Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DYCOM INDUSTRIES INC | fy15marchinvestorconferenc.htm |

Click to edit Master title style Click to edit Master subtitle style Investor Presentation March 2015 Exhibit 99.1

2 This presentation contains “forward-looking statements”. Other than statements of historical facts, all statements contained in this presentation, including statements regarding the Company’s future financial position, future revenue, prospects, plans and objectives of management, are forward-looking statements. Words such as “outlook,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “should,” “could,” “project,” and similar expressions, as well as statements in future tense, identify forward-looking statements. You should not consider forward-looking statements as a guarantee of future performance or results. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief at that time with respect to future events. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors, assumptions, uncertainties, and risks that could cause such differences are discussed in our most recent Annual Report on Form 10-K, filed with the SEC on September 9, 2014 and our other filings with the Securities and Exchange Commission (“SEC”). The forward-looking statements in this presentation are expressly qualified in their entirety by this cautionary statement. The Company undertakes no obligation to update these forward-looking statements to reflect new information, or events or circumstances arising after such date. This presentation includes certain “Non-GAAP” financial measures as defined by SEC rules. As required by the SEC, we have provided a reconciliation of those measures to the most directly comparable GAAP measures on the Regulation G slides included as slides 28 through 33 of this presentation. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our reported GAAP results. Forward Looking Statements and Non-GAAP Information

3 Positioned for Strong Equity Returns A leading supplier of specialty contracting services to telecommunication providers nationwide Telecommunications networks fundamental to economic progress Firm and strengthening end market opportunities head2right Telephone companies deploying FTTX to enable video offerings and 1 gigabit connections head2right Cable operators continuing to deploy fiber to small and medium businesses with cable capital expenditures and new build opportunities expanding head2right Projects resulting from the Connect America Fund (“CAF”) are deploying fiber deeper into rural networks head2right Wireless carriers upgrading from 3G to 4G technologies and increasing 4G capacity Encouraged that industry participants remain committed to multi-year capital spending initiatives which in some cases are meaningfully accelerating and expanding in scope

4 Nationwide Footprint and Significant Resources Notes: Total liquidity of $195.0 million includes cash and equivalents of $18.4 million and availability on Senior Credit Facility of $176.6 million as of January 24, 2015. Nationwide footprint head2right Operates in all 50 states, Washington, D.C. and in Canada head2right Over 40 operating subsidiaries and hundreds of field offices Strong revenue base and customer relationships head2right Revenues of $441.1 million in Q2-15 as compared to $390.5 million in Q2-14 with solid growth from key customers; head2right EPS at $0.27 compared to a loss of $0.09 in year ago quarter Solid financial profile head2right Total liquidity of $195 million at January 24, 2015 head2right $400 million Senior Credit Facility maturing in December 2017 head2right 7.125% Senior Subordinated Notes due 2021 Over 10,800 employees

5 Intensely Focused on Telecommunications Market xrhombus Outside Plant & Equipment Installation xrhombus Premise Equipment Installation xrhombusWireless xrhombus Engineering xrhombus Underground Facility Locating Services Crucial to Customers’ Success Contract revenues of $441.1 million for Q2-15 Telecommunications Electric and Gas Utilities and Other Underground Facility Locating

6 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 -10.0% -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% GDP Traffic Industry Drivers Strong Secular Trend “Cisco projects that mobile data traffic, even after accounting for Wi-Fi offloading, will grow at a compound annual growth rate of 50%, or an eight-fold increase over the next five years. [..] Cisco expects that between now and 2018 we could see another eight-fold increase in data capacity requirements of data sessions and that takes a significant amount of additional spectrum and cell sites. “ Ben Moreland, President & CEO, Crown Castle International Corp – June/July 2014 Sources: U.S. Telecom, The Broadband Association Cisco Visual Networking Index U.S. National Bureau of Economic Analysis North Am erica Internet Protocol Traffic (Petabytes per M onth)Q u a r t e r l y G D P C h a n g e * * Gross Domestic Product (“GDP”)

7 Industry Developments Industry increasing network bandwidth dramatically head2right Major industry participants deploying significant wireline networks head2right Most participants believe newly deployed networks should provision 1 gigabit speeds head2right Industry developments are producing opportunities which are in aggregate unprecedented Delivering valuable service to customers head2right Currently providing services for 1 gigabit full deployments across the country in 17 major metropolitan areas to a number of customers head2right Revenues and opportunities driven by this new standard accelerated during Q2-15 head2right Customer spending modulations have diminished • network strategies have firmed • timing uncertainty has receded Dycom’s scale, market position and capital structure position it well as opportunities continue to expand

