Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K RE BUSINESS UPDATE FEBRUARY 2015 - EDISON INTERNATIONAL | eix-sceform8xkrebusinessup.htm |

February 25, 2015 Business Update February 2015

February 25, 2015 1 Forward-Looking Statements Statements contained in this presentation about future performance, including, without limitation, operating results, asset and rate base growth, capital expenditures, financial outlook, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10- K, most recent form 10-Q, and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation.

February 25, 2015 2 Table of Contents Page New (N) or Updated (U) EIX Shareholder Value 3 U SCE Highlights, Regulatory Model 4‐5 Capital Expenditures and Rate Base 6‐9 U General Rate Case, Cost of Capital 10‐11 U System Investment, Growth Drivers Beyond 2017, Grid of the Future 12‐15 U California Energy Policy 16‐21 N, U Key Regulatory Proceedings 22 U EIX Responding to Industry Change 23 U 2015 Financial Assumptions, Annual Dividends Per Share 24‐25 N, U Appendix SCE Customer Rates and Demand 27‐32 U Operational Excellence 33 N 2014 Earnings Summary, Guidance Reconciliation 34‐36 U, N Non‐GAAP Reconciliations, Results of Operations 37‐40 U

February 25, 2015 3 EIX Shareholder Value Sustainable Earnings Growth Positioning for Transformative Sector Change Financial Discipline Rate Base and Core Earnings Growth: • 9% 5-year SCE rate base CAGR (2009 – 2014) • 12% Core SCE EPS growth (2009 – 2014) • Consistent 7 – 9% rate base growth through 2017 Constructive Regulatory Structure: • Decoupling • Balancing accounts • Forward-looking ratemaking • Rate reform Dividend and CapEx Balancing: • 11 consecutive years of EIX dividend increases • 17.6% dividend increase for 2015 Sustainable Dividend Growth: • Target payout ratio: 45-55% of SCE core earnings • Return to target payout ratio in steps, over time Stable Share Count: • 325.8 million common shares outstanding since 2000 Note: See use of Non-GAAP Financial Measures in Appendix SCE Growth Drivers Beyond 2017: • Reliability • Grid readiness • EV charging • Transmission • Storage • State environmental policy SCE Productivity Improvements: • Help mitigate rate pressure from capital program • Build high-performing organization Edison Energy Competitive Strategy: • Small, targeted investments in emerging technologies

February 25, 2015 4 • One of the nation’s largest electric utilities: ‒ Nearly 14 million residents in service territory ‒ Approximately 5 million customer accounts ‒ 50,000 square-mile service area • Significant infrastructure investments: ‒ 1.4 million power poles ‒ 700,000 transformers ‒ 103,000 miles of distribution and transmission lines ‒ 3,100 MW owned generation • Above average annual rate base growth driven by: ‒ Infrastructure reliability investment ‒ California public policy ‒ Grid technology improvements SCE Highlights

February 25, 2015 5 SCE Decoupled Regulatory Model Decoupling of Regulated Revenues from Sales Major Balancing Accounts • Fuel • Purchased power • Energy efficiency • Pension-related contributions Advanced Long-Term Procurement Planning Forward-looking Ratemaking • SCE earnings are not affected by changes in retail electricity sales • Differences between amounts collected and authorized levels are either billed or refunded to customers • Promotes energy conservation • Stabilizes revenues during economic cycles • Trigger mechanism for fuel and purchased power adjustments at 5% variance level • Utility cost-recovery via balancing accounts represented more than 55% of 2014 costs • Sets prudent upfront standards allowing greater certainty of cost recovery (subject to reasonableness review) • Three-year rate case and cost of capital cycles Regulatory Model Key Benefits

February 25, 2015 6 SCE Historical Capital Expenditures $2.9 $3.8 $3.9 $3.9 $3.5 $4.0 2009 2010 2011 2012 2013 2014 ($ billions)

February 25, 2015 7 $15.0 $16.8 $18.8 $21.0 $21.1 $23.3 2009 2010 2011 2012 2013 2014 SCE Historical Rate Base and Core Earnings Rate Base Core Earnings 9% 12% 2009 – 2014 CAGR Core EPS $4.68$2.68 $3.01 $3.33 $4.10 ($ billions) $3.88 Note: Recorded rate base, year-end basis. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix. 2013 and 2014 rate base excludes SONGS

