Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - TOOTSIE ROLL INDUSTRIES INC | Financial_Report.xls |

| EX-32 - EX-32 - TOOTSIE ROLL INDUSTRIES INC | tr-20141231xex32.htm |

| EX-31.1 - EX-31.1 - TOOTSIE ROLL INDUSTRIES INC | tr-20141231ex3110a9ab5.htm |

| EX-21 - EX-21 - TOOTSIE ROLL INDUSTRIES INC | tr-20141231ex21b4c3d45.htm |

| EX-31.2 - EX-31.2 - TOOTSIE ROLL INDUSTRIES INC | tr-20141231ex31293eddf.htm |

| 10-K - 10-K - TOOTSIE ROLL INDUSTRIES INC | tr-20141231x10k.htm |

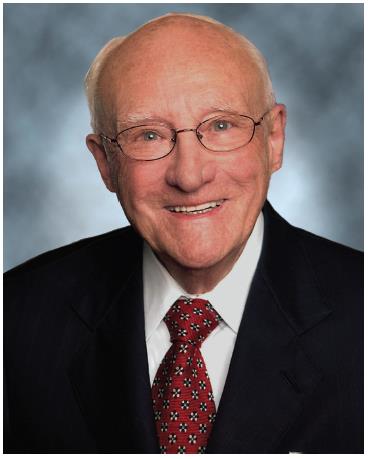

Melvin J. Gordon

1919 - 2015

On January 20, 2015, Melvin J. Gordon, Chairman of the Board of Directors and Chief Executive Officer of Tootsie Roll Industries, passed away at the age of 95 after a brief illness. Mr. Gordon joined the board of what was then Sweets Company of America in 1952 and was elevated to the roles of Chairman and CEO in 1962. Sales at that time were $25 million, profits were $1 million and our product line primarily consisted of Tootsie Rolls and Tootsie Pops.

Mr. Gordon, a man of great vision and drive, reshaped the Company over his long tenure. Early on, he changed the Company's name to Tootsie Roll Industries in recognition of the flagship brand and relocated the Company to a large, centrally located facility in Chicago which remains the Company's headquarters and its largest plant. He expanded operations into Mexico and led the Company through a series of complementary acquisitions which added Dots, Crows, Cella's, Charms, Blow Pop, Junior Mints, Charleston Chew, Sugar Daddy, Sugar Babies, Fluffy Stuff, Andes, Dubble Bubble, Cry Baby and Nik-L-Nip to our portfolio of well-known brands.

Mr. Gordon embraced change and was quick to adopt rapidly evolving technological developments in manufacturing, material handling and information technology. He also directed the development of new products and package configurations to meet changing consumer preferences and evolving trade channels. Throughout his many years as Chairman, the Company saw great growth and success. Today Tootsie Roll is a leading confectioner with a diverse portfolio of well-known brands, seven plants across the United States, Canada and Mexico, and sales in many countries throughout the world.

Mr. Gordon's life represented the very highest values in business, wisdom, generosity, and integrity. His dedication to Tootsie Roll for over fifty years as Board Chair, his creativity, his optimism and his relentless determination to succeed were an inspiration to all who knew him.

1

Corporate Principles

We believe that the differences among companies are attributable to the caliber of their people, and therefore we strive to attract and retain superior people for each job.

We believe that an open family atmosphere at work combined with professional management fosters cooperation and enables each individual to maximize his or her contribution to the Company and realize the corresponding rewards.

We do not jeopardize long-term growth for immediate, short-term results.

We maintain a conservative financial posture in the deployment and management of our assets.

We run a trim operation and continually strive to eliminate waste, minimize cost and implement performance improvements.

We invest in the latest and most productive equipment to deliver the best quality product to our customers at the lowest cost.

We seek to outsource functions where appropriate and to vertically integrate operations where it is financially advantageous to do so.

We view our well known brands as prized assets to be aggressively advertised and promoted to each new generation of consumers.

We conduct business with the highest ethical standards and integrity which are codified in the Company's "Code of Business Conduct and Ethics."

Corporate Profile

Tootsie Roll Industries, Inc. has been engaged in the manufacture and sale of confectionery products for 118 years. Our products are primarily sold under the familiar brand names: Tootsie Roll, Tootsie Roll Pops, Caramel Apple Pops, Child's Play, Charms, Blow Pop, Blue Razz, Cella's chocolate covered cherries, Tootsie Dots, Tootsie Crows, Junior Mints, Junior Caramels, Charleston Chew, Sugar Daddy, Sugar Babies, Andes, Fluffy Stuff cotton candy, Dubble Bubble, Razzles, Cry Baby, Nik-L-Nip and EI Bubble.

Financial Highlights

|

|

|

December 31, |

|

||||

|

|

|

2014 |

|

2013 |

|

||

|

|

|

(in thousands except per share data) |

|

||||

|

Net Product Sales |

|

$ |

539,895 |

|

$ |

539,627 |

|

|

Net Earnings Attributable to Tootsie Roll Industries, Inc. |

|

|

63,298 |

|

|

60,849 |

|

|

Working Capital |

|

|

200,162 |

|

|

179,990 |

|

|

Net Property, Plant and Equipment |

|

|

190,081 |

|

|

196,916 |

|

|

Shareholders' Equity |

|

|

690,809 |

|

|

680,305 |

|

|

Average Shares Outstanding* |

|

|

60,562 |

|

|

61,399 |

|

|

Per Share Items* |

|

|

|

|

|

|

|

|

Net Earnings Attributable to Tootsie Roll Industries, Inc. |

|

$ |

1.05 |

|

$ |

0.99 |

|

|

Cash Dividends Paid |

|

|

0.32 |

|

|

0.24 |

|

*Adjusted for stock dividends.

2

To Our Shareholders

Ellen R. Gordon, Chairman and Chief Executive Officer

Net product sales in 2014 were $539.9 million, as compared to 2013 net product sales of $539.6 million. Most of our core brands posted solid results, and Halloween was once again our largest selling season of the year.

Net earnings grew to $63.3 million in 2014 from $60.8 million in 2013. Earnings per share were $1.05 in 2014, up from $0.99 in the 2013, due to the combination of higher earnings and fewer shares outstanding in 2014.

The increase in earnings was attributable to margin improvements stemming from lower input costs in 2014. We are pleased that we are making progress on restoring our margins to their historical levels before the increases in commodity and other input costs in past years. In order to achieve our profit goals and still deliver maximum value to our consumers, we are challenged to look for every feasible way to keep our operations lean and costs in check.

As a value oriented confectioner, we deem it essential to be a low cost producer. We actively pursue investments in the latest technology to keep us so. We take a long-term view of our business and enact only those measures that improve our operating results without jeopardizing the long-term strength of the Company and its well-known brands.

In this regard, capital expenditures were $10.7 million in 2014. In addition to new state of the art material handling and packaging equipment at a number of our plants, a portion of this figure was directed toward a significant information technology project. We remain committed to enhance productivity through the deployment of leading edge business software.

During 2014, we paid cash dividends of 32 cents per share and again distributed a 3% stock dividend. This was the seventy-second consecutive year the Company has paid cash dividends and the fiftieth consecutive year that a stock dividend was distributed. We also repurchased shares of common stock on the open market.

We ended 2014 with $224.0 million in cash and investments net of interest bearing debt and investments that hedge deferred compensation liabilities. We remain poised to continue investing in our business, improving manufacturing productivity and quality, supporting our brands, paying dividends and repurchasing common stock. We also continue to seek appropriate complementary business acquisitions.

