Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RAYONIER INC | investorpresentationsmarch.htm |

Investor Presentation March 2015

Safe Harbor Statement Certain statements in this document regarding anticipated financial, legal or other outcomes, including Rayonier’s earnings guidance, if any, business and market conditions, outlook, expected dividend rate, Rayonier’s realigned business strategy, including expected harvest schedules, timberland acquisitions and sales of non-strategic timberlands, the anticipated benefits of Rayonier’s realigned business strategy, and other similar statements relating to Rayonier’s future events, developments or financial or operational performance or results, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are identified by the use of words such as “may,” “will,” “should,” “expect,” “estimate,” “believe,” “intend,” “project,” “anticipate” and other similar language. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. While management believes that these forward-looking statements are reasonable when made, forward-looking statements are not guarantees of future performance or events and undue reliance should not be placed on these statements. Forward-looking statements are only as of the date they are made, and the Company undertakes no duty to update its forward-looking statements except as required by law. You are advised, however, to review any further disclosures we make on related subjects in our subsequent Forms 10-Q, 10-K and 8-K, any amendments thereto, and other reports filed with the SEC. The following important factors, among others, could cause actual results or events to differ materially from those expressed in forward-looking statements that may have been made in this document: the cyclical and competitive nature of the industries in which we operate; fluctuations in demand for, or supply of, our forest products and real estate offerings; entry of new competitors into our markets; changes in global economic conditions and world events, including political changes in particular regions or countries; fluctuations in demand for our products in Asia, and especially China; the uncertainties of potential impacts of climate-related initiatives; the cost and availability of third party logging and trucking services; the geographic concentration of a significant portion of our timberland; our ability to identify, finance and complete timberland acquisitions; changes in environmental laws and regulations, timber harvesting, delineation of wetlands, and endangered species, that may restrict or adversely impact our ability to conduct our business, or increase the cost of doing so; adverse weather conditions, natural disasters and other catastrophic events such as hurricanes, wind storms and wildfires, which can adversely affect our timberlands and the production, distribution and availability of our products; interest rate and currency movements; our capacity to incur additional debt, and any decision we may make to do so; changes in tariffs, taxes or treaties relating to the import and export of our products or those of our competitors; changes in key management and personnel; our ability to meet all necessary legal requirements to continue to qualify as a real estate investment trust (“REIT”) and changes in tax laws that could adversely affect tax treatment of our specific businesses or reduce the benefits associated with REIT status. Specifically with respect to our Real Estate business, the following important factors, among others, could cause actual results to differ materially from those expressed in forward-looking statements that may have been made in this document: the cyclical nature of the real estate business generally, including fluctuations in demand for both entitled and unentitled property; a delayed or weak recovery in the housing market; the lengthy, uncertain and costly process associated with the ownership, entitlement and development of real estate, especially in Florida, which also may be affected by changes in law, policy and political factors beyond our control; the potential for legal challenges to entitlements and permits in connection with our properties; unexpected delays in the entry into or closing of real estate transactions; the existence of competing developers and communities in the markets in which we own property; the pace of development and the rate and timing of absorption of existing entitled property in the markets in which we own property; changes in the demographics affecting projected population growth and migration to the Southeastern U.S.; changes in environmental laws and regulations, including laws regarding water withdrawal and management and delineation of wetlands, that may restrict or adversely impact our ability to sell or develop properties; the cost of the development of property generally, including the cost of property taxes, labor and construction materials; the timing of construction and availability of public infrastructure; and the availability of financing for real estate development and mortgage loans. Additional factors are described in the company’s most recent Form 10-K/A and 10-Q and other reports on file with the Securities and Exchange Commission. Rayonier assumes no obligation to update these statements except as is required by law. 1

Rayonier: Best-in-Class, Pure-Play Timber REIT 2 Third-largest timber REIT with 2.7 million acres of high-quality timberland Advantageous REIT structure Geographic diversity – U.S. South, Pacific Northwest, New Zealand Over $800 million invested in high-quality timberlands since 2011 Profitably grow timberland base through disciplined acquisition process Advanced genetics yield long-term volume growth Strong Real Estate platform across U.S. South, including Florida and Georgia coastal corridor Stable base of annual rural land sales Over 39,000 acres with land-use entitlements Net debt to enterprise value of 14% at year-end 2014 Favorable financing facilities Flexibility to pursue timberland acquisitions Leading Pure-Play Timberland REIT Growing Timberland Base Attractive Real Estate Strong Capital Structure

Highly Productive, Geographically Diversified Timberlands 3 372 158 92 18 140 90 332 703 387 451 Total Rayonier = 2.7 million acres 451,000 acres, manage and own 65% of joint venture Pacific Northwest U.S. South New Zealand Washington – 372,000 acres, access to export markets 1.9 million acres, sawlog and pulpwood; Florida & Georgia coastal corridor HBU

Realignment of Strategic Priorities 4 Manage for Sustainability Acquire High-Quality Timberlands Optimize Portfolio Value Focus on Quality of Earnings Enhance Disclosure Design harvest strategy to achieve long-term, sustainable yield Balance biological growth, harvest cash flow and responsible stewardship Pursue timberland acquisitions that improve portfolio quality and sustainable yield Maintain disciplined approach to acquisitions, minimize HBU speculation Pursue value creation activities on select properties to enhance long-term value Opportunistically monetize properties where premium valuations can be achieved Focus on harvest operations and rural land sales to support dividends De-emphasize sale of “non-strategic” timberlands to augment cash flow generation Establish Rayonier as industry leader in transparent disclosure Provide investors with meaningful information about timberland portfolio Rayonier’s goal is to provide an attractive, growing dividend funded from core, recurring cash flows in a tax-efficient REIT structure.

