Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Freescale Semiconductor, Ltd. | d884567d8k.htm |

NXP to Merge with Freescale

Creates an Industry Powerhouse

Investor Presentation | March 2

nd

, 2015

Exhibit 99.1 |

2

SECURE CONNECTIONS FOR A SMARTER WORLD

•

•

•

•

•

•

•

•

Forward Looking Statement

FSL’s and NXP’s forward-looking statements are based on assumptions

that may not prove to be accurate. Neither FSL nor NXP can guarantee future results,

level of activity, performance or achievements. Moreover, neither FSL nor NXP

assumes responsibility for the accuracy and completeness of any of these

forward-looking statements. FSL and NXP assume no obligation to update or

revise any forward-looking statements as a result of new information, future

events or otherwise. Readers are cautioned not to place undue reliance on

these forward-looking statements that speak only as of the date hereof.

the diversion of management time on transaction-related issues.

The ability of either NXP or FSL to effectively integrate their businesses;

and NXP’s and FSL’s ability to achieve the synergies and value

creation contemplated by the proposed transaction; the risk that a regulatory

approval that may be required for the proposed transaction is delayed, is

not obtained, or is obtained subject to conditions that are not

anticipated; the

risk

that

a

condition

to

closing

of

the

proposed

transaction

may

not

be

satisfied;

the timing to consummate the proposed transaction;

the failure to consummate or delay in consummating the proposed transaction for

other reasons; Certain statements in this communication regarding the proposed transaction

between NXP Semiconductors N.V. (“NXP”) and Freescale Semiconductor, Ltd.

(“FSL”) are “forward-looking” statements. The words

“anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,” “estimate,” “probable,” “project,” “forecasts,” “predict,”

“outlook,” “aim,” “will,” “could,” “should,”

“would,” “potential,” “may,” “might,” “anticipate,” “likely,” “plan,” “positioned,” “strategy,” and similar expressions, and the

negative thereof, are intended to identify forward-looking statements. These

forward-looking statements, which are subject to numerous factors, risks and uncertainties

about NXP and FSL, may include projections of their respective future business, strategies, financial condition, results of operations and market data.

These statements are only predictions based on current expectations and projections about future

events. There are important factors, risks and uncertainties that could cause actual

outcomes and results to be materially different from those projected, including the risk factors set forth in NXP’s most recent Form 20-F and

FSL’s most recent reports on Form 10-K, Form 10-Q and other documents on file with the

SEC and the factors given below:

the failure to obtain the approval of shareholders of NXP or FSL in connection with the proposed

transaction; |

3

Strategically & Financially Compelling Transaction

Acceleration of our strategy in Secure Connections for a Smarter

World Creates a powerhouse in High Performance Mixed Signal

Establishes

NXP

as

the

#1

automotive

semiconductor

supplier

(1)

Establishes

NXP

as

the

#1

broad-based

MCU

supplier

(2)

Anticipate $200M of cost synergies in the first full year after close

Clear path to $500M of annual run rate cost synergies

Accretive to non-GAAP EPS in the first full year

3x net debt/TTM adj. EBITDA at close; reducing to 2x within 6 quarters

Will Drive Significantly Higher Cash Flow

Note

1.

2.

SECURE CONNECTIONS FOR A SMARTER WORLD

Based on NXP Corporate Market Intelligence estimates for 2014, excludes Automotive

