Attached files

| file | filename |

|---|---|

| EX-23 - CONSENT OF KLJ & ASSOCIATES, LLP - 12 Retech Corp | ex231.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Devago Inc.

(Name of small business issuer in its charter)

|

Nevada |

|

7371 |

|

TBA |

|

(State or jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Classification Code Number) |

|

Identification Number) |

Calle Dr. Heriberto Nunez #11A

Edificio Apt. 104

Dominican Republic

(tel. no. 809-994-4443)

(Address and telephone number of principal executive offices and principal place of business)

Copies to:

The Doney Law Firm

4955 S. Durango Dr. Ste. 165

Las Vegas, NV 89103

(702) 982-5686 (Tel.)

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box.

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting Company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting Company” in Rule 12b-2 of the Exchange Act.

¨ Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting Company

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

2

PROSPECTUS

DEVAGO INC.

15,000,000 Shares of Common Stock

$0.007 Per Share

This is the initial public offering of common stock of Devago Inc. We are offering for sale a total of 15,000,000 shares of common stock at a fixed price of $0.007 per share. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The amount raised may be minimal and there is no assurance that we will be able to raise sufficient amount to cover our expenses.

The offering is being conducted on a self-underwritten, best efforts basis, which means our officer and director, Jose Armando Acosta Crespo, will attempt to sell the shares. This Prospectus will permit our officer and director to sell the shares directly to the public, with no commission or other remuneration payable to him for any shares he may sell. The offering shall terminate on the earlier of (i) the date when the sale of all 15,000,000 shares is completed, (ii) when the board of directors decides that it is in our best interest to terminate the offering prior the completion of the sale of all 15,000,000 shares registered or (iii) one year after the effective date of this prospectus.

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act ("JOBS Act"). Investing in our shares involves a high degree of risk. BEFORE BUYING ANY SHARES, YOU SHOULD CAREFULLY READ THE DISCUSSION OF MATERIAL RISKS OF INVESTING IN OUR SHARES IN "RISK FACTORS" BEGINNING ON PAGE 8 OF THIS PROSPECTUS.

We are a development stage company with nominal operations and assets. As a result, we are considered a shell company under Rule 405 of the Securities Act and are subject to additional regulatory requirements as a result of this status, including limitations on our shareholders’ ability to re-sell their shares in our company, as well as additional disclosure requirements. Accordingly, investors should consider our shares to be a high-risk and illiquid investment.

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority ("FINRA") for our common stock to be eligible for trading on the OTCBB or the OTCQB operated by OTC Market Group, Inc. We do not yet have a market maker who has agreed to file such application. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop.

Any funds received as a part of this offering will be immediately deposited into our bank account and be available for our use. We have not made any arrangements to place funds in an escrow, trust or similar account for general business purposes as well as to continue our business and operations. If we fail to raise enough capital to commence operations investors may lose their entire investment and will not be entitled to a refund.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, dated March 2, 2015

3

TABLE OF CONTENTS

|

PROSPECTUS SUMMARY |

5 |

|

|

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS |

7 |

|

|

|

|

RISK FACTORS |

8 |

|

|

|

|

USE OF PROCEEDS |

18 |

|

|

|

|

DETERMINATION OF OFFERING PRICE |

19 |

|

|

|

|

DILUTION |

19 |

|

|

|

|

PLAN OF DISTRIBUTION |

20 |

|

|

|

|

LEGAL PROCEEDINGS |

22 |

|

|

|

|

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS |

22 |

|

|

|

|

DESCRIPTION OF SECURITIES |

24 |

|

|

|

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS |

26 |

|

|

|

|

INTERESTS OF NAMED EXPERTS |

28 |

|

|

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION |

28 |

|

|

|

|

DESCRIPTION OF BUSINESS |

29 |

|

|

|

|

MANAGEMENT’S DISCUSSION AND ANAYLSIS OF FINANCIAL CONDITION AND PLAN OF OPERATION |

34 |

|

|

|

|

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS |

38 |

|

|

|

|

EXECUTIVE COMPENSATION |

38 |

|

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS |

39 |

|

|

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

40 |

|

|

|

|

FINANCIAL STATEMENTS |

40 |

4

PROSPECTUS SUMMARY

Our Business

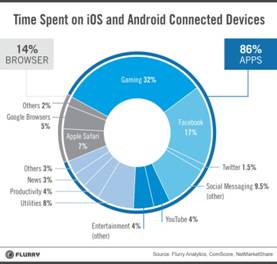

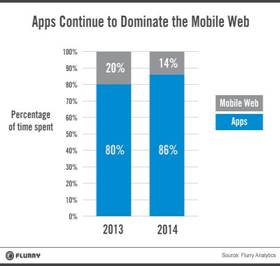

We are a development stage company and engaged in the creation of mobile software applications “Apps.” Our strategic initiative includes developing and marketing our own mobile applications, as well as expanding our mobile application portfolio through the acquisition of third party mobile applications and mobile application development companies.

Currently, we have no fully-developed revenue generating mobile applications. We intend to build a harmonious portfolio of apps that will service a wide range of industries and consumers. We currently have one application (Hotchek) in our portfolio. Hotchek is a multi-use customizable application designed to enable users to easily engage their network audience with the use of highly interactive polls and surveys.

Hotchek is currently in its final stages of development. Our development team for the project is our officer and director, Jose Armando Acosta Crespo, and Softaddicts, a Florida based company that provides web and software development solutions. To date, we have paid Softaddicts $15,000 to help develop the Hotcheck application. This money was used to provide the following services:

1) Application and form design;

2) Database design and architecture;

3) Programmatic code to connect the forms to the database; and

4) Compile iOS and Android applications.

There were no statements of work in connection the above services.

Mr. Crespo oversaw the development work by Softaddicts, made modifications as needed and tested the source imagery and marketing content for the messaging. The services provided by Softaddicts and Mr. Crespo resulted in a working prototype of the application and information page about its functions. This information page is found at http://wwha.softaddicts.com/public-campaigns. Our sole officer and director loaned us $15,000 to pay Softaddicts under an 8% demand promissory note dated February 5, 2015.

