Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INLAND REAL ESTATE CORP | a15-5095_18k.htm |

Exhibit 99.1

|

|

Investor Presentation Fourth Quarter 2014 (February 2015) |

|

|

As of 12/31/14; includes consolidated assets & unconsolidated assets at 100%; excludes development JVs & non-owned IPCC JV properties. As of 12/31/14; includes consolidated assets, unconsolidated assets at 100% & assets IRC does not have an ownership interest in, but that we manage on behalf of a third party. Includes pro rata share of debt related to unconsolidated joint ventures as of 12/31/14; (4) Dividend rate, yield, total return as of 12/31/14. IRC Snapshot Inception 1994 Self advised/managed as of 2000 Listed on NYSE June 2004 Properties in which IRC has ownership interest: 1321 SF of assets in which IRC has ownership interest: 15 million1 Total assets under management2: $3.1 billion $2.3 billion total market capitalization3 Monthly dividend/common share $0.0475 ($0.57 annual)4 Dividend yield 5.2%4 Total Return Trailing 24 Months4: 45.2%; outperformed Morgan Stanley US REIT (33.6%) & SNL US REIT Shopping Ctrs (38.4%) Central United States Expanding into markets within the Southeastern United States Commanding position in 2 top U.S. markets: Chicago & Minneapolis-St. Paul, and growing footprint in other major markets within the Central U.S. History: Geographic Footprint: Portfolio: Market/Stock Information: 2 |

|

|

Investment Highlights High-Quality, Diversified Portfolio Strong asset quality driven by high occupancy (95.4% leased)1 and consistent cash flows Diverse tenant base includes a mix of national retailers across categories Impressive portfolio demographics: dense populations, high incomes, diverse economies Exposure to resilient markets with high barriers to entry and attractive growth prospects; dominant position in core markets Compelling Internal & External Growth Opportunities Solid same-store net operating income (NOI) growth Continued positive leasing spreads on new leases and renewals within the total portfolio Successful redevelopment track record with a robust pipeline in process Strong Liquidity / Debt Maturity Profile Multiple sources of capital to support business plan / strategic growth initiatives Initiatives have improved credit metrics and enhanced balance sheet flexibility Well-laddered debt maturity schedule with minimal near-term refinancing risk Experienced Management Team Fully integrated team with deep experience and successful track record operating within the retail sector and public capital markets Note: (1) Total portfolio as of 12/31/14; includes properties in unconsolidated joint ventures at 100%. 3 |

|

|

Strategic Objectives Generate consolidated same store NOI annual growth of 2% to 3% for 20151; compares to consolidated same NOI growth of 2.3% for 20142 Achieve consolidated same store financial occupancy of 92.5% to 93.5% at YE 2015 Enhance portfolio growth and valuation metrics Reduce cost & extend term of debt; maintain well-balanced debt maturity schedule Lower overall leverage; target net debt-to-total EBITDA ratio below 7x Longer term goal: achieve investment grade status Improve liquidity, leverage and financial flexibility Redeploy capital from dispositions of ~$35-45M in noncore assets into higher growth opportunities3 Grow assets under management and income via on-balance sheet acquisitions and by leveraging lower cost of capital of institutional joint venture partner PGGM Diversify through expansion into new markets Strengthen portfolio’s long-term growth potential through selective sales & acquisitions Notes: Guidance information current as of 4Q14 earnings release dated 2/19/15. Excludes lease termination income. Excludes lease termination income ; includes properties undergoing redevelopment. Based on current pool of assets sold or targeted for sale in 2015. 4 |

|

|

High Quality, Stable Portfolio Ownership strategy based on premise that well-located retail providing everyday goods & services likely to perform and hold value through economic cycles Over 50% of properties in the total portfolio have a grocery component Solid tenant mix strengthened by national/regional exposure: 77% of total portfolio annual base rent Focus on necessity & value retail / high quality national & local tenants Total Portfolio GLA by Property Type Total Portfolio Annual Base Rent by Retailer Type Notes: Data based on total portfolio as of 12/31/14. Excludes properties held in the joint venture with IPCC. 5 National Retailers 73% Regional Retailers 4% Local Retailers 23% |

