Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - TYLER TECHNOLOGIES INC | Financial_Report.xls |

| EX-32 - EX-32 - TYLER TECHNOLOGIES INC | tyl-ex32_201412316.htm |

| EX-23.1 - EX-23.1 - TYLER TECHNOLOGIES INC | tyl-ex231_201412319.htm |

| EX-31.1 - EX-31.1 - TYLER TECHNOLOGIES INC | tyl-ex311_201412318.htm |

| EX-31.2 - EX-31.2 - TYLER TECHNOLOGIES INC | tyl-ex312_201412317.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2014

OR

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-10485

TYLER TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

DELAWARE |

|

75-2303920 |

|

(State or other jurisdiction of incorporation |

|

(I.R.S. employer |

|

5101 Tennyson Parkway |

|

75024 |

|

(Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code: (972) 713-3700

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

COMMON STOCK, $0.01 PAR VALUE |

|

NEW YORK STOCK EXCHANGE |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark if disclosure of delinquent filer pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to the Form 10-K. YES ¨ NO x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

x |

|

Accelerated filer |

|

¨ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller Reporting Company |

|

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) YES ¨ NO x

The aggregate market value of the voting stock held by non-affiliates of the registrant was $2,861,052,000 based on the reported last sale price of common stock on June 30, 2014, which is the last business day of the registrant’s most recently completed second fiscal quarter.

The number of shares of common stock of the registrant outstanding on February 13, 2015 was 33,581,000.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part III of this annual report is incorporated by reference from the registrant’s definitive proxy statement for its annual meeting of stockholders to be held on May 12, 2015.

TYLER TECHNOLOGIES, INC.

FORM 10-K

TABLE OF CONTENTS

|

|

|

|

|

PAGE |

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

3 |

|

|

|

Item 1A. |

|

|

10 |

|

|

|

Item 1B. |

|

|

16 |

|

|

|

Item 2. |

|

|

16 |

|

|

|

Item 3. |

|

|

16 |

|

|

|

Item 4. |

|

|

16 |

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

17 |

|

|

|

Item 6. |

|

|

20 |

|

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

20 |

|

|

Item 7A. |

|

|

35 |

|

|

|

Item 8. |

|

|

35 |

|

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

35 |

|

|

Item 9A. |

|

|

35 |

|

|

|

Item 9B. |

|

|

36 |

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

37 |

|

|

|

Item 11. |

|

|

37 |

|

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

37 |

|

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

37 |

|

|

Item 14. |

|

|

37 |

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

38 |

|

|

|

|

|

40 |

|

||

2

DESCRIPTION OF BUSINESS

Tyler Technologies, Inc. (“Tyler”) is a major provider of integrated information management solutions and services for the public sector, with a focus on local governments. We partner with clients to make local government more accessible to the public, more responsive to the needs of citizens and more efficient in its operations. We have a broad line of software solutions and services to address the information technology (“IT”) needs of major areas of operations for cities, counties, schools and other local government entities. Most of our clients have our software installed in-house. For clients who prefer not to physically acquire the software and hardware, most of our software applications can be delivered as software as a service (“SaaS”), which utilize the Tyler private cloud. We provide professional IT services to our clients, including software and hardware installation, data conversion, training and, at times, product modifications. In addition, we are the nation’s largest provider of outsourced property appraisal services for taxing jurisdictions. We also provide continuing client support services to ensure product performance and reliability, which provides us with long-term client relationships and a significant base of recurring maintenance revenue. In 2010, we began providing electronic document filing solutions (“e-filing”), which simplify the filing and management of court related documents.

Tyler was founded in 1966. Prior to 1998, we operated as a diversified industrial conglomerate, with operations in various industrial, retail and distribution businesses, all of which have been divested. In 1997, we embarked on a multi-phase growth plan focused on serving the specialized information management needs of local governments nationwide. In 1998 and 1999, we entered the local government IT market through a series of strategic acquisitions.

MARKET OVERVIEW

The state and local government market is one of the largest and most decentralized IT markets in the country, consisting of all 50 states, approximately 3,000 counties, 36,000 cities and towns and 13,900 school districts. This market is also comprised of approximately 37,000 special districts and other agencies, each with specialized delegated responsibilities and unique information management requirements.

Traditionally, local government bodies and agencies performed state-mandated duties, including property assessment, record keeping, road maintenance, law enforcement, administration of election and judicial functions, and the provision of welfare assistance. Today, a host of emerging and urgent issues are confronting local governments, each of which demands a service response. These areas include criminal justice and corrections, administration and finance, public safety, health and human services, planning, regulatory and maintenance and records and document management. Transfers of responsibility from the federal and state governments to county and municipal governments and agencies in these and other areas also place additional service and financial requirements on these local government units. In addition, constituents of local governments are increasingly demanding improved service and better access to information from public entities. As a result, local governments recognize the increasing value of information management systems and services to, among other things, improve revenue collection, provide increased access to information, and streamline delivery of services to their constituents. Local government bodies are now recognizing that “e-government” is an additional responsibility for community development. From integrated tax systems to integrated civil and criminal justice information systems, many counties and cities have benefited significantly from the implementation of jurisdiction-wide systems that allow different agencies or government offices to share data and provide a more comprehensive approach to information management. Many city and county governmental agencies also have unique individual information management requirements, which must be tailored to the specific functions of each particular office.

Many local governments also have difficulties attracting and retaining the staff necessary to support their IT functions. As a result, they seek to establish long-term relationships with reliable providers of high quality IT products and services such as Tyler.

Although local governments generally face budgetary constraints in their operations, their primary revenue sources are usually property taxes, and to a lesser extent, utility billings and other fees, which historically tend to be relatively stable. In addition, the acquisition of new technology typically enables local governments to operate more efficiently, and often provides a measurable return on investment that justifies the purchase of software and related services.

Gartner, Inc., a leading information technology research and advisory company, estimates that state and local government application and vertical specific software spending will grow from $11.0 billion in 2015 to $12.9 billion in 2018. The professional services and support segments of the market, where our business is primarily focused, is expected to expand from $32.8 billion in 2015 to $35.0 billion in 2018. Application and vertical specific software sales in the primary and secondary education segments of the market is

3

expected to expand from $2.0 billion in 2015 to $2.5 billion in 2018 while professional services and support are expected to grow from $2.4 billion in 2015 to $2.7 billion in 2018.