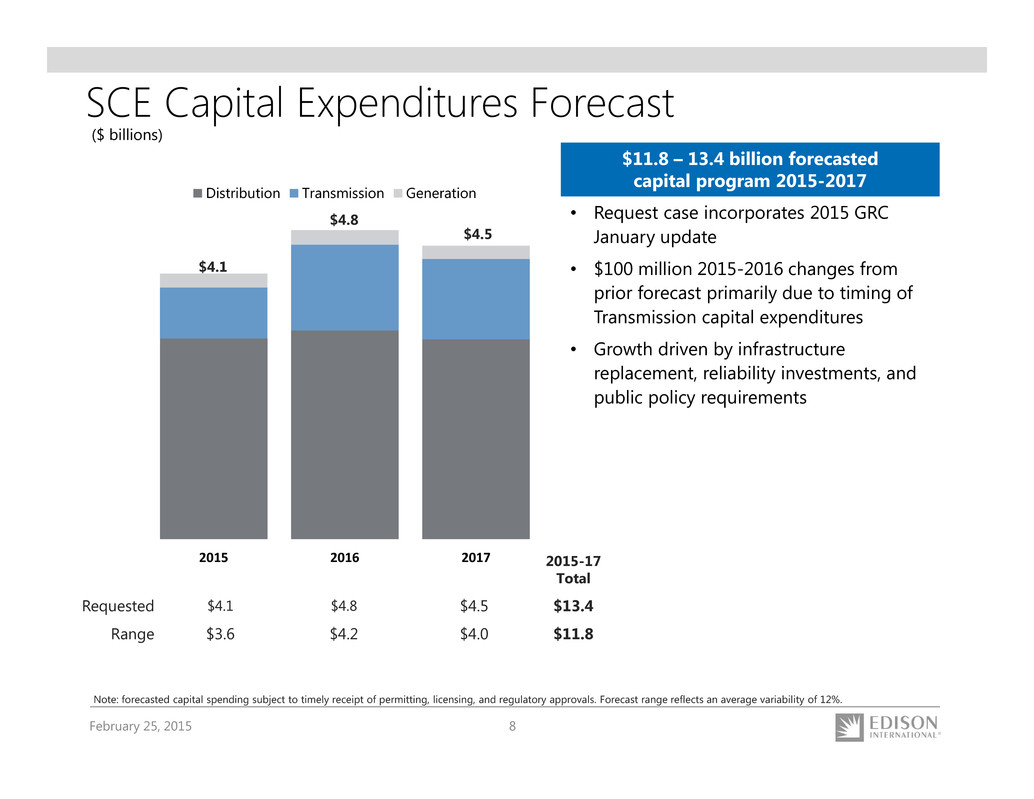

February 25, 2015 8 SCE Capital Expenditures Forecast • Request case incorporates 2015 GRC January update • $100 million 2015-2016 changes from prior forecast primarily due to timing of Transmission capital expenditures • Growth driven by infrastructure replacement, reliability investments, and public policy requirements Note: forecasted capital spending subject to timely receipt of permitting, licensing, and regulatory approvals. Forecast range reflects an average variability of 12%. ($ billions) 2015-17 Total Requested $4.1 $4.8 $4.5 $13.4 Range $3.6 $4.2 $4.0 $11.8 $4.1 $4.8 $4.5 2015 2016 2017 Distribution Transmission Generation $11.8 – 13.4 billion forecasted capital program 2015-2017

February 25, 2015 9 SCE Rate Base Forecast • Incorporates 2015 GRC January update • Net $300 million reduction by 2017 from prior forecast due to: – Extension of bonus depreciation ($400 million reduction) – Timing of transmission spend ($100 million reduction) – SmartConnect deferred tax adjustment ($200 million increase) • FERC rate base includes Construction Work in Progress (CWIP) and is approximately 25% of SCE’s rate base forecast by 2017 • Excludes SONGS regulatory asset ($ billions) Request Range 23.3 25.2 27.4 $23.8 $26.2 $29.0 2015 2016 2017 Note: Weighted-average year basis, 2015-2017 CPUC rate base requests and consolidation of CWIP projects. Rate base forecast range reflects capital expenditure forecast range. 2014 weighted-average rate base was $22.1 billion. Q3 2014 Forecast $23.0 ‐ $24.0 $25.1 ‐ $26.7 $27.2 ‐ $29.3 2015 – 2017 rate base growth consistent with prior 7-9% forecast

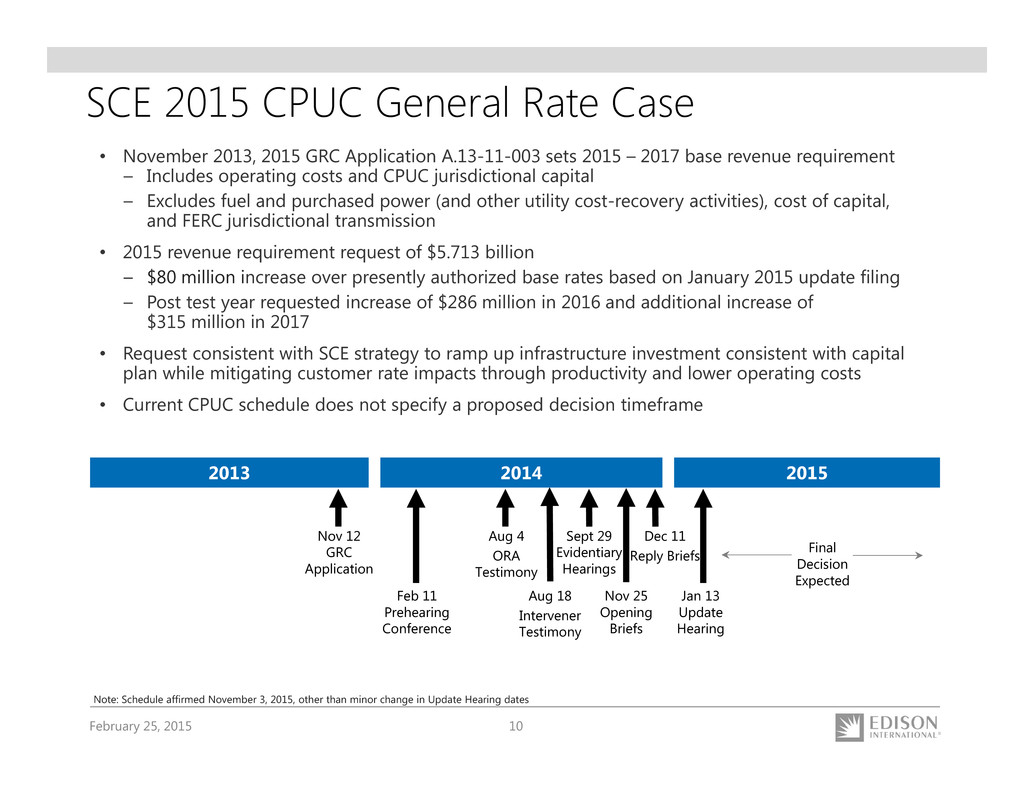

February 25, 2015 10 SCE 2015 CPUC General Rate Case • November 2013, 2015 GRC Application A.13-11-003 sets 2015 – 2017 base revenue requirement – Includes operating costs and CPUC jurisdictional capital – Excludes fuel and purchased power (and other utility cost-recovery activities), cost of capital, and FERC jurisdictional transmission • 2015 revenue requirement request of $5.713 billion – $80 million increase over presently authorized base rates based on January 2015 update filing – Post test year requested increase of $286 million in 2016 and additional increase of $315 million in 2017 • Request consistent with SCE strategy to ramp up infrastructure investment consistent with capital plan while mitigating customer rate impacts through productivity and lower operating costs • Current CPUC schedule does not specify a proposed decision timeframe Nov 12 GRC Application Aug 18 Intervener Testimony Sept 29 Evidentiary Hearings 2013 2014 Feb 11 Prehearing Conference Jan 13 Update Hearing 2015 Aug 4 ORA Testimony Nov 25 Opening Briefs Dec 11 Reply Briefs Note: Schedule affirmed November 3, 2015, other than minor change in Update Hearing dates Final Decision Expected

