Attached files

| file | filename |

|---|---|

| 8-K - CAPSTEAD MORTGAGE CORPORATION 8-K 2-23-2015 - CAPSTEAD MORTGAGE CORP | form8k.htm |

Exhibit 99.1

CAPSTEAD Information as of December 31, 2014 Investor Presentation

Safe Harbor Statement - Private Securities Litigation Reform Act of 1995 Cautionary Statement Concerning Forward-looking StatementsThis document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “will be,” “will likely continue,” “will likely result,” or words or phrases of similar meaning. Forward-looking statements are based largely on the expectations of management and are subject to a number of risks and uncertainties including, but not limited to, the following: In addition to the above considerations, actual results and liquidity are affected by other risks and uncertainties which could cause actual results to be significantly different from those expressed or implied by any forward-looking statements included herein. It is not possible to identify all of the risks, uncertainties and other factors that may affect future results. In light of these risks and uncertainties, the forward-looking events and circumstances discussed herein may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. Forward-looking statements speak only as of the date the statement is made and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, readers of this document are cautioned not to place undue reliance on any forward-looking statements included herein. changes in general economic conditions;fluctuations in interest rates and levels of mortgage prepayments; the effectiveness of risk management strategies; the impact of differing levels of leverage employed; liquidity of secondary markets and credit markets; the availability of financing at reasonable levels and terms to support investing on a leveraged basis;the availability of new investment capital;the availability of suitable qualifying investments from both an investment return and regulatory perspective; changes in legislation or regulation affecting Fannie Mae and Freddie Mac (together, the “GSEs”) and similar federal government agencies and related guarantees; other changes in legislation or regulation affecting the mortgage and banking industries;changes in market conditions as a result of Federal Reserve monetary policy or federal government fiscal challenges;deterioration in credit quality and ratings of existing or future issuances of GSE or Ginnie Mae Securities; changes in legislation or regulation affecting exemptions for mortgage REITs from regulation under the Investment Company Act of 1940; andincreases in costs and other general competitive factors. 2

Company Summary Proven Strategy of Managing a Leveraged Portfolioof Short-Duration ARMAgency Securities Experienced Management TeamAligned with Stockholders Overview of Capstead Mortgage Corporation Founded in 1985, Capstead is the oldest publicly-traded residential mortgage REIT. Our sole focus is on managing a leveraged portfolio of short-duration* agency-guaranteed ARM securities that is appropriately hedged and can earn attractive risk-adjusted returns over the long term, with little, if any, credit risk. At December 31, 2014, our agency-guaranteed ARM securities portfolio stood at $13.91 billion, supported by $1.49 billion in long-term investment capital levered 8.59 times. Our short-duration strategy differentiates us from our peers because the adjustable-rate mortgages underlying our portfolio reset to more current interest rates within a relatively short period of time:allowing us to benefit from a potential recovery in financing spreads that typically contract during periods of rising interest rates, andresulting in smaller fluctuations in portfolio values from changes in interest rates compared to portfolios containing a significant amount of longer-duration ARM or fixed-rate mortgage securities.By virtue of being internally-managed and with our focus on Agency Securities with little or no credit risk, we are the most efficient mortgage REIT in the industry. Our top four executive officers are approaching 100 years of combined mortgage finance industry experience.We are internally-managed with low operating costs and a strong focus on performance-based compensation for our executive officers. This structure greatly enhances the alignment of management interests with those of our stockholders. 3 This singular and straight-forward investment strategy, together with our use of cash flow hedge accounting allows for easily understood, transparent financial reporting, with limited use of non-GAAP financial measures.Additional transparency is evident by virtue of our internally-managed structure – our compensation-related decisions and costs are fully disclosed and subject to annual say-on-pay approvals.We make every effort to provide additional analysis in our earnings reports, SEC filings and analyst presentations that tells our story in a complete and straight-forward fashion. Straight-forward investment strategy and transparent reporting * Duration is a measure of market price sensitivity to interest rate movements and a shorter duration generally indicates less interest rate risk.