3

Sales and Marketing

Our diverse and highly recognizable brand portfolio is popular across all trade channels. We have a range of offerings suitable for virtually every major consumer group and retail format. During 2014, we again used carefully executed and channel-specific promotions to drive sales. These targeted initiatives, directed both to the trade and to consumers, help to move our products into distribution and subsequently to move them off the retail shelf. We find that emphasizing high sell-through and attractive profit margins to the trade and a high quality, attractive value to the consumer is a winning strategy.

Halloween has long been our largest selling period, with third quarter sales nearly double those of any other quarter in the year. We posted strong results last Halloween in all major trade classes including grocery, mass merchandisers, warehouse clubs, dollar stores and drug chains. Especially popular are our large bags of Child's Play and other mixed candy assortments, which are offered in a variety of pack sizes and merchandising presentations including pallet packs, off-shelf displays and display ready cases.

The candy marketplace is highly competitive and we are vigilant in keeping our products contemporary even as they remain iconic. Our product line undergoes continual refinement in order to retain its appeal to ever-evolving preferences and life styles.

Building on the success of our Caramel Apple Pops, our Blow Pop line was expanded with the addition of Caramel Apple Blow Pops. With a candy shell of luscious caramel entwined with tart green apple hard candy and its emblematic bubble gum center, this unique new confection is really three treats in one!

Caramel Apple Blow Pops

4

The selling power of floor stand displays is well established, but some smaller retail venues may lack the floor space or sales volume to support a traditionally sized display. To meet this need, we introduced a new one-eighth size pallet of Tootsie Rolls and Tootsie Pops in bonus bags. This display has the dual attributes of increasing sales velocity for the retailer and attractive feature pricing for the consumer.

1/8 Pallet Display

The addition of a new floor display also contributed added sales in our penny goods line. The half pallet Frootie shipper consists of 192 bags of the most popular flavors, Blue Razz, Fruit Punch, Green Apple and Strawberry, and was well received in the Cash and Carry class of trade. The Frootie line was further expanded with the addition of tart new Lemon-Lime Frooties.

Lemon Lime Frooties

5

For Dots lovers, the next big thing is here—the BIG BOX! Featuring 20.5 ounces of delicious fruit flavored Dots in a reclosable box, this eye-catching pack promises lots of Dots for the whole family to share!

Dots BIG BOX

We put some fizz in gumball fun with the introduction of Dubble Bubble Fizzers. Pop one of five fizzy soda flavors in your mouth and bite down for a unique effervescent experience of bubble-blowing fun!

Dubble Bubble Fizzers

6

Consumers have become increasingly concerned with protecting the environment, and manufacturers are seeking innovative ways to minimize packaging. One such solution that we implemented in 2014 was in our gumball machine refill packs. By replacing bulky, rigid plastic jars with lightweight resealable flexible pouches, packaging weight was reduced considerably without compromising product freshness.

Gumball refill pouch

Our Andes Crème de Menthe thins have a strong selling history during the Thanksgiving and Christmas Holiday seasons. Andes has also had great success selling outside the candy aisle with Andes Crème de Menthe Baking Chips, which have become the top selling mint baking chip. In 2014, we promoted the minty merriment of baking with Andes Recipe Contest. Visit www.tootsie.com to check out the winning entries and other delicious Andes recipes!

Advertising and Public Relations

During 2014, we continued our initiative of engaging with consumers through social media. Numerous game experiences, banner ads and prize contest entries on Facebook, Twitter, Instagram and Pinterest build and strengthen connections to our brands and also provide a venue for consumer feedback.

Mr. Owl and the long-standing "How Many Licks" Tootsie Pop message are prominently featured in our social media program and in our television advertising campaigns. This renowned theme has become part of Americana, ranging from crossword puzzles to scientific studies.

Most recently a group of NYU graduate students developed a model to analyze how fluids dissolve various materials, and applied it to the Tootsie Pop. Their algorithm concluded that it would take precisely one thousand licks to get to the chewy Tootsie Roll center. We will add this data point to the thousands of estimates we have received over the many years. Nonetheless, we can only conclude that the answer to this riddle remains "the world may never know!"

Purchasing

Cost decreases in sugar, corn syrup, cocoa powder, edible oils and packaging were partially offset by increases in coatings, dairy products and gum base components. In packaging the decrease was primarily due to lower corrugated prices.

Though the cost of many of the commodities we use is lower than recent record highs, some remain well above their historical levels and restoring margins continues to be one of our objectives. Competitive bidding, selective hedging and leveraging our high volume of purchases are some of the means we use to mitigate input costs to the greatest extent feasible.

Supply Chain

We continue to invest capital and resources in projects that keep our production and distribution facilities as efficient as possible, support evolving distribution patterns, improve quality and support growing product lines. Much of this investment is driven by continuing advancements in automation technology that we can incorporate on the shop floor.

7

Considerable effort is made in designing new installations to maximize their flexibility so that we can respond to evolving package configurations or product assortments demanded by the market. Incorporating such flexibility can add significant up-front costs. We are fortunate to have sufficient financial resources and are able to make these necessary investments.

International

In Mexico we manufacture and sell products primarily under the trademark Tutsi. Most of our domestic brands are also sold in Canada, though for certain items they are offered in different package configurations and at different price points which are tailored to that market.

We also export our products to many countries in Europe, Asia, and South and Central America. During 2014, we increased our ownership percentage in Fleer Espanola, a Spanish manufacturer of sugared and sugar free gum. We are currently rebranding a number of their sugared offerings under the Dubble Bubble umbrella and hope to expand our presence in Europe and the Middle East.

In Appreciation

We wish to express our appreciation to our many loyal employees, customers, suppliers, sales brokers and distributors throughout the world for their support in 2014. We also thank our fellow shareholders as we remain committed to the pursuit of excellence in every aspect of our operations and face the increasing challenges of today's business environment.

Ellen R. Gordon

Chairman of the Board and

Chief Executive Officer

8

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(in thousands except per share, percentage and ratio figures)

FINANCIAL REVIEW

This financial review discusses the Company’s financial condition, results of operations, liquidity and capital resources, significant accounting policies and estimates, new accounting pronouncements, market risks and other matters. It should be read in conjunction with the Consolidated Financial Statements and related footnotes that follow this discussion.

FINANCIAL CONDITION

The Company’s overall financial position remains very strong as a result of its improving 2014 gross profit margins, higher net earnings and strong cash flows provided by operating activities. Cash flows from 2014 operating activities totaled $88,769 and were used to pay cash dividends of $19,241, purchase and retire $25,020 of its outstanding shares, make capital expenditures of $10,704, and add to our marketable securities investments.

The Company’s net working capital was $200,162 at December 31, 2014 compared to $179,990 at December 31, 2013 which generally reflects higher cash and cash equivalents and short-term investments. As of December 31, 2014, the Company’s aggregate cash, cash equivalents and investments, including all long-term investments in marketable securities, was $303,137 compared to $270,387 at December 31, 2013, an increase of $32,750. The aforementioned includes $71,682 and $63,215 in trading securities as of December 31, 2014 and 2013, respectively. The Company invests in trading securities to provide an economic hedge for its deferred compensation liabilities, as further discussed herein and in Note 7 to the Consolidated Financial Statements.

Shareholders’ equity increased from $680,305 at December 31, 2013 to $690,809 as of December 31, 2014, principally reflecting 2014 net earnings of $63,298, less cash dividends of $19,241, share repurchases of $25,020, and an increase in accumulated other comprehensive loss during 2014.

