Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SILICON IMAGE INC | d876379d8k.htm |

Exhibit 99.1

Silicon Image Overview

Silicon Image is a leading provider of wired and wireless video, audio and data connectivity solutions for the mobile, consumer electronics (“CE”) and personal computer (“PC”) markets. Silicon Image’s go-to-market strategy has been to build a coalition of industry partners in support of incorporating into industry standards its core technologies and latest innovations. This process interconnects multiple markets and industries which Silicon Image addresses through its offerings, which include semiconductors, intellectual property (“IP”) and related service offerings. The company’s CE and mobile products are deployed by the world’s leading electronics manufacturers in devices such as smartphones, tablets, digital televisions (“DTVs”), Blu-ray Disc™ players, Audio/Video receivers, digital cameras, set-top-boxes, as well as desktop and notebook PCs.

Silicon Image has four primary end-markets:

| • | Mobile – Silicon Image offers MHL transmitter and MHL-HDMI bridge products; the company is the leading supplier of MHL products, with over 500 million ICs shipped for integration into smartphones, tablets and adapters since 2011 |

| • | Consumer Electronics (CE) – In the CE market, Silicon Image primarily serves the television and home theater categories with HDMI, MHL and millimeter wave wireless solutions |

| • | Personal Computing (PC) – In the PC market, Silicon Image sells storage and HDMI Transmitter products as well as its recently announced millimeter wave wireless connector product |

| • | Licensing and Services – Silicon Image also monetizes its technology through the licensing of technology cores and patents, and through services |

Silicon Image was incorporated in the State of California, USA in 1995, reincorporated in the State of Delaware, USA June 1999 and is headquartered in Sunnyvale, California, USA. It also has operations and/or sales offices around the world, including in China, India, Japan, South Korea and Taiwan.

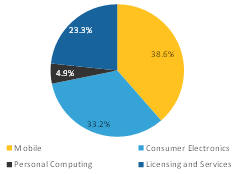

2014 Revenue Breakdown by End Market and Geography

2014 Revenue by End Market 23.3% 4.9%33.2% 38.6% Mobile Personal Computing Consumer Electronics Licensing and Services 2014 Revenue by Geography (1) 13.1% 38.4% 18.5% 14.4% 9.8% 5.8% Korea Japan Americas China Other Europe 1) Geography by bill to location.

|

1 |

|

History of Establishing Industry Standards with Strategic Partners

History of Establishing Industry Standards with Strategic

Partners

HDMI is the Emmy® award-winning de-facto digital interface for HD and 4K UltraHD in the consumer electronics market

Since 2002, over 4 billion HDMI-enabled products have shipped to-date

Approximately 1,600

companies around the world have adopted HDMI

Latest version of the specification is HDMI version 2.0 released in September 2013

HDMI Specification developed by:

The MHL Consortium was formed to create an audio/video

interface optimized for mobile devices, such as smartphones and tablets

Since 2010, over 750 million MHL-enabled products have shipped to-date

Nearly 200 companies around the world have adopted MHL

Latest version of the specification is

superMHL announced in January 2015

MHL Consortium Members:

WirelessHD was the

industry’s first specification for multi-gigabit-per-second wireless transmission over 60GHz

WirelessHD provides high quality, lossless high-definition (HD)

video, multi-channel audio, and data for consumer electronics, PC and portable products

Latest version of the specification is WirelessHD 1.1

WirelessHD Consortium Members:

|

2 |

|

5. Silicon Image Company Overview

|

3 |

|

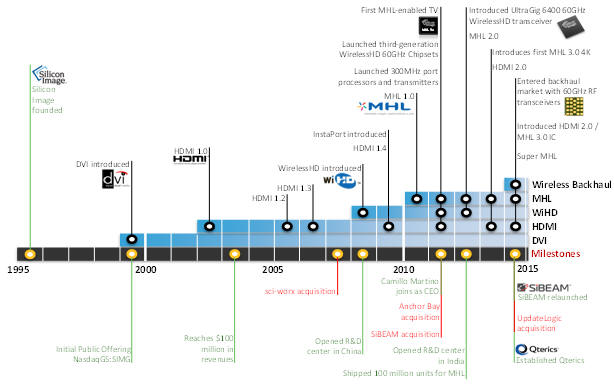

5.1 Business Overview

Silicon Image is a leading provider of wired and wireless video, audio and data connectivity solutions for the mobile, consumer electronics (“CE”) and personal computer (“PC”) markets. Silicon Image’s go-to-market strategy has been to build a coalition of industry partner in support of incorporating into industry standards its core technologies and latest innovations. This process interconnects multiple markets and industries which Silicon Image monetizes through its offerings, which include semiconductors, intellectual property (“IP”) and related service offerings. The company’s CE and mobile products are deployed by the world’s leading electronics manufacturers in devices such as smartphones, tablets, digital televisions (“DTVs”), Blu-ray Disc™ players, audio/video receivers, digital cameras, set-top-boxes, as well as desktop and notebook PCs.

Silicon Image has four primary end-markets:

| • | Licensing and Services – Silicon Image also monetizes its technology through the licensing of technology cores and patents, and through services. |

Silicon Image is recognized for working in cooperation with some of the biggest names in consumer electronics to create industry standards that are at the forefront of emerging trends and innovation. The company has driven the creation of the High-Definition Multimedia Interface (HDMI®) and Mobile High-Definition Link (MHL®); and its CE and mobile products are recognized as providing best-in-class implementations of HDMI® and MHL®.

The company believes that its active participation as a founder in these standards allows it to be in the forefront of emerging trends and innovations leading to new ideas and enhanced product designs that will ultimately benefit consumers.

