Attached files

| file | filename |

|---|---|

| EX-4.1 - COMMON STOCK CERTIFICATE SPECIMEN - CGN Nanotech, Inc. | fs12015ex4i_cgnnanotech.htm |

| EX-3.2 - BY-LAWS - CGN Nanotech, Inc. | fs12015ex3ii_cgnnanotech.htm |

| EX-14.1 - CODE OF ETHICS - CGN Nanotech, Inc. | fs12015ex14i_cgnnanotech.htm |

| EX-10.1 - FORM OF SECURITIES PURCHASE AGREEMENT - CGN Nanotech, Inc. | fs12015ex10i_cgnnanotech.htm |

| EX-23.1 - ACCOUNTANT'S CONSENT - CGN Nanotech, Inc. | fs12015ex23i_cgnnanotech.htm |

| EX-10.4 - STOCK PURCHASE OPTION AGREEMENT - CGN Nanotech, Inc. | fs12015ex10iv_cgnnanotech.htm |

| EX-10.2 - FORM OF SUBSCRIPTION AGREEMENT BETWEEN THE COMPANY AND 36 INVESTORS, ENTERED INTO IN DECEMBER 2014 - CGN Nanotech, Inc. | fs12015ex10ii_cgnnanotech.htm |

| EX-10.3 - GLOBAL SALES AND DISTRIBUTION AGREEMENT - CGN Nanotech, Inc. | fs12015ex10iii_cgnnanotech.htm |

| EX-3.1 - ARTICLES OF INCORPORATION - CGN Nanotech, Inc. | fs12015ex3i_cgnnanotech.htm |

As filed with the Securities and Exchange Commission on , 2015

Registration No. 333- ____

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CGN NANOTECH, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 3640 | 47-2006510 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification No.) |

Suite 2201, 22/F, Malaysia Building, 50 Gloucester Road, Wanchai, Hong Kong

Tel: (852) 3584-7820

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Vcorp Services, LLC

1645 Village Center Circle, Suite 170

Las Vegas, NV89134

Tel: (845) 425-0077

Fax: (845) 818-3588

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer |

☐ | Smaller reporting company | ☒ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Offering Price Per Share (2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee(3) | ||||||||||||

| Common stock, par value $.0001 per share | 1,000,000 | $ | 1.28 | $ | 1,280,000 | $ | 148.74 | |||||||||

| (1) | The company may not sell all of the shares, in fact it may not sell any of the shares. For example, if only 50% of the shares are sold, there will be 500,000 shares sold and the gross proceeds will be $640,000. |

| (2) | The offering price has been arbitrarily determined by the Company and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price. |

| (3) | The proposed maximum offering price per share and the proposed maximum aggregate offering price have been estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

The registrant hereby amends this registration statement on such date or date(s) as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission of which this prospectus is a part becomes effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated , 2015

PRELIMINARY PROSPECTUS

CGN NANOTECH, INC.

Up to 1,000,000 Shares of Common Stock

$1.28 per Share

This is the initial public offering (the “Offering”) of common stock of CGN Nanotech, Inc. and no public market currently exists for the securities being offered. We are offering for sale a total of up to 1,000,000 shares of our common stock at a fixed price of $1.28 per share. We estimate our total offering registration costs to be approximately $10,649. There is no minimum number of shares that must be sold by us for the Offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The Offering will commence promptly on the date upon which the registration statement is declared effective with the Securities and Exchange Commission (the “SEC”) and will conclude upon the earlier of (i) when the Offering period ends (90 days from the effective date of this prospectus), (ii) the date when the sale of all 1,000,000 shares is completed, (iii) when the Board of Directors decides that it is in the best interest of the Company to terminate the Offering prior to the completion of the sale of all 1,000,000 shares registered under the Registration Statement of which this Prospectus is part. The Offering is being conducted on a self-underwritten, best efforts basis, which means our officers and directors will attempt to sell the shares in reliance on the safe harbor from broker-dealer registration under Rule 3a4-1 of the Securities Exchange of 1934, as amended (the “Exchange Act”). This prospectus will permit our directors to sell the shares directly to the public. No commission or other compensation related to the sale of the shares will be paid to the directors. We are making this Offering without the involvement of underwriters or broker-dealers.

No public market currently exists for our common stock being offered hereby. Our common stock is presently not listed on any national securities exchange or reported on any quotation system. Subsequent to the initial filing date of the registration statement on Form S-1, in which this prospectus is included, we may have an application filed on our behalf by a market maker for approval of our common stock for quotation on the OTC Markets Group, Inc. No assurance can be made, however, that we will choose to file such an application or will be able to locate a market maker to submit such application or that such application will be approved.

We qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (“JOBS Act”). For more information, see the prospectus section titled “Emerging Growth Company Status” starting on page 2.

The Company is a “shell company” as defined by Rule 405 of Regulation C promulgated under the Securities Act. Please refer to “Risk Factors” on Page 9.

The Company is currently in the development stage and has minimal operations and revenues to date and there can be no assurance that the company will be successful in furthering its operations and/or revenues. Persons should not invest unless they can afford to lose their entire investment.

Investing in our securities involves a high degree of risk. You should purchase these units only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 5 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ___, 2015

You should rely only on information contained in this prospectus. We have not authorized anyone to provide you with information that is different from that contained in this prospectus. This prospectus is not an offer to sell or buy any shares in any state or other jurisdiction in which it is unlawful. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. We are responsible for updating this prospectus to ensure that all material information is included and will update this prospectus to the extent required by law.

This summary highlights certain information appearing elsewhere in this prospectus. This summary does not contain all of the information you should consider prior to investing in the securities offered hereby. After you read this summary, you should read and consider carefully the more detailed information and financial statements and related notes that we include in this prospectus, especially the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” If you invest in our securities, you are assuming a high degree of risk.

