Attached files

| file | filename |

|---|---|

| 8-K - CINCINNATI BELL INC. 8-K - CINCINNATI BELL INC | a8-kearningsreleaseshellq4.htm |

| EX-99.1 - Q4 2014 EARNINGS RELEASE - CINCINNATI BELL INC | earningsreleaseq42014.htm |

Cincinnati Bell Fourth Quarter 2014 Results February 19, 2015

Today’s Agenda Highlights & Strategic Initiatives Ted Torbeck, President & Chief Executive Officer Financial Overview & Segment Results Leigh Fox, Chief Financial Officer Question & Answer 2

Safe Harbor This presentation and the documents incorporated by reference herein contain forward-looking statements regarding future events and our future results that are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “predicts,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “endeavors,” “strives,” “may,” variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned these forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially and adversely from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this release and those discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on potential risks and uncertainties is available in our recent filings with the SEC, including Cincinnati Bell’s Form 10-K report, Form 10-Q reports and Form 8-K reports. Actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update any forward- looking statements for any reason. 3

Non GAAP Financial Measures This presentation contains information about adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA), Adjusted EBITDA margin, net debt and free cash flow. These are non-GAAP financial measures used by Cincinnati Bell management when evaluating results of operations and cash flow. Management believes these measures also provide users of the financial statements with additional and useful comparisons of current results of operations and cash flows with past and future periods. Non-GAAP financial measures should not be construed as being more important than comparable GAAP measures. Detailed reconciliations of Adjusted EBITDA, net debt and free cash flow (including the Company’s definition of these terms) to comparable GAAP financial measures can be found in the earnings release on our website at www.cincinnatibell.com within the Investor Relations section. 4

Ted Torbeck President & Chief Executive Officer 5

Full Year Highlights Generated Wireline revenue growth for the first time since 2007 ̶ Fioptics annual revenue exceeded $140 million, up more than 40% year-over-year ̶ Wireline strategic revenue totaled $311 million, up 23% over the prior year Completed sale of wireless spectrum licenses – proceeds of $194 million Sold 16 million CyrusOne partnership units for $356 million of cash – proceeds used to repay debt, increasing cash flow $15 million annually Achieved full year financial guidance (excluding Wireless) ̶ Revenue totaled $1.1 billion ̶ Adjusted EBITDA totaled $335 million Produced $12 million positive free cash flow 6

36% 59% 5% ($ in millions) Revenue Growth Trend (excluding Wireless) 7 Integration Legacy Strategic Intercompany Backhaul Revenue ** Recurring revenue excludes hardware * Revenue results are presented net of intercompany 49% 46% 5% 43% 53% 4% Recurring Revenue Trend ** $306 $359 $436 $495 $448 $406 $219 $236 $306 2012 2013 2014 Total Revenue Trend * $1,037 $1,059 $1,162 $17 $16 $14

Wind-down of Wireless Operations Spectrum sale closed on September 30, 2014 for cash proceeds of $194 million Transfer of certain lease liabilities and other assets will occur once we no longer provide wireless service (no later than April 6, 2015) – valued at approximately $25 million Adjusted EBITDA totaled $44 million in 2014 Free cash flow of approximately $35 million in 2014 8

CyrusOne Investment 9 Sold 16 million CyrusOne partnership units for $356 million of cash – proceeds used to repay debt, increasing cash flow $15 million annually CyrusOne continues to produce strong financial results – CyrusOne reported full year results: o Revenue $331 million, up 26% year-over-year o Adjusted EBITDA $169 million, up 22% year-over-year – 2015 guidance targets (at the mid-point of the range) indicate a 14% and 12% growth for Revenue and Adjusted EBITDA, respectively. Announced a 50% increase in the quarterly dividend for the first quarter of 2015 ($0.315 per common share and equivalent) Our strategy has not changed – Patient investor focused on a well-timed and thoughtfully developed monetization strategy to lower our leverage – Remaining 44% ownership valued at approximately $750 million (Dec 31, 2014) – Tax gains from future monetization sheltered by $740 million of tax NOLs

