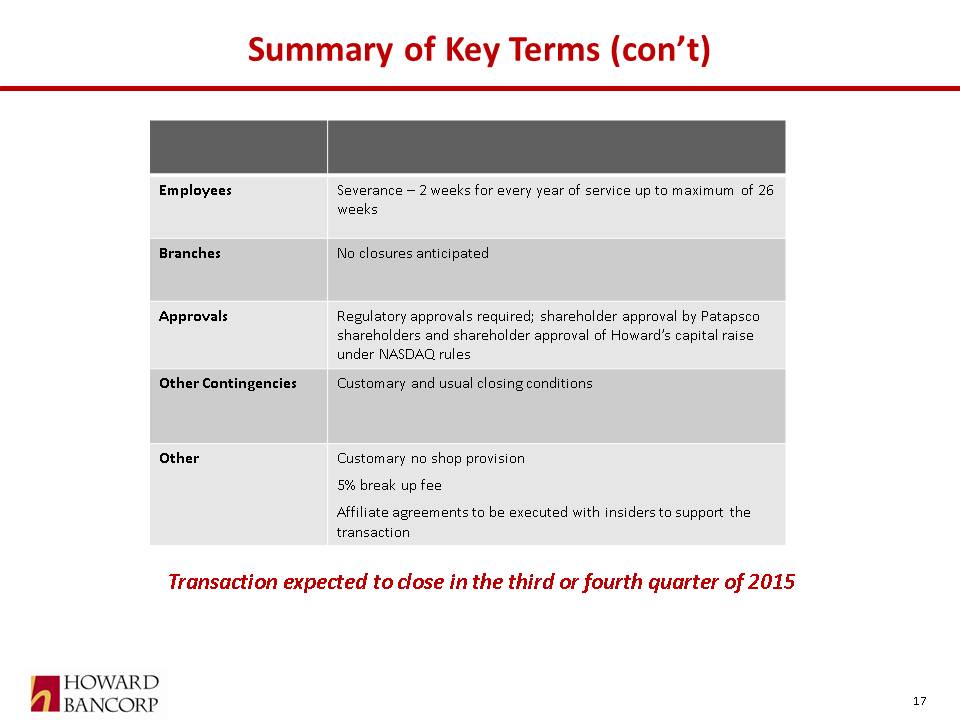

Summary of Key Terms * Howard plans to redeem Patapsco’s TARP at closing at par or a discount to par but retain the Trups

Summary of Key Terms (con’t) Transaction expected to close in the third or fourth quarter of 2015

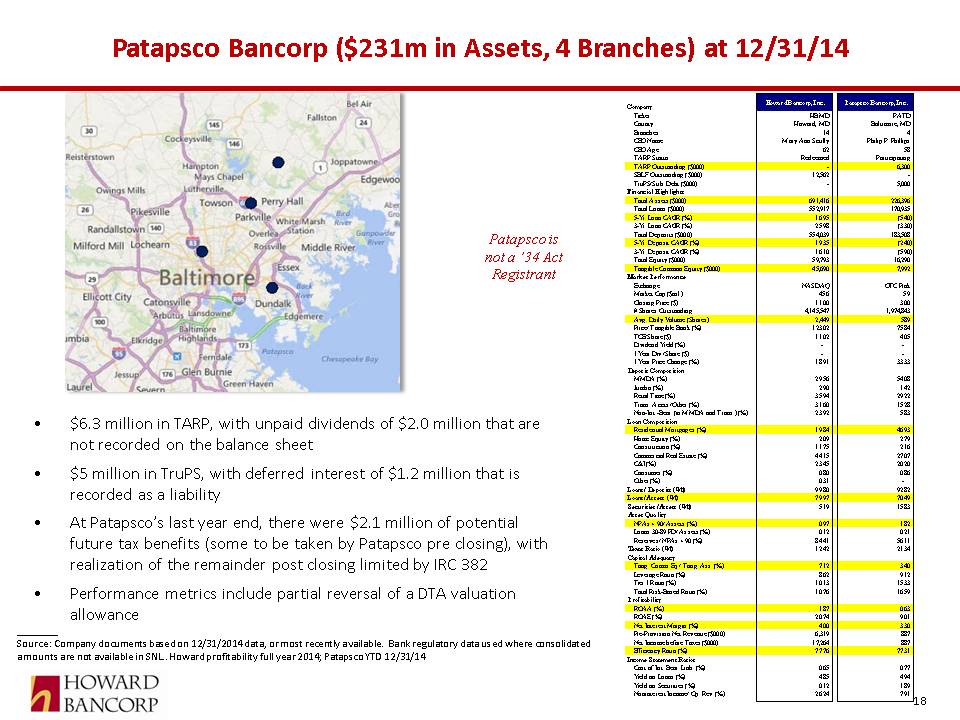

Patapsco Bancorp ($231m in Assets, 4 Branches) at 12/31/14 $6.3 million in TARP, with unpaid dividends of $2.0 million that are not recorded on the balance sheet$5 million in TruPS, with deferred interest of $1.2 million that is recorded as a liabilityAt Patapsco’s last year end, there were $2.1 million of potential future tax benefits (some to be taken by Patapsco pre closing), with realization of the remainder post closing limited by IRC 382Performance metrics include partial reversal of a DTA valuation allowance Source: Company documents based on 12/31/2014 data, or most recently available. Bank regulatory data used where consolidated amounts are not available in SNL.. Howard profitability full year 2014; Patapsco YTD 12/31/14 Patapsco isnot a ’34 Act Registrant