Use of Defined Terms

Except as otherwise indicated by the context, references in this Report to:

●

|

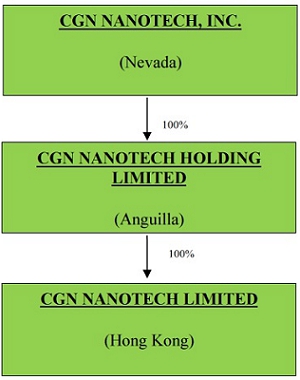

The “Company,” “we,” “us,” or “our,” “CGN” are references to the combined business of the (i) CGN Nanotech, Inc., a corporation incorporated under the laws of State of Nevada (“CGN Nevada”); (ii) CGN Nanotech Holding Limited, a company incorporated under the laws of Anguilla (“CGN Anguilla”); and (iii) CGN Nanotech Limited, a limited liability company formed in Hong Kong (“CGN HK”). | |

● |

“Common Stock” refers to the common stock, par value $.0001, of the Company; | |

| ● | “HK” refers to the Hong Kong; | |

● |

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; | |

● |

“Securities Act” refers to the Securities Act of 1933, as amended; and | |

● |

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

Our Company

CGN Nanotech, Inc. was incorporated in the State of Nevada on September 4, 2014. We are a development-stage company with a fiscal year end of December 31. We have a limited operating history. Our prospects should be considered in light of the risks, uncertainties, expenses and difficulties frequently encountered by companies in the early stages of their development.

We are acting as the exclusive global sales and distributor for lighting products produced by Dongguan Light Power New Energy S&T Co. Ltd. (“DGL”) located in Guangdong, China pursuant to a Global Sales & Distribution Agreement dated November 12, 2014 entered by and between DGL and us (the “Distribution Agreement”). The Distribution Agreement allows us to market, sell and distribute DGL’s products globally.

The products manufactured and provided by DGL are a series of Nano-ceramic Lighting Products (the “Nano-ceramic Lighting Products”). Our initial plan is to distribute the Nano-ceramic Lighting Products to Hong Kong, Japan, Europe and the US. We will have a team of sales person dedicated to promoting the products in the aforementioned markets.

On March 3, 2015, the Company, CGN HK and Dr. Dai Jian Guo, our CEO, President and director who owns 45.5% of equity interests (such portion of equity interests, the “Equity Interests”) of DGL entered into a Stock Purchase Option Agreement, whereby Dr. Dai agreed to grant to CGN HK the exclusive option (the “Option”) to purchase the Equity Interests before July 31, 2016, which is exercisable in CGN HK’s sole option, in exchange of the issuance of a number of shares of Common Stock of the Company, based on fair market value of DGL appraised by an independent appraiser. The Option is exercisable upon the satisfaction of all of the following conditions: (i) the due diligence investigation of DGL is to the satisfaction of CGN HK; (ii) DGL bears no liabilities whatsoever; and (iii) DGL has obtained all the necessary government approval to conduct business.

| 1 |

Our current corporate structure is as follows:

Conflicts of Interest

DGL and CGN Nevada have a common shareholder, Dr. Dai Jian Guo. Dr. Dai owns 78.8% of the total issued and outstanding shares of CGN Nevada before this Offering and 45.5% of the total issued and outstanding capital stock of DGL. Thus, there may be conflict of interest between CGN Nevada and DGL since CGN is an exclusive distributor of DGL and DGL is the only supplier for CGN Nevada. Some employees of DGL acquire shares of Common Stock of CGN Nevada through private placements. Thus, besides Dr. Dai, who is the current shareholder of DGL and CGN Nevada, there will be certain common shareholders who own shares of DGL and CGN Nevada. Therefore, this may create conflicts when we make business decisions and place purchase orders with DGL.

The Company is registering up to 1,000,000 shares of its Common Stock. There is no public market for our common stock. To date, we have not obtained listing or quotation of our securities on a national stock exchange or association, or inter-dealer quotation system. We have not identified any market makers with regard to assisting us to apply for such quotation. However, subsequent to the effectiveness of this prospectus, we intend to have an application filed on our behalf by a market maker for approval of our common stock for quotation on the OTCQB marketplace. No assurance can be made, however, that we will be able to locate a market maker to submit such application or that such application will be approved. In the absence of listing, no public market is available for investors in our Common Stock to sell the shares offered herein. We cannot guarantee that a meaningful trading market will develop or that we will be able to get the shares listed for trading.

Corporate Information

We are a Nevada corporation. Our principal executive offices are located at Unit 2201, 22/F., Malaysia Building, 50 Gloucester Road, Wanchai, Hong Kong. Our phone number is (852) 3584-7820.

Emerging Growth Company

We are an "emerging growth company," as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies.

Section 107(b) of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

| 2 |

| Securities offered | 1,000,000 shares of common stock, par value $0.0001 (“Common Stock”) offered | |

| Offering price | We are offering 1,000,000 shares of Common Stock at $1.28 per share | |

| Number of shares outstanding before the offering of common stock | 109,692,700 shares of Common Stock are currently issued and outstanding. | |

| Number of shares outstanding after the offering of common shares | 110,692,700 common shares will be issued and outstanding if we sell all of the shares we are offering. | |

| Termination of the Offering | The shares will be offered for a period of 90 days from the effective date of this prospectus. The offering shall terminate on the earlier of (i) when the offering period ends (90 days from the effective date of this prospectus), (ii) the date when the sale of all 1,000,000 shares is completed, (iii) when the Board of Directors decides that it is in the best interest of the Company to terminate the Offering prior the completion of the sale of all 1,000,000 shares registered under the Registration Statement of which this Prospectus is a part of. | |

| Use of proceeds | We will receive all proceeds from the sale of the Common Stock and intends to use the proceeds from this Offering to create the business and marketing plan. The expenses of this offering, including the preparation of this prospectus and the filing of this registration statement, estimated at $10,649, are being paid by us. | |

| Dividend policy | We have not declared or paid any dividends on our Common Stock. We currently intend to retain all of our future earnings, if any, for use in our business and do not anticipate paying any cash dividends on our common stock in the foreseeable future. See "Dividend Policy." | |

| Risk factors | See “Risk Factors” beginning on page 5 and the other information set forth in this prospectus for a discussion of factors you should consider before deciding to invest in our securities. | |

| Market for common stock | There is presently no public market for our Common Stock. We anticipate applying for quoting of our common shares on the OTCQB upon the effectiveness of the registration statement of which this prospectus forms a part. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, nor can there be any assurance that such application for quotation will be approved. | |

| Terms of the Offering | Our officers and directors will sell the Common Stock upon effectiveness of this registration statement on a BEST EFFORTS basis. |

| 3 |

The following summary of our financial data should be read in conjunction with, and is qualified in its entirety by reference to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements, appearing elsewhere in this prospectus.

