Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Thompson Creek Metals Co Inc. | a8kq42014earnings.htm |

| EX-99.1 - EARNINGS RELEASE - Thompson Creek Metals Co Inc. | pressrelease2014q4.htm |

NYSE:TC TSX:TCM 2014 Financial Results Investor Conference Call February 20, 2015 NYSE:TC TSX:TCM

2 Webcast Information Webcast: This Webcast can be accessed on the Thompson Creek Metals Company website under the Events Section: www.thompsoncreekmetals.com Q&A Instructions: If you would like to ask a question, please press star 1 on your telephone keypad. If you’re using a speakerphone, please make sure your mute function is turned off to allow your signal to reach the operator.

3 Cautionary Statement This document contains ''forward-looking statements'' within the meaning of the United States Private Securities Litigation Reform Act of 1995 Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and applicable Canadian securities legislation. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "future," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. Our forward-looking statements include, without limitation, statements with respect to: future financial or operating performance of the Company or its subsidiaries and its projects; access to existing or future financing arrangements and ability to refinance or reduce debt on favorable terms or at all; future inventory, production, sales, payments from customers, cash costs, capital expenditures and exploration expenditures; future earnings and operating results; expected concentrate and recovery grades; estimates of mineral reserves and resources, including estimated mine life and annual production; statements as to the projected ramp-up of Mt. Milligan and other projects, including expected achievement of design capacities and the effects of secondary crushing; future operating plans and goals, including timing of installation of secondary crushing capacity; and future molybdenum, copper, gold and silver prices. Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from future results expressed, projected or implied by those forward-looking statements. Important factors that could cause actual results and events to differ from those described in such forward-looking statements can be found in the section entitled "Risk Factors" in Thompson Creek's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed on EDGAR at www.sec.gov and on SEDAR at www.sedar.com. Although we have attempted to identify those material factors that could cause actual results or events to differ from those described in such forward-looking statements, there may be other factors, currently unknown to us or deemed immaterial at the present time that could cause results or events to differ from those anticipated, estimated or intended. Many of these factors are beyond our ability to control or predict. Given these uncertainties, the reader is cautioned not to place undue reliance on our forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

4 Management in Attendance Jacques Perron President, Chief Executive Officer and Director Pam Saxton Executive Vice President and Chief Financial Officer Mark Wilson Executive Vice President and Chief Commercial Officer

5 Jacques Perron President, Chief Executive Officer and Director 2014 Overview

6 2014 Achievements Improved safety record Excellent environmental performance Significantly improved financial results, with a very strong cash balance of $266 million at year-end Mount Milligan reached commercial production in February 2014 and has been cash flow positive since the second quarter of 2014 Achieved copper production and cash cost guidance Non-GAAP unit cash costs1 • By-product basis: Copper - $1.15 per pound • Co-product basis: Copper - $1.97 per pound; Gold - $525 per ounce Copper payable production – 64.6 million pounds Gold payable production – 177,606 ounces Copper and gold sales contributed $351 million to total revenue Updated NI 43-101 Technical Report for Mount Milligan; mine life 24 years 1 Please refer to Appendix for non-GAAP reconciliation.

7 2014 Achievements (continued) 1 Please refer to Appendix for non-GAAP reconciliation. Achieved total molybdenum production and cash cost guidance1 Non-GAAP average cash cost 1 – $6.91 per pound Molybdenum production – 26.3 million pounds Molybdenum sales contributed $441 million to total revenue Completed exchange of approximately 86% of the tMEDs in June and bond repurchases in December 2014 and January 2015 Extinguished approximately $44 million of debt and $14 million of future interest payments Credit rating upgrades from S&P and Moody’s