Market Snapshot(dollars in thousands, except per share amounts) 4 In 2005 and 2006 we issued our 10-year fixed, 20-year variable-rate, unsecured borrowings through trust preferred vehicles. Utilizing forward-starting 20-year swaps, we have hedged the average cost of this capital down to 7.56% by the fall of 2016, an annual interest savings of $930,000, or $0.01 per share.As of December 31, 2014.

Capstead’s Prudent Use of Leverage 5 Portfolio and Portfolio Leverage We increased the portfolio modestly during the 4th quarter to $13.91 billion, contributing to an increase in portfolio leverage (repo borrowings divided by long-term investment capital) to 8.59 to one at year-end from 8.52 to one at September 30, 2014. In our view, borrowing at current levels represents an appropriate and prudent use of leverage for an agency-guaranteed ARM securities portfolio in today’s market conditions. ($ in millions) ($ in billions) Long-term Investment Capital

Capstead’s Proven Short-Duration Investment Strategy 6 As of December 31, 2014 As of December 31, 2014 Low risk agency-guaranteed residential ARM securities financed primarily with 30-90 day “repo” borrowings, augmented with longer-dated repo borrowings when available at attractive terms and relatively low-cost two-year interest rate swap agreements for hedging purposes. Residential ARM Securities Portfolio Repurchase Arrangements & Similar Borrowings Total: $12.81 Billion Total: $13.65 Billion(cost basis) Our portfolio of agency-guaranteed ARM securities have little, if any, credit risk and are either currently resetting to more current rates at least annually or will begin doing so in five years or less. With an asset duration* of approximately 11 ¼ months at year-end, the value of our portfolio naturally is less exposed to changes in interest rates than portfolios containing longer duration ARM or fixed-rate securities. This relative stability affords us more flexibility in managing through periods of market stress. For instance, during 2013 our longer-duration peers were forced to sell assets to reduce leverage or otherwise reposition their portfolios in response to sharply higher rates, and suffered significant declines in book value. We actually increased our leverage during this period and replaced nearly all of our portfolio runoff and did not sell any assets, strongly outperforming our peers.We have long-term relationships with a variety of domestic and foreign lending counterparties and at year-end had repo borrowings outstanding with 27 of these counterparties. Typically we will borrow for 30 to 90 days and extend the duration of our borrowings using relatively low-cost two-year pay interest rate swap agreements. During the latter half of 2014 we took advantage of healthy market conditions by entering into $1.78 billion in 12- to 18-month repo borrowings at attractive rates. Together with the portfolio-related swaps, our repo borrowings had a duration of 9 months at year-end, resulting in a net duration gap of 2 ¼ months. Longer-to-ResetARMs$5.98 Billion(cost basis) Current-ResetARMs$7.67 Billion(cost basis) Borrowings with rates effectively fixed by Currently-Paying Interest Rate Swaps $7.20 Billion RemainingBorrowings$3.33 Billion Forward-starting Interest Rate SwapPositions$500 Million 56% Longer-dated Repo Borrowings$1.78 Billion * Duration is a common measure of market price sensitivity to interest rate movements. A shorter duration generally indicates less interest rate risk.

Quarterly PerformanceAs of December 31, 2014 (unaudited) 7 In 2013 we moved from declaring common dividends that tended to float with anticipated quarterly earnings to establishing a more stable dividend policy. To this end, we paid a $0.31 dividend over the course of 2013 and a $0.34 dividend during 2014. We expect to declare the 1st quarter 2015 dividend on March 12, 2015. Q2 2013 excludes certain one-time effects of preferred capital redemption and issuance transactions totaling $0.23 per common share.

