Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Diplomat Pharmacy, Inc. | Financial_Report.xls |

| EX-23 - EX-23 - Diplomat Pharmacy, Inc. | a2223290zex-23.htm |

| EX-21 - EX 21 - Diplomat Pharmacy, Inc. | a2223290zex-21.htm |

| EX-31.1 - EX-31.1 - Diplomat Pharmacy, Inc. | a2223290zex-31_1.htm |

| EX-32.1 - EX-32.1 - Diplomat Pharmacy, Inc. | a2223290zex-32_1.htm |

| EX-31.2 - EX-31.2 - Diplomat Pharmacy, Inc. | a2223290zex-31_2.htm |

| EX-32.2 - EX-32.2 - Diplomat Pharmacy, Inc. | a2223290zex-32_2.htm |

| EX-10.1.2 - EX-10.1.2 - Diplomat Pharmacy, Inc. | a2223290zex-10_12.htm |

| EX-10.1.3 - EX-10.1.3 - Diplomat Pharmacy, Inc. | a2223290zex-10_13.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2014 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number 001-36677

Diplomat Pharmacy, Inc.

(Exact name of registrant as specified in its charter)

| Michigan (State or other jurisdiction of incorporation or organization) |

38-2063100 (I.R.S. Employer Identification Number) |

4100 S. Saginaw Street

Flint, Michigan 48507

(888) 720-4450

(Address, including ZIP Code, and telephone number,

including area code, of registrant's principal executive offices)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, no par value per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

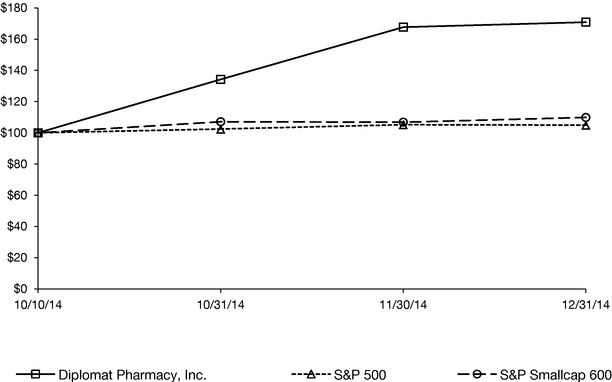

The registrant was not a public company as of June 30, 2014, the last day of the registrant's most recently completed second quarter. The aggregate market value of the registrant's Common Stock held by non-affiliates of the registrant as of October 10, 2014, the initial trading date on the New York Stock Exchange, was $357 million based on the closing price of $16.02 as reported by the New York Stock Exchange on such date. Shares of the registrant's Common Stock held by executive officers, directors and holders of 10% or more of the Common Stock outstanding have been excluded from this calculation because such persons may be deemed affiliates of the registrant; such exclusion does not reflect a determination that such persons are affiliates of the registrant for any other purpose.

The registrant had 51,457,023 shares of Common Stock outstanding as of March 2, 2015.

Documents incorporated by reference:

Certain portions, as expressly described in this report, of the registrant's Proxy Statement for the 2015 Annual Meeting of Shareholders to be filed subsequently are incorporated by reference into Part III of this report.

DIPLOMAT PHARMACY, INC.

2014 ANNUAL REPORT ON FORM 10-K

INDEX

2

Unless the context suggests otherwise, references in this Annual Report on Form 10-K to "Diplomat," "the Company," "we," "us" and "our" refer to Diplomat and its consolidated subsidiaries.

Certain statements contained or incorporated in this Annual Report on Form 10-K which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the "Reform Act"). These forward-looking statements are included throughout this Annual Report on Form 10-K, including under the headings entitled "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business" and relate to matters such as our industry, business strategy, goals and expectations concerning our market position, the pending acquisition of BioRx, LLC, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. We have used the words "anticipate," "assume," "believe," "continue," "could," "estimate," "expect," "future," "intend," "may," "plan," "potential," "predict," "project," "seek," "should," "will," and similar terms and phrases, or the negative thereof, to identify forward-looking statements.

The forward-looking statements contained in this Annual Report on Form 10-K are based on management's good-faith belief and reasonable judgment based on current information, and these statements are qualified by important factors, many of which are beyond our control, that could cause our actual results to differ materially from those in the forward-looking statements, including changes in global, regional or local economic, business, competitive, market, regulatory and other factors, including those described in "Risk Factors." Any forward-looking statement made by us speaks only as of the date of this report. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable laws or regulations.

The following risks related to our business, among others, could cause actual results to differ materially from those described in the forward-looking statements:

- •

- our ability to adapt to changes or trends within the specialty pharmacy industry;

- •

- significant and increasing pricing pressure from third-party payors;

- •

- our relationships with key pharmaceutical manufacturers;

- •

- bad publicity about, or market withdrawal of, specialty drugs we dispense;

- •

- a significant increase in competition from a variety of companies in the health care industry;

- •

- our ability to expand the number of specialty drugs we dispense and related services;

- •

- maintaining existing patients;

- •

- revenue concentration of the top specialty drugs we dispense;

- •

- our ability to maintain relationships with a specified wholesaler and pharmaceutical manufacturer;

- •

- increasing consolidation in the healthcare industry;

- •

- managing our growth effectively;

- •

- limited experience with acquisitions;

- •

- our ability to complete the acquisition of BioRx on a timely basis or at all, and to recognize the expected benefits therefrom;

- •

- fluctuations in operating results;

3

- •

- failure or disruption of our information technology and security systems;

- •

- relationships with clinical experts and key thought leaders at U.S. physician groups and universities;

- •

- reliance on a single shipping provider;

- •

- dependence on our senior management and key employees;

- •

- liability risks associated with our compounding services;

- •

- debt service obligations;

- •

- supply disruption of any of the specialty drugs we dispense;

- •

- loss of orphan drug status for such specialty drugs we dispense;

- •

- reductions of research, development and marketing of specialty drugs; and

- •

- other factors set forth under "Risk Factors."

4

Overview

We are the nation's largest independent specialty pharmacy in the United States, and are focused on improving lives of patients with complex chronic diseases. We define our independence as our singular focus on specialty pharmacy services independent of other operations such as pharmacy benefit management or managed care. Our patient-centric approach positions us at the center of the healthcare continuum for the treatment of complex chronic diseases through partnerships with patients, payors, pharmaceutical manufacturers and physicians. We offer a broad range of innovative solutions to address the dispensing, delivery, dosing and reimbursement of clinically intensive, high-cost specialty drugs. We were formed and incorporated in Michigan in 1975 by our Chief Executive Officer, Philip Hagerman, and his father, Dale, both trained pharmacists who transformed our business from a traditional pharmacy into a leading specialty pharmacy beginning in 2005. When Diplomat opened its doors in 1975 as a neighborhood pharmacy it had one essential tenet: "Take good care of patients, and the rest falls into place." Today, that tradition continues and we are focused on creating a culture that is highly committed to increasing adherence and improving outcomes.

In October 2014, we consummated an initial public offering of 15,333,333 shares of our common stock and listed our common stock on the New York Stock Exchange under the symbol "DPLO." The Company sold 11 million shares of common stock and certain selling shareholders of the Company sold 4,333,333 shares of common stock. We received net proceeds of $130.4 million from the offering.