PRODUCTS AND SERVICES

We provide a comprehensive and flexible suite of products and services that addresses the information technology needs of cities, counties, schools and other local government entities. We derive our revenues from five primary sources:

|

· |

sales of software licenses and royalties; |

|

· |

subscription-based arrangements; |

|

· |

software services; |

|

· |

maintenance and support; and |

|

· |

appraisal services. |

We design, develop and market a broad range of software solutions to serve mission-critical “back-office” functions of local governments. Many of our software applications include Internet-accessible solutions that allow for real-time public access to a variety of information or that allow the public to transact business with local governments via the Internet. Our software solutions and services are generally grouped in five major areas:

|

· |

Financial Management and Education; |

|

· |

Courts and Justice; |

|

· |

Property Appraisal and Tax; |

|

· |

Planning, Regulatory and Maintenance; and |

|

· |

Land and Vital Records Management. |

Each of our core software systems consists of several fully integrated applications. For clients who acquire the software for use in-house, we generally license our systems under standard perpetual license agreements that provide the client with a fully paid, nonexclusive, nontransferable right to use the software. In some of the product areas, such as financial management and education and property appraisal and tax, we offer multiple solutions designed to meet the needs of different sized governments.

We also offer SaaS arrangements, which utilize the Tyler private cloud, for clients who do not wish to maintain, update and operate these systems or to make up-front capital expenditures to implement these advanced technologies. For these clients, we deliver our software using the SaaS model — the software and client data are hosted at our data centers or at third-party locations, and clients typically sign multi-year contracts for these subscription-based services.

Historically, we have had a greater proportion of our annual revenues in the second half of our fiscal year due to governmental budget and spending cycles and the timing of system implementations for clients desiring to “go live” at the beginning of the calendar year.

A description of our suites of products and services follows:

Software Licenses

Financial Management and Education

Our financial management and education solutions are enterprise resource planning systems for local governments, which integrate information across all facets of a client organization. Our financial management solutions include modular fund accounting systems that can be tailored to meet the needs of virtually any government agency or not-for-profit entity. Our financial management systems include modules for general ledger, budget preparation, fixed assets, requisitions, purchase orders, bid management, accounts payable, contract management, accounts receivable, investment management, inventory control, project and grant accounting, work orders, job costing, GASB reporting, payroll and human resources. All of our financial management systems are intended to conform to government auditing and financial reporting requirements and generally accepted accounting principles.

We sell utility billing systems that support the billing and collection of metered and non-metered services, along with multiple billing cycles. Our Web-enabled utility billing solutions allow clients to access information online such as average consumption and transaction history. In addition, our systems can accept secured Internet payments via credit cards and checks.

4

We also offer specialized products that automate numerous city functions, including municipal courts, parking tickets, equipment and project costing, animal licenses, business licenses, permits and inspections, code enforcement, citizen complaint tracking, ambulance billing, fleet maintenance, and cemetery records management.

In addition to providing financial management systems to K-12 schools, we sell student information systems for K-12 schools, which manage such activities as scheduling, grades and attendance. We also offer student transportation solutions to manage school bus routing optimization, fleet management, field trips and other related functions.

Tyler’s financial management and education solutions include Web components that enhance local governments’ service capabilities by facilitating online access to information for both employees and citizens and enabling online transactions.

Courts and Justice

We offer a complete, fully integrated suite of judicial solutions designed to handle complex, multi-jurisdictional county or statewide implementations as well as single county systems. Our solutions help eliminate duplicate data entry, promote more effective business procedures and improve efficiency across the entire justice process.

Our unified court case management system is designed to automate the tracking and management of information involved in all case types, including criminal, traffic, civil, family, probate and juvenile courts. It also tracks the status of cases, processes fines and fees and generates the specialized judgment and sentencing documents, notices and forms required in the court process. Documents received by the court can be scanned into the electronic case file and easily retrieved for viewing. Documents generated by the court can be electronically signed and automatically attached to the electronic case file. Additional modules automate the management of court calendars, coordinate judge’s schedules and generate court dockets. Our targeted courtroom technologies allow courts to rapidly review calendars, cases and view documents in the courtroom. Courts may also take advantage of our related jury management system.

Our law enforcement systems automate police and sheriff functions from dispatch and records management through booking and jail management. Searching, reporting and tracking features are integrated, allowing reliable, up-to-date access to current arrest and incarceration data, including digital mug shots. Our systems also provide warrant checks for visitors or book-ins, inmate classification and risk assessment, commissary, property and medical processing, automation of statistics, and state and federal reporting. Our computer-aided dispatch/emergency 911 system tracks calls and the availability of emergency response vehicles, interfaces with local and state searches, and assists dispatchers with processing emergency situations. The law enforcement and jail management systems are fully integrated with prosecution and other court products that manage the entire judicial process.

Our court and law enforcement systems allow the public to access, via the Internet, a variety of information, including non-confidential criminal and civil court records, jail booking and release information, bond and bondsmen information, and court calendars and dockets. In addition, our systems allow cities and counties to accept payments for traffic and parking tickets over the Internet, with a seamless and automatic interface to back-office justice and financial systems.

Our prosecutor system enables state attorney offices to track and manage criminal cases, including detailed victim information and private case notes. Investigative reports and charging instrument documents can be generated and stored for later viewing. Prosecutors can schedule and record the outcome of grand jury hearings. When integrated with the court system, prosecutors can view the electronic case file and related documents, as well as manage witness lists and subpoenas needed for court hearings.

Our supervision system allows pre-trial and probation offices to manage offender caseloads. Supervision officers can track contact schedules, risk/needs assessments and reassessments, detailed drug test results, employment histories, compliance with conditions and payments of fees and restitution. Documents and forms, like pre-sentence investigations or revocation orders, can be generated and stored for easy viewing. When integrated with the jail and court systems, supervision officers can have easy access and quick notification of offenders that have court hearings scheduled, are arrested locally and have new warrants issued.

We also offer a court case management solution that automates and tracks all aspects of municipal courts and offices. It is a fully integrated, graphical application that provides effective case management, document processing and cash/bond management. This system complies with all state reporting and conviction reports and includes electronic reporting and also integrates with certain of our financial management solutions and public safety solutions. Our public safety solution for municipalities includes more than thirty essential law enforcement, criminal investigation, and administration record management modules. The public safety solution manages information such as arrests and field interviews, traffic reports and citations, and incident and offense reports. It also supports multimedia files, photo lineups, multi-agency security and incident workflow and streamlines mandatory reporting to local, state and federal offices.