Under a Development Agreement dated February 5, 2015, we have outsourced more work in connection with the development for Hotchek to Softaddicts. The agreement with Softaddicts may be terminated upon 15 days’ notice. We are obligated to compensate Softaddicts at an hourly rate of $45 per hour for its work on the project.

We have planned for three releases associated with the Hotchek app, with the following features and costs:

1) Currently we are in development of release one where we are approximately 70% complete on the prototype. Release one should be completed within 60-90 days at a budget of $10,000. Softaddicts will start the completion of release one as soon as we fund the $10,000. The $10,000 will be a retainer against the hourly rate of $45 under the agreement with Softaddicts. The $10,000 will be in addition to the $15,000 we already paid to Softaddicts.

2) Release two will require an additional $15,000 and take 30-60 additional days to complete. The time necessary to complete release two may coincide with the time to complete release one.

3) Release three will be based on the feedback from customers using released versions of release one and two. The time period and budget is unknown until we receive feedback and have a better understanding of the amount of development work required.

We expect to complete releases one and two of the Hotchek app and have it ready for commercial sale by summer 2015.

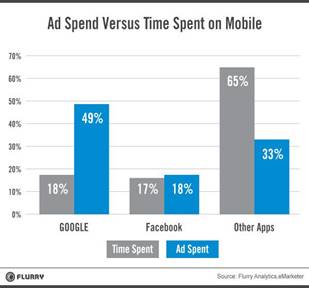

We plan to derive revenue by way of the sale and licensing of our developed and acquired mobile applications, as well as sale of in-app advertising.

5

Being a development stage company, we have no revenues and have limited operating history. We were incorporated in Nevada on September 8, 2014. Our principal executive office is located at Calle Dr. Heriberto Nunez #11A, Edificio Apt. 104, Dominican Republic. Our phone number is 809-994-4443.

Our financial statements for the period from September 8, 2014 (date of inception) to November 30, 2014, report no revenues and a net loss of $5,000. As of November 30, 2014 we had $15,000 in cash on hand. Our independent registered public accountant has issued an audit opinion for our company, which includes a statement expressing substantial doubt as to our ability to continue as a going concern. If we are unable to obtain additional funds our business may fail. We intend to use the net proceeds from this offering to develop our business operations (See “Description of Business" and "Use of Proceeds").

Proceeds from this offering are required for us to proceed with our business plan over the next twelve months. We require minimum funding of $26,250 to conduct our proposed operations and pay all expenses for a minimum period of one year including expenses associated with maintaining a reporting status with the SEC. If we are unable to obtain minimum funding of $26,250, our business may fail. Even if we raise $105,000 from this offering, we may need more funds to develop our growth strategy and to continue maintaining a reporting status.

As of the date of this prospectus, there is no public trading market for our common stock and no assurance that a trading market for our securities will ever develop.

The Offering

|

Common Stock Offered |

Up to 15,000,000 shares at $0.007 per share |

|

|

|

|

Common Stock Outstanding after the Offering |

35,000,000 shares |

|

|

|

|

Use of Proceeds |

If we are successful at selling all the shares we are offering, our proceeds from this offering less offering expenses will be approximately $85,000. We intend to use these net proceeds to execute our business plan. |

|

|

|

|

Risk Factors |

The Shares of Common Stock offered involves a high degree of risk and immediate substantial dilution. See "Risk Factors" |

|

|

|

|

Term of offering |

The offering shall terminate on the earlier of (i) the date when the sale of all 15,000,000 shares is completed, (ii) when the board of directors decides that it is in our best interest to terminate the offering prior the completion of the sale of all 15,000,000 shares registered or (iii) one year after the effective date of this prospectus. |

|

|

|

|

No Symbol for Common Stock |

There is no trading market for our Common Stock. We intend to apply for a quotation on the OTCBB or OTCQB through a market-maker. There is no guarantee that a market-maker will agree to assist us. |

6

Summary Financial Information

|

Balance Sheet Data |

As of November 30, 2014 |

|

Cash |

$15,000 |

|

Total Assets |

$15,000 |

|

Liabilities |

$0 |

|

Total Stockholder’s Equity |

$15,000 |

|

Statement of Operations |

For the Period from Inception to November 30, 2014 |

|

Revenue |

$0 |

|

Net Profit (Loss) for Reporting Period |

($5,000) |

References in this prospectus to “Devago Inc.” “we,” “us,” and “our” refer to Devago Inc.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Securities and Exchange Commission (“SEC”) encourages companies to disclose forward-looking information so that investors can better understand future prospects and make informed investment decisions. This prospectus contains these types of statements. Words such as “may,” “expect,” “believe,” “anticipate,” “estimate,” “project,” or “continue” or comparable terminology used in connection with any discussion of future operating results or financial performance identify forward-looking statements. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this prospectus. All forward-looking statements reflect our present expectation of future events and are subject to a number of important factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. The factors listed in the “Risk Factors” section of this prospectus, as well as any cautionary language in this prospectus, provide examples of these risks and uncertainties. The safe harbor for forward-looking statements is not applicable to this offering pursuant to Section 27A of the Securities Act of 1933.

7

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. Currently, shares of our common stock are not publicly traded. In the event that shares of our common stock become publicly traded, the trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

RISKS RELATED TO OUR FINANCIAL CONDITION AND OUR BUSINESS

Because we have a limited operating history, you may not be able to accurately evaluate our operations.

We have had limited operations to date and have not generated any revenues. Therefore, we have a limited operating history upon which to evaluate the merits of investing in our company. Potential investors should be aware of the difficulties normally encountered by new companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the operations that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to the ability to generate sufficient cash flow to operate our business, and additional costs and expenses that may exceed current estimates. We expect to incur significant losses into the foreseeable future. We recognize that if the effectiveness of our business plan is not forthcoming, we will not be able to continue business operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Our investors may lose their entire investment because our financial status creates a doubt whether we will continue as a going concern.

Our auditors, in their opinion dated December 30, 2014 have stated that currently we do not have sufficient cash nor do we have a significant source of revenues to cover our operational costs and allow us to continue as a going concern. We seek to raise operating capital to implement our business plan in an offering of our common stock.