Statements of Operations Data

| For the year ended December 31, 2014 | ||||

| Revenue | $ | 1,539 | ||

| Operating Income/(Loss) | $ | 447 | ||

| Other Income/(Expense) | $ | (2,679 | ) | |

| Net Income/(Loss) | $ | (2,232 | ) | |

Balance Sheet Data

| December 31, 2014 | ||||

| Current Assets | $ | 282,820 | ||

| Total Assets | $ | 282,820 | ||

| Total Liability | $ | 3,420 | ||

| Total Stockholders' (Deficit) | $ | 279,400 | ||

| 4 |

Please consider the following risk factors and other information in this prospectus relating to our business and prospects before deciding to invest in our Common Stock.

This offering and any investment in our Common Stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We consider the following to be the material risks for an investor regarding this Offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount. Please consider the following risk factors before deciding to invest in our Common Stock.

Risks Relating to our Business

Our ability to generate revenue to support our operations is uncertain, we have a limited operating history that you can use to evaluate us, and the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small developing company.

We are in the early stage of our business and have a limited history of generating revenues. We have a limited operating history upon which you can evaluate our potential for future success, and we are subject to the additional risks affecting early-stage businesses. Rather than relying on historical information, financial or otherwise, to evaluate our Company, you should evaluate our Company in light of your assessment of the growth potential of our business and the expenses, delays, uncertainties, and complications typically encountered by early-stage businesses, many of which will be beyond our control. Early-stage businesses in rapidly evolving markets commonly face risks, such as the following:

| ● | uncertain revenue generation; | |

| ● | operational difficulties; | |

| ● | lack of sufficient capital; | |

| ● | competition from more advanced enterprises; and | |

| ● | unanticipated problems, delays, and expenses relating to the development and implementation of business plans. |

We are not currently profitable and may not ever become profitable.

We have not generated any revenue to date and have incurred operating losses since our formation and expect to incur losses and negative operating cash flows for the foreseeable future, and we may not achieve profitability. We expect to incur substantial losses for the foreseeable future and may never become profitable. We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our business. We are a development stage company with no operating history and we face a high risk of business failure which could result in the loss of your investment.

| 5 |

Our limited operating history may make it difficult for us to accurately forecast our operating results and control our business expense which means we face a high risk of business failure which could result in the loss of your investment.

Our planned expense levels are, and will continue to be, based in part on our expectations, which are difficult to forecast accurately based on our stage of development and factors outside of our control. We may be unable to adjust spending in a timely manner to compensate for any unexpected developments. Further, business development expenses may increase significantly as we expand operations. To the extent that any unexpected expenses precede, or are not rapidly followed by, a corresponding increase in revenue, our business, operating results, and financial condition may be materially and adversely affected which could result in the loss of your investment.

Our revenue and profitability will be adversely affected due to the severe competition.

We face strong competition from manufacturers and distributors of lighting products worldwide. Many of our competitors have stronger capitalization than we do, have strong existing customer relationships and more extensive engineering, manufacturing, sales and marketing capabilities. Competitors could focus their substantial resources on developing a competing technology that may be potentially more attractive to customers than the Nano-ceramic Lighting Products. Our competitors may also offer competitive products at reduced prices in order to improve their competitive positions. Any of these competitive factors could make it more difficult for us to attract and retain customers, require us to lower our prices in order to remain competitive, and reduce our revenue and profitability, any of which could have a material adverse effect on our operating results and financial condition. Many actual and potential competitors we believe are part of much larger companies with substantially greater financial, marketing and other resources than the Company, and there can be no assurance that the Company will be able to compete effectively against any of its future competitors which could result in a loss of part or all of your investment in the Company.

We may need to raise additional financing to support our operations, but we cannot be sure that we will be able to obtain additional financing on terms favorable to us when needed. If we are unable to obtain additional financing to meet our needs, our operations may be adversely affected or terminated.

We have limited financial resources. There can be no assurance that we will be able to obtain financing to fund our operations in light of factors beyond our control such as the market demand for our securities, the state of financial markets, generally, and other relevant factors. Any sale of our Common Stock in the future may result in dilution to existing stockholders. Furthermore, there is no assurance that we will not incur debt in the future, that we will have sufficient funds to repay any future indebtedness or that we will not default on our future debts, which would thereby jeopardize our business viability. We may not be able to borrow or raise additional capital in the future to meet our needs, which might result in the loss of some or all of your investment in our Common Stock. Even if we do raise sufficient capital and generate revenues to support our operating expenses, there can be no assurance that the revenue will be sufficient to enable us to develop our business to a level where it will generate profits and cash flows from operations, or provide a return on investment. In addition, if we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of our stockholders could be significantly diluted, the newly-issued securities may have rights, preferences or privileges senior to those of existing stockholders and the trading price of our Common Stock could be adversely affected. Further, if we obtain additional debt financing, a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest on such indebtedness, and the terms of the debt securities issued could impose significant restrictions on our operations. If we are unable to continue as a going concern, you may lose your entire investment.

| 6 |

We may acquire other businesses, form alliances, or dispose of or spin-off businesses, which could cause us to incur significant expenses and could negatively affect profitability.