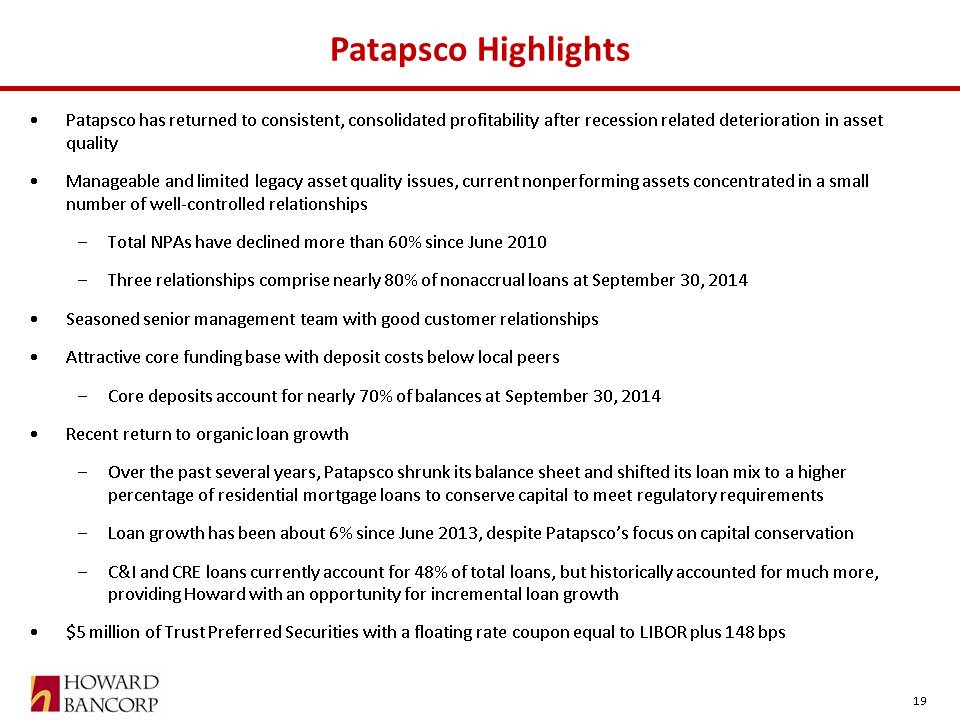

Other Placeholder: Patapsco has returned to consistent, consolidated profitability after recession related deterioration in asset qualityManageable and limited legacy asset quality issues, current nonperforming assets concentrated in a small number of well-controlled relationshipsTotal NPAs have declined more than 60% since June 2010Three relationships comprise nearly 80% of nonaccrual loans at September 30, 2014Seasoned senior management team with good customer relationshipsAttractive core funding base with deposit costs below local peersCore deposits account for nearly 70% of balances at September 30, 2014Recent return to organic loan growthOver the past several years, Patapsco shrunk its balance sheet and shifted its loan mix to a higher percentage of residential mortgage loans to conserve capital to meet regulatory requirementsLoan growth has been about 6% since June 2013, despite Patapsco’s focus on capital conservationC&I and CRE loans currently account for 48% of total loans, but historically accounted for much more, providing Howard with an opportunity for incremental loan growth$5 million of Trust Preferred Securities with a floating rate coupon equal to LIBOR plus 148 bps Patapsco Highlights

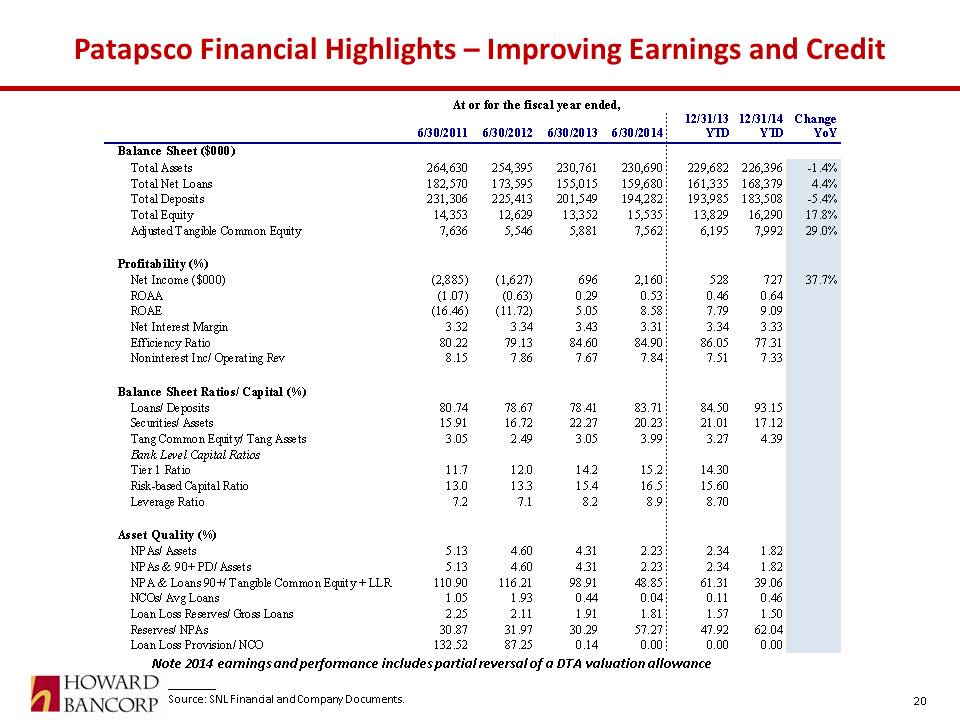

Patapsco Financial Highlights – Improving Earnings and Credit Source: SNL Financial and Company Documents. Note 2014 earnings and performance includes partial reversal of a DTA valuation allowance

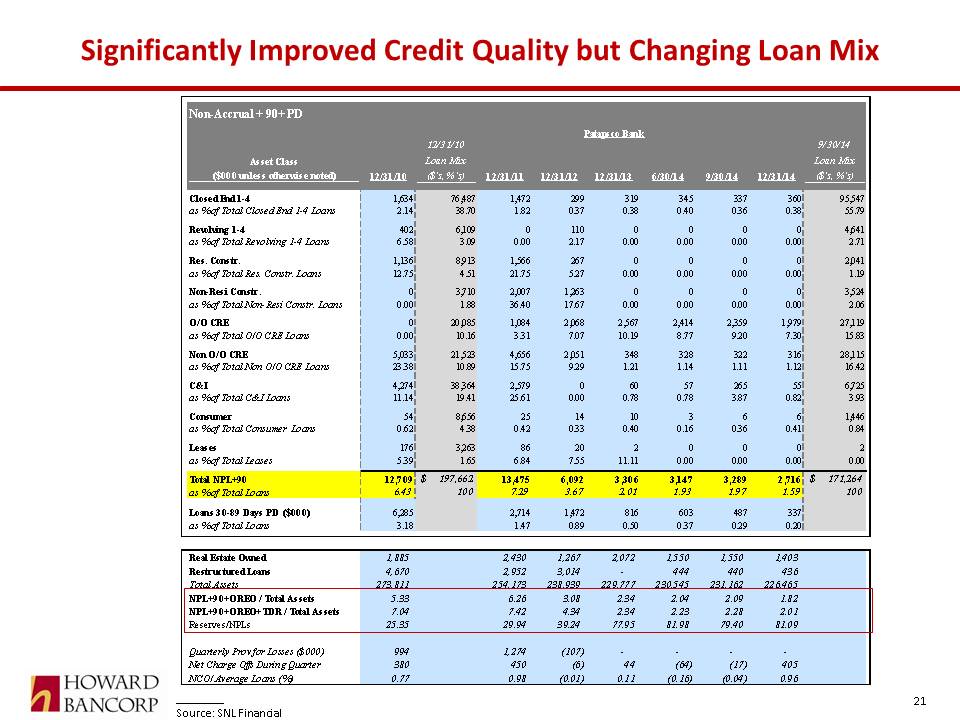

Significantly Improved Credit Quality but Changing Loan Mix Source: SNL Financial

