Attached files

| file | filename |

|---|---|

| 8-K - HomeTrust Bancshares, Inc. | htbi-8kpresent030215.htm |

* March 2, 2015NCBA Bank Directors Assembly

* Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements often include words such as “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” Forward-looking statements are not historical facts but instead represent management’s current expectations and forecasts regarding future events many of which are inherently uncertain and outside of our control. Actual results may differ, possibly materially from those currently expected or projected in these forward-looking statements. Factors that could cause our actual results to differ materially from those described in the forward-looking statements, include expected cost savings, synergies and other financial benefits from the recent acquisitions might not be realized within the expected time frames or at all, and costs or difficulties relating to integration matters might be greater than expected; increased competitive pressures; changes in the interest rate environment; changes in general economic conditions and conditions within the securities markets; legislative and regulatory changes; and other factors described in HomeTrust’s latest annual Report on Form 10-K and Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission-which are available on our website at www.hometrustbanking.com and on the SEC’s website at www.sec.gov. Any of the forward-looking statements that we make in this presentation or our SEC filings are based upon management’s beliefs and assumptions at the time they are made and may turn out to be wrong because of inaccurate assumptions we might make, because of the factors illustrated above or because of other factors that we cannot foresee. We do not undertake and specifically disclaim any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These risks could cause our actual results for fiscal 2015 and beyond to differ materially from those expressed in any forward-looking statements by, or on behalf of, us and could negatively affect our operating and stock performance.

* HomeTrust Profile Founded in 1926Operated as a mutual savings bank 5 mutual combinations from 1996 – 20103/31/12 = $1.6 billion in assets, $171 million in capitalConverted to stock in 2012 and raised $211.6 millionEstablished goal of acquisition and organic growth

* Asset Growth Since 1996 Total assets have doubled since 2008 * Financial data as of 9/30/14; pro forma amounts include the 11/14/14 acquisition of the branch banking operations of ten locations in Virginia and North Carolina from Bank of America Corporation; estimated financial impact for illustrative purposes only; actual results may differ materially. ProForma 9/30/14*

* Organizational Clarity – Differentiation Answers to Six Key Questions1. Why Do We Exist?2. How Do We Behave?3. What Do We Do?4. How Will We Succeed?5. What Needs To Be Done Now?6. Who Will Do What?

* M & A Evaluation (Scale 1-10) 1. Lead with Culture• Initial Discussions • Integration Focus • Ongoing Commitment2. Geographic Footprint – Logical & Efficient 3. Growing Markets w/SMSA of meaningful size 4. Prioritize opportunities where we have 1st look – not bidding wars5. Credit Problems – Worked through, well defined – conservative credit mark6. Lenders with market relationships who can lead growth 7. Asset Origination/Revenue Generation Culture in Place 8. Strong Core Deposit Base

* M & A Evaluation continued 9. Rational price paid • Price adjust TBV • Earnings Accretion – 10%+ • Dilution earn back period <4 years • Board Seats/Social Issues • Realistic Cost Saves • One-Time Costs 10. Integration Risk • Size of deal • Number of locations • Complexity11. Significance of Exposure to Mistakes • Credit mark magnitude • Regulatory Compliance Deficiencies • Undisclosed liabilities12. Regulatory Impact .

* (A) Strategy(B) Execution(C) Repositioned Repositioning for Growth

* (A) Strategy “Our primary objective is to continue to operate and grow HomeTrust Bank as a well-capitalized, profitable, independent community banking organization.”“Expand our presence in contiguous larger markets that will support organic growth.”“Create Value for employees, customers, shareholders and communities.” Business & Operating Strategy & Goals

* (B) Execution Date Commercial Closed Description Assets Locations RM’s July 31, 2013 BankGreenville $101 million 1 location May 2014 Additional Pelham Rd location 4 May 31,2014 Jefferson Bancshares, Inc. $489 million 12 locations – East Tennessee 11 July 21, 2014 Roanoke Loan Production Office – Team with more than 130 yrs. of in-market commercial lending experience 1 location 3 July 31, 2014 Bank of Commerce $123 million 1 location – Midtown Charlotte 2 Nov. 12, 2014 Raleigh Loan Production Office – Team with more than 75 yrs. of in-market commercial lending experience 1 location 4 Nov. 14, 2014 Bank of America– Acquired deposits of 10 offices $240 million in core deposits 8 locations – Southwest VA 1 25 25 Acquisitions & Expansions