8 Key Driver: FTTx Deployments Growth in Subscribers “We expect to continue to invest in our high-speed Internet and Prism TV capabilities with plans to continue to push fiber deeper and deeper into our network, thereby increasing the high-speed Internet speeds that we can offer our customers. We are monitoring the success of our Prism TV in our current markets and expect to enter new markets by midyear 2015.” Stewart Ewing, CFO, CenturyLink, Inc. – January 2015 Sources: Individual Company Press Releases xrhombus Telephone companies are deploying fiber to the home and fiber to the node technologies to enable video offerings and 1 gigabit high-speed connections 0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 4Q 09 2Q 10 4Q 10 2Q 11 4Q 11 2Q 12 4Q 12 2Q 13 4Q 13 2Q 14 4Q 14 Verizon FiOS Video AT&T U-Verse

9 Key Driver: Fiber to Businesses Customer Business Services Revenue and Addressable Business Services Market ”Business Services was again a large contributor to cable revenue growth with revenue increasing 21.9% for the full year to $4 billion. The majority of that revenue is generated by small businesses with less than 20 employees, but the contribution from mid-size businesses is rapidly increasing and accounted for nearly 40% of Business Services revenue growth for the year. Business Services continues to have positive momentum and represents a large and attractive opportunity for the Company.” Michael Angelakis, Vice Chairman & CFO, Comcast - February 2015 Calendar 2014 Business Services Revenue $7.8 Billion Addressable Business Services Market $60 Billion Sources: Individual Company Press Releases & Transcripts

10 Key Driver: Connect America Fund New projects from Connect America Fund deploying fiber deeper into the networks head2right Connect America Fund (“CAF”) is part of FCC’s initiative to bring broadband access to rural communities head2right CAF Phase 2 – FCC offers support of up to $1.8 million annually to large carriers to expand broadband service to rural America • Multi-year subsidies • Broadband speeds of at least 10 Mbps downstream/1 Mbps upstream

11 Key Driver: Wireless Network Upgrades “Our Wireless strategy is built on making consistent network investments and providing a compelling value proposition to our customers. Our investment strategy is focused on adding network capacity ahead of accelerating demand, which is driven by increasing 4G device adoption and higher customer usage.” Fran Shammo, EVP & CFO , Verizon – January 2015 Sources: Industry publications; *1998 wireless cap-ex not provided xrhombus Wireless carriers are upgrading to 4G technologies creating growth opportunities in the near to intermediate term xrhombus Increasing capacity where 4G technologies are already deployed Growth in Number of Cell Sites *

12 Local Credibility, National Capability Dycom’s Nationwide Presence Subsidiaries HEWITT

13 Focused on High Value Profitable Growth xrhombus Anticipate emerging technology trends which drive capital spending xrhombus Deliberately target high quality, long-term industry leaders which generate the vast majority of the industry’s profitable opportunities xrhombus Selectively acquire businesses which complement our existing footprint and enhance our customer relationships xrhombus Leverage our scale and expertise to expand margins through best practices

14 Well Established Customers Blue-chip, predominantly investment grade clients comprise the vast majority of revenue Q2-15 Customer revenue breakdown 22.0% 14.0% 13.1%6.3% 5.0% 4.8% 3.4% 2.9% 2.1%1.2% 25.2% Comcast AT&T CenturyLink Verizon Windstream Charter Parsons Time Warner Cable Other Corning Unnamed customer

15 For comparison purposes, when customers have been combined through acquisition or merger, their revenues have been combined for all periods. Durable Customer Relationships Revenues ($ in millions) Reflects the results of the businesses acquired since date of acquisitions, including telecommunications infrastructure services subsidiaries acquired by Dycom on December 3, 2012 from Quanta Services, Inc. $- $50 $100 $150 $200 $250 $300 $350 $400 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 AT&T Comcast CenturyLink Verizon Charter Comm Time Warner Cable Windstream $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Top 5 customers All Other customers $958 $995 $1,138 $1,230 $1,107 $989 72% 67% 66% 66%66%67% 33%34%33%28% 34%34% $1,036 62% 38% $1,201 60% 40% $1,609 41% 59% $1,812 58% 42%

16 xrhombus Master Service Agreements (MSA’s) head2right Multi-year, multi-million dollar arrangements covering thousands of individual work orders head2right Generally exclusive requirement contracts xrhombus Long-term contracts relate to specific projects with terms in excess of one year from the contract date xrhombus Short-term contracts relate to spot market requirements xrhombus Significant majority of contracts are based on units of delivery Long-term contracts Anchored by Long-Term Agreements Master Service Agreements Short-term contracts Revenues by Contract Type for the Six Months Ended January 24, 2015 Dycom is party to numerous MSA’s and other arrangements with customers that extend for periods of one or more years and generally maintains multiple agreements with each customer

17 Robust Cash Flow Capital Investments FY2005 – January 24, 2015 ($ in millions) $966 million Cash flow from operations $450 million Provided by borrowings, other financing and investing activities and beginning cash on hand Cumulative Cash Flows Fiscal 2005 – January 24, 2015 $1.416 Billion for Investment Notes: Amounts represent cumulative cash flow for fiscal 2005 – Q2-2015; See “Regulation G Disclosure” for a summary of amounts.