Leigh Fox Chief Financial Officer

($ in millions) Fourth Quarter & Full Year Financial Summary Wireline Wireless IT Services & Hardware Corporate Eliminations 11 74 7 (5) Q4 2014 188 110 17 (7) Q4 2014 Revenue $78 $308 Adjusted EBITDA * 741 433 133 (29) YTD 2014 $1,278 $379 Revenue Adjusted EBITDA * Q4 2014 Wireless Adjusted EBITDA totaled $2 million Total revenue of $1.3 billion in 2014, up 3% from prior year (excluding CyrusOne) Full year operating income totaled $116 million and net income was $76 million, resulting in diluted earnings per share of $31 cents Adjusted EBITDA of $379 million in 2014, down 7% from prior year (excluding CyrusOne) - Winding down wireless operations - Increased costs to accelerate fiber build and streamline operations and shared service functions

$69 $110 $80 Revenue EBITDA Q4 2013 Strategic revenue growth in Q4 2014 offset decline from legacy products ‒ Revenue from Fioptics for Q4 2014 totaled $40 million, up 40% from Q4 2013 ‒ Strategic revenue from business customers totaled $42 million in Q4 2014, up 8% from Q4 2013 Adjusted EBITDA Margin for Q4 2014 was 39% - consistent with expectations ‒ Costs associated with accelerating our fiber investments ‒ Other one-time expenses Access line loss was 9%, up slightly from the prior year ‒ On-going impact of wireless subscriber migration ‒ Increased competitive pressures ($ in millions) Wireline Revenue and Adjusted EBITDA Integration Revenue* Strategic Legacy $182 $188 12 * Integration revenue totaled $3 million in Q4 2013 and $8 million in Q4 2014

74 91 80 114 53 61 Q4 2013 Q4 2014 Total Fioptics Subscribers Video Subs Internet Subs Voice Subs 335K addresses passed with Fioptics - approximately 41% of Greater Cincinnati ‒ 59K new addresses passed in 2014 ‒ 4K addresses overbuilt with FTTH (previously FTTN) in 2014 Fioptics Penetration: ‒ Video – 27% ‒ Internet – 34% ‒ Voice – 18% Fioptics monthly ARPU for the quarter was up approximately 8% from 2013. Q4 2014 ARPUs are as follows: ‒ Video – $79 ‒ Internet – $40 ‒ Voice – $32 Total video churn was 2.8% for the quarter ‒ Single-family churn was 2.4% for Q4 2014 ‒ Apartment churn was 5.0% for Q4 2014 Fioptics Highlights (in thousands) Fioptics subscribers increased on average approximately 30% compared to 2013 ‒ 91K video subs; 3,600 net activations in the quarter ‒ 114K internet subs; 7,000 subs added in the quarter 13

($ in millions) IT Services & Hardware Revenue and Adjusted EBITDA $37 $73 $7 Revenue EBITDA Q4 2014 $32 $54 $5 Revenue EBITDA Q4 2013 Revenue of $110 million for Q4 2014, up 27% from Q4 2013 ‒ Strategic Managed and Professional Services revenue totaled $37 million for Q4 2014, was up 17% from prior year ‒ Telecom & IT Equipment revenue of $71 million for Q4 2014 was up 32% from Q4 2013 Adjusted EBITDA totaled $7 million, up $2 million from Q4 2012 Adjusted EBITDA margin was 6%, consistent with last year Integration Revenue Strategic Revenue $86 $110 14

($ in millions) Free Cash Flow Q4 2014 YTD Adjusted EBITDA 78$ 379$ Interest Payments (42) (153) Capital Expenditures (61) (182) Pension and OPEB Payments (4) (31) Dividends from CyrusOne 6 28 Working Capital and Other 23 (29) Free Cash Flow (0)$ 12$ 15 Certain 2015 Free Cash Flow Items Interest payments ~ $120 million Pension and OPEB payments ~ $30 million CyrusOne dividends ~ $33 million Capital Expenditures: $270 - $280 million