The Company has a relatively straight-forward financial structure and has historically maintained a conservative financial position. Except for an immaterial amount of operating leases, the Company has no special financing arrangements or “off-balance sheet” special purpose entities. Cash flows from operations plus maturities of short-term investments are expected to be adequate to meet the Company’s overall financing needs, including capital expenditures, in 2015. Periodically, the Company considers possible acquisitions, and if the Company were to pursue and complete such an acquisition, that could result in bank borrowings or other financing.

Results of Operations

2014 vs. 2013

Net product sales in fourth quarter 2014 increased by 1.8% to $137,929, and twelve months net product sales increased by $268 or 0.1% to $539,895 in 2014. Our sales results in the United States reflect the challenges of certain of our retail customers regarding consumer sales and consumer spending. Overall, 2014 sales volumes in the United States were relatively even with 2013, and there were no significant changes in selling prices and price realization, or product mix. Lower sales in Mexico and Canada, including the effects of a weaker Mexican peso and Canadian dollar, respectively, also adversely affected our reported sales during these same comparative periods.

Product cost of goods sold were $340,933 in 2014 compared to $350,960 in 2013, a decrease of $10,027 or 2.9%. Product cost of goods sold includes $1,140 and $2,457 in certain deferred compensation expenses in 2014 and 2013, respectively. These deferred compensation expenses principally result from changes in the market value of investments and investment income from trading securities relating to compensation deferred in previous years and are not reflective of current operating results. Adjusting for the aforementioned, product cost of goods sold decreased from $348,503 in 2013 to $339,793 in 2014, a decrease of $8,710 or 2.5%. As a percent of net product sales, these adjusted costs decreased from 64.6% in 2013 to 62.9% in 2014, a favorable decrease of 1.7% as a percent of net product sales. Although our overall comparative ingredient costs are more favorable this year, certain key ingredient costs were higher in 2014 compared to 2013. We are continuing our focus on cost reductions and savings, including capital investments to achieve

9

manufacturing efficiencies, and are making progress on restoring our margins to their historical levels before the increases in commodity and other input costs in past years.

Selling, marketing and administrative expenses were $117,722 in 2014 compared to $119,113 in 2013, a decrease of $1,391 or 1.2%. Selling, marketing and administrative expenses include $3,761 and $8,131 in certain deferred compensation expenses in 2014 and 2013, respectively. These deferred compensation expenses principally result from changes in the market value of investments and investment income from trading securities relating to compensation deferred in previous years and are not reflective of current operating results. Adjusting for the aforementioned, selling, marketing and administrative expenses increased from $111,002 in 2013 to $113,961 in 2014, an increase of $2,959 or 2.7%. As a percent of net product sales, these adjusted expenses increased slightly from 20.6% of net product sales in 2013 to 21.1% of net product sales in 2014. Selling, marketing and administrative expenses include $46,525 and $45,367 of freight, delivery and warehousing expenses in 2014 and 2013, respectively, which increased slightly from 8.4% of net product sales in 2013 to 8.6% of net product sales in 2014.

The Company believes that the carrying values of its goodwill and trademarks have indefinite lives as they are expected to generate cash flows indefinitely. In accordance with current accounting guidance, these indefinite-lived intangible assets are assessed at least annually for impairment as of December 31 or whenever events or circumstances indicate that the carrying values may not be recoverable from future cash flows. No impairments were recorded in 2014 or 2013. The fair values of trademarks are assessed each year using the present value of estimated future cash flows and estimated royalties. Based on the Company’s estimate at December 31, 2014, the individual fair values of the indefinite lived intangible assets exceed the net book value by more than 10%. For certain trademarks, holding all other assumptions constant at the test date, a 100 basis point increase in the discount rate or a 100 basis point decrease in the royalty rate would reduce the fair value of certain trademarks by approximately 15% and 11%, respectively. Individually, a 100 basis point increase in the discount rate would indicate a potential impairment of approximately $2,000 as of December 31, 2014. However, if the royalty rate were decreased by 100 basis points no impairment would be indicated as of December 31, 2014.

Earnings from operations were $83,923 in 2014 compared to $72,353 in 2013, an increase of $11,570. Earnings from operations include $4,901 and $10,588 in certain deferred compensation expense in 2014 and 2013, respectively, which are discussed above. Adjusting for these deferred compensation expenses, earnings from operations increased from $82,941 in 2013 to $88,824 in 2014, an increase of $5,883 or 7.1%. This increase in 2014 earnings from operations principally reflects more favorable ingredient costs, plant efficiencies driven by capital investments, and on-going cost control programs.

Management believes the comparisons presented in the preceding paragraphs, after adjusting for changes in deferred compensation, are more reflective of the underlying operations of the Company.

Other income, net was $7,371 in 2014 compared to $12,130 in 2013, a decrease of $4,759. Other income, net principally reflects $4,901 and $10,588 of aggregate net gains and investment income on trading securities in 2014 and 2013, respectively. These trading securities provide an economic hedge of the Company’s deferred compensation liabilities; and the related net gains and investment income were offset by a like amount of expense in aggregate product cost of goods sold and selling, marketing, and administrative expenses in the respective years as discussed above. Other income, net also includes foreign exchange losses of $861 and $790 in 2014 and 2013, respectively.

During fourth quarter 2013, the Company sold its investment in Jefferson County Alabama Sewer Revenue Refunding Warrants for $10,840. This was an auction rate security (ARS) originally purchased for $13,550 in 2008 with an insurance-backed AAA rating. Because the Company recorded an other-than-temporary pre-tax impairment of $5,140 in 2008 on this ARS investment which resulted in a carrying value of $8,410 at that time, a net gain of $2,430 was recorded on this sale in fourth quarter 2013. Since recording this initial impairment in 2008, the Company carried this ARS investment at its estimated fair value utilizing a valuation model with Level 3 inputs, as defined by guidance, and resulting changes in the market value from the date of the original impairment charge in 2008 to its sale in fourth quarter 2013 have been recorded as changes to accumulated other comprehensive income (loss) each year.

10

The consolidated effective tax rate was 31.1% and 28.0% in 2014 and 2013, respectively. This higher effective tax rate in 2014 reflects an additional deferred income tax expense of $2,350 relating the Company’s step acquisition of its Spanish subsidiaries which is discussed below. A reconciliation of the differences between the U.S. statutory rate and these effective tax rates is provided in Note 4 to the Consolidated Financial Statements. At December 31, 2014, the Company’s deferred tax assets include $10,880 of income tax benefits relating to its Canadian subsidiary tax loss carry-forwards which the Company expects to realize before their expiration dates (2027 through 2031). The Company utilized approximately $600 and $400 of these tax carry-forward benefits in 2014 and 2013, respectively. The Company has concluded that it is more-likely-than-not that it would realize these deferred tax assets relating to its Canadian tax operating loss carry-forwards because it is expected that sufficient levels of taxable income will be generated during the carry-forward periods. The Company has provided a full valuation allowance on its Spanish subsidiaries’ tax loss carry-forward benefits of approximately $2,092 as of December 31, 2014 because the Company has concluded that it is not more-likely-than-not that these losses will be utilized before their expiration dates. The Spanish subsidiaries have a history of net operating losses and it is not known when and if they will generate taxable income in the future. The Company has not provided for U.S. federal or foreign withholding taxes on approximately $5,400 and $11,000 of foreign subsidiaries’ undistributed earnings as of December 31, 2014 and December 31, 2013, respectively, because such earnings are considered to be permanently reinvested. The Company estimates that the federal income tax liability on such undistributed earnings would approximate 30% of these amounts.

