Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - POPULAR, INC. | d884671d8k.htm |

| EX-99.2 - EX-99.2 - POPULAR, INC. | d884671dex992.htm |

| EX-99.3 - EX-99.3 - POPULAR, INC. | d884671dex993.htm |

Investor Presentation

Acquisition of Certain Assets and Assumption of

Deposits of Doral Bank

March 2, 2015

Exhibit 99.1 |

Forward-Looking

Statements

1

The information contained in this presentation includes forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995, including our

estimate of the accretive nature of the transaction, the additional fee income from the

transaction, the run-rate annual non-interest expense from the transaction and

our estimates of transaction costs. These forward-looking statements are based on

management's current expectations and involve risks and uncertainties that may cause the

Company's actual results to differ materially from any future results expressed or

implied by such forward-looking statements. Factors that may cause such a

difference include, but are not limited to (i) the rate of growth in the economy and

employment levels, as well as general business and economic conditions; (ii) changes in interest rates, as

well as the magnitude of such changes; (iii) the fiscal and monetary policies of the federal

government and its agencies; (iv) changes in federal bank regulatory and supervisory

policies, including required levels of capital and the impact of proposed capital

standards on our capital ratios; (v) the impact of the Dodd-Frank Act on our

businesses, business practice and cost of operations; (vi) regulatory approvals that may be

necessary to undertake certain actions or consummate strategic transactions such as

acquisitions and dispositions; (vii) the relative strength or weakness of the consumer

and commercial credit sectors and of the real estate markets in Puerto Rico and the

other markets in which borrowers are located; (viii) the performance of the stock and bond

markets; (ix) competition in the financial services industry; (x) possible legislative, tax or

regulatory changes; (xi) additional Federal Deposit Insurance Corporation assessments

and (xii) risks related to the transaction, including (a) our ability to maintain

customer relationships, including managing any potential customer confusion caused by

the alliance structure, (b) risks associated with the limited amount of diligence able to be conducted by a

buyer in an FDIC transaction and (c) difficulties in converting or integrating the Doral

branches or difficulties in providing transition support to alliance co-bidders .

Other than to the extent required by applicable law, the Company undertakes no

obligation to publicly update or revise any forward-looking statement. Please refer to

our Annual Report on Form 10-K for the year ended December 31, 2013 and other SEC reports

for a discussion of those factors that could impact our future

results. |

Transaction

Overview •

Total of $1.8 billion of loans, all performing

•

$848 million of Puerto Rico loans acquired by Banco Popular de Puerto Rico (“BPPR”)

•

$931 million of U.S. mainland loans acquired by Popular Community Bank

(“PCB”) •

Popular

acquired,

in

alliance

with

other

bidders,

certain

assets

and

deposits

from

the FDIC, as

receiver for Doral Bank

•

Popular’s bid was chosen to purchase approximately $5 billion of GSE mortgage servicing

rights (“MSRs”) subject to a servicing transfer agreement acceptable to

Popular •

Sales to co-bidders closed concurrently with primary transaction

•

Doral

Bank

branches

and

operations

acquired

by

Popular

continued

to

operate

under their

normal schedule after the acquisition

Loans

Acquired

Deposits

Assumed

Overview

2

Other

Transaction

Notes

•

$2.3 billion of deposits assumed

•

$612 million of Puerto Rico branch deposits (8 branches) and $431 million of Internet

deposits assumed by BPPR

•

$1.3 billion of NY branch deposits (3 branches) assumed by PCB

•

No brokered CDs assumed

•

No non-performing assets acquired

•

No loss-sharing agreement with the FDIC

•

No holding company assets or liabilities assumed

•

All necessary regulatory approvals have been received and transactions other than MSRs have

closed

Notes: Figures as of 12/31/14 and are subject to customary post-closing and

purchase accounting adjustments. |

Transaction

Rationale Enhances Popular’s Franchise

3

•

Strengthens existing Puerto Rico franchise

•

Continues expansion in New York and adds attractive commercial platform

•

In-market transaction in both Puerto Rico and New York

•

Popular is not acquiring any non-performing loans or REO

•

Popular has successfully managed previous FDIC transactions

•

Effective deployment of capital

•

Significant cost saving opportunities

•

Accretive to earnings

Strategic Advantages

Financially Attractive |

Transaction

Structure 4

•

BPPR served as the lead bidder in alliance with its affiliate PCB,

FirstBank Puerto Rico, an affiliate of J.C. Flowers III, L.P., and

Centennial Bank

•

Transactions with Popular’s alliance partners closed concurrently with

the primary transaction; no seller financing offered

Overview of

Alliance

Structure

($ in millions)

Popular

FirstBank

J.C. Flowers

Centennial

Total

U.S. Mainland Loans

$ 931

$ -

$ 316

$ 42

$ 1,289

Puerto Rico Loans

848

325

-

-

1,173

Total Loans

$ 1,779

$ 325

$ 316

$ 42

$ 2,463

U.S. Mainland Branch Deposits

$ 1,277

$ -

$ -

$ 466

$ 1,743

Puerto Rico Branch Deposits

612

625

-

-

1,237

Internet Deposits (BPPR)

431

-

-

-

431

Total Deposits

$ 2,320

$ 625

$ -

$ 466

$ 3,411

Notes:

Figures

as

of

12/31/14

and

are

subject

to

customary

post-closing

and

purchase

accounting

adjustments.

