Attached files

| file | filename |

|---|---|

| EX-99.2 - BOFI HOLDING, INC. PRESENTATION PDF - Axos Financial, Inc. | bofiipmarch2015.pdf |

| 8-K - 8-K - Axos Financial, Inc. | a8-kmarch2014raymondjamesi.htm |

NASDAQ: BOFI Raymond James IIC March 2015 BofI Holding, Inc. Investor Presentation Greg Garrabrants President and Chief Executive Officer

1 Safe Harbor This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). The words “believe,” “expect,” “anticipate,” “estimate,” “project,” or the negation thereof or similar expressions constitute forward-looking statements within the meaning of the Reform Act. These statements may include, but are not limited to, projections of revenues, income or loss, estimates of capital expenditures, plans for future operations, products or services, and financing needs or plans, as well as assumptions relating to these matters. Such statements involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. For a discussion of these factors, we refer you to the Company's reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended June 30, 2014. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or by any other person or entity that the objectives and plans of the Company will be achieved. For all forward- looking statements, the Company claims the protection of the safe-harbor for forward-looking statements contained in the Reform Act.

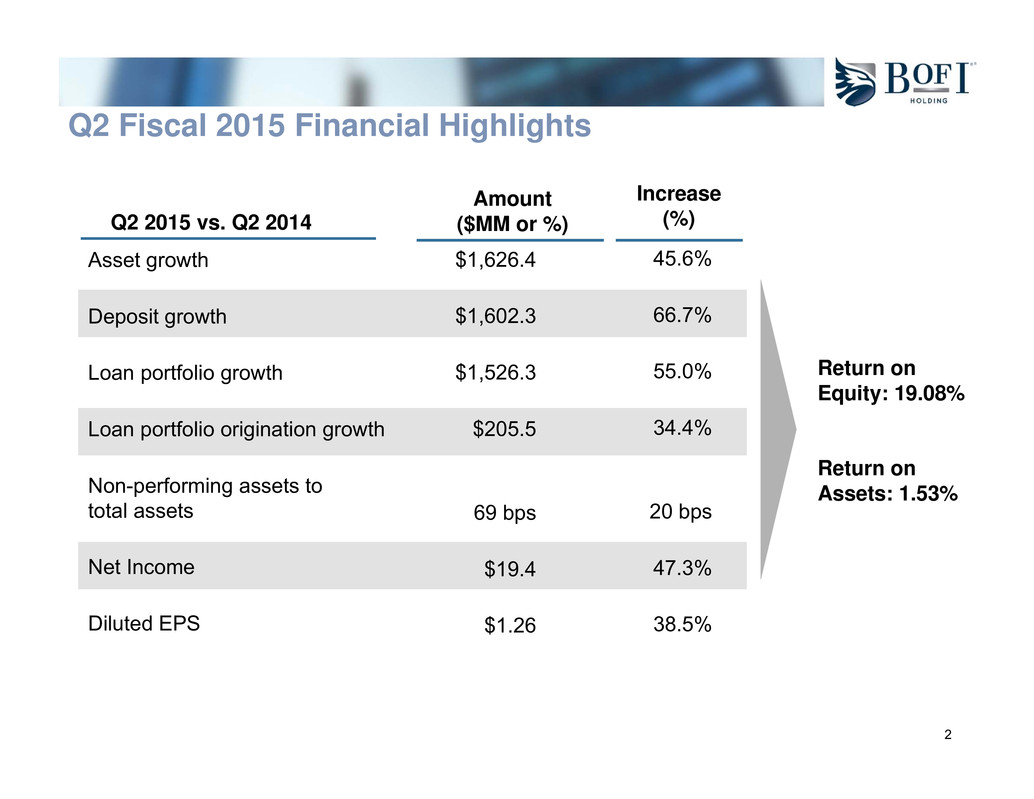

2 Asset growth Deposit growth Loan portfolio growth Loan portfolio origination growth Non-performing assets to total assets Net Income Diluted EPS Q2 2015 vs. Q2 2014 $1,626.4 $1,602.3 $1,526.3 $205.5 69 bps $19.4 $1.26 45.6% 66.7% 55.0% 34.4% 20 bps 47.3% 38.5% Amount ($MM or %) Increase (%) Return on Equity: 19.08% Return on Assets: 1.53% Q2 Fiscal 2015 Financial Highlights

3 BofI Holding, Inc. (BOFI)2 CA 134.61 2,224 1.24 16.09 14.33 42.04 1.20 0.39 2011 The Best of the Biggest Thrifts #2 #1 2012 The Best of the Biggest Thrifts BofI Holding, Inc. (BOFI)1 CA 154.986 2,874.3 1.44 17.72 14.33 38.05 1.11 0.29 Source: SNL Financial 2013 The Best of the Biggest Thrifts #1 BofI Holding, Inc. (BOFI)1 CA 167.418 3,568.3 1.54 17.79 15.36 40.70 0.63 0.03 BofI is Consistently Ranked among the Best of the Biggest Thrifts by SNL Financial...

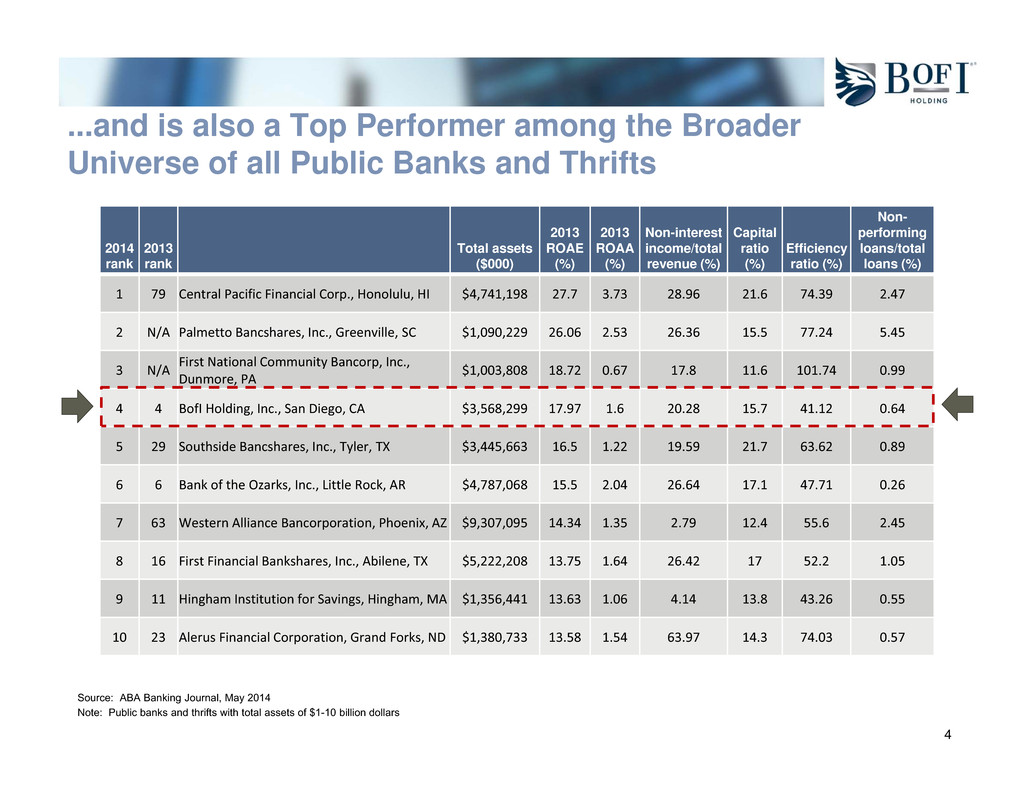

4 ...and is also a Top Performer among the Broader Universe of all Public Banks and Thrifts 2014 rank 2013 rank Total assets ($000) 2013 ROAE (%) 2013 ROAA (%) Non-interest income/total revenue (%) Capital ratio (%) Efficiency ratio (%) Non- performing loans/total loans (%) 1 79 Central Pacific Financial Corp., Honolulu, HI $4,741,198 27.7 3.73 28.96 21.6 74.39 2.47 2 N/A Palmetto Bancshares, Inc., Greenville, SC $1,090,229 26.06 2.53 26.36 15.5 77.24 5.45 3 N/A First National Community Bancorp, Inc., Dunmore, PA $1,003,808 18.72 0.67 17.8 11.6 101.74 0.99 4 4 BofI Holding, Inc., San Diego, CA $3,568,299 17.97 1.6 20.28 15.7 41.12 0.64 5 29 Southside Bancshares, Inc., Tyler, TX $3,445,663 16.5 1.22 19.59 21.7 63.62 0.89 6 6 Bank of the Ozarks, Inc., Little Rock, AR $4,787,068 15.5 2.04 26.64 17.1 47.71 0.26 7 63 Western Alliance Bancorporation, Phoenix, AZ $9,307,095 14.34 1.35 2.79 12.4 55.6 2.45 8 16 First Financial Bankshares, Inc., Abilene, TX $5,222,208 13.75 1.64 26.42 17 52.2 1.05 9 11 Hingham Institution for Savings, Hingham, MA $1,356,441 13.63 1.06 4.14 13.8 43.26 0.55 10 23 Alerus Financial Corporation, Grand Forks, ND $1,380,733 13.58 1.54 63.97 14.3 74.03 0.57 Source: ABA Banking Journal, May 2014 Note: Public banks and thrifts with total assets of $1-10 billion dollars

