Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STRATEGIC HOTELS & RESORTS, INC | a2-24x158xkreinvestorprese.htm |

Investor Presentation February2015

Except for historical information, the matters discussed in this presentation are forward-looking statements subject to certain risks and uncertainties. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. These forward-looking statements are identified by their use of such terms and phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,” “continue” and other similar terms and phrases, including references to assumptions and forecasts of future results. Forward-looking statements are not guarantees of future performance. Actual results could differ materially from the Company’s projections. Factors that may contribute to these differences include, but are not limited to the following: the effects of economic conditions and disruptions in financial markets upon business and leisure travel and the hotel markets in which the Company invests; the Company’s liquidity and refinancing demands; the Company’s ability to obtain, refinance or extend maturing debt; the Company’s ability to maintain compliance with covenants contained in its debt facilities; stagnation or deterioration in economic and market conditions, particularly impacting business and leisure travel spending in the markets where the Company’s hotels operate and in which the Company invests, including luxury and upper upscale product; general volatility of the capital markets and the market price of the Company’s shares of common stock; availability of capital; the Company’s ability to dispose of properties in a manner consistent with its investment strategy and liquidity needs; hostilities and security concerns, including future terrorist attacks, or the apprehension of hostilities, in each case that affect travel within or to the United States or Germany or other countries where the Company invests; difficulties in identifying properties to acquire and completing acquisitions; the Company’s failure to maintain effective internal control over financial reporting and disclosure controls and procedures; risks related to natural disasters; increases in interest rates and operating costs, including insurance premiums and real property taxes; delays and cost-overruns in construction and development; marketing challenges associated with entering new lines of business or pursuing new business strategies; the Company’s failure to maintain its status as a REIT; changes in the competitive environment in the Company’s industry and the markets where the Company invests; changes in real estate and zoning laws or regulations; legislative or regulatory changes, including changes to laws governing the taxation of REITs; changes in generally accepted accounting principles, policies and guidelines; and litigation, judgments or settlements. Additional risks are discussed in the Company’s filings with the Securities and Exchange Commission, including those appearing under the heading “Item 1A. Risk Factors” in the Company’s most recent Form 10-K and subsequent Form 10-Qs. Although the Company believes the expectations reflected in such forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained. The forward-looking statements are made as of the date of this presentation, and the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Disclaimer 1

I. Strategic Hotels: An Overview II. Financial Overview III. Strategic Plan IV. Industry Update & Operating Trends V. Appendix I. Corporate Governance Strategic Hotels: An Overview 2

3 BEE’s Strategy to Drive Shareholder Value Disciplined capital allocation & external growth strategy Enhance and expand our high-end, unique, and irreplaceable hotel portfolio Proactive and conservative balance sheet management Industry leading asset management platform BEE’s strategy has delivered industry leading operating results and shareholder returns

4 BEE’s Consistent Outperformance Source: SNL Financial as of 2/20/15 (1) Includes DRH, LHO, PEB, SHO, and HST BEE has outperformed its peers in 1 year, 2 year and 3 year Total Shareholder Return 80 100 120 140 160 180 200 220 240 2012 2013 2014 2015 BEE Peers SNL Hotel REITs RMS 113.8% 61.0% BEE Peers(1) SNL Hotel REITs RMS 1-yr 37.6% 24.6% 28.0% 26.4% 2-yr 73.9% 49.5% 50.6% 32.3% 3-yr 113.8% 61.0% 68.2% 55.2% (1) 55.2% 68.2%

I. Strategic Hotels: An Overview II. Financial Overview III. Strategic Plan IV. Industry Update & Operating Trends V. Appendix I. Corporate Governance Financial Overview

4th Quarter Results (EBITDA in millions) 6 Strong fourth quarter results 4Q 2013 4Q 2014 Operations (Same Store United States Portfolio) ADR $285 5.9% $302 RevPAR $205 7.3% $220 Total RevPAR $393 6.9% $420 EBITDA Margins 22.4% 160 bps 24.0% Corporate Results Comparable EBITDA $58.3 9.2% $63.7 Comparable FFO / share $0.14 21.4% $0.17 Note: Total RevPAR and EBITDA Margin statistics have been modified to take into account certain adjustments, including those related to the adoption of the Uniform System of Accounts for the Lodging Industry, Eleventh Revised Edition (the “USALI Eleventh Revised Edition”). Both metrics exclude payments recognized pursuant to the JW Marriott Essex House NOI guarantee of $12.8 million and $5.8 million in 2013 and 2014, respectively. EBITDA margins also exclude amortization of the below market hotel management agreement related to the Hotel del Coronado of $0.6 million for the three months ended December 31, 2014.