5

Property Appraisal and Tax

We provide systems and software that automate the appraisal and assessment of real and personal property, including record keeping, mass appraisal, inquiry and protest tracking, appraisal and tax roll generation, tax statement processing, and electronic state-level reporting. These systems are image and video-enabled to facilitate the storage of and access to the many property-related documents and for the online storage of digital photographs of properties for use in defending values in protest situations. Other related tax applications are available for agencies that bill and collect taxes, including cities, counties, school tax offices, and special taxing and collection agencies. These systems support billing, collections, lock box operations, mortgage company electronic payments, and various reporting requirements.

Planning, Regulatory and Maintenance

Our planning, regulatory and maintenance software solutions are designed for public sector agencies such as, community development, planning, building, code enforcement, tax and revenues, public works, transportation, land control, environmental, fire safety, storm water management, regulatory controls and engineering. These solutions help public sector agencies better manage their day-to-day business functions while streamlining and automating the many aspects of their land management, permitting and planning systems. Our mobile solutions extend automation to the field and Web access brings online services to citizens 24 hours a day, 365 days a year.

Land and Vital Records Management

We also offer a number of specialized software applications designed to help county governments enhance and automate courthouse operations. These systems record, scan and index information for the many documents maintained at the courthouse, such as deeds, mortgages, liens, UCC financing statements and vital records (birth, death and marriage certificates). These applications include fully integrated imaging systems with batch and scan processing capabilities and fully integrated receipting and cashiering systems, as well as, Web-enabled public access.

Subscription-Based Services

Subscription-based revenue is primarily derived from our SaaS arrangements, which utilize the Tyler private cloud, as well as our transaction based offerings such as e-filing solutions.

We are able to provide the majority of our software products through our SaaS model. The clients who choose this model typically do not wish to maintain, update and operate these systems or make up-front capital expenditures to implement these advanced technologies. The contract terms for these arrangements range from one to 10 years, but are typically contracted for a period of three to six years. The majority of our SaaS or hosting arrangements include additional professional services as well as maintenance and support services. In certain arrangements, the client may also acquire a license to the software.

As part of our subscription-based services, we provide e-filing solutions that simplify the filing and management of court related documents for courts and law offices. Revenues for e-filing are included in subscription-based revenues, and are derived from transaction fees and in some cases fixed fee arrangements.

Software Services

We provide a variety of professional IT services to clients who utilize our software products. Virtually all of our clients contract with us for installation, training, and data conversion services in connection with their purchase of Tyler’s software solutions. The complete implementation process for a typical system includes planning, design, data conversion, set-up and testing. At the culmination of the implementation process, an installation team travels to the client’s facility to ensure the smooth transfer of data to the new system. Installation fees are charged separately to clients on either a fixed-fee or hourly charge basis, depending on the contract.

Both in connection with the installation of new systems and on an ongoing basis, we provide extensive training services and programs related to our products and services. Training can be provided in our training centers, onsite at clients’ locations, or at meetings and conferences, and can be customized to meet a clients’ requirements. The vast majority of our clients contract with us for training services, both to improve their employees’ proficiency and productivity and to fully utilize the functionality of our systems. Training services are generally billed on an hourly or daily basis, along with travel and other expenses.

6

Maintenance and Support

Following the implementation of our software systems, we provide ongoing software support services to assist our clients in operating the systems and to periodically update the software. Support is provided over the phone to clients through help desks staffed by our client support representatives. For more complicated issues, our staff, with the clients’ permission, can log on to clients’ systems remotely. We maintain our clients’ software largely through releases that contain improvements and incremental additions of features and functionality, along with updates necessary because of legislative or regulatory changes.

Virtually all of our software clients contract with us for maintenance and support, which provides us with a significant source of recurring revenue. We generally provide maintenance and support under annual contracts, with a typical fee based on a percentage of the software product’s license fee. These fees can be increased annually and may also increase as new license fees increase. Maintenance and support fees are generally paid in advance for the entire maintenance contract period. Most maintenance contracts automatically renew unless the client or Tyler gives notice of termination prior to expiration. Similar support is provided to our SaaS clients, and is included in their subscription fees, which are classified as subscription-based revenues.

Appraisal Services

We are the nation’s largest provider of property appraisal outsourcing services for local government taxing authorities. These services include:

|

· |

the physical inspection of commercial and residential properties; |

|

· |

data collection and processing; |

|

· |

sophisticated computer analyses for property valuation; |

|

· |

preparation of tax rolls; |

|

· |

community education regarding the assessment process; and |

|

· |

arbitration between taxpayers and the assessing jurisdiction. |

Local government taxing authorities normally reappraise properties from time to time to update values for tax assessment purposes and to maintain equity in the taxing process. In some jurisdictions, law mandates reassessment cycles; in others, they are discretionary. While some taxing jurisdictions perform reappraisals in-house, many local governments outsource this function because of its cyclical nature and because of the specialized knowledge and expertise requirements associated with it. Our appraisal services business unit has been in this business since 1938.

In some instances, we also sell property tax and/or appraisal software products in connection with appraisal outsourcing projects, while other clients may only engage us to provide appraisal services. Appraisal outsourcing services are somewhat seasonal in nature to the extent that winter weather conditions reduce the productivity of data collection activities in connection with those projects.

STRATEGY

Our objective is to grow our revenue and earnings internally, supplemented by focused strategic acquisitions. The key components of our business strategy are to:

|

· |

Provide high quality, value–added products and services to our clients. We compete on the basis of, among other things, delivering to clients our deep domain expertise in local government operations through the highest value products and services in the market. We believe we have achieved a reputation as a premium product and service provider to the local government market. |

|

· |

Continue to expand our product and service offerings. While we already have what we believe to be the broadest line of software products for local governments, we continually upgrade our core software applications and expand our complementary product and service offerings to respond to technological advancements and the changing needs of our clients. In 2010, we began providing e-filing for courts and law offices, which simplifies the filing and management of court related documents. In late 2012, we signed a contract with the Texas Office of Court Administration to manage e-filing of court documents. In early 2013, the state of Texas issued an order mandating e-filing in civil cases beginning in January 2014. This contract, which took effect in September 2013, provides a recurring revenue stream that totaled $17.0 million in 2014 and is expected to total approximately $19.0 million in 2015. We believe revenue from e-filing solutions will grow over time as more local and state governments begin mandating electronic document filings. We also offer solutions that allow the public to access data and conduct transactions with local governments, such as paying traffic tickets, property taxes and utility bills |