8 Pam Saxton Executive Vice President and Chief Financial Officer 2014 Financial Review

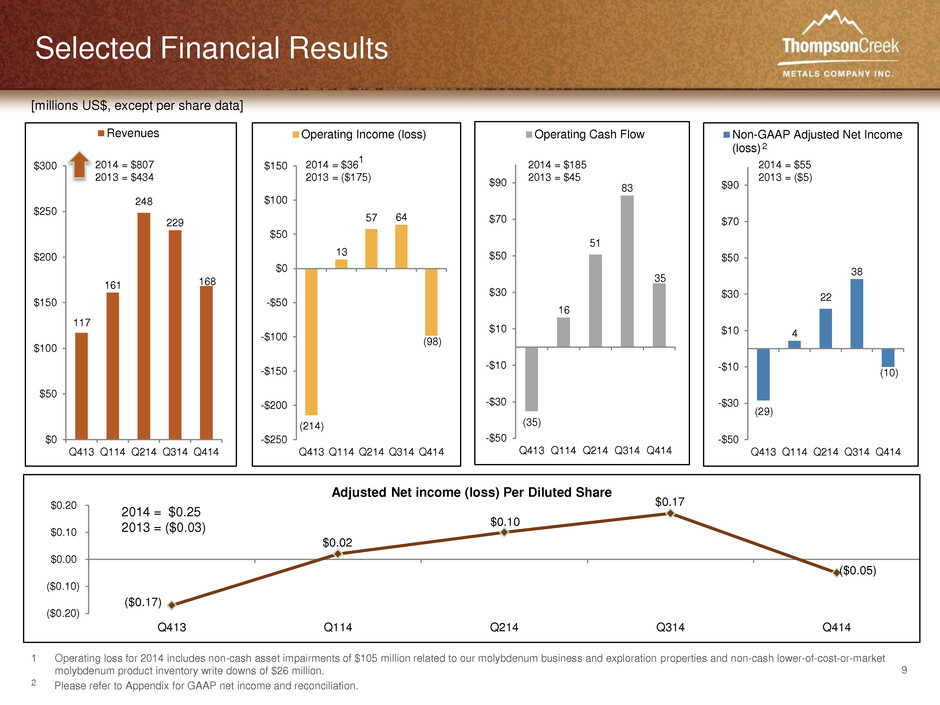

9 Selected Financial Results (29) 4 22 38 (10) -$50 -$30 -$10 $10 $30 $50 $70 $90 Q413 Q114 Q214 Q314 Q414 Non-GAAP Adjusted Net Income (loss) 117 161 248 229 168 $0 $50 $100 $150 $200 $250 $300 Q413 Q114 Q214 Q314 Q414 Revenues (214) 13 57 64 (98) -$250 -$200 -$150 -$100 -$50 $0 $50 $100 $150 Q413 Q114 Q214 Q314 Q414 Operating Income (loss) (35) 16 51 83 35 -$50 -$30 -$10 $10 $30 $50 $70 $90 Q413 Q114 Q214 Q314 Q414 Operating Cash Flow 2014 = $807 2013 = $434 2014 = $36 2013 = ($175) 2014 = $185 2013 = $45 2014 = $55 2013 = ($5) [millions US$, except per share data] 2 1 Operating loss for 2014 includes non-cash asset impairments of $105 million related to our molybdenum business and exploration properties and non-cash lower-of-cost-or-market molybdenum product inventory write downs of $26 million. 2 Please refer to Appendix for GAAP net income and reconciliation. ($0.17) $0.02 $0.10 $0.17 ($0.05) ($0.20) ($0.10) $0.00 $0.10 $0.20 Q413 Q114 Q214 Q314 Q414 Adjusted Net income (loss) Per Diluted Share 1 2014 = $0.25 2013 = ($0.03)

10 Financial Summary Non-GAAP Adjusted EBITDA1 31 32 7 (4) 39 91 91 31 Q113 Q213 Q313 Q413 Q114 Q214 Q314 Q414 [millions of US$] 1 Please refer to Appendix for non-GAAP reconciliation. 2014 = $252 2013 = $66

11 2013 2014 Cash Flow from Operations 44.8 184.8 Cash (used) in Investing Activities (449.1) (93.9) Cash (used) in Financing Activities 110.8 (55.8) Effect of Exchange Rate Changes on Cash 0.6 (3.4) Increase (Decrease) in Cash and Cash Equivalents (292.9) 31.7 Cash and Cash Equivalents, beginning of period 526.8 233.9 Cash and Cash Equivalents, end of period 233.9 265.6 Summary of Statement of Cash Flows [millions of US$]