1 ,0 9 0 1 ,2 2 0 1 ,1 5 6 1 ,3 3 0 1 ,1 8 0 1 ,4 0 0 1 ,1 6 2 1 ,4 6 3 - 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2015 2016 Raymond James FEA Freddie Mac NAHB $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 - 500 1,000 1,500 2,000 2,500 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 Housing Starts Sawtimber Prices Housing Starts Drive Sawtimber Prices 5 Housing Starts vs. Sawtimber Stumpage Prices Housing Starts Projections (starts in 000s / US$ per ton) (starts in 000s) Source: Timber Mart-South south-wide average sawtimber prices. U.S. Census Bureau. Source: Raymond James equity research, Freddie Mac, Forest Economic Advisors and National Association of Homebuilders. A housing recovery is demonstrably underway, which should drive sawtimber prices higher.

$0 $10 $20 $30 $40 $50 $60 $70 198 0 198 1 198 2 198 3 198 4 198 5 198 6 198 7 198 8 198 9 199 0 199 1 199 2 199 3 199 4 199 5 199 6 199 7 199 8 199 9 200 0 200 1 200 2 200 3 200 4 200 5 200 6 200 7 200 8 200 9 201 0 201 1 201 2 201 3 201 4 Pine Pulpwood Pine Chip-n-Saw Pine Sawtimber Trendline (Pine Pulpwood) Trendline (Pine Chip-n-Saw) Trendline (Pine Sawtimber) Return to Trendline Implies Significant Price Recovery in U.S. South 6 ($ per ton) $10 $26 $41 Current Pricing (12/31/2014) Trendline Pricing Difference from Trendline Implied Annual Growth Rate to Reach Trendline 5 Year 10 Year Sawtimber $26.34 / Ton $41.00 / Ton (35.8%) + 9.3% + 4.5% Chip-n-saw $17.59 / Ton $26.00 / Ton (32.3%) + 8.1% + 4.0% Pulpwood $10.52 / Ton $10.00 / Ton 5.2% (1.0%) (0.5%) Source: Timber Mart-South south-wide average stumpage prices. Note: Prices are adjusted for inflation and converted to 2013 dollars based on the Producer Price Index (PPI). U.S. South Stumpage Prices (Real) – Timber Mart-South

Local market supply / demand dynamics determine price Logs typically travel less than 100 miles Supply / demand conditions vary widely across the region Significant sawlog price increases anticipated as recovery in U.S. housing starts progresses 7 Favorable Supply / Demand Dynamics in Rayonier Markets Source: USDA FIA; Rayonier research. Note: Most current FIA cycle data by state (vintage years vary by state).

Advanced Silviculture Increases Harvest Yields Site Management 0% 10% 20% 30% 40% 50% 60% 70% 2008-2009 2010-2011 2012-2013 2014-2015 Genetics Industry leader in controlled mass pollination plantings Future Southeast plantings will be approximately 70% Loblolly Percentage of Loblolly Seedlings from Controlled Mass Pollination Site Index 68 Pulpwood = 42% Grade* = 58% Site Index 73 Pulpwood = 30% Grade* = 70% Stand establishment Fertilization Competition control Southern Pine * Sawlogs and Chip-n-saw 8 Through advanced silviculture, harvest volumes should increase by ~20% over a full rotation cycle. * Sawlogs and Chip-n-saw

