Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Allegiant Travel CO | algt20150302_8k.htm |

Management Presentation March 2015

Forward looking statements 2 This presentation as well as oral statements made by officers or directors of Allegiant Travel Company, its advisors and affiliates (collectively or separately, the "Company“) will contain forward- looking statements that are only predictions and involve risks and uncertainties. Forward-looking statements may include, among others, references to future performance and any comments about our strategic plans. There are many risk factors that could prevent us from achieving our goals and cause the underlying assumptions of these forward-looking statements, and our actual results, to differ materially from those expressed in, or implied by, our forward-looking statements. These risk factors and others are more fully discussed in our filings with the Securities and Exchange Commission. Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The Company cautions users of this presentation not to place undue reliance on forward looking statements, which may be based on assumptions and anticipated events that do not materialize.

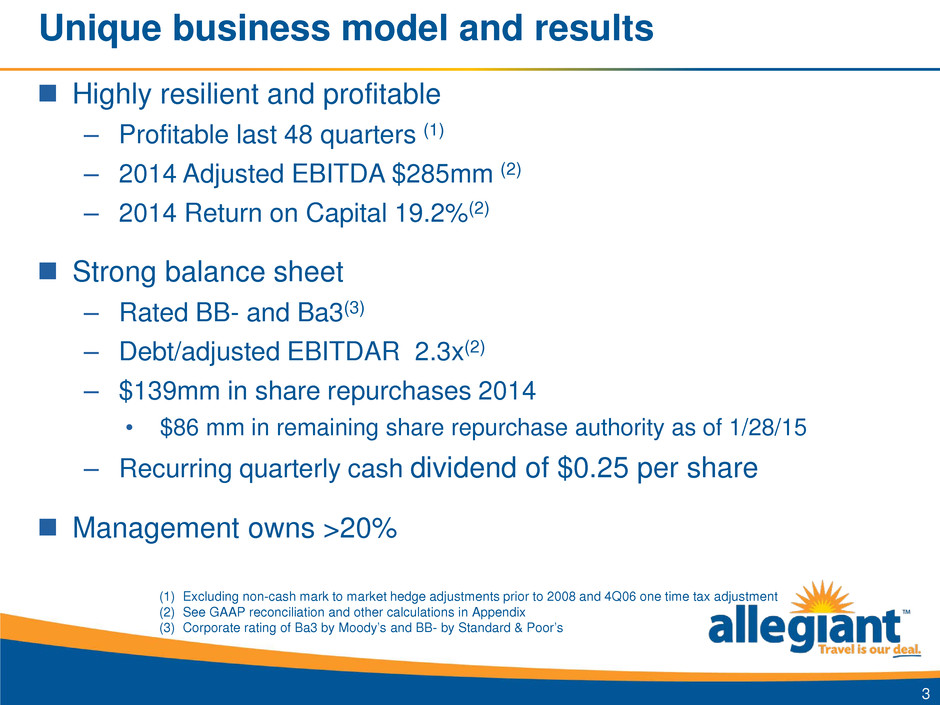

Unique business model and results Highly resilient and profitable – Profitable last 48 quarters (1) – 2014 Adjusted EBITDA $285mm (2) – 2014 Return on Capital 19.2%(2) Strong balance sheet – Rated BB- and Ba3(3) – Debt/adjusted EBITDAR 2.3x(2) – $139mm in share repurchases 2014 • $86 mm in remaining share repurchase authority as of 1/28/15 – Recurring quarterly cash dividend of $0.25 per share Management owns >20% 3 (1) Excluding non-cash mark to market hedge adjustments prior to 2008 and 4Q06 one time tax adjustment (2) See GAAP reconciliation and other calculations in Appendix (3) Corporate rating of Ba3 by Moody’s and BB- by Standard & Poor’s