We may pursue acquisitions, and strategic alliances, or dispose of or spin-off some of our businesses, as part of our business strategy. We may not complete these transactions in a timely manner, on a cost-effective basis, or at all, and may not realize the expected benefits. If we are successful in making an acquisition, the products and technologies that are acquired may not be successful or may require significantly greater resources and investments than originally anticipated. We may not be able to integrate acquisitions successfully into our existing business and could incur or assume significant debt and unknown or contingent liabilities. We could also experience negative effects on our reported results of operations from acquisition or disposition-related charges, amortization of expenses related to intangibles and charges for impairment of long-term assets. There can be no assurance that any future acquisitions, dispositions, or spin-off business would be successful, and any failed efforts by the Company to pursue any of the aforementioned could result in a negative adverse effect on the Company which could lead to a loss of part or all of your investment in the Company.

We rely on only one supplier to produce our products. We may be unable to achieve our growth and profitability objectives if we cannot secure acceptable suppliers or existing supplier relationships dissolve.

There can be no assurances that our current or future supplier arrangements will be able to develop efficient, low-cost manufacturing capabilities and processes that will enable us to meet the quality, price, design and production standards, or production volumes required to successfully mass market such products. Even if the suppliers are successful in developing manufacturing capabilities and processes, we do not know whether we will do so in time to meet market demand. In addition, we may face the risk of the default of our sole supplier on the Distribution Agreement and may not be able to secure a compatible supplier to meet the market requirements. Our sole dependence on one supplier to produce out products could lead to an adverse effect on the Company which could cause you to lose part or all of your investment in the Company.

We are, or in the future may be, subject to substantial regulation related to quality standards applicable to our quality processes. Our failure to comply with applicable quality standards could have an adverse effect on our business, financial condition, or results of operations.

The Environmental Protection Agency regulates the registration, manufacturing, and sales and marketing of lighting products in our industry, and those of our partners, in the United States. Significant government regulation also exists in overseas markets such as Europe, Japan, and Hong Kong. Compliance with applicable regulatory requirements is subject to continual review and is monitored through periodic inspections and other review and reporting mechanisms.

Failure by us to comply with current or future governmental regulations and quality assurance guidelines could lead to product recalls or related field actions, or product shortages. Efficacy or safety concerns with respect to the Nano-ceramic Lighting Products manufactured by our supplier could lead to product recalls, fines, withdrawals, declining sales, and/or our failure to successfully commercialize new products or otherwise achieve revenue growth. Any failure on the Company’s part to comply with all applicable laws and regulations could lead to an adverse effect on the Company which could cause you to lose part or all of your investment in the Company.

The success of our business will depend on our ability to effectively develop and implement strategic business initiatives.

We are currently implementing various strategic business initiatives. In connection with the development and implementation of these initiatives, we will incur additional expenses and capital expenditures to implement the initiatives. The development and implementation of these initiatives also requires management to divert a portion of its time away from day-to-day operations. These expenses and diversions could have a significant impact on our operations and profitability, particularly if the initiatives prove to be unsuccessful. Moreover, if we are unable to implement an initiative in a timely manner, or if those initiatives turn out to be ineffective or are executed improperly, our business and operating results would be adversely affected. There can be no assurances that we will be able to implement any of our planned strategic business initiatives, and our business would be adversely affected potentially leading to the loss of part or all of your investment in the Company.

If we are unable to make necessary capital investments or respond to pricing pressures, our business may be harmed.

In order to remain competitive, we need to invest in customer service and support, and marketing. From time to time, we may have to adjust the prices of the products manufactured by our supplier to remain competitive. We may not have available sufficient financial or other resources to continue to make investments necessary to maintain our competitive position. This would have an adverse effect upon our business and the results of our operations and may result in the loss of part or all of your investment in the Company. We have limited product distribution experience and we expect to rely on third parties who may not successfully sell the Nano-ceramic Lighting Products.

| 7 |

We have limited lighting product distribution experience and currently rely, and plan to rely primarily, on product distribution arrangements with sales agents or other third parties. We expect to enter into distribution agreements in the future, and there can be no assurances that we will be able to enter into these agreements on terms that are favorable to us, if at all. In addition, we may have limited or no control over the distribution activities of these third parties. These third parties could sell competing products and may devote insufficient sales efforts to our products. As a result, our future revenues from sales of our products, if any, will depend on the success of the efforts of these third parties. If we are unable to secure sufficient distribution arrangements for the Company, this would have an adverse effect upon our business and the results of our operations and may result in the loss of part or all of your investment in the Company.

We currently have no insurance coverage and could face significant liabilities in connection with the products manufactured by our supplier, and business operations, which if incurred beyond any insurance limits, would adversely affect our business and financial condition.

We are subject to a variety of potential liabilities connected to the products manufactured by our supplier and business operations, such as potential liabilities related to environmental risks. As a business which markets products for use by consumers and institutions, we may become liable for any damage caused by the products, whether used in the manner intended or not. Any such claim of liability, whether meritorious or not, could be time-consuming and/or result in costly litigation. We currently carry no insurance, and although we intend to obtain insurance against these risks, no assurance can be given that such insurance will be adequate to cover related liabilities or will be available in the future or, if available, that premiums will be commercially justifiable. If we were to incur any substantial liability and related damages were not covered by our insurance or exceeded policy limits, or if we were to incur such liability at a time when we are not able to obtain liability insurance, our business, financial conditions, and results of operations could be materially adversely affected and may result in the loss of part or all of your investment in the Company.

Other factors can have a material adverse effect on our future profitability and financial condition.