Click to edit Master title style Click to edit Master subtitle style Financial Update

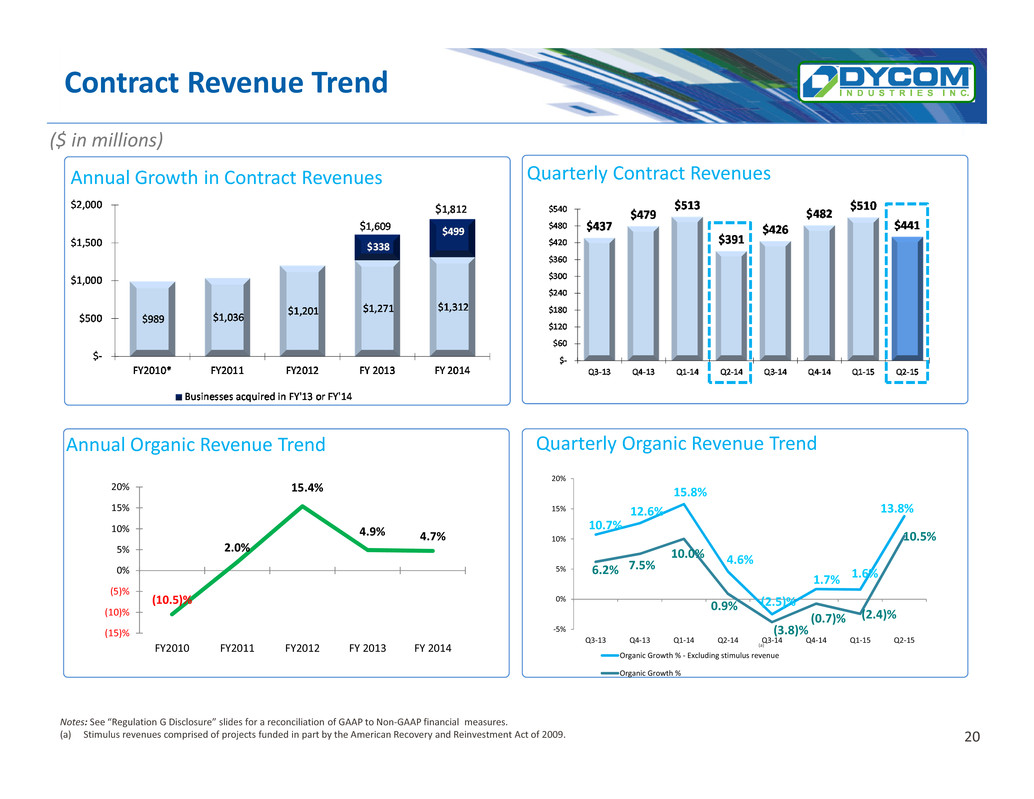

19 Financial Overview xrhombus Contract revenue of $441.1 million in Q2-15 compared to $390.5 million in Q2-14; Organic increase of 10.5% xrhombus Strong operating results head2right Adjusted EBITDA - Non-GAAP of $47.6 million, or 10.8% of revenue, compared to $28.2 million, or 7.2% in Q2-14 head2right Net income of $0.27 per share diluted in Q2-15 compared to $(0.09) loss per share in Q2-14 xrhombus Strong balance sheet, cash flow and liquidity xrhombus Capital structure designed to produce strong equity returns head2right Repurchased 488,768 shares at an average price of $35.08 per share for $17.1 million during Q2-15

20 Contract Revenue Trend Annual Growth in Contract Revenues Quarterly Contract Revenues Quarterly Organic Revenue Trend *Fiscal 2010 includes an incremental week as the result of Dycom’s 52/53 week fiscal year. (a) Notes: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures. (a) Stimulus revenues comprised of projects funded in part by the American Recovery and Reinvestment Act of 2009. ($ in millions) (10.5)% 2.0% 15.4% 4.9% 4.7% (15)% (10)% (5)% 0% 5% 10% 15% 20% FY2010 FY2011 FY2012 FY 2013 FY 2014 Annual Organic Revenue Trend 10.7% 12.6% 15.8% 4.6% (2.5)% 1.7% 1.6% 13.8% 6.2% 7.5% 10.0% 0.9% (3.8)% (0.7)% (2.4)% 10.5% -5% 0% 5% 10% 15% 20% Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 Q4-14 Q1-15 Q2-15 Organic Growth % - Excluding stimulus revenue Organic Growth %