Advantages over the typical carrier 4 Leisure customer – Will travel in all economic conditions – Vacations are valued – price dependent Small/medium cities – Filling a large void – Increasing opportunity - industry restructuring – Diversity of network - minimizes competition Flexibility – Adjust rapidly to changing macro (fuel/economy) – Changes in supply - immediate impact on price – Minimize threat of irrational behavior from others Low cost fleet – Match capacity to demand, highly variable – Low capital needs, higher free cash flow – Can grow and return cash to shareholders Built to be different Leisure customer Underserved markets Little competition Low cost aircraft Low frequency/variable capacity Unbundled pricing Closed distribution Bundled packages Highly profitable

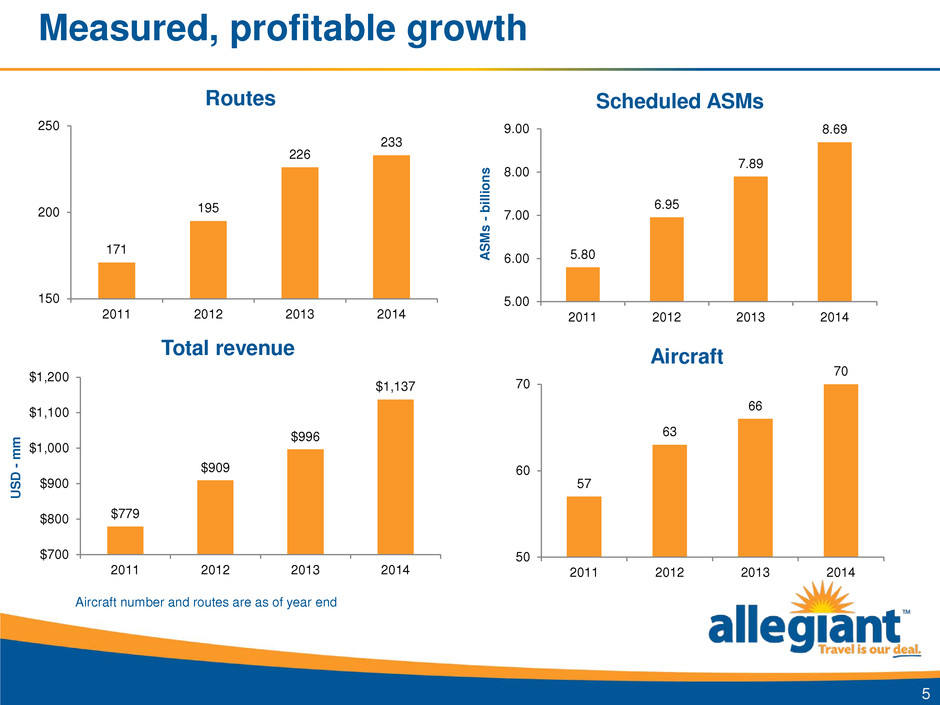

Measured, profitable growth 5 171 195 226 233 150 200 250 2011 2012 2013 2014 Routes 5.80 6.95 7.89 8.69 5.00 6.00 7.00 8.00 9.00 2011 2012 2013 2014 A S M s - b ill io ns Scheduled ASMs $779 $909 $996 $1,137 $700 $800 $900 $1,000 $1,100 $1,200 2011 2012 2013 2014 U S D - m m Total revenue 57 63 66 70 50 60 70 2011 2012 2013 2014 Aircraft Aircraft number and routes are as of year end

A very large niche Based on current published schedule through November 3, 2015 271 routes, 76 operating aircraft 89 small cities, 16 leisure destinations 6 Yellow dots – leisure destinations Blue dots – small cities Large dots - bases

Little competition 33 238 Routes w competition Routes wo competition Current competitive landscape Uniquely built to profitably serve small city markets 7 Competitors – overlapping routes Frontier – 7 Spirit – 1 United – 1 Southwest – 19 US Airways - 2 Delta – 7 Hawaiian – 2 Alaska – 1 JetBlue - 1 American - 1 Based on current published schedule through Nov 3, 2015 Announcements and cancellations as of Feb 20, 2015