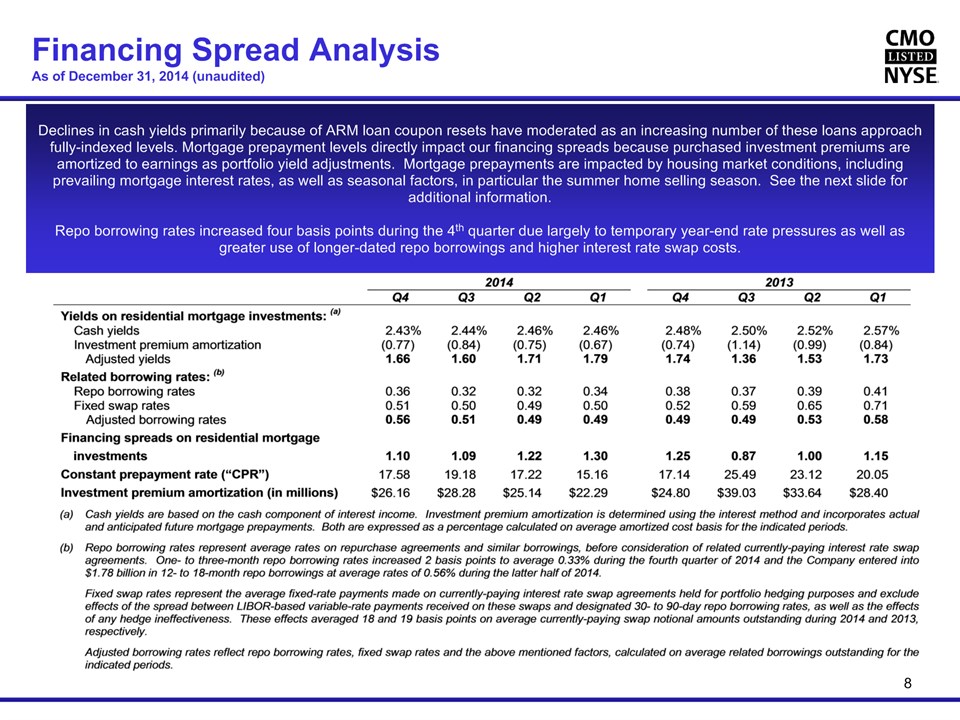

Financing Spread AnalysisAs of December 31, 2014 (unaudited) 8 Declines in cash yields primarily because of ARM loan coupon resets have moderated as an increasing number of these loans approach fully-indexed levels. Mortgage prepayment levels directly impact our financing spreads because purchased investment premiums are amortized to earnings as portfolio yield adjustments. Mortgage prepayments are impacted by housing market conditions, including prevailing mortgage interest rates, as well as seasonal factors, in particular the summer home selling season. See the next slide for additional information.Repo borrowing rates increased four basis points during the 4th quarter due largely to temporary year-end rate pressures as well as greater use of longer-dated repo borrowings and higher interest rate swap costs.