21 Earnings & Backlog Annual Adjusted EBITDA and Adjusted EBITDA as a % of Revenue Net Income – Non-GAAP Quarterly Adjusted EBITDA and Adjusted EBITDA as a % of Revenue Backlog(b) Notes: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures. (a) The amounts and percentages for Adjusted EBITDA are Non-GAAP financial measures adjusted to exclude certain items. See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures. (b) Our backlog estimates represent amounts under master service agreements and other contractual agreements for services projected to be performed over the terms of the contracts and are based on contract terms, our historical experience with customers and, more generally, our experience in similar procurements. The significant majority of our backlog estimates comprise services under master service agreements and long-term contracts. Backlog is not a measure defined by United States generally accepted accounting principles; however, it is a common measurement used in our industry. Our methodology for determining backlog may not be comparable to the methodologies used by others. ($ in millions)

22 Cash Flows and Liquidity Cash Flow from Operations and Cap-ex, net Notes: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures. (a) Capital expenditures, net of proceeds from asset sales represents capital expenditures less proceeds from sale of assets. (b) TTM Q2-2015 cap-ex, net equals the aggregate of quarterly cap-ex from Q3-14, Q4-14, Q1-15, and Q2-15 of $16.9 million, $12.6 million, $16.3 million, and $18.4 million, respectively Cash Flows and Liquidity Support Growth ($ in millions) Liquidity Summary xrhombus Operating cash flows reflect solid earnings and changes in working capital xrhombus Strong balance sheet with ample liquidity of $195.0 million including $18.4 million of cash on hand and $176.6 million in availability under the Credit Agreement xrhombus Repurchased 488,768 shares in Q2-15 at an average price of $35.08 per share for $17.1 million head2right Current authorization of $40 million for share repurchases over the next 18 months Q1-15 Q2-15 $ 16.5 $ 18.4 $ 280.6 $ 280.5 111.7 109.4 75.0 44.0 $ 467.4 $ 433.9 $ 450.9 $ 415.5 $ 145.7 $ 176.6 $ 162.1 $ 195.0 $275 million revolver Cash and equivalents 7.125% Senior Notes Term Loan Total Debt Net Debt (Total Debt less Cash) Availability under revolver Cash and availability under revolver (b)

23 Capital Allocated to Maximize Shareholder Returns xrhombus Organic growth, solid free cash flow and confidence in industry outlook promotes capital allocation strategy to further expand shareholder returns xrhombus Fiscal 2013 - 2015 acquisitions further strengthen our customer base, geographic scope, and technical service offerings xrhombus Repurchase of 19.3 million shares for approximately $338.6 million since fiscal 2005 creates incremental shareholder value and reduces equity claims on future earnings

Click to edit Master title style Click to edit Master subtitle style Questions & Answers

25 Selected Information from Q2-15 Dycom Results Conference Call Materials The following slides 26-27 were used on February 25, 2015 in connection with the Company’s conference call to discuss fiscal 2015 second quarter results and are included for your convenience. Reference is made to slide 2 titled “Forward-Looking Statements and Non-GAAP Information” with respect to these slides. The information and statements contained in slides 26-27 that are forward- looking are based on information that was available at the time the slides were initially prepared and/or management’s good faith belief at that time with respect to future events. Except as required by law, the Company may not update forward-looking statements even though its situation may change in the future. For a full copy of the conference call materials, including the conference call transcript, see the Company’s Form 8-Ks filed with the Securities and Exchange Commission on February 25, 2015 and February 26, 2015.