7

|

via the Internet. We believe that the addition of such features enhances the market appeal of our core products. Since 2001, we have also offered software products as SaaS solutions, which we believe, will, over time, have increasing appeal to local governments and will comprise a larger percentage of our new business mix. In addition, we have also broadened our offerings of consulting and business process reengineering services. |

|

· |

Expand our client base. We seek to establish long-term relationships with new clients primarily through our sales and marketing efforts. While we currently have clients in all 50 states, Canada, the Caribbean, the United Kingdom, and other international locations, not all of our solutions have achieved nationwide geographic penetration. We intend to continue to expand into new geographic markets by adding sales staff and targeting marketing efforts by solutions in those areas. We also intend to continue to expand our customer base to include more large governments. While our traditional market focus has primarily been on small and mid-sized governments, our increased size and market presence, together with the technological advances and improved scalability of certain of our solutions, are allowing us to achieve increasing success in selling to larger clients. |

|

· |

Expand our existing client relationships. Our existing customer base offers significant opportunities for additional sales of solutions and services that we currently offer, but that existing clients do not fully utilize. Add-on sales to existing clients typically involve lower sales and marketing expenses than sales to new clients. |

|

· |

Grow recurring revenues. We have a large recurring revenue base from maintenance and support and subscription-based services, which generated revenues of $300.5 million, or 61% of total revenues, in 2014. We have historically experienced very low customer turnover (approximately 2% annually) and recurring revenues continue to grow as the installed customer base increases. In addition, subscription-based revenues have been our fastest growing revenue category over the past five years, increasing from $23.3 million in 2010 to $87.8 million in 2014. |

|

· |

Maximize economies of scale and take advantage of financial leverage in our business. We seek to build and maintain a large client base to create economies of scale, enabling us to provide value-added products and services to our clients while expanding our operating margins. Because we sell primarily “off-the-shelf” software, increased sales of the same solutions result in incrementally higher gross margins. In addition, we believe that we have a marketing and administrative infrastructure in place that can be leveraged to accommodate significant long-term growth without proportionately increasing selling, general and administrative expenses. |

|

· |

Attract and retain highly qualified employees. We believe that the depth and quality of our operations management and staff is one of our significant strengths, and that the ability to retain such employees is crucial to our continued growth and success. We believe that our stable management team, financial strength and growth opportunities, as well as our leadership position in the local government market, enhance our attractiveness as an employer for highly skilled employees. |

|

· |

Pursue selected strategic acquisitions. While we expect to primarily grow internally, from time to time we selectively pursue strategic acquisitions that provide us with one or more of the following: |

|

q |

new products and services to complement our existing offerings; |

|

q |

entry into new markets related to local governments; and |

|

q |

new clients and/or geographic expansion. |

|

· |

Establish strategic alliances. In January 2007, we announced a strategic alliance with Microsoft Corporation to jointly develop core public sector functionality for Microsoft Dynamics AX to address the unique accounting needs of public sector organizations worldwide. As part of this alliance, we are enhancing Microsoft Dynamics AX with public sector-specific functionality. The arrangement has broadened the functionality of Microsoft Dynamics AX, providing both Tyler and Microsoft with a public sector accounting platform to support their existing and prospective clients well into the future. Microsoft Dynamics AX with public sector functionality was released to the market in August 2011 and is being sold in the United States and internationally through Microsoft’s distribution channels. Tyler is also an authorized Microsoft reseller for the Microsoft Dynamics solutions developed under this arrangement, and we are selling the solutions directly into the government market. Tyler receives license and maintenance royalties on direct and indirect public-sector sales worldwide of the solutions co-developed under this multi-year term relationship. |

On February 4, 2015, we announced that our contractual research and development commitment to develop public sector functionality for Microsoft Dynamics AX expires with the release of Dynamics AX 7. We do not anticipate continuing any research and development commitment, although we will continue to provide sustained engineering and technical support for the public sector functionality within Dynamics AX. We further expect that license and maintenance royalties for all applicable domestic and international sales of Dynamics AX to public sector entities will continue under the terms of the contract.

8

SALES, MARKETING, AND CLIENTS

We market our products and services through direct sales and marketing personnel located throughout the United States. Other in-house sales staff focus on add-on sales, professional services and support.

Sales of new systems are typically generated from referrals from other government offices or departments within a county or municipality, referrals from other local governments, relationships established between sales representatives and county or local officials, contacts at trade shows, direct mailings, and direct contact from prospects already familiar with us. We are active in numerous national, state, county, and local government associations, and participate in annual meetings, trade shows, and educational events.

Clients consist primarily of county and municipal agencies, school districts and other local government offices. In counties, clients include the auditor, treasurer, tax assessor/collector, county clerk, district clerk, county and district court judges, probation officers, sheriff, and county appraiser. At municipal government sites, clients include directors from various departments, including administration, finance, utilities, public works, code enforcement, personnel, purchasing, taxation, municipal court, and police. Contracts for software products and services are generally implemented over periods of three months to one year, with annually renewing maintenance and support update agreements thereafter. Although either the client or we can terminate these agreements, historically almost all support and maintenance agreements are automatically renewed annually. Contracts for appraisal outsourcing services are generally one to three years in duration. During 2014, approximately 43% of our revenue was attributable to ongoing support and maintenance agreements.

COMPETITION

We compete with numerous local, regional, and national firms that provide or offer some or many of the same solutions and services that we provide. Many of these competitors are smaller companies that may be able to offer less expensive solutions than ours. Many of these firms operate within a specific geographic area and/or in a narrow product or service niche. We also compete with national firms, some of which have greater financial and technical resources than we do, including Oracle Corporation, Infor Lawson, SAP AG, SunGard Data Systems, Inc., Thomson Reuters Corporation, New World Systems and Constellation Software, Inc. In addition, we sometimes compete with consulting and systems integration firms, which develop custom systems, primarily for larger governments. We also occasionally compete with central internal information service departments of local governments, which requires us to persuade the end-user department to discontinue service by its own personnel and outsource the service to us.

We compete on a variety of factors, including price, service, name recognition, reputation, technological capabilities, and the ability to modify existing products and services to accommodate the individual requirements of the client. Our ability to offer an integrated system of applications for several offices or departments is often a competitive advantage. Local governmental units often are required to seek competitive proposals through a request for proposal process and some prospective clients use consultants to assist them with the proposal and vendor selection process.

SUPPLIERS

Substantially all of the computers, peripherals, printers, scanners, operating system software, office automation software, and other equipment necessary for the implementation and provision of our software systems and services are presently available from several third-party sources. Hardware is purchased on original equipment manufacturer or distributor terms at discounts from retail. We have not experienced any significant supply problems.

BACKLOG

At December 31, 2014, our estimated revenue backlog was approximately $702.0 million, compared to $551.7 million at December 31, 2013. The backlog represents signed contracts under which the revenue has not been recognized as of year-end. Approximately $381.4 million, or 54%, of the backlog is expected to be recognized during 2015.