We were incorporated on September 8, 2014. Our operations, to date, have been devoted primarily to startup and development activities. Currently, we have no fully-developed revenue generating mobile applications. Because of our limited operating history, it is difficult to predict our capital needs on a monthly, quarterly or annual basis. We have raised $35,000 to date, and we have used $15,000 of those funds on the Hotchek app, and expect to use the remaining funds on the expenses associated with this offering. As such, we will have no capital available to us if we are unable to raise money from this offering or find alternate forms of financing, which we do not have in place at this time. Our plan specifies a minimum amount of $26,250 in additional operating capital to operate for the next twelve months. If we are unable to raise $26,250 from this offering, our business will be in jeopardy and we could be formed to suspend our operations or go out of business. As such, there can be no assurance that this offering will be successful. You may lose your entire investment.

We are dependent on outside financing for continuation of our operations.

Because we have not generated revenues and currently operate at a loss, we are completely dependent on the continued availability of financing in order to continue our business. There can be no assurance that financing sufficient to enable us to continue our operations will be available to us in the future.

We need the proceeds from this offering to start our operations. Our offering has no minimum. Specifically, there is no minimum number of shares that needs to be sold in this offering for us to access the funds. Given that the offering is a best effort, self-underwritten offering, we cannot assure you that all or any shares will be sold. We have no firm commitment from anyone to purchase all or any of the shares offered. We may need additional funds to complete further development of our business plan to achieve a sustainable sales level where ongoing operations can be funded out of revenues. We anticipate that we must raise the minimum capital of $26,250 to commence operations for the 12-month period and expenses for maintaining a reporting status with the SEC. There is no assurance that any additional financing will be available or if available, on terms that will be acceptable to us. We have not taken any steps to seek additional financing.

8

Our failure to obtain future financing or to produce levels of revenue to meet our financial needs could result in our inability to continue as a going concern and, as a result, our investors could lose their entire investment.

We intend to partner with online mobile application retailers to market and distribute our products and thus to generate our revenues. The loss of, a change in or the failure to create any significant relationships with online mobile application retailers would cause us to lose access to their subscribers and thus not achieve or maintain revenues.

Apple’s “App Store” and Android App stores are the primary distribution, marketing, promotion and payment platform for our future mobile Apps. We anticipate generating a substantial proportion of our revenue from the sale of mobile Apps through these platforms and any deterioration in our anticipated relationship with Apple or Android App stores would harm our business and adversely affect the value of our stock.

We are subject to Apple and Android stores’ standard terms and conditions for application developers, which govern the promotion, distribution and operation of mobile Apps on their platforms. Our business would be harmed if:

§ Apple or Android Stores discontinue or limit access to their platform by us and other App developers;

§ Apple or Android Stores modify their terms of service or other policies, including fees charged to, or other restrictions on, us or other application developers, or Apple or Android Stores change how the personal information of its users is made available to application developers on their respective platforms or shared by users;

§ Apple or Android Stores establish more favorable relationships with one or more of our competitors; or

§ Apple or Android Stores develop their own competitive offerings.

If Apple or Android Stores lose their market position or otherwise fall out of favor with mobile users, we would need to identify alternative channels for marketing, promoting and distributing our Apps, which would consume substantial resources and may not be effective. In addition, Apple or Android Stores have broad discretion to change their terms of service and other policies with respect to us and other developers, and those changes may be unfavorable to us. Any such changes in the future could significantly alter how our App users experience our Apps or interact within our Apps, which may harm our business.

We may not be able to develop, establish and maintain our applications on all mobile operating systems.

We intend to ensure that our applications are compatible with as many mobile operating systems as possible, however, each operating system has different technical requirements. Whether our applications are adapted to support a particular operating system will depend on the size of the user base and whether a distribution agreement is in place. Some operating systems may not have a sufficiently large or desirable user base to off-set the cost of adaptation.

Equally, the operating systems are undergoing constant refinement and improvement. Significant changes to an operating system may prevent our applications from working properly, or at all. If we are unable to adapt or maintain our applications on an operating system, the user base will not be able to run our applications or view our content. This could adversely affect our business and results of operations, thereby impacting the value of any investment you may make in our securities.

The mobile applications industry is and will likely continue to be characterized by rapid technological changes which will require us to develop new enhancements or versions of our proposed products or could even render our proposed products obsolete.

9

The market for content and applications for mobile devices is characterized by rapid technological changes with frequent variations in user requirements and preferences, frequent new product and service introductions embodying new technologies and the emergence of new industry standards and practices. Products using emerging industry standards could make our proposed products less attractive.

Our success will depend in part on our ability to enhance our proposed products, develop or incorporate new technologies, respond to emerging industry standards and practices and license leading technologies that will be useful in our business in a cost effective manner. We may not be able to successfully use new technologies or adapt our current technologies to new customer requirements or emerging industry standards. The introduction of new products embodying new technologies or the emergence of new industry standards could render our proposed products obsolete, unmarketable or uncompetitive.

Furthermore, our competitors may have access to technology not available to us, which may enable them to produce products of greater interest to consumers at a more competitive price. Failure to respond in a timely and cost-effective manner may result in serious harm to our business and operating results. Consequently, our success will depend on our ability to develop and market products that respond to technological advances, evolving industry standards and changing consumer preferences in a timely manner.

If we fail to generate revenues through the sale of advertising, our business plan may not be successful.

We expect to monetize our apps through the sale of advertising, initially, through mobile advertising aggregators, and as we grow our product line, through broker advertising agreements with ad agencies and direct agreements with interested companies. If we are unable to actualize this aspect of our strategy, we may not be able to generate sufficient revenues to grow our business as we have planned.

Our growth prospects will suffer if we are unable to develop successful apps for mobile platforms.

Developing apps for mobile platforms is an important component of our strategy. We have devoted and we expect to continue to devote substantial resources to the development of our mobile apps, and we cannot guarantee that we will continue to develop such apps that appeal to consumers. The uncertainties we face include:

§ we have relatively limited experience working with mobile platform providers and other partners whose cooperation we may need in order to be successful;

§ we may encounter difficulties getting new apps and apps updates accepted by consumers; and

§ we may encounter difficulty in developing new apps or redesigning existing Apps for mobile platforms that a sufficient number of consumers will pay for or will support.