|

|

Diversified Tenant Base No single tenant more than 3.5% of total portfolio annual base rent In demand, diversified tenant base provides stability (1) TJ Maxx-8, Marshalls-12, Home Goods-1 (2) Mariano’s-1, Metro Market-1, Rainbow-2, Pick ‘N Save-2, Super Pick ‘N Save-1 (3) Dick’s Sporting Goods-6, Golf Galaxy-1 (4) Bed Bath & Beyond-9, BuyBuy Baby-3, World Market-1 (5) Kroger-1, Food 4 Less-4 (6) Justice-5, Dress Barn-10, Maurice’s-7, Lane Bryant-7, Catherine’s-2 (7) Office Depot-5, OfficeMax-6 (8) Old Navy-11,The GAP-1, The Gap Factory-1 Notes: Based on total portfolio including JV partners’ pro rata share, excluding assets held in IPCC JV; major tenants include tenants representing 1% or more of annual base rent. Ratings source: crmz.com as of 7/2014. 6 Tenant Name # Stores % of Annual Base Rent Long-term S&P Rating Long-term Moody's Rating Supervalu (Cub Foods) 10 3.5% B+ B2 TJX Companies (1) 21 3.3% A+ A3 Roundy's (2) 7 3.2% B- B2 AB Acquisitions (Jewel) 9 3.1% N/A N/A Best Buy 7 2.4% BB Baa2 PetSmart 16 2.3% BB+ N/A Carmax 2 2.0% N/A N/A Dick's Sporting Goods (3) 7 2.0% N/A N/A Bed Bath & Beyond (4) 13 1.9% BBB+ (P)Baa1 Safeway (Dominick's Finer Foods) 4 1.9% BBB Baa3 Michaels 12 1.8% B B3 Kroger (5) 5 1.7% BBB Baa2 Ascena Retail Group (6) 31 1.5% N/A N/A Office Depot (7) 11 1.4% B- B2 The Gap (8) 13 1.3% BBB- Baa3 Ross Dress for Less 9 1.2% A- N/A The Sports Authority 4 1.2% N/A N/A Retail Ventures (DSW) 5 1.2% N/A N/A Ulta 10 1.1% N/A N/A Gordmans 4 1.1% N/A N/A Petco 9 1.0% B B3 Dollar Tree 21 1.0% N/A N/A Total 230 41.1% Major Tenant Summary – Total Portfolio as of 12/31/14 |

|

|

Strong Market Demographics 7 IRC’s retail centers are supported by strong demographics / high barriers to entry 4th highest amongst peers for 3-mile median household income; rank at median of peer group for 3-mile population Notes: Property information from SNL as of 8/2014; properties for which address/latitude-longitude and/or SF were not available are excluded; demographics from ESRI , weighted by SF as reported by SNL; IRC data Includes total portfolio properties as of 12/31/14, excluding IPCC JV properties. Median Household Income 3-Mile Radius Population 3-Mile Radius 127,287 118,814 112,995 102,918 100,595 96,484 87,582 86,759 74,826 69,372 70,852 66,845 57,772 AKR EQY FRT KIM WRI REG IRC CDR RPAI DDR BRX RPT KRG |

|

|

Primary Markets Primary markets include Greater Chicago and Minneapolis-St. Paul Metro Areas Two of the top 20 U.S. markets out of 381 MSAs Markets’ resiliency, diverse economies, dense populations & healthy incomes support stable cash flows Notes: (1) Based on total portfolio, excluding IPCC JV as of 12/31/14. Chicago MSA includes 2 assets located in Indiana. (2) Chicago MSA and Minneapolis/St. Paul MSA average occupancy from CBRE’s Fourth Quarter 2014 Retail MarketView reports. (3) NOI based on total portfolio as of 12/30/14, excluding properties held through JV w/IPCC. IRC’s portfolio in Chicago MSA1: 76 assets, 8.6 million SF 57.7% of total portfolio SF 95.4% leased, 490 bps higher than MSA average2 60.8% of total portfolio NOI from IL3 IRC’s portfolio in Minneapolis-St. Paul MSA1: 24 assets, 2.6 million SF 17.3% of total portfolio SF 94.2% leased, 170 bps higher than MSA average2 15.7% of total portfolio NOI from MN3 Chicago MSA: 3rd largest U.S. metro area; pop. 9.5 million Twin Cities MSA: 16th largest U.S. metro area; pop. 3.1 million 8 |