Consolidation a catalyst US domestic seats 2007 vs 2014 by airport size 8 0 100 200 300 400 500 600 700 2007 2014 S ea ts - m ill io ns Large hubs 0 50 100 150 200 250 2007 2014 S ea ts - m ill io ns Medium hubs 0 20 40 60 80 100 2007 2014 S ea ts - m ill io ns Small hubs Hub classification by 2013 enplanements Large = Over 1.0% Medium = Between 0.25% and 1.0% Small = Between 0.05% and 0.25% 2007 seats - DOT T100 data for CY2007 (Diio T100 Summary by Originating Airport) 2014 seats - Diio Scheduled Level of Ops Report- 1/1/14-12/31/14

Low frequency model 9 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec S ys te m b lo ck h ou rs /A C /d ay 2012 2013 2014 2015E Avg. block hours/AC/day 1 - Peak = peak is defined as 2/13-4/9, 6/5-8/13, 11/20-12/3, 12/18-12/31. Remaining is off peak 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 2x 3x 4x 5x or greater % o f t ot al d ep ar tu re s Weekly frequency of departures Weekly market frequency Peak Off peak Leisure = seasonality Small cities = low frequency(1) 2012 2013 2014 2015E Sched AC 58 65 70 78

Low costs even with low utilization 7.5 JBLU 5.9 SAVE 7.4 ALK 6.6 ALGT 6.1 ALGT 2015 guided 5.0 5.5 6.0 6.5 7.0 7.5 8.0 5 6 7 8 9 10 11 12 13 14 C A S M e x fu el ( ce nt s) Average daily utilization - LTM CASM ex fuel vs daily utilization 10 As of 2014 ALGT – Allegiant, JBLU – JetBlue, ALK – Alaska mainline, SAVE – Spirit ALGT 2015 – midpoint of 2015 guided range of (10) to (6)%

Airbus growth will help improve fuel burn 11 30.0% 35.0% 40.0% 45.0% 2010 2011 2012 2013 2014 Fuel expense/total revenue 1 - As of 2014 Fuel has greatest leverage to earnings – Fuel ~ 40% of total operating expense(1) – Airbus aircraft flew 21% of 2014 block hours 58.0 60.0 62.0 64.0 66.0 68.0 70.0 2010 2011 2012 2013 2014 Historical ASMs/gallon 1,078 1,000 769 731 700 800 900 1,000 1,100 757 MD-80 A320 A319 Gallons/block hour(1) System fuel cost $2.30 $3.07 $3.18 $3.20 $3.01

Airbus utilization Airbus aircraft allows previously marginal flying to be profitable – Longer routes (Bismarck, ND to Orlando) – Off-peak day flying (Columbus, OH to St. Pete Wed/Sat 2x weekly) – Off-peak season flying (Syracuse, NY to St. Pete in September) – Previously canceled markets (Ft. Wayne, IN to Phoenix) 12 2014 Utilization by A/C type Peak Off-Peak Average Airbus 9.9 5.3 7.9 Non-Airbus 7.1 1.9 4.9 All Aircraft 7.5 2.4 5.3 Utilization is block hours per aircraft per day

Airbus fleet growth 13 Actual and projected fleet count of in service aircraft (based on signed contracts only) – end of period Total fleet includes A320, A319, MD-80 and Boeing 757 Total fleet count reflects assumptions of current market expectations and is subject to change Continuously evaluate potential aircraft transactions and seek to acquire additional aircraft opportunistically A320 12 12 16 16 A319 11 17 18 30 Total fleet 81 86 87 99 20% 30% 40% 50% 2015E 2016E 2017E 2018E Airbus as a % of total fleet

