Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Landmark Infrastructure Partners LP | lmrk-20141231ex321a463d2.htm |

| EX-23.1 - EX-23.1 - Landmark Infrastructure Partners LP | lmrk-20141231ex2314cd2b8.htm |

| EX-31.1 - EX-31.1 - Landmark Infrastructure Partners LP | lmrk-20141231ex31150a2b1.htm |

| EX-31.2 - EX-31.2 - Landmark Infrastructure Partners LP | lmrk-20141231ex312a481de.htm |

| EX-21.1 - EX-21.1 - Landmark Infrastructure Partners LP | lmrk-20141231ex211d20b43.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

|

◻ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36735

Landmark Infrastructure Partners LP

(Exact name of registrant as specified in its charter)

|

Delaware |

|

61-1742322 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

2141 Rosecrans Avenue, Suite 2100, P.O. Box 3429 El Segundo, CA 90245 |

|

90245 |

|

(Address of principal executive offices) |

(Zip Code) |

(310) 598-3173

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

|

Securities Registered Pursuant to Section 12(b) of the Act: |

|

|

Common Units Representing Limited Partner Interests |

NASDAQ Global Market |

|

Securities Registered Pursuant to Section 12(g) of the Act: None |

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

Accelerated filer |

Non-accelerated filer ☒ |

Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No ☒

As of June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, the registrant’s equity was not listed on any domestic exchange or over-the-counter market.

The registrant had 4,703,675 common units and 3,135,109 subordinated units outstanding at February 20, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

None

2

Unless the context otherwise requires, references in this report to “Landmark Infrastructure Partners LP,” “our partnership,” “we,” “our,” “us,” or like terms, when used in a historical context (periods prior to November 19, 2014), refer to Landmark Infrastructure Partners LP Predecessor, which we sometimes refer to as our “Predecessor.” When used in the present tense or future tense, these terms refer to Landmark Infrastructure Partners LP and its subsidiaries. References to “our general partner” refer to Landmark Infrastructure Partners GP LLC. References to “Landmark” refer collectively to Landmark Dividend LLC and its subsidiaries, other than us, our subsidiaries and our general partner. References to “Fund A” refer to Landmark Dividend Growth Fund-A LLC and references to “Fund D” refer to Landmark Dividend Growth Fund-D LLC. References to “the Contributing Landmark Funds” refer to Fund A and Fund D, collectively and references to “the Remaining Landmark Funds,” which have granted us a right of first offer on their assets, refer to Landmark Dividend Growth Fund-C LLC, Landmark Dividend Growth Fund-E LLC, Landmark Dividend Growth Fund-F LLC, Landmark Dividend Growth Fund-G LLC and Landmark Dividend Growth Fund-H LLC, collectively.

Some of the information in this Annual Report on Form 10-K may contain forward‑looking statements. Forward‑looking statements give our current expectations, contain projections of results of operations or of financial condition, or forecasts of future events. Words such as “may,” “will,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “project,” “budget,” “potential,” or “continue,” and similar expressions are used to identify forward‑looking statements. They can be affected by and involve assumptions used or known or unknown risks or uncertainties. Consequently, no forward‑looking statements can be guaranteed. When considering these forward‑looking statements, you should keep in mind the risk factors and other cautionary statements in this Annual Report on Form 10-K. Actual results may vary materially. You are cautioned not to place undue reliance on any forward‑looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the following list to be a complete statement of all potential risks and uncertainties. The risk factors and other factors noted throughout this Annual Report on Form 10-K could cause our actual results to differ materially from the results contemplated by such forward‑looking statements, including the following:

|

· |

the number of real property interests that we are able to acquire, and whether we are able to complete such acquisitions on favorable terms, which could be adversely affected by, among other things, general economic conditions, operating difficulties, and competition; |

|

· |

the prices we pay for our acquisitions of real property; |

|

· |

our management’s and our general partner’s conflicts of interest with our own; |

|

· |

the rent increases we are able to negotiate with our tenants, and the possibility of further consolidation among a relatively small number of significant tenants in the wireless communication and outdoor advertising industries; |

|

· |

our relative lack of experience with real property interest acquisition in the renewable power segment and abroad; |

|

· |

changes in the price and availability of real property interests; |

|

· |

changes in prevailing economic conditions; |

|

· |

unanticipated cancellations of tenant leases; |

|

· |

a decrease in our tenants’ demand for real property interest due to, among other things, technological advances or industry consolidation; |

3

|

· |

inclement or hazardous weather conditions, including flooding, and the physical impacts of climate change, unanticipated ground, grade or water conditions, and other environmental hazards; |

|

· |

inability to acquire or maintain necessary permits; |

|

· |

changes in laws and regulations (or the interpretation thereof), including zoning regulations; |

|

· |

difficulty collecting receivables and the potential for tenant bankruptcy; |

|

· |

additional difficulties and expenses associated with being a publicly traded partnership; |

|

· |

our ability to borrow funds and access capital markets, and the effects of the fluctuating interest rate on our existing and future borrowings; |

|

· |

restrictions in our revolving credit facility on our ability to issue additional debt or equity or pay distributions; and |

|

· |

certain factors discussed elsewhere in this Annual Report on Form 10-K. |

All forward‑looking statements are expressly qualified in their entirety by the foregoing cautionary statements.

ITEM 1. Business and Properties

Formation and Initial Public Offering

We are a Delaware limited partnership formed in July 2014 by Landmark to acquire, own and manage a portfolio of real property interests that we lease to companies in the wireless communication, outdoor advertising and renewable power generation industries. On November 19, 2014, we completed our initial public offering (the “IPO”) and issued 2,750,000 common units representing limited partner interests in us, including 100,000 common units issued upon exercise of the underwriters’ over-allotment option. Our common units are listed on the NASDAQ Global Market under the symbol "LMRK". See Notes to Consolidated and Combined Financial Statements for further discussion of the IPO.

