Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - NUVASIVE INC | d879523dex992.htm |

| EX-99.1 - EX-99.1 - NUVASIVE INC | d879523dex991.htm |

| 8-K - FORM 8-K - NUVASIVE INC | d879523d8k.htm |

Updated Non-GAAP Definition

February 24, 2015

Exhibit 99.3 |

Forward-Looking Statements

NuVasive, Inc. (“NuVasive,”

“NUVA”

or the “Company”) cautions you

that statements included in this presentation that are not a description

of historical facts are forward-looking statements that involve risks,

uncertainties, assumptions and other factors which, if they do not

materialize or prove correct, could cause the Company's results to

differ materially from historical results or those expressed or implied

by such forward-looking statements.

Further information on NuVasive’s disclaimer and forward-looking

statements and the potential risks and uncertainties that could cause

actual growth and results to differ materially are more fully described

in the Company’s press releases and periodic filings with the

Securities and Exchange Commission.

2

2 |

Reconciliation of Non-GAAP Information

3

Management uses certain non-GAAP financial measures such as non-GAAP earnings per share,

non-GAAP gross margin, non-GAAP operating expenses, and non-GAAP operating margin,

which, through December 31, 2014 results, exclude non-cash stock-based compensation,

certain intellectual property litigation expenses, amortization of intangible assets, leasehold

related charges, certain acquisition related items, non-cash interest expense on

convertible notes, a litigation liability expense, an out-of-period royalty expense charge,

and an intangible asset impairment charge. Beginning on January 1, 2015, management has

updated the above definition of non-GAAP to include the impact of non-cash

stock-based compensation as well as certain intellectual property expenses. Both measures

are discussed in this presentation, with the definition of the Company’s non-GAAP financial measures

through the end of 2014 referred to as “non-GAAP” while the 2015 and beyond definition

is referred to as “updated non-GAAP.” The

Company also uses measures such as free cash flow, which represents cash flow from operations less cash

used in the acquisition and disposition of capital. Additionally, the Company uses a commonly

used measure as adjusted EBITDA which represents earnings before interest, taxes, depreciation

and amortization as well as excludes the impact of stock-based compensation, a leasehold

related charge, acquisition related items and an intangible asset impairment

charge. Management calculates the non-GAAP financial measures excluding these

costs and uses these non-GAAP financial measures to enable it to further and more consistently

analyze the period-to-period financial performance of its core business

operations. Management believes that providing investors with these non-GAAP measures

gives them additional information to enable them to assess, in the same way management

assesses, the Company’s current and future continuing operations. These non-GAAP measures

are not in accordance with, or an alternative for GAAP, and may be different from non-GAAP

measures used by other companies. Reconciliations of the non-GAAP financial measures

to the comparable GAAP financial measures can be found on the Investor Relations section of the

Company’s website. |

What

Is Changing? •

Updating NUVA’s non-GAAP definition for:

–

Cost of Goods Sold, Gross Margin, Operating Expenses, Operating

Margin, EPS

•

Updated definition to include:

–

Non-cash stock-based compensation

–

Certain intellectual property related litigation expenses

•

Non-GAAP EBITDA measure will continue to exclude stock-based

compensation;