Our core revenues are derived from the customized care management programs we deliver to our patients, including the dispensing of their specialty medications. We focus on specialty drugs that are typically administered on a recurring basis to treat patients with complex chronic diseases that require specialized handling and administration as part of their distribution process. We have expertise across a broad range of high-growth specialty therapeutic categories, including oncology, immunology, hepatitis, multiple sclerosis, HIV and specialty infusion therapy (which involves infusing specialty pharmaceuticals for rare and chronic genetic disorders, primarily for hemophilia and immune globulin treatment).

Our comprehensive, patient-focused services ensure that patients receive a superior standard of care, including assistance with complicated medication therapies, refill processing, third-party funding support programs, side effect management and adherence monitoring. We customize solutions for each patient based on the patient's overall health, disease and family history, lifestyle and financial means. Our managed lives under contract was approximately 13 million as of December 31, 2014. We define managed lives under contract as patients enrolled in a managed care organization network, including pharmacy benefit managers, health plans, state governments, employer groups and unions with whom we contract, through exclusive and preferred relationships with such organizations, whereby we are the only authorized or one of a few preferred specialty pharmacy providers to the patients in their system.

We have grown our business in recent years by strengthening our clinical expertise in key therapeutic categories, such as oncology and immunology, broadening the scope of our services to retailers, hospitals and health systems and strengthening our relationships with patients, payors, pharmaceutical manufacturers and physicians. While we will continue to focus on growing our business organically, we believe that we can opportunistically enhance our competitive position through complementary acquisitions in both existing and new markets. In December 2013, we completed the acquisition of American Homecare Federation, Inc., a specialty infusion therapy provider focused primarily on hemophilia. In June 2014, we acquired MedPro Rx, Inc., a specialty pharmacy focused on specialty infusion therapies including hemophilia and immune globulin. In February 2015, we executed a definitive purchase agreement to acquire BioRx, LLC ("BioRx"), a highly specialized pharmacy and

5

infusion services company that provides treatments for patients with ultra-orphan and rare, chronic diseases.

Our services, together with our proactive engagement with pharmaceutical manufacturers early in the drug development process, have contributed to our current and growing access to limited distribution drugs, which we define as drugs that are only available for distribution by a select network of specialty pharmacies. Our inclusion in limited distribution networks provides critical sources of revenue growth and provides a catalyst for our future growth.

As a part of our mission to improve patient care, we provide specialty pharmacy support services to a national network of retailers and independent pharmacy groups, hospitals and health systems. For many of our retail, hospital and health system partners, we earn revenue by providing clinical and administrative support services on a fee-for-service basis to help them dispense specialty medications.

Specialty Pharmacy Industry

Specialty pharmacy services are a distinct form of pharmacy services that coordinate full service patient care and complex disease management. Specialty pharmacy services are designed to take advantage of economies of scale by using standardized and efficient processes to deliver medications with customized handling, storage and distribution requirements. Specialty pharmacies are also designed to improve clinical, adherence, and economic outcomes for patients with complex, often chronic, or rare conditions through a wide range of oral, injectable and infusible specialty pharmaceuticals.

Less acute, chronic conditions are generally treated with self-administered, oral, injectable or inhalable specialty pharmaceuticals but may also be administered by a physician or nurse. These pharmaceuticals can be distributed directly to the patient for at-home administration or to the patient's physician for in-office administration. Several chronic, genetic conditions and orphan diseases are treated with infused pharmaceuticals via a more complex intravenous form of administration. These pharmaceuticals are dispensed under the supervision of a registered pharmacist and the therapies are typically delivered to the patient for self-administration in the home or administration by a credentialed home-health care nurse or trained caregiver at home or in another care site. Many of the pharmaceuticals handled by specialty pharmacies require refrigeration during shipping as well as special handling to prevent potency degradation. Patients receiving treatment usually require personalized counseling and education regarding their condition and treatment programs.

The specialty pharmacy segment primarily treats conditions such as cancer, immune deficiency disorders, hepatitis, multiple sclerosis, hemophilia, neurological conditions and other chronic conditions. Retail pharmacies and other traditional distributors generally are designed to carry inventories of low cost, high volume products and therefore are not equipped to handle the high cost, low volume specialty pharmaceuticals that have specialized handling and administration requirements. In addition, those entities generally lack both the deep clinical expertise and the administrative and call center support functions necessary to effectively deliver specialty pharmacy services. As a result, specialty pharmaceuticals generally are provided by pharmacies that focus primarily on filling, labeling and delivering oral, injectable, infusible or inhalable pharmaceuticals and related medication and support services.

Segment Information

Our chief operating decision maker reviews our financial results in total when evaluating financial performance and for purposes of allocating resources. Therefore, we have determined that we operate in a single reportable segment—specialty pharmacy services.

6

Recent Developments

Definitive Agreement to Acquire BioRx. On February 26, 2015, we executed a definitive purchase agreement which provides that, upon the terms and conditions set forth therein, we will acquire all of the outstanding equity interests of BioRx. The acquisition is expected to close in March 2015.

BioRx provides patients with personalized medication programs and services for a variety of complex disease states, including hemophilia, hereditary angioedema, immunology, nutrition and digestive disorders and alpha-1 antitrypsin deficiency. BioRx reaches patients in all 50 states and operates dispensing facilities in Ohio, Massachusetts, North Carolina, Iowa, Minnesota, Arizona and California. In 2014, BioRx generated approximately $227 million in revenue and $23 million in earnings before interest, taxes, depreciation and amortization ("EBITDA").

The purchase price consists of (i) $210 million in cash (the "Closing Cash Consideration") and $105 million in shares of the Company's common stock (the "Closing Stock Consideration"), to be paid at closing (collectively, the "Closing Consideration"), and (ii) up to an additional $35 million in common stock to be paid subject to BioRx's achievement of a specified EBITDA-based target in the 12-month period following the closing (the "Contingent Consideration" and, together with the Closing Stock Consideration, the "Stock Consideration"). The common stock to be issued is valued at $25.92 per share, which is the 10-day average closing price of the common stock prior to execution of the purchase agreement.

The Closing Cash Consideration is subject to adjustment at closing for estimated net working capital, indebtedness, cash and certain sellers' expenses, with a final true-up following closing. Payment of the Contingent Consideration is subject to acceleration at the maximum contingent amount in the event of (i) a change in control of the Company or (ii) the termination without cause of either of two principals of BioRx that will continue employment with the Company following the closing, in each case during the 12-month period following the closing. In addition, $10 million of the Closing Cash Consideration will be held in escrow for up to eighteen months to fund certain indemnity obligations of the sellers.

Applicable persons will enter into a registration rights agreement at closing (the "Registration Rights Agreement") with respect to the Stock Consideration, which includes customary piggyback registration rights and demand registration rights.

Certain holders of the Closing Stock Consideration, representing approximately 56% of the Closing Stock Consideration, have agreed with us, subject to certain exceptions, not to sell, dispose of or hedge any of our common stock or securities convertible into or exercisable or exchangeable for shares of common stock as follows: no sales for six months following the closing; sales of up to 33% of the Closing Stock Consideration between six and 18 months following the closing; sales of up to 66% of the Closing Stock Consideration between 18 and 24 months following the closing; and no restrictions thereafter. The other holders of the Closing Stock Consideration will be restricted from selling the common stock for six months following the closing. In the event of acceleration of payment of the Contingent Consideration due to either of the events described above, these restrictions will no longer apply to any holders of Closing Stock Consideration.