In December 2014 Silicon Image announced the establishment of a subsidiary, Qterics, for software-as-a- services offerings, and the purchase by Qualcomm Inc. of a seven percent interest in Qterics. Qterics offers cloud based architecture for authenticating, provisioning, and managing Internet of Things (“IoT”) connected devices, including products to support remote firmware upgrades and remote screen access. Qterics products offer manufacturers and retailers solutions for remotely managing products “after the sale”, enabling them to reduce the number and length of service calls and product returns.

In January of 2015 Silicon Image re-launched its wholly-owned subsidiary, SiBEAM® for its wireless millimeter-wave product offerings, including millimeter wave wireless fiber technology for backhaul and access, WiGig 802.11ad and WirelessHD products and future products incorporating Snap wireless connector technology. The company’s Snap, WiGig 802.11ad and WirelessHD products are primarily targeted at PC, mobile and CE markets. The company’s wireless fiber products are targeted at infrastructure applications such as 4G LTE and campus and wireless broadband backhaul and provide cost effective radio frequency (“RF”) on complementary metal oxide semiconductor (“CMOS”) solutions for medium distance communication.

|

4 |

|

Silicon Image was incorporated in the State of California, USA in 1995, reincorporated in the State of Delaware, USA in June 1999 and is headquartered in Sunnyvale, California, USA. It also has operations and/or sales offices around the world, including in China, India, Japan, South Korea and Taiwan.

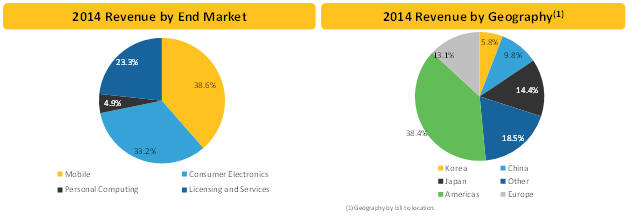

5.2 Company History

Silicon Image traces its roots back to the company’s founding in 1995, when it was formed to develop digital connectivity technology and solutions, including the Digital Visual Interface (“DVI”) standard, a predecessor technology to HDMI. Along with Intel, it formed the Digital Display Working Group (“DDWG”) in 1997, which eventually produced the DVI standard, the first digital video input that gained ubiquitous placement on TVs and PCs. Silicon Image went public in 1999. In 2002, SIMG, along with other leaders in the consumer electronics market, formed the HDMI Consortium to develop the follow-on interface to DVI. In 2010, the company introduced the MHL mobile video standard. In April 2011, Silicon Image announced the acquisition of SiBeam, a maker of wireless connectivity solutions based on the WirelessHD standard.

Silicon Image’s Evolution

Silicon Image founded DVI introduced HDMI 1.0 HDMI 1.2 HDMI 1.3 WirelessHD introduced InstaPort introduced HDMI 1.4 Launched 300MHz port processors and transmitters MHL 1.0 Launched third generation WirelessHD 60GHz Chipsets First MHL enabled TV Introduced UltraGig 6400 60GHz WirelessHD transceiver MHL 2.0 Introduces first MHL 3.0 4K HDMI 2.0 Entered backhaul market with 60GHz RF transceivers Introduced HDMI 2.0 / MHL 3.0 IC Super MHL Wireless Backhaul MHL WiHD HDMI DVI Milestones 1995 2000 2005 2010 2015 SiBEAM relaunched UpdateLogic acquisition Established Qterics Opened R&D center in India Shipped 100 million units for MHL Anchor Bay acquisition SiBEAM acquisition Camillo Martino joins as CEO Opened R&D center in China sci- worx acquisition Reaches $100 million in revenues Initial Public Offering NasdaqGS:SIMG

Since 2012, Silicon Image has been focused on maintaining its leadership in traditional digital connectivity technologies, while pioneering new technologies and standards for next generation connectivity, including 4K-capable HDMI and MHL and 60GHz wireless technologies and products. Version 2.0 of the HDMI specification was released in September 2013 and offers a significant increase in bandwidth to support 4K resolution and enhanced audio. Version 3.0 of MHL was announced in August 2013, featuring 4K resolution, enhanced audio, simultaneous high-speed data and touch screen support. Silicon Image has invested significantly in wireless 60GHz solutions as it pursues even smaller, lower power and more cost effective solutions and supports the WirelessHD standard. Silicon Image launched a new subsidiary, Qterics, in December 2014 to focus on enabling a wide variety of

|

5 |

|

solutions and services for Internet-enabled consumer products including TVs, mobile handsets, tablets, routers, home automation devices, white goods and more. Qterics is comprised of the UpdateLogic services business combined with other related Silicon Image assets, including software and other intellectual property and has received a $7 million strategic investment from Qualcomm Technologies for a 7% ownership interest. Finally, in January 2015, Silicon Image announced the latest MHL specification, superMHL, targeting 8K displays and HDTV’s, re-launched its SiBEAM wireless subsidiary, and launched its revolutionary wireless connector technology, Snap.

Silicon Image Business Overview

Silicon Image Business Overview IC Products and IP IC Products Mobile CE PC IP Licensing HDMI & MHL Royalties & Adopter Fees Patent Monetization IP Cores Millimeter-Wave Wireless Technology Millimeter-wave Wireless Snap WirelessHD WiGig Wireless Fiber Wholly-owned subsidiary of Silicon Image) Services Device Management Services Remote Access Remote Management Alljoyn / IoT (Subsidiary of Silicon Image)

5.3 Market Overview

Silicon Image currently sells its products primarily into three markets: Mobile, CE and PC. During 2014, the company’s mobile business was approximately 39% of total revenue, compared to 54% in 2013. The CE and PC markets comprised 33% and 5% of total revenue in 2014, respectively.