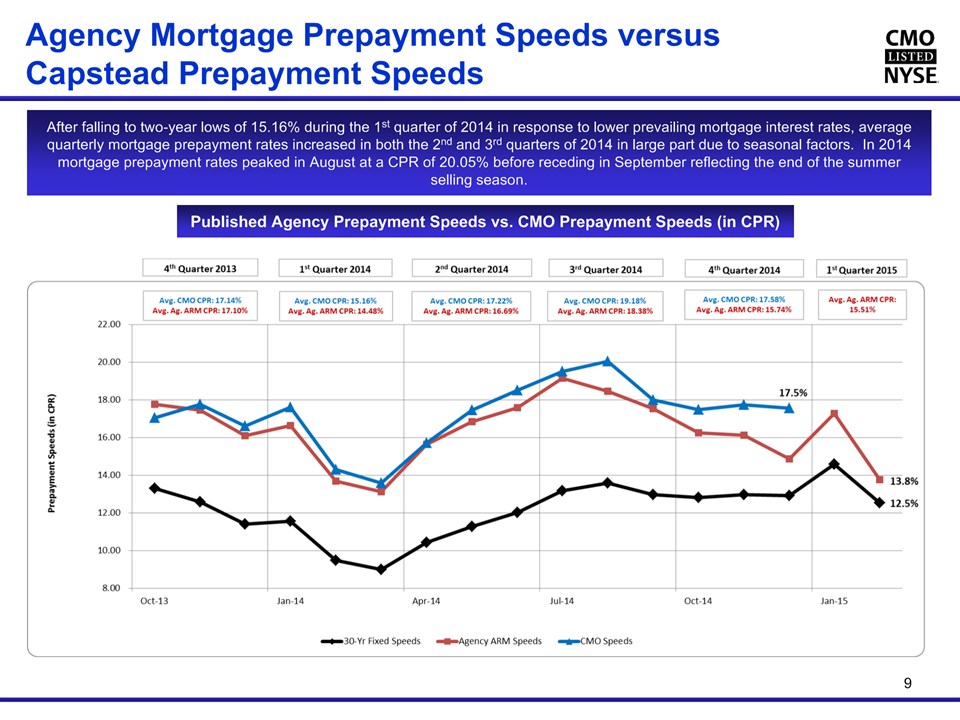

Agency Mortgage Prepayment Speeds versus Capstead Prepayment Speeds 9 Published Agency Prepayment Speeds vs. CMO Prepayment Speeds (in CPR) After falling to two-year lows of 15.16% during the 1st quarter of 2014 in response to lower prevailing mortgage interest rates, average quarterly mortgage prepayment rates increased in both the 2nd and 3rd quarters of 2014 in large part due to seasonal factors. In 2014 mortgage prepayment rates peaked in August at a CPR of 20.05% before receding in September reflecting the end of the summer selling season.

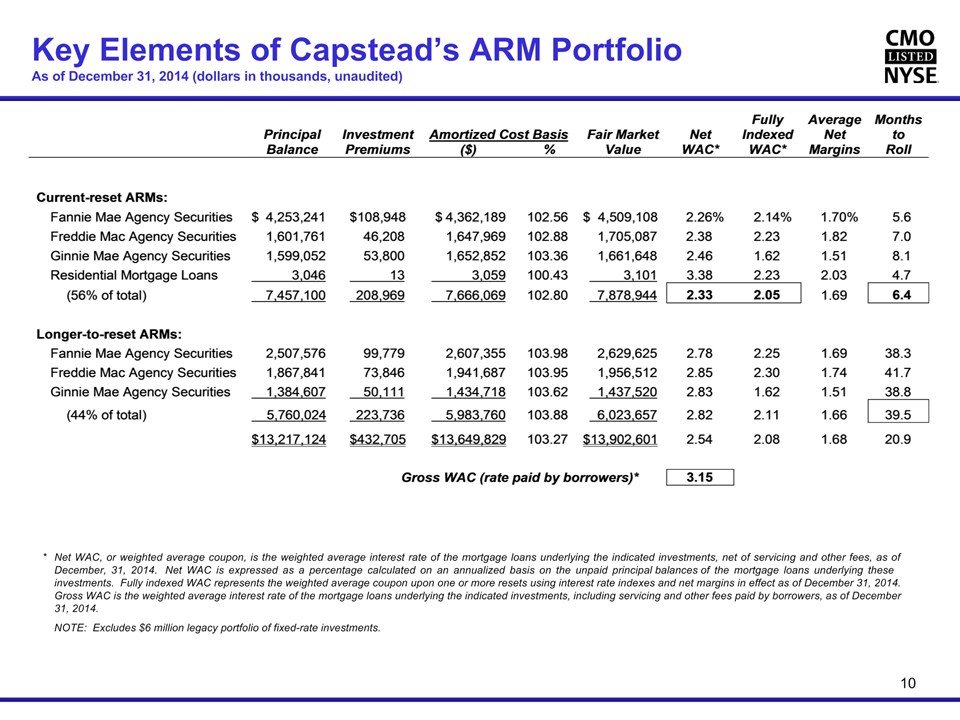

* Net WAC, or weighted average coupon, is the weighted average interest rate of the mortgage loans underlying the indicated investments, net of servicing and other fees, as of December, 31, 2014. Net WAC is expressed as a percentage calculated on an annualized basis on the unpaid principal balances of the mortgage loans underlying these investments. Fully indexed WAC represents the weighted average coupon upon one or more resets using interest rate indexes and net margins in effect as of December 31, 2014. Gross WAC is the weighted average interest rate of the mortgage loans underlying the indicated investments, including servicing and other fees paid by borrowers, as of December 31, 2014. NOTE: Excludes $6 million legacy portfolio of fixed-rate investments. Key Elements of Capstead’s ARM PortfolioAs of December 31, 2014 (dollars in thousands, unaudited) 10