MCU products IHS |

Outstanding Strategic Fit –

Secure Connections for a Smarter World

•

Combined company will

•

Be the leader in automotive semiconductors

•

Leverage NXP security leadership plus Freescale broad MCU

•

Influence evolution of Secure Car & ADAS solutions

•

Capture emerging growth in the Smarter World

•

Broad, diverse customer base

•

Complementary market reach across US, EU, China

•

Ability to effectively cross-sell total solutions

•

Strong and broad product portfolio for emerging IoT market

•

Reinforces the NXP Value Proposition

•

Grow >1.5x faster than the market

•

Deliver superior profitability

4

SECURE CONNECTIONS FOR A SMARTER WORLD

Connected

Car

Security

Portable &

Wearable

Internet

of Things |

5

Transaction Overview

Consideration

•

Total consideration per share

•

0.3521 NXP shares (fixed exchange ratio)

•

$6.25 per share in cash

•

Total equity value: $11.8 Billion

•

$9.8 Billion in equity

•

$2.0 Billion in cash

•

Freescale shareholders to own just below 32% of combined company

Sources of Financing

•

115 Million shares of NXP common stock (approx.)

•

$1 Billion cash from NXP’s balance sheet

•

$1 Billion in new debt financing

Approval Process

•

NXP and Freescale Board of Directors have unanimously approved

•

NXP and Freescale shareholder approval required

•

Regulatory approvals in various jurisdictions

Timing of Transaction Close

•

Expected in the second half of 2015, subject to customary closing conditions

SECURE CONNECTIONS FOR A SMARTER WORLD |

6

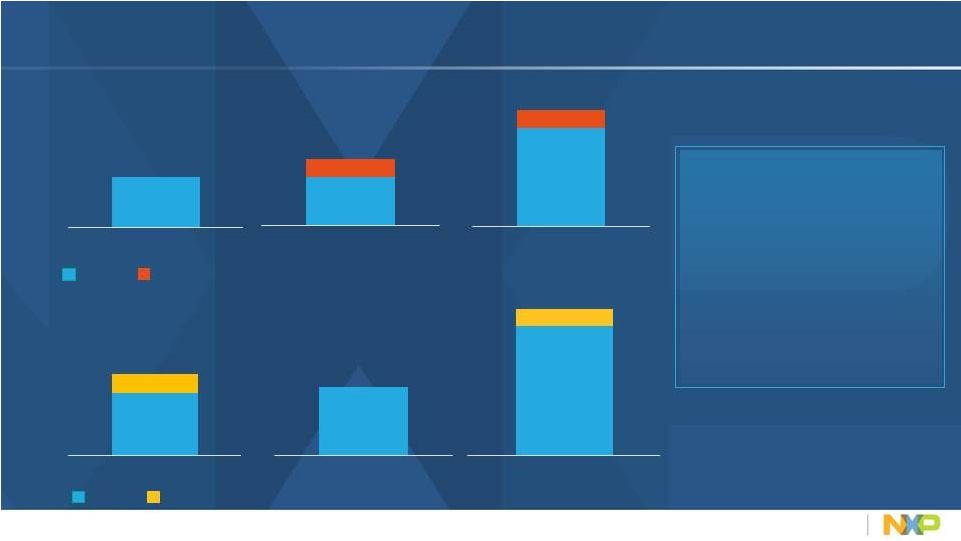

HPMS Market Leader with Sharper Focus, Broader Reach

1.

2.

13%

77%

23%

87%

STDP

HPMS

Combined Company Becomes

•

The Market Leader in HPMS

•

#4 Largest Semi Supplier

•

#1 Auto Semi Supplier

•

#1 Broad-based MCU

•

Minimal Overlap

•

Doubles NXP HPMS SAM

NXP & FSL Overlap

HPMS

$-

$10

$20

$30

$40

$50

NXP SAM 2014E ($B)

FSL SAM 2014E ($B)

NXP + FSL SAM 2014E ($B)

$-

$2

$4

$6

$8

$10

NXP Revenue 2014 ($B)

FSL Revenue 2014 ($B)

NXP + FSL Revenue 2014 ($B)

SECURE CONNECTIONS FOR A SMARTER WORLD

6

2

1

Based On

NXP Corporate Market Intelligence Estimates; estimates for 2014, excludes Automotive MCU products

NXP Corporate Market intelligence estimate: Total semiconductor market excluding memory

|

7

SECURE CONNECTIONS FOR A SMARTER WORLD

Establishes NXP as #1 Auto Semiconductor Vendor

Global Auto Semiconductor

TAM, 2013 $26B

(1)

•

#1

Auto

Semi

Supplier

1,2

•

Doubles Addressable Market

•

Broad Portfolio, No Product Overlap

•

Leadership

Positions

1,2

•

Car Entertainment

•

Keyless Entry & Access

•

In-Vehicle Networking

•

Chassis & Safety

•

Powertrain

•

Synergistic Future Growth Opportunities

•

Infotainment (Audio and Apps Proc.)

•

Securing the Car

•

ADAS (Radar, Vision, Secure V2X)

•

Highly Valued Supplier to All Major OEMs

Based On

1.