Full Year Results (EBITDA in millions) 7 Strong 2014 results 2013 2014 Operations (Same Store United States Portfolio) ADR $284 5.5% $300 RevPAR $213 6.3% $226 Total RevPAR $392 7.4% $421 EBITDA Margins 23.5% 160 bps 25.1% Corporate Results Comparable EBITDA $213.2 16.8% $249.0 Comparable FFO / share $0.43 58.1% $0.68 Note: Total RevPAR and EBITDA Margin statistics have been modified to take into account certain adjustments, including those related to the adoption of the Uniform System of Accounts for the Lodging Industry, Eleventh Revised Edition (the “USALI Eleventh Revised Edition”). Both metrics exclude payments recognized pursuant to the JW Marriott Essex House NOI guarantee of $12.8 million and $5.8 million in 2013 and 2014, respectively. EBITDA margins also exclude amortization of the below market hotel management agreement related to the Hotel del Coronado of $1.2 million for the year ended December 31, 2014.

2015 Guidance (EBITDA in millions) 8 Strong results forecasted to continue Note: 2014 RevPAR, Total RevPAR, and EBITDA margin statistics modified to take into account certain adjustments, including those related to the adoption of the Uniform System of Accounts for the Lodging Industry, Eleventh Revised Edition (the “USALI Eleventh Revised Edition”). Metrics exclude payments recognized pursuant to the JW Marriott Essex House NOI guarantee which totaled $5.8 million in 2014 and the amortization of the below market hotel management agreement related to the Hotel del Coronado which totaled $1.2 million in 2014. 2014 Actual 2015 Guidance Operations (Same Store United States Portfolio) RevPAR $224 5%-7% $235-$240 Total RevPAR $425 4%-6% $442-$451 EBITDA Margins 24.8% 50 - 100bps 25.3%-25.8% Corporate Results Comparable EBITDA $249 20%-29% $300-$320 Comparable FFO / share $0.68 13%-25% $0.77-$0.85

I. Strategic Hotels: An Overview II. Financial Overview III. Strategic Plan IV. Industry Update & Operating Trends V. Appendix I. Corporate Governance Strategic Plan

10 BEE’s Strategy to Drive Shareholder Value Disciplined capital allocation & external growth strategy Enhance and expand our high-end, unique, and irreplaceable hotel portfolio Proactive and conservative balance sheet management Industry leading asset management platform

o Unique portfolio of luxury and upper upscale hotels in public markets o Locations in high-barrier-to-entry urban and resort markets with limited supply growth o Complex hotels with multiple revenue streams managed as mixed-use assets o World-class amenities managed by world-class operators High-End, Unique & Irreplaceable Portfolio 11 Four Seasons Jackson Hole Loews Santa Monica Ritz-Carlton Half Moon Bay Elements of BEE’s Portfolio Strategy

JW Marriott Essex House InterContinental Chicago Westin St. Francis Exceptional Portfolio of Urban and Resort Destinations 12 Ritz-Carlton Laguna Niguel Hotel del Coronado Four Seasons Washington, D.C.

Top-Tier Market Exposure 13 Northern California Westin St. Francis Ritz-Carlton Half Moon Bay Four Seasons Silicon Valley Southern California Loews Santa Monica Ritz-Carlton Laguna Niguel Hyatt Regency La Jolla Hotel del Coronado Chicago InterContinental Chicago Fairmont Chicago Marriott Lincolnshire Four Seasons Jackson Hole JW Marriott Essex House New York Washington, D.C. Four Seasons Washington, D.C. InterContinental Miami Miami Fairmont Scottsdale Princess Phoenix Note: Company also owns a leasehold interest in the Marriott Hamburg Wyoming Four Seasons Scottsdale Troon Montage Laguna Beach

-6% -4% -2% 0% 2% 4% 6% 8% 10% 12% 198 9 199 1 199 3 199 5 199 7 199 9 200 1 200 3 200 5 200 7 200 9 201 1 201 3 o Approximately 2% competitive supply in current pipeline in BEE markets o High-end hotels trading at significant discounts to replacement costs further reducing supply risk o Limited capital available for new hotel development o Long-lead time needed to develop competitive product Limited Competitive Supply Growth in BEE Markets 14 U.S. Luxury Supply Change (TTM) 3.8% Average Source: Smith Travel Research