INTELLECTUAL PROPERTY, PROPRIETARY RIGHTS, AND LICENSES

We regard certain features of our internal operations, software, and documentation as confidential and proprietary and rely on a combination of contractual restrictions, trade secret laws and other measures to protect our proprietary intellectual property. We generally do not rely on patents. We believe that, due to the rapid rate of technological change in the computer software industry, trade secrets and copyright protection are less significant than factors such as knowledge, ability and experience of our employees, frequent product enhancements, and timeliness and quality of support services. We typically license our software products under non-exclusive license agreements, which are generally non-transferable and have a perpetual term.

9

EMPLOYEES

At December 31, 2014, we had 2,856 employees. Appraisal outsourcing projects are cyclical in nature and can be widely dispersed geographically. We often hire temporary employees to assist in these projects whose term of employment generally ends with the project’s completion. None of our employees are represented by a labor union or are subject to collective bargaining agreements. We consider our relations with our employees to be positive.

INTERNET WEBSITE AND AVAILABILITY OF PUBLIC FILINGS

We file annual, quarterly, current and other reports, proxy statements and other information with the Securities and Exchange Commission, or SEC, pursuant to the Securities Exchange Act. You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and other information statements, and other information regarding issuers, including us, that file electronically with the SEC. The address of this site is http://www.sec.gov.

We also maintain a website at www.tylertech.com. We make available free of charge through this site our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Forms 4 and 5, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. In addition, copies of our annual report will be made available, free of charge upon written request.

Our “Code of Business Conduct and Ethics” is also available on our website. We intend to satisfy the disclosure requirements regarding amendments to, or waivers from, a provision of our Code of Business Conduct and Ethics by posting such information on our website.

An investment in our common stock involves a high degree of risk. Investors evaluating our company should carefully consider the factors described below and all other information contained in this Annual Report. Any of the following factors could materially harm our business, operating results, and financial condition. Additional factors and uncertainties not currently known to us or that we currently consider immaterial could also harm our business, operating results, and financial condition. This section should be read in conjunction with the Financial Statements and related Notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in this Annual Report. We may make forward-looking statements from time to time, both written and oral. We undertake no obligation to revise or publicly release the results of any revisions to these forward-looking statements. Our actual results may differ materially from those projected in any such forward-looking statements due to a number of factors, including those set forth below and elsewhere in this Annual Report.

Risks Associated with Selling Products and Services into the Public Sector Marketplace

A prolonged economic slowdown could harm our operations.

A prolonged economic slowdown or recession could reduce demand for our software products and services. Local and state governments may face financial pressures that could in turn affect our growth rate and profitability in the future. There is no assurance that local and state spending levels will be unaffected by declining or stagnant general economic conditions, and if budget shortfalls occur, they may negatively impact local and state information technology (“IT”) spending and could adversely affect our business.

Selling products and services into the public sector poses unique challenges.

We derive substantially all of our revenues from sales of software and services to state, county, and city governments, other municipal agencies, and other public entities. We expect that sales to public sector clients will continue to account for substantially all of our revenues in the future. We face many risks and challenges associated with contracting with governmental entities, including:

|

· |

resource limitations caused by budgetary constraints, which may provide for a termination of executed contracts due to a lack of future funding; |

|

· |

long and complex sales cycles; |

|

· |

contract payments at times being subject to achieving implementation milestones, and we may have differences with clients as to whether milestones have been achieved; |

|

· |

political resistance to the concept of contracting with third-parties to provide IT solutions; |

|

· |

legislative changes affecting local government’s authority to contract with third-parties; |

10

|

· |

varying bid procedures and internal processes for bid acceptance; and |

|

· |

various other political factors, including changes in governmental administrations and personnel. |

Each of these risks is outside our control. If we fail to adequately adapt to these risks and uncertainties, our financial performance could be adversely affected.

A decline in the demand for IT may result in a decrease in our revenues or lower our growth rate.

A decline in the demand for IT among our current and prospective clients may result in decreased revenues or a lower growth rate because our sales depend, in part, on our clients’ level of funding for new or additional IT systems and services. Moreover, demand for our solutions may be reduced by a decline in overall demand for computer software and services. We cannot assure you that we will be able to increase or maintain our revenues.

The open bidding process creates uncertainty in predicting future contract awards.

Many governmental agencies purchase products and services through an open bidding process. Generally, a governmental entity will publish an established list of requirements requesting potential vendors to propose solutions for the established requirements. To respond successfully to these requests for proposals, we must accurately estimate our cost structure for servicing a proposed contract, the time required to establish operations for the proposed client, and the likely terms of any other third-party proposals submitted. We cannot guarantee that we will win any bids in the future through the request for proposal process, or that any winning bids will ultimately result in contracts on favorable terms. Our failure to secure contracts through the open bidding process, or to secure such contracts on favorable terms, may adversely affect our revenue and gross margins.

We face significant competition from other vendors and potential new entrants into our markets.

We believe we are a leading provider of integrated solutions for the public sector. However, we face competition from a variety of software vendors that offer products and services similar to those offered by us, as well as from companies offering to develop custom software. We compete based on a number of factors, including:

|

· |

the attractiveness of our “evergreen” business strategy; |

|

· |

the breadth, depth, and quality of our product and service offerings; |

|

· |

the ability to modify our offerings to accommodate particular clients’ needs; |

|

· |

technological innovation; |

|

· |

name recognition; |

|

· |

price; and |

|

· |

our financial strength and stability. |

We believe the market is highly fragmented with a large number of competitors that vary in size, product platform, and product scope. Our competitors include consulting firms, publicly held companies that focus on selected segments of the public sector market, and a significant number of smaller, privately held companies. Certain competitors have greater technical, marketing, and financial resources than we do. We cannot assure you that such competitors will not develop products or offer services that are superior to our products or services or that achieve greater market acceptance.

We also compete with internal, centralized IT departments of governmental entities, which requires us to persuade the end-user to stop the internal service and outsource to us. In addition, our clients and prospective clients could elect to provide information management services internally through new or existing departments, which could reduce the market for our services.

We could face additional competition as other established and emerging companies enter the public sector software application market and new products and technologies are introduced. Increased competition could result in pricing pressure, fewer client orders, reduced gross margins, and loss of market share. Current and potential competitors may make strategic acquisitions or establish cooperative relationships among themselves or with third-parties, thereby increasing the ability of their products to address the needs of our prospective clients. It is possible that new competitors or alliances may emerge and rapidly gain significant market share. We cannot assure you that we will be able to compete successfully against current and future competitors, and the failure to do so would have a material adverse effect upon our business.