* BOA Branch Purchase Impact Growth in deposit accounts of 60%Growth in low cost core depositsDebit card growth of 170%Internet banking growth of 110%5 Branch locations in Roanoke, VA to complement new Commercial LPO

* Acquisition Pricing Purchase Price(in millions) Price to TBV Cash/Stock BankGreenville (SC) $ 8.7 92% 100% Cash Jefferson Federal (East TN) 51.2 99% 50% Cash/50% Stock Bank of Commerce (NC) 10.0 112% 100% Cash $ 69.9 64% Cash $ 44.3 36% Stock $ 25.6 Source: SNL Financial 10/22/14 FTB purchases TrustAtlantic (Raleigh) – TBV 173%11/18/14 BNC purchases Valley Financial Corp (Roanoke) – TBV 173%

* Our Franchise Footprint

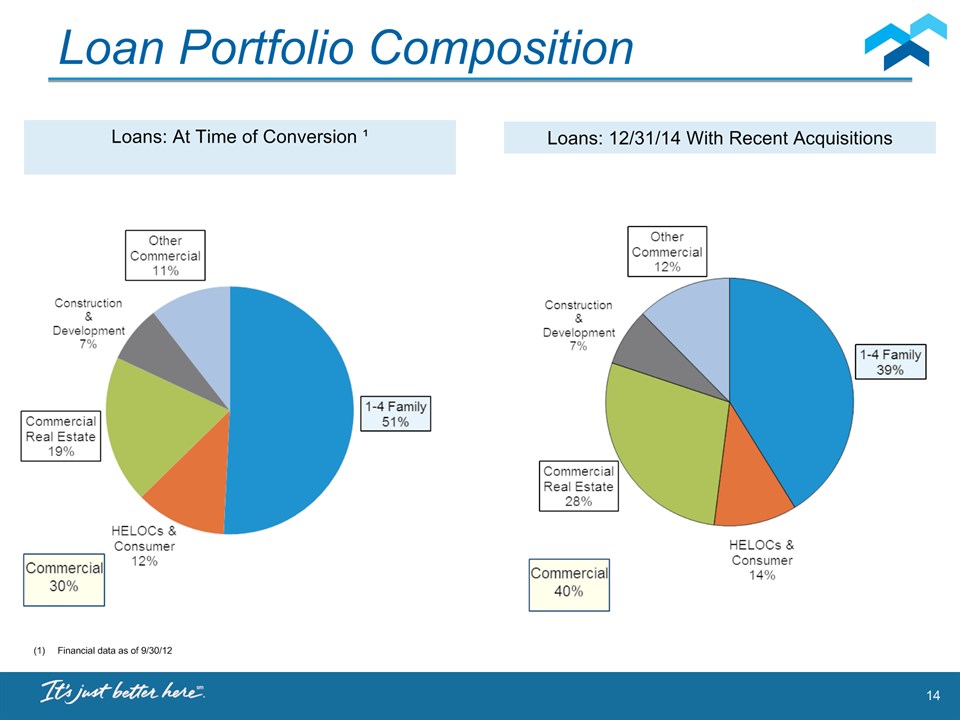

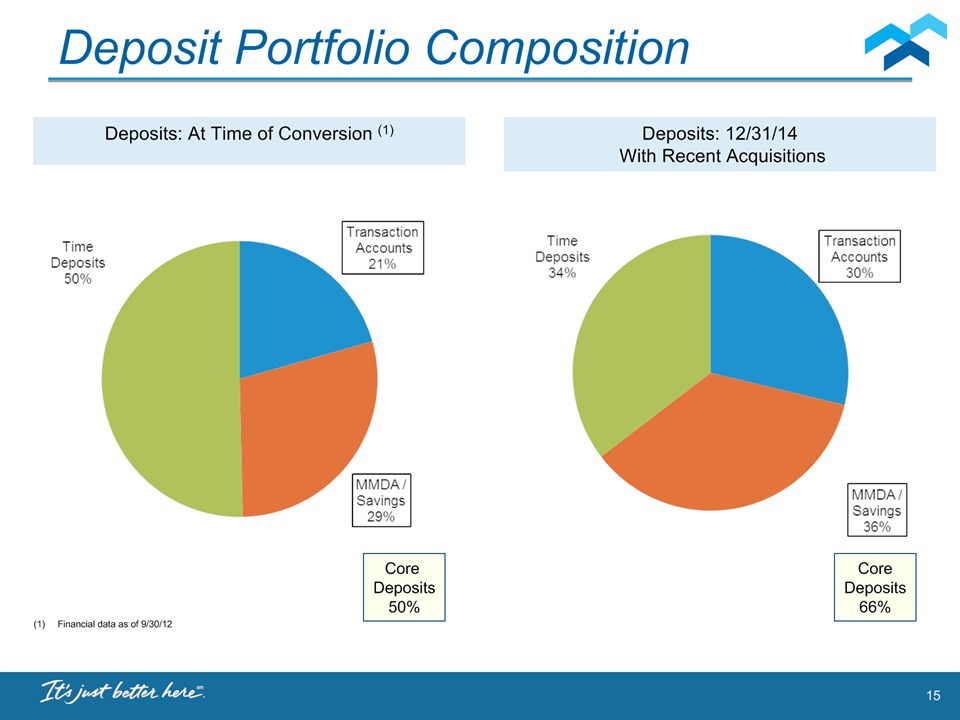

* Growth Since Conversion (past 30 months) Mutual Conversion 9/30/2012 Actual 12/31/2014 Change Since Conversion Change Since Conversion $ % Total Assets $ 1,603 $ 2,640 $ 1,037 65% Total Loan Portfolio $ 1,203 $ 1,650 $ 447 37% 1-4 Family 611 647 36 6% HELOC’s & Consumer 143 228 85 59% Commercial Real Estate 232 455 233 96% Construction & Development 90 119 29 32% Other Commercial 127 201 74 58% Total Deposit Portfolio $ 1,160 $ 1,938 $ 778 67% Checking Accounts 239 581 342 143% Money Market/Savings 337 707 370 110% Time Deposits 584 650 66 11% Loan/Deposits 104% 85% - 19% Locations 20 45 25 125% Employees 315 505 175 56% Source: Company’s Form 10Q (Dollars in thousands)