Mobile Market

As the capability of the smartphone has increased, the requirements for the external communications interface have evolved from PC synchronization to include HD and now 4K video output, data exchange and user interface integration. Many smartphones have adopted MHL as a solution to address these needs. The categories of devices to which an MHL-enabled smartphones can connect have grown to include TVs, audio/video receivers, PC monitors, portable displays, projectors, automotive head-units, and adapters/docks. Silicon Image is the leading supplier of MHL products, with over 500 million ICs shipped for integration into smartphones, tablets and adaptors since 2011. Even though many MHL-enabled smartphones have been shipped, the use of MHL by consumers is not yet pervasive. The company is subject to the risk that increasing cost pressures on OEM customers in the mobile device market, coupled with risks regarding the market adoption of its MHL products, will adversely affect demand for its MHL technology or lead manufacturers to eliminate the technology in some of their products. On December 17, 2014, one of Silicon Image’s largest customers informed the company that it had

|

6 |

|

decided not to include MHL functionality in certain designs in order to reduce costs, and as a result of this decision, on December 18, 2014, Silicon Image announced that it expected a year-over-year revenue decline in 2015 of approximately 10% due to a reduction in mobile design wins at one of its largest customers.

Consumer Electronics Market

Within the CE market, Silicon Image primarily serves the television and home theater categories. DisplaySearch estimated the television market in 2014 to be approximately 229 million units. HDMI is the de-facto worldwide standard for connecting home entertainment devices, with close to 100% adoption rate in high-definition televisions, audio/video receivers, Blu-Ray players, and service operator set-top boxes.

Certain manufacturers of television and home theater devices have chosen to add MHL support for the connection of mobile devices and Smart TV peripheral devices. Silicon Image provides dual-mode HDMI-MHL receiver and port processor products for DTV and Home Theater customers.

Both the HDMI and MHL specifications were advanced in 2013 to address the transmission of 4K content. In 2014 the price of some name brand 50”4K Ultra HD televisions dropped below US $1,000, increasing the unit volume shipment of 4K Ultra HD televisions. Also in 2014, manufacturers such as Sony, Samsung and ZTE released smartphones capable of recording 4K Ultra HD video and then transmitting that video over MHL to 4K displays.

The availability of 4K content, coupled with the prospect of new in-home viewing options such as live events and early window movie releases, is driving the implementation of the HDCP 2.2 enhanced link protection technology (available on both HDMI and MHL connections). Silicon Image’s newest products support the latest versions of the HDMI and MHL specifications, enabling the transmission of 4K content over an HDCP 2.2 link.

PC Market

In January 2015, IDC reported that PC shipments totaled approximately 309 million units in 2014, down -2.1% from the prior year. Silicon Image’s storage and HDMI transmitter products targeted to the PC market will continue to decline due to the general decline in the PC business overall and lack of investment in these product lines.

New Markets

Silicon Image is known as a provider of HDMI and MHL semiconductor (IC) products for the markets discussed above; however, the company has recently expanded its offerings to include 60GHz millimeter-wave wireless products under the SiBEAM brand and cloud-based software and service products under the Qterics brand.

Silicon Image provides 60GHz millimeter-wave wireless connectivity solutions through its SiBEAM subsidiary. Millimeter-wave wireless products include:

| • | WirelessHD solutions which offer the highest quality wireless video connection to the display and are ideal for gaming and other interactive video applications because of the lower latency they provide |

| • | Anticipated Snap Wireless Connector solutions targeted at applications where there is a desire to replace a USB 3, USB 2, DisplayPort, or HDMI connector in favor of a very short distance, high throughput wireless link |

| • | Upcoming Wireless Fiber products targeted to medium distance backhaul and access applications |

Through Qterics, the company offers a cloud based architecture for authenticating, provisioning, and managing connected IoT devices, including products to support remote firmware upgrades and remote screen access. Today, Qterics’ products are deployed primarily in consumer electronics such as televisions, Blu-ray players and tablets. However the Qterics cloud architecture is scalable and applicable to other connected IoT products as well. Qterics services are monetized using multiple fee models including per-unit software license fees, non-recurring engineering fees and pay-per-use fees.

The automotive market is increasingly receptive to the integration of personal electronics with in-vehicle infotainment systems. In 2013, MHL-enabled after-market head units were introduced by JVC, Kenwood and Pioneer. Silicon Image saw continued adoption of MHL in the aftermarket head-units in 2014 from JVC, Pioneer, Kenwood, Alpine and Clarion brands.

|

7 |

|

Competition

The markets in which Silicon Image participates are intensely competitive and are characterized by rapid technological change, evolving standards and short product life cycles. Key factors affecting competition in these markets are levels of product integration, compliance with industry standards, time-to-market, cost, product capabilities, system design costs, intellectual property, customer support, quality and reputation. The company’s ability to remain competitive will depend on how well it is able to anticipate the features and functions that customers will demand and whether we are able to deliver those features in consistent volumes of its products at acceptable levels of quality and at competitive prices.

In general, Silicon Image’s current semiconductor competition for HDMI and MHL products includes:

| • | Discrete HDMI and MHL products offered by companies such as Analog Devices, Analogix, Parade, Panasonic and Explore. |

| • | Companies integrating HDMI or MHL functionality into system-on-a-chip (“SoCs”), such as Broadcom, Qualcomm, Marvell, MStar, and MediaTek. |

| • | In-house semiconductor solutions designed by large consumer electronics OEMs. |

The company’s products also compete against alternative HD connectivity technologies, such as Mobility DisplayPort (“MYDP”), DisplayPort, and MiraCast (or Wi-Fi Display). MYDP was released in 2012 and is positioned as an alternative to MHL primarily for mobile phones. MiraCast is a wireless video technology based on existing WiFi standards that is positioned against WirelessHD and MHL as a wireless alternative to transmit video from a mobile device to a large screen. DisplayPort is primarily found in PCs, but could potentially provide video connectivity between CE devices such as Blu-ray players and HD-TVs as an alternative to HDMI.