11

Fixed-price contracts may affect our profits.

Some of our contracts are on a fixed-priced basis, which can lead to various risks, including:

|

· |

the failure to accurately estimate the resources and time required for an engagement; |

|

· |

the failure to effectively manage our clients’ expectations regarding the scope of services delivered for a fixed fee; and |

|

· |

the failure to timely and satisfactorily complete fixed-price engagements within budget. |

If we do not adequately assess these and other risks, we may be subject to cost overruns and penalties, which may harm our financial performance.

Changes in the insurance markets may affect our business.

Some of our clients, primarily those for our property appraisal services, require that we secure performance bonds before they will select us as their vendor. In addition, we have in the past been required to provide letters of credit as security for the issuance of a performance bond. We cannot guarantee that we will be able to secure such performance bonds in the future on terms that are favorable to us, if at all. Our inability to obtain performance bonds on favorable terms or at all could impact our future ability to win some contract awards, particularly large property appraisal services contracts, which could negatively impact revenues. In addition, the general insurance markets experience volatility, which may lead to future increases in our general and administrative expenses and negatively impact our operating results.

Risks Associated with Our Software Products

We run the risk of errors or defects with new products or enhancements to existing products.

Our software products are complex and may contain errors or defects, especially when first introduced or when new versions or enhancements are released. Although we have not experienced material adverse effects from any such defects or errors to date, we cannot assure you that material defects and errors will not be found in the future. Any such defects could result in a loss of revenues or delay market acceptance. Our license agreements typically contain provisions designed to limit our exposure to potential liability. However, it is possible we may not always successfully negotiate such provisions in our client contracts or the limitation of liability provisions may not be effective due to existing or future federal, state, or local laws, ordinances, or judicial decisions. Although we maintain errors and omissions and general liability insurance, and we try to structure contracts to limit liability, we cannot assure you that a successful claim could not be made or would not have a material adverse effect on our future operating results.

Cyber-attacks and security vulnerabilities can disrupt our business and harm our competitive position.

Threats to IT security can take a variety of forms. Individuals and groups of hackers, and sophisticated organizations including state-sponsored organizations, may take steps that pose threats to our clients and our IT. They may develop and deploy malicious software to attack our products and services and gain access to our networks and data centers, or act in a coordinated manner to launch distributed denial of service or other coordinated attacks. Cyber threats are constantly evolving, thereby increasing the difficulty of detecting and successfully defending against them. Cyber threats can have cascading impacts that unfold with increasing speed across our internal networks and systems and those of our partners and clients. Breaches of our network or data security could disrupt the security of our internal systems and business applications, impair our ability to provide services to our clients and protect the privacy of their data, result in product development delays, compromise confidential or technical business information harming our competitive position, result in theft or misuse of our intellectual property or other assets, require us to allocate more resources to improved technologies, or otherwise adversely affect our business. Our business policies and internal security controls may not keep pace with these evolving threats.

We cannot fully protect client information from security breaches.

As we continue to grow the number and scale of our cloud-based offerings, we store and process increasingly large amounts of personally identifiable and other confidential information of our clients. The continued occurrence of high-profile data breaches provides evidence of an external environment increasingly hostile to information security. Despite our efforts to improve security controls, it is possible our security controls over personal data, our training of employees on data security, and other practices we follow may not prevent the improper disclosure of client data that we store and manage. Improper disclosure could harm our reputation, lead to legal exposure to clients, or subject us to liability under laws that protect personal data, resulting in increased costs or loss of revenue.

12

Hosting services for some of our products are dependent upon the uninterrupted operation of data centers.

A material portion of our business is provided through software hosting services. These hosting services depend on the uninterrupted operation of data centers and the ability to protect computer equipment and information stored in these data centers against damage that may be caused by natural disaster, fire, power loss, telecommunications or Internet failure, acts of terrorism, unauthorized intrusion, computer viruses, and other similar damaging events. If any of our data centers were to become inoperable for an extended period, we might be unable to fulfill our contractual commitments. Although we take what we believe to be reasonable precautions against such occurrences, we can give no assurance that damaging events such as these will not result in a prolonged interruption of our services, which could result in client dissatisfaction, loss of revenue, and damage to our business.

We must timely respond to technological changes to be competitive.

The market for our products is characterized by technological change, evolving industry standards in software technology, changes in client requirements, and frequent new product introductions and enhancements. The introduction of products embodying new technologies and the emergence of new industry standards can render existing products obsolete and unmarketable. As a result, our future success will depend, in part, upon our ability to enhance existing products and develop and introduce new products that keep pace with technological developments, satisfy increasingly sophisticated client requirements, and achieve market acceptance. We cannot assure you that we will successfully identify new product opportunities and develop and bring new products to market in a timely and cost-effective manner. The products, capabilities, or technologies developed by others could also render our products or technologies obsolete or noncompetitive. Our business may be adversely affected if we are unable to develop or acquire new software products or develop enhancements to existing products on a timely and cost-effective basis, or if such new products or enhancements do not achieve market acceptance.

We may be unable to protect our proprietary rights.

Many of our product and service offerings incorporate proprietary information, trade secrets, know-how, and other intellectual property rights. We rely on a combination of contracts, copyrights, and trade secret laws to establish and protect our proprietary rights in our technology. We cannot be certain that we have taken all appropriate steps to deter misappropriation of our intellectual property. There has also been significant litigation recently involving intellectual property rights. We are not currently involved in any material intellectual property litigation; however, we may be a party to such litigation in the future to protect our proprietary information, trade secrets, know-how, and other intellectual property rights. We cannot assure you that third-parties will not assert infringement or misappropriation claims against us with respect to current or future products. Any claims or litigation, with or without merit, could be time-consuming, costly, and a diversion to management. Any such claims and litigation could also cause product shipment delays or require us to enter into royalty or licensing arrangements. Such royalty or licensing arrangements, if required, may not be available on terms acceptable to us, if at all. Therefore, litigation to defend and enforce our intellectual property rights could have a material adverse effect on our business, regardless of the final outcome of such litigation.

Clients may elect to terminate our maintenance contracts and manage operations internally.

It is possible that our clients may elect to not renew maintenance contracts for our software, trying instead to maintain and operate the software themselves using their perpetual license rights (excluding software applications that we provide on a software-as-a-service or hosted basis). This could adversely affect our revenues and profits. Additionally, they may inadvertently allow our intellectual property or other information to fall into the hands of third-parties, including our competitors, which could adversely affect our business.