4

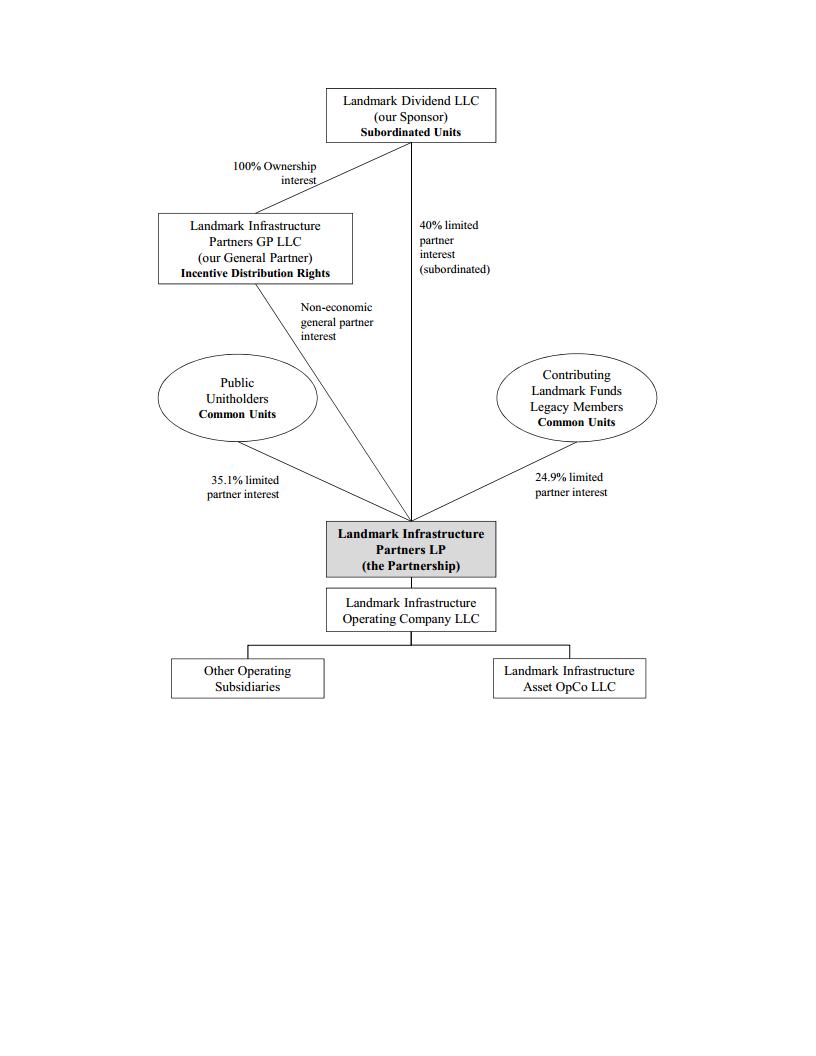

The following simplified diagram depicts our organizational structure and ownership percentages after the IPO.

5

We are a growth‑oriented master limited partnership formed by Landmark to acquire, own and manage a portfolio of real property interests that we lease to companies in the wireless communication, outdoor advertising and renewable power generation industries. Our real property interests underlie our tenants’ infrastructure assets, which include freestanding cellular towers and rooftop wireless sites, billboards and wind turbines. These assets are essential to the operations and profitability of our tenants. We seek to acquire real property interests subject to effectively triple net lease arrangements containing contractual rent increase clauses, or “rent escalators,” which we believe provide us with stable, predictable and growing cash flow.

Our real property interests consist of a diversified portfolio of long‑term and perpetual easements, tenant lease assignments and, to a lesser extent, fee simple properties located in 42 states and the District of Columbia. These real property interests entitle us to receive rental payments from leases on our 701 tenant sites. Approximately 88% of our leased tenant sites are leased to large, publicly traded companies (or their affiliates) that have a national footprint. These tenants, which we refer to as our “Tier 1” tenants, are comprised of AT&T Mobility, Sprint, T‑Mobile and Verizon in the wireless carrier industry, American Tower, Crown Castle and SBA Communications in the cellular tower industry and Outfront Media (formerly CBS Outdoor), Clear Channel Outdoor and Lamar Advertising in the outdoor advertising industry.

We believe the terms of our tenant lease arrangements provide us with stable, predictable and growing cash flow that will support consistent, growing distributions to our unitholders. Substantially all of our tenant lease arrangements are effectively triple net, meaning that our tenants or the underlying property owners are contractually responsible for property‑level operating expenses, including maintenance capital expenditures, property taxes and insurance. Over 95% of our tenant leases have contractual rent escalators, and some of our tenant leases contain revenue‑sharing provisions in addition to the base monthly or annual rental payments. In addition, we believe the physical infrastructure assets at our tenant sites are essential to the ongoing operations and profitability of our tenants. When combined with the challenges and costs of relocating these infrastructure assets and the key strategic locations of our real property interests, we expect continued high tenant retention and occupancy rates. As of December 31, 2014, we had a 99% occupancy rate, with 695 of our 701 total available tenant sites leased.

We benefit significantly from our relationship with Landmark, our sponsor. Landmark, a private company formed in 2010, is one of the largest acquirers of real property interests underlying the operationally essential infrastructure assets in the wireless communication, outdoor advertising and renewable power generation industries. Our initial assets and liabilities were contributed to us from Fund A and Fund D, two private investment funds sponsored, managed and controlled by Landmark. As of December 31, 2014, Landmark controlled 918 additional tenant sites through the Remaining Landmark Funds. The Remaining Landmark Funds have granted us a right of first offer on real property interests that they currently own or acquire in the future before selling or transferring those assets to any third party. We refer to these real property interests as the “right of first offer assets.” We believe Landmark’s asset acquisition and management platform will benefit us by providing us with drop‑down acquisition opportunities from Landmark’s substantial and growing acquisition pipeline, as well as the capability to make direct acquisitions from third parties. Please read “Our Relationship with Landmark.”

We conduct business through three reportable business segments: Wireless Communication, Outdoor Advertising and Renewable Power Generation. Our reportable segments are strategic business units that offer different products and services. They are commonly managed, as all of these businesses require similar marketing and business strategies. We evaluate our segments based on revenue because substantially all of our tenant lease arrangements are effectively triple net. We believe this measure provides investors relevant and useful information because it is presented on an unlevered basis. See Notes to the Consolidated and Combined Financial Statements for additional information on our business segments.

6

Our Portfolio of Real Property Interests

Our portfolio of property interests consists primarily of (i) long‑term and perpetual easements combined with lease assignment contracts, which we refer to as our “lease assignments,” (ii) lease assignments without easements and (iii) to a lesser extent, properties we own in fee simple. In connection with each real property interest, we have also acquired the rights to receive payment under pre‑existing ground leases from property owners, which we refer to as our “tenant leases.” Under our easements, property owners have granted us the right to use and lease the space occupied by our tenants, and when we have not been granted easements, we have acquired economic rights under lease assignments that are substantially similar to the economic rights granted under our easements, including the right to re‑lease the same space if the tenant lease expires or terminates.

The table below provides an overview of our portfolio of real property interests as of December 31, 2014.

Our Real Property Interests

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Available Tenant |

|

Leased Tenant |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

Sites(1) |

|

Sites |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Average |

|

|

|

Average |

|

|

|

|

Average |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Remaining |

|

|

|

Remaining |

|

|

|

|

Monthly |

|

|

|

|

Percentage |

||

|

|

|

Number of |

|

|

|

Property |

|

|

|

Lease |

|

Tenant Site |

|

Effective Rent |

|

Quarterly |

|

of Quarterly |

||||

|

|

|

Infrastructure |

|

|

|

Interest |

|

|

|

Term |

|

Occupancy |

|

Per Tenant |

|

Rental |

|

Rental |

||||

|

Real Property Interest |

|

Locations(1) |

|

Number |

|

(Years) |

|

Number |

|

(Years)(2) |

|

Rate(3)(4) |

|

Site(5)(6) |

|

Revenue(6) |

|

Revenue(6) |

||||

|

Tenant Lease Assignment with Underlying Easement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wireless Communication |

|

356 |

|

480 |

|

75.0 |

(7) |

474 |

|

19.1 |

|

|

|

|

|

|

|

$ |

2,338,636 |

|

68 |

% |

|

Outdoor Advertising |

|

84 |

|

111 |

|

86.9 |

(7) |

111 |

|

14.0 |

|

|

|

|

|

|

|

|

429,024 |

|

12 |

% |

|

Renewable Power Generation |

|

1 |

|

2 |

|

29.5 |

|

2 |

|

23.1 |

|

|

|

|

|

|

|

|

8,944 |

|

— |

% |

|

Subtotal |

|

441 |

|

593 |

|

77.1 |

(7) |

587 |

|

18.1 |

|

|

|

|

|

|

|

$ |

2,776,604 |

|

80 |

% |

|

Tenant Lease Assignment only(8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wireless Communication |