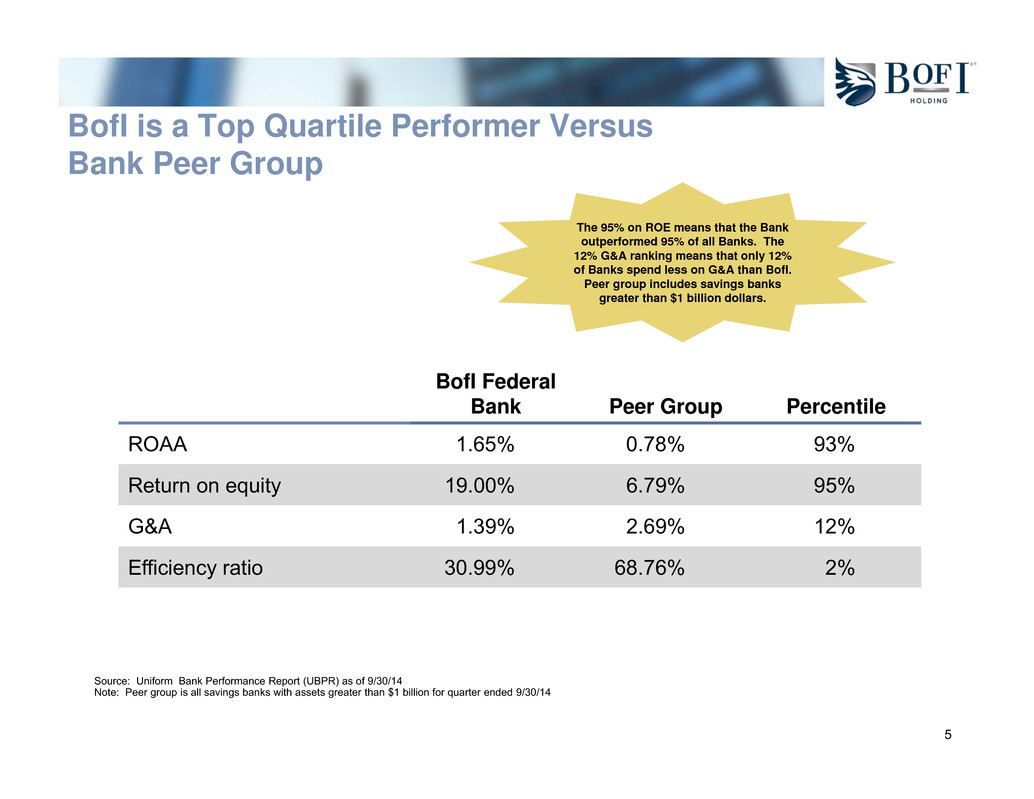

5 BofI is a Top Quartile Performer Versus Bank Peer Group BofI Federal Bank Peer Group Percentile ROAA 1.65% 0.78% 93% Return on equity 19.00% 6.79% 95% G&A 1.39% 2.69% 12% Efficiency ratio 30.99% 68.76% 2% Source: Uniform Bank Performance Report (UBPR) as of 9/30/14 Note: Peer group is all savings banks with assets greater than $1 billion for quarter ended 9/30/14 The 95% on ROE means that the Bank outperformed 95% of all Banks. The 12% G&A ranking means that only 12% of Banks spend less on G&A than BofI. Peer group includes savings banks greater than $1 billion dollars.

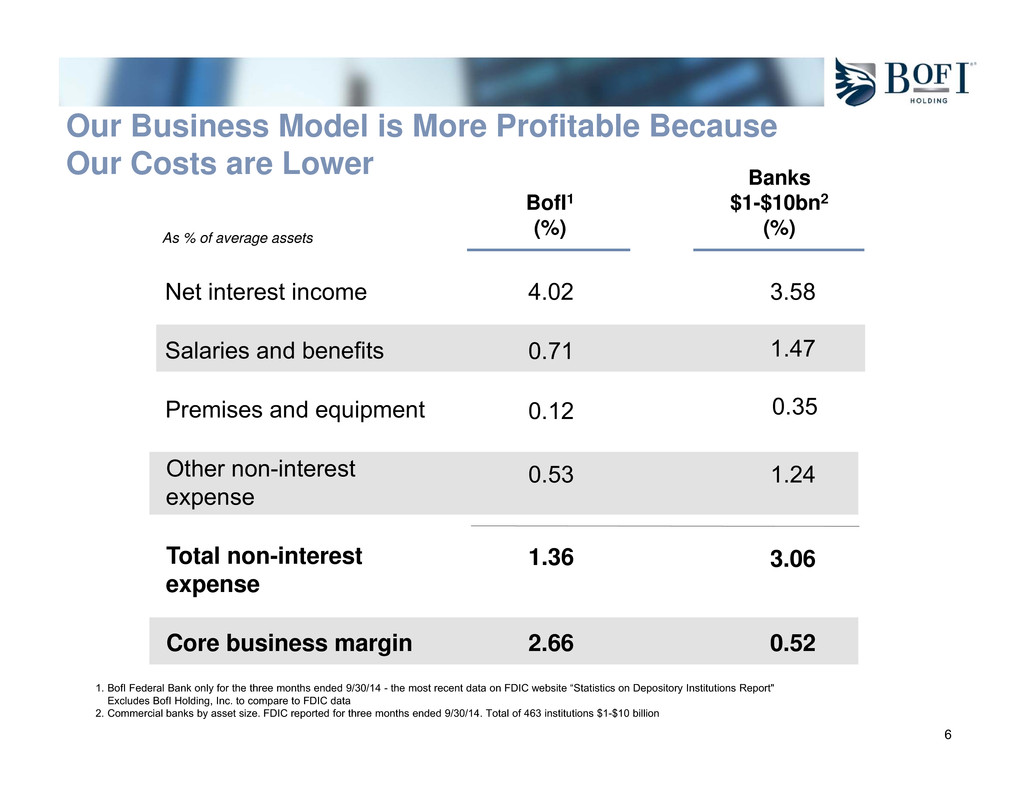

6 Salaries and benefits Premises and equipment BofI1 (%) 0.71 0.12 Other non-interest expense 0.53 Total non-interest expense 1.36 Core business margin 2.66 1.47 0.35 1.24 3.06 0.52 Banks $1-$10bn2 (%) Net interest income 4.02 3.58 As % of average assets 1. BofI Federal Bank only for the three months ended 9/30/14 - the most recent data on FDIC website “Statistics on Depository Institutions Report" Excludes BofI Holding, Inc. to compare to FDIC data 2. Commercial banks by asset size. FDIC reported for three months ended 9/30/14. Total of 463 institutions $1-$10 billion Our Business Model is More Profitable Because Our Costs are Lower

7 Corporate Profile and Vision • $5.2 billion asset savings and loan holding company1 • 14-year operating history, publicly traded on NASDAQ (BOFI) since 2005 • Headquartered in single branch location in San Diego, CA • 430 employees ($12.1 million in assets per employee)1 • Market Capitalization of $1.27 billion2 1. As of 12/31/14 2. As of 01/30/2015 closing price of $84.36 per share We aspire to be the most innovative branchless bank in the United States providing products and services superior to our branch based competitors Vision Key Facts

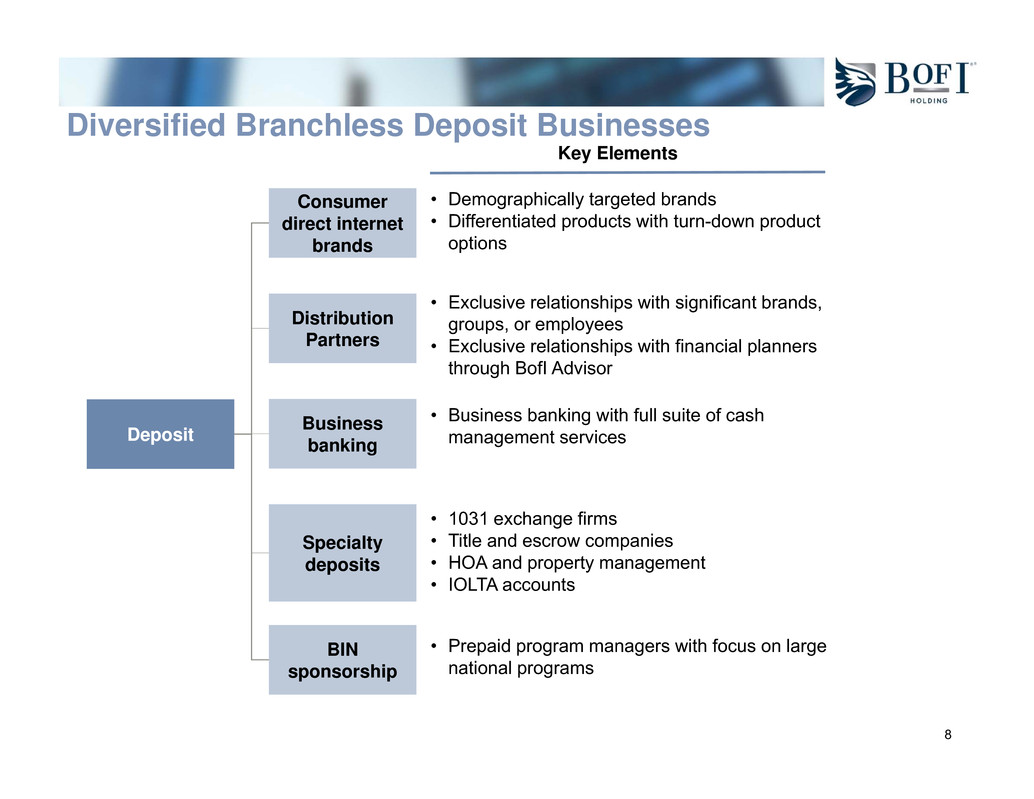

8 Diversified Branchless Deposit Businesses Key Elements Deposit Consumer direct internet brands Distribution Partners BIN sponsorship • Demographically targeted brands • Differentiated products with turn-down product options Business banking • Exclusive relationships with significant brands, groups, or employees • Exclusive relationships with financial planners through BofI Advisor • Business banking with full suite of cash management services • Prepaid program managers with focus on large national programs Specialty deposits • 1031 exchange firms • Title and escrow companies • HOA and property management • IOLTA accounts