WiGig 802.11ad is a 60GHz wireless standard offered as an alternative to wired connectivity and to WirelessHD and while we have announced that we are in development of WiGig 802.11ad products, our products may not be able to compete on features or price against much larger potential competitors such as Qualcomm, Broadcom and Intel.

Proprietary technologies such as Apple’s AirPlay and Google’s Chromecast are also positioned against MHL and WirelessHD as a means to transmit audio and video from mobile devices to Audio/Visual receivers, sound bars, and HD-TVs.

|

8 |

|

5.4 Product Offering

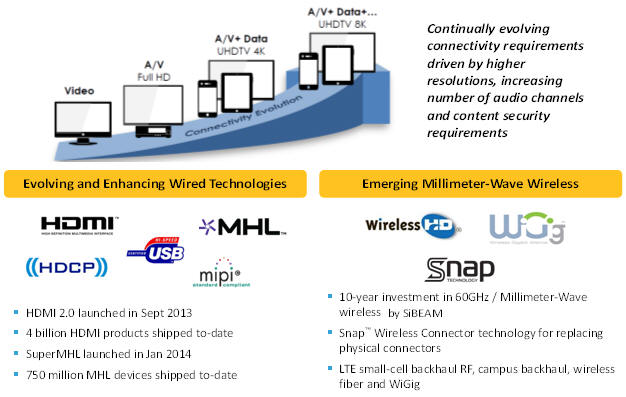

Silicon Image is a Leader in High-Speed Connectivity IP

Silicon Image is a Leader in High-Speed Connectivity IP Continually evolving connectivity requirements driven by higher resolutions, increasing number of audio channels and content security requirements Evolving and Enhancing Wired Technologies Emerging Millimeter-Wave Wireless HDMI 2.0 launched in Sept 2013 4 billion HDMI products shipped to-date SuperMHL launched in Jan 2014 750 million MHL devices shipped to-date 10-year investment in 60GHz / Millimeter-Wave wireless by SiBEAM Snap™ Wireless Connector technology for replacing physical connectors-LTE small-cell backhaul RF, campus backhaul, wireless fiber and WiGig

Connectivity Development

Many of Silicon Image’s wired solutions are based on Transition-minimized Differential Signaling (“TMDS”), a wired technology that was originally developed to address the need to transfer high-definition video from a PC to a monitor. The company then extended TMDS to support audio and High Definition Content Protection (“HDCP”) for the CE market. Most recently, the company has applied TMDS to mobile devices and other consumer electronic devices in the form of MHL. In each generation, TMDS technology has been enhanced to address demands for increased video resolutions and data rates while adding functionality and reducing power consumption and cost.

Silicon Image’s wireless products are based on 60GHz millimeter-wave wireless technology that enables the distribution of very high bandwidth video and data. The company’s portfolio of millimeter-wave products offer solutions for video, data, access and backhaul, and it continues to develop differentiating capabilities, such as advanced beam forming capabilities, to meet emerging needs.

|

9 |

|

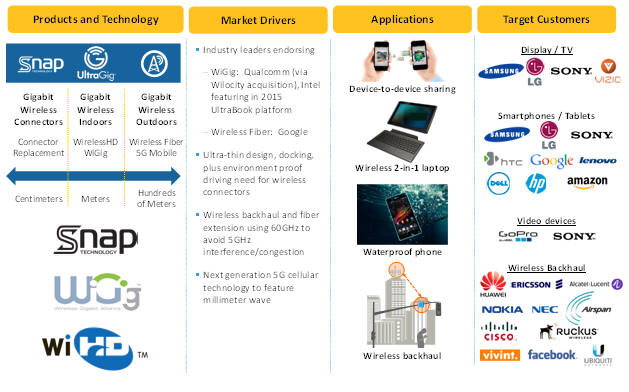

Leadership in Millimeter-Wave Wireless Technology

Leadership in Millimeter-Wave Wireless Technology Products and Technology Gigabit Wireless Connectors Connector Replacement Gigabit Wireless Indoors WirelessHD WiGig Centimeters Wireless Fiber 5G Mobile Hundreds of Meters Market Drivers Industry leaders endorsing WiGig: Qualcomm (via Wilocity acquisition), Intel featuring in 2015 UltraBook platform Wireless Fiber: Google Ultra-thin design, docking, plus environment proof driving need for wireless connectors Wireless backhaul and fiber extension using 60GHz to avoid 5GHz interference/congestion Next generation 5G cellular technology to feature millimeter wave Applications Device-to-device sharing Wireless 2-in-1 laptop Waterproof phone Wireless backhaul Target Customers Display / TV Smartphones / Tablets Video devices Wireless Backhaul

Industry Standards and “Standards Plus” Development

To date, Silicon Image has promoted its technologies by working with industry leaders to incorporate its core technologies and latest innovations into newly developed standards. The broad adoption of an industry standard can result in the rapid proliferation of the company’s technologies. By seeking input from major product companies such as Sony, Samsung, Toshiba, Phillips, Technicolor, Panasonic and others, in the standard creation process the company increases the likelihood that major companies will choose to adopt the standard in their product and in doing so, motivate other companies in the market to also adopt the standard.

To differentiate its products, Silicon Image has taken a “standards-plus” approach to product development. For example, its integrated circuits (“ICs”) implement a given standard, but may also include unique features not available from other manufacturers.