Consummation of the acquisition by the parties is subject to customary closing conditions, including the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. The purchase agreement contains customary indemnification obligations of each party with respect to breaches of representations, warranties and covenants and certain other specified matters. Any indemnification claims by the Company may be satisfied by setting off the amount of such claims against the Closing Cash Consideration amount held in escrow. The purchase agreement also contains specified termination rights for the parties, including

7

by the sellers' representative if the acquisition fails to close within 100 days by the Company if the acquisition fails to close within 120 days, or such later date as the parties agree.

The foregoing description of the purchase agreement and the transactions contemplated thereby is not complete and is subject to and qualified in its entirety by reference to the purchase agreement, a copy of which is included as an exhibit to the Current Report on Form 8-K filed by the Company on February 26, 2015.

For additional discussion of business developments that occurred in 2014, see "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Our Services

We provide specialty pharmacy services dedicated to servicing the needs of patients, while also providing clinical expertise, technology-driven innovation tools, and administrative efficiencies that support physicians, payors, pharmaceutical manufacturers, and retail pharmacies. We purchase specialty pharmaceuticals from manufacturers and wholesale distributors, fill prescriptions, and label, package and deliver the pharmaceuticals to patients' homes or physicians' offices through contract couriers. We utilize our Company-owned distribution facility, seven smaller regional facilities and centralized clinical call centers to provide such services to all 50 states within the United States of America. The services provided to our patients and other constituents described below are integral to securing the relationships that drive our revenue and prescription volumes, and are a central focus of our specialty pharmacy business. In order to successfully compete, we must provide value to each constituent in the specialty pharmacy industry.

Our value to constituents is based on our ability to provide large specialty and limited distribution product access, utilization management, high patient adherence rates, patient funding assistance, data management, outstanding patient and prescriber satisfaction rates and direct and indirect cost savings. Further, we manage the high cost of specialty drugs by pursuing cost savings through channel management, utilization management, formulary management (i.e., the list of specialty drugs that will be reimbursed by a health plan or managed care organization), and waste minimization (including our partial fill program). Channel management is a strategy that targets specialty medications covered under the medical benefit by payors and moving the coverage of these medications to the pharmacy benefit in order to take advantage of deeper discounts, rebates or more detailed reporting when available. Utilization management is the evaluation of the appropriateness, medical need and efficiency of health care services, procedures, drugs and facilities according to established criteria or guidelines and under the provisions of an applicable health benefit plan. Formulary management is an integrated patient care process which enables physicians, pharmacists and other health care professionals to work together to promote clinically sound, cost-effective medication therapy and positive therapeutic outcomes. A drug formulary, or preferred drug list, is a continually updated list of medications and related products supported by current evidence-based medicine, judgment of physicians, pharmacists and other experts in the diagnosis and treatment of disease and preservation of health.

Our programs consist of the following business services:

- •

- Specialty Drug Dispensing. For the years ended December 31, 2014, 2013 and 2012, we derived over 99% of our revenue from the dispensing of drugs and the reporting of data associated with those dispenses to pharmaceutical manufacturers and other outside companies. The other services described below are services included as part of our core business offerings and are included as part of the overall payor reimbursement for dispensed drugs, rather than as separately reimbursable events. We are licensed to dispense prescriptions in all 50 U.S. states and all U.S. territories. Our business processes and dispensing solutions are well established and can provide specialty prescriptions to patients as required by the communicated "need by" date. All specialty prescriptions are verified by registered pharmacists for accuracy and

8

- •

- Patient Care Coordination. Our patient care system is used

to coordinate and track patient adherence and safety. It is built around specific drug therapies and disease states for greater consistency of care using clinical algorithms. Each step within the

patient's treatment regimen is extensively researched based on various disease guideline publications. Our system automatically tracks all clinical interventions and activities and provides real-time

access to patient information. Using this system, our care coordinators, including pharmacists, work with both patients and prescribers to identify potential adherence failures and implement proactive

plans to optimize treatment outcomes.

- •

- Clinical Services. Our pharmacists and nurses, with the

assistance of our pharmacy technicians, provide clinically based drug therapy management programs for clients and patients. Pharmacists provide counseling on compliance and side-effect management. Our

Clinical Help Desk includes several pharmacists, as well as nurses and pharmacy technicians. A pharmacist is available to patients and prescribers 24 hours a day, seven days a week and nurses

are available during normal business hours. Clinical pharmacists are responsible for high level clinical interaction with patients and healthcare practitioners including medication counseling and

clinical advice. Our clinicians work with the patients' primary prescriber to identify adherence failures and to implement a proactive plan to achieve intended outcomes. Our broader sales, clinical

and operations team, has deep clinical expertise and currently includes over 75 licensed pharmacists.

- •

- Compliance and Persistency Programs. Our compliance and persistency programs are drug specific and support the needs of patients based on their therapy regimen. In some cases, a dedicated nurse proactively contacts patients at specific intervals of therapy to discuss precautions, side effect management, administration of medication, and refill procedures.

appropriateness at two separate points in the dispensing process prior to shipping to patient. Our specialty dispensing and distribution capabilities include package tracking through contracted couriers, temperature controls and signature confirmation upon delivery.

Our physical footprint has enabled us to develop a centralized infrastructure that we have successfully scaled to dispense to all 50 states. We now have an advanced distribution center that enables us to ship medications nationwide as well as a centralized clinical call center that helps us deliver localized services on a national scale. In addition to our headquarters, we also operate seven smaller regional facilities in Flint, Michigan; Chicago, Illinois; Ft. Lauderdale, Florida; Ontario, California; Enfield, Connecticut; Raleigh, North Carolina; and Springfield, Massachusetts. We are fully accredited and licensed to conduct business in each of the states that require such licensure. We primarily utilize UPS in the delivery of our specialty pharmaceutical products.

Specialty drug dispensing includes our specialty infusion pharmacy services. Our December 2013 and June 2014 acquisitions of AHF and MedPro, respectively, expanded our specialty infusion pharmacy services. We provide individualized patient-centric specialty infusion services to patients with bleeding disorders, and other chronic conditions, while managing overall drug spend through factor utilization using dose management, assay management (which means ensuring that the prescribed amount is the dispensed amount), clinical and therapy education, intervention, and nursing support in efforts to advance better patient outcomes. Specialty infusion drugs are high cost, with routes of administration intravenously or subcutaneously and can be managed at home or in a hospital or free-standing ambulatory infusion clinic, physician office or through our extensive outsourced network of credentialed specialty nurses whom administer medications in the patent's home or at other sites of care. We estimate our drug reimbursement for specialty infusion patients is approximately 65% medical benefit and 35% pharmacy benefit as of December 31, 2014.