February 25, 2015 11 CPUC and FERC Cost of Capital • CPUC – 48% common equity and Return on Equity (ROE) adjustment mechanism has been extended through 2016 – Weighted average authorized cost of capital – 7.90% – ROE adjustment based on 12-month average of Moody’s Baa utility bond rates, measured from Oct. 1 to Sept. 30 – If index exceeds 100 bps deadband from starting index value, authorized ROE changes by half the difference – Starting index value based on trailing 12 months of Moody’s Baa index as of September 30, 2012 – 5.00% – Application extended to April 2016 for 2017 Cost of Capital – adjustment mechanism continues • FERC – November 2013 settlement 10.45% ROE comprised of: 9.30% base + 50 bps CAISO participation + 65 bps weighted average for project incentives – Moratorium on filing ROE changes through June 30, 2015 – FERC Formula recovery mechanism in effect through December 31, 2017 3 4 5 6 7 10/1/12 10/1/13 10/1/14 10/1/15 R a t e ( % ) CPUC Adjustment Mechanism Moody’s Baa Utility Index Spot Rate Moving Average (10/1/14 – 10/10/14) = 4.69% 100 basis point +/- Deadband Starting Value – 5.00%

February 25, 2015 12 SCE System Investments Distribution Transmission • Large transmission projects: – Tehachapi 4-11 – $2.4 billion total project cost; 2016-17 in service date – Coolwater-Lugo – $0.7 billion total project cost; 2018 in service date pending CPUC review – West of Devers – $1.0 billion total project cost; 2019-20 in service date • Aging system reaching equilibrium replacement rate • 2015 GRC request includes ~120% increase in infrastructure replacement 2015 – 2017 Requested GRC Expenditures for Distribution Assets $9.4 Billion Load Growth New Service Connections Infrastructure Replacement General Plant1 Other Coolwater-Lugo Project need based on current operator’s decision to continue Coolwater Generating Station operations Note: Total Project Costs are nominal direct expenditures, subject to CPUC and FERC cost recovery approval

February 25, 2015 13 SCE Growth Drivers Beyond 2017 Infrastructure Reliability Investment • Sustained level of infrastructure investment required until equilibrium replacement rates are achieved - includes underground cable, poles, switches, and transformers1 Grid Readiness • Accelerate automation and control technology at optimal locations to manage two-way power flows with more dynamic voltage control • Distribution Resources Plan required under AB 327 to identify optimal locations, additional spending, and barriers to deploying distributed energy resources – due to CPUC Q3 2015 Transmission • California ISO 2013-2014 Transmission Plan2 - approved Mesa Loop-in Project (system reliability post-SONGS and renewables integration) with target in-service date of December 31, 2020 • Two existing projects incorporated from prior Transmission Plans in service beyond 2017 include Coolwater-Lugo (2018 – pending CPUC review) and West of Devers (2019-2020) Energy Storage • 290 MW utility owned investment opportunity 2015-2024 Other California Public Policy Requirements and Enabling Projects • Electric vehicle charging infrastructure • Transportation electrification • Renewables mandates beyond 33% 1. Source: A.13-11-0032015 GRC – SCE-01 Policy testimony; equilibrium replacement rate defined as equipment population divided by mean time to failure for type of equipment 2. Approved by the California ISO Board of Governors March 20, 2014

February 25, 2015 14 Distribution Grid of the Future One-Way Electricity Flow • System planned and designed to serve customer demand • Very few distributed energy resources • Voltage simple to maintain • Limited situational awareness and visualization tools for grid operators Subsidized Residential Solar and Lack of Electric Vehicle Charging Infrastructure • Barriers to seamless integration of distributed energy resources • Limited electric vehicle charging infrastructure Current State Future State Variable and Two-Way Electricity Flow • System planned and designed to serve variable customer demand • High penetration of distributed energy resources • Advanced grid equipment (dynamic protection, smart inverters, voltage support, remote fault indicators) • Advanced automation monitoring, control, communications systems monitor and manage two-way flows • Improved data management and grid operations with cyber mitigation Maximize Distributed Generation and Electric Vehicle Adoption • Increased interoperability with distributed energy resources • Distribution grid infrastructure design and siting supports electric vehicle adoption while optimizing grid reliability • Effective rate design

February 25, 2015 15 New Technology Grid Impacts 2 1 3 1 1 1 2 2 Future state based on evolving energy landscape More automated and digital, with more sophisticated voltage control and protection schemes Facilitates increasing renewables & two- way power flow Cyber mitigation must be included 1 2 3 1

February 25, 2015 16 The Future of California Energy Policy • January 2015, Governor Brown’s inauguration speech outlined environmental objectives for 2030: – Increase renewables (RPS) to 50% – Reduce petroleum use in cars by 50% – Double efficiency of existing buildings Renewables Electric Vehicles Energy Efficiency Legislative action, regulation, grid investment: • Renewable Portfolio Standard (RPS) – mandate, currently 33% by 2020 • Clean Energy Standard (CES) – emissions targets met through optimization of renewables, transportation, energy efficiency Utility participation through infrastructure investment: • $355 million SCE ChargeReady application • Distribution grid investments to meet EV impact Continuation of utility programs and earnings mechanism: • SCE 2015 program budget: $333 million • $0.05 per share 2015 earnings potential Utility Role