Monetization

Silicon Image monetizes its technology through the sale of semiconductor devices, licensing of technology cores (referred to as intellectual property licenses) and patents, and through its service offerings. Where system level cost pressures demand the integration of semiconductor technology into system-on-a-chip devices, Silicon Image continues to benefit through the licensing of IP cores which customers integrate into their ICs. Additionally, the company has an extensive portfolio of intellectual property patents and has developed programs that will optimize the utilization and profitability of these valuable assets.

|

10 |

|

Products

Silicon Image provides advanced wired and wireless connectivity solutions for the transmission of video and multi-channel audio. Its MHL mobile products provide low pin-count, connector agnostic solutions delivering up to 4K video, audio and data connectivity while enabling the continuous charging of the connected mobile device from the display. Its CE products support resolutions up to 4K and multi-channel audio and are the first dual mode HDMI-MHL devices that provide advanced features such as fast switching and live picture-in-picture video previewing of each connected device, making switching between source devices simple, intuitive and fast. Its 60GHz WirelessHD-compliant solutions provide the closest to a cable-like experience possible without wires, allowing mobile and PC users to interact with a big screen display wirelessly and with minimal latency.

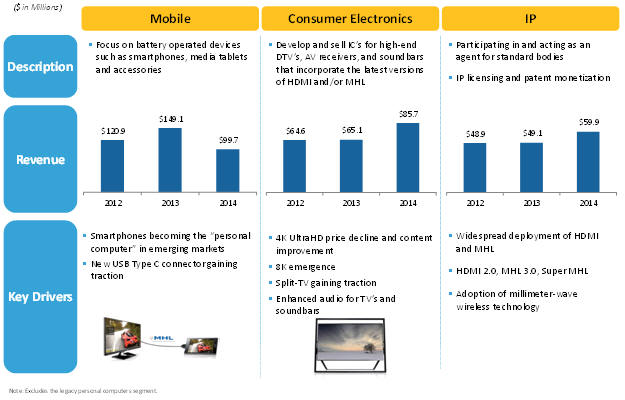

Business Snapshot

Business Snapshot ($ in Millions) Mobile Focus on battery operated devices such as smartphones, media tablets and accessories

Smartphones becoming the “personal computer” in emerging markets New USB Type C connector gaining traction Note: Excludes the legacy personal computers

segment. Consumer Electronics Develop and sell IC’s for high-end DTV’s, AV receivers, and soundbars that incorporate the latest versions of HDMI and/or MHL 4K UltraHD price decline and content improvement 8K emergence Split-TV gaining

traction Enhanced audio for TV’s and soundbars IP Participating in and acting as an agent for standard bodies IP licensing and patent monetization Widespread deployment of HDMI and MHL HDMI 2.0, MHL 3.0, Super MHL Adoption of millimeter-wave

wireless technology

Mobile

Mobile MHL Transmitters

Silicon Image’s Mobile MHL transmitters convert digital video, audio and data into the MHL format supporting resolutions up to 4K with multi-channel audio over a low pin count, connector agnostic interface. These transmitters enable devices, such as smartphones and tablets to connect to televisions, PC monitors, automobile infotainment systems, projectors, audio/video receivers and other devices with MHL inputs or with HDMI inputs using an MHL-to-HDMI adapter. The company’s MHL transmitter products are optimized for small size and low power consumption.

The smartphone market is characterized by a limited set of integrated circuit platform suppliers. Silicon Image works closely with these suppliers to ensure efficient integration of its products. The company works with companies such as Qualcomm and MediaTek to supply reference designs and development kits using its MHL

|

11 |

|

transmitters. The company’s MHL 3.0 transmitter has been designed to work with the latest generation of 4K Ultra HD capable mobile application processors. The company also provides a high-performance MHL 3.0 multimedia switch. This switch is co-located with its MHL 3.0 transmitter and supports switching between an MHL 3.0 port and two USB ports.

MHL Is The Leading Mobile HD Connectivity Standard

MHL Is The Leading Mobile HD Connectivity Standard Powered connectivity between mobile devices and HD displays

An installed base of over 750 million MHL- enabled products MHL 3.0 announced on August 20, 2013 Features 4K resolution, enhanced audio, simultaneous high-speed data, touch screen

support

MHL-to-HDMI Bridges

Silicon Image’s MHL-to-HDMI bridge products are designed to connect MHL enabled mobile products with HDMI-enabled platforms. The company provides multiple bridge ICs and reference designs enabling the conversion of MHL to HDMI. These bridge products enable original equipment manufacturers to develop quickly new accessories such as multimedia audio/video docking stations and adapters that deliver MHL transmitted content to HDMI, DVI, and analog VGA monitors and displays.

SiBEAM SnapTM Technology

The company’s SiBEAM Snap wireless connector technology is based on the same production-proven 60GHz on CMOS technology shipping in multiple generations of SiBEAM products. The wireless technology delivers up to 12 Gb/s of bi-directional bandwidth that provides high speed data channel for mass data and video transfer. The single chip solution can wirelessly replace USB, HDMI, or DisplayPort connectors.

60GHz WirelessHD Transmitters

Silicon Image’s UltraGig™ 6400 60GHz WirelessHD (the “UltraGig 6400”) transmitter product is designed to provide near-zero latency for HD video between mobile devices, such as smartphones and tablets, and a display. The UltraGig 6400 is optimized for size and includes the 60GHz WirelessHD baseband processor, RF, antennas, and an MHL transmitter in a small 10x7mm package. It is also optimized for low power consumption.

|

12 |

|

Latest 60Ghz WirelessHD Products

Sony HWZ-T3W Head Mount Display EPSON EH Projectors DVDO Air3 Wireless Adapter Gefen Wireless Adapter

CE (DTV & Home Theater)

Dual Mode Port Processors

Silicon Image’s dual mode port processors featuring MHL and HDMI functionality are designed for CE products, such as televisions, Audio/Visual receivers, sound bars and Home-Theater-in-a-Box devices. These port processors support the latest versions of the MHL and HDMI specifications and provide the ability to interface to HDMI source devices as well as MHL-enabled devices such as smartphones, tablets and Smart TV streaming sticks. In addition, the company’s port processors provide advanced “Standard-Plus” features such as a live picture-in-picture video preview of each HDMI / MHL input with InstaPrevue™ technology. This feature makes televisions and Audio/Visual receivers easier to use by taking the guesswork out of switching between multiple HDMI sources. Another feature offered by Silicon Image’s port processors is InstaPort™ technology, which allows for fast switching between up to six HDMI / MHL inputs. In 2014, the company introduced new port processors that support the MHL 3.0 and HDMI 2.0 standards as well as the latest HDCP 2.2 link protection required for premium content transmission. All of its port processors are backward compatible with previous versions of the HDMI and MHL standards, thus assuring customers that their products will have a high degree of compatibility and interoperability.

