Attached files

| file | filename |

|---|---|

| 8-K - CHIMERA INVESTMENT CORPORATION 8-K - CHIMERA INVESTMENT CORP | a51049496.htm |

| EX-99.1 - EXHIBIT 99.1 - CHIMERA INVESTMENT CORP | a51049496ex991.htm |

Q4 2014 Supplemental Financial Information March 2, 2015

Disclaimer This material is not intended to be exhaustive, is preliminary in nature and may be subject to change. In addition, much of the information contained herein is based on various assumptions (some of which are beyond the control of Chimera Investment Corporation, the “Company”) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may,” “would,” “projected,” “will” or similar expressions, or variations on those terms or the negative of those terms. The Company’s forward-looking statements are subject to numerous risks, uncertainties and other factors. Furthermore, none of the financial information contained in this material has been audited or approved by the Company’s independent registered public accounting firm.

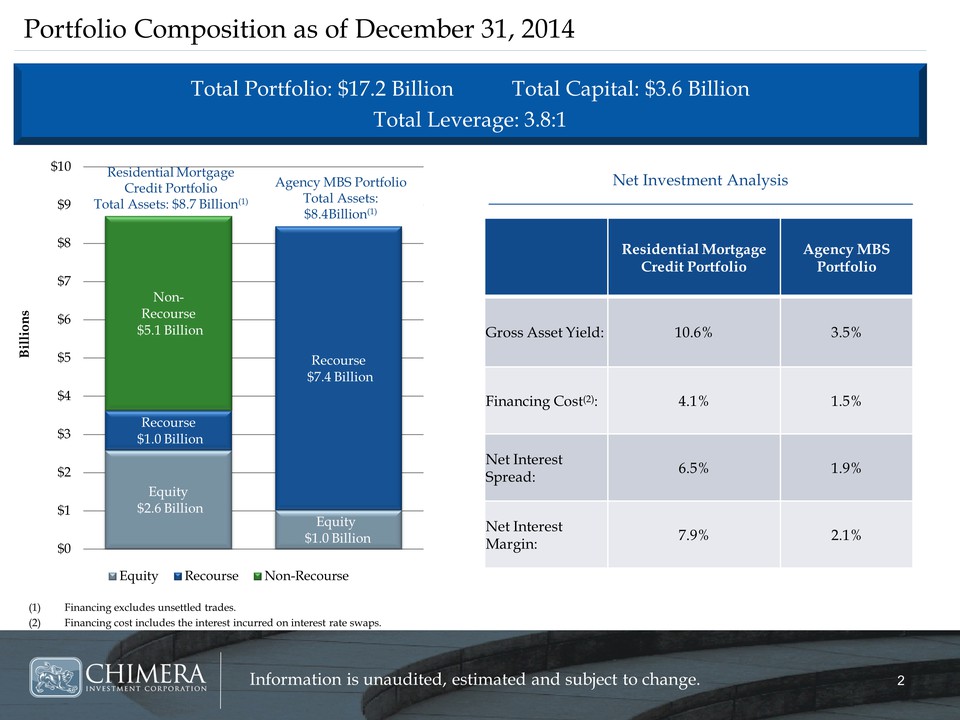

CONFERENCEN AM EGOESHERE2 2Information is unaudited, estimated and subject to change. Portfolio Composition as of December 31, 2014 Equity $2.6 Billion Equity $1.0 Billion Recourse $1.0 Billion Recourse $7.4 Billion Non-Recourse $5.1 Billion $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 Billions Equity Recourse