Financial growth without sacrificing margin 16.4% 20.9% 22.5% 25.0% 15.0% 17.0% 19.0% 21.0% 23.0% 25.0% 27.0% 2011 2012 2013 2014 Adjusted EBITDA margin 14 $128 $190 $224 $285 $442 $458 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2011 2012 2013 2014 2015 consensus 2016 consensus U S D - m m Adjusted EBITDA 11.0% 14.6% 15.5% 17.6% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 2011 2012 2013 2014 Adjusted Operating margin $2.57 $4.06 $4.82 $6.37 $11.48 $11.75 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 2011 2012 2013 2014 2015 consensus 2016 consensus Adjusted EPS Consensus - as of 2/25/15, First Call. EPS consensus reflects 14 analysts, EBITDA consensus reflects 11 analysts Adjusted amounts - see GAAP reconciliation and other calculations in Appendix 3 yr CAGR +31% 3 yr CAGR +35%

Cumulative return to shareholders $0.6 $17.4 $42.7 $96.5 $98.4 $103.4 $187.0 $326.1 $326.1 $14.9 $14.9 $53.5 $53.5 $95.3 $139.6 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2007 2008 2009 2010 2011 2012 2013 2014 2015 $ m m Share repurchases Dividends 15 $466m returned to shareholders since 2007 $86m remaining in share repurchase authority* *- As per announcement on January 28, 2015 **-Diluted share count in 2007 20.5m, share count 2014 17.8 m 2015 includes $44m returned through a special dividend declared in 2014 and paid in January 2015 Reduced diluted share count by 13% since 2007** Announced $0.25 per share quarterly cash dividend

1Q15 PRASM (7) to (5)% 1Q15 TRASM (2) to 0% 1Q15 CASM ex fuel +6 to 8% FY15 CASM ex fuel (10) to (6)% 1Q15 Fixed fee + other revenue $9mm to $11mm FY15 CAPEX ~$230mm 1st Quarter 2015 2nd Quarter 2015 Full year 2015 System departures 6 to 10% 12 to 16% System ASMs 2 to 6% 13 to 17% 9 to 13% Scheduled departures 6 to 10% 12 to 16% Scheduled ASMs 2 to 6% 13 to 17% 9 to 13% Existing guidance 16 Guidance subject to change

