Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - DELTA AIR LINES, INC. | delta_8k.htm |

| EX-99.2 - PRESS RELEASE - DELTA AIR LINES, INC. | delta_8k-ex9902.htm |

Exhibit 99.1

Delta: Delivering Growing Value J.P. Morgan Aviation, Transportation and Industrials Conference March 3, 2015

This presentation contains various projections and other forward - looking statements which represent Delta’s estimates or expectations regarding future events. All forward - looking statements involve a number of assumptions, risks and uncertainties, many of which are beyond Delta’s control, that could cause the actual results to differ materially from the projected results. Factors which could cause such differences include, without limitation, business, economic, competitive, industry, regulatory, market and financial uncertainties and contingencies, as well as the “Risk Factors” discussed in Delta’s SEC filings. Caution should be taken not to place undue reliance on Delta’s forward - looking statements, which represent Delta’s views only as of the date of this presentation, and which Delta has no current intention to update. In this presentation, we will discuss certain non - GAAP financial measures. You can find the reconciliations of those measures to comparable GAAP measures on our website at delta.com. Safe Harbor 2

Delivering Growing Value Significant Opportunity in 2015 Continuing To Expand Margins Balanced Capital Deployment Building on our strengths to expand margins and cash flow in order to reduce debt, return capital to shareholders and invest in our future • Stable revenue environment and lower fuel prices, coupled with Delta - specific initiatives, are expected to produce margin improvement and increased free cash flow in 2015 • Balanced capital allocation drives value to shareholders by continuing to de - risk the enterprise and accelerating return of cash to shareholders • Strategic growth , pricing enhancements, cost productivity and low fuel environment combine to generate long - term revenue growth, margin expansion and greater cash generation 3

• Generated more than $4.5 billion in pre - tax income in 2014, almost $1.9 billion higher than 2013 • $3.7 billion of free cash flow, $7.3 billion of adjusted net debt, $900 million contributed to the pension plans, and more than $1.3 billion returned to shareholders • Industry - leading operational reliability with the highest customer satisfaction of the network carriers 2014 Pre - Tax Income ($M) Record 2014 Excludes special items $4,536 $4,164 $2,233 $1,973 $922 $382 Outpacing The Airline Industry 4

The Backdrop For 2015 Improving on all aspects of our financial performance in 2015 as a solid revenue environment, lower fuel prices and Delta - specific initiatives produce another record year Across The Industry At Delta • Modest economic growth globally, with strength in North America • Continuing international headwinds from weakening currencies and Asian capacity growth in excess of demand • Solid corporate travel environment with Global Business Travel Association expecting 6 % increase in overall corporate travel spend • Market fuel prices of $1.95 - $2.05 per gallon – 90¢ lower than 2014 – representing a ~$3.5 billion run - rate savings in the future for Delta • Increasingly rational industry structure as merger integrations progress • Disciplined approach to capacity – modest system capacity growth of 2%, with domestic up 3% and international up less than 1% • Focus on bringing fuel savings to the bottom line – at current market prices, Delta’s net fuel benefit is $1.8 billion for the year • Further margin expansion through top line growth, lower fuel costs and continued non - fuel cost productivity • Upgauging and other cost initiatives keep non - fuel cost growth below 2% • Significant cash flow generation enables improved capital returns 5

Restructured Hedge Book 6 2H15 hedge book has been restructured to balance exposure while maintaining longer - term upside protection • Took advantage of rebound in market prices during the quarter to restructure 2015 - 16 hedge book • 2H15 hedge book is now better positioned for current market conditions – Early settled one - third of exposure for $300M loss in March quarter, monetizing market contango – Deferred one - third of exposure into 2016, providing more time for market to stabilize – Maintained one - third of exposure so 2H15 will be hedged at ~20%, with total losses of $200 - $300 million for prices between $45 - $75 per barrel • Excluding early settlements, March quarter fuel price ~$0.40 lower year over year, driving $400 million lower fuel expense – Continuing to expand margins, even inclusive of early settlement expense • All - in fuel prices are expected to be in line with industry average starting July 1 $1.87 - $ 1.92 $0.81 ($0.08) $2.60 - $2.65 $0.33 $2.92 - $2.97 Market Price Hedge Loss Refinery Profit DL Price ex. Hedge Restructure Hedge Restructure DL Fuel Price 1Q15E Delta Fuel Price Includes taxes and transportation charges 1