Material portions of our business require the Internet infrastructure to be further developed or adequately maintained.

Part of our future success depends on the use of the Internet as a means to access public information and perform transactions electronically, including, for example, electronic filing of court documents. This in part requires the further development and maintenance of the Internet infrastructure. Among other things, this further development and maintenance will require a reliable network backbone with the necessary speed, data capacity, security, and timely development of complementary products for providing reliable Internet access and services. If this infrastructure fails to be further developed or be adequately maintained, our business would be harmed because users may not be able to access our government portals.

13

Risks Associated with Our Periodic Results and Stock Price

Software revenue recognition rules may require us to delay revenue recognition into future periods.

We have in the past had to, and may in the future be required to, defer revenue recognition for software license fees due to several factors, including whether:

|

· |

license agreements include applications that are under development or other undelivered elements; |

|

· |

client contracts require the delivery of services considered essential to the functionality of the software, including significant modifications, customization, or complex interfaces, that could delay product delivery or acceptance; |

|

· |

the transaction involves acceptance criteria; |

|

· |

the transaction involves contingent payment terms or fees; |

|

· |

we are required to accept a fixed-fee services contract; or |

|

· |

we are required to provide extended payment terms. |

Because of these factors and other specific requirements for software revenue recognition under generally accepted accounting principles in the United States, we must have very precise terms in our contracts to recognize revenue upon the delivery and installation of our software or performance of services. Negotiation of mutually acceptable terms and conditions may extend the sales cycle. We are not always able to negotiate terms and conditions that permit revenue recognition at the time of delivery or even upon project completion.

Fluctuations in quarterly revenue could adversely impact our operating results and stock price.

Our revenues and operating results are difficult to predict and may fluctuate substantially from quarter to quarter for a variety of reasons, including the following:

|

· |

prospective clients’ contracting decisions are often made in the last few weeks of a quarter; |

|

· |

the size of license transactions can vary significantly; |

|

· |

clients may unexpectedly postpone or cancel procurement processes due to changes in strategic priorities, project objectives, budget, or personnel; |

|

· |

client purchasing processes vary significantly and a client’s internal approval, expenditure authorization, and contract negotiation processes can be difficult and time consuming to complete, even after selection of a vendor; |

|

· |

the number, timing, and significance of software product enhancements and new software product announcements by us and our competitors may affect purchase decisions; |

|

· |

we may have to defer revenues under our revenue recognition policies; and |

|

· |

clients may elect subscription-based arrangements, which result in lower software license revenues in the initial year as compared to traditional, on-premise software license arrangements, but generate higher overall subscription-based revenues over the term of the contract. |

In each fiscal quarter, our expense levels, operating costs, and hiring plans are based to some extent on projections of future revenues and are relatively fixed. If our actual revenues fall below expectations, we could experience a reduction in operating results. Also, if actual revenues for any given quarter fall below expectations, it may lead to a decline in our stock price.

Increases in service revenue as a percentage of total revenues could decrease overall margins.

We realize lower margins on software and appraisal service revenues than on license revenue. The majority of our contracts include both software licenses and software services. Therefore, an increase in the percentage of software service and appraisal service revenue compared to license revenue could have a detrimental impact on our overall gross margins and could adversely affect operating results.

14

Our stock price may be volatile.

The market price of our common stock may be volatile. Examples of factors that may significantly impact our stock price include:

|

· |

actual or anticipated fluctuations in our operating results; |

|

· |

announcements of technological innovations, new products, or new contracts by us or our competitors; |

|

· |

developments with respect to patents, copyrights, or other proprietary rights; |

|

· |

conditions and trends in the software and other technology industries; |

|

· |

adoption of new accounting standards affecting the software industry; |

|

· |

changes in financial estimates by securities analysts; and |

|

· |

general market conditions and other factors. |

In addition, the stock market has from time to time experienced significant price and volume fluctuations that have particularly affected the market prices of technology company stocks, and may in the future adversely affect the market price of our stock. Sometimes, securities class action litigation is filed following periods of volatility in the market price of a particular company’s securities. We cannot assure you that similar litigation will not occur in the future with respect to us. Such litigation could result in substantial costs and a diversion of management’s attention and resources, which could have a material adverse effect upon our financial performance.

Financial Outlook.

From time to time, in press releases and otherwise, we may publish forecasts or other forward-looking statements regarding our results, including estimated revenues or earnings. Any forecast of our future performance reflects various assumptions. These assumptions are subject to significant uncertainties, and as a matter of course, any number of them may prove to be incorrect. Further, the achievement of any forecast depends on numerous risks and other factors (including those described in this discussion), many of which are beyond our control. As a result, we cannot be certain that our performance will be consistent with any management forecasts or that the variation from such forecasts will not be material and adverse. Current and potential stockholders are cautioned not to base their entire analysis of our business and prospects upon isolated predictions, but instead are encouraged to utilize our entire publicly available mix of historical and forward-looking information, as well as other available information regarding us, our products and services, and the software industry when evaluating our prospective results of operations.

Risks Associated with Our Growth Strategy and Other General Corporate Risks

We may experience difficulties in executing our acquisition strategy.

A material portion of our historical growth has resulted from strategic acquisitions. Although our focus is on internal growth, we will continue to identify and pursue strategic acquisitions with suitable candidates. These transactions involve significant challenges and risks, including that the transaction does not advance our business strategy, that we get no satisfactory return on our investment, that we have difficulty integrating business systems and technology, that we have difficulty retaining or integrating new employees, that the transactions distract management from our other businesses, that we acquire unforeseen liabilities, and other unanticipated events. Our future success will depend, in part, on our ability to successfully integrate future acquisitions into our operations. It may take longer than expected to realize the full benefits of these transactions, such as increased revenue, enhanced efficiencies, or increased market share, or the benefits may be ultimately smaller than we expected. Although we conduct due diligence reviews of potential acquisition candidates, we may not identify all material liabilities or risks related to acquisition candidates. There can be no assurance that any such strategic acquisitions will be accomplished on favorable terms or will result in profitable operations.

Our failure to properly manage growth could adversely affect our business.

We have expanded our operations significantly since 1998, when we entered the business of providing software solutions and services to the public sector. We intend to continue expansion in the foreseeable future to pursue existing and potential market opportunities. This growth places a significant demand on management and operational resources. In order to manage growth effectively, we must implement and improve our operational systems, procedures, and controls on a timely basis. If we fail to implement these systems, our business may be materially adversely affected.

We may be unable to hire, integrate, and retain qualified personnel.