Appendix

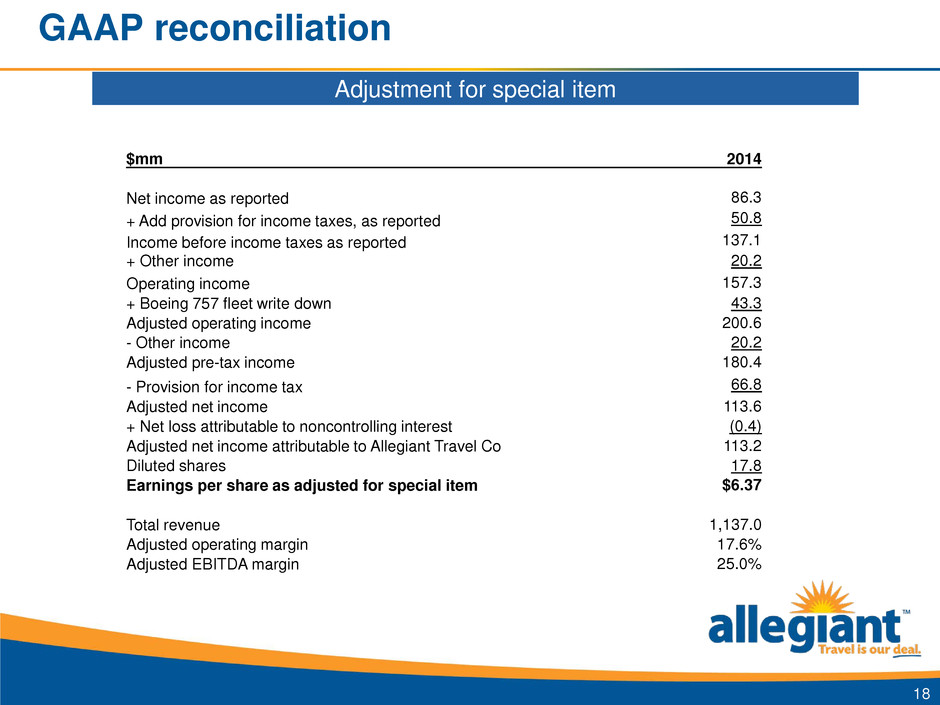

GAAP reconciliation Adjustment for special item 18 2014 $mm Net income as reported 86.3 + Add provision for income taxes, as reported 50.8 Income before income taxes as reported 137.1 + Other income 20.2 Operating income 157.3 + Boeing 757 fleet write down 43.3 Adjusted operating income 200.6 - Other income 20.2 Adjusted pre-tax income 180.4 - Provision for income tax 66.8 Adjusted net income 113.6 + Net loss attributable to noncontrolling interest (0.4) Adjusted net income attributable to Allegiant Travel Co 113.2 Diluted shares 17.8 Earnings per share as adjusted for special item $6.37 Total revenue 1,137.0 Adjusted operating margin 17.6% Adjusted EBITDA margin 25.0%

GAAP reconciliation EBITDA calculations 19 $mm 2014 2013 2012 2011 Net Income 86.7 92.3 78.6 49.4 +Provision for Income Taxes 50.8 54.9 46.2 30.1 +Other Expenses 20.4 8.5 7.8 5.9 +Depreciation and Amortization 83.4 69.3 57.5 42.0 =EBITDA 241.3 225.0 190.1 127.4 + Write down of Boeing 757 fleet 43.3 =Adjusted EBITDA 284.6 + Aircraft lease rental 15.9 9.2 0 1.1 =Adjusted EBITDAR 300.5 234.2 190.1 128.5 Total debt 593.1 234.3 150.9 146.0 +7 x annual rent 111.3 64.6 0 7.7 Adjusted total debt 704.4 298.9 150.9 153.7 =Adjusted Debt to Adjusted EBITDAR 2.3x 1.3x 0.8x 1.2x Average # of in service aircraft in period 69 63 60 52 =Adjusted EBITDA per aircraft 4.1 3.6 3.2 2.4 Interest expense 21.2 9.5 8.7 7.2 = Adjusted interest coverage 13.4x 23.7x 21.9x 17.7x

GAAP reconciliation Return on equity 20 $mm 2014 2013 2012 2011 2010 Adjusted net Income ($mm) 113.2 92.3 78.6 49.4 65.7 Dec 2014 Dec 2013 Dec 2012 Dec 2011 Dec 2010 Dec 2009 Total shareholders equity ($mm) 294.1 377.3 401.7 351.5 297.7 292.0 Return on equity 34% 24% 21% 15% 22% ROE = Net income / Avg shareholders equity Adjusted net income calculation found on Adjustment for special item GAAP reconciliation table

GAAP reconciliation Return on capital employed calculation $mm 2014 2013 2012 2011 2010 + Adjusted net income 113.2 92.3 78.6 49.4 65.7 + Income tax 66.8 54.9 46.2 30.1 37.6 + Interest expense 21.2 9.5 8.7 7.2 2.5 - Interest income 0.8 1.0 1.0 1.2 1.2 200.4 155.7 132.5 85.5 104.6 + Interest income 0.8 1.0 1.0 1.2 1.2 Tax rate 37.1% 37.4% 37.1% 37.9% 36.4% Numerator 126.6 98.1 84.0 53.9 67.3 Total assets prior year 930.2 798.2 706.7 501.3 499.6 - Current liabilities prior year 290.7 210.7 177.6 166.6 158.6 + ST debt of prior year 20.2 11.6 8.0 16.5 21.3 Denominator 659.7 599.3 537.1 351.2 362.3 = Return on capital employed 19.2% 16.4% 15.6% 15.3% 18.6% 21 Adjusted net income calculation found on Adjustment for special item GAAP reconciliation table

