Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - INFINITY PROPERTY & CASUALTY CORP | Financial_Report.xls |

| EX-21 - EXHIBIT 21 - INFINITY PROPERTY & CASUALTY CORP | ipcc-123114exhibit21.htm |

| EX-32 - EXHIBIT 32 - INFINITY PROPERTY & CASUALTY CORP | ipcc-123114exhibit32.htm |

| EX-31.1 - EXHIBIT 31.1 - INFINITY PROPERTY & CASUALTY CORP | ipcc-123114exhibit311.htm |

| EX-31.2 - EXHIBIT 31.2 - INFINITY PROPERTY & CASUALTY CORP | ipcc-123114exhibit312.htm |

| EX-10.25 - EXHIBIT 10.25 - INFINITY PROPERTY & CASUALTY CORP | ipcc-123114exhibit1025.htm |

| EX-10.24 - EXHIBIT 10.24 - INFINITY PROPERTY & CASUALTY CORP | ipcc-123114exhibit1024.htm |

| EX-23 - EXHIBIT 23 - INFINITY PROPERTY & CASUALTY CORP | ipcc-123114exhibit23.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 10-K

________________________________

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014 | |

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission file number 0-50167

________________________________

INFINITY PROPERTY AND CASUALTY CORPORATION

(Exact name of registrant as specified in its charter)

________________________________

OHIO | 03-0483872 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3700 COLONNADE PARKWAY SUITE 600 BIRMINGHAM, ALABAMA | 35243 | |

(Address of principal executive offices) | (Zip Code) | |

(205) 870-4000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(g) of the Act: None

Securities registered pursuant to Section 12(b) of the Act: | Name of each exchange on which registered: | |

Common Stock, no par value | NASDAQ Global Select Market | |

(Title of class)

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ý Yes ¨ No

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ý No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | ¨ | |||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

As of June 30, 2014, the aggregate market value of the voting Common Stock held by non-affiliates of the registrant was $746,839,380 based on the last sale price of Common Stock on that date as reported by The NASDAQ Global Select Market.

As of February 13, 2015, there were 11,473,967 shares of the registrant’s Common Stock outstanding.

________________________________

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for the annual meeting of shareholders to be held on May 19, 2015, are incorporated by reference in Part III hereof.

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

INDEX TO ANNUAL REPORT

ON FORM 10-K

Page | ||

PART I | ||

Item 1 - | ||

Item 1A - | ||

Item 1B - | ||

Item 2 - | ||

Item 3 - | ||

Item 4 - | ||

PART II | ||

Item 5 - | ||

Item 6 - | ||

Item 7 - | ||

Item 7A - | ||

Item 8 - | ||

Item 9 - | ||

Item 9A - | ||

Item 9B - | ||

PART III | ||

Item 10 - | ||

Item 11 - | ||

Item 12 - | ||

Item 13 - | ||

Item 14 - | ||

PART IV | ||

Item 15 - | ||

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain “forward-looking statements” which anticipate results based on our estimates, assumptions and plans that are subject to uncertainty. These statements are made subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements in this report not dealing with historical results or current facts are forward-looking and are based on estimates, assumptions and projections. Statements which include the words “assumes,” “believes,” “seeks,” “expects,” “may,” “should,” “intends,” “likely,” “targets,” “plans,” “anticipates,” “estimates” or the negative version of those words and similar statements of a future or forward-looking nature identify forward-looking statements. Examples of such forward-looking statements include statements relating to expectations concerning market conditions, premium growth, earnings, investment performance, expected losses, rate changes and loss experience.

The primary events or circumstances that could cause actual results to differ materially from what we expect include determinations with respect to reserve adequacy, realized gains or losses on the investment portfolio (including other-than-temporary impairments for credit losses), loss cost trends and competitive conditions in our key Focus States. We undertake no obligation to publicly update or revise any of the forward-looking statements. For a more detailed discussion of some of the foregoing risks and uncertainties that could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” contained in Item 1A.

PART I

ITEM 1

Business

Introduction

We are a holding company that provides, through our subsidiaries, personal automobile insurance with a focus on the nonstandard market. Our headquarters is located in Birmingham, Alabama. We employed approximately 2,200 people at December 31, 2014.

We file our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports as required with the United States Securities and Exchange Commission (“SEC”). Any of these documents may be read and copied at the SEC’s Public Reference Room at 100 F Street NE, Washington, D.C. 20549. Information regarding the operation of the SEC Public Reference Room may be obtained by calling 1-800-SEC-0330. Our filed documents may also be accessed via the SEC Internet site at http://www.sec.gov. All of our SEC filings, news releases and other information may also be accessed free of charge on our website at http://www.infinityauto.com. Information on our website is not part of this Form

10-K.

Please see Note 1 to the Consolidated Financial Statements for additional information regarding our history and organization. References to "we" or "us", unless the context requires otherwise, include the combined operations of our subsidiaries. Unless indicated otherwise, the financial information we present in this report is on a GAAP basis. Schedules may not foot due to rounding.

The Personal Automobile Market

Personal auto insurance is the largest line of property and casualty insurance, accounting for approximately 36%, or $175 billion, of the estimated $480 billion of annual industry premium. Personal auto insurance is comprised of preferred, standard and nonstandard risks. Nonstandard auto insurance is intended for drivers who, due to factors such as their driving record, age or vehicle type, represent a higher than normal risk. As a result, customers who purchase nonstandard auto insurance generally pay a higher premium for similar coverage than the drivers qualifying for standard or preferred policies. While there is no established industry-recognized distinction between nonstandard risks and all other personal auto risks, we believe that nonstandard auto risks constitute approximately 20% of the personal automobile insurance market, with this percentage fluctuating according to competitive conditions in the market. Independent agents sell approximately 27% of all personal automobile insurance. The remainder is sold by captive agents or directly by insurance companies to their customers. We believe that, relative to the standard and preferred auto insurance market, independent agents sell a disproportionately larger portion of nonstandard auto insurance.

The personal auto insurance industry is cyclical, characterized by periods of price competition and excess capacity followed by periods of higher premium rates and shortages of underwriting capacity. We believe that the current competitive environment differs by state.

Industry-wide, rates increased 4.7% during 2012, 3.3% in 2013 and 4.7% in 2014. Our filed average rate adjustments on our personal auto business were 8.3%, 6.7% and 6.8% for 2012, 2013 and 2014, respectively.

The personal auto insurance industry is highly competitive and, except for regulatory considerations, there are relatively few barriers to entry. We generally compete with other insurers based on price, coverage offered, claims handling, customer service, agent commission, geographic coverage and financial strength ratings. We compete with both large national writers and smaller regional companies. In 2013, the five largest automobile insurance companies accounted for approximately 54% of the industry’s net written premium and the largest ten accounted for approximately 71% (2014 industry data is not yet available). Approximately 320 insurance groups and unaffiliated insurance companies compete in the personal auto insurance industry according to SNL Financial, an industry news source. Some of these groups specialize in nonstandard auto insurance while others insure a broad spectrum of personal auto insurance risks.

Our Strategy

We offer personal and commercial automobile insurance primarily in four "Focus States": Arizona, California, Florida and Texas. Our target customers are urban and Hispanic drivers. This narrow geographic and demographic focus allows us to concentrate our efforts and resources on providing competitively priced products to underserved segments while generating adequate returns for our shareholders.

Operations

We are organized along functional responsibilities with the following centralized departments: product management, marketing, claims, customer service, accounting, treasury, human resources and information technology resources. Frequent executive team meetings, which include the Chief Executive Officer, the Chief Financial Officer, the Chief Legal Officer, the Chief Marketing Officer and the Chief Product Management Officer, allow for sharing of information among functional departments and for setting policies and making key strategic decisions.

We estimate that approximately 80% of our personal auto business in 2014 was nonstandard auto insurance. Based on data published by A.M. Best, we believe that we are the second largest provider of nonstandard auto coverage through independent agents in the United States. We also write standard and preferred personal auto insurance, mono-line commercial auto insurance and classic collector automobile insurance.