|

|

Dominant REIT In Primary Markets IRC is the largest shopping center REIT operating in the Chicago & Minneapolis metro areas1 Substantial presence positions IRC as “the retail play” in these markets Minneapolis-St. Paul MSA Note: (1) Based on retail SF and number of assets. Data includes shopping centers plus single tenant retail properties with JVs at 100%. IRC data based on total portfolio excluding IPCC JV as of 12/31/14. Peer data sources: SNL as of 8/2014, data includes owned retail GLA with JVs reflected at 100% regardless of REIT’s actual ownership percentage. 9 8,591 4,249 3,118 2,445 1,863 941 893 750 629 2,577 1,453 1,378 1,188 677 366 IRC 76 BRX 17 KIM 28 DDR 7 REG 14 RPT 5 RPAI 5 FRT 4 KRG 4 IRC 24 BRX 10 DDR 5 KIM 5 REG 5 RPT 1 Gross Leasable Area (SF in Thousands) |

|

|

Operating Strategy in Major Markets Schaumburg Promenade Woodfield Plaza Woodfield Commons Nantucket Square Example: IRC Assets in Schaumburg, IL (1 of 5 Top Submarkets In Chicago MSA) 10 Schaumburg Plaza |

|

|

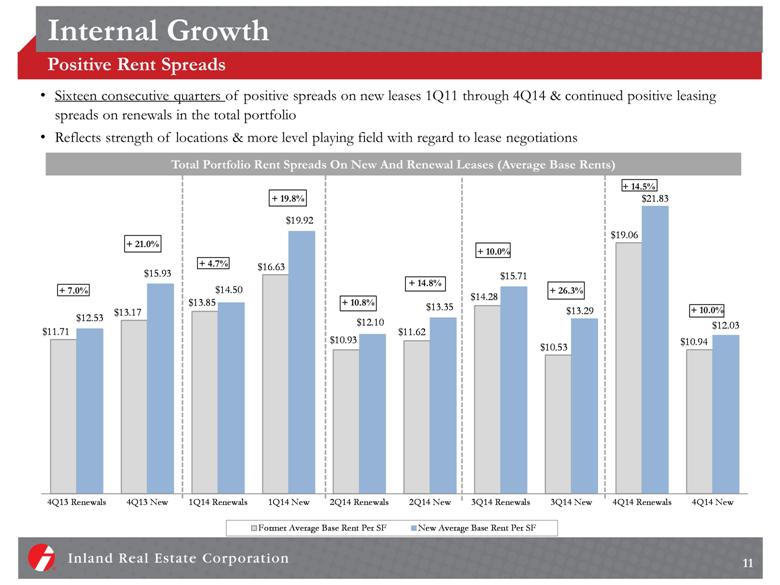

Internal Growth Positive Rent Spreads Sixteen consecutive quarters of positive spreads on new leases 1Q11 through 4Q14 & continued positive leasing spreads on renewals in the total portfolio Reflects strength of locations & more level playing field with regard to lease negotiations + 14.5% + 10.0% + 10.0% + 26.3% + 21.0% + 7.0% + 19.8% + 4.7% + 10.8% + 14.8% 11 Total Portfolio Rent Spreads On New And Renewal Leases (Average Base Rents) $11.71 $13.17 $13.85 $16.63 $10.93 $11.62 $14.28 $10.53 $19.06 $10.94 $12.53 $15.93 $14.50 $19.92 $12.10 $13.35 $15.71 $13.29 $21.83 $12.03 4Q13 Renewals 4Q13 New 1Q14 Renewals 1Q14 New 2Q14 Renewals 2Q14 New 3Q14 Renewals 3Q14 New 4Q14 Renewals 4Q14 New Former Average Base Rent Per SF New Average Base Rent Per SF |

|

|

Value Creation Repositioning/Redevelopment Track Record Case Studies – Asset Redevelopment Projects: Cost ROC 1 Before After Rivertree Court Vernon Hills, IL Theater converted to Gordmans (Phase 1); repositioned Office Depot with Ross, Old Country Buffet with Pier One, Ulta with Shoe Carnival (Phase 2) Completed 2011/2013 $11.0 M 15.4% Crystal Point Crystal Lake, IL Replaced vacant restaurant with multi-tenant outlot building;100% leased to Five Guys, Pot Belly’s & Starbucks Completed 2012 $ 1.6 M 12.2% Salem Square Countryside, IL Repositioning & multi-tenant outlot addition Completed 2011 $ 2.9 M 25.5% Notes: (1) Return on cost (ROC) is based on new capital and related leasing 12 |