Net earnings attributable to Tootsie Roll Industries, Inc. were $63,298 in 2014 compared to $60,849 in 2013, and earnings per share were $1.05 and $0.99 in 2014 and 2013, respectively, an increase of $0.06 or 6.1%. Net earnings principally benefited from improved gross profit margins which are discussed above. Net earnings for the prior year 2013 benefited from a lower effective income tax rate and a capital gain on the sale of an investment security (Jefferson County Warrants discussed above), both of which adversely affects the comparison of 2014 net earnings to those in 2013. Earnings per share in 2014 benefited from the reduction in average shares outstanding resulting from purchases of the Company’s common stock in the open market by the Company. Average shares outstanding decreased from 61,399 in 2013 to 60,562 in 2014.

During first quarter 2014, the Company gained operating control of its two 50% owned Spanish companies when Company employee representatives assumed all positions on their boards of directors. This was considered a step acquisition, whereby the Company remeasured the previously held investment to fair value in first quarter 2014. As a result, the Company’s first quarter 2014 net earnings include a net loss of $529, including an additional income tax provision of $2,350 relating to deferred income taxes. During 2014, the Company further increased its control and ownership to 83% by purchasing and subscribing to additional common shares of its Spanish subsidiaries for approximately $1,400 ($1,200 was paid in 2014, and the balance will be paid in 2015). These Spanish companies had operating losses for each of the years 2008 through 2014. Company management has restructured the Spanish operations and made other changes to its business plan, and management believes that they should be nearing break-even cash flows from operating activities going forward. Management believes that the business, competitive and economic challenges in Spain are likely to continue, and therefore, additional cash financing of these Spanish companies may be required in the future. Other income, net in prior year 2013 includes the results of the Company’s 50% share of two Spanish companies which were accounted for using the equity investment method in 2013. Equity method losses were $967 for 2013. In addition, a pre-tax impairment charge of $975 was recorded in 2013 to write-down the Company’s carrying value of this equity investment to estimated fair value.

Beginning in 2012, the Company received notices from the Bakery, Confectionery, Tobacco Workers and Grain Millers International Union (BC&T) Pension Plan (Plan), a multi-employer defined benefit pension plan for certain Company union employees. The notices indicated that the Plan’s actuary certified the Plan to be in critical status, the “Red Zone”, as defined by the Pension Protection Act (PPA) and the Pension Benefit Guaranty Corporation (PBGC), and that a plan of rehabilitation was adopted by the trustees of the Plan in fourth quarter 2012. The rehabilitation plan, which continues, requires that employer contributions include 5% compounded annual surcharge increases each year for an unspecified period of time beginning January 2013 (in addition to the 5% interim surcharge initiated in June 2012) as well as certain plan benefit reductions. Under the plan of rehabilitation, the Plan is projected to emerge from critical status sometime beyond a 30 year projection period. In the event that a plan does not have the financial resources to ultimately pay benefits at a level specified by law, then it must apply to the PBGC for government financial assistance. The Trustees have advised that neither the PPA nor regulatory guidance currently defines the rehabilitation standards for a plan that is

11

not designed to emerge from critical status within the prescribed 10-year rehabilitation period. Recently enacted legislation (Multiemployer Pension Reform Act of 2014) may also affect the future of this Plan.

The Company was previously advised by the Plan that if the Company had withdrawn from the Plan during 2012 its estimated withdrawal liability would have been $37,200. The Company was recently advised by the Plan that its withdrawal liability would have been $56,400 if it had withdrawn from the Plan during 2014. The increase from 2012 to 2014 principally reflects changes in key actuarial assumptions, principally the effects of a lower interest rates proscribed by PBGC which were partially used to determine the present value of vested benefits, and a change to a more conservative mortality table. Based on the Company’s actuarial study and certain provisions in ERISA relating to withdrawal liability payments, management believes that the Company’s liability would be limited to twenty annual payments of $2,999 which have a present value of $35,193 based on the minimum funding interest rate of 6.5% used by the Plan. Should the Company actually withdraw from the Plan at a future date, a withdrawal liability, which could be higher than the above discussed amounts, could be payable to the Plan.

The Company’s existing labor contract with its BC&T local union commits the Company’s participation in this Plan through third quarter 2017. Pension expense, including surcharges, for the BC&T Plan for 2014 and 2013 was $2,588 and $2,231, respectively. The aforementioned expense includes surcharge increases of $342 and $242 in 2014 and 2013, respectively, related to the contribution increases required under the plan of rehabilitation. The Company is currently unable to determine the ultimate outcome of the above discussed matter and therefore, is unable to determine the effects on its consolidated financial statements, but, the ultimate outcome could be material to its consolidated results of operations in one or more future periods.

2013 vs. 2012

Net product sales were $539,627 in 2013 compared to $545,985 in 2012, a decrease of $6,358 or 1.2%. The decline in 2013 sales reflects some special promotional sales in 2012 that were not repeated in 2013.

Product cost of goods sold were $350,960 in 2013 compared to $365,573 in 2012, a decrease of $14,613 or 4.0%. Product cost of goods sold includes $2,457 and $1,034 in certain deferred compensation expenses in 2013 and 2012, respectively. These deferred compensation expenses principally result from changes in the market value of investments and investment income from trading securities relating to compensation deferred in previous years and are not reflective of current operating results. Adjusting for the aforementioned, product cost of goods sold decreased from $364,539 in 2012 to $348,503 in 2013, a decrease of $16,036 or 4.4%. As a percent of net product sales, these adjusted costs decreased from 66.8% in 2012 to 64.6% in 2013, a favorable decrease of 2.2% as a percent of net product sales. Although certain key ingredient costs were higher in 2013, our overall comparative ingredient costs are more favorable this year; however, our packaging materials and manufacturing plant operating costs did increase in 2013 compared to 2012.

Selling, marketing and administrative expenses were $119,133 in 2013 compared to $113,842 in 2012, an increase of $5,291 or 4.6%. Selling, marketing and administrative expenses include $8,131 and $3,582 in certain deferred compensation expenses in 2013 and 2012, respectively. These deferred compensation expenses principally result from changes in the market value of investments and investment income from trading securities relating to compensation deferred in previous years and are not reflective of current operating results. Adjusting for the aforementioned, selling, marketing and administrative expenses increased from $110,260 in 2012 to $111,002 in 2013, an increase of $742 or 0.7%. As a percent of net product sales, these adjusted expenses increased slightly from 20.2% of net product sales in 2012 to 20.6% of net product sales in 2013. Selling, marketing and administrative expenses include $45,367 and $45,072 of freight, delivery and warehousing expenses in 2013 and 2012, respectively, which increased slightly from 8.3% of net product sales in 2012 to 8.4% of net product sales in 2013.

Earnings from operations were $72,353 in 2013 compared to $69,479 in 2012, an increase of $2,874. Earnings from operations include $10,588 and $4,616 in certain deferred compensation expense in 2013 and 2012, respectively, which are discussed above. Adjusting for these deferred compensation expenses, earnings from operations were $82,941 and $74,095 in 2013 and 2012, respectively, an increase of $8,846 or 11.9%. This increase in 2013 earnings from operations principally reflects more favorable ingredient costs, plant efficiencies driven by capital investments, and on-going cost control programs.

12

Management believes the comparisons presented in the preceding paragraphs after adjusting for changes in deferred compensation are more reflective of the underlying operations of the Company.

Other income, net was $12,130 in 2013 compared to $4,685 in 2012, an increase of $7,445. Other income, net principally reflects $10,588 and $4,616 of aggregate net gains and investment income on trading securities in 2013 and 2012, respectively. These net gains and investment income were offset by a like amount of expense in aggregate product cost of goods sold and selling, marketing, and administrative expenses in the respective years as discussed above. Other income, net also includes foreign exchange gains (losses) of $(790) and $442 in 2013 and 2012, respectively, and a net gain of $2,430 on the sale of its investment in Jefferson County Alabama Warrants as discussed above.