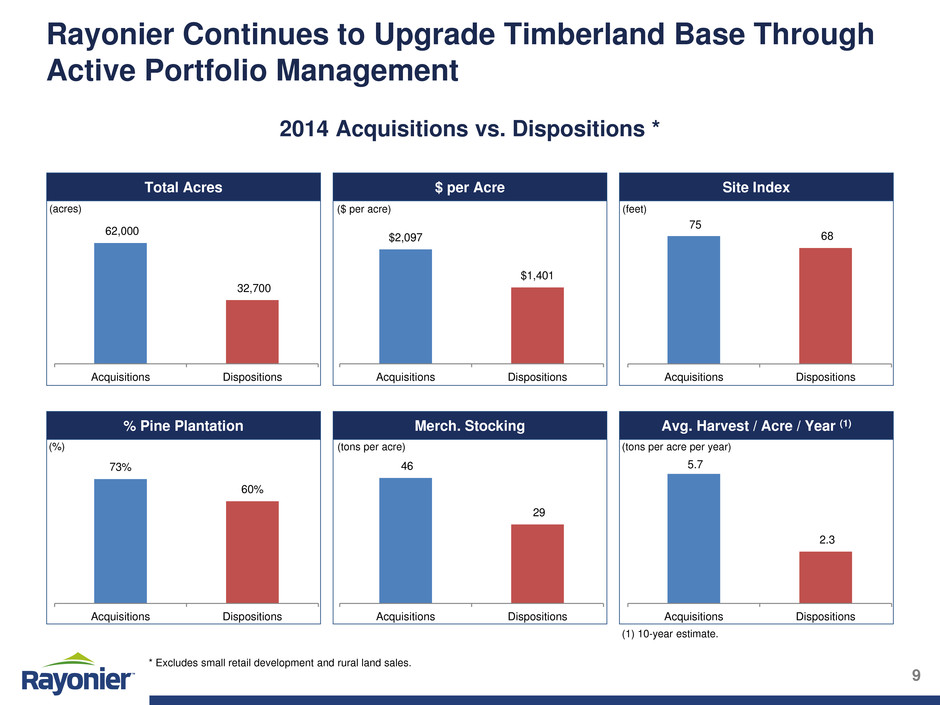

5.7 2.3 Acquisitions Dispositions 46 29 Acquisitions Dispositions 73% 60% Acquisitions Dispositions 75 68 Acquisitions Dispositions $2,097 $1,401 Acquisitions Dispositions 62,000 32,700 Acquisitions Dispositions Rayonier Continues to Upgrade Timberland Base Through Active Portfolio Management 9 Total Acres $ per Acre Site Index % Pine Plantation Merch. Stocking Avg. Harvest / Acre / Year (1) (acres) ($ per acre) (feet) (%) (tons per acre) (tons per acre per year) 2014 Acquisitions vs. Dispositions * (1) 10-year estimate. * Excludes small retail development and rural land sales.

Conservation Non-Strategic Development 10 Overview of Real Estate Strategy Real Estate Strategy Rural Optimize our portfolio with a disciplined land classification system that manages every acre toward its ultimate highest and best use (HBU) Lead initiatives to bring to market land with residential and commercial development potential Execute sales, strategic partnerships and projects when the market is ready Steady and durable rural residential and recreation sales Lead proactive land enhancement and product development strategies to market rural residential and recreation properties Collaborate with conservation organizations to identify lands with ecological, historical, or habitat significance 145,000+ acres conserved Monetize non-strategic timberlands at best possible value De-emphasize non-strategic sales to augment cash flow

11 Timberland ownership base of ~200,000 acres Approximately 40 miles of water frontage Approximately 250 miles of road and highway frontage Land holdings at five interchanges on I-95 and two planned future interchanges Residential, commercial, and industrial land use entitlements in hand Proximity and connection to international airports and seaports, with multiple sites served by rail Value creation efforts focused the 6 highest potential projects across 25 planning nodes spanning coastal corridor ownership = Rayonier landholdings Significant HBU Potential in FL and GA Coastal Corridor

12 Project Belfast Commerce Centre St. Johns North East Nassau Market Street Location Bryan Co, GA St. Johns Co, FL Nassau Co, FL Market Characteristics Port of Savannah's growth driving industrial sector Strong market driving 50% of new home sales in Jacksonville MSA Emerging market Market Segment Industrial Residential Mixed use Approach Horizontal development / entitled Undeveloped / entitled To be determined Status Infrastructure development and marketing underway, 45 acres sold ~2,000 acres under contract Site planning underway Disciplined Approach with Focus on Risk / Reward

$1,530 $2,171 $7,151 Non-Strategic / Conservation Rural Development Non- Strategic / Conservation 128,728 60% Rural / Recreational 81,986 39% Development 2,517 1% Historical Real Estate Sales Summary 13 Real Estate Sales Breakdown (2010-2014) Average Price per Acre (2010-2014) (acres) ($ per acre) Note: Excludes 2013 sale of 128,000 acres in New York for $57 million. Rural land sales activity has historically been the key driver of Rayonier's HBU real estate business.

Appendix

227,710 243,958 269,052 249,127 133,618 91,660 0-4 5-9 10-14 15-19 20-24 25+ U.S. South – Age Class Profile 15 Note: Totals in chart represent net plantation acres; excludes ~71k gross non-timbered acres (i.e., roads, rights of way, etc.) and ~615k acres of hardwoods and natural stands. % of Total 18.7% 20.1% 22.1% 20.5% 11.0% 7.5% Avg. Acres / Year 45,542 48,792 53,810 49,825 26,724 NM % of Total 3.7% 4.0% 4.4% 4.1% 2.2% NM (Acres)

43,574 51,809 31,632 19,562 27,502 43,476 28,919 17,146 7,410 2,246 7,268 0-4 5-9 10-14 15-19 20-24 25-29 30-34 35-39 40-44 45-49 50+ % of Total 15.5% 18.5% 11.3% 7.0% 9.8% 15.5% 10.3% 6.1% 2.6% 0.8% 2.6% Avg. Acres / Year 8,715 10,362 6,326 3,912 5,500 8,695 5,784 3,429 1,482 449 NM % of Total 3.1% 3.7% 2.3% 1.4% 2.0% 3.1% 2.1% 1.2% 0.5% 0.2% NM Avg. MBF / Acre NA NA NA NA 4.8 10.0 15.7 18.8 21.8 25.4 30.2 U.S. Pacific Northwest – Age Class Profile 16 (Acres) Note: Totals in chart represent productive commercial forest acres; does not include 91k acres of non-commercial forest, restricted forest and non-forested areas.