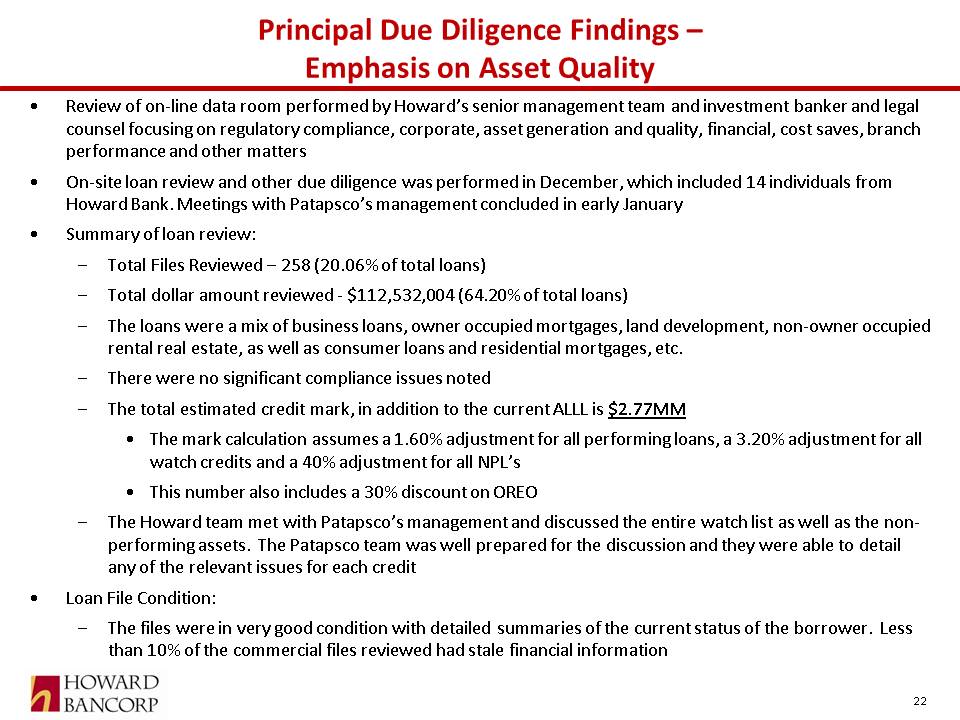

Review of on-line data room performed by Howard’s senior management team and investment banker and legal counsel focusing on regulatory compliance, corporate, asset generation and quality, financial, cost saves, branch performance and other mattersOn-site loan review and other due diligence was performed in December, which included 14 individuals from Howard Bank. Meetings with Patapsco’s management concluded in early JanuarySummary of loan review:Total Files Reviewed – 258 (20.06% of total loans)Total dollar amount reviewed - $112,532,004 (64.20% of total loans)The loans were a mix of business loans, owner occupied mortgages, land development, non-owner occupied rental real estate, as well as consumer loans and residential mortgages, etc.There were no significant compliance issues notedThe total estimated credit mark, in addition to the current ALLL is $2.77MMThe mark calculation assumes a 1.60% adjustment for all performing loans, a 3.20% adjustment for all watch credits and a 40% adjustment for all NPL’sThis number also includes a 30% discount on OREOThe Howard team met with Patapsco’s management and discussed the entire watch list as well as the non-performing assets. The Patapsco team was well prepared for the discussion and they were able to detail any of the relevant issues for each creditLoan File Condition:The files were in very good condition with detailed summaries of the current status of the borrower. Less than 10% of the commercial files reviewed had stale financial information Principal Due Diligence Findings – Emphasis on Asset Quality

IV. Offering of Common Stock The institutional placement is not dependent upon the closing of the Patapsco transaction, but is conditioned on the approval of such placement by Howard’s shareholders as required by NASDAQ listing requirements

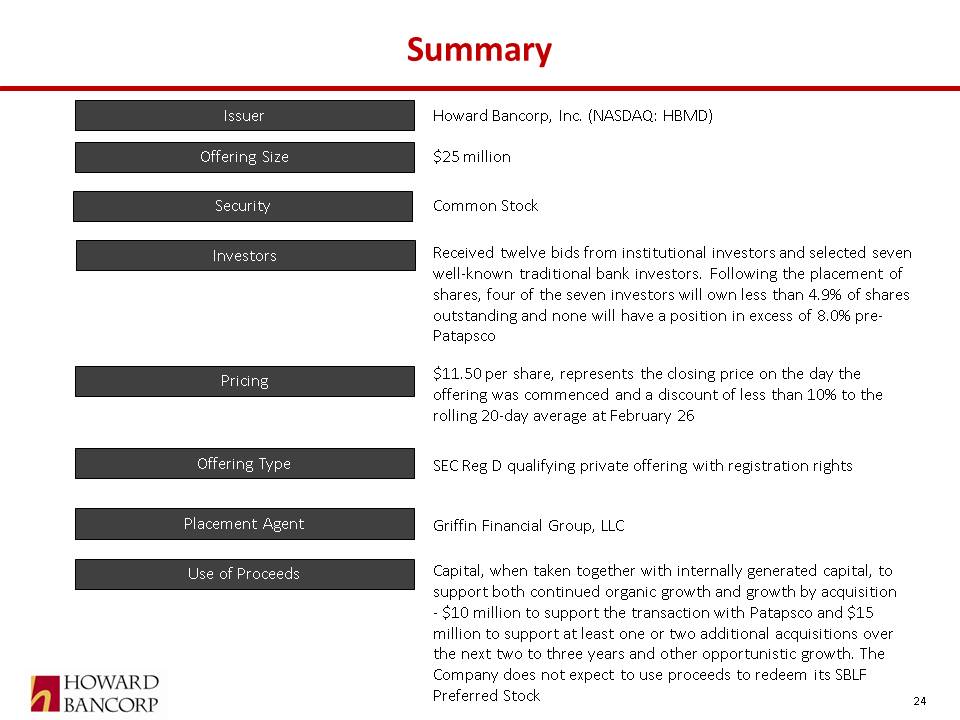

Summary Issuer Offering Size Security Offering Type Use of Proceeds Placement Agent Howard Bancorp, Inc. (NASDAQ: HBMD) $25 million Common Stock SEC Reg D qualifying private offering with registration rights Griffin Financial Group, LLC Capital, when taken together with internally generated capital, to support both continued organic growth and growth by acquisition - $10 million to support the transaction with Patapsco and $15 million to support at least one or two additional acquisitions over the next two to three years and other opportunistic growth. The Company does not expect to use proceeds to redeem its SBLF Preferred Stock Pricing $11.50 per share, represents the closing price on the day the offering was commenced and a discount of less than 10% to the rolling 20-day average at February 26 Investors Received twelve bids from institutional investors and selected seven well-known traditional bank investors. Following the placement of shares, four of the seven investors will own less than 4.9% of shares outstanding and none will have a position in excess of 8.0% pre-Patapsco

Howard, serving superior demographic markets in the greater Baltimore marketplace and led by a pedigreed “big bank” management team, has experienced exceptional growth since inception in 2004 despite the recession and banking crisis and its aftermathStrong organic loan and deposit growth and the opening of seven branchesTwo branch acquisitions, each with strategic implicationsThe acquisition of nearby National Bank of Rising Sun (NBRS) in a FDIC assisted transactionThe creation of de novo mortgage banking operation, primarily by lift-outHoward successfully competes against top 50 banks in the markets it servesHoward enjoys superior asset / credit qualityPatapsco Bancorp, Inc. with $230 million of assets, is Howard’s most coveted merger target. Patapsco represents an attractive in-market and market fill-in opportunity for Howard and provides entry into Baltimore City. It also permits Howard, after its federally assisted deal with NBRS, to reach its initial asset target of $1 billion it set in 2004Howard and Patapsco discussed a merger in early December, and in in mid-January, Patapsco granted exclusivity to Howard through February 27, 2015 (extended to March 2, 2015) in order to provide the parties time to negotiate a definitive agreement, to complete due diligence, and Howard time to obtain signed investor agreements for not less than $10 million During the exclusivity period, Howard successfully obtained signed investor agreements to raise $25 million of common stock at $11.50 per share from institutional bank investors Summary (con’t)