|

|

Value Creation Market Demand Driving Increased Repositioning/Redevelopment Activity Notes: (1) Return on cost (ROC) is based on projected new capital and related leasing; (2) Completed defined as financially occupied. 13 Projected $21.3M investment for 2015-2016 – close to half the amount invested over entire trailing 10-yr period Projects in Process Value-Add Initiative Cost ROC 1 Est. Completion2 Diffley Marketplace, Eagan, MN Add multi-tenant & single-tenant outlot buildings totaling 15K SF of Gross Leasable Area (GLA) $ 2.9 M 12.0% 2015 Lansing Square, Lansing, IL Sold portion of center in Dec. 2013 to Walmart for development of super store; redevelop remainder of property to add 30K SF for junior anchors $ 1.5 M 13.8% 2015 Aurora Commons, Aurora, IL Reposition Jewel store for multi-tenant apparel/discount retailers $ 2.6 M 19.0% 2015 Schaumburg Plaza, Schaumburg, IL Demolish existing restaurant and develop new building for Starbucks, Which Wich $1.0 M 11.7% 2015 Cedar Center South, University Park, OH Redevelop former bowling alley to add 11K SF of multi-tenant retail space $2.0 M 14.1% 2015 Mokena Marketplace, Mokena, IL Add single & multi-tenant outlot buildings totaling 27K SF of additional GLA $4.8 M 15.6% 2016 Joliet Commons, Joliet, IL Theater conversion to retail space for 2 new anchors $6.5 M 7.4% 2016 TOTAL PROJECTS IN PROCESS: Expect to add ~62,000 SF of GLA (net) $21.3 M 12.6% 2015-2016 Joliet Commons Redevelopment |

|

|

Disciplined Investment Strategy Pursue grocery, value & necessity-based, multi-anchor retail centers in both primary and strong secondary markets within the Central and Southeastern United States Target Class A assets with prime market position in trade areas with compelling demographics & high barriers to entry Focus on high-quality national retailer rent rolls, including market-leading grocers Stone Creek (Cincinnati, OH) 14 Point at Clark (Chicago, IL) Evergreen Promenade (Evergreen Park, IL) |

|

|

15 Acquisition Of NYSTRS Interest In JV NYSTRS JV Formed 2004 Leveraged institutional capital to acquire high quality assets while enhancing yield on investment via fee income Added $312M(1) gross value with acquisitions completed 2005-2006 Monetized equity value of contributed assets; reinvested gains on sales into new acquisitions June 2013: Acquired New York State Teachers' Retirement System’s (NYSTRS) 50% ownership interest in the IN Retail Fund for purchase price of $121.1M in cash IRC now owns 100% of IN Retail Fund IN Retail: 13 shopping centers, 2.3 million SF of GLA, 97.5% leased at 3/31/13 Gross value of ~$395.6M (agreed upon by NYSTRS and IRC for purposes of the transaction) Total outstanding mortgage debt of ~$152.2M at closing, plus other related assets/liabilities Acquisition advanced IRC’s strategic goals: Simplified our ownership structure Increased scale: grew consolidated portfolio to $1.6B from $1.2B Balance sheet metrics improved post acquisition: Debt to total gross assets (pro-rata consolidation): 48.1% at 6/30/13, improved 290 bps over 3/31/13 & 50 bps over 6/30/12 Net debt/EBITDA (pro-rata consolidation): 6.6x for 2Q13, vs 7.3x for 1Q13 and 7.2x for 2Q12 Note: (1) Includes Algonquin Commons which was consolidated in 2010. |

|

|

Joint Venture Growth Strategies Diversify Capital Resources + Expand Platform + Drive Growth Joffco Square (Chicago, IL) Walgreens (Somerset, MA) 16 Note: (1) Excludes assets contributed to the JV by IRC, developments in process and land purchases; includes cost of completed development, Evergreen Promenade. (2) Refers to Rainbow Landing development, which IRC is developing with MAB as a fee developer; therefore this project is not included in the IRC-MAB JV. Grocery- Anchored Ctrs (Southeastern U.S.) |