Many other factors can affect our profitability and financial condition, including:

| ● | changes in, or interpretations of, laws and regulations including changes in accounting standards and taxation requirements; | |

| ● | changes in the rate of inflation, interest rates and the performance of investments held by us; | |

| ● | changes in the creditworthiness of counterparties that transact business with; | |

| ● | changes in business, economic, and political conditions, including: war, political instability, terrorist attacks, the threat of future terrorist activity and related military action; natural disasters; the cost and availability of insurance due to any of the foregoing events; labor disputes, strikes, slow-downs, or other forms of labor or union activity; and, pressure from third-party interest groups; | |

| ● | changes in our business and investments and changes in the relative and absolute contribution of each to earnings and cash flow resulting from evolving business strategies, changing product mix, changes in tax rates and opportunities existing now or in the future; | |

| ● | difficulties related to our information technology systems, any of which could adversely affect business operations, including any significant breakdown, invasion, destruction, or interruption of these systems; | |

| ● | changes in credit markets impacting our ability to obtain financing for our business operations; or | |

| ● | legal difficulties, any of which could preclude or delay commercialization of products or technology or adversely affect profitability, including claims asserting statutory or regulatory violations, adverse litigation decisions, and issues regarding compliance with any governmental consent decree. |

The factors described above can have material effects on the Company’s financial condition and profitability, and fluctuations in these factors can lead to an adverse effect on the Company and may result in the loss of part or all of your investment in the Company

Adverse developments in the global economy restricting the credit markets may materially and negatively impact our business.

The recent downturn in the world’s major economies and the constraints in the credit markets have heightened or could continue to heighten a number of material risks to our business, cash flows and financial condition, as well as our future prospects. Continued issues involving liquidity and capital adequacy affecting lenders could affect our ability to access credit facilities or obtain debt financing and could affect the ability of lenders to meet their funding requirements when we need to borrow. Further, in the uncertain event that a public market for our stock develops, the volatility in the equity markets may make it difficult in the future for us to access the equity markets for additional capital at attractive prices, if at all. If we are unable to obtain credit or access capital markets, our business could be negatively impacted.

If we are unable to gain any significant market acceptance for our products or establish a significant market presence, we may be unable to generate sufficient revenue to continue our business.

Our growth strategy is substantially dependent upon our ability to successfully market the products to prospective clients. However, we cannot predict when significant market acceptance for these innovative products will develop. Such acceptance, if achieved, may not be sustained for any significant period of time. Failure of our services to achieve or sustain market acceptance could have a material adverse effect on our business, financial conditions and the results of our operations.

| 8 |

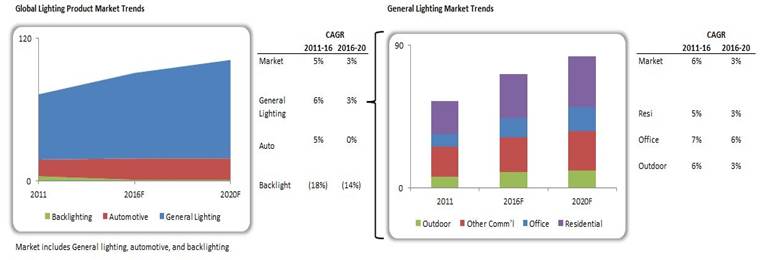

The lighting market is a highly competitive and rapidly evolving market. We face global competition from a variety of well-established and emerging lighting companies and the distributors. We believe that our competitors mainly operate under two distinct business models, with some manufacturing lamps in-house and others purchasing lamps through joint ventures or from original equipment manufacturers, or OEMs, for resale under their own brand. We compete with companies that employ both of these models, including traditional lighting manufacturers and distributors that source and sell finished products. We believe that the key competitive factors in the lighting market include:

| ● | portfolio of products and product quality; | |

| ● | price and cost competitiveness; | |

| ● | access to distribution channels globally; and | |

| ● | customer orientation and strong customer relationships. |

We are a shell company which could affect liquidity in our Common Stock.

Pursuant to Rule 405 of Regulation C promulgated under the Securities Act of 1933, as amended (the “Securities Act”), a “shell company” is defined as a company that has (i) no or nominal operations and (ii) either no or nominal assets, assets consisting solely of cash and cash equivalents, or assets consisting of any amount of cash and cash equivalents and nominal other assets (“Shell Company”). The Company is in development stage and has limited operations. Our assets currently are consisting of only cash. As such, we are a “Shell Company” pursuant to Rule 405. As a Shell Company, there will be (i) additional restrictions on the resale of restricted shares, (ii) additional disclosure required on an acquisition and increased cost related to disclosure and reporting compliance, and (iii) prohibited to use Form S-8.

Shareholders of a Shell Company may not rely on the safe harbor created by Rule 144 of the Securities Act until (i) such company has ceased to be a “Shell Company” for a period of at least 12 months since the date on which the current “Form 10 information” of such company, reflecting its status as a non-Shell Company, is filed with the SEC, (ii) such company is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act, and (iii) such company has filed all reports and other materials to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months. With respect to the disclosure requirements, the “Form 10 information” should include the disclosure required by Form 10 to register such securities to be sold in reliance of Rule 144 under the Exchange Act. Therefore, any restricted securities we sell in the future or issue to consultants or employees in consideration for services rendered or for any other purpose may have no liquidity until and unless such securities are to be resold pursuant to an effective prospectus, or until the Company and the selling stockholder are in compliance with the requirements of Rule 144 of the Securities Act. As a result, it may be more difficult for us to raise funds to support our operations through the sale of debt or equity securities unless we agree to register such securities, which could cause us to expend additional time and cash resources. Further, it may be more difficult for us to compensate our employees and consultants with our securities instead of cash.

If our Company is dissolved, it is unlikely that there will be sufficient assets remaining to distribute to our shareholders.

In the event of the dissolution of our Company, the proceeds realized from the liquidation of our assets, if any, will be used primarily to pay the claims of our creditors, if any, before there can be any distribution to the shareholders. In that case, the ability of purchasers of the offered shares to recover all or any portion of the purchase price for the offered shares will depend on the amount of funds realized and the claims to be satisfied there from.

| 9 |

Risks Related to our Operation as a Public Company

If we become a public reporting company, we are subject to new corporate governance and internal control reporting requirements, and our costs related to compliance with, or our failure to comply with existing and future requirements, could adversely affect our business.