Our continued success will depend upon the availability and performance of our key management, sales, marketing, client support, and product development personnel. The loss of key management or technical personnel could adversely affect us. We believe that

15

our continued success will depend in large part upon our ability to attract, integrate, and retain such personnel. We have at times experienced and continue to experience difficulty in recruiting qualified personnel. Competition for qualified software development, sales, and other personnel is intense, and we cannot assure you that we will be successful in attracting and retaining such personnel.

Compliance with changing regulation of corporate governance may result in additional expenses.

Changing laws, regulations, and standards relating to corporate governance and public disclosure can create uncertainty for public companies. The costs required to comply with such evolving laws are difficult to predict. To maintain high standards of corporate governance and public disclosure, we intend to invest all reasonably necessary resources to comply with evolving standards. This investment may result in an unforeseen increase in general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities, which may harm our operating results.

We don’t foresee paying dividends on our common stock.

We have not declared or paid a cash dividend since we entered the business of providing software solutions and services to the public sector in 1998. We intend to retain earnings for use in the operation and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future.

Provisions in our certificate of incorporation, bylaws, and Delaware law could deter takeover attempts.

Our board of directors may issue up to 1,000,000 shares of preferred stock and may determine the price, rights, preferences, privileges, and restrictions, including voting and conversion rights, of these preferred shares. These determinations may be made without any further vote or action by our stockholders. The rights of the holders of our common stock will be subject to, and may be adversely affected by, the rights of the holders of any preferred stock that may be issued in the future. The issuance of preferred stock may make it more difficult for a third-party to acquire a majority of our outstanding voting stock. In addition, some provisions of our Certificate of Incorporation, Bylaws, and the Delaware General Corporation Law could also delay, prevent, or make more difficult a merger, tender offer, or proxy contest involving us.

Not applicable.

We occupy approximately 617,000 square feet of office space, of which 353,000 square feet is in office facilities we own. We own or lease offices for our major operations in Arizona, Colorado, Georgia, Iowa, Maine, Montana, New York, Ohio, Texas and Washington.

Other than routine litigation incidental to our business, there are no material legal proceedings pending to which we are party or to which any of our properties are subject.

Not applicable.

16

PART II

|

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our common stock is traded on the New York Stock Exchange under the symbol “TYL.” At December 31, 2014, we had approximately 1,611 stockholders of record. A number of our stockholders hold their shares in street name; therefore, there are substantially more than 1,611 beneficial owners of our common stock.

The following table shows, for the calendar periods indicated, the high and low sales price per share of our common stock as reported on the New York Stock Exchange.

|

|

|

High |

|

|

Low |

|

||

|

2013: First Quarter |

|

$ |

61.60 |

|

|

$ |

48.86 |

|

|

Second Quarter |

|

|

70.49 |

|

|

|

57.00 |

|

|

Third Quarter |

|

|

88.68 |

|

|

|

68.60 |

|

|

Fourth Quarter |

|

|

105.74 |

|

|

|

83.25 |

|

|

|

|

|

|

|

|

|

|

|

|

2014: First Quarter |

|

$ |

107.99 |

|

|

$ |

81.54 |

|

|

Second Quarter |

|

|

91.69 |

|

|

|

74.37 |

|

|

Third Quarter |

|

|

97.53 |

|

|

|

84.70 |

|

|

Fourth Quarter |

|

|

115.37 |

|

|

|

86.05 |

|

|

2015: First Quarter (through February 13, 2015) |

|

$ |

116.50 |

|

|

$ |

103.18 |

|

We did not pay any cash dividends in 2014 or 2013. We intend to retain earnings for use in the operation and expansion of our business, and, therefore, we do not anticipate declaring a cash dividend in the foreseeable future.

The following table summarizes certain information related to our stock option plan and our employee stock purchase plan. There are no warrants or rights related to our equity compensation plans as of December 31, 2014.

|

|

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights as of December 31, 2014 |

|

|

Weighted average exercise price of outstanding options, warrants and rights |

|

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in initial column as of December 31, 2014) |

|

|||

|

Plan Category |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity compensation plans approved by security shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock option plan |

|

|

5,536,414 |

|

|

$ |

44.61 |

|

|

|

468,019 |

|

|

Employee stock purchase plan |

|

|

9,676 |

|

|

|

93.02 |

|

|

|

940,525 |

|

|

Equity compensation plans not approved by security shareholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

5,546,090 |

|

|

$ |

44.69 |

|

|

|

1,408,544 |

|

17

As of December 31, 2014, we had authorization to repurchase up to 1.4 million additional shares of Tyler common stock. During 2014, we purchased approximately 294,000 shares of our common stock for an aggregate purchase price of $22.8 million. A summary of the repurchase activity during 2014 is as follows:

|

Period |

Total number of shares repurchased |

|

Average price paid per share |

|

Maximum number of shares that may be repurchased under current authorization |

|

|||

|

Three months ended March 31 |

|

— |

|

$ |

— |

|

|

1,700,000 |

|

|

Three months ended June 30 |

|

294,000 |

|

|

77.54 |

|

|

1,406,000 |

|

|

Three months ended September 30 |

|

— |

|

|

— |

|

|

1,406,000 |

|

|

Three months ended December 31 |

|

— |

|

|

— |

|

|

1,406,000 |

|

|

|

|

294,000 |

|

|

|

|

|

|

|

The repurchase program, which was approved by our board of directors, was announced in October 2002, and was amended at various times from 2003 through 2011. There is no expiration date specified for the authorization and we intend to repurchase stock under the plan from time to time.

18

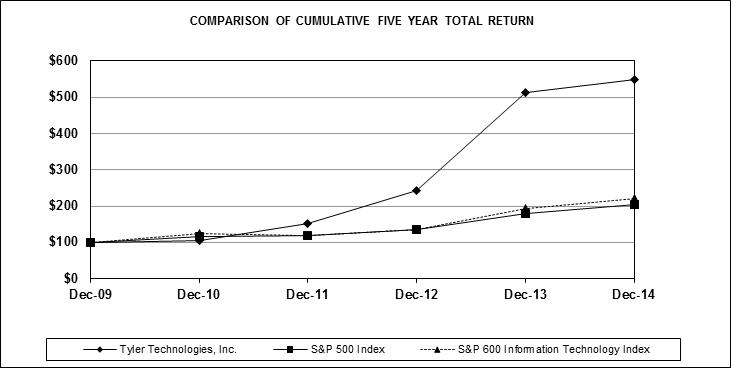

Performance Graph

The following Performance Graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.