($ in millions, except per share data) Profitability 4Q 2014 3Q 2014 4Q 2013 Sales $147 $150 $239 Operating income 14 32 35 Pro forma operating income (1) 17 36 35 Net income attributable to Rayonier Inc. 9 33 80 Pro forma net income (1) 11 36 32 Adjusted EBITDA (1) 51 70 76 Diluted Earnings Per Share: Income from continuing operations 0.07 0.25 0.25 Net income 0.07 0.25 0.62 Pro forma net income (1) 0.09 0.28 0.25 Average diluted shares (millions) 128.3 129.8 128.9 Twelve months ended December 31, Capital Resources & Liquidity 2014 2013 Cash provided by Operating Activities(2) $316 $545 Cash used for Investing Activities(2) (192) (469) Cash used for Financing Activities(2) (161) (157) Cash Available for Distribution (CAD) (1) 115 83 12/31/2014 12/31/2013 Debt 752 1,574 Cash 162 200 Net Debt 590 1,374 Net Debt / Enterprise Value (3) 14% N/M (1) Non-GAAP measures (see page 25 for definitions and pages 18, 26, 27 and 28 for reconciliations). (2) Includes discontinued operations. (3) Enterprise Value based on equity market capitalization plus net debt. 17 Financial Highlights

($ in millions, except per share data) Twelve Months Ended December 31, 2014 2013 Operating Income $98.3 $108.7 Depreciation, depletion, amortization 120.0 116.8 Non-cash cost of land sold 13.2 10.2 Internal review and restatement costs 3.4 – Gain related to consolidation of New Zealand joint venture – (16.1) Adjusted EBITDA* $234.9 $219.6 Cash interest paid (47.6) (44.1) Cash taxes paid(1) (8.8) (28.8) Capital expenditures from continuing operations(2) (63.2) (63.6) Cash Available for Distribution $115.3 $83.1 Working capital changes 18.8 68.2 Capital expenditures from continuing operations(2) 63.2 63.6 Cash flow from discontinued operations(3) 118.3 276.3 Non-cash cost of New York timberland sale – 54.0 Cash Provided by Operating Activities $315.6 $545.2 Shares outstanding 126,773,097 126,257,870 CAD per Share $0.91 $0.66 Dividends per Share - Regular(4) $1.53 $1.86 Dividends per Share - Special (5) $0.50 – * Non-GAAP measure (see page 25 for definition). (3) 2013 includes $70.3 million tax payment to IRS to exchange AFMC for CBPC. (5) Includes a $0.50 special dividend related to the spin-off of the Performance Fibers business. (2) Capital expenditures exclude strategic capital of $130.0 million for timberland acquisitions during the year ended December 31, 2014. For the year ended December 31, 2013, strategic capital totaled $139.9 million for the acquisition of an additional interest in the New Zealand joint venture and $20.4 million for timberland acquisitions. (1) The year ended December 31, 2014 and 2013 include payments made on behalf of the spun-off Performance Fibers business. 2013 excludes a $70.3 million tax payment to the IRS to exchange the alternative fuel mixture credit (AFMC) for CBPC. (4) Includes first and second quarter at pre-spin dividend levels. Cash Available for Distribution* 18

($ in millions) 2014 Continuing Operations 2015 Guidance Sales $604 ~ $575 - 600 Segment Pro forma Operating Income (1) Southern Timber $46 $43 - 48 Pacific Northwest Timber 31 13 - 18 New Zealand Timber 10 5 - 9 Real Estate 48 25 - 35 Trading 2 1 - 2 Corporate and Other (32) ~(20) Total $104 $67 - 92 Segment Adjusted EBITDA (1) Southern Timber $98 $95 - 100 Pacific Northwest Timber 51 30 - 35 New Zealand Timber 46 37 - 41 Real Estate 70 47 - 57 Trading 2 1 - 2 Corporate and other (32) ~(20) Total $235 $190 - 215 CapEx $124 $65 - 68 DD&A $120 ~$113 Non-cash cost of land sold $13 ~$10 (1) Non-GAAP measure (see page 25 for definition). (2) Includes discontinued operations. (2) 2015 Financial Guidance 19