Our specialty drug dispensing services include:

9

- •

- Patient Financial Assistance. Our funding specialists help

patients navigate their benefits and find third-party financial assistance to address coverage deficiencies. We provide services to help patients understand and receive reimbursement benefits and we

work with available co-pay assistance programs, including co-pay card enrollment and program management. We currently work with substantially all major commercial co-pay card programs. Our team also

coordinates with many external charitable foundations and research grant organizations that help subsidize the cost of medications for patients. We also help patients access manufacturer patient

assistance (free drug) programs when necessary and available. These programs result in increased access to specialty drug therapies for the patients and increased revenues for us.

- •

- Specialty Pharmacy Training/Consulting (Diplomat

University). Diplomat University is our education and training department that educates both Diplomat employees and external professionals (including pharmacists,

payors, pharmaceutical partners and physicians) on topics unique to the specialty pharmacy industry. Our in-depth, ongoing training program promotes clinical competence and builds new skills, enabling

employees to provide high-level care for our patients and improve overall business performance. Diplomat University also houses our quality assurance department, which focuses on programs that promote

quality and patient safety. Diplomat University-produced materials have been used in trade conference materials and magazine articles, as well as business meetings, to explain the specialty pharmacy

industry generally and the broad range of solutions we can provide.

- •

- Benefits Investigation. Our standard procedures require that

we conduct a benefits investigation for each patient we work with. In addition to processing test claims, our benefit specialists contact the appropriate medical or pharmacy benefit plan to verify

coverage, deductible, coinsurance, and out-of-pocket maximum. Our specialists provide all necessary coding for the prescribed therapy or service. Any prior authorization or predetermination

requirements are defined at the time of the benefits investigation. Our standard procedures require an initial test adjudication upon receipt of the referral and require subsequent investigations

under certain circumstances.

- •

- Prior Authorization. Our prior authorization specialists

contact the patient's insurance plan and collect all necessary patient specific information, together with supporting documentation, to provide to the third-party payor to support reimbursement for

the prescribed medication, and coordinates with the prescribing physician. In the event that the required therapy is not listed on the third-party payor's formulary, we also compile the necessary

information to file a formulary exception on behalf of the patient.

- •

- Risk Evaluation and Medication Strategy ("REMS"). Our employees are skilled at administering REMS (Risk Evaluation and Mitigation Strategy) protocols on all levels of risk mitigation, which is required by many pharmaceutical manufacturers due to regulatory requirements. The FDA requires REMS from certain manufacturers to ensure that the benefits of a drug or biological product outweigh its risks. Manufacturers are required to comply with specific FDA requirements that may include medication use guides, Black box warnings / patient package insert language, and a communication plan to health care providers. As part of REMS protocols, manufacturers may also be required to comply with

Prior to every refill, we call patients to verify the patient's dose and dosing regimen and shipping address, discuss side effects and confirm that the patient is appropriately taking the medication. Aside from standard protocol, we initiate calls at critical points during the therapy to improve adherence. This adherence program also addresses non-compliance by offering enhanced patient education and communication through customized programs specific to the medications we provide.

10

- •

- Retail Specialty

Services. Retail specialty services connects a retail pharmacy business to the specialty arena. Based on our broad industry experience,

infrastructure and unique treatment-tracking software, retail specialty services offers companies a strategic partner for clinical and administrative support services that help the business and their

specialty patients achieve their best outcomes. Large retailers with pharmacies have access to many of the same specialty drugs we distribute, but lack the expertise and the infrastructure necessary

to manage patients, payors, and physicians regarding these specialty drugs. Development of this infrastructure is very costly, time consuming, and requires trained clinical experts. Our retail

specialty services fills this gap with our breadth of service expertise, which includes nearly every aspect of our business other than purchasing the drugs and filling the prescriptions. We conduct

patient-facing services under the specific retailer's brand name. For example, when our retail specialty services employees interact with patients and prescribers, these customers are unaware they are

not engaging with our retail specialty services clients directly. These strategic relationships with retail pharmacies are important to pharmaceutical manufacturers and can further our access to

additional limited distribution drugs.

- •

- Hospital and Health System

Services. We provide clinical and administrative support services to hospitals and health systems that dispense specialty medications

through their outpatient pharmacies. We partner with hospitals and health systems to assist with strategies and service delivery that is designed to maximize cost containment and improve efficiency

and clinical outcomes related to specialty pharmaceuticals. Our program also supports hospitals that are 340B covered entities through a contracted pharmacy strategy.

- •

- Hub Services. We also offer hub services to capitalize on our expertise in providing the services described above and to compete with other hub service providers. Hub services generally are centralized management services for collaboration and efficiency among the key participants in the specialty pharmacy system (including patients, physicians, payors, pharmaceutical manufacturers, retail pharmacies and other prescribers). In order to maintain client satisfaction and compliance we will keep certain information and software systems, infrastructure and employees "firewalled" from our specialty pharmacy business to avoid commingling or favoring any specialty pharmacy (including ours) within the networks of the hub customers.

Elements to Ensure Safe Use to mitigate a specific serious risk listed in the labeling of the drug, including special training and certifications, required dispensing locations, patient monitoring and associated reporting. We have standard operating procedures in place to support all aspects of a REMS program, including REMS administration, REMS drug fulfillment, disease management, medication guide dispensing and the Elements to Assure Safe Use specific to pharmaceutical manufacturer's program. We also partner with manufacturers to report and track Adverse Drug Events where required. Our patient care system has been designed to capture much of the information the pharmaceutical manufacturer must report to the FDA.

11

Constituent Relationships

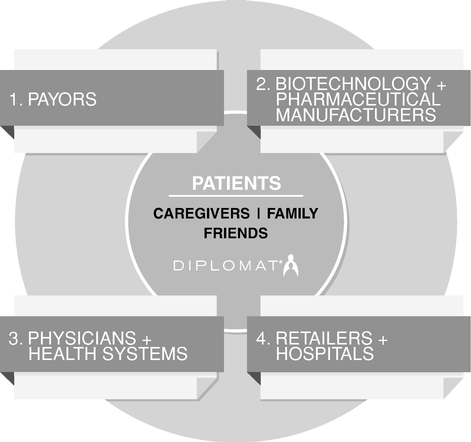

Our patient-centric approach positions us at the center of the healthcare continuum for the treatment of complex chronic diseases through partnerships with patients, payors, pharmaceutical manufacturers and physicians.

Our services provide value to our constituents in the following ways.

Patients

Our core focus is on patients. We help patients adhere to complicated medication therapies, process refills and manage any side effects and insurance concerns to ensure they get the best standard of care. The clinical efficacy of drug therapies, especially for acute and chronic conditions, is typically enhanced when patients precisely follow the prescribed treatment regimens (including dosing and frequency). On the other hand, we believe, though we do not internally track, that medication non-adherence (i.e., patients not following the instructions for their medication or failing to finish taking their medication) can contribute to a substantial worsening of disease and, in some cases, accelerated mortality which increases hospital and other health care costs. We have achieved patient adherence rates of over 90% for the last six fiscal quarters. We believe our high adherence rates are, in part, due to, among other things, our patient training and education, compliance packaging, prophylactic starter kits and nurse adherence calls. We also help identify third-party funding support programs to help cover expensive out-of-pocket costs.