These and other uncertainties make it difficult to know whether we will succeed in continuing to develop commercially viable apps. If we do not succeed in doing so, our growth prospects will suffer.

Actual or perceived security vulnerabilities in mobile devices could negatively affect our business.

The security of mobile devices and wireless networks is crucial to our business. Viruses, worms and other malicious software programs that attack mobile devices and wireless networks have been developed and deployed. Security threats could lead some mobile subscribers to reduce or delay their purchases of mobile content and applications in an attempt to minimize the threat. Wireless carriers and device manufacturers may also spend more on protecting their devices and networks from attack. This could delay adoption of new mobile devices which tend to include more features and functionalities that facilitate increased use of mobile content and applications. In any such instance, actual or perceived security threats and the reactions to those threats could negatively affect our results of operations.

10

Failure of third-party service providers upon which we rely could adversely affect our business and result in the loss of your investment.

We may rely on certain third-party service providers, to provide the programming and additional technical and artistic services for the products we create. Any interruption in these third-party services, or deterioration in their performance or quality, could adversely affect our business. If its arrangement with any third party is terminated, it may not be able to find alternative systems or service providers on a timely basis or on commercially reasonable terms. This could have a material adverse effect on its business, financial condition, results of operations and cash flows.

We operate in a digital content market where piracy is widespread.

Our business strategy is based upon users paying for access to our content or downloads of our applications. If users believe they can access the same or similar content for free via other means including piracy, they may be unwilling to pay for our proposed products. If users are able to obtain our content or download our applications without paying for them, our business and results of operations will be adversely affected.

We operate in a highly competitive environment and if we are unable to compete with our competitors, our business, financial condition, results in operations, cash flows and prospects could be materially adversely affected.

We operate in a highly competitive environment. The mobile application industry is highly competitive, with low barriers to entry and we expect more companies to enter the sector and a wider range of mobile apps and related products and services to be introduced. Our competitors that develop apps vary in size and include both publicly-traded companies and privately-held companies. These companies may already have an established market in our industry, may have significantly greater financial and other resources than us and may have been developing their products and services longer than we have been developing ours. This highly competitive environment could materially adversely affect our business, financial condition, results of operations, cash flows and prospects. It is also likely that we may be forced to lower the prices of our Apps to keep up with competition, which will affect our ability to be profitable.

Defects in our mobile apps may adversely affect our business.

Tools, code, subroutines and processes contained within our mobile apps may contain defects when introduced and also when updates and new versions are released. Our introduction of mobile apps with defects or quality problems may result in adverse publicity, product returns, reduced orders, uncollectible or delayed accounts receivable, product redevelopment costs, loss of or delay in market acceptance of our products or claims by customers or others against us. Such problems or claims may have a material and adverse effect on our business, prospects, financial condition and results of operations.

Failure by us to maintain the proprietary nature of our technology and intellectual property could have a material adverse effect on our business, operating results, financial condition, stock price, and on our ability to compete effectively.

We currently have no patents or trademarks on our brand name and have not and do not intend to seek protection for our brand name or our mobile applications at this time; however, as business develops and operations continue, we may seek such protection. Despite efforts to protect our proprietary rights, such as our brand and service names, since we have no patent or trademark rights unauthorized persons may attempt to copy aspects of our business, including our web site design, services, product information and sales mechanics or to obtain and use information that we regards as proprietary. Any encroachment upon our proprietary information, including the unauthorized use of our brand name, the use of a similar name by a competing company or a lawsuit initiated against us for infringement upon another company's proprietary information or improper use of their trademark, may affect our ability to create brand name recognition, cause customer confusion and/or have a detrimental effect on our business.

11

Any future issued patents or trademarks may not afford sufficient protection against competitors with similar technologies or processes, and the possibility exists that we may infringe upon third party patents or trademarks of others. In addition, there is a risk that others may independently develop proprietary technologies and processes, which are the same as, substantially equivalent or superior to ours, or become available in the market at a lower price.

In addition, foreign laws treat the protection of proprietary rights differently from laws in the United States and may not protect our proprietary rights to the same extent as U.S. laws. The failure of foreign laws or judicial systems to adequately protect our proprietary rights or intellectual property may have a material adverse effect on our business, operations, financial results and stock price.

There is a risk that we have infringed or in the future will infringe patents or trademarks owned by others, that we will need to acquire licenses under patents or trademarks belonging to others for technology potentially useful or necessary to us, and that licenses will not be available to us on acceptable terms, if at all.

We may have to litigate to enforce our proprietary protections or to determine the scope and validity of other parties’ proprietary rights. Litigation could be very costly and divert management’s attention. An adverse outcome in any litigation may have a severe negative effect on our financial results and stock price. To determine the priority of inventions, we may have to participate in interference proceedings declared by the United States Patent and Trademark Office or oppositions in foreign patent and trademark offices, which could result in substantial cost and limitations on the scope or validity of our proprietary protections.

Compliance with changing regulation of corporate governance and public disclosure may result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and new SEC regulations, are creating uncertainty for companies such as ours. These new or changed laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, and as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We are committed to maintaining high standards of corporate governance and public disclosure. As a result, we intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, our reputation may be harmed.

If we fail to attract and retain qualified senior executive and key technical personnel, our business will not be able to expand.

We are dependent on the continued availability of Jose Armando Acosta Crespo, and the availability of new employees to implement our business plans. The market for skilled employees is highly competitive, especially for employees in technical fields. Although we expect that our compensation programs will be intended to attract and retain the employees required for us to be successful, there can be no assurance that we will be able to retain the services of all our key employees or a sufficient number to execute our plans, nor can there be any assurance we will be able to continue to attract new employees as required.

Our personnel may voluntarily terminate their relationship with us at any time, and competition for qualified personnel, especially software engineers, is intense. The process of locating additional personnel with the combination of skills and attributes required to carry out our strategy could be lengthy, costly and disruptive.

If we lose the services of key personnel, or fail to replace the services of key personnel who depart, we could experience a severe negative effect on our financial results and stock price. In addition, there is intense competition for highly qualified software engineering and marketing personnel in the locations where we principally operate.