Q4 2014 YTD Low High Construction 19$ 50$ 80$ 85$ Installation 7 24 40 40 Value added 11 19 40 40 Strategic Fioptics 37$ 93$ 160$ 165$ Other Strategic 10 37 50 55 Total Strategic Investment 47 130 210 220 Maintenance 14 46 60 60 Wireless - 6 - - 61$ 182$ 270$ 280$ 2015 2014 Capital Expenditures and Full Year 2015 Invested $50 million for the construction of Fioptics in 2014: ̶ Passed 59,000 customer locations ̶ Available to more than 40% of Greater Cincinnati Plan to pass 100,000 homes with Fioptics in 2015: ̶ Fioptics expansion to cost between $80 and $85 million in 2015 ̶ Extends our coverage to approximately 55% of Greater Cincinnati ̶ Core network upgrades expected to be approximately $40 million in 2015 (benefits both residential and business customers) Other strategic includes small cell deployment 16 ($ in millions)

2015 Guidance 2015 Guidance Revenue $ 1.1 billion Adjusted EBITDA $297 million* * Plus or minus 2 percent 17

2015 Adjusted EBITDA Guidance ($ in millions) Growth in strategic revenue products continues to stabilize Adjusted EBITDA Year over year decline in Adjusted EBITDA due primarily to: ‒ Wireless costs absorbed by the remaining core business ‒ Costs associated with Fioptics acceleration ‒ Forecasted decline in hardware sales 18

Appendix

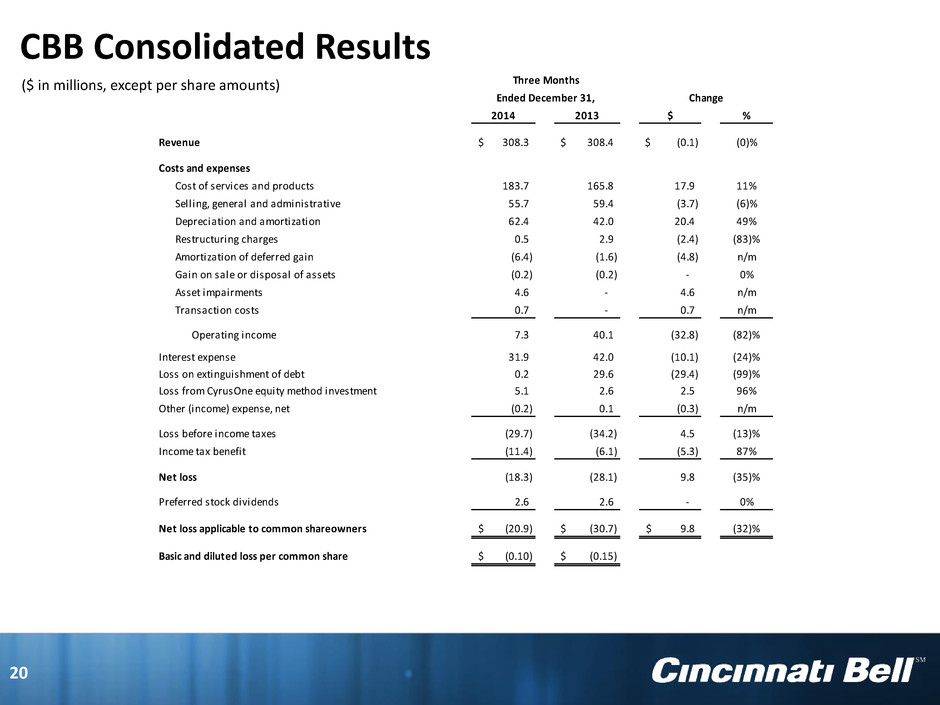

2014 2013 $ % Revenue 308.3$ 308.4$ (0.1)$ (0)% Costs and expenses Cost of services and products 183.7 165.8 17.9 11% Selling, general and administrative 55.7 59.4 (3.7) (6)% Depreciation and amortization 62.4 42.0 20.4 49% Restructuring charges 0.5 2.9 (2.4) (83)% Amortization of deferred gain (6.4) (1.6) (4.8) n/m Gain on sale or disposal of assets (0.2) (0.2) - 0% Asset impairments 4.6 - 4.6 n/m Transaction costs 0.7 - 0.7 n/m Operating income 7.3 40.1 (32.8) (82)% Interest expense 31.9 42.0 (10.1) (24)% Loss on extinguishment of debt 0.2 29.6 (29.4) (99)% Loss from CyrusOne equity method investment 5.1 2.6 2.5 96% Other (income) expense, net (0.2) 0.1 (0.3) n/m Loss before income taxes (29.7) (34.2) 4.5 (13)% Income tax benefit (11.4) (6.1) (5.3) 87% Net loss (18.3) (28.1) 9.8 (35)% Preferred stock dividends 2.6 2.6 - 0% Net loss applicable to common shareowners (20.9)$ (30.7)$ 9.8$ (32)% Basic and diluted loss per common share (0.10)$ (0.15)$ Three Months Ended December 31, Change CBB Consolidated Results 20 ($ in millions, except per share amounts)