9 Focus Current Partner Direct Marketing Retail Event-Based Issuance Distribution Partners

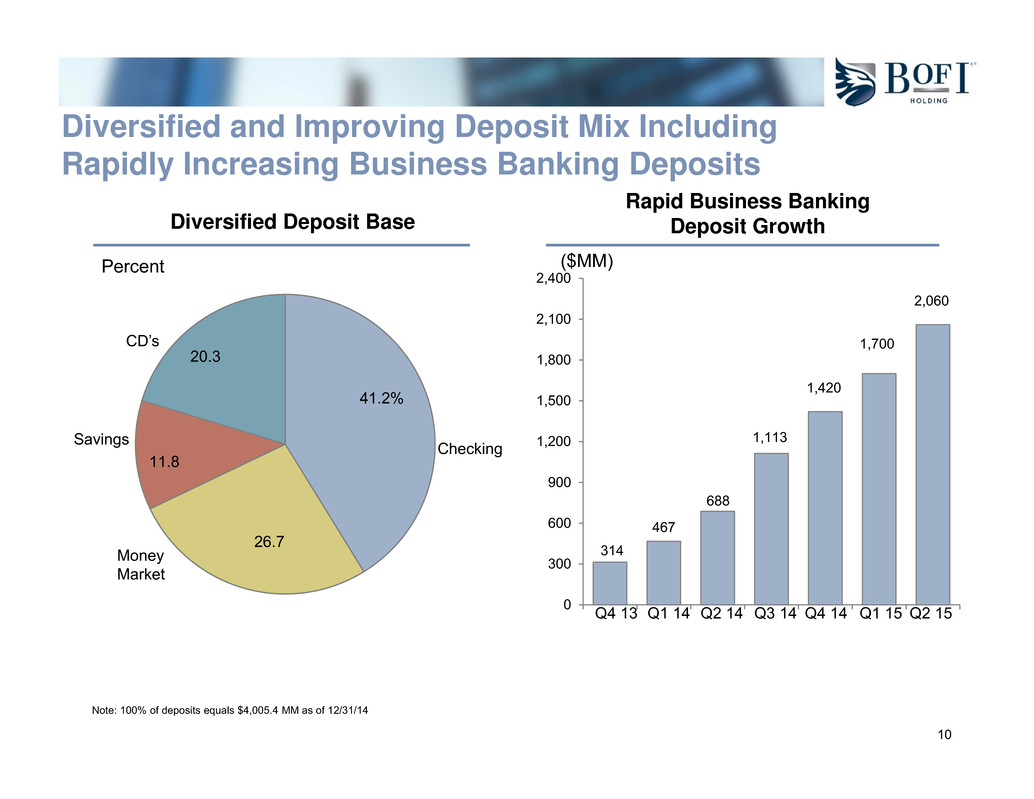

10 314 467 688 1,113 1,420 1,700 2,060 0 300 600 900 1,200 1,500 1,800 2,100 2,400 41.2% 26.7 11.8 20.3 Checking Money Market Savings CD’s Note: 100% of deposits equals $4,005.4 MM as of 12/31/14 Diversified Deposit Base Rapid Business Banking Deposit Growth ($MM) Q4 13 Q1 14 Q2 14 Q4 14Q3 14 Q1 15 Percent Q2 15 Diversified and Improving Deposit Mix Including Rapidly Increasing Business Banking Deposits

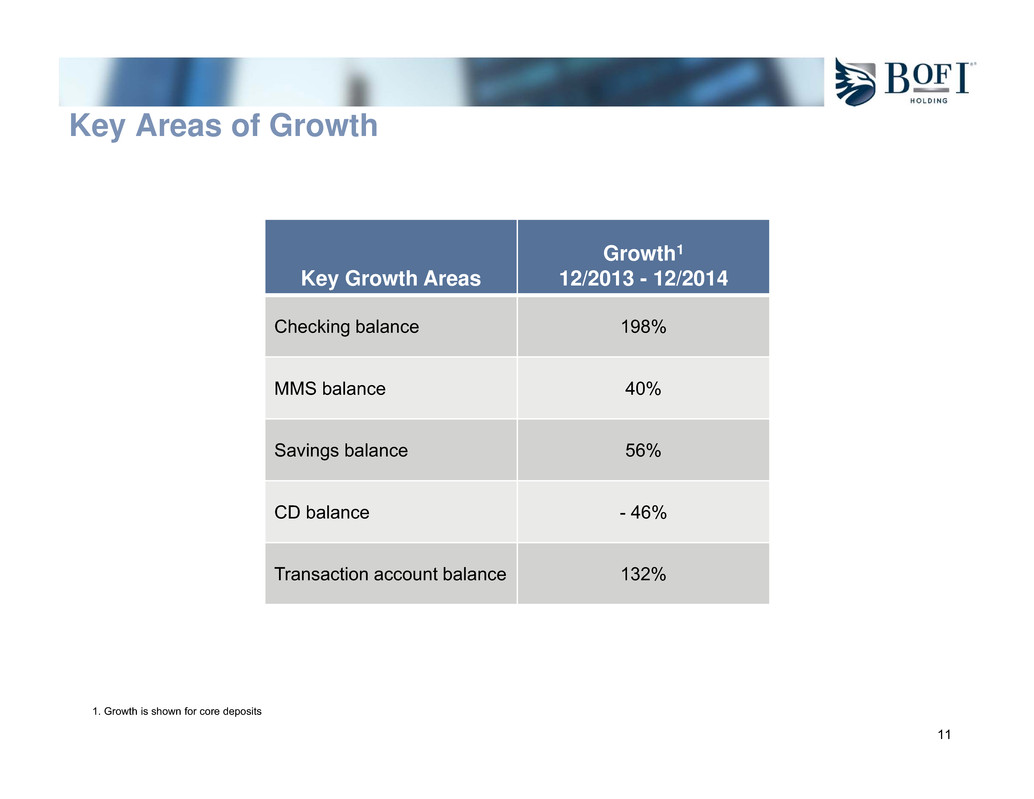

11 Key Growth Areas Growth1 12/2013 - 12/2014 Checking balance 198% MMS balance 40% Savings balance 56% CD balance - 46% Transaction account balance 132% 1. Growth is shown for core deposits Key Areas of Growth

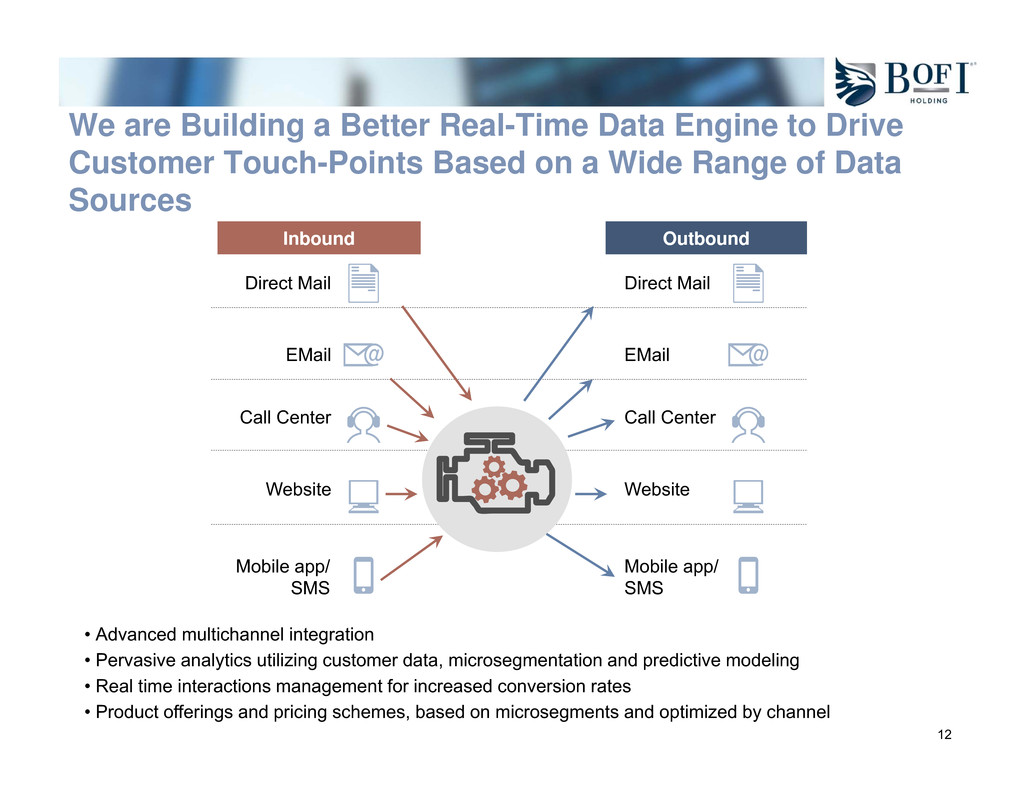

12 Inbound We are Building a Better Real-Time Data Engine to Drive Customer Touch-Points Based on a Wide Range of Data Sources Direct Mail EMail Call Center Website Mobile app/ SMS Direct Mail EMail Call Center Website Mobile app/ SMS Outbound • Advanced multichannel integration • Pervasive analytics utilizing customer data, microsegmentation and predictive modeling • Real time interactions management for increased conversion rates • Product offerings and pricing schemes, based on microsegments and optimized by channel