12

The loss of the services of any key software engineering, marketing or other personnel or our failure to attract, integrate, motivate and retain additional key employees could have a material adverse effect on our business, operating and financial results and stock price.

If we fail to comply with the new rules under the Sarbanes-Oxley Act related to accounting controls and procedures, or if material weaknesses or other deficiencies are discovered in our internal accounting procedures, our stock price could decline significantly.

We are exposed to potential risks from legislation requiring companies to evaluate internal controls under Section 404(a) of the Sarbanes-Oxley Act of 2002. As a smaller reporting company and emerging growth company, we will not be required to provide a report on the effectiveness of its internal controls over financial reporting until our second annual report, and we will be exempt from auditor attestation requirements concerning any such report so long as we are an emerging growth company or a smaller reporting company. We have not yet evaluated whether our internal control procedures are effective and therefore there is a greater likelihood of material weaknesses in our internal controls, which could lead to misstatements or omissions in our reported financial statements as compared to issuers that have conducted such evaluations.

If material weaknesses and deficiencies are detected, it could cause investors to lose confidence in our company and result in a decline in our stock price and consequently affect our financial condition. In addition, if we fail to achieve and maintain the adequacy of our internal controls, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to helping prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock could drop significantly. In addition, we cannot be certain that additional material weaknesses or significant deficiencies in our internal controls will not be discovered in the future.

Insiders will continue to have substantial control over us and our policies after this offering and will be able to influence corporate matters.

Jose Armando Acosta Crespo, whose interests may differ from other stockholders, has the ability to exercise significant control over us. Presently, he beneficially owns 100% of our common stock, and, assuming 100% of this offering is sold, he will continue to beneficially own approximately 57%. He is able to exercise significant influence over all matters requiring approval by our stockholders, including the election of directors, the approval of significant corporate transactions, and any change of control of our company. He could prevent transactions, which would be in the best interests of the other shareholders. Mr. Crespo’s interests may not necessarily be in the best interests of the shareholders in general.

We may become subject to government regulation and legal uncertainties that could reduce demand for our products and services or increase the cost of doing business, thereby adversely affecting our financial results.

We are not currently subject to direct regulation by any domestic or foreign governmental agency, other than regulations applicable to businesses generally and laws or regulations directly applicable to Internet commerce. However, due to the increasing popularity and use of mobile applications, it is possible that a number of laws and regulations may become applicable to us or may be adopted in the future with respect to mobile applications covering issues such as: user privacy; taxation; right to access personal data; copyrights; distribution; and characteristics and quality of services.

The applicability of existing laws governing issues such as property ownership, copyrights and other intellectual property issues, encryption, taxation, libel, export or import matters and personal privacy to mobile applications is uncertain. For example, laws relating to the liability of providers of online services for activities of their users and other third parties are currently being tested by a number of claims, including actions based on invasion of privacy and other torts, unfair competition, copyright and trademark infringement, and other theories based on the nature and content of the materials searched, the ads posted or the content provided by users. It is difficult to predict how existing laws will be applied to our business and the new laws to which we may become subject.

13

If we are not able to comply with these laws or regulations or if we become liable under these laws or regulations, we could be directly harmed, and we may be forced to implement new measures to reduce our exposure to this liability. This may require us to expend substantial resources or to modify our Apps or custom development services, which would harm our business, financial condition and results of operations. In addition, the increased attention focused upon liability issues as a result of lawsuits and legislative proposals could harm our reputation or otherwise impact the growth of our business. Any costs incurred as a result of this potential liability could harm our business and operating results.

Because we are considered to be a “shell company” under applicable securities laws, investors may not be able to rely on the resale exemption provided by Rule 144 of the Securities Act. As a result, investors may not be able to resell our shares and could lose their entire investment.

We are considered to be a “shell company” under Rule 405 of Regulation C of the Securities Act. A "shell company" is a company with either no or nominal operations or assets, or assets consisting solely of cash and cash equivalents. As a result, our investors are not allowed to rely on Rule 144 of the Securities Act for a period of one year from the date that we cease to be a shell company. Because investors may not be able to rely on an exemption for the resale of their shares other than Rule 144, and there is no guarantee that we will cease to be a shell company, they may not be able to re-sell our shares in the future and could lose their entire investment as a result.

Because we are considered to be a “shell company” under applicable securities laws, we are subject to additional disclosure requirements if we acquire or dispose of significant assets in the course of our business. We will incur additional costs in meeting these requirements, which will adversely impact our financial performance and, therefore, the value of your investment.

Because we are considered to be a "shell company" under Rule 405 of Regulation C of the Securities Act, we are subject to additional disclosure requirements if we entered into a transaction which results in a significant acquisition or disposition of assets. In such a situation, we must provide prospectus-level, detailed disclosure regarding the transaction, as well as detailed financial information. In order to comply with these requirements, we will incur additional legal and accounting costs, which will adversely impact our results of operations. As a result, the value of an investment in our shares may decline as a result of these additional costs.

Rule 144 Safe Harbor is unavailable for the resale of shares issued by us unless and until we cease to be a shell company and have satisfied the requirements of Rule 144(i).

We are a "shell company" as defined by Rule 12b-2 promulgated under the Exchange Act. Accordingly, the securities in this offering can only be resold through registration under the Securities Act, meeting the safe harbor provisions of paragraph (i) of Rule 144, or in reliance upon Section 4(1) of the Securities Act of 1933 for non-affiliates.

Pursuant to Rule 144, one year must elapse from the time a "shell company" ceases to be a "shell company" and files Form 10 information with the SEC, during which time the issuer must remain current in its filing obligations, before a restricted shareholder can resell their holdings in reliance on Rule 144.