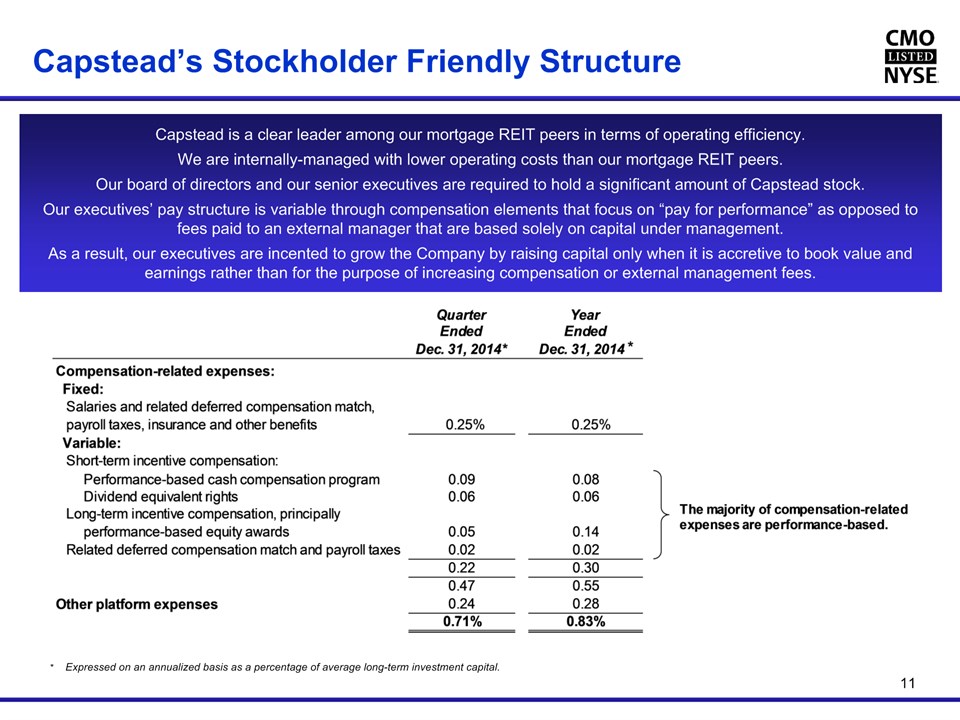

Capstead’s Stockholder Friendly Structure 11 * Expressed on an annualized basis as a percentage of average long-term investment capital. Capstead is a clear leader among our mortgage REIT peers in terms of operating efficiency.We are internally-managed with lower operating costs than our mortgage REIT peers.Our board of directors and our senior executives are required to hold a significant amount of Capstead stock. Our executives’ pay structure is variable through compensation elements that focus on “pay for performance” as opposed to fees paid to an external manager that are based solely on capital under management.As a result, our executives are incented to grow the Company by raising capital only when it is accretive to book value and earnings rather than for the purpose of increasing compensation or external management fees.