2013 2014 Q1 Q2 Q3 Q4 FY 2013 Q1 Q2 Q3 Q4 FY 2014 Sales Volume (Tons in 000s) Pine Pulpwood 773 836 758 814 3,181 776 707 867 934 3,284 Pine Sawtimber 414 501 427 334 1,676 387 363 492 459 1,701 Total Pine Volume 1,187 1,337 1,185 1,148 4,857 1,163 1,070 1,359 1,393 4,985 Hardwood 91 81 131 132 435 111 79 55 66 311 Total Volume 1,278 1,418 1,316 1,280 5,292 1,274 1,149 1,414 1,459 5,296 % Delivered Sales 25% 27% 28% 30% 28% 30% 36% 33% 32% 33% % Stumpage Sales 75% 73% 72% 70% 72% 70% 64% 67% 68% 67% Net Stumpage Pricing ($ per ton) (1) Pine Pulpwood $16.24 $15.67 $16.65 $15.98 $16.12 $18.55 $18.94 $17.99 $18.55 $18.48 Pine Sawtimber 24.44 22.76 24.93 24.47 24.06 27.07 26.16 25.78 26.84 26.45 Weighted Average Pine $19.10 $18.33 $19.63 $18.45 $18.86 $21.38 $21.39 $20.81 $21.28 $21.20 Hardwood 10.61 12.29 13.52 14.19 12.89 13.73 11.58 13.22 13.34 13.01 Weighted Average Total $18.50 $17.98 $19.02 $18.01 $18.37 $20.72 $20.71 $20.51 $20.92 $20.72 Summary Financial Data ($ in MMs) Sales $29.3 $32.0 $31.2 $30.3 $122.8 $33.9 $31.5 $37.5 $38.9 $141.8 (–) Cut & Haul (5.7) (6.6) (6.2) (7.2) (25.7) (7.5) (7.7) (8.5) (8.4) (32.1) Net Stumpage Sales $23.6 $25.4 $25.0 $23.1 $97.1 $26.4 $23.8 $29.0 $30.5 $109.7 Pro forma Operating Income (2) $7.0 $8.0 $9.4 $13.4 $37.8 $10.5 $8.9 $13.5 $13.5 $46.4 (+) DD&A 11.6 13.1 13.0 11.7 49.4 11.9 10.7 14.1 14.8 51.5 Adjusted EBITDA(2) $18.6 $21.1 $22.4 $25.1 $87.2 $22.4 $19.6 $27.6 $28.3 $97.9 Other Data Non-timber Income ($ in MMs) $2.8 $2.6 $4.2 $10.3 $19.9 $3.1 $3.5 $5.0 $5.6 $17.2 Period-End Acres (in 000s) 1,924 1,922 1,914 1,894 1,894 1,898 1,901 1,900 1,910 1,910 (1) Pulpwood and sawtimber product pricing for composite stumpage sales is estimated based on market data. (2) Non-GAAP measure (see page 25 for definition and pages 26, 27 and 28 for reconciliations). (3) Excludes $0.7 million cumulative out-of-period adjustment for depletion expense. (3) Southern Timber Overview 20

2013 2014 Q1 Q2 Q3 Q4 FY 2013 Q1 Q2 Q3 Q4 FY 2014 Sales Volume (Tons in 000s) Northwest Pulpwood 72 82 80 71 305 86 73 51 52 262 Northwest Sawtimber 327 412 415 384 1,538 458 375 295 274 1,402 Total Northwest Volume 399 494 495 455 1,843 544 448 346 326 1,664 Northeast (1) 57 17 21 41 136 – – – – – Total Volume 456 511 516 496 1,979 544 448 346 326 1,664 Northwest Sales Volume (Converted to MBF) Northwest Pulpwood 6,740 7,804 7,589 6,707 28,840 8,111 6,860 4,856 4,934 24,761 Northwest Sawtimber 41,201 53,830 53,930 48,470 197,431 54,570 49,093 39,504 35,731 178,898 Total Northwest Volume 47,941 61,634 61,519 55,177 226,271 62,681 55,953 44,360 40,665 203,659 Northwest Sales Mix % Delivered Sales 73% 52% 49% 54% 56% 47% 41% 61% 83% 55% % Stumpage Sales 27% 48% 51% 46% 44% 53% 59% 39% 17% 45% Delivered Log Pricing Northwest Pulpwood ($ per ton) $37.96 $35.77 $37.16 $37.44 $37.14 $37.92 $37.10 $37.86 $43.23 $39.20 Northwest Sawtimber ($ per ton) 71.00 80.07 80.61 81.47 78.06 81.90 84.46 83.91 79.19 82.05 Weighted Average ($ per ton) $64.73 $72.44 $73.41 $74.85 $71.08 $74.00 $74.51 $76.60 $73.15 $74.44 Summary Financial Data ($ in MMs)(1) Sales $24.8 $29.6 $28.8 $27.3 $110.5 $33.0 $25.1 $22.0 $22.1 $102.2 (–) Cut & Haul (9.6) (8.6) (8.5) (8.1) (34.7) (8.3) (5.9) (6.8) (9.1) (30.2) Net Stumpage Sales $15.2 $21.0 $20.3 $19.2 $75.8 $24.7 $19.2 $15.2 $13.0 $72.0 Pro forma Operating Income (1)(2) $5.5 $9.8 $8.8 $8.6 $32.7 $12.6 $8.8 $6.3 $3.7 $31.4 (+) DD&A 4.8 5.6 5.7 5.2 21.3 6.3 5.2 4.1 3.8 19.4 Adjusted EBITDA(1)(2) $10.3 $15.4 $14.5 $13.8 $54.0 $18.9 $14.0 $10.4 $7.5 $50.8 Other Data (1) Non-timber Income ($ in MMs) $0.7 $0.5 $0.8 $1.1 $3.1 $0.5 $0.8 $0.8 $0.7 $2.8 Period-End Acres (in 000s) 503 503 503 371 371 372 372 372 372 372 Northwest Sawtimber ($ per MBF) $564 $611 $616 $645 $608 $684 $629 $614 $606 $632 Estimated Percentage of Export Volume 17% 16% 35% 37% 26% 27% 21% 29% 21% 25% (1) The 2013 periods reflect results and acres of the New York timberland holdings. These holdings were sold in the fourth quarter of 2013. (2) Non-GAAP measure (see page 25 for definition and pages 26, 27 and 28 for reconciliation). (3) Excludes $1.9 million cumulative out-of-period adjustment for depletion expense. (3) Pacific Northwest Timber Overview 21