however

it

will

include

certain

intellectual

property

related

litigation expenses

•

No impact to reported revenue historically or on go-forward basis

•

Effective as of first quarter 2015 reporting

•

Providing

historically

adjusted

financial

results

for

2012,

2013

and

2014

on

Company’s IR website in conjunction with this announcement

4 |

Why

Now? •

Operating ahead of schedule on profitability improvements, having reached

goal of delivering a 20% non-GAAP operating margin in fourth quarter 2014

and delivering 180 basis points of non-GAAP operating margin

improvement in 2014, above the Company’s stated plan of driving100

basis points of improvement per year

•

Business has reached a state of maturity where it is appropriate

to shift non-

GAAP reporting approach

•

Committed to driving long-term shareholder value, which includes managing

both stock-based compensation and certain intellectual property

litigation expenses

•

Believe these changes increase transparency and better reflect the underlying

financial performance of the business

•

In response to investor feedback and more aligned with peer practices

5 |

Overview of Updated Non-GAAP Definition Impact

6

PRIOR

UPDATED

2012

2013

2014

2012

2013

2014

Gross Margin

75.3%

74.8%

76.1%

75.3%

74.8%

76.1%

Sales, Marketing & Administrative

55.5%

55.9%

54.9%

59.8%

61.3%

59.9%

Research & Development

5.3%

4.1%

4.5%

5.6%

4.4%

4.8%

Operating Expenses

60.8%

60.0%

59.5%

65.4%

65.6%

64.7%

Operating Margin

14.5%

14.9%

16.7%

9.9%

9.2%

11.4%

Non-GAAP Earnings Per Share

$1.04

$1.23

$1.16

$0.65

$0.73

$0.67

EBITDA Margin

N/A

N/A

N/A

20.7%

21.0%

21.9%

Detailed Full Year 2012, 2013 and 2014 Adjusted Financial

Results Available on NUVA Investor Relations Website |

Increasing Scale and Profitability

7

~15%

2013

Operating

Margin

Operating

Margin at

$1B in

Revenue*

Operating

Margin at

Beyond

$1B in

Revenue*

Prior Non-GAAP Definition

Performance Goals

*NuVasive Guidance as of 2/24/15 as Posted on the Company’s Investor Relations Website

Under “IR Overview” ~20%

~25%

~9%

2013

Operating

Margin

Operating

Margin at

$1B in

Revenue*

Operating

Margin at

Beyond

$1B in

Revenue*

Updated Non-GAAP

Definition Performance Goals

>15%

~20%

~21%

2013

EBITDA

Margin

EBITDA

Margin at

$1B in

Revenue*

EBITDA

Margin at

Beyond

$1B in

Revenue*

Updated Non-GAAP

Definition Performance Goals

>25%

~30%

PRIOR

Operating Margin

Performance Goals

UPDATED

Operating Margin

Performance Goals

UPDATED

EBITDA Margin

Performance Goals |

1.

International scale

2.

In-sourcing manufacturing

3.

Improved asset efficiency

4.

Sales force efficiency

5.

Impact of MDT patent expiration

Targeting ~100 bps*

of Operational

Improvements per

Year

Driving

Operating

Margin

Towards

~20%

Beyond

$1

Billion*

in

Revenue

with Well-Identified Long-Term Levers

Pursuing Operating Efficiencies to Drive Operating

Margin Expansion

8

*NuVasive Guidance as of 2/24/15 as Posted on the Company’s Investor Relations Website

Under “IR Overview” |

Driving

Operating

Margin

Towards

~20%

Beyond

$1

Billion

in

Revenue

with Well-Identified Long-Term Levers

Focused on Operating Margin Expansion With

Continued R&D Focus

9

*NuVasive Guidance as of 2/24/15 as Posted on the Company’s Investor Relations Website

Under “IR Overview” Prior

Non-GAAP

Definition

‘14 Actual

Updated Non-

GAAP Definition

(all figures are

approximations)

‘14 Actual

OM @ ~20%

Gross Margin

~76.1%

~76.1%

~78.0%

Sales, Marketing

& Admin.