Presented below is our summarized historical financial data ($ in thousands):

Twelve months ended December 31, | |||||||||||

2014 | 2013 | 2012 | |||||||||

Gross written premium | $ | 1,360,870 | $ | 1,339,819 | $ | 1,254,929 | |||||

Net written premium | 1,347,604 | 1,329,892 | 1,247,198 | ||||||||

Net earnings | 57,201 | 32,633 | 24,319 | ||||||||

As of December 31, | |||||||

2014 | 2013 | ||||||

Total assets | $ | 2,384,812 | $ | 2,317,265 | |||

Total liabilities | 1,687,153 | 1,660,507 | |||||

Total shareholders’ equity | 697,659 | 656,758 | |||||

2

We have a history of underwriting results that outperform the industry. The following table compares our statutory combined ratio, net of fees, in past years with those of the private passenger auto industry. The statutory combined ratio is the sum of the loss ratio (the ratio of losses and loss adjustment expenses (“LAE”) to net earned premium) and the expense ratio (when calculated on a statutory accounting basis, the ratio of underwriting expenses, net of fees, to net written premium). Underwriting results are generally considered profitable when the combined ratio is under 100%; when the ratio is over 100%, underwriting results are generally considered unprofitable. We have consistently performed better than the industry as shown below:

2014 | 2013 | 2012 | 2011 | 2010 | 2010-2014 | 2005-2014 | ||||||||||||||

Infinity | 93.6 | % | 96.0 | % | 98.3 | % | 95.8 | % | 88.4 | % | 94.7 | % | 92.5 | % | ||||||

Industry (a) | 102.2 | % | 101.6 | % | 102.1 | % | 102.0 | % | 101.0 | % | 101.8 | % | 100.0 | % | ||||||

Percentage point difference from industry | 8.6 | % | 5.6 | % | 3.8 | % | 6.2 | % | 12.6 | % | 7.1 | % | 7.5 | % | ||||||

________________

(a) | We obtained the private passenger auto industry combined ratios for 2005 through 2013 from A.M. Best. A.M. Best data is not available for 2014. The industry combined ratio for 2014 is an estimate based on data obtained from Conning Research and Consulting. |

Products

Personal Automobile is our primary insurance product. It provides coverage to individuals for liability to others for bodily injury and property damage and for physical damage to an insured's own vehicle from collision and various other perils. In addition, many states require policies to provide for first party personal injury protection, frequently referred to as no-fault coverage.

Commercial Vehicle provides coverage to businesses for liability to others for bodily injury and property damage and for physical damage to vehicles from collision and various other perils. With our mono-line commercial automobile insurance product, we primarily target businesses with fleets of 20 or fewer vehicles and average 1.8 vehicles per policy. We avoid businesses that are involved in what we consider to be hazardous operations or interstate commerce.

Classic Collector provides protection for classic collectible automobiles. Our Classic Collector program provides coverage to individuals with classic or antique automobiles for liability to others for bodily injury and property damage and for physical damage to an insured's own vehicle from collision and various other perils.

Our three product groups contributed the following percentages of total gross written premium:

Twelve months ended December 31, | ||||||||

2014 | 2013 | 2012 | ||||||

Personal Automobile | 91 | % | 93 | % | 93 | % | ||

Commercial Vehicle | 8 | % | 6 | % | 6 | % | ||

Classic Collector | 1 | % | 1 | % | 1 | % | ||

Total | 100 | % | 100 | % | 100 | % | ||

Distribution and Marketing

We distribute our products primarily through a network of approximately 11,800 independent agencies and brokers in 15,500 locations. Of the locations that produced premium in 2014, approximately 2,160 wrote renewal only business. In 2014, eight independent agencies each accounted for between 1.2% and 7.3% of our gross written premium and 15% of the agency force produced 80% of our gross written premium. Countrywide, our top 10 independent agents and brokers produced 21% of our gross written premium. In California, Infinity’s largest state by premium volume, 52 independent agents and brokers produced 50% of gross written premium (which represents 25% countrywide). Our largest broker in California produced 15% of gross written premium in the state.

We foster agent relationships by providing them with access to our Internet web-based software applications along with programs and services designed to strengthen and expand their marketing, sales and service capabilities. Our Internet-based software applications provide many of our agents with e-signature capabilities and real-time underwriting, claims and policy information. We believe the array of services offered to our agents adds significant value to the agents' businesses. For example, “Easy Street” is our incentive-based program through which agents receive assistance in critical areas such as training, advertising and promotion. In 2014 we spent $6.4 million on co-op advertising and promotions.

3

In 2014 we also wrote $70.2 million of business sold directly to the consumer through sales centers and via the Internet.

We are licensed to write insurance in all 50 states and the District of Columbia, but we focus our operations in targeted urban

areas identified in selected Focus States that we believe offer the greatest opportunity for premium growth and profitability.

We classify the states in which we operate into two categories:

• | “Focus States” – These states include Arizona, California, Florida and Texas. |

• | “Other States” – Includes Georgia, Nevada and Pennsylvania where we began offering renewals only as of |

January 1, 2015, as well as nine states where we are currently running off our writings.

We continually evaluate our market opportunities; thus, the Focus States and Other States may change over time as new market

opportunities arise, as the allocation of resources changes or as regulatory environments change.

Total gross written premium was as follows ($ in thousands):

Twelve months ended December 31, | |||||||||||

Personal Auto Insurance | 2014 | 2013 | 2012 | ||||||||

Focus States: | |||||||||||

California | 45.9 | % | 44.8 | % | 45.4 | % | |||||

Florida | 32.8 | % | 32.2 | % | 26.3 | % | |||||

Texas | 4.6 | % | 4.0 | % | 4.9 | % | |||||

Arizona | 1.3 | % | 1.8 | % | 3.0 | % | |||||

Total Focus States | 84.6 | % | 82.7 | % | 79.6 | % | |||||

Other States | 6.4 | % | 9.9 | % | 13.3 | % | |||||

Total Personal Auto | 91.0 | % | 92.6 | % | 92.9 | % | |||||

Commercial Vehicle | 8.0 | % | 6.4 | % | 6.1 | % | |||||

Classic Collector | 1.1 | % | 1.0 | % | 1.0 | % | |||||

Total all states and all lines | 100.0 | % | 100.0 | % | 100.0 | % | |||||

Total - all states and all lines | $ | 1,360,870 | $ | 1,339,819 | $ | 1,254,929 | |||||

We implement our distribution and marketing efforts with a focus on maintaining a low cost structure. Controlling expenses allows us to price competitively and achieve better underwriting returns. Over the five years ended 2013, years for which industry data are available from A.M. Best, our statutory ratio of underwriting expenses to premium written has averaged 19.6%, which is 7.4 points better than the independent agency segment of the private passenger automobile industry average of 27.0% for the same period.

Claims Handling

We strive for accuracy, consistency and fairness in our claim resolutions. Our claims organization employs approximately 1,275 people, has several field locations in each of our Focus States and provides a 24-hour, seven days per week toll-free service for our customers to report claims. We predominantly use our own local adjusters and appraisers, who typically respond to claims within 24 hours of a report.

We are committed to the field handling of claims and we believe that it provides, when compared to alternative methods, better service to our customers and better control of the claim resolution process. We open claims branch offices in urban areas where the volume of business will support them. Customer interactions can occur with generalists (initial and continuing adjusters) and specialists (staff appraisers, field casualty representatives and special investigators) based on local market volume, density and performance.

In addition to the use of field claims handling, we use centralized claims call centers to receive initial reports of losses and to adjust simple property damage claims.

Ratings

A.M. Best has assigned our insurance company subsidiaries a group financial strength rating of “A” (Excellent). A.M. Best assigns “A” ratings to insurers that, in A.M. Best's opinion, “have an excellent ability to meet their ongoing insurance obligations.” A.M. Best bases our rating on factors that concern policyholders and not upon factors concerning investor protection.

4

Regulatory Environment

Our insurance company subsidiaries are subject to regulation and supervision by insurance departments of the jurisdictions in which they are domiciled or licensed to transact business. State insurance departments have broad administrative power relating to licensing insurers and agents, regulating premium rates and policy forms, establishing reserve and investment requirements, prescribing statutory accounting methods and the form and content of statutory financial reports, and regulating methods and processes of how an insurer conducts its business. Examples of the latter include the establishment in California of auto rating factor and rate approval regulations, proscription on credit based insurance scoring, prohibition of certain business practices with auto body repair shops, and attempts to set uniform auto body repair shop parts and labor rates.

Under state insolvency and guaranty laws, regulated insurers can be assessed or required to contribute to state guaranty funds to cover policyholder losses resulting from insurer insolvencies. Many states also require insurers, as a condition of doing business in the state, to participate in various assigned risk pools, reinsurance facilities or underwriting associations, which provide insurance coverage to individuals who otherwise are unable to purchase that coverage in the voluntary market. Participation in these involuntary plans is generally in proportion to voluntary writings of related lines of business in that state. The underwriting results of these plans traditionally have been unprofitable. The amount of premium we might be required to assume in a given state in connection with an involuntary plan may be reduced because of credit we may receive for nonstandard policies that we voluntarily write. Many states also have laws and regulations that limit an insurer's ability to exit a market. For example, certain states limit an automobile insurer's ability to cancel and non-renew policies.