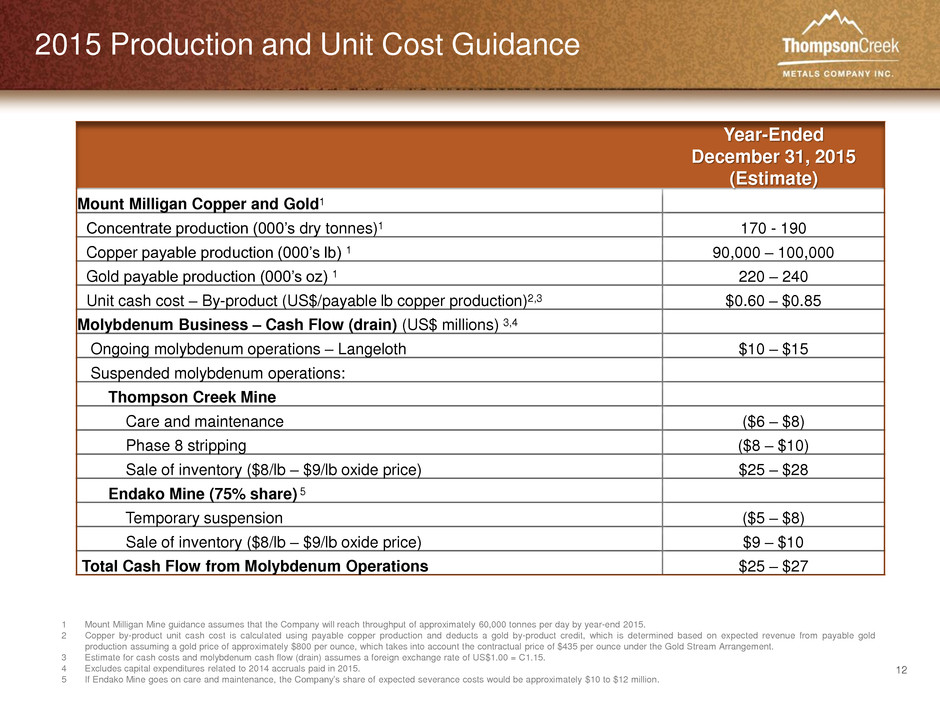

12 2015 Production and Unit Cost Guidance Year-Ended December 31, 2015 (Estimate) Mount Milligan Copper and Gold1 Concentrate production (000’s dry tonnes)1 170 - 190 Copper payable production (000’s lb) 1 90,000 – 100,000 Gold payable production (000’s oz) 1 220 – 240 Unit cash cost – By-product (US$/payable lb copper production)2,3 $0.60 – $0.85 Molybdenum Business – Cash Flow (drain) (US$ millions) 3,4 Ongoing molybdenum operations – Langeloth $10 – $15 Suspended molybdenum operations: Thompson Creek Mine Care and maintenance ($6 – $8) Phase 8 stripping ($8 – $10) Sale of inventory ($8/lb – $9/lb oxide price) $25 – $28 Endako Mine (75% share) 5 Temporary suspension ($5 – $8) Sale of inventory ($8/lb – $9/lb oxide price) $9 – $10 Total Cash Flow from Molybdenum Operations $25 – $27 1 Mount Milligan Mine guidance assumes that the Company will reach throughput of approximately 60,000 tonnes per day by year-end 2015. 2 Copper by-product unit cash cost is calculated using payable copper production and deducts a gold by-product credit, which is determined based on expected revenue from payable gold production assuming a gold price of approximately $800 per ounce, which takes into account the contractual price of $435 per ounce under the Gold Stream Arrangement. 3 Estimate for cash costs and molybdenum cash flow (drain) assumes a foreign exchange rate of US$1.00 = C1.15. 4 Excludes capital expenditures related to 2014 accruals paid in 2015. 5 If Endako Mine goes on care and maintenance, the Company’s share of expected severance costs would be approximately $10 to $12 million.

13 2015 Capital Expenditure Guidance Year-Ended December 31, 2015 (Estimate) Capital Expenditures (US$ in millions) 1, 2 Mount Milligan operations $22 +/- 10% Mount Milligan tailings dam $24 +/- 10% Mount Milligan secondary crusher $15 +/- 10% Langeloth and other $7 +/- 10% Total Cash Capital Expenditures $68 +/- 10% 1 Estimates for cash capital expenditures assume a foreign exchange rate of US$1.00 = C$1.15. 2 Excludes cash capital expenditures related to 2014 accruals paid in 2015.

14 2015 EBITDA Estimates at Various Copper Prices Average Estimated EBITDA1, 2 (in US$ millions) ($1,200/oz Gold and $9/lb Molybdenum Oxide) $130 $160 $180 $200 $0 $50 $100 $150 $200 $250 Cu $2.50/lb Cu $2.80/lb Cu $3.00/lb Cu $3.20/lb 1 EBITDA estimates were assumed to be at the mid-point of guidance, utilizing foreign exchange rate of US$1.00 = C$1.15, and assumes all production for 2015 is sold. EBITDA estimates include approximately $40 million of 2014 inventory expenses related to molybdenum inventory sold in 2015, which is net of third party molybdenum purchases and sales. EBITDA equals operating income excluding the deferred revenue from the Gold Stream Arrangement, depreciation, depletion and amortization, accretion expense and any asset impairments. Does not include any additional severance costs for Endako Mine. 2 EBITDA estimates in (1) above, were updated utilizing a foreign exchange rate of US$1.00 = C$1.25 $150 $180 $200 $220 Exchange Rate US$1.00 = C$1.15 Exchange Rate US$1.00 = C$1.25

15 EBITDA Sensitivities 2015 Estimate US$ millions, Except % Pricing Sensitivity Copper (Cu): + / - $0.10/lb $10 Gold (Au): + / - $50/oz $5.5 FX Sensitivity CAD denominated operating costs at Mount Milligan 90% Per $0.01 + / - C$ to US$ $2.0 Diesel Per $0.10 + / - diesel prices per liter $0.5

16 Hedging Quantity Sell Price Buy Price Maturities Through Forward Copper Sales (lb) 5,512,000 $3.05-$3.19 TBD Feb 2015-May 2015 Quantity Put Price Call Price Maturities Through Gold Collars (oz) 26,500 $1,150- $1,200 $1,237 - $1,360 Feb 2015-Dec 2015 Copper Collars (lb) 19,842,000 $2.00 $2.99 Apr 2015 – Dec 2015