The term "Form 10 information" means the information that is required by SEC Form 10, to register under the Exchange Act each class of securities being sold under Rule 144. The Form 10 information is deemed filed when the initial filing is made with the SEC. Under Rule 144, restricted or unrestricted securities, that were initially issued by a reporting or non-reporting shell company or a company that was at any time previously a reporting or non-reporting shell company, can only be resold in reliance on Rule 144 if the following conditions are met: (1) the issuer of the securities that was formerly a reporting or non-reporting shell company has ceased to be a shell company; (2) the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act; (3) the issuer of the securities has filed all reports and material required to be filed under Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding twelve months (or shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and (4) at least one year has elapsed from the time the issuer filed the current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company

14

As an “emerging growth company” under the JOBS Act, we are permitted to rely on exemptions from certain disclosure requirements.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

§ have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

§ comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

§ submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and

§ disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive’s compensation to median employee compensation.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period. Even if we no longer qualify for the exemptions for an emerging growth company, we may still be, in certain circumstances, subject to scaled disclosure requirements as a smaller reporting company. For example, smaller reporting companies, like emerging growth companies, are not required to provide a compensation discussion and analysis under Item 402(b) of Regulation S-K or auditor attestation of internal controls over financial reporting.

Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Because our principal assets will be located in the Dominican Republic, outside of the United States, and Jose Armando Acosta Crespo, our sole officer and director, resides outside of the United States, it may be difficult for investors to enforce any rights based on U.S. Securities Laws against us and/or Mr. Crespo, or to enforce a judgment rendered by a court in the United States against us and/or Mr. Crespo.

Our principal operations and assets are located in the Dominican Republic, outside of the United States, and Jose Armando Acosta Crespo, our sole officer and director, is a non-resident of the United States he is a resident of the Dominican Republic. Therefore, it may be difficult to effect service of process on Mr. Crespo in the United States, and it may be difficult to enforce any judgment rendered against Mr. Crespo. As a result, it may be difficult or impossible for an investor to bring an action against Mr. Crespo, in the event that an investor believes that such investor’s rights have been infringed under the U.S. securities laws, or otherwise. Even if an investor is successful in bringing an action of this kind, the laws of the Dominican Republic may render that investor unable to enforce a judgment against the assets of Mr. Crespo. As a result, our shareholders may have more difficulty in protecting their interests through actions against our management, director or major shareholder, compared to shareholders of a corporation doing business and whose officers and directors reside within the United States.

15

Additionally, because of our assets are located outside of the United States, they will be outside of the jurisdiction of United States courts to administer, if we become subject of an insolvency or bankruptcy proceeding. As a result, if we declare bankruptcy or insolvency, our shareholders may not receive the distributions on liquidation that they would otherwise be entitled to if our assets were to be located within the United States under United States bankruptcy laws.

Because our current sole officer and director devotes a limited amount of time to our company, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Jose Armando Acosta Crespo, our sole officer and director, currently devotes approximately twenty hours per week providing management services to us. While he presently possesses adequate time to attend to our interest, it is possible that the demands on his from other obligations could increase, with the result that he would no longer be able to devote sufficient time to the management of our business. The loss of Mr. Crespo to our company could negatively impact our business development.

Our sole officer and director does not have any prior experience conducting a best-efforts offering or management a public company.

Our sole executive officer and director does not have any experience conducting a best-effort offering or managing a public company. Consequently, we may not be able to raise any funds or run our public company successfully. If we are not able to raise sufficient funds, we may not be able to fund our operations as planned, and our business will suffer and your investment may be materially adversely affected. Also, our executive’s officer’s and director’s lack of experience of managing a public company could cause you to lose some or all of your investment.

RISKS RELATED TO OUR SECURITIES AND THIS OFFERING

There is no minimum number of shares that have to be sold in order for this offering to proceed.

We do not have a minimum amount of funding set in order to proceed with the offering. If not enough money is raised to begin operations, you might lose your entire investment because we may not have enough funds to implement our business plan.

We are selling the shares in this offering without an underwriter and may be unable to sell any shares.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell our shares through our President, who will receive no commissions. He will offer the shares to friends, family members, and business associates, however, there is no guarantee that he will be able to sell any of the shares. Unless he is successful in selling all of the shares and we receive the proceeds from this offering, we may have to seek alternative financing to implement our business plan. We do not have any plans where to seek this alternative financing at present time.

If a market for our common stock does not develop, shareholders may be unable to sell their shares.

Prior to this offering, there has been no public market for our securities and there can be no assurance that an active trading market for the securities offered herein will develop after this offering, or, if developed, be sustained. We anticipate that, upon completion of this offering, the common stock will be eligible for quotation on the OTCBB or OTCQB. If for any reason, however, our securities are not eligible for initial or continued quotation on the OTCBB or OTCQB or a public trading market does not develop, purchasers of the common stock may have difficulty selling their securities should they desire to do so and purchasers of our common stock may lose their entire investment if they are unable to sell our securities.

16

Our common stock price may be volatile and could fluctuate widely in price, which could result in substantial losses for investors.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including:

- technological innovations or new products and services by us or our competitors;

- government regulation of our products and services;

- the establishment of partnerships with other technology companies;

- intellectual property disputes;

- additions or departures of key personnel;

- sales of our common stock

- our ability to integrate operations, technology, products and services;

- our ability to execute our business plan;

- operating results below expectations;

- loss of any strategic relationship;

- industry developments;

- economic and other external factors; and

- period-to-period fluctuations in our financial results.

Because we are a development stage company with nominal revenues to date, you should consider any one of these factors to be material. Our stock price may fluctuate widely as a result of any of the above.

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Upon effectiveness of this registration statement, we will be subject to the 15(d) reporting requirements under the Securities Exchange Act of 1934, which does not require a company to file all the same reports and information as fully reporting companies.

Upon effectiveness of this registration statement, we will be subject to the 15(d) reporting requirements according to the Securities Exchange Act of 1934. As a Section 15(d) filer, we will be required to file quarterly and annual reports during the fiscal year in which our registration statement is declared effective; however, such duty to file reports shall be suspended as to any fiscal year, other than the fiscal year within which such registration statement became effective, if, at the beginning of such fiscal year the securities of each class are held of record by less than 300 persons. In addition, as a filer subject to Section 15(d) of the Exchange Act, we are not required to prepare proxy or information statements; our common stock will not be subject to the protection of the going private regulations; we will be subject to only limited portions of the tender offer rules; our officers, directors, and more than ten (10%) percent shareholders are not required to file beneficial ownership reports about their holdings in our company; that these persons will not be subject to the short-swing profit recovery provisions of the Exchange Act; and that more than five percent (5%) holders of classes of our equity securities will not be required to report information about their ownership positions in the securities. As such, shareholders will not have access to certain material information which would otherwise be required if it was a fully reporting company pursuant to an Exchange Act registration.