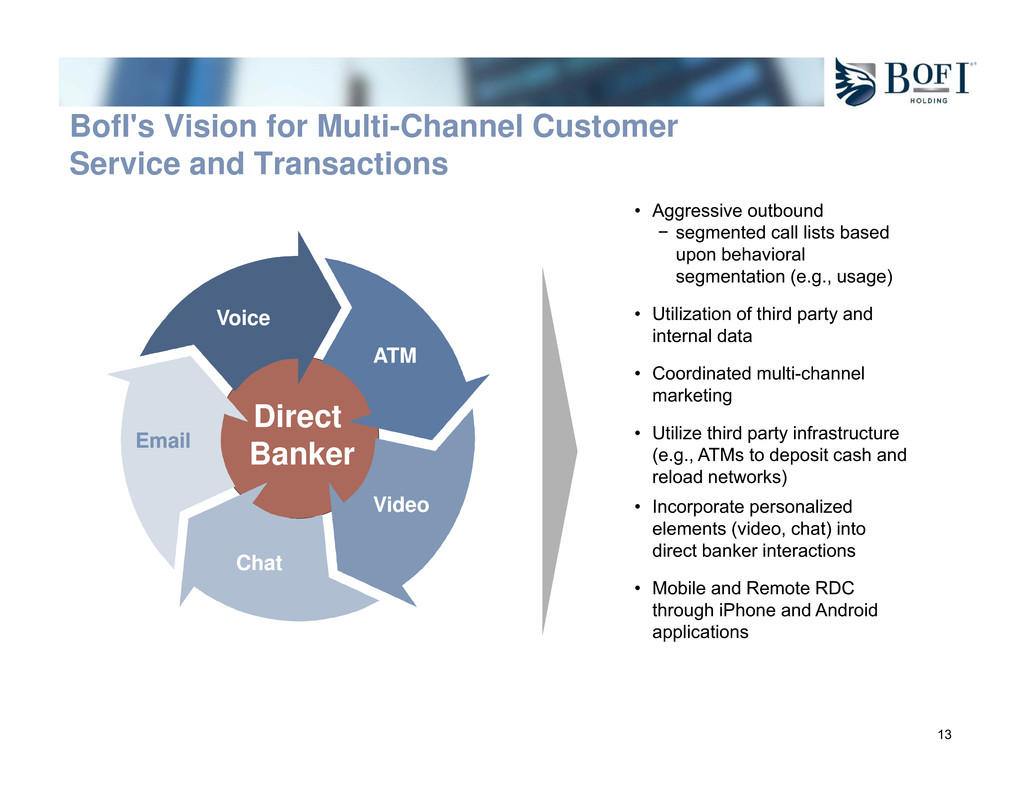

13 BofI's Vision for Multi-Channel Customer Service and Transactions • Aggressive outbound − segmented call lists based upon behavioral segmentation (e.g., usage) • Utilization of third party and internal data • Coordinated multi-channel marketing • Utilize third party infrastructure (e.g., ATMs to deposit cash and reload networks) • Incorporate personalized elements (video, chat) into direct banker interactions • Mobile and Remote RDC through iPhone and Android applications Direct Banker Voice Video Chat Email ATM

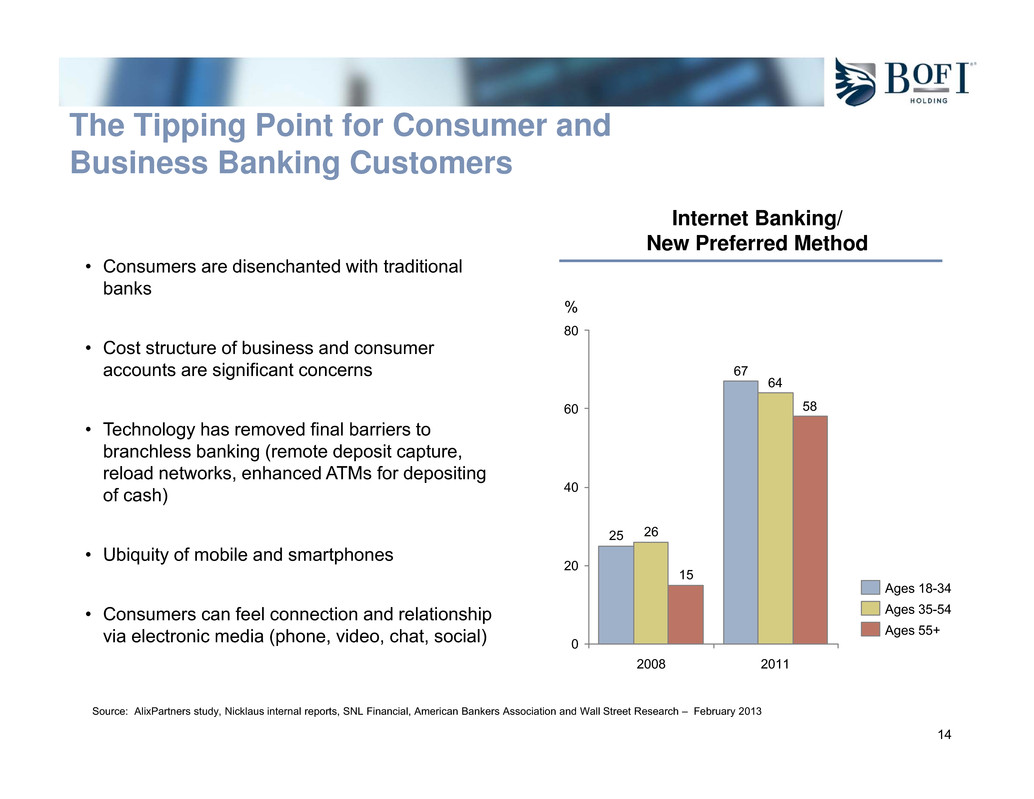

14 The Tipping Point for Consumer and Business Banking Customers • Consumers are disenchanted with traditional banks • Cost structure of business and consumer accounts are significant concerns • Technology has removed final barriers to branchless banking (remote deposit capture, reload networks, enhanced ATMs for depositing of cash) • Ubiquity of mobile and smartphones • Consumers can feel connection and relationship via electronic media (phone, video, chat, social) Internet Banking/ New Preferred Method 67 % 2008 2011 58 0 64 80 25 60 40 20 26 15 Ages 18-34 Ages 55+ Ages 35-54 Source: AlixPartners study, Nicklaus internal reports, SNL Financial, American Bankers Association and Wall Street Research – February 2013

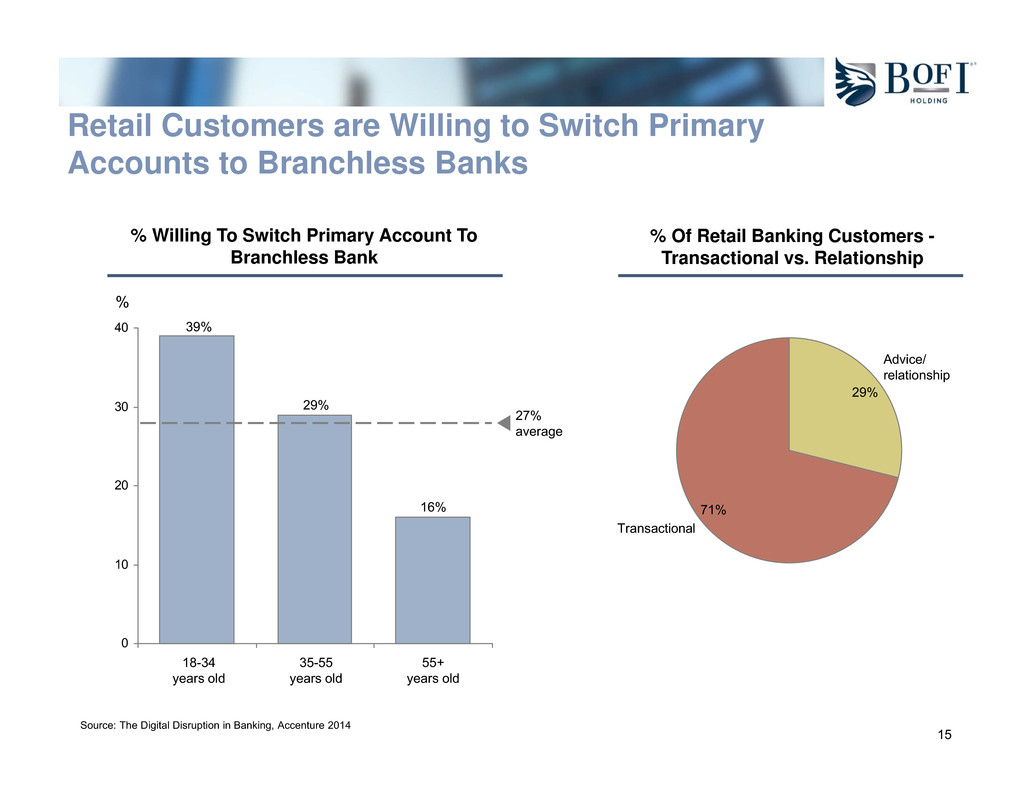

15 Retail Customers are Willing to Switch Primary Accounts to Branchless Banks 0 10 20 30 40 16% 39% 29% 55+ years old 18-34 years old % 35-55 years old 27% average Transactional Advice/ relationship 29% 71% Source: The Digital Disruption in Banking, Accenture 2014 % Willing To Switch Primary Account To Branchless Bank % Of Retail Banking Customers - Transactional vs. Relationship

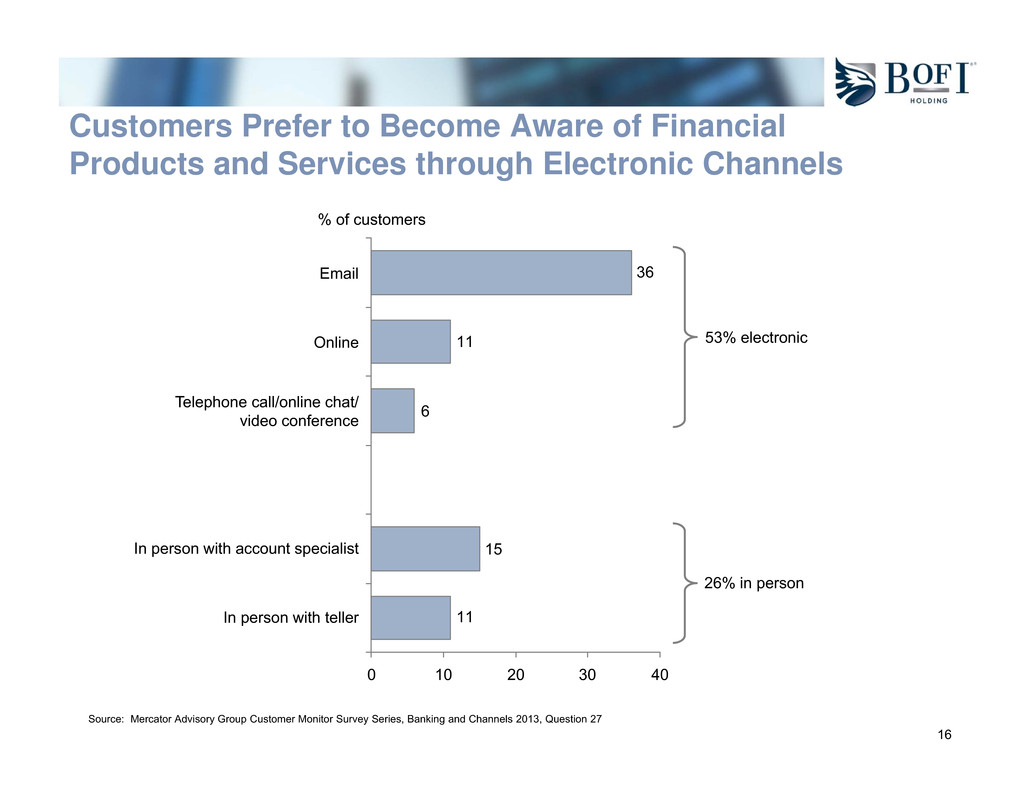

16 Customers Prefer to Become Aware of Financial Products and Services through Electronic Channels 53% electronic 26% in person 11 15 6 11 36 0 10 20 30 40 Email Online Telephone call/online chat/ video conference In person with account specialist In person with teller % of customers Source: Mercator Advisory Group Customer Monitor Survey Series, Banking and Channels 2013, Question 27