2013 2014 Q1 Q2 Q3 Q4 FY 2013 Q1 Q2 Q3 Q4 FY 2014 Sales Volume (Tons in 000s) Domestic Sawtimber (Delivered) 170 195 212 163 740 144 170 179 151 644 Domestic Pulpwood (Delivered) 86 92 88 93 360 73 77 103 99 353 Export Sawtimber (Delivered) 184 188 219 207 798 142 193 230 261 826 Export Pulpwood (Delivered) 6 13 15 9 43 9 16 21 25 71 Stumpage 64 114 147 139 464 91 67 136 172 466 Total Volume 510 602 682 611 2,405 460 523 670 708 2,360 % Delivered Sales 88% 81% 78% 77% 81% 80% 87% 80% 76% 80% % Stumpage Sales 12% 19% 22% 23% 19% 20% 13% 20% 24% 20% Delivered Log Pricing Domestic Sawtimber ($ / ton) $71.45 $74.62 $72.69 $76.80 $73.82 $80.04 $84.64 $78.28 $68.87 $78.15 Domestic Pulpwood ($ / ton) 35.72 37.46 34.71 36.23 36.05 38.34 39.52 38.78 35.18 37.84 Export Sawtimber ( $ / ton) 123.59 130.18 124.11 125.43 125.77 120.62 118.12 104.11 108.96 111.75 Summary Financial Data ($ in MMs) Stumpage Sales $40.2 $47.4 $51.2 $47.0 $185.8 $35.8 $44.1 $48.4 $49.0 $177.3 (–) Cut & Haul (18.3) (22.2) (20.7) (20.4) (81.6) (15.9) (20.3) (22.4) (20.3) (78.9) (–) Port / Freight Costs (8.3) (9.2) (9.1) (8.8) (35.4) (5.6) (9.0) (10.1) (11.1) (35.8) Net Stumpage Sales $13.6 $16.0 $21.4 $17.8 $68.8 $14.3 $14.8 $15.9 $17.6 $62.6 Land Sales – – $0.1 – $0.1 $1.9 $0.4 $0.1 $2.7 $5.1 Other (1) 3.0 – – – 3.0 – – – – – Total Sales $43.2 $47.4 $51.3 $47.0 $188.9 $37.7 $44.5 $48.5 $51.7 $182.4 Operating Income $3.0 $2.3 $4.4 $1.4 $11.1 $2.4 $2.2 $1.9 $2.9 $9.4 (+) DD&A 8.7 8.6 9.8 9.5 36.6 6.5 7.7 9.4 8.7 32.3 (+) Non-cash cost of land sold – – – – – 2.1 – – 2.2 4.3 Adjusted EBITDA(2) $11.7 $10.9 $14.2 $10.9 $47.7 $11.0 $9.9 $11.3 $13.8 $46.0 Other Data NZ$/US$ Exchange Rate 0.8354 0.7718 0.8278 0.8226 0.8156 0.8661 0.8738 0.7804 0.7834 0.8266 Net plantable Period-End Acres (in 000s) 314 314 314 314 314 313 313 312 309 309 Export Sawtimber ( $ / JAS m3) $143.39 $151.04 $144.00 $145.53 $145.92 $139.95 $137.05 $120.79 $126.42 $129.66 * 2013 includes full year results of New Zealand Timber which was consolidated on April 4, 2013. (1) Reflects management fees received from the JV prior to consolidation on April 4, 2013. (2) Non-GAAP measure (see page 25 for definition and pages 27 and 28 for reconciliations). New Zealand Timber Overview* 22