February 25, 2015 17 • Assembly Bill 32 (2006) – reduces State greenhouse gas (GHG) emissions to 1990 levels by 2020 (~16% reduction) • Cap and trade program basics: – State-wide cap in 2013 – decreases over time – Compliance met through allowances, offsets, or emissions reductions – Excess allowances sold, or “banked” for future use – January 2014 – merger with Quebec cap and trade program • SCE received 32.3 million 2013 allowances vs. 10.4 million metric tons 2012 GHG emissions • Allowances sold into quarterly auction and bought back for compliance – SB 1018 (2012) – auction revenues used for rate relief for residential (~93%), small business, and large industrial customers AB32 Emissions Reduction Programs Cap & Trade 22% Other 23% Low Carbon Fuel Standard 19% RPS 14% Energy Efficiency 15% High GWP Gases 7% California Climate Change Policy

February 25, 2015 18 California Renewables Policy • On April 12, 2011, Governor Brown signed SB X 1 2, which codifies a 33% Renewables Portfolio Standard (RPS) for California by 2020 – Allows use of Renewable Energy Credits (RECs) for up to 25% of target with decreasing percentages over time – Applies similar RPS rules to all electricity providers (investor- and publicly-owned utilities, as well as Electric Service Providers) • In order to meet the 33% RPS requirement by 2020, SCE will increase its renewable purchases by 10 billion kWh, or 60% While SCE is on track to meet the 33% renewables target by 2020, the requirement will put upward pressure on customer rates Solar 7% Small Hydro 2% Geothermal 41% Biomass 3% Wind 47% Actual 2013 Renewable Resources: 21.6% of SCE’s portfolio

February 25, 2015 19 Energy Storage • AB2514 directed CPUC to establish procurement targets and policies for storage • CPUC final decision in Energy Storage OIR (R.10-12-007) – 1,325 MW target for IOUs by 2024 (580 MW SCE share) – Three types: transmission (53%), distribution (32%), customer-sited (15%) – Utility ownership limited to 50% of total target (290 MW SCE share) – First standalone procurement cycle began December 2014 – existing storage and prior RFO storage expected to count for ~74MW of SCE’s 90 MW target – Broad range of technologies as defined in AB2514, excluding large hydro (>50 MW) SCE 2014 Existing Storage SCE’s energy storage investment opportunities will focus on distribution grid projects and will be integrated into future capital expenditure requests • Tehachapi Storage Project • Irvine Smart Grid Demonstration Projects • Large Energy Storage Test Apparatus • Discovery Science Center • Catalina Island Battery System • Vehicle-to-Grid Program – LA Air Force Base • Self-Generation Incentive Program • Permanent Load Shifting Program 13.68 16.40 50 30 10 Transmission Distribution Customer M W 2014 Existing Eligible Storage 2014 Storage Target

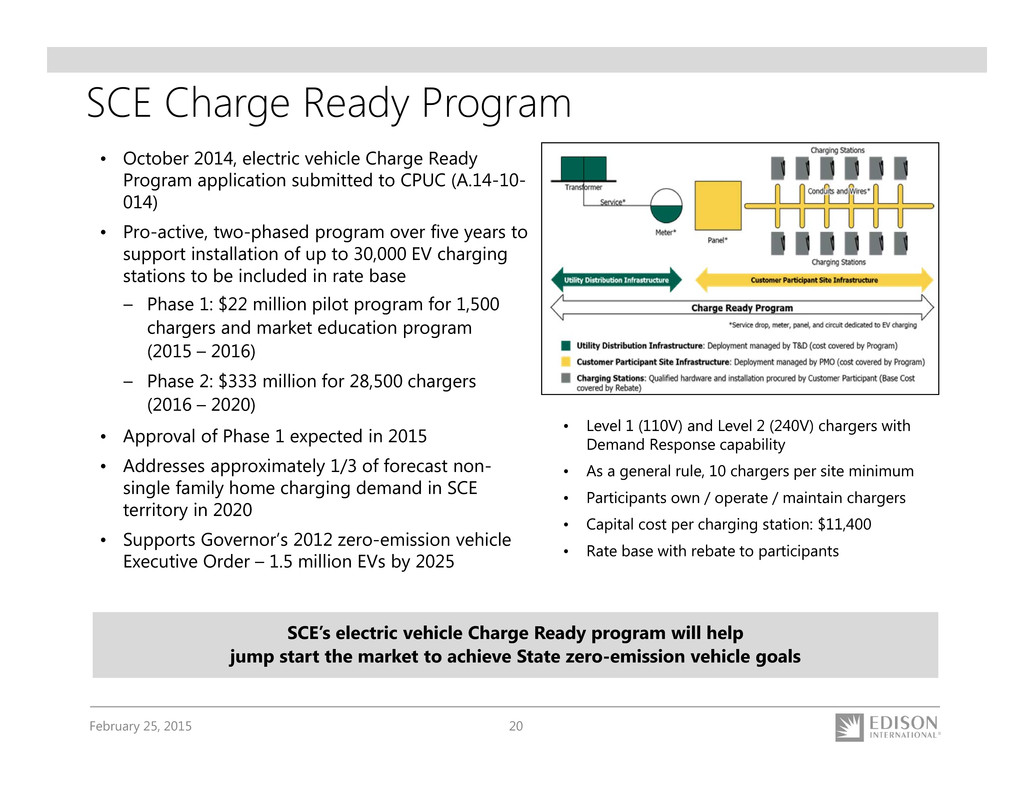

February 25, 2015 20 SCE Charge Ready Program • October 2014, electric vehicle Charge Ready Program application submitted to CPUC (A.14-10- 014) • Pro-active, two-phased program over five years to support installation of up to 30,000 EV charging stations to be included in rate base – Phase 1: $22 million pilot program for 1,500 chargers and market education program (2015 – 2016) – Phase 2: $333 million for 28,500 chargers (2016 – 2020) • Approval of Phase 1 expected in 2015 • Addresses approximately 1/3 of forecast non- single family home charging demand in SCE territory in 2020 • Supports Governor’s 2012 zero-emission vehicle Executive Order – 1.5 million EVs by 2025 SCE’s electric vehicle Charge Ready program will help jump start the market to achieve State zero-emission vehicle goals • Level 1 (110V) and Level 2 (240V) chargers with Demand Response capability • As a general rule, 10 chargers per site minimum • Participants own / operate / maintain chargers • Capital cost per charging station: $11,400 • Rate base with rebate to participants