Amounts

may

not

total

due

to

rounding. |

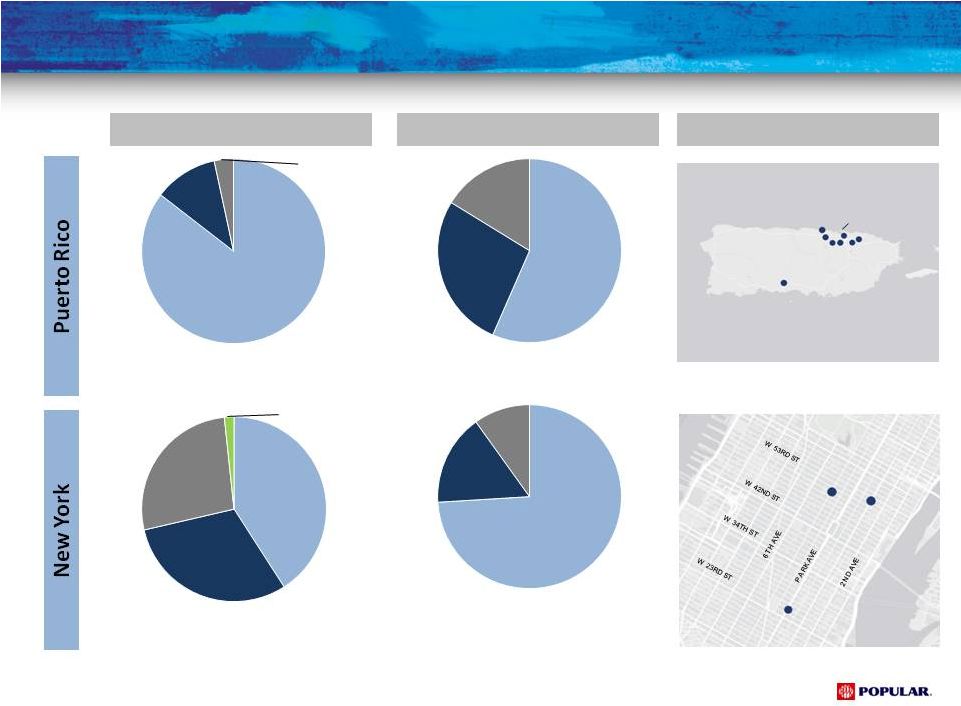

Acquired Assets

and Deposits 5

Loans

Deposits

(1)

Branches

Notes: Figures as of 12/31/14 and are subject to customary post-closing and purchase

accounting adjustments. (1) P.R. time deposits includes $431million of internet

deposits that were booked to BPPR in Puerto Rico. Total:

$1,043

million

Total:

$1,277

million

Total:

$848

million

Total:

$931

million

San Juan

Aguadilla

Mayaguez

Ponce

Guayama

Humacao

Carolina

Time

Savings,

NOW and

MMDA

Demand

Time

Demand

Mortgage

C&I & CRE

Other

Construction

CRE

C&I

Savings, NOW

and MMDA

Mortgage

16%

57%

74%

10%

41%

27%

30%

85%

11%

3%

2%

16%

27% |

6

Key Financial Metrics

•

Accretive to earnings

•

Deposit

repricing

will

be

managed

to

bring

deposit

costs

in

line

with

Popular

•

Additional fee income, excluding revenue from mortgage servicing, of approximately $5

million •

Non-interest

expense

estimate

of

approximately

$30

million

including

estimated

cost

savings

•

Transaction-related costs estimated at $20-25 million

Notes: Figures as of 12/31/14 and are subject to customary post-closing and purchase

accounting adjustments. Amounts may not total due to rounding. Loan & Deposit

Detail Annual Pro Forma Impact excluding MSRs

($ in millions)

Balance

W.A. Coupon / Rate

Transaction Pricing -

Premium / (Discount) -

%

U.S. Mainland Loans

$ 931

5.6 %

0.6)%

Puerto Rico Loans

848

6.0 %

(4.7)%

Total Loans

$ 1,779

5.7 %

(1.9)%

1.1

U.S. Mainland Branch Deposits

$ 1,277

1.15 %

2.0 %

Puerto Rico Branch Deposits

612

0.62 %

1.5 %

Internet Deposits (BPPR)

431

0.94 %

0.0 %

Total Deposits

$ 2,320

0.97 %

1.5 % |

7

Capital Impact

•

Capital impact subject to purchase accounting and finalization of fair market value

analysis

•

Will record an estimate of fair value in Q1 2015 with final valuations expected

later in 2015

•

Currently anticipate creation of $50-100 million of goodwill upon completion of

fair market value analysis

•

Impact on regulatory capital ratios estimated at approximately 150 bps

excluding goodwill

•

Potential partial reversal of U.S. DTA valuation allowance will be assessed

throughout 2015

•

Will

continue

our

ongoing

dialogue

with

regulators

about

capital

return

after

our

March 31st DFAST filing |

Popular Franchise Strengthened

•

Efficient deployment of capital which is accretive to earnings

•

Acquisition grows strategically important New York business

through the addition of an attractive commercial franchise

•

In-market expansion provides significant cost savings

opportunities

•

No non-performing assets acquired

8 |

Investor Presentation

Acquisition of Certain Assets and Assumption of

Deposits of Doral Bank |