HDMI Transmitters

Silicon Image’s HDMI transmitter products are designed for products such as Blu-Ray players, high-definition set-top boxes, Audio/Visual receivers and sound bars. HDMI transmitters convert digital video and audio into the HDMI format. In 2014 the company introduced new transmitter products compliant with the HDMI 2.0 specification and with integrated support for HDCP 2.2 link protection.

|

13 |

|

60GHz WirelessHD Transmitters and Receivers

Silicon Image’s WirelessHD transmitter and receiver products are used in WirelessHD receiver adapters, HDMI extenders, home theater projectors and wireless video accessory devices, such as personal video display glasses.

HDMI Is The HD Connectivity Standard

HDMI Is The HD Connectivity Standard De-facto standard for HD connectivity for 10 years Approximately1,600 adopters and an installed base of 4bn+ HDMI enabled products Version 2.0 released September 4, 2013 HDMI 2.0 offers significant increase in bandwidth and support for new features such as 4K and enhanced audio

Wireless Fiber

60GHz RF Transceivers

Silicon Image’s RF transceiver products are designed for use in 4G LTE small cells and Metro Wi-Fi and fixed wireless broadband point-to-point links. In February 2014, the company introduced two RF transceiver products intended to address medium distance urban applications and short distance enterprise and campus applications respectively. Silicon Image’s beam-steering technology reduces the size and weight of the antenna and eliminates the need for fine manual alignment during and after installation. The low power consumption and high level of integration allows the size and power consumption of the system electronics to be reduced.

PC

Silicon Image continues to provide legacy SATA, PATA and DVI integrated circuits servicing legacy PC designs, industrial PCs, and digital video recorders for the security industry. The company is no longer making any investments in these legacy products.

Simplay Labs, LLC

Silicon Image believes its wholly-owned subsidiary Simplay Labs LLC (“Simplay”) has further enhanced its reputation for quality, reliable products and leadership in the CE and mobile markets. The Simplay HD™ interoperability program offers manufacturers one of the most robust and comprehensive testing engagements for device interoperability. Devices that pass Simplay’s Authorized Testing Centers (“ATCs”) and enhanced interoperability testing requirements are verified to meet HDMI and MHL technology interface compliance specifications and have also demonstrated interoperability through empirical testing against “peer” devices maintained by Simplay. Simplay has service centers operating in the United States, South Korea and China, providing compliance, interoperability and performance testing. Simplay Labs is set up to test products ranging from receiving devices like televisions, audio/video receivers and sound bars to transmitting devices like Blu-ray Disc™ players, set-top boxes, audio/video receivers, gaming consoles, media hubs and other electronic devices.

Simplay also develops and sells test tools to manufacturers to support their efforts to quickly bring high quality and standards compliant products to market. The Simplay test tools include the Simplay Explorer HDMI-CEC test system (“CEC Explorer”), Universal Test System (“UTS”) and protocol analyzer. The Simplay CEC Explorer was the first R&D tool of its kind for CE manufacturers. The Simplay Labs UTS is a new generation test system that utilizes

|

14 |

|

an industry standard shelf-based modular slot approach to support many HD standards, interfaces and function within a single chassis. The UTS is the first test system of its kind to offer both HDMI and MHL system test capabilities within a single platform.

DVDO

Silicon Image’s wholly-owned subsidiary DVDO, Inc. (“DVDO”) delivers video connectivity solutions in the form of finished end products for professional installers and end users. DVDO’s video switchers, wireless adapters and video processors feature advanced technologies to provide professional-quality video from multiple sources across a wide range of displays.

|

15 |

|

5.5 Customers

Silicon Image focuses its sales and marketing efforts on achieving design wins with OEMs of mobile and CE products and wireless infrastructure providers. A small number of customers and distributors have generated and are expected to continue to generate a significant portion of total revenue. Silicon Image’s top five customers, which include distributors, generated 57.9%, 67.1% and 64.4%, of total revenue in 2014, 2013 and 2012, respectively. For the year ended December 31, 2014, total revenue from Samsung Electronics accounted for 28.7% of total revenue. No other customer generated revenues which account for more than 10% of total revenue for the year ended December 31, 2014. For the year ended December 31, 2013, total revenue from Samsung Electronics accounted for 40.2% of total revenue. No other customer generated revenues which account for more than 10% of total revenue for the year ended December 31, 2013. For the year ended December 31, 2012, total revenue from Samsung Electronics and distributor Edom Technology accounted for 35.0% and 10.3% of total revenue, respectively. Silicon Image’s dependence on sales to a relatively small number of large customers subjects it to the risk that one or more large customers loses market share, reduces their purchases of the company’s products, or does not select the company’s products for inclusion in their future products. In December 2014, Silicon Image was notified by one of its largest customers of a reduction in a mobile design win which the company anticipates will lead to a year over year revenue decline in 2015 of approximately 10%.