15 BEE’s Strategy to Drive Shareholder Value Disciplined capital allocation & external growth strategy Enhance and expand our high-end, unique, and irreplaceable hotel portfolio Proactive and conservative balance sheet management Industry leading asset management platform

$107 $50 $70 $90 $110 BEE LHO PEB SHO HST DRH +42% Avg: $75 114.5x 112.8x 111.1x 114.4x 116.2x 116.0x 117.7x 116.7x 100x 104x 108x 112x 116x 120x 2007 2008 2009 2010 2011 2012 2013 2014 o Intense focus on operational excellence o Revenue management systems focused on driving ADR o Expense controls including food and beverage procurement and labor management systems o Strong relationships with and rigorous oversight of brand managers o Execution of value enhancement capital projects Industry Leading Asset Management Platform 16 Asset management expertise has driven outperformance EBITDA per Available Room Note: All metrics represent full-year 2014 results See note included on Page 17 Source: Public filings Includes BEE’s Total U.S. portfolio excluding JW Marriott Essex House, Four Seasons Scottsdale Troon, and Montage Laguna Beach Source: Smith Travel Research Annual RevPAR Index

$300 $120 $180 $240 $300 BEE PEB LHO HST DRH SHO Avg: $215 +39% $226 $150 $170 $190 $210 $230 BEE PEB LHO HST DRH SHO Avg: $174 +30% 7.5% 4.0% 6.0% 8.0% BEE PEB DRH HST SHO LHO Avg: 6.2% +1.4 pts $195 $40 $80 $120 6 $200 BEE HST PEB LHO DRH SHO Avg: $74 +163% ADR RevPAR Non–Rooms Revenue Per Available Room Note: All metrics represent full-year 2014 results Bee metrics modified to take into account certain adjustments, including those related to the adoption of the Uniform System of Accounts for the Lodging Industry, Eleventh Revised Edition (the “USALI Eleventh Revised Edition”) and exclude payments under the JW Marriott NOI guarantee and amortization of the below market management agreement at the Hotel del Coronado (1) Based on the average reported same-store RevPAR growth from each year, however may not reflect a same-store comparison over entire 5-year period. Source: Public filings BEE’s Operating Metrics Lead the Sector 17 BEE delivers industry leading results Average RevPAR Growth 2010-2014(1)

o Group pace remains the most reliable forward looking indicator Year-Over-Year Group Pace(1) Group room nights 7% below peak (1) Graph excludes the JW Marriott Essex House, Four Seasons Scottsdale Troon, and Montage Laguna Beach 2015 Production assumed to be 10% higher in 2015 compared to 2014 2015 Group Booking Outlook 18 2015 group room nights on the books are down slightly; ADR +2.9% Excluding impact of Moscone Center renovation in San Francisco, room nights up approximately 3% 0 200,000 400,000 600,000 800,000 1,000,000 2007 2008 2009 2010 2011 2012 2013 2014 2015F Definite through January Production in the year