17 Mark Wilson Executive Vice President and Chief Commercial Officer Sales Summary and Market Commentary

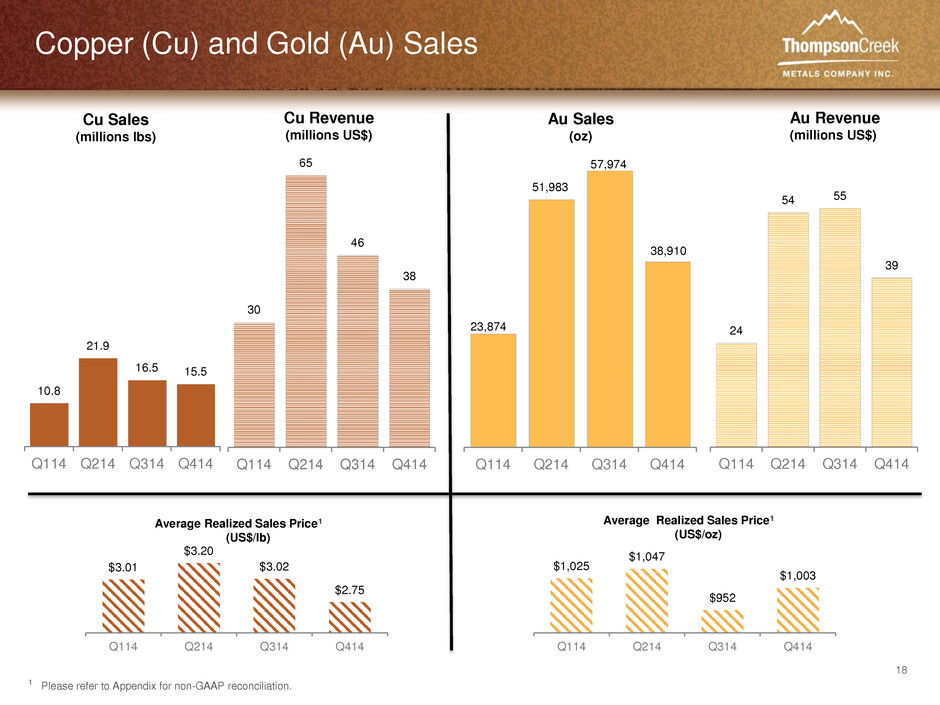

18 Copper (Cu) and Gold (Au) Sales 1 Please refer to Appendix for non-GAAP reconciliation. 10.8 21.9 16.5 15.5 Q114 Q214 Q314 Q414 Cu Sales (millions lbs) Average Realized Sales Price1 (US$/lb) 38,910 Q114 Q214 Q314 Q414 57,974 Au Sales (oz) Average Realized Sales Price1 (US$/oz) 51,983 23,874 30 65 46 38 Q114 Q214 Q314 Q414 24 54 55 39 Q114 Q214 Q314 Q414 $1,025 $1,047 $952 $1,003 Q114 Q214 Q314 Q414 Cu Revenue (millions US$) Au Revenue (millions US$) $3.01 $3.20 $3.02 $2.75 Q114 Q214 Q314 Q414

19 Molybdenum Sales by Quarter Full Year 2013 – 2014 Sales [US$ in millions] Mo Sales Volumes [millions of pounds] $104.7 $112.7 $85.7 $97.7 $102.9 $126.3 $124.3 $87.7 8.8 9.7 8.3 9.7 9.8 9.7 8.9 8.1 Avg Realized Mo Price/Lb. $13.03 $10.45 $10.11 $10.30 $11.60 Q213 Q313 Q413 Q114 Q214 Q314 $11.87 Q113 $13.94 Q414 $10.79

20 Copper and Gold Market Commentary Copper The anticipated 2014 surplus did not materialize to the extent anticipated due to continued project delays Commodity price correction followed the oil surplus supply shock Near term pricing remains hindered by concerns for China demand growth, a building supply surplus and strong US Dollar Market fundamentals remain strong in –mid-term Gold Currency markets and Central Banks play principal role in gold pricing Quantitative easing in Europe helping to support pricing

21 Molybdenum Market Commentary Amidst surplus in supply molybdenum market hit with falling demand from oil and gas sector European steel demand remains soft US industrial demand flat other than automotive sector Pricing to challenge levels not seen since March 2004

22 Operations Review Jacques Perron President, Chief Executive Officer and Director

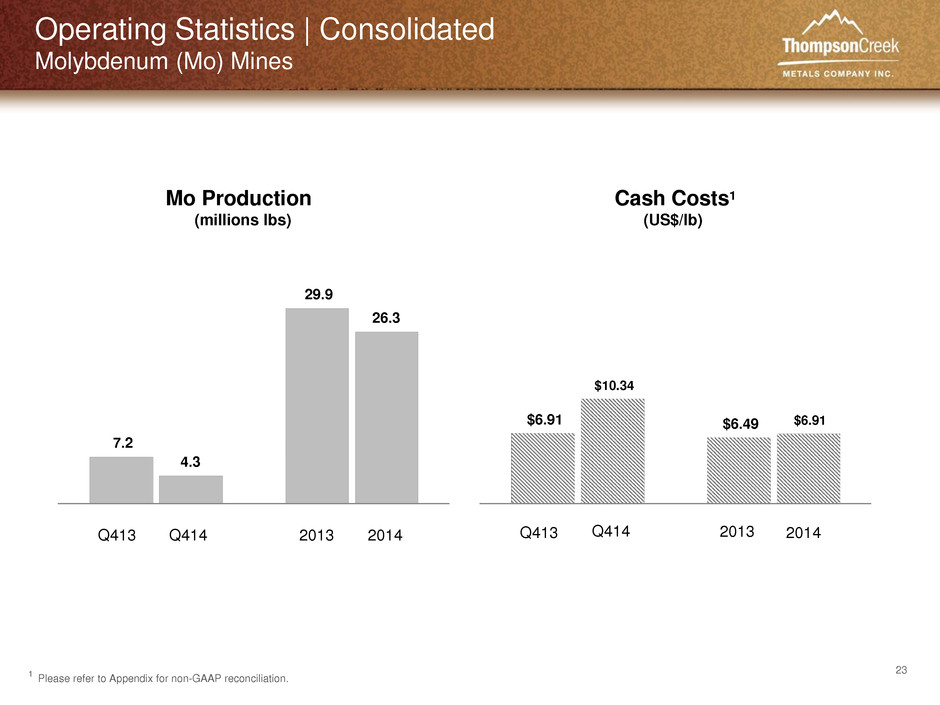

23 Operating Statistics | Consolidated Molybdenum (Mo) Mines 7.2 29.9 4.3 26.3 $6.91 $6.49 $10.34 $6.91 1 Please refer to Appendix for non-GAAP reconciliation. Q413 Q414 2013 2014 Q413 Q414 2013 2014 Mo Production (millions lbs) Cash Costs1 (US$/lb)

24 Operating Statistics | Thompson Creek Mine Molybdenum (Mo) Mines 4.8 20.9 2.5 17.4 $4.69 $4.57 $6.52 $4.44 1 Please refer to Appendix for non-GAAP reconciliation. Q413 Q414 2013 2014 Q413 Q414 2013 2014 Mo Production (millions lbs) Cash Costs1 (US $/lb)