CAPSTEAD Appendix CAPSTEAD 12

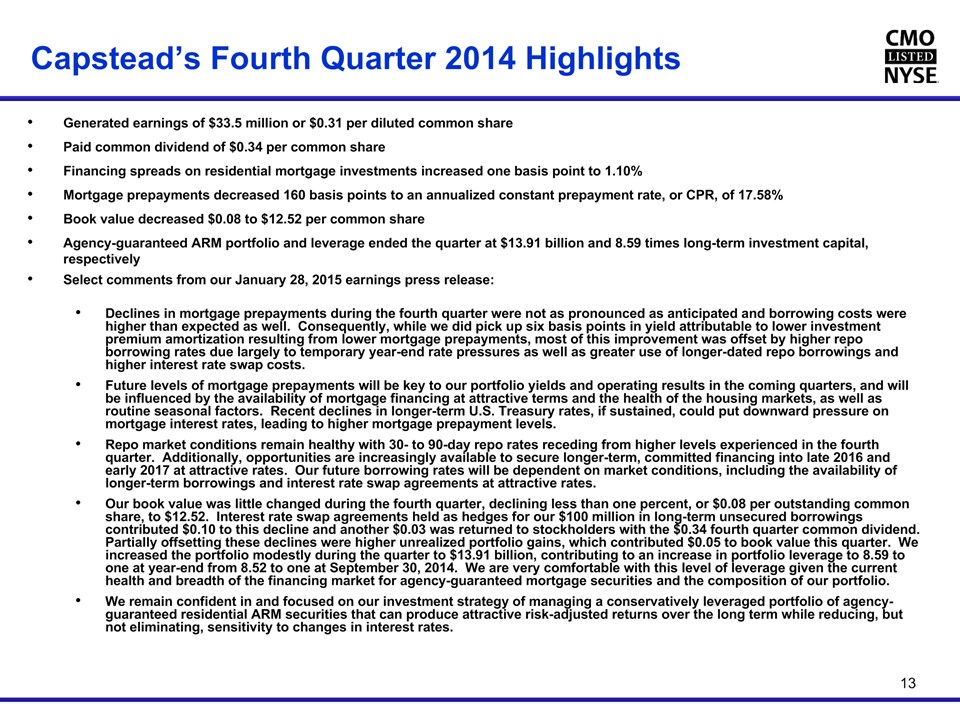

Capstead’s Fourth Quarter 2014 Highlights Generated earnings of $33.5 million or $0.31 per diluted common share Paid common dividend of $0.34 per common shareFinancing spreads on residential mortgage investments increased one basis point to 1.10% Mortgage prepayments decreased 160 basis points to an annualized constant prepayment rate, or CPR, of 17.58%Book value decreased $0.08 to $12.52 per common shareAgency-guaranteed ARM portfolio and leverage ended the quarter at $13.91 billion and 8.59 times long-term investment capital, respectivelySelect comments from our January 28, 2015 earnings press release:Declines in mortgage prepayments during the fourth quarter were not as pronounced as anticipated and borrowing costs were higher than expected as well. Consequently, while we did pick up six basis points in yield attributable to lower investment premium amortization resulting from lower mortgage prepayments, most of this improvement was offset by higher repo borrowing rates due largely to temporary year-end rate pressures as well as greater use of longer-dated repo borrowings and higher interest rate swap costs.Future levels of mortgage prepayments will be key to our portfolio yields and operating results in the coming quarters, and will be influenced by the availability of mortgage financing at attractive terms and the health of the housing markets, as well as routine seasonal factors. Recent declines in longer-term U.S. Treasury rates, if sustained, could put downward pressure on mortgage interest rates, leading to higher mortgage prepayment levels.Repo market conditions remain healthy with 30- to 90-day repo rates receding from higher levels experienced in the fourth quarter. Additionally, opportunities are increasingly available to secure longer-term, committed financing into late 2016 and early 2017 at attractive rates. Our future borrowing rates will be dependent on market conditions, including the availability of longer-term borrowings and interest rate swap agreements at attractive rates. Our book value was little changed during the fourth quarter, declining less than one percent, or $0.08 per outstanding common share, to $12.52. Interest rate swap agreements held as hedges for our $100 million in long-term unsecured borrowings contributed $0.10 to this decline and another $0.03 was returned to stockholders with the $0.34 fourth quarter common dividend. Partially offsetting these declines were higher unrealized portfolio gains, which contributed $0.05 to book value this quarter. We increased the portfolio modestly during the quarter to $13.91 billion, contributing to an increase in portfolio leverage to 8.59 to one at year-end from 8.52 to one at September 30, 2014. We are very comfortable with this level of leverage given the current health and breadth of the financing market for agency-guaranteed mortgage securities and the composition of our portfolio. We remain confident in and focused on our investment strategy of managing a conservatively leveraged portfolio of agency-guaranteed residential ARM securities that can produce attractive risk-adjusted returns over the long term while reducing, but not eliminating, sensitivity to changes in interest rates. 13

Capstead’s Condensed Quarterly Income Statements(dollars in thousands, except per share amounts, unaudited) 14 Consists principally of interest on unsecured borrowings and is presented net of earnings of related statutory trusts prior to their dissolution in December 2013.See page 17 for further information regarding this non-GAAP financial measure.