We may face new corporate governance requirements under the Sarbanes-Oxley Act of 2002, as well as new rules and regulations subsequently adopted by the SEC and the Public Company Accounting Oversight Board. These laws, rules, and regulations continue to evolve and may become increasingly stringent in the future. We will be required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). We will be a smaller reporting company as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Section 404 requires us to include an internal control report with our Annual Report on Form 10-K. The report must include management’s assessment of the effectiveness of our internal control over financial reporting as of the end of the fiscal year. This report must also include disclosure of any material weaknesses in internal control over financial reporting that we have identified. Failure to comply, or any adverse results from such evaluation, could result in a loss of investor confidence in our financial reports and have an adverse effect on the trading price of our securities. We will strive to continuously evaluate and improve our control structure to help ensure that we comply with Section 404. The financial cost of compliance with these laws, rules, and regulations is expected to remain substantial. We cannot assure you that we will be able to fully comply with these laws, rules, and regulations that address corporate governance, internal control reporting, and similar matters. Failure to comply with these laws, rules, and regulations could materially adversely affect our reputation, financial condition, and the value of our securities.

If we become a public company, we will have significant operating costs relating to compliance requirements and our management is required to devote substantial time to compliance initiatives. The costs of being a public company could result in us being unable to continue as a going concern.

Our management has only limited experience operating as a public company. To operate effectively, we will be required to continue to implement changes in certain aspects of our business and develop, manage, and train management level and other employees to comply with on-going public company requirements. Failure to take such actions, or delay in the implementation thereof, could have a material adverse effect on our business, financial condition, and results of operations.

The Sarbanes-Oxley Act, as well as rules subsequently implemented by the SEC, imposes various requirements on public companies, including requiring establishment and maintenance of effective disclosure and financial controls and changes in corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to these new compliance initiatives. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

Further, as a public company, we will have to comply with numerous financial reporting and legal requirements, including those pertaining to audits, quarterly reporting and internal controls. Such costs can be substantial and we must generate enough revenue or raise money from offerings of securities or loans in order to meet these costs and our SEC filing requirements. If our revenues are insufficient, and/or we cannot satisfy many of these costs through the issuance of our shares, we may be unable to satisfy these costs through the normal course of business which would result in our being unable to continue as a going concern.

| 10 |

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| ● | pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; | |

| ● | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and | |

| ● | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements. |

Our internal controls may be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision. If we cannot provide reliable financial reports, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly and result in a loss of some or all of your investment.

Risks Related to our Common Stock

We can provide no assurances as to our future financial performance or the investment result of a purchase of our Common Stock.

Any projected results of operations involve significant risks and uncertainty and should be considered speculative, and depend on various assumptions which may not be correct. The future performance of our Company and the return on our common stock depends on a complex series of events that are beyond our control and that may or may not occur. Actual results for any period may or may not approximate any assumptions that are made and may differ significantly from such assumptions. We can provide no assurance or prediction as to our future profitability or to the ultimate success of an investment in our Common Stock.

The Company is conducting this Offering by the efforts of our officers and directors without the benefit of an underwriter who would have assisted to confirm the accuracy of the disclosure in our prospectus and without the benefit of an underwriter the Company may not be able to sell all or any of the shares offered herein.

The Company is responsible for the accuracy of the disclosure in this prospectus. The Company is conducting a self-underwritten offering on a “best efforts” basis, which means no underwriter has been engaged in any due diligence activities to assist to confirm the accuracy of the disclosure in the prospectus or to provide input as to the offering price. The Common Stock are being offered on our behalf on a best-effort basis. No broker-dealer has been retained as an underwriter and no broker-dealer is under any obligation to purchase any common shares. There are no firm commitments to purchase any of the shares in this offering. Consequently, there is no guarantee that the Company, through its officers and directors, is capable of selling all, or any, of the common shares offered hereby. The sale of only a small number of shares increases the likelihood of no market ever developing for our shares.

The offering price of our Common Stock has been determined arbitrarily.

The offering price has been arbitrarily determined by the Company and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price. The price of our Common Stock in this Offering has not been determined by any independent financial evaluation, market mechanism or by our auditors, and is therefore, to a large extent, arbitrary. Our audit firm has not reviewed management's valuation and, therefore, expresses no opinion as to the fairness of the offering price as determined by our management. As a result, the price of the Common Stock in this offering may not reflect the value perceived by the market. There can be no assurance that the shares offered hereby are worth the price for which they are offered and investors may, therefore, lose a portion or all of their investment.

Since there is no minimum for our offering, if only a few persons purchase shares they will lose their money without us being even able to develop a market for our shares.

Since there is no minimum with respect to the number of shares to be sold directly by the Company in its offering, if only a few shares are sold, we will be unable to even attempt to create a public market of any kind for our shares. In such an event, it is highly likely that the entire investment of shareowners would be lost. We cannot make any assurances that even if all of the shares are purchased, we could have the same result. We cannot assure you that there will be a market in the future for our Common Stock, which may have a negative effect on the market price of our Common Stock. You may not be able to sell your shares at their purchase price or at any price at all. Accordingly, you may have difficulty reselling any shares you purchase from pursuant to this Offering.

| 11 |

Future issuances of our Common Stock could dilute current stockholders or adversely affect the market.

Future issuances of our Common Stock could be at values substantially below the price paid by the current holders of our common stock. In addition, common stock could be issued to fend off unwanted tender offers or hostile takeovers without further stockholder approval. Sales of substantial amounts of our common stock, or even just the prospect of such sales, could depress the prevailing price of our common stock and our ability to raise equity capital in the future. Additionally, large share issuances would generally have a negative impact on our share price. It is possible that, due to additional share issuance, you could lose a substantial amount, or all, of your investment. In addition, if a trading market develops for our common stock, we may attempt to raise capital by selling shares of our common stock, possibly at a discount to market. These actions will result in dilution of the ownership interests of existing shareholders, further dilute common stock book value, and that dilution may be material.

We will be subject to the “penny stock” rules which will adversely affect the liquidity of our common stock.