|

|

Pulaski Promenade, Chicago, IL (Southwest Side) Infill power center comprising 135,000 SF of GLA 80% pre-leased Anchors: Marshalls, Ross, Michaels, PetSmart, Shoe Carnival Anticipated openings: Spring 2016 Chicago MSA – 3 mile demographics: Population: 217,083; Average household income: $67,458 Anticipated return on investment: 8.33% IRC-PGGM developing in JV w/IBT Group & Pine Tree Commercial Realty Development Projects 17 Opportunity to Add Completed Centers to Portfolio at Better Than Market Pricing Evergreen Promenade, Evergreen Park, IL (Chicago MSA) Infill power center comprising 92,000 SF of GLA 96% leased Anchors: PetSmart and Marianos – opened 4Q14 & 1Q15, respectively Chicago MSA – 3-mile demographics: Population: 225,207; Average household income: $67,712 Anticipated return on investment: 8.60% IRC-PGGM developed in JV w/IBT Group & Pine Tree Commercial Realty Status: CONSTRUCTION COMPLETED – ANCHORS OPEN Note: Return on investment (ROI) is based on net acquisition price. Evergreen Promenade (Evergreen Park, IL) Pulaski Promenade (Chicago , IL) |

|

|

Shoppes at Rainbow Landing, Rainbow City, AL Grocery-anchored center comprising 65,000 SF of GLA 74% pre-leased Anchor: Publix Opening anticipated fall of 2015 Location: Etowah County/Gadsden MSA, 1 hour NE of Birmingham. Trade area: Population: 25,169; Average household income: $61,547 Anticipated return on investment: 8.2% IRC developing with MAB American Retail Partners as a fee developer Development Projects 18 Opportunity to Add Completed Centers to Portfolio at Better Than Market Pricing Tanglewood Pavilions, Elizabeth City, NC Regional power center comprising 158,000 SF of GLA 70% pre-leased (leases in negotiation potentially raise rate to 84%) Anchors: Hobby Lobby, TJMaxx, Ross, Dollar Tree Openings anticipated to begin fall 2015 Draws from 16-county region in northeast NC, constituting trade area of: Population: 194,000; Average household income: $55,000 Anticipated return on investment: 8.3% IRC developing in JV with Thompson Thrift Development Inc. Notes: Return on investment (ROI) is based on net acquisition price. Tanglewood Pavilions (Elizabeth City, NC) Shoppes at Rainbow Landing (Rainbow City, AL) |

|

|

Joint Venture Fee Income IPCC venture: generated ~$16.2M of fee income 2010-2014 PGGM JV: provided ~$8.1M of fee income 2010-2014 Notes: Amounts may not foot due to rounding; not included in this chart are immaterial fees earning from managing development joint ventures. (1) Total JV fee income includes both property management and acquisition fee income. (2) Property management JV fee income includes asset management and leasing commissions. 19 PGGM IPCC $2.3M $4.8M $1.6M $0.8M $4.6M $3.0M $6.4M $4.1M Total JV Fee Income PGGM/IPCC1,2 Property Management JV Fee Income PGGM/IPCC2 $6.1M $4.9M |

|

|

Transaction History Consolidated and Core Asset Based Joint Ventures Over half of core asset acquisitions have been principal to principal; typically get best pricing in private deals Increased capital recycling activity in 2013/2014 – 2nd consecutive year of higher than average dispositions; proceeds from sale of non-core assets invested in properties with greater growth potential IRC/Core Asset-Based JV Acquisitions Dispositions As of 12/31/2014; acquisitions are shown on positive axis & include sold core properties and properties acquired through unconsolidated joint ventures at 100 percent; acquisitions exclude land purchases; dispositions are shown on negative axis. 2013 does not include assets acquired as result of consolidation of NYSTRS’ JV properties, as those acquisitions are included in prior year totals. Acquisition value represents full purchase price, including potential earn-outs. 20 $17.8 $77.4 $181.8 $365.8 $298.3 $43.3 $3.3 $207.2 $78.0 $75.3 $143.8 $251.4 $61.4 $138.6 $186.9 $120.4 $133.9 $2.4 $8.4 $12.0 $24.6 $6.2 $15.7 $29.6 $14.8 $6.6 $17.7 $8.2 $19.7 $72.7 $68.6 ($80) ($55) ($30) ($5) $20 $45 $70 $95 $120 $145 $170 $195 $220 $245 $270 $295 $320 $345 $370 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Dispositions / Acquisitions ($MM) |