Timber Segments Selected Operating Information 23 ($ in millions) Three Months Ended Twelve Months Ended 12/31/2014 9/30/2014 12/31/2013 12/31/2014 12/31/2013 Depreciation, Depletion, and Amortization Southern Timber $14.8 $14.8 $11.7 $52.2 $49.4 Pacific Northwest Timber 3.8 6.0 5.3 21.3 21.4 New Zealand Timber (1) 8.7 9.4 9.5 32.2 36.6 Total $27.3 $30.2 $26.5 $105.7 $107.4 Capital Expenditures U.S. Timber Reforestation, Silviculture & Other Capital Expenditures $23.8 $23.4 Property Taxes, Lease Payments & Allocated Overhead 19.6 20.5 Timberland Acquisitions 130.0 20.4 Subtotal U.S. Timber $173.4 $64.3 New Zealand Timber Reforestation, Silviculture & Other Capital Expenditures 10.0 10.4 Property Taxes, Lease Payments & Allocated Overhead 7.6 10.5 Timberland Acquisitions (2) – 139.9 Subtotal New Zealand Timber $17.6 $160.8 Total Timber Segments Capital Expenditures $191.0 $225.1 (1) 2013 includes full year results of New Zealand Timber which was consolidated on April 4, 2013. (2) 2013 includes $139.9 million for the acquisition of an additional interest in the New Zealand joint venture.

Real Estate Overview 24 2013 2014 Q1 Q2 Q3 Q4 2013 Q1 Q2 Q3 Q4 2014 Sales ($ in MMs) Development (Unimproved) $1.5 $0.3 $0.9 $0.2 $2.9 $0.1 $1.4 $1.4 $1.9 $4.8 Development (Improved)(1) – – – 1.6 1.6 – – – – – Rural(2) 2.7 7.1 13.0 4.7 27.5 5.1 5.4 25.1 5.4 41.0 Non-strategic / Timberlands (2)(3) 20.2 6.0 2.0 33.5 61.7 0.3 27.2 0.3 3.8 31.6 Total Sales $24.4 $13.4 $15.9 $40.0 $93.7 $5.5 $34.0 $26.8 $11.1 $77.4 Sales (Development / Rural Only) $4.2 $7.4 $13.9 $6.5 $32.0 $5.2 $6.8 $26.5 $7.3 $45.8 Acres Sold Development (Unimproved) 86 47 122 26 281 27 68 203 554 852 Development (Improved)(1) – – – 45 45 – – – – – Rural(2) 1,175 3,001 7,704 1,953 13,833 1,733 2,030 11,685 2,629 18,077 Non-strategic / Timberlands (2)(3) 5,575 4,202 179 24,711 34,667 362 23,185 234 2,138 25,919 Total Acres Sold 6,836 7,250 8,005 26,735 48,826 2,122 25,283 12,122 5,321 44,848 Acres Sold (Development / Rural Only) 1,261 3,048 7,826 2,024 14,159 1,760 2,098 11,888 3,183 18,929 Percentage of U.S. South acreage sold (4) 0.1% 0.2% 0.5% 0.1% 0.8% 0.1% 0.1% 0.7% 0.2% 1.2% Price per Acre ($ per acre) Development (Unimproved) $17,192 $7,150 $7,116 $6,000 $10,116 $5,259 $20,897 $6,660 $3,389 $5,623 Development (Improved)(1) – – – 34,680 34,680 – – – – – Rural(2) 2,262 2,357 1,687 2,428 1,986 2,958 2,654 2,146 2,040 2,265 Non-strategic / Timberlands (2)(3) 3,615 1,420 1,250 1,355 1,726 723 1,174 1,100 1,779 1,217 Weighted Avg. (Total) $3,554 $1,845 $1,760 $1,494 $1,878 $2,606 $1,345 $2,202 $2,075 $1,723 Weighted Avg. (Development / Rural) (5) $3,284 $2,430 $1,772 $2,475 $2,148 $2,994 $3,245 $2,223 $2,275 $2,417 (1) Reflects land with capital invested in infrastructure improvements. (2) Conservation sales previously reported as Rural are now reported within Non-strategic / Timberlands. (3) Excludes sale of 128,000 acres of timberlands in New York in Q4 2013 for $57 million. (4) Calculated as development / rural acres sold (excluding sales in the Northern region) over U.S. South acres owned. (5) Excludes Development (Improved).

Definitions of Non-GAAP Measures Pro Forma Operating Income is defined as operating income adjusted for internal review and restatement costs, the gain related to consolidation of the New Zealand joint venture and a cumulative out-of-period adjustment for depletion expense. Pro Forma Net Income is defined as net income attributable to Rayonier Inc. adjusted for separation costs related to the Performance Fibers spin-off, internal review and restatement costs, the gain related to consolidation of the New Zealand joint venture, discontinued operations and a cumulative out-of–period adjustment for depletion expense. Adjusted EBITDA is defined as earnings before interest, taxes, depreciation, depletion, amortization, the non-cash cost of real estate sold, the gain related to consolidation of the New Zealand joint venture, discontinued operations and costs related to the spin-off of the Performance Fibers business and the internal review and restatement in 2014. Adjusted EBITDA is a non-GAAP measure used by our Chief Operating Decision Maker, existing shareholders and potential shareholders to measure how the Company is performing relative to the assets under management. Cash Available for Distribution (CAD) is defined as cash provided by operating activities adjusted for capital spending (excluding strategic acquisitions), strategic divestitures, cash provided by discontinued operations and working capital and other balance sheet changes. CAD is a non-GAAP measure of cash generated during a period that is available for dividend distribution, repurchase of the Company's common shares, debt reduction and strategic acquisitions. CAD is not necessarily indicative of the CAD that may be generated in future periods. 25