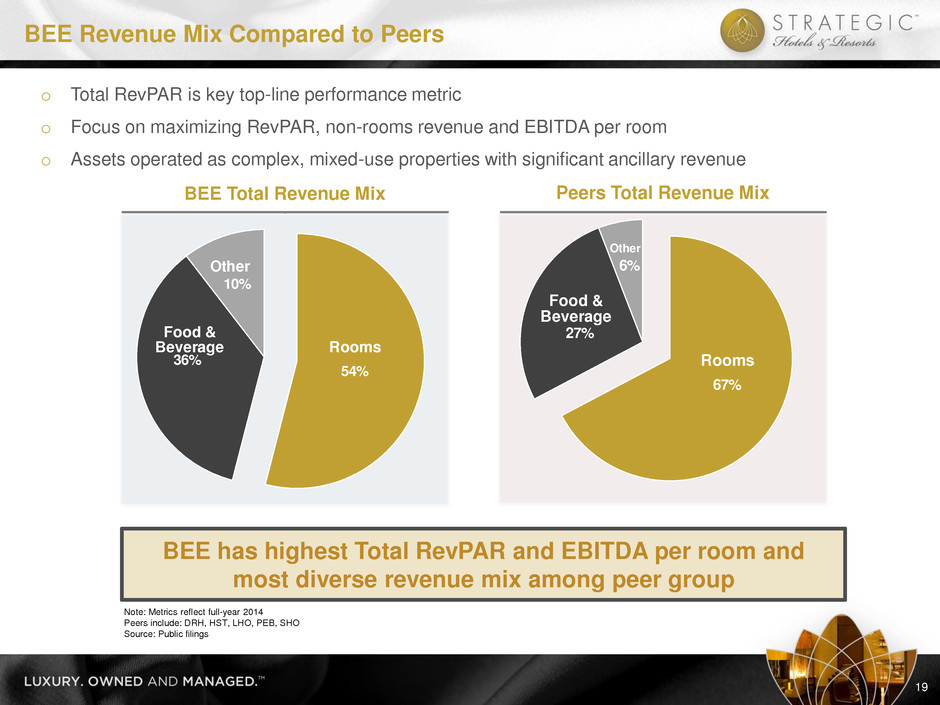

o Total RevPAR is key top-line performance metric o Focus on maximizing RevPAR, non-rooms revenue and EBITDA per room o Assets operated as complex, mixed-use properties with significant ancillary revenue BEE Total Revenue Mix Peers Total Revenue Mix Note: Metrics reflect full-year 2014 Peers include: DRH, HST, LHO, PEB, SHO Source: Public filings BEE Revenue Mix Compared to Peers 19 BEE has highest Total RevPAR and EBITDA per room and most diverse revenue mix among peer group 67% 27% 6% Food & Beverage Other Rooms 54% 36% 10% Rooms Other Food & Beverage

BEE Luxury Assets Outperform Industry 20 (1) Includes 11 hotels: FC, FSP, FSDC, FSJH, FSSV, HdC, IC, IM, LSM, RCHMB, RCLN (2) Per Smith Travel Research 2013 HOST Report, 2014 data not yet available 230 basis point margin outperformance on same RevPAR 2013 BEE (1) Luxury Average (2) Variance Average Number of Rooms 461 301 160 Occupancy 73% 73% 0% ADR $291 $285 $6 RevPAR $212 $209 $3 Rooms Profit Margins 73.1% 71.6% 1.5% F&B Profit Margins 33.4% 27.9% 5.5% Departmental Profit 54.6% 53.5% 1.1% GOP 34.2% 31.9% 2.3%

21 Continually Elevating the Guest Experience Luxury Rooms Meeting / Banquet Premium Dining Retail Outlets Fitness / Spas Bars / Lounges o Properties designed to be vibrant environments with multiple guest offerings and sources of revenue o Destination hotels/resorts with repeat customers o Diverse revenue mix o Unmatched expertise in complex asset management

World-Class Hotels Operated by World-Class Brands 22 11 hotels in Conde Nast Top 100 Hotels in the World 22 AAA Five Diamond Awards 31 hotels on Conde Nast Traveler Gold List 16 hotels in Robb Reports’ Top 100 35 hotels in U.S. News & World Report’s Best Hotel Rankings 28 AAA Five Diamond Properties Top Luxury Hotel Brand by J.D. Power and Associates 17 hotels recognized by Travel + Leisure Magazine World’s Best Awards World Travel Awards Leading Hotel Brand World Travel Awards Leading Business Hotels Brand Best Business Hotel Brand by Business Traveler Awards 10 hotels on Conde Nast Gold List 10 hotels in Travel + Leisure Magazine World’s Best Hotels 8 hotels in the U.S. News & World Report Best hotels in the USA 12 hotels on Conde Nast Traveler Gold List Recipient of five HSMAI Adrian Awards for creative brilliance and best practices Recognized by Travel + Leisure for World’s Best Hotels for Families Travel Weekly Reader’s Choice award for best upper upscale brand 51 AAA Four Diamond Awards 21 hotels in U.S. News & World Report ‘s Best Hotel Rankings 11 hotels received the Gold Key award by Meetings and Conventions magazine 4 hotels in U.S. News & World Report ‘s Best Hotel Rankings 4 hotels in Travel & Leisure Magazine World’s Best 3 AAA Five Diamond Awards Washington, D.C. Silicon Valley Jackson Hole Laguna Niguel Half Moon Bay Chicago Miami Chicago Scottsdale Santa Monica St. Francis, San Francisco Essex House, New York City Laguna Beach