25 Operating Statistics | Endako Mine Molybdenum (Mo) Mines 2.4 9.1 1.8 8.9 $11.44 $10.93 $15.73 $11.72 1 Please refer to Appendix for non-GAAP reconciliation. Q413 Q414 2013 2014 Q413 Q414 2013 2014 Mo Production (75%) (millions lbs) Cash Costs1 (US $/lb)

26 Operating Statistics | 2014 Copper (Cu) 1 Please refer to Appendix for non-GAAP reconciliation. 9.4 14.2 16.0 16.3 18.0 2.8 10.8 21.9 16.5 15.5 0.0 5.0 10.0 15.0 20.0 25.0 Q413 Q114 Q214 Q314 Q414 Cu-Payable Production (millions lbs) Cu-Sales (millions lbs) $7.33 $2.48 $0.33 $0.77 $1.16 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 Q413 Q114 Q214 Q314 Q414 Cu-Cash cost ($/payable lb produced) By-Product 2014 Production = 64,569 2014 Sales = 64,692 2014 Cash Cost = $1.15 1

27 Operating Statistics | 2014 Gold (Au) 1 Please refer to Appendix for non-GAAP reconciliation. 17,952 39,243 37,030 60,366 40,967 5,541 23,874 51,983 57,974 38,910 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 Q413 Q114 Q214 Q314 Q414 Au-Payable Production (oz) Au-Sales (oz) $1,385 $606 $538 $477 $506 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 Q413 Q114 Q214 Q314 Q414 Au-Cash cost ($/payable oz produced) Co-Product 2014 Production = 177,606 2014 Sales = 172,741 2014 Cash Cost = $525 1

28 Mount Milligan Ramp-up 19,409 33,279 38,970 40,445 43,781 0 10,000 20,000 30,000 40,000 50,000 60,000 Q413 Q114 Q214 Q314 Q414 Mill Throughput Design 60,000 tpd 1,246 1,821 1,959 1,958 2,002 1 0 500 1,000 1,500 2,000 2,500 Q413 Q114 Q214 Q314 Q414 1 Previously reported as 2,012. 64.9% 84.3% 89.4% 88.7% 91.1% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Q413 Q114 Q214 Q314 Q414 Hourly Throughput Design 2,715 tpoh Mill Availability Design 92%

29 Mount Milligan Ramp-up Comparison Tonnes per Day 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 0-A 2-O 4-D 6-F 8-A 10-J 12-A 14-O 16-D 18-F 20-A 22-J 24-A 26-O 28-D DMTP D Months Mount Milligan Ramp-up Comparison - Design, 60,000 tpd Actual McNulty Top 1/3

30 Mount Milligan Ramp-up Comparison Tonnes per Hour and Availability 0 500 1,000 1,500 2,000 2,500 3,000 0-A 2-O 4-D 6-F 8-A 10-J 12-A 14-O 16-D 18-F 20-A 22-J 24-A 26-O 28-D DMTPO H Months Mount Milligan Ramp-up Comparison - Design, 2,715 tpoh Actual McNulty Top 1/3 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0-A 2-O 4-D 6-F 8-A 10-J 12-A 14-O 16-D 18-F 20-A 22-J 24-A 26-O 28-D R u n ti me , % o f 24 h o u r d a y Months Mount Milligan Ramp-up Comparison - Design, 92% Availability Actual McNulty Top 1/3

31 Mount Milligan Ramp-up Comparison Recovery 1 Average Cu recovery years 1-5 is 85%. Life of mine Cu recovery is 84%. 2 Average Au recovery years 1-5 is 73%. Life of mine Au recovery is 73%. 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0-A 2-O 4-D 6-F 8-A 10-J 12-A 14-O 16-D 18-F 20-A 22-J 24-A 26-O 28-D C o p p e r Reco v e ry Months Mount Milligan Ramp-up Comparison - Design, 85% Cu Recovery 1 Actual McNulty Top 1/3 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0-A 2-O 4-D 6-F 8-A 10-J 12-A 14-O 16-D 18-F 20-A 22-J 24-A 26-O 28-D G o ld R ec o v e ry Months Mount Milligan Ramp-up Comparison - Design, 73% Au Recovery 2 Actual McNulty Top 1/3

32 Mount Milligan Secondary Crushing Circuit Management has determined that additional crushing capacity is necessary to reach 60,000 tpd on a consistent basis Due to current metal prices, construction of a secondary crushing circuit will not commence until market conditions improve During 2015, detailed engineering phase is expected to be completed and commitments are expected to be made for the long lead items Temporary crushing will be utilized during 2015 and management expects to reach throughput of approximately 60,000 tpd by year-end 2015 Once the secondary crushing circuit is installed and commissioned, design mill throughput is expected to increase to 62,500 tpd

33 Jacques Perron President, Chief Executive Officer and Director Closing Remarks

34 Key Messages Ended the year with approximately $266 million of cash Mount Milligan’s operating costs are positively impacted by current Canadian exchange rate; 90% of costs are in C$ 2015 production and unit cash cost guidance Unit cash cost of $0.60 to $0.85 per pound on a by-product basis, making Mount Milligan one of the world’s lowest-cost copper producers on a by- product basis 90 to 100 million pounds of copper 220,000 to 240,000 ounces of gold Secondary crushing circuit to be constructed at Mount Milligan once market conditions improve; with the utilization of temporary crusher we expect to reach 60,000 tpd by year-end 2015