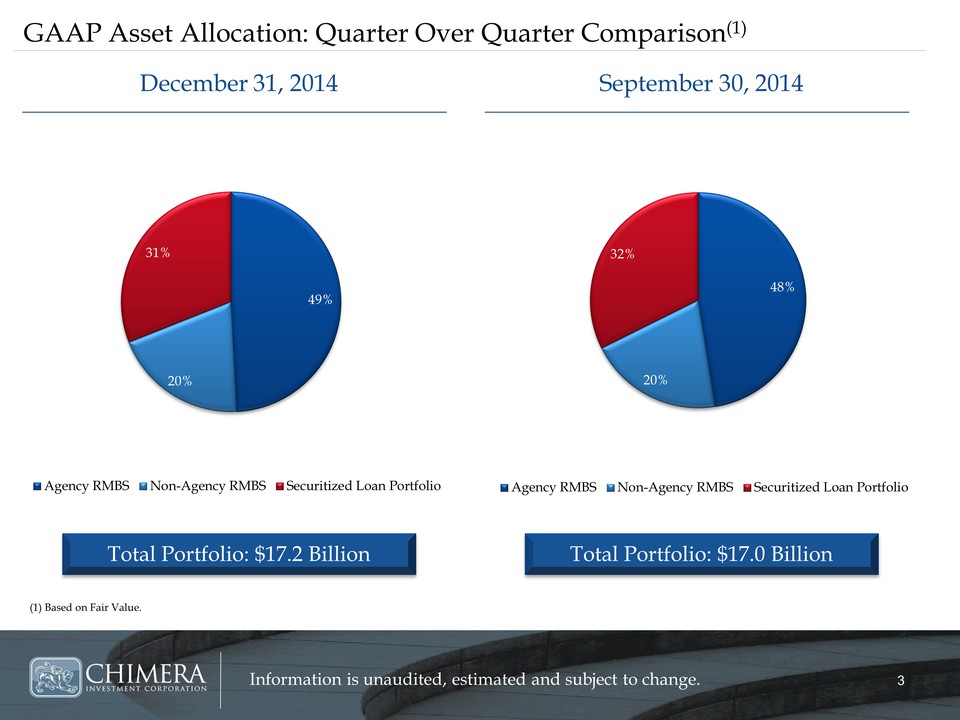

CONFERENCEN AM EGOESHERE3 3Information isun audit ed, estimated and subject to change. GAAP Asset Allocation: Quarter Over Quarter Comparison(1) 49% 20% 31% Agency RMBS Non-Agency RMBS Securitized Loan Portfolio December 31, 2014 September 30, 2014 Total Portfolio: $17.0 Billion Total Portfolio: $17.2 Billion (1) Based on Fair Value. 48% 20% 32% Agency RMBS Non-Agency RMBS Securitized Loan Portfolio