23 BEE’s Strategy to Drive Shareholder Value Disciplined capital allocation & external growth strategy Enhance and expand our high-end, unique, and irreplaceable hotel portfolio Proactive and conservative balance sheet management Industry leading asset management platform

$120.0 $120.0 $350.5 $114.8 $150.0 $117.0 $475.0 $142.4 $115.0 $300.0 Undraw n $0.0 $200.0 $400.0 $600.0 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Bank Life Co. CMBS Corporate $412.4 Objectives o Net Debt / EBITDA: 3.0x – 5.0x o Manage debt maturities across years limiting excess maturities in a single year o Maintain adequate liquidity Balance Sheet Today and Objectives 24 Current Debt Maturity Profile Note: Assumes full extension periods for all loans. Key Balance Sheet Statistics (a) Net Debt / EBITDA 4.8x Net Debt / Total Enterprise Value 28.9% Corporate Liquidity (millions) $425 (a) Metrics reflect midpoint of 2015 Comparable EBITDA guidance

25 BEE’s Strategy to Drive Shareholder Value Disciplined capital allocation & external growth strategy Enhance and expand our high-end, unique, and irreplaceable hotel portfolio Proactive and conservative balance sheet management Industry leading asset management platform

o Recycled capital through well-timed asset sales at attractive valuations o Demonstrated track record of value creation through opportunistic acquisitions o Continued assessment and execution of ROI enhancing capital projects o Purchased the Four Seasons Scottsdale Troon and Montage Laguna Beach o Recent purchase of partners’ interest at the Fairmont Scottsdale Princess and Hotel del Coronado o Sale of the Four Seasons Punta Mita & the Marriott London Grosvenor Square Hotel del Coronado Fairmont Scottsdale Princess Disciplined Capital Allocation 26 Purchased JV partner’s interest March 2014 12.7x EBITDA multiple and 6.5% cap rate Purchased JV partner’s interest June 2014 14.3x EBITDA multiple and 6.2% cap rate

External Growth Strategy 27 Deliver return on investment that exceeds cost of capital Luxury and Upper- Upscale hotels Gateway cities and resort destinations Complex assets with multiple revenue streams Discount to replacement cost Operational upside o Ongoing evaluation of external growth opportunities in North America o Target assets where we can generate more value than other potential owners o Must meet rigorous qualitative and quantitative investment thresholds o Create value through proven asset management platform o Operational improvements o Capital investment plans o Price and leverage discipline are critical Opportunistically evaluating high-end assets in attractive markets that will deliver a return that exceeds the Company’s cost of capital

28 Acquisition of Four Seasons Scottsdale Troon Preeminent Resort Opportunity to own a preeminent luxury resort in Scottsdale Resort is in excellent condition Expansion of High- end Portfolio Company has extensive experience with the Four Seasons and the Scottsdale market Asset management to focus on maximizing operating efficiencies Asset well-positioned to continue to achieve superior results Entitled to add up to an additional 88 keys if desired Strong Growth Prospects The Four Seasons Scottsdale has experienced attractive RevPAR and bottom line growth over the past several years Operating metrics expected to continue to improve, with encouraging forward booking pace, limited supply pipeline in the surrounding market, and superior brand recognition Scottsdale market poised for significant upside, with RevPAR for the market significantly below previous peak o Purchased the Four Seasons Scottsdale Troon for $140.0 million o Transaction closed December 2014 Attractive Valuation Gross purchase price of $140 million, including developable land; $638k per key (excl. $6.0 million land allocation) Excl. land allocation, purchase price represents a 13.4x EBITDA multiple and a 6.0% capitalization rate in 2015

29 Acquisition of Montage Laguna Beach Iconic Asset Widely regarded as one of the top resorts in the country 250 luxurious rooms, all of which have ocean views Expansion of High- end Portfolio Resort operates at a 185x RevPAR Index Total RevPAR expected to exceed $1,000 in 2015 Company has extensive experience with the Laguna Beach market Asset management to focus on maximizing operating efficiencies Opportunity to partner with a growing and leading luxury brand Strong Growth Prospects Southern California remains one of the fastest growing and highest rated markets in the country Almost no competitive supply added in recent years and no supply increases forecasted The Company is in the early stages of identifying potential ROI capital projects o Purchased the Montage Laguna Beach for $360.0 million o Transaction closed January 2015 Attractive Valuation Purchase price of $360.0 million; $1.4 million per key Purchase price represents a 16.5x EBITDA multiple and a 5.0% capitalization rate in 2015 Inexpensive capital raise to fund the transaction