~54.9%

~59.9%

~52.5%

Research & Development

~4.5%

~4.8%

~5.5%

Operating Expenses

~59.5%

~64.7%

~58.0%

Operating Margin

~16.7%

~11.4%

~20.0%

EBITDA Margin

n/a

~21.9%

~30.0% |

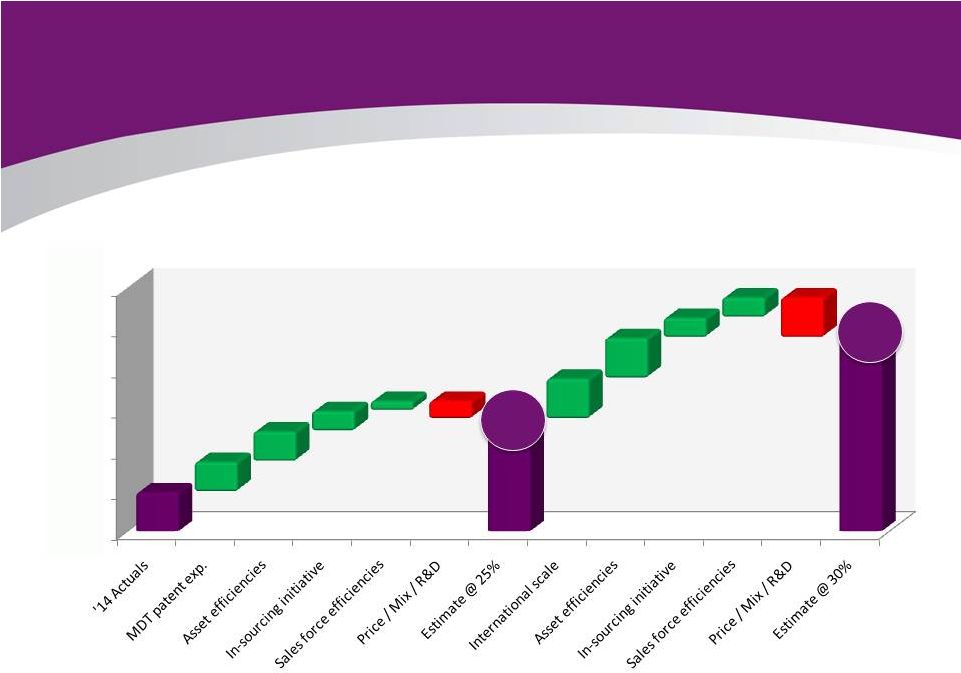

Well-Identified

Operating

Levers

Remain

Unchanged

Driving Operating Margin Towards ~20%

Beyond $1 Billion in Revenue*

10

*NuVasive Guidance as of 2/24/15 as Posted on the Company’s Investor Relations Website

Under “IR Overview” 9.5%

11.5%

13.5%

15.5%

17.5%

19.5%

21.5%

11.4%

~150

~150

~100

~50

~100

~200

~200

~100

~100

~200

~15%

~20%

#’s represent approximation of basis point impact

|

EBITDA Margin* Performance Remains Strong

Driving EBITDA Margin Towards ~30%

Beyond $1 Billion in Revenue^

11

* Non-GAAP EBITDA Margin excludes the impact of stock-based compensation expense

^NuVasive Guidance as of 2/24/15 as Posted on the Company’s Investor Relations Website

Under “IR Overview” 20.0%

22.0%

24.0%

26.0%

28.0%

30.0%

32.0%

21.9%

~150

~150

~100

~50

~100

~200

~200

~100

~100

~200

~25%

~30%

#’s represent approximation of basis point impact

|

•

Utilizing OUS infrastructure to

drive long-term operational

efficiencies

•

ETR expected to gradually

work from 2014 high point

toward mid 30’s as Company

approaches $1 billion in

revenue*

•

Managing for the long term

Committed to Driving EPS Growth at ~ 2x the Rate

of Revenue Growth

•

Stockholders approved new

equity incentive plan in 2014

•

Reducing “burn rate”

to

< 2% in future years

Globalization Initiative

Designed to Drive ETR Lower

Additional EPS Lever Through

Reduced Share Dilution

12

*NuVasive Guidance as of 2/24/15 as Posted on the Company’s Investor Relations Website

Under “IR Overview” |

Evolving into a Global Business

With Increasing Scale and Profitability

By Driving Mid to High Single-Digit

Revenue

Growth

Operating Margin Expansion

To ~20%

EBITDA Margin Expansion to ~30%

And EPS Growth at ~2x the

Rate of Revenue Growth

A Look at NuVasive Beyond $1 Billion in Revenue*

13

*NuVasive Guidance as of 2/24/15 as Posted on the Company’s Investor Relations Website

Under “IR Overview” |

Updated Non-GAAP Definition

February 24, 2015 |