Capstead’s Annual Income Statements – Five Years Ended 2014(dollars in thousands, except per share amounts, unaudited) 15 See page 17 for further information regarding these non-GAAP financial measures.

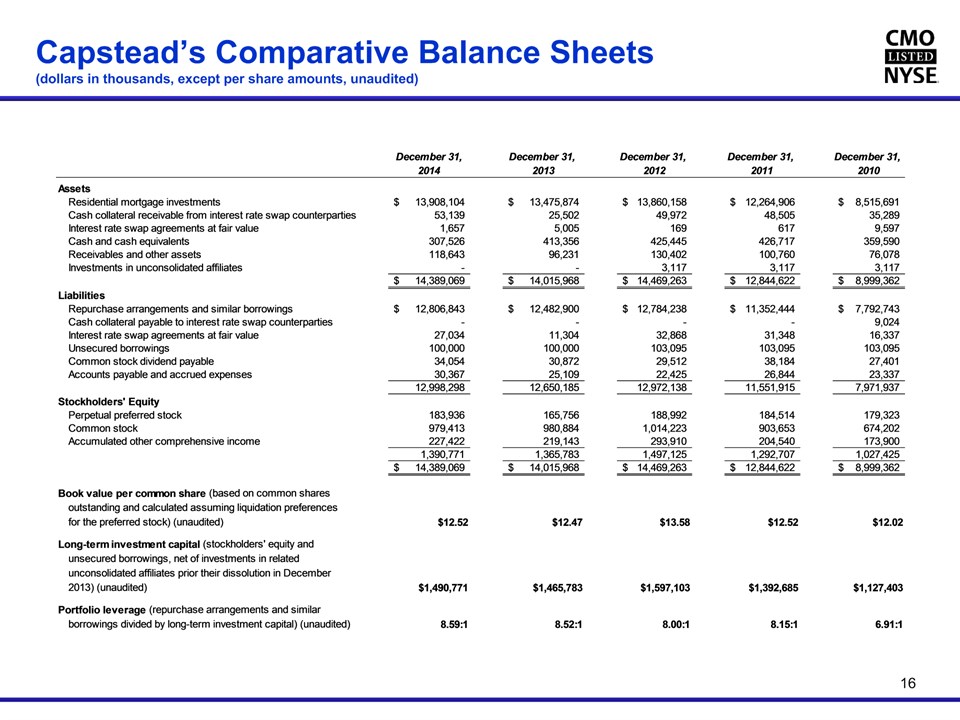

Capstead’s Comparative Balance Sheets(dollars in thousands, except per share amounts, unaudited) 16