|

64 |

|

95 |

|

54.8 |

|

95 |

|

18.2 |

|

|

|

|

|

|

|

$ |

579,710 |

|

17 |

% |

|

Outdoor Advertising |

|

7 |

|

7 |

|

81.9 |

|

7 |

|

17.1 |

|

|

|

|

|

|

|

|

37,367 |

|

1 |

% |

|

Subtotal |

|

71 |

|

102 |

|

56.6 |

|

102 |

|

18.1 |

|

|

|

|

|

|

|

$ |

617,077 |

|

18 |

% |

|

Tenant Lease on Fee Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wireless Communication |

|

2 |

|

5 |

|

99.0 |

(7) |

5 |

|

11.5 |

|

|

|

|

|

|

|

$ |

21,817 |

|

1 |

% |

|

Outdoor Advertising |

|

1 |

|

1 |

|

99.0 |

(7) |

1 |

|

18.5 |

|

|

|

|

|

|

|

|

28,120 |

|

1 |

% |

|

Subtotal |

|

3 |

|

6 |

|

99.0 |

(7) |

6 |

|

12.7 |

|

|

|

|

|

|

|

$ |

49,937 |

|

2 |

% |

|

Total |

|

515 |

|

701 |

|

74.3 |

(9) |

695 |

|

18.1 |

|

|

|

|

|

|

|

$ |

3,443,618 |

|

100 |

% |

|

Aggregate Portfolio |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wireless Communication |

|

422 |

|

580 |

|

71.9 |

|

574 |

|

18.9 |

|

99 |

% |

|

$ |

1,642 |

|

$ |

2,940,163 |

|

86 |

% |

|

Outdoor Advertising |

|

92 |

|

119 |

|

86.7 |

|

119 |

|

14.2 |

|

100 |

% |

|

|

1,348 |

|

|

494,511 |

|

14 |

% |

|

Renewable Power Generation |

|

1 |

|

2 |

|

29.5 |

|

2 |

|

23.1 |

|

100 |

% |

|

|

1,491 |

|

|

8,944 |

|

— |

% |

|

Total |

|

515 |

|

701 |

|

74.3 |

(9) |

695 |

|

18.1 |

|

99 |

% |

|

$ |

1,592 |

|

$ |

3,443,618 |

|

100 |

% |

|

(1) |

“Available Tenant Sites” means the number of individual sites that could be leased. For example, if we have an easement on a single rooftop, on which three different tenants can lease space from us, this would be counted as three “tenant sites,” and all three tenant sites would be at a single infrastructure location with the same address. |

|

(2) |

Assumes the exercise of all remaining renewal options of tenant leases. Assuming no exercise of renewal options, the average remaining lease terms for our wireless communication, outdoor advertising, renewable power generation and aggregate portfolios as of December 31, 2014 were 2.6, 7.2, 23.1 and 3.5 years, respectively. |

|

(3) |

Represents number of leased tenant sites divided by number of available tenant sites. |

|

(4) |

Occupancy and average monthly effective rent per tenant site are shown only on an aggregate portfolio basis by industry. |

|

(5) |

Represents total monthly revenue excluding the impact of amortization of above and below market lease intangibles divided by the number of leased tenant sites. |

|

(6) |

Represents GAAP rental revenue recognized under existing tenant leases for the three months ended December 31, 2014. Excludes interest income on receivables. |

|

(7) |

Fee simple ownership and perpetual easements are shown as having a term of 99 years for purposes of calculating the average remaining term. |

|

(8) |

Reflects “springing lease agreements” whereby the cancellation or nonrenewal of a tenant lease entitles us to enter into a new ground lease with the property owner (up to the full property interest term) and a replacement tenant lease. The remaining lease assignment term is, therefore, equal to or longer than the remaining lease term. Also represents properties for which the “springing lease” feature has been exercised and has been replaced by a lease for the remaining lease term. |

|

(9) |

Excluding perpetual ownership rights, the average remaining property interest term on our tenant sites is approximately 57 years. |

7

Our real property interests entitle us to receive rental payments from tenant leases in the wireless communication, outdoor advertising and renewable power generation industries. The table below summarizes our Tier 1 tenants which comprised approximately 88% of our tenants as of December 31, 2014.

Our Tier 1 Tenants by Industry

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wireless Communication Industry |

|

Outdoor Advertising Industry |

|||||||||||

|

Wireless Carriers |

|

Tower Companies |

|

|

|

|

|

||||||

|

|

|

% of Total |

|

|

|

% of Total |

|

|

|

% of Total |

|||

|

|

|

Leased |

|

|

|

Leased |

|

|

|

Leased |

|||

|

Tenant |

|

Tenant Sites |

|

Tenant |

|

Tenant Sites |

|

Tenant |

|

Tenant Sites |

|||

|

T-Mobile |

|

16 |

% |

|

Crown Castle |

|

15 |

% |

|

Lamar Advertising |

|

5 |

% |

|

Verizon |

|

15 |

% |

|

American Tower |

|

4 |

% |

|

Outfront Media |

|

5 |

% |

|

AT&T Mobility |

|

12 |

% |

|

SBA Communications |

|

3 |

% |

|

Clear Channel Outdoor |

|

3 |

% |

|

Sprint |

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

53 |

% |

|

Total |

|

22 |

% |

|

Total |

|

13 |

% |

Our real property interests underlie a diverse range of tenant structures. We evaluate assets based on a variety of attributes, including, but not limited to, the marketability of the underlying title, the stability of the rental cash flow stream and opportunity for rent increases, tenant quality, the desirability of the structure’s geographic location, the importance of the structure to the ongoing operations and profitability of our tenants and the challenge and costs associated with tenants vacating sites. In certain instances, we lease a tenant site for our tenant’s base station and equipment, but not the tenant’s antenna array located on infrastructure owned by a third party. We refer to this type of arrangement as an “equipment only” lease. Within the wireless communication industry, our tenants’ structure types include rooftop sites, wireless towers (including monopoles, self supporting towers, stealth towers and guyed towers), other structures (including, for example, water towers and church steeples) and equipment only sites. In the outdoor advertising industry, our tenants’ structure types include both static and digital billboards. Our real property interests in the renewable power generation industry currently underlie wind turbines but in the future we expect to also acquire real property interests that underlie solar arrays.