Solid March Quarter Performance 7 Operating margin - excluding hedge restructuring 8% - 9% ~11% Fuel Price - excluding hedge restructuring $2.92 - $2.97 $2.60 - $2.65 Passenger unit revenue change year over year Down ~1% CASM – ex fuel change year over year Flat System capacity change year over year Up ~5 % Free cash flow $800 - 900 million Cash returned to shareholders $500 million Note: Fuel price includes taxes, settled hedges, refinery contribution and excludes MTM adjustments; Fuel price also includes $300 million of expense ($0.33/gal) associated with the early settlement of hedges. CASM ex - fuel excludes special items and profit sharing. Business continues to produce top line growth, margin expansion and strong free cash flow March Quarter 2015 Forecast • Excluding impact of hedge restructuring, March quarter margin forecast is at the low end of original guidance range from January on slightly lower unit revenue and 15 cents higher fuel price – Business producing pre - tax margin expansion year - over - year on a fuel - neutral basis

A High - Quality Company • 11 - 14% operating margins • 2014: 13.1% Operating Margin • Annual EPS growth of 10% - 15% after 2014 • 2014: 70% on a pre - tax basis EPS Growth • 15 - 18% return on invested capital • 2014: 20.7% ROIC • $6 billion annual operating cash flow and $3 billion free cash flow • 2014: $5.8 billion operating cash flow and $3.7 billion free cash flow Cash Flow • $5 billion adjusted net debt by 2016 and pension at 80% funded status by 2020 • 2014: $7.3 billion adj. net debt at year end Balance Sheet Long - Term Goals Long - term goals guide the business toward generating solid margins and cash flow, achieving an investment grade - quality balance sheet and delivering sustainable shareholder returns 10 - 15% 11.6% 14.5% 15 - 18% Return on Invested Capital EPS Growth 12.3% 10 - 15% Delta - Goal Delta - Goal S&P 500 Industrials 2014 - 16 consensus S&P 500 Industrials 2014 - 16 consensus Note: All results exclude special items ; Delta ROIC reflects benefits of NOLs 8

Continuing To Drive Margin Expansion Disciplined Capacity Growth • Drive capacity growth through better utilization of assets, producing more seat departures and higher capacity on a smaller fleet • Focus capacity growth on high - revenue, restricted/constrained markets Pricing Improvements • Investments in network, product and service producing sustainable revenue gains • Next phase of revenue initiatives focus on better customer segmentation and improved offerings for high - value customers Cost Productivity • Maximizing the benefits of scale throughout the network to improve cost efficiency • Focus on bringing fuel benefit to the bottom line • Leveraging supply chain, technology and maintenance expertise to improve productivity Disciplined capacity growth, pricing improvement and cost productivity combine to generate long - term revenue growth, margin expansion and greater cash generation 9

Corporate Customers Are Choosing Delta Running a high - quality, customer - focused airline… …Produces strong gains in corporate revenues Momentum continues as corporate revenues have increased by 6% this year 10 6 7 7 6 6 5 5 4 1 1 1 1 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Business Travel News Survey 13% 8% 5% 5% 5% 4% 3% 5% 6% Financial Services Transportation Defense Technology Automotive Media Manufacturing Other Total 1Q15 Ticketed Revenue vs Prior Year

Higher Revenue Through Better Customer Segmentation Industry - leading consumer products in each of four Branded F are categories, allowing customers to tailor their travel experience Delta One / First Class Delta Comfort+ Main Cabin Basic Economy Delta One / First Class Main Cabin / Basic Economy Delta Comfort+ Delta One / First Class Best - in - class product that includes a spacious seat, pillow and blanket, food options, premium entertainment and priority boarding Delta Comfort+ A distinctive product designed for travelers who desire an elevated experience, including an upgraded snack basket, complimentary alcohol, early boarding, additional leg room, dedicated overhead bin space and free premium entertainment Main Cabin Best - in - market core product, including advance seat selection, access to Wi - Fi, snacks, complimentary entertainment, full Medallion benefits and premium cabin upgradability Basic Economy Best - in - class transportation targeted at price conscious consumers who are indifferent to flexibility or seat selection (and often buy at OTAs) Total Branded Fares opportunity estimated at $1.5 billion+ annually by 2018 11