State insurance departments that have jurisdiction over our insurance subsidiaries may conduct routine, on-site visits and examinations of our subsidiaries' affairs. At December 31, 2014, our insurance subsidiaries were involved in routine market conduct examinations in California and Florida. As of February 26, 2015, these examinations have not been concluded. These examinations have from time to time given rise to, and are likely to give rise to in the future, regulatory orders requiring remedial, injunctive or other action on the part of an insurance subsidiary or the assessment of substantial fines or other penalties against our insurance subsidiaries.

The insurance laws of the states of domicile of our insurance subsidiaries contain provisions to the effect that the acquisition or change of control of a domestic insurer or of any entity that controls a domestic insurer cannot be consummated without the prior approval of the relevant insurance regulator. In addition, certain state insurance laws contain provisions that require pre-acquisition notification to state agencies of a change in control with respect to a non-domestic insurance company licensed to do business in that state. Such approval requirements may deter, delay or prevent certain transactions affecting the ownership of our common stock.

We are a holding company with no business operations of our own. Consequently, our ability to pay dividends to shareholders and meet our debt payment obligations is largely dependent on dividends or other distributions from our insurance company subsidiaries, current investments and cash held. State insurance laws restrict the ability of our insurance company subsidiaries to declare shareholder dividends. These subsidiaries may not make an “extraordinary dividend” until thirty days after the applicable commissioner of insurance has received notice of the intended dividend and has either not objected or has approved the payment of the extraordinary dividend within the 30-day period. An extraordinary dividend is defined as any dividend or distribution that, together with other distributions made within the preceding twelve months, exceeds the greater of 10% of the insurer's surplus as of the preceding December 31st, or the insurer's net income for the twelve-month period ending the preceding December 31st, in each case determined in accordance with statutory accounting practices. In addition, an insurer's remaining surplus after payment of a cash dividend to shareholder affiliates must be both reasonable in relation to its outstanding liabilities and adequate to its financial needs.

If a shareholder dividend does not rise to the statutory level of an extraordinary dividend, then it is an “ordinary dividend.” While an insurance company’s ability to pay an ordinary dividend does not require the approval of a state insurance department, it must file a 10-day notice of ordinary dividend with the appropriate insurance departments. Insurance companies that fail to notify an insurance department of the payment of an ordinary dividend are assessed administrative fines.

State insurance laws require our subsidiaries to maintain specified levels of statutory capital and surplus. Generally, the net admitted assets of insurance companies that, subject to other applicable insurance laws and regulations, are available for transfer to the parent company cannot include the net admitted assets required to meet the minimum statutory surplus requirements of the states where the companies are licensed. In addition, for competitive reasons, our insurance company subsidiaries need to maintain adequate financial strength ratings from independent rating agencies. Both of these factors may limit the ability of our insurance subsidiaries to declare and pay dividends.

5

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

ITEM 1A

Risk Factors

Our business operations face a number of risks. The risks below should be read and considered with other information provided in this report and in other reports and materials we have filed with the SEC. In addition to these risks, other risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

If we fail to price accurately the risks we underwrite, profitability may be affected.

Our profitability depends on our ability to set premium rates accurately. Inflationary pressures on medical care, auto parts and repair services costs complicate pricing with accuracy. Accurate pricing is also dependent on the availability of sufficient, reliable data on which to project both severity and frequency trends and timely recognition of changes in loss cost trends. This process poses more of a challenge in markets where we have less pricing experience. We could under-price risks, which could negatively affect our profit margins, or overprice risks, which could reduce sales volume and competitiveness. Either scenario could adversely affect profitability.

Because of the significant concentration of our business in California and Florida, negative developments in the regulatory, legal or economic conditions in these states may adversely affect our profitability.

California and Florida personal auto business represented 79% of our total gross written premium in 2014. In 2014 our two largest urban zones, one in California and one in Florida, represented 52% of total gross written premium and approximately 88% of total underwriting profits. As we cease writing new business in Georgia, Nevada and Pennsylvania in 2015, our personal auto business may become further concentrated in these states and within our two largest urban zones. Consequently, the dynamic nature of regulatory, legal, competitive and economic conditions in these states affects our revenues and profitability. Further, both California and Florida have regulations that limit the after-tax return on underwriting profit allowed for an insurer. These conditions could negatively affect premium revenue and make it more expensive or less profitable for us to conduct business in these states.

We rely upon a limited number of independent agents to generate a substantial portion of our business. If we were unable to retain or increase the level of business that these independent agents place with us or increase the level of business generated by other agents, our revenues would be negatively affected.

Approximately 15% of our 11,800 independent agencies and brokers accounted for approximately 80% of our gross written premium in 2014. Further, in California, our most profitable state, 52 agencies and brokers produced 50% of our premium in the state, which is 25% of our premium nationwide. Some of our current agencies may merge or be acquired and the surviving entity may reduce the number of insurers with which business is placed. We must compete with other insurance carriers for the business of these agents in an increasingly competitive marketplace. Some competitors offer more advanced systems to quote and process business, a larger variety of products, lower prices for insurance coverage, higher commissions or more attractive cash and non-cash incentives.

If we fail to establish accurate loss reserves, our financial position and results of operations may be affected.

Our loss reserves are our best estimate of the amounts that will be paid for losses incurred as well as losses incurred but not reported. The accuracy of these estimates depends on a number of factors, including but not limited to the availability of sufficient and reliable historical data, inflationary pressures on medical and auto repair costs, changes in regulation, changes in frequency and severity trends and changes in our claims settlement practices. Because of the inherent uncertainty involved in the practice of establishing loss reserves, ultimate losses paid could vary materially from recorded reserves and may adversely affect our operating results.

We are vulnerable to a reduction in business written through the independent agent distribution channel.

Reliance on the independent agency as our primary distribution channel makes us vulnerable to the growing popularity of direct to consumer distribution channels, particularly the Internet. Approximately 73% of all personal automobile insurance sold in the United States is sold direct or through captive agents (agents employed by one company or selling only one company's products) and approximately 27% is sold by independent agents. A material reduction in business generated through the independent agency channel could negatively affect our revenues and growth opportunities.

6

Judicial, regulatory and legislative changes or challenges to prevailing insurance industry practices are ongoing, some of which could adversely affect our operating results.

Political, judicial, economic and financial developments occasionally lead to challenges or changes to established industry practices. Recent examples include challenges to (i) the use of credit and other rating factors in making risk selection and pricing decisions; and (ii) the use of automated databases in the adjustment of claims. Some result in class action litigation, regulatory sanctions and substantial fines or penalties. It is difficult to predict the outcome or impact of current challenges or to identify others that might be brought in the future.

The failure to maintain or to develop further reliable, efficient and secure information technology systems would be disruptive to our operations and diminish our ability to compete successfully.

We are highly dependent on efficient and uninterrupted performance of our information technology and business systems. These systems quote, process and service our business, and perform actuarial functions necessary for pricing and product development. These systems must also be able to undergo periodic modifications and improvements without interruptions or untimely delays in service. This capability is crucial to meeting growing customer demands for user friendly, online capabilities and convenient, quality service. We are undergoing fundamental changes and improvements to our policy services platform. A failure or delay to achieve these improvements could interrupt certain processes or degrade business operations and could place us at a competitive disadvantage. Additionally, failure to maintain secure systems could result in unauthorized access to or theft of sensitive customer data.

The inability to recruit, develop and retain key personnel could prevent us from executing our key business and financial objectives.

Successful execution of our key business and financial objectives will depend, in part, upon the continued services of our Chief Executive Officer, James Gober, along with our ability to retain and develop key personnel and to attract new talent. The highly competitive nature of the industry, along with the advantages that larger, better-known firms possess in the recruiting process, poses a challenge. The loss of key personnel or the inability to attract and retain new talent could hinder us in meeting or exceeding our business and financial objectives.

Extra-contractual losses arising from bad faith claims could materially reduce our profitability.

In California and Florida, the judicial climate, case law or statutory framework are often viewed as unfavorable toward an insurer in litigation brought against it by policyholders and third-party claimants. This tends to increase our exposure to extra-contractual losses, or monetary damages beyond policy limit, in what are known as “bad faith” claims, for which reinsurance may be unavailable. Such claims have in the past, and may in the future, result in losses to us that materially reduce our profitability.

Our goodwill may be at risk for impairment if actual results regarding growth and profitability vary from our estimates.