26 ($ in millions, except earnings per share) (% as a percent of revenue) Q3-2014 Included for comparison Q3-2015 Outlook and Commentary Contract Revenues $ 426.3 $ 455.0 - $ 475.0 head2right Expectation of adverse weather conditions in the beginning of Q3-15 head2right Network investments by several large customers head2right Lower revenue from rural customers on stimulus projects Gross Margin % 17.8% Gross Margin % which expands from Q3-14 head2right Gross margin expectations reflect adverse weather conditions in the beginning of Q3-15, improving mix of customer growth opportunities and lower fuel prices G&A Expense % 9.2% 9.2% - 9.5% head2right General & Administrative expenses reflecting scale and higher performance-based compensation, including share-based award expenseStock-based compensation included in G&A Expense % $ 2.7 $ 3.3 Depreciation & Amortization $ 22.7 $ 23.3 - $ 23.8 head2right Includes amortization of $4.1 in Q3-15 and Q3-14 Interest Expense $ 6.6 Approximately $ 6.7 Other Income $ 5.6 $ 2.3 - $ 2.6 Adjusted EBITDA % - Non-GAAP 9.3% Adjusted EBITDA % which expands from Q3-14 Earnings Per Share– Diluted $ 0.23 $ 0.33 - $ 0.40 EPS increases from revenue growth and expanding EBITDA Diluted Shares (in millions) 34.8 Approximately 35.0 Q3-2015 Outlook Notes: See “Regulation G Disclosure” slides 29-33 for a reconciliation of GAAP to Non-GAAP financial measures. This slide was used on February 25, 2015 in connection with the Company’s conference call to discuss fiscal 2015 second quarter results. Reference is made to slide 2 titled “Forward-Looking Statements and Non-GAAP Information” with respect to this slide. The information and statements below that are forward-looking are based on information that was available at the time the slides were initially prepared and/or management’s good faith belief at that time with respect to future events. Except as required by law, the Company may not update forward-looking statements even though its situation may change in the future. For a full copy of the conference call materials, including the conference call transcript, see the Company’s Form 8-Ks filed with the Securities and Exchange Commission on February 25, 2015 and February 26, 2015.

27 Looking Ahead to Q4-2015 ($ in millions) (% as a percent of revenue) Q4-2014 Included for comparison Q4-2015 Outlook and Commentary Contract Revenues $ 482.1 Revenue growth % of mid- single to low-double digits compared to Q4-14 head2right Network investments by several large customers head2right Lower revenue from rural customers on stimulus projects Gross Margin % - Non-GAAP Q4-14 (a) 19.8% Gross Margin % which increases from Q4-14 G&A Expense % 8.5% G&A in-line as a % of revenue from Q4-14 Stock-based compensation included in G&A Expense % $ 2.9 $ 3.3 Depreciation & Amortization $ 23.1 $ 23.7 - $24.2 Interest Expense $ 6.6 Approximately $ 6.7 Other Income $ 3.0 $ 1.6 - $ 2.1 Adjusted EBITDA % - Non-GAAP 11.9% Adjusted EBITDA % which increases from Q4-14 EBITDA increases from revenue growth and improved gross margin (a) Non-GAAP gross margin % in Q4-14 excludes a $0.6 million charge for a wage and hour class action litigation settlement. Notes: See “Regulation G Disclosure” slides 29-33 for a reconciliation of GAAP to Non-GAAP financial measures. This slide was used on February 25, 2015 in connection with the Company’s conference call to discuss fiscal 2015 second quarter results. Reference is made to slide 2 titled “Forward-Looking Statements and Non-GAAP Information” with respect to this slide. The information and statements below that are forward-looking are based on information that was available at the time the slides were initially prepared and/or management’s good faith belief at that time with respect to future events. Except as required by law, the Company may not update forward-looking statements even though its situation may change in the future. For a full copy of the conference call materials, including the conference call transcript, see the Company’s Form 8-Ks filed with the Securities and Exchange Commission on February 25, 2015 and February 26, 2015.

Click to edit Master title style Click to edit Master subtitle style Supplemental Schedules Regulation G Disclosures