12

We help manage patients' complex disease states through counseling and education regarding their treatment and by providing ongoing monitoring and, in some cases, proactive follow-up contact to encourage patient compliance with the prescribed therapy. The goal of Diplomat's patient care programs is to provide clinical services in a caring and supportive environment, optimize medication adherence, prevent disease progression and improve outcomes. To accomplish this, Diplomat focuses on each individual patient and provides solutions related to medication access, tolerance, and adherence.

Diplomat provides patients with personalized medication programs and services for a variety of complex disease states, including the following:

- •

- Oncology. Cancer therapy often involves the use of highly-toxic chemotherapy or oral

oncolytic agents with a high incidence of adverse events. Goals for these patients include the provision of the most effective therapy at the appropriate dose, adverse event management to ensure

treatment can continue for as long as it is effective, and improvement in quality of life. Our clinicians strive to ensure optimal treatment for these patients by providing high-touch proactive and

reactive care, focusing on appropriate dosage and administration, adverse event management, and adherence monitoring.

- •

- Immunology. Care of patients with autoimmune and/or inflammatory conditions

generally involves the use of therapies aimed at slowing disease progression, reducing the rate of disease relapse, and managing disease symptoms. Goals for these patients include reducing the signs

and symptoms of disease, minimizing short- and long-term side effects and complications of the disease and therapy, and improving or normalizing the patient's quality of life. Our clinicians assist

these patients by providing clinical management providing adverse event management support, proactively monitoring for adherence issues, and following up with prescribers in response to identified

therapy issues.

- •

- Hepatitis. Management of hepatitis C virus infection involves the selection of

appropriate therapy based on HCV genotype, the presence or absence of cirrhosis, transplant status, prior response to therapy, and whether or not the patient is co-infected with HIV or hepatitis B

virus. Goals for these patients include achievement of sustained virologic response, decreasing the disease and therapy burden, and optimal adherence to therapy. Our clinicians ensure that hepatitis C

virus therapy regimens are complete and appropriate, provide adverse event management support, and follow-up with prescribers to ensure optimal therapy.

- •

- Multiple

Sclerosis. Care for patients diagnosed with multiple sclerosis involves life-long support. Goals for these patients include providing

efficacious therapy to reduce the frequency of relapse and improving quality of life. Our clinicians ensure that patients are receiving the appropriate dose of therapy, provide adverse event

counseling and management support, provide education on relapse mitigation strategies, and are available to respond to patient questions regarding therapy effectiveness and adverse events.

- •

- Specialty Infusion

Therapy. Several chronic, genetic conditions and orphan diseases are treated with infused pharmaceuticals with a more complex

intravenous form of administration. These pharmaceuticals are prescribed for individuals including but not limited to the following conditions: hemophilia, immune globulin and auto-immune

deficiencies, hereditary angioedema and lysosomal storage disorders. Patients are generally referred to specialty infusion pharmacy services providers by physicians or case managers. The medications

are dispensed under the supervision of a registered pharmacist and the therapy is typically delivered to the patient or caregiver for self-administration in the home or administration by a

credentialed home-health care nurse or trained caregiver at home or in another care site.

- •

- Other Disease States. We also treat patients who have received organ transplants or who have HIV. Life-long therapy is essential for the prevention of organ rejection in transplant patients,

13

and we seek to optimize adherence to therapy in order to decrease the likelihood of organ rejection. The management of HIV is complex and involves the use of highly active anti-retroviral therapy. Goals for our patients diagnosed with HIV include achieving long-term, maximal suppression of viral load, preserving and improving immune system function (prevention of progression to acquired immunodeficiency syndrome), and prevention of the spread of HIV to others.

Payors

Currently we partner with regional and mid-sized payors and independent pharmacy benefit managers to improve patient outcomes and lower costs by managing high-risk members and implementing patient-focused specialty programs. We manage prescription regimens for chronically ill populations and help payors, which include insurance plans and pharmacy benefit managers, reduce costs through customized specialty pharmacy programs. Our electronic patient care platform, centered on our disease-specific technology solution, is customized for each payor's needs and is designed to improve efficiency and lower costs.

We offer payors access to limited distribution drugs and unique cost containment programs, including partial refill programs, clinical management and motivational interviewing techniques for improving adherence. We believe that medication non-adherence is the largest avoidable cost in specialty pharmacy because it contributes to a substantial worsening of disease and death and significantly increases hospital and other health care costs, and our strong adherence rates benefit patients and payors. For example, through our partial fill program of dispensing prescriptions with less than the typical 30-day supply, we promote more frequent direct intervention and tracking of patients and their therapies by our highly trained clinical experts. Our partial fill program focuses on medications that have a high discontinuation rate based on poor response, adverse effects and non-compliance to address potential waste as well as improve adherence to prescribed therapy. We dispense a two-week supply when prescribed and it is our policy to contact patients on the second and tenth days of therapy to verify patient tolerance. Once confirmed, we will dispense the remainder of that month's supply. If not tolerated, we contact the prescriber to seek an alternate therapy.

We provide payors with a comprehensive approach to meeting their pharmacy service needs. Our specialty pharmacy services offer payors a cost effective solution for the distribution of specialty pharmaceuticals, generally direct to patients for self-administration. We manage high-risk members in the payors' network and assist with adherence to such members' health plans to minimize waste in the purchase of specialty drugs and to optimize patient outcomes. We also provide access to a significant number of limited distribution drugs. Other services include coordination of care with the members' physicians and payors and the provision of clinical and adherence data to evaluate therapy effectiveness.

Pharmaceutical Manufacturers

We offer specialized and highly customized prescription programs for pharmaceutical companies to help them optimize and track patient adherence which helps drive the clinical and commercial success of specialty drugs. In addition, we partner with pharmaceutical manufacturers early by helping them develop specialty pharmaceutical channel strategies as part of their commercial launch preparation.

We provide pharmaceutical manufacturers with a strong distribution channel for their existing pharmaceuticals and their new product launches. We implement patient monitoring programs that encourage compliance with the prescribed therapy. We also provide drug trial assistance including product encapsulation and packaging.

The adherence rates that result from our patient-centered services described above directly benefit pharmaceutical manufacturers through clinically appropriate continued sales of their products to

14

patients, who might otherwise have failed to continue their prescribed therapies. In addition, the financial assistance and reimbursement management we provide to patients further drives pharmaceutical sales.

In addition, pharmaceutical manufacturers frequently seek patient data on the efficacy and utilization of their products, which we currently provide in a de-identified and HIPAA-compliant format. This data provides valuable clinical information in the form of outcomes and compliance data to manufacturers to aid in their evaluation of the efficacy of their products. We continue to invest in new technologies that will enable us to better provide such analytical services.

We have also assisted emerging biotechnology pharmaceutical companies in their commercialization of new drugs. In cases where pharmaceutical companies have successful clinical trials, but little commercialization experience, we are engaged to formulate strategies to market to, educate and fulfill the needs of patients, prescribers and payors. We refer to this tailored, multifaceted approach as "channel strategies." We believe that in some cases, these engagements have led to exclusive rights to administer the products of these pharmaceutical companies or our inclusion in a small panel of authorized specialty pharmacies for limited distribution of drugs.