Reconciliation of Reported to Pro Forma Earnings 26 ($ in millions, except per share amounts) December 31, 2014 September 30, 2014 December 31, 2013 Three Months Ended $ EPS $ EPS $ EPS Operating Income $14.2 $32.1 $34.9 Internal review and restatement costs 2.4 1.0 – Cumulative out-of-period adjustment for depletion expense – 2.6 – Pro Forma Operating Income $16.6 $35.7 $34.9 Net Income attributable to Rayonier Inc. $8.9 $0.07 $32.7 $0.25 $79.7 $0.62 Internal review and restatement costs 2.4 0.02 1.0 0.01 – – Cumulative out-of-period adjustment for depletion expense – – 2.6 0.02 – – Discontinued Operations, net (0.3) – – – (47.7) (0.37) Pro Forma Net Income $11.0 $0.09 $36.3 $0.28 $32.0 $0.25 December 31, 2014 December 31, 2013 Twelve Months Ended $ EPS $ EPS Operating Income $98.3 $108.7 Internal review and restatement costs 3.4 – Cumulative out-of-period adjustment for depletion expense 2.6 – Gain related to consolidation of New Zealand JV – (16.1) Pro Forma Operating Income $104.3 $92.6 Net Income attributable to Rayonier Inc. $99.3 $0.76 $371.9 $2.86 Internal review and restatement costs 3.4 0.02 – – Cumulative out-of-period adjustment for depletion expense 2.6 0.02 – – Gain related to consolidation of New Zealand JV – – (16.1) (0.12) Costs related to spin-off of Performance Fibers business 3.8 0.03 – – Discontinued Operations, net (43.4) (0.33) (268.0) (2.06) Pro Forma Net Income $65.7 $0.50 $87.8 $0.68

Reconciliation of Operating Income to Adjusted EBITDA by Segment 27 ($ in millions) Southern Pacific Northwest New Zealand Real Corporate Three Months Ended Timber Timber Timber Estate Trading and Other Total December 31, 2014 Operating Income $13.5 $3.7 $2.9 $2.6 ($0.3) ($8.2) $14.2 Depreciation, depletion & amortization 14.8 3.8 8.6 2.2 – 0.3 29.7 Non-cash cost of land sold – – 2.2 2.4 – – 4.6 Internal review costs – – – – – 2.4 2.4 Adjusted EBITDA $28.3 $7.5 $13.7 $7.2 ($0.3) ($5.5) $50.9 September 30, 2014 Operating Income $12.8 $4.4 $1.9 $16.4 $2.5 ($5.9) $32.1 Depreciation, depletion & amortization 14.8 6.0 9.4 3.8 – – 34.0 Non-cash cost of land sold – – – 3.2 – – 3.2 Internal review costs – – – – – 1.0 1.0 Adjusted EBITDA $27.6 $10.4 $11.3 $23.4 $2.5 ($4.9) $70.3 December 31, 2013 Operating Income $13.4 $8.6 $1.8 $25.4 $0.5 ($14.8) $34.9 Depreciation, depletion & amortization 11.7 5.2 9.3 8.6 – 0.4 35.2 Non-cash cost of land sold – – – 5.9 – – 5.9 Adjusted EBITDA $25.1 $13.8 $11.1 $39.9 $0.5 ($14.4) $76.0

Reconciliation of Operating Income to Adjusted EBITDA by Segment 28 ($ in millions) Southern Pacific Northwest New Zealand Real Corporate Twelve Months Ended Timber Timber Timber Estate Trading and Other Total December 31, 2014 Operating Income $45.7 $29.5 $9.5 $47.5 $1.7 ($35.6) $98.3 Depreciation, depletion & amortization 52.2 21.3 32.2 13.4 – 0.9 120.0 Non-cash cost of land sold – – 4.3 8.9 – – 13.2 Internal review costs – – – – – 3.4 3.4 Adjusted EBITDA $97.9 $50.8 $46.0 $69.8 $1.7 ($31.3) $234.9 December 31, 2013 Operating Income $37.8 $32.7 $10.6 $55.9 $1.8 ($30.1) $108.7 Depreciation, depletion & amortization 49.4 21.3 27.7 17.4 – 1.0 116.8 Non-cash cost of land sold – – – 10.2 – – 10.2 Gain related to consolidation of New Zealand JV – – – – – (16.1) (16.1) Adjusted EBITDA $87.2 $54.0 $38.3 $83.5 $1.8 ($45.2) $219.6