At December 31, 2014, we had $75.3 million, or approximately $6.56 per share, of goodwill. In accordance with the Goodwill topic of the FASB Accounting Standards Codification, we perform impairment test procedures for goodwill on an annual basis. These procedures require us to calculate the fair value of goodwill, compare the result to our carrying value and record the amount of any shortfall as an impairment charge.

We use a variety of methods to test goodwill for impairment, including estimates of future discounted cash flows and comparisons of our market value to our major competitors. Our cash flow projections rely on assumptions that are subject to uncertainty, including premium growth, loss and loss adjustment expense ratios, interest rates and capital requirements. If actual results differ significantly from these assumptions, the fair value of our goodwill could fall below our carrying value and we could be required to record an impairment charge.

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

ITEM 1B

Unresolved Staff Comments

None.

ITEM 2

Properties

Our insurance subsidiaries lease 461,717 square feet of office and warehouse space in numerous cities throughout the United States. All of these leases expire within 7 years. The most significant leased office spaces are located in Birmingham, Alabama and suburban Los Angeles, California. See Note 14 – Commitments and Contingencies of the Notes to Consolidated Financial Statements for further information about leases. We own a 33,515 square foot call center in McAllen, Texas, a 50,900 square foot call center in Tucson, Arizona, and two properties in Birmingham, Alabama - a 116,433 square foot call center and a 62,808 square foot warehouse.

ITEM 3

Legal Proceedings

See Note 13 – Legal and Regulatory Proceedings of the Notes to the Consolidated Financial Statements for a discussion of our material Legal Proceedings. Except for those legal proceedings disclosed in Note 13 to the Consolidated Financial Statements, we believe that none of the legal proceedings to which we are subject meet the threshold for disclosure under this item.

ITEM 4

Mine Safety Disclosures

Not applicable.

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

PART II

ITEM 5

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

We had 49 registered holders of record as of February 13, 2015. Our common stock is listed and traded on the NASDAQ Global Select Market under the symbol IPCC. The stock prices in the following table are over-the-counter market quotations that reflect transactions between dealers; retail markups and commissions are not reflected. These prices may not represent actual transactions. Our closing per-share stock price on February 13, 2015, was $73.93. See Note 12 – Statutory Information of the Notes to Consolidated Financial Statements for information about restrictions on transfer of funds and assets of subsidiaries.

Infinity Quarterly High and Low Stock Prices and Dividends Paid by Quarter

For the quarter ended: | High | Low | Close | Dividends Declared and Paid Per Share | Return to Shareholders (excluding dividends) (a) | Return to Shareholders (including dividends) (b) | |||||||||||||||

March 31, 2013 | $ | 61.20 | $ | 55.12 | $ | 56.20 | $ | 0.30 | (3.5 | )% | (3.0 | )% | |||||||||

June 30, 2013 | 61.15 | 54.32 | 59.76 | 0.30 | 6.3 | % | 6.9 | % | |||||||||||||

September 30, 2013 | 67.56 | 59.32 | 64.60 | 0.30 | 8.1 | % | 8.6 | % | |||||||||||||

December 31, 2013 | 72.70 | 64.10 | 71.75 | 0.30 | 11.1 | % | 11.5 | % | |||||||||||||

March 31, 2014 | $ | 75.66 | $ | 67.45 | $ | 67.63 | $ | 0.36 | (5.7 | )% | (5.2 | )% | |||||||||

June 30, 2014 | 69.70 | 62.12 | 67.23 | 0.36 | (0.6 | )% | (0.1 | )% | |||||||||||||

September 30, 2014 | 70.28 | 64.00 | 64.01 | 0.36 | (4.8 | )% | (4.3 | )% | |||||||||||||

December 31, 2014 | 78.20 | 62.19 | 77.26 | 0.36 | 20.7 | % | 21.3 | % | |||||||||||||

For the twelve months ended: | |||||||||||||||||||||

December 31, 2013 | $ | 72.70 | $ | 54.32 | $ | 71.75 | $ | 1.20 | 23.2 | % | 25.3 | % | |||||||||

December 31, 2014 | 78.20 | 62.12 | 77.26 | 1.44 | 7.7 | % | 9.7 | % | |||||||||||||

(a) | Calculated by dividing the difference between our share price at the end and the beginning of the periods presented by the share price at the beginning of the period presented. |

(b) | Calculated by dividing the sum of (i) the amount of dividends, assuming dividend reinvestment during the period presented and (ii) the difference between our share price at the end and the beginning of the periods presented by the share price at the beginning of the period presented. |

The information required under the heading “Equity Compensation Plan Information” is provided under Item 12 herein.

During the fiscal year ended December 31, 2014, all of our equity securities sold were registered under the Securities Act of 1933, as amended.

7

The following table presents information with respect to purchases of our common stock made during the three months ended December 31, 2014, by us or any of our "affiliated purchasers" as defined in Rule 10b-18(a)(3) under the Exchange Act.

Period | Total Number of Shares Purchased | Average Price Paid per Share (a) | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar Value that May Yet Be Purchased Under the Plans or Programs (b) | |||||||

October 1, 2014 - October 31, 2014 | 6,400 | $ | 66.84 | 6,400 | $ | 38,855,057 | |||||

November 1, 2014 - November 30, 2014 | 5,600 | $ | 73.41 | 5,600 | $ | 74,610,592 | |||||

December 1, 2014 - December 31, 2014 | 7,300 | $ | 74.84 | 7,300 | $ | 74,064,029 | |||||

Total | 19,300 | $ | 71.77 | 19,300 | $ | 74,064,029 | |||||

(a) | Average price paid per share excludes commissions. |

(b) | On November 4, 2014, our Board of Directors increased the authority under our current share and debt repurchase plan to a total of $75.0 million and extended the date to execute the program to December 31, 2016, from December 31, 2014. |

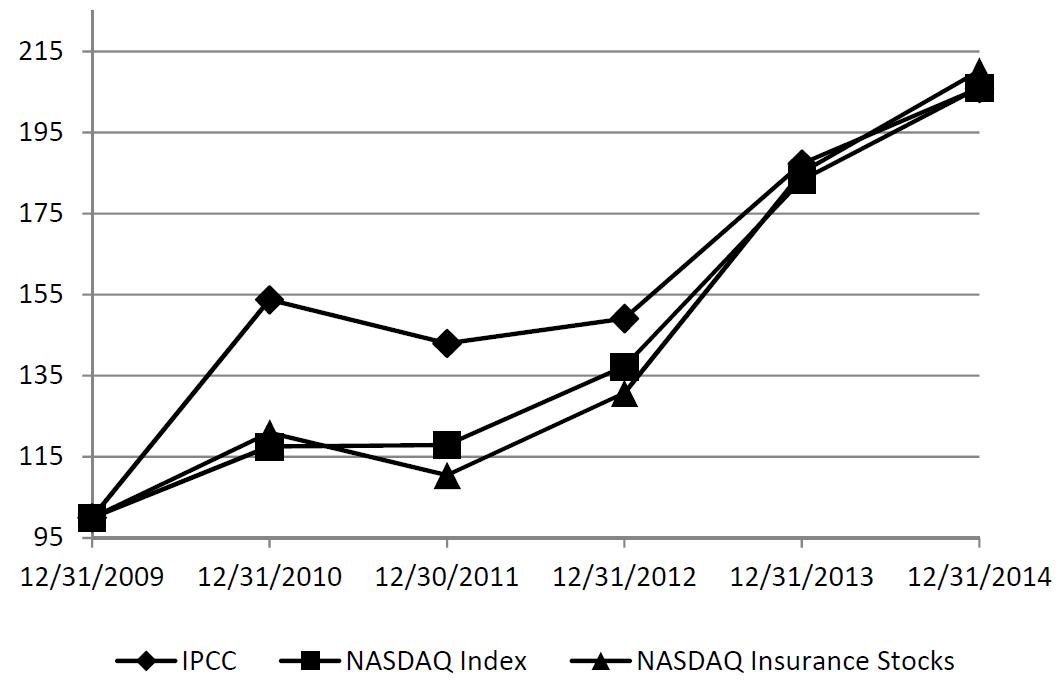

The following graph shows the percentage change in cumulative total shareholder return on our common stock over the five years ending December 31, 2014. The return is measured by dividing the sum of (A) the cumulative amount of dividends, assuming dividend reinvestment during the periods presented and (B) the difference between our share price at the end and the beginning of the periods presented by the share price at the beginning of the periods presented. The graph demonstrates cumulative total returns for Infinity, the NASDAQ OMX Global Total Return Index for NASDAQ US Benchmark and the NASDAQ OMX Global Total Return for Industrial Classification Benchmark (ICB): 8500 Insurance (Supersector).