As of December 31, 2014, we have a portfolio of over 80 limited distribution drugs, all of which are post-launch. We have historically earned access to many limited distribution drugs, both at the time of their launch and post-launch. We actively monitor the drug pipeline and maintain dialogue with many of the major biotechnology and pharmaceutical manufacturers to identify opportunities in all pre-commercial stages of drug development. We believe that limited distribution is becoming the delivery system of choice for many drug manufacturers because it facilitates high patient engagement, clinical expertise and elevated focus on service. We believe that the trend toward limited distribution of specialty drugs will continue to expand in the future, making strong representation in this area essential.

Physicians and Other Prescribers

Our team works with physician offices to manage prior-authorization and other managed care organization requirements, such as denial and appeal process, to ensure that complicated administrative tasks do not impair the delivery of quality patient care. Additionally, we provide risk evaluation services, implement risk mitigation strategies and collect patient adherence data to provide physicians and health systems with enhanced visibility.

Our singular focus on specialty pharmacy and complex chronic diseases has enabled us to develop strong relationships with clinical experts and thought leaders in key therapeutic categories, such as oncology and immunology. We leverage these relationships to gain greater visibility into future drug launches and to stay current on the latest advances in patient care.

We assist physicians and other prescribers with personalized and intensive patient support by providing care management related to their patients' pharmacy needs and improving patient compliance with therapy protocols. We eliminate the need for physicians to carry inventories of high cost prescriptions by distributing medications directly to patients' homes or, in other cases, to the physicians' offices. We also assist physicians and their clinical and non-clinical staff members by performing many of the administratively intensive tasks associated with benefits investigations, prior authorizations and other reimbursement related matters. We generally bill payors directly, on the patient's behalf, in nearly all cases. Further, we assist physicians by helping their patients manage the side effects of their therapies and monitoring adherence. We also provide physicians with clinical updates and assist with managing the pipeline of potential new therapies.

15

Retail Pharmacies, Hospitals and Health Systems

We provide clinical and administrative support services for our hospital partners on a fee-for-service basis. Based on our broad industry experience, infrastructure and treatment-tracking software, our retail specialty network solution provides customized clinical and administrative support services that help retailers and their specialty patients improve financial outcomes. We provide hospitals with unique solutions to maximize cost containment, improve efficiency and clinical outcomes from specialty pharmaceuticals. Our programs also support hospitals that are 340B covered entities, which are organizations that provide access to reduced price prescription drugs to health care facilities in accordance with the federal 340B Drug Pricing Program and that have been certified by the U.S. Department of Health and Human Services, through a contracted pharmacy strategy.

We provide specialty pharmacy management services for a fixed fee to various national, regional and independent retail pharmacies. These services are similar to those provided to payors with respect to their specialty pharmacy customers, except that we do not buy or dispense the specialty product. The services generally include the same patient engagement and adherence programs, reimbursement processing and patient funding programs, and general disease state management services described above. These services constituted less than 1% of our revenues in 2014 and 2013.

We believe that our ability to provide the patient-centric services under the brand names of our retail, hospital and health system partners makes us a valued partner for these entities that lack the infrastructure and expertise to service their specialty drug patients on their own. These partnerships broaden our exposure and influence across the healthcare continuum.

Our Suppliers

We obtain the pharmaceuticals and medical supplies and equipment that we provide to our patients through pharmaceutical manufacturers, distributors and group purchasing organizations. Most of the pharmaceuticals that we purchase are available from multiple sources and are available in sufficient quantities to meet our needs and the needs of our patients. However, some biotechnology drugs are only available through the manufacturer and may be subject to limits on distribution. In such cases, it is important for us to establish and maintain good working relations with the manufacturer in order to ensure sufficient supply to meet our patients' needs.

Most of the manufacturers of the pharmaceuticals we sell have the right to cancel their supply contracts with us without cause and after giving notice (generally 90 days or less). Specialty drug purchases from AmerisourceBergen Drug Corporation ("AmerisourceBergen"), a drug wholesaler, and Celgene Corporation ("Celgene"), a pharmaceutical manufacturer from whom we purchase several drugs, represented 57% and 15%, respectively, of cost of goods sold in 2014, 58% and 19%, respectively, of cost of goods sold in 2013, and 64% and 21%, respectively, of cost of goods sold in 2012. The reason we purchase large quantities from a single wholesaler is primarily for ease of administration and pricing. In the event of a termination of our relationship with AmerisourceBergen, we believe that there is typically at least one alternative drug wholesaler from whom we could source each non-limited distribution drug we dispense. We further believe that we could replace the inventories without a material disruption to our operations.

Through the coverage and clinical expertise of our Company-owned, main distribution facility and seven regional locations, some with retail capabilities and some with limited to moderate distribution capabilities, we provide pharmaceutical manufacturers with a strong distribution channel for their existing pharmaceutical products. In many cases, our national presence is critical to becoming a selected partner in the launch of new products. When providing new products to patients, we implement a monitoring program to encourage compliance with the prescribed therapy and we provide valuable clinical information to the manufacturer to aid in their evaluation of the efficacy of the

16

product. We receive fees, which we record as revenue or a reduction to cost of goods sold, from certain pharmaceutical manufacturers in return for providing them with clinical data.

Billing and Significant Payors

We derive most of our revenue from contracts with third-party payors, such as managed care organizations, insurance companies, self-insured employers, pharmacy benefit managers and Medicare and Medicaid programs. We contract directly with some payors and pharmacy benefit managers or, in other cases, contract with third parties which in turn contract with payors and pharmacy benefit managers on our behalf. See "Constituent Relationships-Payors" for additional information on payors.

We bill payors and track all of our accounts receivable through computerized billing systems. These systems allow our billing staff the flexibility to review and edit claims in the system before they are submitted to payors. For the great majority of our dispensing business, claims are submitted to payors electronically. We have extensive experience managing the coordination of benefits between commercial and government-sponsored plans. We participate with Medicare as a Durable Medical Equipment, Prosthetics, Orthotics and Supplies ("DMEPOS") pharmacy supplier, and participate in Medicare Part D. A benefit coverage specialist reviews all Medicare coverage determinations to ensure that the appropriate benefit is being billed. Upon completion of all benefit verifications, we follow each plan's guidelines to identify which plan is primary and secondary and submit the billing accordingly.

Our financial performance is highly dependent upon effective billing and collection practices. The process begins with an accurate and complete patient admission process, in which all critical information about the patient, the patient's insurance and the patient's care needs is gathered. A critical part of this process is verification of insurance coverage and authorization from insurance to provide the required care, which typically takes place before we initiate services. An exception occurs when a patient referral is received outside of normal business hours, but we have an existing contractual relationship with the patient's insurance carrier. In such cases, we provide the patient with sufficient drugs and services to last until the next business day, when the patient's insurance coverage can be verified.

Sales and Marketing

Our sales and marketing efforts focus on three primary objectives: (1) building new relationships and expanding existing contracts with managed care organizations and other payors or pharmacy benefit managers; (2) establishing, maintaining and strengthening relationships with key opinion leaders, physicians and other prescribers; and (3) maintaining existing and developing new relationships with pharmaceutical manufacturers to gain distribution access as they release new products or improved products. Our national and regional sales directors focus primarily on establishing and expanding our contracts with managed care organizations, while our local account managers focus on maximizing value from these contracts by developing and maintaining relationships with local and regional referral sources, such as physicians, hospital discharge planners, other hospital personnel, health maintenance organizations, preferred provider organizations or other managed care organizations, and insurance companies. In addition, we have a dedicated sales force, through a combination of internal (phone sales) and external (field sales) team members for scalability and efficiency, focused on maintaining and expanding our relationships with biotechnology drug manufacturers to establish our position as an exclusive, semi-exclusive or participating provider. As of December 31, 2014, we had 88 sales employees, including 60 internal and 28 external team members.