|

|

Issued Equity with Attractive Terms 2014: sold 4 million shares of Series B Preferred Stock for net proceeds of ~$97 M, used primarily for acquisitions and debt repayment Total market capitalization increased to $2.30 B @ YE 2014 from $2.18 B @ YE 2013, due to equity issuances and stock price appreciation in 2014 Decreased Cost of Debt & Extended Debt Maturity Profile Amended unsecured credit facilities July 2014: Increased capacity by $115 M to $475 M Lowered rates on leverage-based pricing grids by 5 to 15 bps for line of credit (LOC) and by 10 to 20 bps for term loan Extended terms by one year: LOC to July 2018, term loan to July 2019 Expanded lending group from 6 to 8 banks Reduced Leverage & Enhanced Financial Flexibility In 2014 repaid debt maturities totaling $141 M, including $111.8 M of consolidated secured mortgage debt and $29.2 M of 5% Convertible Senior Notes Key credit metrics show meaningful improvement: Debt / Total Market Cap: 43.2% @ YE 2014, improvement of 360 bps over 46.8% @ YE 2013 Debt / Total Gross Assets1: 46.6% @ YE 2014; improvement of 260 bps over 49.2% @ YE 2013 Net Debt / Recurring EBITDA1: 6.3x for 4Q14 vs 6.7x for 4Q13 Unsecured Debt to Total Debt1: 44.2% @ YE 2014; improvement of 940 bps over 34.8% @ YE 2013 Fixed Charge Coverage Ratio1: 2.7x for 4Q14 vs 2.7x for 4Q13, flat YoY even with $100 M additional preferred 21 Notes: (1) Improvement calculated based on IRC leverage levels at 12/31/14; includes IRC’s pro rata share of unconsolidated joint ventures. Substantial Progress in 2014 Balance Sheet Initiatives |

|

|

Consolidated Debt Maturities Well-Balanced Debt Maturity Profile 22 Notes: Secured debt includes principal amortization through maturity. Includes $90.2M of secured debt for Algonquin Commons in 2014 and 2015. Consolidated Debt as of 12/31/13 Consolidated Debt as of 12/31/14 $230.0 $143.6 $166.8 $240.2 $240.0 Secured Debt Term Loan – Wells Fargo Term Loan – Bank Group $137.6 $36.7 $42.9 $48.6 $40.4 $70.3 $42.1 $64.4 $11.9 $98.7 $7.8 $47.7 $40.2 $70.3 $42.1 $64.1 $11.9 $29.2 $50.0 $50.0 $180.0 $200.0 $95.0 $190.0 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2015 2016 2017 2018 2019 2020 2021 2022 2023 $137.6 $36.7 $42.9 $48.6 $40.4 $70.3 $42.1 $64.4 $11.9 $98.7 $7.8 $47.7 $40.2 $70.3 $42.1 $64.1 $11.9 $29.2 $50.0 $50.0 $180.0 $200.0 $95.0 $190.0 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2015 2016 2017 2018 2019 2020 2021 2022 2023 |

|

|

Investment Summary Assets repositioned with best-in-class retailers Portfolio positioned to provide consistent & dependable income growth Redeveloping assets to meet retailer appetite for new stores Reinvigorated portfolio primed for growth Provides enhanced liquidity & flexibility Progress on reducing cost of debt & extending maturity profile Long term goals: lower leverage, esp. secured debt/total debt & attain investment grade profile Executing long term capital plan Selling non-core assets & investing proceeds in acquisitions with greater growth potential Leveraging capital-efficient joint ventures to grow portfolio & income Improving portfolio diversification metrics by expanding geographic footprint Implementing effective growth strategy 23 |

|

|

Experienced Leadership Team Management Inland Tenure Background / Experience Mark Zalatoris President & CEO 28 yrs. Appointed president & CEO April 2008; EVP & COO 2004-2008; SVP & CFO 1994-2004; extensive knowledge of portfolio Brett Brown Executive Vice President & Chief Financial Officer 11 yrs. (15 yrs. at Great Lakes REIT) Extensive capital markets & public company reporting experience; former Great Lakes REIT SVP, Financial Reporting Scott Carr EVP & Chief Investment Officer, IRC; President, Inland Commercial Property Management Inc. (IRC subsidiary) 26 yrs. Has overseen property management operations since 1994; strong retailer relationships William Anderson Senior Vice President, Transactions 26 yrs. Skilled at analyzing, negotiating retail center acquisitions & dispositions Senior Management Team Averages 25+ Years Real Estate Experience 24 |