In the event that our shares are traded, and our stock trades below $5.00 per share, our stock would be known as a “penny stock”, which is subject to various regulations involving disclosures to be given to you prior to the purchase of any penny stock. The U.S. SEC has adopted regulations which generally define a “penny stock” to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Depending on market fluctuations, our common stock could be considered to be a “penny stock”. A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities to persons other than established members and accredited investors. For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities. In addition, he must receive the purchaser’s written consent to the transaction prior to the purchase. He must also provide certain written disclosures to the purchaser. Consequently, the “penny stock” rules may restrict the ability of broker/dealers to sell our securities, and may negatively affect the ability of holders of shares of our common stock to resell them. These disclosures require you to acknowledge that you understand the risks associated with buying penny stocks and that you can absorb the loss of your entire investment. Penny stocks are low priced securities that do not have a very high trading volume. Consequently, the price of the stock is often volatile and you may not be able to buy or sell the stock when you want to. These rules also limit the ability of broker-dealers to solicit purchases of our Common Stock and therefore reduce the liquidity of the public market for our shares should one develop.

The market for penny stocks has experienced numerous frauds and abuses that could adversely impact investors in our stock.

Company management believes that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

| ● | Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; | |

| ● | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; | |

| ● | "Boiler room" practices involving high pressure sales tactics and unrealistic price projections by sales persons; | |

| ● | Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and | |

| ● | Wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

Any trading market that may develop may be restricted by virtue of state securities “Blue Sky” laws that prohibit trading absent compliance with individual state laws. These restrictions may make it difficult or impossible to sell shares in those states.

There is currently no established public market for our common stock, and there can be no assurance that any established public market will develop in the foreseeable future. Transfer of our common stock may also be restricted under the securities or securities regulations laws promulgated by various states and foreign jurisdictions, commonly referred to as “Blue Sky” laws. Absent compliance with such individual state laws, our common stock may not be traded in such jurisdictions. Because the securities registered hereunder have not been registered for resale under the blue sky laws of any state, the holders of such shares and persons who desire to purchase them in any trading market that might develop in the future, should be aware that there may be significant state blue sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. These restrictions prohibit the secondary trading of our common stock. We currently do not intend to and may not be able to qualify securities for resale in at least 17 states which do not offer manual exemptions (but may not to offer one to us since we are a shell company and may still be a shell company at the time of application) and require shares to be qualified before they can be resold by our shareholders. Accordingly, investors should consider the secondary market for our securities to be a limited one. See also “Plan of Distribution-State Securities-Blue Sky Laws.”

| 12 |

Terms of subsequent financings may adversely impact your investment.

We may have to raise equity, debt financing in the future. Your rights and the value of your investment in our Common Stock could be reduced. For example, if we issue secured debt securities, the holders of the debt would have a claim against our assets that would be prior to the rights of stockholders until the debt is paid. Interest on these debt securities would increase costs and negatively impact operating results.

It is not likely that we will pay dividends on the Common Stock or any other class of stock.

We intend to retain any future earnings for the operation and expansion of our business. We do not anticipate paying cash dividends on our Common Stock, or any other class of stock, in the foreseeable future. Stockholders should look solely to appreciation in the market price of our common shares to obtain a return on investment.

A significant number of our shares will be eligible for sale and their sale or potential sale may depress the market price of our common stock.

Sales of a significant number of shares of our common stock in the public market could harm the market price of our common stock. This prospectus covers 1,000,000 shares of our common stock, which represents approximately 1% of our current issued and outstanding shares of our common stock. As additional shares of our common stock become available for resale in the public market pursuant to this Offering, and otherwise, the supply of our common stock will increase, which could decrease its price. In addition some or all of the shares of common stock may be offered from time to time in the open market pursuant to Rule 144, and these sales may have a depressive effect on the market for our shares of common stock.

Our common stock will not be eligible for quotation on the OTCQB, unless we are current in our filings with the Securities and Exchange Commission.

In the event that our common stock is quoted on the OTCQB, we will be required to remain current in our filings with the SEC in order for shares of our common stock to be eligible for quotation on the over-the-counter marketplace. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 day grace period if we do not make our required filing during that time. If our common stock is not eligible for quotation on the over-the-counter marketplace, investors in our common stock may find it difficult to sell their shares. Regardless of whether our common stock is quoted on the over-the-counter marketplace, under Section 15(d) of the Exchange Act, we will be required to file periodic reports with the SEC once our registration statement becomes effective.

You may have limited access to information regarding our business because our obligations to file periodic reports with the SEC could be automatically suspended under certain circumstances.

As of the effective date of our registration statement of which this prospectus is a part, we will become subject to certain informational requirements of the Exchange Act, as amended and we will be required to file periodic reports (i.e., annual, quarterly and material events) with the SEC which will be immediately available to the public for inspection and copying. In the event during the year that our registration statement becomes effective, these reporting obligations may be automatically suspended under Section 15(d) of the Exchange Act if we have less than 300 shareholders and do not file a registration statement on Form 8-A (of which we have no current plans to file). If this occurs after the year in which our registration statement becomes effective, we will no longer be obligated to file such periodic reports with the SEC and access to our business information would then be even more restricted. After this registration statement on Form S-1 becomes effective, we may be required to deliver periodic reports to security holders as proscribed by the Exchange Act, as amended. However, we will not be required to furnish proxy statements to security holders and our directors, officers and principal beneficial owners will not be required to report their beneficial ownership of securities to the SEC pursuant to Section 16 of the Exchange Act until we have both 500 or more security holders and greater than $10 million in assets. This means that access to information regarding our business and operations will be limited.

We are classified as an “emerging growth company” as well as a “smaller reporting company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies and smaller reporting companies will make our common stock less attractive to investors.

We are an "emerging growth company," as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

| 13 |

Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

We could remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Notwithstanding the above, we are also currently a “smaller reporting company.” Specifically, similar to “emerging growth companies,” “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze our results of operations and financial prospects.

Investing in our Company is highly speculative and could result in the entire loss of your investment.