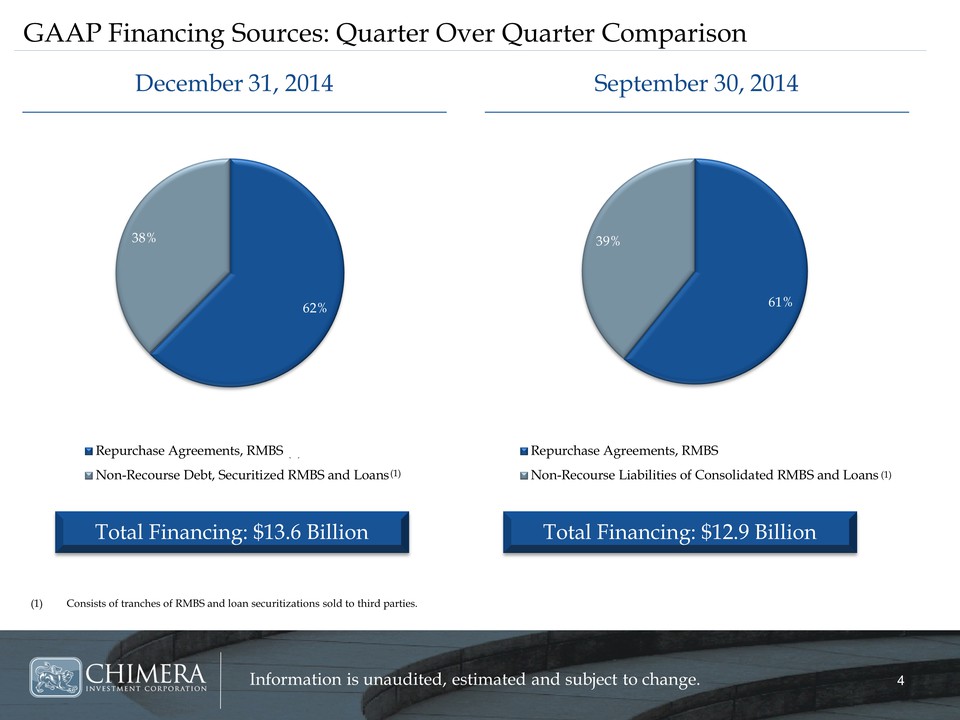

CONFERENCEN AM EGOESHERE4 4Information is unaudited, estimated and subject to change. GAAP Financing Sources: Quarter Over Quarter Comparison 61% 39% Repurchase Agreements, RMBS (1) Non-Recourse Liabilities of Consolidated RMBS and Loans 62% 38% Repurchase Agreements, RMBS (1) Non-Recourse Debt, Securitized RMBS and Loans (1)Consists of tranches of RMBS and loan securitizations sold to third parties. December 31, 2014 September 30, 2014 Total Financing: $12.9 Billion (1) Total Financing: $13.6 Billion (1)

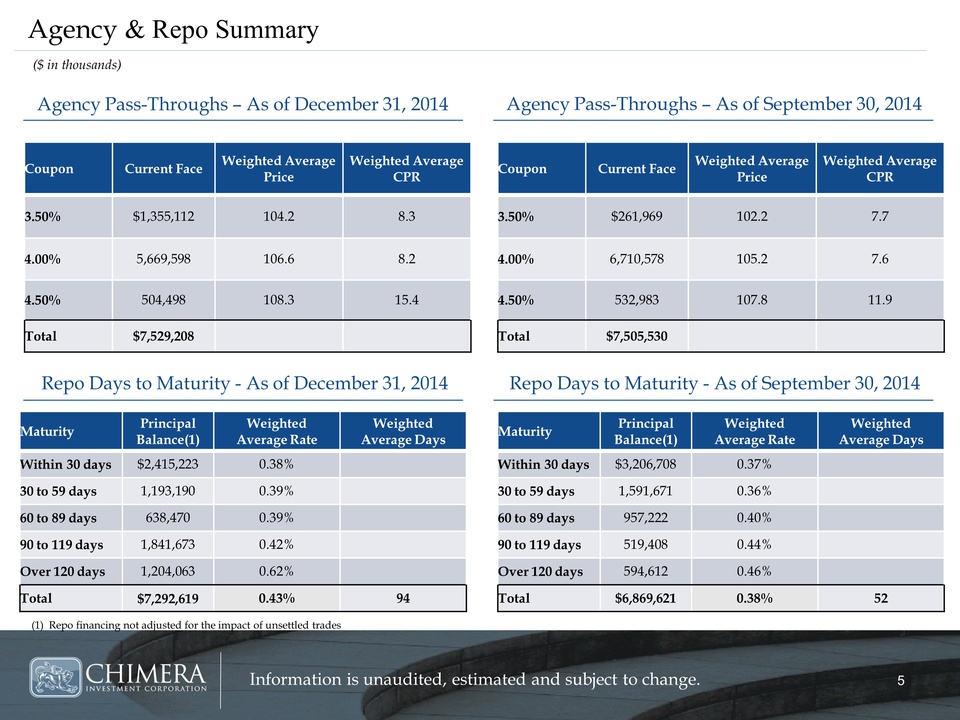

Agency & Repo Summary Agency Pass-Throughs – As of December 31, 2014 Repo Days to Maturity - As of December 31, 2014 Agency Pass-Throughs – As of September 30, 2014 Repo Days to Maturity - As of September 30, 2014 Repo Days to Maturity - As of September 30, 2014