February 25, 2015 21 SCE Energy Efficiency Programs Energy efficiency programs updated for 2013 – 2015 • 2015 budget of $333 million • Savings targets of 983 GWh and 160.1 MW for 2015 – Reduced goals reflect CPUC-identified potential for energy efficiency Energy efficiency earnings incentive mechanism modified • CPUC approved new incentive mechanism for 2013 – 2015 activities comprised of performance rewards and management fees Note: Additional program year 2013 award request, and request for $5.0 million and $1.2 million currently pending, expected to be submitted in 2015 SCE Energy Efficiency Earnings Summary Program Year Total Requested Received Pending CPUC Approval 2010 $15.1 million $0.03/share $15.1 million $0.03/share (2012) 2011 $18.6 million $0.04/share $13.6 million $0.03/share (2013) $5.0 million $0.01/share 2012 $16.2 million $0.03/share $10.8 million $0.02/share $1.2 million $0.00/share 2013 $14.2 million $0.03/share $10.8 million $0.02/share

February 25, 2015 22 SCE Key Regulatory Proceedings Proceeding Description Next Steps Capital 2015 GRC Application (A.13‐11‐003) Rate setting for CPUC 3‐year cycle 2015 – 17 Proposed and final decision in 2015 Cost of Capital Application Capital structure and return on equity Extension to file in April 2016 approved Distribution Resources Plan OIR (R.14‐08‐013) Grid investments to integrate distributed energy resources SCE plan due to CPUC Q3 2015 FERC Formula Rates Transmission rate setting with annual updates ROE moratorium expires June 2015; annual update due December 2015 Rate Design Rate Design OIR (R.12‐06‐013) Tiers, fixed charges, time of use (Phase 1); Net metering tariff (Phase 3) Phase 1 proposed decision Q1 2015; Phase 3 testimony due Q3 2015 Cost Recovery 2012 LTPP Tracks 1 & 4 RFO (D.13‐02‐015) Local capacity/preferred resources to replace SONGS and once through cooling plants 2,221 MW, including 262 MW storage, submitted for PUC approval November 2014 Energy Storage RFO Solicitation for 16.3 MW launched December 2014 Short list notification May 15; final selection September 14 Energy Resource Recovery Account (ERRA) Annual forecast and review of fuel and purchased power costs 2014 review due April 1; 2016 forecast due May 1

February 25, 2015 23 EIX is Responding to Industry Change • Public policy prioritizing environmental sustainability • Innovation facilitating conservation and self-generation • Regulation supporting new forms of competition • Flattening domestic demand for electricity • Grid of the future will be more complex and sophisticated to support increasing use of distributed resources and transportation electrification • SCE Strategy – Invest in, build, and operate the next generation electric grid – Operational and service excellence – Enable California public policies • EIX Competitive Strategy – small, targeted investments in emerging technologies and markets to follow changes in the industry and better exploit opportunities as they arise – Commercial and industrial distributed generation – Energy optimization – Energy efficiency and software – Residential solar industry financial services and software – Electric transportation Long-Term Industry Trends Strategy

February 25, 2015 24 2015 Financial Assumptions ($ billions) SCE Capital Expenditures SCE Authorized Cost of Capital Other SCE Items CPUC Return on Equity 10.45% CPUC Capital Structure 48% equity 43% debt 9% preferred FERC Return on Equity (Inc. FERC Incentives) 10.45% EIX will provide 2015 earnings guidance after a final decision on the SCE 2015 General Rate Case Distribution $16.0 Transmission 5.6 Generation 2.2 Request $23.8 Range $23.3 Distribution $3.1 Transmission 0.8 Generation 0.2 Request $4.1 Range $3.6 SCE Weighted Average Rate Base • SONGS regulatory asset financing completed January 2015 • Energy efficiency potential up to $0.05 per share • Revenues recorded at 2014 levels until 2015 GRC decision is received (retroactive to January 1, 2015)

February 25, 2015 25 EIX Annual Dividends Per Share $0.80 $1.00 $1.08 $1.16 $1.22 $1.24 $1.26 $1.28 $1.30 $1.35 $1.42 $1.67 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Note: See use of Non-GAAP Financial Measures in Appendix Eleven Years of Dividend Growth EIX targets a payout ratio of 45 – 55% of SCE core earnings and plans to return to target payout ratio in steps, over time

February 25, 2015 26 Appendix

February 25, 2015 27 SCE 2014 Bundled Revenue Requirement Note: Rates in effect as of July 7, 2014, based on forecast. Represents bundled service which excludes Direct Access customers that do not receive generation services. 60% utility earnings activities SCE Systemwide Average Rate History (¢/kWh) 2010 2011 2012 2013 2014 14.3 14.1 14.3 15.9 16.7 Fuel & Purchased Power (41%) Distribution (32%) Transmission (6%) Generation (17%) Other (4%) 2014 Bundled Revenue Requirement $millions ¢/kWh Fuel & Purchased Power – includes CDWR Bond Charge 5,071 6.9 Distribution – poles, wires, substations, service centers; Edison SmartConnect® 3,867 5.3 Generation – utility owned generation investment and O&M 2,048 2.8 Transmission – greater than 220kV 735 1.0 Other – CPUC and legislative public purpose programs, system reliability investments, nuclear decommissioning 539 0.7 Total Bundled Revenue Requirement ($millions) $12,260 Bundled kWh (millions) 73,249 = Bundled Systemwide Average Rate (¢/kWh) 16.7¢