A significant percentage of revenue was generated through distributors. Silicon Image’s revenue generated through distributors was 32.3% of total revenue in 2014, compared to 32.2% and 38.4% of total revenue in 2013 and 2012, respectively.

A substantial portion of Silicon Image’s business is conducted outside the United States; therefore, the company is subject to foreign business, political and economic risks. For the years ended December 31, 2014, 2013 and 2012, approximately 61.2%, 52.7% and 57.4% of total revenue, respectively, was generated from customers and distributors located outside of North America, primarily in Asia.

Diverse Blue-Chip Customer Base

Acer ASUS BEST BUY BOSE Canon CISCO DELL DENON FUJITSU FUNAI Harman/kardon Hisense HITACHI hp htc HUAWEI lenovo LG LINKSYS MEIZU MITSUBISHI MOTOROLA ONKYO oppo Panasonic PHILIPS Pioneer SAMSUNG SHARP SONY TATUNG TOSHIBA VESTEL VIZIO Xiaomi Yamaha OEM customer base of over 550

|

16 |

|

5.6 Sales & Marketing

Silicon Image’s worldwide sales and marketing strategy is critical to its objective of becoming the leading supplier of high-performance video, audio and data connectivity products. Silicon Image’s sales and marketing teams work closely with each industry’s respective OEMs and original design manufacturers, or ODMs, to define product features, performance, price and the timing of new products. Members of the company’s sales team have a high level of technical expertise, product and industry knowledge to support the competitive and complex design win process. The company also employs a highly skilled team of application engineers to assist in designing, testing and qualifying designs that incorporate its products. Silicon Image believes that the depth and quality of its design support greatly improves its time-to-market, ability to maintain a high level of customer satisfaction and fosters relationships that encourage customers to use its products through multiple iterations of their products. Silicon Image’s sales strategy for all products is to achieve design wins with key industry companies in order to grow the existing markets in which it participates as well as develop new and emerging markets. The company’s sales strategy also promotes and accelerates the adoption of industry standards that it supports or is developing.

Silicon Image sells its products using direct sales support and marketing field offices located in North America, Europe, Taiwan, China, Japan, South Korea and India. The company also sells its products using an extensive network of distributors located throughout the Americas, Asia and Europe with the additional support of independent Sales Representative companies in the Americas and Europe. A sales cycle typically begins with the receipt of an initial request from a customer and ends when the customer executes a purchase order for production quantities. The length of a sales cycle varies substantially, typically from four months to nine months for CE and mobile products and longer for wireless fiber products. The length depends on a number of factors, including the technical capabilities of the customer, the customer’s need for customization and the customer’s qualification process.

Other marketing activities Silicon Image engages in include public relations, advertising, web-marketing, participation in technical conferences and trade shows, competitive analyses, industry intelligence and other marketing programs. The company’s Corporate Marketing department provides company information regarding products, strategies and technology to the press, industry analysts, and the general public on Silicon Image’s Internet site and through other media.

|

17 |

|

5.7 Supply Chain

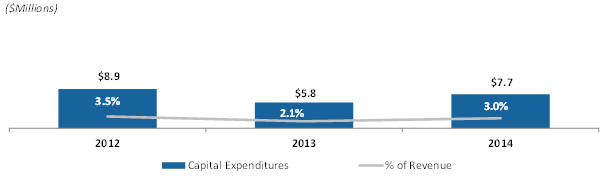

Historical Capex vs Capex as a % of Revenue

($Millions) $8.9 3.5% 2012 $5.8 2.1% 2013 $7.7 3.0% 2014 Capital Expenditures % of Revenue

Historical Capex vs Capex as a % of Revenue ($Millions) $8.9 $5.8 $7.7 2012 2013 20143.5% Capital Expenditures 3.0%

of Revenue

Wafer Fabrication

Silicon Image’s semiconductor products are designed using standard complementary metal oxide semiconductor processes, which permit the company to use independent wafer foundries for fabrication. The company utilizes what is known as a fabless manufacturing strategy for all of its products by employing world-class suppliers for all phases of the manufacturing process, including wafer fabrication, assembly, testing and packaging. This strategy uses the expertise of these suppliers that are certified by the International Standards Organization (ISO) in such areas as fabrication, assembly, quality control and assurance, reliability and testing. In addition, this strategy allows Silicon Image to avoid the significant costs and risks associated with owning and operating manufacturing operations. Outsourcing manufacturing also gives the company direct and timely access to various advanced process technologies. Silicon Image’s suppliers are also responsible for procurement of most of the raw materials used in the production of its products. As a result, the company can focus resources on standard creation, product design, additional quality assurance, marketing and customer support.

Silicon Image utilizes industry-leading suppliers, such as Taiwan Semiconductor Manufacturing Company Limited, to produce semiconductor wafers. The company’s in-house engineering staff designs products with standard cells from foundries or third-party library providers, and provides the designs to foundries for manufacturing. Silicon Image periodically works with foundries to review pricing, capacity, cycle time and other terms. The company also works closely with foundries in order to achieve high manufacturing yields during the wafer fabrication process, which is an important aspect of cost-reduction efforts. Once its semiconductors have been manufactured, they are packaged and tested. The company has developed its own automatic testing program for semiconductors and outsources all of its assembly and testing requirements to other sub-contractors. Silicon Image then utilizes independent subcontractors, such as Advanced Semiconductor Engineering, Inc., Siliconware Precision Industries Company Ltd. and Amkor Technology to perform assembly, testing and packaging of most of its products.