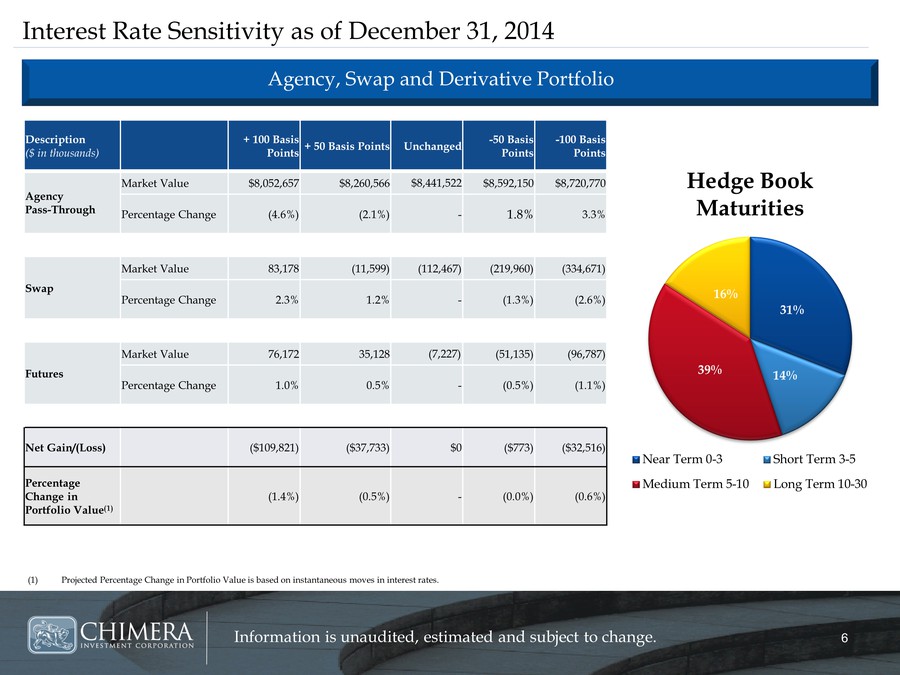

Interest Rate Sensitivity as of December 31, 2014 Agency, Swap and Derivative Portfolio Hedge Book Maturities

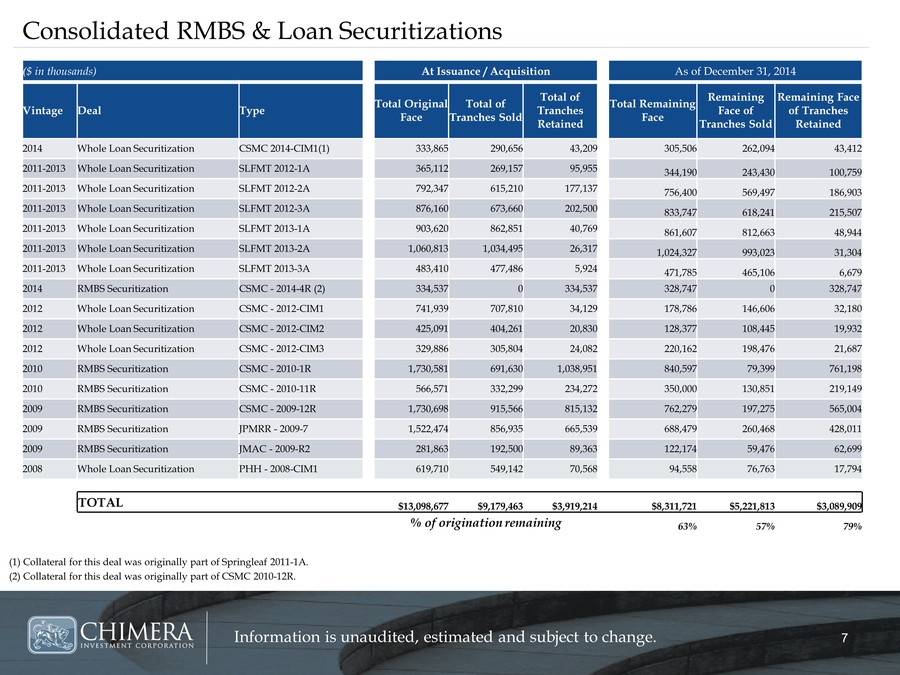

Consolidated RMBS & Loan Securitizations (1) Collateral for this deal was originally part of Springleaf 2011-1A. (2) Collateral for this deal was originally part of CSMC 2010-12R.

CONFERENCEN AM EGOESHERE8 8Informationisun aud it ed, estimated and subject to change. WWW.ANNALY.C OMWWW.CHIMERAREIT.COM Q4 2014 Supplemental Financial Information