February 25, 2015 28 SCE Customer Demand Trends Kilowatt-Hour Sales (millions of kWh) Residential Commercial Industrial Public authorities Agricultural and other Subtotal Resale Total Kilowatt-Hour Sales Customers Residential Commercial Industrial Public authorities Agricultural Railroads and railways Interdepartmental Total Number of Customers Number of New Connections Area Peak Demand (MW) 2012 30,563 40,541 8,504 5,196 1,676 86,480 1,735 88,215 4,321,171 549,855 10,922 46,493 21,917 83 24 4,950,465 22,866 21,981 2011 29,631 39,622 8,490 5,206 1,318 84,267 3,071 87,338 4,301,969 546,936 11,370 46,684 22,086 82 22 4,929,149 19,829 22,374 2010 29,034 39,318 8,507 5,336 1,353 83,548 4,103 87,651 4,285,803 543,016 11,708 46,718 22,321 73 23 4,909,662 25,566 22,771 2009 30,078 40,076 8,522 5,686 1,499 85,861 5,869 91,730 4,262,966 539,270 12,244 46,902 22,315 67 23 4,883,787 32,145 22,112 2013 29,889 40,649 8,472 5,012 1,885 85,907 1,490 87,397 4,344,429 554,592 10,584 46,323 21,679 99 23 4,977,729 27,370 22,534 Note: See Edison International Financial and Statistical Reports for further information

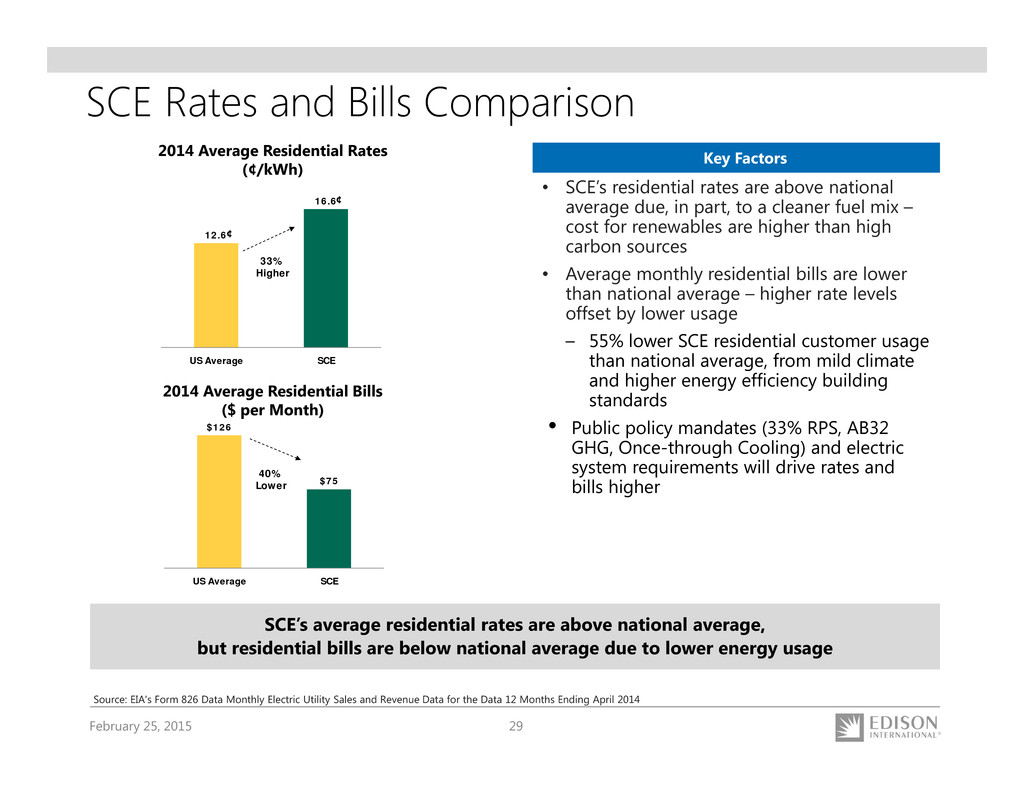

February 25, 2015 29 SCE Rates and Bills Comparison 12.6 16.6 US Average SCE 33% Higher • SCE’s residential rates are above national average due, in part, to a cleaner fuel mix – cost for renewables are higher than high carbon sources • Average monthly residential bills are lower than national average – higher rate levels offset by lower usage – 55% lower SCE residential customer usage than national average, from mild climate and higher energy efficiency building standards • Public policy mandates (33% RPS, AB32 GHG, Once-through Cooling) and electric system requirements will drive rates and bills higher 2014 Average Residential Rates (¢/kWh) 2014 Average Residential Bills ($ per Month) Key Factors ¢ ¢ SCE’s average residential rates are above national average, but residential bills are below national average due to lower energy usage $126 $75 US Average SCE 40% Lower Source: EIA's Form 826 Data Monthly Electric Utility Sales and Revenue Data for the Data 12 Months Ending April 2014