Cumulative Total Return as of December 31, 2014

(Assumes a $100 investment at the close of trading on December 31, 2009)

12/31/2009 | 12/31/2010 | 12/31/2011 | 12/31/2012 | 12/31/2013 | 12/31/2014 | ||||||

IPCC | 100.00 | 153.78 | 143.02 | 149.13 | 187.28 | 205.92 | |||||

NASDAQ US | 100.00 | 117.55 | 117.91 | 137.29 | 183.26 | 206.09 | |||||

ICB: 8500 Insurance | 100.00 | 120.93 | 110.47 | 130.72 | 185.15 | 210.26 | |||||

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

ITEM 6

Selected Financial Data

($ in thousands, except per share data) | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||

Gross written premium | $ | 1,360,870 | $ | 1,339,819 | $ | 1,254,929 | $ | 1,082,466 | $ | 952,426 | |||||||||

Net written premium | 1,347,604 | 1,329,892 | 1,247,198 | 1,075,976 | 946,869 | ||||||||||||||

Net written premium growth | 1.3 | % | 6.6 | % | 15.9 | % | 13.6 | % | 12.2 | % | |||||||||

Net premium earned | 1,325,935 | 1,302,525 | 1,184,090 | 1,019,060 | 905,919 | ||||||||||||||

Total revenues | 1,461,709 | 1,443,233 | 1,349,585 | 1,163,379 | 1,038,396 | ||||||||||||||

Loss & LAE ratio | 75.5 | % | 78.1 | % | 79.6 | % | 75.3 | % | 67.0 | % | |||||||||

Underwriting ratio | 19.6 | % | 19.9 | % | 21.1 | % | 22.7 | % | 22.7 | % | |||||||||

Combined ratio | 95.1 | % | 98.0 | % | 100.7 | % | 98.0 | % | 89.7 | % | |||||||||

Net earnings | $ | 57,201 | $ | 32,633 | $ | 24,319 | $ | 41,833 | $ | 91,062 | |||||||||

Net earnings per diluted share | $ | 4.95 | $ | 2.80 | $ | 2.04 | $ | 3.37 | $ | 6.91 | |||||||||

Return on average common shareholders’ equity | 8.4 | % | 5.0 | % | 3.7 | % | 6.4 | % | 14.4 | % | |||||||||

Cash and investments | $ | 1,611,594 | $ | 1,582,238 | $ | 1,560,116 | $ | 1,308,684 | $ | 1,283,624 | |||||||||

Total assets | 2,384,812 | 2,317,265 | 2,303,593 | 1,930,371 | 1,846,200 | ||||||||||||||

Unpaid losses and LAE | 668,177 | 646,577 | 572,894 | 495,403 | 477,833 | ||||||||||||||

Unearned premium | 589,260 | 566,004 | 538,142 | 474,528 | 417,371 | ||||||||||||||

Debt outstanding | 275,000 | 275,000 | 275,000 | 194,810 | 194,729 | ||||||||||||||

Total liabilities | 1,687,153 | 1,660,507 | 1,647,351 | 1,268,582 | 1,191,173 | ||||||||||||||

Shareholders’ equity | 697,659 | 656,758 | 656,242 | 661,789 | 655,027 | ||||||||||||||

Cash dividend per common share | $ | 1.44 | $ | 1.20 | $ | 0.90 | $ | 0.72 | $ | 0.56 | |||||||||

Common shares outstanding | 11,483 | 11,504 | 11,605 | 11,807 | 12,469 | ||||||||||||||

Book value per common share | $ | 60.75 | $ | 57.09 | $ | 56.55 | $ | 56.05 | $ | 52.53 | |||||||||

Ratios: | |||||||||||||||||||

Debt to total capital | 28.3 | % | 29.5 | % | 29.5 | % | 22.7 | % | 22.9 | % | |||||||||

Debt to tangible capital | 30.6 | % | 32.1 | % | 32.1 | % | 24.9 | % | 25.1 | % | |||||||||

Interest coverage | 7.0 | 4.2 | 2.7 | 6.0 | 12.8 | ||||||||||||||

8

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

ITEM 7

Management’s Discussion and Analysis (“MD&A”) of Financial Condition and Results of Operations

INDEX TO MD&A

Page | |

See “Cautionary Statement Regarding Forward-Looking Statements” on page 1.

9

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

During 2014 we focused on growing premium in California, Florida and Texas personal auto and countrywide Commercial Vehicle while improving the profitability in Arizona, Georgia, Nevada and Pennsylvania. Although we have seen improvement in the combined ratios, we have determined that our personal auto business in Georgia, Nevada and Pennsylvania, which accounted for 5.9% of our total gross written premium as of December 31, 2014, no longer meets our long-term strategic and financial objectives. As a result, we began offering renewal business only in these three states as of January 1, 2015. In addition, we are evaluating strategic alternatives for our Classic Collector book of business, which was 1.1% of our business as of December 31, 2014.

In 2014 our gross written premium grew 1.6%. The majority of this growth came from California and Florida. See Results of Operations - Underwriting – Premium for a more detailed discussion of our gross written premium growth.

Net earnings and diluted earnings per share for the year ended December 31, 2014, were $57.2 million and $4.95, respectively, compared to $32.6 million and $2.80, respectively, for 2013. The increase in diluted earnings per share for the year ended December 31, 2014, was primarily due to an increase in underwriting income with an improvement in the accident year combined ratio from 97.7% at December 31, 2013, to 96.4% at December 31, 2014.

Included in net earnings for the year ended December 31, 2014, was $11.3 million ($17.4 million pre-tax) of favorable development on prior accident year loss and LAE reserves. This development was primarily due to property damage coverage in California and bodily injury coverage in Florida, related to accident year 2013. This compares to $1.9 million ($2.9 million pre-tax) of unfavorable development for 2013. The following table displays GAAP combined ratio results by accident year developed through December 31, 2014.

Accident Year Combined Ratio Developed Through | Prior Accident Year (Favorable) Unfavorable Development | Prior Accident Year (Favorable) Unfavorable Development ($ in millions) | ||||||||||||||||||||||||||

Dec. | Mar. | June | Sep. | Dec. | Q4 | YTD | Q4 | YTD | ||||||||||||||||||||

Accident Year | 2013 | 2014 | 2014 | 2014 | 2014 | 2014 | 2014 | 2014 | 2014 | |||||||||||||||||||

Prior | $ | (0.6 | ) | $ | (1.1 | ) | ||||||||||||||||||||||

2007 | 92.2 | % | 92.2 | % | 92.2 | % | 92.1 | % | 92.1 | % | 0.0 | % | (0.1 | )% | (0.4 | ) | (0.7 | ) | ||||||||||

2008 | 91.3 | % | 91.3 | % | 91.3 | % | 91.3 | % | 91.2 | % | (0.1 | )% | (0.2 | )% | (1.1 | ) | (1.6 | ) | ||||||||||

2009 | 92.3 | % | 92.3 | % | 92.3 | % | 92.4 | % | 92.4 | % | 0.0 | % | 0.1 | % | (0.2 | ) | 0.8 | |||||||||||

2010 | 99.6 | % | 99.5 | % | 99.3 | % | 99.3 | % | 99.2 | % | (0.1 | )% | (0.4 | )% | (0.6 | ) | (3.4 | ) | ||||||||||

2011 | 100.3 | % | 100.2 | % | 100.4 | % | 100.2 | % | 100.1 | % | (0.1 | )% | (0.2 | )% | (1.4 | ) | (2.0 | ) | ||||||||||

2012 | 99.8 | % | 100.1 | % | 100.2 | % | 100.1 | % | 100.1 | % | (0.1 | )% | 0.2 | % | (0.7 | ) | 2.5 | |||||||||||

2013 | 97.7 | % | 97.4 | % | 97.4 | % | 97.1 | % | 96.8 | % | (0.3 | )% | (0.9 | )% | (3.8 | ) | (11.9 | ) | ||||||||||

$ | (8.8 | ) | $ | (17.4 | ) | |||||||||||||||||||||||

See Results of Operations – Underwriting – Profitability for a more detailed discussion of our underwriting results.

Pre-tax net investment income for the year ended December 31, 2014, was $35.6 million compared to $35.5 million for 2013.

Our book value per share increased 6.4% from $57.09 at December 31, 2013, to $60.75 at December 31, 2014. This increase was primarily due to net earnings and an increase in unrealized gains as a result of a decrease in interest rates, partially offset by shareholder dividends during 2014.