35 Key Messages (continued) Current business strategy: Conduct our operations safely and in an environmentally responsible manner Achieve design recoveries and mill throughput at Mount Milligan Mine by the end of 2015, while containing costs Transition Langeloth into one of the largest third party molybdenum conversion plants in the world, which is expected to contribute to positive cash flow from our molybdenum business in 2015 Maintain the optionality of our molybdenum business Improve our balance sheet and our competitive position in the industry

36 NYSE:TC TSX:TCM Thompson Creek Metals Company www.thompsoncreekmetals.com Pamela Solly Director, Investor Relations and Corporate Responsibility Phone (303) 762-3526 Email psolly@tcrk.com

37 Appendix

38 Non-GAAP EBITDA Reconciliation Q414 Q314 Q214 Q114 Q413 Q313 Q213 Q113 Net income (loss) (135.6) (11.1) 61.6 (39.1) (210.5) 13.8 (19.2) 0.9 (Interest income)/expense 20.7 22.5 23.7 23.5 23.1 0.3 (0.2) (0.1) Tax expense (benefit) (16.4) (4.8) 14.5 (15.0) (66.4) 4.2 2.0 (3.2) DD&A 1 21.6 22.7 33.0 22.6 13.4 11.6 14.2 12.7 Accretion 0.9 0.9 0.9 0.9 0.4 0.6 0.6 0.8 Asset impairments 104.8 - - - 194.9 0.8 - - (Gain) loss on foreign exchange 35.3 60.3 (42.3) 46.5 40.8 (24.2) 34.8 19.4 Non-GAAP EBITDA 31.3 90.5 91.4 39.4 (4.3) 7.1 32.2 30.5 1 Certain prior year reclassifications were made to DD&A to conform with current year presentation. (US$ in million)

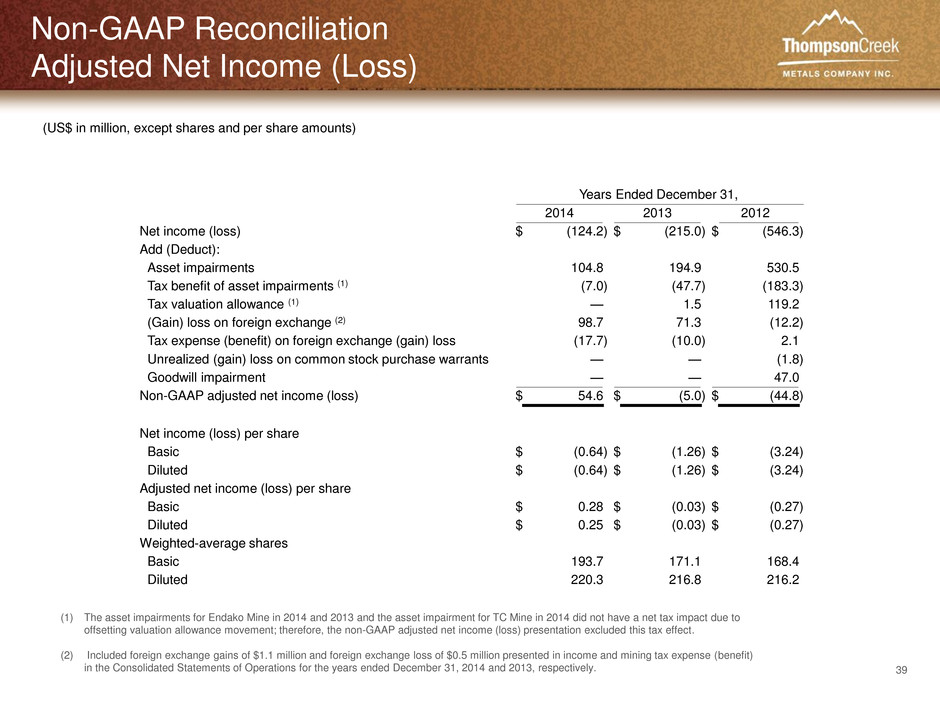

39 Non-GAAP Reconciliation Adjusted Net Income (Loss) (US$ in million, except shares and per share amounts) Years Ended December 31, 2014 2013 2012 Net income (loss) $ (124.2 ) $ (215.0 ) $ (546.3 ) Add (Deduct): Asset impairments 104.8 194.9 530.5 Tax benefit of asset impairments (1) (7.0 ) (47.7 ) (183.3 ) Tax valuation allowance (1) — 1.5 119.2 (Gain) loss on foreign exchange (2) 98.7 71.3 (12.2 ) Tax expense (benefit) on foreign exchange (gain) loss (17.7 ) (10.0 ) 2.1 Unrealized (gain) loss on common stock purchase warrants — — (1.8 ) Goodwill impairment — — 47.0 Non-GAAP adjusted net income (loss) $ 54.6 $ (5.0 ) $ (44.8 ) Net income (loss) per share Basic $ (0.64 ) $ (1.26 ) $ (3.24 ) Diluted $ (0.64 ) $ (1.26 ) $ (3.24 ) Adjusted net income (loss) per share Basic $ 0.28 $ (0.03 ) $ (0.27 ) Diluted $ 0.25 $ (0.03 ) $ (0.27 ) Weighted-average shares Basic 193.7 171.1 168.4 Diluted 220.3 216.8 216.2 (1) The asset impairments for Endako Mine in 2014 and 2013 and the asset impairment for TC Mine in 2014 did not have a net tax impact due to offsetting valuation allowance movement; therefore, the non-GAAP adjusted net income (loss) presentation excluded this tax effect. (2) Included foreign exchange gains of $1.1 million and foreign exchange loss of $0.5 million presented in income and mining tax expense (benefit) in the Consolidated Statements of Operations for the years ended December 31, 2014 and 2013, respectively.