8

The table below presents an overview of the structures underlying our real property interests, as of December 31, 2014:

Our Real Property Interests by Structure Type

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Available Tenant |

|

Leased Tenant |

|

|

|

|

|

|

||||

|

|

|

|

|

Sites(1) |

|

Sites |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Average |

|

|

|

Average |

|

|

|

|

|

|

|

|

|

|

|

|

|

Remaining |

|

|

|

Remaining |

|

|

|

|

Percentage |

|

|

|

|

Number of |

|

|

|

Property |

|

|

|

Lease |

|

Quarterly |

|

of Quarterly |

||

|

|

|

Infrastructure |

|

|

|

Interest |

|

|

|

Term |

|

Rental |

|

Rental |

||

|

Structure Type |

|

Locations(1) |

|

Number |

|

(Years)(2) |

|

Number |

|

(Years)(3) |

|

Revenue(4) |

|

Revenue(4) |

||

|

Rooftops |

|

141 |

|

217 |

|

64.6 |

|

214 |

|

17.3 |

|

$ |

1,360,206 |

|

40 |

% |

|

Towers |

|

187 |

|

214 |

|

74.9 |

|

212 |

|

19.5 |

|

|

948,016 |

|

28 |

% |

|

Billboards |

|

92 |

|

119 |

|

86.7 |

|

119 |

|

14.2 |

|

|

494,511 |

|

14 |

% |

|

Other structures |

|

78 |

|

86 |

|

81.7 |

|

86 |

|

22.1 |

|

|

355,981 |

|

10 |

% |

|

Equipment only(5) |

|

16 |

|

63 |

|

73.4 |

|

62 |

|

17.8 |

|

|

275,960 |

|

8 |

% |

|

Wind turbines |

|

1 |

|

2 |

|

29.5 |

|

2 |

|

23.1 |

|

|

8,944 |

|

— |

% |

|

Total |

|

515 |

|

701 |

|

74.3 |

(6) |

695 |

|

18.1 |

|

$ |

3,443,618 |

|

100 |

% |

|

(1) |

“Available Tenant Sites” means the number of individual sites that could be leased. For example, if we have an easement on a single rooftop, on which three different tenants can lease space from us, this would be counted as three “tenant sites,” and all three tenant sites would be at a single infrastructure location with the same address. |

|

(2) |

Fee simple ownership and perpetual easements are indicated as having a term of 99 years for purposes of calculating the average remaining term. Also includes “springing lease agreements” whereby the cancellation or nonrenewal of a tenant lease entitles us to enter into a new ground lease with the property owner (up to the full term) and a replacement tenant lease. The remaining lease assignment term is, therefore, in many cases, higher than the remaining tenant lease term. |

|

(3) |

Assumes the exercise of all remaining renewal options. Assuming no exercise of renewal options, the average remaining lease terms for our wireless communication, outdoor advertising, renewable power generation and total portfolio as of December 31, 2014 were 2.6, 7.2, 23.1 and 3.5 years, respectively. |

|

(4) |

Represents GAAP rental revenue recognized under existing tenant leases for the three months ended December 31, 2014. Excludes interest income on receivables. |

|

(5) |

In certain instances, we lease our tenant site for our tenant’s base station and equipment, but the tenant’s antenna array and related hardware are located on infrastructure owned by a third party. We refer to this type of arrangement as an “equipment only” lease. At 31 infrastructure locations, we have leased space for equipment together with other structures. |

|

(6) |

Excluding perpetual ownership rights, the average remaining property interest term on our tenant sites is approximately 57 years. |

We are geographically diversified with assets located in 42 states, plus the District of Columbia, and no single state accounted for more than 15% of our tenant sites as of December 31, 2014. Additionally, the majority of our wireless communication and outdoor advertising assets are located in major cities, significant intersections, and traffic arteries in the United States that benefit from high urban density, favorable demographic trends, strong traffic counts and strict zoning restrictions with legacy zoning rights (commonly referred to as “grandfather clauses.”) These attributes enhance the long‑term value of our real property interests, as our wireless communication and outdoor advertising tenants are focused on placing their assets in dense areas with large populations and along high‑traffic corridors. Additionally, local zoning regulations often restrict the construction of new cellular towers, rooftop wireless structures and outdoor advertising and billboard structures, creating barriers to entry and a supply shortage. We believe this leads to improved value of our assets and further increases the likelihood for continued high occupancy.

9

Our Real Property Interest Locations(1)

The table below summarizes our real property interests by state. Our two renewable power generation tenant sites in Kansas are included in the “Total” column.