CBB Consolidated Results 2014 2013 $ % Revenue 1,278.2$ 1,256.9$ 21.3$ 2% Costs and expenses Cost of services and products 699.1 646.3 52.8 8% Selling, general and administrative 223.1 220.8 2.3 1% Depreciation and amortization 231.0 169.6 61.4 36% Restructuring charges 15.9 13.7 2.2 16% Transaction-related compensation - 42.6 (42.6) n/m Amortization of deferred gain (22.9) (3.3) (19.6) n/m Curtailment gain - (0.6) 0.6 n/m (Gain) loss on sale or disposal of assets (0.3) 2.4 (2.7) n/m Asset impairments 12.1 - 12.1 n/m Transaction costs 4.4 1.6 2.8 n/m Operating income 115.8 163.8 (48.0) (29)% Interest expense 148.7 182.0 (33.3) (18)% Loss on extinguishment of debt 19.6 29.6 (10.0) (34)% Loss from CyrusOne equity method investment 7.0 10.7 (3.7) (35)% Gain on sale of CyrusOne equity method investment (192.8) - (192.8) n/m Other expense (income), net 0.3 (1.3) 1.6 n/m Income (loss) before income taxes 133.0 (57.2) 190.2 n/m Income tax (benefit) expense 57.4 (2.5) 59.9 n/m Net Income (loss) 75.6 (54.7) 130.3 n/m Preferred stock dividends 10.4 10.4 - 0% Net income (loss) applicable to common shareowners 65.2$ (65.1)$ 130.3$ n/m Basic and diluted (loss) earnings per common share 0.31$ (0.32)$ Twelve Months Ended December 31, Change Results for 2013 only include CyrusOne's results through January 23, 2013. Effective January 24, 2013, the completion date of CyrusOne's IPO, the Company accounts for CyrusOne as an equity method investment, and therefore does not consolidate the CyrusOne results of operations in the total company or segment results. 21 ($ in millions, except per share amounts)

Revenue Classifications Voice STRATEGIC LEGACY INTEGRATION Fioptics Voice Switched Access Digital Trunking Data Fioptics Internet DWDM DSL (> 10 meg) Metro-Ethernet Dedicated Internet DSL (< 10 meg) Dial up Internet TDM DSO, DS1, DS3 Long Distance/ VoIP VoIP Private Line MPLS Audio Conferencing Managed/ Professional Services Managed Services - Monitoring/Management - Data Storage - Data Security - Virtual Data Center Professional Services - Staff Augmentation - IT Consulting Telecom & IT Equipment Hardware Installation Maintenance Maintenance Information Services Long Distance Entertainment Fioptics Video 22

Wireline IT S&H Wireless Total Eliminations Total Strategic Data 39.7$ -$ -$ Voice - local service 5.5 - - Long distance and VoIP 15.1 - - Entertainment 21.0 - - Other 1.2 - - Managed & Professional Services - 37.0 - Hardware - - - Total Strategic 82.5 37.0 - 119.5 (3.2) 116.3 Legacy Data 43.9$ -$ -$ Voice - local service 41.8 - - Long distance and VoIP 11.1 - - Entertainment - - - Other 1.0 - - Managed & Professional Services - - - Hardware - - - Total Legacy 97.8 - - 97.8 (1.8) 96.0 Integration Data -$ -$ -$ Voice - local service 1.6 - - Long distance and VoIP 0.5 - - Entertainment 0.1 - - Other 5.9 - - Managed & Professional Services - 1.8 - Hardware - 70.7 - Total Integration 8.1 72.5 - 80.6 (1.2) 79.4 Wireless - - 16.8 16.8 (0.2) 16.6 Total Revenue 188.4$ 109.5$ 16.8$ 314.7$ (6.4)$ 308.3$ Eliminations 3.6 2.6 0.2 6.4 184.8$ 106.9$ 16.6$ 308.3$ Q4 2014 Revenue – MD&A Q4 2014 Strategic, Legacy and Integration 23 ($ in millions)