40 Non-GAAP Reconciliation Adjusted Net Income (Loss) (US$ in million, except shares and per share amounts)

41 Non-GAAP Reconciliation Copper-Gold Operations Non-GAAP Cash Cost (US$ in millions) Non-GAAP Cash Cost Three Months Ended December 31, Years Ended December 31, (US$ in millions) 2014 2013 2014 2013 Direct mining costs (1) $ 45.2 $ 71.5 $ 183.4 $ 83.3 Truck and rail transportation and warehousing costs 3.3 0.6 13.3 0.6 Costs reflected in inventory and operations costs $ 48.5 $ 72.1 $ 196.7 $ 83.9 Refining and treatment costs 4.6 0.5 17.5 0.5 Ocean freight and insurance costs 1.5 0.8 6.1 0.8 Direct costs reflected in revenue and selling and marketing costs $ 6.1 $ 1.3 $ 23.6 $ 1.3 Non-GAAP cash costs $ 54.6 $ 73.4 $ 220.3 $ 85.2 Reconciliation to amounts reported (US$ in millions) Direct costs $ (6.1 ) $ (1.3 ) $ (23.6 ) $ (1.3 ) Changes in inventory (6.2 ) (21.2 ) 7.8 (33.1 ) Silver by-product credits (2) (0.9 ) (0.2 ) (4.3 ) (0.2 ) Non cash costs and other — (7.1 ) 1.1 (7.0 ) Copper-Gold segment US GAAP operating expenses $ 41.4 $ 43.6 $ 201.3 $ 43.6 (1) Mining, milling and on-site general and administration costs. Mining includes all stripping costs, but excludes costs capitalized related to the construction of the tailings dam. Stripping costs that provide access to mineral reserves that will be produced in future periods are expensed as incurred under US GAAP. (2) Silver sales are reflected as a credit to operating costs.

42 By-Product (US$ in millions, except pounds and per pound amounts) Non-GAAP Reconciliation Copper-Gold Operations By-Product Unit Cost Per Pound Produced (1) Excluded refining and treatment charges. (2) Silver sales are reflected as a credit to operating costs. Three Months Ended December 31, Years Ended December 31, (US$ in millions, except pounds and per pound amounts) 2014 2013 2014 2013 Copper payable production (000's lbs) 18,024 9,350 64,569 10,362 Non-GAAP cash cost $ 54.6 $ 73.4 $ 220.3 $ 85.2 Gold sales (1) $ 39.0 $ 5.6 $ 173.1 $ 5.6 Less: gold sales related to deferred portion of Gold Stream Arrangement (6.3 ) (1.0 ) (31.2 ) (1.0 ) Net gold by-product credits $ 32.7 $ 4.6 $ 141.9 $ 4.6 Silver by-product credits (2) 0.9 0.2 4.3 0.2 Total by-product credits $ 33.6 $ 4.8 $ 146.2 $ 4.8 Non-GAAP cash cost net of by-product credits $ 21.0 $ 68.6 $ 74.1 $ 80.4 Non-GAAP unit cash cost $ 1.16 $ 7.33 $ 1.15 $ 7.76

43 Co- Product (US$ in millions, except pounds, ounces and per unit amounts) Non-GAAP Reconciliation Copper-Gold Operations Co-Product Costs (1) Gold has been converted from payable ounces to thousands of copper equivalent pounds by using the gold production for the periods presented, using a gold price of $829 and $901 per ounce for the years ended December 31, 2014 and 2103, respectively (adjusted for the Royal Gold price of $435 per ounce) and a copper price of $3.10 and $3.32 per pound for the years ended December 31, 2014 and 2013, respectively. Three Months Ended December 31, Years Ended December 31, (US$ in millions, except pounds, ounces and per unit amounts) 2014 2013 2014 2013 Copper payable production (000’s lbs) 18,024 9,350 64,569 10,362 Gold payable production in Cu eq. (000’s lbs) (1) 10,954 5,006 47,495 5,529 Payable production (000’s lbs) 28,978 14,356 112,064 15,891 Non-GAAP cash cost allocated to Copper $ 34.0 $ 47.8 $ 126.9 $ 55.5 Non-GAAP unit cash cost $ 1.88 $ 5.2 $ 1.97 $ 5.4 Non-GAAP cash cost allocated to Gold $ 20.6 $ 25.6 $ 93.4 $ 29.7 Gold payable production (ounces) 40,967 17,952 177,606 19,879 Non-GAAP unit cash cost $ 506 $ 1,385 $ 525 $ 1,468