Our Real Property Interests by State

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wireless Communication |

|

Outdoor Advertising |

|

Total(1) |

||||||||||||

|

|

|

Number of |

|

|

|

|

Number of |

|

|

|

|

Number of |

|

|

|

|

Percentage of |

|

|

|

|

Available |

|

Quarterly |

|

Available |

|

Quarterly |

|

Available |

|

Quarterly |

|

Quarterly |

||||

|

|

|

Tenant |

|

Rental |

|

Tenant |

|

Rental |

|

Tenant |

|

Rental |

|

Rental |

||||

|

|

|

Sites |

|

Revenue(2) |

|

Sites |

|

Revenue(2) |

|

Sites |

|

Revenue(2) |

|

Revenue |

||||

|

Alabama |

|

3 |

|

$ |

9,238 |

|

1 |

|

$ |

9,174 |

|

4 |

|

$ |

18,412 |

|

0.5 |

% |

|

Alaska |

|

1 |

|

|

3,314 |

|

— |

|

|

— |

|

1 |

|

|

3,314 |

|

0.1 |

% |

|

Arizona |

|

24 |

|

|

100,699 |

|

1 |

|

|

6,160 |

|

25 |

|

|

106,859 |

|

3.1 |

% |

|

Arkansas |

|

6 |

|

|

18,369 |

|

— |

|

|

— |

|

6 |

|

|

18,369 |

|

0.5 |

% |

|

California |

|

87 |

|

|

454,422 |

|

5 |

|

|

40,423 |

|

92 |

|

|

494,845 |

|

14.4 |

% |

|

Colorado |

|

15 |

|

|

83,999 |

|

4 |

|

|

9,429 |

|

19 |

|

|

93,428 |

|

2.7 |

% |

|

Connecticut |

|

9 |

|

|

58,047 |

|

— |

|

|

— |

|

9 |

|

|

58,047 |

|

1.7 |

% |

|

District of Columbia |

|

1 |

|

|

6,234 |

|

— |

|

|

— |

|

1 |

|

|

6,234 |

|

0.2 |

% |

|

Florida |

|

30 |

|

|

181,356 |

|

12 |

|

|

40,056 |

|

42 |

|

|

221,412 |

|

6.4 |

% |

|

Georgia |

|

8 |

|

|

43,909 |

|

20 |

|

|

76,254 |

|

28 |

|

|

120,163 |

|

3.5 |

% |

|

Illinois |

|

46 |

|

|

258,505 |

|

14 |

|

|

105,781 |

|

60 |

|

|

364,286 |

|

10.6 |

% |

|

Indiana |

|

2 |

|

|

16,505 |

|

4 |

|

|

7,600 |

|

6 |

|

|

24,105 |

|

0.7 |

% |

|

Iowa |

|

2 |

|

|

4,093 |

|

1 |

|

|

2,250 |

|

3 |

|

|

6,343 |

|

0.2 |

% |

|

Kansas |

|

3 |

|

|

11,667 |

|

1 |

|

|

2,100 |

|

6 |

|

|

22,711 |

(1) |

0.7 |

% (1) |

|

Kentucky |

|

— |

|

|

— |

|

1 |

|

|

1,500 |

|

1 |

|

|

1,500 |

|

— |

% |

|

Louisiana |

|

6 |

|

|

12,479 |

|

1 |

|

|

1,298 |

|

7 |

|

|

13,777 |

|

0.4 |

% |

|

Maine |

|

2 |

|

|

9,173 |

|

— |

|

|

— |

|

2 |

|

|

9,173 |

|

0.3 |

% |

|

Maryland |

|

3 |

|

|

16,158 |

|

— |

|

|

— |

|

3 |

|

|

16,158 |

|

0.5 |

% |

|

Massachusetts |

|

34 |

|

|

181,366 |

|

— |

|

|

— |

|

34 |

|

|

181,366 |

|

5.3 |

% |

|

Michigan |

|

13 |

|

|

59,918 |

|

9 |

|

|

13,482 |

|

22 |

|

|

73,400 |

|

2.1 |

% |

|

Minnesota |

|

4 |

|

|

13,971 |

|

2 |

|

|

7,913 |

|

6 |

|

|

21,884 |

|

0.6 |

% |

|

Mississippi |

|

2 |

|

|

4,026 |

|

— |

|

|

— |

|

2 |

|

|

4,026 |

|

0.1 |

% |

|

Missouri |

|

14 |

|

|

67,724 |

|

21 |

|

|

67,912 |

|

35 |

|

|

135,636 |

|

3.9 |

% |

|

Montana |

|

1 |

|

|

4,570 |

|

— |

|

|

— |

|

1 |

|

|

4,570 |

|

0.1 |

% |

|

Nebraska |

|

— |

|

|

— |

|

2 |

|

|

3,448 |

|

2 |

|

|

3,448 |

|

0.1 |

% |

|

Nevada |

|

39 |

|

|

131,400 |

|

1 |

|

|

3,600 |

|

40 |

|

|

135,000 |

|

3.9 |

% |

|

New Jersey |

|

53 |

|

|

385,370 |

|

— |

|

|

— |

|

53 |

|

|

385,370 |

|

11.3 |

% |

|

New Mexico |

|

3 |

|

|

13,700 |

|

— |

|

|

— |

|

3 |

|

|

13,700 |

|

0.4 |

% |

|

New York |

|

48 |

|

|

324,862 |

|

— |

|

|

— |

|

48 |

|

|

324,862 |

|

9.4 |

% |

|

North Carolina |

|

2 |

|

|

10,967 |

|

2 |

|

|

5,628 |

|

4 |

|

|

16,595 |

|

0.5 |

% |

|

North Dakota |

|

1 |

|

|

1,078 |

|

— |

|

|

— |

|

1 |

|

|

1,078 |

|

— |

% |

|

Ohio |

|

10 |

|

|

44,839 |

|

6 |

|

|

22,607 |

|

16 |

|

|

67,446 |

|

2.0 |

% |

|

Oklahoma |

|

7 |

|

|

27,831 |

|

— |

|

|

— |

|

7 |

|

|

27,831 |

|

0.8 |

% |

|

Oregon |

|

13 |

|

|

57,092 |

|

1 |

|

|

27,428 |

|

14 |

|

|

84,520 |

|

2.5 |

% |

|

Pennsylvania |

|

14 |

|

|

58,114 |

|

2 |

|

|

15,378 |

|

16 |

|

|

73,492 |

|

2.1 |

% |

|

South Carolina |

|

1 |

|

|

1,977 |

|

— |

|

|

— |

|

1 |

|

|

1,977 |

|

0.1 |

% |

|

South Dakota |

|

6 |

|

|

9,902 |

|

— |

|

|

— |

|

6 |

|

|

9,902 |

|

0.3 |

% |

|

Tennessee |

|

4 |

|

|

13,447 |

|

4 |

|

|

10,387 |

|

8 |

|

|

23,834 |

|

0.7 |

% |

|

Texas |

|

45 |

|

|

135,251 |

|

3 |

|

|

14,015 |

|

48 |

|

|

149,266 |

|

4.3 |

% |

|

Utah |

|

7 |

|

|

22,063 |

|

1 |

|

|

688 |

|

8 |

|

|

22,751 |

|

0.7 |

% |

|

Vermont |

|

4 |

|

|

45,992 |

|

— |

|

|

— |

|

4 |

|

|

45,992 |

|

1.3 |

% |

|

Washington |

|

2 |

|

|

20,900 |

|

— |

|

|

— |

|

2 |

|

|

20,900 |

|

0.6 |

% |

|

Wisconsin |

|

5 |

|

|

15,636 |

|

— |

|

|

— |

|

5 |

|

|

15,636 |

|

0.5 |

% |

|

Total |

|

580 |

|

$ |

2,940,163 |

|

119 |

|

$ |

494,511 |

|

701 |

(1) |

$ |

3,443,618 |

(1) |

100 |

% |

|

(1) |

Total includes 2 tenant sites in the renewable power generation industry. |

|

(2) |

Represents GAAP rental revenue recognized under existing tenant leases for the three months ended December 31, 2014. Excludes interest income on receivables. |

10

Approximately 69% and 79% of our tenant sites are located in Top‑50 and Top‑100 ranked BTAs, respectively, including New York, Los Angeles and Chicago. We believe our locations in major metropolitan population centers are highly desirable for our tenants in the wireless communication and outdoor advertising industries seeking to reach a large customer base.

The table below summarizes our real property interests by BTA rank as of December 31, 2014.

Our Real Property Interests Ranked by Basic Trading Area(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wireless Communication |

|

Outdoor Advertising |

|

Total(2) |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of |

|

|

|

|

Number of |

|

Quarterly |

|

Number of |

|

Quarterly |

|

Number of |

|

Quarterly |

|

Quarterly |

|

|||

|

|

|

Tenant |

|

Rental |

|

Tenant |

|

Rental |

|

Tenant |

|

Rental |

|

Rental |

|

|||

|

BTA Rank |

|

Sites |

|

Revenue(3) |

|

Sites |

|

Revenue(3) |

|

Sites |

|

Revenue(3) |

|

Revenue |

|

|||

|

1 - 5 |

|

211 |

|

$ |

1,333,963 |

|

19 |

|

$ |

146,757 |

|

230 |

|

$ |

1,480,720 |

|

43 |

% |

|

6 - 10 |

|

42 |

|

|

159,924 |

|

18 |

|

|

74,424 |

|

60 |

|

|

234,348 |

|

7 |

% |

|

11 - 20 |

|

75 |

|

|

432,546 |

|

18 |

|

|

88,078 |

|

93 |

|

|

520,624 |

|

15 |

% |

|

21 - 50 |

|

77 |

|

|

330,869 |

|

23 |

|

|

101,444 |

|

100 |

|

|

432,313 |

|

12 |

% |

|

51 - 100 |

|

51 |

|

|

220,143 |

|

15 |

|

|

41,490 |

|

66 |

|

|

261,633 |

|

8 |

% |

|

Subtotal (Top 100) |

|

456 |

|

|

2,477,445 |

|

93 |

|

|

452,193 |

|

549 |

|

|

2,929,638 |

|

85 |

% |

|

101+ |

|

124 |

|

|

462,718 |

|

26 |

|

|

42,318 |

|

150 |

|

|

505,036 |

|

15 |

% |

|

Total |

|

580 |

|

$ |

2,940,163 |

|

119 |

|

$ |

494,511 |

|

699 |

|

$ |

3,434,674 |

|

100 |

% |

|

(1) |

Ranked by population. |

|

(2) |

Excludes tenant sites in the renewable power generation industry. BTA rank is not a relevant metric for the renewable power generation industry. |

|

(3) |

Represents GAAP rental revenue recognized under existing tenant leases for the three months ended December 31, 2014. Excludes interest income on receivables. |

Easements and Lease Assignments

In most locations, our tenant leases were acquired together with an easement granted by the property owner in favor of Landmark, granting us the rights to the tenant site occupied by the tenant under the lease. For our tenant sites that were not accompanied by an easement, our lease assignments provide us with economic rights that are substantially similar to the economic rights granted under our easements, including the right to re‑lease the same space if the tenant lease expires or terminates. In limited circumstances we lease the sites from property owners and then sub‑lease those spaces to our tenants.