Other income, net includes the results of the Company’s 50% share of two Spanish companies which were accounted for using the equity method. These equity method losses were $967 and $1,019 for 2013 and 2012, respectively. In addition, pre-tax impairment charges of $975 and $850 were recorded in 2013 and 2012, respectively, to write-down the Company’s carrying value to estimated fair value.

The consolidated effective tax rate was 28.0% and 29.9% in 2013 and 2012, respectively; a reconciliation of the differences between the U.S. statutory rate and these effective tax rates is provided in Note 4 to the Consolidated Financial Statements. At December 31, 2013, the Company’s deferred tax assets include $12,512 of income tax benefits relating to its Canadian subsidiary tax loss carry-forwards which the Company expects to realize before their expiration dates (2026 through 2031). The Company utilized approximately $400 and $3,000 of these carry-forward tax loss benefits in 2013 and 2012, respectively.

Net earnings were $60,849 in 2013 compared to $52,004 in 2012, and earnings per share were $0.99 and $0.84 in 2013 and 2012, respectively, an increase of $0.15 or 17.9%. Net earnings benefited from improved gross profit margins, as well as a gain on the sale of its Jefferson County warrants, as discussed above, and a lower effective tax rate, all of which are discussed above. Earnings per share benefited from the reduction in average shares outstanding resulting from purchases of the Company’s common stock in the open market by the Company. Average shares outstanding decreased from 62,248 in 2012 to 61,399 in 2013.

LIQUIDITY AND CAPITAL RESOURCES

Cash flows from operating activities were $88,769, $109,823 and $101,418 in 2014, 2013 and 2012, respectively. The $21,054 decrease in cash flows from operating activities from 2013 to 2014 primarily reflects increases in inventories and accounts receivable in 2014, and changes in prepaid expenses and other assets in the respective years. The aforementioned increases in inventories and accounts receivable principally reflect the timing of fourth quarter sales and manufacturing planning for inventories. The increase in cash flows from 2012 to 2013 primarily reflects the 2012 increase in net earnings, as well as changes in inventories and prepaid expenses and other assets in the comparative years.

During fourth quarter 2014 and 2013, the Company contributed $1,000 and $15,000 to a VEBA trust, managed and controlled by the Company, to fund the estimated future costs of certain employee health, welfare and other benefits. The Company is using these funds to pay the actual cost of such benefits through 2017. At December 31, 2014 and 2013, the VEBA trust held $10,845 and $13,991, respectively, of aggregate cash and cash equivalents. This asset value is included in prepaid expenses and long-term other assets in the Company’s Consolidated Statement of Financial Position. These assets are categorized as Level 1 within the fair value hierarchy.

During fourth quarter 2013, the Company restructured and amended its post-retirement health benefits plan provided to corporate office and management employees. These changes resulted in a negative plan amendment, as defined by accounting guidance, resulting in a $10,425 reduction in the Company’s benefit obligation as of December 31, 2013. The plan changes generally limited future annual cost increases in health benefits to 3%, restricted this benefit to current employees with long-term service with the Company, required retirees to pay the full cost of life insurance, and eliminated all post-retirement benefits for future employees effective April 1, 2014. Post-retirement benefits liabilities (as amended) were $12,300 and 8,857 at December 31, 2014 and 2013, respectively. The aforementioned increase reflects actuarial losses relating to an 86 basis point decrease in the discount rate (3.83% discount rate used at December

13

31, 2014) and an update of the mortality table based on the Society of Actuaries’ research that indicates that retirees are living longer.

Cash flows from investing activities reflect capital expenditures of $10,704, $15,752, and $8,886 in 2014, 2013 and 2012, respectively. The changes in amounts each year principally reflects the timing of expenditures relating to plant manufacturing projects. These capital expenditures include $1,676, $1,775 and $830 relating to computer systems and software and implementations in 2014, 2013 and 2012, respectively. Capital expenditures for 2015 are expected to be in line with historical annual spending but actual expenditures can vary due to the timing of larger projects and payments. They are to be funded from the Company’s cash flow from operations and internal sources.

Other than the bank loans and the related restricted cash of the Company’s Spanish subsidiaries which are discussed in Note 1 to the consolidated financial statements, the Company had no bank borrowings or repayments in 2012, 2013, or 2014, and had no outstanding bank borrowings as of December 31, 2012 or 2013. Nonetheless, the Company would consider bank borrowing or other financing in the event that a business acquisition is completed.

Financing activities include Company common stock purchases and retirements of $25,020, $23,143, and $23,803 in 2014, 2013 and 2012, respectively. Cash dividends of $19,241, $14,282, and $52,431 (includes a special one-time dividend of $29,138 in 2012) were paid in 2014, 2013 and 2012, respectively. The fourth quarter 2012 included a special $0.50 per share cash dividend as well as an accelerated payment of the regular quarterly dividend of $0.08 per share which has historically been paid during the first week in January. Both were in response to the uncertainty surrounding the future federal tax treatment of dividends at that time after giving consideration to the Company’s cash and investment position.

SIGNIFICANT ACCOUNTING POLICIES AND ESTIMATES

Preparation of the Company’s financial statements involves judgments and estimates due to uncertainties affecting the application of accounting policies, and the likelihood that different amounts would be reported under different conditions or using different assumptions. The Company bases its estimates on historical experience and other assumptions, as discussed herein, that it believes are reasonable. If actual amounts are ultimately different from previous estimates, the revisions are included in the Company’s results of operations for the period in which the actual amounts become known. The Company’s significant accounting policies are discussed in Note 1 to the Consolidated Financial Statements.

Following is a summary and discussion of the more significant accounting policies which management believes to have a significant impact on the Company’s operating results, financial position, cash flows and footnote disclosure.

Revenue recognition

Revenue, net of applicable provisions for discounts, returns, allowances and certain advertising and promotional costs, is recognized when products are delivered to customers based on a customer purchase order, and collectability is reasonably assured. The accounting for promotional costs is discussed under “Customer incentive programs, advertising and marketing” below.

Provisions for bad debts are recorded as selling, marketing and administrative expenses. Write-offs of bad debts did not exceed 0.1% of net product sales in each of 2014, 2013 and 2012, and accordingly, have not been significant to the Company’s financial position or results of operations.

Intangible assets

The Company’s intangible assets consist primarily of goodwill and acquired trademarks. All trademarks have been assessed by management to have indefinite lives because they are expected to generate cash flows indefinitely. In accordance with accounting guidance, goodwill and other indefinite-lived assets are not amortized, but are instead subjected to annual testing for impairment unless certain triggering events or circumstances are noted. The Company performs its annual impairment testing as of December 31. The Company may utilize third-party professional valuation firms to assist in the determination of valuation of certain trademarks.

With respect to impairment testing of goodwill, the first step compares the reporting unit’s estimated fair value with its carrying value. We estimate a reporting unit’s fair value using projected discounted cash flows. If the carrying value of a

14

reporting unit’s net assets exceeds its fair value, the second step is applied to measure the difference between the carrying value and implied fair value of goodwill. If the carrying value of goodwill exceeds its implied fair value, the goodwill is considered impaired and reduced to its implied fair value.

We test non-amortizable intangible assets, trademarks, for impairment by comparing the fair value of each trademark with its carrying value. We determine fair value of trademarks using discounted cash flows and estimates of royalty rates. If the carrying value exceeds fair value, the trademark is considered impaired and is reduced to fair value.