I. Strategic Hotels: An Overview II. Financial Overview III. Strategic Plan IV. Industry Update & Operating Trends V. Appendix I. Corporate Governance Industry Update & Operating Trends

-15% -10% -5% % 5% 10% 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 o Supply growth remains historically low and lack of active development pipeline o Limited competitive supply growth in BEE markets o No meaningful supply additions for the foreseeable future o Lodging demand historically correlates with GDP (~80%) o Group and transient demographics for luxury / high-end very strong Luxury Demand Growth exceeding Luxury Supply Growth Source: Smith Travel Research Favorable Luxury Lodging Supply & Demand Dynamics Current: 70 bps 31 Demand growth currently exceeds supply growth by 20 bps Average: 50 bps

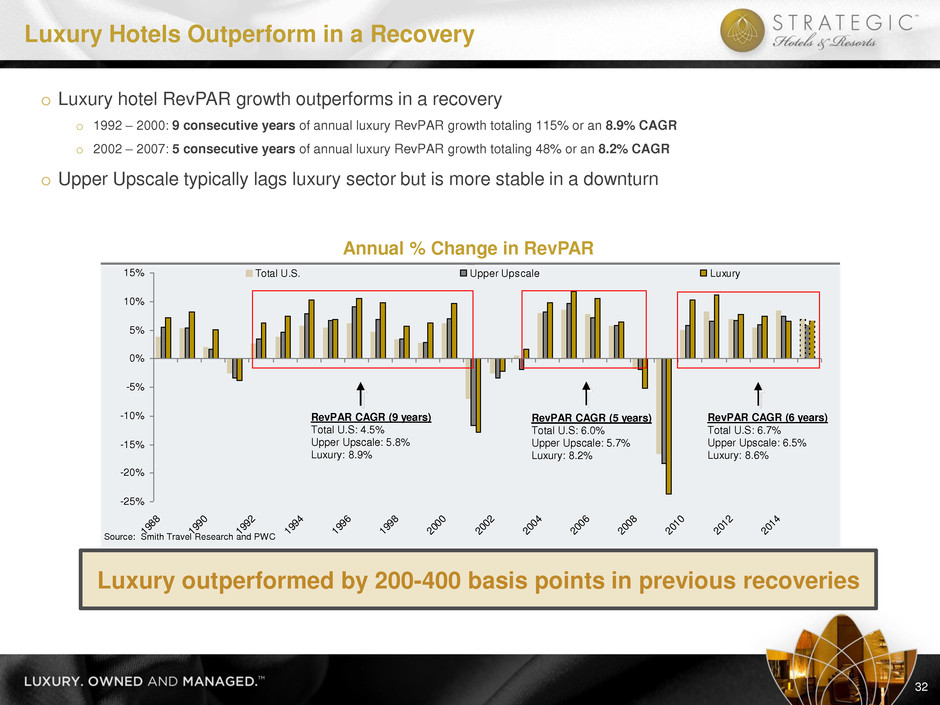

-25% -20% -15% -10% -5% 0% 5% 10% 15% 198 8 199 0 199 2 199 4 199 6 199 8 200 0 200 2 200 4 200 6 200 8 201 0 201 2 201 4 Total U.S. Upper Upscale Luxury Source: Smith Travel Research and PWC Annual % Change in RevPAR o Luxury hotel RevPAR growth outperforms in a recovery o 1992 – 2000: 9 consecutive years of annual luxury RevPAR growth totaling 115% or an 8.9% CAGR o 2002 – 2007: 5 consecutive years of annual luxury RevPAR growth totaling 48% or an 8.2% CAGR o Upper Upscale typically lags luxury sector but is more stable in a downturn Luxury Hotels Outperform in a Recovery 32 Luxury outperformed by 200-400 basis points in previous recoveries RevPAR CAGR (9 years) Total U.S: 4.5% Upper Upscale: 5.8% Luxury: 8.9% RevPAR CAGR (5 years) Total U.S: 6.0% Upper Upscale: 5.7% Luxury: 8.2% RevPAR CAGR (6 years) Total U.S: 6.7% Upper Upscale: 6.5% Luxury: 8.6%