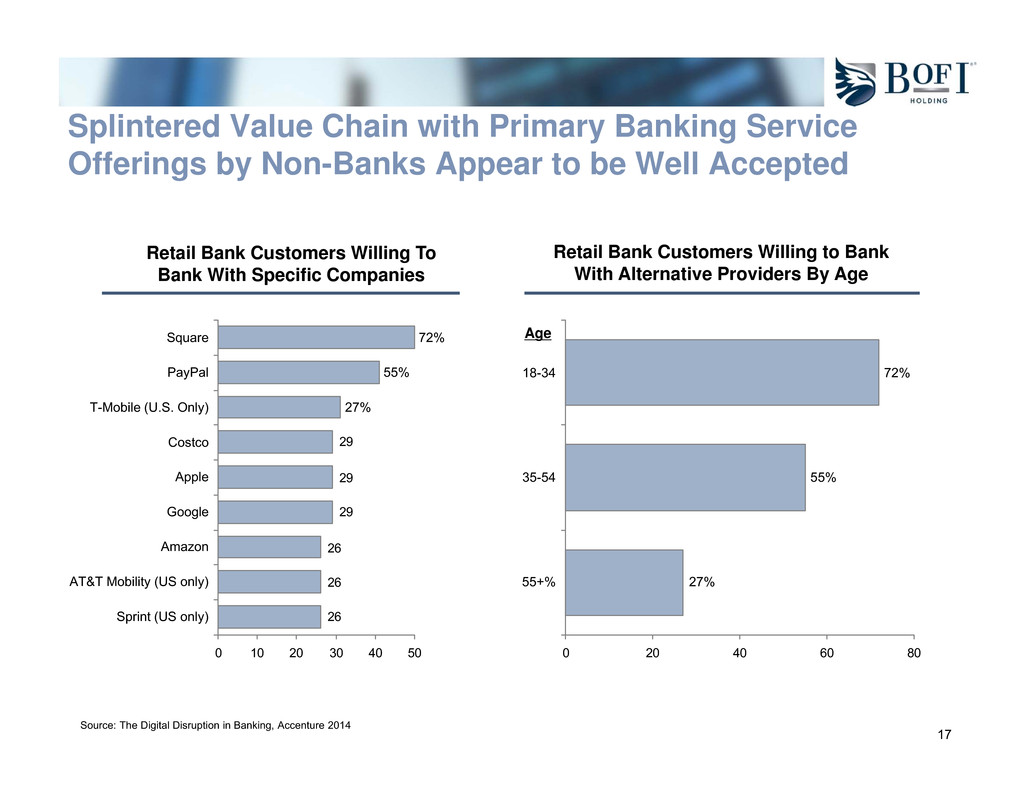

17 Splintered Value Chain with Primary Banking Service Offerings by Non-Banks Appear to be Well Accepted Retail Bank Customers Willing to Bank With Alternative Providers By Age Retail Bank Customers Willing To Bank With Specific Companies 0 20 40 60 80 18-34 35-54 55+% 72% 55% 27% Age 26 26 26 29 29 29 0 10 20 30 40 50 Google T-Mobile (U.S. Only) 27% Amazon AT&T Mobility (US only) Sprint (US only) PayPal 55% Square 72% Costco Apple Source: The Digital Disruption in Banking, Accenture 2014

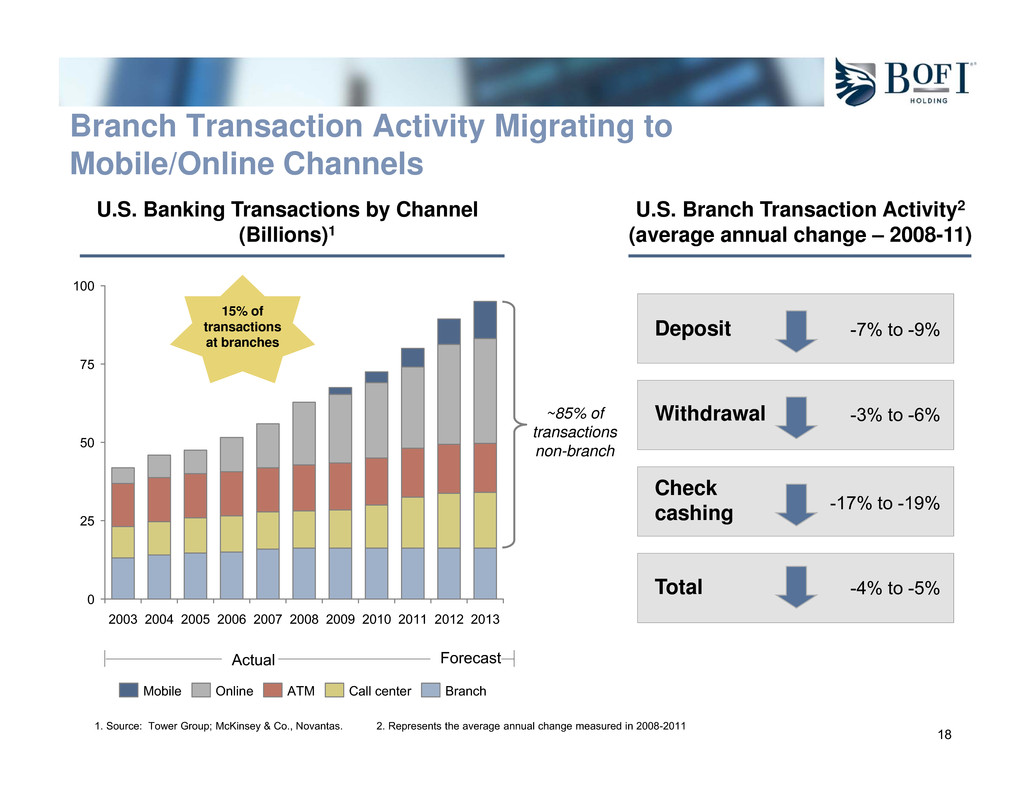

18 Branch Transaction Activity Migrating to Mobile/Online Channels U.S. Banking Transactions by Channel (Billions)1 U.S. Branch Transaction Activity2 (average annual change – 2008-11) Deposit Withdrawal Check cashing Total -7% to -9% -3% to -6% -17% to -19% -4% to -5% 100 75 50 25 0 20132012201120102009200820072006200520042003 BranchCall centerATMOnlineMobile ForecastActual 1. Source: Tower Group; McKinsey & Co., Novantas. 2. Represents the average annual change measured in 2008-2011 15% of transactions at branches ~85% of transactions non-branch

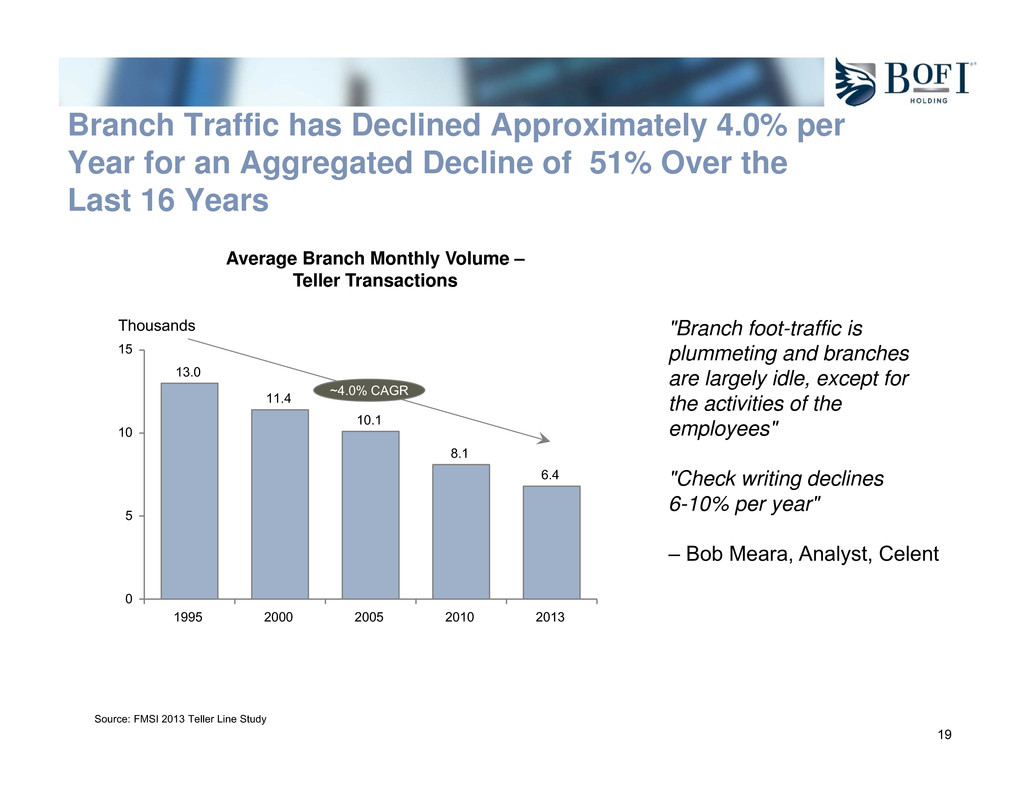

19 Branch Traffic has Declined Approximately 4.0% per Year for an Aggregated Decline of 51% Over the Last 16 Years Source: FMSI 2013 Teller Line Study "Branch foot-traffic is plummeting and branches are largely idle, except for the activities of the employees" "Check writing declines 6-10% per year" – Bob Meara, Analyst, Celent 2010 Thousands 1995 2000 2005 13.0 0 11.4 10.1 15 10 5 6.4 2013 8.1 ~4.0% CAGR Average Branch Monthly Volume – Teller Transactions