* Loan Portfolio Composition Loans: At Time of Conversion ¹ Loans: 12/31/14 With Recent Acquisitions Financial data as of 9/30/12

* Deposit Portfolio Composition Deposits: At Time of Conversion (1) Deposits: 12/31/14 With Recent Acquisitions Financial data as of 9/30/12 Core Deposits50% CoreDeposits66%

* Market Demographics New Markets – 150%Population increase – 532%CRM increase – 417%

* (C) Repositioned for Organic Growth And EPS Growth Added Six Markets Larger than Asheville MSAAdded 25 new locationsAdded 25 Commercial Relationship ManagersAchieved organic loan growthGrew Core deposits by $700 millionAdded Infrastructure Expertise in all LOB’sAdded Indirect Auto LendingAdded CRM system to cross-sell customersConverted to National Bank CharterUnited 7 Names to One Brand – HomeTrust Bank

* Fiscal 2015 Focus IntegrationExecutionOrganic GrowthRevenue / EPS Growth Create Sustainable Value For Shareholders!

* Headwinds Impacting Growth Low interest rates; potential for flat yield curve at 2%Competition for quality loans – rate/structure/termsEconomy – lukewarm / global, not localHousing still weakTechnology – new competitors, cost, cybersecurityRegulatory environment / Compliance burdensCustomer expectations – products and servicesGenerational shiftIncreasing costs and declining margins Stockholder expectations – growth and value creation

* March 2, 2015NCBA Bank Directors Assembly