The cash flow projections discussed above requires us to make assumptions and estimates regarding our future plans, including sales projections and profit margins, market based discount rates, competitive factors, and economic conditions; and our actual results and conditions may differ over time. A change in the assumptions relating to the impairment analysis of goodwill and trademarks, including but not limited to a reduction in projected cash flows, the use of a different discount rate to discount future cash flows or a different royalty rate applied to the Company’s trademarks, could cause impairment in the future.

Customer incentive programs, advertising and marketing

Advertising and marketing costs are recorded in the period to which such costs relate. The Company does not defer the recognition of any amounts on its consolidated balance sheet with respect to such costs. Customer incentives and other promotional costs are recorded at the time of sale based upon incentive program terms and historical utilization statistics, which are generally consistent from year to year.

The liabilities associated with these programs are reviewed quarterly and adjusted if utilization rates differ from management’s original estimates. Such adjustments have not historically been material to the Company’s operating results.

Split dollar officer life insurance

The Company provides split dollar life insurance benefits to certain executive officers and records an asset principally equal to the cumulative premiums paid. The Company will fully recover these premiums in future years under the terms of the plan. The Company retains a collateral assignment of the cash surrender values and policy death benefits payable to insure recovery of these premiums.

Valuation of long-lived assets

Long-lived assets, primarily property, plant and equipment are reviewed for impairment as events or changes in business circumstances occur indicating that the carrying value of the asset may not be recoverable. The estimated cash flows produced by assets or asset groups, are compared to the asset carrying value to determine whether impairment exists. Such estimates involve considerable management judgment and are based upon assumptions about expected future operating performance. As a result, actual cash flows could differ from management’s estimates due to changes in business conditions, operating performance, and economic and competitive conditions.

Income taxes

Deferred income taxes are recognized for future tax effects of temporary differences between financial and income tax reporting using tax rates in effect for the years in which the differences are expected to reverse. The Company records valuation allowances in situations where the realization of deferred tax assets, including those relating to net operating tax losses, is not more-likely-than-not; and the Company adjusts and releases such valuation allowances when realization becomes more-likely-than-not as defined by accounting guidance. The Company periodically reviews assumptions and estimates of the Company’s probable tax obligations and effects on its liability for uncertain tax positions, using informed judgment which may include the use of third-party consultants, advisors and legal counsel, and historical experience.

15

Valuation of investments

Investments, primarily municipal bonds, mutual funds and equity method investments are reviewed for impairment at each reporting period by comparing the carrying value or amortized cost to the fair market value. The Company may utilize third-party professional valuation firms as necessary to assist in the determination of the value of investments that utilize Level 3 inputs as defined by guidance. In the event that an investment security’s fair value is below carrying value or amortized cost, the Company will record an other-than-temporary impairment or a temporary impairment based on accounting guidance.

Other matters

In the opinion of management, other than contracts for foreign currency forwards and raw materials, including currency and commodity hedges and outstanding purchase orders for packaging, ingredients, supplies, and operational services, all entered into in the ordinary course of business, the Company does not have any significant contractual obligations or future commitments. The Company’s outstanding contractual commitments as of December 31, 2014, all of which are generally normal and recurring in nature, are summarized in the chart on page 12, which is incorporated by reference herein.

RECENT ACCOUNTING PRONOUNCEMENTS

See Note 1 of the Company’s Note to Consolidated Financial Statements.

MARKET RISKS

The Company is exposed to market risks related to commodity prices, interest rates, investments in marketable securities, equity price and foreign exchange.

The Company’s ability to forecast the direction and scope of changes to its major input costs is impacted by significant volatility in crude oil, sugar, corn, soybean and edible oils, cocoa and dairy products markets. The prices of these commodities are influenced by changes in global demand, changes in weather and crop yields, including the effects of climate change, changes in governments’ farm policies, including mandates for ethanol and bio-fuels, environmental matters, and fluctuations in the U.S. dollar relative to dollar-denominated commodities in world markets. The Company believes that its competitors face the same or similar challenges.

In order to address the impact of rising input and other costs, the Company periodically reviews each item in its product portfolio to ascertain if price realization adjustments or other actions should be taken. These reviews include an evaluation of the risk factors relating to market place acceptance of such changes and their potential effect on future sales volumes. In addition, the estimated cost of packaging modifications associated with weight changes is evaluated. The Company also maintains ongoing cost reduction and productivity improvement programs under which cost savings initiatives are encouraged and progress monitored. The Company is not able to accurately predict the outcome of these cost savings initiatives and their effects on its future results.

Commodity future and foreign currency forward contracts

Commodity price risks relate to ingredients, primarily sugar, cocoa, chocolate, corn syrup, dextrose, soybean and edible oils, milk, whey and gum base ingredients. The Company believes its competitors face similar risks, and the industry has historically adjusted prices to compensate for adverse fluctuations in commodity costs. The Company, as well as competitors in the confectionery industry, has historically taken actions, including higher price realization to mitigate rising input costs for ingredients, energy, freight and delivery. Although management seeks to substantially recover cost increases over the long-term, there is risk that higher price realization cannot be fully passed on to customers and, to the extent they are passed on, they could adversely affect customer and consumer acceptance and resulting sales volume.

The Company utilizes commodity futures contracts and commodity options contracts, as well as annual supply agreements, to hedge and plan for anticipated purchases of certain ingredients, including sugar, in order to mitigate commodity cost fluctuation. The Company also may purchase forward foreign exchange contracts to hedge its costs of

16

manufacturing certain products in Canada for sale and distribution in the United States, and periodically does so for purchases of equipment or raw materials from foreign suppliers. Such commodity futures, commodity options and currency forward contracts are cash flow hedges and are effective as hedges as defined by accounting guidance. The unrealized gains and losses on such contracts are deferred as a component of accumulated other comprehensive loss (or gain) and are recognized as a component of product cost of goods sold when the related inventory is sold.

The potential change in fair value of commodity and foreign currency derivative instruments held by the Company at December 31, 2014, assuming a 10% change in the underlying contract price, was $3,303. The analysis only includes commodity and foreign currency derivative instruments and, therefore, does not consider the offsetting effect of changes in the price of the underlying commodity or foreign currency. This amount is not significant compared with the net earnings and shareholders’ equity of the Company.

Interest rates

Interest rate risks primarily relate to the Company’s investments in tax exempt marketable securities with maturities or auction dates of generally up to three years.

The majority of the Company’s investments, which are classified as available for sale, have historically been held until they mature, which limits the Company’s exposure to interest rate fluctuations. The accompanying chart summarizes the maturities of the Company’s investments in debt securities at December 31, 2014.

|

|

|

|

|

|

|

Less than 1 year |

|

$ |

39,436 |

|

|

1 – 2 years |

|

|

42,491 |

|

|

2 – 3 years |

|

|

48,691 |

|

|

Over 3 years |

|

|

714 |

|

|

Total |

|

$ |

131,332 |

|

The Company’s outstanding debt at December 31, 2014 and 2013 was $7,500 in an industrial revenue bond in which interest rates reset each week based on the current market rate. Therefore, the Company does not believe that it has significant interest rate risk with respect to its interest bearing debt.

Investment in marketable securities

As stated above, the Company invests primarily in tax exempt marketable securities with maturities or auction dates generally up to three years. The Company utilizes professional money managers and maintains investment policy guidelines which emphasize quality and liquidity in order to minimize the potential loss exposures that could result in the event of a default or other adverse event, including failed auctions. The Company continues to monitor these investments and markets, as well as its investment policies, however, the financial markets could experience unanticipated or unprecedented events as it did beginning in 2008, and future outcomes may be less predictable than in the past.