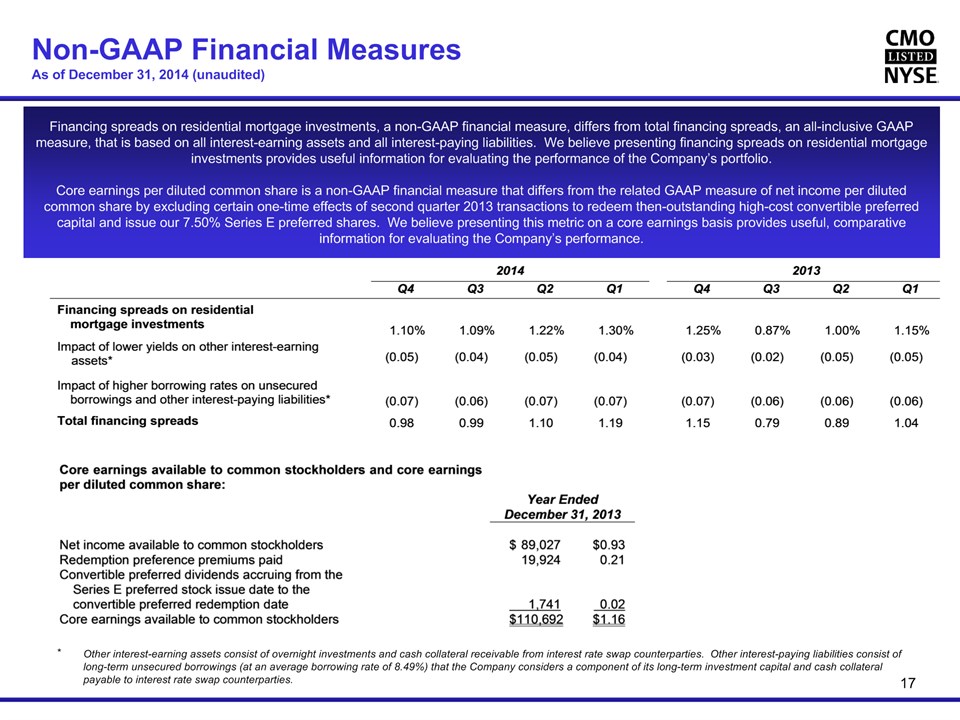

Non-GAAP Financial MeasuresAs of December 31, 2014 (unaudited) 17 Financing spreads on residential mortgage investments, a non-GAAP financial measure, differs from total financing spreads, an all-inclusive GAAP measure, that is based on all interest-earning assets and all interest-paying liabilities. We believe presenting financing spreads on residential mortgage investments provides useful information for evaluating the performance of the Company’s portfolio.Core earnings per diluted common share is a non-GAAP financial measure that differs from the related GAAP measure of net income per diluted common share by excluding certain one-time effects of second quarter 2013 transactions to redeem then-outstanding high-cost convertible preferred capital and issue our 7.50% Series E preferred shares. We believe presenting this metric on a core earnings basis provides useful, comparative information for evaluating the Company’s performance. Other interest-earning assets consist of overnight investments and cash collateral receivable from interest rate swap counterparties. Other interest-paying liabilities consist of long-term unsecured borrowings (at an average borrowing rate of 8.49%) that the Company considers a component of its long-term investment capital and cash collateral payable to interest rate swap counterparties.

Experienced Management Team 18 Nearly 100 years of combined mortgage finance industry experience, most of it with Capstead. Andrew F. Jacobs – President and Chief Executive Officer, DirectorHas served as president and chief executive officer since 2003 and has held various executive positions at Capstead since 1988Previously served as a member of the Executive Board of the National Association of Real Estate Investment Trusts (“NAREIT”) and was founding chairman of NAREIT’s Council of Mortgage REITs; is a member of the Executive Committee of the Chancellor’s Council of the University of Texas System; and is a member of the Advisory Council of the McCombs School of Business, the Advisory Council to the Department of Accounting at the McCombs School of Business, and the Executive Council of the Real Estate Finance and Investment Center, each at the University of Texas at Austin. Mr. Jacobs is a Certified Public Accountant (“CPA”).Phillip A. Reinsch – Executive Vice President and Chief Financial Officer, SecretaryHas held various financial accounting and reporting positions at Capstead since 1993Formerly employed by Ernst & Young LLP as an audit senior manager focusing on mortgage banking and asset securitizationCPA, Member AICPA, FEI, NACDRobert A. Spears – Executive Vice President, Director of Residential Mortgage InvestmentsHas served in asset and liability management positions at Capstead since 1994Formerly Vice President of secondary marketing with NationsBanc Mortgage CorporationMichael W. Brown – Senior Vice President, Asset and Liability Management, TreasurerHas served in asset and liability management positions at Capstead since 1994MBA, Southern Methodist University, Dallas, Texas