17

We have not paid cash dividends in the past and do not expect to pay cash dividends in the future on our common stock. Any return on investment may be limited to the value of our common stock.

We have never paid cash dividends on our common stock and do not anticipate paying cash dividends in the foreseeable future. The payment of cash dividends on our common stock will depend on earnings, financial condition and other business and economic factors at such time as the board of directors may consider relevant. If we do not pay cash dividends, our common stock may be less valuable because a return on your investment will only occur if its stock price appreciates.

In the event that we are unable to sell sufficient shares of common stock we may need additional capital in the future, which may not be available to us on favorable terms, or at all, and the raising of additional capital at a later time may dilute your ownership of our common stock.

We are conducting a best-efforts offering. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The amount raised may be minimal and there is no assurance that we will be able to raise sufficient amount to cover our expenses.

If we are able to sell the maximum of shares in this offering, we will receive net proceeds $85,000, which we believe will be sufficient to meet our expected needs for working capital and capital expenditures to fully implement and carry out our business plan for the next twelve months. If we need to raise capital in the future, through private or public offerings, depending on the terms of the offerings, such sales of additional shares may dilute the holdings of investors who purchase our shares in this offering beyond the dilution figures we have presented in this prospectus. We cannot be certain that additional financing through private placements of our stock or borrowing will be available to us when required, on favorable terms, or at all. Our inability to obtain adequate capital or financing may limit our ability to achieve the level of corporate growth that we believe to be necessary to succeed in our business or may require us to cease business operations entirely.

We must raise at least 25% of the offering to pursue our business plan on a limited basis.

We have no alternative plan of operation if at least 25% of the shares offered herein are not sold. Those investing in our common stock through this offering are taking substantial risk in that they may lose their entire investment if we do not sell at least 25% of the shares offered (See Use of Proceeds).

Investors purchasing common stock less than our 25% ($6,250 net after offering cost of $20,000) threshold of the offering may lose their entire investment.

We may fail and cease operations all together if 25% or $26,250 of common stock is not sold. Therefore, investors who purchase stock at the beginning of our offering are at greater risk of losing their entire investment than those investing after the 25% threshold is made.

Our management will have broad discretion over the use of the proceeds we receive in this offering and might not apply the proceeds in ways that increase the value of your investment.

The offering has no escrow, and investor funds may be used on receipt. There is no escrow of any funds received by us in this offering, and any funds received may be used by us for any corporate purpose as the funds are received.

We intend to use the money raised in this offering as detailed in “Use of Proceeds” section of this prospectus. However, our management has the discretion to use the money as it sees fit, and may diverge from using the proceeds of this offering as explained herein. The use of proceeds may not be used to increase the value of your investment.

18

As a new investor, you will experience substantial dilution as a result of future equity issuances.

In the event we are required to raise additional capital it may do so by selling additional shares of common stock thereby diluting the shares and ownership interests of existing shareholders.

Our shares may be considered a “penny stock” within the meaning of Rule 3a-51-1 of the Securities Exchange Act which will affect your ability to sell your shares; “penny stocks” often suffer wide fluctuations and have certain disclosure requirements which make resale in the secondary market difficult.

Our shares will be subject to the Penny Stock Reform Act, which will affect your ability to sell your shares in any secondary market, which may develop. If our shares are not listed on a nationally approved exchange or NASDAQ, do not meet certain minimum financing requirements, or have a bid price of at least $5.00 per share, they will likely be defined as a “penny stock”. Broker-dealer practices, in connection with transactions in “penny stocks”, are regulated by the SEC. Rules associated with transactions in penny stocks include the following:

· the delivery of standardized risk disclosure documents;

· the provision of other information such as current bid/offer quotations, compensation to be provided broker-dealer and salesperson, monthly accounting for penny stocks held in the customers account;

· written determination that the penny stock is a suitable investment for purchaser;

· written agreement to the transaction from purchaser; and

· a two-business day delay prior to execution of a trade

These disclosure requirements and the wide fluctuations that “penny stocks” often experience in the market may make it difficult for you to sell your shares in any secondary market, which may develop.

USE OF PROCEEDS

The net proceeds to us from the sale of the shares of common stock offered are estimated to be approximately $85,000 if all shares in this offering are sold, provided the offering expenses are $20,000.

The following table shows our use of net proceeds if 25%, 50%, 75%, and 100% of the shares are sold. There can be no assurance that any shares will be sold in this offering. We intend to raise $105,000 selling 15,000,000 shares of our common stock at $0.007 per share.

|

|

25% |

50% |

75% |

100% |

|

|

|

|

|

|

|

Gross Proceeds |

$26,250 |

$52,500 |

$78,750 |

$105,000 |

|

Minus Offering Expenses |

$20,000 |

$20,000 |

$20,000 |

$20,000 |

|

Net Proceeds |

$26,250 |

$52,500 |

$78,750 |

$105,000 |

|

Current Funds(1) |

$20,000 |

$20,000 |

$20,000 |

$20,000 |

|

USE OF NET PROCEEDS |

|

|

|

|

|

Legal and accounting(2) |

$25,000 |

$25,000 |

$25,000 |

$25,000 |

|

Sales and Marketing (3) |

$0 |

$6,000 |

$17,250 |

$25,000 |

|

Product Development(4) |

$0 |

$10,000 |

$25,000 |

$25,000 |

|

Website Development(5) |

$0 |

$10,000 |

$10,000 |

$10,000 |

|

Working capital (6) |

$1,250 |

$1,500 |

$1,500 |

$20,000 |

|

Total |

|

|

|

|

19

(1) Current Funds: we have available funds to cover the offering expenses from the sale of stock to our officer and director of $20,000.

(2) Legal and Accounting: A portion of the proceeds will be used to pay legal, accounting, and related compliance costs in connection with our future needs.

(3) Sales and Marketing: A portion of the proceeds will be used to pay Sales and Marketing expenses to include sales rep commissions, advertising, PR, promotional and marketing material and media.

(4) Product Development: A portion of the proceeds will be used to continuously improve on the core technology used in our Apps and the ongoing funding of new product development.