The company’s semiconductor products are currently fabricated using 0.35, 0.25, 0.18, 0.13, 0.065, 0.055 and 0.040 micron processes. For Silicon Image’s IP customers, the company develops IP at all these nodes and additionally at 0.028 micron. For these customers the company also uses other foundries such as Semiconductor Manufacturing International Corporation, Fujitsu, and others. Silicon Image continuously evaluates the benefits, primarily the improved performance, costs and feasibility, of migrating products to smaller geometry process technologies. Because of the cyclical nature of the semiconductor industry, available capacity can change quickly and significantly.

|

18 |

|

Assembly and Test

Silicon Image’s semiconductor products are designed to use low-cost standard packages and to be tested with widely available semiconductor test equipment. The company outsources all of its packaging and test requirements. This enables the company to take advantage of economies of scale and supply flexibility and gives direct and timely access to advanced packaging and test technologies. Since the fabrication yields of the company’s products have historically been high and the costs of its packaging have historically been low, the company tests its products after they are assembled and does not, in general, do wafer level testing. This testing method has not caused the company to experience unacceptable failures or yields. However, lack of testing prior to assembly could have adverse effects if there are significant problems with wafer processing. For more recent products in the wireless market, the die sizes are relatively larger and Silicon Image does perform wafer level testing before assembly. Additionally, for newer wired products and products for which yield rates have not stabilized, we may conduct bench testing using our personnel and equipment, which is more expensive than fully automated testing. RF testing of its 60 GHz wireless products also requires customized test equipment and fixtures which are challenging to build and maintain in a production test environment. Silicon Image’s operations personnel closely review the process and control and monitor information provided to us by foundries. To ensure quality, the company has established firm guidelines for rejecting wafers that it considers unacceptable.

Quality Assurance

Silicon Image focuses on product quality through all stages of the design and manufacturing process. The company’s designs are subjected to in depth circuit simulation at temperature, voltage and processing extremes before being fabricated. The company also subjects pre-production parts to extensive characterization and reliability testing. We also sample early production parts to ensure we are getting the same results as we did during pre-production. The company pre-qualifies each subcontractor through an audit and analysis of the subcontractor’s quality system and manufacturing capability. For the highest volume parts, Silicon Image has an ongoing monitoring process that samples product and subjects it to rigorous testing to determine if there is any weakness or marginality in performance. The company also participates in quality and reliability monitoring through each stage of the production cycle by reviewing data from wafer foundries and assembly subcontractors. Silicon Image closely monitors wafer foundry production to ensure consistent overall quality, reliability and yields. The company’s independent foundries and its assembly and test subcontractors have achieved ISO 9001 certification.

|

19 |

|

5.8 Research & Development

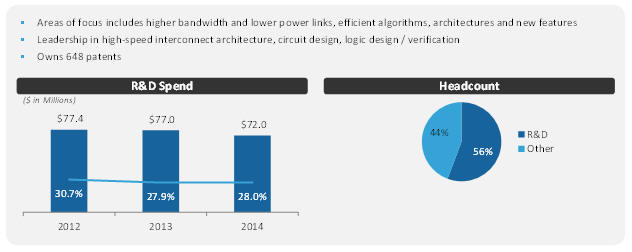

Silicon Image’s research and development efforts continue to focus on innovative technology standards, services and IC products featuring, among other things, higher bandwidth and lower power links, efficient algorithms, architectures and new features. By utilizing its patented technologies and optimized architectures, the company believes its semiconductor products can scale with advances in semiconductor manufacturing process technology, simplify system design and provide innovative solutions for customers.

The company has extensive experience in the areas of high-speed interconnect architecture, circuit design, logic design/verification, firmware/software, digital audio/video systems, wireless baseband, and radio frequency (“RF”) technology and architecture. Silicon Image has invested and expects that it will continue to invest, significant funds for research and development activities, and may face challenges in funding the increasing costs of product development.

Silicon Image’s success and future revenue growth depend in large part on its ability to protect its intellectual property. The company relies on a combination of patents, copyrights, trademarks, trade secret laws, contractual provisions and licenses to protect intellectual property. The company is also exploring means to obtain further consideration from its patent portfolio beyond the existing standards-based licensing and defensive use. Silicon Image enters into confidentiality agreements with its employees, consultants, suppliers and customers and seeks to control access to and distribution of documentation and other proprietary information. In addition, Silicon Image often incorporates the intellectual property of other companies into its designs and has certain obligations with respect to the non-use and non-disclosure of their intellectual property.

As of December 31, 2014, Silicon Image owns 648 issued United States and International patents and had 544 United States and International patent applications pending. Silicon Image’s U.S. issued patents have expiration dates which range from 2017 to 2033 subject to its payment of periodic maintenance fees. The company’s policy is to seek to protect its intellectual property rights throughout the world by filing patent applications in select foreign jurisdictions. Despite these precautions, it may be possible for a third party to copy or otherwise obtain and use Silicon Image’s products and technology without authorization, independently develop similar technology or design around its patents. In addition, the company may not be able to successfully enforce its patents against infringing products in every jurisdiction.

Research & Development

Research & Development Areas of focus includes higher bandwidth and lower power links, efficient algorithms, architectures and new features Leadership in high-speed interconnect architecture, circuit design, logic design / verification § Owns 648 patents R&D Spend ($ in Millions) $77.4 $77.0 $72.0 2012 2013 2014 44% 56% R&D Other

|

20 |

|

5.9 Employees

As of December 31, 2014, Silicon Image had a total of 671 full-time employees. None of the company’s employees are represented by a collective bargaining agreement. Silicon Image has never experienced any work stoppages. The company considers its relations with its employees to be good. Silicon Image depends on the continued service of its key technical, sales and senior management personnel and its ability to attract and retain additional qualified personnel. The company is subject to the risk that it may not be able to retain key employees, given the intense competition for talent in the geographic regions in which it operates and the financial challenges facing the company, which required that it reduces operating expenses in order to bring them in line with the financial outlook. In addition, Silicon Image is subject to the risk of transitions in its management team.

|

21 |

|