Equity price

Equity price risk relates to the Company’s investments in mutual funds which are principally used to fund and hedge the Company’s deferred compensation liabilities. At December 31, 2014, the Company has investments in mutual funds, classified as trading securities, of $71,682. Any change in the fair value of these trading securities is completely offset by a corresponding change in the respective hedged deferred compensation liability.

Foreign currency

Foreign currency risk principally relates to the Company’s foreign operations in Canada, Mexico and Spain, as well as periodic purchase commitments of machinery and equipment from foreign sources.

Certain of the Company’s Canadian manufacturing costs, including local payroll and plant operations, and a portion of its packaging and ingredients are sourced in Canadian dollars. The Company may purchase Canadian forward contracts

17

to receive Canadian dollars at a specified date in the future and uses its Canadian dollar collections on Canadian sales as a partial hedge of its overall Canadian manufacturing obligations sourced in Canadian dollars. The Company also periodically purchases and holds Canadian dollars to facilitate the risk management of these currency changes.

From time to time, the Company may use foreign exchange forward contracts and derivative instruments to mitigate its exposure to foreign exchange risks, as well as those related to firm commitments to purchase equipment from foreign vendors. See Note 10, Fair Value Measurements, for outstanding foreign exchange forward contracts as of December 31, 2014.

RISK FACTORS

The Company’s operations and financial results are subject to a number of risks and uncertainties that could adversely affect the Company’s operating results and financial condition. Significant risk factors, without limitation, that could impact the Company, are the following: (i) significant competitive activity, including advertising, promotional and price competition, and changes in consumer demand for the Company’s products; (ii) fluctuations in the cost and availability of commodities and ingredients, including the effects adverse weather and climate change, and disease in west Africa which could affect cocoa supplies; and the ability to recover cost increases through product sales price increases; (iii) inherent risks in the marketplace, including uncertainties about trade and consumer acceptance of product pricing changes and seasonal events such as Halloween, the Company’s largest sales season; (iv) the effect of acquisitions on the Company’s results of operations and financial condition; (v) the effect of changes in foreign currencies on the Company’s foreign subsidiaries operating results, and the effect of the fluctuation of the Canadian dollar on products manufactured in Canada and marketed and sold in the United States in U.S. dollars; (vi) the Company’s reliance on third party vendors for various goods and services, including commodities used for ingredients that are primarily grown or sourced from foreign locations; (vii) the Company’s ability to successfully implement new production processes and manufacturing automation and computer systems without disruption or quality problems; (viii) the effect of changes in assumptions, including discount rates, sales growth and profit margins, which could affect the Company’s impairment testing and analysis of its goodwill and trademarks; (ix) changes in the confectionery marketplace including actions taken by major retailers and customers; (x) customer, consumer and competitor response to marketing programs and price and product weight adjustments, and new products; (xi) dependence on significant customers, including the volume and timing of their purchases, availability of shelf space, and competitive products; (xii) increases in energy costs, including freight and delivery, that cannot be passed along to customers through increased price realization due to competitive reasons; (xiii) any significant labor stoppages, strikes or production interruptions; (xiv) changes in governmental laws or regulations that affect ingredients used in products, or taxes, tariffs or other government restrictions on products sold; (xv) the adverse effects should the Company either voluntarily or involuntarily recall its product(s) from the marketplace; (xvi) the risk that the market value of Company’s investments could decline including being classified as “other-than-temporary” as defined; (xvii) the Company’s dependence on its enterprise resource planning computer system to manage its supply chain and customer deliveries, and the risk that the Company’s information technology systems fail to perform adequately; (xviii) the adverse effects if the Company is unable to protect such information technology systems against data corruption, cyber-based attacks or network security breaches; (xix) the potential adverse effects on the Company as to changes to improve the funding status of the Bakery and Confectionery Union and Industry Pension Plan, a multi-employer plan which covers certain Company union employees; (xx) the adverse effects if restructuring efforts and changes in business plans with respect to the Company’s Spanish subsidiaries are not fully successful; and (xxi) the potential effects of current and future macroeconomic conditions and geopolitical events.

Forward-looking statements

This discussion and certain other sections contain forward-looking statements that are based largely on the Company’s current expectations and are made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of words such as “anticipated,” “believe,” “expect,” “intend,” “estimate,” “project,” and other words of similar meaning in connection with a discussion of future operating or financial performance and are subject to certain factors, risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in the forward-looking statements. Such factors, risks, trends and uncertainties which in some instances are beyond the Company’s control, include the overall competitive

18

environment in the Company’s industry, changes in assumptions and judgments discussed above under the heading “Significant Accounting Policies and Estimates”, and factors identified and referred to above under the heading “Risk Factors.”

The risk factors identified and referred to above are believed to be significant factors, but not necessarily all of the significant factors that could cause actual results to differ from those expressed in any forward-looking statement. Readers are cautioned not to place undue reliance on such forward-looking statements, which are made only as of the date of this report. The Company undertakes no obligation to update such forward-looking statements.

Open Contractual Commitments as of December 31, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less than |

|

1 to 3 |

|

3 to 5 |

|

More than |

|

||||

|

Payable in |

|

Total |

|

1 Year |

|

Years |

|

Years |

|

5 Years |

|

|||||

|

Commodity hedges |

|

$ |

5,422 |

|

$ |

5,422 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

Foreign currency hedges |

|

|

27,604 |

|

|

16,641 |

|

|

10,963 |

|

|

— |

|

|

— |

|

|

Purchase obligations |

|

|

8,406 |

|

|

8,406 |

|

|

— |

|

|

— |

|

|

— |

|

|

Interest bearing debt |

|

|

7,500 |

|

|

— |

|

|

— |

|

|

— |

|

|

7,500 |

|

|

Operating leases |

|

|

1,428 |

|

|

978 |

|

|

449 |

|

|

1 |

|

|

— |

|

|

Total |

|

$ |

50,360 |

|

$ |

31,447 |

|

$ |

11,412 |

|

$ |

1 |

|

$ |

7,500 |

|

Note: Commodity hedges and foreign currency hedges reflect the amounts at which the Company will settle the related contracts. The above amounts exclude deferred income tax liabilities of $47,356, liabilities for uncertain tax positions of $8,584, postretirement health care benefits of $11,983 and deferred compensation and other liabilities of $78,674 because the timing of payments relating to these items cannot be reasonably determined.

19

CONSOLIDATED STATEMENTS OF

Earnings and Retained Earnings

|

TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES |

(in thousands except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended December 31, |

|

|||||||

|

|

|

2014 |

|

2013 |

|

2012 |

|

|||

|

Net product sales |

|

$ |

539,895 |

|

$ |

539,627 |

|

$ |

545,985 |

|

|

Rental and royalty revenue |

|

|

3,630 |

|

|

3,756 |

|

|

3,885 |

|

|

Total revenue |

|

|

543,525 |

|

|

543,383 |

|

|

549,870 |

|

|

Product cost of goods sold |

|

|

340,933 |

|

|

350,960 |

|

|

365,573 |

|

|

Rental and royalty cost |

|

|

947 |

|

|

937 |

|

|

976 |

|

|

Total costs |

|

|

341,880 |

|

|

351,897 |

|

|

366,549 |

|

|

Product gross margin |

|

|

198,962 |

|

|

188,667 |

|

|

180,412 |

|

|

Rental and royalty gross margin |

|

|

2,683 |

|

|

2,819 |

|

|

2,909 |

|

|

Total gross margin |

|

|

201,645 |

|

|

191,486 |

|

|

183,321 |

|

|

Selling, marketing and administrative expenses |

|

|

117,722 |

|

|

119,133 |

|

|

113,842 |

|

|

Earnings from operations |

|

|

83,923 |

|

|

72,353 |

|

|

69,479 |

|

|

Other income, net |

|

|

7,371 |

|

|

12,130 |

|

|

4,685 |

|

|

Earnings before income taxes |

|

|

91,294 |

|

|

84,483 |

|

|

74,164 |

|

|

Provision for income taxes |

|

|

28,434 |

|

|

23,634 |

|

|

22,160 |

|

|

Net earnings |

|

|

62,860 |

|

|

60,849 |

|

|

52,004 |

|

|

Less: Net loss attributable to noncontrolling interests |

|

|

438 |

|

|

— |

|

|

— |

|

|

Net earnings attributable to Tootsie Roll Industries, Inc. |

|

$ |

63,298 |

|

$ |

60,849 |

|

$ |

52,004 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings attributable to Tootsie Roll Industries, Inc. per share |