The terms of our easements and lease assignments generally range from 40 years to 99 years with certain assets having perpetual easement terms. The average remaining term of our easements and lease assignments is approximately 74 years (assuming perpetual easements, which comprise approximately 41% of our total easements, have a term of 99 years). When we acquire an easement or lease assignment in connection with a property subject to a mortgage, we generally also enter into a non‑disturbance agreement with the mortgage lender in order to protect us against potential foreclosure on the property owner at the infrastructure location, which foreclosure could, absent a non‑disturbance agreement, extinguish our easement or lease assignment. In some instances where we obtain non‑disturbance agreements, we still remain subordinated to some indebtedness. As of December 31, 2014, at least 90% of our tenant sites were either subject to non‑disturbance agreements or had been otherwise recorded in local real estate records in senior positions to any mortgages.

Our easements and lease assignments strengthen and protect our real property interests in any given infrastructure location by allowing us to control the use of the tenant site after the expiration of the primary lease term (plus extension options) and to prevent a property owner from interfering with the operations of our tenants.

11

Additionally, we believe that our easements and lease assignments have been and will continue to be acquired and structured in a manner that mitigates additional risks in many ways, including the following:

|

· |

We record our easements and lease assignments in local real property records, giving constructive notice of our real property interest to all successor property owners and other parties of interest (such as future lenders). |

|

· |

We perform a title search prior to the acquisition of the easement or lease assignment and obtain title insurance on the easement or lease assignment except where doing so would not be economic or otherwise feasible, and all material exceptions to title are typically addressed prior to purchase. |

|

· |

Our possessory use rights to the underlying property mitigate our liability exposure, and we are typically indemnified by the property owners or our tenants for environmental liability, if any, relating to the property. In addition, general liability insurance is typically provided by our tenants. |

|

· |

Our easements and lease assignments, together with our non‑disturbance agreements, generally protect our real property interest in case of a foreclosure against the property owner. |

|

· |

The property owner is generally contractually responsible for their property‑level operating expenses, including maintenance capital expenditures, taxes and insurance. |

Finally, in the event that one of our tenant leases expires without renewal or is terminated, all of our easements and substantially all of our lease assignments allow us to enter into a new lease of the same space for the same use within a specified period of time. If we do not enter into a new lease during the tenant replacement period (typically three to five years), in the case of an easement, the easement terminates and control of the space reverts back to the property owner, or in the case of a lease assignment, we forfeit our right to re‑lease the space.

In limited circumstances we have granted a landowner the right to re‑acquire our lease assignment at a purchase price which we believe makes us economically whole for the loss of an asset. To date, no landowner has exercised this right.

Fee Simple Properties

Our portfolio of real property interests includes only three properties we own in fee simple. These properties have associated tenant leases in the wireless communication and outdoor advertising industry. These properties have associated operating and property tax expense for which we are responsible. For the three months ended December 31, 2014, we received less than $0.1 million in quarterly rental revenue related to these properties, representing only 1.5% of our quarterly rental revenue.

12

The table below provides an overview of the remaining term and rental quarterly revenue under our easements, lease assignments and fee simple properties as of December 31, 2014.

Our Real Property Interests by Remaining Term

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leased Tenant Sites(2) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Average |

|

|

|

|

Percentage of |

|

|

|

|

Number of |

|

|

|

Remaining |

|

Quarterly |

|

Quarterly |

|

|

|

|

|

Infrastructure |

|

|

|

Lease Term |

|

Rental |

|

Rental |

|

|

|

Remaining Term of Real Property Interest(1) |

|

Locations |

|

Number |

|

(years)(3) |

|

Revenue(4) |

|

Revenue(4) |

|

|

|

Wireless Communication |

|

|

|

|

|

|

|

|

|

|

|

|

|

Less than or equal to 20 years |

|

4 |

|

7 |

|

19.1 |

|

$ |

45,148 |

|

1 |

% |

|

20 to 29 years |

|

23 |

|

31 |

|

18.1 |

|

|

203,723 |

|

6 |

% |

|

30 to 39 years |

|

80 |

|

104 |

|

17.5 |

|

|

607,252 |

|

18 |

% |

|

40 to 49 years |

|

53 |

|

89 |

|

16.7 |

|

|

493,228 |

|

15 |

% |

|

50 to 99 years |

|

99 |

|

119 |

|

22.2 |

|

|

552,052 |

|

16 |

% |

|

Perpetual(5) |

|

162 |

|

224 |

|

18.7 |

|

|

1,038,760 |

|

30 |

% |

|

Subtotal |

|

421 |

|

574 |

|

18.9 |

|

$ |

2,940,163 |

|

86 |

% |

|

Outdoor Advertising |

|

|

|

|

|

|

|

|

|

|

|

|

|

20 to 29 years |

|

3 |

|

6 |

|

7.2 |

|

$ |

9,338 |

|

— |

% |

|

30 to 39 years |

|

7 |

|

8 |

|

8.7 |

|

|

56,478 |

|

2 |

% |

|

40 to 49 years |

|

6 |

|

7 |

|

9.3 |

|

|

22,062 |

|

1 |

% |

|

50 to 99 years |

|

28 |

|

35 |

|

17.8 |

|

|

149,729 |

|

4 |

% |

|

Perpetual(5) |

|

49 |

|

63 |

|

14.1 |

|

|

256,904 |

|

7 |

% |

|

Subtotal |

|

93 |

|

119 |

|

14.2 |

|

$ |

494,511 |

|

14 |

% |

|

Renewable Power Generation |

|

|

|

|

|

|

|

|

|

|

|

|

|

30 to 39 years |

|

1 |

|

2 |

|

23.1 |

|

$ |

8,944 |

|

— |

% |

|

Subtotal |

|

1 |

|

2 |

|

23.1 |

|

$ |

8,944 |

|

— |

% |

|

Aggregate Portfolio |

|

|

|

|

|

|

|

|

|

|

|

|

|

Less than or equal to 20 years |

|

4 |

|

7 |

|

19.1 |

|

$ |

45,148 |

|

1 |

% |

|

20 to 29 years |

|

26 |

|

37 |

|

16.7 |

|

|

213,061 |

|

6 |

% |

|

30 to 39 years |

|

88 |

|

114 |

|

16.8 |

|

|

672,674 |

|

20 |

% |

|

40 to 49 years |

|

59 |

|

96 |

|

16.1 |

|

|

515,290 |

|

16 |

% |

|

50 to 99 years |

|

127 |

|

154 |

|

21.2 |

|

|

701,781 |

|

20 |

% |

|

Perpetual(5) |

|

211 |

|

287 |

|

17.7 |

|

|

1,295,664 |

|

37 |

% |

|

Total |

|

515 |

|

695 |

|

18.1 |

|

$ |

3,443,618 |

|

100 |

% |

|

(1) |

Remaining term of real property interest is based on the assumption that the site is not vacant for a period longer than our tenant replacement period. This assumption is not used in calculating the remaining tenant lease terms and is inapplicable to the remaining term of real property interest of our fee simple properties. |