As stated above, Howard intends to apply the $25 million, net of offering expenses, to support the Patapsco transaction ($10 million) with the remainder to support additional growth, including growth by M&A as the economy and banking environment continue to improve. There are 45 independent banks between $100 million and $600 million in assets in the markets Howard serves and in contiguous markets, many of which Howard believes may be for sale in the near future. Howard has explored transactions with at least seven to eight of them in the last 12 months and expects that number to increase in light of changes in the environment. Howard believes it offers these banks an opportunity to exit at a fair price with substantial future equity upside, as well as continued relevance in the marketplace, on a basis not available from other potential buyers in the market. Howard believes that a $15 million capital cushion is important to attracting, winning and obtaining regulatory approval for such opportunities, as well as for seizing other opportunities for growth, including organic growth resulting from lift-outs. Management’s track record and Howard’s history of growth during difficult times supports this belief. The Patapsco acquisition, coupled with a capital cushion, strengthens Howard’s position as the consolidator of choice in a market with substantial acquisition opportunities. Howard has no present intent to repay its SBLF with the proceeds of the offeringBecause Howard’s earnings, tangible book value and stock price are expected to migrate substantially higher prior to the closing of Patapsco (estimated late in the third or early in the fourth quarter of 2015) and because of likely increases in multiples resulting from such growth the transaction has been structured so that the exchange ratio will be fixed near closing and not at announcement Summary (con’t)

V. Howard and Patapsco Combined with $10 million Notional Amount of New Common Equity Howard believes that, of the $25 million of new capital raised, $10 million should be notionally allocated to support the Patapsco

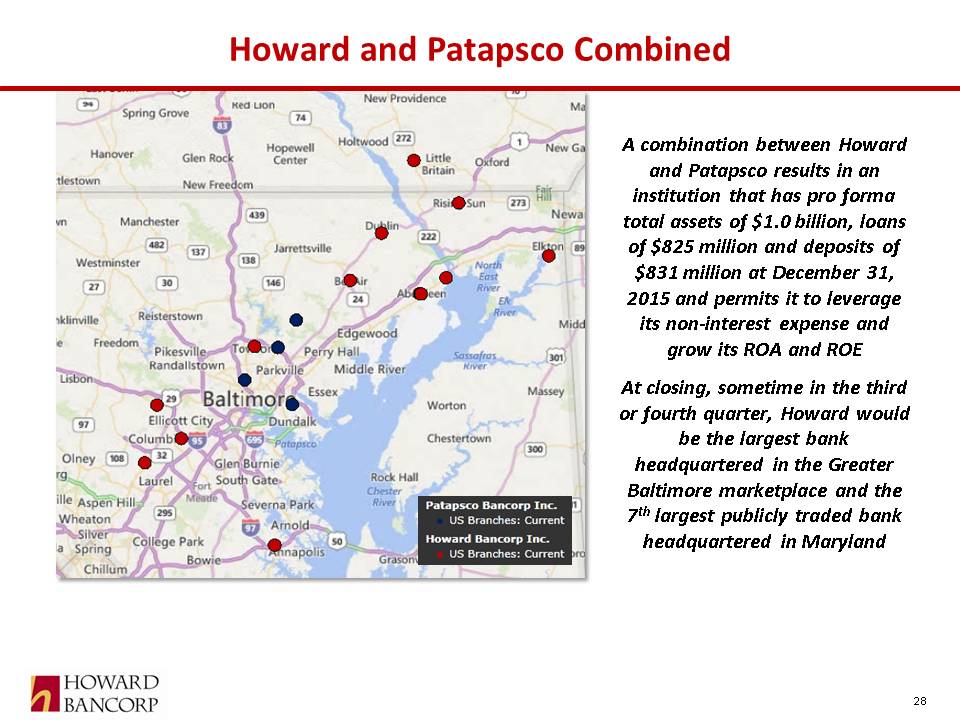

Howard and Patapsco Combined A combination between Howard and Patapsco results in an institution that has pro forma total assets of $1.0 billion, loans of $825 million and deposits of $831 million at December 31, 2015 and permits it to leverage its non-interest expense and grow its ROA and ROEAt closing, sometime in the third or fourth quarter, Howard would be the largest bank headquartered in the Greater Baltimore marketplace and the 7th largest publicly traded bank headquartered in Maryland

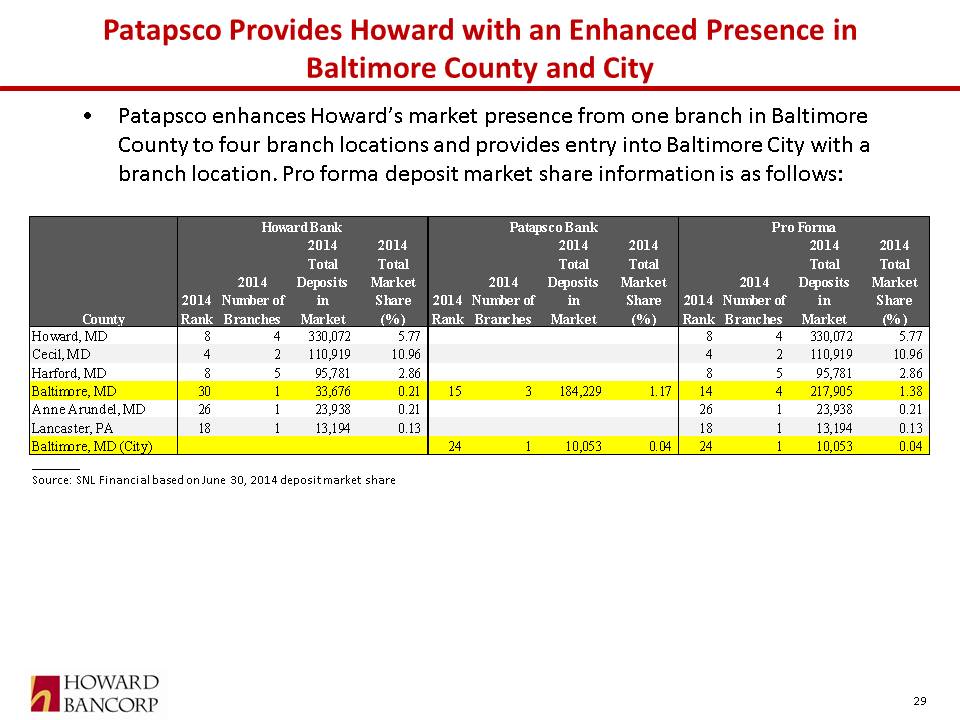

Patapsco enhances Howard’s market presence from one branch in Baltimore County to four branch locations and provides entry into Baltimore City with a branch location. Pro forma deposit market share information is as follows: Patapsco Provides Howard with an Enhanced Presence in Baltimore County and City Source: SNL Financial based on June 30, 2014 deposit market share