Enhanced Agreement With American Express Partnering with American Express since 1996 to create the world’s most valuable airline co - brand portfolio • New, multi - year contract with American Express continues growth momentum of Delta’s $2 billion co - brand revenue stream • Significantly improved economics achieved across multiple business lines including co - brand card, Membership Rewards, Sky Club, and Merchant Services – Early renewal increased effective rate by 15% in 2015 and 20% over the new contract period – New agreement will double benefits to Delta over the next five years • Leveraging American Express’ unique position as both credit card provider and largest global travel agency 12

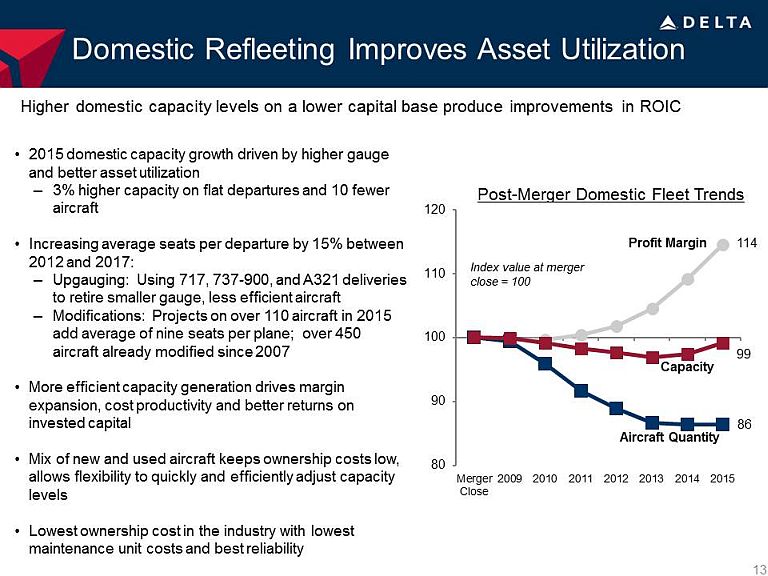

Domestic Refleeting Improves Asset Utilization Higher domestic capacity levels on a lower capital base produce improvements in ROIC • 2015 domestic capacity growth driven by higher gauge and better asset utilization – 3% higher capacity on flat departures and 10 fewer aircraft • Increasing average seats per departure by 15% between 2012 and 2017: – Upgauging: Using 717, 737 - 900, and A321 deliveries to retire smaller gauge, less efficient aircraft – Modifications: Projects on over 110 aircraft in 2015 add average of nine seats per plane; over 450 aircraft already modified since 2007 • More efficient capacity generation drives margin expansion, cost productivity and better returns on invested capital • Mix of new and used aircraft keeps ownership costs low, allows flexibility to quickly and efficiently adjust capacity levels • Lowest ownership cost in the industry with lowest maintenance unit costs and best reliability Post - Merger Domestic Fleet Trends 80 90 100 110 120 Merger Close 2009 2010 2011 2012 2013 2014 2015 Note: Margin data Profit Margin Capacity Aircraft Quantity 114 86 99 Index value at merger close = 100 13

International Revenues Face Headwinds • Strong dollar puts pressure on revenue and RASM but is margin accretive • Re - evaluating post - summer capacity plans in Atlantic, Pacific, and Brazil in light of continued currency headwinds West Coast Atlantic Pacific Latin • Redeployment of capacity with Virgin Atlantic is providing the foundation for long - term success in a key business corridor • Continuing to benefit from strong relationship with Air France / KLM • Africa, the Middle East, and Russia remain challenging markets despite 2014 capacity adjustments • Continue to develop Seattle hub as part of Pacific restructuring strategy – intra - west network now serves 95%+ of US/Canada West Coast to Asia demand • Restructuring of the region and realignment of the Narita hub remain top priority • Foreign currency depreciation and declining fuel surcharges represent significant headwinds in the region • Completing major capacity investment in Latin America with profitability and margins improving as additions mature • Growth in 2015 is front loaded and focused on Mexico, Brazil and Caribbean, with entity growth nearly flat for the second half of the year • Evaluating tactical capacity adjustments in line with country - specific economic growth 14