|

|

Appendix 25 Earnings Before Interest, Taxes , Depreciation and Amortization (EBITDA) EBITDA is defined as earnings (losses) from operations excluding: (1) interest expense; (2) income tax benefit or expenses; (3) depreciation and amortization expense; and (4) gains (loss) on non-operating property. We believe EBITDA is useful to us and to an investor as a supplemental measure in evaluating our financial performance because it excludes expenses that we believe may not be indicative of our operating performance. By excluding interest expense, EBITDA measures our financial performance regardless of how we finance our operations and capital structure. By excluding depreciation and amortization expense, we believe we can more accurately assess the performance of our portfolio. Because EBITDA is calculated before recurring cash charges such as interest expense and taxes and is not adjusted for capital expenditures or other recurring cash requirements, it does not reflect the amount of capital needed to maintain our properties nor does it reflect trends in interest costs due to changes in interest rates or increases in borrowing. EBITDA should be considered only as a supplement to net earnings and may be calculated differently by other equity REITs. We believe EBITDA is an important non-GAAP measure. We utilize EBITDA to calculate our interest expense coverage ratio, which equals EBITDA divided by total interest expense. We believe that using EBITDA, which excludes the effect of non-operating expenses and non-cash charges, all of which are based on historical cost and may be of limited significance in evaluating current performance, facilitates comparison of core operating profitability between periods and between REITs, particularly in light of the use of EBITDA by a seemingly large number of REITs in their reports on Forms 10-Q and 10-K. We believe that investors should consider EBITDA in conjunction with net income and the other required U.S. GAAP measures of our performance to improve their understanding of our operating results. Recurring EBITDA includes adjustments to EBITDA for the impact of least termination income and non-cash impairment charges in comparable periods in order to present the performance of our core portfolio operations. Three months ended December 31, Twelve months ended December 31, 2014 2013 2014 2013 Net income (loss) attributable to Inland Real Estate Corporation $ 6,528 (4,884 ) 39,175 111,684 Gain on sale of investment properties (1,128 ) (5,436 ) (24,449 ) (10,702 ) Gain on sale of development properties (950 ) — (950 ) (863 ) Gain from change in control of investment properties — — — (95,378 ) Income tax (benefit) expense of taxable REIT subsidiaries 785 (4,220 ) 1,455 (2,721 ) Interest expense 7,949 9,195 34,591 34,621 Interest expense associated with discontinued operations — 89 — 590 Interest expense associated with unconsolidated joint ventures 2,192 1,970 8,340 9,580 Depreciation and amortization 17,438 22,102 71,554 67,770 Depreciation and amortization associated with discontinued operations — 243 — 2,147 Depreciation and amortization associated with unconsolidated joint ventures 5,731 3,654 18,744 18,579 EBITDA 38,545 22,713 148,460 135,307 Gain from settlement of receivables — — — (3,095 ) Lease termination income — (1,000 ) (146 ) (6,431 ) Lease termination income included in equity in earnings of unconsolidated joint ventures 6 — (76 ) (22 ) Impairment loss, net of taxes: Provision for asset impairment — 15,848 222 16,402 Impairment of investment securities — — — 98 Provision for asset impairment included in equity in earnings of unconsolidated joint ventures — — — 507 Recurring EBITDA $ 38,551 37,561 148,460 142,766 Total Interest Expense $ 10,141 11,254 42,931 44,791 EBITDA: Interest Expense Coverage Ratio 3.8 x 2.0 x 3.5 x 3.0 x Recurring EBITDA: Interest Expense Coverage Ratio 3.8 x 3.3 x 3.5 x 3.2 x |

|

|

Forward-Looking Statements Certain statements in this presentation constitute "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on their knowledge and understanding of the business and industry, the economy and other future conditions. These statements are not guarantees of future performance, and investors should not place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or forecasted in the forward-looking statements due to a variety of risks, uncertainties and other factors, including but not limited to the factors listed and described under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2013 as may be updated or supplemented by our Form 10-Q filings. These factors include, but are not limited to: market and economic challenges experienced by the U.S. economy or real estate industry as a whole, including dislocations and liquidity disruptions in the credit markets; the inability of tenants to continue paying their rent obligations due to bankruptcy, insolvency or a general downturn in their business; competition for real estate assets and tenants; impairment charges; the availability of cash flow from operating activities for distributions and capital expenditures; our ability to refinance maturing debt or to obtain new financing on attractive terms; future increases in interest rates; actions or failures by our joint venture partners, including development partners; and other factors that could affect our ability to qualify as a real estate investment trust. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. 26 |