Information Technology

Our information technology centers around a custom-developed scalable patient care system that provides real-time prescription and patient care status to us, prescribers and contracted partners. Our

17

technology allows us to track and report industry standard metrics on call centers, dispensing, adherence, length of therapy, and persistency. We can also provide HIPAA compliant reports that contain inventory data, prescription status, persistency, compliance, discontinuation, and payor data. In addition to reporting on patient and prescriber demographics, turnaround times, spend, and error reporting, we can also report on patient assessment data, clinical status, and other monitoring parameters. We have invested significantly in information technology in recent years to position us to improve cost efficiencies among us and our constituents and to provide additional services regarding the de-identified data we accumulate to take greater advantage of our relationships with data-driven pharmaceutical manufacturers. In 2014, we determined to in-source a substantial portion of our information technology development. We also use an off-the-shelf pharmacy software system for purposes of transmitting claims to payors.

Competition

There are a significant number of competitors that distribute specialty pharmacy drugs and provide related services, some of which have greater resources than we do. Our competitors include: pharmacy benefit managers; retail pharmacy chains and independent retail pharmacies; health plans; national, regional and niche specialty pharmacies; specialty infusion therapy companies; physician practices and hospital systems; and group purchasing organizations.

We are currently the largest independent specialty pharmacy in the U.S., with a 3% overall market share (based on 2014 revenues from pharmacy-dispensed specialty drugs). The three largest specialty pharmacies are Express Scripts, CVS Caremark and Walgreens. We understand that a number of other traditionally non-specialty pharmacies with significant resources are attempting to build, acquire or partner with specialty pharmacies due to the double-digit growth anticipated in spending on specialty prescription drugs compared to low to mid single digit growth in spending on traditional prescription drugs. There are also many smaller specialty pharmacies and other entities in the healthcare industry that provide limited specialty pharmacy services that compete with us to a lesser extent. Some of these smaller entities, however, may be able to invest significant resources, through acquisition or otherwise, to compete with us on a larger scale.

Many of the retail pharmacies to which we provide patient management services may in the future acquire a competing specialty pharmacy business or start their own specialty pharmacy business and thereby become our competitors. In addition, many of our pharmacy benefit management customers have their own specialty pharmacy businesses, and to the extent certain of our products can be obtained internally, these customers could cease doing business with us.

Governmental Regulation

The healthcare industry is subject to extensive regulation by a number of governmental entities at the federal, state and local level. The industry is also subject to frequent regulatory change. Laws and regulations in the healthcare industry are extremely complex and, in many instances, the industry does not have the benefit of significant regulatory or judicial interpretation. Moreover, our business is impacted not only by those laws and regulations that are directly applicable to us but also by certain laws and regulations that are applicable to our managed care and other clients. If we fail to comply with the laws and regulations directly applicable to our business, we could suffer civil and/or criminal penalties, and we could be excluded from participating in Medicare, Medicaid and other federal and state healthcare programs, which would have an adverse impact on our business.

Professional Licensure

Pharmacists, nurses, and certain other healthcare professionals employed by us are required to be individually licensed or certified under applicable state law. We perform criminal, government exclusion

18

and other background checks on employees and take steps to ensure that our employees possess all necessary licenses and certifications, and we believe that our employees comply in all material respects with applicable licensure laws.

Pharmacy Licensing and Registration

State laws require that each of our pharmacy locations be appropriately licensed and/or registered to dispense pharmaceuticals in that state. We are licensed in all states that require such licensure and believe that we substantially comply with all state licensing laws applicable to our business. Where required by law, we also have pharmacists licensed in all states in which we dispense.

Laws enforced by the U.S. Drug Enforcement Administration, as well as some similar state agencies, require our pharmacy locations to individually register in order to handle controlled substances, including prescription pharmaceuticals. A separate registration is required at each principal place of business where we dispense controlled substances. Federal and state laws also require that we follow specific labeling, reporting and record-keeping requirements for controlled substances. We maintain U.S. Drug Enforcement Administration registrations for each of our facilities that require such registration and follow procedures intended to comply with all applicable federal and state requirements regarding controlled substances.

Food, Drug and Cosmetic Act

Certain provisions of the federal Food, Drug and Cosmetic Act govern the handling and distribution of pharmaceutical products. This law exempts many pharmaceuticals and medical devices from federal labeling and packaging requirements as long as they are not adulterated or misbranded and are dispensed in accordance with and pursuant to a valid prescription. We believe that we comply with all applicable requirements.

Fraud and Abuse Laws—Anti-Kickback Statute

The federal Anti-Kickback Statute prohibits individuals and entities from knowingly and willfully paying, offering, receiving, or soliciting money or anything else of value in order to induce the referral of patients or to induce a person to purchase, lease, order, arrange for, or recommend services or goods covered by Medicare, Medicaid, or other government healthcare programs. The federal courts have held that an arrangement violates the Anti-Kickback Statute if any one purpose of the remuneration is to induce the referral of patients covered by the Medicare or Medicaid programs, even if another purpose of the payment is to compensate an individual for rendered services. The Anti-Kickback Statute is broad and potentially covers many standard business arrangements. Violations can lead to significant penalties, including criminal fines of up to $25,000 per violation and/or five years imprisonment, civil monetary penalties of up to $50,000 per violation plus treble damages, and/or exclusion from participation in Medicare, Medicaid, and other federal government healthcare programs. In an effort to clarify the conduct prohibited by the Anti-Kickback Statute, the Office of the Inspector General of the United States Department of Health and Human Services has published regulations that identify a limited number of safe harbors. Business arrangements that satisfy all of the elements of a safe harbor are immune from criminal enforcement or civil administrative actions. The Anti-Kickback Statute is an intent based statute and the failure of a business relationship to satisfy all of the elements of a safe harbor does not in and of itself mean that the business relationship violates the Anti-Kickback Statute. The Office of the Inspector General, in its commentary to the safe harbor regulations, has recognized that many business arrangements that do not satisfy a safe harbor nonetheless operate without the type of abuses the Anti-Kickback Statute is designed to prevent. We attempt to structure our business relationships to satisfy an applicable safe harbor. However, in those situations where a business relationship does not fully satisfy the elements of a safe harbor, or where no safe harbor exists, we attempt to satisfy as many elements of an applicable safe harbor as possible. The Office of

19

the Inspector General is authorized to issue advisory opinions regarding the interpretation and applicability of the Anti-Kickback Statute, including whether an activity constitutes grounds for the imposition of civil or criminal sanctions. We have sought advisory opinions regarding future business relationships prior to execution, and may do so in the future.