GAAP reconciliation Free cash flow calculations 22 $mm 2014 2013 2012 2011 Cash from operations 269.8 196.9 176.8 129.9 - Cash CAPEX 279.4 177.5 105.1 88.0 = Free cash flow (9.6) 19.4 71.7 41.9 2014 CAPEX is cash CAPEX and does not include $142m in assumed debt included in the $236.1m SPC Aircraft Acquisitions closed in June 2014

GAAP reconciliation Net debt 23 $mm Dec 2014 Dec 2013 Dec 2012 Dec 2011 Current maturities of long term debt 53.8 20.2 11.6 7.9 Long term debt, net of current maturities 539.3 214.1 139.2 138.2 Total debt 593.1 234.3 150.8 146.1 Cash and cash equivalents 89.6 97.7 89.6 150.7 Short term investments 269.8 253.4 239.1 154.8 Long term investments 57.4 36.0 24.0 14.0 Total cash 416.8 387.1 352.7 319.5 = Net debt $176.3 ($152.8) ($201.9) ($173.4)

Revenue components 24 $89.15 $88.90 $91.69 $91.30 $85 $90 $95 2011 2012 2013 2014 Average fare - scheduled service $5.18 $5.48 $5.21 $4.56 $4.00 $4.50 $5.00 $5.50 $6.00 2011 2012 2013 2014 Average fare - ancillary third party products $31.17 $35.72 $40.52 $41.37 $25.00 $30.00 $35.00 $40.00 $45.00 2011 2012 2013 2014 Average fare - ancillary air-related charges $126 $130 $137 $137 $120 $125 $130 $135 $140 2011 2012 2013 2014 Average fare - total All revenue is revenue per scheduled passenger

2014 cost per passenger Low cost drivers $48 $43 $48 $60 $12 $17 $11 $14 $11 $5 $9 $13 $24 $22 $49 $40 $21 $23 $30 $38 ALGT SAVE LUV JBLU 25 Source: Company filings Ownership includes depreciation & amortization + aircraft rent Other excludes special items and one-time charges for other carriers ALGT other excludes $43m Boeing 757 fleet write down Other Aircraft $71 $68 $87 $45 $79 $78 Ex fuel cost = $68 Fuel cost = $48 Total Allegiant = $116 Ex fuel cost = $99 Fuel cost = $48 Total Southwest = $147 Ex fuel cost = $105 Fuel cost = $60 Total JetBlue = $165 $65 $45 Ex fuel cost = $67 Fuel cost = $43 Total Spirit = $110 Fuel Ownership Maintenance Other Labor

Credit metrics 15.3% 15.6% 16.4% 19.2% 8.5% -5% 5% 15% 25% 2011 2012 2013 2014 LUV 2014 26 Return on capital employed 15.0% 21.0% 24.0% 34.0% 16.1% 0% 10% 20% 30% 40% 2011 2012 2013 2014 LUV 2014 Return on equity 17.7 x 21.9 x 23.7 x 13.4 x 22.0 x 0 5 10 15 20 25 2011 2012 2013 2014 LUV 2014 Interest coverage 1.2 x 0.8 x 1.3 x 2.3 x 1.5 x 0 1 2 3 2011 2012 2013 2014 LUV 2014 Debt / Adjusted EBITDAR LUV = Southwest Airlines, based on published information Please see GAAP reconciliation table in appendix for calculation

Strong cash generation $127 $190 $225 $285 $100 $125 $150 $175 $200 $225 $250 $275 $300 2011 2012 2013 2014 $ m m 27 Adjusted EBITDA $2.4 $3.2 $3.6 $4.1 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 2011 2012 2013 2014 $ m m Adj EBITDA per AC Free cash flow $42 $72 $19 -$10 -$25 $0 $25 $50 $75 $100 2011 2012 2013 2014 $ m m ($173) ($202) ($153) $176 -$225 -$150 -$75 $0 $75 $150 $225 2011 2012 2013 2014 $ m m Net debt See reconciliation tables Net debt is end of period EBITDA per AC is referring to average number of aircraft in service