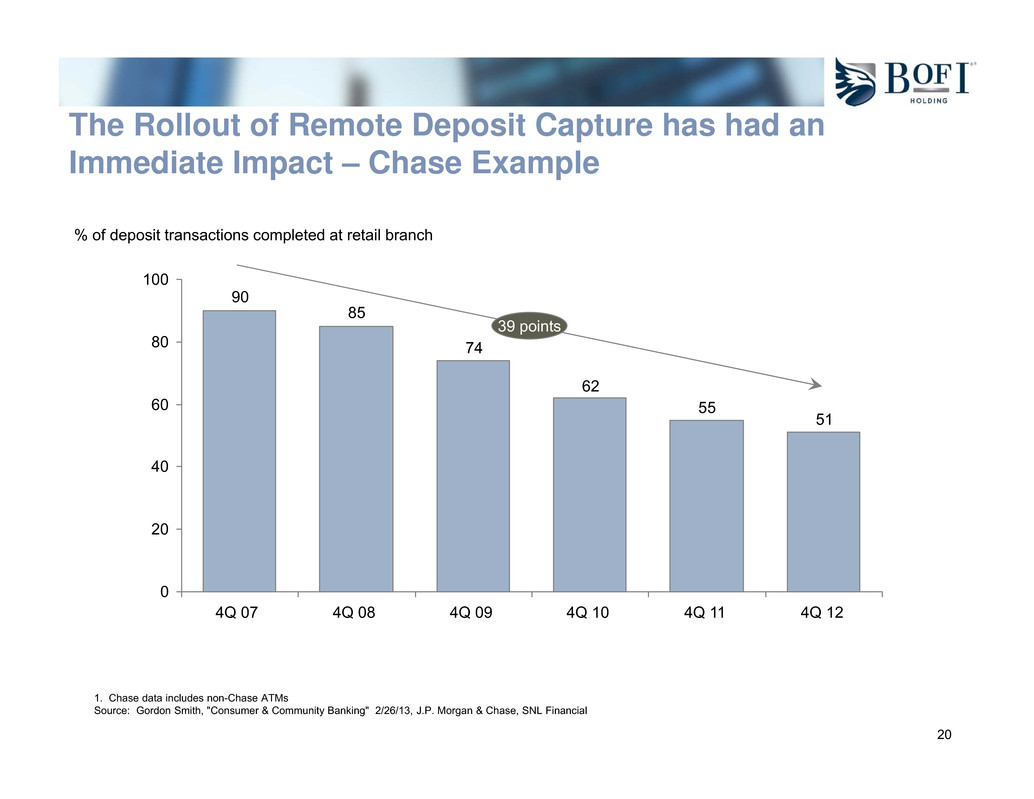

20 1. Chase data includes non-Chase ATMs Source: Gordon Smith, "Consumer & Community Banking" 2/26/13, J.P. Morgan & Chase, SNL Financial 51 55 62 74 85 90 0 20 40 60 80 100 39 points 4Q 11 4Q 124Q 07 4Q 104Q 094Q 08 The Rollout of Remote Deposit Capture has had an Immediate Impact – Chase Example % of deposit transactions completed at retail branch

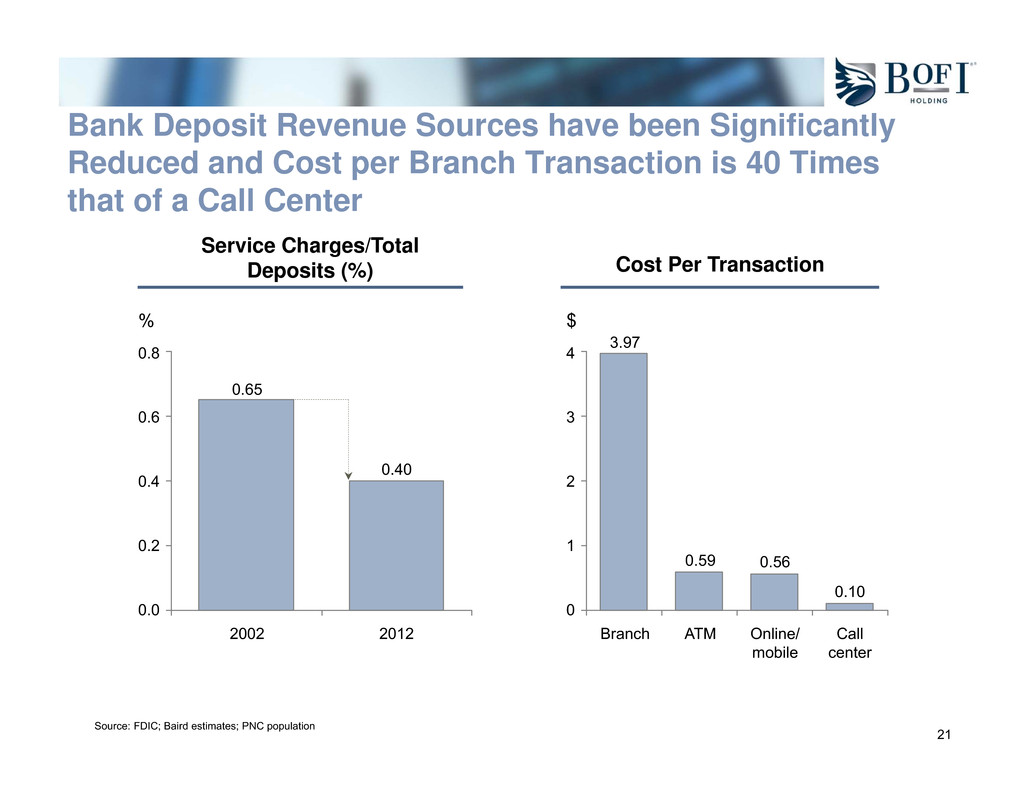

21 Bank Deposit Revenue Sources have been Significantly Reduced and Cost per Branch Transaction is 40 Times that of a Call Center Service Charges/Total Deposits (%) Source: FDIC; Baird estimates; PNC population Cost Per Transaction % 0.40 2002 2012 0.2 0.65 0.0 0.8 0.4 0.6 0.56 Call center Online/ mobile $ 0.10 0 ATM 0.59 Branch 3.97 1 4 3 2

22 Branch Banks Cannot Cost-Effectively Serve Most Customers Chase 23 23 23 19 12 United States 32 20 21 19 8 Segment 1 (<$5K D&I) Segment 2 ($5K-$25K D&I) Segment 3 ($25-$100K D&I) Segment 4 ($100-$500K D&I) Segment 5 ($500K+ D&I) >30% of Chase households have >$100K in D&I and make up ~55% of revenue Of the remaining 70%, Chase has publically stated that 70% are not profitable Source: MacroMonitor 2010 Survey of the U.S. households, U.S. Census Bureau; Chase data post implementation of Durbin Amendment

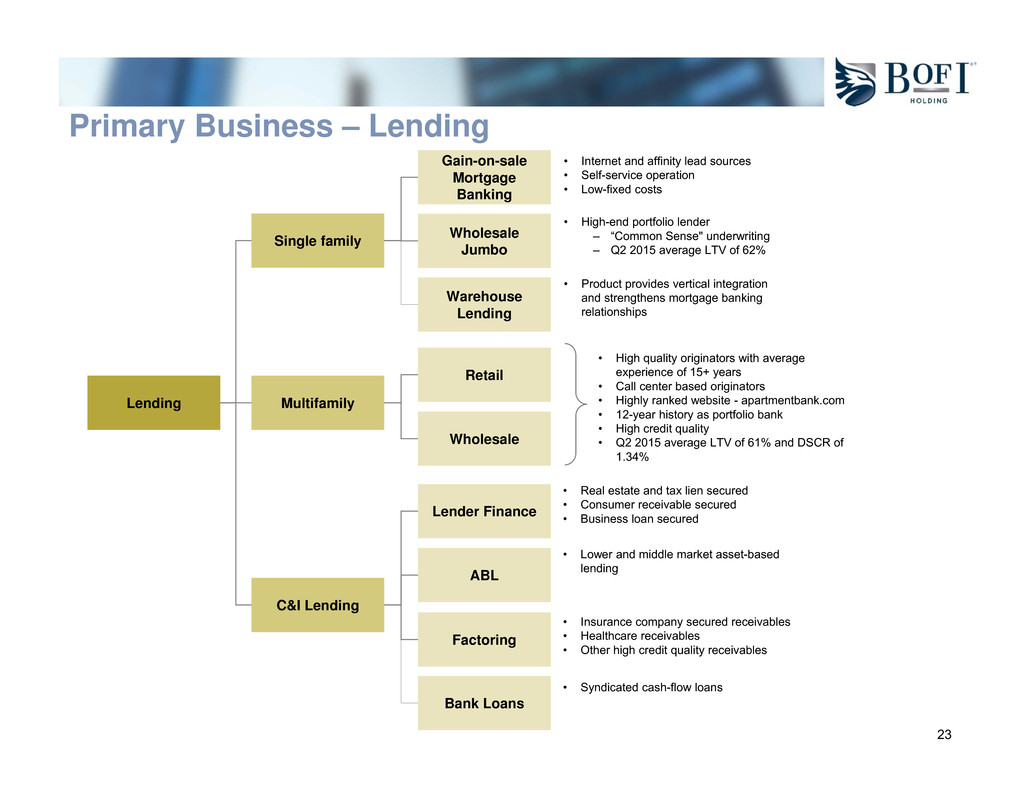

23 Lending Single family Multifamily C&I Lending Gain-on-sale Mortgage Banking Wholesale Jumbo Retail Wholesale Lender Finance ABL • Internet and affinity lead sources • Self-service operation • Low-fixed costs • High-end portfolio lender – “Common Sense" underwriting – Q2 2015 average LTV of 62% • High quality originators with average experience of 15+ years • Call center based originators • Highly ranked website - apartmentbank.com • 12-year history as portfolio bank • High credit quality • Q2 2015 average LTV of 61% and DSCR of 1.34% • Real estate and tax lien secured • Consumer receivable secured • Business loan secured • Lower and middle market asset-based lending Warehouse Lending • Product provides vertical integration and strengthens mortgage banking relationships Factoring • Insurance company secured receivables • Healthcare receivables • Other high credit quality receivables Bank Loans • Syndicated cash-flow loans Primary Business – Lending