29 Notes: Amounts above may not add due to rounding. (a) Organic Revenue – Non-GAAP are revenues from businesses that are included for the full period in both the current and prior year quarter, excluding storm restoration services, if any. Organic Revenue growth is calculated as the percentage increase in revenues over those of the comparable prior year period (fiscal quarter) for revenues from businesses that are included in both periods for the full fiscal period, excluding revenues from storm restoration services, if any. (b) For comparisons of Organic Revenue beginning with Q3-14, Organic Revenue – Non-GAAP includes revenues of businesses acquired in Q2-13 (“Acquired Subsidiaries”) as the revenues from these businesses are included in both quarters (Q3-14 and Q3-13). (c) Organic revenues from customers for stimulus work is comprised of projects funded in part by the American Recovery and Reinvestment Act of 2009. Revenues from stimulus work included in the Non-GAAP adjustments include all stimulus revenues beginning with Q3-14 organic calculation when the Acquired Subsidiaries were in both periods. Appendix: Regulation G Disclosure Contract Revenue and Organic Growth - Reconciliation of GAAP to Non-GAAP Measures ($ in millions) The table below reconciles GAAP revenue growth (decline) to Non-GAAP organic revenue growth (decline). NON-GAAP ADJUSTMENTS GAAP % NON-GAAP - Organic % (a) NON-GAAP - Organic % excluding stimulus (a) (c) Q2-15 Organic Growth: Q2-15 441.1$ (9.5)$ -$ 431.5$ (9.1)$ 422.4$ 12.9% 10.5% 13.8% Q2-14 390.5$ -$ -$ 390.5$ (19.2)$ 371.3$ Prior Quarters Organic Growth (Decline): Q1-15 510.4$ (10.1)$ -$ 500.3$ (14.0)$ 486.3$ (0.5)% (2.4)% 1.6% Q1-14 512.7$ -$ -$ 512.7$ (34.2)$ 478.6$ Q4-14 482.1$ (9.5)$ -$ 472.6$ (23.8)$ 448.7$ 0.7% (0.7)% 1.7% Q4-13 478.6$ (2.6)$ -$ 476.1$ (34.8)$ 441.3$ Q3-14 426.3$ (5.6)$ -$ 420.7$ (26.0)$ 394.7$ (2.5)% (3.8)% (2.5)% Q3-13 437.4$ -$ -$ 437.4$ (32.5)$ 404.8$ Q2-14 390.5$ (111.5)$ -$ 279.0$ (11.0)$ 268.1$ 5.7% 0.9% 4.6% Q2-13 369.3$ (75.9)$ (16.7)$ 276.7$ (20.3)$ 256.4$ Q1-14 512.7$ (157.1)$ -$ 355.6$ (19.7)$ 335.9$ 58.6% 10.0% 15.8% Q1-13 323.3$ -$ -$ 323.3$ (33.1)$ 290.2$ Q4-13 478.6$ (139.1)$ -$ 339.5$ (19.9)$ 319.6$ 50.5% 7.5% 12.6% Q4-12 318.0$ -$ (2.3)$ 315.8$ (31.9)$ 283.9$ Q3-13 437.4$ (122.9)$ -$ 314.5$ (19.0)$ 295.5$ 47.7% 6.2% 10.7% Q3-12 296.1$ -$ -$ 296.1$ (29.2)$ 266.9$ NON-GAAP ADJUSTMENTS NON-GAAP Organic Contract Revenues - Excluding stimulus (a) Revenue Growth (Decl ine) % Revenues from businesses acquired (a) Revenues from storm restoration services Organic revenues from customers for stimulus work (c) NON-GAAP Organic Contract Revenues (a)(b) GAAP Contract Revenues

30 Notes: Amounts may not add due to rounding. (a) Other financing activities represents net cash provided by (used in) financing activities less repurchases of common stock. (b) Other investing activities represents net cash provided by (used in) investing activities less capital expenditures, net of proceeds from asset sales and less cash paid for acquisitions, net of cash acquired. Appendix: Regulation G Disclosure Calculation of Cumulative Cash Flows Fiscal 2005 through January 24, 2015 ($ in millions) Net Cash Provided by Operating Activities Capital Expenditures, Net of Proceeds from Asset Sales Cash Paid for Acquisitions, net of cash acquired Repurchases of Common Stock Borrowings and Other Financing Activities (a) Other Investing Activities (b) Total Other Financing and Investing Activities Jan -15 YTD 83.3$ (34.7)$ (9.8)$ (17.1)$ (23.4) (0.5) (23.9) FY-14 84.2 (73.7) (17.1) (10.0) 19.0 (0.3) 18.7 FY-13 106.7 (58.8) (330.3) (15.2) 263.5 0.1 263.6 FY-12 65.1 (52.8) - (13.0) 7.6 0.9 8.5 FY-11 43.9 (49.2) (36.5) (64.5) 47.5 0.2 47.7 FY-10 54.1 (46.6) - (4.5) (4.4) - (4.4) FY-09 126.6 (25.3) - (2.9) (15.7) (0.1) (15.8) FY-08 104.3 (62.3) 0.5 (25.2) (13.8) (0.3) (14.1) FY-07 108.5 (62.3) (61.8) - 7.7 (0.4) 7.3 FY-06 102.3 (47.3) (65.4) (186.2) 141.2 (0.3) 140.9 FY-05 87.4 (48.4) (8.5) - (1.8) 22.9 21.1 Cumulative 966.4$ (561.5)$ (528.9)$ (338.6)$ 427.4$ 22.2$ 449.6$ Cash at July 31, 2004 31.4$ Cash at January 24, 2015 18.4 13.0$ 462.6$ Difference representing beginning cash used during the period Total amount provided by Other Financing and Investing Activities and beginning cash on hand