Balanced Capital Deployment Drives Value Reinvest In The Business • ~50% of operating cash flow to be reinvested in the business • Plan to invest $2 - $3 billion annually into fleet, products, facilities and technology Strengthen The Balance Sheet • Nearly $10 billion in debt reduction in last five years • Committed to ~$1 billion per year in pension funding • Progress toward investment grade metrics evident in three S&P upgrades in last 18 months • Current ratings two notches away from investment grade Return Cash To Shareholders • Returned over $2 billion since starting program less than two years ago • On track to complete $2 billion repurchase authorization by end of 2015, one year ahead of expiration Balanced approach to capital deployment has driven significant value for shareholders 15

Paying Down Debt Remains A Priority Clear path to achieve $5 billion debt target in 2016, resulting in $1 billion of run - rate interest savings versus 2009 $ 17.0B $ 15.0B $ 12.9B $ 11.7B $ 9.4B $ 7.3B < $6.0B 2009 2010 2011 2012 2013 2014 2015E Adjusted Net Debt Interest $1.3B $1.2B $1.1B $1.0B $850M $650M $475M Expense 16

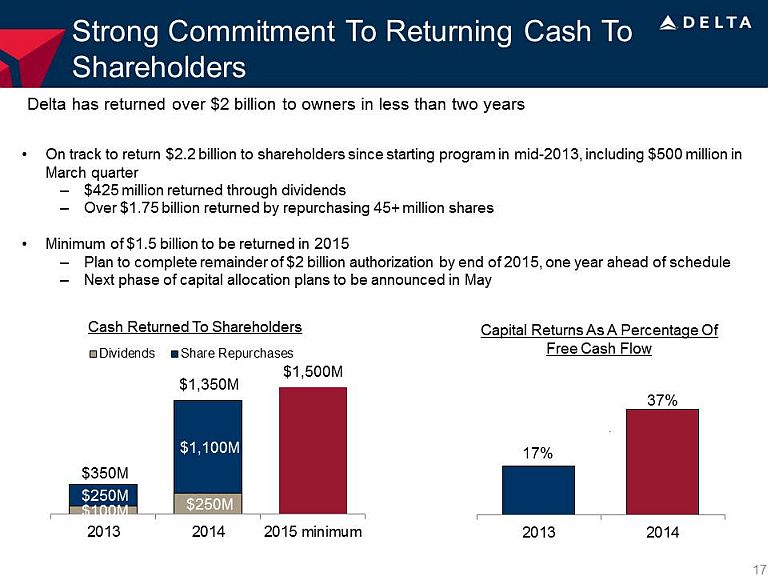

…is now competing on capital returns Delta has returned over $2 billion to owners in less than two years 17% 37% 2013 2014 Strong Commitment To Returning Cash To Shareholders Capital Returns As A Percentage Of Free Cash Flow Cash Returned To Shareholders $ 100M $ 250M $ 250M $ 1,100M 2013 2014 2015 minimum Dividends Share Repurchases $350M $1,350M • On track to return $2.2 billion to shareholders since starting program in mid - 2013, including $500 million in March quarter – $425 million returned through dividends – Over $1.75 billion returned by repurchasing 45+ million shares • Minimum of $1.5 billion to be returned in 2015 – Plan to complete remainder of $2 billion authorization by end of 2015, one year ahead of schedule – Next phase of capital allocation plans to be announced in May 17 $1,500M

The Path To Value Creation Delta S&P Industrials Free Cash Flow Delta S&P Industrials EPS Growth Note: S&P Industrials are 2014 - 16 consensus estimates obtained from FactSet. Delta P/E reflects benefit of NOLs. Delta S&P Industrials Forward Price/Earnings Delta S&P Industrials Free Cash Flow Yield Achieving our long - term goals and lowering risk across the business should result in improved valuation Delta S&P Industrials ROIC 10 - 15% 12.3% 15 - 18% 14.5% $3B+ $1.7B 9.6x 17.1x 10% 5.5% 18

| 19 |

Non-GAAP Financial Measures

Delta sometimes uses information ("non-GAAP financial measures") that is derived from the Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Under the U.S. Securities and Exchange Commission rules, non-GAAP financial measures may be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. The tables below show reconciliations of non-GAAP financial measures used in this presentation to the most directly comparable GAAP financial measures.