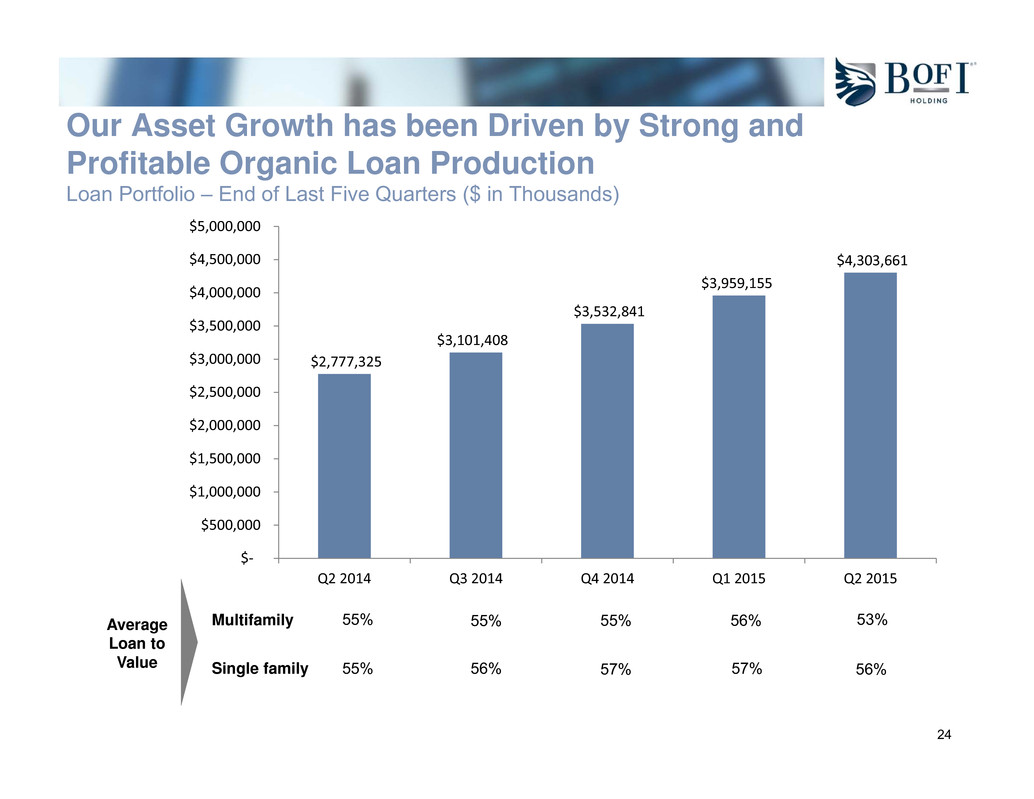

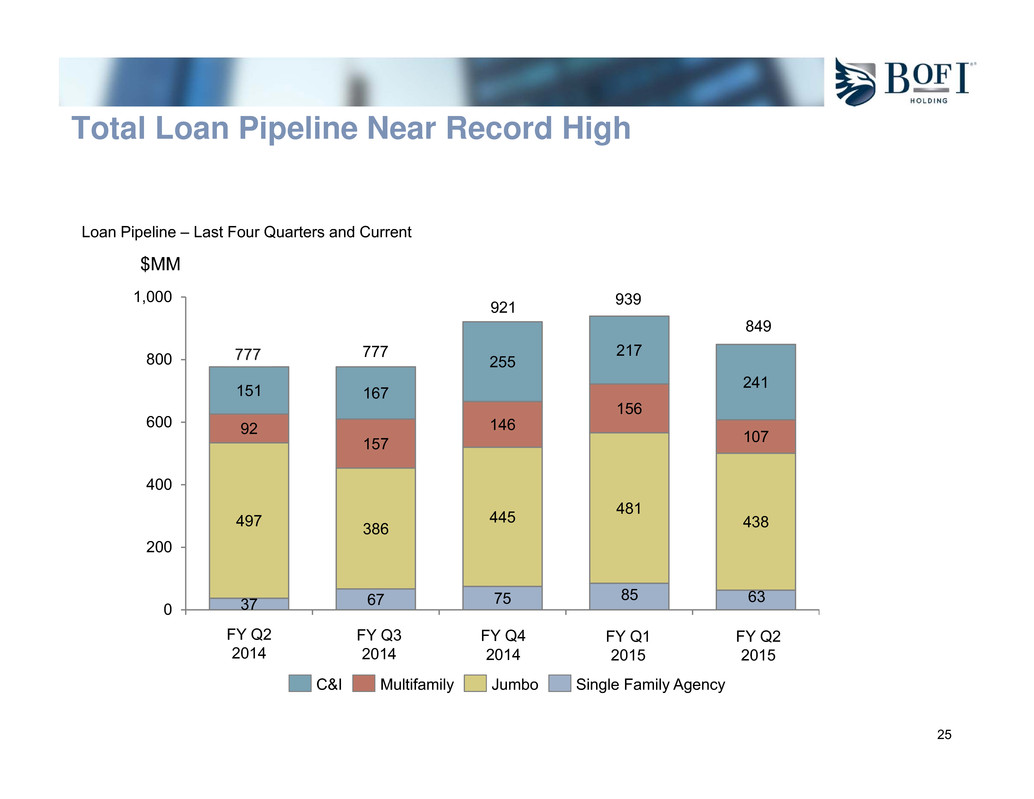

24 Our Asset Growth has been Driven by Strong and Profitable Organic Loan Production Loan Portfolio – End of Last Five Quarters ($ in Thousands) Multifamily Single family 55% 55% 55% 56% 53% 55% 56% 57% 57% 56% Average Loan to Value $2,777,325 $3,101,408 $3,532,841 $3,959,155 $4,303,661 $‐ $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 $4,000,000 $4,500,000 $5,000,000 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015

25 C&I Multifamily Jumbo Single Family Agency 37 67 75 85 63 497 386 445 481 438 92 157 146 156 107 151 167 255 217 241 0 200 400 600 800 1,000 $MM 777 921 939 849 FY Q2 2014 FY Q3 2014 FY Q4 2014 FY Q1 2015 FY Q2 2015 Loan Pipeline – Last Four Quarters and Current Total Loan Pipeline Near Record High

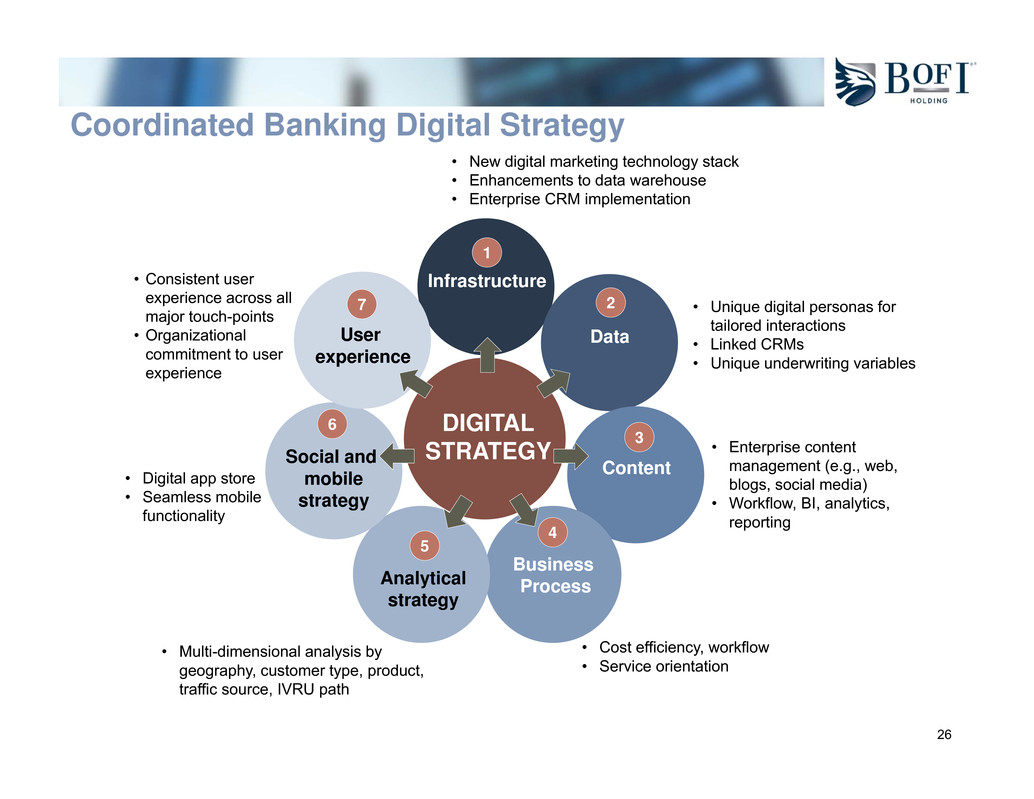

26 Coordinated Banking Digital Strategy Infrastructure Data Content Business ProcessAnalytical strategy Social and mobile strategy User experience DIGITAL STRATEGY 2 3 4 5 6 7 1 • Unique digital personas for tailored interactions • Linked CRMs • Unique underwriting variables • Cost efficiency, workflow • Service orientation • Enterprise content management (e.g., web, blogs, social media) • Workflow, BI, analytics, reporting • Digital app store • Seamless mobile functionality • Multi-dimensional analysis by geography, customer type, product, traffic source, IVRU path • Consistent user experience across all major touch-points • Organizational commitment to user experience • New digital marketing technology stack • Enhancements to data warehouse • Enterprise CRM implementation