Critical Accounting Policies

(See Note 1- Significant Reporting and Accounting Policies of the Notes to Consolidated Financial Statements)

The preparation of financial statements requires management to make estimates and assumptions that can have a significant effect on amounts reported in the financial statements. As more information becomes known, these estimates and assumptions could change and thus impact amounts reported in the future. We believe that the establishment of insurance reserves, the determination of “other-than-temporary” impairment on investments, accruals for litigation and valuation of goodwill are the

10

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

areas where the degree of judgment required to determine amounts recorded in the financial statements makes the accounting policies critical.

Insurance Reserves

Insurance reserves, or unpaid losses and LAE, are our best estimate of the ultimate amounts that will be paid for (i) all claims that have been reported up to the date of the current accounting period but have not yet been paid, (ii) all claims that have occurred but have not yet been reported to us (“incurred but not reported” or “IBNR”), and (iii) unpaid claim settlement expenses.

We establish IBNR reserves for the quarter and year-end based on a quarterly reserve analysis by our actuarial staff. We apply various standard actuarial tests to subsets of the business at a state, product and coverage level. Included in the analyses are the following:

• | Paid and incurred extrapolation methods utilizing paid and incurred loss development to predict ultimate losses; |

• | Paid and incurred frequency and severity methods utilizing paid and incurred claims count development and paid and incurred loss development to predict ultimate average frequency (claims count per policy or auto insured) or ultimate average severity (cost of claim per claim); and |

• | Paid and incurred Bornhuetter-Ferguson methods adding expected development to actual paid or incurred experience to project ultimate losses. |

For each subset of the business evaluated, each test generates a point estimate based on development factors applied to known paid and incurred losses and claim counts to estimate ultimate paid losses and claim counts. We base our selection of factors on historical loss development patterns with adjustment based on professional actuarial judgment where anticipated development patterns vary from those seen historically. This estimation of IBNR requires selection of hundreds of such factors. We then select a single point estimate for the subset evaluated from the results of various tests, based on a combination of simple averages of the point estimates of the various tests and selections based on professional actuarial judgment.

Estimating the liability for unpaid losses and LAE is inherently judgmental and is influenced by factors that are subject to significant variation. We estimate liabilities for the costs of losses and LAE for both reported and unreported (IBNR) claims based on historical trends in the following areas adjusted for deviations in such trends:

• | Claims settlement and payment practices; |

• | Business mix; |

• | Coverage limits and deductibles; |

• | Inflation trends in auto repair and medical costs; and |

• | Legal and regulatory trends affecting claims settlements. |

When possible, we make quantitative and qualitative modifications to, or selections of, such factors where deviations from historical trends in these key areas exist. We analyze the adequacy of reserves using actuarial data and analytical reserve development techniques, including projections of ultimate paid losses, to determine the ultimate amount of reserves. The list of historical trends provided above are non-exhaustive examples of major factors that we take into account in developing these estimates.

We review loss reserve adequacy quarterly by accident year at a state and coverage level. We adjust reserves as additional information becomes known. We reflect such adjustments in current year operations.

During each quarterly review by the internal actuarial staff, using the additional information obtained with the passage of time, factor selections are updated, which in turn adjust the ultimate loss estimates and held IBNR reserves for the subset of the business and accident periods affected by such updates. The actuarial staff also performs various tests to estimate ultimate average severity and frequency of claims. Severity represents the average cost per claim and frequency represents the number of claims per auto or per policy. As an overall review, the staff then evaluates for reasonableness loss and LAE ratios by accident year by state and by coverage.

Factors that can significantly affect actual frequency include, among others, changes in weather, driving patterns or trends and class of driver. Changes in claims settlement and reserving practices can affect estimates of average frequency and severity. Auto repair and medical cost inflation, jury awards and changes in policy limit profiles can affect loss severity. Estimation of LAE reserves is subject to variation from factors such as the use of outside adjusters, frequency of lawsuits, claims staffing and experience levels.

11

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

We believe that our relatively low average policy limit and concentration on the nonstandard auto driver classification help stabilize fluctuations in frequency and severity. For example, approximately 85% of our policies include only the state-mandated minimum policy limits for bodily injury, which somewhat mitigates the challenge of estimating average severity. These low limits tend to reduce the exposure of the loss reserves on this coverage to medical cost inflation on severe injuries since the minimum policy limits will limit the total payout.

Ultimate loss estimates, excluding extra-contractual obligation (“ECO”) losses, usually experience the greatest adjustment within the first twelve to eighteen months after the accident year. Accordingly, the highest degree of uncertainty is associated with reserves for the current accident year because the current accident year contains the greatest proportion of losses that have not been reported or settled, and we must estimate these elements as of the current reporting date. The proportion of losses with these characteristics typically diminishes in subsequent years.

As compared with loss and LAE reserves held at December 31, 2014, our best estimate of reserve ranges using indicated results from utilized estimates of loss and LAE could range from a deficiency of 7% or $46.6 million to a redundancy of 8% or $53.8 million. These ranges do not present a forecast of future redundancy or deficiency since actual development of future losses on current loss reserves may vary materially from those estimated in the year-end 2014 reserve tests. Reserves recorded are our best estimate of the ultimate amounts that will be paid.

As noted above, the highest degree of uncertainty is associated with reserves in the first twelve to eighteen months. The following table displays the accident year combined ratios as developed through December 31, 2014, for the four most recent accident years along with the potential combined ratios based on the low and high outcomes of the loss and LAE tests utilized:

Combined Ratios Developed Through | |||||||||

December 31, 2014 | |||||||||

Accident year | Low | As Reported | High | ||||||

2011 | 99.6 | % | 100.1 | % | 100.4 | % | |||

2012 | 99.3 | % | 100.1 | % | 100.6 | % | |||

2013 | 95.7 | % | 96.8 | % | 97.7 | % | |||

2014 | 94.8 | % | 96.4 | % | 98.1 | % | |||

ECO losses represent estimates of losses incurred from actual or threatened litigation by claimants alleging improper handling of claims by us, which are commonly known as “bad faith” claims. Oftentimes, the onset of such litigation, subsequent discovery, settlement discussions, trial and appeal may occur several years after the date of the original claim. Because of the infrequent nature of such claims, we accrue a liability for each case based on the facts and circumstances in accordance with the Loss Contingency topic of the FASB Accounting Standards Codification, which requires that such loss be probable and estimable. As such, no reserve is permissible for IBNR for threatened litigation yet to occur on accidents with dates prior to the balance sheet date. Consequently, the effect of setting accruals for such items likely will result in unfavorable reserve development in the following reserve tables.

Calendar year losses incurred for ECO losses, gross and net of reinsurance, over the past five calendar years have ranged from $0.3 million to $4.2 million, averaging $1.7 million per year. Losses for 2014, 2013 and 2012 have been $4.2 million, $1.3 million and $1.7 million, respectively.

The following tables present the development of our loss reserves, net of reinsurance, on a GAAP basis for the calendar years 2004 through 2014. The top line of each table shows the estimated liability for unpaid losses and LAE recorded at the balance sheet date for the indicated years. The next line shows the re-estimated liability as of December 31, 2014. The remainder of the table presents intervening development as percentages of the initially estimated liability. Additional information and experience in subsequent years results in development. The middle line shows a cumulative deficiency (redundancy) which represents the aggregate percentage increase (decrease) in the liability initially estimated. The lower portion of the table indicates the cumulative amounts paid as of successive periods as a percentage of the original loss reserve liability.

These tables do not present accident or policy year development data. Furthermore, in evaluating the re-estimated liability and cumulative deficiency (redundancy), note that each percentage includes the effects of changes in amounts for prior periods. Conditions and trends that have affected development of the liability in the past may not necessarily exist in the future. Accordingly, it is not appropriate to extrapolate future redundancies or deficiencies based on these tables.