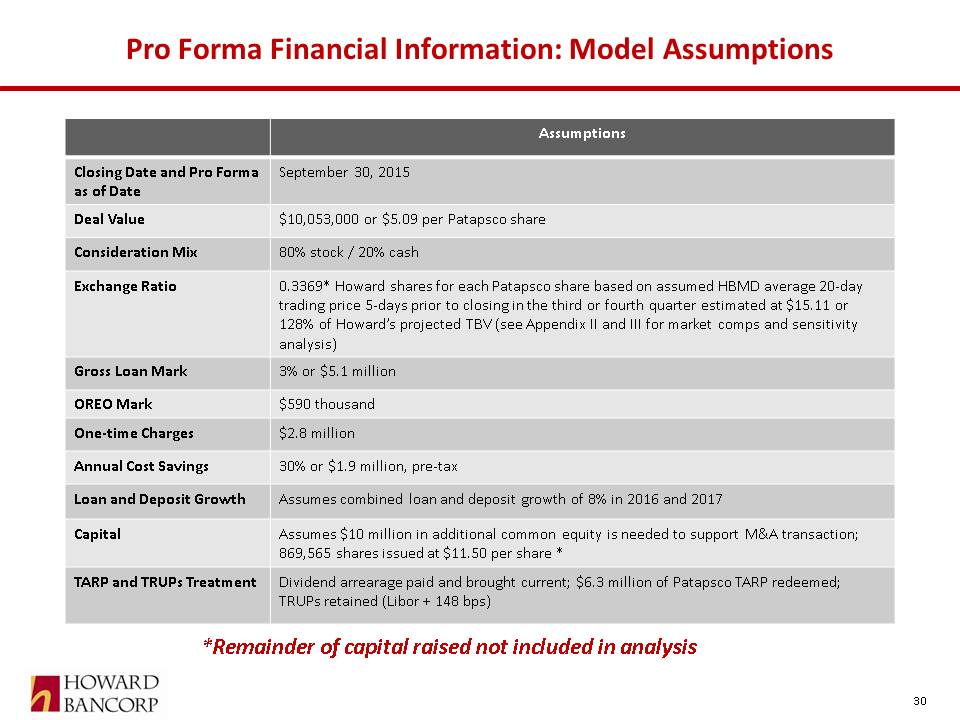

Pro Forma Financial Information: Model Assumptions *Remainder of capital raised not included in analysis

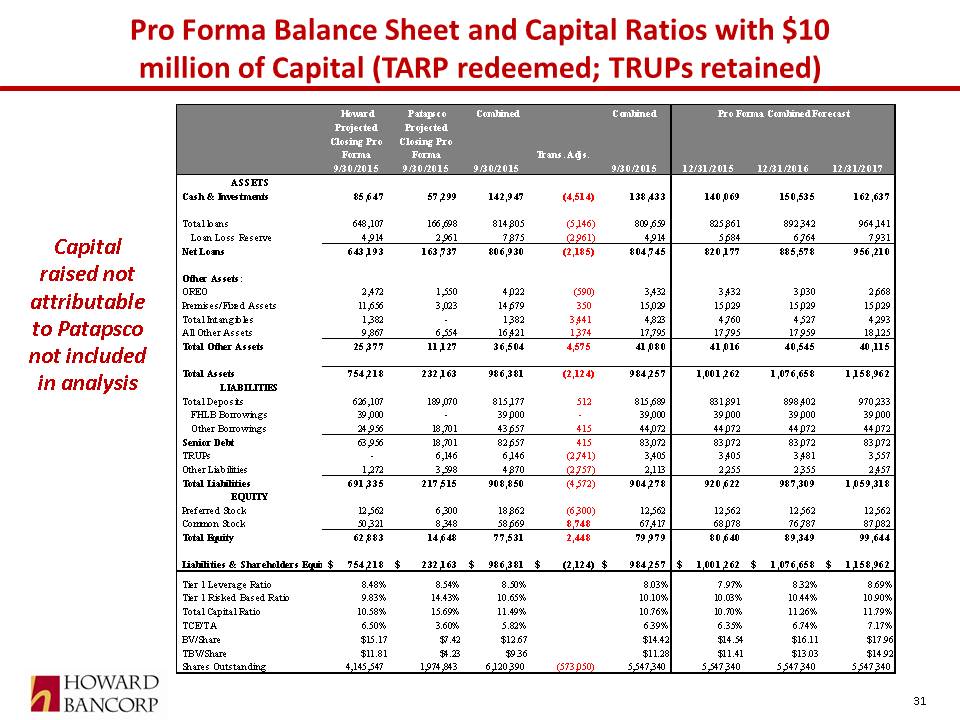

Pro Forma Balance Sheet and Capital Ratios with $10 million of Capital (TARP redeemed; TRUPs retained) Capital raised not attributable to Patapsco not included in analysis

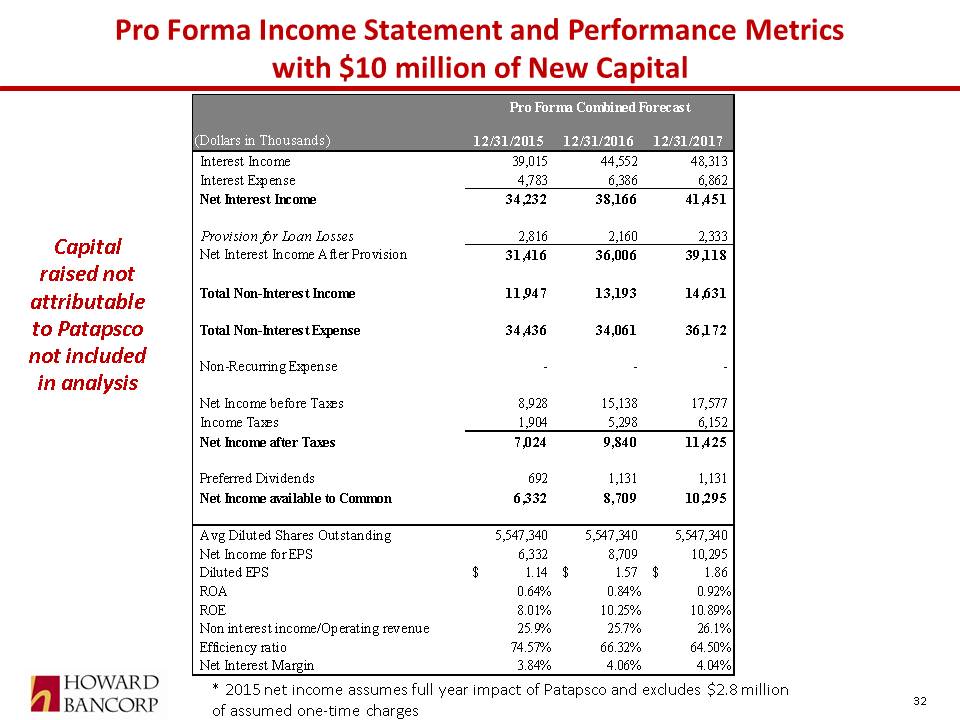

Pro Forma Income Statement and Performance Metrics with $10 million of New Capital * 2015 net income assumes full year impact of Patapsco and excludes $2.8 million of assumed one-time charges Capital raised not attributable to Patapsco not included in analysis