|

(2) |

“Leased Tenant Sites” means the number of individual sites that are leased. For example, if we have an easement on a single rooftop, on which three different tenants lease space from us, this would be counted as three “tenant sites,” and all three tenant sites would be at a single infrastructure location with the same address. |

|

(3) |

Assumes the exercise of all remaining renewal options of tenant leases. Assuming no exercise of renewal options, the average remaining lease terms for our wireless communication, outdoor advertising, renewable power generation and aggregate portfolios as of December 31, 2014 were 2.6, 7.2, 23.1 and 3.5 years, respectively. |

|

(4) |

Represents GAAP rental revenue recognized under existing tenant leases for the three months ended December 31, 2014. Excludes interest income on receivables. Totals may not sum due to rounding. |

|

(5) |

Includes both fee simple and perpetual easement interests. |

13

Other Assets

While we generate substantially all of our revenue from our ownership and leasing of real property interests, we also generate a small amount of revenue from other, non‑core assets, which were in most cases acquired as part of a portfolio transaction of real property interests. These other assets include financing arrangements and management agreements whereby we purchased the right to receive a portion of a rental payment under a contract but are not a party to the lease and do not have a real property interest. Our other assets also include arrangements with T‑Mobile whereby we purchased the right to retain a portion of a lease payment prior to passing the remainder to the property owner. These cash flow financing arrangements are accounted for as receivables in our financial statements. We generally will not seek to acquire assets that are similar to these cash flow financing arrangements.

Tenant Leases

The majority of our tenant leases were acquired from property owners, who assigned to us all of the property owner’s rights, title and interest in and pursuant to (but generally excluding obligations under) a pre‑existing lease between the property owner and a third‑party tenant, such as a wireless carrier, cellular tower operator, billboard owner or renewable power producer. Generally, we do not assume the landlord’s obligations under the tenant lease, such as the obligation to provide quiet enjoyment of the property or to pay property taxes. These leases previously provided the property owner with a stream of rental payments, typically paid monthly or annually, and were assigned to us in exchange for an up‑front lump sum payment.

Of our 695 leased tenant sites, 689 are subject to effectively triple net lease arrangements, meaning that our tenants or the underlying property owners are contractually responsible for property‑level operating expenses, including maintenance capital expenditures, taxes and insurance. For this reason, we expect to have minimal ongoing expenses relating to our assets. For each year ended December 31, 2014 and 2013, our property operating and maintenance expenses and maintenance capital expenditures were collectively equal to less than 1% of revenue.

We believe our effectively triple net lease arrangements support a stable, consistent and predictable cash flow profile due to the following characteristics:

|

· |

no equipment maintenance costs or obligations (tenant is responsible for all maintenance and Landmark’s role is limited to billing, collections and managing the ground lease); |

|

· |

no property‑level maintenance capital expenditures; and |

|

· |

no property tax or insurance obligations (tenant or property owner is responsible for these costs). |

Our tenant leases are typically structured with five‑year or ten‑year initial terms and four additional, successive five‑year renewal terms. The average remaining lease term of our tenant leases is 18 years including renewal terms, and the average remaining lease term of our tenant leases is four years excluding renewal terms. In Landmark’s five‑year history, including assets in our portfolio as well as assets held by the Remaining Landmark Funds, it has had 471 tenant sites come up for renewal and 468 (over 99%) have been renewed. Our tenant leases produce an average of approximately $1,600 per month in GAAP rental payments, but can range from as low as $30 per month to as much as $9,700 per month. In addition, most of our tenant leases include built‑in rent escalators, which are typically structured as fixed amount increases, fixed percentage increases, or CPI‑based increases and increase rent annually or on the renewal of the lease term. Furthermore, 39 of our tenant leases, primarily in the outdoor advertising industry, contain revenue sharing provisions. As of December 31, 2014, 95% of our tenant leases contained contractual rent escalators, 88% of which were fixed‑rate (with an average annual escalation rate of approximately 2.6%) and 7% of which were tied to CPI.

Though our tenant leases are typically structured as long‑term leases with fixed rents and rent escalators, our tenants generally may cancel their leases upon 30 to 180 days’ notice. However, occupancy rates under our tenant leases have historically been very high. As of December 31, 2014, we had an occupancy rate of 99%, with 695 tenant sites leased and six tenant sites available for lease. We believe the infrastructure improvements and operations of the tenant assets located on our real property interests are essential to the ongoing operations and profitability of our tenants. We

14

believe that the importance of these assets, combined with the challenges and costs of relocating these infrastructure improvements, make it likely that we will continue to enjoy high tenant retention and occupancy rates.

We believe that by focusing on high‑quality real property interests we increase the likelihood that our tenants will renew their leases upon expiration. In Landmark’s history, including assets in our portfolio as well as assets held by the Remaining Landmark Funds, it has had 471 tenant sites come up for renewal and 468 (over 99%) have been renewed.

We monitor tenant credit quality on an ongoing basis by reviewing, where available, the publicly filed financial reports, press releases and other publicly available industry information regarding the parent entities of our tenants. In addition, we monitor payment history data for all of our tenants. We are otherwise generally not entitled to financial results or other credit‑related data from our tenants.

The tables below summarize the remaining lease terms under our tenant leases as of December 31, 2014.

Our Tenant Sites by Remaining Tenant Lease Terms

(assuming full exercise of remaining renewal terms)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of |

|

|

|

|

Number of Leased |

|

Quarterly |

|

Quarterly |

|

|

|

Remaining Lease Term |

|

Tenant Sites |

|

Rental Revenue(1) |

|

Rental Revenue(1) |

|

|

|

Less than or equal to 5 years |

|

67 |

|

$ |

284,308 |

|

8 |

% |

|

5 to 9 years |

|

101 |

|

|

498,987 |

|

14 |

% |

|

10 to 14 years |

|

111 |

|

|

602,818 |

|

18 |

% |

|

15 years or more |

|

416 |

|

|

2,057,505 |

|

60 |

% |

|

Total |

|

695 |

|

$ |

3,443,618 |

|

100 |

% |

|

(1) |

Represents GAAP rental revenue recognized under existing tenant leases for the three months ended December 31, 2014. Excludes interest income on receivables. |

Our Tenant Sites by Remaining Tenant Lease Terms

(assuming no exercise of remaining renewal terms)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of |

|

|

|

|

Number of Leased |

|

Quarterly |

|

Quarterly |

|

|

|

Remaining Lease Term |

|

Tenant Sites |

|

Rental Revenue(1) |

|

Rental Revenue(1) |

|

|

|

Less than 1 year |

|

154 |

|

$ |

767,428 |

|

22 |

% |

|

1 to 2 years |

|

115 |

|

|

577,418 |

|

17 |

% |

|

2 to 5 years |

|

351 |

|

|

1,760,418 |

|

51 |

% |

|

5 years or more |

|

75 |

|

|

338,354 |

|

10 |

% |

|

Total |

|

695 |

|

$ |

3,443,618 |

|

100 |

% |

|

(1) |

Represents GAAP rental revenue recognized under existing tenant leases for the three months ended December 31, 2014. Excludes interest income on receivables. |

Our Tenants

Our tenants operate in the wireless communication, outdoor advertising and renewable power generation industries. They are generally large, publicly traded companies (or their affiliates) with a national footprint. Approximately 90% of our rental revenue for the three months ended December 31, 2014 was derived from our Tier 1

15

tenants. In the course of evaluating acquisition opportunities, we assess the desirability of an infrastructure location to our tenants and factors impacting demand of their customers.