(5) Website Development: A portion of the proceeds will be used to develop our website.

(6) Working Capital: A portion of the proceeds will be used for working capital needs.

There are no arrangements or plans to use underwriters or broker/dealers to offer our common stock. However, we reserve the right to utilize the services of licensed broker/dealers and compensate these broker/dealers with a commission not to exceed 10% of the proceeds raised.

The allocation of the net proceeds of the offering set forth above represents our best estimates based upon our current plans and certain assumptions regarding industry and general economic conditions and our future revenues and expenditures. If any of these factors change, we may find it necessary or advisable to reallocate some of the proceeds within the above-described categories. Working capital includes payroll, office expenses and supplies, insurance, and other general expenses.

DETERMINATION OF OFFERING PRICE

As of the date of this prospectus, there is no public market for our common stock. The offering price of $0.007 per share was determined arbitrarily by us and should not be considered an indication of the actual value of our company or our shares of common Stock. It was not based on any established criteria of value and bears no relation to our assets, book value, earnings or net worth. In determining the offering price and the number of shares to be offered, we considered such factors as the price paid by our initial investor, our financial condition, our potential for profit and the general condition of the securities market.

We decided on the offering price of $0.007 per share because we believe that the price of $0.007 per share will be the easiest price at which to sell the shares. The price of the common stock that will prevail in any market that develops after the offering, if any, may be higher or lower than the price you paid. There is also no assurance that an active market will ever develop in our securities. You may not be able to resell any shares you purchased in this offering. Our common stock has never been traded on any exchange or market prior to this offering.

DILUTION

The price of the current offering is fixed at $0.007 per common share. This price is significantly higher than the price paid by our sole director and officer for common equity since our inception on September 8, 2014. Jose Armando Acosta Crespo, our sole officer and director, paid $0.001 per share for the 20,000,000 common shares he owns.

As of November 30, 2014, the historical net tangible book value was $0.00075 per share. Historical net tangible book value per share of common stock is equal to our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding as of November 30, 2014.

Assuming completion of the offering, there will be up to 35,000,000 common shares outstanding. The following table illustrates the per common share dilution that may be experienced by investors at various funding levels.

20

|

Funding Level |

$ |

105,000 |

$ |

78,750 |

$ |

52,500 |

$ |

26,250 |

|

Offering price |

$ |

.007 |

$ |

.007 |

$ |

.007 |

$ |

.007 |

|

Net tangible book value per common share before offering |

$ |

.00075 |

$ |

.00075 |

$ |

.00075 |

$ |

.00075 |

|

Increase per common share attributable to investors |

$ |

.00265 |

$ |

.00225 |

$ |

.00165 |

$ |

.00095 |

|

Pro forma net tangible book value per common share after offering |

$ |

.0034 |

$ |

.003 |

$ |

.0024 |

$ |

.0017 |

|

Dilution to investors |

$ |

.0036 |

$ |

.004 |

$ |

.0046 |

$ |

.0053 |

|

Dilution as a percentage of offering price |

% |

51 |

% |

57 |

% |

65 |

% |

75 |

PLAN OF DISTRIBUTION

We have 20,000,000 shares of common stock issued and outstanding as of the date of this prospectus. We are registering an additional 15,000,000 shares of our common stock for sale at the price of $0.007 per share.

In connection with our selling efforts in the offering, Jose Armando Acosta Crespo will not register as a broker-dealer pursuant to Section 15 of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an offering of the issuer’s securities. Mr. Crespo is not subject to any statutory disqualification, as that term is defined in Section 3(a) (39) of the Exchange Act. Mr. Crespo will not be compensated in connection with his participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Mr. Crespo is not, nor has he been within the past 12 months, a broker or dealer, and he is not, nor has he been within the past 12 months, an associated person of a broker or dealer. At the end of the offering, Mr. Crespo will continue to primarily perform substantial duties for us or on our behalf otherwise than in connection with transactions in securities. Mr. Crespo will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

We plan to sell the shares in this offering through Mr. Crespo, who intends to offer them to friends, family members and business acquaintances using this prospectus and a subscription agreement as the only materials to offer potential investors.

As Mr. Crespo will sell the shares being offered pursuant to this offering, Regulation M prohibits us and our officers and directors from certain types of trading activities during the time of distribution of our securities. Specifically, Regulation M prohibits our officer and director from bidding for or purchasing any common stock or attempting to induce any other person to purchase any common stock, until the distribution of our securities pursuant to this offering has ended.

We will receive all proceeds from the sale of the 15,000,000 shares being offered. The price per share is fixed at $0.007 for the duration of this offering. Although our common stock is not listed on a public exchange or quoted over-the-counter, we intend to seek to have our shares of common stock quoted on the OTCBB or OTCQB. In order to be quoted on the OTCBB or OTCQB, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, nor can there be any assurance that such an application for quotation will be approved. However, sales by us must be made at the fixed price of $0.007 per share.

21

We will not offer our shares for sale through underwriters, dealers, agents or anyone who may receive compensation in the form of underwriting discounts, concessions or commissions from us and/or the purchasers of the shares for whom they may act as agents. The shares of common stock sold by us may be occasionally sold in one or more transactions; all shares sold under this prospectus will be sold at a fixed price of $0.007 per share.

State Securities – Blue Sky Laws

There is no established public market for our common stock, and there can be no assurance that any market will develop in the foreseeable future. Transfer of our common stock may also be restricted under the securities or securities regulations laws promulgated by various states and foreign jurisdictions, commonly referred to as "Blue Sky" laws. Absent compliance with such individual state laws, our common stock may not be traded in such jurisdictions. Because the securities registered hereunder have not been registered for resale under the blue sky laws of any state, the holders of such shares and persons who desire to purchase them in any trading market that might develop in the future, should be aware that there may be significant state blue-sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. Accordingly, investors may not be able to liquidate their investments and should be prepared to hold the common stock for an indefinite period of time.

In order to comply with the applicable securities laws of certain states, the securities will be offered or sold in those only if they have been registered or qualified for sale; an exemption from such registration or if qualification requirement is available and with which we have complied.

In addition and without limiting the foregoing, we will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the period of time when this Registration Statement is effective.