44 Average Realized Sales Prices Non-GAAP Reconciliation Copper-Gold Operations Average Realized Sales Prices Three Months Ended December 31, Years Ended December 31, 2014 2013 2014 2013 Average realized sales price for Copper Payable pounds of copper sold (000's lb) 15,478 2,801 64,692 2,801 Copper sales, net $ 38.2 $ 8.7 $ 178.4 $ 8.7 Refining and treatment costs 4.4 0.5 16.7 0.5 Copper sales, gross $ 42.6 $ 9.2 $ 195.1 $ 9.2 Average realized sales price per payable pound for sold 1 $ 2.75 $ 3.29 $ 3.02 $ 3.29 Average realized sales price for Gold Payable ounces of gold sold under the Gold Stream Arrangement 20,217 2,845 89,546 2,845 TCM share of payable ounces of gold sold to MTM Customers 18,692 2,696 83,194 2,696 Payable ounces of gold sold 38,909 5,541 172,740 5,541 Gold sales related to cash portion of Gold Stream Arrangement $ 8.8 $ 1.3 $ 39.0 $ 1.3 Gold sales related to deferred portion of Gold Stream Arrangement 6.3 1.0 31.2 1.0 Gold sales under Gold Stream Arrangement 15.1 2.3 70.2 2.3 TCM share of gold sales to MTM Customers 23.7 3.3 102.1 3.3 Gold sales, net 38.8 5.6 172.3 5.6 Refining and treatment charges 0.2 — 0.8 — Gold sales, gross $ 39.0 $ 5.6 $ 173.1 $ 5.6 Average realized sales price related to cash portion of Gold Stream Arrangement $ 435 $ 435 $ 435 $ 435 Average realized sales price related to deferred portion of Gold Stream Arrangement $ 312 $ 359 $ 348 $ 359 Average realized sales price per payable ounce sold under Gold Stream Arrangement $ 747 $ 794 $ 783 $ 794 Average realized sales price per payable ounce sold for TCM share 1 $ 1,279 $ 1,234 $ 1,237 $ 1,234 Average realized sales price per payable ounce sold (1) $ 1,002 $ 1,006 $ 1,002 $ 1,006 1 The average realized sales price per payable pound of copper sold and payable ounces of gold sold is impacted by any final volume and pricing adjustments and mark-to-market adjustments for shipments made in prior periods. (US$ in millions, except pounds, ounces and per unit amounts)

45 Molybdenum Operations - Cash Cost per Pound Produced, Weighted-Average Cash Cost per Pound Produced and Average Realized Sales Price per Pound Sold Three Months Ended December 31, 2014 December 31, 2013 Operating Expenses Pounds Produced 1 $/lb Operating Expenses Pounds Produced 1 $/lb TC Mine Cash cost - Non-GAAP $ 16.5 2,532 $ 6.52 $ 22.6 4,826 $ 4.69 Add/(Deduct): Stock-based compensation 0.1 0.2 Inventory and other adjustments 4.7 13.1 US GAAP operating expenses $ 21.3 $ 35.9 Endako Mine Cash cost - Non-GAAP $ 28.3 1,796 $ 15.73 $ 27.1 2,368 $ 11.44 Add/(Deduct): Stock-based compensation 0.1 0.1 Inventory and other adjustments 5.8 (2.8 ) US GAAP operating expenses $ 34.2 $ 24.4 Other operations US GAAP operating expenses 2 $ 31.7 $ 11.7 Molybdenum segments US GAAP operating expenses $ 87.2 $ 72.0 Weighted-average cash cost—Non-GAAP $ 44.8 4,328 $ 10.34 $ 49.7 7,194 $ 6.91 (US$ in millions, except pounds and per pound amounts) Non-GAAP Reconciliation Molybdenum Cash Cost Per Pound Produced 1 Pounds produced are shown in molybdenum oxide and include an estimated loss from our share of the sulfide production from the mines to oxide. They exclude molybdenum processed from purchased product. 2 Other operations represent activities related to the roasting and processing of third-party concentrate and other metals at the Langeloth Facility and exclude product volumes and costs related to the roasting and processing of TC Mine and Endako Mine concentrate. The Langeloth Facility costs associated with roasting and processing of TC Mine and Endako Mine concentrate are included in their respective operating results above.

46 Years Ended December 31, 2014 December 31, 2013 Operating Expenses Pounds Produced 1 $/lb Operating Expenses Pounds Produced 1 $/lb TC Mine Cash cost - Non-GAAP $ 77.1 17,371 $ 4.44 $ 95.5 20,889 $ 4.57 Add/(Deduct): Stock-based compensation 0.7 0.9 Inventory and other adjustments 22.2 29.7 US GAAP operating expenses $ 100.0 $ 126.1 Endako Mine Cash cost - Non-GAAP $ 104.1 8,885 $ 11.72 $ 99.0 9,056 $ 10.93 Add/(Deduct): Stock-based compensation 0.3 0.4 Inventory and other adjustments 10.8 (18.2 ) US GAAP operating expenses $ 115.2 $ 81.2 Other operations US GAAP operating expenses 2 $ 107.3 $ 77.3 Molybdenum segments US GAAP operating expenses $ 322.5 $ 284.6 Weighted-average cash cost—Non- GAAP $ 181.4 26,256 $ 6.91 $ 194.3 29,945 $ 6.49 Molybdenum Operations - Cash Cost per Pound Produced, Weighted-Average Cash Cost per Pound Produced and Average Realized Sales Price per Pound Sold (US$ in millions, except pounds and per pound amounts) 1 Pounds produced are shown in molybdenum oxide and include an estimated loss from our share of the sulfide production from the mines to oxide. They exclude molybdenum processed from purchased product. 2 Other operations represent activities related to the roasting and processing of third-party concentrate and other metals at the Langeloth Facility and exclude product volumes and costs related to the roasting and processing of TC Mine and Endako Mine concentrate. The Langeloth Facility costs associated with roasting and processing of TC Mine and Endako Mine concentrate are included in their respective operating results above. Non-GAAP Reconciliation Molybdenum Cash Cost Per Pound Produced