Forward Looking Projections. Delta is unable to reconcile certain forward-looking projections to GAAP as the nature or amount of special items cannot be estimated at this time.

| 20 |

Pre-Tax Income, excluding special items

Delta excludes special items from pre-tax income because management believes the exclusion of these items is helpful to investors to evaluate the company's recurring core operational performance in the periods shown. Therefore, we adjust for these amounts to arrive at more meaningful financial measures. Special items excluded in the tables below showing the reconciliation of pre-tax income are:

Mark-to-market adjustments for fuel hedges recorded in periods other than the settlement period ("MTM adjustments"). MTM adjustments are based on market prices at the end of the reporting period for contracts settling in future periods. Such market prices are not necessarily indicative of the actual future value of the underlying hedge in the contract settlement period. Therefore, excluding these adjustments allows investors to better understand and analyze the company's core operational performance in the periods shown.

Restructuring and other. Because of the variability in restructuring and other, the exclusion of this item is helpful to investors to analyze our recurring core operational performance in the periods shown.

Loss on extinguishment of debt. Because of the variability in loss on extinguishment of debt, the exclusion of this item is helpful to investors to analyze the company’s recurring core operational performance in the periods shown.

Virgin Atlantic MTM Adjustments. We record our proportionate share of earnings from our equity investment in Virgin Atlantic in other expense. We exclude Virgin Atlantic's MTM adjustments to allow investors to better understand and analyze the company’s financial performance in the periods shown.

| Year Ended December 31, | ||||||||

| (in millions) | 2014 | 2013 | ||||||

| Pre-tax income | $ | 1,072 | $ | 2,527 | ||||

| Items excluded: | ||||||||

| MTM adjustments | 2,346 | (276 | ) | |||||

| Restructuring and other | 716 | 424 | ||||||

| Loss on extinguishment of debt | 268 | – | ||||||

| Virgin Atlantic MTM adjustments | 134 | – | ||||||

| Pre-tax income, excluding special items | $ | 4,536 | $ | 2,675 | ||||

| Year Ended December 31, | ||||||||||||

| (in millions, except per share data) | 2014 | 2013 | Change | |||||||||

| Pre-tax income, excluding special items | $ | 4,536 | $ | 2,675 | ||||||||

| Weighted average diluted shares | 845 | 858 | ||||||||||

| Pre-tax income per diluted share | $ | 5.37 | $ | 3.12 | 70% | |||||||

| 21 |

Free Cash Flow

Delta presents free cash flow because management believes this metric is helpful to investors to evaluate the company's ability to generate cash that is available for use for debt service or general corporate initiatives. This metric is adjusted for the posting of hedge margin as we believe this inclusion removes the impact of current market volatility on our unsettled hedges and allows investors to better understand and analyze the company’s core operational performance in the periods shown.

| Year Ended December 31, | ||||||||

| (in billions) | 2014 | 2013 | ||||||

| Net cash provided by operating activities | $ | 4.9 | $ | 4.5 | ||||

| Net cash used in investing activities | (2.5 | ) | (2.7 | ) | ||||

| Adjustments: | ||||||||

| Net purchases of short-term investments and other | 0.4 | – | ||||||

| Hedge margin | 0.9 | – | ||||||

| SkyMiles used pursuant to advance purchase under AMEX agreement | – | 0.3 | ||||||

| Total free cash flow | $ | 3.7 | $ | 2.1 | ||||

| Capital Returns | $ | 1.35 | $ | 0.35 | ||||

| Capital Returns as a % of free cash flow | 37 | % | 17% | |||||

Adjusted Net Debt

Delta uses adjusted total debt, including aircraft rent, in addition to long-term adjusted debt and capital leases, to present estimated financial obligations. Delta reduces adjusted debt by cash, cash equivalents and short-term investments and hedge margin receivable, resulting in adjusted net debt, to present the amount of assets needed to satisfy the debt. Management believes this metric is helpful to investors in assessing the company’s overall debt profile. Management has reduced adjusted debt by the amount of hedge margin receivable, which reflects cash posted to counterparties, as we believe this removes the impact of current market volatility on our unsettled hedges and is a better representation of the continued progress we have made on our debt initiatives.