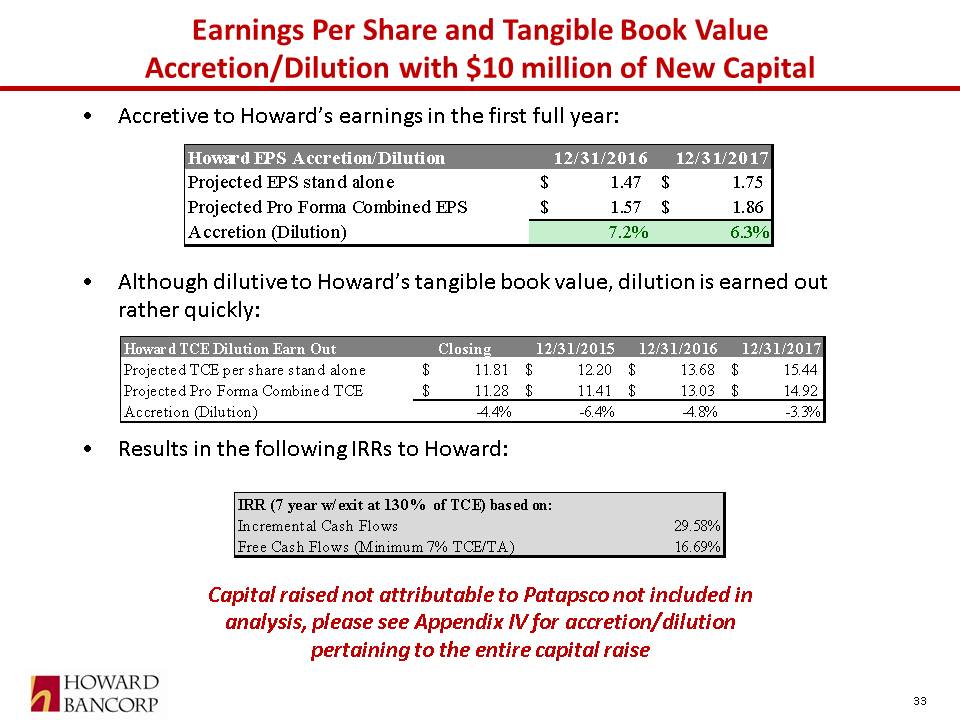

Accretive to Howard’s earnings in the first full year:Although dilutive to Howard’s tangible book value, dilution is earned out rather quickly:Results in the following IRRs to Howard: Earnings Per Share and Tangible Book Value Accretion/Dilution with $10 million of New Capital Capital raised not attributable to Patapsco not included in analysis, please see Appendix IV for accretion/dilution pertaining to the entire capital raise

VI. Summary

Summary Exceptionally performing 10 year old bankLocated in some of the best markets in the Mid Atlantic regionStrong record of organic growth, growth by lift-out, and growth by M&A despite the recession and sluggish economic recoverySolid asset quality“Big Bank” management and proven acquirer and integratorDisciplined ability to deploy capital to support continued growth quickly, both organically and by acquisitionWith Patapsco, Howard will be close to $1 billion in assets and expands presence in a market which is strategically important to it for a purchase price of less than $12 millionThe use of a fixed price, floating exchange ratio facilitated by expected growth in tangible book value through 2015 will optimize accretion/dilutionAcquisition, coupled with excess capital, strengthens an already formidable company solidifying it as the consolidator of choice in a market with substantial acquisition opportunities and gives it the cushion necessary to accelerate organic growth via opportunistic lift-outs and other opportunities

Appendices Patapsco PricingMarket ComparablesAccretion/Dilution Sensitivity Analysis to Howard’s Stock Price for Determining Exchange Ratio for PatapscoPro Forma Accretion/Dilution with Patapsco and $10 to $30 million of Capital

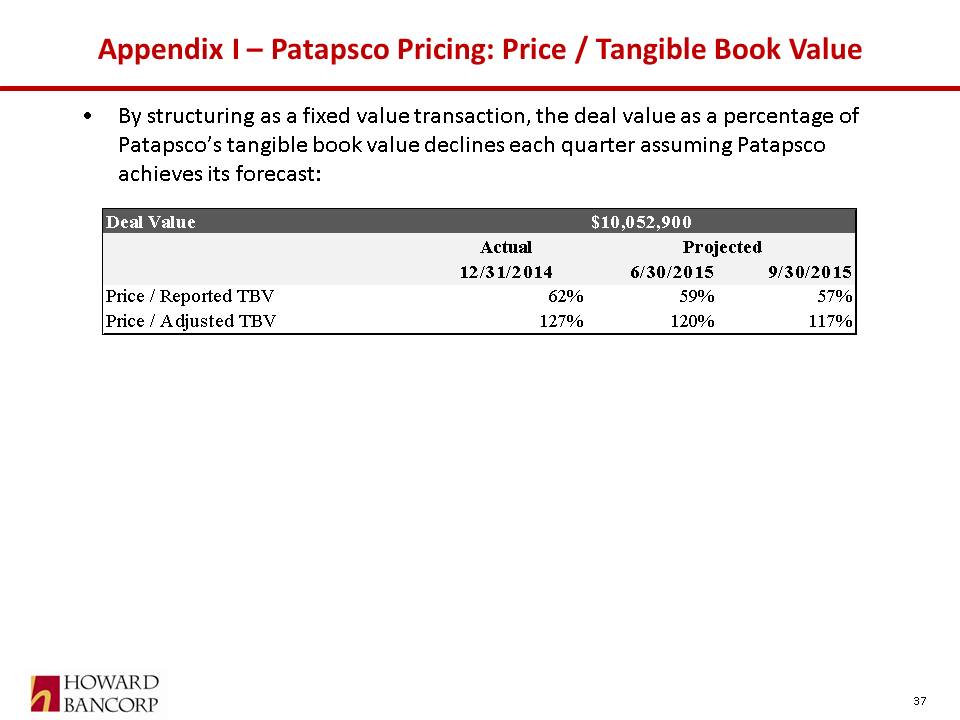

By structuring as a fixed value transaction, the deal value as a percentage of Patapsco’s tangible book value declines each quarter assuming Patapsco achieves its forecast: Appendix I – Patapsco Pricing: Price / Tangible Book Value