February 25, 2015 30 Residential Rate Design OIR 14.85 19.28 28.10 32.10 0 5 10 15 20 25 30 35 0 200 400 600 800 1,000 1,200 1,400 ¢ / k W h kWh/month SCE Proposed 2018 Tiers: • Two tiers: Tier 1 – 16.4¢/kWh Tier 2 – 19.7¢/kWh • June 2012, CPUC opened Order Instituting Ratemaking (OIR) R.12-06-013: – Comprehensive review of residential rate structure – Transition to Time of Use (TOU) rates – AB327 rate design • Phase 2 (Summer 2014): simple tiered rate adjustments – Settlement approved in June; rates implemented in July – 12% increase to Tier 1 rate, 17% increase to Tier 2 rate • Phase 1 (2015 – 2018): longer-term rates – 2 tiers (2017); TOU rates (2018) – Fixed charge or minimum bill (2015) – Proposed Decision expected March 2015 • Net Energy Metering: successor tariff proposed decision due Q4 2015 (statutory deadline) Tier 1 Tier 2 Tier 3 Tier 4 OIR Phase 2 Settlement Summary Fixed Monthly Charge Current: $0.94/month SCE Proposed: $10/month Note: Rates in effect as of July 7, 2014, based on forecast

February 25, 2015 31 SCE Residential Net Metering Rate Structure 8.7¢ 30.6¢21.9¢ 0 5 10 15 20 25 30 35 ¢ / k W h Solar Subsidies (Illustrative) Generation Rate Subsidy Paid by Other Ratepayers Equivalent Solar Rate Current rate design results in residential solar customers receiving a subsidy funded by all other non-solar customers in higher tiers • Residential solar customer generation offsets total retail rate • Average retail rate of 30.6¢/kWh vs. actual generation cost of 8.7¢/kWh – 21.9¢/kWh subsidy funded by non-solar customers in Tiers 3 and 4 • 20-year grandfathering at retail rate for existing customers and new installations up to 5% cap (2,240 MW for SCE) SCE 2014 Net Energy Metering Statistics: • 103,900 combined residential and non- residential projects – 880 MW installed – 99.5% solar – 100,300 residential – 500 MW – 3,600 non-residential – 380 MW • Approximately 1,270,000 kWh / year generated • Currently at 2% toward NEM cap Note: Based on average home usage of 1,150 kWh/month, a 4-tier rate structure, and a 4.8kW solar system with a 18% capacity factor that generates 631 kWh per month

February 25, 2015 32 Fixed Charge vs. Minimum Bill AB 327 permits the CPUC to authorize up to a $10/month fixed charge, and the Commission may consider whether minimum bills are appropriate as a substitute for any fixed charges • SCE has proposed a $10/month fixed charge while some parties have proposed a “minimum bill” of $10 instead of a fixed charge • Vast majority of SCE’s customers would avoid the minimum bill, given their usage, at the levels proposed by other parties SCE proposes a fixed charge because it begins to mitigate intra-class subsidies from high-usage to low-usage customers and would reduce bill volatility Fixed Charge Minimum Bill • Collected from all customers every month regardless of usage • Triggered only if the customer’s usage falls below a threshold number of kWh $10/month fixed charge recovers 8% of authorized revenue $10 minimum bill recovers 1% of authorized revenue

February 25, 2015 33 SCE Operational Excellence Top Quartile • Safety • Cost efficiency • Reliability • Customer service Optimize • Capital productivity • Purchased power cost High performing, continuous improvement culture Defining Excellence Measuring Excellence • Employee and public safety metrics • System reliability (SAIDI, SAIFI, MAIFI) • J.D. Power customer satisfaction • O&M cost per customer • Reduce system rate growth with O&M / purchased power cost reductions Ongoing Operational Excellence Efforts

February 25, 2015 34 Fourth Quarter Earnings Summary • SCE $0.08 – change in estimate of SONGS settlement • Discontinued Operations $0.12 – income tax benefits from resolution of 2003-2006 tax positions and other tax impacts related to EME Q4 2014 Q4 2013 Variance Core EPS1 SCE $1.09 $0.79 $0.30 EIX Parent & Other (0.01) 0.02 (0.03) Core EPS1 $1.08 $0.81 $0.27 Non-Core Items SCE $0.08 $– $0.08 EIX Parent & Other 0.01 – 0.01 Discontinued Operations 0.12 0.11 0.01 Total Non-Core $0.21 $0.11 $0.10 Basic EPS $1.29 $0.92 $0.37 Diluted EPS $1.27 $0.92 $0.35 SCE Key Core Earnings Drivers Higher revenue $0.28 SONGS impact 0.02 Lower O&M2 0.05 Higher depreciation (0.08) Higher net financing costs (0.01) Income taxes and other 0.04 - Higher income tax benefits 0.07 - Property and other taxes (0.01) - Other (0.02) Total $0.30 EIX Key Core Earnings Drivers Lower income tax benefits $(0.03) Higher corporate expenses (0.02) Higher income from Edison Capital 0.02 Total $(0.03) 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Includes non-San Onofre Nuclear Generating Station (SONGS) severance of $0.00 and $0.02 for the quarters ended December 31, 2014 and 2013, respectively Non-Core Earnings

February 25, 2015 35 Full-Year Earnings Summary 2014 2013 Variance Core EPS1 SCE $4.68 $3.88 $0.80 EIX Parent & Other (0.09) (0.08) (0.01) Core EPS1 $4.59 $3.80 $0.79 Non-Core Items SCE $(0.22) $(1.12) $0.90 EIX Parent & Other 0.01 0.02 (0.01) Discontinued Operations 0.57 0.11 0.46 Total Non-Core $0.36 $(0.99) $1.35 Basic EPS $4.95 $2.81 $2.14 Diluted EPS $4.89 $2.78 $2.11 EIX Key Core Earnings Drivers Higher corporate expenses and costs of new businesses $(0.06) Higher income from Edison Capital 0.05 Total $(0.01) SCE Key Core Earnings Drivers Higher revenue $0.95 SONGS impact 0.01 Lower O&M2 0.02 Higher depreciation (0.28) Higher net financing costs (0.06) Income taxes and other 0.16 - Higher income tax benefits 0.20 - Property taxes and other (0.03) - Other (0.01) Total $0.80 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Includes non-SONGS severance of $0.01 and $0.07 for the years ended December 31, 2014 and 2013, respectively