33 BEE’s Strategy to Drive Shareholder Value Disciplined capital allocation & external growth strategy Enhance and expand our high-end, unique, and irreplaceable hotel portfolio Proactive and conservative balance sheet management Industry leading asset management platform BEE’s strategy has delivered industry leading operating results and shareholder returns

I. Strategic Hotels: An Overview II. Financial Overview III. Strategic Plan IV. Industry Update & Operating Trends V. Appendix I. Corporate Governance Corporate Governance

o The Company’s board and management team have significant depth and breadth of expertise in the hotel and REIT industries o Eight of the Company’s nine board members are independent o All directors elected annually, and committees only comprised of independent members o Recently enhanced board and appointed new lead independent director o Accelerated the expiration date of shareholder rights plan o The Company’s target total direct compensation opportunity for its NEOs is generally at the median of the Company’s compensation peer group o The Company’s compensation plan for NEOs is more heavily weighted to performance share units based on TSR than the average of the Company’s compensation peer group o The Company’s Say On Pay vote was in excess of 99% of shares voted Corporate Governance Initiatives 35 The Company is committed to maintaining the highest standards of corporate governance

36 BEE’s Strong Leadership Team Prior Experience Management Years with BEE Former President of the Global Development Group for Starwood Hotels and Resorts Former Director, Chairman and CEO of Starwood Vacation Ownership and served as Chairman and Co-CEO of Vistana, a company he sold to Starwood Serves on the Board of Directors of Marriott Vacations Worldwide 6 years Raymond L. “Rip” Gellein Jr. Chairman & CEO Diane Morefield Executive VP & CFO 5 years Former CFO of Equity International; 12 year tenure at Sam Zell related entities including Equity Office Serves on the Board and is Audit Committee Chair of Spirit Realty Capital Senior officer with Barclays Bank real estate group Richard Moreau Executive VP & COO 17 years Former Principal at Gremor Hospitality Executive / officer positions at Hyatt Hotels, Inn America Corporation and Howard Johnson Company Paula Maggio Executive VP, Secretary & General Counsel 14 years Responsible for the Company’s legal affairs since 2000 Former lawyer for Altheimer & Gray

37 BEE’s Highly Qualified & Independent Board of Directors Experience Chairman and CEO of Strategic Hotels & Resorts Former President of the Global Development Group for Starwood Hotels and Resorts Former Director, Chairman and CEO of Starwood Vacation Ownership and served as Chairman and Co-CEO of Vistana Serves on the Board of Directors of Marriott Vacations Worldwide Directors Raymond “Rip” Gellein Jr. Former Partner of Arthur Andersen, LLP Served as member of Arthur Andersen’s hospitality industry team Previously served as a Director of Gaylord Entertainment and Equity Inns Robert Bowen James Jeffs Managing Director and CIO of The Whittier Trust Company Former Chairman and CEO of Chaparral Resources, CIO and Senior VP of Trust Services America and President and CEO of TSA Capital Management Director of Primexx Operating Corporation and Director and Co-Chairman of Max Petroleum Sir David Michels Former CEO of Hilton Group PLC and Hilton International, previously a Non-Exec. Director of Hilton Hotels Serves as Deputy Chairman and Senior Director of Marks & Spencer, Director of Jumeirah Hotels, Chairman of London & Capital, Chairman of Michels & Taylor, and non-exec. director Miroma Ventures and Savoy London Previously served as Deputy Chairman and Senior Director of easy Jet PLC and CEO of Stakis PLC William Prezant Partner in the law firm of Prezant & Mollath Serves on the Board of Directors of Forward Management, Macroh USA, and You Technologies Previously served as Director of MacGregor Golf Company Sheli Rosenberg Lead Independent Director Former President, CEO and Vice Chairman of Equity Group Investments Previously a Principal of Rosenberg & Liebentritt PC and a Managing Partner of Schiff Hardin, LLP Lead Independent Director of Equity Lifestyle Properties and Director of Nanosphere, Spirit Realty, Ventas, and Cellular Dynamics International Richard Kincaid Independent Years of Service 6 years 11 years 9 years 9 years 10 years 3 years 6 years President and Founder of the BeCause Foundation Former President, CEO and Director of Equity Office Properties Trust, where he also had positions of Executive Vice President, COO and CFO Serves on the Board of Directors of Rayonier and Vail Resorts Eugene Reilly CEO of the Americas for Prologis, which merged with his former company, AMB Property Corporation Former CIO of Cabot Properties Member of the Urban Land Institute 6 years David Johnson President and CEO of Aimbridge Hospitality Previously Executive Vice President/Chief Marketing Officer and President of Wyndham Hotels Serves on the Board of Directors for The Juvenile Diabetes Research Foundation, Meeting Professionals International, and Active International. Previously served on the Board of Directors for Gaylord Entertainment Appointed in 2014