Purchasing the offered shares is highly speculative and involves significant risk. The offered shares should not be purchased by any person who cannot afford to lose their entire investment. Our business objectives are also speculative, and it is possible that we would be unable to accomplish them. Our shareholders may be unable to realize a substantial or any return on their purchase of the offered shares and may lose their entire investment. For this reason, each prospective purchaser of the offered shares should read this prospectus and all of its exhibits carefully and consult with their attorney, business and/or investment advisor.

Because there is no public trading market for our common stock, you may not be able to resell your stock.

We intend to apply to have our common stock quoted on the OTC Market Group LLC’s OTCQB Marketplace (“OTCQB”). This process takes at least 60 days and the application must be made on our behalf by a market maker. Our stock may be listed or traded only to the extent that there is interest by broker-dealers in acting as a market maker. Despite our best efforts, it may not be able to convince any broker/dealers to act as market-makers and make quotations on OTCQB. We may consider pursuing a listing on OTCQB after this registration becomes effective and we have completed our offering.

If our common stock becomes listed and a market for the stock develops, the actual price of our shares will be determined by prevailing market prices at the time of the sale.

We cannot assure you that there will be a market in the future for our common stock. The trading of securities on OTCQB is often sporadic and investors may have difficulty buying and selling our shares or obtaining market quotations for them, which may have a negative effect on the market price of our common stock. You may not be able to sell your shares at their purchase price or at any price at all. Accordingly, you may have difficulty reselling any shares you purchase from the selling security holders.

Financial Industry Regulatory Authority (“FINRA”) sales practice requirements may also limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional members, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some Members. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their Members buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

| 14 |

The market price of our common stock may be volatile following this offering, and our stock price may fall below the initial public offering price at the time you desire to sell your shares of our common stock, resulting in a loss on your investment.

The market price of our common stock may fluctuate substantially due to a variety of factors, many of which are beyond our control, including, without limitation:

| ● | actual or anticipated variations in our quarterly and annual operating results, financial condition or asset quality; | |

| ● | changes in general economic or business conditions, both domestically and internationally; | |

| ● | the effects of, and changes in, trade, monetary and fiscal policies, including the interest rate policies of the Federal Reserve, or in laws and regulations affecting us; | |

| ● | the number of securities analysts covering us; | |

| ● | publication of research reports about us, our competitors, or the financial services industry generally, or changes in, or failure to meet, securities analysts’ estimates of our financial and operating performance, or lack of research reports by industry analysts or ceasing of coverage; | |

| ● | changes in market valuations or earnings of companies that investors deemed comparable to us; | |

| ● | the average daily trading volume of our common stock; | |

| ● | future issuances of our common stock or other securities; | |

| ● | additions or departures of key personnel; | |

| ● | perceptions in the marketplace regarding our competitors and/or us; | |

| ● | significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving our competitors or us; and | |

| ● | other news, announcements or disclosures (whether by us or others) related to us, our competitors, our core market or the financial services industry. |

The stock market and, in particular, the market for financial institution stocks have experienced significant fluctuations in recent years. In many cases, these changes have been unrelated to the operating performance and prospects of particular companies. In addition, significant fluctuations in the trading volume in our common stock may cause significant price variations to occur. Increased market volatility may materially and adversely affect the market price of our common stock, which may make it difficult for you to resell your shares at the volume, prices and times desired.

We may receive no proceeds or very minimal proceeds from the offering.

Since there is no minimum amount of shares that must be sold by the company, we may receive no proceeds or very minimal proceeds from the offering and potential investors may end up holding shares in a company that:

| ● | Has not received enough proceeds from the offering to begin operations; and |

| ● | Has no market for its shares. |

Risk Related to Doing Business in Hong Kong

You may have difficulty enforcing judgments against us.

We are a Nevada corporation but most of our assets are and will be located outside of the United States. Almost all of our operations will be conducted in Hong Kong and later in mainland China if we acquire DGL pursuant to the Option Agreement. In addition, our officers and directors are nationals and residents of a country other than the United States. All of their assets are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon them. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, since they are not residents in the United States. In addition, there is uncertainty as to whether the courts of Hong Kong or other Asian countries would recognize or enforce judgments of U.S. courts.

Our business is subject to the risk of international operations.

Substantially all of our business operations are conducted in Hong Kong. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments Hong Kong. Following the closing of our initial public offering, we will derive a significant portion of our revenue and earnings from the operation in Hong Kong. Operating in foreign country involves substantial risk. For example, our business activities subject us to a number of laws and regulations, such as anti-corruption laws, tax laws, foreign exchange controls and cash repatriation restrictions, data privacy and security requirements, labor laws, intellectual property laws, privacy laws, and anti-competition regulations. As we expand into additional countries, the complexity inherent in complying with these laws and regulations increases, making compliance more difficult and costly and driving up the costs of doing business in foreign jurisdictions. Any failure to comply with foreign laws and regulations could subject us to fines and penalties make it more difficult or impossible to do business in that country and harm our reputation.

| 15 |

Operating in foreign countries also subjects us to risk from currency fluctuations. Our primary exposure to movements in foreign currency exchange rates relates to non-U.S. dollar denominated sales and operating expenses. The weakening of foreign currencies relative to the U.S. dollar adversely affects the U.S. dollar value of our foreign currency-denominated sales and earnings. This could either reduce the U.S. dollar value of our prices or, if we raise prices in the local currency, it could reduce the overall demand for our offerings. Either could adversely affect our revenue. Conversely, a rise in the price of local currencies relative to the U.S. dollar could adversely impact our profitability because it would increase our costs denominated in those currencies, thus adversely affecting gross margins.

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We will have operations, agreements with third parties and make sales in East Asia, which may experience corruption. Our proposed activities in Asia create the risk of unauthorized payments or offers of payments by one of the employees, consultants, or sales agents of our Company, because these parties are not always subject to our control. It will be our policy to implement safeguards to discourage these practices by our employees. Also, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, or sales agents of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

Our operation may be subject to the regulation of environmental laws of the countries in which we may provide services in the future.