February 25, 2015 36 2014 Earnings Guidance Result Reconciliation $3.40 $1.03 $4.30 $0.25 $0.04 $4.59 ($0.13) SCE 2014 EPS from Rate Base Forecast SCE 2014 Variances EIX Parent & Other October 28, 2014 Guidance Midpoint Fourth Quarter SCE Variances Fourth Quarter EIX Parent & Other Variances 2014 Core EPS • Cost Savings / Other +$0.69 • Income Taxes +$0.41 • No Energy Efficiency Earnings • SONGS ($0.07) • Income Taxes +$0.10 • Rate base adjustment +$0.05 • Energy Efficiency +$0.04 • SONGS +$0.01 • Cost Savings / Other +$0.05 • Higher income from Edison Capital Note: See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix

February 25, 2015 37 Earnings Non-GAAP Reconciliations ($ millions) Reconciliation of EIX Core Earnings to EIX GAAP Earnings Earnings Attributable to Edison International Core Earnings SCE EIX Parent & Other Core Earnings Non-Core Items SCE EIX Parent & Other Discontinued operations Total Non-Core Basic Earnings Q4 2013 $258 6 $264 $– – 37 37 $301 Q4 2014 $356 (1) $355 $24 2 39 65 $420 2013 $1,265 (28) $1,237 $(365) 7 36 (322) $915 2014 $1,525 (28) $1,497 $(72) 2 185 115 $1,612 Note: See Use of Non-GAAP Financial Measures in Appendix

February 25, 2015 38 SCE Core EPS Non-GAAP Reconciliations Earnings Per Share Attributable to SCE Core EPS Non-Core Items Tax settlement Health care legislation Regulatory and tax items Impairment and other charges Total Non-Core Items Basic EPS Reconciliation of SCE Core Earnings Per Share to SCE Basic Earnings Per Share 2009 $2.68 0.94 — 0.14 — 1.08 $3.76 2010 $3.01 0.30 (0.12) — — 0.18 $3.19 CAGR 12% 4% 2011 $3.33 — — — — — $3.33 2012 $4.10 — — 0.71 — 0.71 $4.81 2013 $3.88 — — — (1.12) (1.12) $2.76 Note: See Use of Non-GAAP Financial Measures in Appendix 2014 $4.68 — — — (0.22) (0.22) $4.46

February 25, 2015 39 $1,590 — 608 398 79 — 1,085 505 (136) (3) 366 83 283 25 $258 $1,341 1,073 268 — — — 1,341 — — — — — — — $— $1,808 — 604 472 86 (68) 1,094 714 (130) (12) 572 164 408 28 $380 $1,296 1,029 266 — — — 1,295 1 (1) — — — — — $— $3,104 1,029 870 472 86 (68) 2,389 715 (131) (12) 572 164 408 28 $380 $356 24 $380 $2,931 1,073 876 398 79 — 2,426 505 (136) (3) 366 83 283 25 $258 $258 — $258 SCE Results of Operations – Fourth Quarter 2014 • Utility earning activities – revenue authorized by CPUC and FERC to provide reasonable cost recovery and return on investment • Utility cost-recovery activities – CPUC- and FERC-authorized balancing accounts to recover specific project or program costs, subject to reasonableness review or compliance with upfront standards ($ millions) Utility Earning Activities Utility Cost- Recovery Activities Total Consolidated Q4 2014 Utility Earning Activities Utility Cost- Recovery Activities Total Consolidated Q4 2013 Operating revenue Purchased power and fuel Operation and maintenance Depreciation, decommissioning and amortization Property and other taxes Impairment and other charges Total operating expenses Operating income Interest expense Other income and expenses Income before income taxes Income tax expense Net income Preferred and preference stock dividend requirements Net income available for common stock Core earnings Non-core earnings Total SCE GAAP earnings Note: See Use of Non-GAAP Financial Measures in Appendix

February 25, 2015 40 $6,602 — 2,348 1,622 307 575 4,852 1,750 (519) 48 1,279 279 1,000 100 $900 $5,960 4,891 1,068 — — — 5,959 1 (1) — — — — — $— $6,831 — 2,106 1,720 318 163 4,307 2,524 (528) 43 2,039 474 1,565 112 $1,453 $6,549 5,593 951 — — — 6,544 5 (5) — — — — — $— $13,380 5,593 3,057 1,720 318 163 10,851 2,529 (533) 43 2,039 474 1,565 112 $1,453 $1,525 (72) $1,453 $12,562 4,891 3,416 1,622 307 575 10,811 1,751 (520) 48 1,279 279 1,000 100 $900 $1,265 (365) $900 SCE Results of Operations – Full-Year 2014 • Utility earning activities – revenue authorized by CPUC and FERC to provide reasonable cost recovery and return on investment • Utility cost-recovery activities – CPUC- and FERC-authorized balancing accounts to recover specific project or program costs, subject to reasonableness review or compliance with upfront standards Utility Earning Activities Utility Cost- Recovery Activities Total Consolidated 2014 Utility Earning Activities Utility Cost- Recovery Activities Total Consolidated 2013 Operating revenue Purchased power and fuel Operation and maintenance Depreciation, decommissioning and amortization Property and other taxes Impairment and other charges Total operating expenses Operating income Interest expense Other income and expenses Income before income taxes Income tax expense Net income Preferred and preference stock dividend requirements Net income available for common stock Core earnings Non-core earnings Total SCE GAAP earnings Note: See Use of Non-GAAP Financial Measures in Appendix ($ millions)

February 25, 2015 41 Use of Non-GAAP Financial Measures Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including sale of certain assets, and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. EIX Investor Relations Contacts Scott Cunningham, Vice President (626) 302‐2540 scott.cunningham@edisonintl.com Felicia Williams, Senior Manager (626) 302‐5493 felicia.williams@edisonintl.com