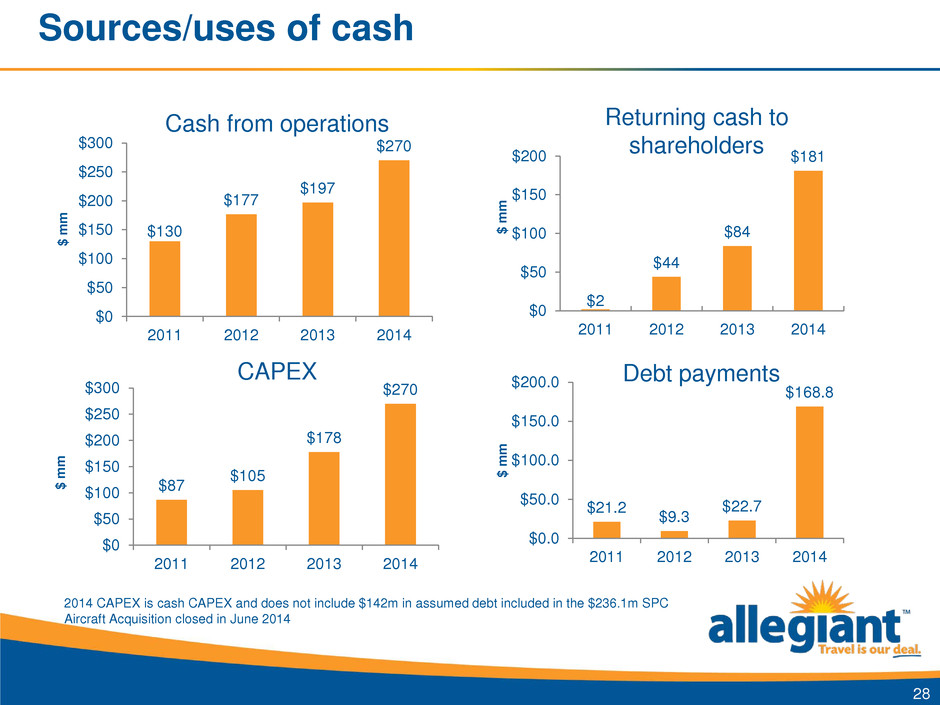

Sources/uses of cash $87 $105 $178 $270 $0 $50 $100 $150 $200 $250 $300 2011 2012 2013 2014 $ m m 28 CAPEX $21.2 $9.3 $22.7 $168.8 $0.0 $50.0 $100.0 $150.0 $200.0 2011 2012 2013 2014 $ m m Debt payments Cash from operations $130 $177 $197 $270 $0 $50 $100 $150 $200 $250 $300 2011 2012 2013 2014 $ m m $2 $44 $84 $181 $0 $50 $100 $150 $200 2011 2012 2013 2014 $ m m Returning cash to shareholders 2014 CAPEX is cash CAPEX and does not include $142m in assumed debt included in the $236.1m SPC Aircraft Acquisition closed in June 2014

Capitalization structure Actual 12/31/14 (MM USD) Debt to LTM Adj EBITDAR Rate Maturity Unrestricted cash 416.8 LTM Adjusted EBITDAR 300.5 Secured by AC 38.5 L + 2.95% Apr 2018 Secured by AC 131.5 L + 3.08% Nov 2018 Secured by AC 34.9 L + 2.95% May 2018 Secured by AC 36.8 L + 3.99% Oct 2018 Secured by real estate 9.7 2.86% Oct 2018 Secured by AC 41.7 L + 2.46% Nov 2019 Total secured debt 293.1 1.0x Senior notes 300 5.5% Jul 2019 Total debt 593.1 2.0x 7x LTM aircraft rent 111.3 Adjusted debt 704.4 2.3x 29