Below is a summary of our tenants as of December 31, 2014.

Our Tenants By Industry

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of |

|

|

|

|

Quarterly |

|

|

|

|

|

|

|

Leased |

|

% of |

|

Rental |

|

% of |

|||

|

Tenant(1) |

|

Tenant Sites |

|

Total |

|

Revenue(2) |

|

Total |

|||

|

Wireless Communication (Carriers) |

|

|

|

|

|

|

|

|

|

|

|

|

T-Mobile |

|

111 |

|

16 |

% |

|

$ |

659,681 |

|

19 |

% |

|

Verizon |

|

106 |

|

15 |

% |

|

|

559,258 |

|

16 |

% |

|

Sprint |

|

72 |

|

10 |

% |

|

|

433,448 |

|

13 |

% |

|

AT&T Mobility |

|

80 |

|

12 |

% |

|

|

423,041 |

|

12 |

% |

|

Others |

|

40 |

|

6 |

% |

|

|

155,694 |

|

5 |

% |

|

Wireless Communication (Carriers) Subtotal |

|

409 |

|

59 |

% |

|

$ |

2,231,122 |

|

65 |

% |

|

Wireless Communication (Tower Companies) |

|

|

|

|

|

|

|

|

|

|

|

|

Crown Castle |

|

101 |

|

15 |

% |

|

$ |

391,594 |

|

12 |

% |

|

American Tower |

|

29 |

|

4 |

% |

|

|

146,088 |

|

4 |

% |

|

SBA Communications |

|

21 |

|

3 |

% |

|

|

110,708 |

|

3 |

% |

|

Others |

|

14 |

|

2 |

% |

|

|

60,651 |

|

2 |

% |

|

Wireless Communication (Tower Companies) Subtotal |

|

165 |

|

24 |

% |

|

$ |

709,041 |

|

21 |

% |

|

Outdoor Advertising |

|

|

|

|

|

|

|

|

|

|

|

|

Outfront Media (formerly CBS Outdoor) |

|

33 |

|

5 |

% |

|

$ |

155,540 |

|

4 |

% |

|

Clear Channel Outdoor |

|

24 |

|

3 |

% |

|

|

153,069 |

|

4 |

% |

|

Lamar Advertising |

|

36 |

|

5 |

% |

|

|

97,398 |

|

3 |

% |

|

Others |

|

26 |

|

4 |

% |

|

|

88,504 |

|

3 |

% |

|

Outdoor Advertising Subtotal |

|

119 |

|

17 |

% |

|

$ |

494,511 |

|

14 |

% |

|

Renewable Power Generation |

|

|

|

|

|

|

|

|

|

|

|

|

Others |

|

2 |

|

— |

% |

|

$ |

8,944 |

|

— |

% |

|

Total |

|

695 |

|

100 |

% |

|

$ |

3,443,618 |

|

100 |

% |

|

(1) |

Includes affiliates and subsidiaries. |

|

(2) |

Represents GAAP rental revenue recognized under existing tenant leases for the three months ended December 31, 2014. Excludes interest income on receivables. |

Wireless Communication

Our wireless communication tenants consist primarily of wireless carriers (and their affiliates), such as AT&T Mobility, Sprint, T‑Mobile and Verizon, and tower companies (and their affiliates) such as American Tower, Crown Castle and SBA Communications. These tenants generally lease from us space underlying their cellular towers that contain antennas, radios and other electronic communications equipment. Our wireless communication sites also include space on existing buildings and structures, such as building rooftops, especially in dense urban areas and other locations where it is impossible or uneconomical to place a traditional cellular tower.

We have strong renewal rates among our wireless communication tenants. We believe that this trend will continue because the decommissioning and repositioning of a current site in an existing carrier’s network is expensive and often requires the reconfiguration of several other sites within the carrier’s network, which may impact the carrier’s network quality and coverage. In addition, zoning restrictions may significantly delay, hinder or prevent entirely the construction of new sites. Construction, decommissioning and relocation of a current site may also require the carrier to

16

obtain additional governmental permits, further increasing the cost of non‑renewal of a lease with us. In addition, as thousands of new tenant sites are constructed each year, many of these sites will be co‑located on towers and other structures located on our real property interests. We believe each of these attributes helps us achieve stable, consistent and predictable cash flow, which will lead to consistent distributions for our unitholders.

Rental rates associated with wireless communication assets are tied to various factors, including:

|

· |

infrastructure location; |

|

· |

amount, type and function of the tenant’s equipment on the infrastructure location; |

|

· |

ground space necessary for the tenant’s base station and other infrastructure required for the transmission and reception of radio signal; |

|

· |

remaining capacity at the infrastructure location; |

|

· |

shared back‑up power availability; |

|

· |

type of structure (e.g., stealth tower, rooftop, water tower); and |

|

· |

location of the customer’s antennas on the infrastructure location. |

Outdoor Advertising

Our outdoor advertising tenants include companies (and their affiliates) that own and manage billboards, such as Clear Channel Outdoor, Lamar Advertising and Outfront Media (formerly CBS Outdoor). These tenants generally lease space from us underlying billboards, typically along highly trafficked freeways and intersections.

We have strong renewal rates among our outdoor advertising tenants. We believe that this trend will continue because billboards are the primary revenue generating assets of our outdoor advertising tenants. The outdoor advertising market is characterized by strict local regulations and zoning laws, which have made it extremely difficult to erect new billboards in many markets. Additionally, many existing sites are “non‑conforming” with regard to current zoning standards but have been “grandfathered” in (and therefore not required to be removed) as they have been in place for long periods of time prior to the change in zoning standards. As such, there is typically a very high rate of lease renewal among our outdoor advertising tenants, and we believe that these renewals will continue to provide stable, growing revenue.

Rental rates associated with outdoor advertising assets are tied to various factors, including:

|

· |

infrastructure location; |

|

· |

illumination for night‑time visibility; |

|

· |

display and face size; |

|

· |

roadside position with respect to traffic flow; |

|

· |

angle to the road for maximum visibility; |

|

· |

street type (e.g., highway, interstate, cross‑section); |

17

|

· |

traffic count; |

|

· |

viewer traffic metrics; |

|

· |

type of display (e.g., static face, digital billboard, tri‑vision); and |

|

· |

height above ground level. |

Renewable Power Generation