| (in billions) | December 31, 2014 | December 31, 2013 | December 31, 2012 | December 31, 2011 | December 31, 2010 | December 31, 2009 | ||||||||||||||||||||||||||||||

| Debt and capital lease obligations | $ | 9.8 | $ | 11.3 | $ | 12.7 | $ | 13.8 | $ | 15.3 | $ | 17.2 | ||||||||||||||||||||||||

| Plus: unamortized discount, net from purchase accounting and fresh start reporting | 0.1 | 0.4 | 0.5 | 0.6 | 0.6 | 1.1 | ||||||||||||||||||||||||||||||

| Adjusted debt and capital lease obligations | $ | 9.9 | $ | 11.7 | $ | 13.2 | $ | 14.4 | $ | 15.9 | $ | 18.3 | ||||||||||||||||||||||||

| Plus: 7x last twelve months' aircraft rent | 1.6 | 1.5 | 1.9 | 2.1 | 2.7 | 3.4 | ||||||||||||||||||||||||||||||

| Adjusted total debt | 11.5 | 13.2 | 15.1 | 16.5 | 18.6 | 21.7 | ||||||||||||||||||||||||||||||

| Less: cash, cash equivalents and short-term investments | (3.3 | ) | (3.8 | ) | (3.4 | ) | (3.6 | ) | (3.6 | ) | (4.7 | ) | ||||||||||||||||||||||||

| Less: hedge margin receivable | (0.9 | ) | – | – | – | – | – | |||||||||||||||||||||||||||||

| Adjusted net debt | $ | 7.3 | $ | 9.4 | $ | 11.7 | $ | 12.9 | $ | 15.0 | $ | 17.0 | ||||||||||||||||||||||||

| 22 |

Operating Margin, adjusted

Delta excludes MTM adjustments and restructuring and other from operating margin for the reasons described above under the heading Pre-Tax Income, excluding special items.

| Year Ended | |

| December 31, 2014 | |

| Operating margin | 5.5% |

| Items excluded: | |

| MTM adjustments | 5.8% |

| Restructuring and other | 1.8% |

| Operating margin, adjusted | 13.1% |

Return on Invested Capital

Delta presents return on invested capital as management believes this metric is helpful to investors in assessing the company’s ability to generate returns using its invested capital and as a measure against the industry. Return on invested capital is adjusted total operating income divided by average invested capital.

| Year Ended | ||||

| (in billions, except % of return) | December 31, 2014 | |||

| Adjusted book value of equity | $ | 18.5 | ||

| Average adjusted net debt | 8.2 | |||

| Average invested capital | $ | 26.7 | ||

| Adjusted total operating income | $ | 5.5 | ||

| Return on invested capital | 20.7% | |||

| 23 |

Operating Cash Flow, adjusted

Delta presents operating cash flow, adjusted because management believes adjusting for these amounts provides a more meaningful financial measure for investors. This metric is adjusted for the posting of hedge margin as we believe this inclusion removes the impact of current market volatility on our unsettled hedges and allows investors to better understand and analyze the company’s core operational performance in the period shown. Management believes investors should be informed that reimbursements related to build-to-suit leased facilities and other effectively reduce net cash provided by operating activities and related capital expenditures.

| Year Ended | ||||

| (in millions) | December 31, 2014 | |||

| Net cash provided by operating activities (GAAP) | $ | 4,947 | ||

| Adjustments: | ||||

| Hedge margin | 925 | |||

| Reimbursements related to build-to-suit leased facilities and other | (92 | ) | ||

| Operating cash flow, adjusted | $ | 5,780 | ||

| 24 |

Delta restructured its fuel hedge portfolio by early settling certain of its 2015 hedges and deferring the settlement of a portion of its remaining positions. A portion of contracts originally scheduled to expire in the second half of 2015 were early settled in cash, resulting in the acceleration of losses totaling $300 million to the March 2015 quarter. Additionally, Delta deferred a portion of its hedge portfolio until 2016 by entering into fuel derivative transactions that will provide $300 million in cash receipts (excluding market movements) during the second half of 2015 and $300 million in cash payments (excluding market movements) in 2016. These cash settlements will be reflected in the reported hedge results in the respective periods. By deferring settlement of a portion of the original derivative transactions, the restructured hedge portfolio provides additional time for the fuel market to stabilize.

| Three Months Ending March 31, 2015 | ||||||||

| (in millions, except fuel price) | Hedge Results | Price Impact | ||||||

| Hedge loss before restructuring | $ | 750 | 0.81 | |||||

| Effect of hedge restructuring | 300 | 0.33 | ||||||

| Estimated hedge loss | $ | 1,050 | $ | 1.14 | ||||

| 25 |