12

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

($ in millions) | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||||||||||||||||||

Liability for unpaid losses & LAE: | |||||||||||||||||||||||||||||||||||||||||||

As originally estimated | $ | 669 | $ | 610 | $ | 568 | $ | 590 | $ | 524 | $ | 491 | $ | 461 | $ | 481 | $ | 559 | $ | 632 | $ | 654 | |||||||||||||||||||||

As re-estimated at December 31, 2014 | 610 | 510 | 461 | 466 | 388 | 389 | 445 | 486 | 557 | 615 | N/A | ||||||||||||||||||||||||||||||||

Liability re-estimated: | |||||||||||||||||||||||||||||||||||||||||||

One year later | 97.5 | % | 94.9 | % | 97.6 | % | 95.0 | % | 87.5 | % | 85.0 | % | 101.0 | % | 103.4 | % | 100.5 | % | 97.3 | % | |||||||||||||||||||||||

Two years later | 94.2 | % | 91.6 | % | 91.3 | % | 86.5 | % | 78.7 | % | 83.0 | % | 99.2 | % | 102.7 | % | 99.6 | % | |||||||||||||||||||||||||

Three years later | 93.7 | % | 89.1 | % | 85.2 | % | 81.7 | % | 76.8 | % | 81.0 | % | 97.8 | % | 101.0 | % | |||||||||||||||||||||||||||

Four years later | 93.7 | % | 85.6 | % | 82.4 | % | 80.5 | % | 75.5 | % | 79.7 | % | 96.5 | % | |||||||||||||||||||||||||||||

Five years later | 91.9 | % | 84.0 | % | 81.7 | % | 79.6 | % | 74.7 | % | 79.1 | % | |||||||||||||||||||||||||||||||

Six years later | 91.2 | % | 83.8 | % | 81.5 | % | 79.3 | % | 74.1 | % | |||||||||||||||||||||||||||||||||

Seven years later | 91.2 | % | 83.7 | % | 81.4 | % | 79.0 | % | |||||||||||||||||||||||||||||||||||

Eight years later | 91.1 | % | 83.7 | % | 81.2 | % | |||||||||||||||||||||||||||||||||||||

Nine years later | 91.3 | % | 83.7 | % | |||||||||||||||||||||||||||||||||||||||

Ten years later | 91.2 | % | |||||||||||||||||||||||||||||||||||||||||

Cumulative deficiency (redundancy) | (8.8 | )% | (16.4 | )% | (18.8 | )% | (21.0 | )% | (25.9 | )% | (20.9 | )% | (3.5 | )% | 1.0 | % | (0.5 | )% | (2.8 | )% | N/A | ||||||||||||||||||||||

Cumulative deficiency (redundancy) excluding ECO losses | (17.0 | )% | (23.0 | )% | (24.7 | )% | (24.8 | )% | (26.2 | )% | (22.0 | )% | (4.7 | )% | (0.4 | )% | (1.4 | )% | (3.4 | )% | N/A | ||||||||||||||||||||||

Cumulative paid as of: | |||||||||||||||||||||||||||||||||||||||||||

One year later | 52.6 | % | 50.3 | % | 48.4 | % | 54.6 | % | 46.8 | % | 48.2 | % | 62.5 | % | 64.5 | % | 62.7 | % | 59.7 | % | |||||||||||||||||||||||

Two years later | 72.6 | % | 66.5 | % | 69.1 | % | 67.4 | % | 61.0 | % | 65.9 | % | 81.1 | % | 84.2 | % | 82.4 | % | |||||||||||||||||||||||||

Three years later | 80.1 | % | 77.4 | % | 74.8 | % | 72.9 | % | 67.9 | % | 72.7 | % | 88.8 | % | 92.3 | % | |||||||||||||||||||||||||||

Four years later | 87.3 | % | 79.9 | % | 77.4 | % | 75.8 | % | 70.9 | % | 75.5 | % | 92.0 | % | |||||||||||||||||||||||||||||

Five years later | 88.5 | % | 81.1 | % | 78.8 | % | 77.1 | % | 72.3 | % | 76.9 | % | |||||||||||||||||||||||||||||||

Six years later | 89.3 | % | 81.7 | % | 79.5 | % | 77.8 | % | 72.6 | % | |||||||||||||||||||||||||||||||||

Seven years later | 89.7 | % | 82.3 | % | 80.1 | % | 77.9 | % | |||||||||||||||||||||||||||||||||||

Eight years later | 90.1 | % | 82.7 | % | 80.1 | % | |||||||||||||||||||||||||||||||||||||

Nine years later | 90.4 | % | 82.6 | % | |||||||||||||||||||||||||||||||||||||||

Ten years later | 88.2 | % | |||||||||||||||||||||||||||||||||||||||||

13

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following table presents a reconciliation of our net liability to the gross liability for unpaid losses and LAE ($ in millions):

2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |||||||||||||||||||||||||||||||||

As originally estimated | |||||||||||||||||||||||||||||||||||||||||||

Net liability shown above | $ | 669 | $ | 610 | $ | 568 | $ | 590 | $ | 524 | $ | 491 | $ | 461 | $ | 481 | $ | 559 | $ | 632 | $ | 654 | |||||||||||||||||||||

Add reinsurance recoverables | 27 | 15 | 28 | 28 | 21 | 18 | 17 | 15 | 14 | 14 | 14 | ||||||||||||||||||||||||||||||||

Gross liability | $ | 696 | $ | 625 | $ | 595 | $ | 618 | $ | 545 | $ | 509 | $ | 478 | $ | 495 | $ | 573 | $ | 647 | $ | 668 | |||||||||||||||||||||

As re-estimated at | |||||||||||||||||||||||||||||||||||||||||||

December 31, 2014 | |||||||||||||||||||||||||||||||||||||||||||

Net liability shown above | $ | 610 | $ | 510 | $ | 461 | $ | 466 | $ | 388 | $ | 389 | $ | 445 | $ | 486 | $ | 557 | $ | 615 | N/A | ||||||||||||||||||||||

Add reinsurance recoverables | 48 | 38 | 32 | 30 | 25 | 22 | 17 | 15 | 14 | 15 | N/A | ||||||||||||||||||||||||||||||||

Gross liability | $ | 658 | $ | 548 | $ | 493 | $ | 497 | $ | 414 | $ | 411 | $ | 462 | $ | 501 | $ | 570 | $ | 630 | N/A | ||||||||||||||||||||||

Gross cumulative deficiency (redundancy) | (5.5 | )% | (12.4 | )% | (17.2 | )% | (19.7 | )% | (24.1 | )% | (19.3 | )% | (3.3 | )% | 1.0 | % | (0.4 | )% | (2.6 | )% | N/A | ||||||||||||||||||||||

Gross cumulative deficiency (redundancy) excluding ECO losses | (15.7 | )% | (19.9 | )% | (23.5 | )% | (23.8 | )% | (24.4 | )% | (20.4 | )% | (4.4 | )% | (0.3 | )% | (1.4 | )% | (3.2 | )% | N/A | ||||||||||||||||||||||

We find it useful to evaluate accident year loss and LAE ratios by calendar year to monitor reserve development. The following table presents, by accident year, loss and LAE ratios (including IBNR):

Accident Year Loss and LAE Ratios Through Calendar Year End | |||||||||||||||||||||||||||||

2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||||||

Accident Year | |||||||||||||||||||||||||||||

2005 | 70.5 | % | 69.6 | % | 67.8 | % | 66.2 | % | 65.2 | % | 64.8 | % | 64.6 | % | 64.6 | % | 64.5 | % | 64.5 | % | |||||||||

2006 | 70.3 | % | 71.0 | % | 68.9 | % | 67.4 | % | 66.8 | % | 66.5 | % | 66.4 | % | 66.3 | % | 66.3 | % | |||||||||||

2007 | 71.9 | % | 72.5 | % | 71.0 | % | 69.8 | % | 69.5 | % | 69.1 | % | 69.0 | % | 68.9 | % | |||||||||||||

2008 | 73.5 | % | 71.9 | % | 69.9 | % | 69.6 | % | 69.4 | % | 69.2 | % | 69.0 | % | |||||||||||||||

2009 | 74.2 | % | 71.0 | % | 71.0 | % | 70.7 | % | 70.4 | % | 70.4 | % | |||||||||||||||||

2010 | 75.1 | % | 76.7 | % | 76.8 | % | 76.9 | % | 76.5 | % | |||||||||||||||||||

2011 | 74.9 | % | 77.3 | % | 77.6 | % | 77.4 | % | |||||||||||||||||||||

2012 | 78.2 | % | 78.7 | % | 79.0 | % | |||||||||||||||||||||||

2013 | 77.9 | % | 77.0 | % | |||||||||||||||||||||||||

2014 | 76.9 | % | |||||||||||||||||||||||||||

14

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following table summarizes the effect on each calendar year of reserve re-estimates, net of reinsurance, for each of the accident years presented. The total of each column details the amount of reserve re-estimates made in the indicated calendar year and shows the accident years to which the re-estimates are applicable.