Wireline IT S&H Wireless Total Eliminations Total Strategic Data 33.7$ -$ -$ Voice - local service 4.8 - - Long distance and VoIP 13.3 - - Entertainment 15.8 - - Other 1.6 - - Managed & Professional Services - 31.5 - Hardware - - - Total Strategic 69.2 31.5 - 100.7 (3.4) 97.3 Legacy Data 47.2$ -$ -$ Voice - local service 48.3 - - Long distance and VoIP 12.7 - - Entertainment - - - Other 1.9 - - Managed & Professional Services - - - Hardware - - - Total Legacy 110.1 - - 110.1 (2.7) 107.4 Integration Data -$ -$ -$ Voice - local service 1.6 - - Long distance and VoIP 0.7 - - Entertainment - - - Other 0.5 - - Managed & Professional Services - 1.2 - Hardware - 53.4 - Total Integration 2.8 54.6 - 57.4 (0.5) 56.9 Wireless - - 47.4 47.4 (0.6) 46.8 Total Revenue 182.1$ 86.1$ 47.4$ 315.6$ (7.2)$ 308.4$ Eliminations 4.0 2.6 0.6 7.2 178.1$ 83.5$ 46.8$ 308.4$ Q4 2013 24 Revenue – MD&A Q4 2013 Strategic, Legacy and Integration ($ in millions)

Wireline IT S&H Wireless Total Eliminations Total Strategic Data 151.1$ -$ -$ Voice - local service 21.0 - - Long distance and VoIP 58.1 - - Entertainment 75.5 - - Other 4.8 - - Managed & Professional Services - 138.7 - Hardware - - - Total Strategic 310.5 138.7 - 449.2 (13.6) 435.6 Legacy Data 183.8$ -$ -$ Voice - local service 175.8 - - Long distance and VoIP 47.0 - - Entertainment - - - Other 7.7 - - Managed & Professional Services - - - Hardware - - - Total Legacy 414.3 - - 414.3 (8.3) 406.0 Integration Data -$ -$ -$ Voice - local service 6.7 - - Long distance and VoIP 2.2 - - Entertainment 0.5 - - Other 6.5 - - Managed & Professional Services - 6.6 - Hardware - 287.7 - Total Integration 15.9 294.3 - 310.2 (4.7) 305.5 Wireless - - 132.8 132.8 (1.7) 131.1 Total Revenue 740.7$ 433.0$ 132.8$ 1,306.5$ (28.3)$ 1,278.2$ Eliminations 15.6 11.0 1.7 28.3 725.1$ 422.0$ 131.1$ 1,278.2$ YTD Q4 2014 25 Revenue – MD&A YTD 2014 Strategic, Legacy and Integration ($ in millions)

Wireline IT S&H Wireless Total Eliminations Total Strategic Data 122.1$ -$ -$ Voice - local service 17.9 - - Long distance and VoIP 51.1 - - Entertainment 54.8 - - Other 6.7 - - Managed & Professional Services - 118.1 - Hardware - - - Total Strategic 252.6 118.1 - 370.7 (12.1) 358.6 Legacy Data 195.7$ -$ -$ Voice - local service 204.2 - - Long distance and VoIP 52.1 - - Entertainment - - - Other 7.5 - - Managed & Professional Services - - - Hardware - - - Total Legacy 459.5 - - 459.5 (11.7) 447.8 Integration Data -$ -$ -$ Voice - local service 7.0 - - Long distance and VoIP 4.0 - - Entertainment 0.4 - - Other 1.3 - - Managed & Professional Services - 3.4 - Hardware - 222.6 - Total Integration 12.7 226.0 - 238.7 (2.6) 236.1 Wireless - - 201.5 201.5 (2.3) 199.2 Total Revenue 724.8$ 344.1$ 201.5$ 1,270.4$ (28.7)$ 1,241.7$ Eliminations 16.8 9.6 2.3 28.7 708.0$ 334.5$ 199.2$ 1,241.7$ YTD Q4 2013 26 Revenue – MD&A YTD 2013 Strategic, Legacy and Integration ($ in millions)