2.

NXP +

13%

#2

11%

#3

9%

#4

7%

#5

6%

#6

5%

#7

3%

#8

3%

#9

3%

Others

40%

NXP Corporate Market Intelligence estimates for 2014

IHS |

8

SECURE CONNECTIONS FOR A SMARTER WORLD

Creates

the

Leader

in

Broad-based

MCU

(2)

MCU Semiconductor TAM

2013 $11B

(1)

•

#1

in

Broad-based

MCU

(2)

•

Leader

in

fast

growing

32-bit

ARM

MCU

(2)

•

Broad-based, general purpose MCU portfolio

•

Ability to pull-through Analog with MCU platform

•

Outstanding customer access in key growth verticals

•

Synergistic Future Growth Opportunities

•

Ideally Positioned to deliver IoT Solutions

•

Security

•

MCU

•

Software

•

Connectivity

•

Building on extensive customer base

Gained

Share 2014

(2)

#1

15%

NXP+

14%

#3

10%

#4

9%

#5

8%

#6

8%

#7

6%

#8

3%

#9

3%

Others

24%

Based On

1.

2.

IHS, MCU Market excluding Automotive

NXP Corporate Market Intelligence estimates for 2014, excludes Automotive MCU products

|

9

SECURE CONNECTIONS FOR A SMARTER WORLD

Compelling Value Proposition

Will drive Significant Additional Shareholder Value

World Leader in Automotive semiconductors

Strengthen Position in High Growth Focus Markets

Profitable Growth

Leveraging Operational Excellence & Cost Synergies

Strong Cash Generation

World-Class Team Globally

Customer-Focused Passion to WIN |

10

SECURE CONNECTIONS FOR A SMARTER WORLD

Additional Information about the Merger and Where to Find it.

No Offer or Solicitation This

communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or

approval. This communication relates to a proposed business combination between NXP and

FSL. Participants in Solicitation

NXP, FSL, their respective directors and certain of their respective executive officers may be

considered participants in the solicitation of proxies in connection with the proposed

transaction. Information about the directors and executive officers of NXP is set forth in its Annual Report on Form 20-F for

the year ended December 31, 2013, which was filed with the SEC on February 28, 2014, and in its Form

6-K furnished to the SEC on May 20, 2014. Information about the directors and

executive officers of FSL is set forth in its Annual Report on Form 10-K for the year ended December 31, 2014,

which was filed with the SEC on February 6, 2015, and its proxy statement for its 2014 annual meeting

of shareholders, which was filed with the SEC on March 21, 2014.

These documents can be obtained free of charge from the sources indicated above. Additional

information regarding the participants in the proxy solicitations and a description of their

direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus

and other relevant materials to be filed with the SEC when they become available.

Important Information For Investors And Shareholders In connection with this

proposed business combination, NXP and/or FSL may file one or more proxy statements, registration statements, proxy

statement/prospectus or other documents with the Securities and Exchange Commission (the

“SEC”). This communication is not a substitute for any

proxy statement, registration statement, proxy statement/prospectus or other document NXP and/or FSL

may file with the SEC in connection with the

REGISTRATION STATEMENT(S), PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION. Any definitive proxy statement(s) (if and when available) will be

mailed to shareholders of NXP and/or FSL, as applicable. Investors and security holders

will be able to obtain free copies of these documents (if and when available) and other documents

filed with the SEC by NXP and/or FSL through the website maintained by the SEC at

http://www.sec.gov. Copies of the documents filed with the SEC by NXP will also be available free of charge on NXP’s

Investor Relations internet website at http://www.nxp.com/investor or by contacting NXP’s

Investor Relations Contact by phone at 1-408-518-5411. Copies of the

documents filed with the SEC by FSL will be available free of charge on FSL’s Investor Relations internet website at

http://investors.freescale.com or by writing to Freescale Semiconductor, Ltd., c/o Freescale

Semiconductor, Inc., 6500 William Cannon Drive West, Austin, Texas 78735, Attention: Investor

Relations or by phone at 1-512-895-2454. proposed

transaction.

INVESTORS

AND

SECURITY

HOLDERS

OF

NXP

AND

FSL

ARE

URGED

TO

READ

THE

PROXY

STATEMENT(S), |