Calendar Year Impact of Reserve Development by Accident Year (Favorable) Unfavorable Reserve Development | |||||||||||||||||||||||||||||||||||

($ in millions) | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||||||||||||

Accident year | |||||||||||||||||||||||||||||||||||

Prior | $ | (23 | ) | $ | (3 | ) | $ | (0 | ) | $ | (12 | ) | $ | (5 | ) | $ | 0 | $ | (1 | ) | $ | 1 | $ | (1 | ) | ||||||||||

2005 | (9 | ) | (17 | ) | (15 | ) | (10 | ) | (4 | ) | (2 | ) | (0 | ) | (1 | ) | 0 | ||||||||||||||||||

2006 | 7 | (21 | ) | (14 | ) | (6 | ) | (3 | ) | (1 | ) | (1 | ) | (1 | ) | ||||||||||||||||||||

2007 | 6 | (16 | ) | (12 | ) | (3 | ) | (4 | ) | (1 | ) | (1 | ) | ||||||||||||||||||||||

2008 | (15 | ) | (19 | ) | (3 | ) | (2 | ) | (2 | ) | (2 | ) | |||||||||||||||||||||||

2009 | (28 | ) | 0 | (3 | ) | (3 | ) | 1 | |||||||||||||||||||||||||||

2010 | 14 | 1 | 0 | (3 | ) | ||||||||||||||||||||||||||||||

2011 | 25 | 3 | (2 | ) | |||||||||||||||||||||||||||||||

2012 | 6 | 2 | |||||||||||||||||||||||||||||||||

2013 | (12 | ) | |||||||||||||||||||||||||||||||||

Total | $ | (31 | ) | $ | (13 | ) | $ | (29 | ) | $ | (65 | ) | $ | (74 | ) | $ | 5 | $ | 16 | $ | 3 | $ | (17 | ) | |||||||||||

Decreases in severity in property damage coverage in California and in both severity and frequency in Florida bodily injury coverage, related to accident year 2013, were the primary sources of the $17.4 million favorable reserve development during the twelve months ended December 31, 2014.

Increases in severities in both bodily injury coverage in California and personal injury protection coverage in Florida related to

accident year 2012 were the primary sources of the $2.9 million unfavorable reserve development during the twelve months ended December 31, 2013.

Increases in severities in both bodily injury coverage in California and personal injury protection coverage in Florida related to

accident year 2011 were the primary sources of the $16.2 million unfavorable reserve development during the twelve months ended December 31, 2012.

Other-than-Temporary Losses on Investments

The determination of whether unrealized losses on investments are “other-than-temporary” requires judgment based on subjective as well as objective factors. We consider the following factors and resources:

• | whether the unrealized loss is credit-driven or a result of changes in market interest rates; |

• | the length of time the security’s market value has been below its cost; |

• | the extent to which fair value is less than cost basis; |

• | the intent to sell the security; |

• | whether it is more likely than not that there will be a requirement to sell the security before its anticipated recovery; |

• | historical operating, balance sheet and cash flow data contained in issuer SEC filings; |

• | issuer news releases; |

• | near-term prospects for improvement in the issuer and/or its industry; |

• | industry research and communications with industry specialists; and |

• | third-party research and credit rating reports. |

15

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

We regularly evaluate our investment portfolio for potential impairment by evaluating each security position that has either of the following: a fair value of less than 95% of our book value or an unrealized loss that equals or exceeds $100,000. Since accurately predicting if or when a specific security will become other-than-temporarily impaired is not possible, total impairment charges could be material to the results of operations in a future period.

For fixed maturity securities that are other-than-temporarily impaired, we assess our intent to sell and the likelihood that we will be required to sell the security before recovery of our amortized cost. If a fixed maturity security is considered other-than-temporarily impaired but we do not intend to and will not more than likely be required to sell the security before our recovery to amortized cost, the amount of the impairment is separated into a credit loss component and the amount due to all other factors. The excess of the amortized cost over the present value of the expected cash flows determines the credit loss component of an impairment charge on a fixed maturity security. The present value is determined using the best estimate of cash flows discounted at (1) the effective interest rate implicit at the date of acquisition for non-structured securities or (2) the book yield for structured securities. The techniques and assumptions for determining the best estimate of cash flows vary depending on the type of security. We recognize the credit loss component of an impairment charge in net earnings and the non-credit component in accumulated other comprehensive income. If we intend to sell or will, more likely than not, be required to sell a security, the entire amount of the impairment is treated as a credit loss.

Accruals for Litigation

We continually evaluate potential liabilities and reserves for litigation using the criteria established by the Loss Contingency topic of the FASB Accounting Standards Codification. Under this guidance, we may only record reserves for loss if the likelihood of occurrence is probable and the amount is reasonably estimable. We consider each legal action and record reserves for losses in accordance with this guidance. We believe the current assumptions and other considerations used to estimate potential liability for litigation are appropriate. Certain claims and legal actions have been brought against us for which, under the rules described above, no loss has been accrued. While it is not possible to know with certainty the ultimate outcome of these claims or lawsuits, we do not expect them to have a material effect on our financial condition or liquidity. See Note 13 - Legal and Regulatory Proceedings of the Notes to Consolidated Financial Statements for a discussion of our material Legal Proceedings.

Goodwill

In accordance with the Goodwill topic of the FASB Accounting Standards Codification, we perform impairment test procedures for goodwill on an annual basis. These procedures require us to calculate the fair value of goodwill, compare the result to our carrying value and record the amount of any shortfall as an impairment charge.

We performed this test as of October 1, 2014, using a variety of methods, including estimates of future discounted cash flows and comparisons of our market value to that of our major competitors. Our cash flow projections rely on assumptions that are subject to uncertainty, including premium growth, loss and LAE ratios, interest rates and capital requirements.

The October 1, 2014, test results indicated that the fair value of our goodwill exceeded our carrying value and therefore no impairment charge was required at that date. Additionally, there was no indication of impairment at December 31, 2014.

16

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Liquidity and Capital Resources

Ratios

The National Association of Insurance Commissioners’ (“NAIC”) model law for risk-based capital (“RBC”) provides formulas to determine the amount of capital that an insurance company needs to ensure that it has an acceptable expectation of not becoming financially impaired. At December 31, 2014, the capital ratios of all our insurance subsidiaries exceeded the RBC requirements.

Sources of Funds

We are a holding company and our insurance subsidiaries conduct our operations. Accordingly, we will have continuing cash needs for administrative expenses, the payment of interest on borrowings, shareholder dividends, share repurchases and taxes.

Funds to meet expenditures at the holding company come primarily from dividends from the insurance subsidiaries as well as cash and investments held by the holding company. The ordinary dividend capacity and payment activity of our insurance companies for the two most recent years as well as the dividend capacity for the upcoming year are shown in the following table ($ in thousands):

2015 | 2014 | 2013 | |||||||||

Maximum ordinary dividends available to Infinity | $ | 68,143 | $ | 66,770 | $ | 60,770 | |||||

Dividends paid from subsidiaries to parent | N/A | 60,100 | 125 | ||||||||

As of December 31, 2014, the holding company had $136.6 million of cash and investments. In 2015, our insurance subsidiaries may pay us up to $68.1 million in ordinary dividends without prior regulatory approval. Rating agency capital requirements, among other factors, will be considered when determining the actual amount of dividends paid in 2015.

Our insurance subsidiaries generate liquidity to satisfy their obligations, primarily by collecting and investing premium in advance of paying claims. Our insurance subsidiaries had positive cash flow from operations of approximately $117.9 million in 2014, $145.6 million in 2013 and $175.3 million in 2012. In addition, to satisfy their obligations, our insurance subsidiaries generate cash from maturing securities from their combined $1.4 billion portfolio.

In September 2012 we issued $275 million principal of senior notes due September 2022 (the “5.0% Senior Notes”). The 5.0%

Senior Notes accrue interest at 5.0%, payable semiannually each March and September. The majority of the proceeds from this

issuance were used to redeem the 5.5% senior notes due 2014 (the "5.5% Senior Notes"). On October 17, 2012, we fully redeemed the $195.0 million outstanding principal of 5.5% Senior Notes at a price of 106.729%, or $208.1 million plus accrued interest of $1.8 million. Refer to Note 4 - Long Term Debt of the Notes to Consolidated Financial Statements for more information on our long-term debt.

In August 2014 we renewed our agreement for a $50 million three-year revolving credit facility (the “Credit Agreement”) that

requires us to meet certain financial and other covenants. We are currently in compliance with all covenants under the Credit

Agreement. At December 31, 2014, there were no borrowings outstanding under the Credit Agreement.

In June 2013 we filed a "shelf" registration statement with the Securities and Exchange Commission registering $300.0 million of our securities, which will allow us to sell any combination of senior or subordinated debt securities, common stock, preferred stock, warrants, depositary shares and units in one or more offerings should we choose to do so in the future.

Uses of Funds

In February 2015 we increased our quarterly dividend to $0.43 per share from $0.36 per share. At this current amount, our 2015 annualized dividend payments will be approximately $19.8 million.