31 Notes: Amounts may not add due to rounding. (a) Organic Revenue – Non-GAAP are revenues from businesses that are included for the full period in both the current and prior year presented, excluding storm restoration services, if any. Organic Revenue growth is calculated as the percentage increase in revenues over those of the comparable prior year period for revenues from businesses that are included in both periods for the full fiscal period, excluding revenues from storm restoration services, if any. (b) Non-GAAP adjustments in FY 2010 reflect adjustments in Q4-10 result from the Company’s 52/53 week fiscal year of $20.1 million. The Q4-10 Non-GAAP adjustments reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks. The result, representing one week of contract revenues, is subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP basis for comparison purposes. Appendix: Regulation G Disclosure Contract Revenue and Organic Growth - Reconciliation of GAAP to Non-GAAP Measures ($ in millions) The table below reconciles GAAP revenue growth to Non-GAAP organic revenue growth (decline). Revenues from businesses acquired (a) Revenues from storm restoration services Adjustment for extra week as a result of 52/53 week fiscal year (b) Total Adjustment GAAP NON-GAAP FY 2014 1,811.6$ (499.3)$ -$ -$ (499.3)$ 1,312.3$ 12.6% 4.7%1,608.6$ (337.9)$ (354.6)$ 1,254.0$ FY 2013 1,608.6$ (337.9)$ (16.7)$ -$ (354.6)$ 1,254.0$ FY 2013 1,608.6$ (337.9)$ (16.7)$ -$ (354.6)$ 1,254.0$ 33.9% 4.9%1,201.1$ -$ (6.0)$ 1,195.1$ FY 2012 1,201.1$ -$ (6.0)$ -$ (6.0)$ 1,195.1$ FY 2012 1,201.1$ (54.5)$ (6.0)$ -$ (60.5)$ 1,140.6$ 16.0% 15.4%1,035.9$ (33.8)$ (47.8)$ 988.1$ FY 2011 1,035.9$ (33.8)$ (14.1)$ -$ (47.8)$ 988.1$ FY 2011 1,035.9$ (33.8)$ (14.1)$ -$ (47.8)$ 988.1$ 4.8% 2.0%988.6$ -$ (20.1)$ 968.5$ FY 2010 988.6$ -$ -$ (20.1)$ (20.1)$ 968.5$ FY 2010 988.6$ -$ -$ (20.1)$ (20.1)$ 968.5$ (10.7)% (10.5)%Q4-10 1,106.9$ -$ (24.3)$ 1,082.6$ 0.0% 0.0% FY 2009 1,106.9$ -$ (24.3)$ -$ (24.3)$ 1,082.6$ Q4-09 # 1,230.0$ (101.9)$ (101.9)$ 1,128.1$ GAAP Contract Revenues NON-GAAP Contract Revenues(a)(b) Organic Growth (Decline) % NON-GAAP ADJUSTMENTS

32 Appendix: Regulation G Disclosure Selected Information- Reconciliation of GAAP to Non-GAAP Measures ($ in millions) Notes: Amounts above may not add due to rounding. The above table presents a reconciliation of the Non-GAAP financial measure of Adjusted EBITDA for the periods specified to the most directly comparable GAAP measure. Adjusted EBITDA is a Non-GAAP financial measure within the meaning of Regulation G promulgated by the Securities and Exchange Commission. The Company defines Adjusted EBITDA - Non-GAAP as earnings before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, and certain non-recurring items. The Company believes this Non-GAAP financial measure provides information that is useful to the Company’s investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the Company’s results of operations in any particular period. Additionally, the Company uses this Non-GAAP financial measure to evaluate its past performance and prospects for future performance. Adjusted EBITDA is not a recognized term under GAAP and does not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. Fiscal 2010 Fiscal 2011 Fiscal 2012 Fiscal 2013 Fiscal 2014 Adjusting Items: Write-off of deferred financing costs -$ -$ -$ 0.3$ -$ (Loss) gain on debt extinguishment, net -$ 8.3$ -$ -$ -$ Charges for settlement of wage and hour l itigation 1.6$ 0.6$ -$ 0.5$ 0.6$ Reversal of certain income tax related l iabil ities (1.0)$ -$ -$ -$ -$ Valuation allowance on deferred tax asset 1.1$ -$ -$ -$ -$ Acquisition related costs -$ 0.2$ -$ 6.8$ -$ Pre tax effect of Adjusting Items 1.6$ 9.1$ -$ 7.6$ 0.6$ After tax effect of Adjusting Items 0.9$ 5.8$ -$ 4.6$ 0.4$ Net income (GAAP) 5.8$ 16.1$ 39.4$ 35.2$ 40.0$ Provision for income taxes 4.9 12.4 25.2 23.0 26.3 Pre-tax income 10.7 28.5 64.6 58.2 66.3 Interest expense, net 14.2 15.9 16.7 23.3 26.8 Depreciation 57.2 55.8 56.2 64.8 74.5 Amortization 6.4 6.7 6.5 20.7 18.3 EBITDA 88.5 106.9 144.0 167.0 185.9 Gain on sale of fixed assets (7.7) (10.2) (15.4) (4.7) (10.7) Stock-based compensation expense 3.4 4.4 7.0 9.9 12.6 Pre-tax effect of Adjusting Items (from above) (a) 1.6 9.1 - 7.6 0.6 EBITDA - Adjusted (Non-GAAP) 85.8$ 110.2$ 135.5$ 179.8$ 188.4$ -$ (a) Amounts exclude items already added back into the calculation of EBITDA 0 Net income (GAAP)* 5.8$ 16.1$ 39.4$ 35.2$ 40.0$ Adjusting Items from above, after tax 0.9 5.8 - 4.6 0.4 Net income - Non-GAAP 6.8$ 21.9$ 39.4$ 39.8$ 40.3$ - Total contract revenues 988.6$ 1,035.9$ 1,201.1$ 1,608.6$ 1,811.6$ EBITDA (from above) as a percentage of contract revenues 9.0% 10.3% 12.0% 10.4% 10.3% EBITDA - Adjusted (Non-GAAP) (from above) as a percentage of contract revenues 8.7% 10.6% 11.3% 11.2% 10.4% Reconciliation of Net Income (GAAP) to EBITDA- Adjusted (Non-GAAP) Reconciliation of Net Income (GAAP), to Net Income - Non-GAAP (Non-GAAP)