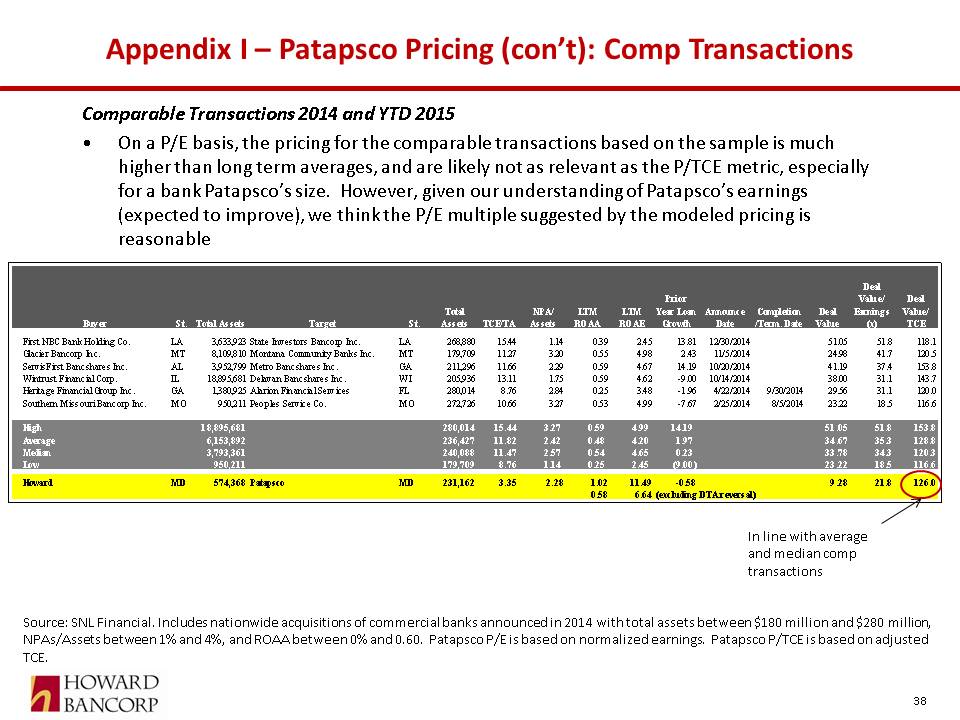

Comparable Transactions 2014 and YTD 2015On a P/E basis, the pricing for the comparable transactions based on the sample is much higher than long term averages, and are likely not as relevant as the P/TCE metric, especially for a bank Patapsco’s size. However, given our understanding of Patapsco’s earnings (expected to improve), we think the P/E multiple suggested by the modeled pricing is reasonable Appendix I – Patapsco Pricing (con’t): Comp Transactions Source: SNL Financial. Includes nationwide acquisitions of commercial banks announced in 2014 with total assets between $180 million and $280 million, NPAs/Assets between 1% and 4%, and ROAA between 0% and 0.60. Patapsco P/E is based on normalized earnings. Patapsco P/TCE is based on adjusted TCE. In line with average and median comp transactions

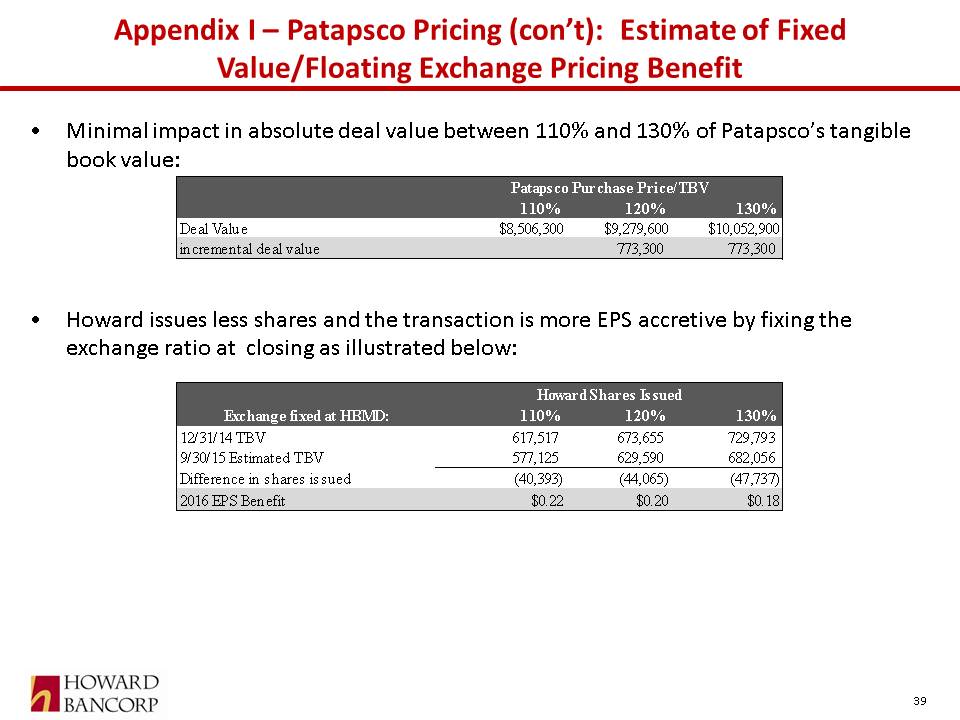

Minimal impact in absolute deal value between 110% and 130% of Patapsco’s tangible book value:Howard issues less shares and the transaction is more EPS accretive by fixing the exchange ratio at closing as illustrated below: Appendix I – Patapsco Pricing (con’t): Estimate of Fixed Value/Floating Exchange Pricing Benefit

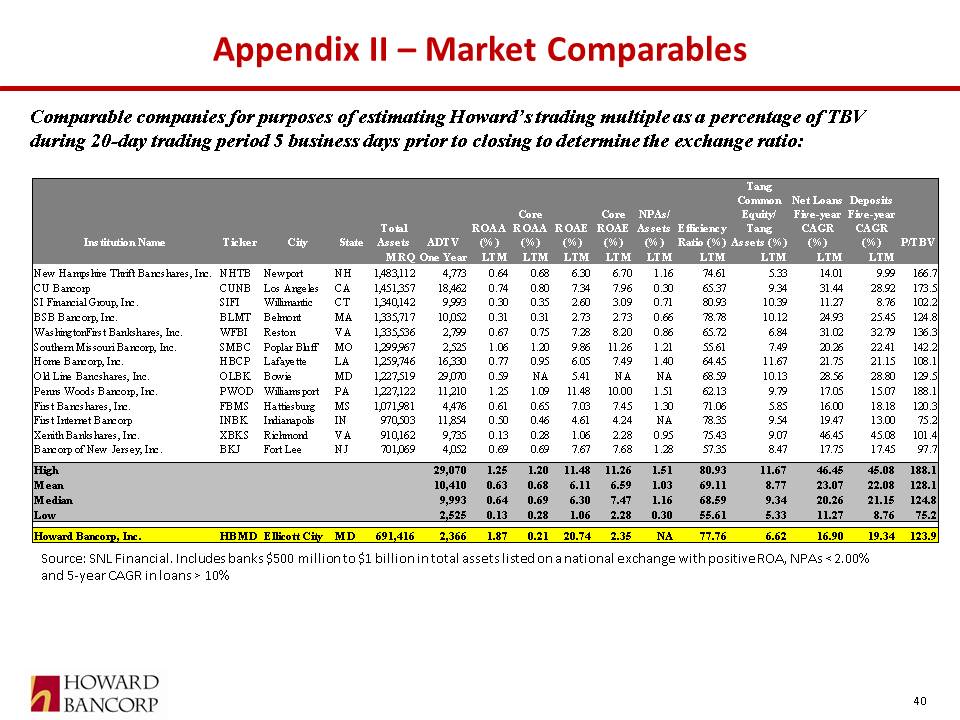

Appendix II – Market Comparables Source: SNL Financial. Includes banks $500 million to $1 billion in total assets listed on a national exchange with positive ROA, NPAs < 2.00% and 5-year CAGR in loans > 10% Comparable companies for purposes of estimating Howard’s trading multiple as a percentage of TBV during 20-day trading period 5 business days prior to closing to determine the exchange ratio:

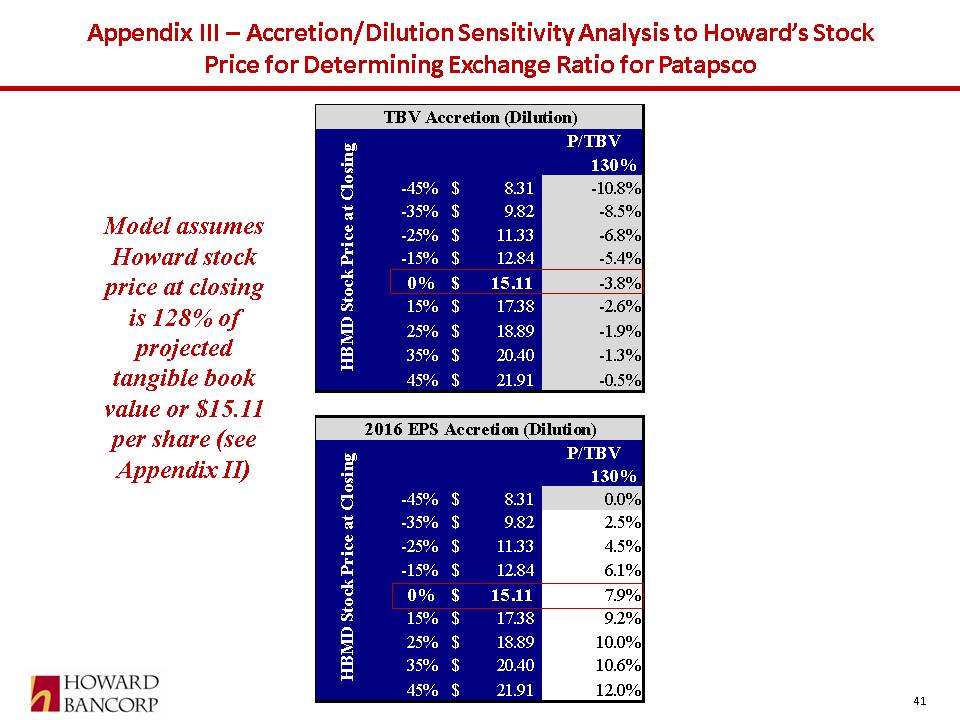

Appendix III – Accretion/Dilution Sensitivity Analysis to Howard’s Stock Price for Determining Exchange Ratio for Patapsco Model assumes Howard stock price at closing is 128% of projected tangible book value or $15.11 per share (see Appendix II)

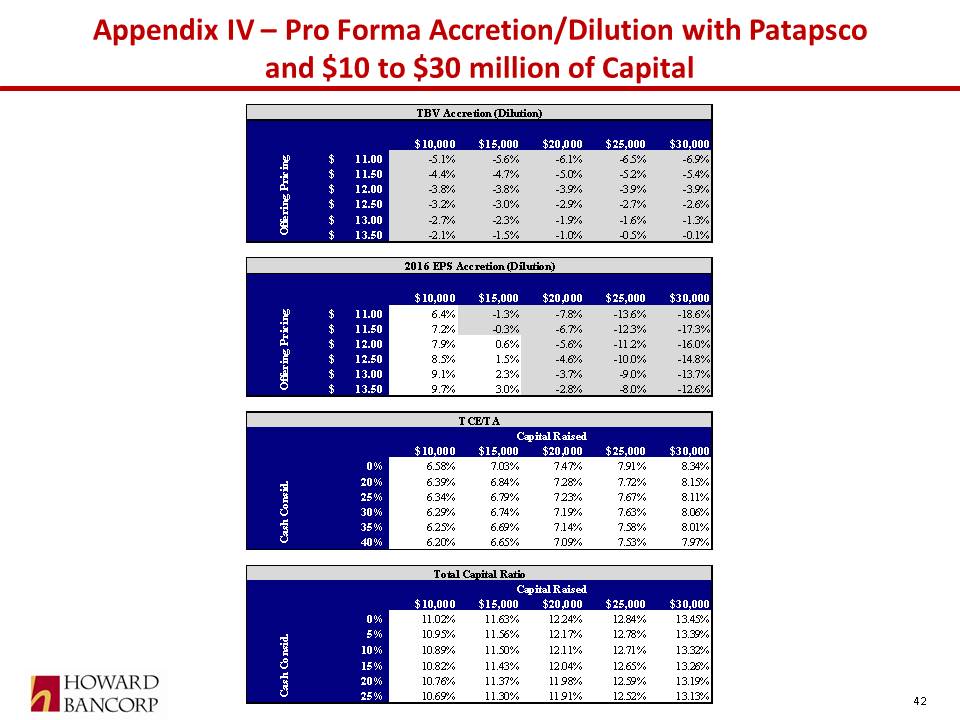

Appendix IV – Pro Forma Accretion/Dilution with Patapsco and $10 to $30 million of Capital

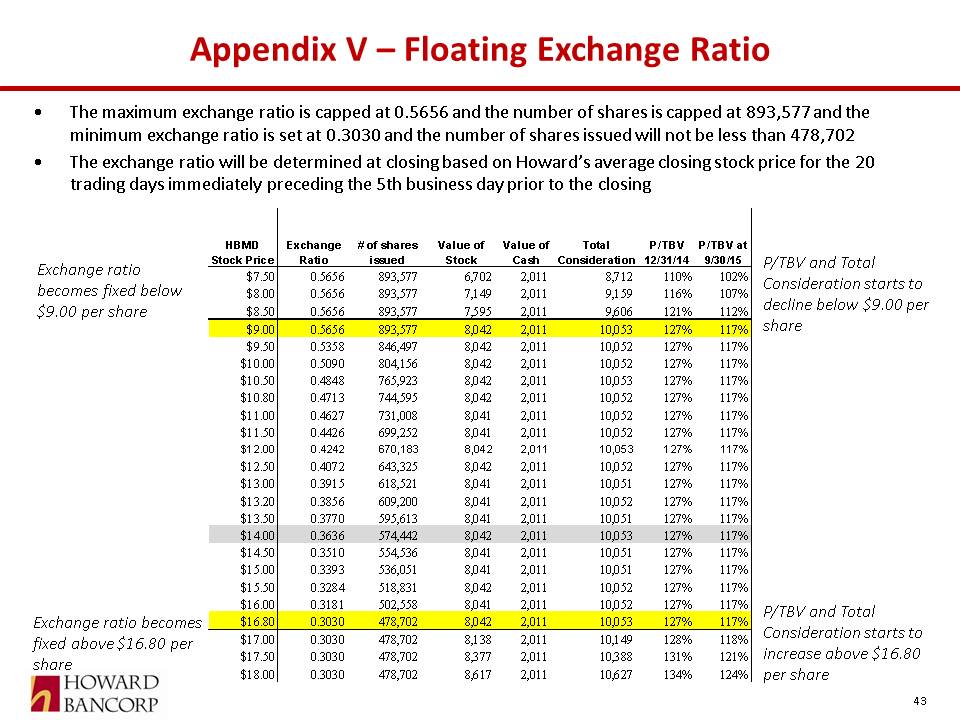

The maximum exchange ratio is capped at 0.5656 and the number of shares is capped at 893,577 and the minimum exchange ratio is set at 0.3030 and the number of shares issued will not be less than 478,702The exchange ratio will be determined at closing based on Howard’s average closing stock price for the 20 trading days immediately preceding the 5th business day prior to the closing Appendix V – Floating Exchange Ratio Exchange ratio becomes fixed below $9.00 per share Exchange ratio becomes fixed above $16.80 per share P/TBV and Total Consideration starts to decline below $9.00 per share P/TBV and Total Consideration starts to increase above $16.80 per share