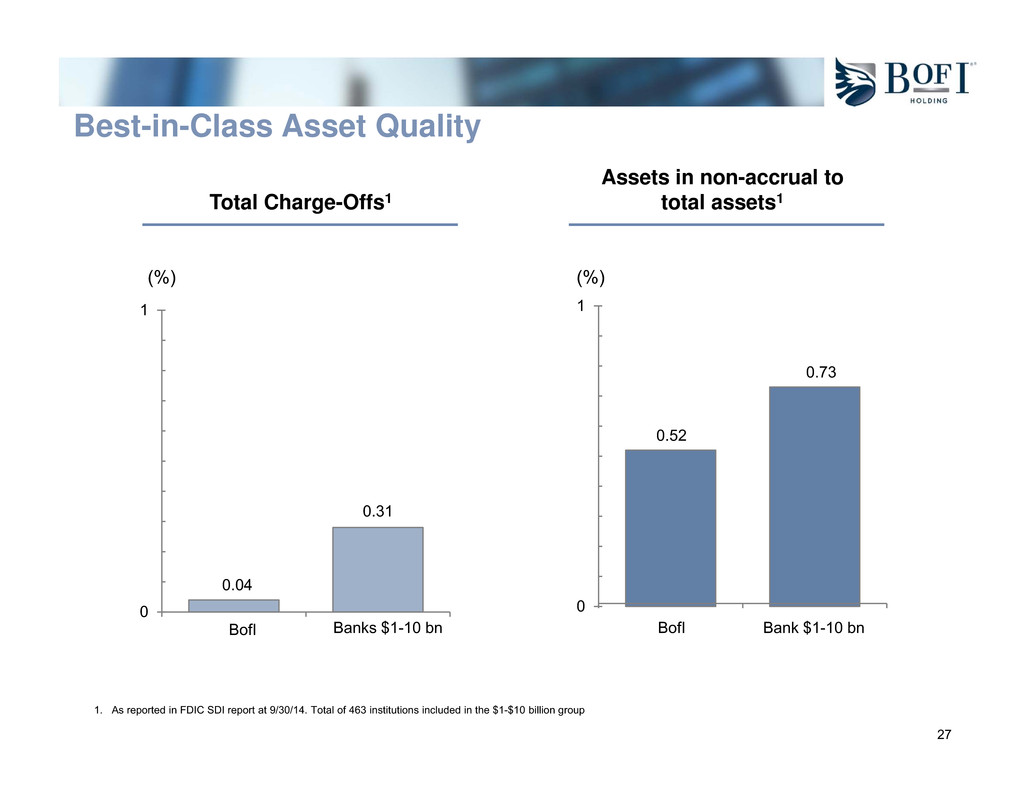

27 0.04 0.31 0 1 (%) BofI Banks $1-10 bn Total Charge-Offs1 Assets in non-accrual to total assets1 0.52 0.73 0 1 (%) BofI Bank $1-10 bn 1. As reported in FDIC SDI report at 9/30/14. Total of 463 institutions included in the $1-$10 billion group Best-in-Class Asset Quality

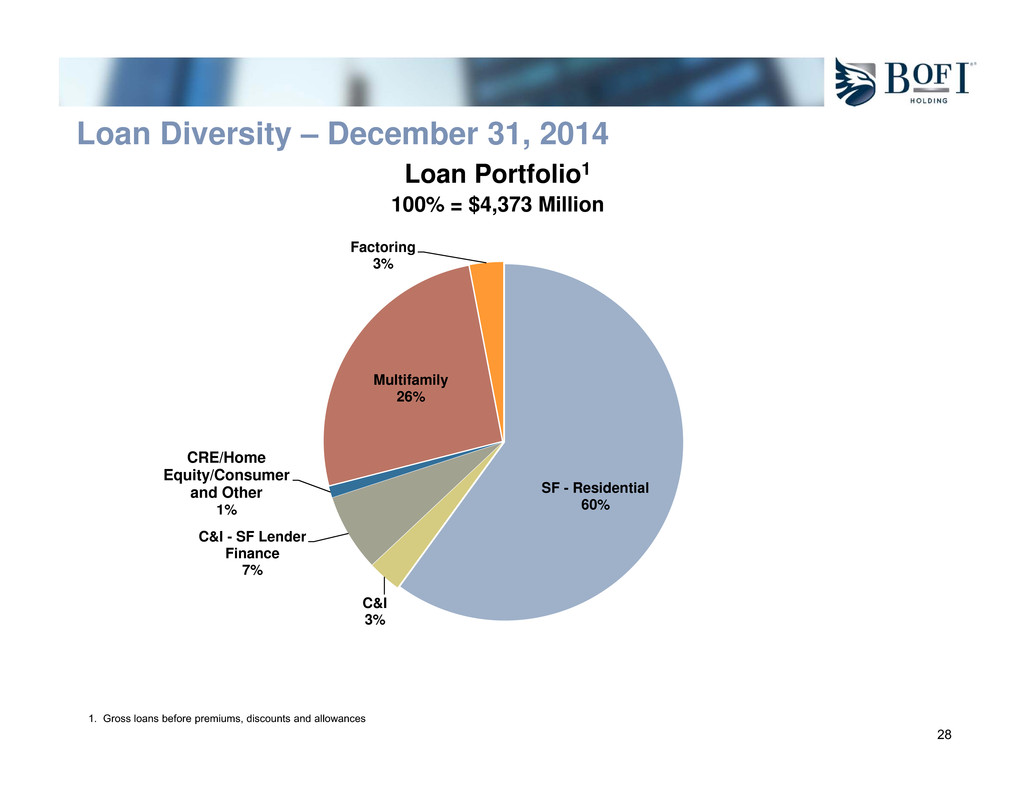

28 Loan Portfolio1 100% = $4,373 Million SF - Residential 60% C&I 3% C&I - SF Lender Finance 7% CRE/Home Equity/Consumer and Other 1% Multifamily 26% Factoring 3% 1. Gross loans before premiums, discounts and allowances Loan Diversity – December 31, 2014

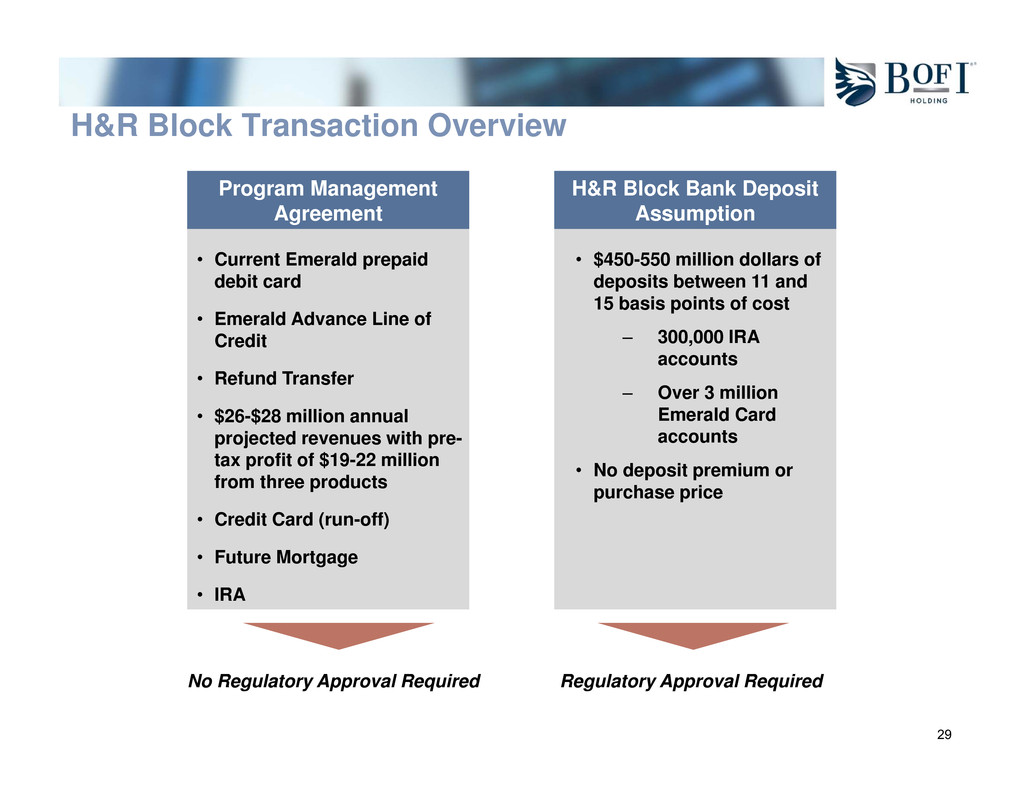

29 H&R Block Transaction Overview Program Management Agreement H&R Block Bank Deposit Assumption • Current Emerald prepaid debit card • Emerald Advance Line of Credit • Refund Transfer • $26-$28 million annual projected revenues with pre- tax profit of $19-22 million from three products • Credit Card (run-off) • Future Mortgage • IRA • $450-550 million dollars of deposits between 11 and 15 basis points of cost ‒ 300,000 IRA accounts ‒ Over 3 million Emerald Card accounts • No deposit premium or purchase price Regulatory Approval RequiredNo Regulatory Approval Required

30 Full service branchless banking platform with structural cost advantages vs. traditional banks Superior growth and ROE relative to large and small competitors Solid track record of allocating capital to businesses with best risk-adjusted returns New business initiatives will generate incremental growth in customers, loans and profits Robust risk management systems and culture has resulted in lower credit, counterparty and regulatory risks Investment Summary

31 Greg Garrabrants, President and CEO Andy Micheletti, EVP/CFO investors@bofi.com www.bofiholding.com Johnny Lai, VP Corporate Development and Investor Relations Phone: 858.649.2218 ext. 1609 Mobile: 858.245.1442 jlai@bofifederalbank.com Contact Information