Non-GAAP to GAAP Reconciliations 38 Reconciliation of Net Debt / TEV ($ in 000s) 2014 Adjustments (1) Adj. 2014 Consolidated Debt $1,706.4 $150.0 $1,856.4 Pro rata share of consolidated debt (151.8) (151.8) Cash and cash equivalents (a) (442.6) 230.4 (212.2) Net Debt $1,112.0 $230.4 $1,492.4 Preferred Equity 90.4 (90.4) 0.0 Net Debt + Preferred $1,202.4 ($90.4) $1,492.4 Market Capitalization $3,575.5 $100.0 $3,675.5 Total Debt + Preferreds 1,645.0 1,704.7 Cash and cash equivalents (442.6) (212.2) Total Enterprise Value $4,778.0 $100.0 $5,168.0 Net Debt / Enterprise Value 28.9% Reconciliation of Net Debt / EBITDA ($ in 000s) 2014 Adjustments (1) Adj. 2014 Consolidated debt $1,706.4 $150.0 $1,856.4 Pro rata share of consolidated debt (151.8) (151.8) Cash and cash equivalents (442.6) 230.4 (212.2) Net Debt $1,112 $230.4 $1,492.4 Comparable EBITDA $310.0 t ebt / EBITDA 4.8x Midpoint of Current Guidance $310.0 (1) Adjustments include the Company's acquisition of the Montage Laguna Beach, retirement of the Series B Preferred Equity, and distribution of JW Marriott Essex House refinancing proceeds to the Company's joint venture partner

Non-GAAP to GAAP Reconciliations 39

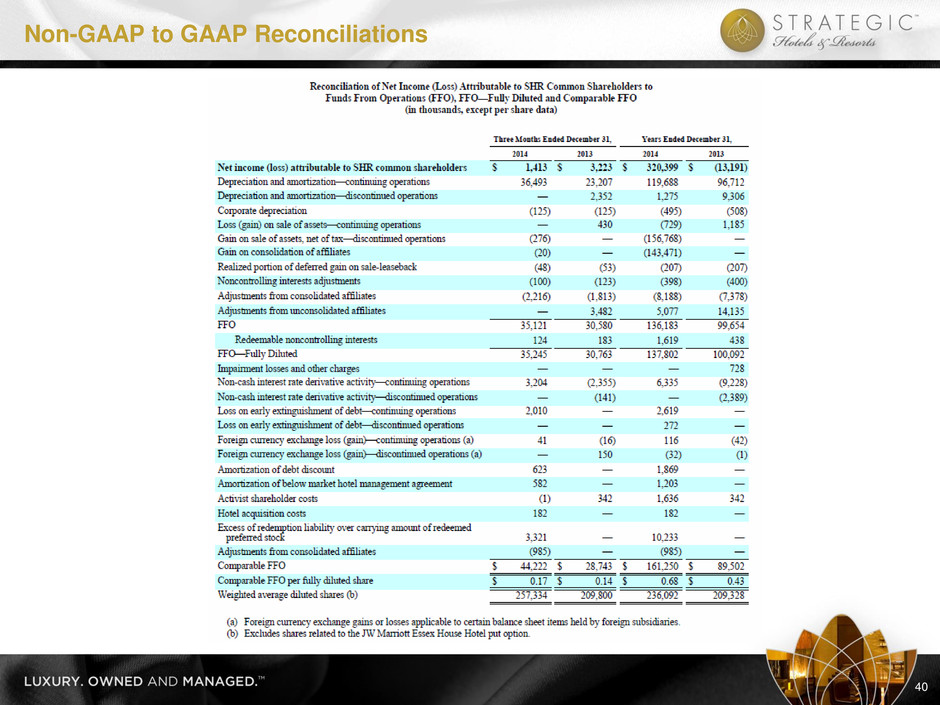

Non-GAAP to GAAP Reconciliations 40

Non-GAAP to GAAP Reconciliations 41

Non-GAAP to GAAP Reconciliations 42 Update when Guidance ranges available