|

$ |

1.05 |

|

$ |

0.99 |

|

$ |

0.84 |

|

|

Average number of shares outstanding |

|

|

60,562 |

|

|

61,399 |

|

|

62,248 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retained earnings at beginning of period |

|

$ |

73,109 |

|

$ |

80,210 |

|

$ |

114,269 |

|

|

Net earnings attributable to Tootsie Roll Industries, Inc. |

|

|

63,298 |

|

|

60,849 |

|

|

52,004 |

|

|

Cash dividends |

|

|

(19,199) |

|

|

(18,922) |

|

|

(47,729) |

|

|

Stock dividends |

|

|

(52,281) |

|

|

(49,028) |

|

|

(38,334) |

|

|

Retained earnings at end of period |

|

$ |

64,927 |

|

$ |

73,109 |

|

$ |

80,210 |

|

(The accompanying notes are an integral part of these statements.)

20

CONSOLIDATED STATEMENTS OF

Comprehensive Earnings

|

TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES |

(in thousands except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended December 31, |

|

|||||||

|

|

|

2014 |

|

2013 |

|

2012 |

|

|||

|

Net earnings |

|

$ |

62,860 |

|

$ |

60,849 |

|

$ |

52,004 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss), before tax: |

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

(4,453) |

|

|

(102) |

|

|

1,303 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pension and postretirement reclassification adjustment: |

|

|

|

|

|

|

|

|

|

|

|

Unrealized gains (losses) for the period on postretirement and pension benefits |

|

|

(2,746) |

|

|

20,037 |

|

|

1,066 |

|

|

Less: reclassification adjustment for (gains) losses to net earnings |

|

|

(1,804) |

|

|

671 |

|

|

1,036 |

|

|

Unrealized gains (losses) on postretirement and pension benefits |

|

|

(4,550) |

|

|

20,708 |

|

|

2,102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments: |

|

|

|

|

|

|

|

|

|

|

|

Unrealized gains (losses) for the period on investments |

|

|

(606) |

|

|

1,091 |

|

|

1,980 |

|

|

Less: reclassification adjustment for (gains) losses to net earnings |

|

|

— |

|

|

(2,430) |

|

|

— |

|

|

Unrealized gains (losses) on investments |

|

|

(606) |

|

|

(1,339) |

|

|

1,980 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivatives: |

|

|

|

|

|

|

|

|

|

|

|

Unrealized gains (losses) for the period on derivatives |

|

|

(3,137) |

|

|

(2,107) |

|

|

(339) |

|

|

Less: reclassification adjustment for (gains) losses to net earnings |

|

|

1,295 |

|

|

1,446 |

|

|

(243) |

|

|

Unrealized gains (losses) on derivatives |

|

|

(1,842) |

|

|

(661) |

|

|

(582) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other comprehensive income (loss), before tax |

|

|

(11,451) |

|

|

18,606 |

|

|

4,803 |

|

|

Income tax benefit (expense) related to items of other comprehensive income |

|

|

2,991 |

|

|

(6,797) |

|

|

(1,297) |

|

|

Total comprehensive earnings |

|

|

54,400 |

|

|

72,658 |

|

|

55,510 |

|

|

Comprehensive earnings attributable to noncontrolling interests |

|

|

438 |

|

|

— |

|

|

— |

|

|

Total comprehensive earnings attributable to Tootsie Roll Industries, Inc. |

|

$ |

54,838 |

|

$ |

72,658 |

|

$ |

55,510 |

|

21

|

CONSOLIDATED STATEMENTS OF |

|

|

Financial Position |

|

|

TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES |

(in thousands) |

Assets

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

||||

|

|

|

2014 |

|

2013 |

|

||

|

CURRENT ASSETS: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

100,108 |

|

$ |

88,283 |

|

|

Investments |

|

|

39,450 |

|

|

33,572 |

|

|

Accounts receivable trade, less allowances of $1,968 and $2,042 |

|

|

43,253 |

|

|

40,721 |

|

|

Other receivables |

|

|

3,577 |

|

|

4,616 |

|

|

Inventories: |

|

|

|

|

|

|

|

|

Finished goods and work-in-process |

|

|

44,549 |

|

|

37,012 |

|

|

Raw materials and supplies |

|

|

25,830 |

|

|

24,844 |

|

|

Prepaid expenses |

|

|

6,060 |

|

|

5,581 |

|

|

Deferred income taxes |

|

|

1,794 |

|

|

5,482 |

|

|

Total current assets |

|

|

264,621 |

|

|

240,111 |

|

|

PROPERTY, PLANT AND EQUIPMENT, at cost: |

|

|

|

|

|

|

|

|

Land |

|

|

22,360 |

|

|

21,683 |

|

|

Buildings |

|

|

113,279 |

|

|

111,044 |

|

|

Machinery and equipment |

|

|

350,929 |

|

|

340,405 |

|

|

Construction in progress |

|

|

1,641 |

|

|

3,403 |

|

|

|

|

|

488,209 |

|

|

476,535 |

|

|

Less—Accumulated depreciation |

|

|

298,128 |

|

|

279,619 |

|

|

Net property, plant and equipment |

|

|

190,081 |

|

|

196,916 |

|

|

OTHER ASSETS: |

|

|

|

|

|

|

|

|

Goodwill |

|

|

73,237 |

|

|

73,237 |

|

|

Trademarks |

|

|

175,024 |

|

|

175,024 |

|

|

Investments |

|

|

163,579 |

|

|

148,532 |

|

|

Split dollar officer life insurance |

|

|

33,632 |

|

|

40,296 |

|

|

Prepaid expenses |

|

|

6,927 |

|

|

10,260 |

|

|

Restricted cash |

|

|

1,589 |

|

|

— |

|

|

Deferred income taxes |

|

|

1,696 |

|

|

4,033 |

|

|

Total other assets |

|

|

455,684 |

|

|

451,382 |

|

|

Total assets |

|

$ |

910,386 |

|

$ |

888,409 |

|

(The accompanying notes are an integral part of these statements.)

22

(in thousands except per share data)

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

||||

|

|

|

2014 |

|

2013 |

|

||

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

11,641 |

|

$ |

9,153 |

|

|

Bank loans |

|

|

124 |

|

|

— |

|

|

Dividends payable |

|

|

4,814 |

|

|

4,742 |

|

|

Accrued liabilities |

|

|

46,482 |

|

|

45,580 |

|

|

Postretirement health care benefits |

|

|

328 |

|

|

319 |

|

|

Income taxes payable |

|

|

1,070 |

|

|

327 |

|

|

Total current liabilities |

|

|

64,459 |

|

|

60,121 |

|

|

NONCURRENT LIABILITIES: |