A number of states have statutes and regulations that prohibit the same general types of conduct as those prohibited by the Anti-Kickback Statute described above. Some state anti-fraud and anti-kickback laws apply only to goods and services covered by Medicaid. Other state anti-fraud and anti-kickback laws apply to all healthcare goods and services, regardless of whether the source of payment is governmental or private. Where applicable, we attempt to structure our business relationships to comply with these statutes and regulations.

Fraud and Abuse Laws—False Claims Act

We are subject to state and federal laws that govern the submission of claims for reimbursement. These laws generally prohibit an individual or entity from knowingly and willfully presenting a claim or causing a claim to be presented for payment from a federal healthcare program that is false or fraudulent. The standard for "knowing and willful" may include conduct that amounts to a reckless disregard for the accuracy of information presented to payors. Penalties under these statutes include substantial civil and criminal fines, exclusion from the Medicare or Medicaid programs and imprisonment. One of the most prominent of these laws is the federal False Claims Act, which may be enforced by the federal government directly or by a private plaintiff by filing a qui tam lawsuit on the government's behalf. Under the False Claims Act, the government and private plaintiffs, if any, may recover monetary penalties in the amount of $5,500 to $11,000 per false claim, as well as an amount equal to three times the amount of damages sustained by the government as a result of the false claim. A number of states, including states in which we operate, have adopted their own false claims statutes as well as statutes that allow individuals to bring qui tam actions. In recent years, federal and state government authorities have launched several initiatives aimed at uncovering practices that violate false claims or fraudulent billing laws, and they have conducted numerous investigations of pharmaceutical manufacturers, PBMs, pharmacies and health care providers with respect to false claims, fraudulent billing and related matters. We believe that we have procedures in place to ensure the accuracy of our claims.

Ethics in Patient Referrals Law—Stark Law

The federal Stark Law generally prohibits a physician from making referrals for certain Designated Health Services, reimbursable by Medicare or Medicaid, to entities with which the physician or an immediate family member has a financial relationship, unless an exception applies. A financial relationship is generally defined as an ownership, investment or compensation relationship. Designated Health Services include, but are not limited to, outpatient pharmaceuticals, parenteral and enteral nutrition products, home health services, durable medical equipment, physical and occupational therapy services, and inpatient and outpatient hospital services. Among other sanctions, a civil monetary penalty of up to $15,000 may be imposed for each bill or claim for a service a person knows or should know is for a service for which payment may not be made due to the Stark Law. Such persons or entities are also subject to exclusion from the Medicare and Medicaid programs. Any person or entity participating in a circumvention scheme to avoid the referral prohibitions is liable for a civil monetary penalty of up to $100,000. A $10,000 fine may be imposed for failure to comply with reporting requirements regarding an entity's ownership, investment and compensation arrangements for each day for which reporting is required to have been made under the Stark Law.

The Stark Law is a broad prohibition on certain business relationships, with detailed exceptions. However, unlike the Anti-Kickback Statute under which an activity may fall outside a safe harbor and still be lawful, a referral for Designated Health Services that does not fall within an exception is strictly

20

prohibited by the Stark Law. We attempt to structure all of our relationships with physicians who make referrals to us in compliance with an applicable exception to the Stark Law.

In addition to the Stark Law, many of the states in which we operate have comparable restrictions on the ability of physicians to refer patients for certain services to entities with which they have a financial relationship. Certain of these state statutes mirror the Stark Law while others may be more restrictive. We attempt to structure all of our business relationships with physicians to comply with any applicable state self-referral laws.

HIPAA and Other Privacy and Confidentiality Legislation

Our activities involve the receipt, use and disclosure of confidential health information, including disclosure of the confidential information to a customer's health benefit plan, as permitted in accordance with applicable federal and state privacy laws. In addition, we use and disclose de-identified data for analytical and other purposes. Many state laws restrict the use and disclosure of confidential medical information, and similar new legislative and regulatory initiatives are underway at the state and federal level.

HIPAA imposes extensive requirements on the way in which healthcare providers that engage in certain actions covered by HIPAA, as well as healthcare clearinghouses (each known as "covered entities") and the persons or entities that create, receive, maintain, or transmit protected health information ("PHI") on behalf of covered entities (known as "business associates") and their use, disclosure and safeguarding of PHI, including requirements to protect the integrity, availability and confidentiality of electronic PHI. Many of these obligations were expanded under HITECH, passed as part of the American Recovery and Reinvestment Act of 2009. In January 2013, the Office for Civil Rights of HHS issued a final rule under HITECH that makes significant changes to the privacy, security, breach notification and enforcement regulations promulgated under HIPAA (the "Final Omnibus Rule"), and which generally took effect in September 2013. The Final Omnibus Rule enhances individual privacy protections, provides individuals new rights to their health information and strengthens the government's ability to enforce HIPAA.

The privacy regulations (the "Privacy Rule") issued by the Office of Civil Rights pursuant to HIPAA give individuals the right to know how their PHI is used and disclosed, as well as the right to access, amend and obtain information concerning certain disclosures of PHI. Covered entities, such as pharmacies and health plans, are required to provide a written Notice of Privacy Practices to individuals that describes how the entity uses and discloses PHI, and how individuals may exercise their rights with respect to their PHI. For most uses and disclosures of PHI other than for treatment, payment, healthcare operations, and certain public policy purposes, HIPAA generally requires that covered entities obtain a valid written individual authorization. In most cases, use or disclosure of PHI must be limited to the minimum necessary to achieve the purpose of the use or disclosure. The Final Omnibus Rule modifies the content of Notice of Privacy Practices in significant ways, requiring, among other things, statements informing individuals of their rights to receive notifications of any breaches of unsecured PHI and to restrict disclosures of PHI to a health plan where the individual pays out of pocket.

We are a covered entity under HIPAA in connection with our operation of specialty service pharmacies. To the extent that we provide services other than as a covered entity and we perform a function or activity, or provide a service to, a covered entity that involves PHI, the covered entity may be required to enter into a business associate agreement with us. Business associate agreements mandated by the Privacy Rule create a contractual obligation for us, as a business associate, to perform our duties for the applicable covered entity in compliance with the Privacy Rule. In addition, HITECH subjects us to certain aspects of the Privacy Rule and the HIPAA security regulations when we act as a business associate, including imposing direct liability on business associates for impermissible uses and

21

disclosures of PHI and the failure to disclose PHI to the covered entity, the individual or the individual's designee (as specified in the business associate agreement), as necessary to satisfy a covered entity's obligations with respect to an individual's request for an electronic copy of PHI. The Final Omnibus Rule also extends the business associate provisions of the HIPAA Rules to subcontractors where the function, activity, or service delegated by the business associate to the subcontractor involves the creation, receipt, maintenance, or transmission of PHI. As such, business associates are required to enter into business associate agreements with subcontractors for services involving access to PHI and may be subject to civil monetary penalties for the acts and omissions of their subcontractors.

Importantly, the Final Omnibus Rule greatly expands the types of product- and service-related communications to patients or enrollees that will require individual authorizations by requiring individual authorization for all treatment and health care operations communications where the covered entity receives payment in exchange for the communication from or on behalf of a third- party whose product or service is being described. While the Office of Civil Rights has established limited exceptions to this rule where individual authorization is not required, the marketing provisions finalized in the Final Omnibus Rule could potentially have an adverse impact on our business and revenues.