33 Appendix: Regulation G Disclosure Selected Information- Reconciliation of GAAP to Non-GAAP Measures ($ in millions) Notes: Amounts above may not add due to rounding. The above table presents a reconciliation of the Non-GAAP financial measure of Adjusted EBITDA for the periods specified to the most directly comparable GAAP measure. Adjusted EBITDA is a Non-GAAP financial measure within the meaning of Regulation G promulgated by the Securities and Exchange Commission. The Company defines Adjusted EBITDA - Non-GAAP as earnings before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, and certain non-recurring items. The Company believes this Non-GAAP financial measure provides information that is useful to the Company’s investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the Company’s results of operations in any particular period. Additionally, the Company uses this Non-GAAP financial measure to evaluate its past performance and prospects for future performance. Adjusted EBITDA is not a recognized term under GAAP and does not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 Q4-14 Q1-15 Q2-15 Adjusting Items: Write-off of deferred financing costs -$ -$ -$ -$ -$ -$ -$ -$ Charges for settlement of wage and hour litigation -$ 0.5$ -$ -$ -$ 0.6$ -$ -$ Acquisition related costs -$ 0.2$ -$ -$ -$ -$ -$ -$ Pre tax effect of Adjusting Items -$ 0.7$ -$ -$ -$ 0.6$ -$ -$ Reconciliation of Net Income (GAAP) to EBITDA- Adjusted (Non-GAAP) Net income (loss) (GAAP) 7.2$ 14.7$ 18.7$ (3.1)$ 7.9$ 16.5$ 20.8$ 9.4$ Provision (benefit) for income taxes 4.6 9.4 12.4 (2.0) 5.2 10.7 13.5 6.1 Pre-tax income (loss) 11.8 24.0 31.1 (5.0) 13.1 27.2 34.3 15.6 Interest expense (income), net 6.6 6.8 6.9 6.8 6.6 6.6 6.7 6.7 Depreciation 17.5 17.7 18.4 18.7 18.6 18.9 18.8 19.2 Amortization 7.1 7.1 5.2 4.8 4.1 4.2 4.1 4.1 EBITDA 43.0 55.6 61.5 25.2 42.4 56.8 64.0 45.6 Gain on sale of fixed assets (1.5) (0.8) (1.9) (0.6) (5.5) (2.8) (1.5) (1.7) Stock-based compensation expense 2.5 2.6 3.5 3.5 2.7 2.9 3.9 3.7 Pre-tax effect of Adjusting Items (from above) - 0.7 - - - 0.6 - - EBITDA - Adjusted (Non-GAAP) 44.0$ 58.1$ 63.2$ 28.2$ 39.6$ 57.5$ 66.4$ 47.6$ Total contract revenues 437.4$ 478.6$ 512.7$ 390.5$ 426.3$ 482.1$ 510.4$ 441.1$ EBITDA (from above) as a percentage of contract revenues 9.8% 11.6% 12.0% 6.5% 9.9% 11.8% 12.5% 10.3% EBITDA - Adjusted (Non-GAAP) (from above) as a percentage of contract revenues 10.1% 12.1% 12.3% 7.2% 9.3% 11.9% 13.0% 10.8%

Click to edit Master title style Click to edit Master subtitle style Investor Presentation March 2015